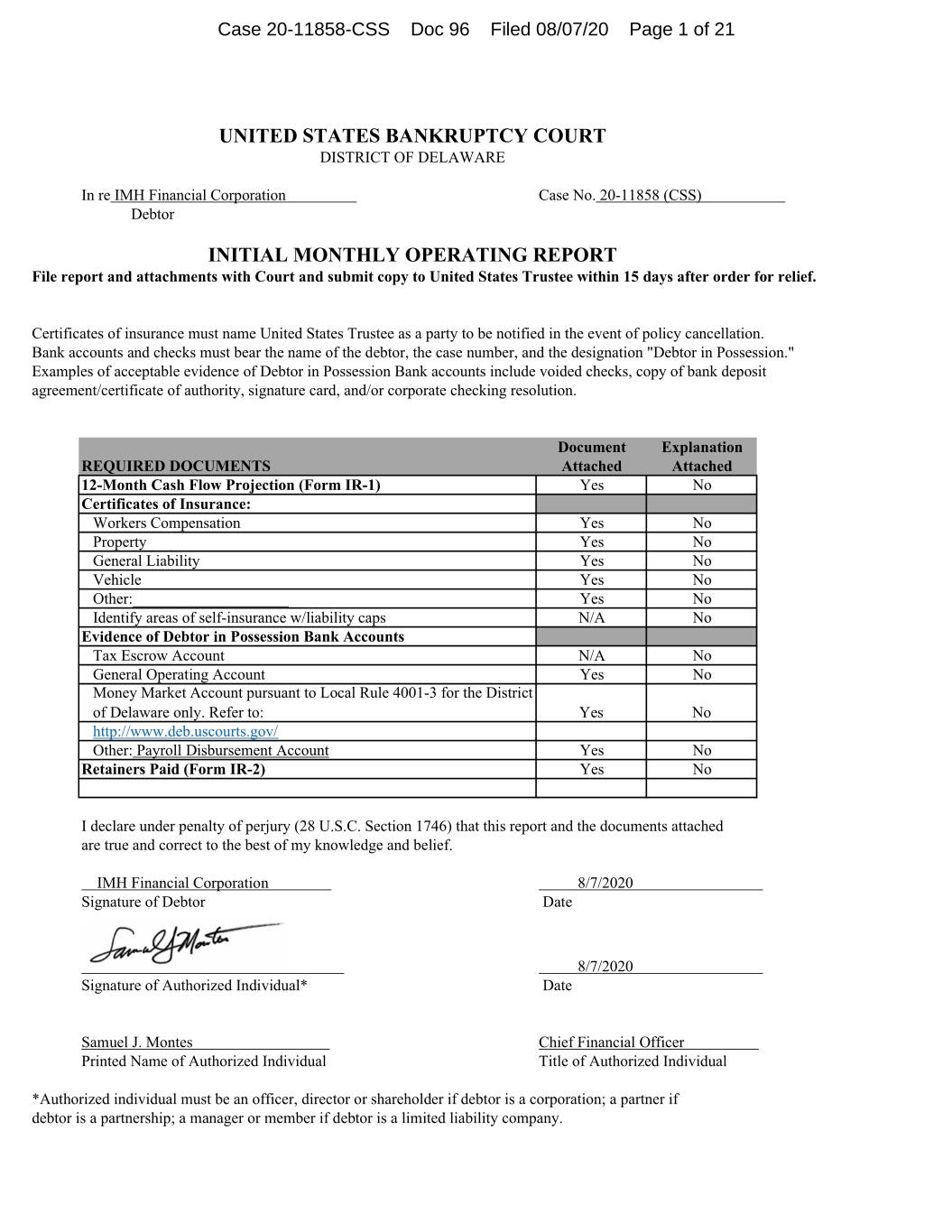

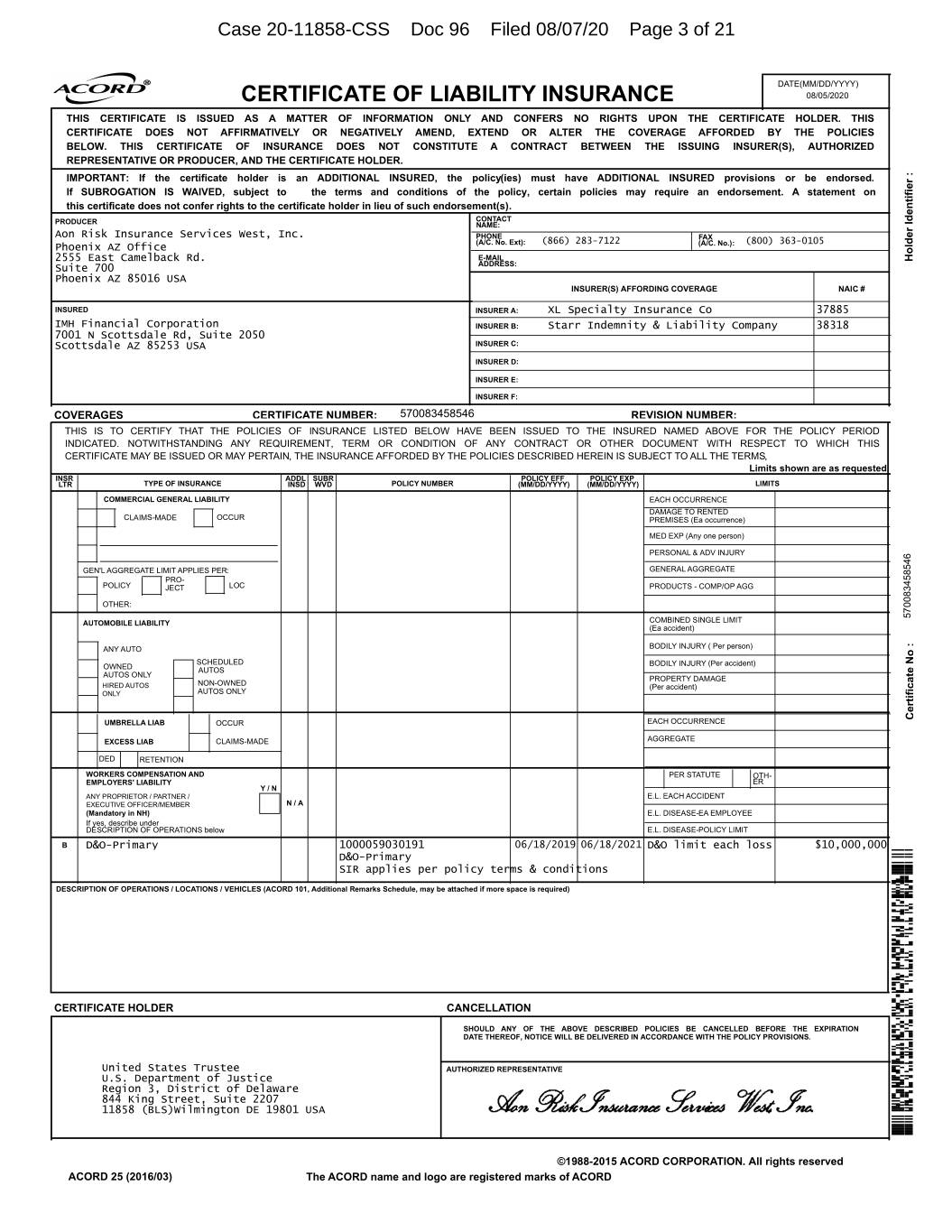

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 1 of 21 UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE In re IMH Financial Corporation Case No. 20-11858 (CSS) Debtor INITIAL MONTHLY OPERATING REPORT File report and attachments with Court and submit copy to United States Trustee within 15 days after order for relief. Certificates of insurance must name United States Trustee as a party to be notified in the event of policy cancellation. Bank accounts and checks must bear the name of the debtor, the case number, and the designation "Debtor in Possession." Examples of acceptable evidence of Debtor in Possession Bank accounts include voided checks, copy of bank deposit agreement/certificate of authority, signature card, and/or corporate checking resolution. Document Explanation REQUIRED DOCUMENTS Attached Attached 12-Month Cash Flow Projection (Form IR-1) Yes No Certificates of Insurance: Workers Compensation Yes No Property Yes No General Liability Yes No Vehicle Yes No Other:____________________ Yes No Identify areas of self-insurance w/liability caps N/A No Evidence of Debtor in Possession Bank Accounts Tax Escrow Account N/A No General Operating Account Yes No Money Market Account pursuant to Local Rule 4001-3 for the District of Delaware only. Refer to: Yes No http://www.deb.uscourts.gov/ Other: Payroll Disbursement Account Yes No Retainers Paid (Form IR-2) Yes No I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the documents attached are true and correct to the best of my knowledge and belief. IMH Financial Corporation 8/7/2020 Signature of Debtor Date 8/7/2020 Signature of Authorized Individual* Date Samuel J. Montes Chief Financial Officer Printed Name of Authorized Individual Title of Authorized Individual *Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company.

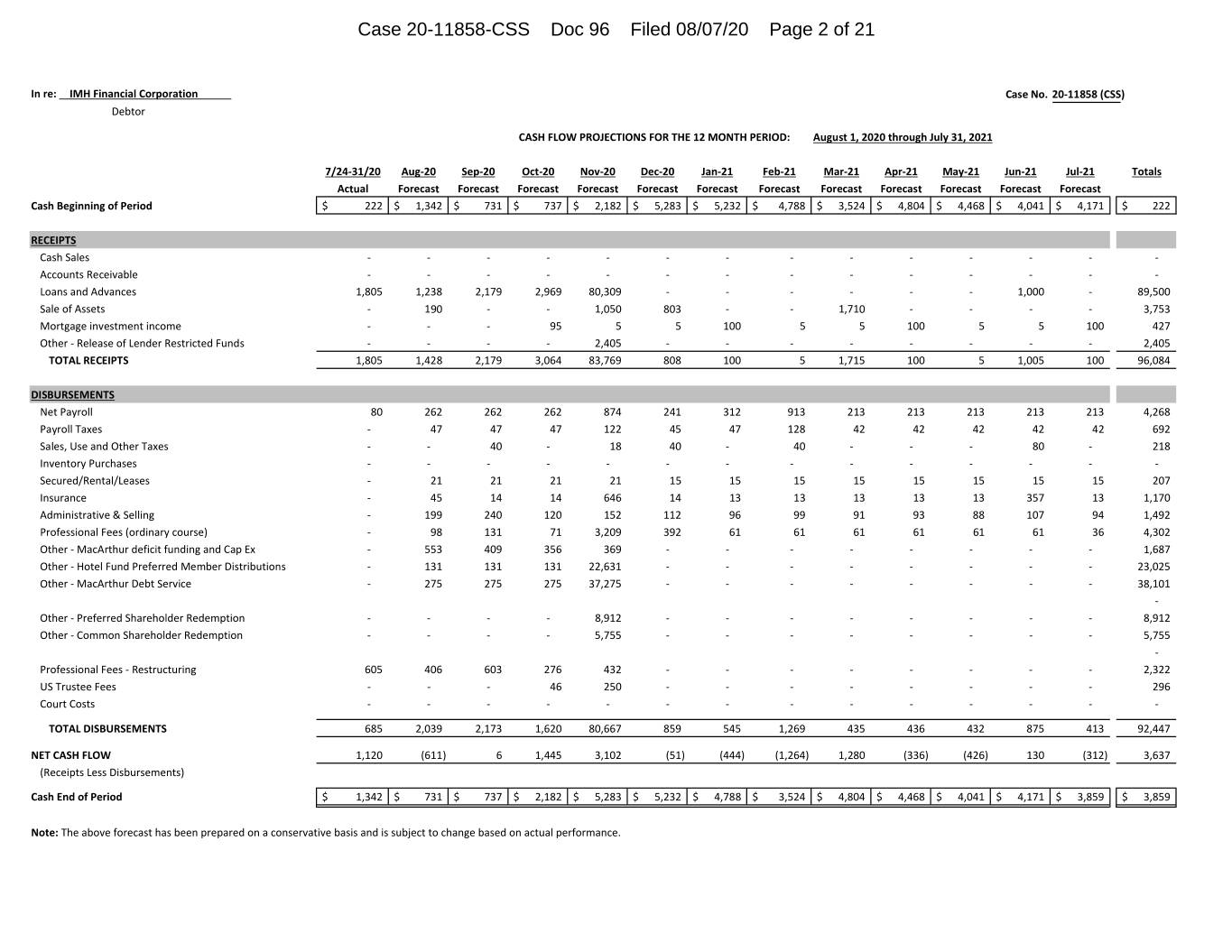

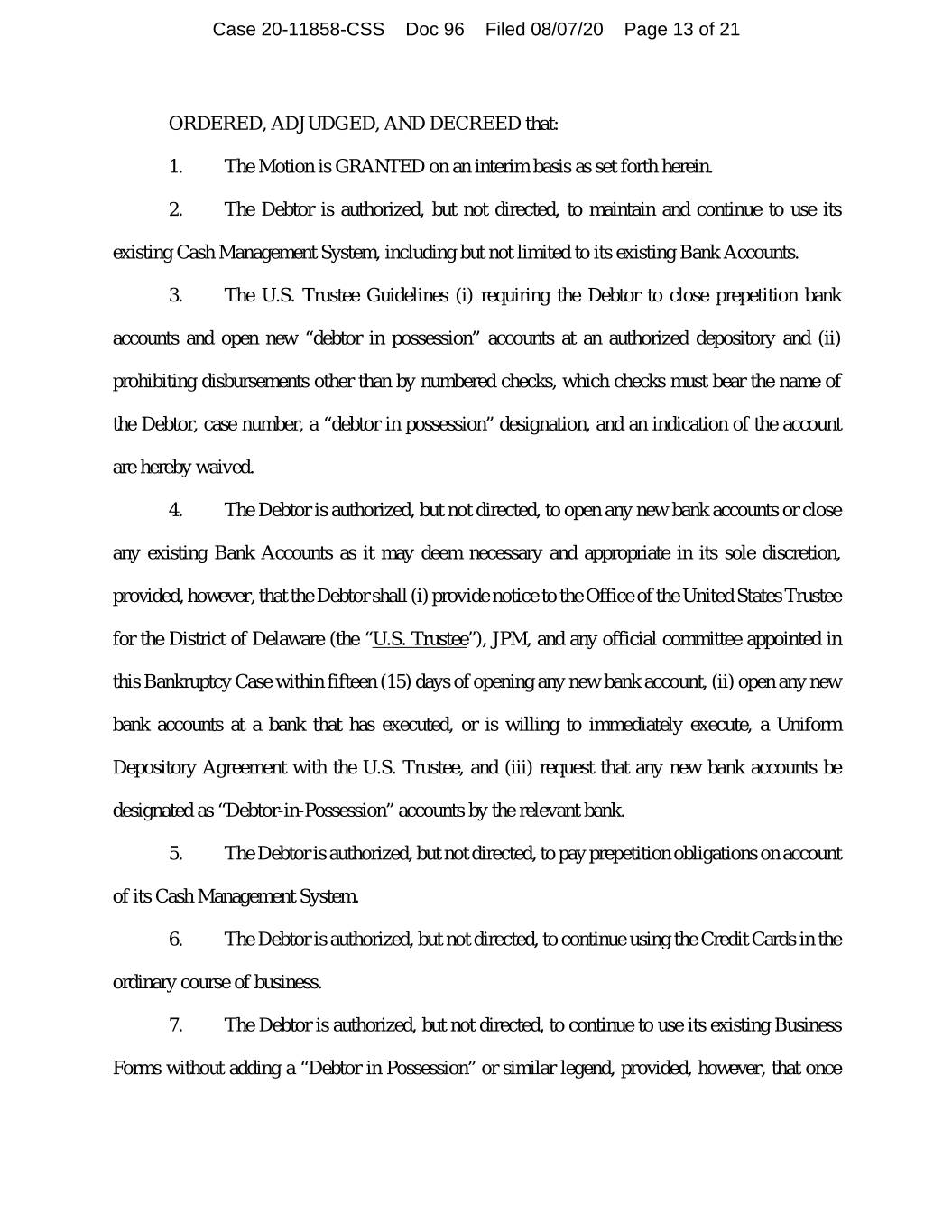

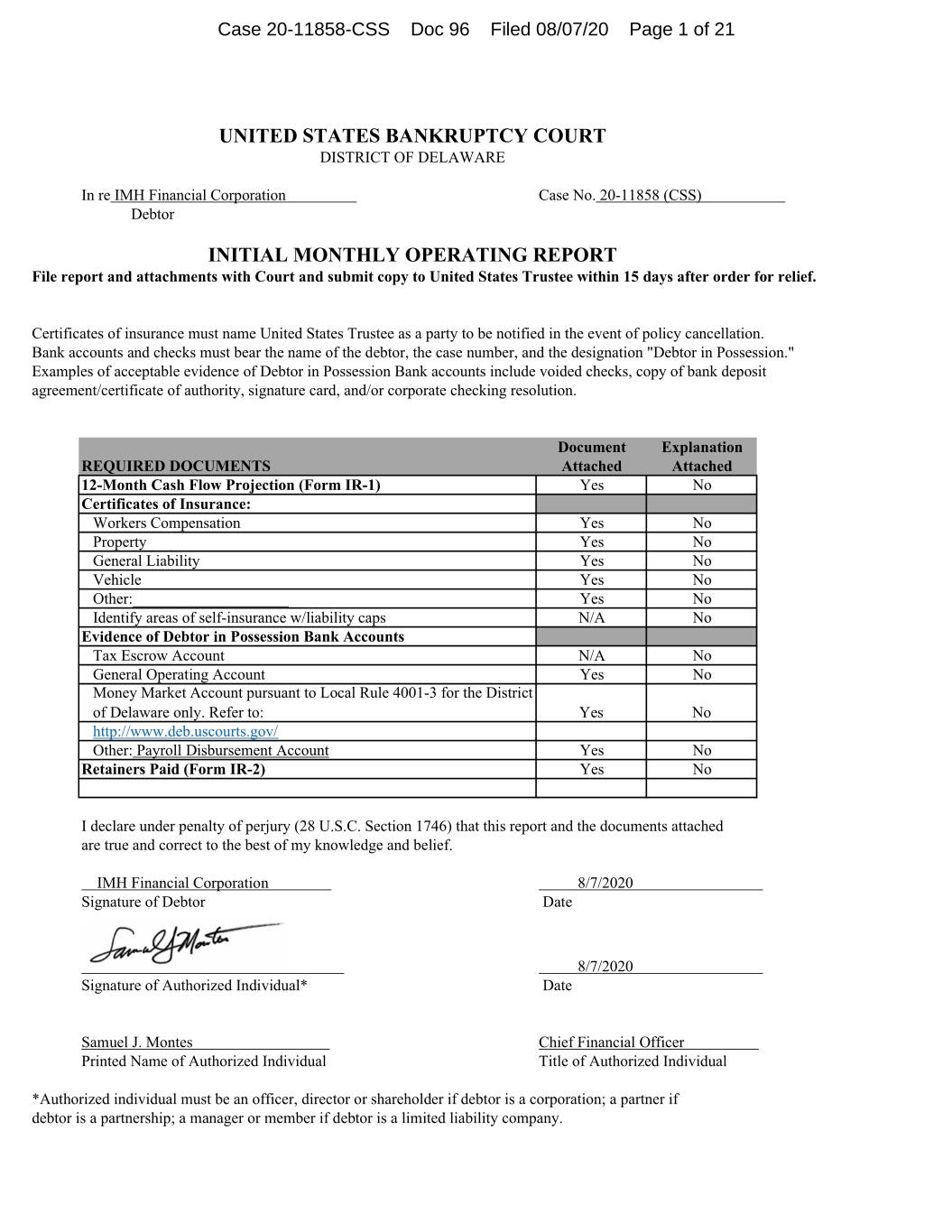

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 2 of 21 IMH Financial Corporation In re: Case No. 20‐11858 (CSS) Debtor CASH FLOW PROJECTIONS FOR THE 12 MONTH PERIOD: rough July 31, 2021August 1, 2020 th 7/24‐31/20 Aug‐20 Sep‐20 Oct‐20 Nov‐20 Dec‐20 Jan‐21 Feb‐21 Mar‐21 Apr‐21 May‐21 Jun‐21 Jul‐21 Totals Actual Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Cash Beginning of Period $ $ 222 $ 1,342 $ $ $ $ 731 7372,182 5,283 $ 5,232 $ 4,788 $ $ $ $ 3,524 4,804 4,468 4,041 4,171 $ 222 RECEIPTS Cash Sales ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Accounts Receivable ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Loans and Advances 1,805 1,238 2,179 2,969 80,309 ‐ ‐ ‐ ‐ ‐ ‐ 1,000 ‐ 89,500 Sale of Assets ‐ 190 ‐ ‐ 1,050 803 ‐ ‐ 1,710 ‐ ‐ ‐ ‐ 3,753 Mortgage investment income ‐ ‐ ‐ 95 5 100 5 5 100 5 5 100 5 427 Other ‐ Release of Lender Restricted Funds ‐ ‐ ‐ ‐ 2,405 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 2,405 TOTAL RECEIPTS 1,805 1,428 2,179 3,064 83,769 808 100 5 1,715 100 5 1,005 100 96,084 DISBURSEMENTS Net Payroll 80 262 262 262 874 241 312 913 213 213 213 213 213 4,268 Payroll Taxes ‐ 47 47 47 122 45 47 128 42 42 42 42 42 692 Sales, Use and Other Taxes ‐ ‐ 40 ‐ 18 40 ‐ 40 ‐ ‐ ‐ 80 ‐ 218 Inventory Purchases ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Secured/Rental/Leases ‐ 21 21 21 21 15 15 15 15 15 15 15 15 207 Insurance ‐ 45 14 14 646 14 13 13 13 13 13 357 1,17013 Administrative & Selling ‐ 199 240 120 152 112 96 99 91 93 88 107 1,49294 Professional Fees (ordinary course) ‐ 98 131 3,209 71 392 61 61 61 61 61 61 4,30236 Other ‐ MacArthur deficit funding and Cap Ex ‐ 553 409 356 369 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 1,687 Other ‐ Hotel Fund Preferred Member Distributions ‐ 131 131 22,631 131 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 23,025 Other ‐ MacArthur Debt Service ‐ 275 275 37,275 275 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 38,101 ‐ Other ‐ Preferred Shareholder Redemption ‐ ‐ ‐ ‐ 8,912 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 8,912 Other ‐ Common Shareholder Redemption ‐ ‐ ‐ ‐ 5,755 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 5,755 ‐ Professional Fees ‐ Restructuring 605 406 603 276 432 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 2,322 US Trustee Fees ‐ ‐ ‐ 46 250 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 296 Court Costs ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ TOTAL DISBURSEMENTS 685 2,039 2,173 1,620 80,667 859 545 1,269 435 436 432 875 413 92,447 NET CASH FLOW 1,120 (611) 6 1,445 3,102 (51) (444) (1,264) 1,280 (336) (426) 130 (312) 3,637 (Receipts Less Disbursements) Cash End of Period $ 1,342 $ $ $ $ $ $ 731 7372,182 5,283 5,232 $ 4,788 $ 3,524 $ $ $ $ 4,804 4,468 4,041 4,171 $ 3,859 3,859 Note: The above forecast has been prepared on a conservative basis and is subject to change based on actual performance.

