_________________________________________________________________

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities and Exchange Act of 1934

Filed by the Registrant þ

Filed by a party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under § 240.14a-12

Anywhere Real Estate Inc.

(Name of Registrant as Specified In Its Charter)

___________________________

Payment of Filing Fee (Check all boxes that apply):

þ No fee required

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

_________________________________________________________________

NOTICE OF 2024 ANNUAL MEETING

OF STOCKHOLDERS AND

PROXY STATEMENT

A Letter from our Chief Executive Officer March 19, 2024

Dear Stockholders:

Anywhere Real Estate Inc. drove meaningful results in 2023, reinforcing our consistent track record and our leadership position in the real estate industry. In a challenging year for the housing market, we generated solid Operating EBITDA and free cash flow, reduced our debt, invested in the business for future growth, overdelivered on our cost savings, and mitigated risk by reaching a nationwide settlement in our antitrust litigation.

We are optimistic about the opportunities for Anywhere in the year ahead as we utilize our financial strength, propel our strategic priorities forward, and leverage our competitive advantages to deliver even greater value to our affiliated agents, franchisees, and stockholders.

Strategic Leadership

In 2023, Anywhere continued to invest in our strategic vision while transforming our cost structure. We harnessed our competitive advantages to capture future growth, integrating our brokerage and title operations to streamline the transaction experience; strengthening our high-octane franchise network; furthering our valuable luxury leadership; and driving our ambitious product, technology, and generative AI agenda.

We reinforced our industry leadership by successfully architecting the first nationwide settlement in the seller antitrust class action litigation, allowing our leadership and investments to fully focus on supporting our customers and advancing our strategic goals, not on litigation. We are pleased with this outcome and look forward to our final approval hearing in May.

Cost and Capital Structure Progress

Even in 2023’s tough housing market, Anywhere made financial progress to improve both our cost and capital structures, amplifying our future earning power. We continued to focus on permanently lowering our cost base, realizing approximately $220 million of cost savings in the year, about 10% higher than our target. We also anticipate another $100 million in savings in 2024.

Debt reduction remains a top capital allocation priority for Anywhere, and we are committed to further improving our capital structure. In 2023, we reduced

debt by over $300 million, achieving an impressive $900 million in debt reduction since 2019.

Talent and Culture Power

Anywhere is consistently recognized as a home for top talent, named one of Fortune’s America’s Most Innovative Companies 2023 and one of Forbes’ 2023 World’s Best Employers for the third year in a row, in addition to our designation as a Great Place to Work® for the sixth year. We were also once again honored for our culture of integrity as one of the World’s Most Ethical Companies® for the 13th consecutive year.

We believe our strong focus on attracting, retaining, and developing phenomenal talent is a meaningful strategic advantage. We continue to engage the Board in our talent and succession planning focus. This includes welcoming new leaders and innovators like Rudy Wolfs, our recently appointed Chief Technology Officer, to lead critical areas for our long-term vision.

Moving to What’s Next

In a challenging year for real estate, Anywhere continued to execute on what we could control while propelling our long-term strategic vision. As we look ahead to 2024 and a potentially improving housing market, we will continue to build on our competitive advantages, accelerate our strategic agenda, and amplify our leadership power to set Anywhere up for future growth.

I am especially energized by the opportunity ahead for Anywhere as we lead the world on a better real estate journey and charge forward in our mission to empower everyone’s next move.

On behalf of our Board of Directors, my senior leadership team, and our employees, thank you for your continued support of and investment in Anywhere.

Sincerely,

Ryan M. Schneider

Chief Executive Officer and President

A Letter from our Independent Chairman of the Board March 19, 2024

To Our Stockholders:

In 2023, Anywhere Real Estate Inc. distinguished itself as a proven leader in the real estate industry, capitalizing on its strengths and accelerating its strategic vision for the future. Even in the face of a very challenging housing market and uncertainties in the real estate brokerage industry, Anywhere delivered significant results in the areas directly within its control, including significant cost reduction, exceptional risk management mitigation, continued growth in our luxury brands, effective management of the balance sheet, and talent and employee engagement. As the industry faces change ahead, we remain focused on seizing this moment to leverage our distinct advantages and position Anywhere for greatness into the future.

The Board of Directors is confident that, under the leadership of CEO Ryan Schneider and his management team, Anywhere is uniquely equipped to lead the real estate industry through this transformational time with the vision, agility, and integrity required to not only face, but help shape, an even brighter future.

Throughout the year, the Board continued to focus on key areas including:

Investor Outreach

The Board continues to prioritize direct engagement with our investors and maintains a proactive investor outreach program. For the sixth consecutive year, the Board engaged directly with our stockholders, meeting with seven of our top ten stockholders in 2023, covering key topics such as strategy, leadership, governance and compensation.

We greatly value investor feedback, including feedback on adjusting executive compensation plans to support both strategic and retention goals as we navigate a fluctuating housing market. Based on the suggestion of several investors, we incorporated metrics within the control of our management team to reward critical strategic progress in addition to financial performance. This effort allows us to both mitigate swings in compensation as a result of macroeconomic conditions and also focus on retaining exceptional executive talent like our CEO during a continued market downturn and industry uncertainty. We remain committed to building upon our governance and compensation best practices and continuing to gather and implement feedback from investors.

Successful Navigation of Litigation Uncertainties

The Board, with significant oversight by its Ad Hoc Special Committee, worked with management to navigate industry-wide challenges and, in particular, we are pleased to have received preliminary court approval of our nationwide settlement agreement in the sell-side antitrust class action litigation. Our efforts to resolve these claims remove future uncertainty and legal expense for Anywhere, our franchisees, and affiliated agents, allowing us to focus more intently on delivering the future.

Strategy and Capital Allocation

The Board continues to be closely involved in the oversight of the Anywhere strategy, which is centered around accelerating growth in our core business, simplifying the sale and purchase of a home, and transforming our cost structure. We believe we can leverage our unique advantages and integrated business model to lead through near-term housing challenges and propel our strategic vision for the future.

During 2023, the Board (with oversight by the Ad Hoc Special Committee) and management opportunistically addressed its balance sheet and focused on debt reduction, even in a challenging landscape. The Company reduced its overall debt by more than $300 million during the year, and the Board continues to prioritize opportunities to further reduce our debt while identifying efficiencies to drive long-term value and thoughtfully investing in our future.

Board Governance

We take pride in our commitment to strong board governance, reinforced by our Nominating & Corporate Governance Committee. With the addition of Joe Lenz, Managing Director at TPG Angelo Gordon, and Egbert Perry, CEO of Integral LLC and former Chair of Fannie Mae, the Anywhere Board now comprises 13 directors, 12 of whom are independent for purposes of New York Stock Exchange listing standards.

On behalf of your Board of Directors, thank you for your continued investment in Anywhere. We appreciate the opportunity to serve the Company on your behalf.

