EXHIBIT 99.1

In this report, references to the “Company,” “we,” “us,” “our” and “Successor” refer to Duff & Phelps Corporation and its consolidated subsidiaries during the period subsequent to October 3, 2007, the date we consummated our initial public offering (“IPO”) and related transactions. Prior to the IPO, Duff & Phelps Acquisitions, LLC and its subsidiaries (“D&P Acquisitions” or “Predecessor,”) was comprised of certain consolidated entities under the common ownership of D&P Acquisitions. References to “revenue” or “revenues” refer to revenue excluding client reimbursable expenses. Amounts are reported in thousands, except for per share amounts, rate-per-hour, headcount or where the context requires otherwise.

Part I

Item 1. Business.

Overview

We are a leading provider of independent financial advisory and investment banking services. Our mission is to help our clients protect, maximize and recover value. The foundation of our services is our ability to provide independent advice on issues involving highly technical and complex assessments in the areas of valuation, transactions, financial restructuring, disputes and taxation. We believe the Duff & Phelps brand is associated with a high level of professional service and integrity, knowledge leadership and independent, trusted advice. With 975 experienced and credentialed client service professionals at December 31, 2008, we serve a global client base through offices in 24 cities, comprised of offices in 18 U.S. cities, including New York, Chicago, Dallas and Los Angeles, and six international offices located in Amsterdam, London, Munich, Paris, Shanghai and Tokyo.

We provide our services globally to a wide variety of companies who are in need of industry-leading, customized financial advice. Our clients include publicly-traded and privately-held companies, government entities, and investment firms such as private equity firms and hedge funds. Additionally, we maintain extensive relationships with law, accounting and investment banking firms from whom we receive referral business.

We have a collaborative culture that is based on a team approach. This approach promotes the cross-selling of new business opportunities across practice groups and enables us to deliver the most appropriate Duff & Phelps professionals to meet a client's needs. In addition, our integrated, multi-disciplinary approach enables us to cross-staff our professionals across multiple service lines to better manage the utilization of our staff. We believe that, as a result of our firm's culture, global scale, broad service offering and strong brand name, Duff & Phelps provides an attractive career platform, which allows us to attract and retain highly qualified professionals.

Our History

The original Duff & Phelps business was founded in 1932 to provide high quality investment research services focused on the utility industry. Over several decades, it evolved into a diversified financial services firm providing investment banking, credit rating, and investment management services. In 1994, the credit rating business of Duff & Phelps was spun off into a separate public company that was eventually purchased by Fitch Ratings, Ltd. In 2000, Duff & Phelps, LLC, the company that operated the investment banking practice of the Duff & Phelps business, was acquired by Webster Financial Corporation (“Webster”). In 2004, Duff & Phelps, LLC was acquired from Webster by its management and an investor group led by Lovell Minnick Partners LLC (“Lovell Minnick”).

In 2005, Duff & Phelps, LLC teamed with Lovell Minnick and Vestar Capital Partners (“Vestar”), another leading private equity firm, to acquire the Corporate Value Consulting business (“CVC”) from the Standard & Poor's division of The McGraw-Hill Companies, Inc. (“McGraw-Hill”). CVC was formed in the 1970s, initially as part of the financial advisory service groups of Price Waterhouse and Coopers & Lybrand. These practices were combined in 1998 when Price Waterhouse merged with Coopers & Lybrand to form PricewaterhouseCoopers (“PwC”) and were subsequently acquired by McGraw-Hill in 2001, thereby establishing independence from the audit practice of PwC. In connection with the acquisition of CVC, D&P Acquisitions was formed and Duff & Phelps, LLC became a wholly-owned subsidiary of D&P Acquisitions. In October 2006, D&P Acquisitions acquired Chanin Capital Partners, LLC (“Chanin”), an independent specialty investment bank providing restructuring advisory services.

The Company was incorporated on April 23, 2007 as a holding company for the purpose of facilitating the IPO and to become the sole managing member of D&P Acquisitions. In connection with the IPO, the Company sold 9,545 shares of Class A common stock. The IPO closed on October 3, 2007 and the Company began consolidating the results of D&P Acquisitions.

On September 1, 2007, the Company entered into a stock purchase agreement with Shinsei Bank, Limited (“Shinsei”), a Japanese corporation, pursuant to which the Company agreed to sell to Shinsei 3,375 shares of Class A common stock for $54,236 (the “Shinsei Investment”).

The IPO, together with the Shinsei Investment, resulted in the issuance by the Company of 12,920 shares of Class A common stock and net proceeds to the Company of $186,718. D&P Acquisitions used the contributed net proceeds from the IPO and the Shinsei Investment to redeem approximately $140,500 of New Class A Units (as defined and described below) held by existing unitholders of D&P Acquisitions, used $35,000 to repay borrowings and used approximately $11,200 for general corporate purposes.

