September 30, 2009

Supplement

SUPPLEMENT DATED SEPTEMBER 30, 2009 TO THE PROSPECTUS OF

MORGAN STANLEY NATURAL RESOURCE DEVELOPMENT SECURITIES INC.

Dated June 30, 2009

On September 24, 2009, the Board of Directors (the "Board") of Morgan Stanley Natural Resource Development Securities Inc. (the "Fund") approved an Agreement and Plan of Reorganization by and between the Fund and Morgan Stanley Commodities Alpha Fund ("Commodities Alpha"), a series of Morgan Stanley Series Funds, pursuant to which substantially all of the assets of the Fund would be combined with those of Commodities Alpha and shareholders of the Fund would become shareholders of Commodities Alpha, receiving shares of Commodities Alpha equal to the value of their holdings in the Fund (the "Reorganization"). Each shareholder of the Fund will receive the Class of shares of Commodities Alpha that corresponds to the Class of shares of the Fund currently held by that shareholder. The Reorganization is subject to the approval of shareholders of the Fund at a special meeting of shareholders to be held during the first quarter of 2010. A proxy statement formally detailing the proposal, the reasons for the Reorganization and information concerning Commodities Alpha will be distributed to shareholders of the Fund during the fourth quarter of 2009. The Fund will be closed for purchases by new investors as of the close of business on October 9, 2009.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE.

NRESPT1

INVESTMENT MANAGEMENT

Morgan Stanley Natural Resource Development Securities Inc.

A mutual fund that seeks capital growth.

Prospectus

June 30, 2009

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Contents

The Fund

| Investment Objective | | | 1 | | |

|

| Principal Investment Strategies | | | 1 | | |

|

| Principal Risks | | | 2 | | |

|

| Past Performance | | | 5 | | |

|

| Fees and Expenses | | | 7 | | |

|

| Additional Investment Strategy Information | | | 9 | | |

|

| Additional Risk Information | | | 9 | | |

|

| Portfolio Holdings | | | 10 | | |

|

| Fund Management | | | 10 | | |

|

Shareholder Information

| Pricing Fund Shares | | | 12 | | |

|

| How to Buy Shares | | | 13 | | |

|

| How to Exchange Shares | | | 14 | | |

|

| How to Sell Shares | | | 16 | | |

|

| Distributions | | | 19 | | |

|

| Frequent Purchases and Redemptions of Fund Shares | | | 20 | | |

|

| Tax Consequences | | | 21 | | |

|

| Share Class Arrangements | | | 22 | | |

|

| Additional Information | | | 29 | | |

|

| Financial Highlights | | | 30 | | |

|

| Morgan Stanley Funds | | | Inside Back Cover | | |

|

This Prospectus contains important information about the Fund. Please read it carefully and keep it for future reference.

The Fund

Investment Objective

Morgan Stanley Natural Resource Development Securities Inc. seeks capital growth.

Morgan Stanley Natural Resource Development Securities Inc. seeks capital growth.

Principal Investment Strategies

Capital Growth

An investment objective having the goal of selecting securities with the potential to rise in price rather than pay out income.

The Fund will normally invest at least 80% of its assets in common stocks of domestic and foreign companies engaged in the natural resource and related businesses. These companies may be engaged in the exploration, development, production or distribution of natural resources, the development of energy-efficient technologies or in providing natural resource related supplies or services. A company will be considered engaged in the natural resource and related businesses if it derives at least 50% of its revenues from those businesses or it devotes at least 50% of its assets to activities in those businesses. The Fund's "Investment Adviser," Morgan Stanley Investment Advisors Inc., will seek to identify favorable industries within the natural resource and related business areas and will seek to invest in companies with attractive valuations or business prospects within those industries. In selecting securities to buy, hold or sell for the Fund, the Investment Adviser and/or "Sub-Adviser," Morgan Stanley Investment Management Limited, consider the fundamental and quantitative research of affiliated and unaffiliated research providers as well as their own research. The Investment Adviser and/or the Sub-Adviser use a proprietary, systematic investment process to incorporate this research in the construction of a portfolio that the Investment Adviser and/or the Sub-Adviser believe offers attractive capital growth with an acceptable level of risk. The Investment Adviser and/or the Sub-Adviser generally consider selling a portfolio holding when they determine that the holding no longer satisfies their investment criteria.

The Fund will normally invest at least 80% of its assets in common stocks of domestic and foreign companies engaged in the natural resource and related businesses. These companies may be engaged in the exploration, development, production or distribution of natural resources, the development of energy-efficient technologies or in providing natural resource related supplies or services. A company will be considered engaged in the natural resource and related businesses if it derives at least 50% of its revenues from those businesses or it devotes at least 50% of its assets to activities in those businesses. The Fund's "Investment Adviser," Morgan Stanley Investment Advisors Inc., will seek to identify favorable industries within the natural resource and related business areas and will seek to invest in companies with attractive valuations or business prospects within those industries. In selecting securities to buy, hold or sell for the Fund, the Investment Adviser and/or "Sub-Adviser," Morgan Stanley Investment Management Limited, consider the fundamental and quantitative research of affiliated and unaffiliated research providers as well as their own research. The Investment Adviser and/or the Sub-Adviser use a proprietary, systematic investment process to incorporate this research in the construction of a portfolio that the Investment Adviser and/or the Sub-Adviser believe offers attractive capital growth with an acceptable level of risk. The Investment Adviser and/or the Sub-Adviser generally consider selling a portfolio holding when they determine that the holding no longer satisfies their investment criteria.

The Investment Adviser and/or the Sub-Adviser invest in companies that they believe are responsive to domestic and world demand for natural resources and that engage in the development of natural resources. These companies include those that:

n own or process natural resources, such as precious metals, other minerals, chemicals, water, timberland, paper and forest products and other materials;

n own or produce sources of energy such as oil, natural gas, coal, uranium, geothermal, oil shale and biomass;

n participate in the exploration for and development of natural resource supplies from new and conventional sources;

n own or control oil, gas or other mineral leases, rights or royalty interests;

1

n provide natural resource transportation, distribution or processing services, such as refining and pipeline services;

n provide related services or supplies, such as drilling, well servicing, chemicals, parts and equipment; or

n contribute energy-efficient technologies, such as systems for energy conversion, conservation and pollution control.

The Fund's stock investments may include foreign securities (held either directly or in the form of depositary receipts). However, the Fund may only invest up to 25% of its net assets in foreign securities that are not listed in the United States on a national securities exchange or are not securities of Canadian issuers (of this 25%, up to 15% may be invested in emerging market securities).

The remaining 20% of the Fund's assets may be invested in the common stock of companies not engaged in the natural resource and related business areas, convertible securities, fixed-income securities and U.S. government securities.

Common stock is a share ownership or equity interest in a corporation. It may or may not pay dividends, as some companies reinvest all of their profits back into their businesses, while others pay out some of their profits to shareholders as dividends. A depositary receipt is generally issued by a bank or financial institution and represents an ownership interest in the common stock or other equity securities of a foreign company. A convertible security is a bond, debenture, note, preferred stock, right, warrant or other security that may be converted into or exchanged for a prescribed amount of common stock or other security of the same or a different issuer or into cash within a particular period of time at a specified price or formula. A convertible security generally entitles the holder to receive interest paid or accrued on debt securities or the dividend paid on preferred stock until the convertible security matures or is redeemed, converted or exchanged.

In pursuing the Fund's investment objective, the Investment Adviser and/or the Sub-Adviser have considerable leeway in deciding which investments they buy, hold or sell on a day-to-day basis and which trading strategies they use. For example, the Investment Adviser and/or the Sub-Adviser in their discretion may determine to use some permitted trading strategies while not using others.

