Exhibit 10.1

GENPACT LIMITED

2007 OMNIBUS INCENTIVE COMPENSATION PLAN

PERFORMANCE SHARE AWARD AGREEMENT

THIS PERFORMANCE SHARE AWARD AGREEMENT (the “Agreement”), dated as of March 6, 2012 (the “Award Date”), is made by and between Genpact Limited, an exempted limited company organized under the laws of Bermuda (the “Company”) and (“Participant”). To the extent not defined herein, all capitalized terms in this Agreement shall have the meanings assigned to them in the Genpact Limited 2007 Omnibus Incentive Compensation Plan (the “Plan”).

RECITALS:

WHEREAS, the Company has adopted the Plan for the purpose of promoting the interests of the Company and its shareholders by attracting and retaining exceptional directors, officers, employees and consultants and enabling such individuals to participate in the long-term growth and financial success of the Company.

WHEREAS, the Committee has determined that it is in the best interests of the Company and its shareholders to grant to Participant a performance share award under the Plan as provided for herein.

NOW, THEREFORE, for and in consideration of the premises and covenants of the parties contained in this Agreement, and for other good and valuable consideration, the receipt of which is hereby acknowledged, the parties hereto, for themselves, their successors and assigns, hereby agree as follows:

1.Grant of Performance Shares Award.The Company hereby awards to Participant, as of the Award Date, a performance share award (the “Award”) under the Plan entitling Participant to receive a number of Shares based on the extent, if any, to which the applicable vesting criteria are satisfied. The initial number of Shares that shall be used to determine Participant’s rights pursuant to this Award is «Shares_Granted» (the “Target Performance Shares”). The number of Target Performance Shares shall be used solely to calculate the maximum number of Shares that may be issued to Participant under this Agreement (“Actual Performance Shares”). Both the number of Target Performance Shares and Actual Performance Shares shall be subject to adjustment as set forth in the Plan. The number of Shares issuable under the Award may be subject to reduction as set forth in Paragraph 3.

2.Vesting Requirements. The Shares subject to the Award shall initially be unvested and shall vest only in accordance with the vesting provisions of this Paragraph 2 or the special vesting acceleration provisions of Paragraph 4. The Shares in which Participant shall vest under this Paragraph 2 shall be determined pursuant to a two-step process: (i) first there shall be calculated the maximum number of Shares in which Participant can vest based upon the level at which the Performance Goals specified in Appendix A of this Agreement (the “Performance Goals”) for the performance period commencing on January 1, 2012 and ending on December 31, 2012 (the “Performance Period”) are actually attained and (ii) then the number of the Actual Performance Shares resulting from the clause (i) calculation in which Participant shall actually

vest shall be determined on the basis of Participant’s completion of the applicable service vesting provisions set forth below. Accordingly, the vesting of the Shares shall be calculated as follows:

(a)Performance Vesting. The number of Actual Performance Shares to which Participant may become entitled under this Agreement shall be calculated following the end of the Performance Period and shall be based on the level at which the Performance Goals for the Performance Period are determined to have been attained. The number of Actual Performance Shares to which Participant may become entitled at the end of the Performance Period shall be calculated by multiplying the designated number of Target Performance Shares by a performance percentage ranging from 0% to 150%. The actual performance percentage to be used for such purpose shall be determined in accordance with the methodology set forth in Appendix A and shall be tied to the attained level of Company performance for the Performance Period described in Appendix A. In no event may the number of Actual Performance Shares exceed one hundred fifty percent (150%) of the Target Performance Shares.

(b)Service Vesting: The Actual Performance Shares so determined represent the maximum number of Shares in which Participant can vest hereunder. The actual number of Shares in which Participant shall vest shall be determined as follows:

(i) If Participant remains in continued employment or service with the Company or an Affiliate from January 1, 2012 through December 31, 2014 (the “Service Period”), on December 31, 2014, Participant shall vest in 100% of the Actual Performance Shares.