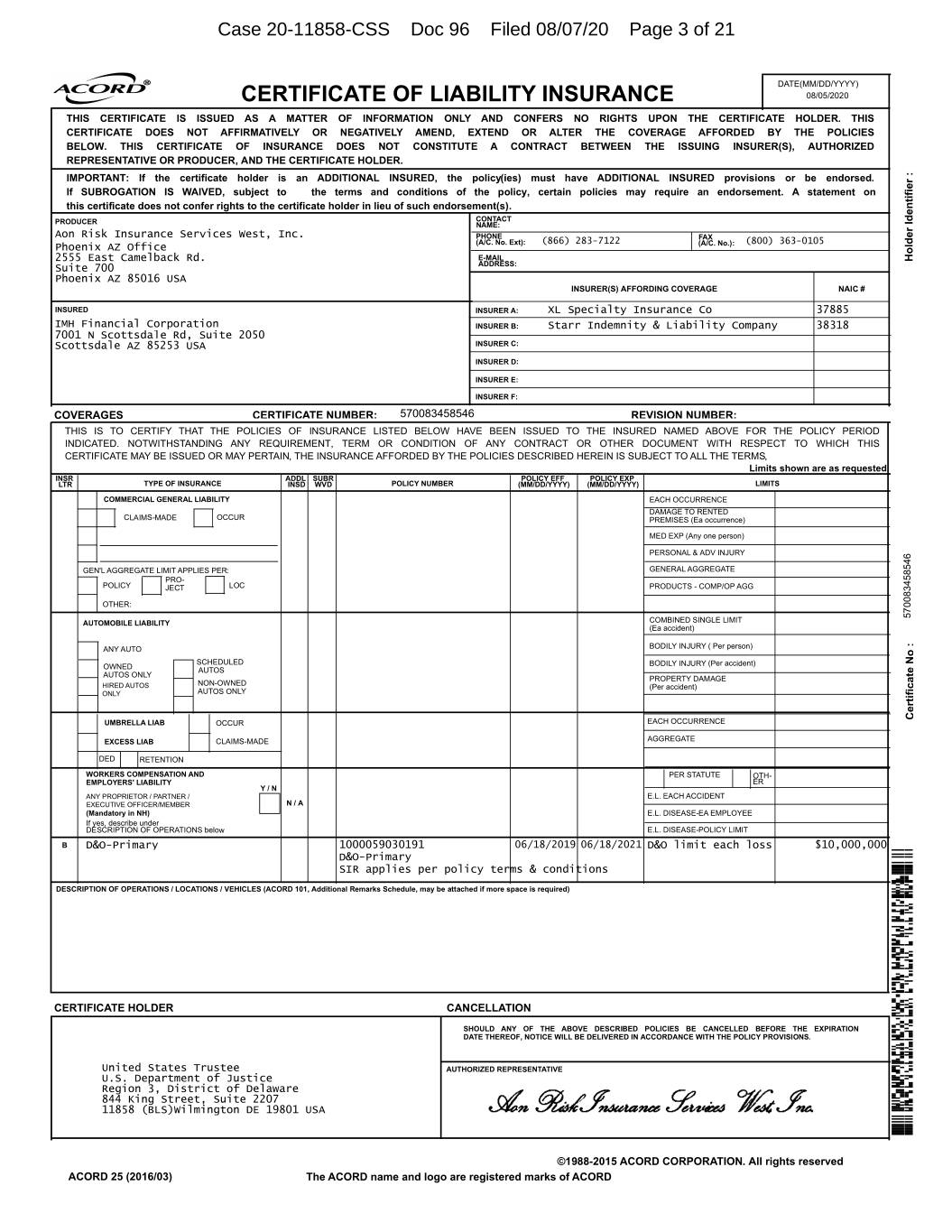

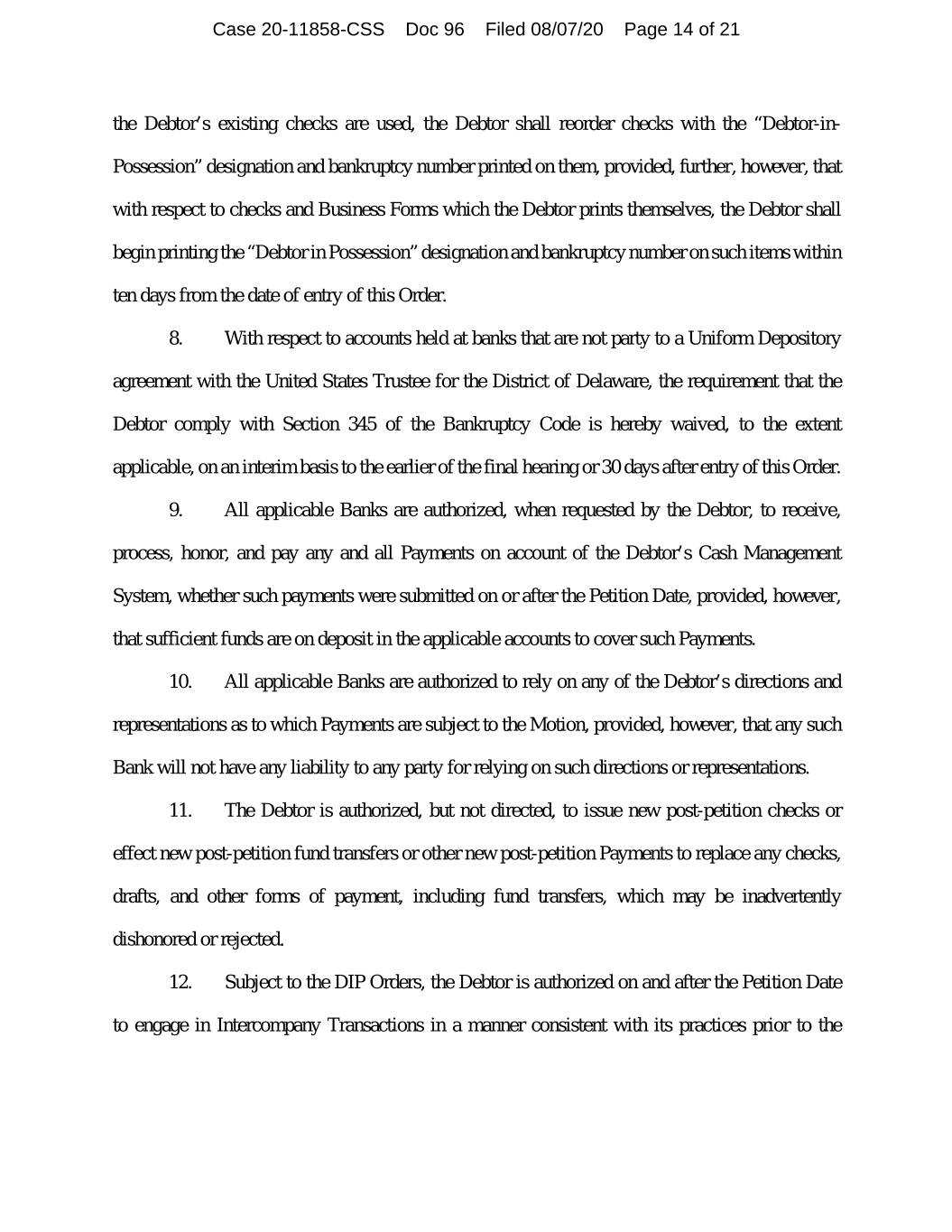

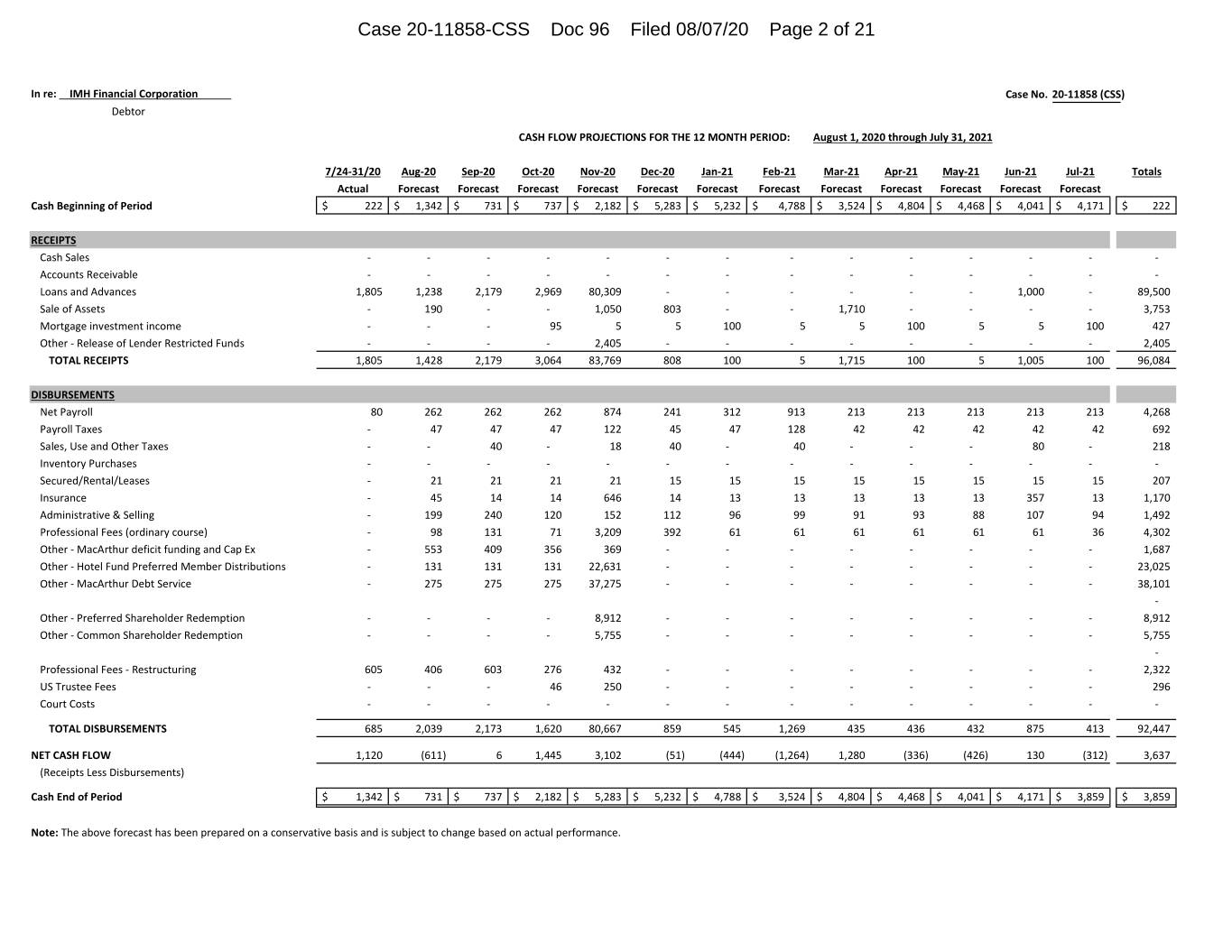

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 3 of 21 DATE(MM/DD/YYYY) CERTIFICATE OF LIABILITY INSURANCE 08/05/2020 THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s). CONTACT PRODUCER NAME: Aon Risk Insurance Services West, Inc. PHONE (866) 283-7122 FAX (800) 363-0105 Phoenix AZ Office (A/C. No. Ext): (A/C. No.): 2555 East Camelback Rd. E-MAIL Holder Identifier : Suite 700 ADDRESS: Phoenix AZ 85016 USA INSURER(S) AFFORDING COVERAGE NAIC # INSURED INSURER A: XL Specialty Insurance Co 37885 IMH Financial Corporation INSURER B: Starr Indemnity & Liability Company 38318 7001 N Scottsdale Rd, Suite 2050 Scottsdale AZ 85253 USA INSURER C: INSURER D: INSURER E: INSURER F: COVERAGES CERTIFICATE NUMBER: 570083458546 REVISION NUMBER: THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, Limits shown are as requested INSR ADDL SUBR POLICY EFF POLICY EXP LTR TYPE OF INSURANCE INSD WVD POLICY NUMBER (MM/DD/YYYY) (MM/DD/YYYY) LIMITS COMMERCIAL GENERAL LIABILITY EACH OCCURRENCE DAMAGE TO RENTED CLAIMS-MADE OCCUR PREMISES (Ea occurrence) MED EXP (Any one person) PERSONAL & ADV INJURY GEN'L AGGREGATE LIMIT APPLIES PER: GENERAL AGGREGATE PRO- POLICY JECT LOC PRODUCTS - COMP/OP AGG OTHER: AUTOMOBILE LIABILITY COMBINED SINGLE LIMIT 570083458546 (Ea accident) ANY AUTO BODILY INJURY ( Per person) SCHEDULED BODILY INJURY (Per accident) OWNED AUTOS AUTOS ONLY PROPERTY DAMAGE HIRED AUTOS NON-OWNED (Per accident) ONLY AUTOS ONLY UMBRELLA LIAB OCCUR EACH OCCURRENCE Certificate No : EXCESS LIAB CLAIMS-MADE AGGREGATE DED RETENTION WORKERS COMPENSATION AND PER STATUTE OTH- EMPLOYERS' LIABILITY ER Y / N ANY PROPRIETOR / PARTNER / E.L. EACH ACCIDENT EXECUTIVE OFFICER/MEMBER N / A (Mandatory in NH) E.L. DISEASE-EA EMPLOYEE If yes, describe under DESCRIPTION OF OPERATIONS below E.L. DISEASE-POLICY LIMIT B D&O-Primary 1000059030191 06/18/2019 06/18/2021 D&O limit each loss $10,000,000 D&O-Primary SIR applies per policy terms & conditions DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) CERTIFICATE HOLDER CANCELLATION SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. United States Trustee AUTHORIZED REPRESENTATIVE U.S. Department of Justice Region 3, District of Delaware 844 King Street, Suite 2207 11858 (BLS)Wilmington DE 19801 USA 7777777707070700077763616065553330763717665026645607762117550534310072771546055211020746153623255402207345155607631200076326022746355560762640371032170007726011750074512077727252025773110777777707000707007 6666666606060600062606466204446200622200426004220206200226260242222060222260402422200622220624204200006220004060042202062220260422420000622000406006200206220006042242000066646062240664440666666606000606006 ©1988-2015 ACORD CORPORATION. All rights reserved ACORD 25 (2016/03) The ACORD name and logo are registered marks of ACORD

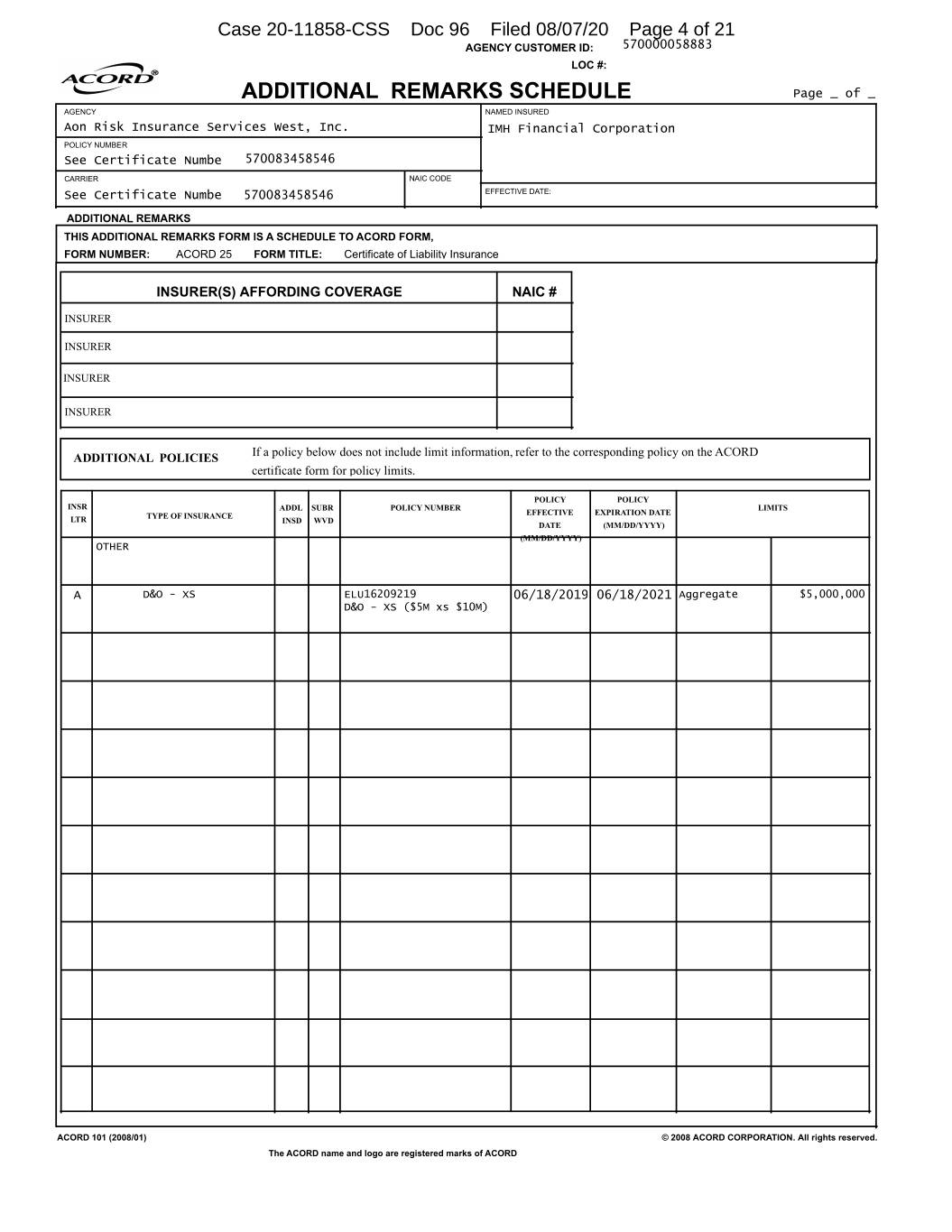

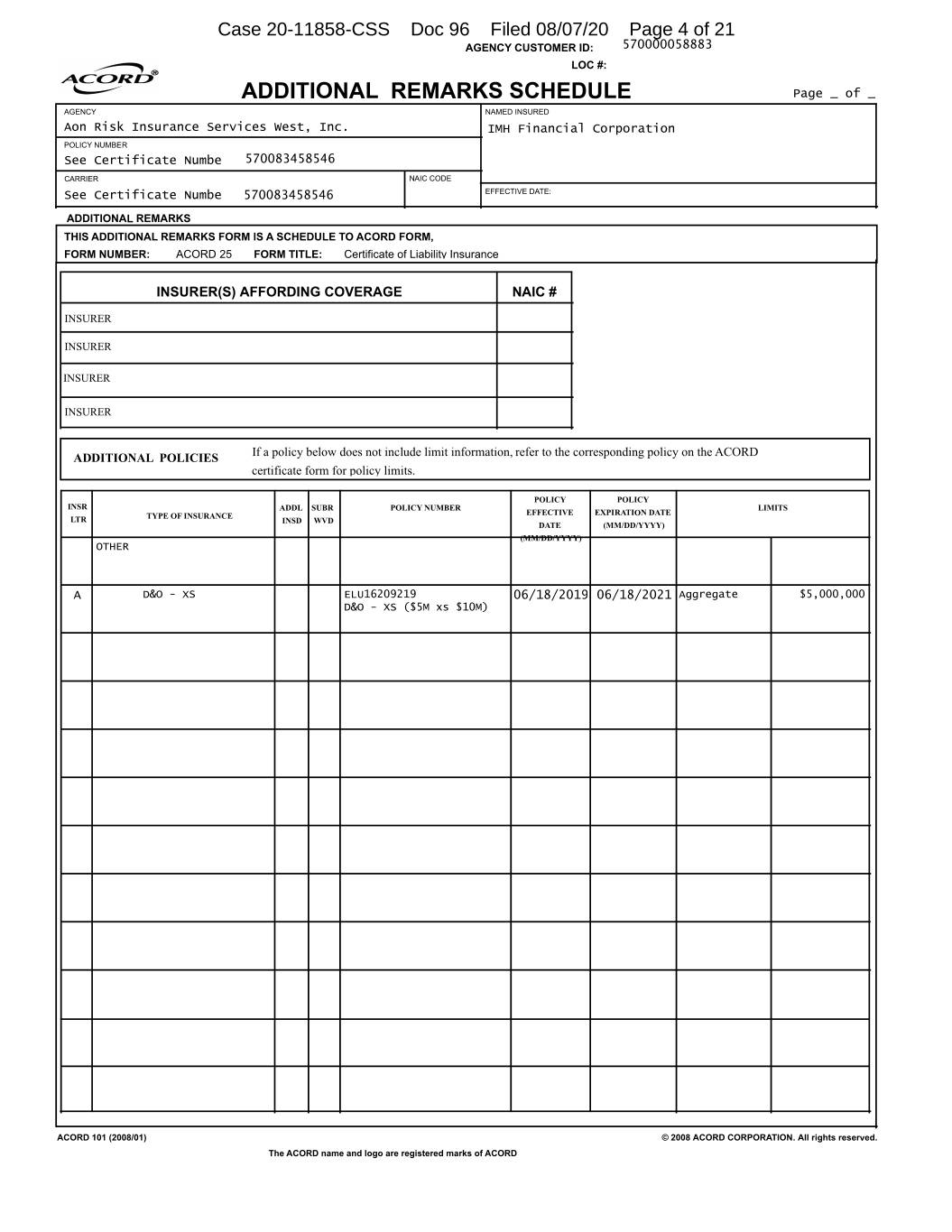

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 4 of 21 AGENCY CUSTOMER ID: 570000058883 LOC #: ADDITIONAL REMARKS SCHEDULE Page _ of _ AGENCY NAMED INSURED Aon Risk Insurance Services West, Inc. IMH Financial Corporation POLICY NUMBER See Certificate Numbe 570083458546 CARRIER NAIC CODE See Certificate Numbe 570083458546 EFFECTIVE DATE: ADDITIONAL REMARKS THIS ADDITIONAL REMARKS FORM IS A SCHEDULE TO ACORD FORM, FORM NUMBER: ACORD 25 FORM TITLE: Certificate of Liability Insurance INSURER(S) AFFORDING COVERAGE NAIC # INSURER INSURER INSURER INSURER ADDITIONAL POLICIES If a policy below does not include limit information, refer to the corresponding policy on the ACORD certificate form for policy limits. POLICY POLICY INSR ADDL SUBR POLICY NUMBER LIMITS TYPE OF INSURANCE EFFECTIVE EXPIRATION DATE LTR INSD WVD DATE (MM/DD/YYYY) (MM/DD/YYYY) OTHER A D&O - XS ELU16209219 06/18/2019 06/18/2021 Aggregate $5,000,000 D&O - XS ($5M xs $10M) ACORD 101 (2008/01) © 2008 ACORD CORPORATION. All rights reserved. The ACORD name and logo are registered marks of ACORD

