October 9, 2012

BY HAND AND EDGAR

Duc Dang

Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, DC 20549-7010

| | Re: | Realogy Holdings Corp. |

| | | Registration Statement on Form S-1 |

Dear Mr. Dang:

On behalf of Realogy Holdings Corp., formerly known as Domus Holdings Corp. (the “Company”), enclosed please find attachments that were provided to the staff of the Commission (the “Staff”) in connection with (i) comment number 6 of the Staff set forth in the Staff’s letter to the Company dated as of September 5, 2012 and (ii) comment number 10 of the Staff set forth in the Staff’s letter to the Company dated as of September 17, 2012.

Please telephone the undersigned at (212) 735-3497 if you have any questions or require any additional information.

Very truly yours,

/s/ Stacy J. Kanter

Stacy J. Kanter

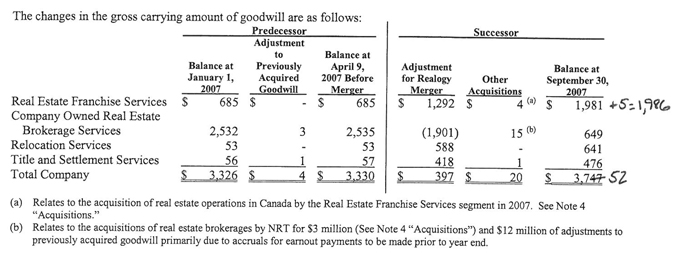

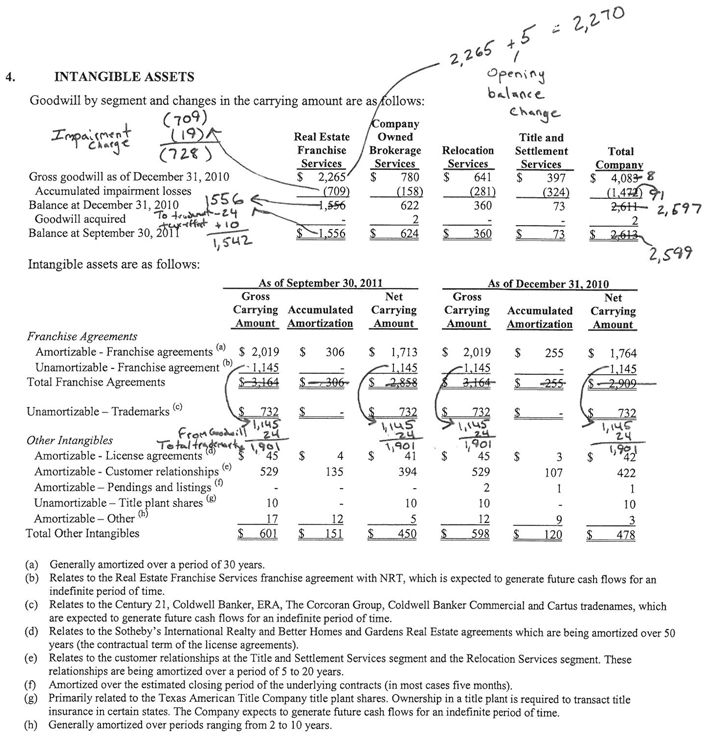

Realogy - RFG Reporting Unit

Impairment Analysis – 2008

(In millions)

| | | | |

As Reported | |

Goodwill: | | | | |

Original RFG Goodwill at Acquisition plus $4 other acquisitions in 2007 | | $ | 2,265 | |

Fair Value of Goodwill per 2008 “Step 2” valuation report | | | 1,556 | |

| | | | |

Cumulative Impairment to Goodwill at December 31, 2008 | | | (709 | ) |

| |

Intangible Assets: | | | | |

Franchise Agreement with NRT at Acquisition | | | 1,671 | |

Fair Value of Franchise Agreement per 2008 “Step 2” valuation report | | | 1,145 | |

| | | | |

Cumulative Impairment to Franchise Agreement at December 31, 2008 | | | (526 | ) |

| | | | |

Cumulative Impairment on a Combined Basis | | $ | (1,235 | ) |

| | | | |

| |

Pro Forma - If NRT Franchise Agreement with RFG had been recorded as Goodwill | | | |

Original RFG Goodwill at Acquisition plus $4 other acquisitions in 2007 | | $ | 2,265 | |

Franchise Agreement with NRT at Acquisition | | | 1,671 | |

| | | | |

Combined Goodwill | | | 3,936 | |

Fair Value of Goodwill per 2008 “Step 2” valuation report | | | 1,556 | |

Fair Value of Franchise Agreement per 2008 “Step 2” valuation report | | | 1,145 | |

| | | | |

Fair Value of Combined Goodwill | | | 2,701 | |

| | | | |

Cumulative Impairment on a Combined Basis | | $ | (1,235 | ) |

| | | | |

Difference in Cumulative Impairment on a Combined Basis | | $ | — | |

| | | | |

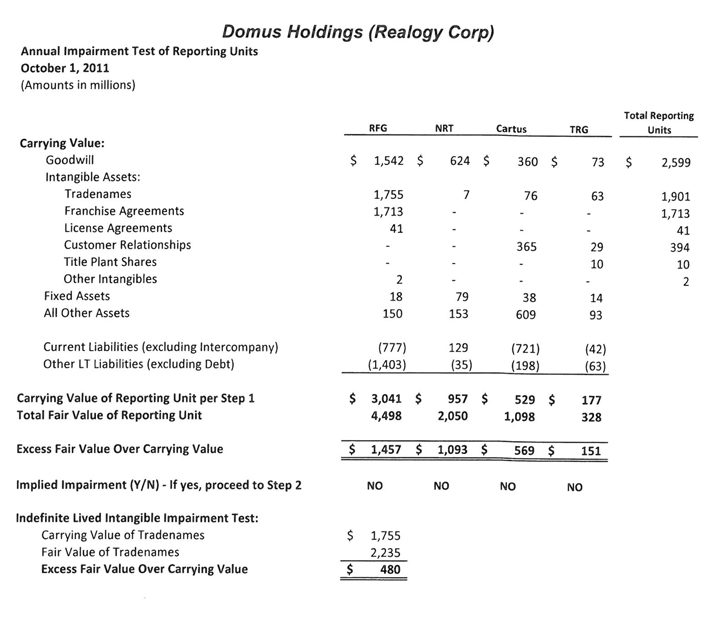

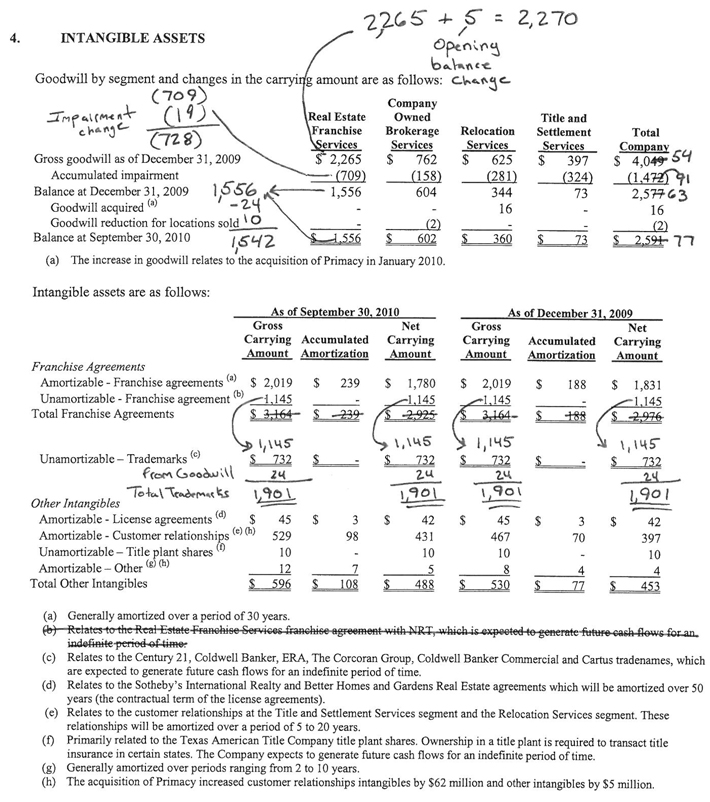

Realogy Corporation

CALCULATIONS RELATED TO THE ASC 350 REVIEW FOR REALOGY CORPORATION SUMMARY OF STEP 1 CONCLUSION

(Amounts in millions)