As a result of the IPO and the Recapitalization Transactions (as defined and described below), the Company became the sole managing member of D&P Acquisitions and, through D&P Acquisitions and its subsidiaries, operates the Duff & Phelps business. Accordingly, although the Company has a minority economic interest in D&P Acquisitions (41.3% as of December 31, 2008), the Company has sole voting power (100%) and controls the management of D&P Acquisitions. Immediately prior to the closing of the IPO, D&P Acquisitions effectuated certain transactions intended to simplify the capital structure of D&P Acquisitions (the “Recapitalization Transactions”). The net effect of the Recapitalization Transactions was to convert the multiple-class structure into a single new class of units called “New Class A Units.” The holders of New Class A Units also own one share of the Company’s Class B common stock for each New Class A Unit. The New Class A Units are exchangeable pursuant to an exchange agreement on a one-for-one basis for shares of the Company’s Class A common stock. In connection with an exchange, a corresponding number of shares of the Company’s Class B common stock are cancelled.

2008 Developments

General developments during 2008 included the following:

| | § | The unprecedented economic environment, especially the dislocation of the credit markets and the financial services industry, continued to present us with opportunities and challenges. While our service offerings that are generally correlated to the volume of M&A transactions continued to experience reduced demand, growth in other business units offset this reduction in 2008 with opportunities arising from counter-cyclical and non-cyclical services. Services we believe to be counter-cyclical include our global restructuring services, dispute consulting, and goodwill impairment testing in conjunction with Statement of Financial Accounting Standards (“SFAS”) No. 142, Goodwill and Other Intangible Assets (“SFAS 142”). Services we believe to be non-cyclical include portfolio valuations; financial engineering; transfer pricing; and tax services. We believe that revenue and earnings growth for the year demonstrate the resiliency of our balanced portfolio of services and diversified client base, whose demand for complex financial advisory and valuation services continues in this uncertain economic environment. |

| | § | The secular trends driving opportunities for our services also continued in 2008. These trends include the need for greater transparency, the application of fair value accounting, demands for independence and a greater level of corporate restructurings. The current economic environment underscores the benefits of these drivers of our business. In addition, the emerging global regulatory and accounting landscape continues to present opportunities for us to help our clients navigate through complex issues relating to valuation and objective presentation of value on their financial statements. |

| | § | In 2008, our revenues increased to $381,476, or 11.8%, from a combination of organic growth and acquisitions, compared to $341,158 in 2007. Revenues attributable to the Financial Advisory and Corporate Finance Consulting segments increased by 16.0% and 36.7%, respectively, partially offset by a 12.0% decrease in revenues from our Investment Banking segment. Revenue growth attributable to our Financial Advisory segment was driven by demand from the Tax Services and Dispute and Legal Management Consulting business units throughout the year, and to a lesser extent Valuation Advisory during the first half of the year. Revenue growth attributable to our Corporate Finance Consulting segment was driven by demand from Portfolio Valuation, Financial Engineering and Strategic Valuation Advisory, partially offset by a decrease in revenues from Due Diligence. Our Investment Banking segment was impacted by the general economic environment and dislocation in the credit markets which led to a lower volume of M&A transactions and a decline in revenues. |

| | § | For the quarter ended December 31, 2008, our revenues were $94,208, compared to $92,708 of revenues in the quarter ended December 31, 2007. Revenues attributable to the Financial Advisory and Corporate Finance Consulting segments increased by 1.5% and 17.5%, respectively, partially offset by a 6.8% decrease in revenues from our Investment Banking segment. Growth attributable to our Financial Advisory segment was driven by our Tax Services and Dispute & Legal business units. Revenues from our Valuation Advisory business unit decreased as a result of reduced demand for fixed asset/real estate valuations and financial reporting, primarily purchase price allocations related to SFAS No. 141, Business Combinations (“SFAS 141”). Revenue growth attributable to our Corporate Finance Consulting segment was driven by demand from Portfolio Valuation, Financial Engineering and Strategic Valuation Advisory, partially offset by a decrease in revenues from Due Diligence. Our Investment Banking segment was impacted by the general economic environment and dislocation in the credit markets which led to a lower volume of M&A transactions and a decrease in revenue. However, this decrease was partially offset by an increase in revenues from our Global Restructuring Advisory business unit from a higher number of restructuring engagements during the fourth quarter. |