Michael J. Williams

Independent Chairman of the Board

| | | | | |

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS | |

| | | | | | | | | | | |

| Date: | Thursday, May 2, 2024 | | Who may attend the meeting Only stockholders, persons holding proxies from stockholders, invited representatives of the financial community and other guests of Anywhere may attend the Annual Meeting. See Frequently Asked Questions—How do I attend the Annual Meeting on page 88. We intend to hold the Annual Meeting as a virtual-only meeting. Accordingly, there will not be a physical meeting location. You will be able to attend the meeting online, examine a list of our stockholders of record, submit your questions and vote your shares electronically by visiting www.virtualshareholdermeeting.com/HOUS2024. Your vote is important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. You can vote by Internet before the Annual Meeting, by telephone, by requesting a printed copy of the proxy materials and using the enclosed proxy card or by Internet during the Annual Meeting. By order of the Board of Directors, Marilyn J. Wasser Corporate Secretary

March 19, 2024 |

| Time: | 9:00 a.m., Eastern Daylight Time | |

| Place: | www.virtualshareholdermeeting.com/HOUS2024 |

| | |

Record Date Owners of Anywhere Real Estate Inc.* common stock as of March 6, 2024, are entitled to notice of, and to vote at, the 2024 Annual Meeting of Stockholders (and any adjournments or postponements of the meeting) (the "Annual Meeting"). | |

| | |

| Purposes of the meeting | |

| 1. | to elect thirteen Directors for a term expiring at the 2025 Annual Meeting of Stockholders | |

| 2. | to vote on an advisory resolution to approve executive compensation | |

| 3. | to vote on a proposal to ratify the appointment of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for fiscal year 2024 | |

| 4. | to transact any other business that may be properly brought before the meeting or any adjournment or postponement of the meeting | |

| | |

| The matters specified for voting above are more fully described in the attached proxy statement. | |

| |

Important Notice Regarding Availability of Proxy Materials for the 2024 Annual Meeting of Stockholders: Our Notice of Annual Meeting, Proxy Statement and Annual Report for the fiscal year ended December 31, 2023, are available on the Investors section of our website at www.anywhere.re | |

| | |

| * Except as otherwise indicated or unless the context otherwise requires, references in this proxy statement to "we," "us," "our," "the Company," "Anywhere" and "Anywhere Real Estate" refer to Anywhere Real Estate Inc. and our consolidated subsidiaries, including but not limited to Anywhere Real Estate Group LLC. References in this proxy statement to "Anywhere Group" mean Anywhere Real Estate Group LLC. | | Website addresses given in this proxy statement are provided as inactive textual references. The contents of these websites are not incorporated by reference herein or otherwise a part of this proxy statement. |

This proxy statement is issued in connection with the solicitation of proxies by the Board of Directors of Anywhere Real Estate Inc. for use at the Annual Meeting. On or about March 19, 2024, we will begin distributing print or electronic materials regarding the Annual Meeting to each stockholder entitled to vote at the meeting. Shares represented by a properly executed proxy will be voted in accordance with instructions provided by the stockholder.

Forward Looking Statements. This proxy statement contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements preceded by, followed by or that otherwise include the words “intends”, "believes", "expects", "forecasted", "projects", "estimates" and "plans" and similar expressions or future or conditional verbs such as "will", "should", "would", "may" and "could" are generally forward-looking in nature and not historical facts. Any statements that refer to expectations or other characterizations of future events, circumstances or results are forward-looking statements.

The Company wishes to caution each participant to consider carefully the specific factors discussed with each forward-looking statement in this proxy statement and other factors contained in the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023, under the captions “Forward-Looking Statements”, "Summary of Risk Factors", “Risk Factors”, "Legal Proceedings" and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as such factors in some cases have affected, and in the future (together with other factors) could affect, the ability of the Company to implement its business strategy and may cause actual results to differ materially from those contemplated by the statements expressed herein. The Company assumes no obligation to update the information or the forward-looking statements contained herein, whether as a result of new information or otherwise.

Non-GAAP Financial Measures. This proxy statement includes certain supplemental measures of the Company’s performance that are not Generally Accepted Accounting Principles (“GAAP”) measures, including Operating EBITDA (and Plan Operating EBITDA) and Cumulative Free Cash Flow. Definitions of these non-GAAP terms and reconciliations to their most comparable GAAP terms are included as Annex A to this proxy statement.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement before voting

| | | | | | | | | | | | | | |

| PROPOSALS TO BE PRESENTED AT THE 2024 ANNUAL MEETING |

| | | | |

| Proposal 1 | | | | The Board recommends a vote FOR all director nominees |

| Election of Thirteen Director Nominees | | | Our Nominating and Corporate Governance Committee and our Board have determined that each director nominee possesses the skills and experience to oversee Anywhere's business strategy and that the mix of backgrounds and qualifications represented by our Directors strengthen our Board's effectiveness. |

Go to page 28 for additional information on Proposal 1 |

| | | | |

| Proposal 2 | | | | The Board recommends a vote FOR this proposal |

| Advisory Vote on Executive Compensation Program | | | Our independent Compensation and Talent Management Committee designed our 2023 executive compensation program to attract, motivate and retain high-performing executives particularly in light of a deep downturn in the real estate market and the challenging industry litigation and regulatory climate with a view that executive compensation is tied to achievement of our strategic and business goals and aligned with long-term value creation. |

Go to our Compensation Discussion and Analysis ("CD&A") on page 39 and Proposal 2 on page 81 for additional information on our executive compensation program |

| | | | |

| Proposal 3 | | | | The Board recommends a vote FOR this proposal |

| Ratification of the Appointment of the Independent Registered Public Accounting Firm | | | As a matter of good corporate governance, the Board is asking stockholders to vote on a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2024. |

Go to page 82 for additional information on Proposal 3 |

| | | | |

The challenges in the residential real estate market continued in 2023, with sales of existing homes continuing to fall (sales have declined 33% since the beginning of 2022, according to Fannie Mae). Despite these challenges, we maintained focus on our strategic priorities. Specifically, we reduced debt, realized substantial cost savings and mitigated substantial litigation uncertainties (avoiding a devastating, multi-billion dollar judgment in our sell-side antitrust class action litigation) while still generating $200 million of Operating EBITDA.

Management continued to focus on improving the Company's debt profile in 2023, reducing the principal amount of debt by $308 million through a combination of debt exchange transactions, open market repurchases and reduction of our outstanding revolver balance. The debt exchange transactions reduced our total principal amount of debt by approximately $160 million while incurring minimal incremental interest expense and retaining our flexibility and long-dated maturities. Our opportunistic open market repurchases of Senior Notes due 2029 and Senior Notes due 2030 allowed us to capture approximately $20 million of discount, further reducing the principal amount of our debt

by approximately $70 million. We also reduced the amount outstanding under our revolving credit facility by $65 million. These achievements were in addition to our debt profile improvements between 2020 and 2022, when we reduced the principal amount of our debt by $600 million, extended our maturities, shifted our debt from mostly secured debt to unsecured debt and reduced our interest expense.

