TABLE OF CONTENTS

acquisition of D&P Acquisitions interests, the income tax basis of the assets of D&P Acquisitions underlying a portion of the interests we acquire will be adjusted based upon the amount that we have paid for that portion of our D&P Acquisitions interests. We have entered into an agreement with the existing unitholders’ of D&P Acquisitions (for the benefit of the existing unitholders’ of D&P Acquisitions) that will provide for the payment by us to the unitholders of D&P Acquisitions of 85% of the amount of cash savings, if any, in U.S. federal, state and local income tax that we realize (i) from the tax basis in our proportionate share of D&P Acquisitions' goodwill and similar intangible assets (determined as of the date of this offering) that we receive as a result of the exchanges and (ii) from the federal income tax election referred to above.

Cash and cash equivalents increased from $59.1 million at December 31, 2006 to $90.2 million at December 31, 2007, primarily due to cash flow from operations, offset by the payment of bonuses to our professionals and tax distributions to the members of D&P Acquisitions with respect to fiscal 2006.

Operating Activities

During the year ended December 31, 2007 (on an aggregated basis), cash of $74.7 million was provided by operating activities, primarily as a result of non-cash equity-based compensation and depreciation and amortization, partially offset primarily by payment of bonuses with respect to fiscal 2006 and increases in accounts receivable, unbilled services and deferred tax assets. During the year ended December 31, 2006, cash of $40.9 million was provided by operating activities, including $10.5 million from net income. During the year ended December 31, 2005, cash of $5.1 million was provided by operating activities, offsetting a $12.5 million net loss during the period. The increase in cash provided by operating activities is largely attributable to higher net income as a result of overall growth in the business, higher non-cash higher non-cash equity-based compensation and accrued bonus compensation, partially offset by a higher investment in working capital (primarily accounts receivable) due to the increase in revenue.

Investing Activities

During the years ended December 31, 2007 (on an aggregated basis) and 2006, cash of $25.6 million and $21.9 million, respectively, was used for investing activities. In 2007, cash used in investing activities related primarily to the acquisition of Rash and the purchase of property and equipment, while in 2006, it included the cash portion of the purchase price in connection with the acquisition of Chanin, net of cash acquired. The purchase of investments related to the Company’s deferred compensation plan and is held in a rabbi trust. Investment in property, plant and equipment increased $2.0 million to $12.8 million for the year ended December 31, 2007 from $10.8 million for the year ended December 31, 2006, primarily as a result of increased investment in real estate and technology infrastructure to support our continued growth, particularly internationally and with respect to our New York headquarters office. For the year ended December 31, 2006, investment in property, plant and equipment increased $7.4 million to $10.8 million for the year ended December 31, 2006 from $3.4 million for the year ended December 31, 2005, primarily as a result of increased investment in real estate and technology infrastructure following the CVC acquisition and to support our continued growth.

Financing Activities

During the year ended December 31, 2007 (on an aggregated basis), cash of $19.1 million was used in financing activities, primarily as a result of the proceeds from the IPO and the Shinsei Investment, offset by the Redemption, the repayment of $35.8 million of indebtedness and tax distributions to members of D&P Acquisitions. During the year ended December 31, 2006, cash of $27.7 million was provided by financing activities, including proceeds of $30.0 million from issuance of debt in connection with the acquisitions of Chanin and CVC, partially offset primarily by repayments of debt, repurchase of equity units and distributions to unitholders. There was no material effect of exchange rates on cash and cash equivalents during the periods.

Duff & Phelps, LLC, a subsidiary of D&P Acquisitions, entered into a senior secured credit facility, dated as of September 30, 2005, as amended on June 14, 2006, on October 31, 2006, on August 31, 2007, on October 4, 2007 and and on January 31, 2008, with a syndicate of financial institutions, including General Electric Capital Corporation as administrative agent. The credit facility provides for an $80.0 million term loan facility that matures on October 1, 2012 and a revolving credit facility with a $20.0 million aggregate loan commitment amount available, including a $5.0 million sub-facility for letters of credit and a $5.0 million swingline facility, that matures on October 1, 2011.

All obligations under the credit facility are unconditionally guaranteed by each of our existing and future subsidiaries, other than certain foreign and regulated subsidiaries. The credit facility and the related guarantees are secured by substantially all of Duff & Phelps, LLCs present and future assets and all present and future assets of each guarantor on a first lien basis.

At December 31, 2007, $43.6 million was outstanding under the term loan facility (before debt discount) and no amount was outstanding under the revolving credit facility. Borrowings under the credit facility bear interest at a rate based on LIBOR plus a margin of 2.75%. We incur an annual commitment fee of 0.5% of the unused portion of the revolving credit facility and 1% on the unused portion of the term loan facility.

TABLE OF CONTENTS

The credit facility includes customary events of default and covenants for maximum net debt to EBITDA, minimum interest coverage ratio and maximum capital expenditures. We were in compliance with the financial covenants at December 31, 2007. The credit facility requires a mandatory prepayment in an amount equal to half the Excess Cash Flow (as defined in the credit agreement) for fiscal year 2006 and each fiscal year thereafter if it is positive. Excess Cash Flow was negative for the fiscal years 2007 and 2006.

Following completion of our IPO on October 3, 2007, we used a portion of the proceeds to repay $35.0 million of the borrowings under this credit facility.

We regularly monitor our liquidity position, including cash, other significant working capital assets and liabilities, debt, and other matters relating to liquidity and compliance with regulatory net capital requirements.

Future Needs

Our primary financing need has been to fund our growth. Our growth strategy includes hiring additional revenue-generating client service professionals and expanding our service offerings through existing client service professionals, new hires or acquisitions of new businesses. We intend to fund such growth over the next twelve months with funds generated from operations and borrowings under our credit agreement. Because we expect that our future annual growth rate in revenues and related percentage increases in working capital balances will be moderate, we believe cash generated from operations, supplemented as necessary by borrowings under our credit facility, will be adequate to fund this growth. Our ability to secure short-term and long-term financing in the future will depend on several factors, including our future profitability, the quality of our accounts receivable and unbilled services, our relative levels of debt and equity and the overall condition of the credit markets.

Contractual Obligations

The contractual obligations presented in the table below represent our estimates of future payments under fixed contractual obligations and commitments at December 31, 2007. Changes in our business needs or interest rates, as well as actions by third parties and other factors, may cause these estimates to change. Because these estimates are complex and necessarily subjective, our actual payments in future periods are likely to vary from those presented in the table.

Summary of Contractual Obligations

At December 31, 2007

(Dollars in Thousands)

| |  | |  | |  | |  | |  |

| | | | Payments Due by Period |

| Contractual Obligations | | Total | | Less Than

1 Year | | 2 to 3

Years | | 4 to 5

Years | | More Than

5 Years |

| Credit facility(1) | | $ | 54,893 | | | $ | 2,868 | | | $ | 5,663 | | | $ | 46,362 | | | $ | — | |

| Operating lease obligations | | | 147,158 | | | | 13,412 | | | | 25,624 | | | | 23,635 | | | | 84,487 | |

| Acquisition retention expenses | | | 850 | | | | 850 | | | | — | | | | — | | | | — | |

| Total | | $ | 202,901 | | | $ | 17,130 | | | $ | 31,287 | | | $ | 69,997 | | | $ | 84,487 | |

| (1) | Includes assumed interest at LIBOR plus 2.75% or 5.62%. |

Off-Balance Sheet Arrangements

We do not invest in any off-balance sheet vehicles that provide liquidity, capital resources, market or credit risk support, or engage in any leasing activities that expose us to any liability that is not reflected in our combined/consolidated financial statements.

Exchange Rate Risk

We are exposed to risk from changes in foreign exchange rates related to our subsidiaries that use a foreign currency as their functional currency. We currently manage our foreign exchange exposure without the use of derivative instruments. We do not believe this risk is material in relation to our consolidated financial statements.

Recent Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 160,Noncontrolling Interests in Consolidated Financial Statements (“SFAS 160”), an amendment to ARB No. 51,Consolidated Financial Statements. SFAS 160 requires all entities to report noncontrolling (minority) interests in subsidiaries as equity in the consolidated financial statements. This is effective for fiscal years beginning after December 15, 2008. We are currently evaluating the impact this standard may have on our financial position, results of operations and cash flows.

