Advancing medicines. Solving problems. Improving lives. Second Quarter 2024 Earnings Supplemental Materials August 6, 2024 1

2 ® Disclaimer Forward-Looking Statement Certain statements in this press release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “may,” “will,” or the negative of those terms, and similar expressions, are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the advancement and related timing of our product candidate Anaphylm (epinephrine) Sublingual Film through clinical development and approval by the FDA, including submission of supporting clinical studies and the NDA for Anaphylm in the near term and the following launch of Anaphylm, if approved by the FDA; that Anaphylm will be the first and only oral administration of epinephrine and accepted as an alternative to existing standards of care, if Anaphylm is approved by the FDA; the commercial opportunity of Anaphylm; the advancement and related timing of our Adrenaverse pipeline epinephrine prodrug product candidates, including AQST-108, through clinical development and regulatory approval process, including holding a pre-IND meeting with the FDA for AQST-108; the commercial opportunity of our Adrenaverse epinephrine prodrug platform and its ability to transform the Company; the continued expansion of market access and coverage, commercial and distribution capabilities and future market opportunity for Libervant (diazepam) Buccal Film for the indicated epilepsy patient population aged between two and five years; the advancement and related timing of Libervant for these epilepsy patients aged between six and eleven years through the clinical development and regulatory approval process; the approval for U.S. market access of Libervant for this patient population aged twelve years and older and overcoming the orphan drug market exclusivity of an FDA approved nasal spray product of another company extending to January 2027 for Libervant for these epilepsy patients six years of age and older; the focus on continuing to manufacture Suboxone®, Emylif®, Sympazan®, Ondif® and other licensed products and continued growth of these products over several years in the future and our ability to support the manufacture and supply of these products in the U.S. and abroad; the potential benefits our products could bring to patients; our cash requirements, cash funding and cash burn; short-term and longer term liquidity and the ability to fund our business operations; our growth and future financial and operating results and financial position, including with respect to our 2024 financial outlook; and business strategies, market opportunities, and other statements that are not historical facts. These forward-looking statements are based on our current expectations and beliefs and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Such risks and uncertainties include, but are not limited to, risks associated with our development work, including any delays or changes to the timing, cost and success of our product development activities and clinical trials and plans, including those relating to Anaphylm (including for pediatric patients), AQST-108, Libervant for patients aged between six and eleven years, and the Company's other product candidates; risks associated with the Company’s distribution work for Libervant, including any delays or changes to the timing, cost and success of Company's distribution activities and expansion of market access to patients aged two to five for Libervant; risk of litigation brought by third parties relating to overcoming their orphan drug exclusivity of an FDA approved product for pediatric epilepsy patients between two to five years of age; risk of delays in advancement of the regulatory approval process through the FDA of Anaphylm, including the filing of the NDAAQST-108 and our other product candidates or failure to receive FDA approval at all of any of these product candidates; risk of the Company’s ability to generate sufficient data in its PK/PD comparability submission for FDA approval of Anaphylm; risk of the Company’s ability to address the FDA’s comments on the Company’s future clinical trials and other concerns identified in the FDA Type C meeting minutes for Anaphylm, including the risk that the FDA may require additional clinical studies for approval of Anaphylm; risk of the success of any competing products; risk that we may not overcome the seven year orphan drug exclusivity granted by the FDA for the approved nasal spray product of another company in the U.S. in order for Libervant to be granted U.S. market access for patients aged between two and five years until the expiration of the exclusivity period in January 2027 or for other reasons; risks and uncertainties inherent in commercializing a new product (including technology risks, financial risks, market risks and implementation risks and regulatory limitations); risk of development of a sales and marketing capability for commercialization of our product Libervant and other product candidates including Anaphylm; risk of sufficient capital and cash resources, including sufficient access to available debt and equity financing, including under our ATM facility and the Lincoln Park Purchase Agreement, and revenues from operations, to satisfy all of our short-term and longer-term liquidity and cash requirements and other cash needs, at the times and in the amounts needed, including to fund commercialization activities relating to Libervant for patients between two and five years of age and to fund future clinical development and commercial activities for Anaphylm, should Anaphylm be approved by the FDA; risk that our manufacturing capabilities will be sufficient to support demand for Libervant for patients between two and five years of age and for older patients, should Libervant receive U.S. market access for these older patients, and for demand for our licensed products in the U.S. and abroad; risk of eroding market share for Suboxone® and risk as a sunsetting product, which accounts for the substantial part of our current operating revenue; risk of default of our debt instruments; risk related to government claims against Indivior for which we license, manufacture and sell Suboxone; risks related to the outsourcing of certain sales, marketing and other operational and staff functions to third parties; risk of the rate and degree of market acceptance in the U.S. and abroad of Libervant for epilepsy patients between two and five years of age, and for older epilepsy patients upon approval for U.S. market access of Libervant for these older epilepsy patients after the expiration of the orphan drug exclusivity period in January 2027; risk of the rate and degree of market acceptance in the U.S. and abroad of Anaphylm, AQST-108 and our other products and product candidates, should these product candidates be approved by the FDA, and for our licensed products in the U.S. and abroad; risk of the success of any competing products including generics, risk of the size and growth of our product markets; risk of compliance with all FDA and other governmental and customer requirements for our manufacturing facilities; risks associated with intellectual property rights and infringement claims relating to our products; risk of unexpected patent developments; risk of legislation and regulatory actions and changes in laws or regulations affecting our business including relating to our products and products candidates and product pricing, reimbursement or access therefor; risk of loss of significant customers; risks related to claims and legal proceedings including patent infringement, securities, business torts, investigative, product safety or efficacy and antitrust litigation matters; risk of product recalls and withdrawals; risks related to any disruptions in our information technology networks and systems, including the impact of cyberattacks; risk of increased cybersecurity attacks and data accessibility disruptions due to remote working arrangements; risk of adverse developments affecting the financial services industry; risks related to inflation and rising interest rates; risks related to the impact of the COVID-19 global pandemic and other pandemic diseases on our business, including with respect to our clinical trials and the site initiation, patient enrollment and timing and adequacy of those clinical trials, regulatory submissions and regulatory reviews and approvals of our product candidates, availability of pharmaceutical ingredients and other raw materials used in our products and product candidates, supply chain, manufacture and distribution of our products and product candidates; risks and uncertainties related to general economic, political (including the Ukraine and Israel wars and other acts of war and terrorism), business, industry, regulatory, financial and market conditions and other unusual items; and other uncertainties affecting us including those described in the "Risk Factors" section and in other sections included in the Company’s 2023 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the U.S. Securities and Exchange Commission. Given those uncertainties, you should not place undue reliance on these forward-looking statements, which speak only as of the date made. All subsequent forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by this cautionary statement. The Company assumes no obligation to update forward-looking statements or outlook or guidance after the date of this press release whether as a result of new information, future events or otherwise, except as may be required by applicable law. © 2024 Property of Aquestive Therapeutics, Inc.

3 Q2 2024 earnings: key messages AnaphylmTM (epinephrine) Sublingual Film ● Completed and received positive topline data for temperature/pH and self-administration studies ● Final supportive study, the Oral Allergy Syndrome (OAS) study, is underway and expected to be completed late in the third quarter or early fourth quarter of 2024 ● Anticipate submitting a pre-NDA meeting request letter to the FDA in the third quarter 2024 ● Anticipate commencement of the single-dose pediatric study immediately following the pre-NDA meeting ● Plan to begin the NDA submission before the end of 2024 and complete in first quarter 2025 LibervantTM (diazepam) Buccal Film ● Received FDA approval for Libervant for patients between the ages of two and five years old ● Anticipate expanding to a national sales team of up to 10 sales reps by fourth quarter 2024 ● Anticipate national retail distribution in place by fourth quarter 2024 AQST-108 (epinephrine) Topical Gel ● Expect to hold a pre-IND meeting with the FDA in fourth quarter 2024 ● Planning a phase 2a study in the first half of 2025 Strengthened the Balance Sheet Extending Cash Runway into 2026 ● Finished the second quarter 2024 with a cash balance of approximately $90 million