As of October 1, 2011

| | | | | | | | | | | | | | | | |

| | | Fair Value of

Reporting Unit | | | Carrying Value

of Reporting Unit | | | Difference | | | Implied

Impairment

(Y/N) | |

| | | | | | | | | | | | | |

RFG | | $ | 4,498 | | | $ | 3,041 | | | $ | 1,457 | | | | NO | |

NRT | | | 2,050 | | | | 958 | | | | 1,092 | | | | NO | |

Cartus | | | 1,098 | | | | 529 | | | | 569 | | | | NO | |

TRG | | | 328 | | | | 177 | | | | 151 | | | | NO | |

| | | | | | | | | | | | | | | | |

Total Reporting Units | | $ | 7,974 | | | $ | 4,705 | | | | | | | | | |

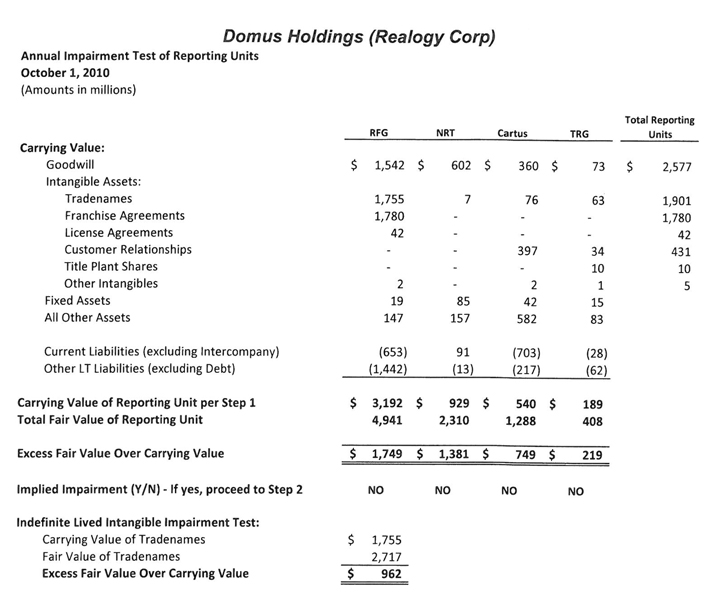

As of October 1, 2010

| | | | | | | | | | | | | | | | |

| | | Fair Value of

Reporting Unit | | | Carrying Value

of Reporting Unit | | | Difference | | | Implied

Impairment

(Y/N) | |

| | | | | | | | | | | | | |

RFG | | $ | 4,941 | | | $ | 3,192 | | | $ | 1,749 | | | | NO | |

NRT | | | 2,310 | | | | 929 | | | | 1,381 | | | | NO | |

Cartus | | | 1,288 | | | | 540 | | | | 748 | | | | NO | |

TRG | | | 408 | | | | 189 | | | | 219 | | | | NO | |

| | | | | | | | | | | | | | | | |

Total Reporting Units | | $ | 8,947 | | | $ | 4,850 | | | | | | | | | |

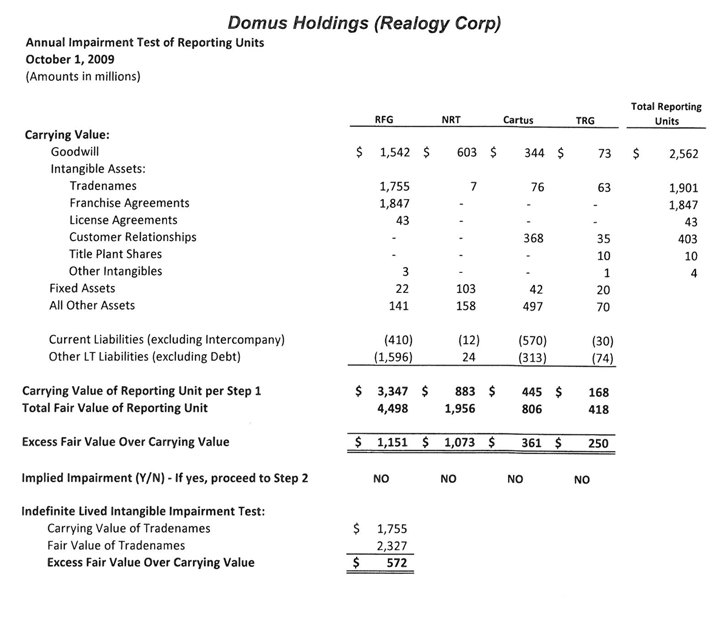

As of October 1, 2009

| | | | | | | | | | | | | | | | |

| | | Fair Value of

Reporting Unit | | | Carrying Value

of Reporting Unit | | | Difference | | | Implied

Impairment

(Y/N) | |

| | | | | | | | | | | | | |

RFG | | $ | 4,498 | | | $ | 3,347 | | | $ | 1,151 | | | | NO | |

NRT | | | 1,956 | | | | 882 | | | | 1,074 | | | | NO | |

Cartus | | | 806 | | | | 445 | | | | 361 | | | | NO | |

TRG | | | 418 | | | | 167 | | | | 250 | | | | NO | |

| | | | | | | | | | | | | | | | |

Total Reporting Units | | $ | 7,678 | | | $ | 4,842 | | | | | | | | | |

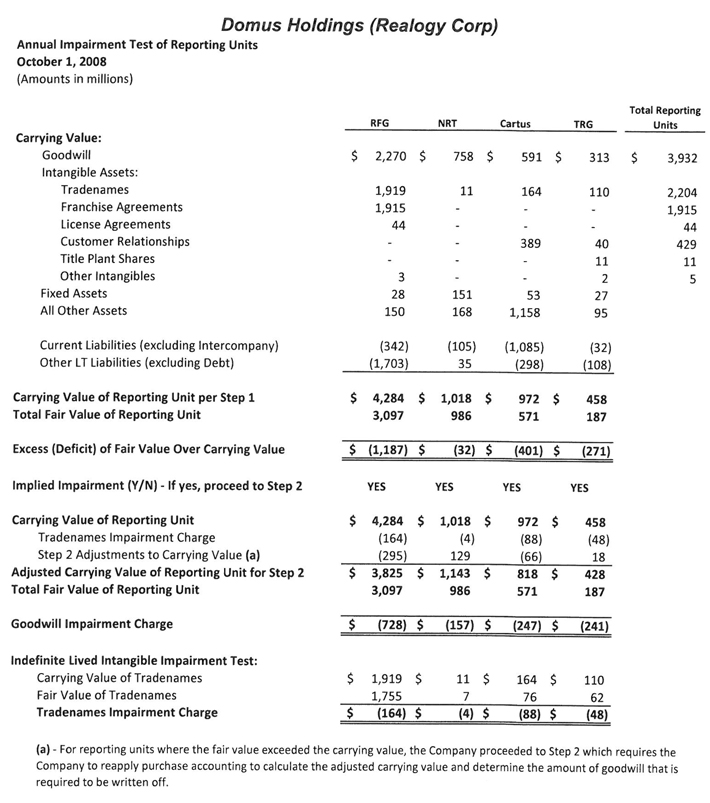

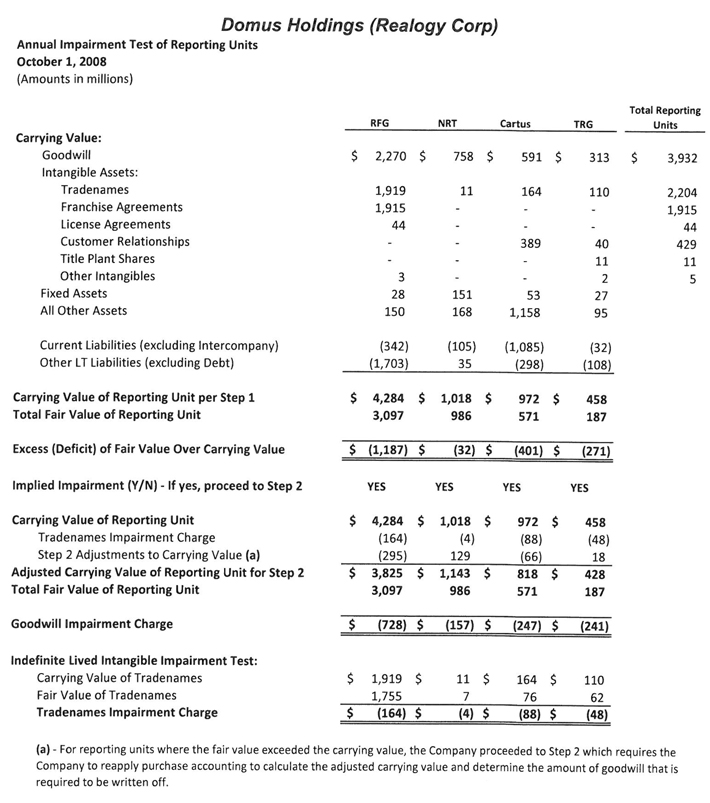

Realogy Corporation

CALCULATIONS RELATED TO THE SFAS 142 REVIEW FOR RFC

As of October 1, 2008

SUMMARY OF STEP 2 CONCLUSION

(Amounts in millions)

| | | | | | | | |

DETERMINATION OF IMPAIRMENT | | As Reported | | | Pro Forma As

Adjusted | |

Total Fair Value of Reporting Unit | | $ | 3,097 | | | $ | 3,097 | |

Add: Other Liabilities | | | 1,716 | | | | 1,716 | |

Less: Other Assets | | | 174 | | | | 174 | |

Less: Fair Value of Identified Intangible Assets (excluding RFG Franchise Agreement with NRT) | | | 1,938 | | | | 1,938 | |

Less: Fair Value of RFG Franchise Agreement with NRT | | | 1,145 | | | | — | |

| | | | | | | | |

Fair Value of Goodwill | | | 1,556 | | | | 2,701 | |

Goodwill Balance | | | 2,265 | | | | 3,936 | * |

| | | | | | | | |

Goodwill Impairment | | $ | 709 | | | $ | 1,235 | |

| | | | | | | | |

| * | Pro Forma As Adjusted Goodwill includes the acquisition value of the RFG Franchise Agreement with NRT of $1,671 million. |

| | | | |

RFG FRANCHISE AGREEMENT WITH NRT | | | |

RFG Franchise Agreement with NRT at Acquisition | | $ | 1,671 | |

Fair Value of RFG Franchise Agreement with NRT | | | 1,145 | |

| | | | |

Impairment to NRT Franchise Agreement | | | 526 | |

| | | | |

Total Impairment of Goodwill and RFG Franchise Agreement with NRT | | $ | 1,235 | |

| | | | |

CAPITALIZATION

The following table sets forth our cash and cash equivalents and capitalization as of June 30, 2012:

| | • | | on a pro forma basis giving effect to the conversion of approximately $1.903 billion aggregate principal amount of Convertible Notes by the Significant Holders into 73,006,178 shares of common stock substantially concurrently with the closing of this offering; and |

| | • | | on a pro forma as adjusted basis giving effect to (i) our sale of 40,000,000 shares of common stock in this offering at an assumed initial public offering price of $25.00 per share, which is the midpoint of the offering price range set forth on the cover page of this prospectus, and our expected use of the net proceeds of this offering as described in “Use of Proceeds” and (ii) the issuance of 9,125,776 shares of common stock to the Significant Holders pursuant to the Significant Holders letter agreements described under “Prospectus Summary—Letter Agreements with Holders of Convertible Notes.” |

To the extent that any Convertible Notes not owned by the Significant Holders are converted into common stock, the portion of the net proceeds of this offering that would have been used to pay the redemption price for such Convertible Notes will instead be applied to the repayment of our other indebtedness.

You should read this table in conjunction with the information included under the headings “Unaudited Pro Forma Financial Information,” “Selected Historical Consolidated and Combined Financial Statements,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and notes thereto included elsewhere in this prospectus.

| | | | | | | | | | | | |

| | | As of June 30, 2012 | |

| Capitalization (excluding securitization obligations) | | Actual | | | Pro Forma | | | Pro Forma As

Adjusted | |

| | | (In millions) | |

Cash and cash equivalents(1) | | $ | 138 | | | $ | 138 | | | $ | 49 | |

| | | | | | | | | | | | |

Long-term debt (including current portion): | | | | | | | | | | | | |

Senior Secured Credit Facility: | | | | | | | | | | | | |

Extended revolving credit facility(2) | | | 109 | | | | 109 | | | | 201 | |

Extended term loan facility(3) | | | 1,822 | | | | 1,822 | | | | 1,822 | |

7.625% First Lien Notes due 2020 | | | 593 | | | | 593 | | | | 593 | |

7.875% First and a Half Lien Notes due 2019 | | | 700 | | | | 700 | | | | 700 | |

9.000% First and a Half Lien Notes due 2020 | | | 325 | | | | 325 | | | | 325 | |

Second Lien Loans(4) | | | 650 | | | | 650 | | | | — | |

Other bank indebtedness(5) | | | 105 | | | | 105 | | | | 105 | |

10.50% Senior Notes due 2014 | | | 64 | | | | 64 | | | | — | |

11.00/11.75% Senior Toggle Notes due 2014 | | | 41 | | | | 41 | | | | — | |

12.375% Senior Subordinated Notes due 2015(6) | | | 188 | | | | 188 | | | | 188 | |

11.50% Senior Notes due 2017(7) | | | 489 | | | | 489 | | | | 489 | |

12.00% Senior Notes due 2017(8) | | | 129 | | | | 129 | | | | 129 | |

13.375% Senior Subordinated Notes due 2018 | | | 10 | | | | 10 | | | | 10 | |

11.00% Convertible Notes due 2018(9) | | | 2,110 | | | | 207 | | | | — | |

| | | | | | | | | | | | |

Total long-term debt (including current portion) | | | 7,335 | | | | 5,432 | | | | 4,562 | |

| | | | | | | | | | | | |

Equity: | | | | | | | | | | | | |

Common stock; 178,000,000 authorized shares; 8,021,276 shares issued and outstanding (actual); 81,027,454 shares issued and outstanding (pro forma); 130,153,230 shares issued and outstanding (pro forma as adjusted) | | | — | | | | 1 | | | | 1 | |

Additional paid-in capital(10) | | | 2,035 | | | | 3,937 | | | | 5,136 | |

Accumulated deficit(11) | | | (3,728 | ) | | | (3,734 | ) | | | (4,078 | ) |

Accumulated other comprehensive income (loss) | | | (30 | ) | | | (30 | ) | | | (30 | ) |

Noncontrolling interests | | | 2 | | | | 2 | | | | 2 | |

| | | | | | | | | | | | |

Total equity (deficit) | | | (1,721 | ) | | | 176 | | | | 1,031 | |

| | | | | | | | | | | | |

Total capitalization(12) | | $ | 5,614 | | | $ | 5,608 | | | $ | 5,593 | |

| | | | | | | | | | | | |

55

| (1) | Readily available cash as of June 30, 2012 was $89 million. Readily available cash includes cash and cash equivalents less statutory cash required for our title business. Pro forma as adjusted cash and cash equivalents reflects (i) the payment of interest of approximately $59 million, representing the interest on indebtedness that will be repaid as described in “Use of Proceeds,” and (ii) the cash payment of approximately $105 million pursuant to the Significant Holders letter agreements as described in “Use of Proceeds.” The amount of such payment is equal to the interest that the Significant Holders would have otherwise been entitled to receive with respect to the Convertible Notes held by them if they held such Convertible Notes through October 15, 2012, the next regularly scheduled interest payment date. The Significant Holders will not receive the interest payment to be paid on the Convertible Notes on October 15, 2012. See footnote 2 of the Notes to Unaudited Pro Forma Financial Information under the heading “Unaudited Pro Forma Financial Information.” |

| (2) | Interest rates with respect to revolving loans under the senior secured credit facility are based on, at our option, (a) adjusted LIBOR plus 3.25% or (b) JPMorgan Chase Bank, N.A.’s prime rate (“ABR”) plus 2.25% in each case subject to reductions based on the attainment of certain leverage ratios. The available capacity under this facility was reduced by $89 million of outstanding letters of credit as of June 30, 2012. On September 17, 2012, the Company had $ 60 million outstanding on the extended revolving credit facility and $ 95 million of outstanding letters of credit, leaving$ 208 million of available capacity. |

| (3) | Interest rates with respect to term loans under the senior secured credit facility are based on, at our option, (a) adjusted LIBOR plus 4.25% or (b) the higher of the Federal Funds Effective Rate plus 1.75% and JPMorgan Chase Bank, N.A.’s prime rate plus 3.25%. |

| (4) | The Second Lien Loans accrue interest at a rate of 13.50% per annum. |

| (5) | Consists of revolving credit facilities that are supported by letters of credit issued under the senior secured credit facility, a portion of which are issued under the synthetic letter of credit facility; $50 million is due in January 2013, $50 million is due in July 2013, and $5 million is due in August 2013. |

| (6) | Consists of $190 million of 12.375% Senior Subordinated Notes, less a discount of $2 million. |

| (7) | Consists of $492 million of 11.50% Senior Notes, less a discount of $3 million. |

| (8) | Consists of $130 million of 12.00% Senior Notes, less a discount of $1 million. |

| (9) | The Significant Holders have agreed to convert all of their Convertible Notes into common stock substantially concurrently with the closing of this offering, representing in the aggregate approximately $1.903 billion principal amount of outstanding Convertible Notes. |

| (10) | Pro forma additional paid-in capital reflects the conversion of approximately $1.903 billion of our Convertible Notes by the Significant Holders. |

Pro forma as adjusted additional paid-in capital includes the impact of the following transactions: (i) the net proceeds from this offering of approximately $946 million; (ii) the fair value of the shares of common stock issued to the Significant Holders pursuant to the Significant Holders letter agreements of $228 million; and (iii) the $25 million portion of the Management Agreement Termination Fee to be paid in shares of our common stock on January 15, 2013.

| (11) | Pro forma accumulated deficit reflects a $6 million loss on the extinguishment of debt, related to the write-off of deferred financing costs due to the conversion of the Convertible Notes held by the Significant Holders. |

Pro forma as adjusted accumulated deficit includes the impact of (i) the expense of $ 228 million, which represents the fair value of the shares of common stock issued to the Significant Holders pursuant to the Significant Holders letter agreements ; (ii) $105 million of expense related to the cash payment to be made pursuant to the Significant Holders letter agreements as described in “Use of Proceeds”; (iii) interest expense of $59 million, which represents the interest payable from April 15, 2012 through the anticipated prepayment date on the indebtedness that will be repaid as described in “Use of Proceeds”; (i v) $40 million of expense to be recognized related to the Management Agreement Termination Fee payment to be paid $15 million in cash and $25 million in shares of our common stock on January 15, 2013; (v) $7 million of prepayment fees associated with the prepayment of our indebtedness; (vi) a $4 million loss on the extinguishment of debt, related to the write-off of deferred financing costs on other indebtedness; offset by

56

(a) a $21 million gain related to the $207 million of Convertible Notes redeemed by the Company at 90 % of the principal amount thereof, (b) a $44 million reduction of accrued interest recorded on the Convertible Notes held by the Significant Holders which will not be paid as a result of the cash payment made pursuant to the Significant Holders letter agreements, (c) a $26 million reduction in accrued interest recorded as of June 30, 2012 which is included in the interest expense of $59 million reflected above and (d) an $8 million reduction in the amount accrued related to the management fee agreement.

| (12) | Total capitalization excludes our securitization obligations which are collateralized by relocation related assets and appear in our current liabilities |

57

UNAUDITED PRO FORMA FINANCIAL INFORMATION

We derived the unaudited pro forma financial data set forth below by the application of pro forma adjustments to the audited and unaudited consolidated financial statements included elsewhere in this prospectus.