61

TABLE OF CONTENTS

In December 2007, the FASB issued SFAS No. 141 (Revised 2007), Business Combinations (“SFAS 141(R)”). SFAS 141(R) requires all entities to account for business combinations and subsequent consolidations to follow the entity view in which the parent company consolidates 100% of the book value of the acquiree’s net assets plus 100% of the fair value increment and where goodwill is recognized and allocated between controlling and non-controlling interests. This is effective for business combinations for which the acquisition date is on or after the beginning of the first fiscal period beginning on or after December 15, 2008. Therefore, the adoption of this standard will not have a material impact on the Company’s financial position, results of operations and cash flows.

In February 2007, the FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities (“SFAS 159”). SFAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value that currently are not required to be measured at fair value. This is effective no later than fiscal years beginning on or after November 15, 2007. We are currently evaluating the impact this standard may have on our financial position, results of operations and cash flows.

In December 2006, we adopted the provisions of SFAS No. 158,Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans (“SFAS 158”). SFAS 158 requires that employers recognize on a prospective basis the funded status of an entity's defined benefit postretirement plan as an asset or liability in the financial statements, requires the measurement of defined benefit postretirement plan assets and obligations as of the end of the employer's fiscal year, and requires the recognition of the change in the funded status of defined benefit post retirement plans in other comprehensive income. SFAS 158 also requires additional disclosures in the notes to the financial statements.

In September 2006, SFAS No. 157,Fair Value Measurements (“SFAS 157”), was issued. SFAS 157 defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. SFAS 157 does not require any new fair value measurements in financial statements, but standardizes its definition and guidance in GAAP. Thus, for some entities, the application of this statement may change current practice. SFAS 157 will become effective for us beginning on January 1, 2008. We are currently evaluating the impact that the adoption of this statement may have on our financial position, results of operations and cash flows.

In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48,Accounting for Uncertainty in Income Taxes: An Interpretation of FASB Statement No. 109 (“FIN 48”), was issued and is effective for fiscal years beginning after December 15, 2006. FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The adoption of FIN 48 on January 1, 2007 did not have a material impact on our consolidated financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to market risks related to interest rates and changes in the market value of our investments. Our exposure to changes in interest rates is limited to borrowings under our bank credit agreement, which has variable interest rates tied to the LIBOR or prime rate. At December 31, 2007, we had borrowings outstanding totaling $43.6 million (before debt discount) that bear interest at LIBOR plus a margin of 2.75%. A hypothetical 1% adverse change in interest rates would have an unfavorable impact of $0.4 million on our earnings, based on our level of debt at December 31, 2007.

We have a $36.5 million notional amount interest rate swap that effectively converted floating rate LIBOR payments to fixed payments at 4.94%. The swap agreement terminates December 31, 2010. We elected not to apply hedge accounting to this instrument. The estimated fair value of the interest rate swap is based on quoted market prices. The estimated fair value of the swap at December 31, 2007 and December 31, 2006 resulted in a liability of $0.6 million and an asset of $0.1 million, respectively. We recorded a loss of $0.7 million for the year ended December 31, 2007 and a gain of $0.3 million for the year ended December 31, 2006, for the change in fair value of the interest rate swap.

From time to time, we invest excess cash in marketable securities. These investments principally consist of overnight sweep accounts and short-term commercial paper. Due to the short maturity of our investments, we have concluded that we do not have material market risk exposure with respect to such investments.

62

TABLE OF CONTENTS

Item 8. Financial Statements and Supplemental Data

The Company’s consolidated financial statements are included under Item 15 of this report.

The unaudited consolidated pro forma statement of operations for the year ended December 31, 2007 as set forth below presents D&P Corporation’s consolidated results of operations giving pro forma effect to the IPO Transactions (as defined in “Item 1. Business” included previously in this Form 10-K) and the use of the estimated net proceeds as if such transactions occurred on January 1, 2007. The pro forma adjustments are based on available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma basis, the impact of these transactions and the IPO on the historical financial information of D&P Corporation.

The unaudited consolidated pro forma financial information set forth below should be read together with “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” and D&P Corporation’s consolidated financial statements and related notes included elsewhere in this Form 10-K. The unaudited consolidated pro forma financial information is included for informational purposes only and does not purport to reflect the results of operations or financial position of D&P Corporation that would have occurred had D&P Corporation operated as a public company during the period presented. The unaudited consolidated pro forma financial information also does not project the results of operations or financial position for any future period or date.

The pro forma adjustments principally give effect to the following items:

| • | the IPO Transactions and the use of the estimated net proceeds as described in D&P Corporation’s consolidated financial statements and related notes included elsewhere in this Form 10-K; |

| • | a provision for corporate income taxes at an effective rate of 41.5%, which includes a provision for U.S. federal income taxes and assumes the highest statutory rates apportioned to each state, local and/or foreign jurisdiction; and |

| • | the estimated impact of the Tax Receivable Agreement associated with the Redemption (as described in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” included previously in this Form 10-K). |

63

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED PRO FORMA STATEMENT OF OPERATIONS (Unaudited)

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

| |  | |  | |  | |  |

| | Predeccessor | | Successor | | Pro Forma Successor – Aggregated |

| | | Period from

January 1 to

October 3,

2007 | | Period from

October 4 to

December 31,

2007 | | Adjustments

for IPO

Transactions | | Pro Forma

Year Ended December 31,

2007 |

| Revenues | | $ | 253,275 | | | $ | 87,883 | | | $ | — | | | $ | 341,158 | |

| Reimbursable expenses | | | 9,946 | | | | 2,824 | | | | — | | | | 12,770 | |

| Total revenues | | | 263,221 | | | | 90,707 | | | | — | | | | 353,928 | |

Direct client service costs

| | | | | | | | | | | | | | | | |

| Compensation and benefits | | | 158,748 | | | | 71,141 | | | | (8,412 | )(1) | | | 221,477 | |

| Other direct client service costs | | | 2,307 | | | | 1,440 | | | | — | | | | 3,747 | |

| Acquisition retention expenses | | | 2,035 | | | | 217 | | | | — | | | | 2,252 | |

| Reimbursable expenses | | | 10,079 | | | | 2,586 | | | | — | | | | 12,665 | |

| | | | 173,169 | | | | 75,384 | | | | (8,412 | ) | | | 240,141 | |

Operating expenses

| | | | | | | | | | | | | | | | |

| Selling, general and adminitrative | | | 70,946 | | | | 25,308 | | | | (3,270 | )(1) | | | 92,984 | |

| Depreciation and amortization | | | 6,754 | | | | 2,384 | | | | — | | | | 9,138 | |

| Merger and acquisition costs | | | — | | | | — | | | | — | | | | — | |

| | | | 77,700 | | | | 27,692 | | | | (3,270 | ) | | | 102,122 | |

| |

| Operating income/(loss) | | | 12,352 | | | | (12,369 | ) | | | 11,682 | | | | 11,665 | |

Other expense/(income)

| | | | | | | | | | | | | | | | |

| Interest income | | | (1,306 | ) | | | (763 | ) | | | (345 | )(2) | | | (2,414 | ) |

| Interest expense | | | 5,494 | | | | 1,426 | | | | (2,143 | )(3) | | | 4,777 | |

| Other expense/(income) | | | 215 | | | | 369 | | | | — | | | | 584 | |

| | | | 4,403 | | | | 1,032 | | | | (2,488 | ) | | | 2,947 | |

| Income/(loss) before non-controlling interest and income taxes | | | 7,949 | | | | (13,401 | ) | | | 14,170 | | | | 8,718 | |

| Non-controlling interest | | | — | | | | (8,225 | ) | | | 13,576 | (4) | | | 5,351 | |

| Provision for income taxes | | | 1,051 | | | | 1,176 | | | | (830 | )(5) | | | 1,397 | |

| Net income/(loss) | | $ | 6,898 | | | $ | (6,352 | ) | | $ | 1,424 | (5) | | $ | 1,970 | |

Weighted average shares of Class A common stock outstanding

| | | | | | | | | | | | | | | | |

| Basic | | | | | | | 13,018 | | | | (74 | )(7) | | | 12,944 | |

| Diluted | | | | | | | 13,018 | | | | (74 | )(7) | | | 12,944 | |

Net income/(loss) available to holders of shares of Class A common stock per share

| | | | | | | | | | | | | | | | |

| Basic | | | | | | $ | (0.49 | ) | | $ | 0.64 | | | $ | 0.15 | |

| Diluted | | | | | | $ | (0.49 | ) | | $ | 0.64 | | | $ | 0.15 | |

64

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED PRO FORMA STATEMENT OF OPERATIONS (Unaudited)