| | § | For the quarter ended December 31, 2008, our revenues were $94,208, compared to $96,314 of revenues in the quarter ended September 30, 2008. Revenues attributable to the Financial Advisory and Corporate Finance Consulting segments decreased sequentially by 5.8% and 11.5%, respectively, partially offset by a 21.3% sequential increase in revenues from our Investment Banking segment. Our Financial Advisory and Corporate Finance Consulting segments were impacted by the current economic environment which impacted revenue from these services. Growth from our Investment Banking segment benefited from an increase in our transaction opinions and restructuring businesses. |

| | § | Our number of client service professionals increased by 131 from 844 at December 31, 2007 to 975 at December 31, 2008. Our number of client service managing directors increased by 38 from 130 at December 31, 2007 to 168 at December 31, 2008. |

| | § | We expanded the business through targeted acquisitions that strengthen our core services: |

| Effective | | | | |

| Date | | Acquisition | | Description |

| | | | | |

| 8/8/08 | | Financial and IP Analysis, Inc. | | Financial consulting firm that specializes in intellectual |

| | | (d/b/a The Lumin Expert Group) | | property dispute support and expert testimony. |

| | | | | |

| 7/31/08 | | Kane Reece Associates, Inc. | | Valuation, management and technical consulting firm with a |

| | | | | focus on the communications, entertainment and media industries. |

| | | | | |

| 7/15/08 | | World Tax Service US, LLC | | Tax advisory firm focused on the delivery of specialized |

| | | | | international and domestic tax services. |

| | | | | |

| 4/11/08 | | Dubinsky & Company, P.C. | | Washington, D.C. metro based specialty consulting firm primarily |

| | | | | primarily focused on litigation support and forensic services. |

| | § | We increased our global restructuring capability by adding experienced restructuring professionals in Paris, including three managing directors. |

| | § | We had $81,381 of cash and $42,972 of debt at December 31, 2008. In addition, we amended our credit agreement to increase, among other things, our flexibility and capacity to complete strategic acquisitions. |

Overview of Our Services

Through the end of 2008, we provided services through our Financial Advisory and Investment Banking segments. Effective January 1, 2009 and in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 131, Disclosures about Segments of an Enterprise and Related Information, we changed the structure of our internal organization in a manner that caused the composition of our reportable segments to change. In order to align our segment reporting with the focus of our business in 2009 and beyond, the Corporate Finance Consulting business, previously part of Financial Advisory, became a stand-alone segment. Corporate Finance Consulting is further described in the following section. Revenues and operating income by segment are reported in Note 17 of the Notes to the Consolidated Financial Statements and incorporated herein by reference. Segment revenues as a percentage of total revenues excluding reimbursable expenses are summarized as follows:

| | | Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| Financial Advisory | | | 66 | % | | | 64 | % | | | 67 | % |

| Corporate Finance Consulting | | | 15 | % | | | 12 | % | | | 10 | % |

| Investment Banking | | | 19 | % | | | 24 | % | | | 23 | % |

| | | | 100 | % | | | 100 | % | | | 100 | % |

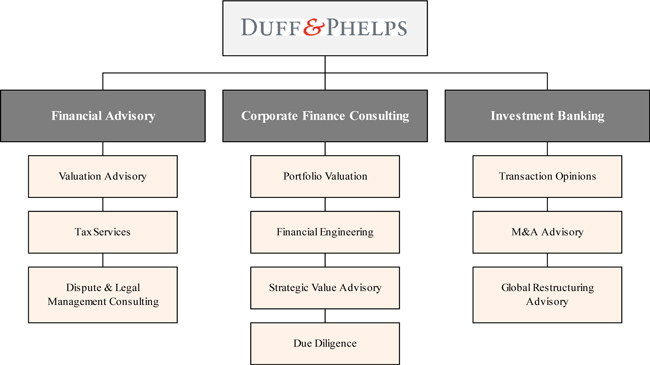

Our Financial Advisory segment provides valuation advisory, tax services and dispute and legal management consulting services. We believe our services help our clients effectively navigate through increasingly complex financial, accounting, tax, regulatory and legal issues. Our Corporate Finance Consulting segment provides services related to portfolio valuation, financial engineering, strategic value advisory and due diligence. Our Investment Banking segment provides mergers and acquisitions (“M&A”) advisory services, transaction opinions and global restructuring advisory services. Through these services we provide independent advice to our clients in order to assist them in making critical decisions in a variety of strategic situations.

Our segments serve a broad base of clients and work collaboratively to identify and capture new business opportunities. The services we offer within these segments are often complementary, which presents opportunities for us to cross-sell related services and, we believe, increase our relevance to our clients. In addition, our client service professionals possess core financial and valuation skill sets that are highly portable within operating segments, facilitating the sharing of resources across the organization. Revenues, operating profit and the presentation of certain other financial information by segment is summarized and discussed in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Financial Advisory

The foundation of our Financial Advisory segment is our core competency in making highly technical and complex assessments of value. We believe we are one of the leading independent valuation services firms in the world. Our Financial Advisory segment provides our clients with valuation advisory, tax services, and dispute and legal management consulting services delivered by client service professionals who possess highly specialized skills in finance, valuation, accounting and tax. We typically price these services based on our assessment of the hours required to deliver the work and the billing rates of the client service professionals assigned to the project.

