Exhibit 25.1

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939

OF A CORPORATION DESIGNATED TO ACT AS TRUSTEE

| ¨ | Check if an Application to Determine Eligibility of a Trustee Pursuant to Section 305(b)(2) |

WILMINGTON SAVINGS FUND SOCIETY, FSB

(Exact name of Trustee as specified in its charter)

| | |

| N/A | | 51-0054940 |

(Jurisdiction of incorporation of organization if not a U.S. national bank) | | (I.R.S. Employer Identification No.) |

500 Delaware Avenue, 11th Floor

Wilmington, DE 19801

(302) 792-6000

(Address of principal executive offices, including zip code)

WILMINGTON SAVINGS FUND SOCIETY

CONTROLLERS OFFICE

500 Delaware Avenue

Wilmington, DE 19801

(302) 792-6000

(Name, address, including zip code, and telephone number, including area code, of agent of service)

Rex Energy Corporation

(Exact name of obligor as specified in its charter)

| | |

| Delaware | | 20-8814402 |

(State or other jurisdiction or incorporation or organization) | | (I.R.S. Employer Identification No.) |

366 Walker Drive

State College, Pennsylvania 16801

(Address of principal executive offices, including zip code)

1.00%/8.00% Senior Secured Second Lien Notes due 2020

(Title of the indenture securities)

ITEM 1. GENERAL INFORMATION.Furnish the following information as to the trustee:

| | (a) | Name and address of each examining or supervising authority to which it is subject. |

Securities and Exchange Commission

Washington, DC 20549

Federal Reserve

District 3

Philadelphia, PA

FDIC

Washington, DC 20549

Office of the Comptroller of the Currency

New York, NY 10173

| | (b) | Whether it is authorized to exercise corporate trust powers. |

The trustee is authorized to exercise corporate trust powers.

| ITEM 2. | AFFILIATIONS WITH THE OBLIGOR.If the obligor is an affiliate of the trustee, describe each affiliation: |

Based upon an examination of the books and records of the trustee and information available to the trustee, the obligor is not an affiliate of the trustee.

| ITEMS 3-15. | Items 3-15 are not applicable because to the best of the trustee’s knowledge, the obligor isnot in default under any indenture for which the trustee acts as trustee. |

| ITEM 16. | LIST OF EXHIBITS.Listed below are all exhibits filed as part of this Statement of Eligibility and Qualification. |

| | |

| Exhibit 1. * | | A copy of the articles of association of the trustee as now in effect. |

| Exhibit 2. ** | | A copy of the certificate of authority of the trustee to commence business, if not contained in the articles of association. |

| Exhibit 3. ** | | A copy of the authorization of the trustee to exercise corporate trust powers, if such authorization is not contained in the documents specified in paragraph (1) or (2) above. |

| Exhibit 4. * | | A copy of the existing bylaws of the trustee, or instruments corresponding thereto. |

| Exhibit 5. ** | | A copy of each indenture referred to in Item 4, if the obligor is in default. |

| Exhibit 6. * | | The consents of United States institutional trustees required by Section 321(b) of the Act. |

| Exhibit 7. * | | A copy of the latest report of condition of the trustee published pursuant to law or the requirements of its supervising or examining authority. |

| Exhibit 8. ** | | A copy of any order pursuant to which the foreign trustee is authorized to act as sole trustee under indentures qualified or to be qualified under the Act. |

| Exhibit 9. ** | | Foreign trustees are required to file a consent to serve of process of Form F-X [§269.5 of this chapter]. |

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the trustee, Wilmington Savings Fund Society, FSB, a federal savings bank organized and existing under the laws of the United States of America, has duly caused this Statement of Eligibility to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of Wilmington and State of Delaware on the 11th day of May, 2016.

| | |

| | WILMINGTON SAVINGS FUND SOCIETY, FSB |

| |

| Attest:/s/ Patrick Healy | | By:/s/ Geoffrey J. Lewis |

| Assistant Secretary | | Name: Geoffrey J. Lewis |

| | Title: Vice President |

Exhibit 1 Charter of Wilmington Savings Fund Society, FSB (see: attached)

Office of the Comptroller of the Currency Washington, DC 20219 CERTIFIED FEDERAL SAVINGS ASSOCIATION CHARTER I, Thomas J. Curry, Comptroller of the Currency, do hereby certify that the document hereto attached is a true and correct copy, as recorded in the Office of the Comptroller of the Currency (successor to the Office of Thrift Supervision), of the charter for the federal savings association listed below: Wilmington Savings Fund Society, FSB Wilmington, Delaware OTS Docket No. 7938 IN TESTIMONY WHEREOF, today, July 29, 2015, I have hereunto subscribed my name and caused my seal of office to be affixed to these presents at the U.S. Department of the Treasury, in the City of Washington, District of Columbia. Signature Comptroller of the Currency

OTS DOCKET # 7398 FEDERAL STOCK CHARTER Wilmington Savings Fund Society Section 1. Corporate Title. The full corporate title of the savings bank is “ Wilmington Saving Fund Society. Federal Savings Bank,” Section 2. Office. The home office of the savings bank shall be located in the County of New Castle, State of Delaware. SECTION 3, Duration. The duration of the savings bank is perpetual Section 4, Purpose and Powers. The purpose of the savings bank is to pursue any or all of the lawful objectives of a Federal savings bank chattered under Section 5 of the Home Owners’ Loan Act and to exercise all (he express, implied, and incidental powers conferred thereby and by all acts amendatory thereof and supplemental thereto, subject to the Constitution and laws of the United States as they are now in effect, or as they may hereafter be amended, and subject to all lawful and applicable rules, regulations, and orders of the Federal Home Loan Bank Board (“Board”). In addition, the savings bank may make any Investment and engage in any activity as may be specifically authorized by action of the Board, including authorization by delegated authority, in connection with action approving the issuance of the charter. Section 5. Capital Stock. The total number of shares of all classes of the capital stock which the savings bank has authority to Issue is Twenty Five Million (25.000,000), of which Seventeen and One Half Million (17,500,000) shall be common stock, pas value S.01 per share, and of which Seven and One Half Million (7,500,000) shall be preferred stock, par value S.01 per share. The shares may be issued from time to time as authorized by the board of directors without further approval of stockholders except as otherwise provided in this Section 5 or to the extent that such approval is required by governing law, rule, or regulation. The consideration for the issuance of the shares shall be paid in full before their issuance and shall not be less than the par value. Neither promissory notes not future services shall constitute payment or part payment for the issuance of shares of the savings bank. The consideration for the shares shall be cash, tangible or Intangible property (to the extent direct investment in such property would be permitted), labor or services actually performed for the savings bank, or any combination of the foregoing. In the absence of actual fraud in the transaction, the value of such property, labor, or services, as determined by the board of directors of the savings bank, shall be conclusive. Upon payment of such consideration, such shares shall be deemed to be fully paid and nonassessable. In the case of a stock dividend, that pan of the surplus of the savings bank which is transferred to stated capital upon the issuance of shares as a share dividend shall be deemed to be the consideration for their issuance, Except for shares issuable in connection with the conversion of the savings bank from the mutual to the stock form of capitalization, no shares of capital stock (including shares issuable upon conversion, exchange, or exercise of other securities) shall be issued, directly or indirectly, to officers, directors, or controlling persons of the savings bank other than as part of a general public offering or as qualifying shares to a director, unless their issuance or the plan under which they would be issued has been approved by a majority of the total votes eligible to be cast at a legal meeting. Nothing contained in this Section 5 (or in any supplementary section hereto) shall entitle the holders of any class of a series of capital stock to vote as a separate class or series or to more than one vote per share, except as to the cumulation of votes for the election of directors: Provided, That this restriction on voting separately by class or series shall not apply: (i) To any provision which would authorize the holders of preferred stock, voting as a class or series, to elect some members of the board of directors, less than a majority thereof, in the event of default in the payment of dividends on any classor series of preferred stock:

(ii)-To any provision which would require the holders of preferred stock, voting as a class or series, to approve the merger or consolidation of the savings bank with another corporation or the sale, lease, or conveyance (other than by mortgage or pledge) of properties or business in exchange for securities of a corporation other than the savings bank if the preferred stock is exchanged for securities of such other corporation: Provided, That no provision may require such approval for transactions undertaken with the assistance or pursuant to the direction of the Federal Savings and Loan Insurance Corporation; (iii) To any amendment which would adversely change the specific terms of any class of series of capital stock as set forth in this Section 5 (or in any supplementary sections hereto), including any amendment which would create or enlarge any class or series ranking prior thereto In rights and preferences. An amendment which increases the number of authorized shares of any class or series of capital stock, or substitutes the surviving association in a merger or consolidation for the savings bank, shall not be considered to be such an adverse change. A description of the different classes and series (if any) of the savings bank’s capital stock and a statement of the designations, and the relative rights, preferences, and limitations or the shares of each class of add series (if any) of capital stock are as follows: A Common Stock Except as provided in this Section 5 (or in any supplementary sections hereto) the holders of the common stock shall exclusively possess all voting power. Each holder of shares of Common stock shall be entitled to one vote for each share held by such holder, except as to the cummulation of rates for the election of directors. Whenever there shall have been paid, or declared and set aside for payment, to the holders of the outstanding shares of any class of stock having preference over the common stock as to the payment of dividends, the full amount of dividends and of sinking fund, retirement fund, or other retirement payments, if any, to which such holder are respectively entitled in preference; to the common stock, then dividends may be paid on the common stock and or any class or series of stock entitled to participate therewith as to dividends out of any assets legally available for the payment of dividends. In the event of any liquidation, dissolution, or winding up of the savings bank, the holders of the common stock (and the holders of any class or series of stock entitled to participate with the common stock in the distribution of assets) shall be entitled to receive, in cash or in kind, the assets of the savings bank available for distribution remaining after. (i) payment or provision for payment of the savings bank’s debts and liabilities; (ii) distributions or provision for distributions in settlement of its liquidation account; and (iii) distributions or provision for distributions to holders of any daw or series of stock having preference over the common stock in the liquidation, dissolution, or winding up of the savings bank, Each share of common stock shall have the same relative rights as and be identical in all respects with all the other shares of common stock. a Preferred Stock. The savings bank may provide in supplementary sections to its charter for one or more classes of preferred stock, which shall be separately identified. The shares of any class may be divided Into and issued in series, with each series separately designated so as to distinguish the shares thereof from the shares of all other series and classes. The terms of each series shall be set forth in a supplementary section to the charter. All shares of the same class shall be identical except as to the following relative rights and preferences, as to which there may be variations between different series: (a) The distinctive serial designation and the number of shares constituting such series; (b) The dividend rate or she amount of dividends to be paid on the shares of such series, whether dividends shall be cumulative and, if so, from which date(s) the payment date(s) for dividends, and the participating or other special rights, if any, with respect to dividends; (c) The voting powers. full or limited, if any, of the shares of such series; (d) Whether the shares of such series shall be redeemable and, if so. the price(s) at which, and the terms and conditions on which, such shares may be redeemed;

(e) The amount(s) payable upon the shares of such series in the event of voluntary or involuntary liquidation, dissolution, or winding up to the savings bank; (f) Whether the shares of such series shall be entitled to the benefit of a sinking or retirement fund to be applied to the purchase or redemption of such shares, and if so entitled, the amount of such fund and the manner of its application, including the price(s) at which such shares may be redeemed or purchased through the application of such fund; (g) Whether the shares of such series shall be convertible into, or exchangeable for, shares of any other class or classes of stock of the savings bank and, if to, the conversion price(s) or the rate(s) of exchange, and the adjustments thereof, if any, at which such conversion or exchange may be made, and any other terms and conditions of such conversion or exchange, (h) The price or other consideration for which the shares or such series shall be issued; and (I) Whether the shares of such series which are redeemed or convened shall have the status of authorized but unissued shares of serial preferred stock and whether such shares may be reissued at shares of the same or any other series of serial preferred stock. Each share of each series of serial preferred stock shall have the same relative rights as and be identical in all respects with all the other shares of the same series. The board of directors shall have authority to divide, by the adoption of supplementary charter sections, any authorized class of preferred stock into series, and, within the limitations set forth in this section and the articles of incorporation, fix and determine the relative rights and preferences of the shares of any series so established. Prior to the issuance of any preferred shares of a series established by a supplementary chatter section adopted by the board of directors, the savings bank shall file with the Secretary to the Board a dated copy of that supplementary section of this charter establishing and designating the series and fixing and determining the relative rights and preferences thereof. Section 6. Net Worth Certificates. Notwithstanding any provision of Section 5. Capital Stack, the savings bank may issue net worth certificates, Income capital certificates or similar certificates to the Federal Savings and Loan Insurance Corporation (the ‘‘Corporation”) or the Federal Deposit Insurance Corporation in exchange for appropriate consideration, inducting promissory notes of the Corporation, In accordance with the rules, regulations, and policies Of the Board. Subject to such rules, regulations, and policies, the board of directors of the savings bank is authorized without the prior approval of the stockholders of the savings bank and by resoiudon(s) from time to time adopted by the board of directors to cause the issuance of net worth certificates to the Corporation and to fix the designations, preferences, and relative, participating, optional, or other special rights of the certificates, and the qualifications, limitations, and restrictions thereon. Stockholders of the savings bank shall nor be entitled to preemptive rights with respect to the issuance of net worth certificates, nor shall bolders of such certificates be entitled to preemptive rights with respect to any additional issuance of net worth certificates. Section7. PreemptiveRights. Holders of the capital stock of the savings bank shall not be entitled to preemptive rights with respect to any shares of the savings bank which may be issued. Section 8. Certain provisions applicable for five years. Notwithstanding anything contained in the savings bank charter or bylaws to the contrary, for a period of five years from the date of completion Of the conversion of the savings bank from mutual to stock form, the following provisions shall apply; A. Beneficial ownership limitation. No person shall directly or indirectly offer to acquire or acquire the beneficial ownership of more than 10 percent of any class of an equity security of the savings bank. This limitation shall not apply to a transaction in which the savings bank forms a holding company without change in the respective beneficial ownership interests of its stockholders other than pursuant to the exercise of any dissenter and appraisal rights or the purchase of shares by underwriters in connection with a public offering. In the event shares are acquired in violation of this Section 8, all shares beneficially owned by any person in excess of 10% shall be considered ‘excess shares’ and shall not be counted as shares entitled to vote and shall not be voted by any person or counted as voting shares in connection with any matters submitted to the stockholders for a vote.

For the purposes of this Section 8, the following definitions apply. (1) The term “person” includes an individual. a group Acting in concert, a corporation, a partnership, an association, a Joint stock company, a trust, any unincorporated organization or similar company, a syndicate or any other group formed for the purpose of acquiring, holding or disposing of securities of the savings bank. (2) The term “offer” includes every offer to buy or otherwise acquire, solicitation of an offer to sell, tender offer for, or request or invitation for tenders of, a security or interest in a security for value. (3) The term “acquire” includes every type of acquisition, whether effected by purchase, exchange, operation of law or otherwise. (4) The term “acting in concert” means (a) knowing participation in a joint activity or conscious parallel action towards a common goal whether or not pursuant to an express agreement, or (b) a combination or pooling of voting or other interests in the securities of an issuer for a common purpose pursuant to any contract, understanding, relationship, agreement or other arrangements, whether written or otherwise. B. Cumulative voting limitation. Stockholders shall not be permitted to cumulate their votes for election of directors. C. Call for special meetings. Special meetings of stockholders relating to changes in control of the savings bank or amendments to its charter shall be called only upon direction of the board of directors. Section 9. Liquidation Account. Pursuant to the requirements of the Board’s regulations (12 C.F.R. Subchapter D), the savings bank shall establish and maintain a liquidation account for the benefit of its savings account holders as of December 31, 1983 (“eligible savers”). In the event of a complete liquidation of the savings bank, it shall comply with such regulations with respect to the amount and the priorities on liquidation of each of the savings bank’s eligible saver’s inchoate interest in the liquidation account, to the extent It is still in existence: Provided, that an eligible saver’s Inchoate interest In the liquidation account shall not entitle tie such eligible saver to any voting rights at meetings of the savings bank’s stockholders. Section 10. Directors. The savings bank shall be under the direction of a board of directors. The authorized number of directors, as stated in the savings bank’s bylaws, shall not be less than seven or more than fifteen except when a greater number is approved by the Board. Section 11. Amendment of Charier. Except as provided in Section 5, no amendment, addition, alteration, change, or repeal of this charter shall be made, unless such is first proposed by the board of directors or the savings bank, then preliminarily approved by the Board, which preliminary approval may be granted by the Board pursuant to regulations specifying preapproved charter amendments, and thereafter approved by the shareholders by a majority of the total votes eligible to be cast as a legal meeting. Any amendment, addition, alteration, change, or repeal so acted upon shall be effective upon filing with the Board in accordance with regulatory procedures or on such other date as the Board may specify in Its preliminary approval. A

any amendment, addition, alteration, change or repeal to acted upon shall be effective upon filing with the Board in accordance with the regulatory procedures or on such other date as the Board may specify in its preliminary approval Attest: Secretary of the Savings Bank Declared effective this President or Chief Executive Officer of the Savings Bank day of ,1986. Attest: Secretary to the Board Federal Home Loan Bank Board Associate General Counsel for Conversions