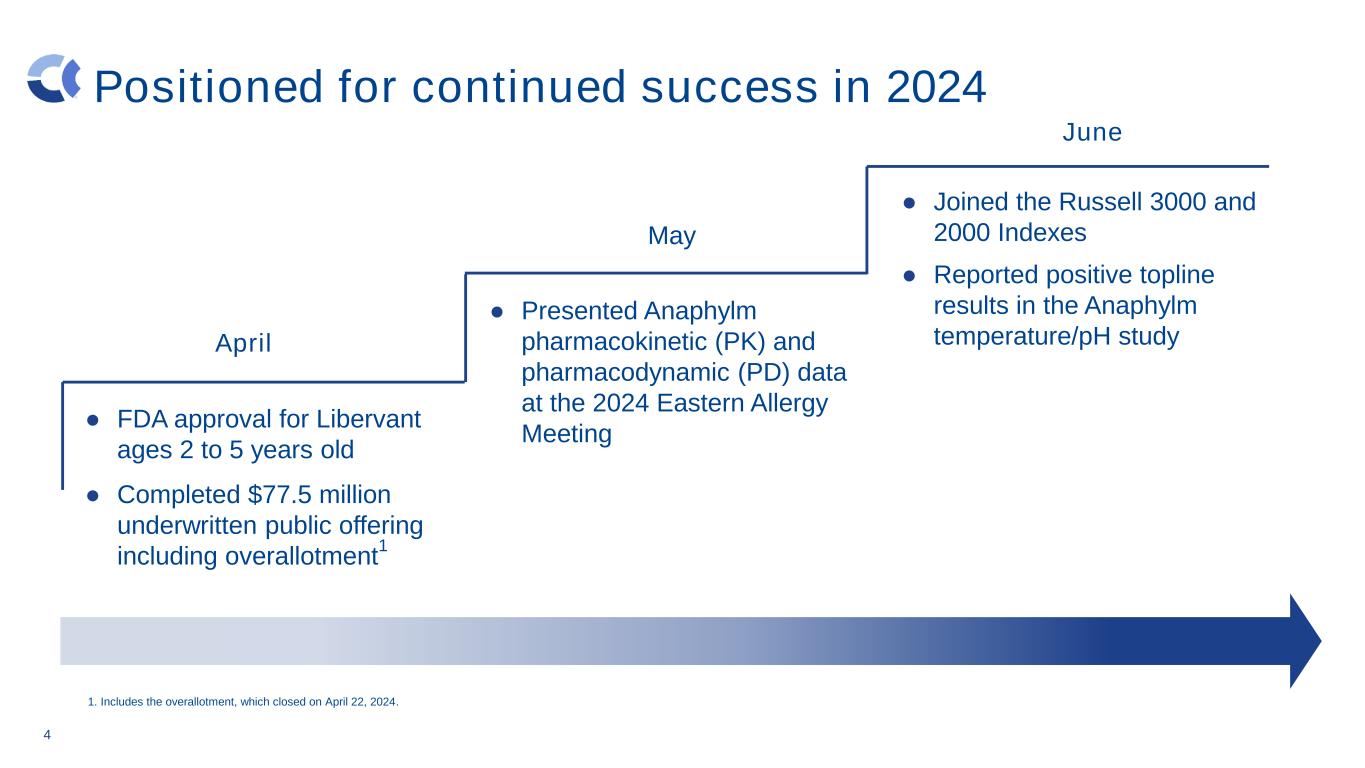

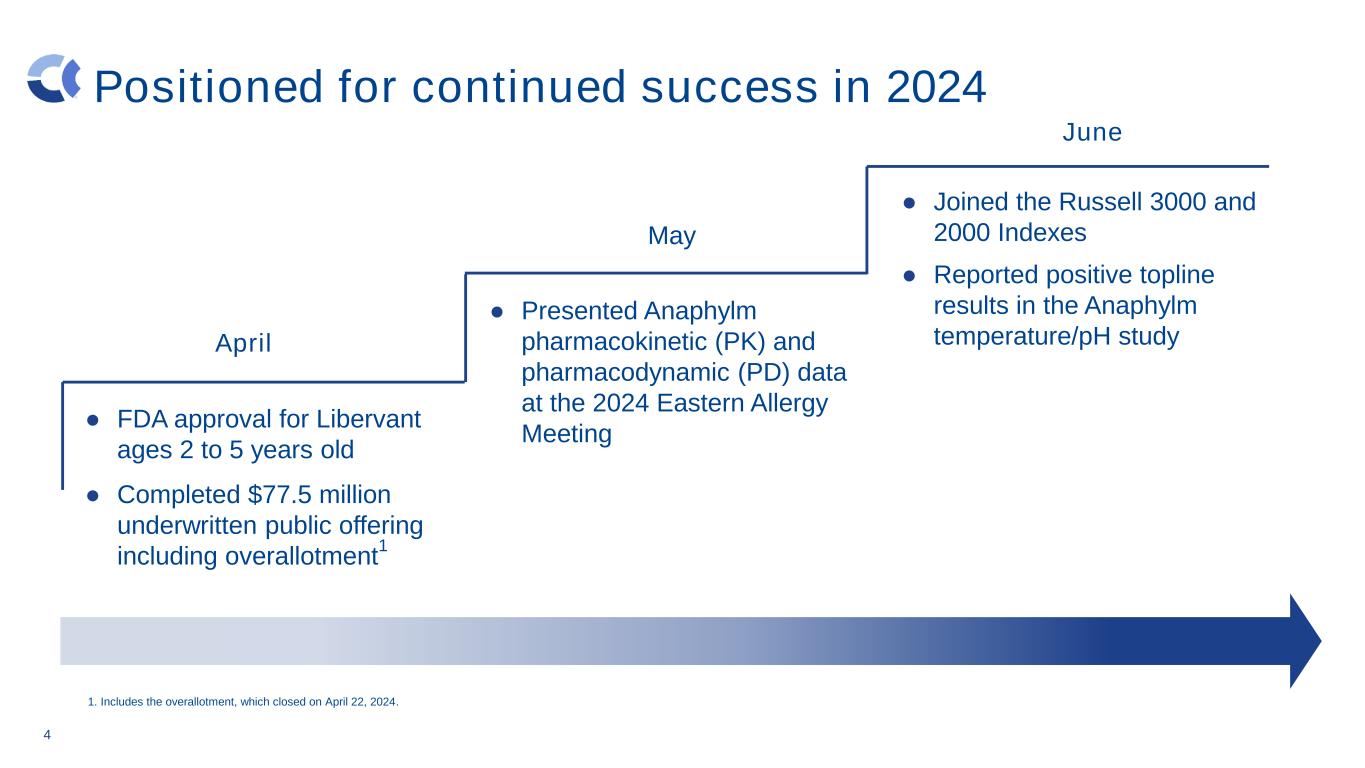

4 Positioned for continued success in 2024 ● FDA approval for Libervant ages 2 to 5 years old ● Completed $77.5 million underwritten public offering including overallotment 1 May ● Presented Anaphylm pharmacokinetic (PK) and pharmacodynamic (PD) data at the 2024 Eastern Allergy Meeting April ● Joined the Russell 3000 and 2000 Indexes ● Reported positive topline results in the Anaphylm temperature/pH study June 1. Includes the overallotment, which closed on April 22, 2024.

