Genpact Q2 2016 Earnings Presentation August 3, 2016 Ticker (NYSE: G) Exhibit 99.2

Forward-looking Statements These materials contain certain statements concerning our future growth prospects and forward-looking statements, as defined in the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those in such forward-looking statements. These risks, uncertainties and other factors include but are not limited to a slowdown in the economies and sectors in which our clients operate, a slowdown in the business process outsourcing and information technology services sectors, the risks and uncertainties arising from our past and future acquisitions, our ability to convert bookings to revenues, our ability to manage growth, factors which may impact our cost advantage, wage increases, changes in tax rates and tax legislation, our ability to attract and retain skilled professionals, risks and uncertainties regarding fluctuations in our earnings, foreign currency fluctuations, general economic conditions affecting our industry as well as other risks detailed in our reports filed with the U.S. Securities and Exchange Commission, including Genpact’s Annual Report on Form 10-K. These filings are available at www.sec.gov or on the Investor Relations section of our website, www.genpact.com. Genpact may from time to time make additional written and oral forward-looking statements, including statements contained in our filings with the Securities and Exchange Commission and our reports to shareholders. Although Genpact believes that these forward-looking statements are based on reasonable assumptions, you are cautioned not to put undue reliance on these forward-looking statements, which reflect management’s current analysis of future events and should not be relied upon as representing management’s expectations or beliefs as of any date subsequent to the time they are made. Genpact undertakes no obligation to update any forward-looking statements that may be made from time to time by or on behalf of Genpact. Non-GAAP Financial Measures These materials also include measures defined by the SEC as non-GAAP financial measures. Genpact believes that these non-GAAP measures can provide useful supplemental information to investors regarding financial and business trends relating to its financial condition and results of operations when read in conjunction with the Company’s reported results. Reconciliations of these non-GAAP measures from GAAP are available in this presentation and in our earnings release dated August 3, 2016.