Valuation Advisory

Financial Reporting. We believe we are a leading independent provider of valuation services for financial reporting. We provide objective and independent valuation reports that allow our clients to meet important regulatory, market and fiduciary requirements. Our finance and accounting expertise, combined with our use and development of sophisticated valuation methodologies, fulfill even the most complex financial reporting requirements. Examples of the financial reporting services we offer include: SFAS No. 141(R), Business Combinations (“SFAS 141(R)”); SFAS 142; valuations used in conjunction with purchase price allocation and periodic impairment testing; valuations for compensations related to SFAS No. 123 (revised 2004), Share-Based Payment (“SFAS 123(R)”); “cheap stock” valuation; and fresh start accounting for companies emerging from Chapter 11 bankruptcy. The acute sensitivity of our clients at the highest levels of the organization to the quality and transparency of the financial information they present to their investors results in strong customer loyalty, which often leads to repeat client engagements and creates an established entry point for the delivery of additional services.

Fixed Asset/Real Estate Valuation. We provide integrated fixed asset and real estate valuations, with specialized expertise in machinery and equipment valuation, fixed asset reconciliation, cost segregation, real estate valuation and real estate consulting. Our services are used for a variety of purposes, including: valuation of machinery and equipment for financial and tax reporting and loan/lease structuring; satisfying Sarbanes-Oxley Act Section 404 requirements for fixed asset internal controls; optimizing tax depreciation benefits; and various real estate appraisal purposes. Our geographic scale enables us to compete effectively and win large client assignments involving multiple asset sites on both a national and global basis.

Tax Valuation. We specialize in tax valuations and related advisory services when tax laws and regulations stipulate that a valuation is required or when assistance is needed to implement a client's tax strategies. We offer tax valuation and advisory services for a variety of transaction-related, compliance and planning purposes, including taxable reorganizations; purchase price allocations; inventory, fixed asset, intangible asset and goodwill valuations; net operating loss and built-in gains analyses; and estate and gift taxes. We have the expertise and testimony experience to defend our work and our clients' valuation positions in regulatory inquiries. We have advised staff and members of the U.S. Senate Finance Committee, the U.S. House Ways and Means Committee and the Joint Committee on Taxation on tax valuation and related legislative matters.

Tax Services

Transfer Pricing. Transfer pricing is a significant international tax issue facing multi-national companies. Most tax authorities require comprehensive transfer pricing documentation and have other compliance requirements, and impose severe penalties for failure to comply. Furthermore, transfer pricing presents significant tax optimization opportunities for multi-national companies. We provide a full scope of transfer pricing services to ensure that inter-company transactions comply with required arm's-lengths standards, as well as create the contemporaneous documentation to support global compliance requirements.

State & Local Tax Services. We provide tax valuation and consulting services for a variety of transaction-related, compliance, planning and dispute purposes.

| | § | Property tax services – Property taxes are a significant recurring expense paid by companies, but one of the least understood due to the complexity of the applicable tax regulations. We assist companies in identifying opportunities for property tax savings by reviewing their property tax assessments and liabilities. Our services include negotiating assessment appeals, providing property tax due diligence for acquisitions, preparing studies to remove non-taxable embedded costs, obtaining property tax exemptions and providing general property tax consulting and compliance services. |

| | § | Business incentives advisory – State and local governments often offer valuable tax incentives in return for investments in their jurisdictions. Whether the planned investment will create new facilities, expand or relocate operations, penetrate new markets, result in hiring additional or replacement employees, or initiate research and development activities, business incentives in the form of tax exemptions, tax credits, project grants and other tax benefits may be available at the state and local levels to offset some of these costs. Our strategic geographic network of business incentives experts provides us with specialized, local knowledge of the potential business incentives available to our clients. |

| | § | Unclaimed property and tax risk advisory – Our professionals combine their extensive experience and technical resources to help our clients manage their unclaimed property responsibilities. This includes performance of the following services to help clients effectively manage the reporting of unclaimed property: audit representation and negotiation, transaction planning and M&A assistance, and outsourcing of the unclaimed property compliance process. |