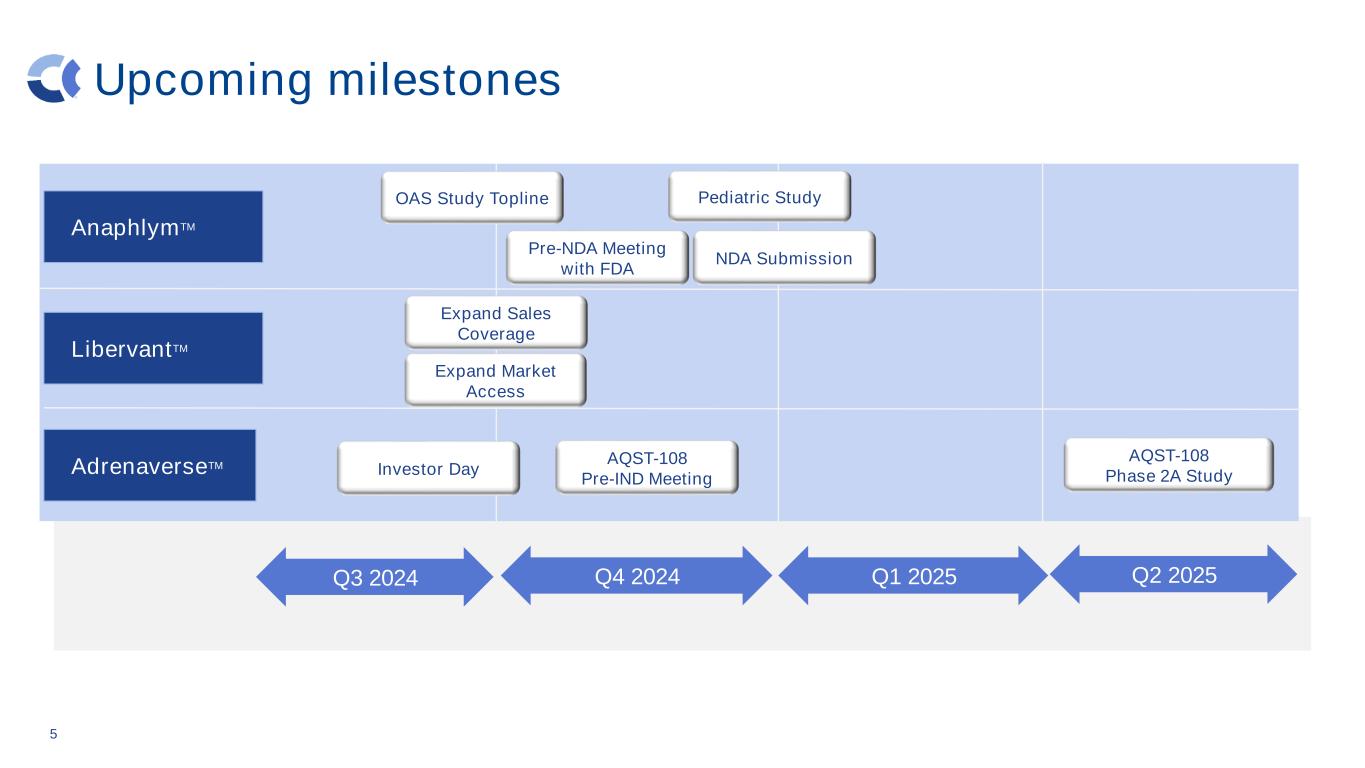

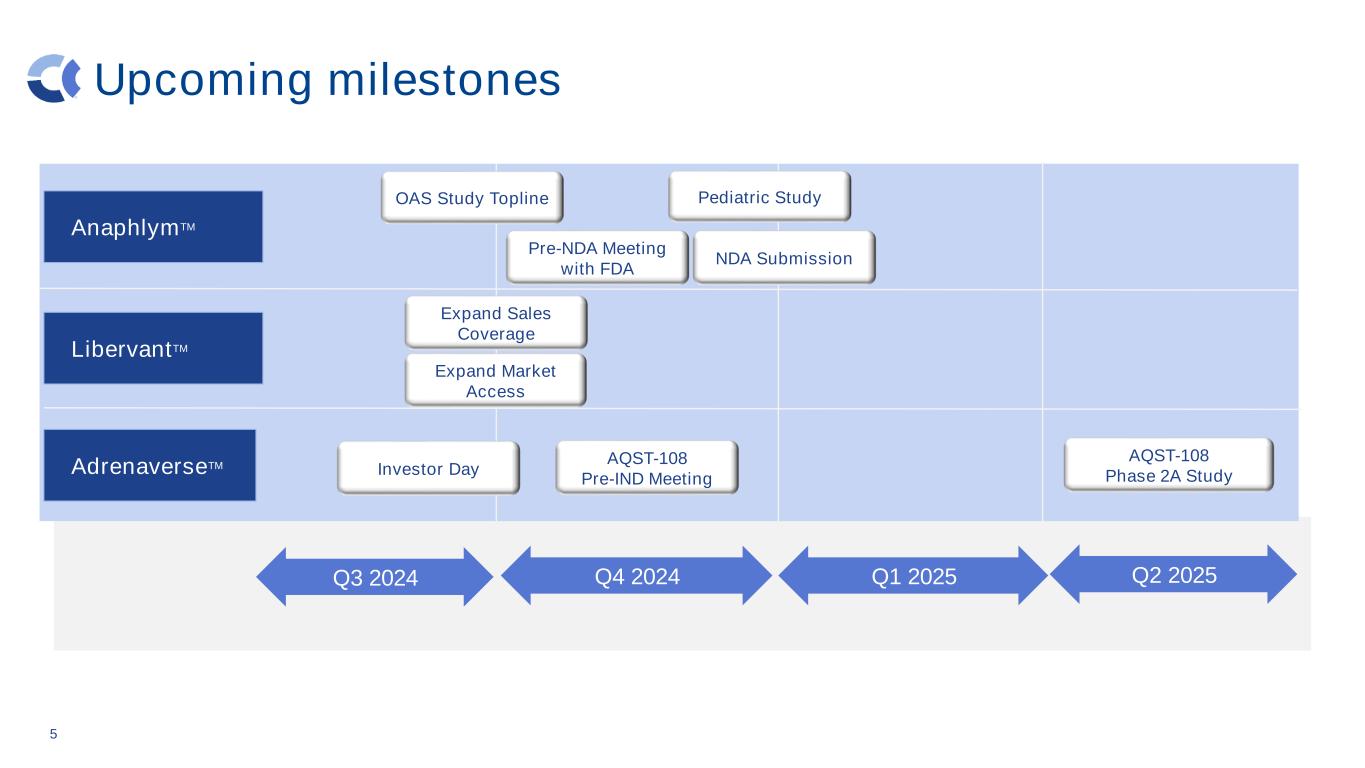

Upcoming milestones 5 AdrenaverseTM LibervantTM Q3 2024 Q4 2024 Q1 2025 Q2 2025 AQST-108 Pre-IND Meeting AQST-108 Phase 2A StudyInvestor Day AnaphlymTM Pre-NDA Meeting with FDA OAS Study Topline Expand Sales Coverage NDA Submission Pediatric Study Expand Market Access

Advancing medicines. Solving problems. Improving lives. Anaphylm Program Update 6

7 Temperature/pH study pharmacokinetic (PK) results1 1. Aquestive Therapeutics data on file. Test Condition Maximum Plasma Concentration (Cmax) (Test Condition/Room Temperature Water) Area under the curve (AUC) 0-60min (Test Condition/Room Temperature Water) Cold water 106% 98% Hot water 104% 107% Lemon water (target pH: 3) 98% 99% Baking soda water (target pH:8) 123% 132% Key Takeaways: ● No significant difference in PK results based on changes in temperature and pH

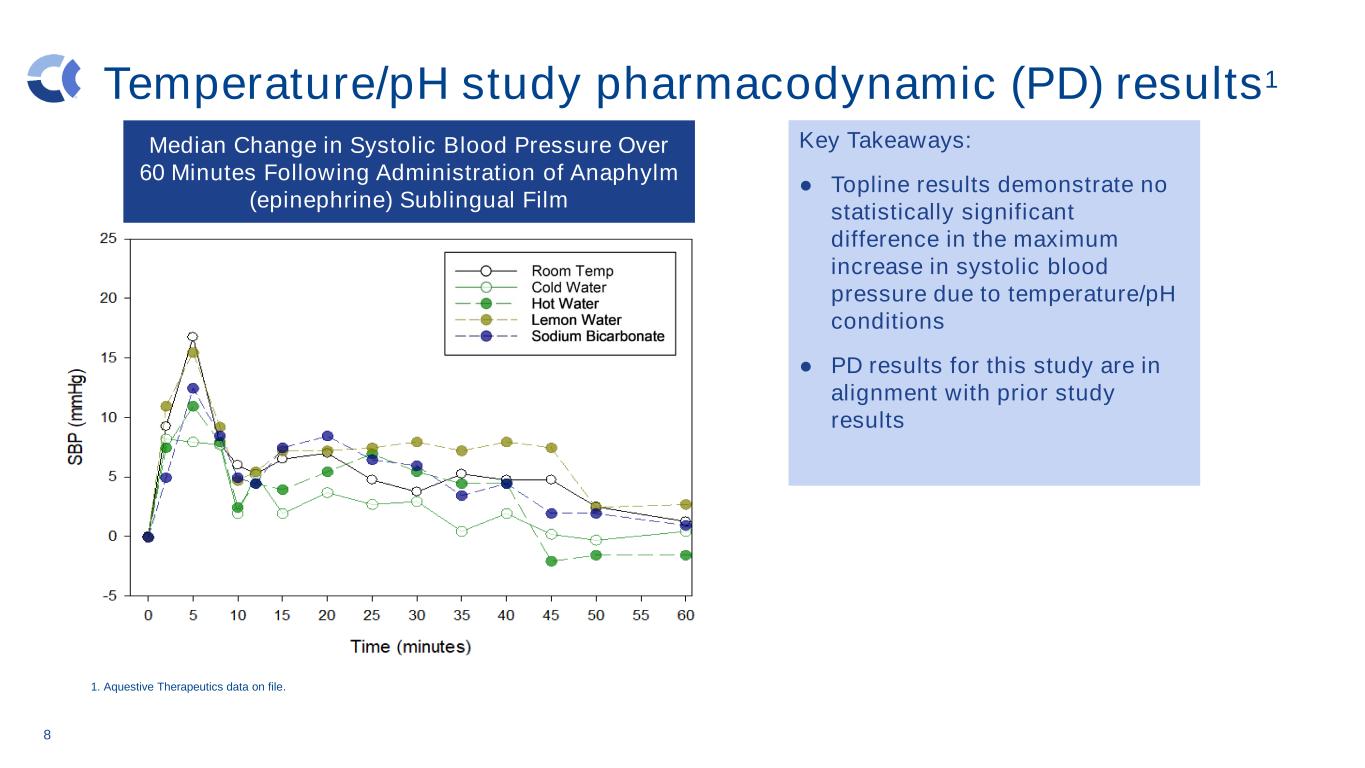

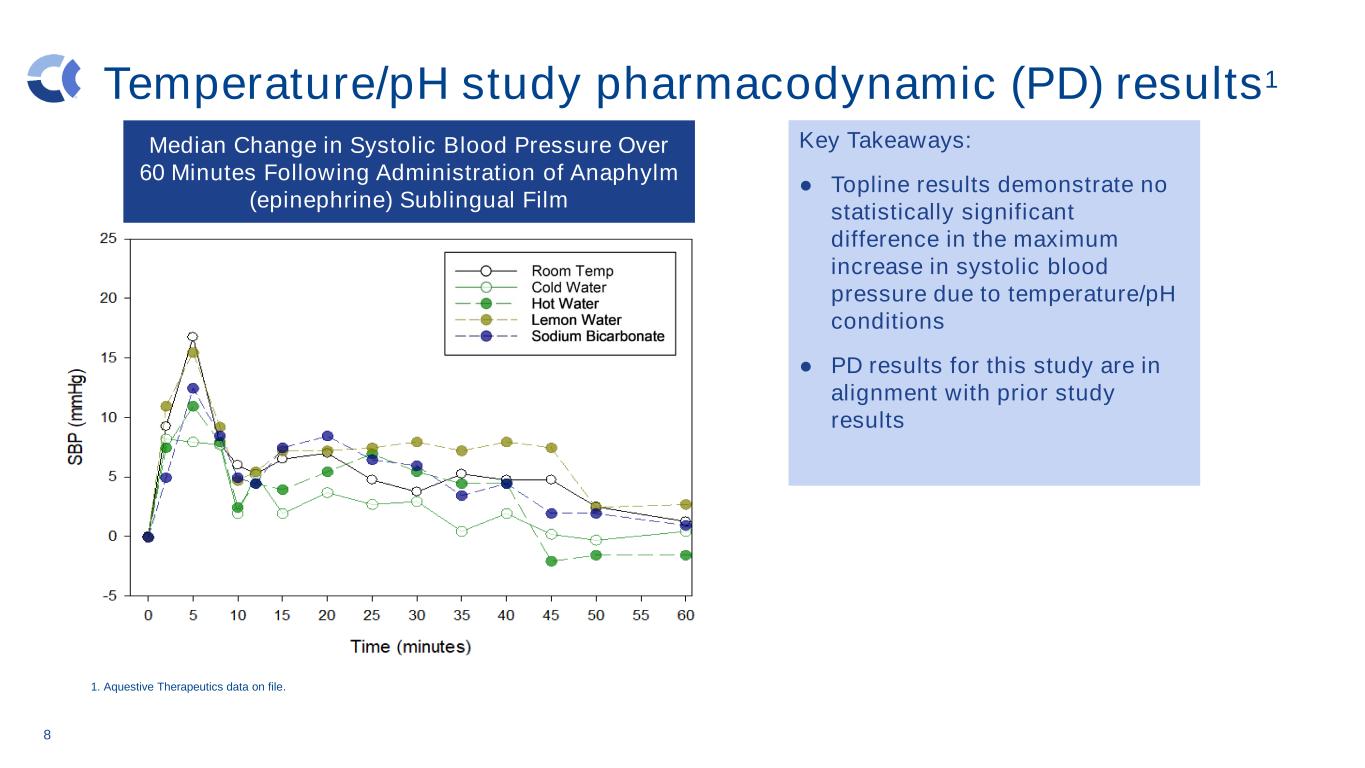

8 Temperature/pH study pharmacodynamic (PD) results1 Key Takeaways: ● Topline results demonstrate no statistically significant difference in the maximum increase in systolic blood pressure due to temperature/pH conditions ● PD results for this study are in alignment with prior study results Median Change in Systolic Blood Pressure Over 60 Minutes Following Administration of Anaphylm (epinephrine) Sublingual Film 1. Aquestive Therapeutics data on file.

9 Self-administration study PK results1 Key Takeaways: ● Cmax was not statistically different whether Anaphylm was self-administered or administered by an HCP ● Median time to maximum concentration (Tmax) was 15 minutes for Anaphylm whether self-administered or administered by a healthcare provider (HCP) ● Median Tmax for the Adrenalin intramuscular (IM) injection was 50 minutes after dosing 1. Aquestive Therapeutics data on file.

10 Self-administration study PD results1 Key Takeaways: ● Topline PD results demonstrate no difference in the median increase in systolic blood pressure whether Anaphylm is self-administered or HCP-administered ● PD results for this study are in alignment with prior study results Median Change in Systolic Blood Pressure Over 60 Minutes 1. Aquestive Therapeutics data on file.

