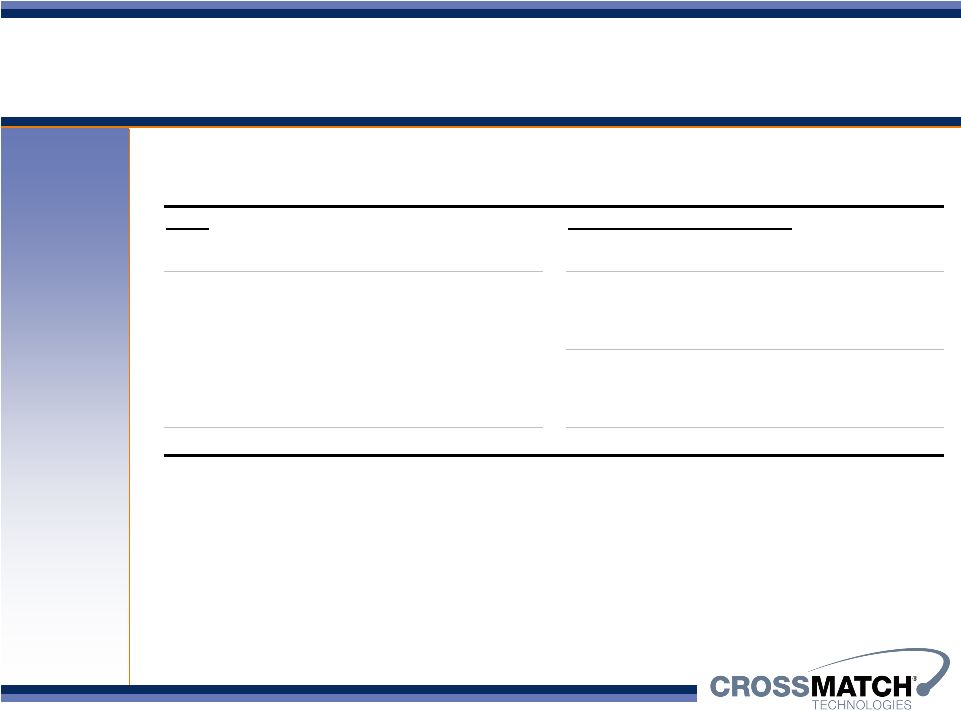

Cross Match Technologies / Company Confidential and Proprietary 40 EBITDA and Adjusted EBITDA are not measures of performance under United States generally accepted accounting principles. EBITDA is defined as net loss before other interest (income) expense, provision for income taxes and depreciation and amortization. Adjusted EBITDA is defined as EBITDA as further adjusted to eliminate the following non-recurring expenses, none of which management views as relevant to the assessment of our core operating performance: (a) research and development expenses attributable to Authorizer Technologies, Inc., or ATI, a wholly-owned subsidiary we spun-off to our stockholders in June 2006, (b) expenses we incurred in connection with the spin-off of ATI, and (c) expenses we incurred in connection with the design and implementation of our accounting, administration and compliance infrastructure associated with our preparations for becoming a public company. We believe that the presentation of EBITDA and Adjusted EBITDA included in this presentation provides useful information to investors regarding our results of operations because it assists in analyzing and benchmarking the performance of our business over the periods presented. We believe that these measures are useful because they exclude items described above that are not directly related to the operating performance of our business. These measures also provide an assessment of controllable ongoing operating expenses and are used by management to assess and make decisions regarding our financial performance. Furthermore, they also are used by management to determine whether capital assets are being allocated efficiently. In addition, we believe EBITDA is used by securities analysts, investors and other interested parties in evaluating companies, many of which present an EBITDA measure when reporting their results. EBITDA and Adjusted EBITDA as presented in this presentation may differ from and may not be comparable to similarly titled measures by other companies. Although we use EBITDA and Adjusted EBITDA as financial measures to assess the performance of our business, their use is limited because they do not include certain material expenses, such as depreciation, amortization and interest. We disclose the reconciliation between EBITDA (and Adjusted EBITDA) and net loss below to compensate for this limitation. While we use net loss as a significant measure of financial performance, we also believe that EBITDA and Adjusted EBITDA, when presented along with net loss, provides balanced disclosure which, for the reasons set forth above, is useful to investors in evaluating our operating performance. However, EBITDA and Adjusted EBITDA have important limitations as an analytical tool. For example, EBITDA and Adjusted EBITDA do not reflect: • our cash expenditures or requirements for capital expenditures or capital commitments; • changes in, or cash requirements for, our working capital needs; • our interest expense or cash requirements necessary to service interest or principal payments on our debts; • tax payments that represent a reduction in cash available to us; and • any cash requirements for assets being depreciated and amortized that may have to be replaced in the future. EBITDA and Adjusted EBITDA included in this presentation should be considered in addition to, and not as a substitute for, net loss as calculated in accordance with United States generally accepted accounting principles as a measure of performance. The following is a reconciliation of net loss to EBITDA and Adjusted EBITDA: Explanatory Information 2003 2004 2005 2006 H1'07 Net loss $ (12.0) $ (4.6) $ (4.9) (11.3) $ (0.3) Interest (income) expense 1.3 - (0.1) (0.5) (0.2) Provision for income taxes - - 0.8 2.5 1.6 Depreciation 1.3 1.1 1.5 2.4 1.5 Amortization - - 1.0 2.5 1.4 EBITDA (9.4) (3.5) (1.7) (4.4) 4.0 ATI research and development expenses 0.2 0.9 1.3 1.2 - ATI spin-off expenses - - - 0.7 - Non-recurring charges related to accounting, administration and compliance infrastructure - - - 2.7 1.0 Adjusted EBITDA $ (9.2) $ (2.6) $ (0.4) $ 0.2 $ 5.0 |