Principal Risks

There is no assurance that the Fund will achieve its investment objective. The Fund's share price and return will fluctuate with changes in the market value of the Fund's portfolio securities. When you sell Fund shares, they may be worth less than what you paid for them and, accordingly, you can lose money investing in this Fund.

There is no assurance that the Fund will achieve its investment objective. The Fund's share price and return will fluctuate with changes in the market value of the Fund's portfolio securities. When you sell Fund shares, they may be worth less than what you paid for them and, accordingly, you can lose money investing in this Fund.

Common Stock. A principal risk of investing in the Fund is associated with its common stock investments. In general, stock values fluctuate in response to activities specific to the company as well as general market, economic and political conditions. Stock prices can fluctuate widely in response to these factors.

Convertible Securities. Investments in convertible securities subject the Fund to the risks associated with both fixed-income securities, including credit risk and interest rate risk, and common stocks. To the extent that a convertible security's investment value is greater than its conversion value, its price will be likely to increase when interest rates fall and decrease when interest rates rise. If the conversion value exceeds the investment value, the price of the convertible security will tend to fluctuate directly with the price of the underlying equity security. A portion of the Fund's

2

convertible securities investments may be rated below investment grade. Securities rated below investment grade are commonly known as "junk bonds" and have speculative characteristics.

Natural Resources. The Fund's investments in natural resource industries can be significantly affected by events relating to those industries, such as international political and economic developments, energy conservation, global warming, the success of exploration projects, tax and other government regulations, as well as other factors. The Fund's portfolio securities, and consequently the Fund's net asset value, may experience substantial price fluctuations as a result of these factors. Unlike most diversified mutual funds, the Fund is subject to the risks associated with concentrating its assets in a particular sector—natural resources. Thus, the Fund's overall portfolio may decline in value due to developments specific to this sector. Given the Fund's concentration policy, Fund shares should not be considered a complete investment program.

Foreign Securities. The Fund's investments in foreign securities involve risks that are in addition to the risks associated with domestic securities. One additional risk is currency risk. While the price of Fund shares is quoted in U.S. dollars, the Fund may convert U.S. dollars to a foreign market's local currency to purchase a security in that market. If the value of that local currency falls relative to the U.S. dollar, the U.S. dollar value of the foreign security will decrease. This is true even if the foreign security's local price remains unchanged.

Foreign securities also have risks related to economic and political developments abroad, including expropriations, confiscatory taxation, exchange control regulation, limitations on the use or transfer of Fund assets and any effects of foreign social, economic or political instability. Foreign companies, in general, are not subject to the regulatory requirements of U.S. companies and, as such, there may be less publicly available information about these companies. Moreover, foreign accounting, auditing and financial reporting standards generally are different from those applicable to U.S. companies. Finally, in the event of a default of any foreign debt obligations, it may be more difficult for the Fund to obtain or enforce a judgment against the issuers of the securities.

Securities of foreign issuers may be less liquid than comparable securities of U.S. issuers and, as such, their price changes may be more volatile. Furthermore, foreign exchanges and broker-dealers are generally subject to less government and exchange scrutiny and regulation than their U.S. counterparts. In addition, differences in clearance and settlement procedures in foreign markets may cause delays in settlement of the Fund's trades effected in those markets and could result in losses to the Fund due to subsequent declines in the value of the securities subject to the trades.

The foreign securities in which the Fund may invest may be issued by issuers located in emerging market or developing countries. Compared to the United States and other developed countries, emerging market or developing countries may have relatively unstable governments, economies based on only a few industries and securities markets that trade a small number of securities. Securities issued by companies located in these countries tend to be especially volatile and may be less liquid than securities traded in developed countries. In the past, securities in these countries have been characterized by greater potential loss than securities of companies located in developed countries.

Depositary receipts involve many of the same risks as those associated with direct investment in foreign securities. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities.

3

Non-Diversified Classification. The Fund is a "non-diversified" mutual fund and, as such, its investments are not required to meet certain diversification requirements under federal securities law. Compared with "diversified" funds, the Fund may invest a greater percentage of its assets in the securities of an individual corporation or governmental entity. Thus, the Fund's assets may be invested in fewer securities than other funds. A decline in the value of those investments would cause the Fund's overall value to decline to a greater degree.

Other Risks. The performance of the Fund also will depend on whether or not the Investment Adviser and/or the Sub-Adviser are successful in applying the Fund's investment strategies. The Fund is also subject to other risks from its permissible investments, including the risks associated with its investments in fixed-income securities. For more information about these risks, see the "Additional Risk Information" section.

Shares of the Fund are not bank deposits and are not guaranteed or insured by the FDIC or any other government agency.

4

Past Performance

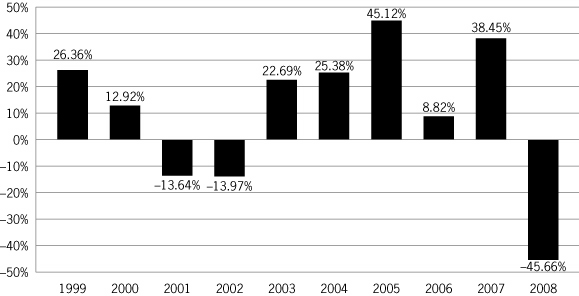

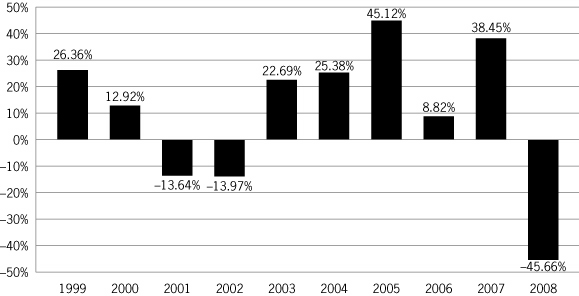

The bar chart and table below provide some indication of the risks of investing in the Fund. The Fund's past performance (before and after taxes) does not indicate how the Fund will perform in the future.

The bar chart and table below provide some indication of the risks of investing in the Fund. The Fund's past performance (before and after taxes) does not indicate how the Fund will perform in the future.

Annual Total Returns

This chart shows how the performance of the Fund's Class B shares has varied from year to year over the past 10 calendar years.

Annual Total Returns—Calendar Years

The bar chart reflects the performance of Class B shares; the performance of the other Classes will differ because the Classes have different ongoing fees. The performance information in the bar chart does not reflect the deduction of sales charges; if these amounts were reflected, returns would be less than shown. The year-to-date total return as of March 31, 2009 was –9.34%.

During the periods shown in the bar chart, the highest return for a calendar quarter was 25.05% (quarter ended September 30, 2005) and the lowest return for a calendar quarter was –35.40% (quarter ended September 30, 2008).

5

Average Annual Total Returns

This table compares the Fund's average annual total returns with those of indices that represent broad measures of market performance, as well as an index that represents a group of similar mutual funds, over time. The Fund's returns include the maximum applicable sales charge for each Class and assume you sold your shares at the end of each period (unless otherwise noted).