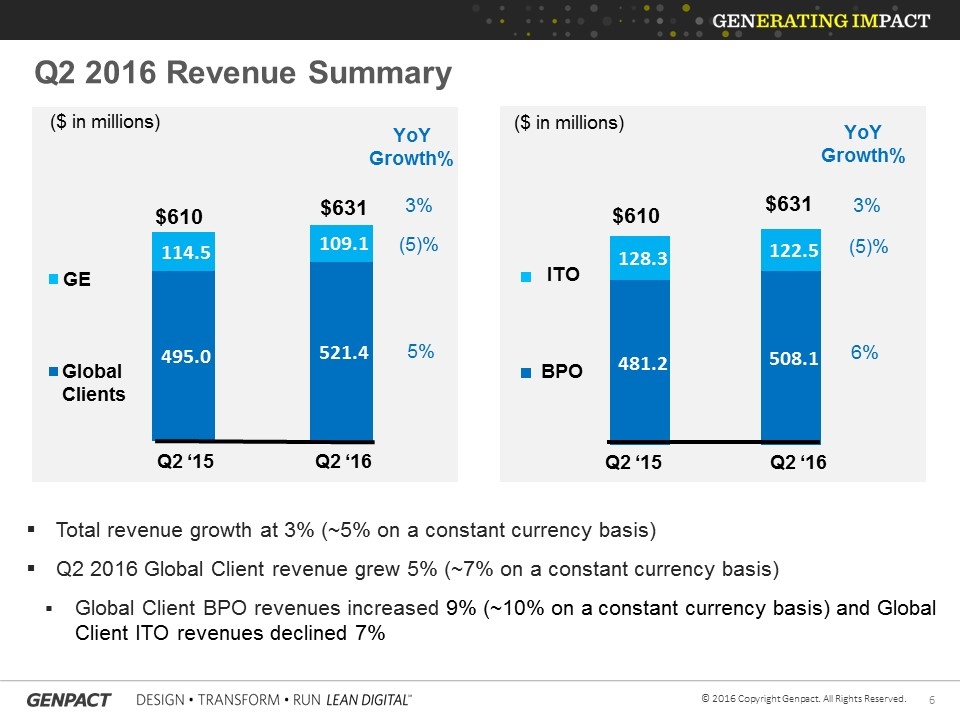

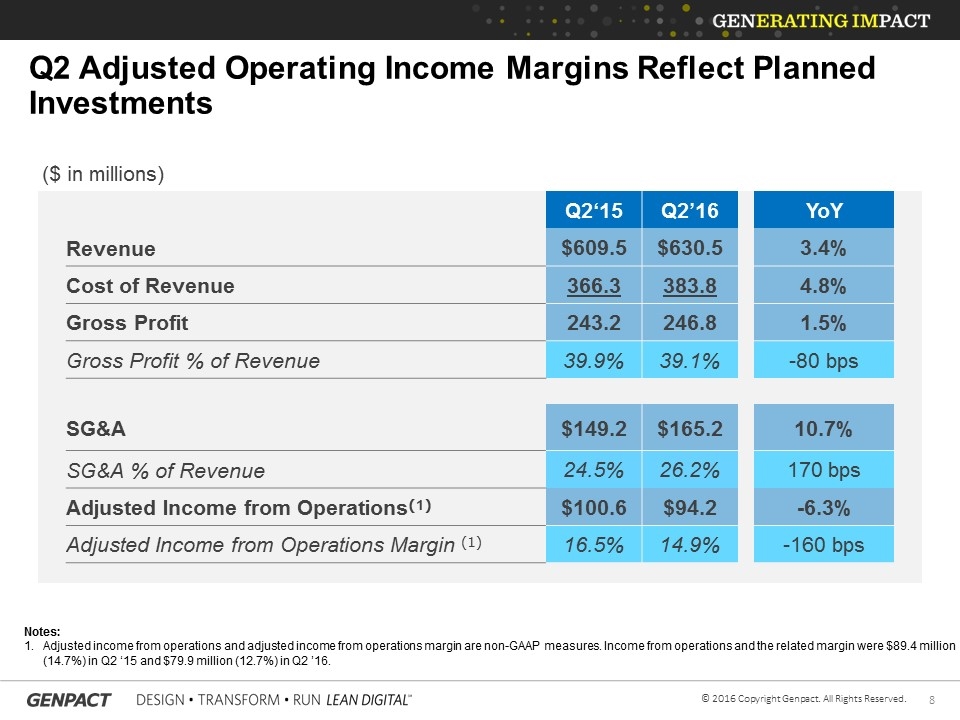

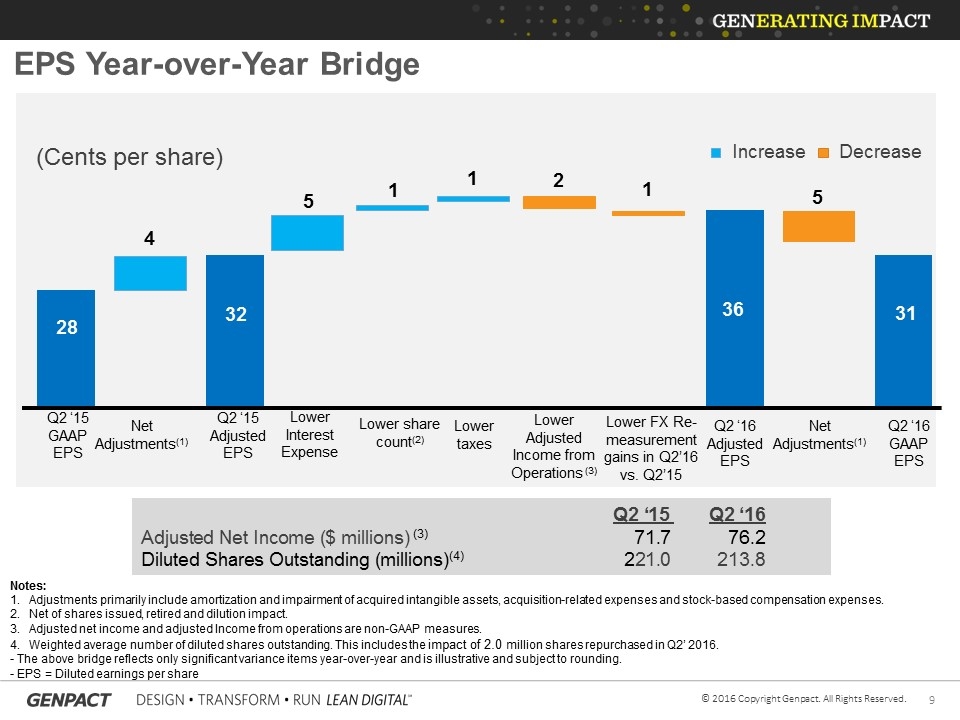

Q2 2016 – Key Financial Highlights Year-Over-Year Comparisons: Total revenue: +3% (~ +5% on constant currency basis)(1) Global Clients revenue: +5% (~ +7% on constant currency basis) Global Client BPO revenue +9% (~ +10% on constant currency basis) GE revenue: -5% (~ -5% on constant currency basis) Adjusted income from operations(2) decreased 6%, with a margin of 14.9% Adjusted diluted earnings per share(2) grew 10% YoY to $0.36 Global Client growth was broad-based across most of our target verticals and service lines, including: BFS, CPG, Life Sciences and High Tech; and Finance & Accounting, Consulting and Core Industry Vertical Operations Global Client ITO revenue impacted by lower levels of discretionary spending in investment banking and healthcare industries. Notes: Revenue growth on a constant currency basis is a non-GAAP measure and is calculated by restating current-period activity using the prior fiscal period’s foreign currency exchange rates adjusted for hedging gains/losses in such period. Adjusted income from operations and adjusted diluted EPS are non-GAAP measures. Q2 ‘16 GAAP income from operations margin was 12.7% and GAAP EPS was $0.31.

Continued Momentum for Our Unique and Highly Differentiated Lean DigitalSM Approach More client discussions are focused on higher value end-to-end process design and transformation towards agile and nimble business models Continued to invest to further strengthen Lean DigitalSM capabilities: Solid progress to reach ~1,000 certified Lean DigitalSM experts by year-end; Announced an agreement to acquire PNMSoft; significantly enhancing capabilities in dynamic workflows digitization; and ~80 Lean DigitalSM assets currently in various stages of design and implementation; remain on path to create ~100 by year-end Set up our Lean DigitalSM innovation center in Silicon Valley to develop and showcase innovative digital solutions for clients

Pipeline Continues to be Strong Our pipeline continues to grow across most of our targeted industry verticals with inflows up Win rates remain near historical high levels Investments in client-facing teams and capabilities driving traction for Lean DigitalSM transformation solutions Lean DigitalSM positions Genpact very well to help clients transform and to penetrate our addressable market

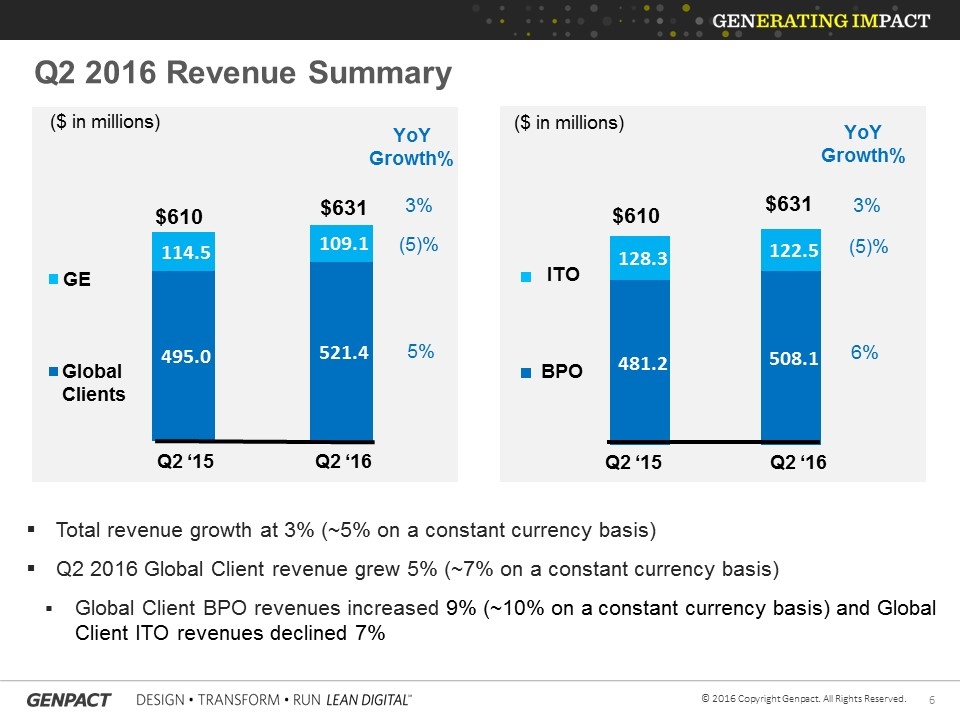

Total revenue growth at 3% (~5% on a constant currency basis) Q2 2016 Global Client revenue grew 5% (~7% on a constant currency basis) Global Client BPO revenues increased 9% (~10% on a constant currency basis) and Global Client ITO revenues declined 7% Global Clients GE BPO ITO 3% YoY Growth% 5% (5)% 3% (5)% 6% YoY Growth% Q2 ‘15 Q2 ‘16 Q2 ‘15 Q2 ‘16 ($ in millions) ($ in millions) $610 $631 $631 $610 Q2 2016 Revenue Summary