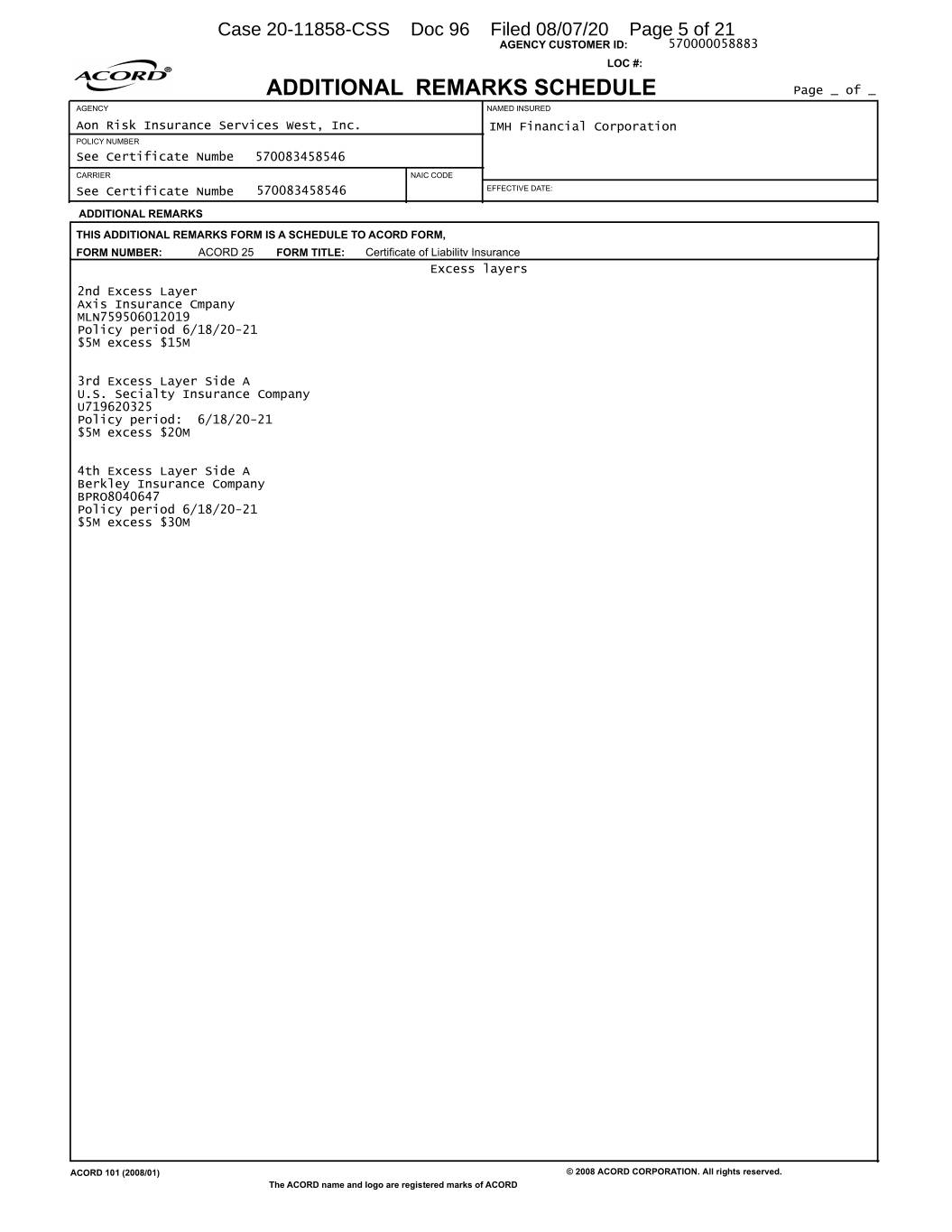

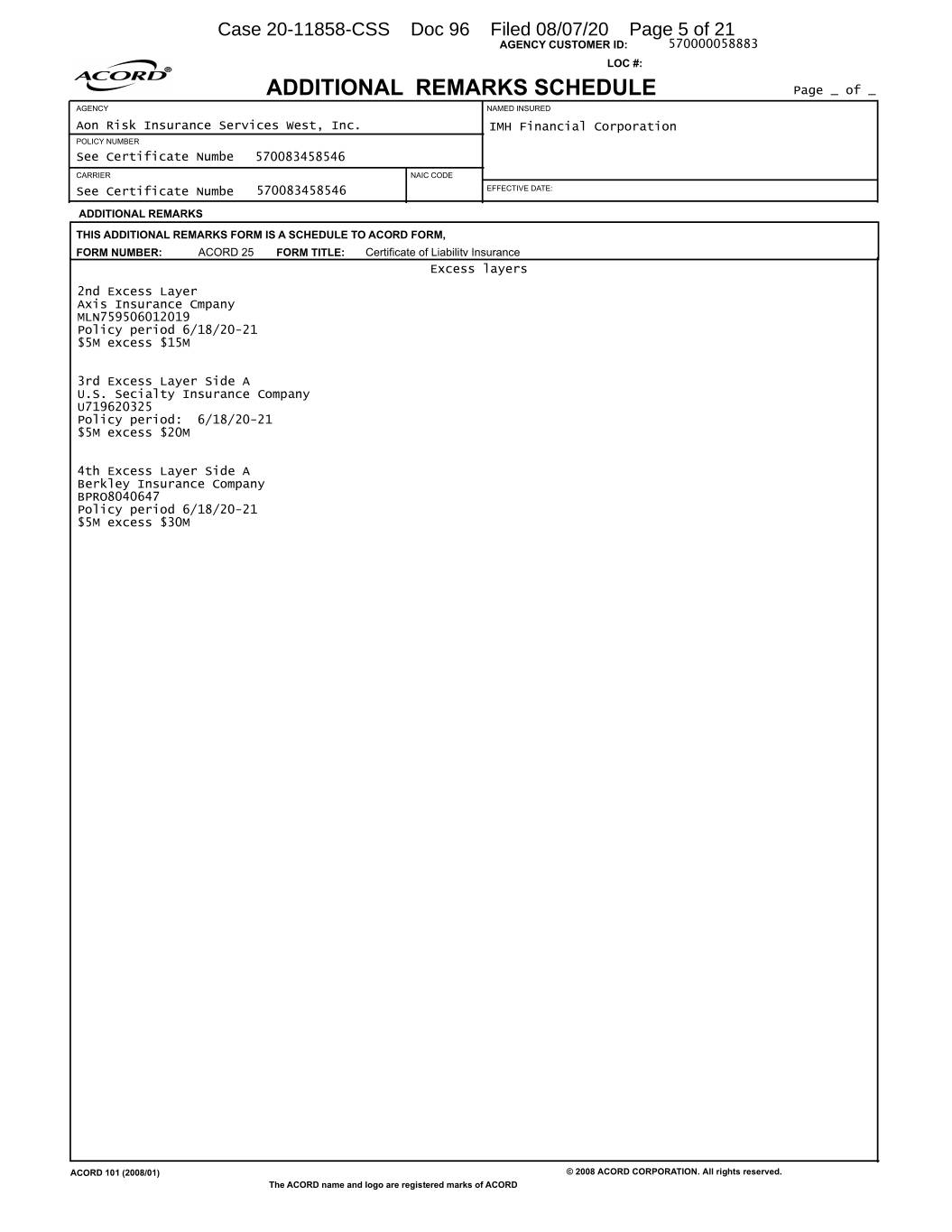

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 5 of 21 AGENCY CUSTOMER ID: 570000058883 LOC #: ADDITIONAL REMARKS SCHEDULE Page _ of _ AGENCY NAMED INSURED Aon Risk Insurance Services West, Inc. IMH Financial Corporation POLICY NUMBER See Certificate Numbe 570083458546 CARRIER NAIC CODE See Certificate Numbe 570083458546 EFFECTIVE DATE: ADDITIONAL REMARKS THIS ADDITIONAL REMARKS FORM IS A SCHEDULE TO ACORD FORM, FORM NUMBER: ACORD 25 FORM TITLE: Certificate of Liability Insurance Excess layers 2nd Excess Layer Axis Insurance Cmpany MLN759506012019 Policy period 6/18/20-21 $5M excess $15M 3rd Excess Layer Side A U.S. Secialty Insurance Company U719620325 Policy period: 6/18/20-21 $5M excess $20M 4th Excess Layer Side A Berkley Insurance Company BPRO8040647 Policy period 6/18/20-21 $5M excess $30M ACORD 101 (2008/01) © 2008 ACORD CORPORATION. All rights reserved. The ACORD name and logo are registered marks of ACORD

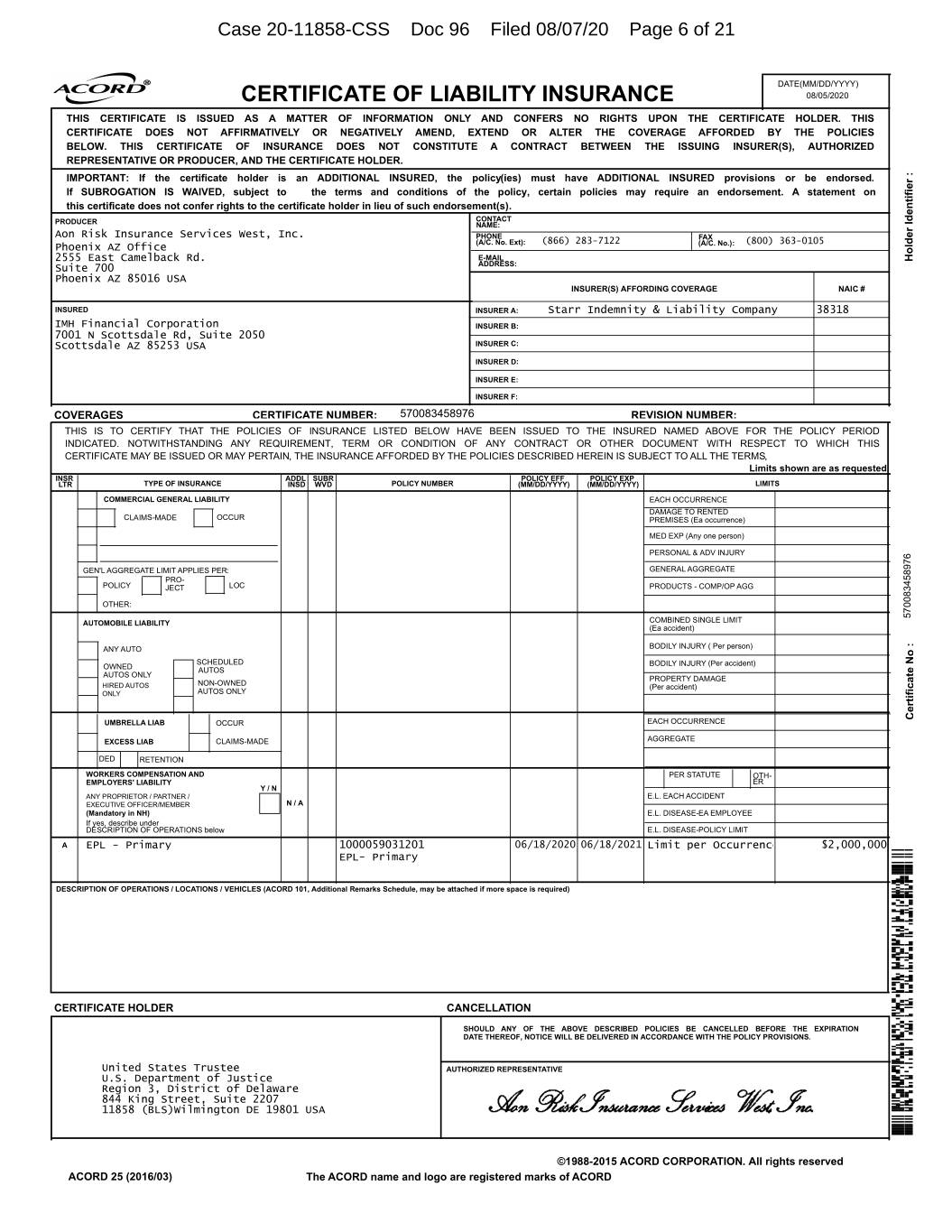

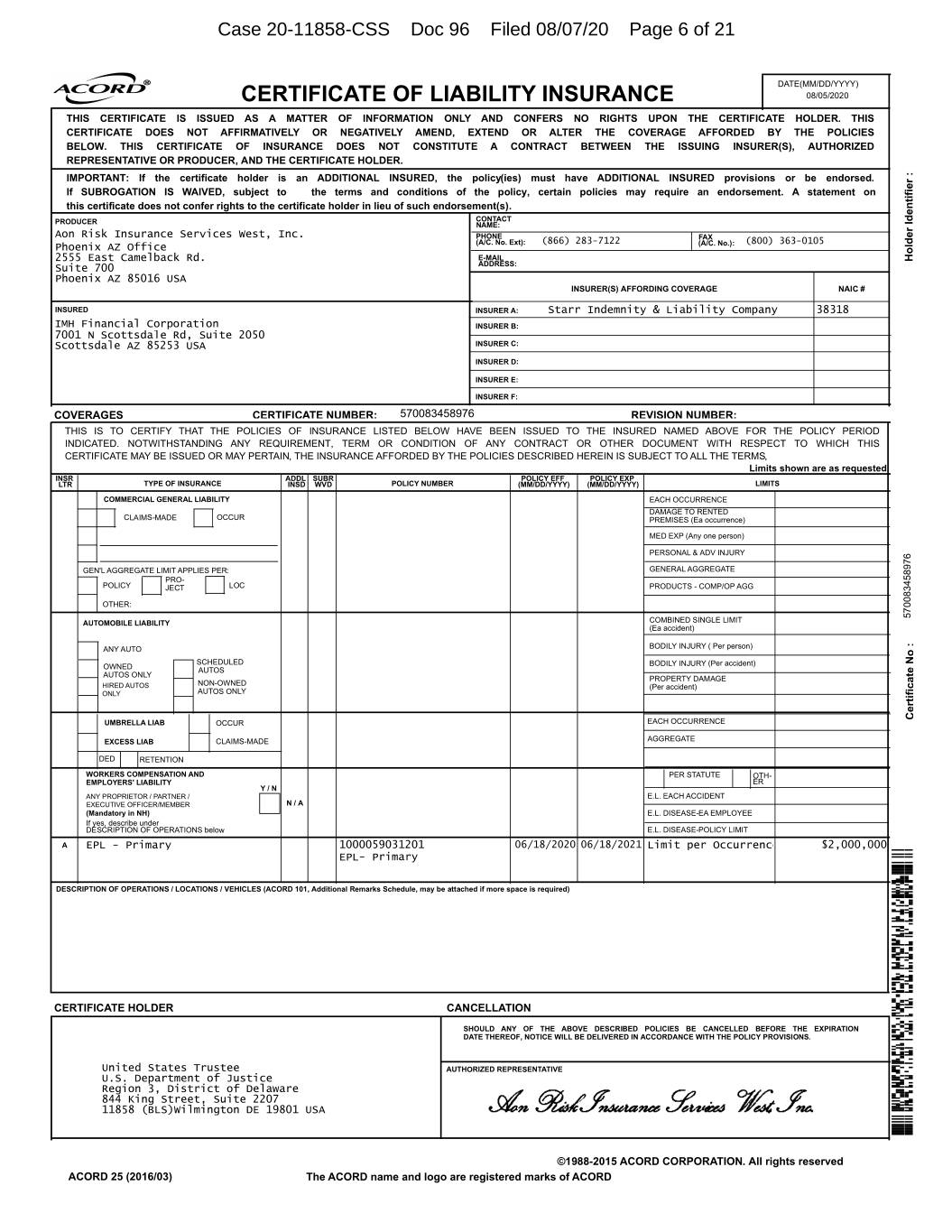

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 6 of 21 DATE(MM/DD/YYYY) CERTIFICATE OF LIABILITY INSURANCE 08/05/2020 THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s). CONTACT PRODUCER NAME: Aon Risk Insurance Services West, Inc. PHONE (866) 283-7122 FAX (800) 363-0105 Phoenix AZ Office (A/C. No. Ext): (A/C. No.): 2555 East Camelback Rd. E-MAIL Holder Identifier : Suite 700 ADDRESS: Phoenix AZ 85016 USA INSURER(S) AFFORDING COVERAGE NAIC # INSURED INSURER A: Starr Indemnity & Liability Company 38318 IMH Financial Corporation INSURER B: 7001 N Scottsdale Rd, Suite 2050 Scottsdale AZ 85253 USA INSURER C: INSURER D: INSURER E: INSURER F: COVERAGES CERTIFICATE NUMBER: 570083458976 REVISION NUMBER: THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, Limits shown are as requested INSR ADDL SUBR POLICY EFF POLICY EXP LTR TYPE OF INSURANCE INSD WVD POLICY NUMBER (MM/DD/YYYY) (MM/DD/YYYY) LIMITS COMMERCIAL GENERAL LIABILITY EACH OCCURRENCE DAMAGE TO RENTED CLAIMS-MADE OCCUR PREMISES (Ea occurrence) MED EXP (Any one person) PERSONAL & ADV INJURY GEN'L AGGREGATE LIMIT APPLIES PER: GENERAL AGGREGATE PRO- POLICY JECT LOC PRODUCTS - COMP/OP AGG OTHER: AUTOMOBILE LIABILITY COMBINED SINGLE LIMIT 570083458976 (Ea accident) ANY AUTO BODILY INJURY ( Per person) SCHEDULED BODILY INJURY (Per accident) OWNED AUTOS AUTOS ONLY PROPERTY DAMAGE HIRED AUTOS NON-OWNED (Per accident) ONLY AUTOS ONLY UMBRELLA LIAB OCCUR EACH OCCURRENCE Certificate No : EXCESS LIAB CLAIMS-MADE AGGREGATE DED RETENTION WORKERS COMPENSATION AND PER STATUTE OTH- EMPLOYERS' LIABILITY ER Y / N ANY PROPRIETOR / PARTNER / E.L. EACH ACCIDENT EXECUTIVE OFFICER/MEMBER N / A (Mandatory in NH) E.L. DISEASE-EA EMPLOYEE If yes, describe under DESCRIPTION OF OPERATIONS below E.L. DISEASE-POLICY LIMIT A EPL - Primary 1000059031201 06/18/2020 06/18/2021 Limit per Occurrence $2,000,000 EPL- Primary DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) CERTIFICATE HOLDER CANCELLATION SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. United States Trustee AUTHORIZED REPRESENTATIVE U.S. Department of Justice Region 3, District of Delaware 844 King Street, Suite 2207 11858 (BLS)Wilmington DE 19801 USA 7777777707070700077763616065553330763717665026645607762117550534310072771546055211020746153623255402207345155607631200076326022746355560762640371032170007362011750034512077727252025773110777777707000707007 6666666606060600062606466204446200620200626004002006002006262060000060002242622602000620000606224200006202224062262002062202042622402220622000606204000206202226242042222066646062240664440666666606000606006 ©1988-2015 ACORD CORPORATION. All rights reserved ACORD 25 (2016/03) The ACORD name and logo are registered marks of ACORD