Average Annual Total Returns (as of December 31, 2008)

| | | Past 1 Year | | Past 5 Years | | Past 10 Years | |

| Class A—Return Before Taxes | | | –48.09 | % | | | 7.95 | % | | | 7.12 | % | |

| Class B—Returns Before Taxes | | | –47.49 | % | | | 8.11 | % | | | 7.00 | %** | |

| Returns After Taxes on Distributions1 | | | –50.30 | % | | | 5.55 | % | | | 5.82 | %** | |

Returns After Taxes on Distributions

and Sale of Fund Shares | | | –25.86 | % | | | 8.16 | % | | | 6.68 | %** | |

| Class C—Return Before Taxes | | | –45.93 | % | | | 8.33 | % | | | 6.86 | % | |

| Class I*—Return Before Taxes | | | –45.08 | % | | | 9.39 | % | | | 7.92 | % | |

S&P North American Natural

Resources Sector IndexTM2 | | | –42.55 | % | | | 8.96 | % | | | 8.37 | % | |

| S&P 500® Index3 | | | –37.00 | % | | | –2.19 | % | | | –1.38 | % | |

| Lipper Natural Resources Funds Index4 | | | –49.00 | % | | | 10.16 | % | | | 11.10 | % | |

* Effective March 31, 2008, Class D shares were renamed Class I shares.

** Effective April 2005, Class B shares will generally convert to Class A shares approximately eight years after the end of the calendar month in which the shares were purchased. The "Past 10 Years" performance for Class B shares reflects this conversion.

(1) These returns do not reflect any tax consequences from a sale of your shares at the end of each period, but they do reflect any applicable sales charges on such a sale.

(2) The S&P North American Natural Resources Sector IndexTM is a market capitalization-weighted index of stocks designed to measure the performance of companies in the natural resources sector. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(3) The Standard & Poor's 500® Index (S&P 500®) measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(4) The Lipper Natural Resources Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Natural Resources Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 10 funds represented in this Index.

Included in the table above are the after-tax returns for the Fund's Class B shares. The after-tax returns for the Fund's other Classes will vary from the Class B shares' returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period shown and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns may be higher than before-tax returns due to foreign tax credits and/or an assumed benefit from capital losses that would have been realized had Fund shares been sold at the end of the relevant periods, as applicable.

6

Fees and Expenses

The table below briefly describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The Fund offers four Classes of shares: Classes A, B, C and I. Each Class has a different combination of fees, expenses and other features, which should be considered in selecting a Class of shares. The Fund does not charge account or exchange fees. However, certain shareholders may be charged an order processing fee by the broker-dealer through which shares are purchased, as described below. See the "Share Class Arrangements" section for further fee and expense information.

The table below briefly describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The Fund offers four Classes of shares: Classes A, B, C and I. Each Class has a different combination of fees, expenses and other features, which should be considered in selecting a Class of shares. The Fund does not charge account or exchange fees. However, certain shareholders may be charged an order processing fee by the broker-dealer through which shares are purchased, as described below. See the "Share Class Arrangements" section for further fee and expense information.

Shareholder Fees

These fees are paid directly from your investment.

Shareholder Fees

| | | Class A | | Class B | | Class C | | Class I | |

Maximum sales charge (load) imposed on

purchases (as a percentage of offering price) | |

5.25%1 | |

None | |

None | |

None | |

Maximum deferred sales charge (load) (as a

percentage based on the lesser of the offering

price or net asset value at redemption) | |

None2 | |

5.00%3 | |

1.00%4 | |

None | |

Annual Fund Operating Expenses

These expenses are deducted from the Fund's assets and are based on expenses paid for the fiscal year ended February 28, 2009.

Annual Fund Operating Expenses

| | | Class A | | Class B | | Class C | | Class I | |

| Advisory fee | | 0.54% | | 0.54% | | 0.54% | | 0.54% | |

| Distribution and service (12b-1) fees5 | | 0.25% | | 1.00% | | 1.00% | | 0.00% | |

| Other expenses | | 0.37% | | 0.37% | | 0.37% | | 0.37% | |

| Total annual Fund operating expenses6 | | 1.16%7 | | 1.91%7 | | 1.91%7 | | 0.91%7 | |

7

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Fund, your investment has a 5% return each year, and the Fund's operating expenses remain the same (except for the ten-year amounts for Class B shares which reflect the conversion to Class A shares eight years after the end of the calendar month in which shares were purchased). Although your actual costs may be higher or lower, the tables below show your costs at the end of each period based on these assumptions, depending upon whether or not you sell your shares at the end of each period.

| | | If You SOLD Your Shares: | | If You HELD Your Shares: | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

| Class A | | $ | 637 | | | $ | 874 | | | $ | 1,130 | | | $ | 1,860 | | | $ | 637 | | | $ | 874 | | | $ | 1,130 | | | $ | 1,860 | | |

| Class B | | $ | 694 | | | $ | 900 | | | $ | 1,232 | | | $ | 2,038 | * | | $ | 194 | | | $ | 600 | | | $ | 1,032 | | | $ | 2,038 | * | |

| Class C | | $ | 294 | | | $ | 600 | | | $ | 1,032 | | | $ | 2,233 | | | $ | 194 | | | $ | 600 | | | $ | 1,032 | | | $ | 2,233 | | |

| Class I | | $ | 93 | | | $ | 290 | | | $ | 504 | | | $ | 1,120 | | | $ | 93 | | | $ | 290 | | | $ | 504 | | | $ | 1,120 | | |

* Based on conversion to Class A shares eight years after the end of the calendar month in which the shares were purchased.

(1) Reduced for purchases of $25,000 and over.

(2) Investments that are not subject to any sales charges at the time of purchase are subject to a contingent deferred sales charge ("CDSC") of 1.00% that will be imposed if you sell your shares within 18 months after purchase, except for certain specific circumstances.

(3) The CDSC is scaled down to 1.00% during the sixth year, reaching zero thereafter. See "Share Class Arrangements" for a complete discussion of the CDSC.

(4) Only applicable if you sell your shares within one year after purchase.

(5) The Fund has adopted a Rule 12b-1 Distribution Plan pursuant to which it reimburses the distributor for distribution-related expenses (including personal services to shareholders) incurred on behalf of Class A, Class B and Class C shares in an amount each month up to an annual rate of 0.25%, 1.00% and 1.00% of the average daily net assets of Class A, Class B and Class C shares, respectively.

(6) The total annual Fund operating expenses listed above are based on the average net assets of the Fund as of its fiscal year ended February 28, 2009. To the extent that the Fund's average net assets decrease over the Fund's next fiscal year, such expenses can be expected to increase, potentially significantly, because certain fixed costs will be spread over a smaller amount of assets.

(7) The total annual Fund operating expenses disclosed above do not include a rebate of certain Fund expenses in connection with investments in Morgan Stanley Institutional Liquidity Funds-Money Market Portfolio-Institutional Class during the period ended February 28, 2009, which had a net effect on the Fund's total annual operating expenses of 0.01%. Taking into account this rebate of 0.01%, the Fund's total annual operating expenses for Class A, Class B, Class C and Class I shares would have been 1.15%, 1.90%, 1.90% and 0.90% respectively, for the fiscal year ended February 28, 2009.

While Class B and Class C shares do not have any front-end sales charges, their higher ongoing annual expenses (due to higher 12b-1 fees) mean that over time you could end up paying more for these shares than if you were to pay front-end sales charges for Class A shares.

Order Processing Fees. Your financial intermediary may charge processing or other fees in connection with the purchase or sale of the Fund's shares. For example, client accounts held through the Morgan Stanley channel of Morgan Stanley Smith Barney LLC ("Morgan Stanley Smith Barney") are charged an order processing fee of $5.25 (except in certain circumstances, including, but not limited to, activity in fee-based accounts, exchanges, dividend reinvestments and systematic investment and withdrawal plans) when a client buys or redeems shares of the Fund. Please consult your financial representative for more information regarding any such fees.

8

Additional Investment Strategy Information

This section provides additional information relating to the Fund's investment strategies.

This section provides additional information relating to the Fund's investment strategies.