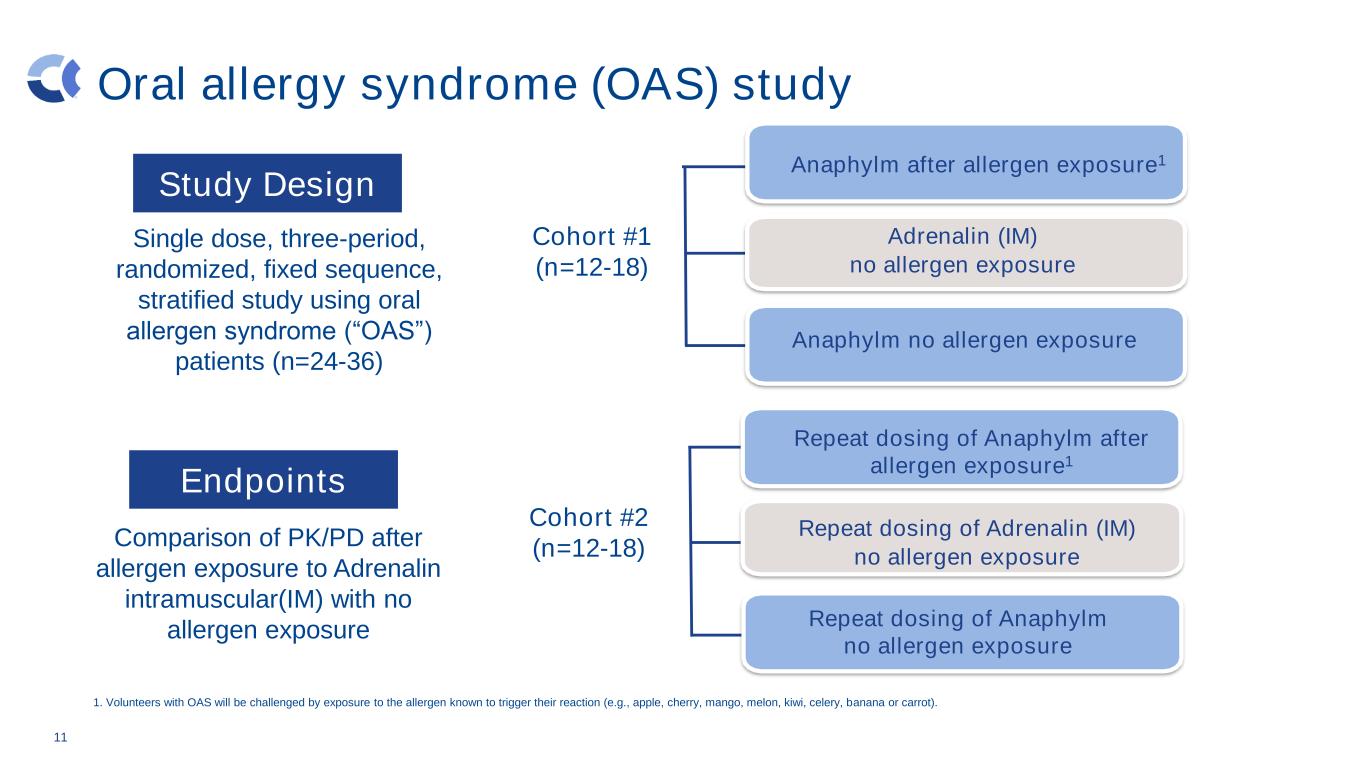

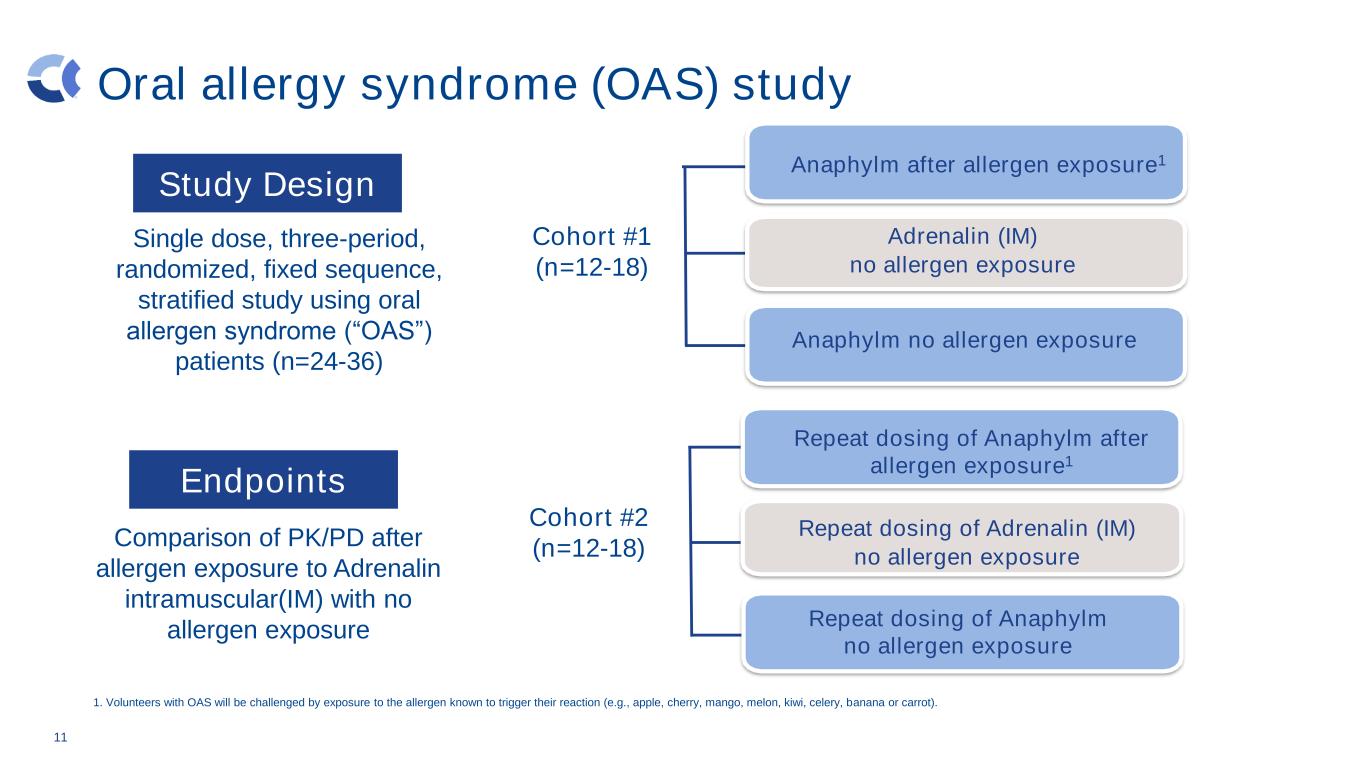

Oral allergy syndrome (OAS) study Repeat dosing of Adrenalin (IM) no allergen exposure 11 Single dose, three-period, randomized, fixed sequence, stratified study using oral allergen syndrome (“OAS”) patients (n=24-36) Comparison of PK/PD after allergen exposure to Adrenalin intramuscular(IM) with no allergen exposure Adrenalin (IM) no allergen exposure Anaphylm after allergen exposure1 Cohort #1 (n=12-18) Cohort #2 (n=12-18) Repeat dosing of Anaphylm after allergen exposure1 1. Volunteers with OAS will be challenged by exposure to the allergen known to trigger their reaction (e.g., apple, cherry, mango, melon, kiwi, celery, banana or carrot). Anaphylm no allergen exposure Repeat dosing of Anaphylm no allergen exposure Study Design Endpoints