The unaudited pro forma condensed consolidated balance sheet at June 30, 2012 and pro forma consolidated statement of operations for the year ended December 31, 2011 and the pro forma condensed consolidated statement of operations for the six months ended June 30, 2012 have been presented:

| | • | | on a pro forma basis which gives effect to the conversion of approximately $1.903 billion aggregate principal amount of the Convertible Notes by the Significant Holders into 73,006,178 shares of common stock substantially concurrently with the closing of this offering; and |

| | • | | on a pro forma as adjusted basis, which gives effect to (i) our sale of 40,000,000 shares of common stock in this offering at an initial public offering price of $ 25.00 per share, which is the midpoint of the offering price range set forth on the cover page of this prospectus, and our expected use of the net proceeds of this offering as described in “Use of Proceeds” and (ii) the issuance of 9,125,776 shares of common stock to the Significant Holders pursuant to the Significant Holders letter agreements described under “Prospectus Summary—Letter Agreements with Holders of Convertible Notes.” |

The pro forma condensed consolidated balance sheet gives effect to the pro forma adjustments as if they occurred on June 30, 2012 and the pro forma consolidated statement of operations gives effect to the pro forma adjustments as if they occurred on January 1, 2011. In addition, the pro forma condensed consolidated balance sheet at June 30, 2012 has also been presented on a pro forma basis and on a pro forma as adjusted basis giving further effect to the conversion of all of the approximately $207 million aggregate principal amount of the Convertible Notes not held by the Significant Holders. See footnotes 7-9 of the Notes to Unaudited Pro Forma Financial Information.

The pro forma adjustments set forth below were based on available information and certain assumptions made by our management and may be revised as additional information becomes available. The unaudited pro forma financial information is presented for informational purposes only, and does not purport to represent what our balance sheet and results of operations would actually have been if the transactions had occurred on the dates indicated, nor does it purport to project our results of operations or financial condition that we may achieve in the future.

You should read our unaudited pro forma financial information and the accompanying notes in conjunction with all of the historical financial statements and related notes included elsewhere in this prospectus and the financial and other information appearing elsewhere in this prospectus, including information contained in “Risk Factors,” “Selected Historical Consolidated Financial Data,” “Use of Proceeds,” “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

61

REALOGY HOLDINGS CORP.

PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

June 30, 2012

(In millions)

| | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Convertible

Notes

Pro Forma

Adjustments(1) | | | Pro Forma | | | Offering

Transaction

Adjustments(2) | | | Pro Forma As

Adjusted | |

ASSETS | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 138 | | | $ | — | | | $ | 138 | | | $ | (89 | ) | | $ | 49 | |

Trade receivables | | | 147 | | | | — | | | | 147 | | | | — | | | | 147 | |

Relocation receivables | | | 419 | | | | — | | | | 419 | | | | — | | | | 419 | |

Relocation properties held for sale | | | 10 | | | | — | | | | 10 | | | | — | | | | 10 | |

Deferred income taxes | | | 59 | | | | — | | | | 59 | | | | — | | | | 59 | |

Other current assets | | | 97 | | | | — | | | | 97 | | | | — | | | | 97 | |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 870 | | | | — | | | | 870 | | | | (89 | ) | | | 781 | |

Property and equipment, net | | | 151 | | | | — | | | | 151 | | | | — | | | | 151 | |

Goodwill | | | 2,618 | | | | — | | | | 2,618 | | | | — | | | | 2,618 | |

Trademarks | | | 732 | | | | — | | | | 732 | | | | — | | | | 732 | |

Franchise agreements, net | | | 2,808 | | | | — | | | | 2,808 | | | | — | | | | 2,808 | |

Other intangibles, net | | | 418 | | | | — | | | | 418 | | | | — | | | | 418 | |

Other non-current assets | | | 225 | | | | (6 | ) | | | 219 | | | | (4 | ) | | | 215 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 7,822 | | | $ | (6 | ) | | $ | 7,816 | | | $ | (93 | ) | | $ | 7,723 | |

| | | | | | | | | | | | | | | | | | | | |

LIABILITIES AND EQUITY (DEFICIT) | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | 214 | | | $ | — | | | $ | 214 | | | $ | — | | | $ | 214 | |

Securitization obligations | | | 267 | | | | — | | | | 267 | | | | — | | | | 267 | |

Due to former parent | | | 76 | | | | — | | | | 76 | | | | — | | | | 76 | |

Revolving credit facilities and current portion of long-term debt | | | 214 | | | | — | | | | 214 | | | | 92 | | | | 306 | |

Accrued expenses and other current liabilities | | | 583 | | | | — | | | | 583 | | | | (78 | ) | | | 505 | |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 1,354 | | | | — | | | | 1,354 | | | | 14 | | | | 1,368 | |

Long-term debt | | | 7,121 | | | | (1,903 | ) | | | 5,218 | | | | (962 | ) | | | 4,256 | |

Deferred income taxes | | | 895 | | | | — | | | | 895 | | | | — | | | | 895 | |

Other non-current liabilities | | | 173 | | | | — | | | | 173 | | | | — | | | | 173 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 9,543 | | | | (1,903 | ) | | | 7,640 | | | | (948 | ) | | | 6,692 | |

| | | | | | | | | | | | | | | | | | | | |

Total equity (deficit) | | | (1,721 | ) | | | 1,897 | | | | 176 | | | | 855 | | | | 1,031 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity (deficit) | | $ | 7,822 | | | $ | (6 | ) | | $ | 7,816 | | | $ | (93 | ) | | $ | 7,723 | |

| | | | | | | | | | | | | | | | | | | | |

See Notes to Unaudited Pro Forma Financial Information.

62

REALOGY HOLDINGS CORP.

PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 31, 2011

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Convertible

Notes

Pro Forma

Adjustments(3) | | | Pro Forma | | | Offering

Transaction

Adjustments(4) | | | Pro Forma As

Adjusted | |

Revenues | | | | | | | | | | | | | | | | | | | | |

Gross commission income | | $ | 2,926 | | | $ | — | | | $ | 2,926 | | | $ | — | | | $ | 2,926 | |

Service revenue | | | 752 | | | | — | | | | 752 | | | | — | | | | 752 | |

Franchise fees | | | 256 | | | | — | | | | 256 | | | | — | | | | 256 | |

Other | | | 159 | | | | — | | | | 159 | | | | — | | | | 159 | |

| | | | | | | | | | | | | | | | | | | | |

Net revenues | | | 4,093 | | | | — | | | | 4,093 | | | | — | | | | 4,093 | |

| | | | | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | | | | | |

Commission and other agent-related costs | | | 1,932 | | | | — | | | | 1,932 | | | | — | | | | 1,932 | |

Operating | | | 1,270 | | | | — | | | | 1,270 | | | | — | | | | 1,270 | |

Marketing | | | 185 | | | | — | | | | 185 | | | | — | | | | 185 | |

General and administrative | | | 254 | | | | — | | | | 254 | | | | 7 | | | | 261 | |

Former parent legacy costs (benefit), net | | | (15 | ) | | | — | | | | (15 | ) | | | — | | | | (15 | ) |

Restructuring costs | | | 11 | | | | — | | | | 11 | | | | — | | | | 11 | |

Merger costs | | | 1 | | | | — | | | | 1 | | | | — | | | | 1 | |

Depreciation and amortization | | | 186 | | | | — | | | | 186 | | | | — | | | | 186 | |

Interest expense, net | | | 666 | | | | (210 | ) | | | 456 | | | | (120 | ) | | | 336 | |

Loss on the early extinguishment of debt | | | 36 | | | | — | | | | 36 | | | | — | | | | 36 | |

| | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 4,526 | | | | (210 | ) | | | 4,316 | | | | (113 | ) | | | 4,203 | |

| | | | | | | | | | | | | | | | | | | | |

Loss before income taxes, equity in earnings and noncontrolling interests | | | (433 | ) | | | 210 | | | | (223 | ) | | | 113 | | | | (110 | ) |

Income tax expense | | | 32 | | | | — | | | | 32 | | | | — | | | | 32 | |

Equity in earnings of unconsolidated entities | | | (26 | ) | | | — | | | | (26 | ) | | | — | | | | (26 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | | (439 | ) | | | 210 | | | | (229 | ) | | | 113 | | | | (116 | ) |

Less: Net income attributable to noncontrolling interests | | | (2 | ) | | | — | | | | (2 | ) | | | — | | | | (2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss attributable to Realogy Holdings | | $ | (441 | ) | | $ | 210 | | | $ | (231 | ) | | $ | 113 | | | $ | (118 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss per share attributable to Realogy Holdings: | | | | | | | | | | | | | | | | | | | | |

Basic loss per share: | | $ | (55.01 | ) | | | | | | $ | (2.85 | ) | | | | | | $ | (0.91 | ) |

Diluted loss per share: | | | (55.01 | ) | | | | | | | (2.85 | ) | | | | | | | (0.91 | ) |

Weighted average common and common equivalent shares of Realogy Holdings outstanding: | | | | | | | | | | | | | | | | | | | | |

Basic: | | | 8.0 | | | | | | | | 81.0 | | | | | | | | 130.1 | |

Diluted: | | | 8.0 | | | | | | | | 81.0 | | | | | | | | 130.1 | |

See Notes to Unaudited Pro Forma Financial Information.

63

REALOGY HOLDINGS CORP.

PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

SIX MONTHS ENDED JUNE 30, 2012

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Convertible

Notes

Pro Forma

Adjustments (5) | | | Pro

Forma | | | Offering

Transaction

Adjustments (6) | | | Pro Forma As

Adjusted | |

Revenues | | | | | | | | | | | | | | | | | | | | |

Gross commission income | | $ | 1,589 | | | $ | — | | | $ | 1,589 | | | $ | — | | | $ | 1,589 | |

Service revenue | | | 380 | | | | — | | | | 380 | | | | — | | | | 380 | |

Franchise fees | | | 130 | | | | — | | | | 130 | | | | — | | | | 130 | |

Other | | | 85 | | | | — | | | | 85 | | | | — | | | | 85 | |

| | | | | | | | | | | | | | | | | | | | |

Net revenues | | | 2,184 | | | | — | | | | 2,184 | | | | — | | | | 2,184 | |

| | | | | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | | | | | |

Commission and other agent-related costs | | | 1,064 | | | | — | | | | 1,064 | | | | — | | | | 1,064 | |

Operating | | | 643 | | | | — | | | | 643 | | | | — | | | | 643 | |

Marketing | | | 103 | | | | — | | | | 103 | | | | — | | | | 103 | |

General and administrative | | | 156 | | | | — | | | | 156 | | | | 4 | | | | 160 | |

Former parent legacy costs (benefit), net | | | (3 | ) | | | — | | | | (3 | ) | | | — | | | | (3 | ) |

Restructuring costs | | | 5 | | | | — | | | | 5 | | | | — | | | | 5 | |

Depreciation and amortization | | | 89 | | | | — | | | | 89 | | | | — | | | | 89 | |

Interest expense, net | | | 346 | | | | (105 | ) | | | 241 | | | | (60 | ) | | | 181 | |

Loss on the early extinguishment of debt | | | 6 | | | | — | | | | 6 | | | | — | | | | 6 | |

Other (income)/expense, net | | | 1 | | | | — | | | | 1 | | | | — | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 2,410 | | | | (105 | ) | | | 2,305 | | | | (56 | ) | | | 2,249 | |

| | | | | | | | | | | | | | | | | | | | |

Loss before income taxes, equity in earnings and noncontrolling interests | | | (226 | ) | | | 105 | | | | (121 | ) | | | 56 | | | | (65 | ) |

Income tax expense | | | 15 | | | | — | | | | 15 | | | | — | | | | 15 | |

Equity in earnings of unconsolidated entities | | | (25 | ) | | | — | | | | (25 | ) | | | — | | | | (25 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | | (216 | ) | | | 105 | | | | (111 | ) | | | 56 | | | | (55 | ) |

Less: Net income attributable to noncontrolling interests | | | (1 | ) | | | — | | | | (1 | ) | | | — | | | | (1 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss attributable to Realogy Holdings | | $ | (217 | ) | | $ | 105 | | | $ | (112 | ) | | $ | 56 | | | $ | (56 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss per share attributable to Realogy Holdings: | | | | | | | | | | | | | | | | | | | | |

Basic loss per share: | | $ | (27.07 | ) | | | | | | $ | (1.38 | ) | | | | | | $ | (0.43 | ) |

Diluted loss per share: | | | (27.07 | ) | | | | | | | (1.38 | ) | | | | | | | (0.43 | ) |

Weighted average common and common equivalent shares of Realogy Holdings outstanding: | | | | | | | | | | | | | | | | | | | | |

Basic: | | | 8.0 | | | | | | | | 81.0 | | | | | | | | 130.1 | |

Diluted: | | | 8.0 | | | | | | | | 81.0 | | | | | | | | 130.1 | |

See Notes to Unaudited Pro Forma Financial Information.