Other Investments. The Fund may invest up to 20% of its assets in common stocks of companies not engaged in the natural resource and related business areas, investment grade corporate debt securities and U.S. government securities. The Fund's fixed-income investments may include zero coupon securities, which are purchased at a discount and generally accrue interest but make no payments until maturity.

Defensive Investing. The Fund may take temporary "defensive" positions in attempting to respond to adverse market conditions. The Fund may invest any amount of its assets in cash or money market instruments in a defensive posture that may be inconsistent with the Fund's principal investment strategies when the Investment Adviser believes it is advisable to do so.

Although taking a defensive posture is designed to protect the Fund from an anticipated market downturn, it could have the effect of reducing the benefit from any upswing in the market. When the Fund takes a defensive position, it may not achieve its investment objective.

Portfolio Turnover. The Fund may engage in active and frequent trading of its portfolio securities. The Financial Highlights Table at the end of this Prospectus shows the Fund's portfolio turnover rates during recent fiscal years. A portfolio turnover rate of 200%, for example, is equivalent to the Fund buying and selling all of its securities two times during the course of the year. A high portfolio turnover rate (over 100%) could result in high brokerage costs and an increase in taxable capital gains distributions to the shareholders. See the sections on "Distributions" and "Tax Consequences."

* * *

The percentage limitations relating to the composition of the Fund's portfolio apply at the time the Fund acquires an investment. Subsequent percentage changes that result from market fluctuations generally will not require the Fund to sell any portfolio security. However, the Fund may be required to sell its illiquid securities holdings, or reduce its borrowings, if any, in response to fluctuations in the value of such holdings. The Fund may change its principal investment strategies without shareholder approval; however, you would be notified of any changes.

Additional Risk Information

This section provides additional information relating to the risks of investing in the Fund.

This section provides additional information relating to the risks of investing in the Fund.

Fixed-Income Securities. All fixed-income securities are subject to two types of risk: credit risk and interest rate risk. Credit risk refers to the possibility that the issuer of a security will be unable to make interest payments and/or repay the principal on its debt. Interest rate risk refers to fluctuations in the value of a fixed-income security resulting from changes in the general level of interest rates. When the general level of interest rates goes up, the prices of most fixed-income securities go down. When the general level of interest rates goes down, the prices of most fixed-income

9

securities go up. (Zero coupon securities are typically subject to greater price fluctuations than comparable securities that pay interest.)

Portfolio Holdings

A description of the Fund's policies and procedures with respect to the disclosure of the Fund's portfolio securities is available in the Fund's Statement of Additional Information ("SAI").

A description of the Fund's policies and procedures with respect to the disclosure of the Fund's portfolio securities is available in the Fund's Statement of Additional Information ("SAI").

Fund Management

Morgan Stanley Investment Advisors Inc.

The Investment Adviser, together with its affiliated asset management companies, had approximately $351 billion in assets under management or supervision as of March 31, 2009.

The Fund has retained the Investment Adviser—Morgan Stanley Investment Advisors Inc.—to provide investment advisory services. The Investment Adviser is a wholly-owned subsidiary of Morgan Stanley, a preeminent global financial services firm engaged in securities trading and brokerage activities, as well as providing investment banking, research and analysis, financing and financial advisory services. The Investment Adviser's address is 522 Fifth Avenue, New York, New York 10036.

The Fund has retained the Investment Adviser—Morgan Stanley Investment Advisors Inc.—to provide investment advisory services. The Investment Adviser is a wholly-owned subsidiary of Morgan Stanley, a preeminent global financial services firm engaged in securities trading and brokerage activities, as well as providing investment banking, research and analysis, financing and financial advisory services. The Investment Adviser's address is 522 Fifth Avenue, New York, New York 10036.

The Investment Adviser has entered into a sub-advisory agreement with Morgan Stanley Investment Management Limited, located at 25 Cabot Square, Canary Wharf, London, E14 QA, England. The Sub-Adviser is a wholly owned subsidiary of Morgan Stanley. The Sub-Adviser provides the Fund with investment advisory services subject to the overall supervision of the Investment Adviser and the Fund's Officers and Directors. The Investment Adviser pays the Sub-Adviser on a monthly basis a portion of the net advisory fees the Investment Adviser receives from the Fund.

The Fund is managed within the Quantitative and Structured Solutions team. The team consists of portfolio managers and analysts. Current members of the team jointly and primarily responsible for the day-to-day management of the Fund's portfolio are Michael Nolan, a Managing Director of the Investment Adviser, Helen Krause, an Executive Director of the Sub-Adviser, Arthur Robb, an Executive Director of the Investment Adviser, and Neil Chakraborty, an Executive Director of the Sub-Adviser.

Mr. Nolan has been associated with the Investment Adviser in an investment management capacity since November 2005 and began managing the Fund in November 2008. Prior to November 2005, Mr. Nolan was part of Morgan Stanley's institutional securities group in London where he worked on a variety of structured products. Ms. Krause has been associated with the Sub-Adviser in an investment management capacity since April 2008 and began managing the Fund in November 2008. Prior to April 2008, Ms. Krause was a quantitative equity portfolio manager and senior quantitative researcher on the active equity team at Barclays Global Investors. Mr. Robb has been associated with the Investment Adviser in an investment management capacity since July 2007 and began managing the Fund in November 2008. Prior to July 2007, Mr. Robb was a vice president of financial modeling at CIFG and vice president of analytics at Integrated Finance. Mr. Chakraborty has been associated with the Sub-Adviser in an investment management capacity since October 2006

10

and began managing the Fund in November 2008. Prior to October 2006, Mr. Chakraborty was a quantitative analyst on the hedge fund team of Credit Suisse.

Mr. Nolan is the lead portfolio manager of the Fund. Ms. Krause, Mr. Robb and Mr. Charkraborty are co-portfolio managers of the Fund. Members of the team collaborate to manage the assets of the Fund.

The Fund's SAI provides additional information about the portfolio managers' compensation structure, other accounts managed by the portfolio managers and the portfolio managers' ownership of securities in the Fund.

The composition of the team may change from time to time.

The Fund pays the Investment Adviser a monthly advisory fee as full compensation for the services and facilities furnished to the Fund, and for Fund expenses assumed by the Investment Adviser. The fee is based on the Fund's average daily net assets. For the fiscal year ended February 28, 2009, the Fund accrued total compensation to the Investment Adviser amounting to 0.54% of the Fund's average daily net assets.

A discussion regarding the Board of Directors' approval of the investment advisory agreement is available in the Fund's semiannual report to shareholders for the period ended August 31, 2008. A discussion regarding the Board of Directors' approval of the sub-advisory agreement will be available in the Fund's semiannual report to shareholders for the period ending August 31, 2009.

11

Shareholder Information

Pricing Fund Shares

The price of Fund shares (excluding sales charges), called "net asset value," is based on the value of the Fund's portfolio securities. While the assets of each Class are invested in a single portfolio of securities, the net asset value of each Class will differ because the Classes have different ongoing distribution fees.

The price of Fund shares (excluding sales charges), called "net asset value," is based on the value of the Fund's portfolio securities. While the assets of each Class are invested in a single portfolio of securities, the net asset value of each Class will differ because the Classes have different ongoing distribution fees.

The net asset value per share of the Fund is determined once daily at 4:00 p.m. Eastern time on each day that the New York Stock Exchange ("NYSE") is open (or, on days when the NYSE closes prior to 4:00 p.m., at such earlier time). Shares will not be priced on days that the NYSE is closed.