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

| (1) | Reflects a reduction in equity-based compensation as a result of the IPO Transactions which converted all liability based awards to equity treatment expensed at $16.00 per share and the expense associated with the options granted in conjunction with the IPO Transactions, as if they occurred as of January 1, 2007. |

| (2) | Reflects an increase in interest income as a result of additional cash on hand following the IPO, as if it occurred as of January 1, 2007. |

| (3) | Reflects a reduction in interest expense as a result of the $35,000 repayment of debt following the IPO, as if it occurred as of January 1, 2007. |

| (4) | D&P Corporation became the sole managing member of D&P Acquisitions effective as of the close of business October 3, 2007. Accordingly, although D&P Corporation will have a minority economic interest in D&P Acquisitions, it will have a majority voting interest and control the management of D&P Acquisitions. As a result, subsequent to the IPO Transactions, D&P Corporation will consolidate D&P Acquisitions and record a non-controlling interest for the economic interest in D&P Acquisitions held by the existing unitholders. |

| (5) | Following the IPO Transactions, D&P Corporation is subject to U.S. federal income taxes, in addition to state, local and international taxes, with respect to its allocable share of any net taxable income of D&P Acquisitions, which results in higher income taxes and an increase in income taxes paid. As a result, this reflects an adjustment to the provision for corporate income taxes to reflect an effective rate of 41.5%, which includes provision for U.S. federal income taxes and assumes the highest statutory rates apportioned to each state, local and/or foreign jurisdiction. |

| (6) | Net income available to holders of Class A common stock per share represents net income adjusted for any preferred dividends. The impact of D&P Acquisitions’ New Class A Units are not reflected as their inclusion would be antidilutive. |

| (7) | Reflects adjustment to weighted average shares outstanding for the year ended December 31, 2007 as if the total number of Class A shares raised in the IPO transactions had been outstanding since January 1, 2007. |

65

TABLE OF CONTENTS

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A(T). Controls and Procedures

| (a) | Evaluation of Disclosure Controls and Procedures |

Our management, including our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15 under the Exchange Act as of the end of the period covered by this report. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of the period covered by this quarterly report, our disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) are effective, in all material respects, to ensure that information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

| (b) | Management’s Annual Report on Internal Control Over Financial Reporting and Report of Independent Registered Public Accounting Firm |

This annual report does not include a report of management's assessment regarding internal controls over financial reporting or an attestation report of our registered public accounting firm due to a transition period established by the rules of the SEC for newly public companies.

| (c) | Change in Internal Control Over Financial Reporting |

No change in our internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act) occurred during our most recent fiscal quarter that has materially affected, or is likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information

None.

66

TABLE OF CONTENTS

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The information required by this Item is incorporated herein by reference to the Proxy Statement.

Item 11. Executive Compensation

The information required by this Item is incorporated herein by reference to the Proxy Statement.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The information contained in this section is incorporated herein by reference to the Proxy Statement and this Annual Report on Form 10-K under the caption Part II — Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Item 13. Certain Relationships and Related Transactions, and Director Independence

The information required by this Item is incorporated herein by reference to the Proxy Statement.

Item 14. Principal Accountant Fees and Services

The information required by this Item is incorporated herein by reference to the Proxy Statement.

PART IV

Item 15. Exhibits and Financial Statement Schedules.

| (a) | The following documents are filed as part of this report: |

| (1) | Consolidated Financial Statements — The consolidated financial statements listed in the “Index to Consolidated Financial Statements” described at F-1 are incorporated by reference herein. |

| (2) | Financial Statement Schedules — All schedules have been omitted because they are not applicable, not required or the information required is included in the financial statements or notes thereto. |

| (3) | Exhibits — Certain of the exhibits to this Annual Report are hereby incorporated by references, as summarized in (b) below. |

A list of exhibits required to be filed as part of this report is set forth in the Exhibit Index immediately following the Consolidated Financial Statements filed as part of this report on Form 10-K and is incorporated herein by reference.

| (c) | All other financial statement schedules have been omitted since they are either not required, not applicable or the required information is shown in the financial statements or related notes. |

67

TABLE OF CONTENTS

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on March 25, 2008.

DUFF & PHELPS CORPORATION

| By: | /s/ Noah Gottdiener

Noah Gottdiener

Chairman of the Board and Chief Executive Officer

(Principal Executive Officer) |

Pursuant to the requirements of the Securities Act of 1934, as amended, this Report has been signed below by the following persons on behalf of the Registrant in the capacities and as of the date indicated.

| |  | |  |

| Signature | | Capacity | | Date |

/s/ Noah Gottdiener

Noah Gottdiener Noah Gottdiener | | Chairman of the Board,

Chief Executive Officer and Director

(Principal Executive Officer) | | March 25, 2008

|

/s/ Gerard Creagh

Gerard Creagh Gerard Creagh | | President and Director | | March 25, 2008 |

/s/ Jacob Silverman

Jacob Silverman Jacob Silverman | | Chief Financial Officer

(Principal Financial and Accounting Officer) | | March 25, 2008 |

/s/ Robert Belke

Robert Belke Robert Belke | | Director | | March 25, 2008 |

/s/ Peter Calamari

Peter Calamari Peter Calamari | | Director | | March 25, 2008 |

/s/ William Carapezzi

William Carapezzi William Carapezzi | | Director | | March 25, 2008 |

/s/ Harvey Krueger

Harvey Krueger Harvey Krueger | | Director | | March 25, 2008 |

/s/ Sander Levy

Sander Levy Sander Levy | | Director | | March 25, 2008 |

/s/ Jeffrey Lovell

Jeffrey Lovell Jeffrey Lovell | | Director | | March 25, 2008 |

68

F-1

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Duff & Phelps Corporation:

We have audited the accompanying consolidated balance sheet of Duff & Phelps Corporation and subsidiaries (the “Successor”) as of December 31, 2007, and the related consolidated statements of operations, changes in stockholders’ equity and comprehensive income/(loss), and cash flows for the period October 4, 2007 to December 31, 2007. We have also audited the balance sheet of Duff & Phelps Acquisitions, LLC and subsidiaries (the “Predecessor”) as of December 31, 2006 and the related consolidated statements of operations, changes in unitholders’ equity/(deficit) and comprehensive income/(loss), and cash flows for the period January 1, 2007 to October 3, 2007, and the years ended December 31, 2006 and 2005. These financial statements are the responsibility of the Successor’s and Predecessor’s (collectively the “Company”) management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the Successor’s consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Successor as of December 31, 2007 and the results of its operations and its cash flows for the period October 4, 2007 to December 31, 2007 in conformity with accounting principles generally accepted in the United States of America. Further, in our opinion, the Predecessor’s consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Predecessor as of December 31, 2006 and the results of its operations and its cash flows for the period January 1, 2007 to October 3, 2007, and the years ended December 31, 2006 and 2005, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 1 to the consolidated financial statements, the Successor commenced operations on October 4, 2007 as a result of the closing of its initial public offering and obtaining control of the Predecessor. As discussed in Note 15 to the consolidated financial statements, the Predecessor adopted Statement of Financial Accounting Standards No. 158,Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, as of December 31, 2006.