64

REALOGY HOLDINGS CORP.

PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

(ASSUMING CONVERSION OF ALL OF THE CONVERTIBLE NOTES)

June 30, 2012

(In millions)

| | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Convertible

Notes

Pro Forma

Adjustments(7) | | | Pro

Forma | | | Offering

Transaction

Adjustments(8) | | | Pro Forma As

Adjusted | |

ASSETS | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 138 | | | $ | — | | | $ | 138 | | | $ | (89 | ) | | $ | 49 | |

Trade receivables | | | 147 | | | | — | | | | 147 | | | | — | | | | 147 | |

Relocation receivables | | | 419 | | | | — | | | | 419 | | | | — | | | | 419 | |

Relocation properties held for sale | | | 10 | | | | — | | | | 10 | | | | — | | | | 10 | |

Deferred income taxes | | | 59 | | | | — | | | | 59 | | | | — | | | | 59 | |

Other current assets | | | 97 | | | | — | | | | 97 | | | | — | | | | 97 | |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 870 | | | | — | | | | 870 | | | | (89 | ) | | | 781 | |

Property and equipment, net | | | 151 | | | | — | | | | 151 | | | | — | | | | 151 | |

Goodwill | | | 2,618 | | | | — | | | | 2,618 | | | | — | | | | 2,618 | |

Trademarks | | | 732 | | | | — | | | | 732 | | | | — | | | | 732 | |

Franchise agreements, net | | | 2,808 | | | | — | | | | 2,808 | | | | — | | | | 2,808 | |

Other intangibles, net | | | 418 | | | | — | | | | 418 | | | | — | | | | 418 | |

Other non-current assets | | | 225 | | | | (7 | ) | | | 218 | | | | (3 | ) | | | 215 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 7,822 | | | $ | (7 | ) | | $ | 7,815 | | | $ | (92 | ) | | $ | 7,723 | |

| | | | | | | | | | | | | | | | | | | | |

LIABILITIES AND EQUITY (DEFICIT) | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | $ | 214 | | | $ | — | | | $ | 214 | | | $ | — | | | $ | 214 | |

Securitization obligations | | | 267 | | | | — | | | | 267 | | | | — | | | | 267 | |

Due to former parent | | | 76 | | | | — | | | | 76 | | | | — | | | | 76 | |

Revolving credit facilities and current portion of long-term debt | | | 214 | | | | — | | | | 214 | | | | (94 | ) | | | 120 | |

Accrued expenses and other current liabilities | | | 583 | | | | | | | | 583 | | | | (79 | ) | | | 504 | |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 1,354 | | | | — | | | | 1,354 | | | | (173 | ) | | | 1,181 | |

Long-term debt | | | 7,121 | | | | (2,110 | ) | | | 5,011 | | | | (755 | ) | | | 4,256 | |

Deferred income taxes | | | 895 | | | | — | | | | 895 | | | | — | | | | 895 | |

Other non-current liabilities | | | 173 | | | | — | | | | 173 | | | | — | | | | 173 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 9,543 | | | | (2,110 | ) | | | 7,433 | | | | (928 | ) | | | 6,505 | |

| | | | | | | | | | | | | | | | | | | | |

Total equity (deficit)(9) | | | (1,721 | ) | | | 2,103 | | | | 382 | | | | 836 | | | | 1,218 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and equity (deficit) | | $ | 7,822 | | | $ | (7 | ) | | $ | 7,815 | | | $ | (92 | ) | | $ | 7,723 | |

| | | | | | | | | | | | | | | | | | | | |

See Notes to Unaudited Pro Forma Financial Information.

65

Notes to Unaudited Pro Forma Financial Information

Balance Sheet

| (1) | Pro forma gives effect to the conversion of approximately $1,903 million aggregate principal amount of the Convertible Notes held by the Significant Holders substantially concurrently with the closing of this offering. The pro forma balance sheet also reflects the write-off of deferred financing costs of $6 million as a result of the repayment of outstanding debt as described in “Use of Proceeds.” |

| (2) | Pro forma as adjusted gives effect to the following: |

| | | | | | |

| • | | Anticipated gross proceeds from the sale of common stock in this offering | | $ | 1,000 | |

| • | | Use of cash on hand | | | 89 | |

| • | | Borrowings under our revolving credit facility | | | 92 | |

| |

| Less | | | | |

| • | | Transaction related costs, including 447.5 million in underwriting discounts and commissions | | | (54 | ) |

| • | | Prepayment of all of the aggregate outstanding principal amount of the Second Lien Loans | | | (650 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the 10.40% Senior Notes | | | (64 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the Senior Toggle Notes | | | (41 | ) |

| • | | Payment of prepayment premiums and fees | | | (7 | ) |

| • | | Redemption of the approximately $207 million aggregate principal amount of the convertible Notes that are not held by the significant Holders following the closing date of this offering at a redemption price equal to 90% of the principal amount hereof | | | (186 | ) |

| • | | Payment of the cash portion of the Management Agreement Termination Fee to be paid on January 15, 2013 | | | (15 | ) |

| • | | Payment of cash pursuant to the Significant Holders letter agreements (the Significant Holders will not receive the interest payment to be paid on the Convertible Notes on October 15, 2012, the next regularly scheduled interest payment date for the Convertible Notes) | | | (105 | ) |

| • | | Payment of interest ($26 million was accrued at June 30, 2012), which represents the interest payable from April 15, 2012 through the anticipated prepayment date on the indebtedness that will be repaid as described in “Use of Proceeds.” | | | (59 | ) |

The decrease in other non-current assets reflects the write-off of deferred financing costs of $4 million as a result of the repayment of outstanding debt as described in “Use of Proceeds.”

The reduction in accrued liabilities of $78 million is due to: (a) a $44 million reduction in accrued interest recorded as of June 30, 2012 on the Convertible Notes held by the Significant Holders which will not be paid as a result of the conversion of their Convertible Notes pursuant to the Significant Holders letter agreements; (b) a $26 million reduction in accrued interest recorded as of June 30, 2012 which is included in the interest expense of $59 million reflected above; and (c) an $8 million reduction in the amount accrued related to the management fee agreement.

The decrease in long -term debt of $962 million is comprised of the prepayment of $650 million principal amount of the Second Lien Loans, $64 million principal amount of the 10.50% Senior Notes , $41 million principal amount of the Senior Toggle Notes and $207 million principal amount of the Convertible Notes.

Statement of Operations for the Year Ended December 31, 2011

| (3) | Pro forma gives effect to the reduction in interest expense due to the conversion of approximately $1,903 million aggregate principal amount of the Convertible Notes held by the Significant Holders. The |

66

adjustment to interest expense includes a $209 million reduction in interest expense due to the conversion of such Convertible Notes and a $1 million reduction in deferred financing costs which are amortized to interest expense. The Company has not included in the pro forma statement of operations the loss on the extinguishment of debt as it is nonrecurring.

Pro forma also gives effect to the issuance of 73,006,178 additional shares as a result of the conversion of approximately $1,903 million aggregate principal amount of the Convertible Notes held by the Significant Holders.

| (4) | Pro forma as adjusted gives effect to the use of net proceeds from this offering, cash on hand and borrowings under our revolving credit facility to facilitate: |

| | | | | | |

| • | | Prepayment of all of the aggregate outstanding principal amount of the Second Lien Loans | | $ | (650 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the 10.50% Senior Notes | | | (64 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the Senior Toggle Notes | | | (41 | ) |

| • | | Redemption of the approximately $207 million aggregate principal amount of the Convertible Notes that are not held by the Significant Holders following the closing date of this offering at a redemption price equal to 90% of the principal amount thereof | | | (186 | ) |

The adjustment to interest expense includes a $121 million reduction in interest expense due to the repayment of outstanding debt noted above and a $2 million reduction in deferred financing costs, which are amortized to interest expense ; offset by a $3 million increase in interest expense related to additional borrowings under our revolving credit facility.

If the $207 million aggregate principal amount of Convertible Notes not held by the Significant Holders are converted into common stock instead of being redeemed, the Company will utilize the $186 million of proceeds from this offering that otherwise would have been applied to redeem the Convertible Notes to instead repay other indebtedness, which would result in additional annual interest savings.

The increase in general and administrative expenses of $7 million is for stock compensation expense for the grant of stock options (vesting over four years) and restricted stock (vesting over three years) in connection with this offering assuming an initial public offering price of $25.00 per share, which is the midpoint of the offering price range set forth on the cover page of this prospectus.

We have not included in our pro forma statement of operations the impact of non-recurring charges which include the following:

| | | | | | |

| • | | Expense which represents the fair value of the shares of common stock to be issued to the Significant Holders pursuant to the Significant Holders letter agreements | | $ | 228 | |

| • | | Expense related to the cash payment to be made pursuant to the Significant Holders letter agreements as described in “Use of Proceeds” | | | 105 | |

| • | | Expense to be recognized related to the Management Agreement Termination Fee to be paid $15 million in cash and $25 million in shares of our common stock on January 15, 2013 | | | 40 | |

| • | | Payment of prepayment premiums and fees associated with the prepayment of our indebtedness as described in “Use of Proceeds” | | | 7 | |

| • | | Loss on the extinguishment of debt, related to the write-off of deferred financing costs | | | 4 | |

67

| | | | | | |

| Offset by | | | | |

| • | | Gain related to the approximately $207 million principal amount of Convertible Notes to be redeemed by the Company at 90% of the principal amount thereof | | | 21 | |

| • | | Reduction in accrued interest recorded as of June 30, 2012 on the Convertible Notes held by the Significant Holders which will not be paid as a result of the conversion of their Convertible Notes pursuant to the Significant Holders letter agreements | | | 44 | |

| • | | Reduction in accrued interest recorded as of June 30, 2012 which is included in the interest expense of $59 million reflected above | | | 26 | |

| • | | Reduction in the amount accrued related to the management fee agreement | | | 8 | |

Pro forma as adjusted also gives effect to the issuance of 9,125,776 additional shares pursuant to the Significant Holders letter agreements and the issuance of 40,000,000 shares in this offering.

Statement of Operations for the Six Months Ended June 30, 2012

| (5) | Pro forma gives effect to the reduction in interest expense due to the conversion of $1,903 million aggregate principal amount of Convertible Notes held by the Significant Holders. The adjustment to interest expense includes a $105 million reduction in interest expense due to the conversion of the Convertible Notes. The Company has not included in the pro forma statement of operations the loss on the extinguishment of debt as it is nonrecurring. |

Pro forma also gives effect to the issuance of 73,006,178 additional shares as a result of the conversion of $1,903 million aggregate principal amount of the Convertible Notes held by the Significant Holders.

| (6) | Pro forma as adjusted gives effect to the use of net proceeds related to the offering, cash on hand and borrowings under our revolving credit facility to facilitate: |

| | | | | | |

| • | | Prepayment of all of the aggregate outstanding principal amount of the Second Lien Loans | | $ | (650 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the 10.50% Senior Notes | | | (64 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the Senior Toggle Notes | | | (41 | ) |

| • | | Redemption of the approximately $207 million aggregate principal amount of the Convertible Notes that are not held by the Significant Holders following the closing date of this offering at a redemption price equal to 90% of the principal amount thereof | | | (186 | ) |

The adjustment to interest expense includes a $61 million reduction in interest expense due to the repayment of outstanding debt noted above and a $1 million reduction in deferred financing costs, which are amortized to interest expense; offset by a $2 million increase in interest expense related to additional borrowings under our revolving credit facility.

If the $207 million aggregate principal amount of Convertible Notes not held by the Significant Holders are converted into common stock instead of being redeemed, the Company will utilize the $186 million of proceeds from this offering that otherwise would have been applied to redeem the Convertible Notes to instead repay other indebtedness, which would result in additional annual interest savings.