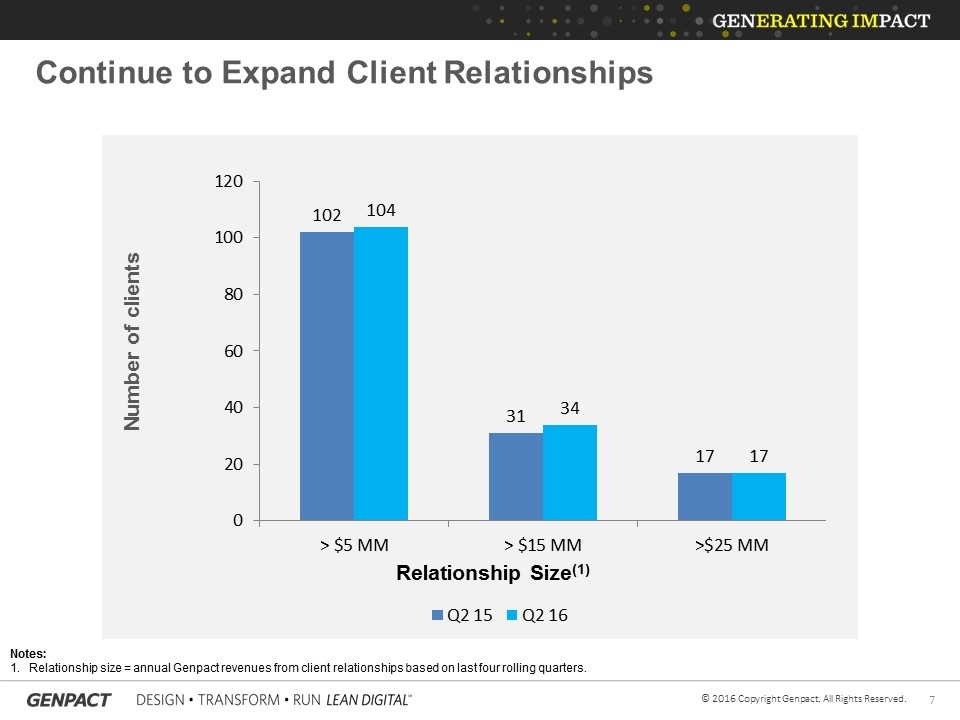

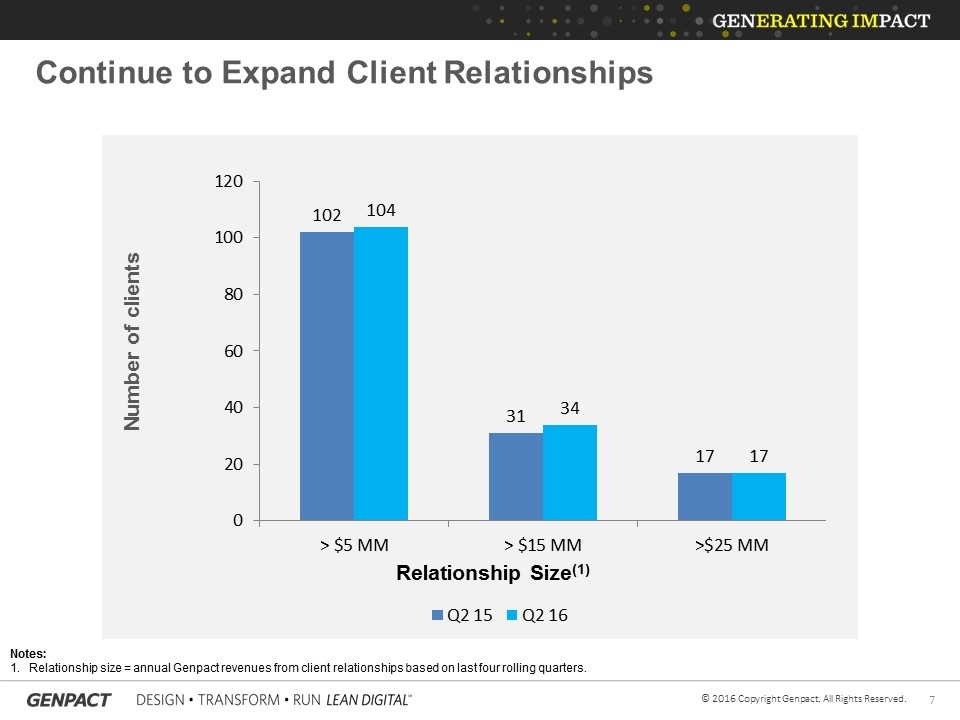

Number of clients Notes: Relationship size = annual Genpact revenues from client relationships based on last four rolling quarters. Relationship Size(1) Continue to Expand Client Relationships

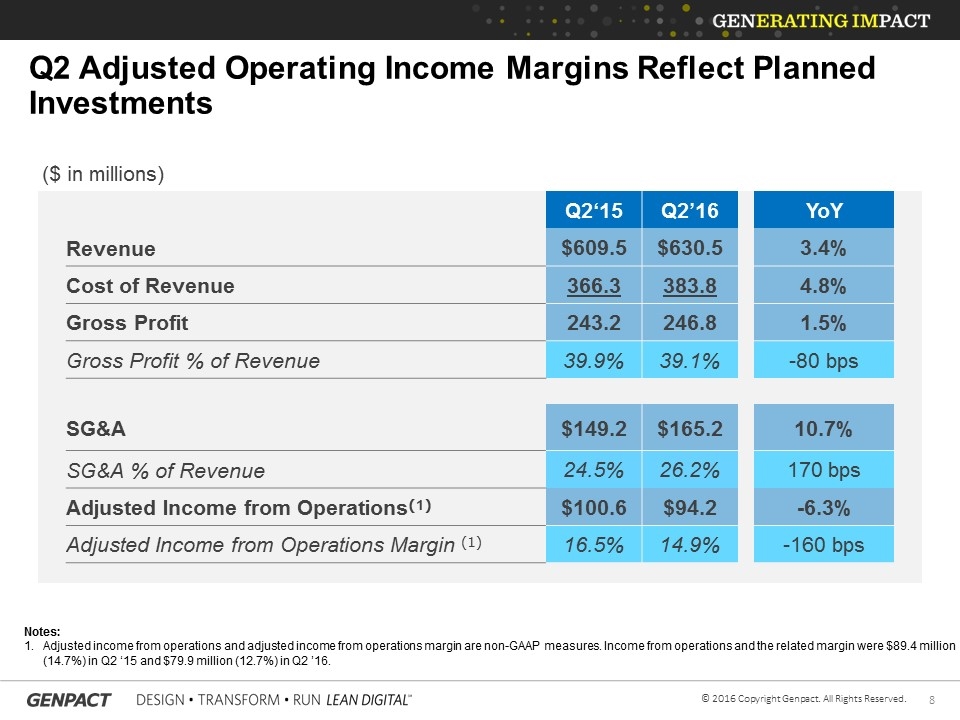

Q2‘15 Q2’16 YoY Revenue $609.5 $630.5 3.4% Cost of Revenue 366.3 383.8 4.8% Gross Profit 243.2 246.8 1.5% Gross Profit % of Revenue 39.9% 39.1% -80 bps SG&A $149.2 $165.2 10.7% SG&A % of Revenue 24.5% 26.2% 170 bps Adjusted Income from Operations(1) $100.6 $94.2 -6.3% Adjusted Income from Operations Margin (1) 16.5% 14.9% -160 bps ($ in millions) Notes: Adjusted income from operations and adjusted income from operations margin are non-GAAP measures. Income from operations and the related margin were $89.4 million (14.7%) in Q2 ‘15 and $79.9 million (12.7%) in Q2 ’16. Q2 Adjusted Operating Income Margins Reflect Planned Investments