/s/ KPMG LLP

New York, New York

March 25, 2008

F-2

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands, Except Per Share Data)

| |  | |  | |  | |  |

| | Successor | | Predecessor |

| | | Period from October 4 to December 31, 2007 | | Period from January 1 to October 3, 2007 | | Year Ended December 31, 2006 | | Year Ended December 31, 2005 |

| Revenues | | $ | 87,883 | | | $ | 253,275 | | | $ | 246,742 | | | $ | 73,926 | |

| Reimbursable expenses | | | 2,824 | | | | 9,946 | | | | 12,526 | | | | 4,313 | |

| Total revenues | | | 90,707 | | | | 263,221 | | | | 259,268 | | | | 78,239 | |

Direct client service costs

| | | | | | | | | | | | | | | | |

Compensation and benefits (includes $23,806 of equity-based compensation for the period

October 4, 2007 to December 31, 2007; $23,187 for the period January 1 to October 3, 2007; and $10,244 and $2,113 for the years ended December 31, 2006 and 2005, respectively) | | | 71,141 | | | | 158,748 | | | | 146,926 | | | | 44,387 | |

| Other direct client service costs | | | 1,440 | | | | 2,307 | | | | 1,034 | | | | 145 | |

| Acquisition retention expenses | | | 217 | | | | 2,035 | | | | 6,003 | | | | 11,695 | |

| Reimbursable expenses | | | 2,586 | | | | 10,079 | | | | 12,685 | | | | 4,541 | |

| | | | 75,384 | | | | 173,169 | | | | 166,648 | | | | 60,768 | |

Operating expenses

| | | | | | | | | | | | | | | | |

Selling, general and administrative (includes $2,856 of of equity-based compensation for the period October 4, 2007 to December 31, 2007; $8,241 for the period January 1 to October 3, 2007; and $3,790 and $1,803 for the years ended December 31, 2006 and 2005,

respectively) | | | 25,308 | | | | 70,946 | | | | 68,606 | | | | 22,246 | |

| Depreciation and amortization | | | 2,384 | | | | 6,754 | | | | 7,702 | | | | 3,186 | |

| Merger and acquisition costs | | | — | | | | — | | | | — | | | | 2,138 | |

| | | | 27,692 | | | | 77,700 | | | | 76,308 | | | | 27,570 | |

| Operating (loss)/income | | | (12,369 | ) | | | 12,352 | | | | 16,312 | | | | (10,099 | ) |

Other expense/(income)

| | | | | | | | | | | | | | | | |

| Interest income | | | (763 | ) | | | (1,306 | ) | | | (556 | ) | | | (137 | ) |

| Interest expense | | | 1,426 | | | | 5,494 | | | | 5,911 | | | | 1,661 | |

| Other expense/(income) | | | 369 | | | | 215 | | | | (243 | ) | | | 542 | |

| | | | 1,032 | | | | 4,403 | | | | 5,112 | | | | 2,066 | |

| (Loss)/income before non-controlling interest and income taxes | | | (13,401 | ) | | | 7,949 | | | | 11,200 | | | | (12,165 | ) |

| Non-controlling interest | | | (8,225 | ) | | | — | | | | — | | | | — | |

| Provision for income taxes | | | 1,176 | | | | 1,051 | | | | 701 | | | | 330 | |

| Net (loss)/income | | $ | (6,352 | ) | | $ | 6,898 | | | $ | 10,499 | | | $ | (12,495 | ) |

| Basic and diluted weighted average shares of Class A common stock outstanding | | | 13,018 | | | | | | | | | | | | | |

| Basic and diluted loss per share of Class A common stock | | $ | (0.49 | ) | | | | | | | | | | | | |

See accompanying notes to the consolidated financial statements.

F-3

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Share Data)

| |  | |  |

| | Successor | | Predecessor |

| | | December 31, 2007 | | December 31, 2006 |

ASSETS

| | | | | | | | |

Current assets

| | | | | | | | |

| Cash and cash equivalents | | $ | 90,243 | | | $ | 59,132 | |

| Accounts receivable, net | | | 45,572 | | | | 43,398 | |

| Unbilled services | | | 23,075 | | | | 14,199 | |

| Prepaid expenses | | | 4,491 | | | | 2,151 | |

| Other current assets | | | 1,784 | | | | 3,387 | |

| Net deferred income taxes, current | | | 9,551 | | | | 83 | |

| Total current assets | | | 174,716 | | | | 122,350 | |

| Property and equipment, net | | | 21,967 | | | | 15,609 | |

| Goodwill | | | 107,562 | | | | 98,314 | |

| Intangible assets, net | | | 27,466 | | | | 27,122 | |

| Other assets | | | 7,556 | | | | 4,410 | |

| Net deferred income taxes, non-current | | | 65,246 | | | | 226 | |

| Total non-current assets | | | 229,797 | | | | 145,681 | |

| Total assets | | $ | 404,513 | | | $ | 268,031 | |

LIABILITIES AND UNITHOLDERS' AND STOCKHOLDERS' EQUITY

| | | | |

Current liabilities

| | | | | | | | |

| Accounts payable | | $ | 5,032 | | | $ | 6,858 | |

| Accrued expenses | | | 10,105 | | | | 6,424 | |

| Accrued compensation and benefits | | | 72,713 | | | | 52,695 | |

| Deferred revenue | | | 7,931 | | | | 4,761 | |

| Equity-based compensation liability, current | | | 498 | | | | 3,241 | |

| Current portion of long-term debt | | | 794 | | | | 794 | |

| Current portion due to non-controlling unitholders | | | 3,114 | | | | — | |

| Total current liabilities | | | 100,187 | | | | 74,773 | |

| Long-term debt, less current portion | | | 42,387 | | | | 77,203 | |

| Equity-based compensation liability, non-current | | | — | | | | 11,566 | |

| Other long-term liabilities | | | 15,260 | | | | 10,471 | |

| Due to non-controlling unitholders | | | 65,196 | | | | — | |

| Total non-current liabilities | | | 122,843 | | | | 99,240 | |

| Total liabilities | | | 223,030 | | | | 174,013 | |

Commitments and contingencies (Note 12)

| | | | | | | | |

| Non-controlling interest | | | 111,979 | | | | — | |

Redeemable units

| | | | | | | | |

| Class A Units (liquidation preference of $1.64 per unit at December 31, 2006; issued and outstanding zero and 50,689,190 units at December 31, 2007 and 2006, respectively) | | | — | | | | 80,458 | |

| Class B Units (liquidation preference of $1.64 per unit at December 31, 2006; issued and outstanding zero and 24,161,835 units at December 31, 2007 and 2006, respectively) | | | — | | | | 11,515 | |

| | | | — | | | | 91,973 | |

Unitholders' and stockholders’ equity/(deficit)

| | | | | | | | |

| Class C Units (liquidation preference of $163.74 per unit at December 31, 2006; issued and outstanding zero and 99,516 units at December 31, 2007 and 2006, respectively) | | | — | | | | — | |

| Class D Units (issued and outstanding zero and 9,852,073 units at December 31, 2007 and 2006, respectively) | | | — | | | | — | |

| Class E Units (issued and outstanding zero and 16,947,500 units at December 31, 2007 and 2006, respectively) | | | — | | | | — | |

| Class F Units (liquidation preference of $1.00 per unit at December 31, 2006; issued and outstanding zero and 3,000,000 units at December 31, 2007 and 2006, respectively) | | | — | | | | 1,710 | |

| Class G Units (issued and outstanding zero and 9,855,000 units at December 31, 2007 and 2006, respectively) | | | — | | | | — | |

| Preferred stock (50,000,000 shares authorized; zero issued and outstanding) | | | — | | | | — | |

| Class A common stock, par value $0.01 per share (100,000,000 shares authorized; 13,063,641 and zero shares issued and outstanding at December 31, 2007 and 2006, respectively) | | | 131 | | | | — | |

| Class B common stock, par value $0.0001 per share (50,000,000 shares authorized; 21,089,637 and zero shares issued and outstanding at December 31, 2007 and 2006, respectively) | | | 2 | | | | — | |

| Additional paid-in capital | | | 75,375 | | | | 2,343 | |

| Accumulated other comprehensive income/(loss) | | | 348 | | | | (248 | ) |

| Accumulated deficit | | | (6,352 | ) | | | (1,760 | ) |

| Total unitholders' and stockholders' equity | | | 69,504 | | | | 2,045 | |

| Total liabilities and unitholders' and stockholders' equity | | $ | 404,513 | | | $ | 268,031 | |

See accompanying notes to the consolidated financial statements.