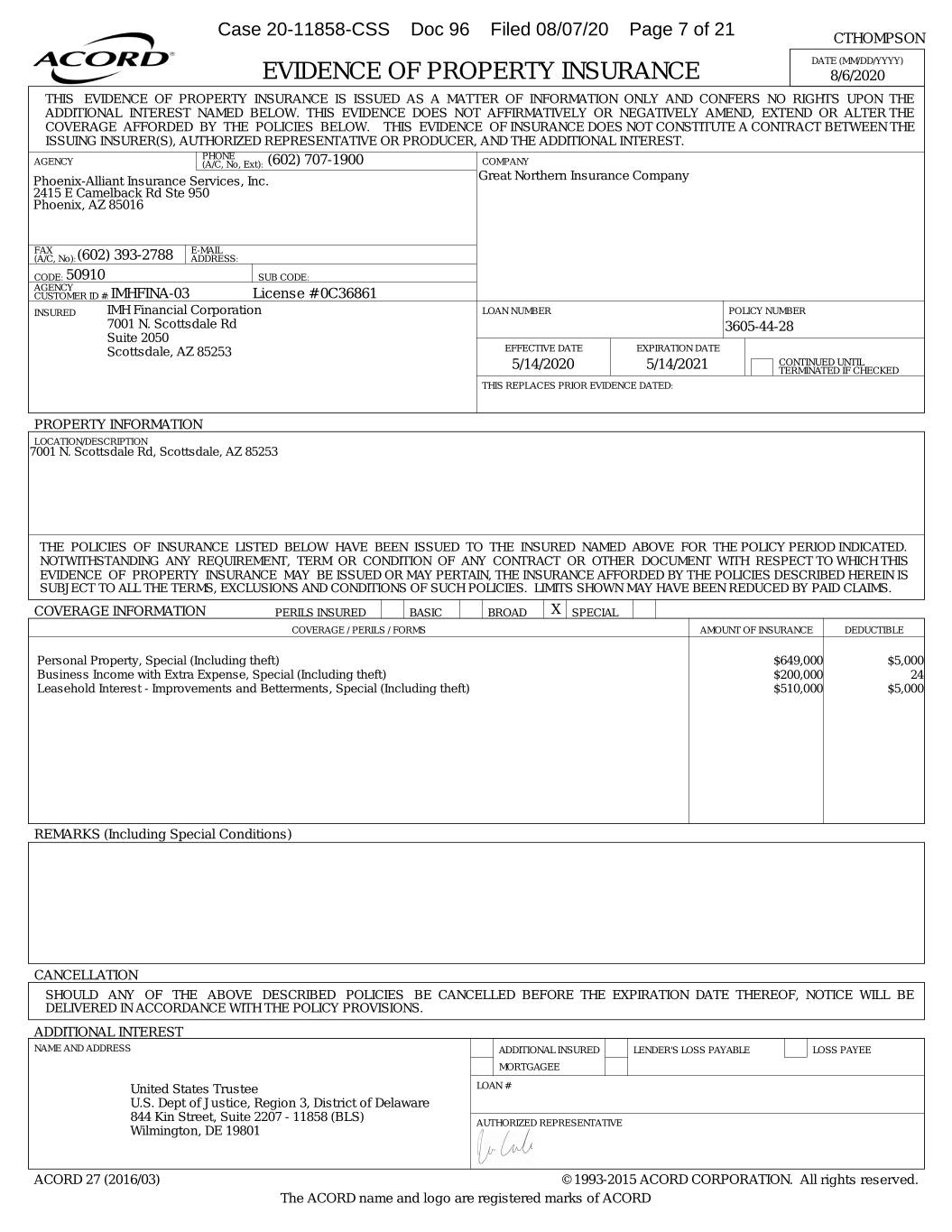

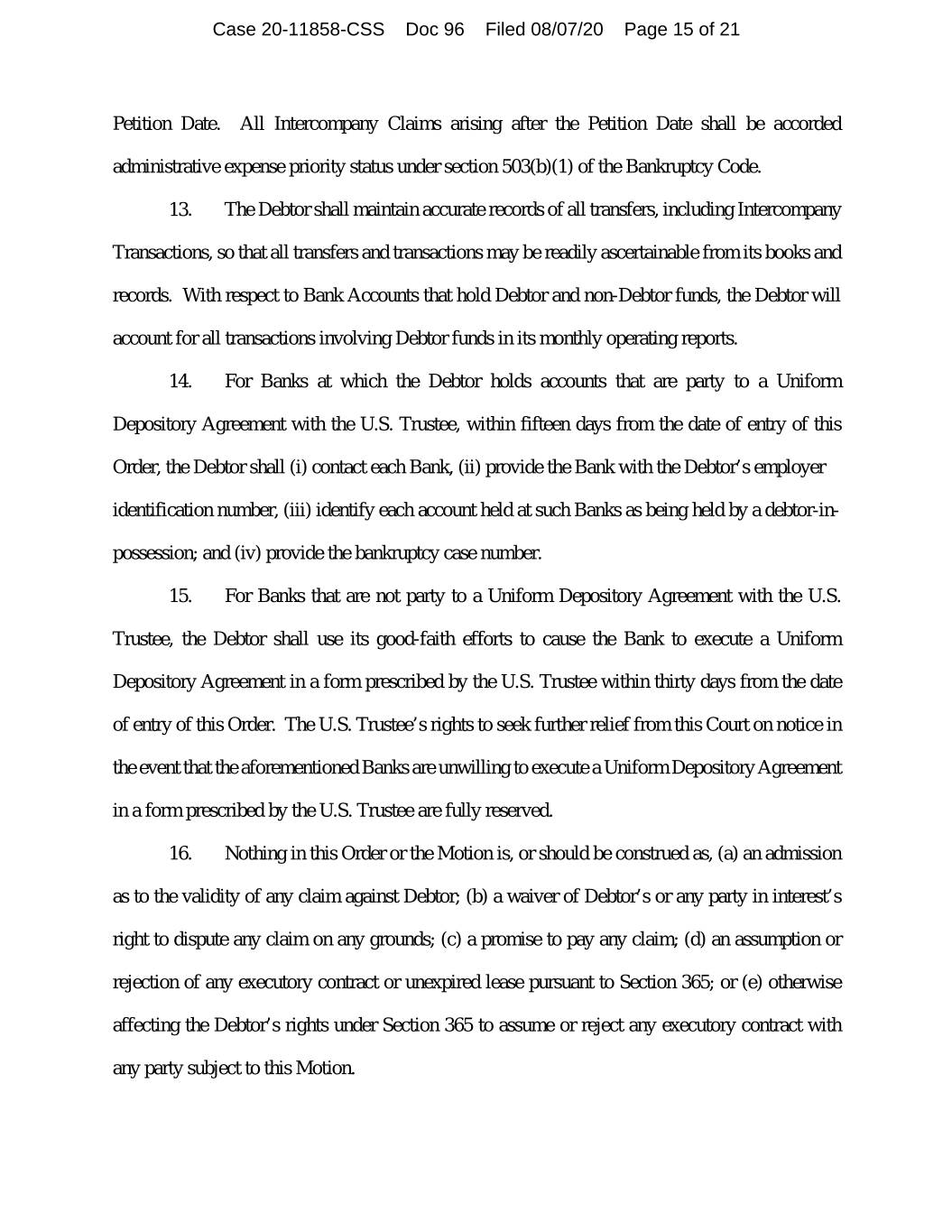

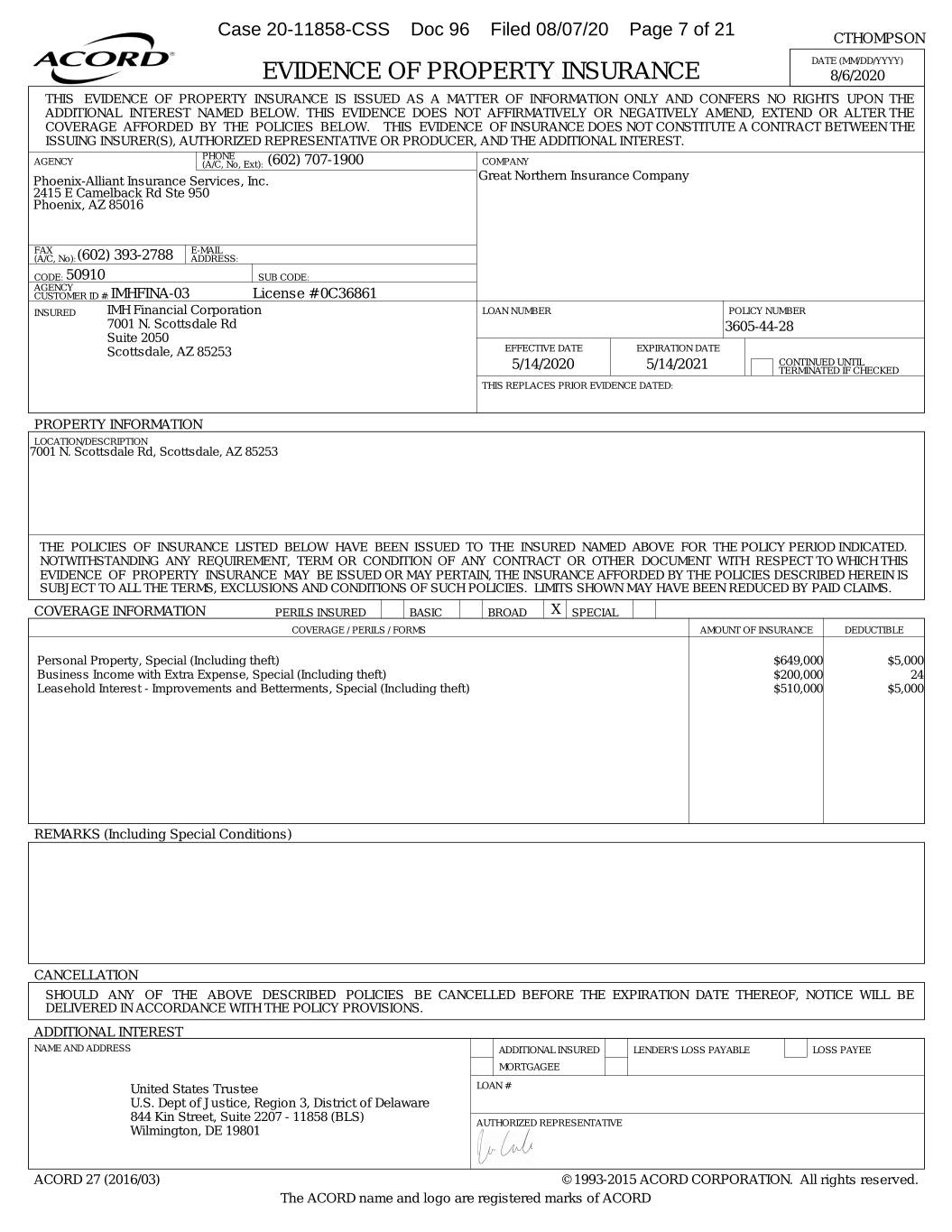

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 7 of 21 CTHOMPSON DATE (MM/DD/YYYY) EVIDENCE OF PROPERTY INSURANCE 8/6/2020 THIS EVIDENCE OF PROPERTY INSURANCE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE ADDITIONAL INTEREST NAMED BELOW. THIS EVIDENCE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS EVIDENCE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE ADDITIONAL INTEREST. PHONE AGENCY (A/C, No, Ext): (602) 707-1900 COMPANY Phoenix-Alliant Insurance Services, Inc. Great Northern Insurance Company 2415 E Camelback Rd Ste 950 Phoenix, AZ 85016 FAX E-MAIL (A/C, No):(602) 393-2788 ADDRESS: CODE: 50910 SUB CODE: AGENCY CUSTOMER ID #: IMHFINA-03 License # 0C36861 INSURED IMH Financial Corporation LOAN NUMBER POLICY NUMBER 7001 N. Scottsdale Rd 3605-44-28 Suite 2050 Scottsdale, AZ 85253 EFFECTIVE DATE EXPIRATION DATE CONTINUED UNTIL 5/14/2020 5/14/2021 TERMINATED IF CHECKED THIS REPLACES PRIOR EVIDENCE DATED: PROPERTY INFORMATION LOCATION/DESCRIPTION 7001 N. Scottsdale Rd, Scottsdale, AZ 85253 THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS EVIDENCE OF PROPERTY INSURANCE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. COVERAGE INFORMATION PERILS INSURED BASIC BROADX SPECIAL COVERAGE / PERILS / FORMS AMOUNT OF INSURANCE DEDUCTIBLE Personal Property, Special (Including theft) $649,000 $5,000 Business Income with Extra Expense, Special (Including theft) $200,000 24 Leasehold Interest - Improvements and Betterments, Special (Including theft) $510,000 $5,000 REMARKS (Including Special Conditions) CANCELLATION SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. ADDITIONAL INTEREST NAME AND ADDRESS ADDITIONAL INSURED LENDER'S LOSS PAYABLE LOSS PAYEE MORTGAGEE United States Trustee LOAN # U.S. Dept of Justice, Region 3, District of Delaware 844 Kin Street, Suite 2207 - 11858 (BLS) AUTHORIZED REPRESENTATIVE Wilmington, DE 19801 ACORD 27 (2016/03) © 1993-2015 ACORD CORPORATION. All rights reserved. The ACORD name and logo are registered marks of ACORD

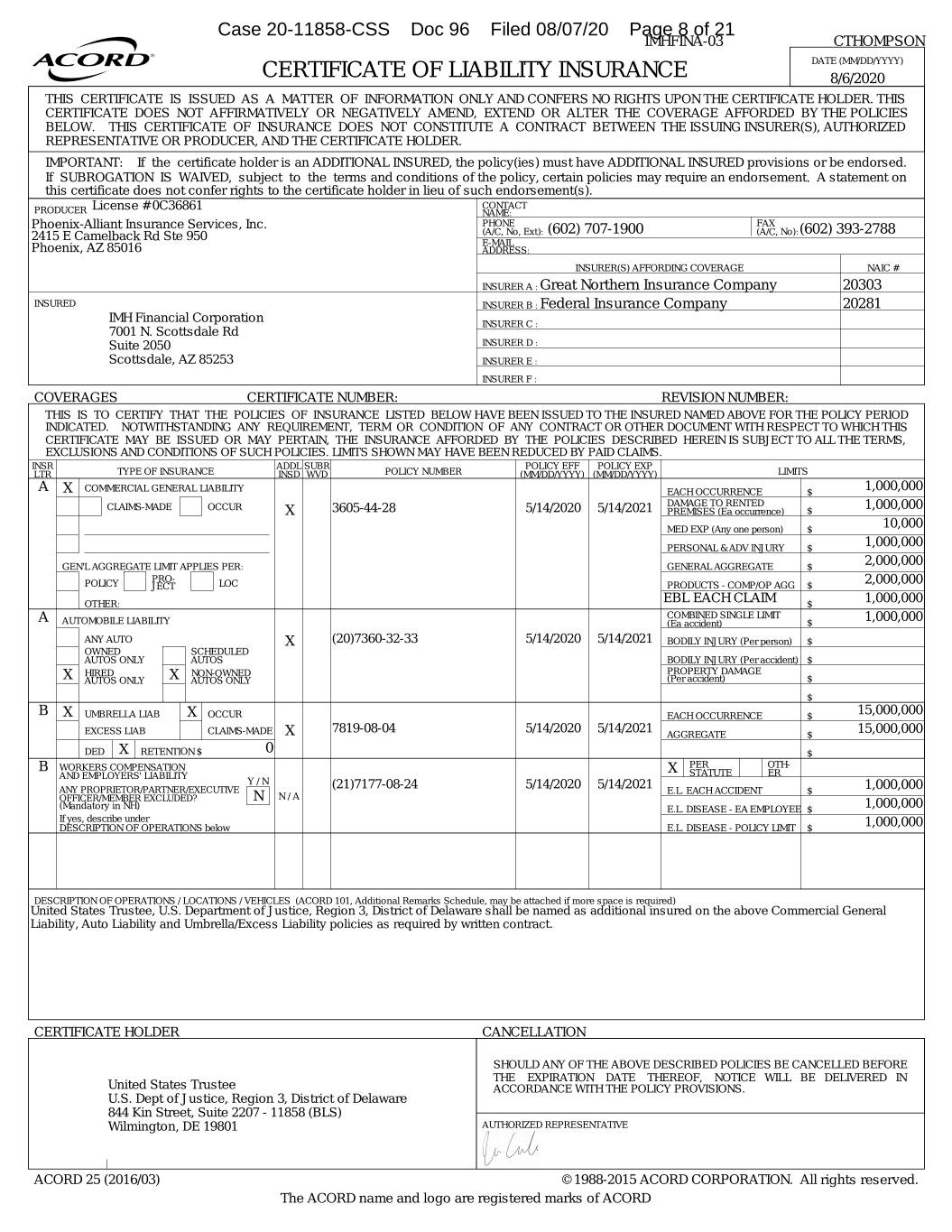

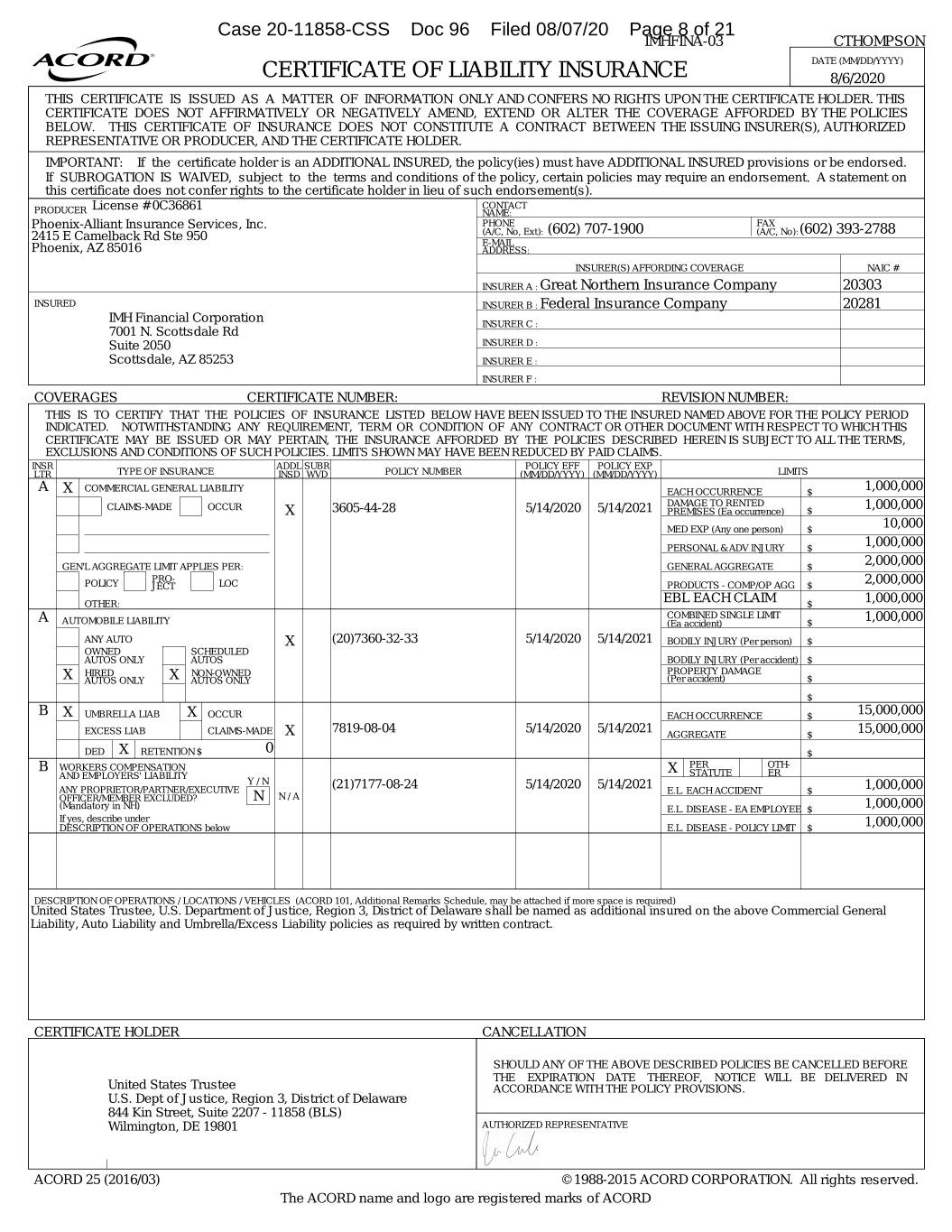

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 8 of 21 IMHFINA-03 CTHOMPSON DATE (MM/DD/YYYY) CERTIFICATE OF LIABILITY INSURANCE 8/6/2020 THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s). License # 0C36861 CONTACT PRODUCER NAME: Phoenix-Alliant Insurance Services, Inc. PHONE (602) 707-1900 FAX (602) 393-2788 2415 E Camelback Rd Ste 950 (A/C, No, Ext): (A/C, No): E-MAIL Phoenix, AZ 85016 ADDRESS: INSURER(S) AFFORDING COVERAGE NAIC # INSURER A : Great Northern Insurance Company 20303 INSURED INSURER B : Federal Insurance Company 20281 IMH Financial Corporation INSURER C : 7001 N. Scottsdale Rd Suite 2050 INSURER D : Scottsdale, AZ 85253 INSURER E : INSURER F : COVERAGES CERTIFICATE NUMBER: REVISION NUMBER: THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. INSR ADDL SUBR POLICY EFF POLICY EXP LTR TYPE OF INSURANCE INSD WVD POLICY NUMBER (MM/DD/YYYY) (MM/DD/YYYY) LIMITS A X COMMERCIAL GENERAL LIABILITY EACH OCCURRENCE $ 1,000,000 DAMAGE TO RENTED 1,000,000 CLAIMS-MADE OCCUR X 3605-44-28 5/14/2020 5/14/2021 PREMISES (Ea occurrence) $ MED EXP (Any one person) $ 10,000 PERSONAL & ADV INJURY $ 1,000,000 GEN'L AGGREGATE LIMIT APPLIES PER: GENERAL AGGREGATE $ 2,000,000 PRO- 2,000,000 POLICY JECT LOC PRODUCTS - COMP/OP AGG $ OTHER: EBL EACH CLAIM $ 1,000,000 COMBINED SINGLE LIMIT 1,000,000 A AUTOMOBILE LIABILITY (Ea accident) $ ANY AUTO X (20)7360-32-33 5/14/2020 5/14/2021 BODILY INJURY (Per person) $ OWNED SCHEDULED AUTOS ONLY AUTOS BODILY INJURY (Per accident) $ HIRED NON-OWNED PROPERTY DAMAGE X AUTOS ONLY X AUTOS ONLY (Per accident) $ $ B X UMBRELLA LIAB X OCCUR EACH OCCURRENCE $ 15,000,000 7819-08-04 5/14/2020 5/14/2021 EXCESS LIAB CLAIMS-MADE X AGGREGATE $ 15,000,000 DED X RETENTION $ 0 $ B WORKERS COMPENSATION X PER OTH- AND EMPLOYERS' LIABILITY STATUTE ER Y / N (21)7177-08-24 5/14/2020 5/14/2021 ANY PROPRIETOR/PARTNER/EXECUTIVE E.L. EACH ACCIDENT $ 1,000,000 OFFICER/MEMBER EXCLUDED? N N / A (Mandatory in NH) E.L. DISEASE - EA EMPLOYEE $ 1,000,000 If yes, describe under DESCRIPTION OF OPERATIONS below E.L. DISEASE - POLICY LIMIT $ 1,000,000 DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) United States Trustee, U.S. Department of Justice, Region 3, District of Delaware shall be named as additional insured on the above Commercial General Liability, Auto Liability and Umbrella/Excess Liability policies as required by written contract. CERTIFICATE HOLDER CANCELLATION SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN United States Trustee ACCORDANCE WITH THE POLICY PROVISIONS. U.S. Dept of Justice, Region 3, District of Delaware 844 Kin Street, Suite 2207 - 11858 (BLS) Wilmington, DE 19801 AUTHORIZED REPRESENTATIVE ACORD 25 (2016/03) © 1988-2015 ACORD CORPORATION. All rights reserved. The ACORD name and logo are registered marks of ACORD