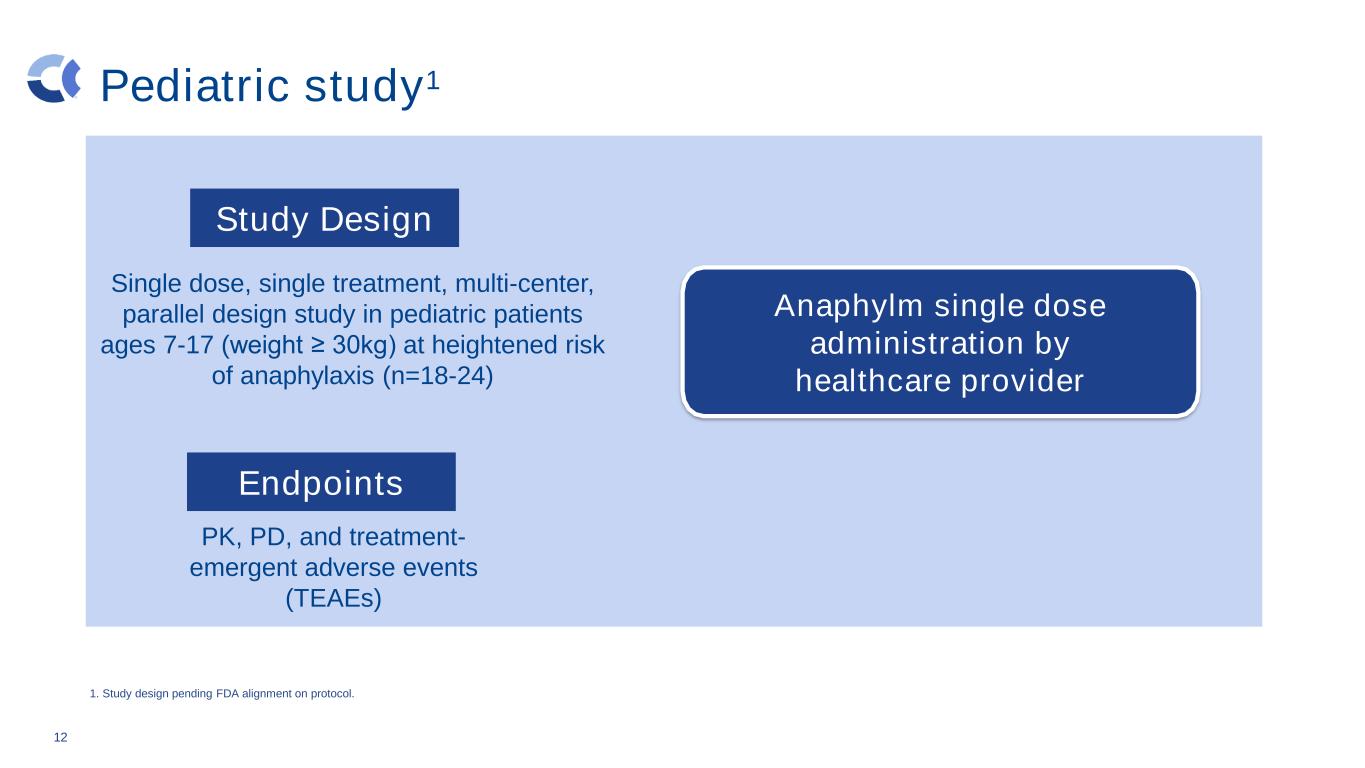

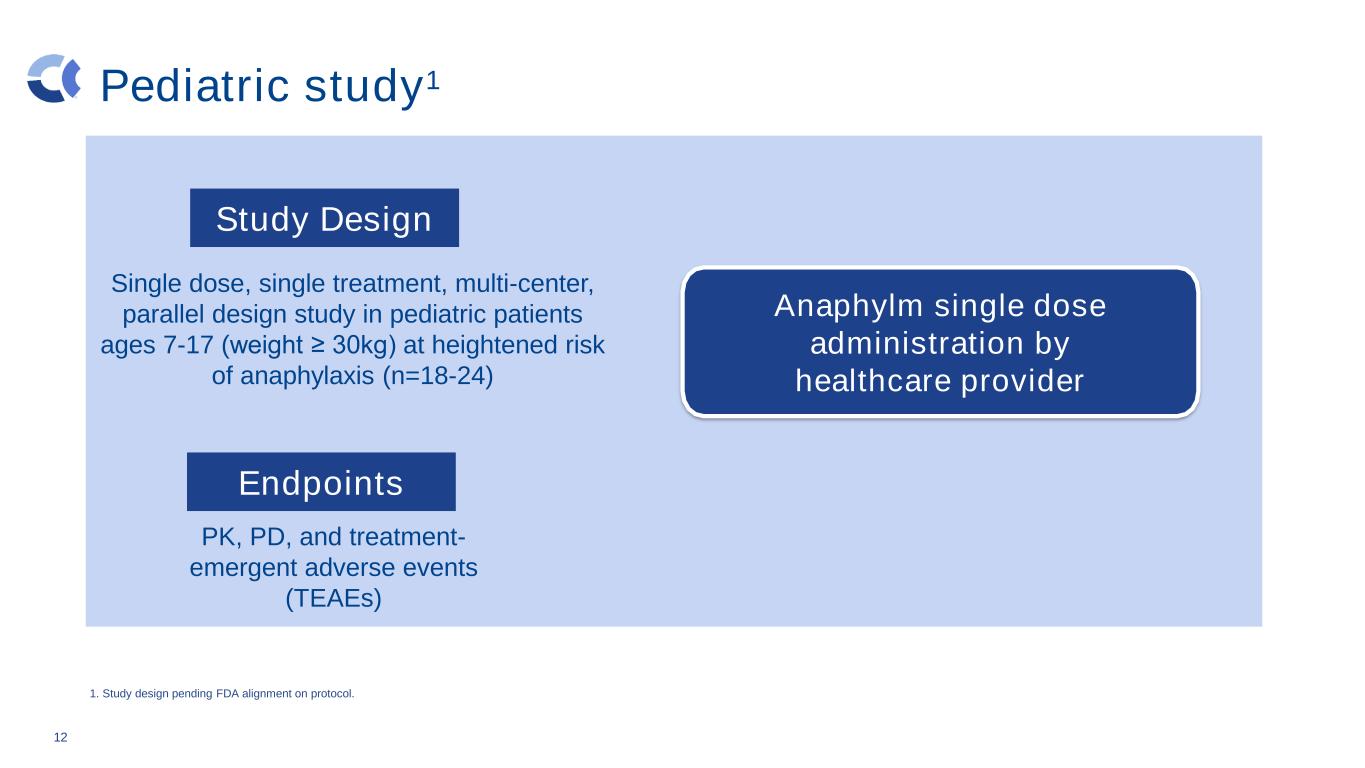

Pediatric study1 12 Single dose, single treatment, multi-center, parallel design study in pediatric patients ages 7-17 (weight ≥ 30kg) at heightened risk of anaphylaxis (n=18-24) PK, PD, and treatment- emergent adverse events (TEAEs) Adrenalin (IM) no allergen exposure Anaphylm single dose administration by healthcare provider 1. Study design pending FDA alignment on protocol. Study Design Endpoints

Advancing medicines. Solving problems. Improving lives. Libervant Launch Update 13