F-4

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF UNITHOLDERS’ EQUITY/(DEFICIT)

AND COMPREHENSIVE INCOME/(LOSS)

(In Thousands, Except Unit Amounts)

| |  | |  | |  |

| | Predecessor |

| | | Period from January 1 to October 3, 2007 | | Year Ended December 31, 2006 | | Year Ended December 31, 2005 |

Unitholders' equity:

| | | | | | | | | | | | |

| Class C Units at beginning-of-period | | | 99,516 | | | | 104,432 | | | | — | |

| Issuance of units in conjunction with CVC acquisition | | | — | | | | — | | | | 104,432 | |

| Repurchase of units | | | — | | | | (4,916 | ) | | | — | |

| Class C Units at end-of-period | | | 99,516 | | | | 99,516 | | | | 104,432 | |

| Class D Units at beginning-of-period | | | 9,852,073 | | | | 10,338,782 | | | | — | |

| Issuance of units in conjunction with CVC acquisition | | | — | | | | — | | | | 10,338,782 | |

| Forfeiture of units | | | — | | | | (486,709 | ) | | | — | |

| Class D Units at end-of-period | | | 9,852,073 | | | | 9,852,073 | | | | 10,338,782 | |

| Class E Units at beginning-of-period | | | 16,947,500 | | | | 14,500,000 | | | | — | |

| Issuance of units in conjunction with CVC acquisition | | | — | | | | — | | | | 14,500,000 | |

| Granted | | | 1,272,000 | | | | 4,795,000 | | | | — | |

| Repurchase of units | | | (22,000 | ) | | | — | | | | — | |

| Forfeiture of units | | | (764,000 | ) | | | (2,347,500 | ) | | | — | |

| Class E Units at end-of-period | | | 17,433,500 | | | | 16,947,500 | | | | 14,500,000 | |

| Class F Units at beginning-of-period | | | 3,000,000 | | | | — | | | | — | |

| Issuance of units in conjunction with Chanin acquisition | | | — | | | | 3,000,000 | | | | — | |

| Class F Units at end-of-period | | | 3,000,000 | | | | 3,000,000 | | | | — | |

| Class G Units at beginning-of-period | | | 9,855,000 | | | | — | | | | — | |

| Issuance of units in conjunction with Chanin acquisition | | | — | | | | 9,855,000 | | | | — | |

| Forfeiture of units | | | (519,582 | ) | | | — | | | | — | |

| Class G Units at end-of-period | | | 9,335,418 | | | | 9,855,000 | | | | — | |

See accompanying notes to the consolidated financial statements.

F-5

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF UNITHOLDERS’ EQUITY/(DEFICIT)

AND COMPREHENSIVE INCOME/(LOSS) – (continued)

(In Thousands, Except Unit Amounts)

| |  | |  | |  |

| | Predecessor |

| | | Period from January 1 to October 3, 2007 | | Year Ended December 31, 2006 | | Year Ended December 31, 2005 |

| Class F Units at beginning-of-period | | $ | 1,710 | | | $ | — | | | $ | — | |

| Issuance of units in conjunction with Chanin acquisition | | | — | | | | 1,710 | | | | — | |

| Class F Units at end-of-period | | | 1,710 | | | | 1,710 | | | | — | |

Members' interests:

| | | | | | | | | | | | |

| Members' interests at beginning-of-period | | | — | | | | — | | | | 10,935 | |

Issuance of interests in conjunction with Valuemetrics

transaction | | | — | | | | — | | | | 294 | |

| Issuance of interests | | | — | | | | — | | | | 466 | |

| Conversion of interests to units in conjunction with CVC acquisition | | | — | | | | — | | | | (11,695 | ) |

| Balance at end-of period | | | — | | | | — | | | | — | |

Additional paid-in capital:

| | | | | | | | | | | | |

| Balance at beginning-of-period | | | 2,343 | | | | 3,916 | | | | — | |

| Reclassification of equity-based awards | | | 6,262 | | | | (2,602 | ) | | | — | |

| Equity-based compensation | | | 861 | | | | 1,345 | | | | 3,916 | |

| Conversion of DPA liability awards to equity | | | 91,937 | | | | — | | | | — | |

| Collapse of DPA redeemable units | | | 39,024 | | | | — | | | | — | |

| Collapse of DPA Class F units | | | 1,710 | | | | — | | | | — | |

| Repurchase of units | | | (219 | ) | | | (316 | ) | | | — | |

| Balance at end-of period | | | 141,918 | | | | 2,343 | | | | 3,916 | |

Accumulated other comprehensive income/(loss):

| | | | | | | | | | | | |

| Balance at beginning-of-period | | | (248 | ) | | | — | | | | — | |

| Effect of adoption of SFAS No. 158 | | | — | | | | (515 | ) | | | — | |

| Amortization of post-retirement benefits | | | 36 | | | | — | | | | — | |

| Currency translation adjustment | | | 755 | | | | 267 | | | | — | |

| Balance at end-of period | | | 543 | | | | (248 | ) | | | — | |

Retained earnings/(deficit)

| | | | | | | | | | | | |

| Balance at beginning-of-period | | | (1,760 | ) | | | (11,853 | ) | | | 2,415 | |

| Net income/(loss) | | | 6,898 | | | | 10,499 | | | | (12,495 | ) |

| Distribution to unitholders | | | (28,277 | ) | | | (406 | ) | | | (1,773 | ) |

| Balance at end-of period | | | (23,139 | ) | | | (1,760 | ) | | | (11,853 | ) |

| Total unitholders' equity/(deficit) | | $ | 119,322 | | | $ | 2,045 | | | $ | (7,937 | ) |

Comprehensive income/(loss):

| | | | | | | | | | | | |

| Net income/(loss) | | $ | 6,898 | | | $ | 10,499 | | | $ | (12,495 | ) |

| Amortization of post-retirement benefits | | | 36 | | | | — | | | | — | |

| Currency translation adjustment | | | 755 | | | | 267 | | | | — | |

| Total comprehensive income/(loss) | | $ | 7,689 | | | $ | 10,766 | | | $ | (12,495 | ) |

See accompanying notes to the consolidated financial statements.

F-6

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME/(LOSS)

(In Thousands)

| |  | |  | |  | |  | |  | |  | |  | |  |

| |

Common Stock – Class A | | Common Stock – Class B | | Additional Paid-in-Capital | | Accumulated

Other

Comprehensive

Income | | Retained Earnings | | Total

Stockholders'

Equity |

| | | Shares | | Dollars | | Shares | | Dollars |

SUCCESSOR

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Beginning balance | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Issuance of common stock (IPO), net of $20,238 issuance costs | | | 9,545 | | | | 96 | | | | — | | | | — | | | | 132,386 | | | | — | | | | — | | | | 132,482 | |

| Issuance of common stock for Shinsei transaction | | | 3,375 | | | | 34 | | | | — | | | | — | | | | 54,202 | | | | — | | | | — | | | | 54,236 | |

| Issuance of common stock for Rash acquisition | | | 144 | | | | 1 | | | | — | | | | — | | | | 2,999 | | | | — | | | | — | | | | 3,000 | |

| Contribution of DPA net assets | | | — | | | | — | | | | 30,000 | | | | 3 | | | | 119,322 | | | | — | | | | — | | | | 119,325 | |

| Redemption of DPA New Class A Units | | | — | | | | — | | | | (8,887 | ) | | | (1 | ) | | | (140,498 | ) | | | — | | | | — | | | | (140,499 | ) |

| Initial allocation of non-controlling interest in DPA | | | — | | | | — | | | | — | | | | — | | | | (102,535 | ) | | | — | | | | — | | | | (102,535 | ) |

| Cancellations | | | — | | | | — | | | | (23 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Deferred tax asset effective tax rate conversion | | | — | | | | — | | | | — | | | | — | | | | 1,580 | | | | — | | | | — | | | | 1,580 | |

| Equity-based compensation | | | — | | | | — | | | | — | | | | — | | | | 26,164 | | | | — | | | | — | | | | 26,164 | |

| Distributions to DPA non-controlling unitholders | | | — | | | | — | | | | — | | | | — | | | | (576 | ) | | | — | | | | — | | | | (576 | ) |

| Non-controlling interest allocation for the period from October 4 to December 31, 2007 | | | — | | | | — | | | | — | | | | — | | | | (17,669 | ) | | | — | | | | — | | | | (17,669 | ) |

| Balance as of December 31, 2007 | | | 13,064 | | | | 131 | | | | 21,090 | | | | 2 | | | | 75,375 | | | | — | | | | — | | | | 75,508 | |

| Net loss available to holders of Class A common stock for the period October 4 to December 31, 2007 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (6,352 | ) | | | (6,352 | ) |

| Currency translation adjustment | | | — | | | | — | | | | — | | | | — | | | | — | | | | 337 | | | | — | | | | 337 | |

| Amortization of post-retirement benefits | | | — | | | | — | | | | — | | | | — | | | | — | | | | 11 | | | | — | | | | 11 | |

| Total comprehensive income | | | — | | | | — | | | | — | | | | — | | | | — | | | | 348 | | | | (6,352 | ) | | | (6,004 | ) |

| Balance as of December 31, 2007 | | | 13,064 | | | $ | 131 | | | | 21,090 | | | $ | 2 | | | $ | 75,375 | | | $ | 348 | | | $ | (6,352 | ) | | $ | 69,504 | |