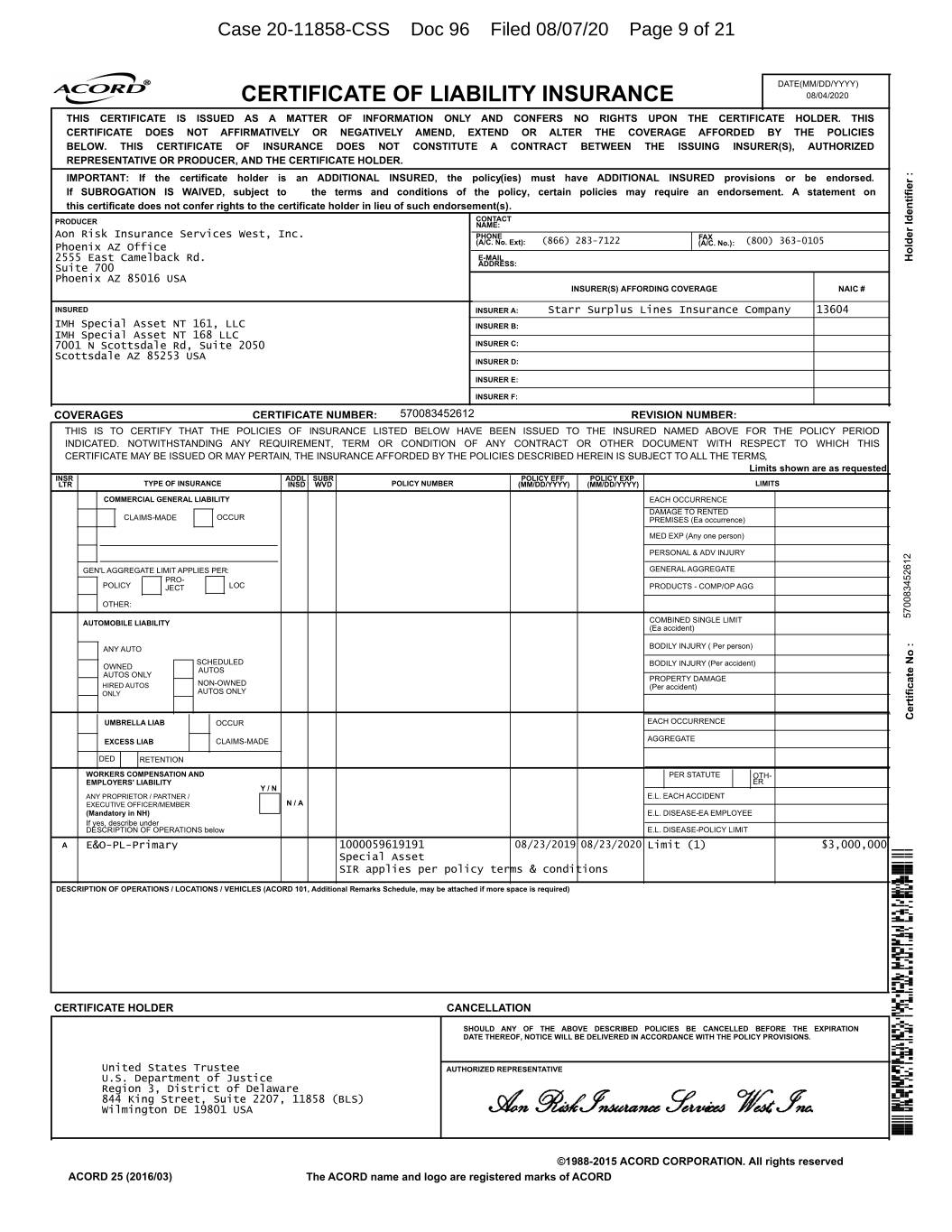

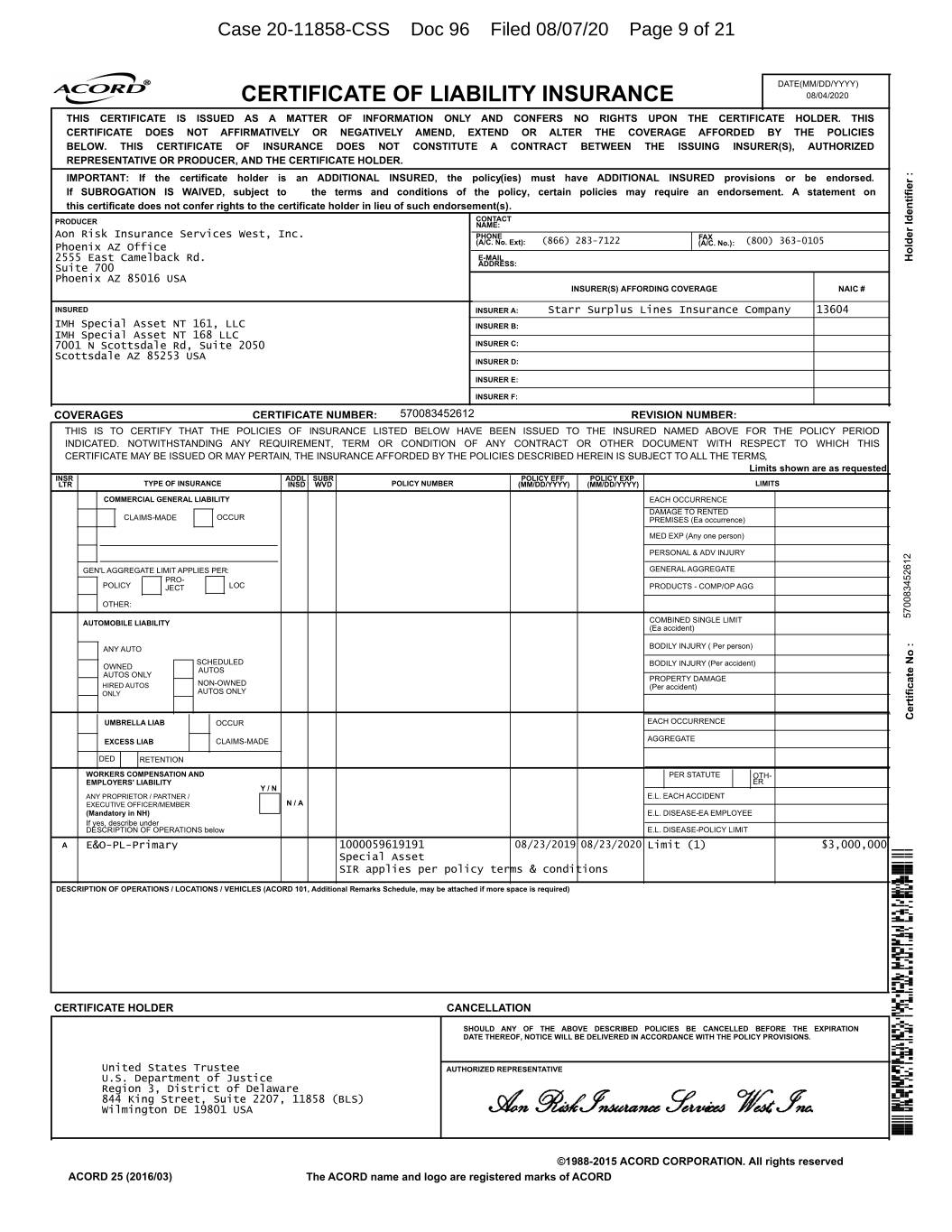

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 9 of 21 DATE(MM/DD/YYYY) CERTIFICATE OF LIABILITY INSURANCE 08/04/2020 THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s). CONTACT PRODUCER NAME: Aon Risk Insurance Services West, Inc. PHONE (866) 283-7122 FAX (800) 363-0105 Phoenix AZ Office (A/C. No. Ext): (A/C. No.): 2555 East Camelback Rd. E-MAIL Holder Identifier : Suite 700 ADDRESS: Phoenix AZ 85016 USA INSURER(S) AFFORDING COVERAGE NAIC # INSURED INSURER A: Starr Surplus Lines Insurance Company 13604 IMH Special Asset NT 161, LLC INSURER B: IMH Special Asset NT 168 LLC 7001 N Scottsdale Rd, Suite 2050 INSURER C: Scottsdale AZ 85253 USA INSURER D: INSURER E: INSURER F: COVERAGES CERTIFICATE NUMBER: 570083452612 REVISION NUMBER: THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, Limits shown are as requested INSR ADDL SUBR POLICY EFF POLICY EXP LTR TYPE OF INSURANCE INSD WVD POLICY NUMBER (MM/DD/YYYY) (MM/DD/YYYY) LIMITS COMMERCIAL GENERAL LIABILITY EACH OCCURRENCE DAMAGE TO RENTED CLAIMS-MADE OCCUR PREMISES (Ea occurrence) MED EXP (Any one person) PERSONAL & ADV INJURY GEN'L AGGREGATE LIMIT APPLIES PER: GENERAL AGGREGATE PRO- POLICY JECT LOC PRODUCTS - COMP/OP AGG OTHER: AUTOMOBILE LIABILITY COMBINED SINGLE LIMIT 570083452612 (Ea accident) ANY AUTO BODILY INJURY ( Per person) SCHEDULED BODILY INJURY (Per accident) OWNED AUTOS AUTOS ONLY PROPERTY DAMAGE HIRED AUTOS NON-OWNED (Per accident) ONLY AUTOS ONLY UMBRELLA LIAB OCCUR EACH OCCURRENCE Certificate No : EXCESS LIAB CLAIMS-MADE AGGREGATE DED RETENTION WORKERS COMPENSATION AND PER STATUTE OTH- EMPLOYERS' LIABILITY ER Y / N ANY PROPRIETOR / PARTNER / E.L. EACH ACCIDENT EXECUTIVE OFFICER/MEMBER N / A (Mandatory in NH) E.L. DISEASE-EA EMPLOYEE If yes, describe under DESCRIPTION OF OPERATIONS below E.L. DISEASE-POLICY LIMIT A E&O-PL-Primary 1000059619191 08/23/2019 08/23/2020 Limit (1) $3,000,000 Special Asset SIR applies per policy terms & conditions DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) CERTIFICATE HOLDER CANCELLATION SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. United States Trustee AUTHORIZED REPRESENTATIVE U.S. Department of Justice Region 3, District of Delaware 844 King Street, Suite 2207, 11858 (BLS) Wilmington DE 19801 USA 7777777707070700077763616065553330763717665026645607762117550534310072771546055211020746153623255402207345155607631200076326022746355560762640371032170007362055310074112077727252025773110777777707000707007 6666666606060600062606466204446200620002406224020006002206262240002060200262602400000600002404026220206020026262240222062002240622600200600202626004200006222024040240020066646062240664440666666606000606006 ©1988-2015 ACORD CORPORATION. All rights reserved ACORD 25 (2016/03) The ACORD name and logo are registered marks of ACORD

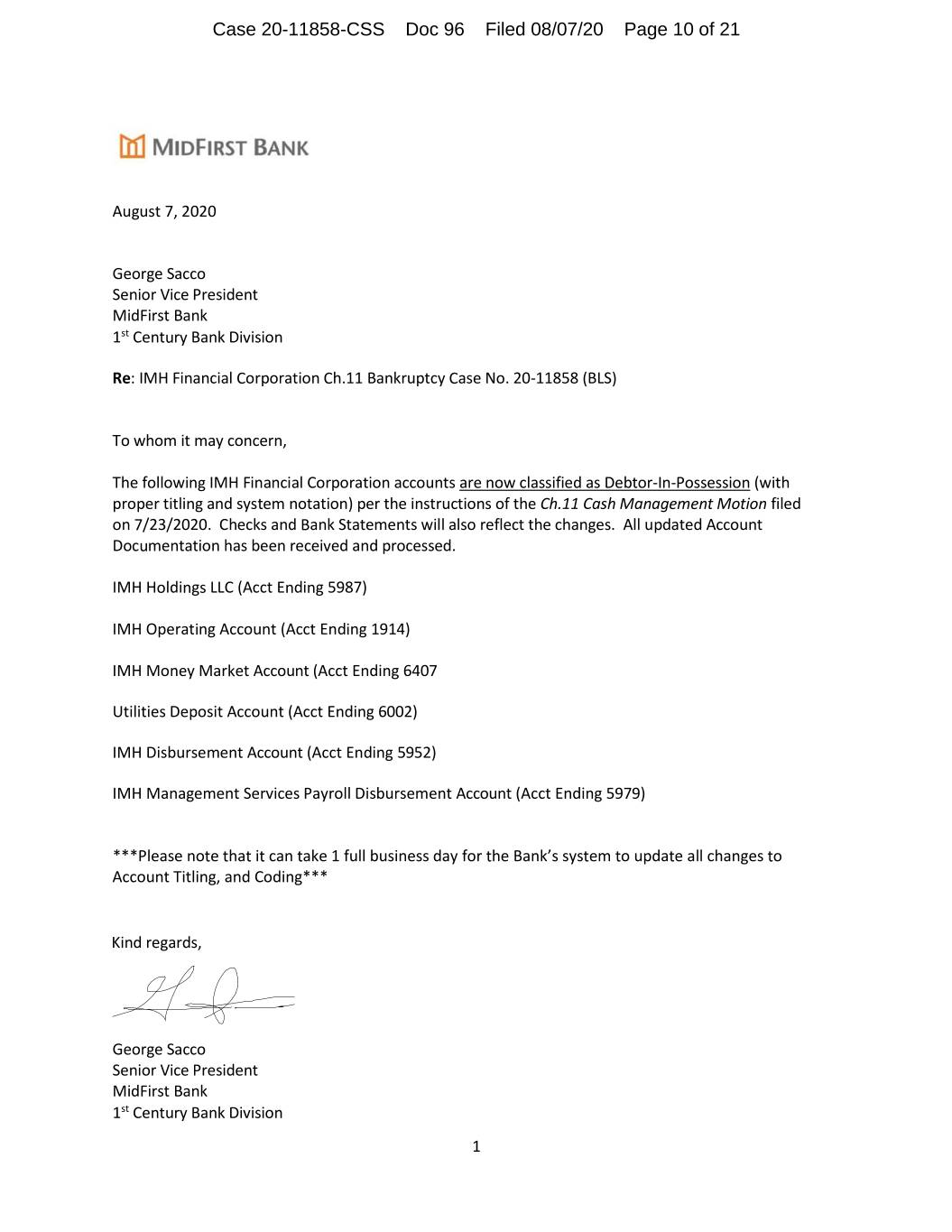

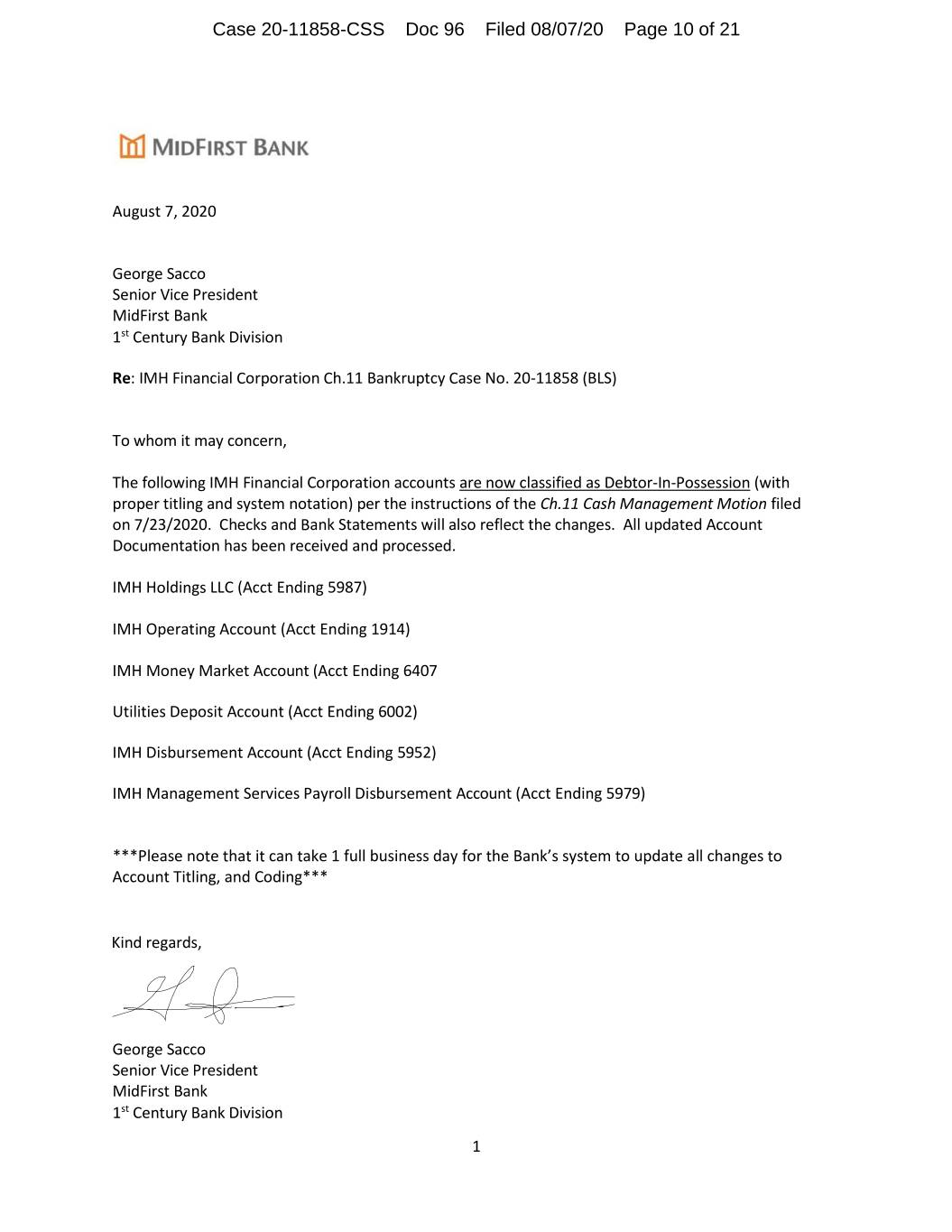

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 10 of 21 August 7, 2020 George Sacco Senior Vice President MidFirst Bank 1st Century Bank Division Re: IMH Financial Corporation Ch.11 Bankruptcy Case No. 20-11858 (BLS) To whom it may concern, The following IMH Financial Corporation accounts are now classified as Debtor-In-Possession (with proper titling and system notation) per the instructions of the Ch.11 Cash Management Motion filed on 7/23/2020. Checks and Bank Statements will also reflect the changes. All updated Account Documentation has been received and processed. IMH Holdings LLC (Acct Ending 5987) IMH Operating Account (Acct Ending 1914) IMH Money Market Account (Acct Ending 6407 Utilities Deposit Account (Acct Ending 6002) IMH Disbursement Account (Acct Ending 5952) IMH Management Services Payroll Disbursement Account (Acct Ending 5979) ***Please note that it can take 1 full business day for the Bank’s system to update all changes to Account Titling, and Coding*** Kind regards, George Sacco Senior Vice President MidFirst Bank 1st Century Bank Division 1

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 11 of 21 323.203.7455 gsacco@1cbank.com 1875 Century Park East Suite 1400 Century City, CA 90067 2