(ii) In the event of Participant’s termination of continued employment or service with the Company or an Affiliate that occurs during the Service Period by reason of death or Disability, Participant shall be entitled to receive a number of Shares determined by multiplying (A) the number of Actual Performance Shares (if any) to which Participant would be entitled based on the actual level at which the Performance Goals are achieved by (B) a fraction, the numerator of which is the number of months of employment or service in the Service Period prior to the termination (rounded up to the closest whole month) and the denominator of which is thirty-six (36).

(iii) Should Participant cease continued employment or service with the Company or an Affiliate for any other reason prior to the end of the Service Period, the Award shall be immediately canceled and Participant shall thereupon cease to have any right or entitlement to receive any Shares under the Award.

3.Performance Goals.

(a)Committee Determination. Following the end of the Performance Period, the Committee shall determine whether and the extent to which the Performance Goals have been achieved for the Performance Period and shall determine the number of Actual Performance Shares, if any, issuable to Participant with respect to the level of achievement of the Performance Goals based on completion of the service vesting requirement; provided that with respect to any Award to a “covered employee” within the meaning of Section 162(m) of the Code, the Committee shall have certified the achievement of the Performance Goals. The

2

Committee’s determinations with respect to the achievement of the Performance Goals shall be based on the Company’s audited financial statements, subject to any adjustments made by the Committee in accordance with Paragraph 3(b) below. If the threshold levels for the Performance Goals are not achieved, the Award shall be cancelled and Participant shall thereupon cease to have any right or entitlement to receive any Shares under the Award

(b)Committee Discretion to Reduce or Eliminate Award. Notwithstanding satisfaction, achievement or completion of the Performance Goals (or any adjustments thereto as provided below), the number of Shares issuable hereunder may be reduced or eliminated by the Committee on the basis of such further considerations as the Committee in its sole discretion shall determine.

(c)Modification of Performance Goals. The Committee shall have the right to adjust or modify the calculation of the Performance Goals as permitted under the Plan.

(d)Section 162(m). To the extent the Committee has determined that this Award is intended to comply with the performance-based exception to Section 162(m) of the Code and Participant is a “covered employee” within the meaning of Section 162(m) of the Code, all actions taken hereunder (including without limitation any adjustments of Performance Goals) shall be made in a manner which would comply with Section 162(m) of the Code.

4.Change of Control: In the event a Change of Control occurs during the Service Period, the number of Shares issuable under this Award and the date of issuance of the Shares shall be determined as follows notwithstanding any provisions of this Agreement or the Plan to the contrary:

(a) In the event the Change of Control occurs prior to completion of the Performance Period and Participant remains in continued employment or service with the Company or an Affiliate through the effective date of that Change of Control, then this Award shall be converted into a right to receive the number of Target Performance Shares without any measurement of Performance Goal attainment to date, subject to the provisions of Paragraphs 4(c) and 4(d) below.

(b) If the Change of Control occurs on or after completion of the Performance Period but prior to completion of the Service Period and Participant remains in continued employment or service with the Company or an Affiliate through the effective date of that Change of Control, this Award shall entitle Participant to receive the number of Actual Performance Shares based on the level of attainment of the Performance Goals, subject to the provisions of Paragraphs 4(c) and 4(d) below.

(c) If this Award is assumed, continued or substituted in connection with the Change of Control in accordance with the Plan, then provided Participant remains in continued employment or service with the Company or an Affiliate through the completion of the Service Period, the Shares issuable under this Award (as determined in accordance with the applicable provisions of Paragraphs 4(a) and 4(b)) or other consideration payable in connection with such assumption, continuation or substitution, shall be issued on January 1, 2015 or as soon as practicable thereafter but in no event later than March 15, 2015. If Participant’s continued

3

employment or service terminates prior to completion of the Service Period, then except as otherwise provided in Paragraph 4(f) and Paragraph 4(g), the Award shall be immediately cancelled upon such termination and Participant shall thereupon cease to have any right or entitlement to receive any Shares or other consideration under the Award.

