Exhibit 99.1

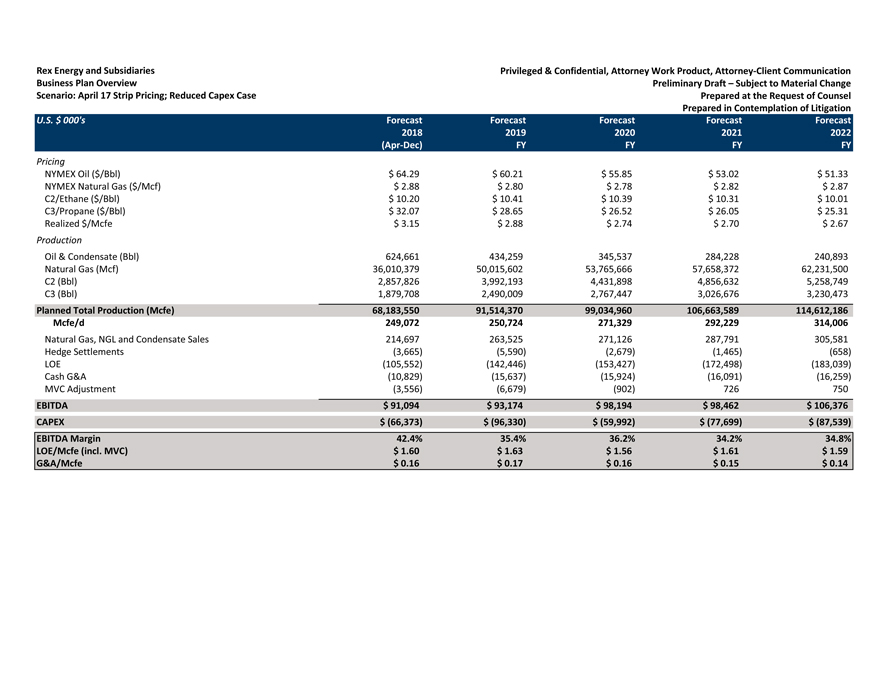

Rex Energy and Subsidiaries Privileged & Confidential, Attorney Work Product, Attorney-Client Communication

Business Plan Overview Preliminary Draft – Subject to Material Change

Scenario: April 17 Strip Pricing; Reduced Capex Case Prepared at the Request of Counsel

Prepared in Contemplation of Litigation

U.S. $ 000’s Forecast Forecast Forecast Forecast Forecast

2018 2019 202020212022

(Apr-Dec) FY FY FY FY

Pricing

NYMEX Oil ($/Bbl) $ 64.29 $ 60.21$ 55.85$ 53.02$ 51.33

NYMEX Natural Gas ($/Mcf) $ 2.88 $ 2.80$ 2.78$ 2.82$ 2.87

C2/Ethane ($/Bbl) $ 10.20 $ 10.41$ 10.39$ 10.31$ 10.01

C3/Propane ($/Bbl) $ 32.07 $ 28.65$ 26.52$ 26.05$ 25.31

Realized $/Mcfe $ 3.15 $ 2.88$ 2.74$ 2.70$ 2.67

Production

Oil & Condensate (Bbl) 624,661 434,259345,537284,228240,893

Natural Gas (Mcf) 36,010,379 50,015,60253,765,66657,658,37262,231,500

C2 (Bbl) 2,857,826 3,992,1934,431,8984,856,6325,258,749

C3 (Bbl) 1,879,708 2,490,0092,767,4473,026,6763,230,473

Planned Total Production (Mcfe) 68,183,550 91,514,37099,034,960106,663,589114,612,186

Mcfe/d 249,072 250,724271,329292,229314,006

Natural Gas, NGL and Condensate Sales 214,697 263,525271,126287,791305,581

Hedge Settlements (3,665) (5,590)(2,679)(1,465)(658)

LOE (105,552) (142,446)(153,427)(172,498)(183,039)

Cash G&A (10,829) (15,637)(15,924)(16,091)(16,259)

MVC Adjustment (3,556) (6,679)(902)726750

EBITDA $ 91,094 $ 93,174$ 98,194$ 98,462$ 106,376

CAPEX $ (66,373) $ (96,330)$ (59,992)$ (77,699)$ (87,539)

