As filed with the Securities and Exchange Commission on July 20, 2007

Registration No. 333-142443

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Cross Match Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 7373 | | 65-0637546 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

3950 RCA Boulevard, Suite 5001

Palm Beach Gardens, Florida 33410

(561) 622-1650

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

William A. Smith II, Esq.

Senior Vice President, General Counsel and Secretary Cross Match Technologies, Inc.

3950 RCA Boulevard, Suite 5001

Palm Beach Gardens, Florida 33410

(561) 622-1650

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| | |

Alan L. Dye, Esq. John B. Beckman, Esq. Hogan & Hartson L.L.P. 555 Thirteenth Street, N.W. Washington, D.C. 20004 Telephone: (202) 637-5600 | | Kris F. Heinzelman, Esq. Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019 Telephone: (212) 474-1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 20, 2007

11,833,334 Shares

Cross Match Technologies, Inc.

Common Stock

Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock is expected to be between $14.00 and $16.00 per share. We intend to apply to list our common stock on The NASDAQ Global Market under the symbol “CROS.”

We are selling 8,333,334 shares of common stock and the selling stockholders are selling 3,500,000 shares of common stock. We will not receive any of the proceeds from the shares of common stock sold by the selling stockholders.

The underwriters have an option to purchase a maximum of 1,775,000 additional shares from us to cover over-allotments of shares.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 8.

| | | | | | | | |

| | | Price to Public | | Underwriting

Discounts and

Commissions | | Proceeds to

Issuer | | Proceeds to the

Selling

Stockholders |

Per Share | | $ | | $ | | $ | | $ |

Total | | $ | | $ | | $ | | $ |

Delivery of the shares of common stock will be made on or about , 2007.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Credit Suisse

| | |

| |

| UBS Investment Bank | | Morgan Stanley |

Raymond James

The date of this prospectus is , 2007

TABLE OF CONTENTS

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

Dealer Prospectus Delivery Obligation

Until , 2007 (25 days after the commencement of this offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

PROSPECTUS SUMMARY

The summary highlights information contained in other parts of this prospectus. You should read the entire prospectus carefully, especially the matters discussed under “Risk Factors” and the financial statements and related notes included in this prospectus, before deciding to invest in shares of our common stock. References in this prospectus to “Cross Match,” “our company,” “our,” “we” or “us” are to Cross Match Technologies, Inc. and its consolidated subsidiaries, unless the context otherwise requires.

Our Business

We are a global provider of biometric technologies designed to protect people, property and privacy. Our customers include systems integrators, governments, law enforcement agencies and businesses around the world that use our products in identity management systems. Our products include fingerprint, palm and full-hand scanning devices, commonly known in the industry as Livescan devices, document readers and proprietary software, such as criminal booking, civil identification and facial recognition applications. We offer customized products to meet individual customer needs by combining our proprietary software applications with our biometric devices and third-party technologies. In addition, we provide maintenance and installation and training services. We believe our products are recognized for their quality, reliability, performance, ease-of-use and functionality, which we believe positions us well in the rapidly growing biometrics market and security industry. Our total revenue has grown at a compound annual growth rate, or CAGR, of 33% from 2002 to 2006. For 2006, our total revenue was $76.9 million.

Our product offerings are built around our proprietary technologies that are used to capture and process the unique physiological characteristics of individuals for the purposes of establishing and verifying identity. Our fingerprint, palm and full-hand scanning devices incorporate our patented optical component designs, advanced image-capturing and image-processing technologies and self-calibration functionality to collect and process biometric data. Our document readers use many of the same proprietary technologies as our fingerprint devices to authenticate and verify documents. Our proprietary software applications enable the capture, processing, analysis, matching and electronic submission of biometric and other data to searchable databases. The interoperable architecture of our products enables customers to easily upgrade devices and systems and to enhance features and functionality of existing infrastructure.

The deployments of our products range from single-site installations to large-scale government initiatives. Uses of our products include identity verification at national borders, consulates and other checkpoints; registration and verification for drivers’ licenses, passports, voting and other civil identification and benefits programs; criminal booking applications; prevention of identity fraud; and background checks for job applicants. As of March 31, 2007, we had deployed more than 80,000 products to more than 5,000 customers in over 80 countries. We sell our products directly and through leading systems integrators, such as Motorola, Northrop Grumman and Sagem Morpho, and other strategic partners. Our hardware and software products have been integrated into large-scale identity management projects, such as the U.S. Department of Homeland Security’s US-VISIT program and IDENT1 in the United Kingdom.

We believe that our history of internal product development and strategic acquisitions provides us with the experience, technology and global scope to address the evolving biometric-enabled identity management needs of our customers. We have a long track record of being the first to market with leading biometric products that meet evolving customer needs and comply with industry standards. Our continuing focus on innovation has resulted in more than 80 current patent registrations and more than 80 pending patent applications worldwide. Our acquisitions of Smiths Heimann Biometrics GmbH and C-Vis Computer Vision and Automation GmbH have expanded our international presence, strengthened our manufacturing, engineering and research and development capabilities and added critical facial recognition technology to our current offerings. We will continue our commitment to research and development and follow a disciplined acquisition strategy as we seek to enhance our product offerings, increase our customer base and expand our scope of operations.

1

Our Market Opportunity

We believe that the international biometrics market is large, growing and evolving rapidly. According to the International Biometric Group, or IBG, an independent market research firm, the biometrics market is estimated to be $3.0 billion in 2007, with the fingerprint-related segment representing a majority of this market. IBG projects the overall biometrics market to grow to approximately $7.4 billion by 2012, representing a CAGR of approximately 20%.

More stringent security requirements, an increasingly global economy and more mobile populations have given rise to greater demand for technologies that offer a reliable and efficient means to verify identity. Biometrics, with its focus on uniquely individual characteristics, addresses the limitations inherent in traditional identification and authentication processes, such as paper credentials, passwords, PIN codes and magnetic access cards. Biometrics provides a dynamic solution for a broad range of applications, including border management, national identification programs, immigration control, identity theft and critical infrastructure applications such as employee verification, access control and information systems protection. We believe that government and commercial entities will increasingly adopt biometric-enabled solutions to address these limitations and vulnerabilities. Among the factors we believe will contribute to growth of the biometrics industry are:

| | • | | Heightened security concerns. Increasing threats to personal security encountered in areas such as transportation and identity theft. |

| | • | | Increased government adoption. Government-mandated implementation of biometric identification for employees, citizens and foreign nationals in national security-oriented applications. |

| | • | | Emerging standards. Evolving industry standards that promote interoperability across devices, software and systems, enabling a broader range of deployments. |

| | • | | Growing acceptance of biometrics. Increasing acceptance of biometrics that facilitates widespread incorporation of biometric technology into everyday use. |