In a historically challenging residential real estate market, which was accelerated by the series of rapid interest rate hikes initiated by the U.S. Federal Reserve in March 2022 intended to tame inflation, we continued to take decisive action on our cost savings initiatives, overachieving our 2023 goal by 10% and realizing cost savings of approximately $220 million in 2023 and approximately $370 million in the past two years. We also prudently managed our cash.

Finally, the Company was the first to reach a nationwide settlement of the sell-side antitrust class actions against it and other industry participants. The $83.5 million settlement releases the Company, and all its subsidiaries, brands, affiliated agents, and franchisees. Subsequent to our settlement, the non-settling defendants received a $1.785 billion (before trebling) judgment based on claims representing a small fraction of the potential nationwide claims. In addition, the non-settling defendants and other industry participants now face a significant number of additional cases brought in other jurisdictions on similar grounds. The Company’s settlement, which was driven by our management team in close collaboration with our Board, avoided a devastating monetary judgment, provided a defense against the additional sell-side antitrust cases being brought around the country, removed significant future uncertainty for the Company, its employees, agents and franchisee, greatly reduced ongoing legal expenses and management distraction, and served the best interests of the Company, our affiliated agents and franchisees, and stockholders.

| | | | | | | | | | | | | | |

| EXECUTIVE COMPENSATION HIGHLIGHTS |

2023 Target Compensation Emphasized Performance-Based Compensation Aligned with Strategy

We have an established pay-for-performance compensation philosophy that rewards our NEOs for their achievements, reinforces ethical behavior and aligns compensation with stockholder interests in both short-term performance and long-term value creation via various metrics.

The CEO's 2023 target direct compensation, which was set by the Board in February 2023(1), included:

| | | | | | | | | | | | | | |

91% of 2023 CEO Target Direct Compensation(1) is "At-Risk" and 61% is tied to Performance Metrics |

| At-Risk | Compensation Element | Why We Pay It | CEO Target Direct Compensation (%) | Performance-Based |

| Base Salary | Attract and retain talent | 9% | |

| Cash (Short-Term Incentive) | | Total: 27% | |

| ● | Annual Incentive | Drive short-term performance | 18% | ● |

| Equity (Long-Term Incentive)(2) | | Total: 73% | |

| ● | Performance-Based PSUs(3) | Long-term value creation | 43% | ● |

| ● | Time-Based RSUs | Align with stockholder interests | 29% | |

(1)Target direct compensation includes base salary, annual cash incentive under our Executive Incentive Plan (EIP) at target and the value assigned by the Compensation and Talent Management Committee to long-term incentive (equity) awards including performance share units (PSUs) at target and restricted stock units (RSUs), but excludes the cash-based Exceptional Achievements Award and Performance Awards approved by the Board in November 2023. (2)60% of long-term equity granted in the form of PSUs and 40% in the form of RSUs. (3)60% of PSUs tied to Cumulative Free Cash Flow (CFCF PSUs) and 40% tied to Relative Total Stockholder Return (RTSR PSUs). |

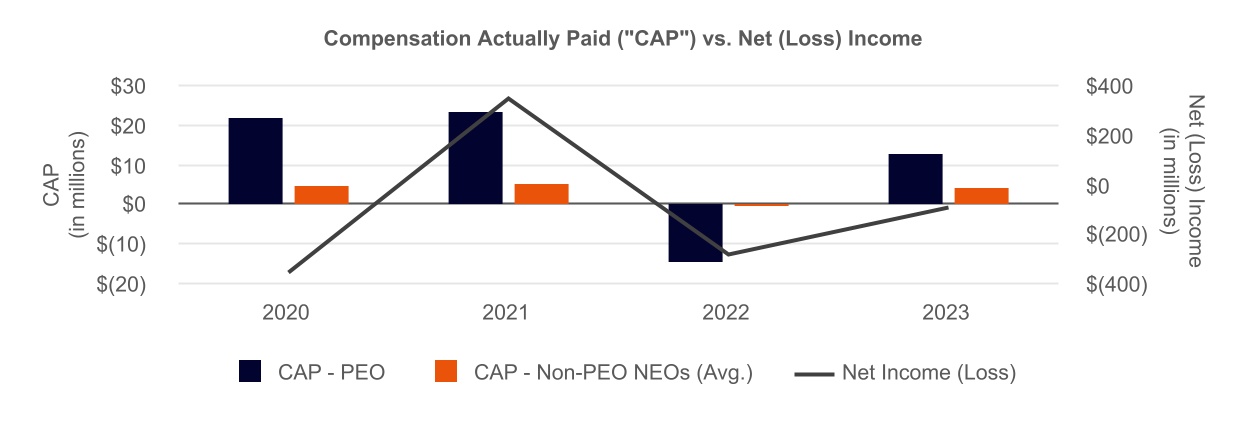

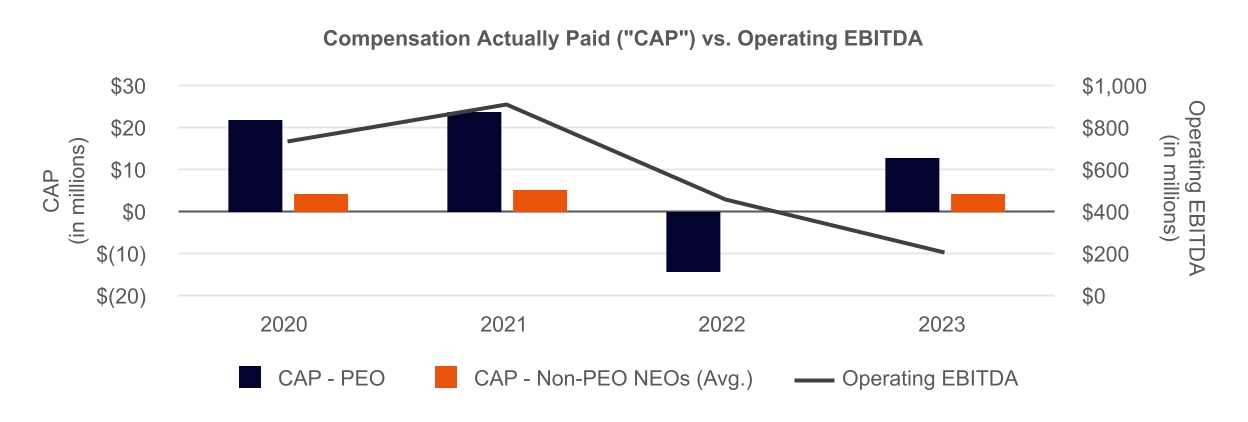

The Compensation and Talent Management Committee believes that the outcomes for awards with performance periods ended in 2023 demonstrate that our pay-for-performance executive compensation program effectively tracked the Company’s achievement of the performance metrics utilized.

