Investor Presentation

March 17, 2008

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934, which reflect our current views with respect to,

among other things, our operations and financial performance. In some cases, you can identify these forward-

looking statements by the use of words such as “outlook”, “believes”, “expects”, “potential”, “continues”, “may”,

“will”, “should”, “seeks”, “approximately”, “predicts”, “intends”, “plans”, “estimates”, “anticipates” or the negative

version of these words or other comparable words. All statements other than statements of historical fact included

in this presentation are forward-looking statements and are based on various underlying assumptions and

expectations and are subject to known and unknown risks, uncertainties and assumptions, and may include

projections of our future financial performance based on our growth strategies and anticipated trends in our

business. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are

or will be important factors that could cause actual outcomes or results to differ materially from those indicated in

these statements. We believe these factors include, but are not limited to, those described under “Risk Factors”

discussed in our prospectus filed with the SEC dated September 28, 2007. These factors should not be construed

as exhaustive and should be read in conjunction with the other cautionary statements that are included in this

discussion. In addition, new risks and uncertainties emerge from time to time, and it is not possible for us to

predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to

which any factor, or combination of factors, may cause actual results to differ materially from those contained in

any forward-looking statements. Accordingly, you should not rely upon forward-looking statements as a prediction

of actual results and we do not assume any responsibility for the accuracy or completeness of any of these

forward-looking statements. We undertake no obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future developments or otherwise.

Forward Looking Statements

2

Introduction to Duff & Phelps

Noah Gottdiener

Chief Executive Officer

Positioned to capitalize on key industry trends

Uniquely qualified to succeed

Broad and well-balanced service offerings for all markets

Benefiting from today’s volatile market environment

Strong financial performance

Significant growth opportunities

Investment Highlights

4

Positioned to Capitalize on Key Industry Trends

“Investors have been clamoring for more use

of fair value in financial statements, because

they think it provides a more accurate picture

of the company’s balance sheet than

historical cost figures.” – Reuters, September

2006

“Turnaround firms, faced with increasing

demand for their service…, are beefing up

staffs in anticipation of an increase in

corporate restructurings and bankruptcies

this year.” – Wall Street Journal, May 2007

“Companies often hire small, independent

boutiques to provide deal advice that

counterbalances input from bulge-bracket

firms . . . that may have many internal

competing agendas.” – Wall Street Journal,

September 2007

Corporate Restructuring

Fair Value Accounting

Independent Advice

5

Valuation Services are the Foundation of Our Business

Fair Value

Accounting

Transparency

Corporate

Restructuring

Independence

VALUATION SERVICES

- Financial Reporting - Portfolio Valuation

- Transaction Opinions - Tax Valuation

- General Business Valuations - Financial Engineering

Specialty

Tax

Dispute

Consulting

M&A

Restructuring

Technical Expertise

Market Trends

6

Long-Standing, Diverse Client Base

35% of the S&P 500 companies

Leading multi-national firms

Top-tier private equity firms and hedge funds

Client diversification

7

Technical Expertise

Independence

Scale

Brand

Culture

What Makes Duff & Phelps Unique?