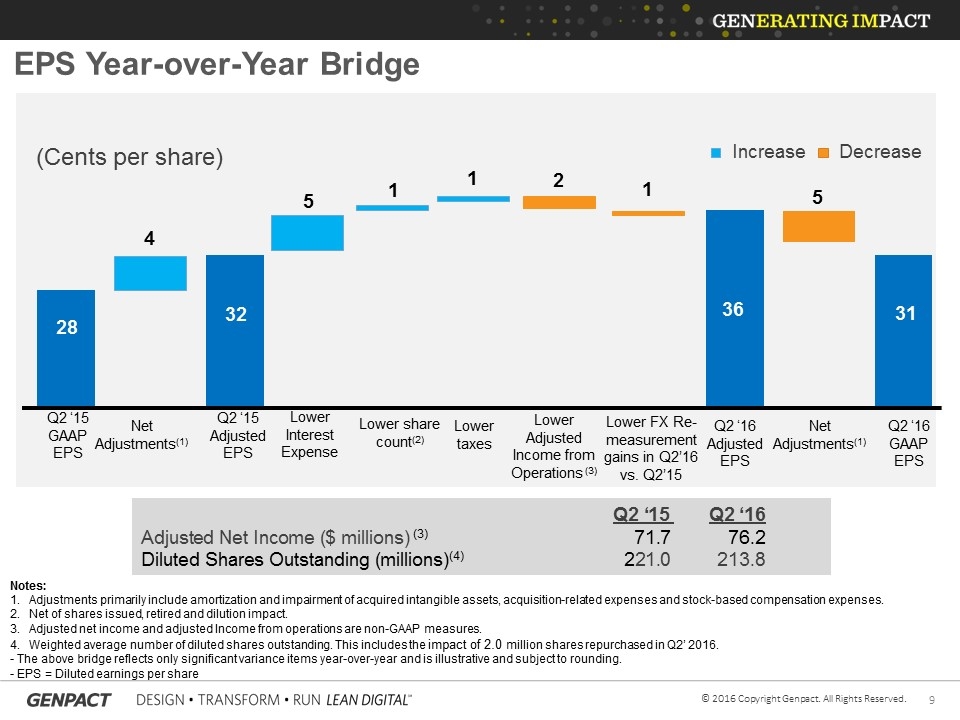

EPS Year-over-Year Bridge Q2 ‘15 Q2 ‘16 Adjusted Net Income ($ millions) (3) 71.7 76.2 Diluted Shares Outstanding (millions)(4)221.0213.8 28 5 Lower FX Re-measurement gains in Q2’16 vs. Q2’15 Q2 ‘15 GAAP EPS 31 (Cents per share) Net Adjustments(1) 32 4 Net Adjustments(1) Q2 ‘15 Adjusted EPS Q2 ‘16 Adjusted EPS Q2 ‘16 GAAP EPS Lower Interest Expense 5 Increase Decrease Notes: Adjustments primarily include amortization and impairment of acquired intangible assets, acquisition-related expenses and stock-based compensation expenses. Net of shares issued, retired and dilution impact. Adjusted net income and adjusted Income from operations are non-GAAP measures. Weighted average number of diluted shares outstanding. This includes the impact of 2.0 million shares repurchased in Q2’ 2016. - The above bridge reflects only significant variance items year-over-year and is illustrative and subject to rounding. - EPS = Diluted earnings per share 36 1 Lower taxes 2 Lower Adjusted Income from Operations (3) Lower share count(2) 1 1