The value of the Fund's portfolio securities is based on the securities' market price when available. When a market price is not readily available, including circumstances under which the Investment Adviser and/or the Sub-Adviser determine that a security's market price is not accurate, a portfolio security is valued at its fair value, as determined under procedures established by the Fund's Board of Directors.

In addition, with respect to securities that primarily are listed on foreign exchanges, when an event occurs after the close of such exchanges that is likely to have changed the value of the securities (for example, a percentage change in value of one or more U.S. securities indices in excess of specified thresholds), such securities will be valued at their fair value, as determined under procedures established by the Fund's Board of Directors. Securities also may be fair valued in the event of a significant development affecting the country or region or an issuer-specific development which is likely to have changed the value of the security.

In these cases, the Fund's net asset value will reflect certain portfolio securities' fair value rather than their market price. Fair value pricing involves subjective judgment and it is possible that the fair value determined for a security is materially different than the value that could be realized upon the sale of that security. With respect to securities that are primarily listed on foreign exchanges, the value of the Fund's portfolio securities may change on days when you will not be able to purchase or sell your shares.

To the extent the Fund invests in open-end management companies that are registered under the Investment Company Act of 1940, as amended ("Investment Company Act"), the Fund's net asset value is calculated based upon the net asset value of such funds. The prospectuses for such funds explain the circumstances under which they will use fair value pricing and its effects.

An exception to the Fund's general policy of using market prices concerns its short-term debt portfolio securities. Debt securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost. However, if the cost does not reflect the securities' market value, these securities will be valued at their fair value.

12

Contacting a Financial Advisor

If you are new to the Morgan Stanley Funds and would like to contact a Morgan Stanley Smith Barney Financial Advisor, call toll-free 1-866-MORGAN8 for the telephone number of the Morgan Stanley office nearest you. You may also access our office locator on our Internet site at: www.morganstanley.com/im

How to Buy Shares

You may open a new account to buy Fund shares or buy additional Fund shares for an existing account by contacting your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative. Your Financial Advisor will assist you, step-by-step, with the procedures to invest in the Fund. The Fund's transfer agent, Morgan Stanley Trust ("Transfer Agent"), in its sole discretion, may allow you to purchase shares directly by calling and requesting an application.

You may open a new account to buy Fund shares or buy additional Fund shares for an existing account by contacting your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative. Your Financial Advisor will assist you, step-by-step, with the procedures to invest in the Fund. The Fund's transfer agent, Morgan Stanley Trust ("Transfer Agent"), in its sole discretion, may allow you to purchase shares directly by calling and requesting an application.

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account. What this means to you: when you open an account, we will ask your name, address, date of birth and other information that will allow us to identify you. If we are unable to verify your identity, we reserve the right to restrict additional transactions and/or liquidate your account at the next calculated net asset value after your account is closed (less any applicable sales/account charges and/or tax penalties) or take any other action required by law. In accordance with federal law requirements, the Fund has implemented an anti-money laundering compliance program, which includes the designation of an anti-money laundering compliance officer.

Because every investor has different immediate financial needs and long-term investment goals, the Fund offers investors four Classes of shares: Classes A, B, C and I. Class I shares are only offered to a limited group of investors. Each Class of shares offers a distinct structure of sales charges, distribution and service fees, and other features that are designed to address a variety of needs. Your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative can help you decide which Class may be most appropriate for you. When purchasing Fund shares, you must specify which Class of shares you wish to purchase.

When you buy Fund shares, the shares are purchased at the next share price calculated (plus any applicable front-end sales charge for Class A shares) after we receive your purchase order. Your payment is due on the third business day after you place your purchase order. We reserve the right to reject any order for the purchase of Fund shares for any reason.

Order Processing Fees. Your financial intermediary may charge processing or other fees in connection with the purchase or sale of the Fund's shares. For example, client accounts held through the Morgan Stanley channel of Morgan Stanley Smith Barney are charged an order processing fee of $5.25 (except in certain circumstances, including, but not limited to, activity in fee-based accounts, exchanges, dividend reinvestments and systematic investment and withdrawal plans) when a client buys or redeems shares of the Fund. Please consult your financial representative for more information regarding any such fees.

13

EasyInvest®

A purchase plan that allows you to transfer money automatically from your checking or savings account or from a Money Market Fund on a semi-monthly, monthly or quarterly basis. Contact your Morgan Stanley Smith Barney Financial Advisor for further information about this service.

Minimum Investment Amounts

| | | Minimum Investment | |

| Investment Options | | Initial | | Additional | |

| Regular Account | | $ | 1,000 | | | $ | 100 | | |

| Individual Retirement Account | | $ | 1,000 | | | $ | 100 | | |

| Coverdell Education Savings Account | | $ | 500 | | | $ | 100 | | |

EasyInvest®

(Automatically from your checking or savings account or Money Market Fund) | | $ | 100 | * | | $ | 100 | * | |

* Provided your schedule of investments totals $1,000 in 12 months.

There is no minimum investment amount if you purchase Fund shares through: (1) the Investment Adviser's mutual fund asset allocation program; (2) a program, approved by the Fund's distributor, in which you pay an asset-based fee for advisory, administrative and/or brokerage services; (3) the following programs approved by the Fund's distributor: (i) qualified state tuition plans described in Section 529 of the Internal Revenue Code or (ii) certain other investment programs that do not charge an asset-based fee; (4) employer-sponsored employee benefit plan accounts; (5) certain deferred compensation programs established by the Investment Adviser or its affiliates for their employees or the Fund's Directors; or (6) the reinvestment of dividends in additional Fund shares.

Investment Options for Certain Institutional and Other Investors/Class I Shares. To be eligible to purchase Class I shares, you must qualify under one of the investor categories specified in the "Share Class Arrangements" section of this Prospectus.

Subsequent Investments Sent Directly to the Fund. In addition to buying additional Fund shares for an existing account by contacting your Morgan Stanley Smith Barney Financial Advisor, you may send a check directly to the Fund. To buy additional shares in this manner:

n Write a "letter of instruction" to the Fund specifying the name(s) on the account, the account number, the social security or tax identification number, the Class of shares you wish to purchase and the investment amount (which would include any applicable front-end sales charge). The letter must be signed by the account owner(s).

n Make out a check for the total amount payable to: Morgan Stanley Natural Resource Development Securities Inc.

n Mail the letter and check to Morgan Stanley Trust at P.O. Box 219885, Kansas City, MO 64121-9885.

How to Exchange Shares

Permissible Fund Exchanges. You may exchange shares of any Class of the Fund for the same Class of any other continuously offered Multi-Class Fund, or for shares of a Money Market Fund or the Limited Duration U.S. Government Trust, without the imposition of an exchange fee. In addition, Class Q shares of Morgan Stanley Global Infrastructure Fund may be exchanged for Class A shares of the Fund without payment of sales charges (including contingent

Permissible Fund Exchanges. You may exchange shares of any Class of the Fund for the same Class of any other continuously offered Multi-Class Fund, or for shares of a Money Market Fund or the Limited Duration U.S. Government Trust, without the imposition of an exchange fee. In addition, Class Q shares of Morgan Stanley Global Infrastructure Fund may be exchanged for Class A shares of the Fund without payment of sales charges (including contingent

14

deferred sales charges ("CDSCs")) or the imposition of an exchange fee. Front-end sales charges are not imposed on exchanges of Class A shares. See the inside back cover of this Prospectus for each Morgan Stanley Fund's designation as a Multi-Class Fund or Money Market Fund. If a Morgan Stanley Fund is not listed, consult the inside back cover of that fund's current prospectus for its designation.

The current prospectus for each Morgan Stanley Fund describes its investment objective(s), policies and investment minimums, and should be read before investment. Since exchanges are available only into continuously offered Morgan Stanley Funds, exchanges are not available into Morgan Stanley Funds that are not currently being offered for purchase.