| | § | Sales and use tax – Our sales and use tax services assist our clients in complying with their sales and use tax obligations while identifying potential opportunities to reduce costs related to these taxes. We offer audit management through traditional approaches to manage the risk of audit assessments and potential negative adjustments while identifying potential refund opportunities. Our extensive resources include sales and use tax compliance outsourcing through our national compliance center. We assist companies with multi-state taxation issues, determine collection and remittance responsibilities, negotiate with state and local authorities to minimize prior liabilities if they exist, and register companies to establish proper filings with the various states. |

| | § | Transactional tax advisory services – Our transactional tax advisory services include due diligence and structuring; domestic tax planning; cross-border transaction structuring; global holding, financing and repatriation planning; investment fund structuring; and corporate and fund tax compliance. We also assist clients in the identification, measurement, documentation and quantification of income tax liabilities in accordance with SFAS No. 109, Accounting for Income Taxes, and Financial Accounting Standards Board (“FASB”) Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109. |

Dispute and Legal Management Consulting

Dispute Consulting. We offer a broad array of dispute consulting services to corporate clients in a variety of industries. Our professionals provide comprehensive support throughout all stages of a dispute including early case assessment, electronic discovery services, complex data management, forensic accounting and damages testimony. Our experts have provided testimony in a variety of subject matters including bankruptcy and retrospective solvency, business insurance consulting, intellectual property disputes, commercial and shareholder litigation, forensic accounting and investigative services, and purchase price disputes. Our clients include Fortune 500 corporations and outside counsel from the largest and most prominent law firms in the country. Our professionals have provided testimony in arbitrations, mediations, federal and state courts and on behalf of clients involved in governmental inquiries. In addition to the industry and forensic accounting experts which are a part of our practice, we also maintain an external network of affiliates with specialized skills whom we work with on an as-needed basis in order to provide our clients with comprehensive support.

Legal Management Consulting. We provide various services designed to enable chief legal officers, chief compliance officers and law firms to analyze and implement strategy, operations, compliance and risk management decisions. Legal management consulting services are matched to the specific needs of the client, and have encompassed technology and infrastructure planning, merger and acquisition integration, caseload management, compliance program implementation, intellectual asset management and strategy development. We serve a vast array of industries including financial institutions, entertainment companies, professional service firms, energy companies, utilities, pharmaceutical, healthcare and consumer product companies.

Global Electronic Discovery and Investigations. Our electronic discovery and investigations practice supports the efforts of both the Dispute Consulting and Legal Management Consulting practices. Our services include computer forensic investigations and expert testimony, litigation readiness and electronic discovery cost containment consulting, complex data management and electronic discovery collection, preservation, processing, analysis, review and production of a wide variety of digital evidence types.

Corporate Finance Consulting

The foundation of our Corporate Finance Consulting segment is expertise in assisting clients in the valuation of alternative investments, especially for securities and positions for which there are no “active market” quotations available. With the global trend of an accelerated shift to fair value accounting, evidenced in part by SFAS 157, Fair Value Measurements, the “old” methods for determining the fair value of illiquid investments often do not live up to current fair value standards or the expectations of the reporting entity’s constituents. Estimating and supporting fair value is ever more challenging as the securities held by investors are becoming increasingly complex. Given the dramatic rise in the number and value of illiquid securities held by hedge funds, private equity funds, pension funds, endowments and corporations, the scrutiny and attention by investors and regulators to fair value reporting standards has sharpened dramatically. In light of these trends, it is imperative that reported fair values are not only accurate, but are also supported by a well defined and consistently applied valuation policy that complies with the relevant reporting standards. Through our Corporate Finance Consulting segment, we deliver extensive and unparalleled industry specific experience through years of working with some of the world’s foremost investors in alternative assets.

Portfolio Valuation

Our portfolio valuation client service professionals specialize in valuing the investment portfolios of our private equity and hedge fund clients. The majority of these portfolios are comprised of illiquid or restricted securities, including secured and unsecured loans and other debt instruments, privately held preferred equity and common equity, convertible securities, warrants and options, as well as other derivative securities. Similar to our corporate clients, our private equity and hedge fund clients are under intense scrutiny regarding their fiduciary duties to their investors, which has prompted many of these firms to obtain outside assurances on the valuations of their investment portfolios. Conflict of interest considerations typically prevent any accounting firm which has an audit relationship with a portfolio company from rendering valuation advisory services on the entire portfolio. As a result, we typically do not compete with large accounting firms, such as the four largest international accounting firms (the “Big Four”), in providing these services. We typically deliver these services on a recurring, quarterly basis. We believe we are a market leader in portfolio valuations, which provides us with an attractive opportunity to increase our revenues in this practice group and increase our brand equity and recognition among private equity firms and hedge funds.