| | | | | | | | | | | | | | |

| Performance Goal Achievement as of December 31, 2023 |

| Award Type | Achievement | Target Goal | Funding/Payout Achievement | Aggregate Realized Value |

| Annual Cash Incentive Award |

Plan Operating EBITDA | Below Target $250 million | $253 million | 97% | 95%(1) |

Strategic Objectives | At Target | operational excellence (cost savings), consumer experience, talent | 100% |

| PSUs - 2021 to 2023 Cycle |

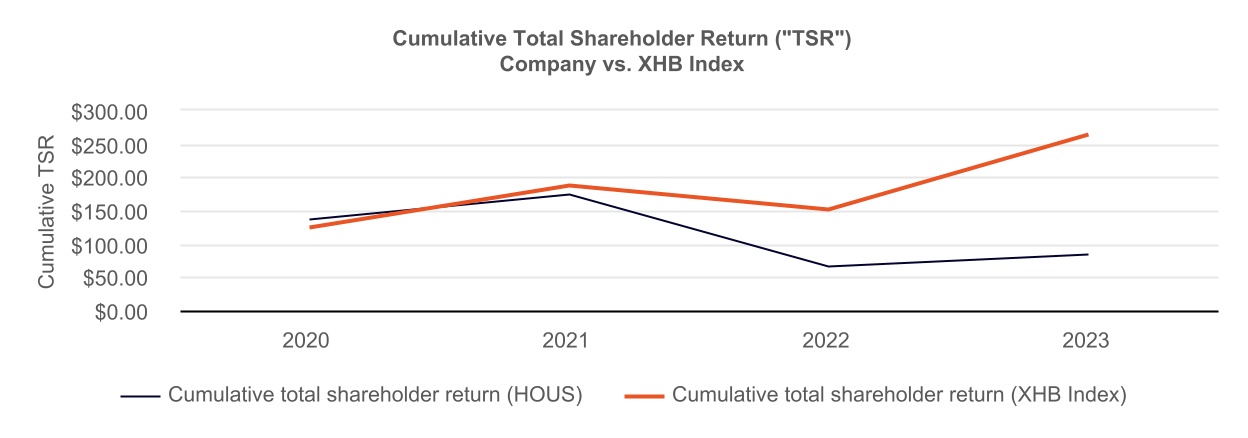

Relative Total Stockholder Return | Below Threshold - No Payout | Equal to S&P MidCap 400 | 0% | 23%(2) |

Cumulative Free Cash Flow | $866 million | $1,007 million | 77% |

| 2023 CEO Market Share Award |

| Market Share | Below Threshold - No Payout | (3) | 0% | 0% |

(1)The Executive Incentive Plan, or "EIP", performance factor was 98% of target and each NEO achieved 100% individual performance, however, to align NEO payouts with payouts under the broad-based employee annual cash bonus plan, the Committee determined to payout the EIP at 95%.

(2)Aggregate realized value of PSU awards is determined by comparing (i) the product of (A) the aggregate number of shares or units earned by the NEOs and (B) the stock price or unit value on the last day of the performance cycle vs. (ii) the target value of the awards approved by the Compensation and Talent Management Committee.

(3)Goal was met if our market share (as measured by transaction volume for existing home sale transactions) as of September 30, 2023 exceeded our market share as of September 30, 2022.

Compensation During Historic Industry Downturn and Unprecedented Industry Uncertainty

Industry Downturn and Uncertainty

The residential real estate market is currently in the midst of unprecedented uncertainty.

According to Freddie Mac, average mortgage rates for a 30-year, conventional, fixed-rate mortgage more than doubled in 2022 and in the fourth quarter of 2023 reached the highest levels in more than two decades. Federal interest rates are one of the factors that contribute to mortgage rates, and the U.S. Federal Reserve Board (the "Federal Reserve") aggressively raised the target federal funds rate by over 400 basis points during 2022 and by an additional 100 basis points during 2023. The rapidly rising mortgage rates combined with high inflation, reduced affordability, low inventory levels and broader macroeconomic concerns have driven significant declines in homesale transactions since mid-2022 such that the industry is now at the lowest transaction levels since 1995.

Additionally, the residential real estate industry has been under margin pressure as brokers' share of homesale commissions has dramatically decreased in recent years (Anywhere's average share of homesale broker commissions, commonly referred to as our "split", declined over 1000 basis points between 2016 and 2022).

In addition to these economic pressures, there is unprecedented uncertainty about the future structure of the residential real estate industry, with significant litigation and regulatory headwinds with particular focus on antitrust and competition. While we have settled our sell-side antitrust case and are not subject to the large verdict entered against the other defendant's in those cases, the overall industry will continue to be impacted by the enormity of the verdict and the dozens of new copycat cases filed across the country. Given the combination of the prospect of

years of new copycat litigation and appeals of the initial verdict, there is substantial pressure for industry change. There is considerable uncertainty about potential changes to industry rules that may adversely impact commissions. Such industry structure changes could arise from litigation and injunctive relief. The industry also still faces regulatory or governmental actions, market forces, changing competitive dynamics and changes in consumer preferences. Moreover, we believe certain industry participants, including listing aggregators and participants pursuing non-traditional methods of marketing real estate, are pursuing changes to the rules and regulations of multiple listing services ("MLSs") and the National Association of Realtors ("NAR") that are intended to benefit their competitive position to the disadvantage of historical real estate brokerage models.