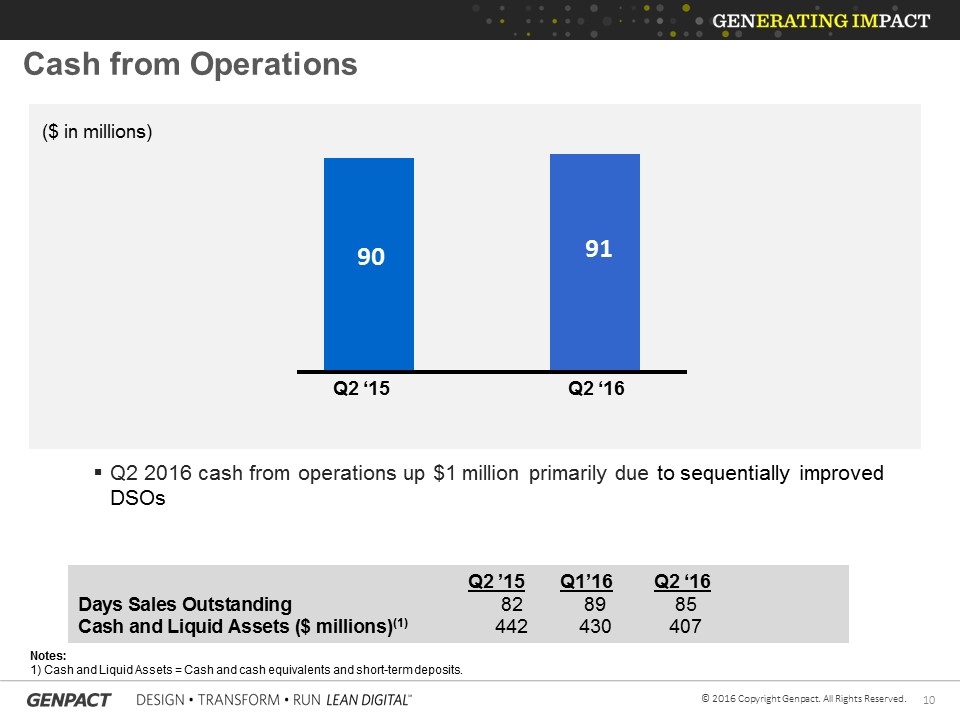

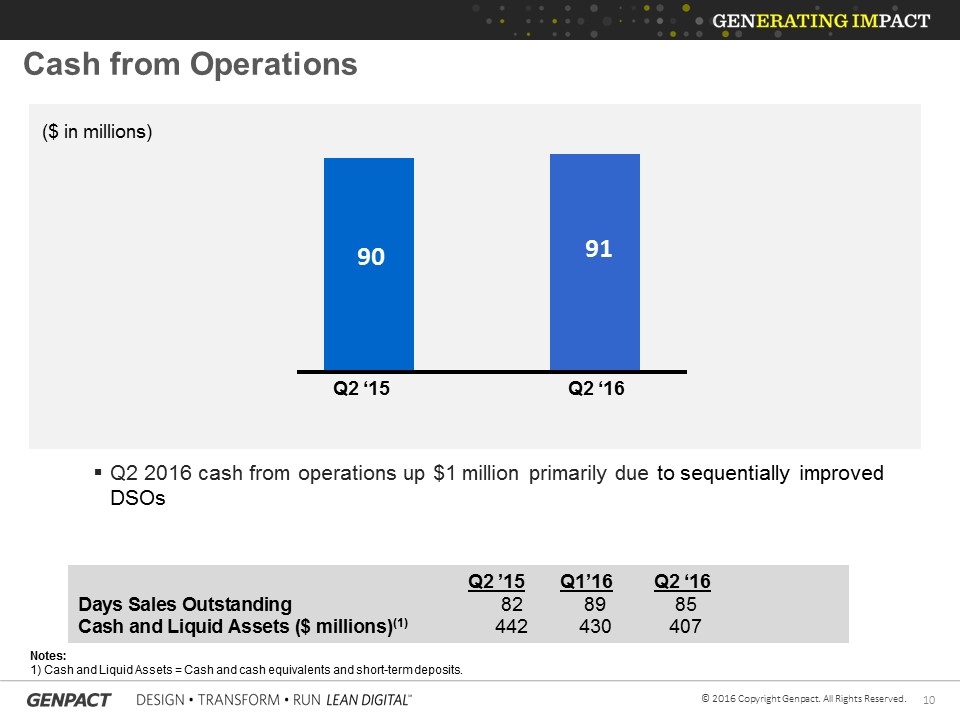

Q2 2016 cash from operations up $1 million primarily due to sequentially improved DSOs Q2 ‘15 Q2 ‘16 Notes: 1) Cash and Liquid Assets = Cash and cash equivalents and short-term deposits. ($ in millions) Q2 ’15 Q1’16 Q2 ‘16 Days Sales Outstanding82 89 85 Cash and Liquid Assets ($ millions)(1) 442 430 407 Cash from Operations

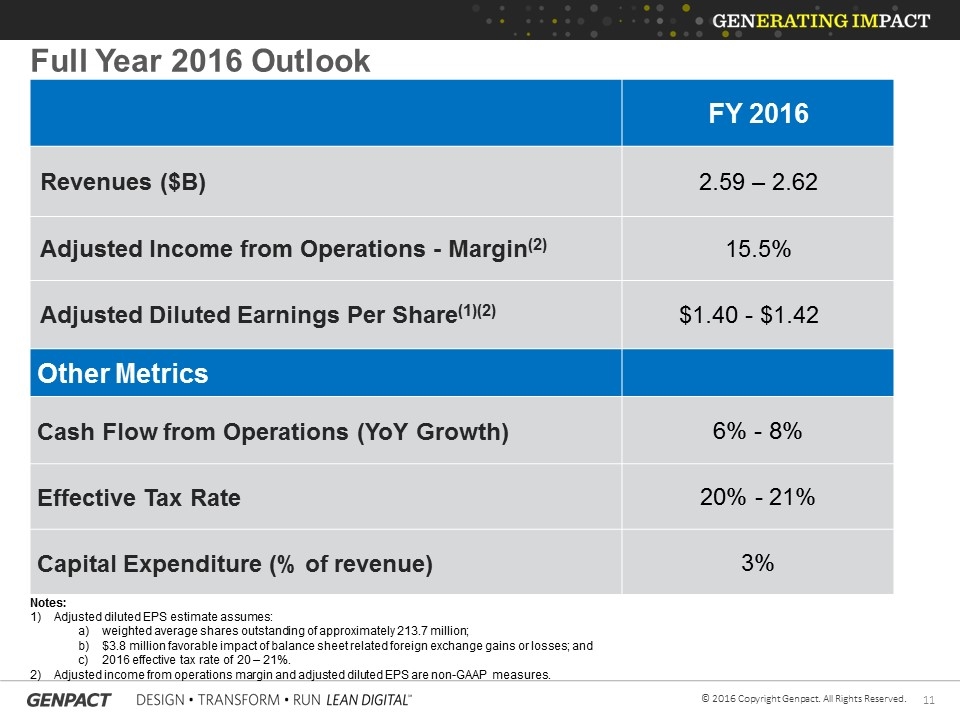

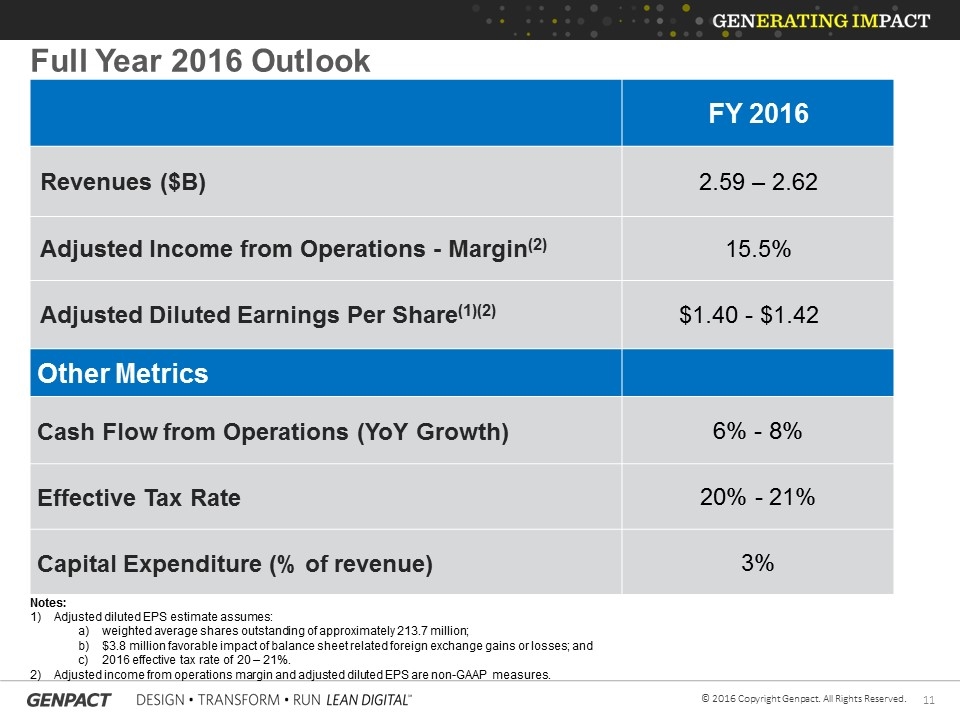

FY 2016 Revenues ($B) 2.59 – 2.62 Adjusted Income from Operations - Margin(2) 15.5% Adjusted Diluted Earnings Per Share(1)(2) $1.40 - $1.42 Other Metrics Cash Flow from Operations (YoY Growth) 6% - 8% Effective Tax Rate 20% - 21% Capital Expenditure (% of revenue) 3% Full Year 2016 Outlook Notes: Adjusted diluted EPS estimate assumes: weighted average shares outstanding of approximately 213.7 million; $3.8 million favorable impact of balance sheet related foreign exchange gains or losses; and 2016 effective tax rate of 20 – 21%. Adjusted income from operations margin and adjusted diluted EPS are non-GAAP measures.