The increase in general and administrative expenses of $4 million is for stock compensation expense for the grant of stock options (vesting over 4 years) and restricted stock (vesting over 3 years) in connection with this offering assuming an initial public offering price of $25.00 per share, which is the midpoint of the offering price range set forth on the cover page of this prospectus.

Pro forma as adjusted also gives effect to the issuance of 9,125,776 additional shares pursuant to the Significant Holders letter agreements and the issuance of 40,000,000 shares of common stock in this offering.

68

Notes to Unaudited Pro Forma Financial Information

(Assuming Conversion of all of the Convertible Notes)

Balance Sheet (assuming conversion of all of the Convertible Notes)

| (7) | Pro forma gives effect to the conversion of all of the approximately $1,903 million aggregate principal amount of the Convertible Notes held by the Significant Holders substantially concurrently with the closing of this offering and the assumed conversion of the approximately $207 million of Convertible Notes within 30 days from the closing of this offering , representing all of the Convertible Notes that will remain outstanding. The pro forma balance sheet also reflects the write-off of deferred financing costs of $7 million as a result of the repayment of outstanding debt. |

| (8) | Pro forma as adjusted gives effect to the following: |

| | | | | | |

| • | | Anticipated gross proceeds from the sale of common stock in this offering | | $ | 1,000 | |

| • | | Use of cash on hand | | | 89 | |

| • | | Borrowings under our revolving credit facility | | | 6 | |

| |

| Less | | | | |

| • | | Transaction related costs, including $47.5 million in underwriting discounts and commissions | | | (54 | ) |

| • | | Prepayment of all of the aggregate outstanding principal amount of the Second Lien Loans | | | (650 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the 10.50% Senior Notes | | | (64 | ) |

| • | | Redemption of all of the aggregate outstanding principal amount of the Senior Toggle Notes | | | (41 | ) |

| • | | Payment of prepayment premiums and fees | | | (7 | ) |

| • | | Repayment of other bank indebtedness | | | (100 | ) |

| • | | Payment of the cash portion of the Management Agreement Termination Fee to be paid on January 15, 2013 | | | (15 | ) |

| • | | Payment of cash pursuant to the Significant Holders letter agreements (the Significant Holders will not receive the interest payment to be paid on the Convertible Notes on October 15, 2012, the next regularly scheduled interest payment date for the Convertible Notes) | | | (105 | ) |

| • | | Payment of interest ($26 million was accrued at June 30, 2012), which represents the interest payable from April 15, 2012 through the anticipated prepayment date on the indebtedness that will be repaid as described in “Use of Proceeds.” | | | (59 | ) |

The decrease in other non-current assets reflects the write-off of deferred financing costs of $3 million as a result of the repayment of outstanding debt.

The decrease in short-term debt of $94 million is comprised of the prepayment of $100 million of other bank indebtedness, offset by $6 million of borrowings under our revolving credit facility.

The reduction in accrued liabilities of $79 million is due to: (a) a $44 million reduction in accrued interest recorded as of June 30, 2012 on the Convertible Notes held by the Significant Holders which will not be paid as a result of the conversion of their Convertible Notes pursuant to the Significant Holders letter agreements; (b) a $26 million reduction in accrued interest recorded as of June 30, 2012 which is included in the interest expense of $59 million reflected above; and (c) an $8 million reduction in the amount accrued related to the management fee agreement.

The decrease in long-term debt of $755 million is comprised of the prepayment of $650 million principal amount of the Second Lien Loans , $64 million principal amount of the 10.50% Senior Notes and $41 million principal amount of the Senior Toggle Notes.

| (9) | Pro forma reflects interest savings of $ 233 million as a result of the conversion of all of the $2,110 million aggregate principal amount of Convertible Notes and pro forma as adjusted reflects interest savings of $107 |

69

million as a result of proceeds being utilized to repay $650 million principal amount of the Second Lien Loans, $64 million principal amount of the 10.50% Senior Notes, $41 million principal amount of the Senior Toggle Notes, $100 million of other bank indebtedness and $86 million of reduced borrowings under our revolving credit facility resulting in total interest savings of $340 million.

Pro forma gives effect to the issuance of 81,032,3 79 additional shares as a result of the conversion of all of the $2,110 million aggregate principal amount of Convertible Notes. Pro forma as adjusted gives effect to the issuance of 9,739,901 additional shares pursuant to the letter agreements and the issuance of 40,000,000 shares in this offering.

The table below sets forth selected pro forma condensed consolidated statement of operations data for the six months ended June 30, 2012 on a pro forma basis and on a pro forma as adjusted basis giving further effect to the conversion of all of the approximately $207 million aggregate principal amount of the Convertible Notes not held by the Significant holders.

| | | | | | | | | | | | |

| | | Actual | | | Pro Forma | | | Pro Forma

As Adjusted | |

Loss attributable to Realogy Holdings | | $ | (441 | ) | | $ | (231 | ) | | $ | (118 | ) |

Additional interest savings | | | — | | | | 23 | | | | 10 | |

| | | | | | | | | | | | |

Adjusted net loss attributable to Realogy Holdings | | $ | (441 | ) | | $ | (208 | ) | | $ | (108 | ) |

| | | | | | | | | | | | |

Loss per share attributable to Realogy Holdings: | | | | | | | | | | | | |

Basic loss per share: | | $ | (55.01 | ) | | $ | (2.34 | ) | | $ | (0.78 | ) |

Diluted loss per share: | | | (55.01 | ) | | | (2.34 | ) | | | (0.78 | ) |

Weighted average common and common equivalent shares of Realogy Holdings outstanding: | | | | | | | | | | | | |

Basic: | | | 8.0 | | | | 89.0 | | | | 138.8 | |

Diluted: | | | 8.0 | | | | 89.0 | | | | 138.8 | |

70

Allowance for doubtful accounts

We estimate the allowance necessary to provide for uncollectible accounts receivable. The estimate is based on historical experience, combined with a review of current developments, and includes specific accounts for which payment has become unlikely. The process by which we calculate the allowance begins in the individual business units where specific problem accounts are identified and reserved and an additional reserve is generally recorded driven by the age profile of the receivables. Our allowance for doubtful accounts was $58 million, $64 million and $67 million at June 30, 2012, December 31, 2011 and 2010, respectively.

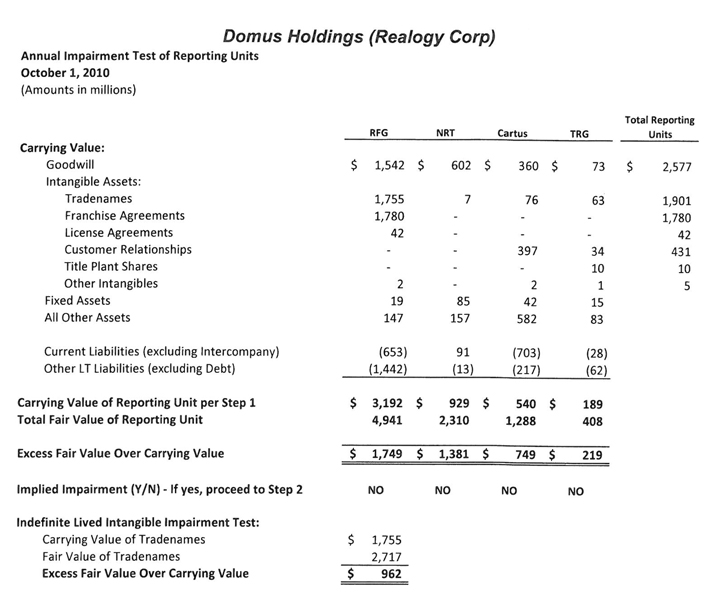

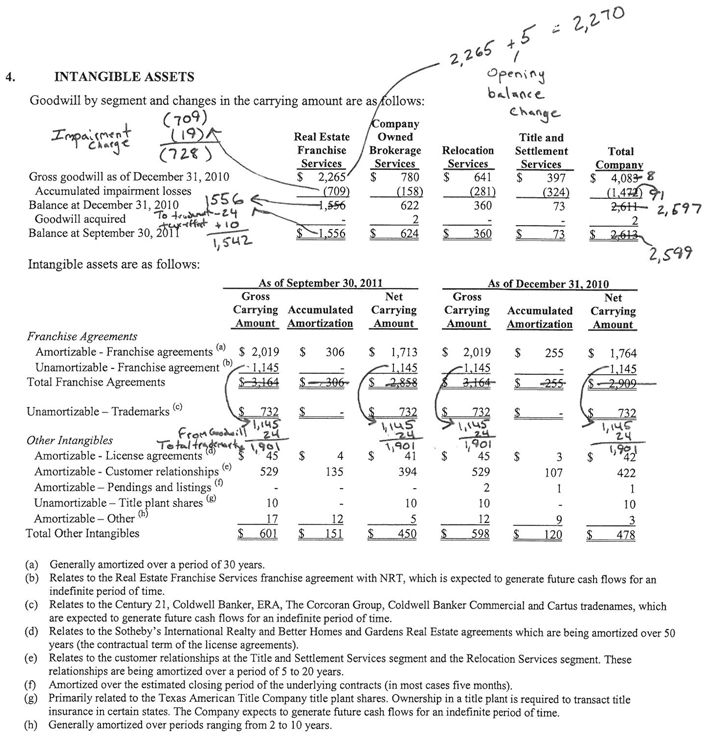

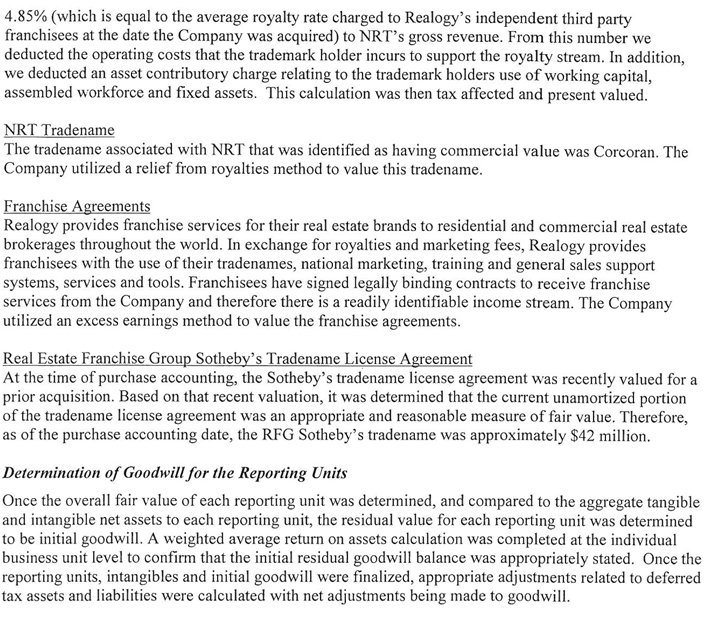

Impairment of goodwill and other indefinite-lived intangible assets

With regard to the goodwill and other indefinite-lived intangible assets recorded in connection with business combinations, we annually, or more frequently if circumstances indicate impairment may have occurred, analyze their carrying values to determine if an impairment exists. In performing this analysis, we are required to make an assessment of fair value for our goodwill and other indefinite-lived intangible assets. We determine the fair value of our reporting units utilizing our best estimate of future revenues, operating expenses, cash flows, market and general economic conditions as well as assumptions that we believe marketplace participants would utilize including discount rates, cost of capital, and long term growth rates. Although we believe our assumptions are reasonable, actual results may vary significantly. A change in these underlying assumptions could cause a change in the results of the tests and, as such, could cause the fair value to be less than the respective carrying amount. In such an event, we would be required to record a charge, which would impact earnings.

The aggregate carrying value of our goodwill and other indefinite-lived intangible assets was $2,618 million and $1,887 million, respectively, at June 30, 2012. It is difficult to quantify the impact of an adverse change in financial results and related cash flows, as certain changes may be isolated to one of our four reporting units or spread across our entire organization. Based upon the impairment analysis performed in the fourth quarter of 2011, there was no impairment for 2011. Management did evaluate the effect of lowering the estimated fair value for each of the reporting units by 10% and determined that no impairment of goodwill would have been recognized under this evaluation.

Common stock valuation

On occasion, we grant stock-based awards to certain senior management employees and directors. These awards are measured at the grant date based on the fair value as calculated using the Black-Scholes option pricing model and are recognized as expense over the service period based on the vesting requirements, or when requisite performance metrics or milestones are achieved. Determining the fair value of stock-based awards at the grant date requires considerable judgment, including estimating expected volatility, expected term and risk-free rate.

In April 2012, the Compensation Committee of our Board of Directors granted 972,000 of time vesting stock options and 80,000 of performance based options to certain senior management employees. Our expected volatility for these options is based on the average volatility rates of similar actively traded companies. The expected holding period of the option is calculated based on the simplified method and is estimated to be 6.25 year. The risk-free rate is derived from the U.S. Treasuries, the period of which relates to the grant’s holding period. If factors change and we employ different assumptions, the fair value of future awards and resulting stock-based compensation expense may differ significantly from what we have estimated historically.