Financial Engineering

New financial processes and sophisticated quantitative models are transforming the way investors analyze and manage risk, price financial instruments and evaluate business strategies. Our financial engineering practice provides the models investors use, including models that value alternative and derivative instruments, to enhance their ability to identify, control, diversify, mitigate and exploit risk. Financial engineering analyses and valuations can be used to support financial reporting, tax planning, risk management, securities design and investment decision making. We draw upon the latest developments in finance theory, mathematics and computer science to design and evaluate financial instruments that help achieve investors' goals. Financial engineering services include auction rate securities valuation; derivatives valuations pursuant to SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities; alternative assets valuations pursuant to SFAS No. 157, Fair Value Measurements (“SFAS 157”); and valuations for employee stock options and incentives pursuant to SFAS 123(R).

Due Diligence

We provide buy-side and sell-side due diligence services to private equity and strategic buyers. Our professionals assist with the accounting, financial, commercial, operational, tax and information technology aspects of the due diligence process by developing and executing a due diligence plan that focuses on the key value drivers and risks that are critical to our clients' investment or divestiture decision. We believe our independence provides us with a competitive advantage over the Big Four accounting firms and allows us to provide a broader and deeper array of services to our clients. We believe our ability to collaborate across our practice areas creates a more efficient transaction process for our clients, giving us a distinct competitive advantage. We also provide advisory post-transaction services. These services include interim financial management (CFO, controller, etc.), working capital and cash flow analysis/forecasts, performance analysis and benchmarking, and lender analysis and covenant reviews. We believe these services enable our clients to obtain further transparency into their investment portfolio and enhance their ability to proactively make investment lifecycle decisions.

Strategic Value Advisory

Our strategic value advisory practice advises management and boards of directors of companies that are evaluating strategic alternatives, looking to raise capital, or considering mergers, acquisitions, joint ventures or divestitures. We apply technical expertise and best practice methodologies to deliver robust, flexible and transparent financial models used by our clients’ to analyze and support strategic and tactical business decisions. We also help companies address profitability and operational issues and we advise companies with a need to allocate limited capital. We believe that we assist clients in understanding and maximizing value by applying industry experience, know-how in corporate finance and capital markets, accepted valuation methods and powerful tools and analysis. We also provide financial projection services, developing and reviewing financial projections for transaction and operational purposes, and we develop technically sophisticated mathematical models where required to assist clients in solving critical and complex business problems.

Investment Banking

Our Investment Banking segment focuses on providing M&A advisory services, transaction opinions and global restructuring advisory services to corporate and investor clients. A significant portion of revenues in this segment are generated from success-based fees that are paid when a transaction closes and are generally tied to the value of the transaction. As a result, revenues in this segment can be less predictable and more event-driven than revenues in our Financial Advisory segment. However, projects in this segment have the potential to generate higher revenue per client service professional, generally resulting in higher margins.

M&A Advisory Services

We provide objective valuation, structuring and negotiation services tailored to help our clients achieve their strategic goals on the best possible terms. We have developed our expertise through hundreds of sell-side, buy-side, divestiture and capital raising assignments across a wide range of industries. We provide our services primarily to middle-market clients, including the portfolio companies of our private equity clients, focusing primarily on transaction values ranging from $20 million to $1 billion (actual dollars).

Transaction Opinions

Our independent fairness and solvency opinions help provide boards of directors and other corporate fiduciaries with a legally defensible basis to support important corporate decisions. Our ability to offer opinions that satisfy all constituencies, including regulators, has been developed through extensive research, detailed financial analyses and a commitment to stay current on key governance and regulatory issues. In recent years, we believe our fairness opinion practice has benefited from an increase in the perceived standard of diligence required by boards of directors to adequately satisfy their fiduciary duties, particularly when faced with financial advisors who may have conflicts arising from the receipt of success-based transaction advisory or financing fees in conjunction with sell-side advisory assignments. According to Thomson Financial, we were the third highest ranked provider of fairness opinions for transactions involving a U.S.-target and the thirteenth highest ranked provider of fairness opinions in the world based on number of opinions delivered in 2008. Finally, we believe we are one of the leading financial advisors in transactions involving benefit plans, including employee stock ownership plans (“ESOPs”). We have a strong background in resolving the unique financial, valuation, tax and structural issues involving employee benefit plans under the Employee Retirement Income Security Act of 1974 (“ERISA”), and also provide recurring ERISA/ESOP valuation services for our clients on a periodic basis.

Global Restructuring Advisory

We have a global restructuring practice with a meaningful presence in the United States and Europe. Our restructuring client service professionals provide financial restructuring advice to all constituencies in the business reorganization process, including debtors, senior and junior lenders, existing and potential equity investors and other interested parties for clients domestically and internationally. Our services include strategy, plan development and implementation, working capital forecasting and management, exchange offers and consent solicitations, out-of-court workouts, Chapter 11 restructurings and debtor-in-possession and exit financing advisory. Since 1984, our restructuring advisory practice, which includes our subsidiary Chanin Capital Partners, has advised hundreds of clients in transactions valued collectively at over $230 billion (actual dollars).