Our Competitive Strengths

We believe that the following competitive strengths will continue to enhance our leadership position in the biometrics industry and contribute to our growth in the future:

| | • | | Superior product performance and reliability. Based on feedback from our customers, we believe that many of our products are among the most user-friendly, efficient, durable and reliable in our industry. As a result, our products are often deployed in harsh environments and high-traffic areas. |

| | • | | Strength in research and development. We focus our research and development efforts on delivering technologically advanced and innovative products to remain at the forefront of our industry. Our investment in research and development has enabled us to deliver industry-leading technologies that meet, and often exceed, changing customer requirements. |

| | • | | Large installed base and brand recognition. As of March 31, 2007, we had deployed more than 80,000 products to more than 5,000 customers worldwide. Our broad and growing installed base contributes to our strong brand image and industry-wide name recognition and also provides opportunities for new and repeat business. |

| | • | | Global platform. Our products are installed in over 80 countries around the world, which we believe represents a broader international presence than any of our primary competitors. We believe our European operations provide us with a strong platform to continue to expand our international presence. |

| | • | | Standards-based, interoperable products. We provide strong leadership in the development of national and international standards for biometric devices. We design our products to meet these standards and |

2

| | to facilitate interoperability of our products across the identity management industry. This offers our customers significant flexibility in deploying biometric programs by using our solutions with existing or third-party components. |

| | • | | Experienced management team. We continue to emphasize the importance of attracting and retaining the most highly qualified personnel in our industry. Our management team has a mix of government and private sector experience across different geographies and industries, and holds leadership positions with various international standards-setting bodies and industry groups. |

Our Growth Strategy

Our strategy is to capitalize on our leadership position in the rapidly growing biometrics industry. As part of our growth strategy, we seek to:

| | • | | Capitalize on growth in the biometrics industry. We intend to use our market leadership, broad customer base, established strategic and customer relationships and recognized brand to capitalize on the growth of the biometrics industry. |

| | • | | Further penetrate markets with our existing products. We seek to increase penetration of our markets by continuing to expand our installed products base in U.S. and non-U.S. government markets and in commercial sectors. |

| | • | | Maintain leadership in biometric technology. We intend to maintain our technology leadership by continuing to improve our existing technologies, expanding the features and functionality of our existing products and adding new product offerings. |

| | • | | Leverage manufacturing, technology and operational expertise to produce efficiencies. We believe our technology and international operations provide us significant economies of scale and our manufacturing capacity at existing facilities can be significantly increased with limited incremental capital expenditures. |

| | • | | Supplement our internal growth through acquisitions and strategic relationships. We will continue to pursue acquisitions of, and strategic relationships with, businesses that complement our existing technologies, enhance our product offerings and expand our customer base. |

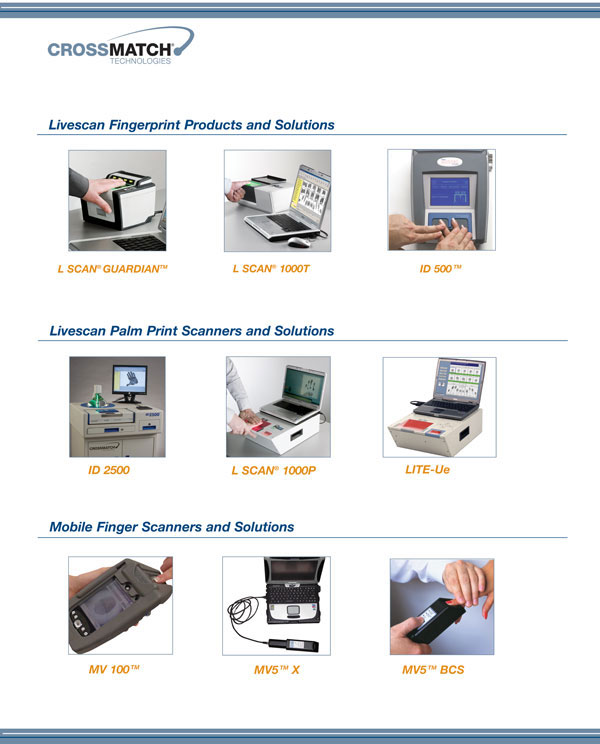

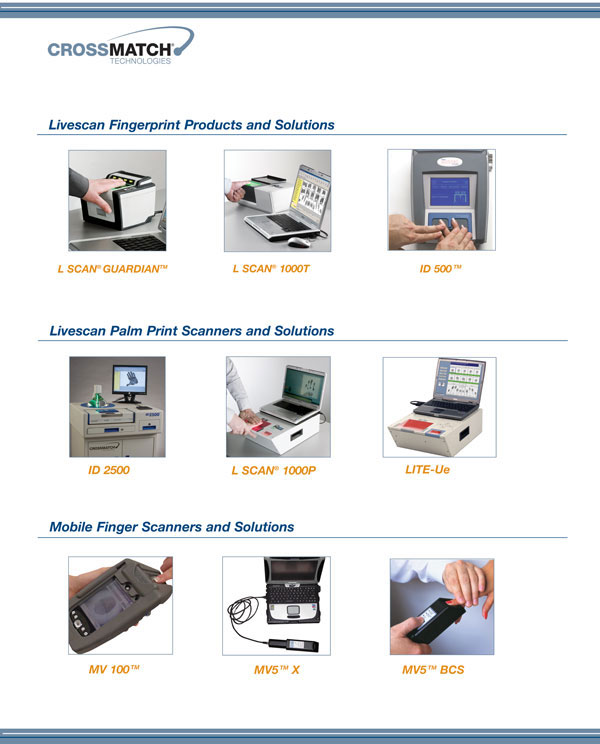

Our Products and Services

We offer a broad range of biometric hardware, software and services:

| | • | | Hardware.Our hardware products include fingerprint, palm and full-hand scanning devices and document readers. Our fingerprint scanning devices incorporate our proprietary optical systems and software algorithms to capture fingerprint and associated data in real time and generate electronic fingerprint transmission files, or EFTs, suitable for submission to searchable databases such as the FBI’s integrated automated fingerprint identification system, or IAFIS. We use similar optical technologies in our document readers, which are capable of recognizing and authenticating various types of documents by inspecting security features and capturing information from the scanned document. |

| | • | | Software. Our software products facilitate the use of our scanning devices in a variety of deployments. Products range from basic enabling software, such as device drivers, to advanced software, such as criminal booking, civil identification and facial recognition applications. We also offer market-specific solutions that combine our advanced software applications and enabling hardware. |

| | • | | Services.We provide our customers with maintenance and implementation and training services. Post-warranty maintenance accounts for the majority of our service revenue. Implementation and training services are either priced separately from our products or as part of a bundled offering. |

3

Risk Associated With Our Business

Our business is subject to numerous risks, including, but not limited to, the following:

| | • | | History of operating losses. We have had a history of operating losses and may not succeed in achieving or sustaining profitable operations. At March 31, 2007, we had an accumulated deficit of approximately $54.8 million. |

| | • | | Growth in the biometrics market.If the biometrics market does not experience significant growth or if our products do not achieve wide market acceptance, we may not be able to execute our growth strategy. |

| | • | | Reliance on fingerprint based products for substantially all of our revenue. Our historical dependence on sales of fingerprint based biometric products for substantially all of our revenue could adversely affect our business if other biometric methodologies supplant the fingerprint based products currently utilized by our customers and we are unable to successfully expand our offerings into other biometric technologies. |

| | • | | Historical dependence on governmentcustomers andour key systems integrators. When combined, sales to various branches of the U.S. government accounted for approximately 31%, 21% and 28% of revenue in 2005 and 2006 and the three months ended March 31, 2007, respectively. Our dependence on government customers and a small group of systems integrators makes us vulnerable to political, budgetary, purchasing and delivery constraints that may affect the timing of orders and could adversely affect our operating results. Although no single customer accounted for 10% or more of our revenue in 2005, 15% of our revenue derived from a single systems integrator in 2006 and 23% of our revenue derived from two systems integrators in the three months ended March 31, 2007. The loss of one of these customers or another key systems integrator could reduce our revenue and gross profit in any given year. |

These and other risks related to our business or this offering are discussed more fully in the section of this prospectus entitled “Risk Factors” beginning on page 8.