SUPPLEMENTARY SECTION TO THE FEDERAL STOCK CHARTER OF WILMINGTON SAVINGS FOND SOCIETY, OTSDOCKET # 7938 FEDERAL SAVINGS BANK Authorization of Non-Cumulative Convertible Perpetual Preferred Stock, Series I, $.01 Par Value Per Share RESOLVED that, pursuant to Section 5 of the Federal Stock Charter of Wilmington Savings Fund Society, Federal Savings Bank (the ‘Bank’) the Board of Directors of the Bank does hereby adopt a Supplementary Section to the Federal Stock Charter of the Bank to provide for the issuance of shares of Preferred Stock is a series to consist of Two Million (2,000,000) shares, $.01 par value per share, to be known at the Bank’s *Non-Cumulative Convertible Perpetual Preferred Stock, Series 1st and does hereby fix the distinguishing characteristics, relative rights and preferences, including the designation, preferences and relative participating, optional or other special rights, and the qualifications, limitations and restrictions thereof, of such series of stock (In addition to those set forth in the Federal Stock Charter of the Bank which are applicable to the Preferred Stock of all series), as follows: Section 1. Designation and Amount. The share of this series shall be designated as “Non-cumulative Perpetual Convertible Preferred Stock, Series 1st (the ‘Series 1 Preferred Stock*) and the number of shares constituting the Series 1 Preferred Stock shall be Two Million (2,000,000) shares. Section 2. Dividends and Distributions. (A) The holders of record of shires of Series 1 Preferred Stock shall be entitled to receive, if, as and when declared by the Board of Directors out of funds legally available for the purpose, quarterly cash dividends payable in arrears on the first day of January, April, july and October in each year (each such date being referred to herein as a ’Quarterly Dividend Payment Date*), to the holders of record of the Series I Preferred Stock at the close of business on or about the 15th day of (he month next preceding the first day of January, April, July or October, as the case may be, fixed by the Board of Directors (the ‘Record Date’*), commencing on the first Quarterly Dividend Payment Date after March 31,1994 in an amount (if any) per share (rounded to the nearest cent), subject to the provision for adjustment hereinafter set forth, equal to one-quarter, of the total annual dividend of ninety cent (90s) per share. (B) Dividends due pursuant to paragraph (A) of this Section shall begin to accrue on outstanding shares of Series 1 Preferred Stock from the Quarterly Dividend Payment Date next preceding March 31, 1994. Dividends accruing on outstanding shares of Series 1 Preferred Stock shall not be cumulative. Dividends paid on the share* of Series 1 Preferred Stock in an amount less than the total amount of such dividends at the time accrued and payable on such share* shall be allocated pro rata on a share-by-share basis among all such share at the time outstanding. (C) No dividends shall accrue or be paid on the Series 1 Preferred Stock, if after payment, the Bank would be undercapitalized within the meaning of Section 38(d) of the Federal Deposit Insurance Act. Section 3. Certain Restrictions*. (A) Prior to March 31, 1994, the Bank shall not in any circumstances, and after March 31, 1994, whenever quarterly dividend* or other dividends or distribution payable on the Series 1 Preferred Stock as provided in Section 2 are in arrears, thereafter and until all accrued and unpaid dividends and distributions, whether or not declared, on shares of Series 1 Preferred Stock outstanding shall have been paid in full, the Bank shall not: (i) declare or pay dividends, or make any other distributions, on any shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) (to the Series 1 Preferred Stock; (ii) declare or pay dividends, or make any other distributions, on any shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series 1 Preferred Stock, except dividends paid ratably on the Series 1 Preferred Stock and all such parity stock on which dividends are payable or in arrears in proportion to the total amounts to which the holders of all such shares are then entitled; or

(iii) redeem or purchase or otherwise acquire for consideration shares of any stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series 1 Preferred Stock, provided that the Bank may at any time redeem, purchase or otherwise acquire shares of any such junior stock in exchange for shares of any stock of the Bank ranking junior (as to dividends and upon dissolution, liquidation or winding up) to the Series 1 Preferred Stock. (B) The Bank shall not permit any subsidiary of the Bank to purchase or otherwise acquire for consideration any shares of stock of the Bank unless the Bank could, under paragraph (A) of this Section 3, purchase or otherwise acquire such shares at such time and In such manner. Section 4. Voting Rights. Except as otherwise provided by statute, the Bank’s Federal Stock Charter or the regulations of the Office of Thrift Supervision, or any successor thereto, holders of Series 1 Preferred Stock shall have no special voting rights and their consent shall not be required for taking any corporate action. Section 5. Conversion. (A) Conversion Privilege. Each holder of a share of Series 1 Preferred Stock shall have the right, at his option, at any time or from time to time to convert such share into six (6) fully paid and nonassessable shares of the Bank’s common stock, $0.1 par value per share (the “Common Stock”). No adjustment or allowance shall be made for dividends on shares of Series 1 Preferred Stock surrendered for conversion, whether accrued, accumulated or otherwise. If the Bank subdivides or combine in a larger or smaller number of shares its outstanding shares of Common Stock, then the number of shares of Common Stock issuable upon the conversion of Series 1 Preferred Stock will be proportionately increased in the case of a subdivision and decreased in the case of a combination, effective in either case at the close of business on the date that the subdivision or combination becomes effective. If the Bank at any time pays to the holders of its Common Stock a dividend in Common Stock, the number of shares of Common Stock issuable upon the conversion of series1 Preferred Stock shall be proportionally increased, effective at the close of business on the record date for determination of the holders of the Common Stock entitled to the dividend. In addition, the number of shares into which the Series 1 Preferred Stock shall convert shall be automatically adjusted from time to time in the same manner and to the same extent as the number of shares into which the 10% Convertible Preferred Stock, Series 1, $.01 par value per share, of Star States Corporation the ‘Star States Series 1 Preferred Stocks shall be entitled to convert so that each share of the Series 1 Preferred Stock shall at all times be convertible into the same number of shares of Common Stock as a share of Star States Series 1 Preferred Stock would then be entitled to convert. (B) Manner of Exercise- In order to exercise the conversion privilege with respect to any shares of Series 1 Preferred Stock, the holder thereof shall surrender the certificate or certificates therefor to any transfer agent of the Bank for the Series 1 Preferred Stock, duly endorsed in blank for transfer, accompanied by written notice of election to convert such shares of Series I Preferred Stock or a portion thereof executed on the form set forth on such certificates or on such other form as may be provided from time to time by the Bank. As soon as practicable after the surrender of such certificates as provided above, the Bank shall cause to be issued and delivered, at the office of such transfer agent, to or on the order of the holder of the certificates thus surrendered, a certificate or certificates for the number of full shares of Common Stock issuable hereunder upon the cooversion of such shares of Series 1 Preferred Stock and scrip, in respect of any fraction of a share of Common Stock issuable upon such conversion as provided in paragraph (C). Such conversion shall be deemed to have been effected on the date on which the certificates for such shares of series 1 Preferred Stock have been surrendered as provided above, and the person in whose name any certificate or certificates for shares of Common Stock are issuable upon such conversion shall be deemed to have become on such date the holder of record of the shares represented thereby. (C) . Issuance of Scrip in Lieu of Fractional Shares. No fractional shares of Common Stock shall be issued upon any conversion of Series 1 Preferred Stock. If two of more shares of Series 1 Preferred Stock are surrendered for conversion at one time by the same holder, the number of full shares issuable upon the conversion of such shares shall be computed on the basis of the aggregate Original Liquidation Value (without adjustment for allowance for dividends whether accrued, accumulated or otherwise) of such shares. In lieu of any fraction of a share of Common Stock to which any holder would otherwise be entitled upon conversion of any shares of Series 1 Preferred Stock, the Bank shall issue non-interest-bearing and non-voting scrip certificates which shall not be entitled to dividends for such fraction, such certificates, together with other similar certificates, to be exchangeable for the number of full shares of Common Stock represented thereby, To be issued in such