(d) If this Award is not assumed, continued or substituted in connection with the Change of Control in accordance with the Plan, then the Shares issuable under this Award (as determined pursuant to Paragraphs 4(a) or 4(b)) or other consideration payable with respect to such Shares in consummation of the Change of Control shall be issued on the effective date of the Change of Control or as soon as administratively practicable thereafter, but in no event more than fifteen (15) business days after such effective date.

(e) Following a Change of Control, Participant shall not have any right to receive any Shares under this Award in excess of the number of Shares determined under this Paragraph 4.

(f) In the event of Participant’s termination of continued employment or service with the Company or an Affiliate that occurs during the Service Period by reason of death or Disability, Participant shall be entitled to receive a number of Shares determined by multiplying (A) the number of Shares (if any) to which Participant would be entitled in accordance with the applicable provisions of Paragraphs 4(a) and 4(b) had Participant’s employment or service not terminated by (B) a fraction, the numerator of which is the number of months of service in the Service Period prior to the termination (rounded up to the closest whole month) and the denominator of which is thirty-six (36). To the extent not issued at the time of the Change of Control, such Shares (or other consideration issuable under this Award) shall be issued immediately upon such termination or as soon as practicable thereafter, but not later than the fifteenth (15th) day of the third (3rd) calendar month following the year of such termination.

(g) Notwithstanding anything to the contrary, in the event of Participant’s Involuntary Termination that occurs during the Service Period and within twenty-four (24) months following a Change of Control in connection with which this Award is assumed, continued or substituted, Participant shall immediately vest in the Shares (as determined in accordance with the applicable provisions of Paragraphs 4(a) and 4(b) above) or other consideration payable in connection with such assumption, continuation or substitution issuable under this Award and such Shares or other consideration shall be issued immediately upon such Involuntary Termination or as soon as practicable thereafter, but in no event more than fifteen (15) business days after such Involuntary Termination.

(h) Each issuance of Shares shall be subject to the Company’s collection of any Applicable Taxes.

(i) For purposes of this Agreement, the following definitions shall apply:

(i) “Involuntary Termination” shall mean the termination of Participant’s continued employment or service with the Company or an Affiliate which occurs by reason of such individual’s involuntary dismissal or discharge by the Company (or Affiliate) for reasons other than Cause.

4

(ii) “Cause” shall mean “Cause” as defined in any employment or consulting agreement between Participant and the Company or an Affiliate in effect at the time of termination or, in the absence of such an employment or consulting agreement: (A) any conviction by a court of, or entry of a pleading of guilty ornolo contendere by Participant with respect to, a felony or any lesser crime involving moral turpitude or a material element of which is fraud or dishonesty; (B) Participant’s willful dishonesty of a substantial nature towards the Company and any of its Affiliates; (C) Participant’s use of alcohol or drugs which materially interferes with the performance of his duties to the Company and/or its Affiliates or which materially compromises the integrity and reputation of Participant or the Company and/or its Affiliates; or (D) Participant’s material, knowing and intentional failure to comply with material applicable laws with respect to the execution of the Company’s and its Affiliates’ business operations.

5.Issuance of Shares; Withholding.

(a) Except as otherwise provided under Paragraph 4, the Company shall issue the Shares to which Participant becomes entitled as soon as practicable following completion of the Service Period but in no event later than the fifteenth (15th) day of the third (3rd) calendar month following the end of the Service Period, subject to the Company’s collection of any Applicable Taxes; provided, however, that any Shares to which Participant becomes entitled under Paragraph 2(b)(ii) shall be issued no later than the fifteenth (15th) day of the third (3rd) calendar month following the year of Participant’s termination.

(b) Any Applicable Taxes required to be withheld with respect to the issuance of the Shares under this Agreement shall be paid through an automatic Share withholding procedure pursuant to which the Company will withhold, at the time of such issuance, a portion of the Shares with a Fair Market Value (measured as of the issuance date) equal to the amount of those taxes. Notwithstanding the foregoing, the Company may, in its sole discretion, require that such Applicable Taxes be paid through Participant’s delivery of his or her separate check payable to the Company in the amount of such taxes or such other method as the Company deems appropriate.