Other Information

Company Information

Cross Match was organized under the laws of the State of Florida in 1996. In 2002, we reincorporated under the laws of the State of Delaware. Our principal executive offices are located at 3950 RCA Boulevard, Suite 5001, Palm Beach Gardens, Florida 33410, and our main telephone number at that address is (561) 622-1650. Our corporate website address is www.crossmatch.com.The contents of our website are not a part of this prospectus.

Trademarks

We own, or claim ownership rights to, a variety of trade names, service marks and trademarks for use in our business, including Cross Match®, Cross Match stylized logo appearing on the cover page of this prospectus, L SCAN®, L SCAN® Guardian™ and D SCAN® in the United States and, where appropriate, in other countries. This prospectus also includes product names and other trade names and service marks owned by us and other companies. The trade names and service marks of other companies are the property of those other companies.

4

The Offering

Common stock offered by Cross Match offering | 8,333,334 shares |

Common stock offered by the selling stockholders | 3,500,000 shares |

Total common stock offered | 11,833,334 shares |

Common stock outstanding after the offering | 28,694,610 shares |

Proposed NASDAQ Global Market symbol . | “CROS” |

Use of proceeds | We estimate that our net proceeds from the offering will be approximately $114.2 million, based on the midpoint of the price range set forth on the cover page of this prospectus. We intend to use the net proceeds for working capital and other general corporate purposes as well as funding for possible acquisitions. We also intend to repay in full the $4.4 million outstanding as of June 30, 2007 under our term loan from Silicon Valley Bank. |

| | The amounts we actually spend in these areas will depend on a variety of factors, including our future revenue. |

| | We will not receive any of the proceeds from the sale of shares in this offering by the selling stockholders. |

The number of shares of our common stock to be outstanding immediately after the offering excludes:

| | • | | 3,192,805 shares of our common stock reserved for issuance under our new 2007 Omnibus Incentive Plan; |

| | • | | 6,804,141 shares of common stock issuable upon the exercise of outstanding stock options as of June 30, 2007; and |

| | • | | 1,377,466 shares of common stock issuable upon the exercise of outstanding warrants as of June 30, 2007. |

Unless we indicate otherwise, the information in this prospectus:

| | • | | reflects a 1-for-2 reverse split of our outstanding common stock implemented immediately before the completion of this offering; |

| | • | | reflects the conversion of all of our outstanding Series A preferred stock into 461,244 shares of common stock upon completion of this offering; |

| | • | | the filing of our restated certificate of incorporation and the adoption of our amended and restated bylaws immediately before the completion of this offering; |

| | • | | assumes that the initial public offering price of our common stock will be $15 per share, which is the midpoint of the price range set forth on the cover page of this prospectus; and |

| | • | | assumes that the underwriters will not exercise their over-allotment option. |

5

Summary Consolidated Financial Data

The following table shows our summary consolidated statements of operations data and other financial and operating data for each of the years ended December 31, 2004, 2005 and 2006 and the three months ended March 31, 2006 and 2007 and our balance sheet data as of March 31, 2007. The summary consolidated statements of operations data and the other financial data for the years ended December 31, 2004, 2005 and 2006 are derived from our audited consolidated financial statements and related notes, prepared in accordance with generally accepted accounting principles in the United States, which appear elsewhere in this prospectus. The summary consolidated statements of operations data and the other financial data for the three months ended March 31, 2006 and 2007 and the balance sheet data as of March 31, 2007, are derived from unaudited consolidated financial statements, which appear elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on the same basis as our audited financial statements and reflect, in the opinion of management, all adjustments necessary for a fair presentation of such financial statements in all material respects. Our historical results are not necessarily indicative of our results for any future period.

This information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months Ended March 31, | |

| | | 2004 | | | 2005(1) | | | 2006(2) | | | 2006 | | | 2007 | |

| | | | | | | | | | | | (unaudited) | |

| | | (Dollars in thousands, except per share data) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 31,808 | | | $ | 46,200 | | | $ | 76,938 | | | $ | 17,518 | | | $ | 22,167 | |

Cost of revenue | | | 15,802 | | | | 24,498 | | | | 40,703 | | | | 9,451 | | | | 10,310 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 16,006 | | | | 21,702 | | | | 36,235 | | | | 8,067 | | | | 11,857 | |

| | | | | |

Selling and marketing expenses | | | 5,998 | | | | 6,024 | | | | 9,994 | | | | 1,955 | | | | 2,646 | |

Research and development expenses | | | 8,423 | | | | 10,606 | | | | 14,273 | | | | 3,318 | | | | 3,345 | |

General and administrative expenses | | | 6,165 | | | | 9,393 | | | | 21,242 | | | | 4,722 | | | | 5,587 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 20,586 | | | | 26,023 | | | | 45,509 | | | | 9,995 | | | | 11,578 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (4,580 | ) | | | (4,321 | ) | | | (9,274 | ) | | | (1,928 | ) | | | 279 | |

| | | | | |

Other (expense) income, net | | | (35 | ) | | | 191 | | | | 505 | | | | 77 | | | | 56 | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income before income taxes | | | (4,615 | ) | | | (4,130 | ) | | | (8,769 | ) | | | (1,851 | ) | | | 335 | |

Provision for income taxes | | | — | | | | 805 | | | | 2,500 | | | | 951 | | | | 913 | |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (4,615 | ) | | $ | (4,935 | ) | | $ | (11,269 | ) | | $ | (2,802 | ) | | $ | (578 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net loss per share, basic and diluted(3) | | $ | (0.48 | ) | | $ | (0.39 | ) | | $ | (0.60 | ) | | $ | (0.15 | ) | | $ | (0.03 | ) |

Weighted average shares outstanding, basic and diluted | | | 9,718,771 | | | | 13,180,223 | | | | 19,399,345 | | | | 18,495,386 | | | | 19,822,099 | |

| | | | | |

Pro forma net loss per share, basic and diluted(5) | | | | | | | | | | $ | (0.57 | ) | | | | | | $ | (0.03 | ) |