EBITDA Margin 42.4% 35.4%36.2%34.2%34.8%

LOE/Mcfe (incl. MVC) $ 1.60 $ 1.63$ 1.56$ 1.61$ 1.59

G&A/Mcfe $ 0.16 $ 0.17$ 0.16$ 0.15$ 0.14

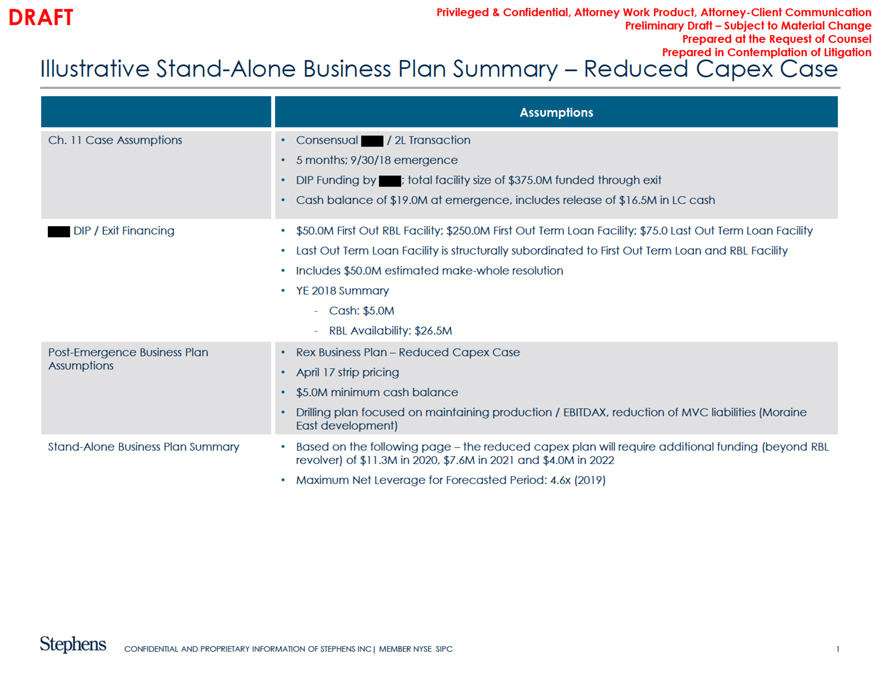

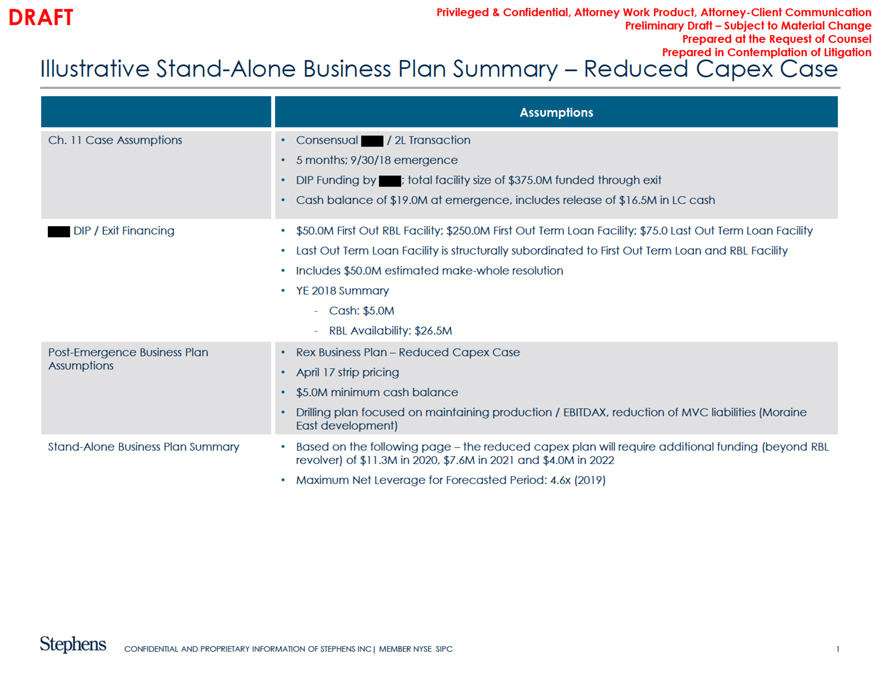

DRAFT Privileged & Confidential, Attorney Work Product, Attorney-Client Communication Preliminary Draft – Subject to Material Change Prepared at the Request of Counsel Prepared in Contemplation of Litigation