F-7

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| |  | |  | |  | |  |

| | Successor | | Predecessor |

| | | Period from October 4 to December 31, 2007 | | Period from January 1 to October 3, 2007 | | Year Ended December 31, 2006 | | Year Ended December 31, 2005 |

Cash flows from operating activities:

| | | | | | | | | | | | | | | | |

| Net (loss)/income | | $ | (6,352 | ) | | $ | 6,898 | | | $ | 10,499 | | | $ | (12,495 | ) |

Adjustments to reconcile net income/(loss) to net cash provided by operating activities:

| | | | | | | | | | | | | | | | |

| Depreciation | | | 1,209 | | | | 3,170 | | | | 3,039 | | | | 706 | |

| Amortization of intangibles | | | 1,175 | | | | 3,584 | | | | 4,663 | | | | 2,492 | |

| Amortization of deferred credits | | | 168 | | | | 377 | | | | (114 | ) | | | — | |

| Amortization of post-retirement benefits | | | 22 | | | | 69 | | | | — | | | | — | |

| Equity-based compensation | | | 26,662 | | | | 31,428 | | | | 14,034 | | | | 3,916 | |

| Allowance for doubtful accounts | | | (264 | ) | | | 289 | | | | 1,409 | | | | 374 | |

| Non-controlling interest | | | (8,225 | ) | | | — | | | | — | | | | — | |

| Amortization of interest rate swap | | | 393 | | | | 299 | | | | (347 | ) | | | — | |

| Deferred income taxes | | | (4,015 | ) | | | 242 | | | | 309 | | | | — | |

| Loss on disposal of assets | | | 125 | | | | 135 | | | | — | | | | — | |

Changes in assets and liabilities providing/(using) cash:

| | | | | | | | | | | | | | | | |

| Accounts receivable | | | 10,829 | | | | (12,253 | ) | | | (13,042 | ) | | | (4,997 | ) |

| Unbilled services | | | (4,919 | ) | | | (3,796 | ) | | | (3,280 | ) | | | (4,731 | ) |

| Prepaid expenses | | | 544 | | | | (2,865 | ) | | | 273 | | | | (825 | ) |

| Deferred credits | | | 2,120 | | | | 361 | | | | 4,274 | | | | 1,642 | |

| Other assets | | | 7,645 | | | | (2,674 | ) | | | (3,578 | ) | | | (2,595 | ) |

| Due from affiliates | | | — | | | | (20,063 | ) | | | — | | | | — | |

| Accounts payable | | | (2,220 | ) | | | 4,844 | | | | 5,420 | | | | 1,530 | |

| Accrued expenses | | | 2,800 | | | | 15,213 | | | | 2,601 | | | | 1,382 | |

| Accrued compensation and benefits | | | 15,815 | | | | 3,836 | | | | 17,542 | | | | 11,645 | |

| Deferred revenues | | | 2,388 | | | | (247 | ) | | | (2,761 | ) | | | 7,087 | |

| Net cash provided by operating activities | | | 45,900 | | | | 28,847 | | | | 40,941 | | | | 5,131 | |

Cash flows from investing activities:

| | | | | | | | | | | | | | | | |

| Purchase of property and equipment | | | (3,799 | ) | | | (9,013 | ) | | | (10,804 | ) | | | (3,420 | ) |

| Purchase of investments | | | (1,789 | ) | | | — | | | | — | | | | — | |

| Business acquisitions, net of cash acquired | | | (11,528 | ) | | | 513 | | | | (11,085 | ) | | | (121,361 | ) |

| Net cash used in investing activities | | | (17,116 | ) | | | (8,500 | ) | | | (21,889 | ) | | | (124,781 | ) |

Cash flows from financing activities:

| | | | | | | | | | | | | | | | |

| Net proceeds from issuance of equity | | | 186,718 | | | | — | | | | 200 | | | | 81,118 | |

| Repurchase of equity units | | | — | | | | (343 | ) | | | (1,079 | ) | | | — | |

| Redemption of D&P Acquisitions’ unitholders' equity | | | (140,498 | ) | | | — | | | | — | | | | — | |

| Proceeds from issuance of debt | | | — | | | | — | | | | 30,000 | | | | 49,169 | |

| Repayments of debt | | | (35,000 | ) | | | (793 | ) | | | (650 | ) | | | (9,012 | ) |

| Principal payments under capital lease obligation | | | (62 | ) | | | (187 | ) | | | (386 | ) | | | — | |

| Distributions to D&P Acquisitions’ unitholders | | | (575 | ) | | | (28,374 | ) | | | (406 | ) | | | (1,773 | ) |

| Net cash provided by/(used in) financing activities | | | 10,583 | | | | (29,697 | ) | | | 27,679 | | | | 119,502 | |

| Effect of exchange rate on cash and cash equivalents | | | 337 | | | | 756 | | | | 267 | | | | — | |

| Net increase/(decrease) in cash and cash equivalents | | | 39,705 | | | | (8,594 | ) | | | 46,998 | | | | (148 | ) |

| Cash and cash equivalents at beginning of period | | | 50,538 | | | | 59,132 | | | | 12,134 | | | | 12,282 | |

| Cash and cash equivalents at end of period | | $ | 90,243 | | | $ | 50,538 | | | $ | 59,132 | | | $ | 12,134 | |

Supplemental disclosure of cash flow activities:

| | | | | | | | | | | | | | | | |

| Cash paid during the period for interest | | $ | — | | | $ | 6,102 | | | $ | 5,170 | | | $ | 381 | |

| Cash paid during the period for income taxes | | | 3,670 | | | | 1,815 | | | | 902 | | | | 91 | |

Supplemental disclosures of non-cash investing and financing activities:

| | | | | | | | | | | | |

| Property and equipment acquired under capital leases | | $ | — | | | $ | — | | | $ | 635 | | | $ | — | |

| Common stock or units issued in conjunction with business acquisitions | | | 3,000 | | | | — | | | | 1,710 | | | | — | |

F-8

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

Note 1. Organization and Nature of the Company

Duff & Phelps Corporation (“D&P Corporation,” “DPC” or the “Company”), a Delaware corporation, was incorporated on April 23, 2007 as a holding company for the purpose of facilitating an initial public offering (“IPO”) of common equity and to become the sole managing member of Duff & Phelps Acquisitions, LLC and subsidiaries (“D&P Acquisitions” or “DPA”). D&P Corporation has not engaged in any business or other activities except in connection with its formation and the IPO.

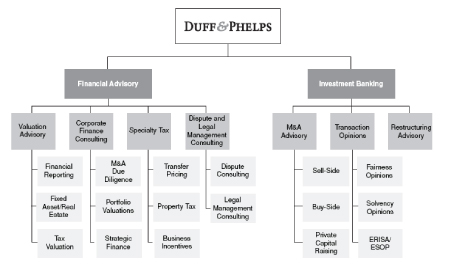

The Company is a leading provider of independent financial advisory and investment banking services. Its mission is to help its clients protect, maximize and recover value. The foundation of its services is its ability to provide independent advice on issues involving highly technical and complex assessments of value. The Company principally supports client needs in financial and tax valuation (especially in the context of business combinations and other corporate transactions), mergers and acquisitions (“M&A”), restructuring and litigation and disputes. The Company believes the Duff & Phelps brand is associated with a high level of professional service and integrity, knowledge leadership and independent, trusted advice. The Company serves a global client base through offices in 23 cities, comprised of offices in 17 U.S. cities, including New York, Chicago and Los Angeles, and 6 international offices located in Amsterdam, London, Munich, Paris, Tokyo and Zurich.

On September 27, 2007, a registration statement relating to shares of Class A common stock of D&P Corporation was declared effective and the price of such shares was set at $16.00 per share. The IPO closed on October 3, 2007. Pursuant to the IPO, D&P Corporation sold 9,545,000 shares of Class A common stock (including 1,245,000 shares of Class A common stock sold as a result of the exercise of the underwriters’ over-allotment option).

References to “D&P Corporation,” the “Company,” and “Successor” refer subsequent to the IPO and related transactions described below to Duff & Phelps Corporation and its consolidated subsidiaries. These references (other than “Successor”) refer prior to the IPO and related transactions to D&P Acquisitions (“Predecessor”).

As a result of the IPO and the Recapitalization Transactions described below, D&P Corporation became the sole managing member of and has a controlling interest in D&P Acquisitions. D&P Corporation’s only business is to act as the sole managing member of D&P Acquisitions, and, as such, D&P Corporation operates and controls all of the business and affairs of D&P Acquisitions and consolidates the financial results of D&P Acquisitions into D&P Corporation’s consolidated financial statements effective as of the close of business October 3, 2007.