Exchange Procedures. You can process an exchange by contacting your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative. You may also write the Transfer Agent or call toll-free (800) 869-NEWS, our automated telephone system (which is generally accessible 24 hours a day, seven days a week), to place an exchange order. You automatically have the telephone exchange privilege unless you indicate otherwise by checking the applicable box on the new account application form. If you hold share certificates, no exchanges may be processed until we have received all applicable share certificates.

Exchange requests received on a business day prior to the time shares of the funds involved in the request are priced will be processed on the date of receipt. "Processing" a request means that shares of the fund which you are exchanging will be redeemed at the net asset value per share next determined on the date of receipt. Shares of the fund that you are purchasing will also normally be purchased at the net asset value per share, plus any applicable sales charge, next determined on the date of receipt. Exchange requests received on a business day after the time that shares of the funds involved in the request are priced will be processed on the next business day in the manner described herein.

The Fund may terminate or revise the exchange privilege upon required notice or in certain cases without notice. See "Limitations on Exchanges." The check writing privilege is not available for Money Market Fund shares you acquire in an exchange.

Telephone Exchanges. Morgan Stanley and its subsidiaries, including the Transfer Agent, and the Fund employ procedures considered by them to be reasonable to confirm that instructions communicated by telephone are genuine. Such procedures may include requiring certain personal identification information prior to acting upon telephone instructions, tape-recording telephone communications and providing written confirmation of instructions communicated by telephone. If reasonable procedures are employed, none of Morgan Stanley, the Transfer Agent or the Fund will be liable for following telephone instructions which it reasonably believes to be genuine. Telephone exchanges may not be available if you cannot reach the Transfer Agent by telephone, whether because all telephone lines are busy or for any other reason; in such case, a shareholder would have to use the Fund's other exchange procedures described in this section.

Telephone instructions will be accepted if received by the Transfer Agent between 9:00 a.m. and 4:00 p.m. Eastern time on any day the NYSE is open for business. During periods of drastic economic or market changes, it is possible that the telephone exchange procedures may be difficult to implement, although this has not been the case with the Fund in the past.

Margin Accounts. If you have pledged your Fund shares in a margin account, contact your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative regarding restrictions on the exchange of such shares.

15

Tax Considerations of Exchanges. If you exchange shares of the Fund for shares of another Morgan Stanley Fund, there are important tax considerations. For tax purposes, the exchange out of the Fund is considered a sale of Fund shares and the exchange into the other fund is considered a purchase. As a result, you may realize a capital gain or loss.

You should review the "Tax Consequences" section and consult your own tax professional about the tax consequences of an exchange.

Limitations on Exchanges. Certain patterns of past exchanges and/or purchase or sale transactions involving the Fund or other Morgan Stanley Funds may result in the Fund rejecting, limiting or prohibiting, at its sole discretion, and without prior notice, additional purchases and/or exchanges and may result in a shareholder's account being closed. Determinations in this regard may be made based on the frequency or dollar amount of the previous exchanges or purchase or sale transactions. The Fund reserves the right to reject an exchange request for any reason.

CDSC Calculations on Exchanges. See the "Share Class Arrangements" section of this Prospectus for a discussion of how applicable CDSCs are calculated for shares of one Morgan Stanley Fund that are exchanged for shares of another.

For further information regarding exchange privileges, you should contact your Morgan Stanley Smith Barney Financial Advisor or call toll-free (800) 869-NEWS.

How to Sell Shares

You can sell some or all of your Fund shares at any time. If you sell Class A, Class B or Class C shares, your net sale proceeds are reduced by the amount of any applicable CDSC. Your shares will be sold at the next price calculated after we receive your order to sell as described below.

You can sell some or all of your Fund shares at any time. If you sell Class A, Class B or Class C shares, your net sale proceeds are reduced by the amount of any applicable CDSC. Your shares will be sold at the next price calculated after we receive your order to sell as described below.

| Options | | Procedures | |

| Contact Your Financial Advisor | | To sell your shares, simply call your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative. Payment will be sent to the address to which the account is registered or deposited in your brokerage account. | |

|

| By Telephone | | You can sell your shares by telephone and have the proceeds sent to the address of record or your bank account on record. You automatically have the telephone redemption privilege unless you indicate otherwise by checking the applicable box on the new account application form.

Before processing a telephone redemption, keep the following information in mind:

n You can establish this option at the time you open the account by completing the Morgan Stanley Funds New Account Application or subsequently by calling toll-free (800) 869-NEWS.

n Call toll-free (800) 869-NEWS to process a telephone redemption using our automated telephone system which is generally accessible 24 hours a day, seven days a week.

n Your request must be received prior to market close, generally 4:00 p.m. Eastern time.

n If your account has multiple owners, the Transfer Agent may rely on the instructions of any one owner. | |

|

16

| Options | | Procedures | |

By Telephone

(continued) | | n Proceeds must be made payable to the name(s) and address in which the account is registered.

n You may redeem amounts of $50,000 or less daily if the proceeds are to be paid by check or by Automated Clearing House.

n This privilege is not available if the address on your account has changed within 15 calendar days prior to your telephone redemption request.

n Telephone redemption is available for most accounts other than accounts with shares represented by certificates.

If you request to sell shares that were recently purchased by check, the proceeds of that sale may not be sent to you until it has been verified that the check has cleared, which may take up to 15 calendar days from the date of purchase.

Morgan Stanley and its subsidiaries, including the Transfer Agent, employ procedures considered by them to be reasonable to confirm that instructions communicated by telephone are genuine. Such procedures may include requiring certain personal identification information prior to acting upon telephone instructions, tape-recording telephone communications and providing written confirmation of instructions communicated by telephone. If reasonable procedures are employed, neither Morgan Stanley nor the Transfer Agent will be liable for following telephone instructions which it reasonably believes to be genuine. Telephone redemptions may not be available if a shareholder cannot reach the Transfer Agent by telephone, whether because all telephone lines are busy or for any other reason; in such case, a shareholder would have to use the Fund's other redemption procedures described in this section. | |

|

| By Letter | | You can also sell your shares by writing a "letter of instruction" that includes:

n your account number;

n the name of the Fund;

n the dollar amount or the number of shares you wish to sell;

n the Class of shares you wish to sell; and

n the signature of each owner as it appears on the account.

If you are requesting payment to anyone other than the registered owner(s) or that payment be sent to any address other than the address of the registered owner(s) or pre-designated bank account, you will need a signature guarantee. You can obtain a signature guarantee from an eligible guarantor acceptable to the Transfer Agent. (You should contact the Transfer Agent toll-free at (800) 869-NEWS for a determination as to whether a particular institution is an eligible guarantor.) A notary public cannot provide a signature guarantee. Additional documentation may be required for shares held by a corporation, partnership, trustee or executor.

Mail the letter to Morgan Stanley Trust at P.O. Box 219886, Kansas City, MO 64121-9886. If you hold share certificates, you must return the certificates, along with the letter and any required additional documentation.

A check will be mailed to the name(s) and address in which the account is registered, or otherwise according to your instructions. | |

|

17

| Options | | Procedures | |

| Systematic Withdrawal Plan | | If your investment in all of the Morgan Stanley Funds has a total market value of at least $10,000, you may elect to withdraw amounts of $25 or more, or in any whole percentage of a fund's balance (provided the amount is at least $25), on a monthly, quarterly, semi-annual or annual basis, from any fund with a balance of at least $1,000. Each time you add a fund to the plan, you must meet the plan requirements.