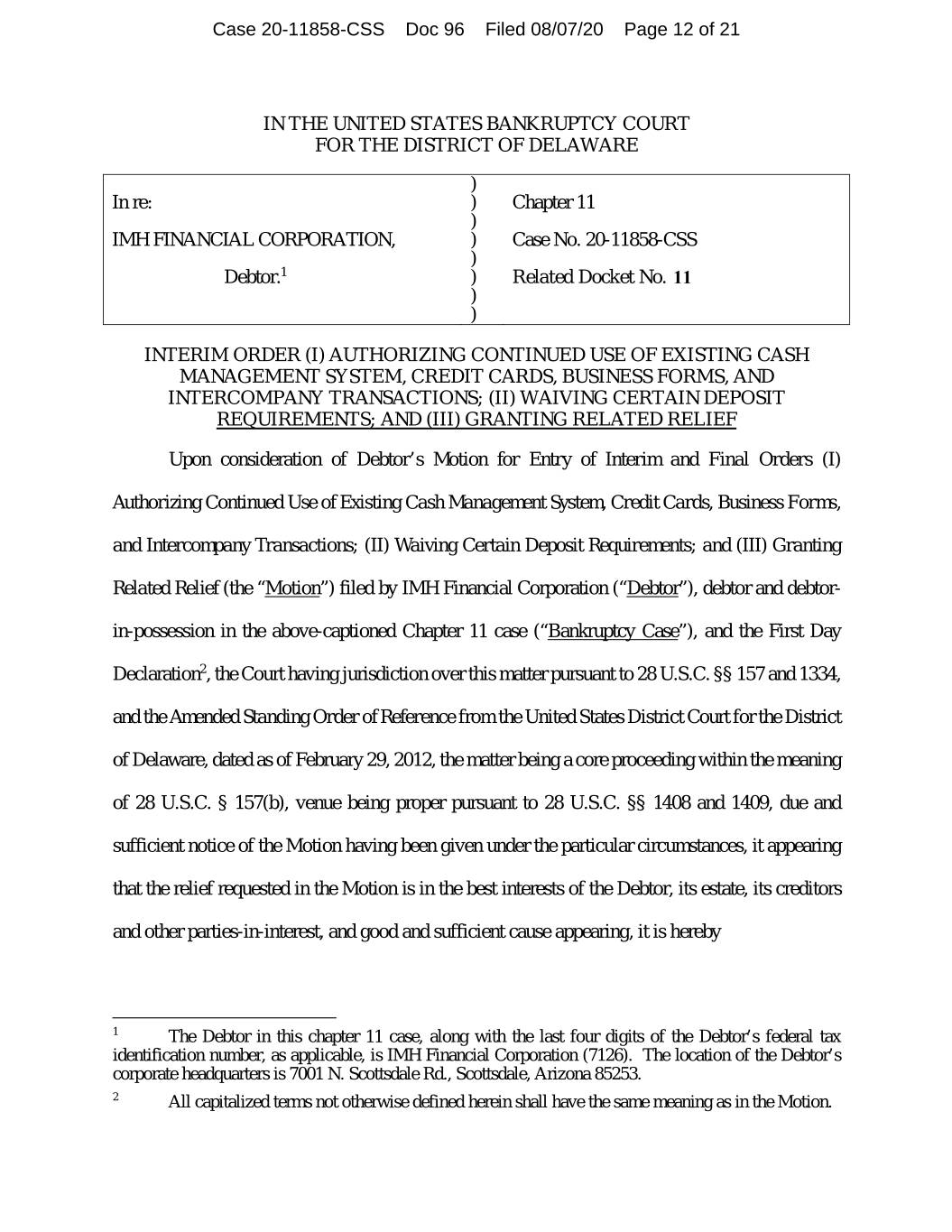

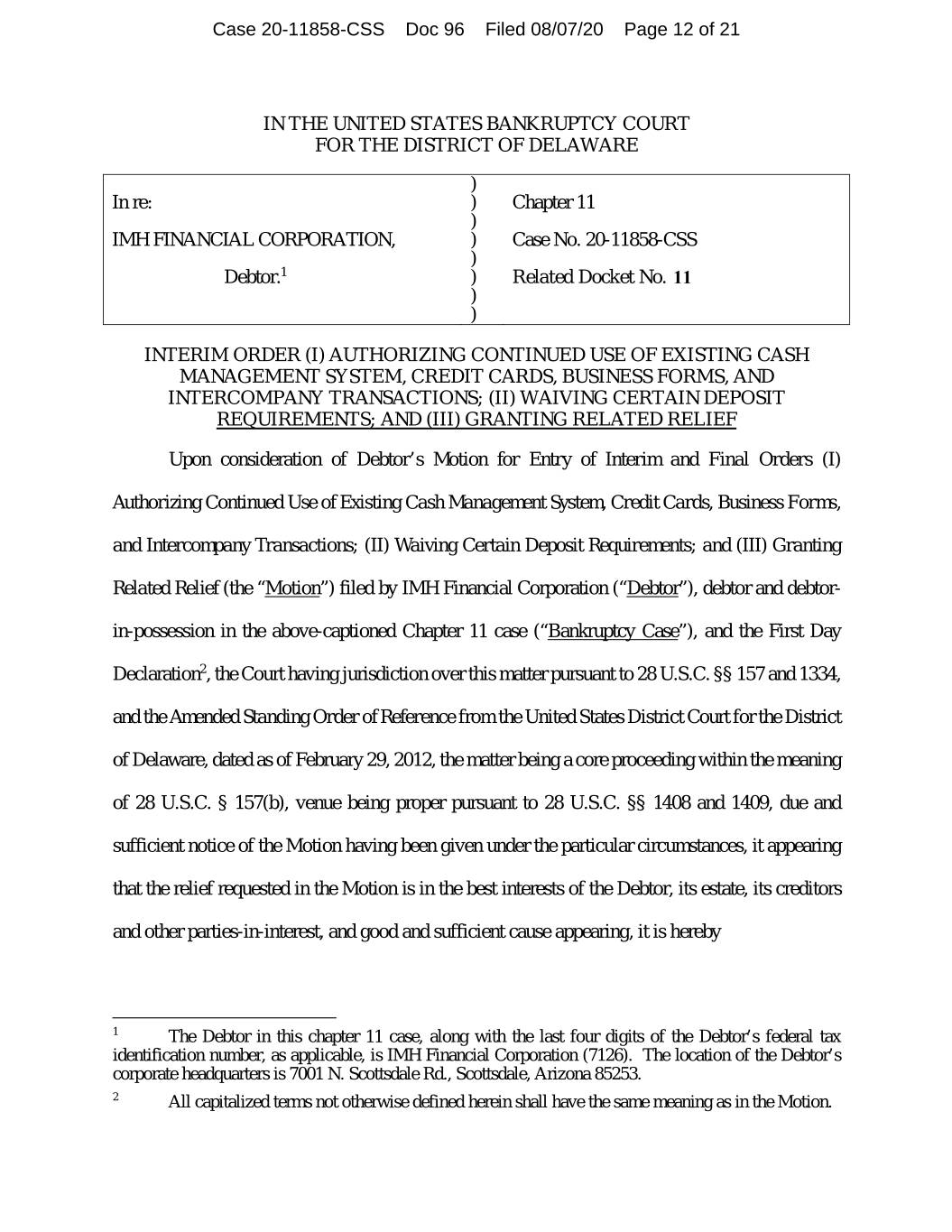

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 12 of 21 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re: ) Chapter 11 ) IMH FINANCIAL CORPORATION, ) Case No. 20-11858-CSS ) Debtor.1 ) Related Docket No. 11 ) ) INTERIM ORDER (I) AUTHORIZING CONTINUED USE OF EXISTING CASH MANAGEMENT SYSTEM, CREDIT CARDS, BUSINESS FORMS, AND INTERCOMPANY TRANSACTIONS; (II) WAIVING CERTAIN DEPOSIT REQUIREMENTS; AND (III) GRANTING RELATED RELIEF Upon consideration of Debtor’s Motion for Entry of Interim and Final Orders (I) Authorizing Continued Use of Existing Cash Management System, Credit Cards, Business Forms, and Intercompany Transactions; (II) Waiving Certain Deposit Requirements; and (III) Granting Related Relief (the “Motion”) filed by IMH Financial Corporation (“Debtor”), debtor and debtor- in-possession in the above-captioned Chapter 11 case (“Bankruptcy Case”), and the First Day Declaration2, the Court having jurisdiction over this matter pursuant to 28 U.S.C. §§ 157 and 1334, and the Amended Standing Order of Reference from the United States District Court for the District of Delaware, dated as of February 29, 2012, the matter being a core proceeding within the meaning of 28 U.S.C. § 157(b), venue being proper pursuant to 28 U.S.C. §§ 1408 and 1409, due and sufficient notice of the Motion having been given under the particular circumstances, it appearing that the relief requested in the Motion is in the best interests of the Debtor, its estate, its creditors and other parties-in-interest, and good and sufficient cause appearing, it is hereby 1 The Debtor in this chapter 11 case, along with the last four digits of the Debtor’s federal tax identification number, as applicable, is IMH Financial Corporation (7126). The location of the Debtor’s corporate headquarters is 7001 N. Scottsdale Rd., Scottsdale, Arizona 85253. 2 All capitalized terms not otherwise defined herein shall have the same meaning as in the Motion.

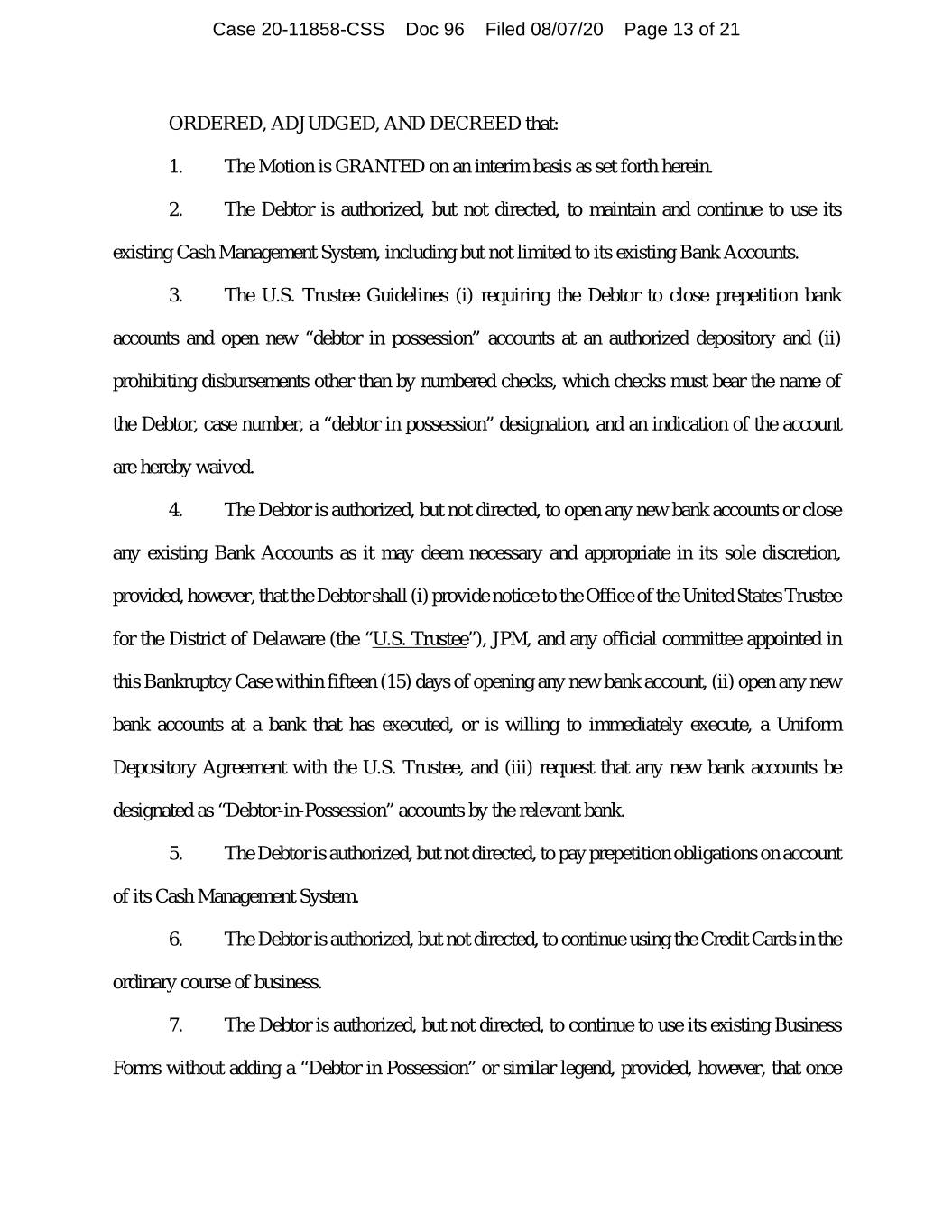

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 13 of 21 ORDERED, ADJUDGED, AND DECREED that: 1. The Motion is GRANTED on an interim basis as set forth herein. 2. The Debtor is authorized, but not directed, to maintain and continue to use its existing Cash Management System, including but not limited to its existing Bank Accounts. 3. The U.S. Trustee Guidelines (i) requiring the Debtor to close prepetition bank accounts and open new “debtor in possession” accounts at an authorized depository and (ii) prohibiting disbursements other than by numbered checks, which checks must bear the name of the Debtor, case number, a “debtor in possession” designation, and an indication of the account are hereby waived. 4. The Debtor is authorized, but not directed, to open any new bank accounts or close any existing Bank Accounts as it may deem necessary and appropriate in its sole discretion, provided, however, that the Debtor shall (i) provide notice to the Office of the United States Trustee for the District of Delaware (the “U.S. Trustee”), JPM, and any official committee appointed in this Bankruptcy Case within fifteen (15) days of opening any new bank account, (ii) open any new bank accounts at a bank that has executed, or is willing to immediately execute, a Uniform Depository Agreement with the U.S. Trustee, and (iii) request that any new bank accounts be designated as “Debtor-in-Possession” accounts by the relevant bank. 5. The Debtor is authorized, but not directed, to pay prepetition obligations on account of its Cash Management System. 6. The Debtor is authorized, but not directed, to continue using the Credit Cards in the ordinary course of business. 7. The Debtor is authorized, but not directed, to continue to use its existing Business Forms without adding a “Debtor in Possession” or similar legend, provided, however, that once

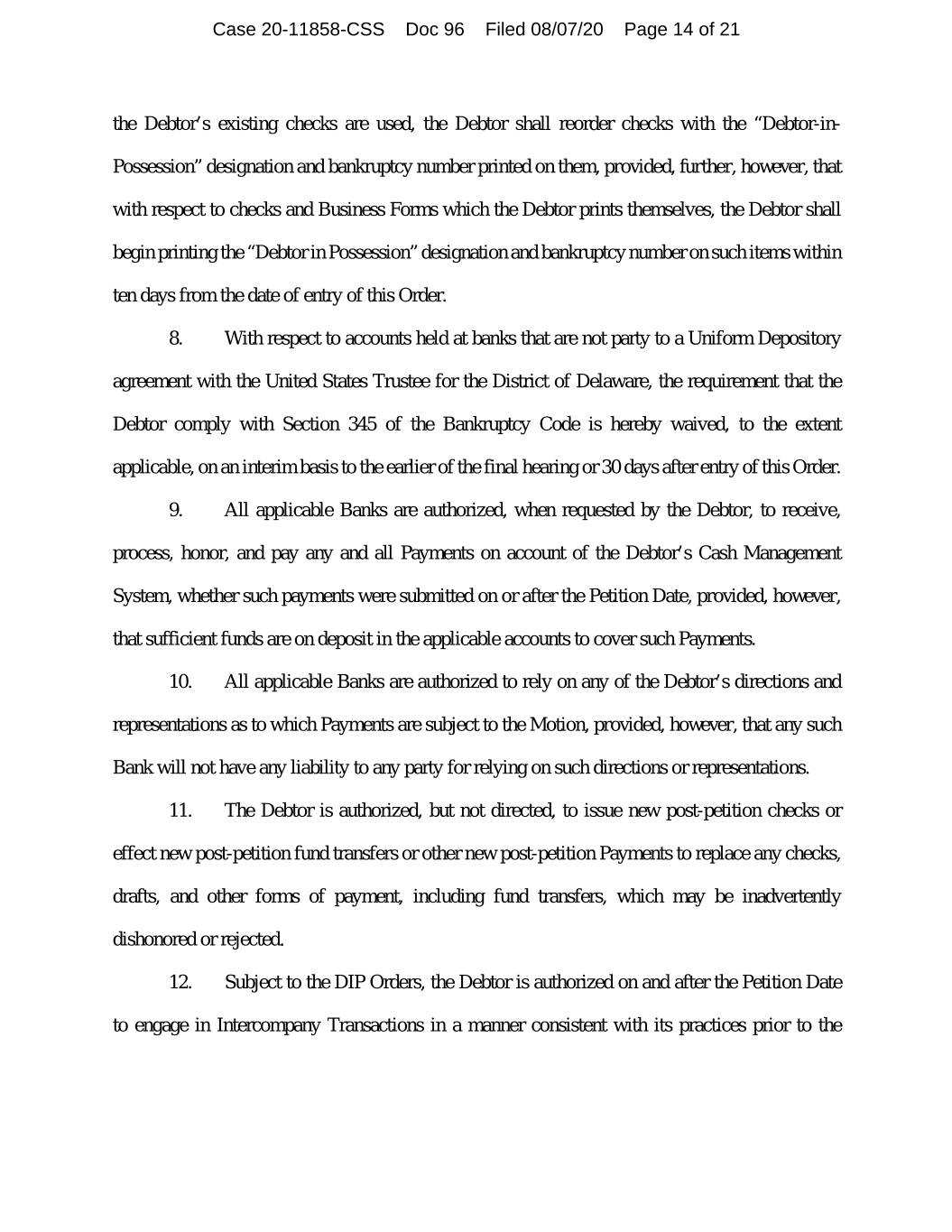

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 14 of 21 the Debtor’s existing checks are used, the Debtor shall reorder checks with the “Debtor-in- Possession” designation and bankruptcy number printed on them, provided, further, however, that with respect to checks and Business Forms which the Debtor prints themselves, the Debtor shall begin printing the “Debtor in Possession” designation and bankruptcy number on such items within ten days from the date of entry of this Order. 8. With respect to accounts held at banks that are not party to a Uniform Depository agreement with the United States Trustee for the District of Delaware, the requirement that the Debtor comply with Section 345 of the Bankruptcy Code is hereby waived, to the extent applicable, on an interim basis to the earlier of the final hearing or 30 days after entry of this Order. 9. All applicable Banks are authorized, when requested by the Debtor, to receive, process, honor, and pay any and all Payments on account of the Debtor’s Cash Management System, whether such payments were submitted on or after the Petition Date, provided, however, that sufficient funds are on deposit in the applicable accounts to cover such Payments. 10. All applicable Banks are authorized to rely on any of the Debtor’s directions and representations as to which Payments are subject to the Motion, provided, however, that any such Bank will not have any liability to any party for relying on such directions or representations. 11. The Debtor is authorized, but not directed, to issue new post-petition checks or effect new post-petition fund transfers or other new post-petition Payments to replace any checks, drafts, and other forms of payment, including fund transfers, which may be inadvertently dishonored or rejected. 12. Subject to the DIP Orders, the Debtor is authorized on and after the Petition Date to engage in Intercompany Transactions in a manner consistent with its practices prior to the

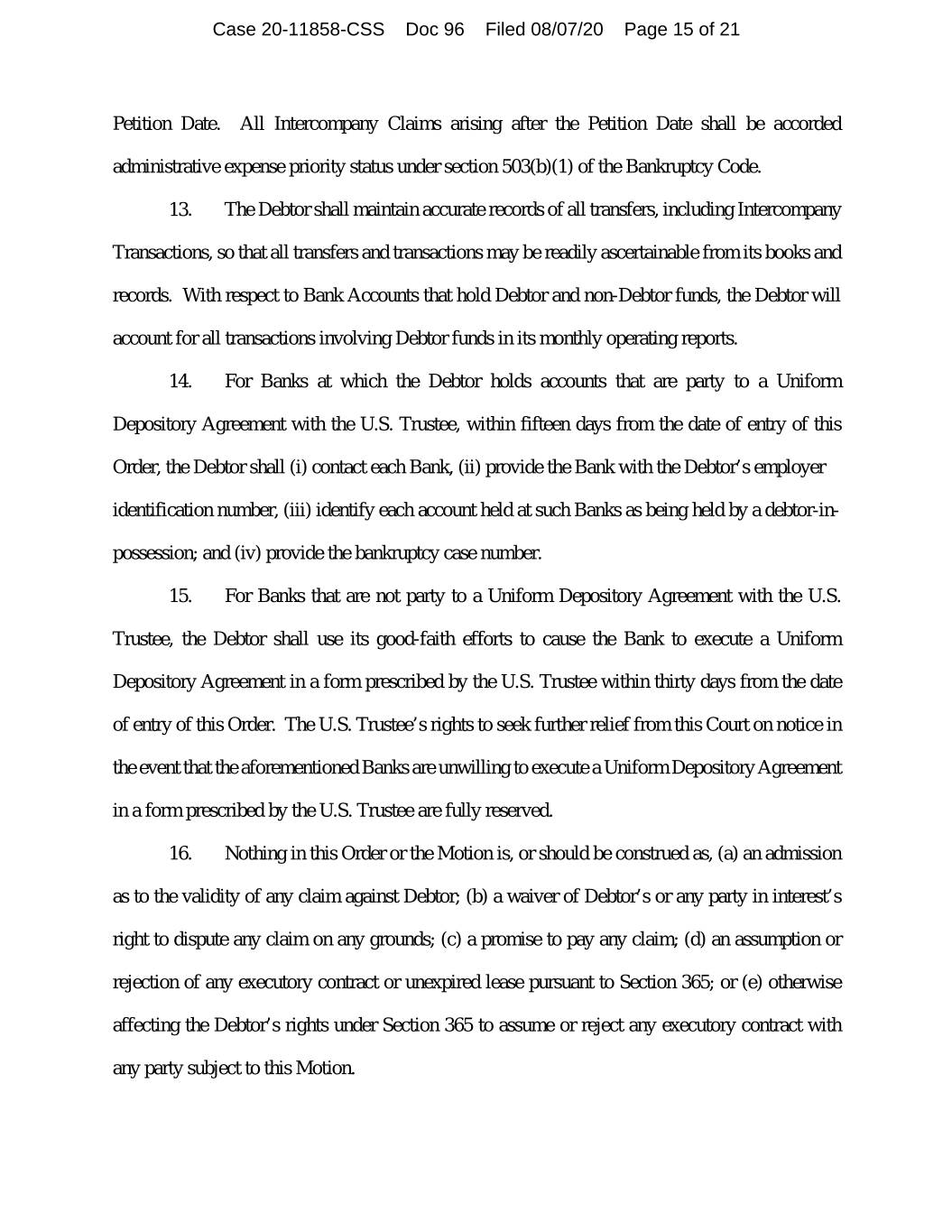

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 15 of 21 Petition Date. All Intercompany Claims arising after the Petition Date shall be accorded administrative expense priority status under section 503(b)(1) of the Bankruptcy Code. 13. The Debtor shall maintain accurate records of all transfers, including Intercompany Transactions, so that all transfers and transactions may be readily ascertainable from its books and records. With respect to Bank Accounts that hold Debtor and non-Debtor funds, the Debtor will account for all transactions involving Debtor funds in its monthly operating reports. 14. For Banks at which the Debtor holds accounts that are party to a Uniform Depository Agreement with the U.S. Trustee, within fifteen days from the date of entry of this Order, the Debtor shall (i) contact each Bank, (ii) provide the Bank with the Debtor’s employer identification number, (iii) identify each account held at such Banks as being held by a debtor-in- possession; and (iv) provide the bankruptcy case number. 15. For Banks that are not party to a Uniform Depository Agreement with the U.S. Trustee, the Debtor shall use its good-faith efforts to cause the Bank to execute a Uniform Depository Agreement in a form prescribed by the U.S. Trustee within thirty days from the date of entry of this Order. The U.S. Trustee’s rights to seek further relief from this Court on notice in the event that the aforementioned Banks are unwilling to execute a Uniform Depository Agreement in a form prescribed by the U.S. Trustee are fully reserved. 16. Nothing in this Order or the Motion is, or should be construed as, (a) an admission as to the validity of any claim against Debtor; (b) a waiver of Debtor’s or any party in interest’s right to dispute any claim on any grounds; (c) a promise to pay any claim; (d) an assumption or rejection of any executory contract or unexpired lease pursuant to Section 365; or (e) otherwise affecting the Debtor’s rights under Section 365 to assume or reject any executory contract with any party subject to this Motion.