The estimate of the intrinsic value of these options (share value at the time of issuance less exercise price) was based on a contemporaneous share valuation prepared with the assistance of a third party specialist. In conjunction with the preparation of this valuation, we adhered to the guidance provided by the AICPA as prescribed in its Practice Aid entitled, “Valuation of Privately-Held-Company Equity Securities Issued as Compensation.” This Practice Aid specifically addresses valuation of common stock in private companies and outlines approaches that can be taken for that valuation, as well as providing guidelines for each approach. The approaches outlined in the Practice Aid are: (1) discounted cash flow, or income; (2) public company market approach (market multiples); and (3) the guideline transaction (M&A) market approach. Consistent with these

123

guidelines, we employed the income (discounted cash flows) and public company market (market multiples) approaches when performing the valuation, which provided an arm’s length transaction that established an observable price for our shares in the absence of having a quoted market price on an active exchange.

Two inputs for the discounted cash flow model were comprised of our internal forecasts along with a weighted average cost of capital (discount rate). The Company’s weighted average cost of capital provides an expected rate of return based on the Company’s capital structure, the required yield on the Company’s equity and the required yield on the Company’s interest-bearing debt. The inputs used for deriving the multiples that were employed in the market approach analysis were obtained from published financial information from comparable companies, as well as from our historical and forecasted financial results. The results from these two valuation approaches, income (DCF) and market multiples, were given equal weight to determine the value of the enterprise. The Company chose the probability weighted expected return method, as described in the AICPA Practice Aid cited above, given the existing plans to pursue an initial public offering. Two scenarios were prepared, one assuming the Company continued as a private company and one where the company successfully completed an initial public offering based on its then current financial position and the uncertainty of the housing market as of the date of grant. After consideration of these factors, the two scenarios were equally weighted. The results of each scenario were averaged to determine the fair value of our shares of $20.50.

The information used in the above model was based on the most readily available and relevant information at the time the valuation was performed. The valuation model employed both observable and objective inputs, such as market data, as well as inputs which were more subjective, such as assumptions used in preparing our forecasts, which were based on our best estimates at the valuation date. Additional factors such as a marketability discount were factored into the final determination of the fair value of our shares. The below table details the grant prices and grant totals for stock option grants issued in April 2012:

| | | | | | | | | | | | | | | | |

Type of Grant | | Number

of options

granted | | | Estimated

share value

used for fair

value calculation | | | Fair value

of options at

grant date | | | Option

exercise price | |

Time Vested | | | 972,000 | | | $ | 20.50 | | | $ | 10.25 | | | $ | 17.50 | |

Performance Based | | | 80,000 | | | $ | 20.50 | | | $ | 9.75 | | | $ | 17.50 | |

Based upon an estimated offering price of $25.00 per share, which is the midpoint of the estimated public offering price range set forth on the cover page of this prospectus, the April 2012 options would have an intrinsic value of approximately $8 million.

Income taxes

We recognize deferred tax assets and liabilities based on the differences between the financial statement carrying amounts and the tax bases of assets and liabilities. We regularly review our deferred tax balances to assess their potential realization and establish a valuation allowance for amounts that we believe will not be ultimately realized. In performing this review, we make estimates and assumptions regarding projected future taxable income, the expected timing of the reversals of existing temporary differences and the identification of tax planning strategies. A change in these assumptions could cause an increase or decrease to our valuation allowance resulting in an increase or decrease in our effective tax rate, which could materially impact our results of operations.

124

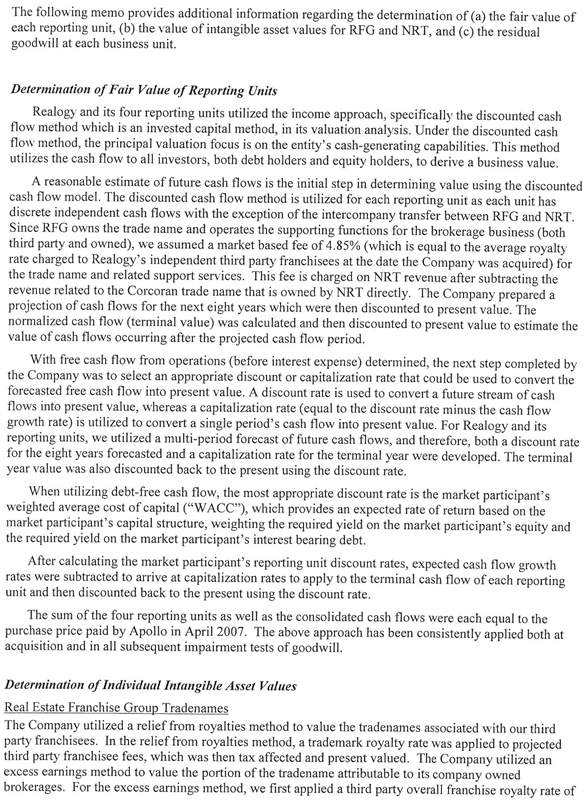

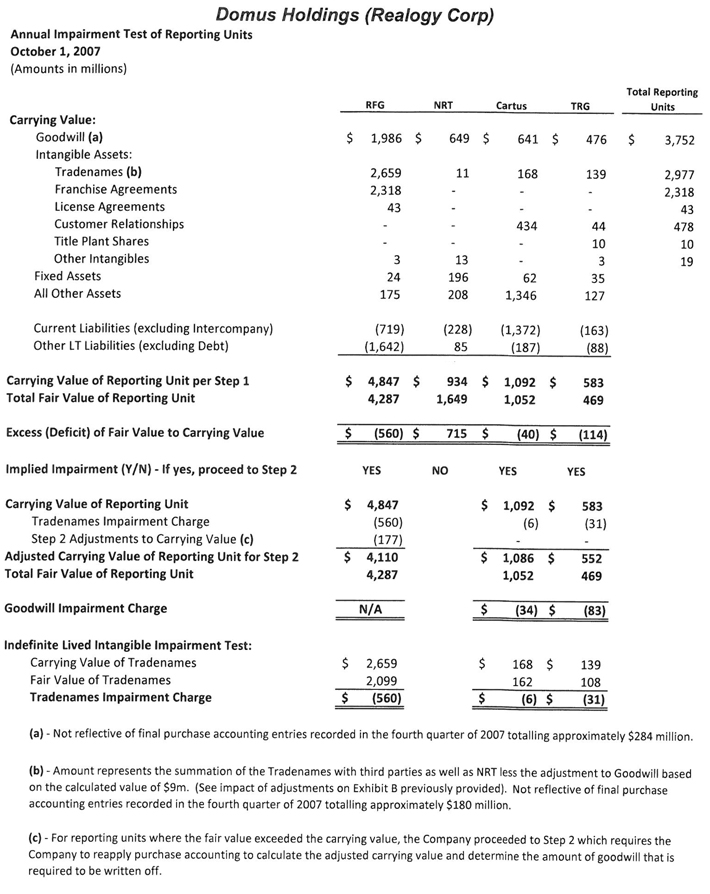

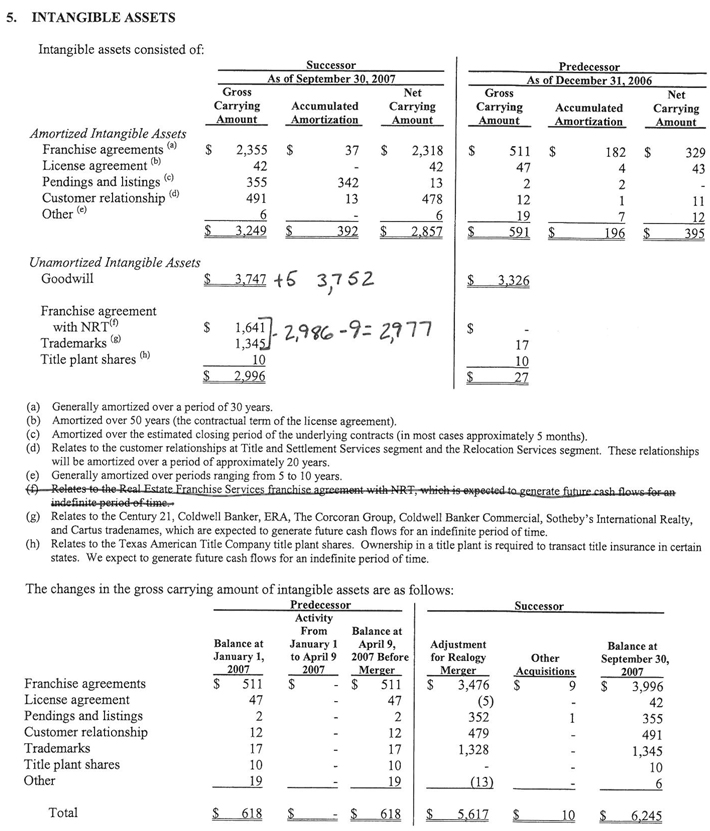

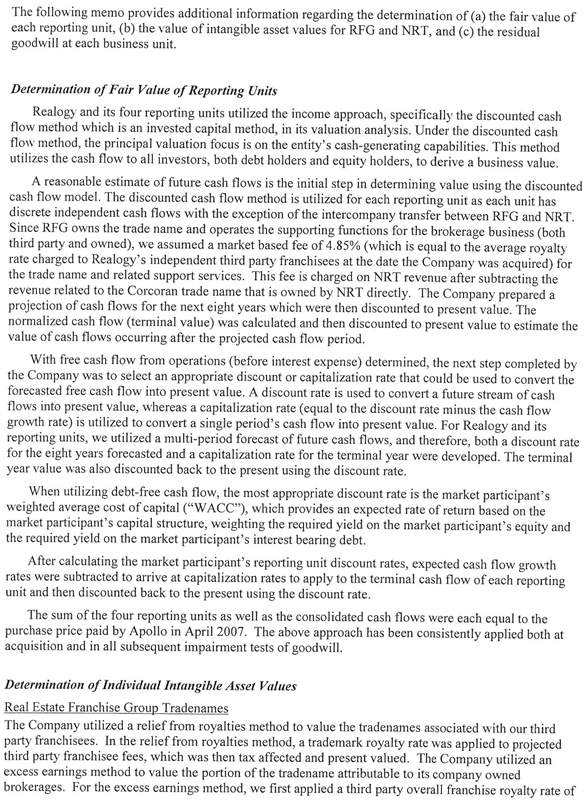

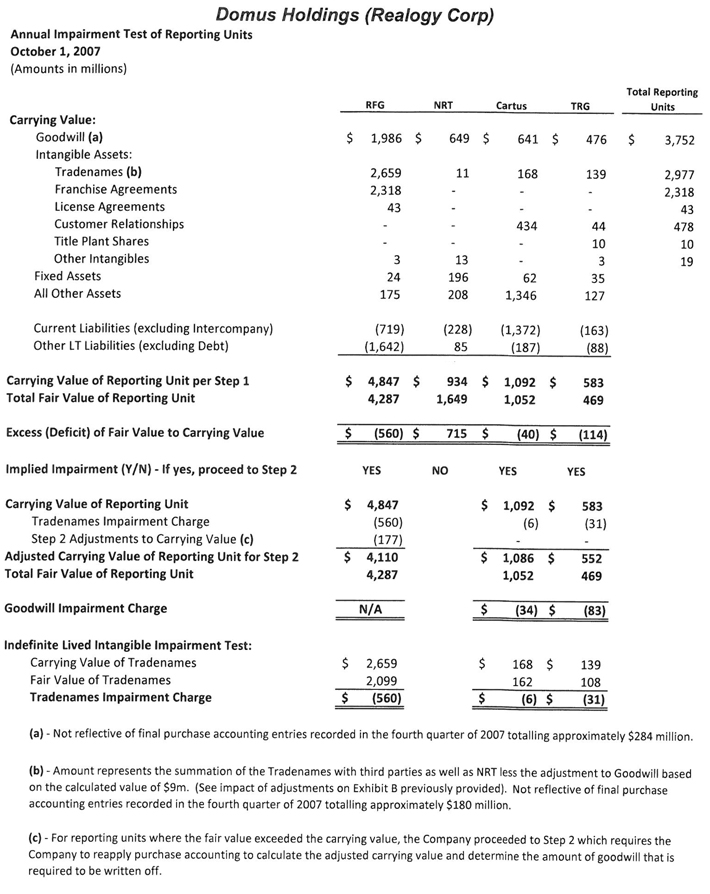

Domus Holdings (Realogy Corp)

Summary Memo: 2007 Acquired Intangibles

The Company has carefully reconsidered its previous valuation of identified acquired intangibles to determine how the value derived from the Company owned brokerages should be reflected on our opening balance sheet recorded as part of our original purchase accounting in April 2007. After further evaluation, we conclude that in valuing acquired intangible assets, we should ignore the intercompany contractual commitment associated with the NRT franchise agreement and assess what additional asset value should have been attributed to the Company’s owned brokerages. As our Company owned brokerage operations derive their revenues (value) from their ability to exclusively license the applicable trade names in their selected locations, we believe it is appropriate to include both the third party franchise royalty feesandthe income earned by the Company’s owned brokerages in determining the value of the acquired trade names. Accordingly, in recalculating the original purchase accounting value for the trade name, we separately evaluated each of the distinct revenue streams as noted below.