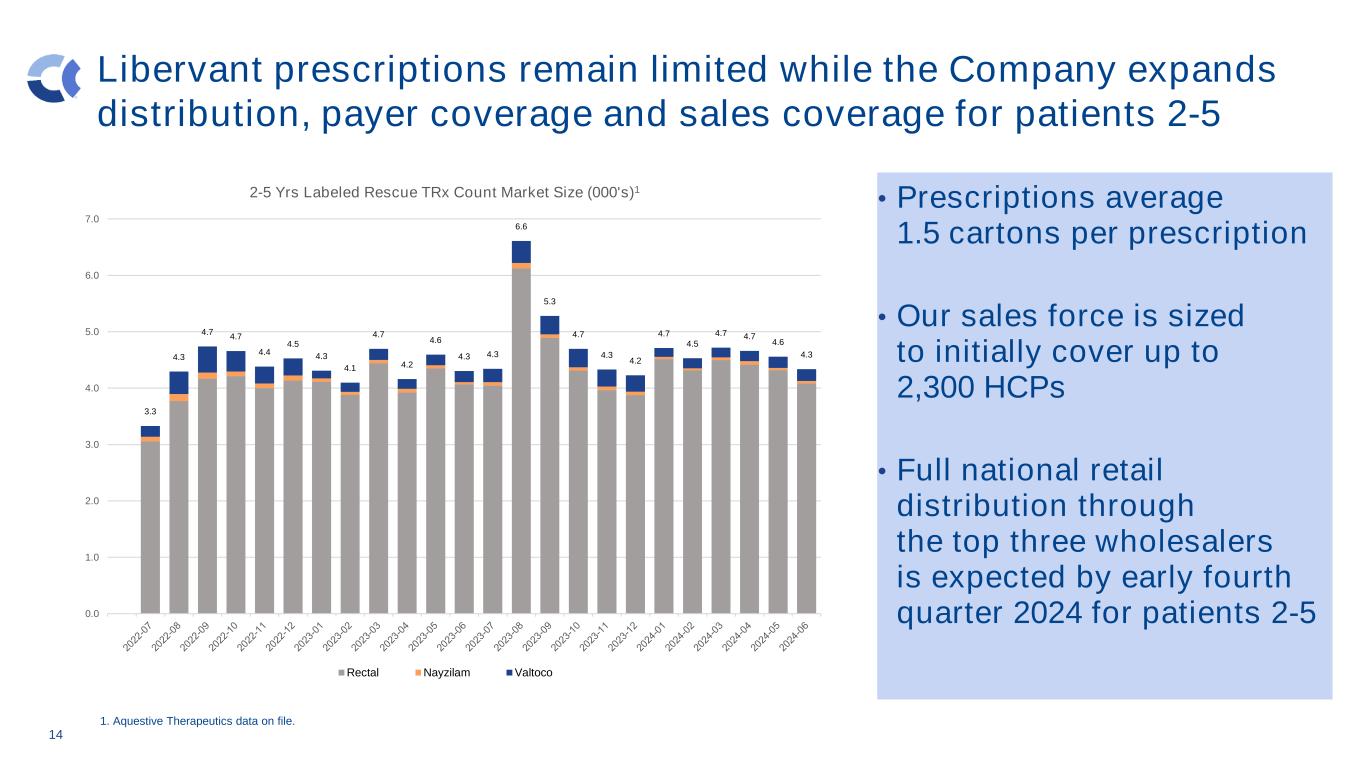

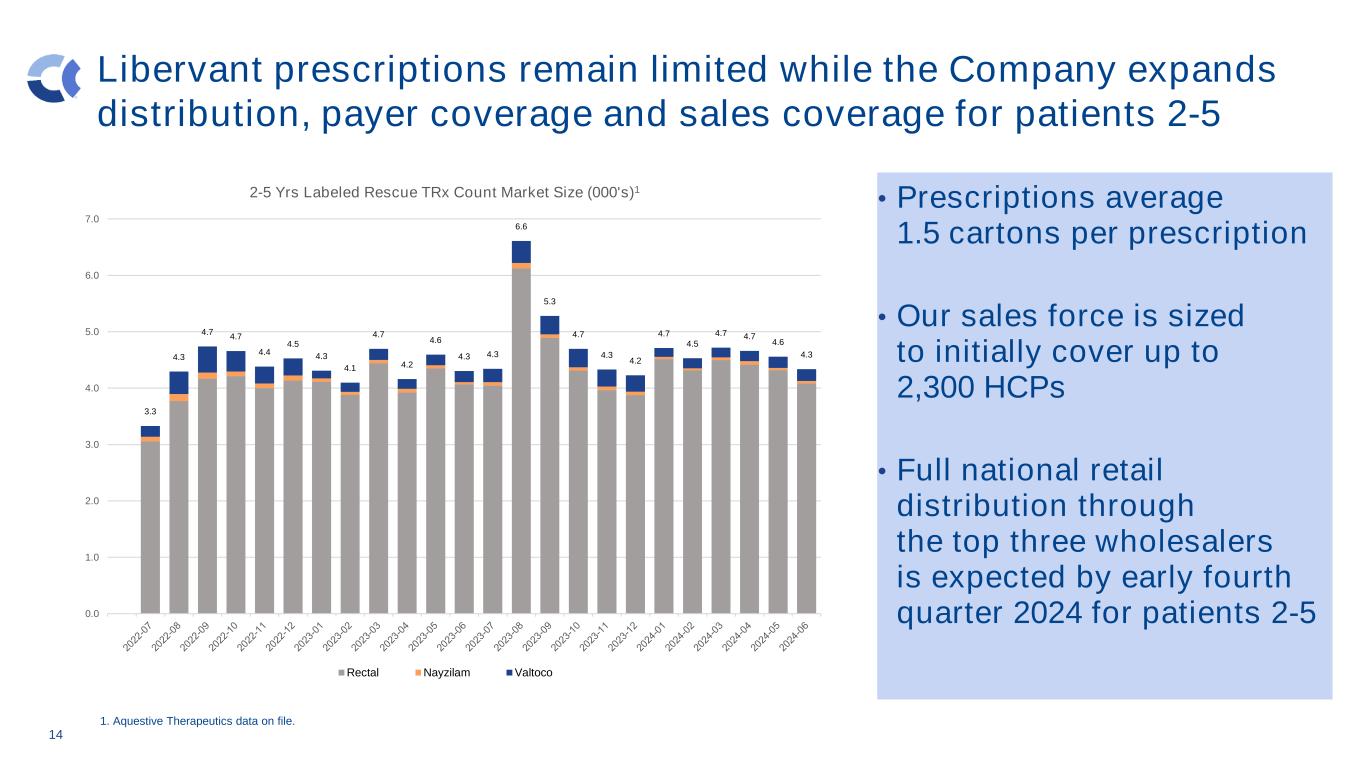

14 Libervant prescriptions remain limited while the Company expands distribution, payer coverage and sales coverage for patients 2-5 • Prescriptions average 1.5 cartons per prescription • Our sales force is sized to initially cover up to 2,300 HCPs • Full national retail distribution through the top three wholesalers is expected by early fourth quarter 2024 for patients 2-5 1. Aquestive Therapeutics data on file. 3.3 4.3 4.7 4.7 4.4 4.5 4.3 4.1 4.7 4.2 4.6 4.3 4.3 6.6 5.3 4.7 4.3 4.2 4.7 4.5 4.7 4.7 4.6 4.3 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 2-5 Yrs Labeled Rescue TRx Count Market Size (000's)1 Rectal Nayzilam Valtoco

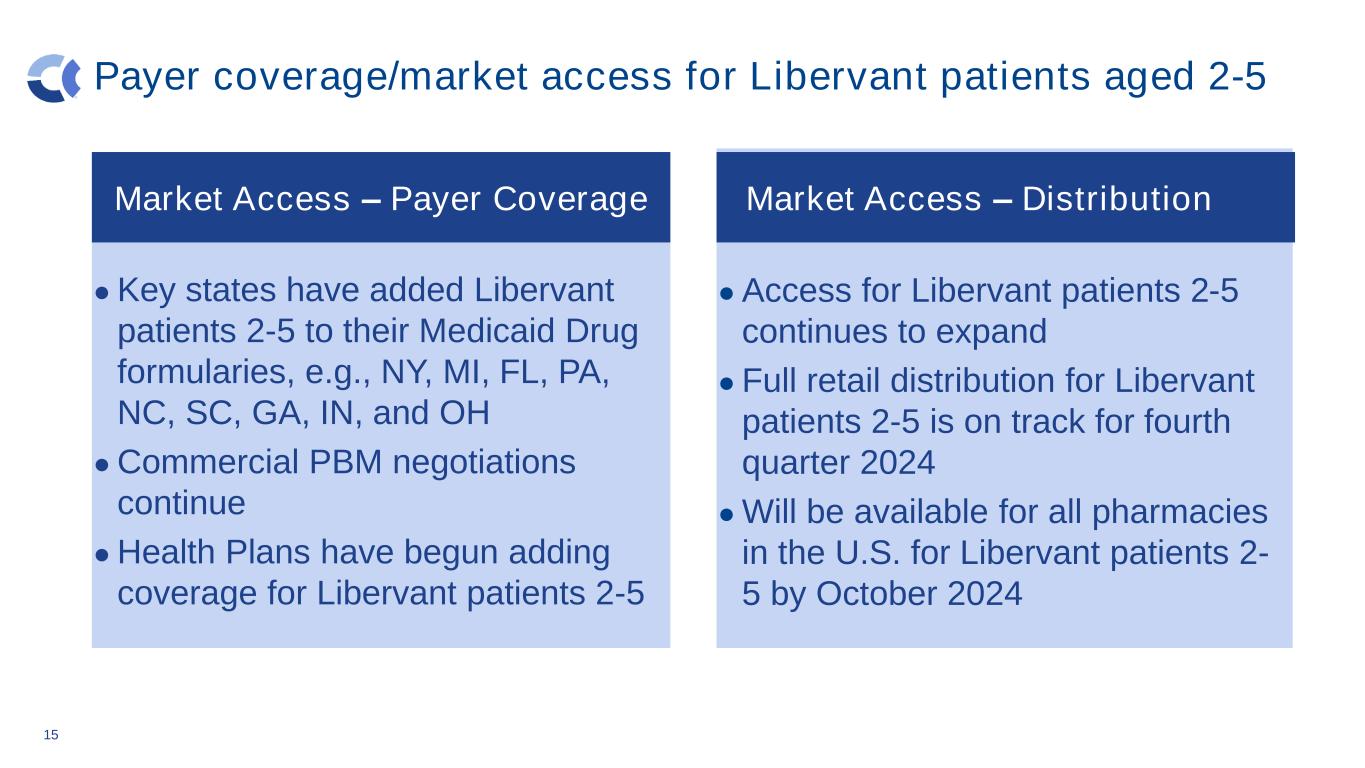

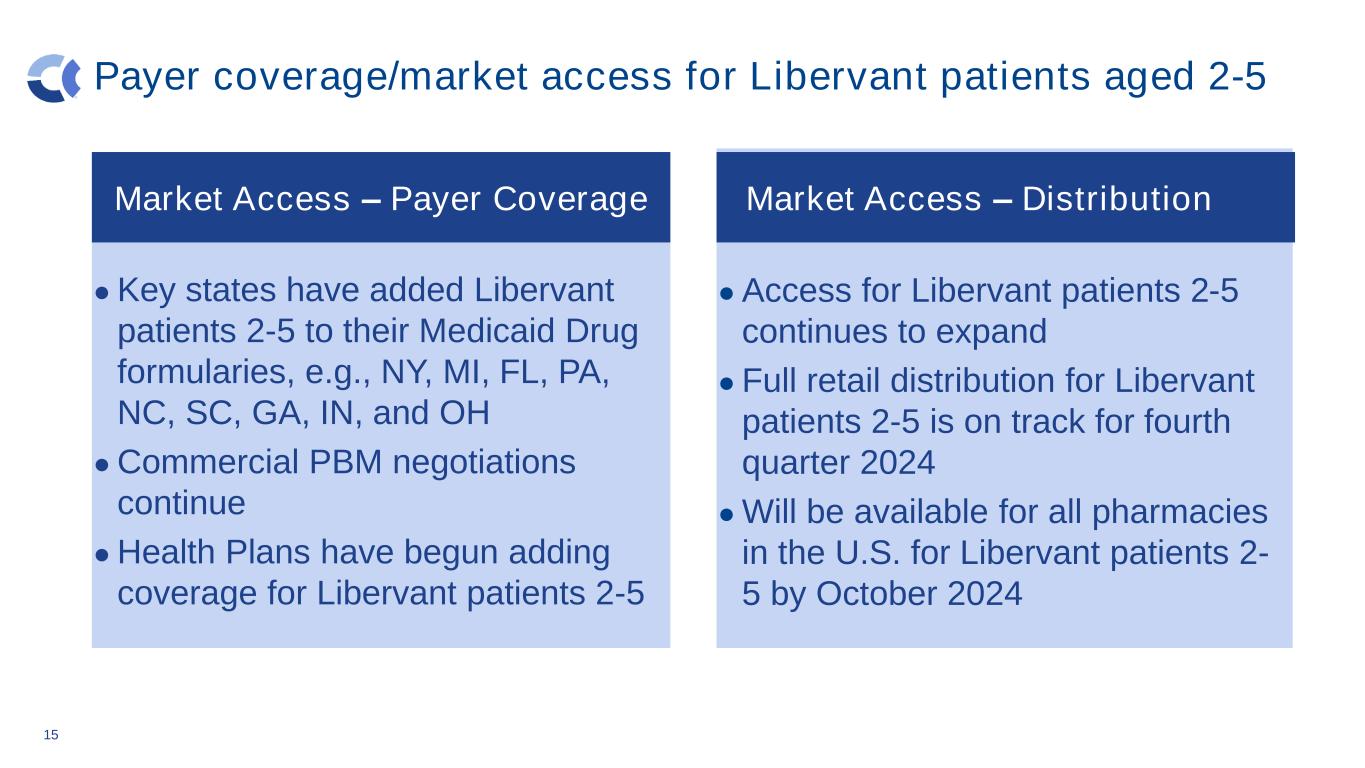

Payer coverage/market access for Libervant patients aged 2-5 Market Access - Payer Coverage ● Key states have added Libervant patients 2-5 to their Medicaid Drug formularies, e.g., NY, MI, FL, PA, NC, SC, GA, IN, and OH ● Commercial PBM negotiations continue ● Health Plans have begun adding coverage for Libervant patients 2-5 15 Market Access- Distribution ● Access for Libervant patients 2-5 continues to expand ● Full retail distribution for Libervant patients 2-5 is on track for fourth quarter 2024 ● Will be available for all pharmacies in the U.S. for Libervant patients 2- 5 by October 2024 Market Access – Payer Coverage Market Access – Distribution

Advancing medicines. Solving problems. Improving lives. Financial Results 16

Cash position significantly improved following equity raise in Q1 2024 17 24.9 23.9 95.2 89.9 -15 5 25 45 65 85 105 125 Q3 23 Q4 23 Q1 24 Q2 24 U S D ( M ill io n s ) Ending Cash Balance by Quarter