8

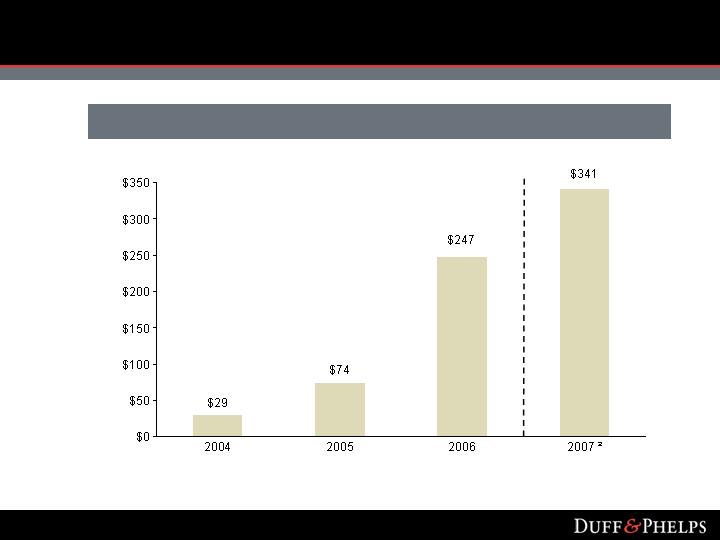

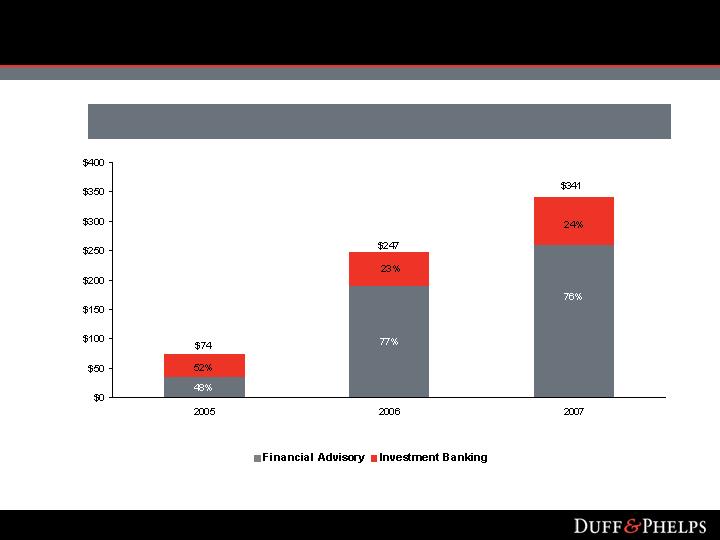

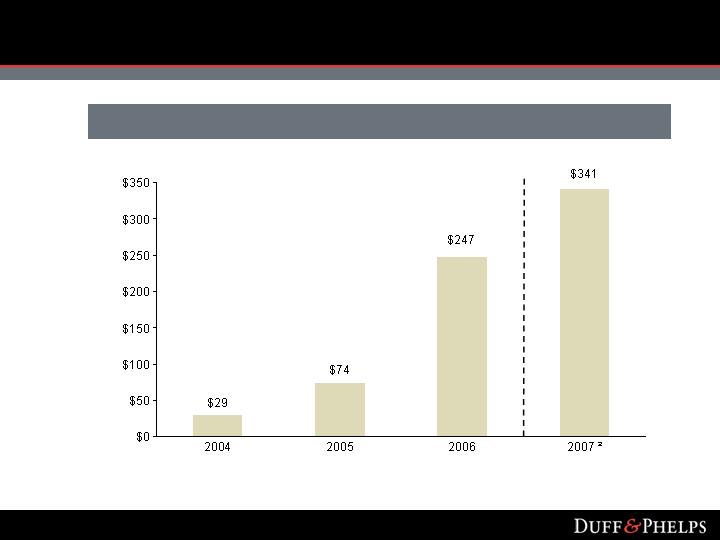

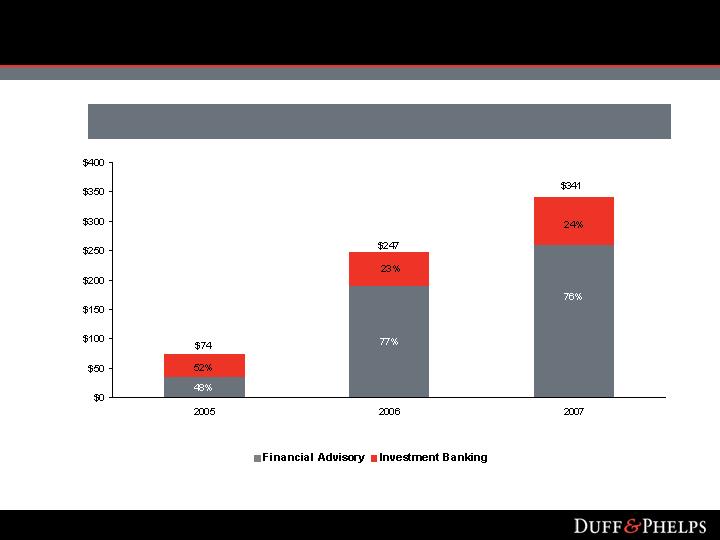

Financial Highlights

1 Total revenue excludes reimbursable expenses.

2 Unaudited. 2007 Revenue represents Aggregated Successor and Predecessor results.

Duff & Phelps Revenue1

($ in millions)

9

Broad & Well-Balanced Service Portfolio

Counter-Cyclical

Restructuring Advisory

Dispute Consulting

FAS 142 (goodwill

impairment)