denominations and in such form, to expire after such reasonable time (which shall be not less than one year after the date of issue thereof), to contain such provisions for the sale, for the account of the holders of such certificates, of shares of Common Stock for which such certificate are exchangeable , and to be subject to such other terms and conditions, as the Board of Directors may from time to time determine prior to the issue thereof. (D) The Bank shall at all times reserve and keep available out of the authorized Common Stock the full number of shares of the Common Stock issuable upon the conversion of all outstanding shares of the Series 1 Preferred Stock. Section 6. Redemption of the Series 1 Preferred Stock. (A) Redemption at the Bank’s Option. At any time on or after January 1, 1996, the Bank may redeem all Or any portion of the Series 1 Preferred Stock then outstanding at a price per share equal to the Redemption Price (as defined herein). For each share which is called for redemption, the Bank will be obligated to pay to the holder thereof on the date on which redemption Is to be made (the “Redemption Date”), upon surrender by such holder at the offices of the transfer agent for the Series 1 Preferred Stock of the certificate representing such share, duly endorsed in blank or accompanied by as appropriate form of assignment, as amount in cash equal to nine dollars ($9) per share (the ‘Redemption Price ). (B) Partial Redemption. In the event that less than all of the outstanding shares of the Series 1 Preferred Stock are to be redeemed, the number of shares to be redeemed shall be determined by the Board of Directors of the Bank and the shares to be redeemed shall be determined by lot or pro rata or by any other method as may be determined by such Board of Directors in its sole discretion to be equitable, and the certificate of the Bank’s Secretary filed with the transfer agent for the Series 1 Preferred Stock in respect of such determination shall be conclusive. (C) Notice of Redemption. In the event the Bank shall redeem shares of Series 1 Preferred Stock, notice of such redemption shall be given by first class mail, postage prepaid, mailed not less than fifteen (15) nor more than sixty (60) days prior to the Redemption Date, to each record holder of the shares to be redeemed, at such holder’s address as the same appears on the books of the Bank. Each such notices shall state: (1) the time and date as of which the redemption shall occur; (ii) the total number of shares of Series 1 Preferred Stock to be redeemed and, if fewer than all the shares held by such holder are to be redeemed, the number of such shares to be redeemed from such holder, (iii) the Redemption price; (iv) that the shares of Series 1 Preferred Stock called for redemption may be converted at any time prior to the time and date fixed for redemption; (v) the applicable conversion price or rate; (vi) the place or places where certificates for such shares to be surrendered for payment of the Redemption Price; and (vii) that dividends on the shares to be redeemed will cease to accrue on such Redemption Date. (D) Dividends After Redemption Date. If notice of redemption shall have been given as provided in paragraph (C), dividends on the shares of Series 1 Preferred Stock so called for redemption shall cease to accrue, such shares shall so longer be deemed to be outstanding, and all rights of the holders thereof as stockholders of the Bank (except the right to receive from the Bank the Redemption Price without interest and except the right to convert such shares in accordance with Section 5) shall cease (including any right to receive dividends otherwise payable on any Dividend Payment Date that would have occurred after the Redemption Date) from and after the time and date fixed in the notice of Redemption Date or (ii) if the Bank shall so elect and state in the notice of redemption, from and after the time and date (which date shall be the Redemption Date or an earlier date not less than fifteen (15) days after the date of mailing of the redemption notice) on which the Bank shall irrevocably deposit with a designated bank or trust company, as paying agent, money sufficient to pay at the office of such paying agent on the Redemption Date, the Redemption Price. Any money so deposited with any such paying agent which shall not be required for such redemption because of the exercise of any right of conversion or otherwise shall be returned to the Bank forthwith. Upon surrender (In accordance With the notice of redemption) of the certificate or certificates for any shares to be so redeemed (properly endorsed or assigned for transfer, if the Bank shall so require and the notice of redemption shall so state), such shares shall be redeemed by the Bank at the Redemption Price, In case fewer than all the shares represented by any such certificate are to be redeemed, a new certificate shall be issued representing the unredeemed shares, without cost to the holder thereof, together with scrip in lieu of fractional shares in accordance with Section 5(C), Subject to applicable escheat laws, any moneys so set aside by the Bank and unclaimed at the end of one year from the Redemption Date shall revert to the general funds of the Bank, after which reversion the holders of such shares so called for redemption shall look only to the general funds of the Bank for the payment of the Redemption Price without interest. Any interest accrued on funds so deposited shall be paid to the Bank from time to time.

(E) No Other Redemption. The Series 1 Preferred Stock shall not be subject to redemption except as provided in this Section 6. Section 7. Reacquired Shares. Any shares of Series 1 Preferred Stock purchased or otherwise acquired by the Bank in any manner whatsover shall be retired and cancelled promptly after the acquisition thereof. All such shares shall upon their cancellation become authorized but unissued shares of Preferred Stock and may be reissued as part of a new series of Preferred Stock subject to the conditions and restrictions on issuance set forth herein, in the Federal Stock Charter of the Bank, including any supplementary section to the Federal Stock Charter creating a series of Preferred Stock or any similar stock or as otherwise required by law. Section 8. Liquidation, Dissolution or Winding Up. Upon any liquidation, dissolution or winding up of the Bank the holders of shares of Series 1 Preferred Stock shall be entitled to receive, after payment or provision for payment of the Bank’s debts and liablities and distributions or provisions for distributions in settlement of Its liquidation account, as aggregate amount per share, subject to the provision for adjustment hereinafter set forth, equal to nine dollars (S9) (the ‘Original Liquidation Value’} per share and the holders of the Series 1 Preferred Stock shall shall not be entitled to any further payment, such amounts being herein sometimes referred to as the ‘Liquidation Payments. * Upon any such liquidation, dissolution or winding up of the Bank, after the holders of the series 1 Preferred Stock shall have been paid in full the amounts to which they shall be entitled, the remaining net assets of the Bank may be distributed to the holders of the Common Stock. Written notice of any such liquidation, dissolution or winding up, stating a payment date, the amount of the Liquidation payments and the place where said sums shall be payable shall be given by mail, postage prepaid, not less than thirty (30) days prior to the payment date stated therein, to the holders of record of the series 1 Preferred Stock, such notice to be addressed to each stockholder at his post office address as shown by the records of the Bank. Neither the consolidation nor merger of the Bank into or with any other corporation or corporations, nor the sale or transfer by the Bank of all or any part of its assets, nor the reduction of the capital stock of the Bank, shall be deemed to be a liquidation, dissolution or winding up of tbe Bank within the meaning of any of the provisions of this Section 8. Section 9. Consolidation, Merger, etc. In the event the Bank shall enter into any consolidation, merger, combination or other transaction in which the shares of Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, then in any such event each share of Series 1 Preferred Stock shall at the same time be similarly exchanged or changed into an amount per share, subject to the provision for adjustment hereinafter set forth, equal to the amount which would have been received by the holder thereof if such share of series 1 Preferred Stock had been converted to Common Stock immediately prior to such transaction pursuant to Section 5 hereof. The undersigned President and Secretary of the Bank hereby certify that the foregoing Supplementary Section to the Federal Stock Charter of the Bank was duty adopted by the Board of Directors of the Bank. Dated as of the 9 th day of September, 1992. WILMINGTON SAVINGS FUND SOCIETY, FEDERAL SAVINGS BANK (SEAL) By: /s/ Marvin N. Schoenhals Marvin N. Schoenhals, President ATTEST: By: /s/ John D. Waters John D. Waters, Secretary

Exhibit 4 Bylaws of Wilmington Savings Fund Society, FSB (see attached)