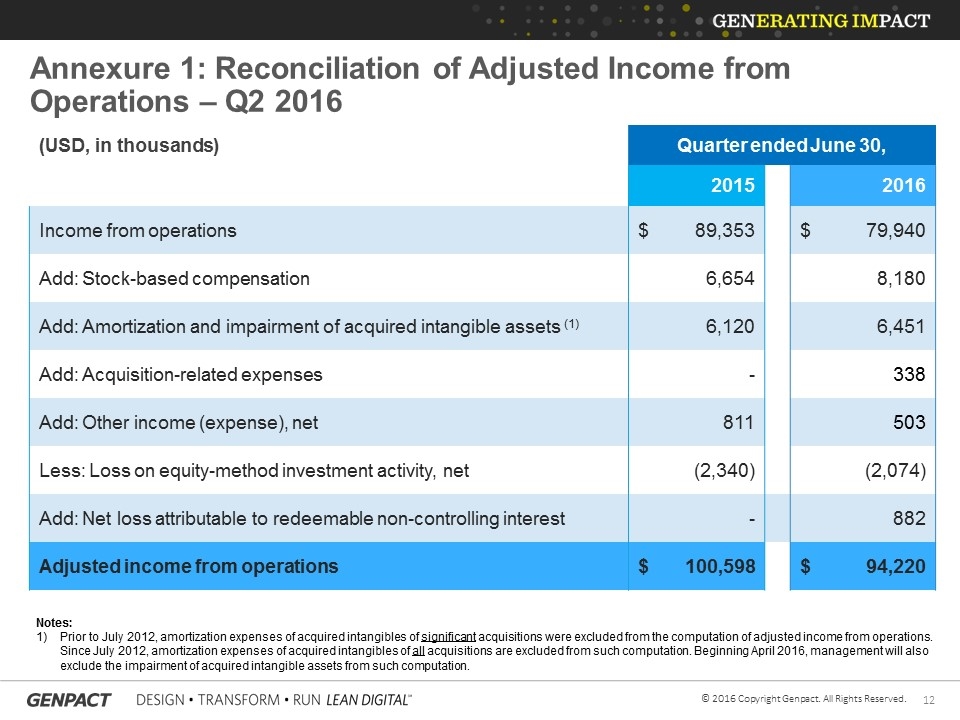

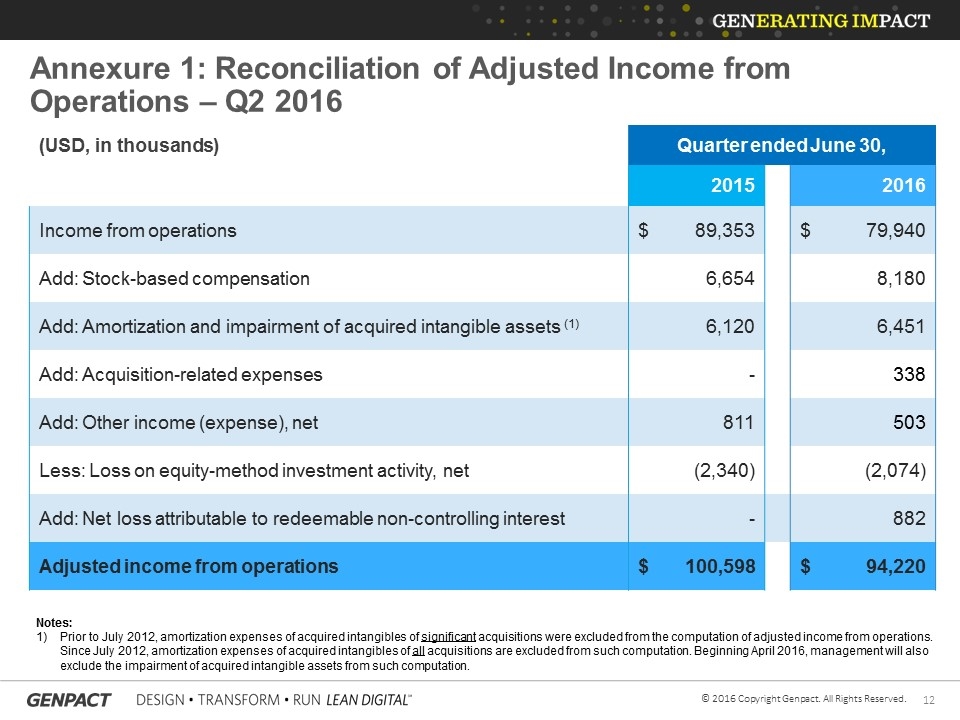

Annexure 1: Reconciliation of Adjusted Income from Operations – Q2 2016 (USD, in thousands) Quarter ended June 30, 2015 2016 Income from operations $ 89,353 $ 79,940 Add: Stock-based compensation 6,654 8,180 Add: Amortization and impairment of acquired intangible assets (1) 6,120 6,451 Add: Acquisition-related expenses - 338 Add: Other income (expense), net 811 503 Less: Loss on equity-method investment activity, net (2,340) (2,074) Add: Net loss attributable to redeemable non-controlling interest - 882 Adjusted income from operations $ 100,598 $ 94,220 Notes: Prior to July 2012, amortization expenses of acquired intangibles of significant acquisitions were excluded from the computation of adjusted income from operations. Since July 2012, amortization expenses of acquired intangibles of all acquisitions are excluded from such computation. Beginning April 2016, management will also exclude the impairment of acquired intangible assets from such computation.