(c) Regardless of any action the Company takes with respect to any or all Applicable Taxes, Participant acknowledges that the ultimate liability for all Applicable Taxes legally due by Participant is and remains Participant’s responsibility and that the Company (i) makes no representations or undertakings regarding the treatment of any Applicable Taxes in connection with any aspect of the Award, including the grant, vesting or settlement of the Award, and the subsequent sale of any Shares acquired at settlement; and (ii) does not commit to structure the terms of the grant or any aspect of the Award to reduce or eliminate Participant’s liability for Applicable Taxes.

(d) In no event will any fractional shares be issued.

(e) The holder of this Award shall not have any shareholder rights, including voting or dividend rights, with respect to the Shares subject to the Award until Participant becomes the record holder of those Shares following their actual issuance after the satisfaction of the Applicable Taxes.

5

6.Limited Transferability. Prior to actual receipt of the Shares which vest and become issuable hereunder, Participant may not transfer any interest in the Award or the underlying Shares. Any Shares which vest hereunder but which otherwise remain unissued at the time of Participant’s death may be transferred pursuant to the provisions of Participant’s will or the laws of inheritance or to Participant’s designated beneficiary or beneficiaries of this Award. Participant may make such a beneficiary designation at any time by filing the appropriate form with the Committee or its designee.

7.Clawback. If a Participant resident in the United States or India has breached any restrictive covenant (whether non-solicitation, non-competition, non-disparagement or confidentiality) under any agreement between Participant and the Company or an Affiliate during employment or during the one (1) year period following termination of Participant’s employment or service with the Company or an Affiliate, the Company shall have the right to terminate this Award (and Participant shall thereupon cease to have any right or entitlement to receive any Shares under this Award) to the extent outstanding and to cancel any Shares issued hereunder and be paid any proceeds received by Participant from the sale of Shares issued hereunder.

8.Sections 409A and 457A.

(a) It is the intention of the parties that the provisions of this Agreement shall, to the maximum extent permissible, comply with the requirements of the short-term deferral exceptions of Section 409A of the Code and the Treasury Regulations issued thereunder and Section 457A of the Code and any guidance with respect to Code Section 457A, including but not limited to Notice 2009-8. Accordingly, to the extent there is any ambiguity as to whether one or more provisions of this Agreement would otherwise contravene the requirements or limitations of Code Section 409A or of Code Section 457A applicable to such short-term deferral exceptions, then those provisions shall be interpreted and applied in a manner that does not result in a violation of the requirements or limitations of Code Section 409A and the Treasury Regulations thereunder and Code Section 457A and any guidance with respect to Code Section 457A, including but not limited to Notice 2009-8, that apply to such exceptions.

(b) Notwithstanding any provision to the contrary in this Agreement, to the extent this Award may be deemed to create a deferred compensation arrangement under Code Section 409A, then Shares or other amounts which become issuable or distributable under this Agreement by reason of Participant’s cessation of continued employment or service shall actually be issued or distributed to Participant prior to theearlier of (i) the first day of the seventh (7th) month following the date of Participant’s Separation from Service (as determined under Code Section 409A and Treasury Regulations thereunder) or (ii) the date of Participant’s death, if Participant is deemed at the time of such Separation from Service to be a specified employee under Section 1.409A-1(i) of the Treasury Regulations issued under Code Section 409A, as determined by the Committee in accordance with consistent and uniform standards applied to all other Code Section 409A arrangements of the Company, and such delayed commencement is otherwise required in order to avoid a prohibited distribution under Code Section 409A(a)(2). The deferred Shares or other distributable amount shall be issued or distributed in a lump sum on the first day of the seventh (7th) month following the date of Participant’s Separation from Service or, if earlier, the first day of the month immediately following the date the Company receives proof of Participant’s death.

6

9.Compliance with Laws and Regulations. The issuance of Shares pursuant to the Award shall be subject to compliance by the Company and Participant with all applicable laws, rules and regulations and to such approvals by any regulatory or governmental agency as may be required. The Committee, in its sole discretion, may postpone the issuance or delivery of Shares as the Committee may consider appropriate and may require Participant to make such representations and furnish such information as it may consider appropriate in connection with the issuance or delivery of Shares in order to be in compliance with applicable laws, rules and regulations.