BYLAWS OF WILMINGTON SAVINGS FUND SOCIETY, FEDERAL SAVINGS BANK ARTICLE I. HOME OFFICE The home office of WILMINGTON Savings Fund Society, Federal Savings Bank (“Bank”) SHALL be AT Wilmington in the county of New Castle in the State of Delaware. ARTICLE II. STOCKHOLDERS Section 1. Place of Meetings. All annual and special meetings of stockholders shall be held at such place as the board of directors may determine in the state in which the Bank has Its principal place of business. Section 2. Annual meeting. The annual meeting of the stockholders of the Bank for the election of directors and for the transaction of any other business of the Bank shall be held within 120 days after the end of the bank’s fiscal ’year. Such meeting date shall be designated annually by the board of directors. Section 3. Special Meetings. Special Meetings of the shareholders for any purpose or purposes, unless otherwise prescribed by the regulations of the Federal Home Loan Bank Board (“Board”) (which as hereinafter used includes the Federal Savings and Loan insurance Corporation), may be called at any time by the chairman of the board, the president, or a majority of the board of directors, and shall be called by the chairman of the board, the president, or the secretary upon the written request of the holders of not less than one-tenth of all of the outstanding capital stock of the Bank entitled to vote at the meeting. Such written request shall state the purpose or purposes of the meeting and shall be delivered to the home office of the Bank addressed to the chairman of the board, the president, or the secretary. Section 4. Conduct of Meetings. Annual and special meetings shall be conducted is accordance with the most current edition of Robert’s Rules of Order unless otherwise prescribed by regulations of the Federal Home Loan Bank Board, or these bylaws. The board of directors shall designate, when present, either the chairman of the board or president to preside at such meetings. Section 5. Notice of Meetings. Written notice stating the place, day and hour of the meeting and the purpose or purposes for which the meeting is called shall be delivered not less than twenty nor more than fifty days before the date of the meeting, either personally or by mail, by or at the direction of the chairman of the board, the president, the secretary, the directors calling the meeting to each stockholder of record entitled to vote at such meeting. If mailed, such notice shall be deemed to be delivered when deposited in the U.S. mail, addressed to the stockholder at his address as it appears on the stock transfer books or records of the Bank as of the record date prescribed In Section 6 of this Article II. with postage direction propaids when any stockholders meeting amount or special is adjourned for thirty days or more, notice of the adjourned meeting shall be given as in the case of on original meeting. It shall not be necessary to give any notice of the time and place of any meeting adjourned for less than thirty days or of the business to be transacted thereat, other than an announcement at the meeting at which such adjournment is taken. Section 6. Fixing of Record Date. For the purpose of determining stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, or stockholders entitled to receive payment of any dividend, or In order to make a determination of stockholders for any other proper purpose, the board of directors shall fix in advance a date as the record date for any such determination of stockholders. Such date in any case shall be not more than sixty days and, in case of a meeting of

stockholders, not fewer Than ten days prior to the date on which the particular action, requiring such determination of stockholders, is to be taken. When a determination of stockholders entitled to vote at any meeting of stockholders has been made as provided in this section, such determination shall apply to any adjournment thereof. Section 7. Voting lists. The officer or agent having charge of the stock transfer books for shares of the Bank shall make, at least twenty days before each meeting of the stockholders, a complete list of the stockholders entitled to vote at such meeting, or any adjournment thereof, arranged in alphabetical order, with the address of and the number of shares held by each, which list, shall be kept on file at the home office of the Bank and shall be subject to inspection by any stockholder at any time during usual business hours, for a period of twenty days prior to such meeting. Such list shall also be produced and kept open at the time and place of the meeting and shall be subject to the inspection of any stockholder during the whole time of the meeting. The original stock transfer book shall be prime facle evidence as to who are the stockholders entitled to examine such list or transfer books or to Vote at any meeting of stockholders. In lieu of making the stockholders list available foe inspection by any stockholder as provided in the preceding paragraph, the board of directors may elect to follow the procedures prescribed in Section 552.6( d) of the Board’s Regulations, as now or hereafter in effect. Section 8. Quorum. A majority of the outstanding shares of the Bank entitled to vote, represented in person or by proxy, shall constitute a quorum at a meeting of stockholders. If less than a majority of the outstanding shares are represented at a meeting, a majority of the shares so represented may adjourn the meeting from time to time without further notice. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally notified. This stockholders present at a duly organized meeting may continue to transact business until adjournment, notwithstanding the withdrawal of enough stockholders to leave less than a quorum. Section 9. Proxies. At all meetings of stockholders, a stockholder may vote by proxy executed in writing by the stockholder or by his duly authorized attorney In fact. Proxies solicited on behalf of the management shall be voted as directed by the stockholder or, in the absence of such direction, as determined by a majority of the board or directors. No proxy shall be valid after eleven months from the date of its execution except for a proxy coupled with an Interest. Section 10. Voting of Shares in the Name of two or More Persons. When ownership stands in the name of two or more persons, in the absence of written directions to the Bank to the contary, at any meeting of the stockholders of the Bank any one or more of such stockholders may cast, in person or by proxy, all votes to which such ownership is entitled. In the event an attempt is made to cast conflicting votes, in person or by proxy, by the several persons in whose names shares of stock stand, the vote or votes to which those persons are entitled shall be cast as directed by a majority of those holding such stock and present In person or by proxy at such meeting, but no votes shall be cast for such stock if a majority cannot agree. Section 11. Voting of Shares by Certain Holders. Shares standing in the name of another corporation may bo voted by any officer, agent or proxy as the bylaws of such corporation may prescribe, or, in the absence of such provision, as the board of directors of such corporation may determine. Shares held by an administrator, executor, guardian or conservator may be voted by him, either in person or by proxy, without transfer of such shares into his name, shares trading in the name of a trustee may be voted by him, either In person or by proxy, but no trustee shall be entitled to vote shares Held by him without a transfer of such shares Into his name. Shares standing in the name of a receiver may be voted by such receiver, and shares held by or under the control of a receiver nay be voted by such receiver without the transfer thereof Into his name if authority to do so is contained In an appropriate order of the court or other public authority by which such receiver was appointed. A stockholder whose shares are pledged shall be entitled to vote such shares until the shares have been transferred Into the name of the pledgee and thereafter the pledgee shall be entitled to vote the shares so transferred.

Neither treasury shares of its own stock held by the Bank, nor shares held by another corporation, If a majority of the shares entitled to vote for the election of directors of such other corporation are held by the Bank, shall be voted at any meeting or counted in determining the total number of outstanding shares at any given time for purposes of any meeting. Section 12. Cumulative Voting. For a period of five years following the date of the completion of the conversion of the Bank from mutual to stock form, the cumulation of votes for the election of director is not permitted. Thereafter, at each election for directors every stockholder entitled to vote at such election shall have the right either to vote, in person or by proxy, the number of shares owned by him for as many persons as there are directors to be elected and for whole election he has a right to vote, or to cumulate his voter by giving or candidate as many votes as the number of such.directors to be elected multiplied by the number of his shares shall equal, or by distributing such votes on the same principle among any number of candidates. Section 13. Informal Action by Stockholders. Any action required to be taken at a meeting of the stockholders, or any other action which may be taken at a meeting of the stockholders, may be taken without a meeting if unanimous consent In writing, setting forth the action so taken, shall be given by all of the stockholders entitled to vote with respect to the subject matter thereof. Section 14. Inspectors of Election. In advance of any meeting of stockholders, the board of directors may appoint any persons other than nominees for office as inspectors of elections to act at such meeting or any adjournment thereof. The number of Inspectors shall be either one or three. If the board of directors so appoints either one or three such inspectors that appointment shall not be altered at the meeting. If inspectors of election are not to appointed, the chairman of the board or the president may make such appointment at the meeting. If appointed at the meeting, the majority of the votes present shall determine whether one or three Inspectors are to be appointed. In case any person appointed as Inspectors falls to appear or refuses to act, the vacancy may be filled by appointment by the board of directors In advance of the meeting, by the chairman of the board, or by the president. Unless Otherwise prescribed by regulations of the Federal Home Loan Bank Board, the duties of such Inspectors shall Include: determining the number of shares of stock and the voting power of each shares, the shares of stock represented at the meeting the existence of a quorum, the authenticity, validity and effect of proxies; receiving votes, ballots or consents; hearing and determinig all challenges and questions In any way arising In connection with the rights to vote; counting and tabulating all votes consents; determining the result and such acts as may be proper to conduct the election or vote with fairness to all stockholders. Section 15. Nominating Commitee. The board of directors shall act as a nominating committee for selecting the management nominees for selecting the management nominees for election as directors. Except in the case of a nominee substituted as a result of the death or other, Incapacity of a management nominee, the nominating committee shall deliver written nominations to the secretary at least 20 days prior to the class of the annual meeting. Upon delivery, such nominations shall be posted In a completions place in each office of the Bank. No nominations for directors except those made by the nominating committee shall be voted upon at the annual meeting unless other nominations by stockholders are made in writing and delivered to the secretary of the Bank at least five days prior to the date or the annual meeting. Upon delivery, such nomination shall be posted In a conspicuous place in each office of the Bank. Ballots bearing the names of all the persons nominated by the nominating committee and by stockholders shall be provided for use at the annual meeting. However, if the nominating committee shall fail or refuse to act at least 20 days prior to the annual meeting, nominations for directors may made at the annual meeting by any stockholder entitled to vote and shall be voted upon. SECTION 16. New Business. Any new business proposed by a stockholder to be taken up at the annual meeting shall be stated In writing and filed with the secretary of the Bank at least five days before the date of the annual meeting, and all business so stated, proposed and filed shall be considered at the annual meeting, but no other proposed shall be acted upon at the annual meeting. Such writing filed with the secretary shall contain such information as required by Regulation 14A and Schedule 14A under the Securities Exchange Act 1934. Any stockholder may make any other proposal at the annual meeting and the same may be discussed and considered, but unless stated In writing and filed with the secretory at least five days before the meeting, as provided above, such proposal shall be laid over for action at an