Illustrative Stand-Alone Business Plan Summary – Reduced Capex Case

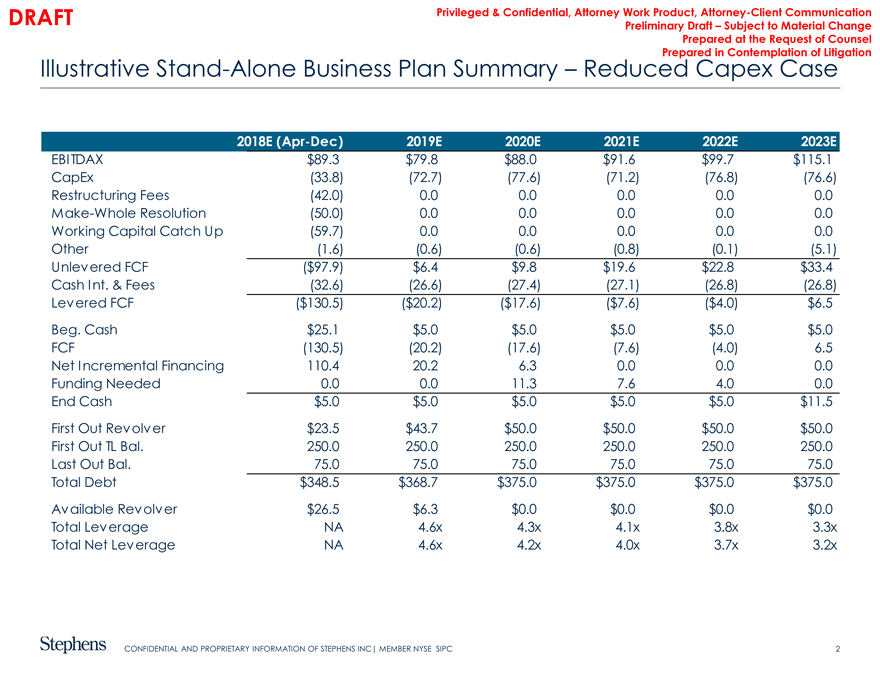

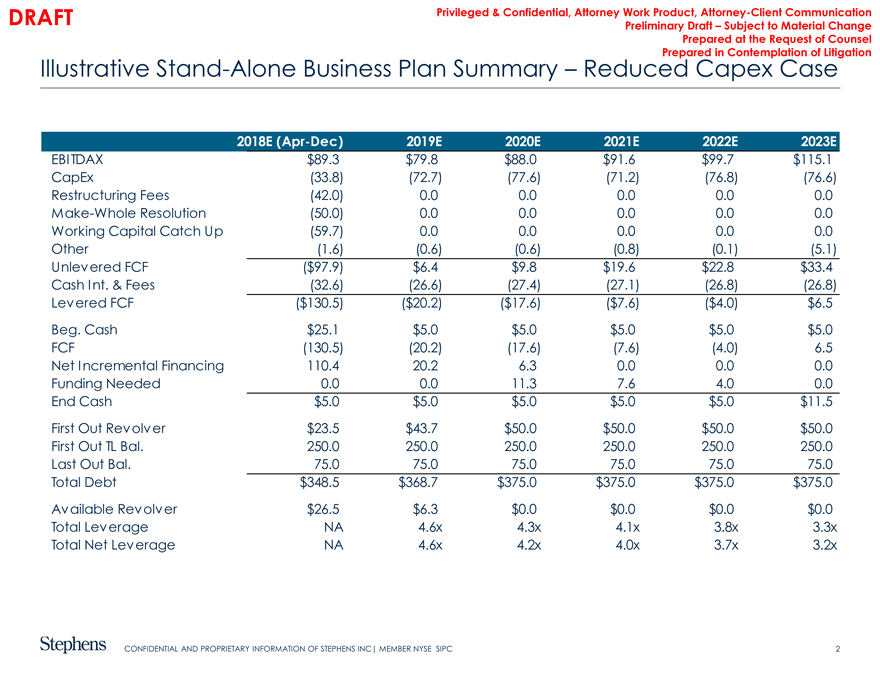

DRAFT Privileged & Confidential, Attorney Work Product, Attorney-Client Communication Preliminary Draft – Subject to Material Change Prepared at the Request of Counsel Prepared in Contemplation of Litigation

Illustrative Stand-Alone Business Plan Summary – Reduced Capex Case

2018E(Apr-Dec) 2019E 2020E2021E2022E2023E

EBITDAX $89.3 $79.8$88.0$91.6$99.7$115.1

CapEx (33.8) (72.7)(77.6)(71.2)(76.8)(76.6)

Restructuring Fees (42.0) 0.00.00.00.00.0

Make-Whole Resolution (50.0) 0.00.00.00.00.0

Working Capital Catch Up (59.7) 0.00.00.00.00.0

Other (1.6) (0.6)(0.6)(0.8)(0.1)(5.1)

Unlevered FCF ($97.9) $6.4$9.8$19.6$22.8$33.4

Cash Int. & Fees (32.6) (26.6)(27.4)(27.1)(26.8)(26.8)

Levered FCF ($130.5) ($20.2)($17.6)($7.6)($4.0)$6.5

Beg. Cash $25.1 $5.0$5.0$5.0$5.0$5.0

FCF (130.5) (20.2)(17.6)(7.6)(4.0)6.5

Net Incremental Financing 110.4 20.26.30.00.00.0

Funding Needed 0.0 0.011.37.64.00.0

End Cash $5.0 $5.0$5.0$5.0$5.0$11.5

First Out Revolver $23.5 $43.7$50.0$50.0$50.0$50.0

First Out TL Bal. 250.0 250.0250.0250.0250.0250.0

Last Out Bal. 75.0 75.075.075.075.075.0

Total Debt $348.5 $368.7$375.0$375.0$375.0$375.0

Available Revolver $26.5 $6.3$0.0$0.0$0.0$0.0

Total Leverage NA 4.6x4.3x4.1x3.8x3.3x

Total Net Leverage NA 4.6x4.2x4.0x3.7x3.2x

CONFIDENTIAL AND PROPRIETARY INFORMATION OF STEPHENS INC| MEMBER NYSE SIPC 2