10.Successors and Assigns. Except to the extent otherwise provided in this Agreement, the provisions of this Agreement shall inure to the benefit of, and be binding upon, the Company and its successors and assigns and Participant and Participant’s assigns, beneficiaries, executors, administrators, heirs and successors.

11.Notices. All notices, demands and other communications provided for or permitted hereunder shall be made in writing and shall be by registered or certified first-class mail, return receipt requested, telecopier, courier service or personal delivery:

if to the Company:

Genpact Limited

Canon’s Court

22 Victoria Street

Hamilton HM EX

Bermuda

Attn: Secretary

with a copy to:

Genpact LLC

105 Madison Avenue

Second Floor

New York, NY 10016

Attn: Legal Department

if to Participant, at Participant’s last known address on file with the Company.

All such notices, demands and other communications shall be deemed to have been duly given when delivered by hand, if personally delivered; when delivered by courier, if delivered by commercial courier service; five (5) business days after being deposited in the mail, postage prepaid, if mailed; and when receipt is mechanically acknowledged, if telecopied.

12.Construction. This Agreement and the Award evidenced hereby are made and granted pursuant to the Plan and are in all respects limited by and subject to the terms of the Plan. All decisions of the Committee with respect to any question or issue arising under the Plan or this Agreement shall be conclusive and binding on all persons having an interest in the Award.

7

13.Governing Law. This Agreement shall be construed and interpreted in accordance with the laws of the State of New York without regard to principles of conflicts of law thereof, or principles of conflicts of laws of any other jurisdiction which could cause the application of the laws of any jurisdiction other than the State of New York. Each Participant and the Company hereby waive, to the fullest extent permitted by applicable law, any right either of them may have to a trial by jury in respect to any litigation directly or indirectly arising out of, under or in connection with this Agreement or the Plan.

14.Employment at Will. Nothing in this Agreement or in the Plan shall confer upon Participant any right to remain in employment or service for any period of specific duration or interfere with or otherwise restrict in any way the rights of the Company (or any Affiliate employing or retaining Participant) or of Participant, which rights are hereby expressly reserved by each, to terminate Participant’s employment or service at any time for any reason, with or without cause, subject to applicable law and the terms of any employment agreement between Participant and the Company (or any Affiliate employing or retaining Participant).

15.No Acquired Right. Participant acknowledges and agrees that:

(a) the Plan is established voluntarily by the Company, the grant of awards under the Plan is made at the discretion of the Committee and the Plan may be modified, amended, suspended or terminated by the Company at any time. All decisions with respect to future awards, if any, will be at the sole discretion of the Committee;

(b) this Award and any similar awards the Company may in the future grant to Participant, even if such awards are made repeatedly or regularly, and regardless of their amount, (A) are wholly discretionary, are not a term or condition of employment and do not form part of a contract of employment, or any other working arrangement, between Participant and the Company or any Affiliate, (B) do not create any contractual entitlement to receive future awards or benefits in lieu thereof; (C) do not constitute compensation of any kind for services of any kind related to the Company or any Affiliate and are outside the scope of Participant’s employment contract, if any; and (D) do not form part of salary or remuneration for purposes of determining pension payments or any other purposes, including without limitation termination indemnities, severance, resignation, payment in lieu of notice, redundancy, dismissal, end of service payments, bonuses, long-term service awards, pension or retirement or welfare benefits, or similar payments, except as otherwise required by the applicable law of any governmental entity to whose jurisdiction the award is subject;

(c) Participant is voluntarily participating in the Plan;

(d) this Award and the Shares subject to the Award are not intended to replace any pension rights or compensation;

(e) in the event that Participant’s employer is not the Company, the grant of this Award and any similar awards the Company may grant in the future to Participant will not be interpreted to form an employment contract or relationship with the Company and, furthermore, the grant of this Award and any similar awards the Company may grant in the future to Participant will not be interpreted to form an employment contract with Participant’s employer or any Affiliate;