Our Global Reach

Increasing our global presence remains a key strategy. Revenue from our international locations increased 66% and 119% in 2008 and 2007, respectively. Revenues excluding reimbursable expenses attributable to geographic area are reported in Note 17 of the Notes to the Consolidated Financial Statements, incorporated herein by reference and summarized as follows:

| | | Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| United States | | | 90 | % | | | 93 | % | | | 96 | % |

| Europe | | | 9 | % | | | 6 | % | | | 4 | % |

| Asia | | | 1 | % | | | 1 | % | | | 0 | % |

| Total revenues | | | 100 | % | | | 100 | % | | | 100 | % |

Our Clients

We have a client base that includes Fortune 1000 and smaller companies, prominent law firms and leading private equity and hedge funds. Our clients operate in a broad array of industries. The following table summarizes our global client base and the number of engagements we performed for each client:

| | | Approximate | | | Approximate | |

| | | Number of | | | Number of | |

| | | Clients | | | Engagements | |

| 2008 | | | 2,300 | | | | 4,900 | |

| 2007 | | | 1,900 | | | | 3,800 | |

| 2006 | | | 1,600 | | | | 3,300 | |

In addition, our client base included approximately 37% of S&P 500 companies in 2008. Our top ten clients represented 8.5% of our revenues and no single client accounted for more than 1.1% of our revenues in 2008.

Our Professionals

We believe our core asset is our professional staff, their intellectual capital, their professional relationships and their dedication to providing the highest quality services to our clients. We seek talented, motivated and detail-oriented individuals with a desire to grow in a challenging, professional and diversified work environment. We believe individuals are attracted to us as an employer because we combine the stability, professionalism and client relationships of a large firm with the collaborative culture and conflict-free environment of a smaller, high growth firm, which enables our personnel to maximize their commercial potential and career development opportunities.

At December 31, 2008, we had 1,236 globally based personnel, consisting of 975 experienced and credentialed client service professionals, 162 internal support personnel and 99 administrative staff. Of our 975 client service professionals, 168 were managing directors and 807 were directors, vice-presidents, senior associates and analysts. Of the 975 client service professionals, 86% were based domestically and 14% internationally. Most of our client service professionals have backgrounds in accounting, finance or economics. The common elements of these skill sets enables us to readily transfer staff between service lines to better manage the utilization and career development of our client service professionals. We source these client service professionals from top undergraduate and graduate schools, and from a variety of our competitors, including the Big Four, independent specialty consulting firms, middle market investment banks, and larger, diversified investment banks.

We consistently monitor the performance of our personnel through an annual performance management process which is designed to align performance with our business strategy, assess competency against appropriately set benchmarks and identify development needs in the context of short and long-term career aspirations. To reward performance we have implemented a reward program which aims to aggressively differentiate compensation based on performance. Our reward program includes base pay, an incentive bonus and a variety of benefits. We also aim to align our interests with those of our personnel through equity ownership programs. Many of our senior client service professionals are subject to restrictive covenants which, in most cases, prohibit the individual from soliciting our clients for a period of two years following termination of the person's employment with us and from soliciting our personnel for a period of two years after termination of the person's employment.

We have comprehensive training programs in place to further enhance the development of our personnel. We provide ongoing professional development through the D&P University (our annual multi-week national training event) for new client service professionals and internal courses on both technical and non-technical subjects, and support personnel in their career progression through training and development programs designed to help new and recently promoted personnel to quickly become effective in their new roles.

Business Development & Marketing

Our goal is to build a leading, global, well-recognized brand that is synonymous with high quality, financial advisory and investment banking services. We generate new business opportunities primarily based on the professional relationships of our managing directors, our reputation in the marketplace, and referrals from third party advisors, including law, accounting and investment banking firms and our corporate investor clients. Our managing directors are respected within their chosen fields and are instrumental to our business development activities. Many of our managing directors are recognized as leaders in their fields of expertise and are members of national trade boards and committees of trade associations.

Our client service professionals are encouraged to generate new business from both existing and new clients, and are rewarded with increased compensation and promotions for obtaining new business. Many of our client service professionals have published articles in industry, business opportunities, economic and legal journals and have made speeches and presentations at industry conferences and seminars, which serve as a means of attracting new business and enhancing their reputations. In pursuing new business, our client service professionals emphasize Duff & Phelps' institutional reputation and experience, while also promoting the expertise of the particular individuals who will work on the matter. We augment the business development activities of our managing directors and other client service professionals with a centralized marketing group that provides traditional marketing services such as local advertising in business and industry periodicals, the production of marketing materials and the organization and sponsorship of seminars, trade conferences and other events.