Compensation Decisions in Light of Industry Downturn and Uncertainty

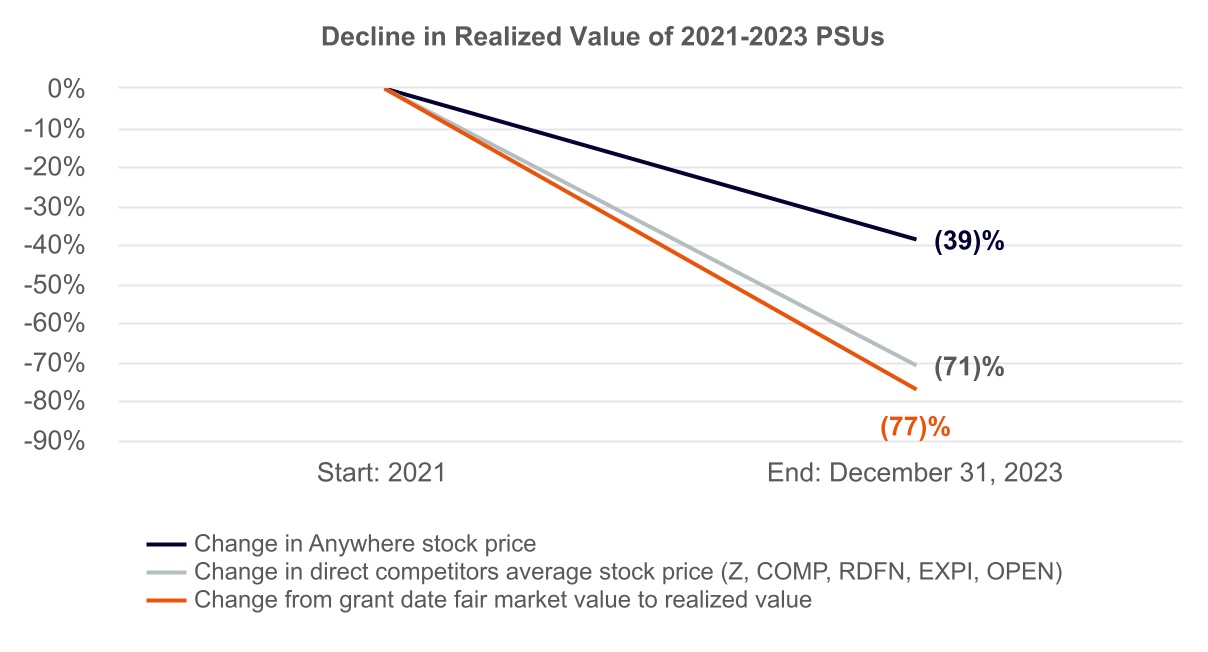

The cyclical nature of the real estate industry has always posed certain challenges in designing compensation programs that meet each of the components of our compensation philosophy of pay-for-performance, rewarding our NEOs for their achievements and reinforcing ethical behavior. However, the current downturn, now entering its third year, is historic in both its magnitude and duration and has dramatically reduced or eliminated the retentive value of outstanding awards in our incentive compensation programs for reasons outside of our control.

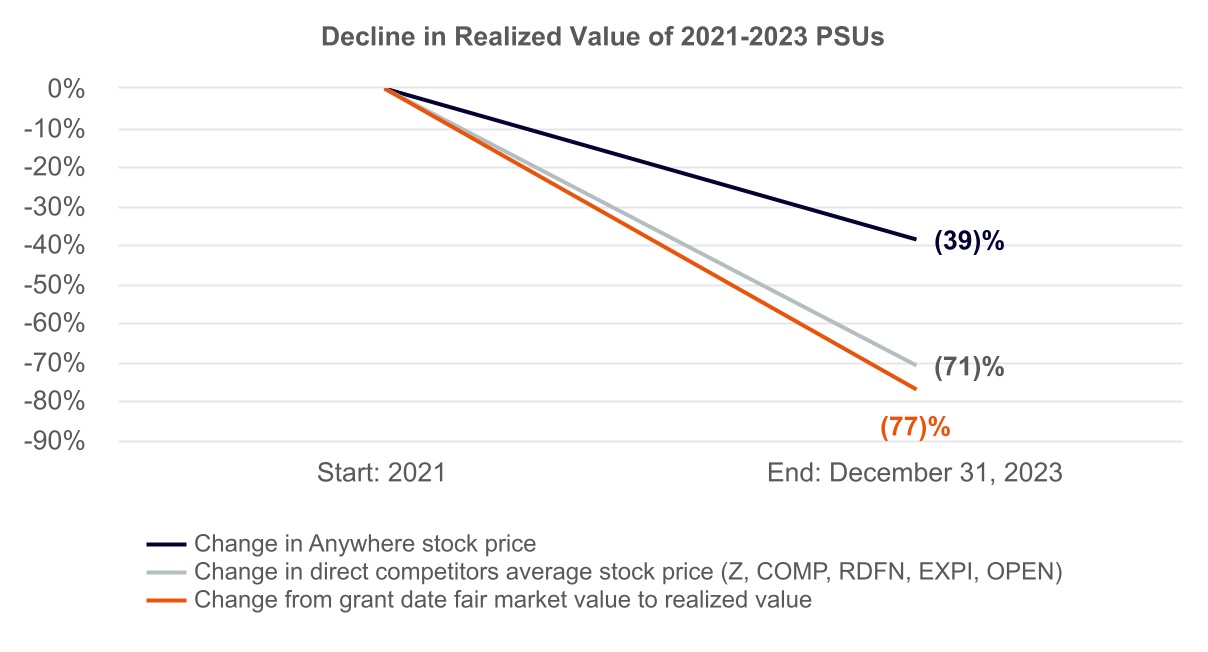

Specifically, the downturn had a significant impact on the attainability of our CFCF goals for our 2021-2023 and 2022-2024 PSU award cycles. Performance goals for these cycles assumed a pre-March 2022 macroeconomic environment. As illustrated in the tables below, the downturn since the grant of those awards has had a significant impact on the realized value or expected realized value for these cycles (table as of December 31, 2023).

| | | | | | | | | | | | | | | | | |

PSU Award Cycle

and Metric | | |

| 2021 | 2022 | 2023 | 2024 | 2025 |

2021-2023 PSU Award(1) | Completed in 2023 (Aggregate Realized Value: 23%) | | |

RTSR(2) | No Payout | | |

| CFCF | Below Target Payout (77%) | | |

2022-2024 PSU Award(3) | | 66% Completed | |

RTSR(2) | | Tracking Below Threshold | |

| CFCF | | Tracking Below Threshold | |

2023-2025 PSU Award(3) | | | 33% Complete |

RTSR(2) | | | Tracking at or around Target |

| CFCF | | | Tracking at or around Target |

(1)Aggregate realized value of PSU awards is determined by comparing (i) the product of (A) the aggregate number of shares or units earned by the NEOs times (B) the stock price or unit value on the last day of the performance cycle vs. (ii) the target grant date value of the awards approved by the Compensation and Talent Management Committee.

(2)RTSR for completed and outstanding RTSR PSU award cycles is measured against S&P MidCap 400.

(3)Actual results to be determined based upon results under the applicable metric at the conclusion of the applicable 3-year cycle.

Beginning in 2022 and continuing through 2023, the Board and Compensation and Talent Management Committee had robust discussions regarding how to address the increased retention risk resulting from the significant decline in realizable value of outstanding equity awards and the low realized value of incentive award payouts in recent years, despite:

▪the Company's stock performing well compared to its direct competitors (as shown in the following chart),

▪the Company's generation of $200M of operating EBITDA and $67M of free cash flow in 2023 (for comparison, four of the Company's five direct competitors reported either lower or negative operating EBITDA for 2023), and

▪management's exceptional performance during difficult and unexpected market conditions, including, for example, continuing to improve the Company's debt profile, continuing to realize substantial cost savings, and reaching a nationwide settlement of its sell-side antitrust class actions.