adjourned, special or annual meeting of the stockholders taking place thirty days or more thereafter. This provision shall not prevent the consideration and approval of disapproval at the annual meeting of reports of officers, directors end committees, but in connection with such reports so new business shall be acted upon at such annual meeting unless stated and filed as herein provided, ARTICLE IIL Board of DIRECTORS SECTION 1. General Powers. The business and affairs of the Bank shall be under the direction of its board of directors. The board of directors shall annually elect a chairman of the board and a president from among its member and shall designate, when present, either the chairman of the board or tha president to president at its meeting, Section 2. Number and Term. The board of directors shall consist of eleven (11) members and shall . be divided into three classes as nearly equal in number as possible. .The members of each class shall be elected for a term of three yraras and until their successors are elected and qualified. One class shall be elected by ballot annually. Section 3. Regular Meeting. A regular meeting of the board of directors shall be held without other notice than this bylaw immediately after, and it the same place, the annual meeting of stockholder. The board of directors may provide, by resolution. the time and place, without the Bank’s regular lending area, for the holding of additional regular meeting without other notice than such resolution. Section 4. Qualification. Eachi Directors shall as all tltues be the beneficial owner of not lass than 100 shares of capital stock of the association unless the association is a wholly owned subsidiary of a holding company. Section 5. Special Meetings. Special meeting of the board of directors may bo called by or at the request of tha chilrman of the board, thi president or one-third of the directors. The persons authorized to call special meetingof the board of directors may fix any place, within the Banks regular lending area, as the place for holding any special meeting of the board of direotors called by such person All meeting of the board Of directors shall be conducted In accordance with the most current edition of Rubers’s Rules of Order. Members of the board of directors may partcipate in meeting by means of conference telephone, or by meant of similar communications equipment by which all persons participating In the meeting can hear each other. Such participation shall constitute presence in person but shall not constitute attendance for the purpose of compensation pursuant to Section 12 of this Article. Section 6. Notice. Written notice of any special meeting shall be given to each director at least two days prior thereto delivered personally or by telegram, or at least five days prior thereto when delivered by mail at the address at which the director is most likely to be reached. Such notice shall be deemed to be delivered when deposited In the U.s, mail so addressed, with postage thereon prepaid If mailed, or when delivered to the telegraph company If sent by telegram. Any director may waive notice of any meeting by a writing filed with the secretary. The attendance of a director atends a meeting shall constitute a waiver of notice of such meeting, except where a director attends a meeting for the espress purpose of objecting to the transaction of any business because the meeting Is not Iawfully called or convened. Neither the business to be transacted at, nor the purpose of, any meeting of the board of directors need be specified In the notice or waiver of notice of such meeting. Section 7. Quorum. A majority of the number of directors fixed by Section 2 of this Article III shall constitute a person for the transaction of business at any meeting of the board of directors but if less than such majority is present at a meeting, a majority of the directors present may adjourn the meeting from time to time. Notice of any adjourned meeting shall be given in the same manner as prescribed by section 6 of this article III. Section 8. Manner of Acting. The act of the majority of tha directors present at a meeting at which a quorum is present shall be the act of the board of directors, unless governing law, rules or regulation requires otherwise. Section 9, Action Without a Meeting. Any action required or permitted to be taken by the board of directors at a meeting may be takes without a meeting it a content In writing, setting forth the action to taken, shall be signed by all of the directors.

SECTION 10. Resignation. Any director may resign at any time by sending a written notice of such resignation to the home office of the Bank addressed to the secretary. unless otherwise specified therein such resignation shall take effect upon receipt thereof by the secretary. SECTION 11. Vacancies. Any vacancy occurring in the board of directors may be filled by the affirmative vote of a majority of the remaining directors, even if less than a quorum of the board of directors remains. A director elected to fill a vacancy shall be elected to serve until the next election of directors by the stockholders. Any directorship to be filled by reason of an increase in the number Of directors may be filled by the board of directors for a term of office continuing only until the next election of directors by the stockholders. SECTION 12. Compensation. Directors, as such, may receive a stated compensation for their services, By resolution of the board of directors, a reasonable fixed sum, and reasonable expenses of attendance, if any, may be allowed for actual attendance at each regular or special meeting of the board of directors. Members of either standing or special committees may be allowed such compensation for actual attendance at committee meetings as the board of directors may determine. SECTION 13. presumption of Assent. A director of the Bank who is present at a meeting of the board of directors at which action on any Bank matter is taken shall be presumed to have assented to the action taken unless his dissent or abstention shall be entered In the minutes of the meeting or unless he shall file his written dissent to such action with the person acting as the secretary of the meeting before the adjournment thereof or shall forward such dissent by registered mail to the secretary of the Bank within five days after the date he receives a copy of the minutes of the meeting. Such right to dissent shall not apply to the director who voted in favor of such section. SECTION 14. Removal of Directors. At a meeting of stockholders called expressly for that purpose, any director may be removed for cause by a vote of the holders of a majority of the shares then entitled to vote at an election of directors. If less then the entire board is to be removed, no one of the directors may be removed If the votes case against the removal would be sufficient to elect a director if then cumulatively voted at an election of the class of directors of which such director is a part. Whenever the holders of the shares of any class are entitled to elect one or more directors by the provisions of the charter or supplemental sections thereto, the provision of this section shall apply, in respect to the removal of a director or directors so elected, to the vote of the holders of the outstanding shares of that class and not to the vote of the outstanding shares as a whole. SECTION 15. Age limitation on directors. No person shall be eligible for election, re-election, appointment, or reappointment to the board of directors of the Bank if such person is then more than 75 years of age. No director shall serve beyond the annual meeting of the Bank Immediately following his attainment of 75 years of age. The age limitation shall not apply to a person serving as a director emeritus of the Bank. Directors emeritus may be appointed and their compensation for services (In an amount not to exceed those feets paid to voting directors) determined by resolution of the board or directors of the Bank. Only former directors of the Bank (including former directors of other banks which have merged with, or otherwise been acquired by the Bank) shall be eligible to serve as directors emeritus. Directors emeritus shall be available for consultation with and advice to management of the Bank. Directors emeritus may attend meetings of the board of directors, but shall have no vote on any matter acted upon by such board. ARTICle IV. ExecutiveAND OTHER COMMITTIES Section 1. Appointment. The board of directors, by resolution adopted by a majority of the full board, may designate the chief executive officer and two or more of the other directors to constitute an executive committee. The designation of any committee pursuant to this Article IV and the delegation of authority thereto shall not operate to relieve the board of directors, or any director, of any responsibility Imposed by law or regulation. Section 2. Authority. The exeeudve committee, when the board of directors Is not in session, shall have and may exercise all of the authority of the board of directors except to the extent, if any, that such

authority shall be limited by the resolution appointing the executive committee; and except also that the executive committee shall not have the authority of the board of directors with reference to: a declaration of dividends, an amendment of the charter or bylaws of Bank, or recoomending to the stockholders a plan of merger, consolidation, or conversion; the sale, lease or other disposition of all or substantiallly all of the property and assets of the Bank otherwise than In the usual and regular course of its business; a voluntary dissolution of the Bank; a revocation of any of the foregoing; or the approval of a transaction In which any member of the executive committee, directly or indirectly, has any material beneficial interest. Section 3. Ttnure. Subject to the provisions of Section 8 or this Atilclt IV, each member of the executive committee shall hold office until the next regular annual meeting of the board of directors following his designation and until his successor is designated as a member of the executive committee. SECTION 4. Meetings. Regular meetings of the executive committee may be held without notice at such times and places as the executive committee may fix from time by resolution. Special meetings of the executive committee may be called by a member thereof upon not less than one dayts notice stating the place, date and hour of the meeting, which notice may ba written or oral. Any member of the executive committee may walve notice of any meeting and no notice of any meeting need be given to any member thereof who attends in person. The notice of a meeting of the executive committee need not state the business proposed to be transacted at the meeting.