Competition

Our competition varies by segment. Within our Financial Advisory and Corporate Finance Consulting segments, we compete primarily with the consulting practices of major accounting firms, such as the Big Four, and regional and global consulting companies. Within our Investment Banking segment, we compete with both boutique M&A and restructuring advisory firms as well as large, diversified investment banks. We believe the principal competitive factors in all segments include the reputation of the firm and its professionals, technical expertise and experience, the ability to rapidly deploy large teams for client engagements, geographic presence, and to a lesser extent, price.

Regulation

As a participant in the financial services industry, we are subject to extensive regulation in the U.S., the United Kingdom and elsewhere. As a matter of public policy, regulatory bodies in the U.S. and foreign jurisdictions are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets. In the United States, the Securities and Exchange Commission (“SEC”) is the federal agency responsible for the administration of the federal securities laws. Duff & Phelps Securities, LLC, our subsidiary through which we provide our M&A advisory services, is registered as a broker-dealer with the SEC and is a member firm of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, the conduct and activities of Duff & Phelps Securities, LLC are subject to the rules and regulations of and oversight by the SEC, FINRA, and other self-regulatory organizations which are themselves subject to oversight by the SEC. As Duff & Phelps Securities, LLC is also registered to conduct business in a substantial majority of the U.S. states, the District of Columbia and Puerto Rico, state securities regulators also have regulatory or oversight authority over Duff & Phelps Securities, LLC. In addition, Duff & Phelps Securities, Ltd., is registered with the Financial Services Authority in the U.K. Our business may also be subject to regulation by non-U.S. governmental and regulatory bodies and self-regulatory authorities in other jurisdictions in which we operate.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales methods, trade practices among broker-dealers, use and safekeeping of customers' funds and securities, capital structure, record-keeping, the financing of customers' purchases and the conduct and qualifications of directors, officers and employees. In particular, as a registered broker-dealer and member of various self-regulatory organizations, Duff & Phelps Securities, LLC is subject to the SEC's uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of a broker-dealer's assets be kept in relatively liquid form. The SEC and various self-regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC's uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital. Certain of our businesses are subject to compliance with laws and regulations of U.S. federal and state governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or reputational damage.

Additional legislation, changes in rules promulgated by the SEC and self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules, either in the United States or elsewhere, may directly affect the mode of our operation and profitability.

The U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the United States, are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer or its directors, officers or employees.

Intellectual Property

Our success has resulted in part from our methodologies and other proprietary intellectual property rights. We rely upon a combination of nondisclosure and other contractual arrangements, trade secret, copyright and trademark laws to protect our proprietary rights and rights of third parties from whom we license intellectual property. We also enter into confidentiality and intellectual property agreements with our personnel that limit the distribution of proprietary information. We have only a limited ability to protect our important intellectual property rights. Pursuant to a name use agreement between us and Phoenix Duff & Phelps Corporation, a subsidiary of Phoenix Life Insurance Company, we have the perpetual exclusive right to use the Duff & Phelps name in connection with capital raising, M&A advisory services, corporate valuation, fairness opinions, strategic financial consulting, capital adequacy opinions and certain other investment banking businesses. See “Risk Factors – Risks Related to Our Business.”

Available Information

Our website address is www.duffandphelps.com. We make available free of charge on the Investor Relations section of our website (http://ir.duffandphelps.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. We also make available through our website other reports filed with or furnished to the SEC under the Exchange Act, including our Proxy Statements and reports filed by our officers and directors under Section 16(a) of that Act. Our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Whistleblower Policy and Committee Charters are also available on our website. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

Any materials we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

In reviewing the agreements included as exhibits to this Annual Report on Form 10-K (whether incorporated by reference or otherwise), please remember they are included to provide you with information regarding their terms and are not intended to provide any other factual or disclosure information about the Company or the other parties to the agreements. The agreements contain representations and warranties by each of the parties to the applicable agreement. These representations and warranties have been made solely for the benefit of the other parties to the applicable agreement and (i) should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate; (ii) have been qualified by disclosures that were made to the other party in connection with the negotiation of the applicable agreement, which disclosures are not necessarily reflected in the agreement; (iii) may apply standards of materiality in a way that is different from what may be viewed as material to you or other investors; and (iv) were made only as of the date of the applicable agreement or such other date or dates as may be specified in the agreement and are subject to more recent developments. Accordingly, these representations and warranties may not describe the actual state of affairs as of the date they were made or at any other time.