Pro forma weighted average shares outstanding, basic and diluted | | | | | | | | | | | 19,860,589 | | | | | | | | 20,283,343 | |

| | | | | |

Other Data: | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization(4) | | $ | 1,149 | | | $ | 1,548 | | | $ | 2,404 | | | $ | 483 | | | $ | 763 | |

Amortization of intangible assets(4) | | | — | | | | 960 | | | | 2,535 | | | | 585 | | | | 678 | |

Capital expenditures | | | 889 | | | | 1,802 | | | | 2,915 | | | | 395 | | | | 433 | |

6

| | | | | | | | | |

| | | As of March 31, 2007 |

| | | Actual | | Pro

forma(5) | | Pro forma,

As Adjusted(6) |

| | | (unaudited) |

| | | (In thousands) |

Balance Sheet Data: | | | | | | | | | |

Cash and cash equivalents | | $ | 20,335 | | $ | 20,335 | | $ | 129,624 |

Working capital(7) | | | 33,577 | | | 33,577 | | | 142,866 |

Total assets | | | 150,447 | | | 150,447 | | | 259,736 |

Total deferred revenue | | | 3,396 | | | 3,396 | | | 3,396 |

Total debt | | | 4,861 | | | 4,861 | | | — |

Stockholders’ equity | | | 23,214 | | | 120,537 | | | 234,687 |

| (1) | Includes the results of operations of Smiths Heimann Biometrics GmbH from the date of acquisition on August 1, 2005 through December 31, 2005. |

| (2) | Includes the results of operations of Smiths Heimann Biometrics GmbH for the full year in 2006. |

| (3) | Because we had net losses for all periods presented, all common stock equivalents were antidilutive during these periods, and therefore are excluded from the weighted average shares outstanding. The total common stock equivalents excluded from the calculation of weighted average shares outstanding were as follows: |

| | | | | | | | | | |

| | | Year Ended December 31, | | Three Months Ended

March 31, |

| | | 2004 | | 2005 | | 2006 | | 2006 | | 2007 |

| | | | | | | | | (unaudited) |

Convertible preferred stock | | 37,940 | | 359,783 | | 460,771 | | 459,306 | | 461,250 |

Stock options | | 830,972 | | 776,895 | | 923,353 | | 737,963 | | 998,511 |

Warrants | | 1,057,179 | | 905,255 | | 229,124 | | 480,959 | | 83,828 |

| | | | | | | | | | |

Total | | 1,926,091 | | 2,041,933 | | 1,613,248 | | 1,678,228 | | 1,543,589 |

| | | | | | | | | | |

| (4) | Depreciation and amortization is calculated using the straight-line method over the estimated useful lives of the assets. |

| (5) | On a pro forma basis to reflect the automatic conversion of all of our outstanding Series A preferred stock into 461,244 shares of common stock upon completion of this offering and the termination of the put option held by Smiths Group Holdings Netherlands B.V. in connection with the acquisition of Smith Heimann Biometrics GmbH. See Note 16 to our Consolidated Financial Statements, which appear elsewhere in this prospectus. |

| (6) | On a pro forma as adjusted basis to reflect (i) the sale of 8,333,334 shares of common stock offered by us at an assumed initial public offering price of $15 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and the application of the net proceeds from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, to repay amounts outstanding under our term loan from Silicon Valley Bank (ii) the automatic conversion of all of our outstanding Series A preferred stock into 461,244 shares of common stock upon completion of this offering, and (iii) the termination of the put option held by Smiths Group Holdings Netherlands B.V. in connection with the acquisition of Smith Heimann Biometrics GmbH. See Note 16 to our Consolidated Financial Statements, which appear elsewhere in this prospectus. |

| (7) | Working capital is calculated by subtracting total current liabilities from total current assets. |

7

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the other information in this prospectus, before making an investment decision. If any of the risks described below occurs, our business, financial condition, results of operations or cash flows would suffer. As a result, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

We have had a history of operating losses and may not succeed in achieving or sustaining profitable operations.

We have experienced net losses in each fiscal year since we began business operations in 1996, including a net loss of $11.3 million in 2006 and $578,000 for the three months ended March 31, 2007. At March 31, 2007, we had an accumulated deficit of approximately $54.8 million. We may not succeed in achieving or sustaining profitable operations in the near future or ever.

We may be unable to continue the significant revenue growth we have experienced in 2006 and in prior periods.

Our revenue increased 66.5% from $46.2 million in 2005 to $76.9 million in 2006, a significant portion of which was attributable to our acquisition of Smiths Heimann Biometrics GmbH. Our revenue increased 26.5% from $17.5 million for the three months ended March 31, 2006 to $22.2 million for the three months ended March 31, 2007. We may not be able to achieve similar growth rates in future periods. You should not rely on the results of any prior periods as an indication of our future operating performance. If we are unable to maintain adequate revenue growth, our stock price may decline, and we may not have adequate financial resources to execute our business plan.

If the biometrics market does not experience significant growth or if our products do not achieve wide market acceptance, we may not be able to execute our growth strategy.

We earn substantially all of our revenue from sales of our biometric products. We cannot accurately predict the future growth rate or the size of the biometrics market. Even if biometric products gain wide market acceptance, our products may not adequately address market requirements and benefit from this market acceptance. If biometric products generally, or our products specifically, do not gain wide market acceptance, we may not be able to execute our growth strategy. The expansion of the biometrics market and the market for our biometric products depends on a number of factors, including:

| | • | | the cost, performance and reliability of our products and those offered by our competitors; |

| | • | | customers’ perceptions regarding the benefits of biometric products; |

| | • | | the development and growth of demand for biometric products in markets outside of government and law enforcement; |

| | • | | national or international events that may affect the need for, or interest in, biometric products; |

| | • | | public perceptions regarding the intrusiveness of biometric products and the manner in which organizations use the biometric information collected; and |

| | • | | legislation related to privacy of information. |

If products based on biometric methodologies other than fingerprints become more significant in our industry, our operating results may suffer.

We derive substantially all of our revenue from sales of fingerprint-based biometric products. It is possible that other biometric methodologies, such as voice, face or iris recognition, could supplant the fingerprint-based products currently preferred by our customers. Such a development would have an adverse effect on our revenue

8

and our ability to expand our business. While we currently offer document readers and facial recognition products and are in the process of developing products based on other biometric methodologies, we may not be able to generate revenue from these products sufficient to replace the potential loss of revenue from a decline in demand for fingerprint-based biometric products.

The intense competition we face could adversely affect our operating performance and result in lower revenue.

Acts of terrorism worldwide and subsequent regulatory and policy changes in the United States and other countries have heightened interest in the use of biometric products for security purposes. We expect competition in our industry, which is already substantial, to intensify. A significant number of established companies have developed or are developing and marketing products and software for biometric products and applications that currently compete or will compete directly with our products. Our competitors also are developing and marketing fingerprint image capture devices using different technologies and other products based on alternative biometric methodologies, including retinal blood vessel, iris pattern, hand geometry, vein-mapping, voice or various types of facial structure recognition devices. In the future, our products may also compete with non-biometric technologies, such as certificate authorities and traditional keys, cards, surveillance systems and passwords. Widespread adoption of one or more of these technologies or approaches in our markets could significantly reduce the potential market for our products. Our competitors may introduce products that are competitively priced, have increased performance or functions or incorporate technological advances that we have not yet developed or implemented. Our operating results and prospects will suffer if we do not continue to develop, market and sell new and enhanced products at competitive prices, which will require substantial research and development expenditures.