Franchise Royalties

A third party broker earns revenue from a homesale transaction. When a homesale occurs, the third party broker collects, in this example, 6% of the selling price of the home from the seller and records this amount as gross commission income on its financial statements. From this revenue, the broker pays (1) commissions to its independent real estate agents (typically about 65% of the gross commission income), (2) marketing costs, (3) overhead costs to operate its real estate offices (rent, salaries of office personnel, etc), and (4) royalties to Realogy, calculated in accordance with its franchise agreement (typically 6% of the gross commission income). (See Exhibit A attached for a walk down of a sample real estate transaction for a third party broker.) The value of the trade name was calculated using an income approach, specifically the relief from royalty method for this portion of the analysis. The calculation assumes that in lieu of ownership, the Company could obtain comparable rights to use the trade name via a license from a hypothetical third-party owner to determine a market royalty rate. (In fact, the Company has such arm’s length third party agreements with Sotheby’s and Better Homes and Gardens trade name owners.) As a result, the fair value of the asset is estimated by calculating the present value of licensing fees avoided because the trade names are owned and not licensed from third parties. As these license fees would be required to support the overall value of the franchise operations to its franchise customers, future estimated third party royalty revenue was multiplied by a market participant royalty rate, and then discounted back to present value to arrive at fair value. The portion of the intangible asset attributable to third party franchisees was recalculated to exclude the intercompany royalty revenue, in order to include all company owned brokerage revenues in the determination of the value of trade names, as described below.

1

Company Owned Brokerages

Our company owned brokerage operations records revenue, listed as gross commission income on the face of our statement of operations, of approximately 6% (in this example) of the selling price of the home from the seller. From this revenue the company owned broker pays the following costs to third parties: (1) commissions to its independent real estate agents (typically about 65% of the gross commission income), (2) marketing costs, and (3) overhead costs to operate its real estate offices. (See Exhibit A attached for walk down of sample real estate transaction for company owned brokerage.) Even if we exclude the intercompany royalty fees that are paid by the company owned brokerage, the costs of operating the brokerage are substantial, resulting in the Company retaining only about 10% of revenue. As a result, we determined that it would be inappropriate to value this portion of the trade name intangible asset using the relief from royalties method, because the third party market royalty rate is based on a net royalty paid, rather than gross commission income, or revenue, of the brokerage. In addition, as NRT is three times larger than its nearest competitor and 26 times larger than our largest franchisee (both as measured by 2011 sales volume), we were unable to determine an appropriate arm’s-length third party market royalty rate for NRT, as such rates vary with volume. Therefore, we determined that the proper methodology for valuing this portion of the trade name was the excess earnings method, which is an acceptable alternate method used to derive the value of an intangible asset. The excess earnings method derives the value of an asset by calculating profit and deducting a charge for the utilization of the identified assets (the contributory charge). This contributory charge specifically excludes any expense relating to the intercompany agreement.

After recalculating the fair market value of its intangible assets and goodwill, including our related impairment analysis, for all years since 2007, the table below shows net increases / (decreases) to our balance sheet, as compared to reported balances.

| | | | | | | | | | | | | | | | | | | | |

($ in millions) As of December 31, | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2012 | |

Net carrying value of total intangible assets | | | (56 | ) | | | 24 | | | | 24 | | | | 24 | | | | 24 | |

Net carrying value of goodwill | | | 5 | | | | (14 | ) | | | (14 | ) | | | (14 | ) | | | (14 | ) |

Deferred tax liability | | | (22 | ) | | | 10 | | | | 10 | | | | 10 | | | | 10 | |

Retained earnings | | | (29 | ) | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

(See exhibit B for a detailed roll forward of impairment as reported and as revised per the methodology described above for December 31, 2007 and 2008.) The Company recalculated its annual impairment analysis of trade names as well as its Step 1 impairment analysis of goodwill for the years ended December 31, 2009, 2010, and 2011, which resulted in no additional impairment. (See Exhibit C for a summary of the annual impairment analysis of trade names and goodwill for the years ended December 31, 2009, 2010, and 2011.)

Please see Exhibit D for the expected changes to the balance sheet and Exhibit E for a draft of the footnote to describe the revision to the S-1.

2

Doms Holdings (Realogy Corp)

Exhibit A

Example of a real estate transaction, comparing a company owned brokerage to a third party franchisee

| | | | | | |

| | Company owned broker example,excluding intercompany royalty payment | | | | Third party franchisee broker |

| | | |

| Transaction | | $200,000 home with 6% ($12,000) | | | | $200,000 home with 6% ($12,000) |

| Assumption | | brokers fee | | | | brokers fee |

| | | |

| | Realogy revenue = $12,000 GrossCommission Income | | | | Brokerage revenue = $12,000 Grosscommission income |

| | | |

| | Less: $7,800 agent commission (65%) | | | | Third party broker pays $7,800 agent commission (65%) |

| | Less: $3200 overhead and marketing | | | | Third party broker pays overhead and marketing |

Amount retained by Realogy | | $1,000 profit retained by | | | | $720 royalty fee paid to franchisor by third party broker (6% of $12,000) |

| | | | | | |

| | In 2011, company owned brokerage revenue = $2.9 billion, less 65% to agents, less $792 million for offices, marketing, G&A | | | | In 2011, third party franchisee royalties to Realogy = $232 m |

| | | |

| | (723 offices and 41,500 real estate agents) | | | | (3,150 US franchisees, 6,100 offices and 166,000 real estate agents) |

3

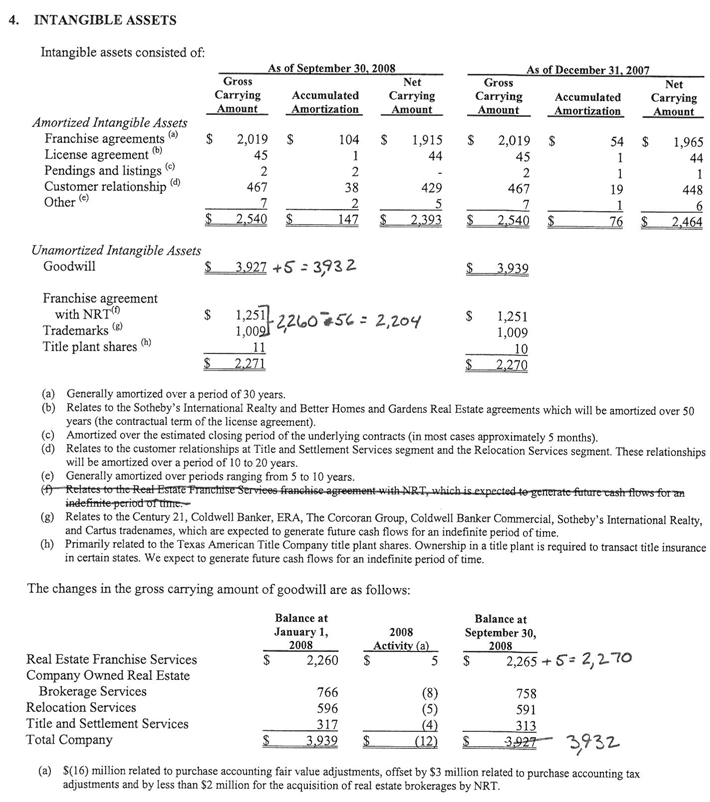

Domus Holdings (Realogy Corp)

Exhibit B

As Reported

| | | | | | | | | | | | | | | | | | | | |

| | | Open Balance

4/10/07 | | | Impairment/

Tax Impact | | | 12/31/07 | | | Impairment/

Tax Impact | | | 12/31/08 | |

Selected Balance Sheet Items DR/(CR): | | | | | | | | | | | | | | | | | | | | |

RFG Goodwill | | | 2,265 | | | | | | | | 2,265 | | | | (709 | ) | | | 1,556 | |

RFG Tradenames | | | 817 | | | | (93 | ) | | | 724 | | | | (138 | ) | | | 586 | |

RFG Franchise Agreement with NRT | | | 1,671 | | | | (420 | ) | | | 1,251 | | | | (106 | ) | | | 1,145 | |

| | | | | | | | | | | | | | | | | | | | |

RFG Tradenames and Franchise Agreement with NRT | | | 2,488 | | | | (513 | ) | | | 1,975 | | | | (244 | ) | | | 1,731 | |

Deferred Tax Liability Associated with Intangibles | | | (1,001 | ) | | | 205 | | | | (796 | ) | | | 86 | | | | (710 | ) |

Net Impact to Retained (Earnings) / Deficit | | | — | | | | 308 | | | | 308 | | | | 867 | | | | 1,175 | |

Selected Statement of Operations Items: | | | | | | | | | | | | | | | | | | | | |

Impairment Associated with RFG Assets | | | | | | | 513 | | | | | | | | 953 | | | | | |

Income Tax Expense / (Benefit) | | | | | | | (205 | ) | | | | | | | (86 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | |

Impact to Net Loss / (Income) | | | | | | | 308 | | | | | | | | 867 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

As Adjusted | |

| | | Open Balance

4/10/07 | | | Impairment/ Tax Impact | | | 12/31/07 | | | Impairment/

Tax Impact | | | 12/31/08 | |

Selected Balance Sheet Items DR/(CR): | | | | | | | | | | | | | | | | | | | | |

RFG Goodwill | | | 2,270 | | | | — | | | | 2,270 | | | | (728 | ) | | | 1,542 | |

RFG Tradenames | | | 2,479 | | | | (560 | ) | | | 1,919 | | | | (164 | ) | | | 1,755 | |

RFG Franchise Agreement with NRT | | | — | | | | | | | | — | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

RFG Tradenames and Franchise Agreement with NRT | | | 2,479 | | | | (560 | ) | | | 1,919 | | | | (164 | ) | | | 1,755 | |

Deferred Tax Liability Associated with Intangibles | | | (997 | ) | | | 223 | | | | (774 | ) | | | 54 | | | | (720 | ) |

Net Impact to Retained Earnings / (Deficit) | | | — | | | | 337 | | | | 337 | | | | 838 | | | | 1,175 | |

Selected Statement of Operations Items: | | | | | | | | | | | | | | | | | | | | |

Impairment Associated with RFG Assets | | | | | | | 560 | | | | | | | | 892 | | | | | |

Income Tax Expense / (Benefit) | | | | | | | (223 | ) | | | | | | | (54 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | |

Impact to Net Loss / (Income) | | | | | | | 337 | | | | | | | | 838 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

Impact of Adjustments to Balance Sheet and Income Statement | |

| | | Open Balance 4/10/07 | | | Impairment/

Tax Impact | | | 12/31/07 | | | Impairment/

Tax Impact | | | 12/31/08 | |

Selected Balance Sheet Increase / (Decrease): | | | | | | | | | | | | | | | | | | | | |

RFG Goodwill | | | 5 | | | | — | | | | 5 | | | | (19 | ) | | | (14 | ) |

RFG Tradenames | | | 1,662 | | | | (467 | ) | | | 1,195 | | | | (26 | ) | | | 1,169 | |

RFG Franchise Agreement with NRT | | | (1,671 | ) | | | 420 | | | | (1,251 | ) | | | 106 | | | | (1,145 | ) |

RFG Tradenames and Franchise Agreement with NRT | | | (9 | ) | | | (47 | ) | | | (56 | ) | | | 80 | | | | 24 | |

Impact on Assets | | | (4 | ) | | | (47 | ) | | | (51 | ) | | | 61 | | | | 10 | |

| | | | | | | | | | | | | | | | | | | | |

Deferred Tax Liability Associated with Intangibles | | | 4 | | | | 18 | | | | 22 | | | | (32 | ) | | | (10 | ) |

Net Impact to Retained Earnings / (Deficit) | | | — | | | | 29 | | | | 29 | | | | (29 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | |

Impact on Liabilities and Equity | | | 4 | | | | 47 | | | | 51 | | | | (61 | ) | | | (10 | ) |

| | | | | | | | | | | | | | | | | | | | |

Selected Statement of Operations Items: | | | | | | | | | | | | | | | | | | | | |

Impairment Associated with RFG Assets | | | | | | | 47 | | | | | | | | (61 | ) | | | | |

Income Tax Expense / (Benefit) | | | | | | | (18 | ) | | | | | | | 32 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Impact to Net Loss / (Income) | | | | | | | 29 | | | | | | | | (29 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | |

4

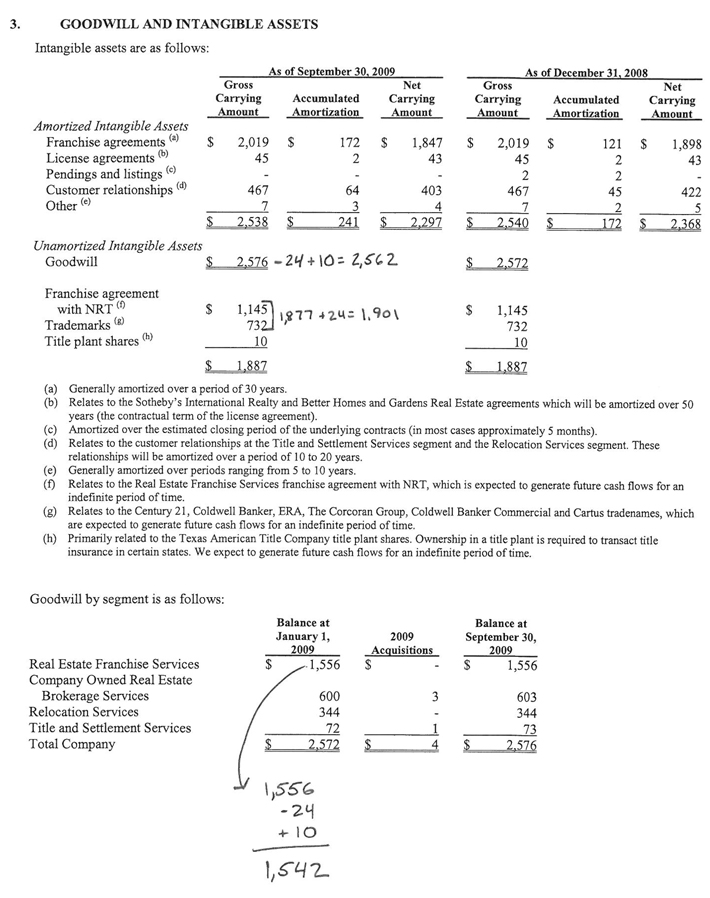

Domus Holdings (Realogy Corp)