Against the backdrop of the historic industry downturn and uncertainty, and the exceptional performance shown by our CEO and management team, the Board considered two compensation actions for our CEO.

The first action was to reward Mr. Schneider for his extraordinary achievements over the past several years under the incredibly challenging and difficult circumstances facing the Company (see "Proxy Summary—Key Business Highlights" on page 1 for more details) with a $5 million cash Exceptional Achievements Awards paid in late 2023 but subject to clawback if Mr. Schneider resigns without Good Reason prior to March 1, 2025. The second action was to motivate Mr. Schneider moving forward to strategically position the Company for the eventual anticipated housing market recovery and to steer us through the industry changes that may follow from ongoing industry litigation and potential related injunctive relief, and regulatory actions.

The Board believes Mr. Schneider will continue to add exceptional value to the Company. He has become an industry leader, earning the number one ranking as ‘most powerful leader in the residential real estate industry’ by the Swanepoel Power 200. In addition, stockholders have expressed their appreciation and support for his leadership, vision and performance.

Given the market challenges going forward, and in consideration of the depressed values of outstanding PSU awards, the Board, on the recommendation of the Compensation and Talent Management Committee, granted a Performance Award to Mr. Schneider consisting of two $5 million tranches which will be payable in cash based on achievement of metrics set by the Compensation and Talent Management Committee, as described below.

| | | | | | | | | | | | | | |

| Award | Performance Period | Performance Metric | Award Payout if Achieved | Subject to clawback if resignation without Good Cause prior to: |

| $5M 2024 cash performance award | FY 2024 | Cost savings goal established in late 2023 | Early 2025 | March 1, 2026 |

| $5M 2025 cash performance award | FY 2025 | To be established by early 2025(1) | Early 2026 | March 1, 2027 |

(1)The Board deferred setting a specific metric for the 2025 performance period to retain flexibility to ensure alignment with the Company's 2025 strategic priorities.

For a full description of the Exceptional Achievements Award and the 2024 and 2025 Performance Awards, see "Executive Compensation—CD&A—Summary of CEO 2023 Compensation" on page 45.

| | | | | | | | | | | | | | |

| 2023 INVESTOR OUTREACH PROGRAM |

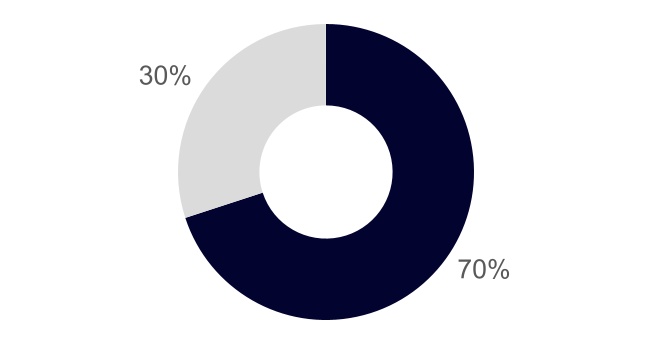

Board Outreach

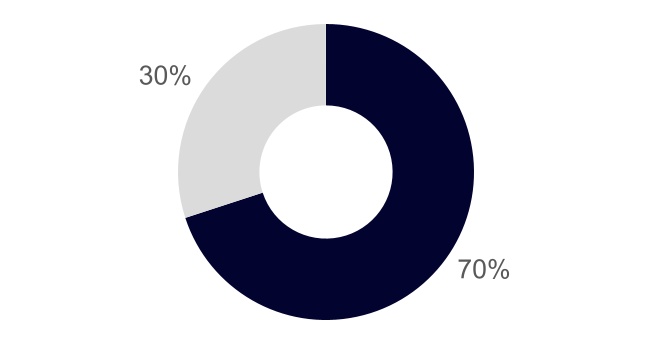

Our Board maintains a proactive and robust investor outreach program, offering meetings to a substantial majority of shares each year since 2018. During the 2023 Board Investor Outreach Program, which included spring and fall sessions, the Board reached out to stockholders representing over 70% of our outstanding shares and held calls with investors holding an aggregate of approximately 45% of our outstanding shares (based on estimated holdings at June 3, 2023). We believe offering our stockholders an opportunity for regular communication with our Board is critical to our Board's ability to ensure thoughtful and informed consideration of evolving corporate governance and executive compensation best practices. Investor feedback received during this outreach has served as a catalyst for substantive changes to both our governance and executive compensation programs.

At our 2023 Annual Meeting of Stockholders, our say-on-pay proposal received support from 87% of the votes cast, which we believe indicates support both for our executive compensation program, and our robust disclosure of the program in our 2023 proxy statement. See "Executive Compensation—CD&A—Consideration of Stockholder Feedback and 2023 Say on Pay Vote" on page 43 for more information. | | | | | | | | | | | | | | |

| | | | |

| | In the course of the 2023 Board Investor Outreach Program, Board members met with seven of our top ten stockholders. | | Mr. Williams, Independent Chairman of the Board, and Mr. Silva, Chair of the Compensation and Talent Management Committee, attended all investor meetings. |

| | | | |

Key topics discussed during these sessions included:

| | | | | | | | | | | | | | |

■strategy ■capital allocation | | ■executive compensation ■corporate governance | | ■leadership |

The strength of the Board's governance profile was noted with approval by many investors. Many investors also noted their approval of the leadership team and their execution of our strategic priorities, especially the execution of matters within management's control, in a business that is cyclical and heavily influenced by macroeconomic factors. In particular, investors noted the Company's actions:

▪to reduce total indebtedness by $308 million in 2023, particularly in light of the industry facing a downturn that is historic in both its magnitude and duration, as well as significantly compressed margins;

▪to realize significant cost savings of approximately $220 million in 2023, 10% higher than our target; and

▪to settle, on a nationwide basis, the sell-side antitrust class action litigation, thereby avoiding a devastating monetary judgement, providing defenses against the additional cases being brought around the country, eliminating substantial litigation uncertainties and reducing ongoing costs and management distraction. The settlement received preliminary court approval in November 2023, with final approval anticipated in mid-2024.

Investors noted their continued support for our approach to executive compensation and the continued alignment of pay with performance. They approved of the changes made to the 2023 executive compensation program described in the "Compensation Discussion and Analysis" (CD&A) section of this proxy statement, and encouraged the Company to focus on continued refinement of the program to incentivize and reward management based on meeting goals that are within its control in addition to being aligned with Company performance. Investors also recognized the need to retain key executives during the industry downturn and the uncertainties with respect to potential industry changes arising from ongoing antitrust litigation involving other industry players and potential regulatory reform. See "Executive Compensation—CD&A—Consideration of Stockholder Feedback and 2023 Say on Pay Vote" on page 43 for more information on responsive actions by the Company for the 2023 executive compensation program, and "Executive Compensation—CD&A—2024 Annual and Long-Term Incentive Programs" on page 58 for more information on responsive actions by the Company for the 2024 executive compensation program.