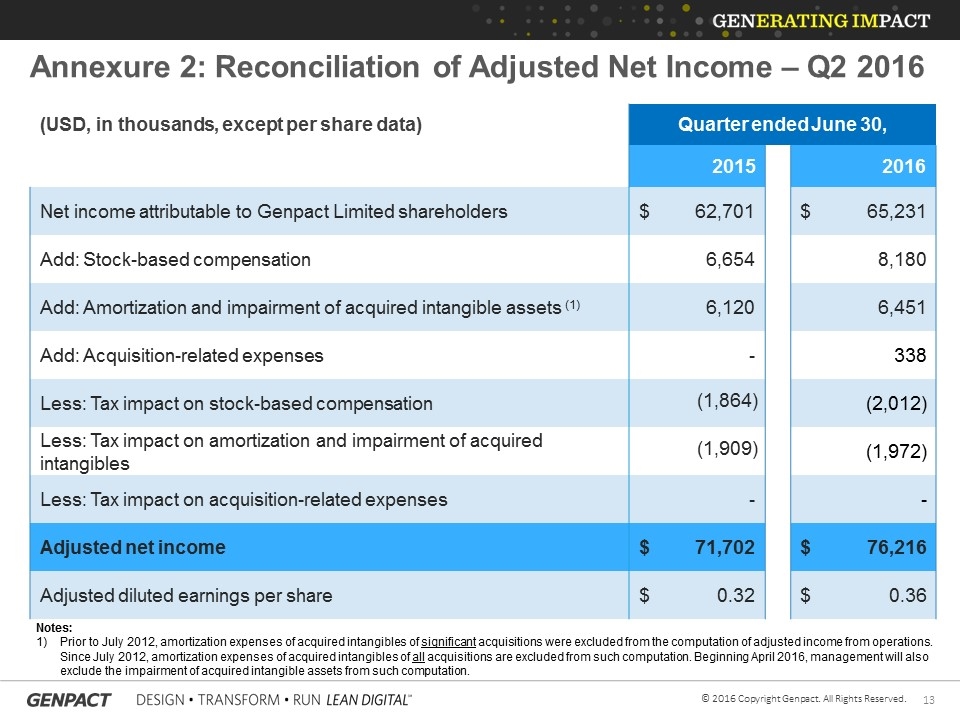

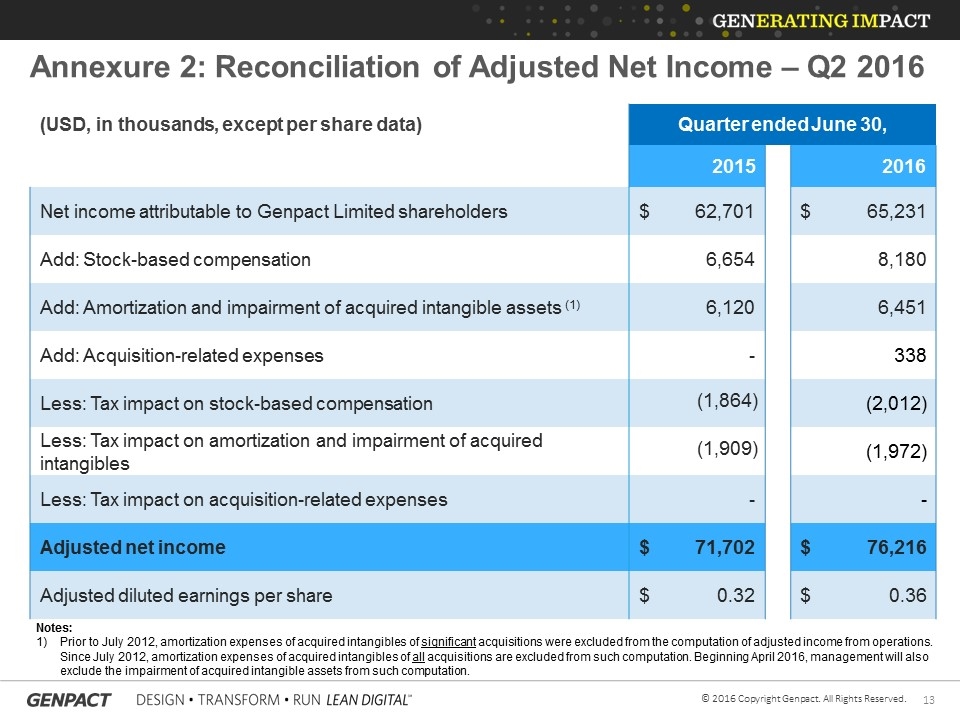

Annexure 2: Reconciliation of Adjusted Net Income – Q2 2016 (USD, in thousands, except per share data) Quarter ended June 30, 2015 2016 Net income attributable to Genpact Limited shareholders $ 62,701 $ 65,231 Add: Stock-based compensation 6,654 8,180 Add: Amortization and impairment of acquired intangible assets (1) 6,120 6,451 Add: Acquisition-related expenses - 338 Less: Tax impact on stock-based compensation (1,864) (2,012) Less: Tax impact on amortization and impairment of acquired intangibles (1,909) (1,972) Less: Tax impact on acquisition-related expenses - - Adjusted net income $ 71,702 $ 76,216 Adjusted diluted earnings per share $ 0.32 $ 0.36 Notes: Prior to July 2012, amortization expenses of acquired intangibles of significant acquisitions were excluded from the computation of adjusted income from operations. Since July 2012, amortization expenses of acquired intangibles of all acquisitions are excluded from such computation. Beginning April 2016, management will also exclude the impairment of acquired intangible assets from such computation.