Section 5. Quorum. A majority or the members of the executive committee shall consitute a quorum for the transaction of business at any meeting thereof, and action of the executive committee must be authorized by the affirmative vote of majority of the members present at meeting at which a quorum is present. Section 6. Action Without a Meeting . Any action required or permitted to be taken by the executive committee at a meeting may be taken without a meeting if a consent in writing, secting forth the action so taken, shall be signed by all of the members of the executive committee. Section 7. Vacancies. Any vacaney, in the executive committee may be filled by a resolution adopted by a majority of the full board of directors. Section 8. Resignations and Removal. Any member of the executive committee may be removed at any time with or without cause by resolution adopted by a majority of the full board of directors. Any member of the executive committee may resign from the executive committee at any time by giving written noticc to the president or the secretary of the Bank. Unless otherwise specified therein, such resignation shall take effect upon receipt. The acceptance of such resignation shall not be neccessary to make It effective. Section 9. Procedure. The executive comminess shall clear a presiding officer from its members and may fix its own rules of procedure which shall not be inconsistent with these bylaws. It than keep regular minutes of its proceedings and report the same to the board of directors for its Information at the meeting thereof held next after the proceedings shall have occurred. Section 10. Other Comminess.The board of directors may by resolution establish an audit comminess, a loan commitree or other commitrees composed of directors as they may determine to be neccessary or appropriate for the conduct of the business of the Bank and may prescribe the duties, consitution and procedures thereof. Article V. Officers Section 1. Positions..The officers of the Bank shall be a president, one or more vice presidents, a secretary and a treasurer, each of whom shall be elected by the board of directors. The board of directors may also designate the chairman of the board as an officer. The prctident shall be the chief executive officer, unless the board of directors designates the chairman of the board as chief executive officer. The president shall ba a director of the Bank. The offices of the secretary and treasurer may be held by the same person and a vice president may also be either the secratary or the treasurer. The board of directors may designate one or more vice presidents as executive vice president or senior vice president. The board may designate one or more vice presidents as executive vice president or senior vice president. The board

of directors may also elect or authorize the appointment of such other officers as the business of the Bank may require. The officers shall have such authority and perform.such duties as the board of directors may from time to time authorize of determine. In the absence of action by the board of directors, the officers shall have such powers and duties as generally pertain to their respective offices. SECTION 2. Election and Term of Office. The officers of the Bank shall be elected annually at the first meeting of the board of directors held after each annual meeting of the stockholders. If the election of officers is not held at such meeting, such election shall be held as soon thereafter as possible, Each officer shall hold office until his successor shall have been duly elected and qualified or until his death or until he shall resign or shall have been removed in the manner hereafter provided. Election or appointment of an officer, employee or agent shall not of itself create contract rights. The board of directors may authorize the Bank to enter Into an employment contract with any officer In accordance with regulations of the Federal Home Loan Bank board; but no such contract shall impair the right of the board of directors to remove any officer at any time in accordance with Section 3 of this Article V.

Section 3. Removal. Any officer may be removed by the board of directors whenever its judgment the beat interests of the Bank shall be served thereby, but such removal, other than for cause, shall be without prejudice to the contract rights, if any, of the person so removed. Section 4. Vacancies. A vacancy In any office because of death, resignation, removal, disqualification or otherwise, may be filled by the board of directors for the unexpired portion of the term.* Section 5. Remuneration. The remuneration of the officers shall be fixed from time to time by the board or directors. SECTION 6. Age limitation on officer. No person 65 years of age or above shall be eligible for election, re-election, appointment, or reappointment as an officer of the Bank, No officer shall serve beyond the annual meeting of the Bank immediately following his or her becoming 65. Article VL Contracts, Loans, Checks And Deposits Section 1. Contract.. To the extent permitted by regulations of tha Federal home Loan Bank Board, and except as otherwise prescribed by the bylaws with respect to certificates for shares, the board of directors may authorize any officer, employee, or agent of the bank to enter into any contract or execute and deliver any instrument in the name of and on behalf of the Bank. such authority may be general or confined to specific instances. Section 2. Loans. No loans shall be contracted on behalf of the Bank and no evidence of Indebtedness shall be issued in its name unless authorized by the board of directors. Such authority may be general or confined to specific instances.

Section 3. Checks, Drafts, Etc. All checks , drafts or orders for the payment of money, notes or other evidences of Indebtedness Issued In the name of the Bank shall be signed by one or more officers, employees or agents of the Bank in such manner as shall from time to time be determined by the board of directors. Section 4. Deposits. All funds of the Bank not otherwise employed shall be deposited from time to time to the credit of the Bank in any of its duly authorized depositories as the board of directors may select. Article VII. Certificates For Shares and their transfer Section 1. Certificates for shares. Certificates representing shares of capital stock of the Bank shall be in such form as shall be determined by the board of directors and approved by the Federal Home Loan Bank Board. Such certificate shall be signed by the chief executive officer or by any other officer of the Back authorized by the board of directors, arrested by the secretary or an assistant secretary, and sealed with the corporate seal of a facsimile thereof. The signatures of such officers upon n certificate may be facsimilles if the certificate it manually signed on behalf of a transfer agent or a register, other than the Bank itself or one of its employees. Each certificate for shares of capital stock shall be consecutively

numbered or otherwise Identified. The name and address of the person to whom the shares are Issued, with the number of shares end date of Issue, shell be entered on the stock transfer books of the Bank. All certificates surrendered to the Bank for transfer shall be cancelled and no new certificate shall be Issued until the former certificate for a like number of shares shall have been surrendered and cancelled, except that In case of a loss or destroyed certificate, a new certificate may be Issued therefor upon such terms and Indemnity to the Bank as the board of directors may prescribe. Section 2. Transfer of Shares. Transfer of shares of capital stock of the Bank shall be made only on Its stock transfer books. Authority for such transfer shall be given only by the holder of record thereof or by his legal representative, who shall furnish proper evidence of such authority, or by his attorney thereunto authorized by power of attorney duly executed and filed with the Bank. Such transfer shall be made only on surrender for cancellation of the certificate for such shares. The person In whose name shares of capital stock stand on the books of the Bank shall be deemed by the Bank to be the owner thereof for all purposes. Article VIII. FIScal Year Annual Audit The fiscal year of the Bank shall end on the 31st day of December of each year. The Bank shall be subject to an annual audit as of the end of Its fiscal year by independent public accountants appointed by by and responsible to the board of directors. The appointment or such accountants shall be subject to annual ratification by the stockholders. Article IX. Divedends Subject to the terms of the Bank’s charter and the regulations and orders of the Federal Home loan Bank Board, the board of directiors may, from time to time, declare and the Bank may pay, dividends to Its outstanding shares of capital stock. Article X. Corporate Seal The board of directors shall approve a Bank seal. Article XI. Amendments These bylaws may be amended In any manner not inconsistent with applicable laws, rules, regulations or the charter at any time by a majority of the full board of directors, or by a majority vote of the votes cast by the shareholder of the Bank at any legal meeting called expressly for that purpose.

Exhibit 6 Consent of Wilmington Savings Fund Society FSB (See attached)

RESOLUTION WHEREAS, It Is necessary that the officers of the Christina Trust division (hereinafter ”Trust Division”) of Wilmington Saving Fund Society, PSB (hereinafter “Company”) In connection with the Company’s fiduciary and agency activities be authorized by and on behalf of the Company, to make, execute and deliver certain agreements, certificates, Instruments, documents and/or other writings on behalf of the Company, including in the name of the Trust Division, as such officers or officers acting on behalf of the Company may approve. NOW THEREFORE, BE IT RESOLVED, that the signing authority outlined below Is hereby approved and adopted In all respect effective March 24,2011. I. Client Funds Checks prepared on behalf of the Trust Division-Any two Trust Officers other than trust operations officer for amounts up to $125,00 and any trust officer and a Trust Vice President for amounts over $25,000. II. Other Documents A. The Chief Trust Officer or the Executive Vice President of Wealth Management may execute, sign and/or deliver on behalf of the Company, Including in the name of the Trust Division, any agreement. Instrument, document and/or other writing for the acceptance of any fiduciary or agency appointment or the conduct of business in any agency or fiduciary capacity, and shall have the power to delegate to other officers of the Company such authority. B. Trust Officer, Assistant Vice President, Vice President Any one of the above Is authorized to: 1. Execute, sign and/or deliver any agreement, instrument, document and/or other writing on behalf of the Company, including in the name of the Trust Division. In connection with the acceptance of any fiduciary or agency appointment or the exercise of any fiduciary or agency power, Including, but not limited to, any writings of any nature with respect lo any real or personal property, tangible or Intangible, or any Interest therein, Including reports and returns to regulatory and tax authorities and the acceptance of new accounts. 2 Execute, sign and/or deliver any agreement, instrument, document and/or other writing on behalf of the Company, Including in the name of the Trust Division, with reference to the purchase, sale, investment , divestment admission, or withdrawal of mufual fund, common funds collective founds or cash management vehicles acquired or held by an account, as fiduciary, or at agent.