Unless we keep pace with changing technologies, we could lose existing customers and fail to win new customers.

To compete effectively in the biometrics market, we must continue to design, develop or acquire and market new and enhanced products at competitive prices and must have the resources available to invest in significant research and development activities. If we do not introduce new products, services and enhancements in a timely manner, fail to choose correctly among technical alternatives or fail to offer innovative products and services at competitive prices, customers may forego purchases of our products and services and purchase those of our competitors. We may not be able to predict accurately which technologies customers will purchase.

Our business could be adversely affected by changes in the procurement or fiscal policies of governments and government entities.

We believe that the near-term growth of our business will continue to depend on our successful procurement of government awards. Our business could be adversely affected by changes in:

| | • | | fiscal policies or decreases in available government funding; |

| | • | | government programs or applicable requirements; |

| | • | | existing laws or regulations; |

| | • | | political or social attitudes with respect to security and defense issues; and |

| | • | | industry standards, which could require significant changes to our product lines. |

These and other factors could cause governments and their agencies to reduce their spending on our products. As a general rule, government agencies may not place orders before appropriations are available. In addition, many of our government customers are subject to stringent budgetary constraints. Therefore, additional orders from government agencies could be negatively affected by spending reductions, changes in the government appropriations process or budgetary cutbacks at these agencies.

9

Our sale of products and services directly or indirectly to government entities makes us vulnerable to political, budgetary, purchasing and delivery constraints, which may produce volatility in our revenue and earnings.

Sales to various branches of the U.S. government combined accounted for approximately 31%, 21% and 28% of revenue in 2005 and 2006 and the three months ended March 31, 2007, respectively. We sell to government customers directly and indirectly through systems integrators and other strategic partners. Our dependence on government agencies for a significant portion of our revenue makes us vulnerable to political, budgetary, purchasing and delivery constraints that may affect the timing of orders. This could adversely affect our operating results and cause significant fluctuations in our revenue across fiscal periods. In addition, local government agency orders may be contingent upon the availability of funds from federal or state entities.

Government orders frequently are made only after formal competitive bidding processes, which have been and may continue to be protracted. In many cases, unsuccessful bidders for government program awards are provided the opportunity to protest awards through agency, administrative and judicial channels. The protest process may substantially delay a successful bidder’s performance and distract management from operational matters. We may not be successful in winning competitive bids, and substantial delays may follow a successful bid as a result of protests.

We may not succeed in increasing our sales of products to commercial customers.

Our business historically has been focused on sales to the government and law enforcement markets.We intend to diversify our revenue sources by expanding our sales to commercial customers. The commercial market for biometric products remains in an early stage of development compared to the market for law enforcement and other government sector biometric products. Our ability to diversify into the commercial market is subject to the risks that this market will not develop and grow as we expect, that we will not successfully develop products for this market and that we will not achieve the same success in this market that we have experienced in the government and law enforcement markets.

Our financial results often vary significantly from quarter to quarter and may be negatively affected by a number of factors.

Individual orders often represent a significant portion of our revenue and net income in any single quarter. As a result, the deferral or cancellation of a single large order or our failure to close a single large order in a quarter can contribute to revenue results that fall short of our expectations. Because our operating costs are largely fixed, we are not generally able to reduce our costs in any quarter to compensate for an unexpected near-term shortfall in revenue. Accordingly, even a small revenue shortfall in any quarter could disproportionately and adversely affect our financial results for that quarter.

Our financial results may fluctuate from quarter to quarter and be negatively affected by a number of factors, including the following:

| | • | | the lack or reduction of government funding and the political, budgetary and purchasing patterns and constraints on our government customers; |

| | • | | the size and timing of customer orders; |

| | • | | fluctuation in demand for our products; |

| | • | | price reductions or adjustments or the introduction of enhanced products and services from new or existing competitors; |

| | • | | the inability to complete the installation of our products on a timely basis; |

| | • | | the lack of availability or increase in cost of key components and sub-assemblies; |

10

| | • | | manufacturing disruptions or delays due to manufacturing capacity limitations; |

| | • | | delays in orders from government customers; |

| | • | | protests of federal, state or local government awards by competitors; |

| | • | | legal expenses, including litigation or administrative protest costs; |

| | • | | expenses related to acquisitions or mergers; |

| | • | | impairment charges arising out of our assessments of goodwill and intangibles; and |

| | • | | other one-time financial charges. |

Our lengthy and variable sales cycle may make it difficult to predict our financial results.

The sale and deployment of our products often requires a lengthy cycle ranging from several months to over one year before we can complete installation. The lengthy sales cycle makes forecasting the volume and timing of sales difficult and raises additional risks that customers may cancel or decide not to enter into contracts. The length of the sales cycle depends on the size and complexity of the project, the customer’s in-depth evaluation of our products and, in some cases, the protractedness of a bidding process. Because a significant portion of our operating expenses is fixed, we may incur substantial expense before we earn associated revenue. If customer cancellations occur, they could result in the loss of anticipated sales without allowing us sufficient time to reduce our operating expenses.

We may lose clients and suffer negative publicity if security breaches result in the disclosure of sensitive government information or private personal information.

Many of our products process private personal information involved in sensitive government and commercial functions. Internal procedures and protective measures may not prevent unintended disclosure of such information and security breaches. The failure to prevent such disclosures or security breaches may disrupt our business, damage our reputation and expose us to litigation and liability. A party that is able to circumvent security measures used in these systems could misappropriate sensitive or proprietary information or materials or cause interruptions or otherwise damage our reputation or the property of our customers. If unauthorized parties obtain sensitive data and information, or create bugs or viruses or otherwise sabotage the functionality of our products, we may receive negative publicity, incur liability to our customers or suffer termination of client contracts. We may be required to expend significant capital and other resources to protect ourselves against the threat of security breaches or to alleviate problems caused by these breaches. Protective or remedial measures may not be available at a reasonable price or at all, or may not be entirely effective if commenced. Our insurance coverage may be insufficient to cover losses and liabilities that may result from accidental disclosures or security breaches.

Our reputation and operating performance may be negatively affected if our products are not timely delivered or do not perform as promised.

We provide complex products that often require substantial lead-time for ordering parts and materials and for assembly and installation. In addition, our customers often demand that we fulfill orders quickly to respond to their immediate needs. The time required to order parts and materials and assemble and install our products may in turn lead to delays or shortages in the availability of some products. The negative effects of any delay or shortage could be exacerbated if the delay or shortage occurs in products that provide personal security, secure sensitive computer data, authorize significant financial transactions or perform other functions in which a security breach could have significant consequences. If a product is delayed or is the subject of shortage because of problems with our ability to manufacture or assemble the product on a timely basis, or if a product or software otherwise fails to meet performance criteria, we may lose revenue opportunities entirely or experience delays in revenue recognition associated with a product or service in addition to incurring higher operating expenses during the period required to correct the problem.