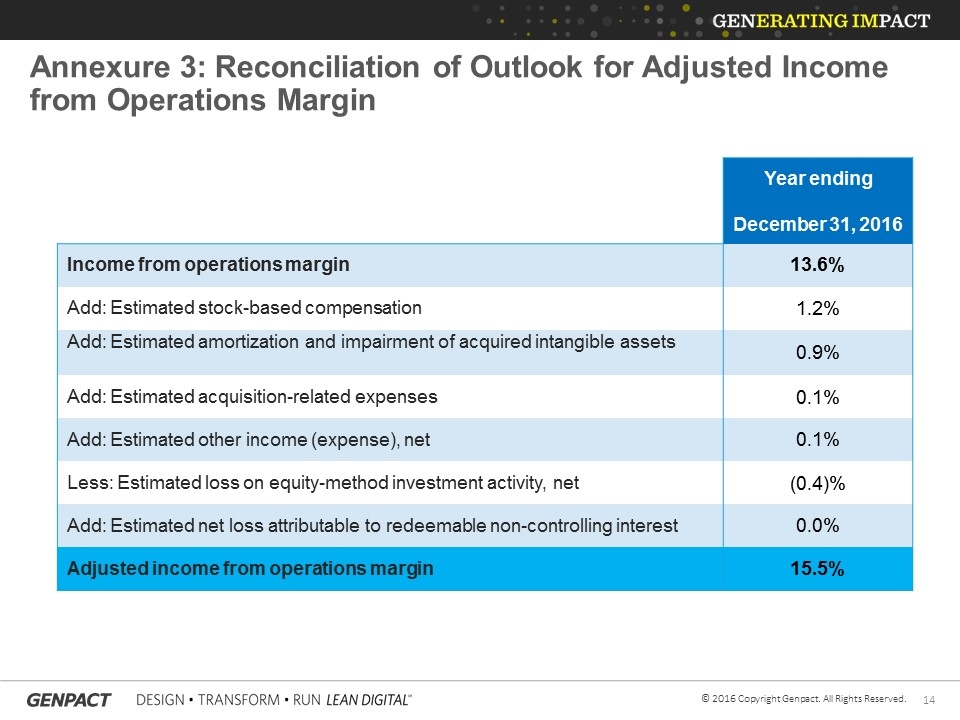

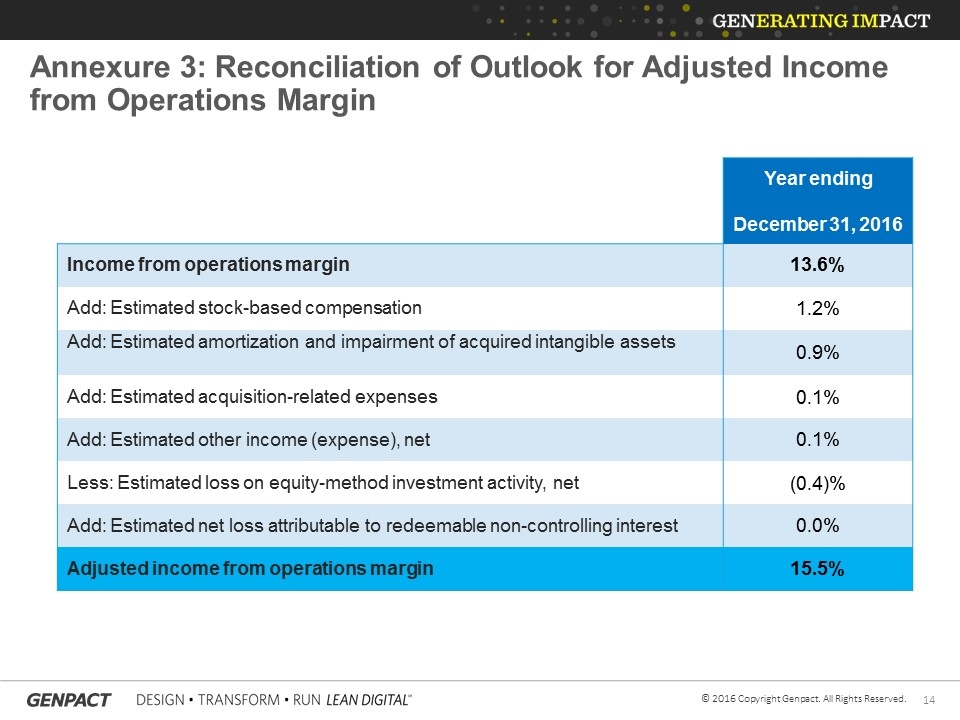

Annexure 3: Reconciliation of Outlook for Adjusted Income from Operations Margin Year ending December 31, 2016 Income from operations margin 13.6% Add: Estimated stock-based compensation 1.2% Add: Estimated amortization and impairment of acquired intangible assets 0.9% Add: Estimated acquisition-related expenses 0.1% Add: Estimated other income (expense), net 0.1% Less: Estimated loss on equity-method investment activity, net (0.4)% Add: Estimated net loss attributable to redeemable non-controlling interest 0.0% Adjusted income from operations margin 15.5%

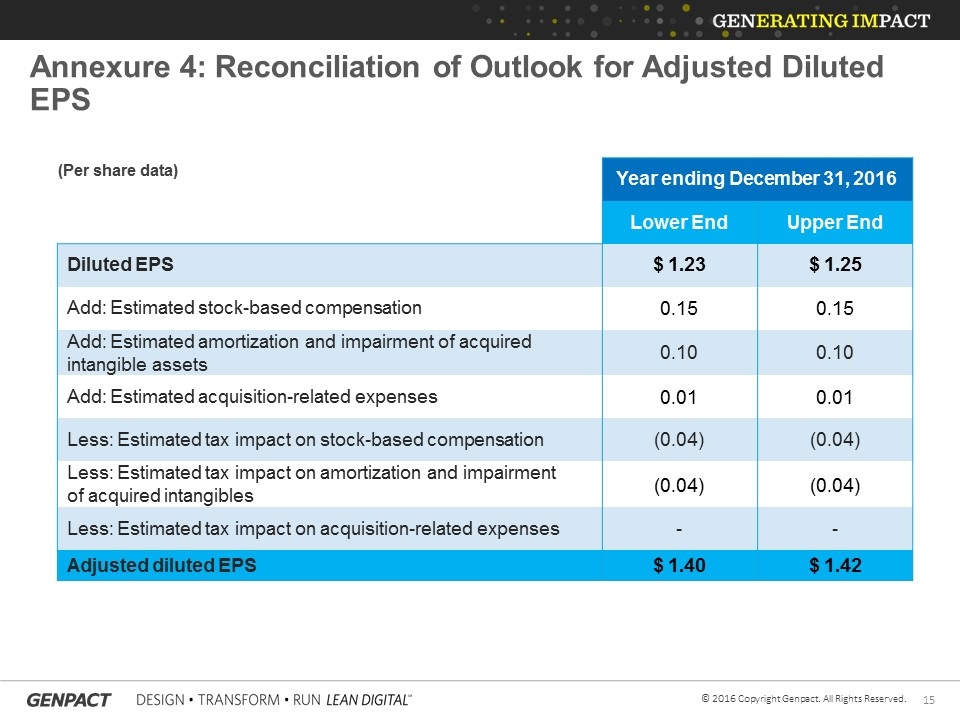

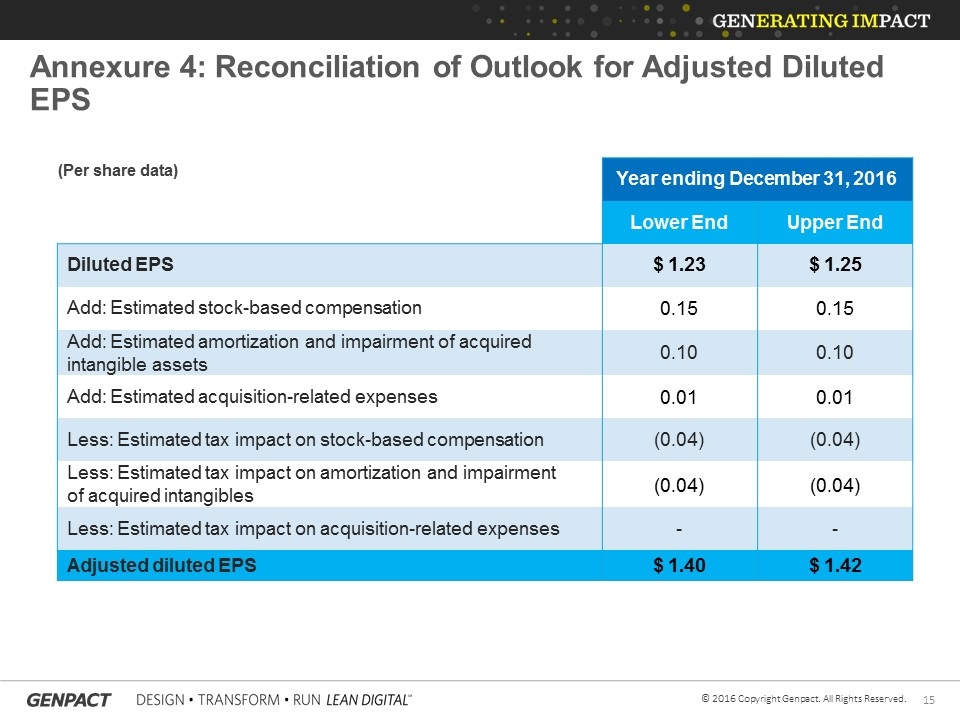

Annexure 4: Reconciliation of Outlook for Adjusted Diluted EPS (Per share data) Year ending December 31, 2016 Lower End Upper End Diluted EPS $ 1.23 $ 1.25 Add: Estimated stock-based compensation 0.15 0.15 Add: Estimated amortization and impairment of acquired intangible assets 0.10 0.10 Add: Estimated acquisition-related expenses 0.01 0.01 Less: Estimated tax impact on stock-based compensation (0.04) (0.04) Less: Estimated tax impact on amortization and impairment of acquired intangibles (0.04) (0.04) Less: Estimated tax impact on acquisition-related expenses - - Adjusted diluted EPS $ 1.40 $ 1.42

Thank you