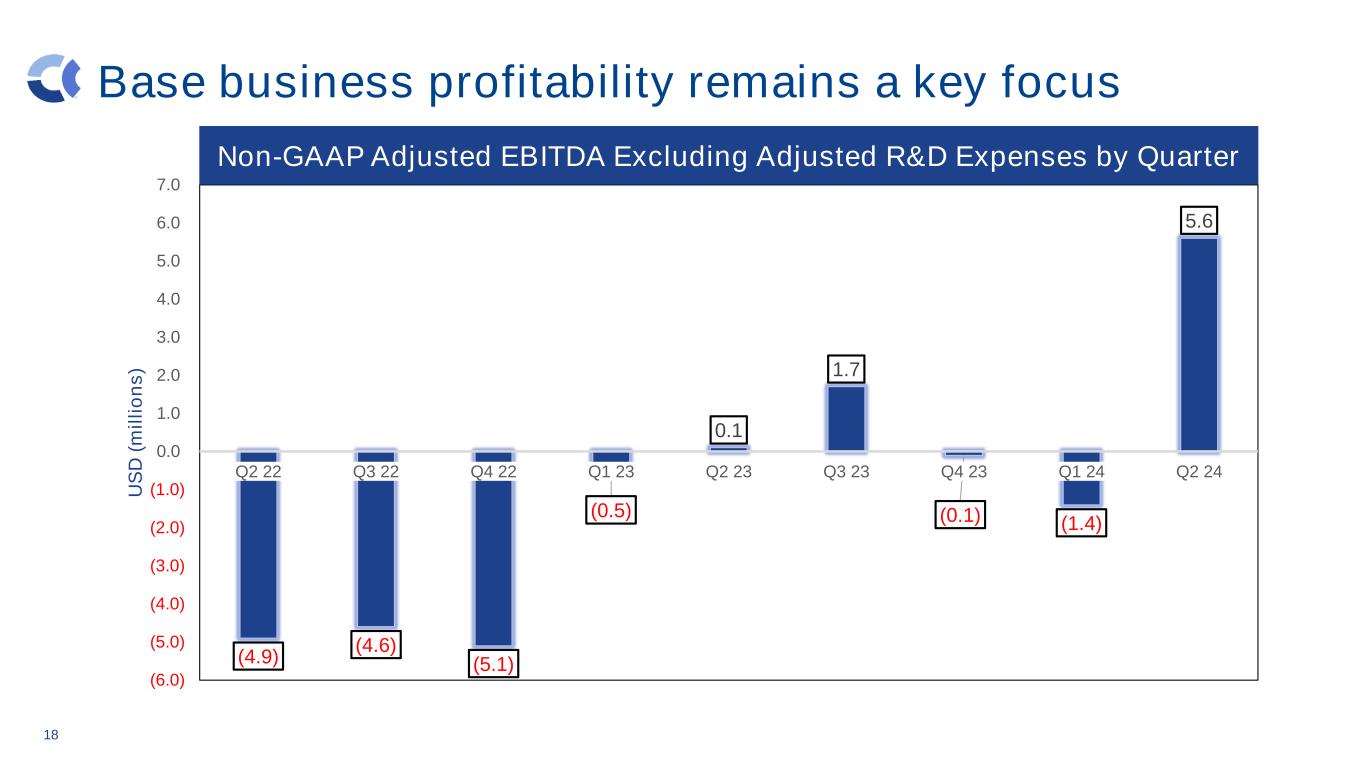

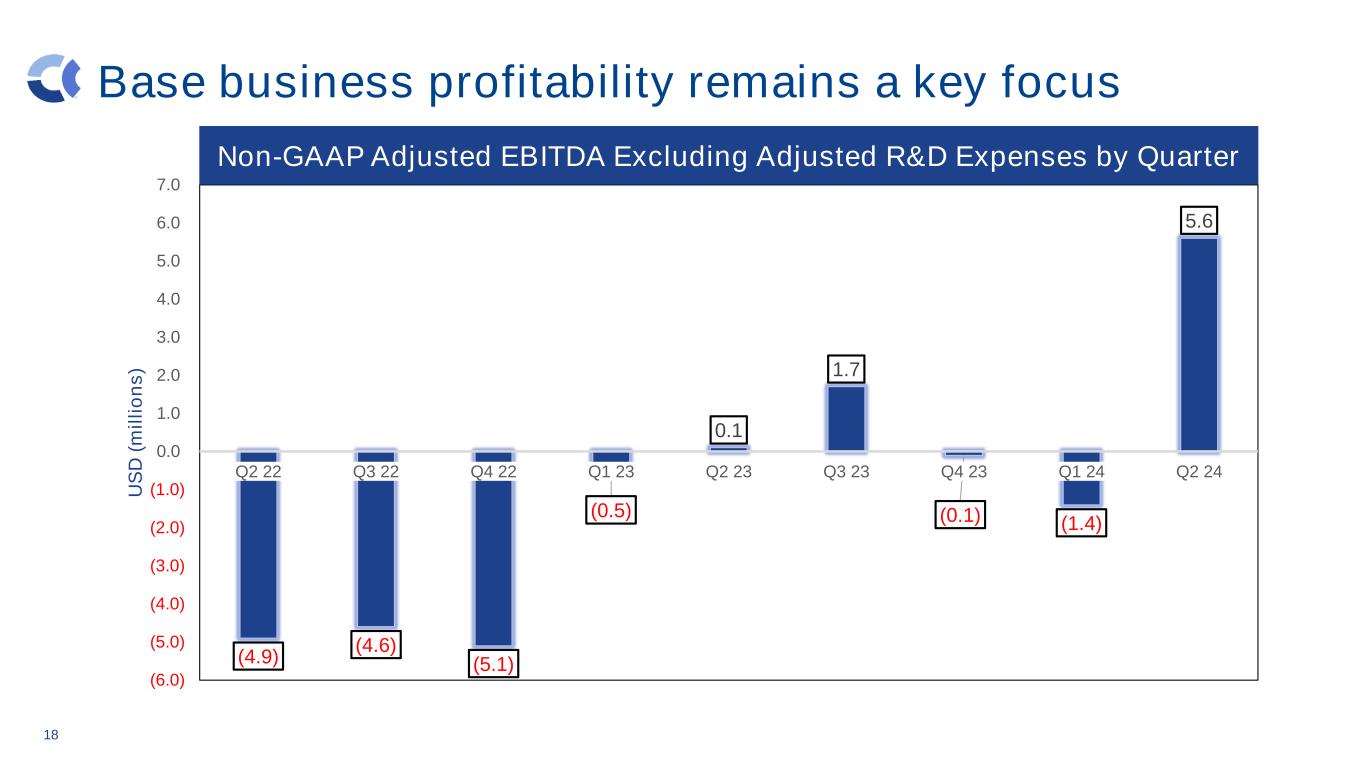

Base business profitability remains a key focus 18 (4.9) (4.6) (5.1) (0.5) 0.1 1.7 (0.1) (1.4) 5.6 (6.0) (5.0) (4.0) (3.0) (2.0) (1.0) 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 U S D ( m il li o n s ) Non-GAAP Adjusted EBITDA Excluding Adjusted R&D Expenses by Quarter