Management Outreach

Anywhere management—including our CEO, CFO and Investor Relations team—also maintains an active stockholder engagement program designed to reach current and prospective investors through earnings calls, investor conferences, individual and group meetings and other communication channels. In 2023, management engaged with investors representing almost 50% of shares outstanding, including through conferences, fireside chats, non-deal road shows, group meetings, or one-on-one meetings. Management also participated in 11 investor conferences, reaching over 230 current and potential investors, as well as panel discussions and podcasts.

We consider investor feedback from both the Board Investor Outreach and management outreach programs, and may incorporate consistent key themes into our business.

Our Board and the Compensation and Talent Management Committee oversee the talent management and compensation of the executive officer members of our Executive Committee, which is comprised of the Chief Executive Officer and the most senior leaders in the Company.

From left to right: Top Row: Ryan Schneider, Chief Executive Officer & President; Charlotte Simonelli, EVP, Chief Financial Officer and Treasurer; Susan Yannaccone, President & CEO, Anywhere Brands & Anywhere Advisors; and Marilyn Wasser, EVP, General Counsel and Corporate Secretary.

Second Row: Don Casey, President & CEO, Anywhere Integrated Services; Tanya Reu-Narvaez, EVP, Chief People Officer; Rudy Wolfs, EVP, Chief Technology Officer; Eric Chesin, EVP, Chief Strategy Officer; and Trey Sarten, SVP, Communications and Corporate Affairs.

| | | | | | | | | | | | | | |

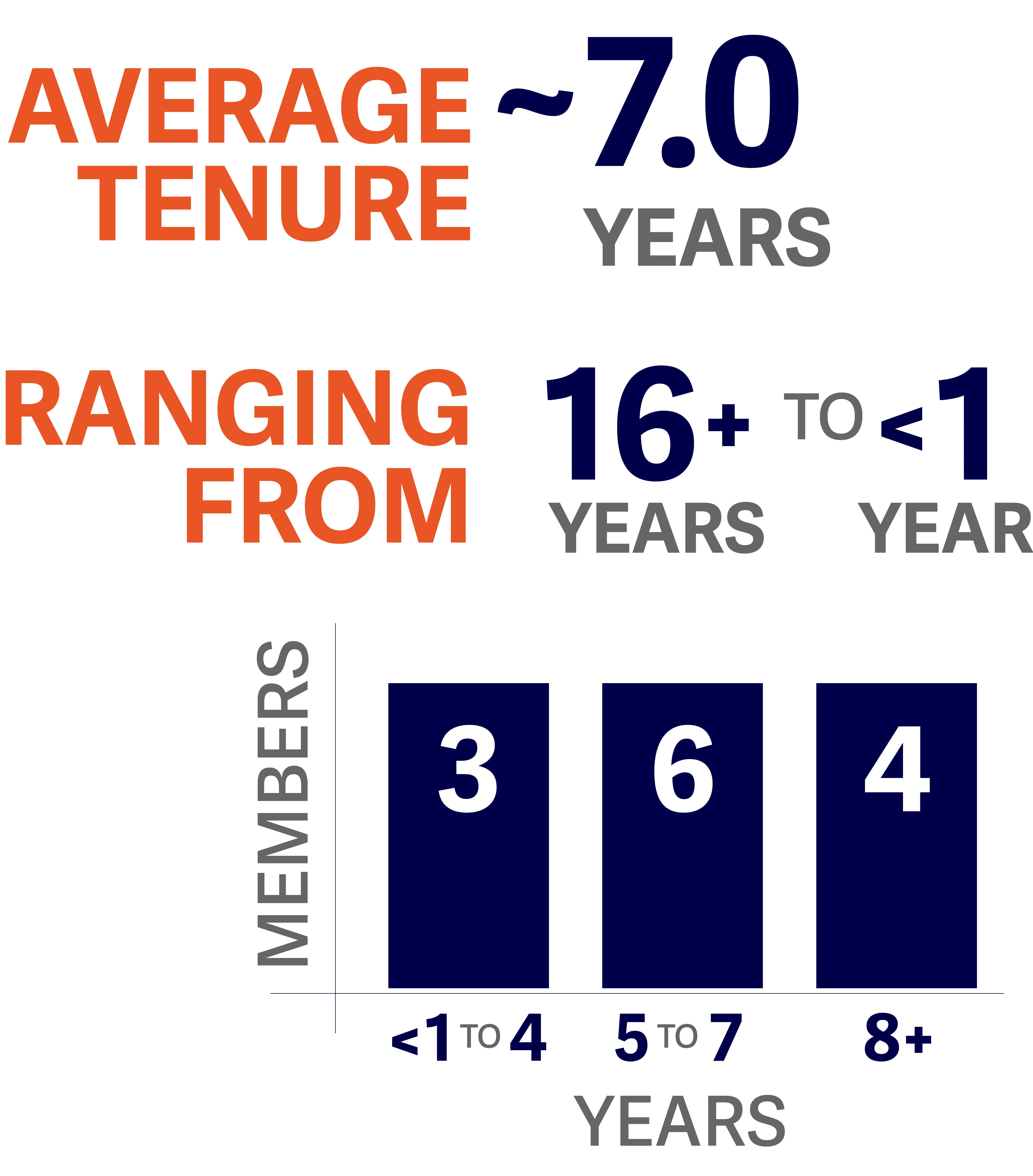

| BOARD COMPOSITION HIGHLIGHTS |

Our Board is comprised of highly-qualified individuals who are committed to our Company.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name and Age | Director Since | Current or Key Business Experience | Independent | Committee Membership* |

| AC | CC | NGC | PTC |

| Fiona P. Dias, 58 | 2013 | Digital Commerce Consultant, Former Chief Strategy Officer, ShopRunner (2011-2014) | ● | | ● | | ● |

| Matthew J. Espe, 65 | 2016 | Former President and CEO, Armstrong World Industries, Inc. (2010-2015) | ● | | ● | C | |

| V. Ann Hailey, 73 | 2008 | Former CFO, L Brands, Inc. (formerly, Limited Brands, Inc.) (1997-2006) | ● | ● | | ● | |

| Bryson R. Koehler, 48 | 2019 | Chief Executive Officer, Revinate, Inc. (since 2024), former Chief Technology Officer, Equifax Inc. (2018-2024) | ● | ● | | | ● |

| Joseph Lenz, 35 | 2024 | Managing Director, TPG Angelo Gordon (since 2019) | ● | | | | |

| Duncan L. Niederauer, 64 | 2016 | Former CEO, NYSE Euronext (2007-2013) | ● | |

| ● | ● |

| Egbert L.J. Perry, 68 | 2023 | Chairman and Chief Executive Officer, The Integral Group LLC (since 1993) | ● | | ● | | |

| Ryan M. Schneider, 54 | 2017 | President and CEO, Anywhere Real Estate Inc. (since 2018) | | | | | |

| Enrique Silva, 58 | 2018 | CEO, Culver Franchising System, LLC (2021) | ● |

| C | | |

| Sherry M. Smith, 62 | 2014 | Former CFO, SuperValu, Inc. (2010-2013) | ● | ● | ● |

| |

| Christopher S. Terrill, 56 | 2016 | Former CEO of ANGI Homeservices (2017-2018) | ● | | | ● | C |

| Felicia Williams, 58 | 2021 | Former CFO (2020) and finance and risk leader at Macy’s (2004 to 2023) | ● | C | | | |