Strong Secular

Trends / Non-Cyclical

Portfolio Valuation

Financial Engineering

Transfer Pricing

Property Tax

General Valuation

International

M&A Driven

FAS 141

M&A Advisory

Transaction Opinions

M&A Due Diligence

M&A Driven

Counter-

Cyclical

10

Impact of Today’s Credit Environment

Duff & Phelps is benefiting from the market dislocation

Hired by multiple global financial institutions to provide independent valuation

assessments of their loan and CDO portfolios

Hired to provide multiple transaction opinions and related advice with respect to

distressed bail-out situations in the financial services sector

Hired as a restructuring advisor in connection with a distressed sub-prime

situation

Major corporate clients are hiring D&P to value their investment portfolios,

particularly given their typical concentrations in money-market, municipals and

CDO-related investments

FAS 142 impairment valuation practice seeing lift in today’s environment

11

Growth Strategy

International expansion

Complementary / new service offerings

Cross-selling

Brand building

Focus on balance

12

International

Domestic

Expanding Global Platform

Tokyo

Paris

Zurich

Amsterdam

Munich

London

San

Francisco

Silicon Valley

Los Angeles

Denver

Chicago

Detroit

Atlanta

Houston

Austin

Dallas

Morristown

Boston

New York City

Philadelphia

Seattle

Significant International Growth Opportunities

13

Expanding Global Platform – Shinsei Strategic Alliance

$5 billion Japanese financial

institution associated with

J.C. Flowers

Recently purchased equity

stake in Duff & Phelps

Established reputation

Strong client base

High Growth Platform for Asian Market Penetration

Deep knowledge base

Robust Financial Advisory

and Investment Banking

capabilities

Multi-national clients

14

Our Culture

Unconflicted

Dynamic

Environment

Multiple Growth

Channels

Cross-selling

75 Year History

Partnership

Heritage

Global Presence

Blue Chip Clients

Diverse Portfolio

Collaborative, Team-Oriented Culture

LARGE, STABLE

ORGANIZATION

HIGH GROWTH

FIRM

15

Operational and Financial Highlights

Jake Silverman

Chief Financial Officer

Delivering Solutions

Financial Advisory

Valuation Advisory

Corporate Finance

Consulting

Specialty Tax

Dispute & Legal

Management

Consulting

Investment Banking

M&A Advisory

Transaction Opinions

Restructuring

17

Business Model Diversification

Pricing

Key Metrics

Financials

Rates & Hours

Utilization

Rate per Hour

Mid 40% Gross Margin

More Predictable

Big 4

Specialty consulting

Retainer / Success Fee

Revenue per Professional

Backlog / Pipeline

High 40% Gross Margin

Transaction Based

Boutique investment banks

FINANCIAL

ADVISORY

INVESTMENT

BANKING

24%

Technical Expertise in Financial Analysis & Valuation

76%

Competition

18

Selected Operating Metrics

Financial Advisory

Investment Banking

Total

2005

2006

2007 2

425

84

509

553

118

671

746

98

844

($000s)

Financial Advisory

Investment Banking

Total

$344

$414

$377

$374

$651

$415

$409

$808

$464

Utilization

Rate per hour ($)

71.4%

$264

68.1%

$300

69.0%

$323

1 Revenue per professional calculated by dividing total segment revenue by average headcount for the given period of time.

2 Unaudited. Revenue used for calculation represents Aggregated Successor and Predecessor results and excludes reimbursable expenses.

3 Excludes certain professionals associated with Rash & Associates.

19

Financial Highlights

¹ 2007 is Unaudited and represents Aggregated Successor and Predecessor results; Total revenue excludes reimbursable expenses.

Revenue1

($ in millions)