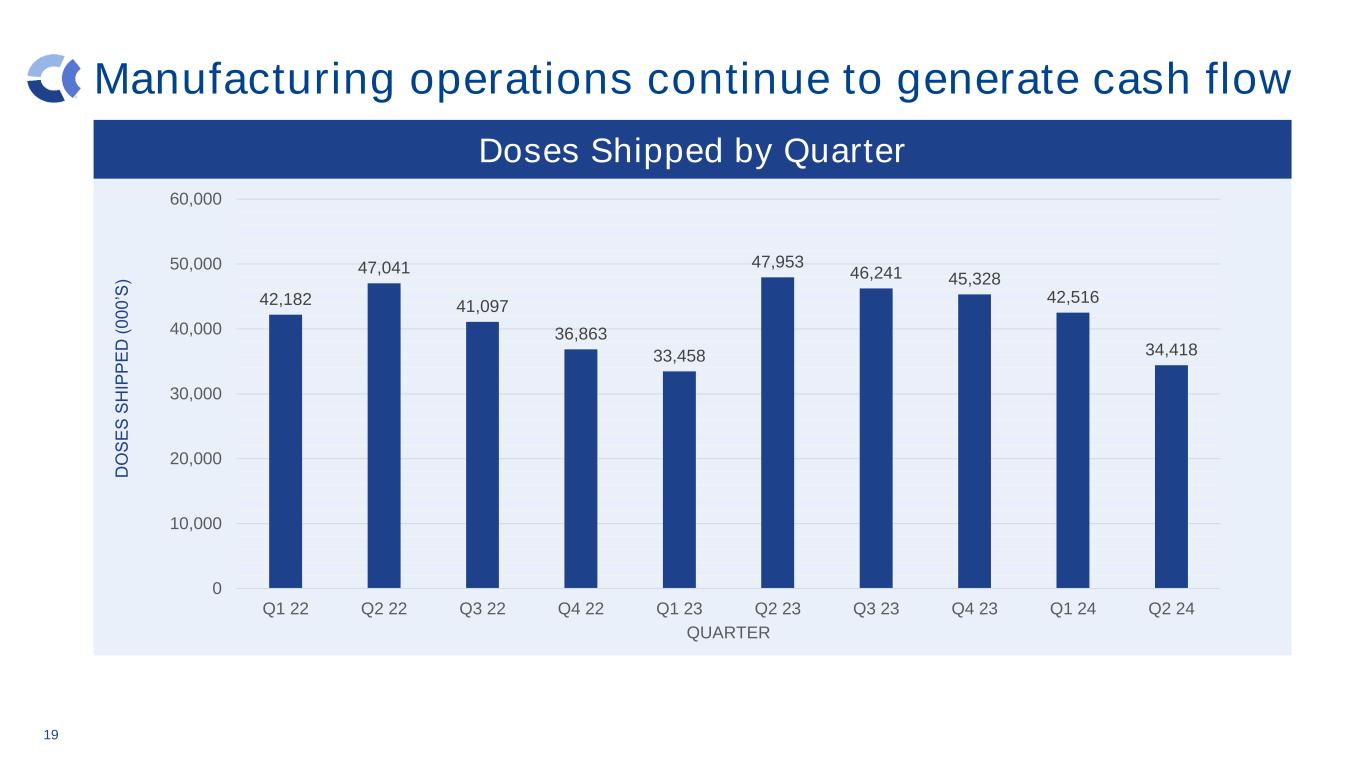

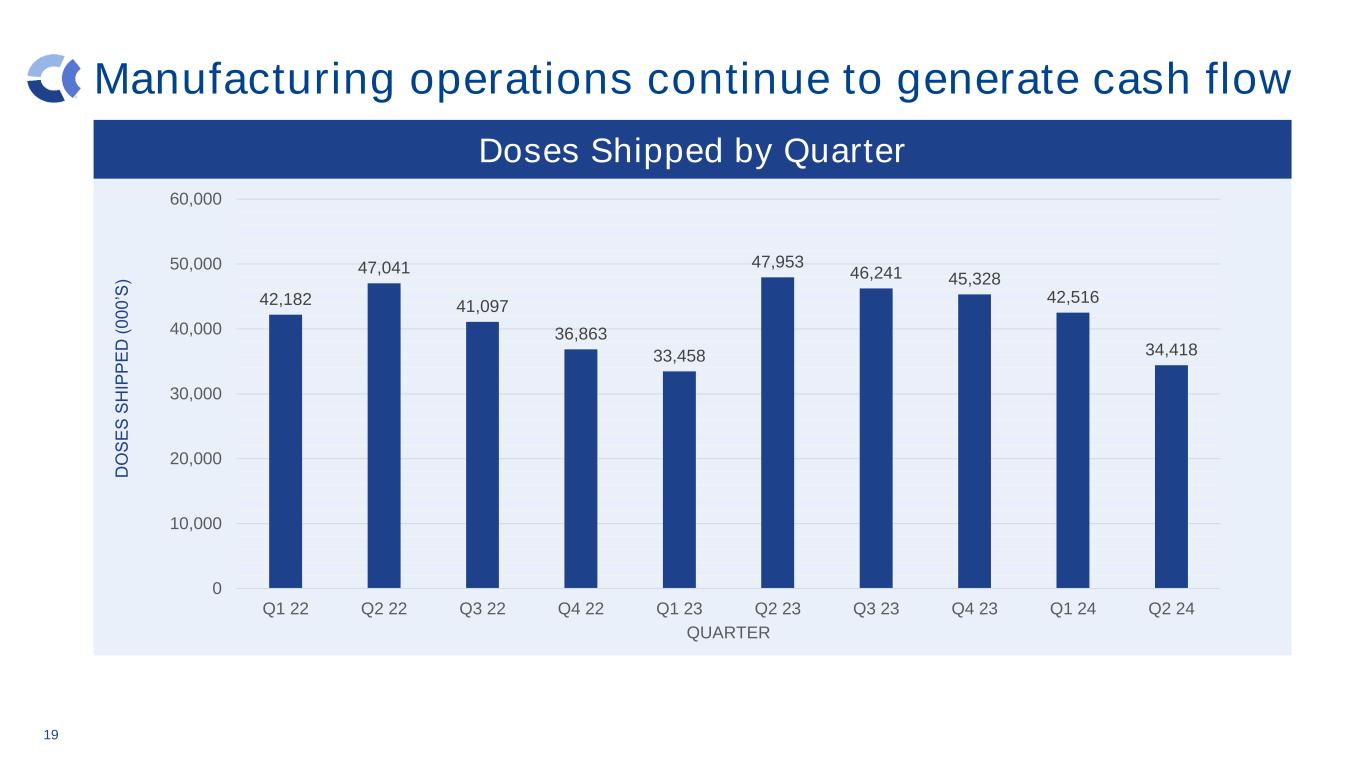

Manufacturing operations continue to generate cash flow 19 42,182 47,041 41,097 36,863 33,458 47,953 46,241 45,328 42,516 34,418 0 10,000 20,000 30,000 40,000 50,000 60,000 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 D O S E S S H IP P E D ( 0 0 0 ’S ) QUARTER Doses Shipped by Quarter

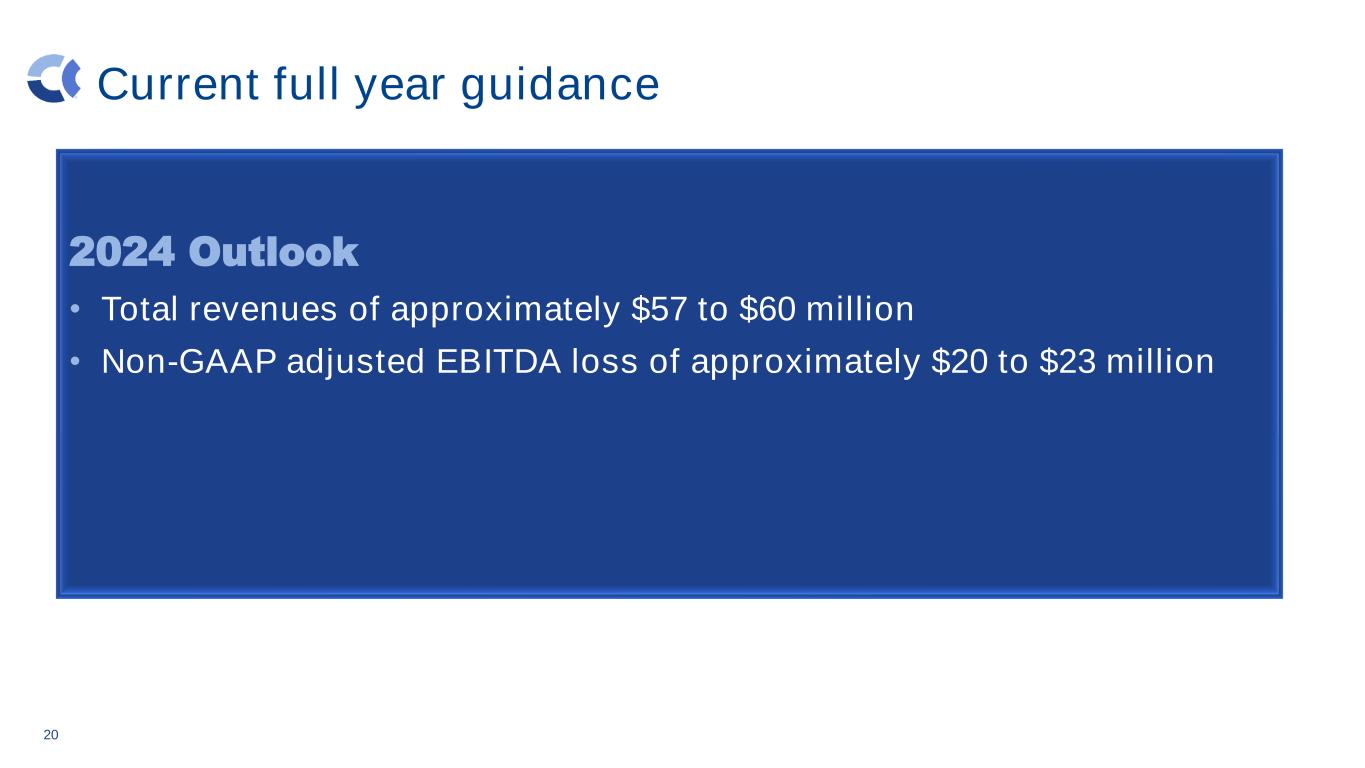

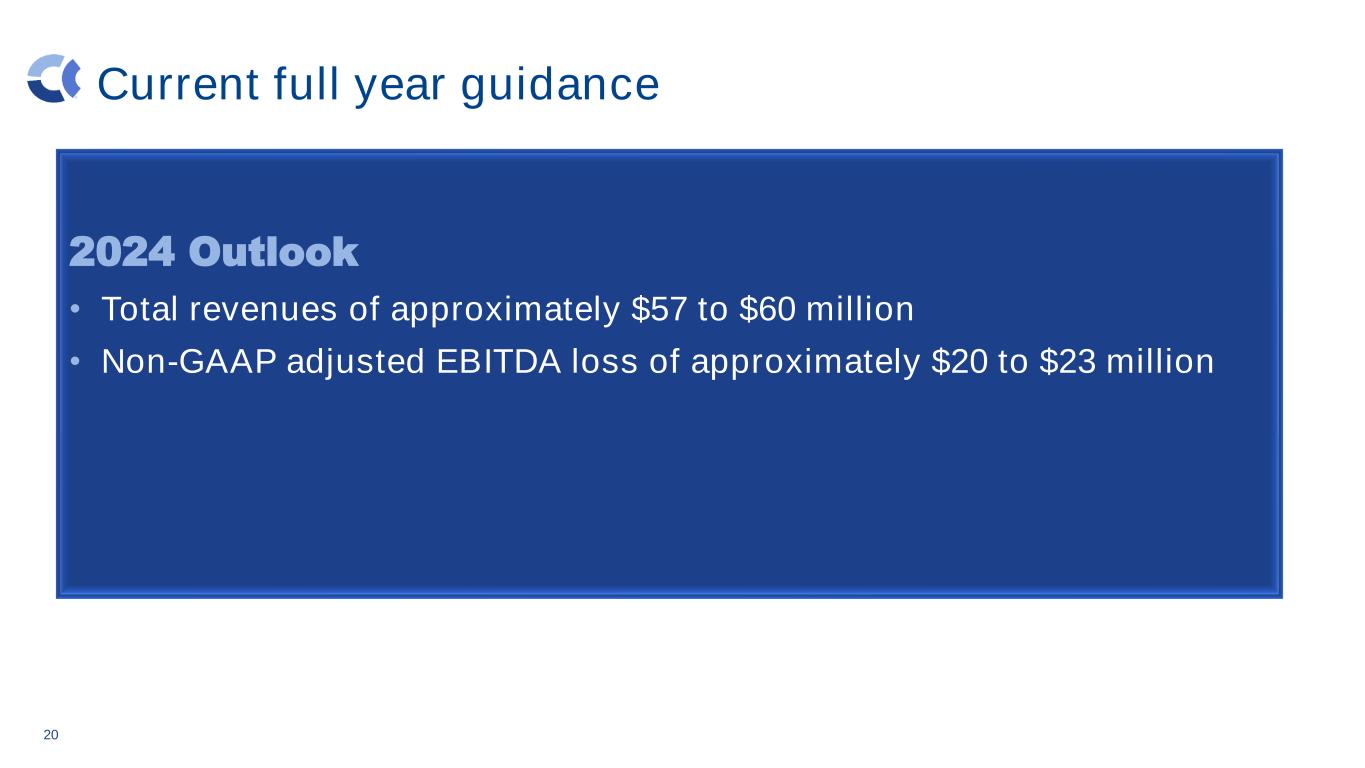

Current full year guidance 20 2024 Outlook • Total revenues of approximately $57 to $60 million • Non-GAAP adjusted EBITDA loss of approximately $20 to $23 million

Advancing medicines. Solving problems. Improving lives. Thank You 21