8

(f) the future value of the underlying Shares is unknown and cannot be predicted with certainty; if Participant vests in the Award and receives Shares, the value of the acquired Shares may increase or decrease. Participant understands that the Company is not responsible for any foreign exchange fluctuation between the United States Dollar and Participant’s local currency that may affect the value of the Award or the Shares; and

(g) Participant shall have no rights, claim or entitlement to compensation or damages as a result of Participant’s cessation of employment for any reason whatsoever, whether or not in breach of contract or local labor law, or notice to terminate having been given by either Participant or Participant’s employer, insofar as these rights, claim or entitlement arise or may arise from Participant’s ceasing to have rights under this Award as a result of such cessation (or notice) or loss or diminution in value of the Award or any of the Shares issuable under this Award as a result of such cessation (or notice), and Participant irrevocably releases his or her employer, the Company and its Affiliates, as applicable, from any such rights, entitlement or claim that may arise. If, notwithstanding the foregoing, any such right or claim is found by a court of competent jurisdiction to have arisen, then, by signing this Agreement, Participant shall be deemed to have irrevocably waived his or her entitlement to pursue such rights or claim.

16.Data Protection.

(a)In order to facilitate Participant’s participation in the Plan and the administration of the Award, it will be necessary for the Company (or its Affiliates or payroll administrators) to collect, hold and process certain personal information about Participant (including, without limitation, Participant’s name, home address, telephone number and e-mail address, date of birth, nationality, social insurance or other identification number and job title and details of the Award and other awards granted, cancelled, exercised, vested, unvested or outstanding and Shares held by Participant). Participant consents explicitly and unambiguously to the Company (or its Affiliates or payroll administrators) collecting, holding and processing Participant’s personal data and transferring this data (in electronic or other form) by and among, as applicable, Participant’s employer, the Company and its Affiliates and other third parties (collectively, the “Data Recipients”) insofar as is reasonably necessary to implement, administer and manage the Plan and the Award. Participant understands that the Data Recipients may be located in Participant’s country or elsewhere, and that Data Recipient’s country may have different data privacy laws and protections than Participant’s county. Participant authorizes the Data Recipients to receive, possess, use, retain and transfer the data for the purposes of implementing, administering and managing the Plan and the Award including any requisite transfer of such data as may be required to a broker or third party.

(b)The Data Recipients will treat Participant’s personal data as private and confidential and will not disclose such data for purposes other than the management and administration of the Plan and the Award and will take reasonable measures to keep Participant’s personal data private, confidential, accurate and current. Participantunderstands that the data will be held only as long as is necessary to implement, administer and manage his or her participation in the Plan.

9

(c)Participant understands that Participant may, at any time, view his or her personal data, require any necessary corrections to it or withdraw the consents herein in writing by contacting the Company but acknowledges that without the use of such data it may not be practicable for the Company to administer Participant’s involvement in the Plan in a timely fashion or at all and this may be detrimental to Participant and may result in the possible exclusion of Participant from continued participation with respect to this Award or any future awards under the Plan.

17.Provisions Applicable to Participant Resident in the People’s Republic of China. In accordance with the requirements of the State Administration of Foreign Exchange (“SAFE”), Participant must hold the Shares issued following vesting of the Award with the Company’s designated broker until sale. The net proceeds realized upon the sale of the Shares will be repatriated to China and such net proceeds (less any applicable taxes required to have been withheld in connection with the Award) shall be paid to Participant in local currency. Participant shall have no access to the sales proceeds until such distribution. The remittance, conversion and payment of the net proceeds shall be made in accordance with the procedures adopted by the Company in order to comply with SAFE regulations and accordingly, are subject to change from time to time.

18.Provisions Applicable to Participant Resident in Singapore.

(a)Securities Law Notice: The Award is being granted pursuant to the “Qualifying Person” exemption under section 273(1)(f) of the Singapore Securities and Futures Act (Chapter 289, 2006 Ed.) (“SFA”). The Plan has not been lodged or registered as a prospectus with the Monetary Authority of Singapore. Participant should note that such grant is subject to section 257 of the SFA and Participant will not be able to make any subsequent sale in Singapore, or any offer of such subsequent sale of the Shares underlying the Award unless such sale or offer in Singapore is made pursuant to the exemptions under Part XIII Division (1) Subdivision (4) (other than section 280) of the SFA.