Immediately prior to the closing of the IPO of D&P Corporation on October 3, 2007, D&P Acquisitions effectuated certain transactions intended to simplify the capital structure of D&P Acquisitions (“Recapitalization Transactions”). Prior to the Recapitalization Transactions, D&P Acquisitions' capital structure consisted of seven different classes of membership interests (Classes A through G, collectively “Legacy Units”), each of which had different capital accounts and amounts of aggregate distributions above which its holders share in future distributions (see Note 16). The net effect of the Recapitalization Transactions was to convert the multiple-class structure into a single new class of units called “New Class A Units.” The conversion of all of the different classes of units of D&P Acquisitions occurred in accordance with conversion ratios for each class of outstanding units based upon the liquidation value of D&P Acquisitions, as if it had been liquidated upon the IPO, with such value determined by the $16.00 price per share of Class A common stock sold in the IPO. The distribution of New Class A Units per class of outstanding units was determined pursuant to the distribution provisions set forth in D&P Acquisitions' Second Amended and Restated Limited Liability Company Agreement, dated October 31, 2006 (“2nd LLC Agreement”).

In connection with the IPO, 8,887,465 New Class A Units of D&P Acquisitions were redeemed for an aggregate value of approximately $140,500 (“Redemption”). Upon completion of the Recapitalization Transactions and after the Redemption, there were 34,032,535 New Class A Units issued and outstanding, of which

F-9

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

Note 1. Organization and Nature of the Company – (continued)

12,920,000 units were held by D&P Corporation and 21,112,535 units were held by existing unitholders of D&P Acquisitions. Pursuant to the incorporation of D&P Corporation and the IPO Transactions (as defined below), D&P Corporation issued a number of shares of Class B common stock to existing unitholders of D&P Acquisitions in an aggregate amount equal to the number of New Class A Units held by existing unitholders of D&P Acquisitions.

Shinsei Investment and Initial Public Offering

On September 1, 2007, D&P Corporation entered into a stock purchase agreement with Shinsei Bank, Limited, a Japanese corporation, pursuant to which D&P Corporation agreed to sell to Shinsei 3,375,000 shares of Class A common stock for approximately $54,200, or at a purchase price equal to $16.07 per share. The shares were held in escrow until the closing of the IPO on October 3, 2007, at which time they were issued. Shares of Class A common stock owned by Shinsei are subject to restrictions on transfer until September 5, 2009. Shinsei may sell up to 50% of its Class A common stock on or after September 5, 2008, 75% of its Class A common stock on or after March 5, 2009 and 100% of its Class A common stock on or after September 5, 2009. In addition, Shinsei is restricted from purchasing any additional Class A common stock until March 5, 2009. In connection with this investment, D&P Corporation granted Shinsei registration rights.

The IPO, together with the Shinsei Investment, resulted in the issuance by D&P Corporation of 12,920,000 shares of Class A common stock (including 1,245,000 shares of Class A common stock offered as a result of the exercise of the underwriters’ over-allotment option), and net proceeds to D&P Corporation of approximately $186,718 (after deducting estimated fees and expenses associated with the IPO and Shinsei Investment). Upon consummation of the IPO and the Shinsei Investment, D&P Corporation contributed all of the net proceeds from the IPO and the Shinsei Investment to D&P Acquisitions, and D&P Acquisitions issued to D&P Corporation a number of New Class A Units equal to the number of shares of Class A common stock that D&P Corporation issued in connection with the IPO and the Shinsei Investment. In connection with its acquisition of New Class A Units, D&P Corporation became the sole managing member of D&P Acquisitions. D&P Acquisitions used the contributed net proceeds from the IPO and the Shinsei Investment to redeem approximately $140,500 of New Class A Units held by existing unitholders of D&P Acquisitions, $35,000 to repay borrowings and approximately $11,200 for general corporate purposes.

In connection with the closing of the IPO, D&P Acquisitions and certain of its existing unitholders entered into an Exchange Agreement under which, subject to the applicable minimum retained ownership requirements and certain other restrictions, including notice requirements, from time to time, typically once a quarter, such unitholders (or certain transferees thereof) will have the right to exchange with D&P Acquisitions their New Class A Units for shares of D&P Corporation’s Class A common stock on a one-for-one basis.

The following table summarizes the proceeds received from the IPO and Shinsei investment:

| |  |

| Stock subscription: 8,300,000 shares at $16.00 per share | | $ | 132,800 | |

| Stock subscription: 3,375,000 shares at $16.07 per share | | | 54,236 | |

| Over allotment: 1,245,000 shares at $16.00 per share | | | 19,920 | |

| IPO related expenses | | | (20,238 | ) |

| Net proceeds | | $ | 186,718 | |

F-10

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

Note 1. Organization and Nature of the Company – (continued)

| • | D&P Corporation became the sole managing member of D&P Acquisitions and, through D&P Acquisitions and its subsidiaries, operates the Duff & Phelps business. Accordingly, although D&P Corporation has a minority economic interest (38%) in D&P Acquisitions, D&P Corporation has a majority voting interest (100%) and controls the management of D&P Acquisitions. As a result, D&P Corporation consolidates the financial results of D&P Acquisitions and records non-controlling interest for the economic interest in D&P Acquisitions held by the existing unitholders to the extent the book value of their interest in D&P Acquisitions is greater than zero; |

| • | Investors in the IPO and Shinsei held 12,920,000 shares of D&P Corporation’s Class A common stock, the existing unitholders of D&P Acquisitions held 21,112,535 shares of D&P Corporation’s Class B common stock and 21,112,535 New Class A Units of D&P Acquisitions, and D&P Corporation held 12,920,000 New Class A Units of D&P Acquisitions immediately following the IPO; and |

| • | the New Class A Units are exchangeable with D&P Acquisitions on a one-for-one basis for shares of D&P Corporation Class A common stock. In connection with an exchange, a corresponding number of shares of D&P Corporation Class B common stock will be required to be cancelled. However, the exchange of New Class A Units for shares of D&P Corporation Class A common stock will not affect D&P Corporation’s Class B common stockholders' voting power since the votes represented by the cancelled shares of D&P Corporation Class B common stock will be replaced with the votes represented by the shares of Class A common stock for which such New Class A Units are exchanged. |

The Recapitalization Transactions, the Shinsei Investment and the IPO are collectively referred to as the “IPO Transactions.”

The following table summarizes the conversion of Legacy Units to New Class A Units:

Conversion of Legacy Units to New Class A Units

| |  | |  | |  | |  | |  | |  | |  | |  | |  | |  |

| | Legacy Class A | | Legacy Class B | | Legacy Class C | | Legacy Class D | | Legacy Class E | | Legacy Class F | | Legacy Class G | | Shinsei

and IPO

Transactions | | Redemptions | | Total |

Outstanding

Legacy Units at

September 30, 2007 | | | 50,689,190 | | | | 24,086,021 | | | | 99,516 | | | | 9,852,073 | | | | 17,433,500 | | | | 3,000,000 | | | | 9,335,418 | | | | | | | | | | | | | |

Converted

Legacy Units | | | (35,683,382 | ) | | | (17,067,057 | ) | | | 939,654 | | | | (7,944,112 | ) | | | (14,201,885 | ) | | | (2,831,659 | ) | | | (7,707,277 | ) | | | | | | | | | | | | |

Total Converted

Units at

October 3, 2007 | | | 15,005,808 | | | | 7,018,964 | | | | 1,039,170 | | | | 1,907,961 | | | | 3,231,615 | | | | 168,341 | | | | 1,628,141 | | | | 12,920,000 | | | | (8,887,465 | ) | | | 34,032,535 | |

F-11

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

Note 1. Organization and Nature of the Company – (continued)