Products as complex as ours may develop or contain undetected defects or errors. Despite testing, defects or errors may arise in our existing or new products, which could result in claims for monetary damages against us,

11

loss of revenue or market share, failure to achieve market acceptance, diversion of development resources, injury to our reputation and increased service and maintenance costs. Defects or errors in our products might discourage customers from purchasing future products.

We may be required to repair or replace a substantial number of products as a result of warranty claims. Our contractual provisions may not adequately minimize our product and related liabilities or may even be unenforceable. We carry product liability insurance, but existing coverage may not be adequate to cover actual claims. The failure of our products to perform as promised could result in increased costs, lower margins, liquidated damage payment obligations and harm to our reputation.

We face inherent product liability or other liability risks which could result in large claims against us.

We face the inherent risk of exposure to product liability and other liability claims resulting from the use of our products, especially to the extent customers may depend on our products in public safety situations that may involve physical harm or even death to individuals, as well as exposure to potential loss or damage to property. Despite quality control systems and inspection, there remains an ever-present risk of an accident resulting from a faulty manufacture or maintenance of our products, or an act of an agent outside of our control or our suppliers’ control. Even if our products perform properly, we may become subject to claims and costly litigation due to the catastrophic nature of the potential injury and loss. A product liability claim, or other legal claims based on theories including personal injury or wrongful death, made against us could adversely affect our operations and financial condition. Although we may have insurance to cover product liability claims, the amount of our coverage may not be sufficient.

The substantial lead-time required for ordering parts and materials may lead to inventory problems.

The lead-time for ordering components for many of our products can be many months. As a result, we must order components based on forecasted demand. If demand for our products lags significantly behind our forecasts, we may order more components than we require, which could result in cash flow problems and excess or obsolete inventory.

Systems failures that disrupt our business and impair our ability to provide our products and services to customers in an effective manner may damage our reputation and adversely affect our revenue and profitability.

We may experience system failures, including network, software or hardware failures, whether caused by us, third-party service providers, intruders or hackers, computer viruses, natural disasters, power outages or terrorist attacks. Any such failures could cause loss of data and interruptions or delays in our business and could damage our reputation. In addition, the failure or disruption of our communications or utilities could cause us to interrupt or suspend our operations or otherwise adversely affect our business. Our property and business interruption insurance may not be adequate to compensate us for all losses that may occur as a result of any system or operational failure or disruption and, as a result, our future results could be adversely affected.

Our headquarters are located in Florida, which is subject to significant natural disaster risks.

Our headquarters and our U.S. manufacturing facilities are located in Florida. The risk of a hurricane in Florida is significant. During 2004 and 2005, our facilities were affected by three hurricanes, which caused power outages and disrupted our business operations. The future occurrence of hurricanes and other natural disasters could materially disrupt our production capacity or otherwise disrupt our business operations.

Our dependence on a sole or limited number of suppliers for some product components may result in delays or additional expense in filling customer orders.

We obtain some of our product components from a sole or limited group of suppliers. While there are other suppliers available for these components and sub-assemblies, we believe it is more cost-effective to purchase certain highly customized components from sole source suppliers. We do not have any multi-year agreements

12

with any of these suppliers obligating them to continue to sell components to us. Our reliance on these suppliers involves significant risks, including reduced control over quality, price and delivery schedules. Our ability to meet customer demands may be disrupted and our gross margins reduced if suppliers fail to deliver components or products on a timely basis, in sufficient quantities and of sufficient quality, or if we experience any significant increase in the price of components. If we lose these sources of supply, we may be required to incur additional development, manufacturing and other costs to establish alternative sources. It may take several months for us to obtain alternative suppliers, if required, or to re-tool our products to accommodate components from different suppliers. We may not be able to obtain replacement components within the periods we require at an affordable cost. Many of the components, such as optical sub-assemblies, are used in multiple product lines. Therefore, the loss of any of these sources of supplies could cause us to suspend our manufacturing operations while an alternative source is established or result in a significant increase in the cost to us of obtaining the necessary components.

Any failure to maintain the proprietary nature of our technology and intellectual property could impair our ability to compete effectively.

We rely primarily on patents, trademarks, copyrights, trade secrets and confidentiality procedures to protect the proprietary nature of our technology and our intellectual property. These measures can only provide limited legal protection and, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property or otherwise gaining access to our technology. If we fail to protect our intellectual property rights adequately, our competitors may gain access to our technology and our business may be harmed. Unauthorized third parties may try to copy or reverse-engineer portions of our products or otherwise obtain or use our intellectual property. In addition, any of our patents, trademarks or other intellectual property rights may be challenged by others or invalidated through administrative processes or litigation. Any such legal proceedings, whether or not they are ultimately resolved in our favor, could result in significant expense to us and divert the efforts of our technical and management personnel. Further, legal standards relating to the validity, enforceability and scope of protection of intellectual property rights are uncertain and vary from country to country. Effective patent, trademark, copyright and trade secret protection may not be available to us in every country in which we market our products, and we may decide for business reasons not to pursue such protection in every country. We may modify our worldwide intellectual property strategy to reflect changes in law, markets, competition and perceived business advantage. The laws of some countries may not protect intellectual property rights to the same extent as U.S. laws and administrative practices, and domestic and international mechanisms for enforcement of intellectual property rights may be inadequate or pursuing such remedies may be too expensive.

We may be sued by third parties for alleged infringement of their proprietary rights or intellectual property.

As the size of our market increases, the likelihood of intellectual property claims against us increases. We receive communications from time to time from third parties alleging that we infringe their intellectual property. Any intellectual property claims, with or without merit, could be time-consuming and expensive to litigate or settle, and could divert management’s attention away from the execution of our business plan. In addition, we may be required to indemnify our customers for third-party intellectual property infringement claims, which would increase the cost to us of an adverse ruling in such a claim. An adverse determination also could prevent us from offering our products or services to customers, or could adversely affect our operations and financial condition.

The loss of any key member of our management team may impair our ability to operate effectively and may harm our business.

Our success depends largely upon the continued services of our executive officers and other key management and technical personnel. The loss of one or more members of our management team could harm our business. We are substantially dependent on the continued services of our existing engineering and other skilled personnel because of the highly technical nature of our products. Except for the employment agreements we have

13

with our named executive officers, we do not have employment agreements with any of our other executive officers or key personnel. We do not maintain key person life insurance policies on any of our employees.

We may not be able to attract and retain the skilled personnel we need to support our growth strategy.

To execute our growth strategy, we must attract and retain highly skilled personnel. If we fail to attract new skilled personnel or fail to retain and motivate our existing skilled personnel, our business and growth prospects could be severely harmed. Competition for hiring skilled personnel is intense, especially with regard to engineers with high levels of experience in designing, developing and integrating biometric products. We may not be successful in attracting and retaining skilled personnel. Many of the companies with which we compete for experienced personnel have greater resources than we possess. In addition, in making employment decisions, particularly in the high-technology industries, job candidates often consider the value of the stock options they are to receive in connection with their employment. Significant volatility in the price of our stock may adversely affect the value of our stock options to a potential candidate. Further, recent changes to generally accepted accounting principles in the United States, or GAAP, relating to the expensing of stock options may discourage us from granting the sizes or types of stock options that job candidates may require to join our company.

