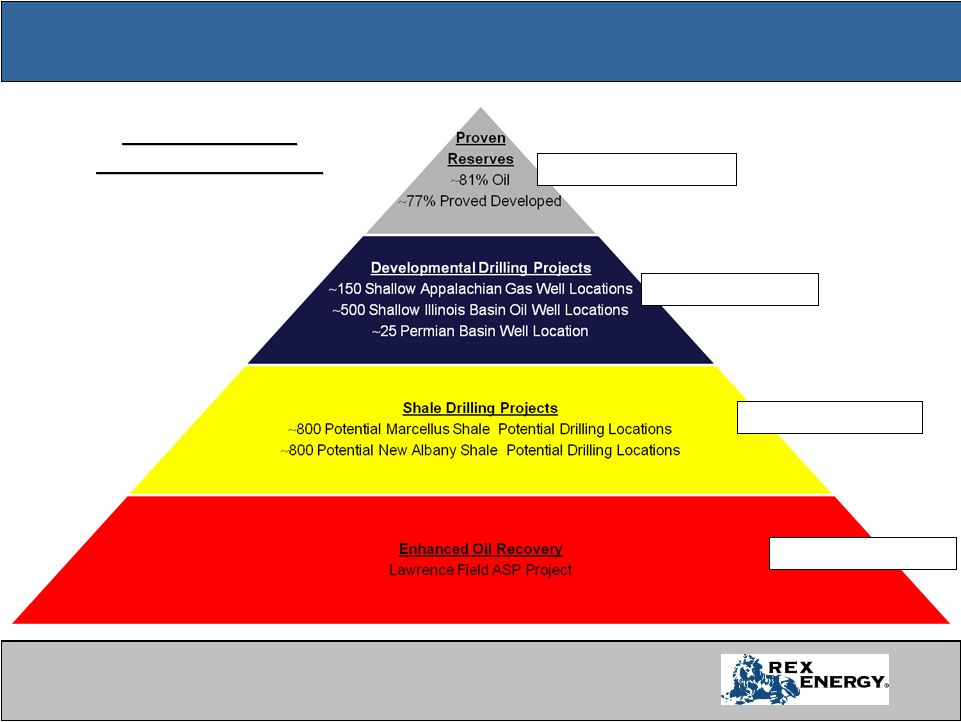

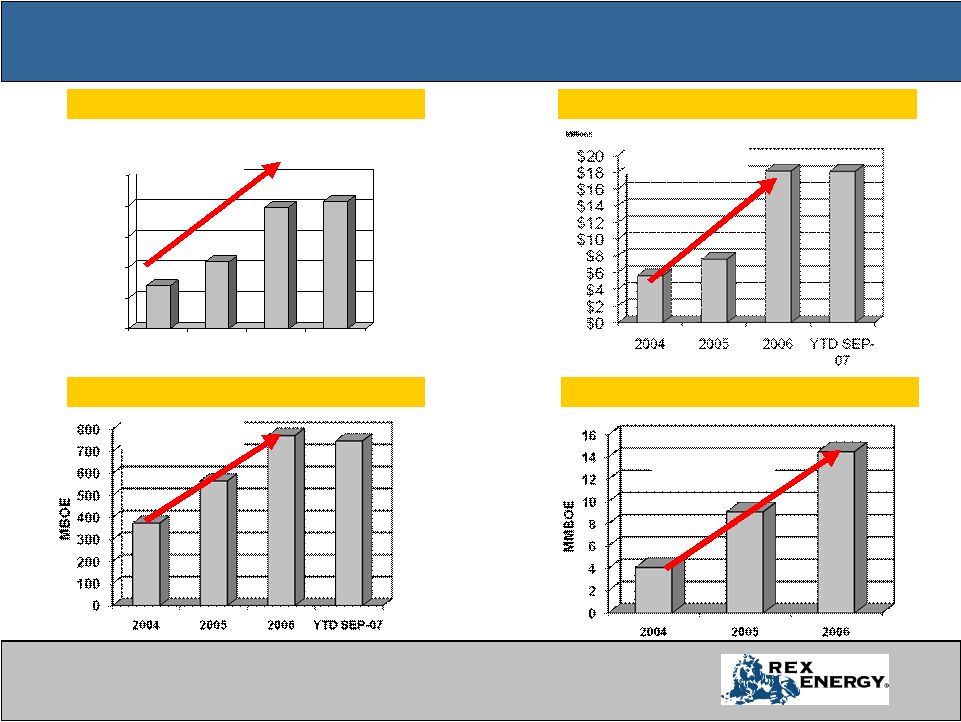

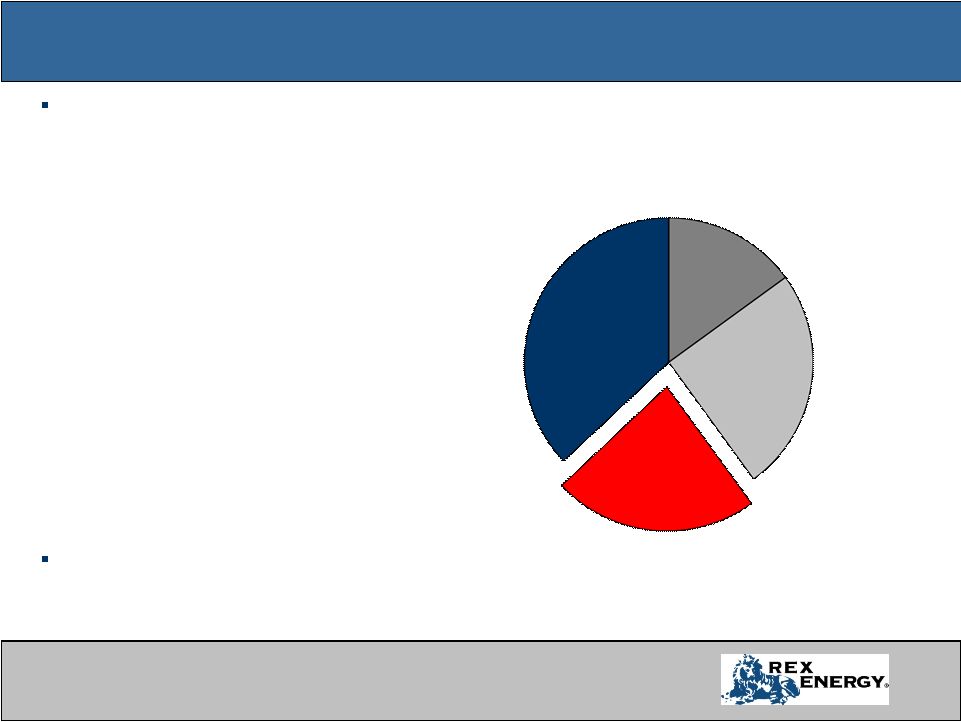

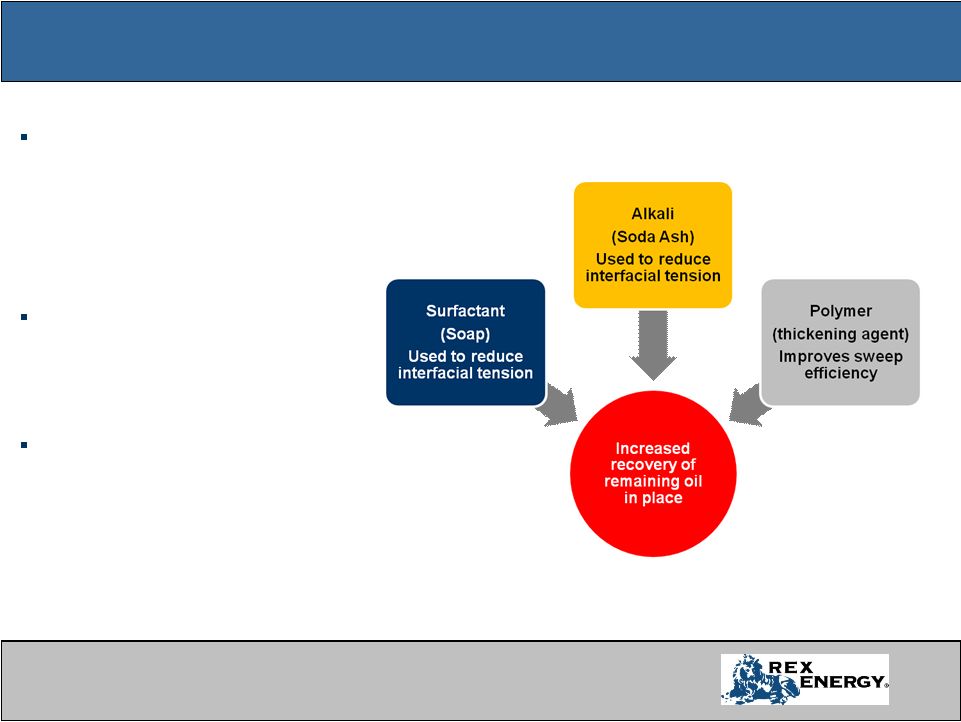

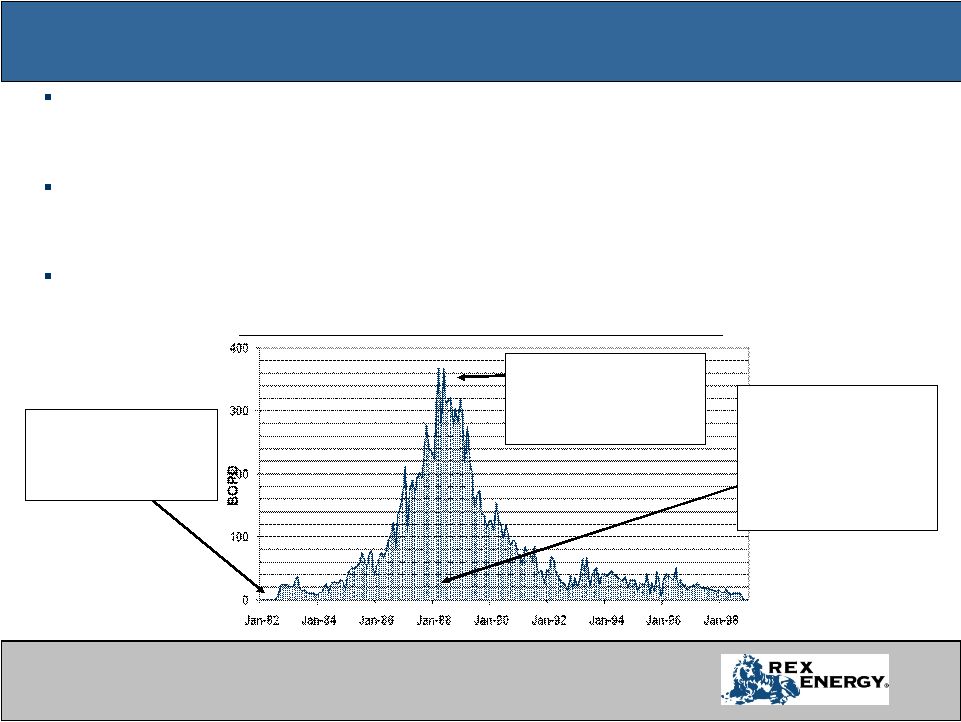

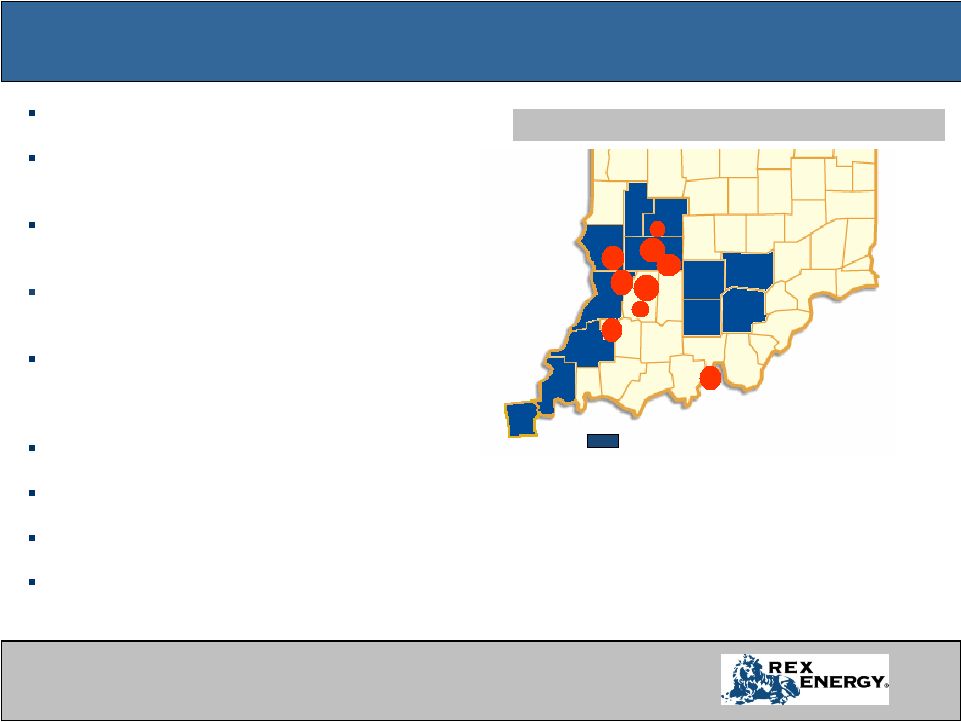

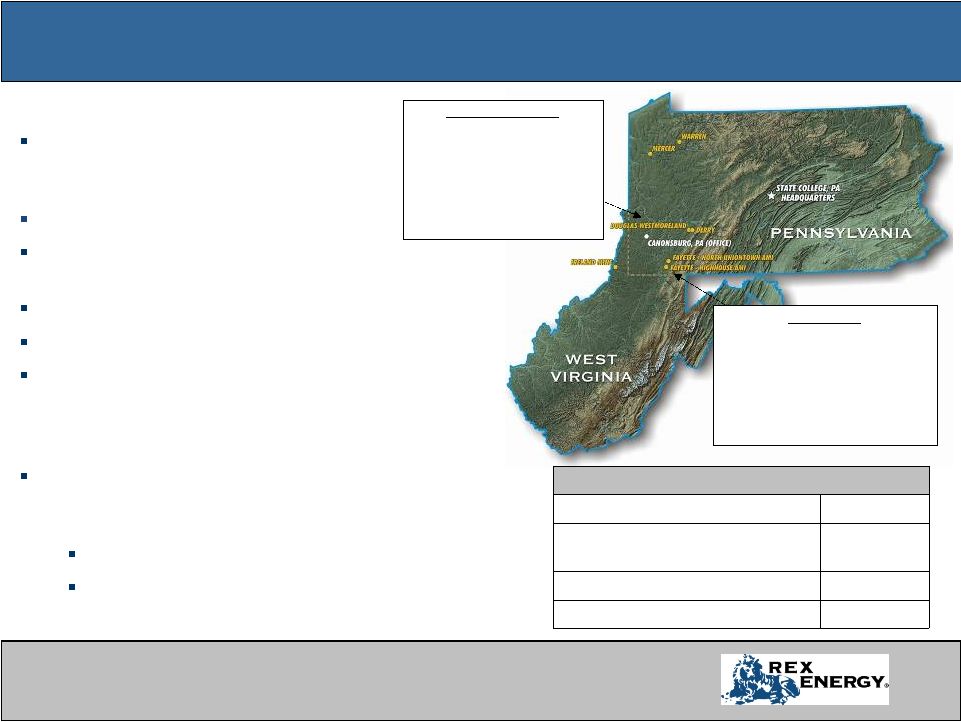

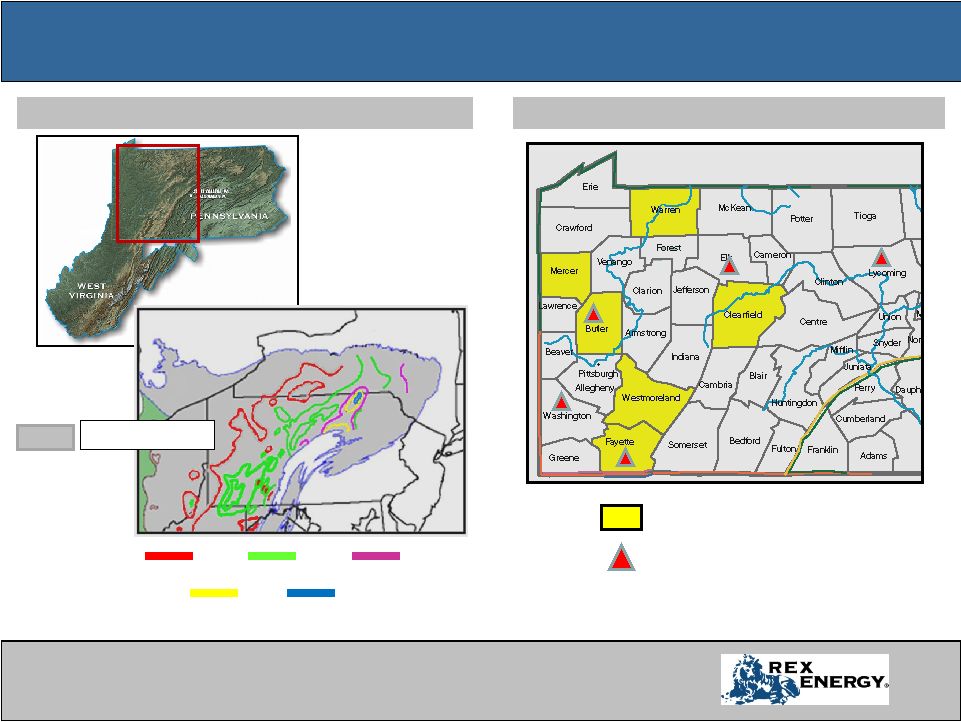

6 Significant Reserve Base with Stable Production – 14.5 MMboe