Non-Controlling Interest

Although D&P Corporation has a majority voting interest (100%) in and controls the management of D&P Acquisitions, it owns a minority economic interest (38%) in D&P Acquisitions. As a result, D&P Corporation consolidates the financial results of D&P Acquisitions and records non-controlling interest for the economic interest in D&P Acquisitions held by the existing unitholders to the extent the book value of their interest in D&P Acquisitions is greater than zero. Non-controlling interest on the statement of operations represents the portion of earnings or loss attributable to the economic interest in D&P Acquisitions held by the non-controlling unitholders. Non-controlling interest on the balance sheet represents the portion of net assets of D&P Acquisitions attributable to the non-controlling unitholders based on the portion of total New Class A Units owned by such unitholders. The ownership of the New Class A Units is summarized as follows:

| |  | |  | |  |

| | Non-controlling Unitholders | | D&P

Corporation | | Total |

| October 4, 2007 | | | 21,112 | | | | 12,920 | | | | 34,032 | |

| Cancellations | | | (23 | ) | | | — | | | | (23 | ) |

| Issuance for Rash acquisition | | | — | | | | 144 | | | | 144 | |

| December 31, 2007 | | | 21,089 | | | | 13,064 | | | | 34,153 | |

| | | | 62 | % | | | 38 | % | | | 100 | % |

The non-controlling interest associated with the initial investment by D&P Corporation in D&P Acquisitions and subsequent transactions is calculated as follows:

| |  |

| Total DPA unitholders’ net assets (Predecessor) as of October 3, 2007 | | $ | 119,322 | |

| DPC investment in DPA | | | 186,718 | |

| Redemption of DPA New Class A Units | | | (140,498 | ) |

| DPA equity balance post Redemption | | | 165,542 | |

| Non-controlling unitholders' percentage | | | 62 | % |

| Initial allocation of non-controlling interest in DPA | | | 102,535 | |

| Non-controlling interest associated with the Rash acquisition | | | 1,854 | |

| Non-controlling interest associated with the DPA tax distribution | | | (357 | ) |

| Non-controlling interest associated with the equity-based compensation | | | 15,960 | |

| Non-controlling interest associated with other comprehensive income | | | 212 | |

| Total non-controlling interest allocation for the period from October 4 to December 31, 2007 | | | 17,669 | |

| Allocation of loss of DPA | | | (8,225 | ) |

| Balance of non-controlling interest as of December 31, 2007 | | $ | 111,979 | |

Tax Receivable Agreement and Tax Distributions

As a result of D&P Corporation’s acquisition of New Class A Units of D&P Acquisitions as described above, D&P Corporation expects to benefit from depreciation and other tax deductions reflecting D&P Acquisitions' tax basis for its assets. Those deductions will be allocated to D&P Corporation and will be taken into account in reporting D&P Corporation’s taxable income. Further, as a result of a U.S. federal income tax election made by D&P Acquisitions applicable to a portion of D&P Corporation’s acquisition of D&P Acquisitions’ units, the income tax basis of the assets of D&P Acquisitions underlying a portion of the units D&P Corporation has and will acquire (pursuant to the Exchange Agreement described above) will be adjusted based upon the amount that D&P Corporation has paid for that portion of its D&P Acquisitions units. D&P

F-12

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

Note 1. Organization and Nature of the Company – (continued)

Corporation has entered into an agreement with the existing unitholders of D&P Acquisitions (for the benefit of the existing unitholders of D&P Acquisitions) that will provide for the payment by D&P Corporation to the existing unitholders of D&P Acquisitions of 85% of the amount of cash savings, if any, in U.S. federal, state and local income tax that D&P Corporation realizes (i) from the tax basis in its proportionate share of D&P Acquisitions' goodwill and similar intangible assets (determined as of the date of the IPO) that D&P Corporation receives as a result of the exchanges and (ii) from the federal income tax election referred to above.

The actual amount of the adjusted tax basis, as well as the amount and timing of any payments under this agreement will vary depending upon a number of factors, including the basis of our proportionate share of D&P Acquisitions’ assets on the dates of exchanges, the timing of exchanges, the price of shares of our Class A common stock at the time of each exchange, the extent to which such exchanges are taxable, the deductions and other adjustments to taxable income which D&P Acquisitions is entitled. Payments under the tax receivable agreement will give rise to additional tax benefits and therefore to additional potential payments under the tax receivable agreement. In addition, the tax receivable agreement will provide for interest accrued from the due date (without extensions) of the corresponding tax return to the date of payment under the agreement.

The Company has recorded a liability of $68,310, including a current portion of $3,114 as of December 31, 2007, representing the payments due to D&P Acquisitions’ unitholders under the tax receivable agreement as a result of the Redemption payments.

Note 2. Summary of Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements of the Successor and Predecessor have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and include the accounts of the Company, its controlled subsidiaries and other entities consolidated as required by GAAP.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the financial statements and reported amounts of revenues and expenses during the periods presented. Actual results could differ from these estimates. Estimates and assumptions are reviewed periodically and the effects of revisions are reflected in the consolidated financial statements in the period they are deemed to be necessary. Significant estimates made in the accompanying consolidated financial statements include, but are not limited to, proportional performance under client engagements for the purpose of determining revenue recognition, accounts receivable and unbilled services valuation, incentive compensation, useful lives of intangible assets, the carrying value of goodwill and intangible assets, allowances for doubtful accounts, gains and losses on engagements, amounts due to non-controlling unitholders, reserves for estimated tax liabilities and certain estimates and assumptions used in the calculation of the fair value of equity compensation issued to employees.

The Company is subject to uncertainties, such as the impact of future events, economic, environmental and political factors, and changes in the business climate; therefore, actual results may differ from those estimates. When no estimate in a given range is deemed to be better than any other when estimating contingent liabilities, the low end of the range is accrued. Accordingly, the accounting estimates used in the preparation of the Company's consolidated financial statements will change as new events occur, as more experience is acquired, as additional information is obtained and as the Company's operating environment changes. Changes in estimates are made when circumstances warrant. Such changes and refinements in estimation methodologies are reflected in reported results of operations; if material, the effects of changes in estimates are disclosed in the notes to the consolidated financial statements.

F-13

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

Note 2. Summary of Significant Accounting Policies – (continued)

Revenue Recognition

The Company recognizes revenues in accordance with Staff Accounting Bulletin (“SAB”) No. 101,Revenue Recognition in Financial Statements, as amended by SAB No. 104,Revenue Recognition. Revenue is recognized when persuasive evidence of an arrangement exists, the related services are provided, the price is fixed or determinable and collectability is reasonably assured.

Revenues are primarily generated from financial advisory and investment banking services. The Company typically enters into these engagements on a time-and-materials basis, a fixed-fee basis or a contingent-fee basis.

Revenues from time-and-materials engagements are recognized as the hours are incurred by the Company's professionals.

Revenues from fixed-fee engagements are recognized as the services are provided under a proportional performance method. The nature of services typically provided under fixed-fee engagements include (but are not limited to) purchase price allocations, goodwill and intangible asset impairment, international business combinations, option valuations, transfer pricing and litigation support services. Revenues for engagements under a proportional performance method are recognized based on estimates of work completed versus the total services to be provided under the engagement. Estimates of work completed are based on the level of services or billable hours provided by each member of the engagement team during the period relative to the estimated total level of effort or total billable hours required to perform the engagement. These estimates are continually monitored during the term of the contract and if appropriate are amended as the contract progresses.

Revenue recognition is affected by a number of factors that change the estimated amount of work required to complete the project such as changes in scope, the staffing on the engagement and the level of client participation. Periodic engagement reviews require the Company to make judgments and estimates regarding the overall profitability and stage of project completion, which, in turn, affect how the Company recognizes revenue.

Losses, if any, on fixed-fee engagements are recognized in the period in which the loss becomes probable and reasonably estimated.

In the absence of clear and reliable output measures, the Company believes that our method of recognizing service revenues, for contracts with fixed fees, based on hours of service provided represents an appropriate surrogate for output measures. The Company determined that an input-based approach was most appropriate because the input measures are deemed to be a reasonable substitute for output measures based on the performance of our obligations to the customer, and due to the fact that an input-based approach would not vary significantly from an output measure approach. The Company believes this methodology provides a reliable measure of the revenue from the advisory services the Company provides to our customers under fixed-fee engagements given the nature of the consulting services the Company provide and the following additional considerations:

| • | the Company is a specialty consulting firm; |

| • | the Company’s engagements do not typically have specific interim deliverables or milestones; |

| • | the customer receives the benefit of the Company’s services throughout the contract term; |

| • | the customer is obligated to pay for services rendered even if a final deliverable is not produced, typically based on the proportional hours performed to date; |

| • | the Company does not incur setup costs; and |

| • | the Company expenses contract fulfillment costs, which are primarily compensation costs, as incurred. |

F-14

TABLE OF CONTENTS

DUFF & PHELPS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands, Except Unit and Share Amounts or as Otherwise Indicated)

Note 2. Summary of Significant Accounting Policies – (continued)