Amounts withdrawn are subject to any applicable CDSC. A CDSC may be waived under certain circumstances. See the Class B waiver categories listed in the "Share Class Arrangements" section of this Prospectus.

To sign up for the systematic withdrawal plan, contact your Morgan Stanley Smith Barney Financial Advisor or call toll-free (800) 869-NEWS. You may terminate or suspend your plan at any time. Please remember that withdrawals from the plan are sales of shares, not Fund "distributions," and ultimately may exhaust your account balance. The Fund may terminate or revise the plan at any time. | |

|

Payment for Sold Shares. After we receive your complete instructions to sell as described above, a check will be mailed to you within seven days, although we will attempt to make payment within one business day. Payment may also be sent to your brokerage account.

Payment may be postponed or the right to sell your shares suspended under unusual circumstances. If you request to sell shares that were recently purchased by check, the proceeds of that sale may not be sent to you until it has been verified that the check has cleared, which may take up to 15 calendar days from the date of purchase.

Payments-in-Kind. If we determine that it is in the best interest of the Fund not to pay redemption proceeds in cash, we may pay you partly or entirely by distributing to you securities held by the Fund. Such in-kind securities may be illiquid and difficult or impossible for a shareholder to sell at a time and at a price that a shareholder would like. Redemptions paid in such securities generally will give rise to income, gain or loss for income tax purposes in the same manner as redemptions paid in cash. In addition, you may incur brokerage costs and a further gain or loss for income tax purposes when you ultimately sell the securities.

Order Processing Fees. Your financial intermediary may charge processing or other fees in connection with the purchase or sale of the Fund's shares. For example, client accounts held through the Morgan Stanley channel of Morgan Stanley Smith Barney are charged an order processing fee of $5.25 (except in certain circumstances, including, but not limited to, activity in fee-based accounts, exchanges, dividend reinvestments and systematic investment and withdrawal plans) when a client buys or redeems shares of the Fund. Please consult your financial representative for more information regarding any such fees.

Tax Considerations. Normally, your sale of Fund shares is subject to federal and state income tax. You should review the "Tax Consequences" section of this Prospectus and consult your own tax professional about the tax consequences of a sale.

18

Reinstatement Privilege. If you sell Fund shares and have not previously exercised the reinstatement privilege, you may, within 35 days after the date of sale, invest any portion of the proceeds in the same Class of Fund shares at their net asset value and receive a pro rata credit for any CDSC paid in connection with the sale.

Involuntary Sales. The Fund reserves the right, on 60 days' notice, to sell the shares of any shareholder (other than shares held in an individual retirement account ("IRA") or 403(b) Custodial Account) whose shares, due to sales by the shareholder, have a value below $100, or in the case of an account opened through EasyInvest®, if after 12 months the shareholder has invested less than $1,000 in the account.

However, before the Fund sells your shares in this manner, we will notify you and allow you 60 days to make an additional investment in an amount that will increase the value of your account to at least the required amount before the sale is processed. No CDSC will be imposed on any involuntary sale.

Margin Accounts. If you have pledged your Fund shares in a margin account, contact your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative regarding restrictions on the sale of such shares.

Distributions

Targeted

DividendsSM

You may select to have your Fund distributions automatically invested in other Classes of Fund shares or Classes of another Morgan Stanley Fund that you own. Contact your Morgan Stanley Smith Barney Financial Advisor for further information about this service.

The Fund passes substantially all of its earnings from income and capital gains along to its investors as "distributions." The Fund earns income from stocks and interest from fixed-income investments. These amounts are passed along to Fund shareholders as "income dividend distributions." The Fund realizes capital gains whenever it sells securities for a higher price than it paid for them. These amounts may be passed along as "capital gain distributions."

The Fund passes substantially all of its earnings from income and capital gains along to its investors as "distributions." The Fund earns income from stocks and interest from fixed-income investments. These amounts are passed along to Fund shareholders as "income dividend distributions." The Fund realizes capital gains whenever it sells securities for a higher price than it paid for them. These amounts may be passed along as "capital gain distributions."

The Fund declares income dividends separately for each Class. Distributions paid on Class A and Class I shares usually will be higher than for Class B and Class C shares because distribution fees that Class B and Class C shares pay are higher. Normally, income dividends are distributed to shareholders semi-annually. Capital gains, if any, are usually distributed in June and December. The Fund, however, may retain and reinvest any long-term capital gains. The Fund may at times make payments from sources other than income or capital gains that represent a return of a portion of your investment. These payments would not be taxable to you as a shareholder, but would have the effect of reducing your basis in the Fund.

Distributions are reinvested automatically in additional shares of the same Class and automatically credited to your account, unless you request in writing that all distributions be paid in cash. If you elect the cash option, the Fund will mail a check to you no later than seven business days after the distribution is declared. However, if you purchase Fund shares through a Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative within three business days prior

19

to the record date for the distribution, the distribution will automatically be paid to you in cash, even if you did not request to receive all distributions in cash. No interest will accrue on uncashed checks. If you wish to change how your distributions are paid, your request should be received by the Transfer Agent at least five business days prior to the record date of the distributions.

Frequent Purchases and Redemptions of Fund Shares

Frequent purchases and redemptions of Fund shares by Fund shareholders are referred to as "market-timing" or "short-term trading" and may present risks for other shareholders of the Fund, which may include, among other things, dilution in the value of Fund shares held by long-term shareholders, interference with the efficient management of the Fund's portfolio, increased brokerage and administrative costs, incurring unwanted taxable gains and forcing the Fund to hold excess levels of cash.

Frequent purchases and redemptions of Fund shares by Fund shareholders are referred to as "market-timing" or "short-term trading" and may present risks for other shareholders of the Fund, which may include, among other things, dilution in the value of Fund shares held by long-term shareholders, interference with the efficient management of the Fund's portfolio, increased brokerage and administrative costs, incurring unwanted taxable gains and forcing the Fund to hold excess levels of cash.

In addition, the Fund is subject to the risk that market-timers and/or short-term traders may take advantage of time zone differences between the foreign markets on which the Fund's portfolio securities trade and the time as of which the Fund's net asset value is calculated ("time-zone arbitrage"). For example, a market-timer may purchase shares of the Fund based on events occurring after foreign market closing prices are established, but before the Fund's net asset value calculation, that are likely to result in higher prices in foreign markets the following day. The market-timer would redeem the Fund's shares the next day when the Fund's share price would reflect the increased prices in foreign markets, for a quick profit at the expense of long-term Fund shareholders.

Investments in other types of securities also may be susceptible to short-term trading strategies. These investments include securities that are, among other things, thinly traded, traded infrequently or relatively illiquid, which have the risk that the current market price for the securities may not accurately reflect current market values. A shareholder may seek to engage in short-term trading to take advantage of these pricing differences (referred to as "price arbitrage"). Investments in certain fixed-income securities may be adversely affected by price arbitrage trading strategies.

The Fund's policies with respect to valuing portfolio securities are described in "Shareholder Information—Pricing Fund Shares."

The Fund discourages and does not accommodate frequent purchases and redemptions of Fund shares by Fund shareholders and the Fund's Board of Directors has adopted policies and procedures with respect to such frequent purchases and redemptions. The Fund's policies with respect to purchases, redemptions and exchanges of Fund shares are described in the "How to Buy Shares," "How to Exchange Shares" and "How to Sell Shares" sections of this Prospectus. Except as described in each of these sections, and with respect to trades that occur through omnibus accounts at intermediaries, as described below, the Fund's policies regarding frequent trading of Fund shares are applied uniformly to all shareholders. With respect to trades that occur through omnibus accounts at intermediaries, such as investment managers, broker-dealers, transfer agents and third party administrators, the Fund (i) has requested assurance that such intermediaries currently selling Fund shares have in place internal policies and procedures reasonably designed to address market-timing concerns and has instructed such intermediaries to notify the Fund immediately if they are unable to comply with such policies and procedures and (ii) requires all prospective intermediaries to agree to cooperate in enforcing the Fund's policies with respect to frequent purchases, redemptions and exchanges of Fund shares.