We may not be able to increase our sales if we do not successfully expand our sales organizations and partnering arrangements.

Our future success depends on increasing the size and scope of our sales force and partnering arrangements, both domestically and internationally. We face intense competition for personnel and may not be able to attract, assimilate or retain additional qualified sales personnel on a timely basis. Moreover, given the large-scale deployment required by some of our customers, we will need to hire and retain a number of highly trained customer service and support personnel. We may not succeed in increasing the size of our customer service and support organization on a timely basis to provide the high quality of support required by our customers.

Any significant impairment of our goodwill could lead to a decrease in our assets and reduction in our net income or increase in our net losses.

Approximately 53% of our assets consisted of goodwill as of March 31, 2007. If we make changes in our business strategy or if market or other conditions adversely affect our business, or our net losses continue, we may be forced to record an impairment charge, which would lead to a decrease in our assets and reduction in our net income or increase in our net losses. We test our goodwill for impairment annually or whenever events or changes in circumstances indicate an impairment may have occurred. If a test of our goodwill for impairment indicates that impairment has occurred, we are required to record an impairment charge for the difference between the carrying value of the goodwill and the implied fair value of the goodwill in the period in which the determination is made.

Our plan to increase international sales may be limited by risks related to conditions in foreign markets.

Approximately 38% and 36% of our revenue in 2006 and the three months ended March 31, 2007, respectively, was derived from sales to non-U.S. customers. Our international revenue and operations are subject to a number of risks inherent in developing, marketing, selling and delivering products in foreign countries, including:

| | • | | difficulties in managing foreign operations; |

| | • | | regulatory uncertainties in foreign countries; |

| | • | | difficulties in enforcing agreements and collecting receivables through foreign legal systems and other relevant legal issues; |

| | • | | foreign and U.S. taxation issues; |

| | • | | currency fluctuations, including fluctuations affecting the U.S. Dollar and the Euro; |

14

| | • | | delays in, or prohibitions on, exporting products resulting from export restrictions for some products and technologies; |

| | • | | involuntary renegotiations of contracts with foreign governments; and |

| | • | | unexpected domestic and international regulatory, economic or political changes. |

We expect that we may have increased exposure to foreign currency fluctuations, which could harm our profitability. Our net revenue and related expenses generated from our operations in Germany are primarily denominated in Euros and are exposed to foreign exchange rate fluctuations. Our accumulated other comprehensive (loss) income recorded in our statements of changes in stockholders’ equity and comprehensive (loss) income includes foreign currency translation adjustments of $8.6 million and $9.7 million for 2006 and the three months ended March 31, 2007, respectively. In addition, downward fluctuations in the value of foreign currencies relative to the U.S. Dollar or the Euro may make our products more expensive and less competitive than local products in international locations. Although we currently engage in some currency hedging activities to limit the risks of currency fluctuations, any hedges we may obtain from time to time may not adequately protect us from all of these risks.

We could be prohibited from shipping our products to some countries.

We must comply with U.S. and German laws regulating the export of our products. In some cases, we may need express authorization from the home government to export our products. The export regimes and the governing policies applicable to our business are subject to change. Our ability to take advantage of growth opportunities in other markets will be negatively affected if we are unable to continue to obtain the requisite government authorization regarding the export of our products, or if current or future export laws applicable to us limit or otherwise restrict our business.

If we fail to comply with export control regulations, we could be subject to substantial fines or other sanctions.

Some of our products manufactured or assembled in the United States are subject to the U.S. Export Administration Regulations, administered by the U.S. Department of Commerce, Bureau of Industry and Security, which require that we obtain an export license before we can export such products to specified countries. Additionally, some of our products are subject to the International Traffic in Arms Regulations, which restrict the export of information and material that may be used for military or intelligence applications by a non-U.S. person. Failure to comply with these laws could harm our business by subjecting us to sanctions by the U.S. government, including substantial monetary penalties, denial of export privileges and debarment from U.S. government contracts.

We may not benefit from our acquisition strategy.

As part of our business strategy, we intend to consider acquisitions of companies, technologies and products that we believe could accelerate or enhance our ability to compete in or further penetrate our markets or allow us to enter new markets. Our ability to benefit from an acquisition may be adversely affected by:

| | • | | difficulties in integrating operations, technologies, accounting systems and personnel of the acquired entity; |

| | • | | difficulties in supporting and transitioning customers of the acquired company; |

| | • | | the diversion of financial and management resources from existing operations; |

| | • | | exposure to unknown liabilities of acquired companies or assets; |

| | • | | failure to realize the potential of acquired technologies; |

| | • | | inability to maintain uniform standards, controls, procedures and policies; |

| | • | | the loss of key employees and customers as a result of changes in management or ownership; and |

| | • | | risks of entering new markets. |

15

If we fail to properly evaluate acquisitions, we may not achieve the anticipated benefits of acquisitions, and may incur costs in excess of amounts we anticipate. Acquisitions also frequently result in the recording of goodwill and other intangible assets, which are subject to potential impairment in the future that could harm our financial results. In addition, if we finance acquisitions by issuing convertible debt or equity securities, our existing stockholders may suffer dilution of their interest in our company, which could depress the price of our stock.

We may be unable to raise the additional capital we will need to fund our operations and finance our growth.

Our capital requirements depend on the rate of market acceptance of our products and services, our ability to expand and retain our customer base and other factors. If our cash requirements vary materially from our current expectations or if we fail to generate sufficient cash flow from our operations, we may require additional financing sooner than anticipated. In addition, we may need to seek additional financing to respond to competitive pressures or to undertake initiatives not currently contemplated. We may be unable to obtain the additional financing we need. Even if we are successful in raising additional financing, sales of our capital stock may be dilutive to existing stockholders, while the incurrence of indebtedness may limit our operating flexibility. Failure to secure additional financing in a timely manner and on acceptable terms could have a material adverse effect on our financial performance and stock price and could require us to delay or abandon our business strategy and limit our ability to compete.

Our sales performance may suffer if systems integrators and other strategic partners do not actively promote our products or pursue installations that use our products.

We obtained approximately 55% of our revenue in 2006 from sales to systems integrators and other strategic partners that sell our products. We cannot control the amount and timing of resources that these partners devote to promote our products or pursue installations that use our products. Some of our relationships with these partners have not been formalized in a written contract and may be subject to termination at any time. Even where we have executed written contracts, the agreements are often terminable with little notice and may be subject to periodic amendment. We may not be able to find and negotiate relationships on acceptable terms.

The loss of a key customer could reduce our revenues and gross profit.