3. Execute sign and/or deliver any agreement, instrument, document and/or other writing on behalf of the Company, Including in the name of the Trust Division, with reference to the purchase, only receipt, delivery or exchange of securities or other Kinds of property, real or personal tangible, or intangible, enquired or help by the Company for its own account, or as fiduciary, or as agent. 4. Execute sign and/or deliver any agreement, instrument, document and/or other writing on behalf of the Trust Division, Including in the name of the Company, in connection with the settlement of a purchase, sale exchange, transfer or other transaction with respect to any security or asset and the admission, deposit, withdrawal of any moneys to any daily investment vehicles maintained by the Trust Division in a fiduciary or agency capacity. 5. Execute sign and/or deliver on behalf of the company, including in the name of the Trust Division, any security or other instrument in its capacity as trustee or in any other fiduciary capacity or as agent and certificates of authentication appearing upon any securities issued under the instruments or other writing under which the Company is acting as trustee, transfer agent fiscal agent or in any similar fiduciary or agency capacity. 6. Guarantee signatures, identify and guarantee assignments, transfer and endorsements for transfer on bonds, stock certificates, interim participation and other certificates, identify and guarantee signature on stock powers attormey, and to waive presentment, demand, protest and to execute amicable revivals of judgment. 7. Affix the seal of the Company to any agreement, Instrument, document and/or other writing and to attest to the execution of any agreement, Instrument, document and/or other writing by the Trust Division, including in the name of the Company, in a fiduciary or agency capacity and to the affixing of the seal thereto.

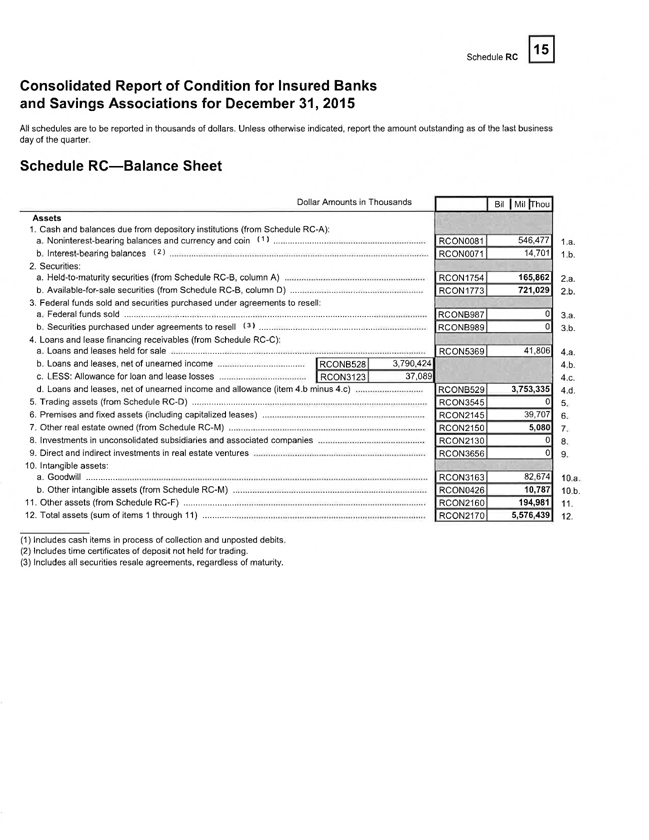

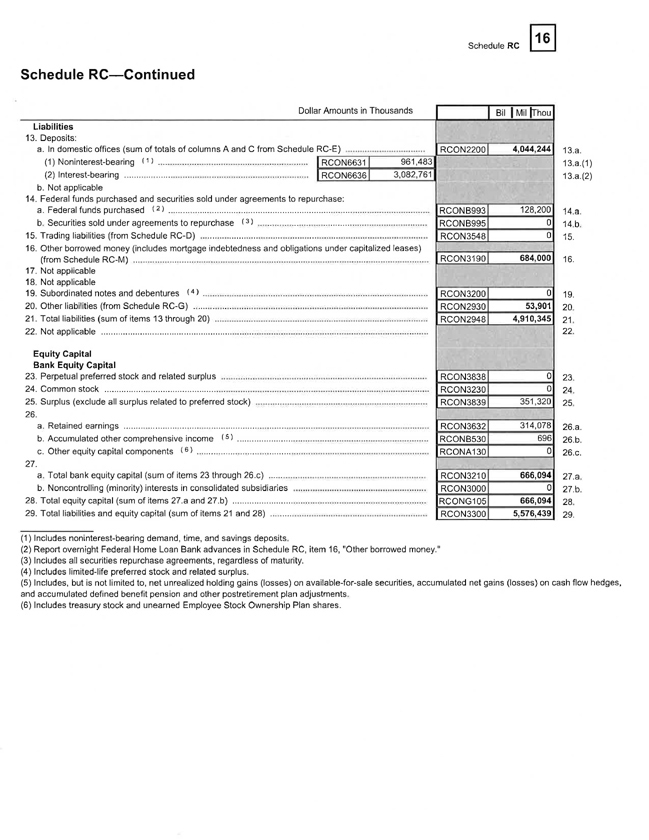

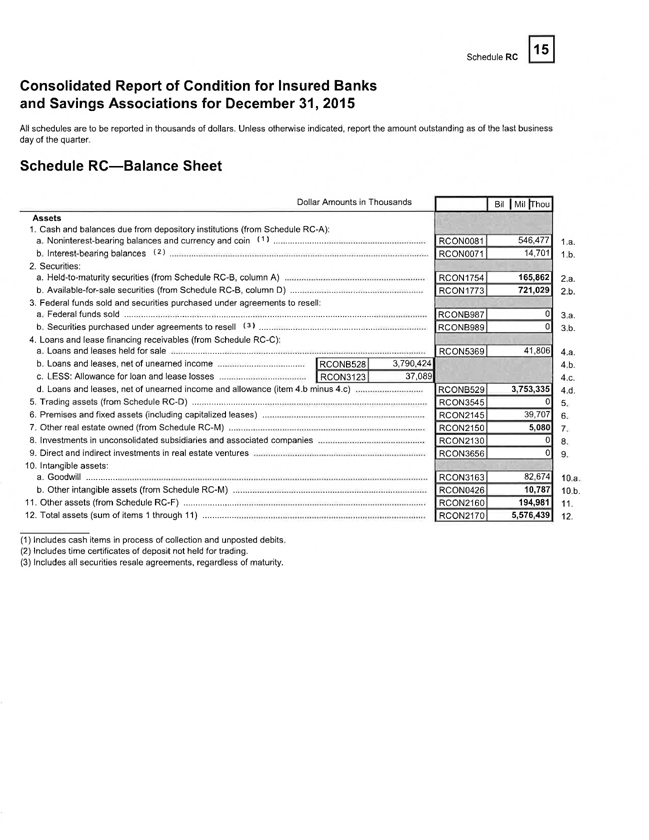

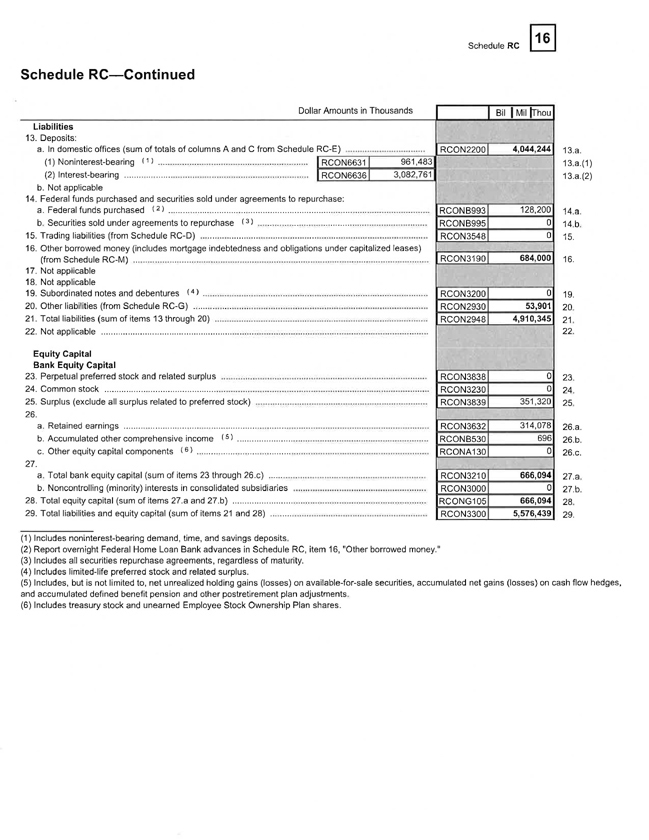

Exhibit 7 Current Report of Wilmington Savings Eund Society, FSB (see attached)