20

Omnibus accounts generally do not identify customers' trading activity to the Fund on an individual ongoing basis. Therefore, with respect to trades that occur through omnibus accounts at financial intermediaries, to some extent, the Fund relies on the financial intermediary to monitor frequent short-term trading within the Fund by the financial intermediary's customers. However, the Fund or the distributor has entered into agreements with financial intermediaries whereby intermediaries are required to provide certain customer identification and transaction information upon the Fund's request. The Fund may use this information to help identify and prevent market-timing activity in the Fund. There can be no assurance that the Fund will be able to identify or prevent all market-timing activities.

Tax Consequences

As with any investment, you should consider how your Fund investment will be taxed. The tax information in this Prospectus is provided as general information. You should consult your own tax professional about the tax consequences of an investment in the Fund.

As with any investment, you should consider how your Fund investment will be taxed. The tax information in this Prospectus is provided as general information. You should consult your own tax professional about the tax consequences of an investment in the Fund.

Unless your investment in the Fund is through a tax-deferred retirement account, such as a 401(k) plan or IRA, you need to be aware of the possible tax consequences when:

n The Fund makes distributions; and

n You sell Fund shares, including an exchange to another Morgan Stanley Fund.

Taxes on Distributions. Your distributions are normally subject to federal and state income tax when they are paid, whether you take them in cash or reinvest them in Fund shares. A distribution also may be subject to local income tax. Any income dividend distributions and any short-term capital gain distributions are taxable to you as ordinary income. Any long-term capital gain distributions are taxable to you as long-term capital gains, no matter how long you have owned shares in the Fund. Under current law, a portion of the income dividends you receive may be taxed at the same rate as long-term capital gains. However, even if income received in the form of income dividends is taxed at the same rates as long-term capital gains, such income will not be considered long-term capital gains for other federal income tax purposes. For example, you generally will not be permitted to offset income dividends with capital losses. Short-term capital gain distributions will continue to be taxed at ordinary income rates.

If more than 50% of the Fund's assets are invested in foreign securities at the end of any fiscal year, the Fund may elect to permit shareholders to take a credit or deduction on their federal income tax return for foreign taxes paid by the Fund.

Every January, you will be sent a statement (IRS Form 1099-DIV) showing the taxable distributions paid to you in the previous year. The statement provides information on your dividends and capital gains for tax purposes.

Taxes on Sales. Your sale of Fund shares normally is subject to federal and state income tax and may result in a taxable gain or loss to you. A sale also may be subject to local income tax. Your exchange of Fund shares for shares of another Morgan Stanley Fund is treated for tax purposes like a sale of your original shares and a purchase of your new shares. Thus, the exchange may, like a sale, result in a taxable gain or loss to you and will give you a new tax basis for your new shares.

21

When you open your Fund account, you should provide your social security or tax identification number on your investment application. By providing this information, you will avoid being subject to federal backup withholding tax on taxable distributions and redemption proceeds (as of the date of this Prospectus this rate is 28%). Any withheld amount would be sent to the IRS as an advance payment of your taxes due on your income.

Share Class Arrangements

The Fund offers several Classes of shares having different distribution arrangements designed to provide you with different purchase options according to your investment needs. Your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative can help you decide which Class may be appropriate for you.

The Fund offers several Classes of shares having different distribution arrangements designed to provide you with different purchase options according to your investment needs. Your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative can help you decide which Class may be appropriate for you.

The general public is offered three Classes: Class A shares, Class B shares and Class C shares, which differ principally in terms of sales charges and ongoing expenses. A fourth Class, Class I shares, is offered only to a limited category of investors. Shares that you acquire through reinvested distributions will not be subject to any front-end sales charge or CDSC.

Sales personnel may receive different compensation for selling each Class of shares. The sales charges applicable to each Class provide for the distribution financing of shares of that Class.

The chart below compares the sales charge and annual 12b-1 fee applicable to each Class:

| Class | | Sales Charge | | Maximum Annual 12b-1 Fee | |

A

| | Maximum 5.25% initial sales charge reduced for purchases of $25,000 or more; shares

purchased without an initial sales charge are generally subject to a 1.00% CDSC if sold

during the first 18 months | | | 0.25 | % | |

| B | | Maximum 5.00% CDSC during the first year decreasing to 0% after six years | | | 1.00 | % | |

| C | | 1.00% CDSC during the first year | | | 1.00 | % | |

| I | | None | | | None | | |

Certain shareholders may be eligible for reduced sales charges (i.e., breakpoint discounts), CDSC waivers and eligibility minimums. Please see the information for each Class set forth below for specific eligibility requirements. You must notify your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative (or the Transfer Agent if you purchase shares directly through the Fund) at the time a purchase order (or in the case of Class B or Class C shares, a redemption order) is placed, that the purchase (or redemption) qualifies for a reduced sales charge (i.e., breakpoint discount), CDSC waiver or eligibility minimum. Similar notification must be made in writing when an order is placed by mail. The reduced sales charge, CDSC waiver or eligibility minimum will not be granted if: (i) notification is not furnished at the time of order; or (ii) a review of the records of Morgan Stanley Smith Barney, Morgan Stanley & Co. Incorporated ("Morgan Stanley & Co.") or other authorized dealer of Fund shares, or the Transfer Agent does not confirm your represented holdings.

In order to obtain a reduced sales charge (i.e., breakpoint discount) or to meet an eligibility minimum, it may be necessary at the time of purchase for you to inform your Morgan Stanley Smith Barney Financial Advisor or other authorized financial representative (or the Transfer Agent if you purchase shares directly through the Fund) of the

22

existence of other accounts in which there are holdings eligible to be aggregated to meet the sales load breakpoints or eligibility minimums. In order to verify your eligibility, you may be required to provide account statements and/or confirmations regarding shares of the Fund or other Morgan Stanley Funds held in all related accounts described below at Morgan Stanley Smith Barney, Morgan Stanley & Co. or by other authorized dealers, as well as shares held by related parties, such as members of the same family or household, in order to determine whether you have met a sales load breakpoint or eligibility minimum. The Fund makes available, in a clear and prominent format, free of charge, on its web site, www.morganstanley.com/im, information regarding applicable sales loads, reduced sales charges (i.e., breakpoint discounts), sales load waivers and eligibility minimums. The web site includes hyperlinks that facilitate access to the information.

CLASS A SHARES Class A shares are sold at net asset value plus an initial sales charge of up to 5.25% of the public offering price. The initial sales charge is reduced for purchases of $25,000 or more according to the schedule below. Investments of $1 million or more are not subject to an initial sales charge, but are generally subject to a CDSC of 1.00% on sales made within 18 months after the last day of the month of purchase. The CDSC will be assessed in the same manner and with the same CDSC waivers as with Class B shares. In addition, the CDSC on Class A shares will be waived in connection with sales of Class A shares for which no commission or transaction fee was paid by the distributor to authorized dealers at the time of purchase of such shares. Class A shares are also subject to a distribution and shareholder services (12b-1) fee of up to 0.25% of the average daily net assets of the Class. The maximum annual 12b-1 fee payable by Class A shares is lower than the maximum annual 12b-1 fee payable by Class B or Class C shares.