In any given year, one or more systems integrators could individually represent more than 10% of our revenue depending upon the size and magnitude of their projects. Although no single customer accounted for 10% or more of our revenue in 2005, in 2006, we derived 15% of our revenue from a single systems integrator customer, Sagem Morpho. In the three months ended March 31, 2007, we derived 13.6% and 9.6% of our revenue from Sagem Morpho and Bundesdruckerei, respectively. Further, the loss of Sagem Morpho as a customer or the loss of another key systems integrator customer could reduce our revenue and gross profit. Other than Sagem Morpho, no individual customer accounted for more than 10% of our revenue in 2006. We have an agreement with Sagem Morpho that provides for general terms and conditions of product sales and obligates Sagem Morpho to purchase minimum quantities of certain of our products over the term of the agreement. Sagem Morpho may not renew this agreement or maintain or increase its volume of orders for our products and services in the future. If Sagem Morpho reduces its purchases of our products and services, or if we are required to sell products to Sagem Morpho at reduced prices or on less favorable terms, our revenue and gross profit could be adversely affected.

Our principal stockholder may be able, under certain circumstances, to exercise a significant influence over matters requiring stockholder approval.

After completion of this offering, Smiths Group Holdings Netherlands B.V., or Smiths, will beneficially own approximately 18.3% of our outstanding common stock, or 17.3% of our outstanding common stock if the underwriters exercise their over-allotment option in full. As a result, Smiths may be able, under certain circumstances, to exercise significant influence over matters requiring stockholder approval, including the election of directors, equity compensation plans and significant corporate transactions. For example, Smiths may vote against a transaction involving an actual or potential change of control of our company or other transaction

16

that you may deem to be in the stockholders’ best interests. In addition, two of our directors, whose terms expire at our 2009 and 2010 annual meetings, respectively, were designated for appointment to our board of directors by Smiths. Following this offering, Smiths will no longer be entitled to designate directors to our board.

We have never operated as a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002 and rules subsequently implemented by the SEC and the NASDAQ Stock Market have imposed various requirements on public companies, including public disclosure, internal control, changes in corporate governance practices and other matters. Our management and other personnel will need to devote a substantial amount of time to comply with these requirements. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

Our limited experience with a recently implemented accounting system may cause delays in the preparation of our financial results.

We recently implemented a new accounting system to improve our financial reporting capabilities. We expect that the new system will allow us to expedite the preparation of our financial statements, as well as provide our management team with additional analytical capabilities so we can manage our business more effectively. However, until we have additional experience with our accounting system, we cannot be certain that our financial reporting can be prepared without significant additional resources and management oversight or without significant delays.

If we fail to maintain proper and effective internal controls over financial reporting or fail to implement any required changes, our ability to produce accurate financial statements could be impaired, which could increase our operating costs, impair our ability to operate our business and adversely affect our stock price.

Ensuring that we have adequate internal controls over financial reporting in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. We are in the process of documenting, reviewing and improving our internal controls and procedures in anticipation of being a public company and eventually being subject to the requirements of Section 404 of the Sarbanes-Oxley Act, which will require annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent auditors addressing these assessments. We will be required to comply with the internal controls evaluation and certification requirements of Section 404 of the Sarbanes-Oxley Act effective with the end of our 2008 fiscal year.

In connection with our 2006 audit, we have determined that we had a “material weakness” in our internal controls over financial reporting as defined in standards established by the American Institute of Certified Public Accountants relating primarily to the existence of significant deficiencies in our disclosure and presentation of financial information in accordance with U.S. GAAP. Management, together with our independent registered public accounting firm, jointly identified significant deficiencies and agreed that when considered in the aggregate, these significant deficiencies constitute a material weakness in the Company’s internal control over financial reporting as of December 31, 2006. We record certain manual journal entries as part of our closing process. We identified a weakness in the design of a control that requires a review of these journal entries and supporting analysis by someone other than the preparer prior to being recorded in the general ledger. We did not maintain effective controls over reconciliations of certain financial statement accounts. Specifically, controls over the preparation, review and monitoring of certain account reconciliations and data validation were not operating effectively to ensure that account balances were accurate and supported with appropriate underlying detail, calculations or other documentation. As a result of these deficiencies, adjustments were recorded to our financial statements. These findings and the related adjustments individually constitute significant deficiencies that when aggregated together form a material weakness in internal controls. A material weakness is a significant deficiency or combination of significant deficiencies that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected.

17

Any failure to maintain adequate internal controls, or the inability to produce accurate financial statements on a timely basis, could increase our operating costs and impair our ability to operate our business. In addition, investors’ perceptions that our internal controls are inadequate or that we are unable to produce accurate financial statements could adversely affect our stock price. Implementing any required changes to our internal controls may require modifications to our existing accounting systems or additional accounting personnel. This could be costly and distract our officers, directors and employees from the operation of our business. Even if implemented, these changes may not, however, be effective in maintaining the adequacy of our internal controls by the time we complete this offering.

We will record substantial expenses related to our issuance of stock-based compensation, which may have a negative impact on our operating results for the foreseeable future.

Effective January 1, 2006, we adopted the Statement of Financial Accounting Standards No. 123 (revised 2004),Share-Based Payment, or SFAS No. 123(R), for stock-based employee compensation. Our stock-based compensation expenses are expected to be significant in future periods, which will have an adverse impact on our operating income and net income. SFAS No. 123(R) requires the use of subjective assumptions, including the option’s expected life and the price volatility of our common stock. Changes in the subjective input assumptions can materially affect the amount of our stock-based compensation expense. In addition, an increase in the competitiveness of the market for qualified employees could result in an increased use of stock-based compensation awards, which in turn would result in increased stock-based compensation expense in future periods.

Risks Related to this Offering

We do not know whether a market will develop for our common stock or what the market price of our common stock will be.

Before this offering, there was no public trading market for our common stock. If a market does not develop or is not sustained, it may be difficult for you to sell your shares of common stock at an attractive price or at all. We cannot predict the prices at which our common stock will trade. The initial public offering price for our common stock has been determined through negotiations with the underwriters and may not bear any relationship to the market price at which the common stock will trade after this offering or to any other established criteria of our value. It is possible that in one or more future periods our operating results may be below the expectations of public market analysts and investors and, as a result of these and other factors, the price of our common stock may decline.

The price of our common stock may be volatile.

The trading price of our common stock following this offering may fluctuate substantially. The price of the common stock that will prevail in the market after this offering may be lower than the price you pay, depending on many factors, some of which are beyond our control and may not be related to our operating performance. The price of the common stock may fluctuate as a result of:

| | • | | price and volume fluctuations in the overall stock market from time to time; |

| | • | | significant volatility in the market price and trading volume of comparable companies; |

| | • | | actual or anticipated changes in our earnings or fluctuations in our operating results or in the expectations of securities analysts; |

| | • | | announcements of technological innovations, new products, strategic alliances or significant agreements by us or by our competitors; |

| | • | | general economic conditions and trends; |

| | • | | sales of large blocks of our stock; and |

| | • | | recruitment or departure of key personnel. |

18

In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been brought against that company. Because of the potential volatility of our stock price, we may become the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and resources from our business.

If securities analysts do not publish research or reports about our business or if they downgrade their evaluations of our stock, the price of our stock could decline.