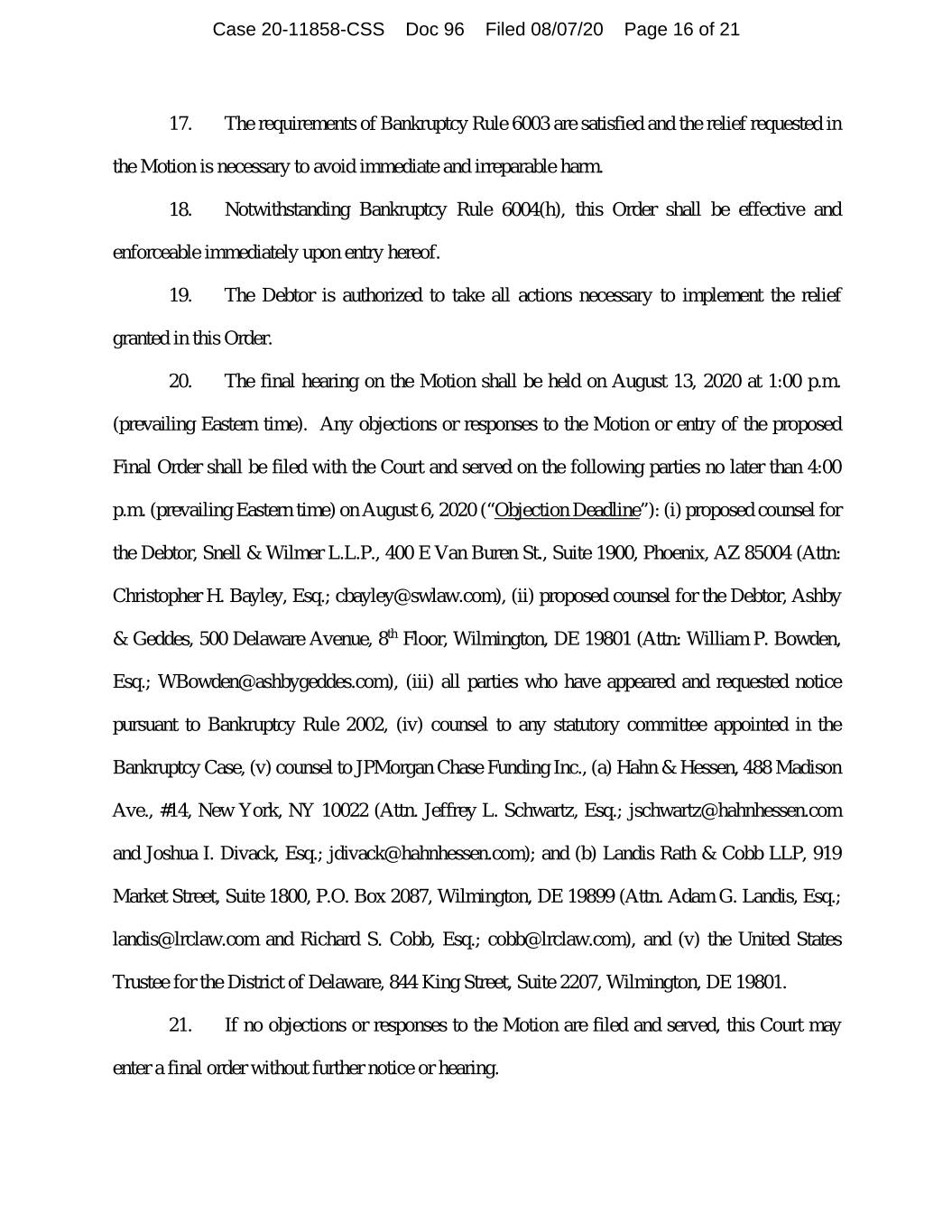

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 16 of 21 17. The requirements of Bankruptcy Rule 6003 are satisfied and the relief requested in the Motion is necessary to avoid immediate and irreparable harm. 18. Notwithstanding Bankruptcy Rule 6004(h), this Order shall be effective and enforceable immediately upon entry hereof. 19. The Debtor is authorized to take all actions necessary to implement the relief granted in this Order. 20. The final hearing on the Motion shall be held on August 13, 2020 at 1:00 p.m. (prevailing Eastern time). Any objections or responses to the Motion or entry of the proposed Final Order shall be filed with the Court and served on the following parties no later than 4:00 p.m. (prevailing Eastern time) on August 6, 2020 (“Objection Deadline”): (i) proposed counsel for the Debtor, Snell & Wilmer L.L.P., 400 E Van Buren St., Suite 1900, Phoenix, AZ 85004 (Attn: Christopher H. Bayley, Esq.; cbayley@swlaw.com), (ii) proposed counsel for the Debtor, Ashby & Geddes, 500 Delaware Avenue, 8th Floor, Wilmington, DE 19801 (Attn: William P. Bowden, Esq.; WBowden@ashbygeddes.com), (iii) all parties who have appeared and requested notice pursuant to Bankruptcy Rule 2002, (iv) counsel to any statutory committee appointed in the Bankruptcy Case, (v) counsel to JPMorgan Chase Funding Inc., (a) Hahn & Hessen, 488 Madison Ave., #14, New York, NY 10022 (Attn. Jeffrey L. Schwartz, Esq.; jschwartz@hahnhessen.com and Joshua I. Divack, Esq.; jdivack@hahnhessen.com); and (b) Landis Rath & Cobb LLP, 919 Market Street, Suite 1800, P.O. Box 2087, Wilmington, DE 19899 (Attn. Adam G. Landis, Esq.; landis@lrclaw.com and Richard S. Cobb, Esq.; cobb@lrclaw.com), and (v) the United States Trustee for the District of Delaware, 844 King Street, Suite 2207, Wilmington, DE 19801. 21. If no objections or responses to the Motion are filed and served, this Court may enter a final order without further notice or hearing.

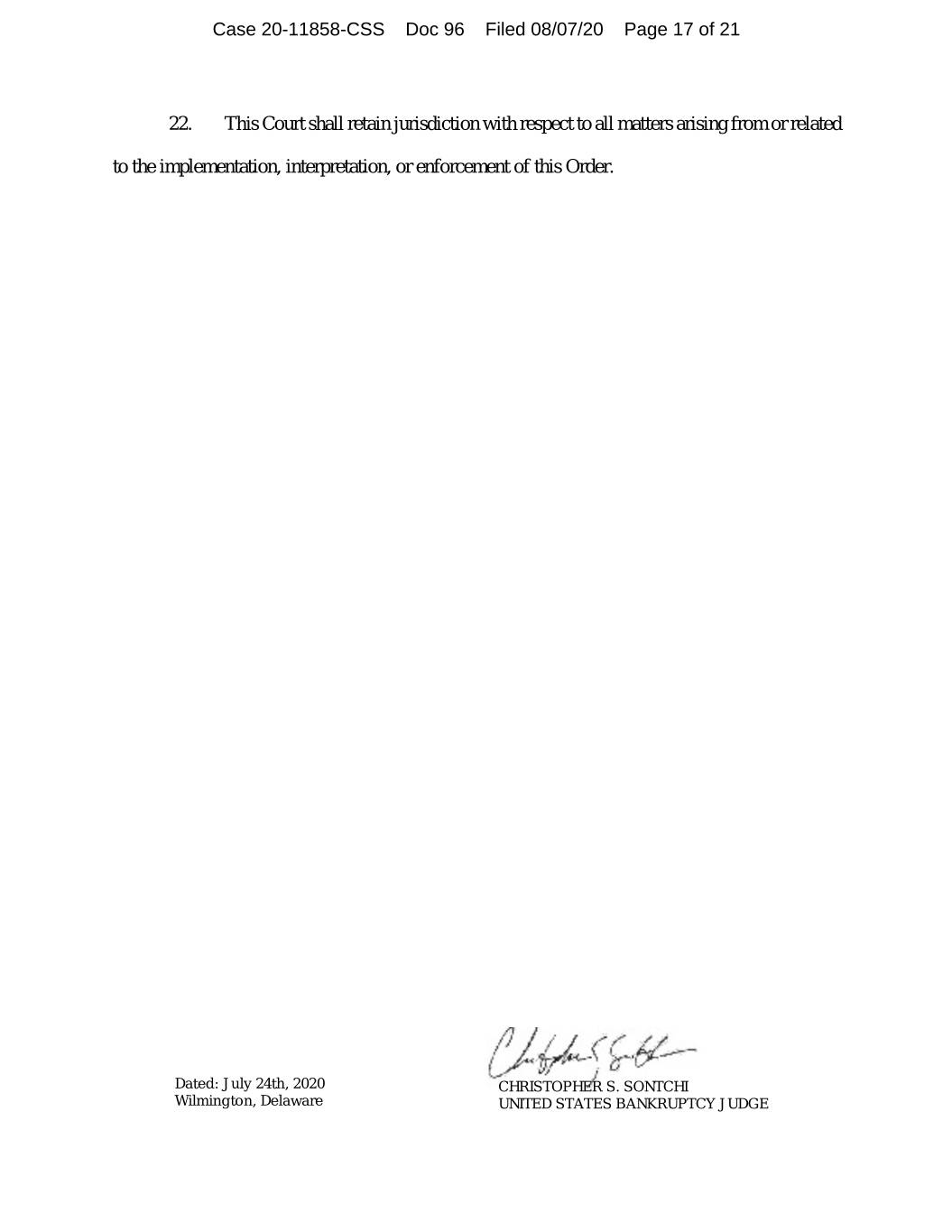

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 17 of 21 22. This Court shall retain jurisdiction with respect to all matters arising from or related to the implementation, interpretation, or enforcement of this Order. Dated: July 24th, 2020 CHRISTOPHER S. SONTCHI Wilmington, Delaware UNITED STATES BANKRUPTCY JUDGE

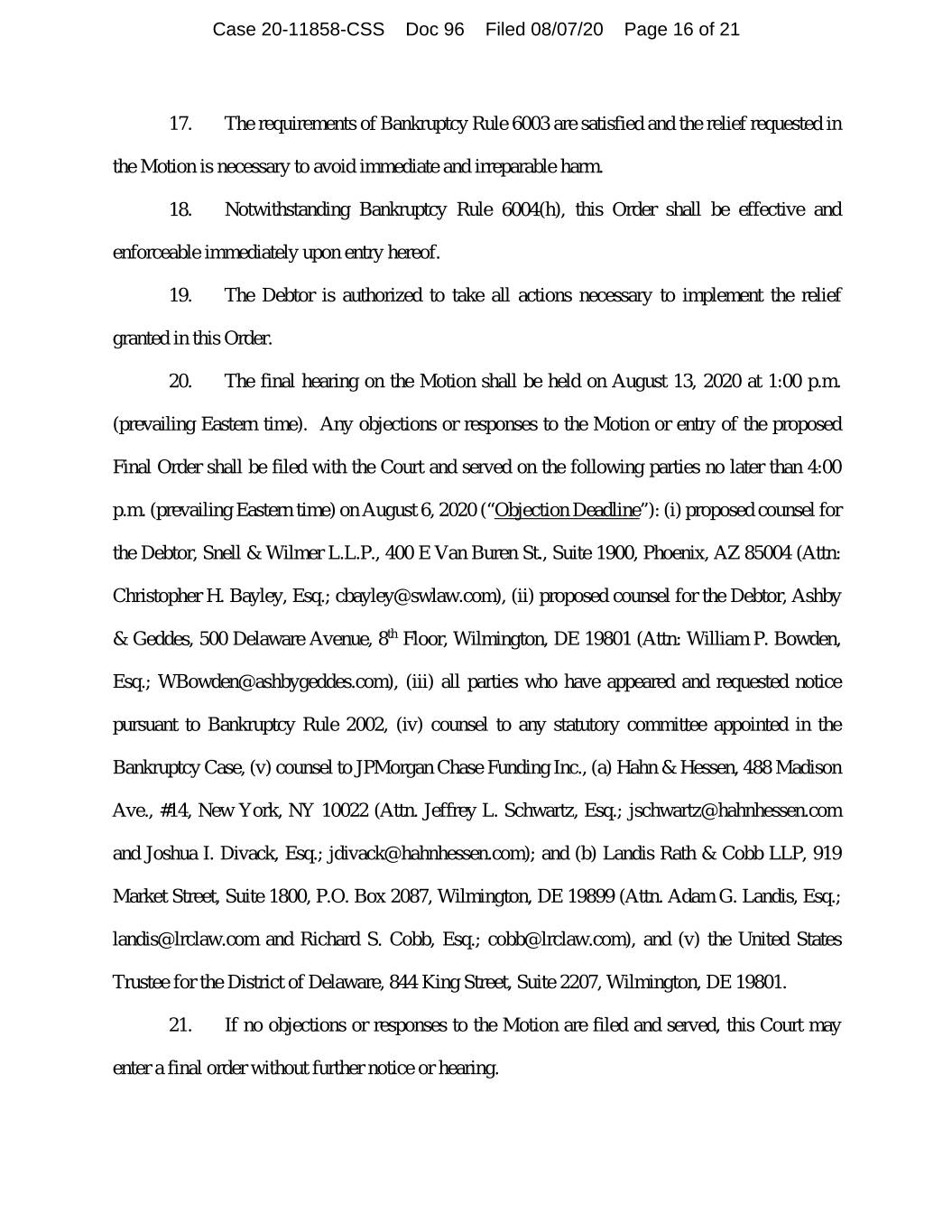

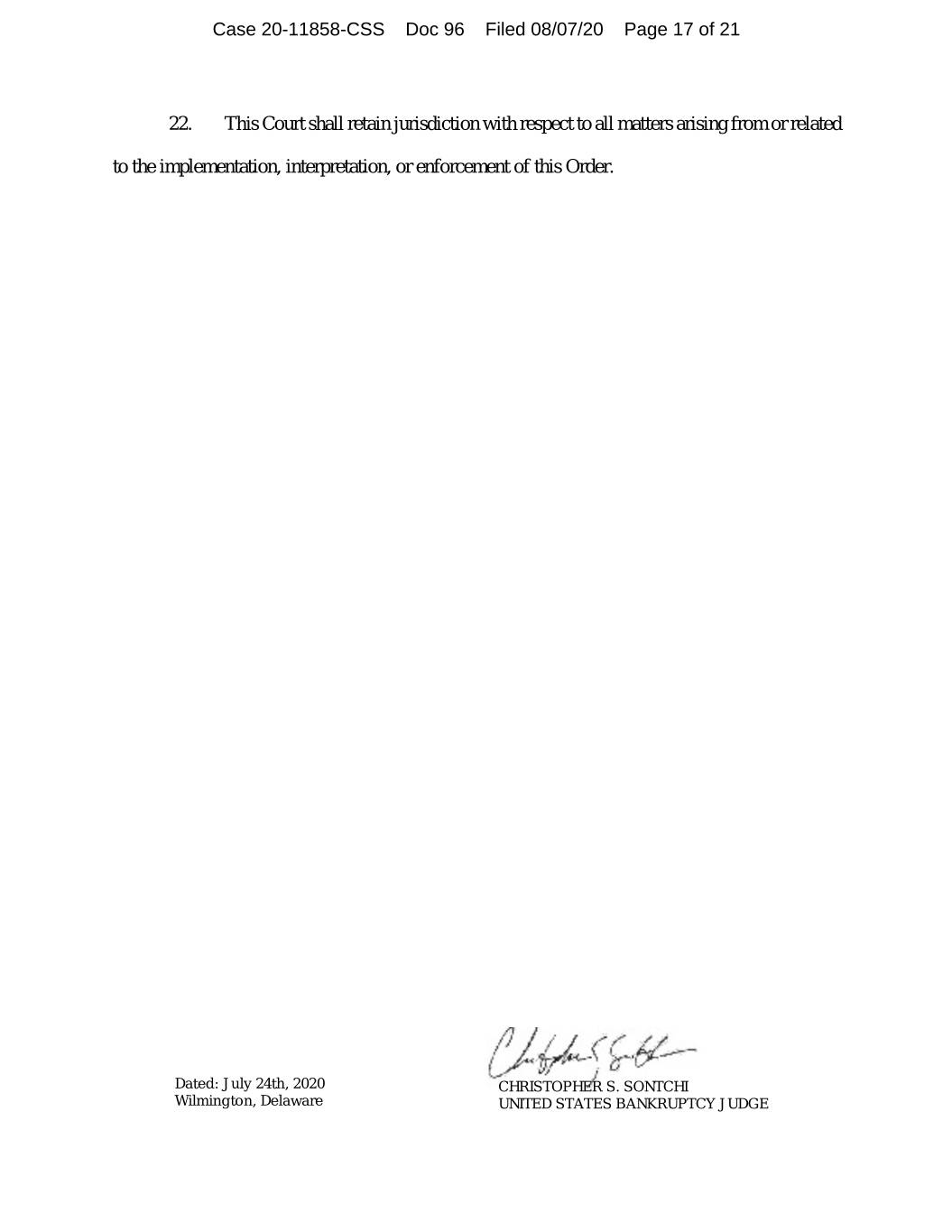

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 18 of 21 Whether the Name of Account Funds are Bank Name Account Name Account Holder Number Status Debtor-in- Possession Funds? st 1 Century Bank IMH Holdings, Account Ending 1st Century Bank – IMH Holdings *5987 Active Yes LLC LLC st 1 Century Bank IMH Financial Account Ending 1st Century Bank – IMH Operating *1914 Active Yes Account Corporation 1st Century Bank Account Ending st – IMH Money IMH Financial 1 Century Bank Market Account Corporation *6407 Active Yes (MMA) 1st Century Bank Account Ending st IMH Financial 1 Century Bank – Utilities *6002 Active Yes Deposit Account Corporation 1st Century Bank IMH Account Ending st – IMH 1 Century Bank Disbursement Disbursements, *5952 Active In-Part Account LLC 1st Century Bank – IMH IMH Account Ending st Management *5979 In-Part 1 Century Bank Services Payroll Management Active Disbursement Services, LLC Account IMH BOKF, NA Rabbi Trust Management Account Ending Active No Account Services, LLC *2-01-5 1st Century Bank IMH Account Ending 1st Century Bank – IMH PPP Loan Management *3854 Active No Account Services, LLC Chase Bank – L’Auberge de Account Ending Chase Bank Hotel Fund Sonoma Resort *6765 Inactive No Account Fund, LLC {01588867;v1 } 1