(b)Director Notification Requirement: If Participant is a director, associate director or shadow director of a Singapore Affiliate of the Company, Participant is subject to certain notification requirements under the Singapore Companies Act. Among these requirements is an obligation to notify the Singaporean Affiliate of the Company in writing when Participant receives an interest (e.g., the Award or Shares) in the Company or any Affiliate of the Company. In addition, Participant must notify the Singaporean Affiliate when Participant sells Shares or shares of any other Affiliate of the Company (including when Participant sells Shares acquired under the Award). These notifications must be made within two (2) days of acquiring or disposing of an interest in the Company or any Affiliate of the Company. In addition, within two (2) days of becoming a director, Participant must notify the Singaporean Affiliate of any interest Participant may have in the Company or any Affiliate of the Company. Participant is advised to seek appropriate professional advice as to Participant’s reporting obligations under the Singapore Companies Act.

10

19.Signature in Counterparts. This Agreement may be signed in counterparts, each of which shall be an original, with the same effect as if the signatures thereto were upon the same instrument.

11

IN WITNESS WHEREOF, the parties have executed this Agreement on the day and year first indicated above.

| | |

| GENPACT LIMITED |

| |

| Signature: | | |

| |

| Name: | | |

| |

| Title: | | |

| | |

| PARTICIPANT |

| |

| Signature: | | |

| |

| Name: | | |

| |

| Address: | | |

12

Exhibit 10.1

Appendix A

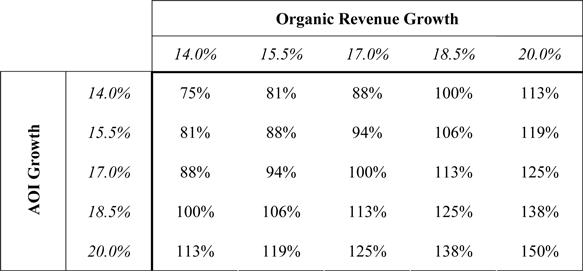

Organic Performance Goals:The Performance Goals to be achieved under the Award are revenue growth and adjusted income from operations growth for the Company for the period commencing January 1, 2012 and ending December 31, 2012 (the “Performance Period”) compared to the period beginning January 1, 2011 and ending December 31, 2011. For each goal there are three designated levels of attainment – threshold, target and outstanding.

| | | | |

Performance Level | | Revenue Growth | | Adjusted Income from

Operations Growth |

Outstanding | | 20% | | 20% |

Target | | 17% | | 17% |

Threshold | | 14% | | 14% |

| | • | | For such purpose, revenue growth and adjusted income from operations growth shall be calculated without taking into account the effect of any acquisition or restructuring that occurred during the Performance Period. |

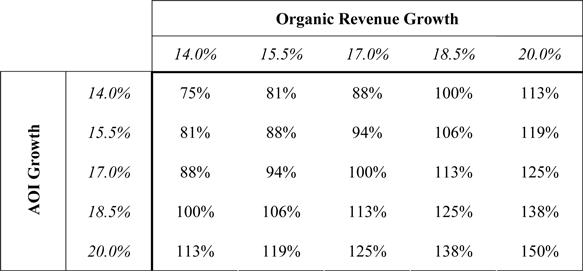

| | • | | The Actual Performance Shares to which Participant may become entitled subject to continued employment or service during the Service Period shall be calculated by multiplying the designated number of Target Performance Shares by a performance percentage based on the level of achievement of each Performance Goal as follows (and rounding down to the nearest whole number): |

| | • | | Straight line interpolation will apply to performance levels between the ones illustrated above. |

| | • | | If performance below threshold occurs for either metric, payout on the other metric will also be zero regardless of performance. |

| | • | | The goals will be measured based on Company-wide performance on a consolidated basis. |