of proved reserves, with “long-life” production, in Illinois Basin, Appalachia and Southwestern region – Leading oil producer in Illinois Basin (provides premium pricing, unique local knowledge, advantaged consolidator position) Significant Production and Reserve Growth Opportunities from Broad Project Inventory – Lawrence Field ASP enhanced oil recovery project in Illinois – Marcellus Shale acreage position of over 70,000 gross acres in Pennsylvania. – New Albany Shale acreage position of over 270,000 gross acres in southern Indiana – Conventional oil drilling opportunities in the Illinois Basin, including 500 proven undeveloped and proven developed non-producing locations in Illinois & Indiana – Active oil and gas exploration and development projects in the Permian Basin Financial Flexibility to Support Growth – Approximately 7% debt to market capitalization ratio – Cash flows able to fund significant portion of planned capital expenditures – $200 million credit facility with $75 million initial borrowing base Experienced Management Team with Proven Track Record Creating Value for Investors – Management team has built high-quality asset base through acquisitions and development, creating significant value for investors – Technical team of geologists and engineers average over 20 years of experience – 17 acquisitions completed to date by the management team at average cost of $6.99 per proved BOE Management and Board Aligned with Stockholders – Directors, officers and their affiliates own over 50% of the shares outstanding KEY VALUE DRIVERS KEY VALUE DRIVERS |