20

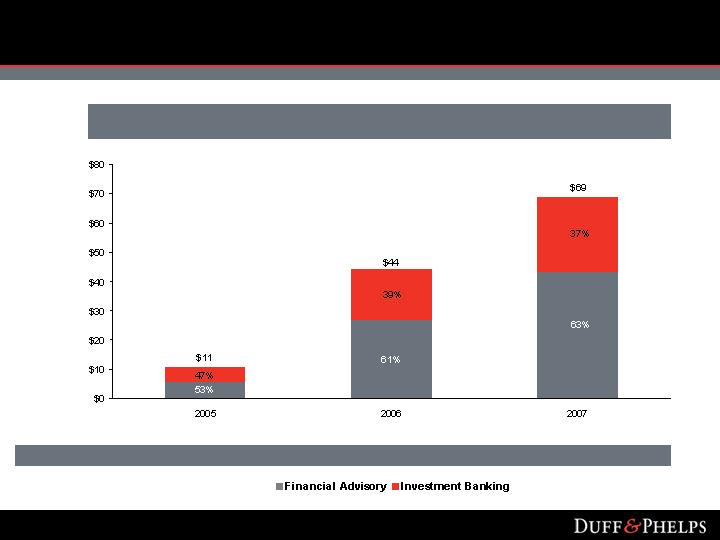

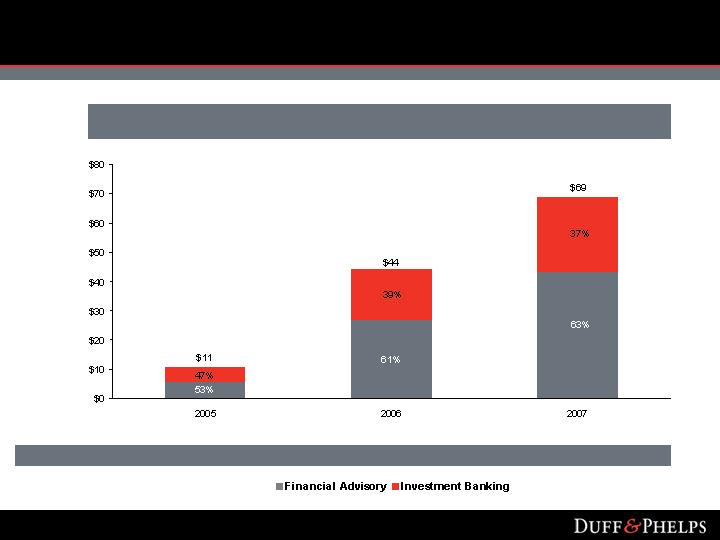

Financial Highlights

($ in millions)

Adj. EBITDA Margin 14.7% 17.9% 20.2%

Segment Operating Income1

¹ 2007 is Unaudited and represents Aggregated Successor and Predecessor results.

21

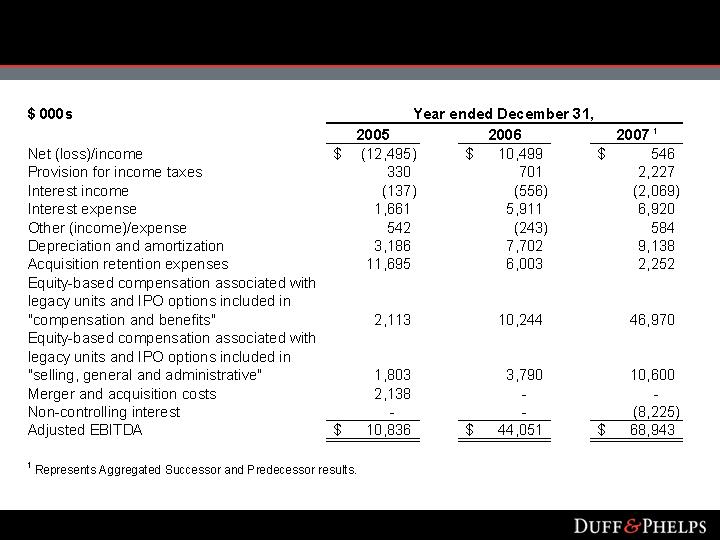

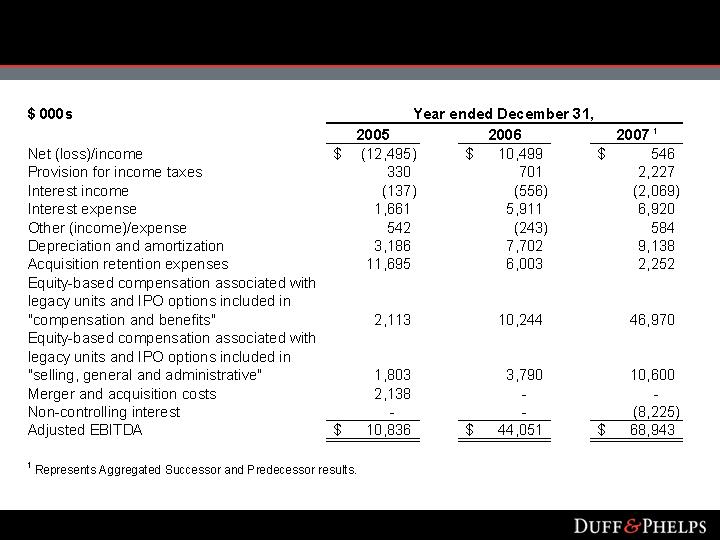

Adjusted EBITDA Reconciliation

22

Guidance Discussion

Duff & Phelps provides annual guidance only

2008 guidance generally in line with previously stated long-

term financial objectives; please consult 2007 earnings call

transcript for more information

While Duff & Phelps does not provide quarterly guidance, the

company believes that revenue will be weighted towards

second half of 2008

23

Conclusion

Noah Gottdiener

Chief Executive Officer

Positioned to capitalize on key industry trends

Uniquely qualified to succeed

Broad and well-balanced service offerings for all markets

Benefiting from today’s volatile market environment

Strong financial performance

Significant growth opportunities

Investment Highlights

25