Exhibit C

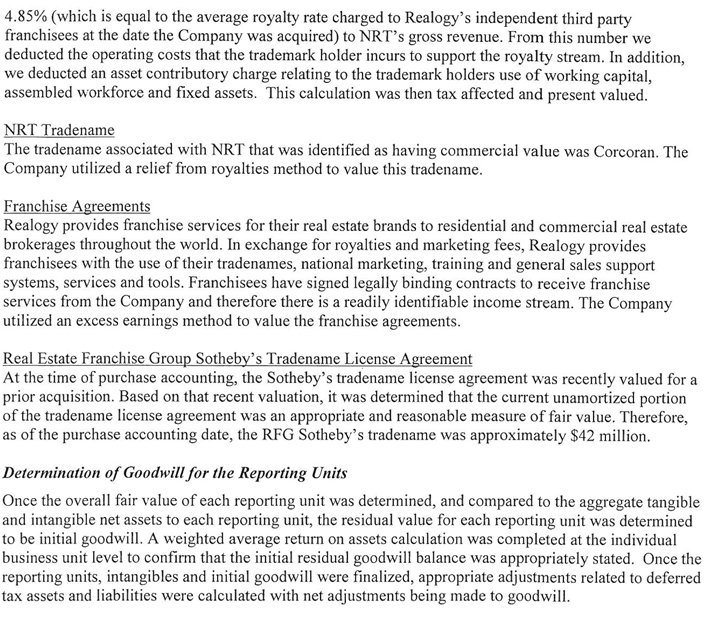

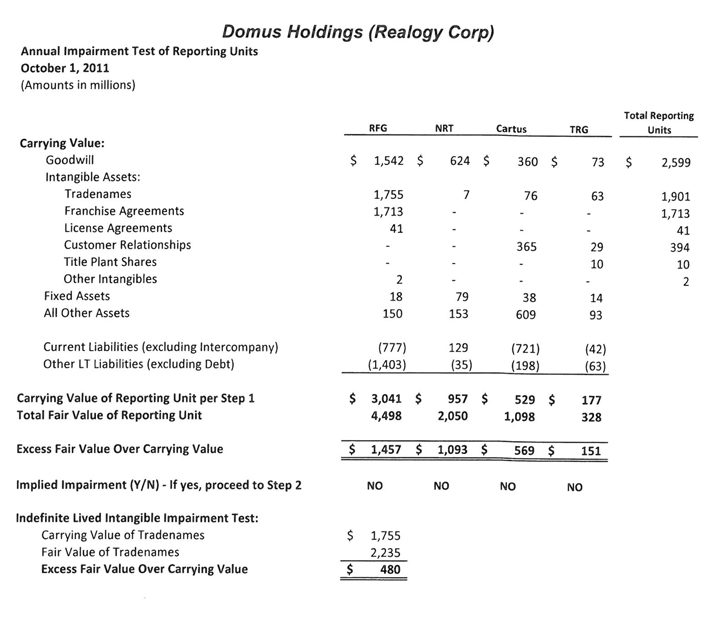

CALCULATIONS RELATED TO THE ASC 350 REVIEW FOR REALOGY CORPORATION

SUMMARY OF STEP 1 CONCLUSION

(Amounts in millions)

As of October 1, 2011

| | | | | | | | | | | | | | |

| | | Fair Value | | | Carrying Value | | | Excess Fair Value | | | Implied

Impairment

(Y/N) |

| | | | | | | | | | | | |

RFG Trademarks | | $ | 2,235 | | | $ | 1,755 | | | $ | 480 | | | NO |

Reporting Unit Value: | | | | | | | | | | | | | | |

RFG | | $ | 4,498 | | | $ | 3,041 | | | $ | 1,457 | | | NO |

NRT | | | 2,050 | | | | 958 | | | | 1,092 | | | NO |

Cartus | | | 1,098 | | | | 529 | | | | 569 | | | NO |

TRG | | | 328 | | | | 177 | | | | 151 | | | NO |

Total Reporting Units | | $ | 7,974 | | | $ | 4,705 | | | | | | | |

As of October 1, 2010

| | | | | | | | | | | | | | |

| | | Fair Value | | | Carrying Value | | | Excess Fair Value | | | Implied

Impairment

(Y/N) |

| | | | | | | | | | | | |

RFG Trademarks | | $ | 2,717 | | | $ | 1,755 | | | $ | 962 | | | NO |

Reporting Unit Value: | | | | | | | | | | | | | | |

RFG | | $ | 4,941 | | | $ | 3,192 | | | $ | 1,749 | | | NO |

NRT | | | 2,310 | | | | 929 | | | | 1,381 | | | NO |

Cartus | | | 1,288 | | | | 540 | | | | 748 | | | NO |

TRG | | | 408 | | | | 189 | | | | 219 | | | NO |

Total Reporting Units | | $ | 8,947 | | | $ | 4,850 | | | | | | | |

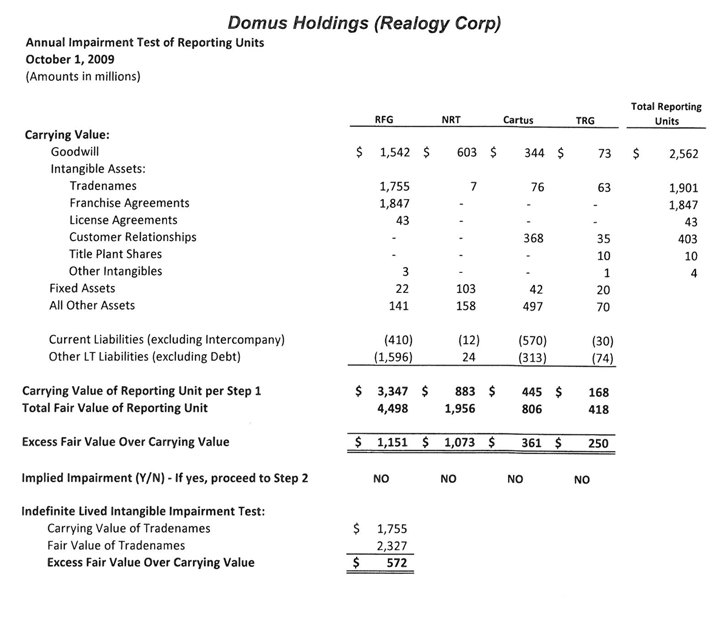

As of October 1, 2009

| | | | | | | | | | | | | | |

| | | Fair Value | | | Carrying Value | | | Excess Fair Value | | | Implied

Impairment

(Y/N) |

| | | | | | | | | | | | |

RFG Trademarks | | $ | 2,327 | | | $ | 1.755 | | | $ | 572 | | | NO |

Reporting Unit Value: | | | | | | | | | | | | | | |

RFG | | $ | 4,498 | | | $ | 3,347 | | | $ | 1,151 | | | NO |

NRT | | | 1,956 | | | | 882 | | | | 1,074 | | | NO |

Cartus | | | 806 | | | | 445 | | | | 361 | | | NO |

TRG | | | 418 | | | | 167 | | | | 250 | | | NO |

Total Reporting Units | | $ | 7,678 | | | $ | 4,842 | | | | | | | |

5

Exhibit D

REALOGY HOLDINGS CORP.

CONSOLIDATED BALANCE SHEETS

(In millions)

| | | | | | | | |

| | | December 31, | |

| | 2011 | | | 2010 | |

ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 143 | | | $ | 192 | |

Trade receivables (net of allowance for doubtful accounts of $64 and $67) | | | 120 | | | | 114 | |

Relocation receivables | | | 378 | | | | 386 | |

Relocation properties held for sale | | | 11 | | | | 21 | |

Deferred income taxes | | | 66 | | | | 76 | |

Other current assets | | | 88 | | | | 109 | |

| | | | | | | | |

Total current assets | | | 806 | | | | 898 | |

Property and equipment, net | | | 165 | | | | 186 | |

Goodwill | | | 2,600 | | | | 2,597 | |

Trademarks | | | 1,901 | | | | 1,901 | |

Franchise agreements, net | | | 1,697 | | | | 1,764 | |

Other intangibles, net | | | 439 | | | | 478 | |

Other non-current assets | | | 212 | | | | 215 | |

| | | | | | | | |

Total assets | | $ | 7,820 | | | $ | 8,039 | |

| | | | | | | | |

LIABILITIES AND EQUITY (DEFICIT) | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 184 | | | $ | 203 | |

Securitization obligations | | | 327 | | | | 331 | |

Due to former parent | | | 80 | | | | 104 | |

Revolving credit facility and current portion of long-term debt | | | 325 | | | | 194 | |

Accrued expenses and other current liabilities | | | 520 | | | | 525 | |

| | | | | | | | |

Total current liabilities | | | 1,436 | | | | 1,357 | |

Long-term debt | | | 6,825 | | | | 6,698 | |

Deferred income taxes | | | 900 | | | | 893 | |

Other non-current liabilities | | | 167 | | | | 163 | |

| | | | | | | | |

Total liabilities | | | 9.328 | | | | 9,111 | |

| | | | | | | | |

Commitments and contingencies (Notes 13 and 14) | | | | | | | | |

Equity (deficit): | | | | | | | | |

Realogy Holdings common stock: $.01 par value; 178,000,000 shares authorized, 4,200 Class A shares outstanding, 8,017,080 Class B shares outstanding at December 31, 2011 and 8,017,240 Class B shares outstanding at December 31, 2010 | | | — | | | | — | |

Additional paid-in capital | | | 2,033 | | | | 2,026 | |

Accumulated deficit | | | (3,511 | ) | | | (3,070 | ) |

Accumulated other comprehensive loss | | | (32 | ) | | | (30 | ) |

| | | | | | | | |

Total Realogy Holdings stockholders’ deficit | | | (1,510 | ) | | | (1,074 | ) |

| | | | | | | | |

Noncontrolling interests | | | 2 | | | | 2 | |

| | | | | | | | |

Total equity (deficit) | | | (1,508 | ) | | | (1,072 | ) |

| | | | | | | | |

Total liabilities and equity (deficit) | | $ | 7,820 | | | $ | 8,039 | |

| | | | | | | | |

6

Domus Holdings (Realogy Corp)

Exhibit E

Revision of Prior Period Financial Statements

In connection with the preparation of our Registration Statement, we identified and corrected an error in the manner in which we had allocated the purchase price paid by Apollo subsequent to their 2007 acquisition. Specifically, we inappropriately identified the discounted cash flows generated from the Real Estate Franchise Services franchise agreement with NRT as a separately identifiable indefinite lived intangible asset. We concluded that the value ascribed to this agreement should have been attributed to the value of the indefinite lived tradenames owned by the Real Estate Franchise Services business unit. Accordingly, we corrected our error through the elimination of the Real Estate Franchise Services franchise agreement with NRT intangible asset and increased the value associated with our tradenames. In accordance with accounting guidance found in ASC 250-10 (SEC Staff Accounting Bulletin No. 99, Materiality), we assessed the materiality of the errors and concluded that the errors were not material to any of our previously issued financial statements. In accordance with the accounting guidance in ASC 250-10 (SEC Staff Accounting Bulletin No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements), we have revised all affected periods. These non-cash errors had no impact to our consolidated statement of operations or cash flows for any of the periods presented.

The following table presents the effect the revision had on the Consolidated Balance Sheet at December 31, 2011 and 2010:

| | | | | | | | | | | | |

| | | December 31, 2011 | |

| | (in millions) | |

| | As Previously Reported | | | Adjustment | | | As Revised | |

Goodwill | | $ | 2,614 | | | $ | (14 | ) | | $ | 2,600 | |

Trademarks | | | 732 | | | | 1,169 | | | | 1,901 | |

Franchise agreements, net | | | 2,842 | | | | (1,145 | ) | | | 1,697 | |

Total Assets | | | 7,810 | | | | 10 | | | | 7,820 | |

Deferred income taxes | | | 890 | | | | 10 | | | | 900 | |

Total Liabilities | | | 9,318 | | | | 10 | | | | 9,328 | |

| | | | | | | | | | | | |

| | | December 31, 2010 | |

| | | (in millions) | |

| | | As Previously Reported | | | Adjustment | | | As Revised | |

Goodwill | | $ | 2,611 | | | $ | (14 | ) | | $ | 2,597 | |

Trademarks | | | 732 | | | | 1,169 | | | | 1,901 | |