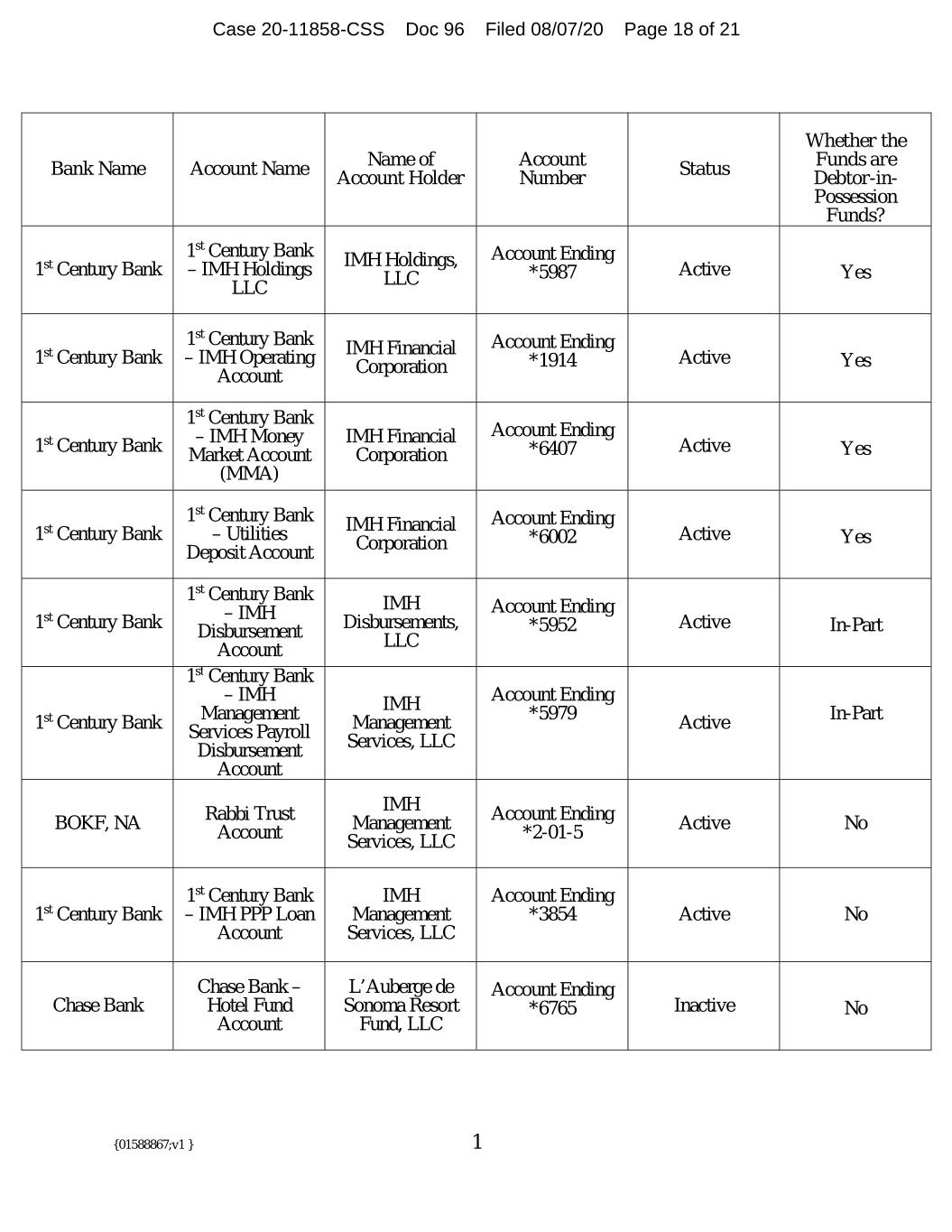

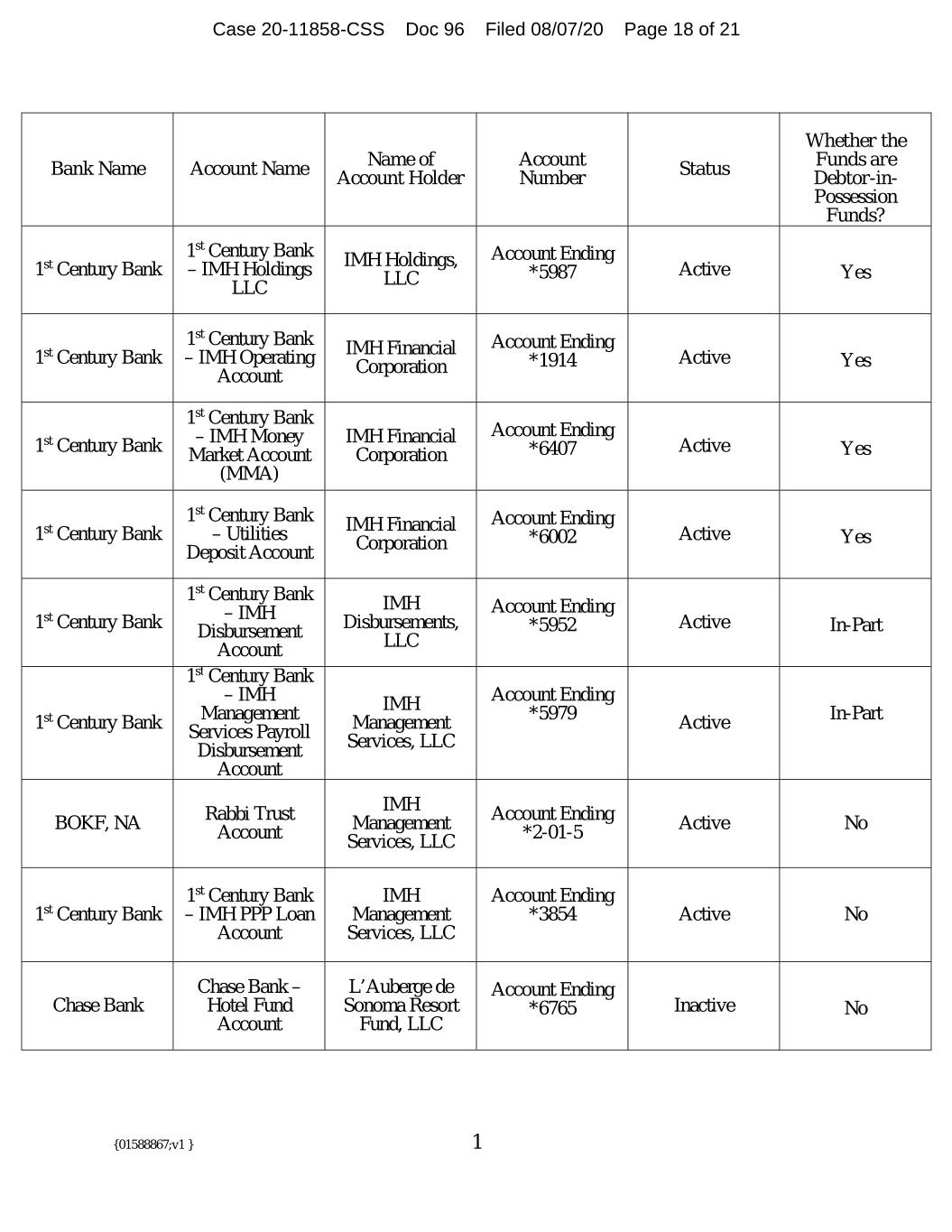

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 19 of 21 1st Century Bank L’Auberge de Account Ending 1st Century Bank – MacArthur PPP Sonoma Resort *3862 Active No Loan Account Fund, LLC 1st Century Bank L’Auberge de Account Ending st – MacArthur 1 Century Bank Hotel Fund Sonoma Resort *1922 Active No Account Fund, LLC MidFirst Bank – MacArthur Held by MidFirst MidFirst Bank Capital L’Auberge de Restricted No Improvements Sonoma, LLC Reserve MidFirst Bank – MacArthur Tax L’Auberge de Held by MidFirst MidFirst Bank and Insurance Sonoma, LLC Restricted No Reserve MidFirst Bank – L’Auberge de Held by MidFirst MidFirst Bank MacArthur FF&E Restricted No Reserve Sonoma, LLC MidFirst Bank – L’Auberge de Held by MidFirst MidFirst Bank MacArthur Inactive N/A Interest Reserve Sonoma, LLC 1st Century Bank IMH Broadway Account Ending 1st Century Bank – Broadway Tower Senior *6550 Inactive No Tower Account Lender, LLC st Account Ending st 1 Century Bank IMH Charities, 1 Century Bank – IMH Charities LLC *5995 Active No 1st Century Bank Antinori Account Ending 1st Century Bank – Antinori Investments, *6533 Active No Investments LLLP st 1 Century Bank Serengetti Account Ending 1st Century Bank – Serengetti *6541 Active No Properties Properties, LLLP st 1 Century Bank Justin Ranch 123, Account Ending 1st Century Bank – Justin Ranch *6010 Active No LLC LLLP {01588867;v1 } 2

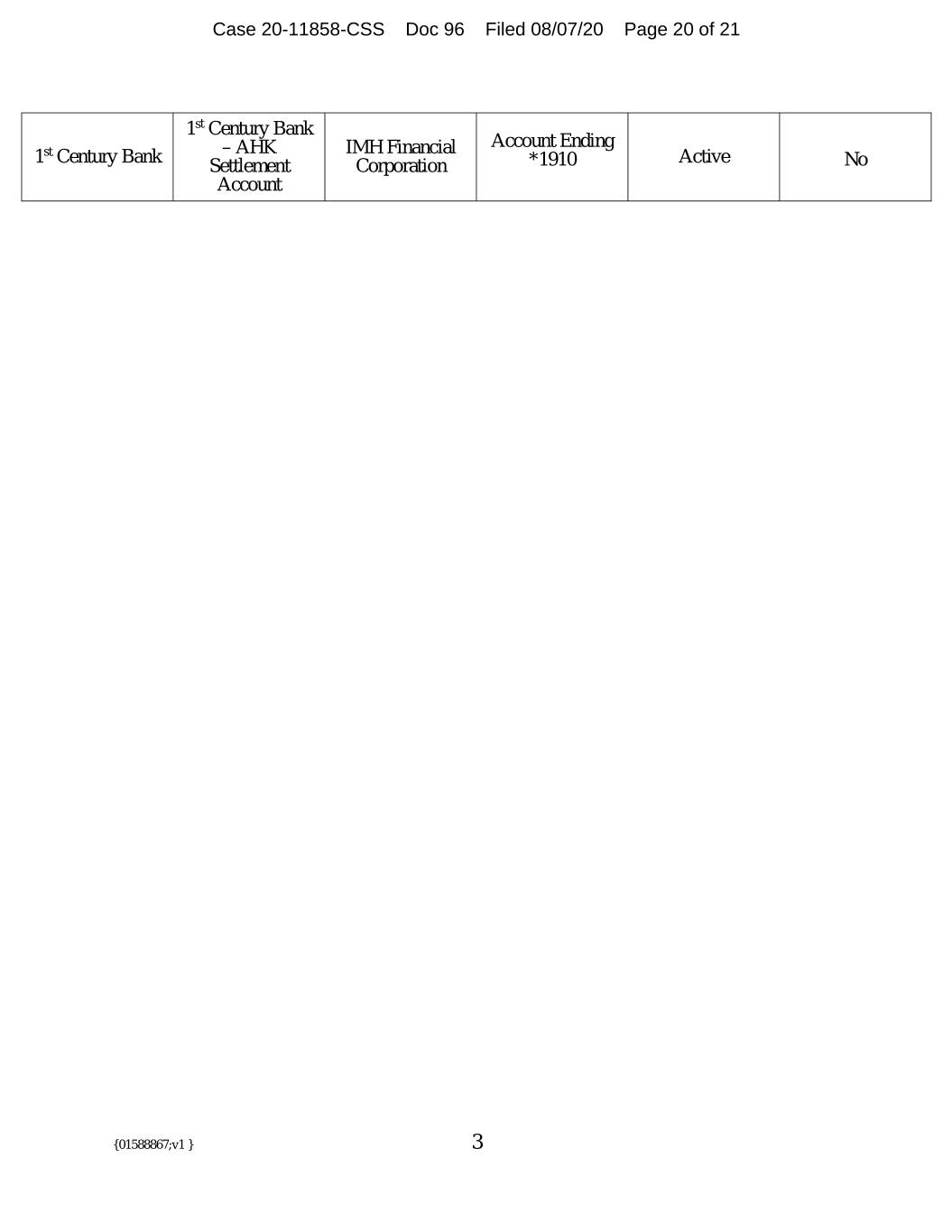

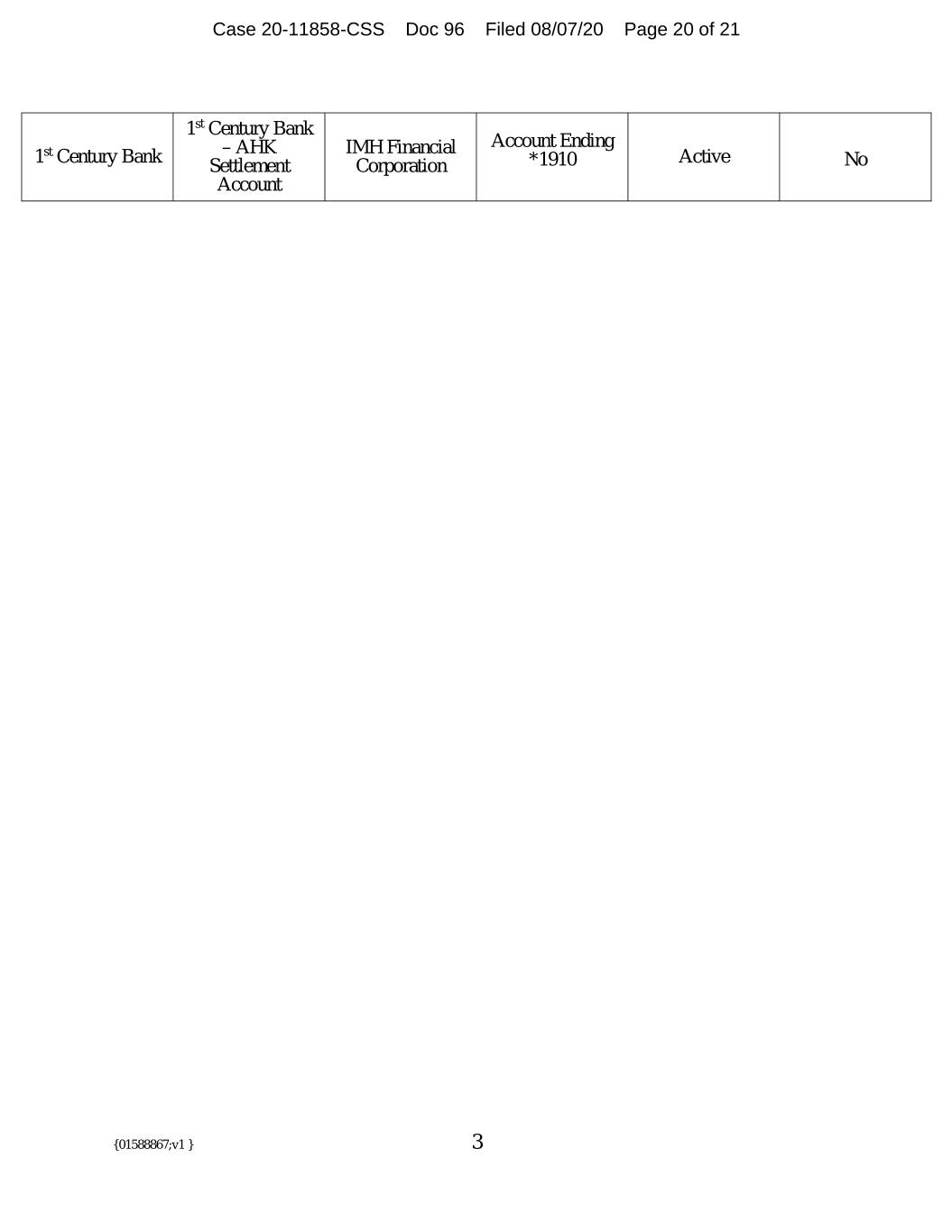

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 20 of 21 1st Century Bank Account Ending st – AHK IMH Financial 1 Century Bank Settlement Corporation *1910 Active No Account {01588867;v1 } 3

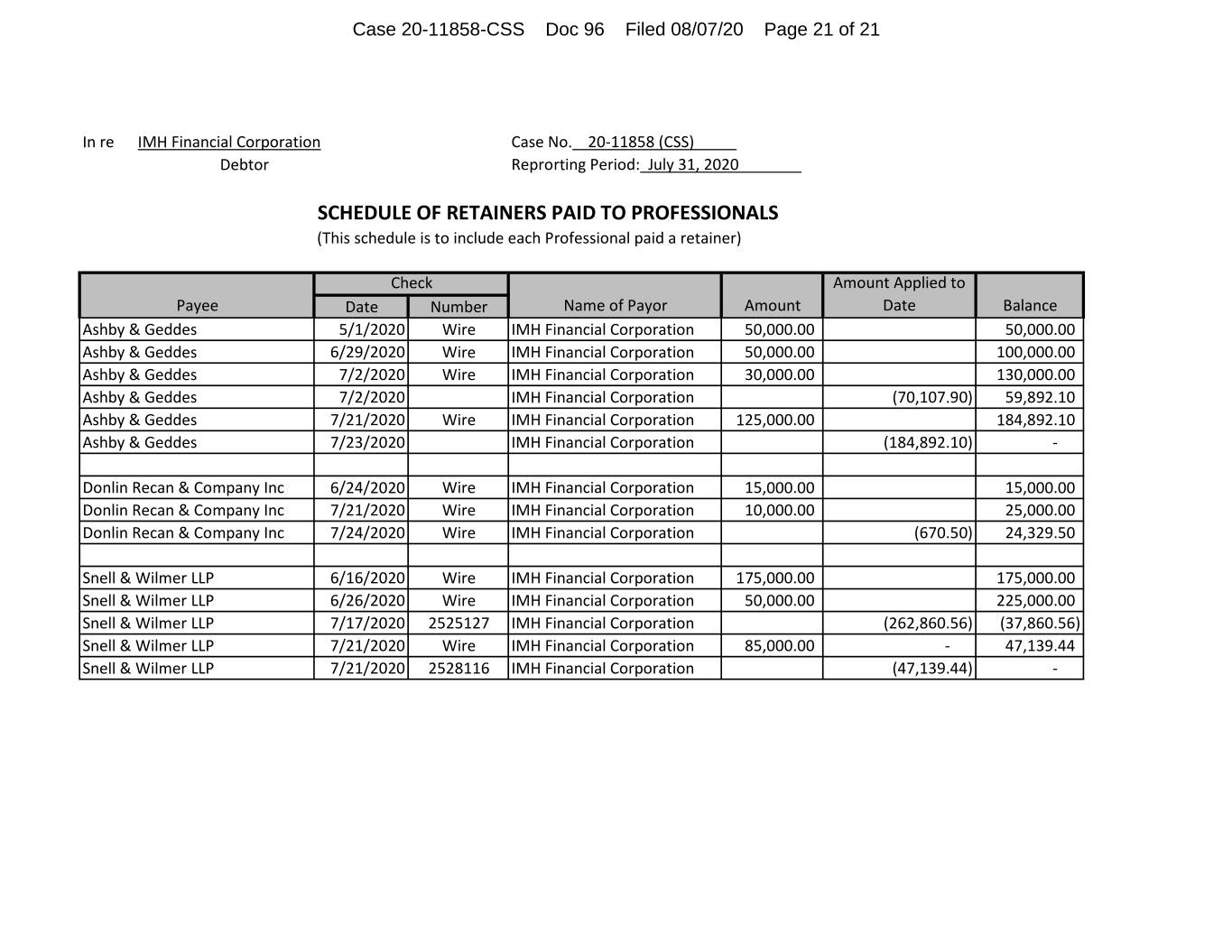

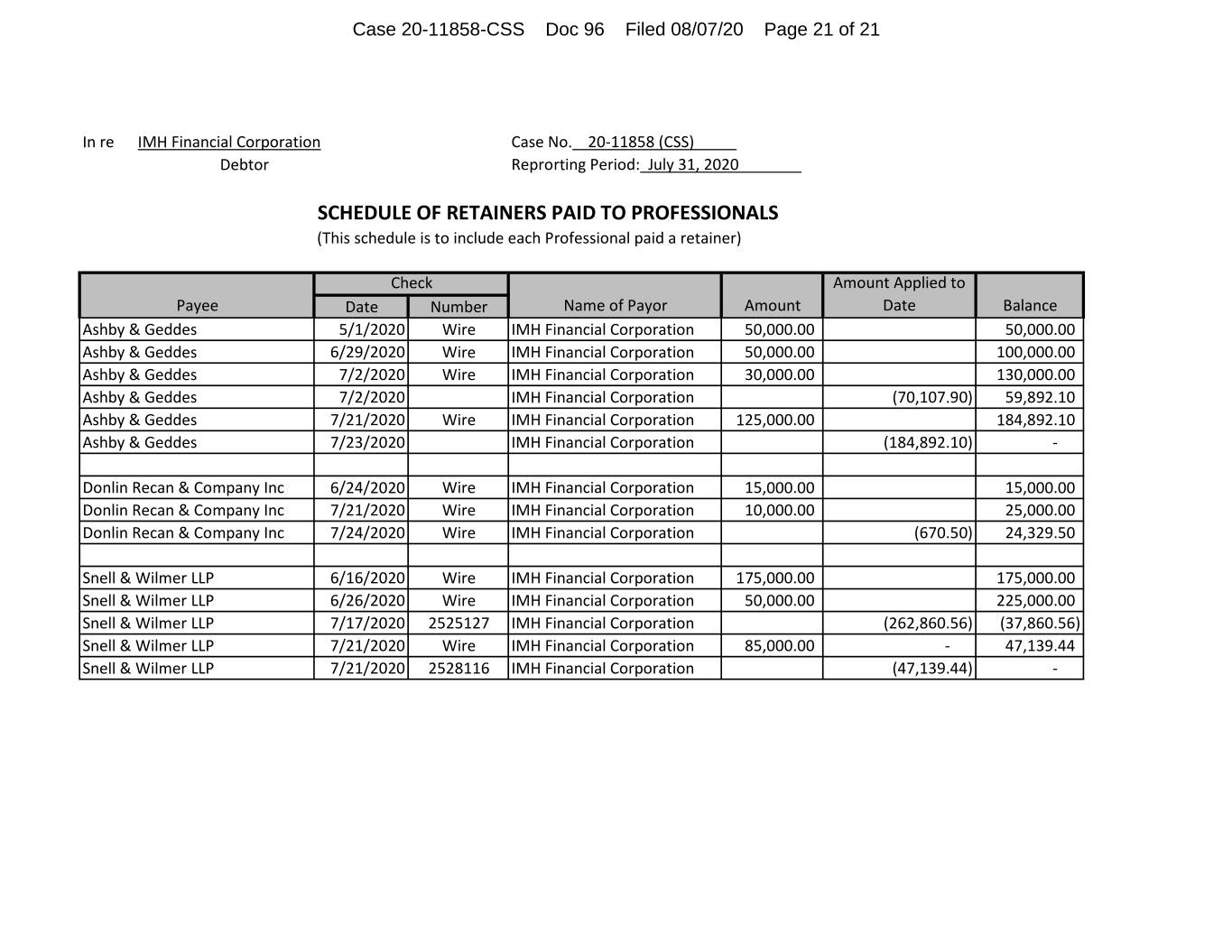

Case 20-11858-CSS Doc 96 Filed 08/07/20 Page 21 of 21 In re IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reprorting Period: July 31, 2020 SCHEDULE OF RETAINERS PAID TO PROFESSIONALS (This schedule is to include each Professional paid a retainer) Check Amount Applied to Payee Date Number Name of Payor Amount Date Balance Ashby & Geddes 5/1/2020 Wire IMH Financial Corporation 50,000.00 50,000.00 Ashby & Geddes 6/29/2020 Wire IMH Financial Corporation 50,000.00 100,000.00 Ashby & Geddes 7/2/2020 Wire IMH Financial Corporation 30,000.00 130,000.00 Ashby & Geddes 7/2/2020 IMH Financial Corporation (70,107.90) 59,892.10 Ashby & Geddes 7/21/2020 Wire IMH Financial Corporation 125,000.00 184,892.10 Ashby & Geddes 7/23/2020 IMH Financial Corporation (184,892.10) - Donlin Recan & Company Inc 6/24/2020 Wire IMH Financial Corporation 15,000.00 15,000.00 Donlin Recan & Company Inc 7/21/2020 Wire IMH Financial Corporation 10,000.00 25,000.00 Donlin Recan & Company Inc 7/24/2020 Wire IMH Financial Corporation (670.50) 24,329.50 Snell & Wilmer LLP 6/16/2020 Wire IMH Financial Corporation 175,000.00 175,000.00 Snell & Wilmer LLP 6/26/2020 Wire IMH Financial Corporation 50,000.00 225,000.00 Snell & Wilmer LLP 7/17/2020 2525127 IMH Financial Corporation (262,860.56) (37,860.56) Snell & Wilmer LLP 7/21/2020 Wire IMH Financial Corporation 85,000.00 - 47,139.44 Snell & Wilmer LLP 7/21/2020 2528116 IMH Financial Corporation (47,139.44) -

Case 20-11858-CSS Doc 96-1 Filed 08/07/20 Page 1 of 1 CERTIFICATE OF SERVICE I, Stacy L. Newman, hereby certify that, on August 7, 2020, I caused one copy of the foregoing to be served upon the party below via first class mail. Office of the United States Trustee Benjamin A. Hackman 844 King Street, Suite 2207 Lockbox 35 Wilmington, DE 19801 /s/ Stacy L. Newman Stacy L. Newman (#5044) {01594906;v1 }