Michael J. Williams, 66 (Independent Chairman) | 2012 | Former President and CEO, Fannie Mae (2009-2012) | ● | ● | | ● | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| * | C = Chair | | AC = Audit Committee | | CC = Compensation and Talent Management Committee | | NGC = Nominating &

Corporate Governance

Committee | | PTC = Product & Technology Committee |

CORPORATE GOVERNANCE

As the largest full-service residential real estate services company in the U.S., Anywhere is responsible for supporting people in one of life’s most meaningful and significant transactions: buying and selling a home—and we take that role very seriously. We know that our agents, suppliers and customers trust our brands and companies not only because of our outstanding service, but also because of the way we operate. At Anywhere, integrity drives our success and we ensure that integrity and excellence are at the heart of everything we do.

Anywhere’s Code of Ethics and core values provide the guiding principles of our organization to treat people with respect and dignity, to be accountable for our actions, and to operate transparently and honestly. For the past thirteen years, Anywhere has been recognized as one of the World’s Most Ethical Companies® by Ethisphere Institute based on our robust ethics program, strong corporate governance, and the dedication and enthusiasm of our employees.

Our Board of Directors oversees the management and ethics functions of Anywhere. We maintain strong governance practices, which we continue to enhance and evolve through critical feedback from our investors. For the sixth year in a row, our Board of Directors sought perspectives of our stockholders with the 2023 Investor Outreach Program, through which we held meetings with investors holding an aggregate of approximately 45% of outstanding shares. This program allows the Board to engage directly with stockholders on key topics, including strategy, leadership, governance, talent and compensation. Through this feedback, our Board and its Committees have continued to evolve our executive compensation program and our capital allocation strategy by further reducing our debt and extending maturities. For additional information, see "Proxy Summary—2023 Investor Outreach Program" on page 6 and "Executive Compensation—CD&A—Consideration of Stockholder Feedback and 2023 Say on Pay Vote" on page 43. The Company, led and supported by the Board, has also provided thought leadership within the residential real estate industry, including being the first to settle the sell-side antitrust class action litigation, adopting and advocating for the industry to adopt many of the practice changes proposed by the settlement, which promote more transparency and simplification for both consumers and real estate agents, supporting Ms. Yannaccone's speaking out on behalf of women and calling for industry leaders to use their voices so that the industry reflects the values it promotes, and establishing an industry-first initiative designed to support entrepreneurs from historically underrepresented populations. The Company's leadership has been recognized within the industry, with six leaders honored as 2023 HousingWire Women of Influence and six executives ranking in the top 30 of the 2023 Swanepoel Power 200 list of most powerful industry leaders.

GOVERNANCE HIGHLIGHTS

Our corporate governance practices are consistently recognized by investors, proxy advisors, and others as exemplifying best practice. We have a strong commitment and a roadmap to continue advancing our best corporate governance practices in order to promote the long-term interests of stockholders. Examples of our governance best practices include:

| | | | | | | | | | | |

| Independent Chairman of the Board | | |

| | |

| 92% Independent Directors | |

| | |

| Annual Election of Directors | |

| | |

| Majority Voting for Directors | |

| | |

| Board Investor Outreach Program | |

| | |

| Strong Stock Ownership Guidelines | |

| | |

| Annual Say-on-Pay Vote | |

| | |

| Proxy Access Bylaws | |

| | |

| Strong Enterprise Risk Management Oversight | |

| | |

| Culture and Talent Focus | |

| | | |

| | | | | | | | | | | |

| Annual Corporate Social Responsibility Report | | |

| Annual Two-Day Board Meeting Focused Exclusively on Strategy (with quarterly updates) |

| | | |

| Frequent Communications between CEO, Chairman and Directors |

Strategic Planning & Business Execution

Our Board spends a substantial amount of time working with management on Anywhere's mid- and long-term strategy and its near-term objectives, such as efforts focused on navigating the current industry downturn, and addressing potential changes in industry structure, improving operating efficiencies, reducing our debt, managing litigation, and enhancing our value proposition and market position growth.

The Board receives updates on our strategy at its meetings throughout the year and holds an additional annual two-day meeting focused exclusively on strategy. These strategic meetings focus on core aspects of our business, including initiatives to advance our business strategy, capital allocation, litigation and regulatory matters and our competitive position in light of emerging and existing competitive trends.

During these meetings, the Board considers whether business strategies are appropriately aligned to mitigate the risks identified in the Company's enterprise risk management process (described in "Oversight of Risk Management" below), as well as the pursuit of initiatives intended to advance the Company's strategy, enhance consumer and agent value, and keep the Company well-positioned for the future.

In 2023, the Board also closely oversaw and collaborated with management on key business accomplishments, including (1) reducing total indebtedness by $308 million, even in the face of a downturn that is historic in both its magnitude and duration, and significantly compressed margins, (2) realizing significant cost savings of approximately $220 million and (3) settling, on a nationwide basis, the sell-side antitrust class action litigation, thereby avoiding a devastating monetary judgement, providing defenses against the additional cases being brought around the country, eliminating substantial litigation uncertainties and reducing ongoing costs and management distraction (see "Proxy Summary—Key Business Highlights" on page 1 for more details). The Board also appointed an Ad Hoc Special Committee in 2022, which met frequently in 2023, to focus on litigation management and related risk mitigation strategies, and the committee provided oversight of the debt exchange transactions. The committee worked closely with management, while also retaining its own independent counsel and advisors, including advisors with expertise in managing unique and contingent liabilities, in connection with certain aspects of their oversight. Oversight of Risk Management

Our Board, as a whole and through its committees, has responsibility for overseeing our risk management and believes that effective risk management is critical to Anywhere’s ability to achieve its strategy. The oversight responsibility of our Board and its committees is facilitated by regular reports from management, informed by our annual integrated risk assessment and ongoing dynamic risk assessment process, that are designed to provide visibility to our Board and its committees about the identification, assessment, and management of critical risks and management’s risk mitigation strategies. Each committee also provides regular reports to the Board regarding its oversight activities.

Through our dynamic risk assessment process, management and our Board and its committees consistently evaluate the risk environment and adjust the Company's risk profile and focus as needed to respond to industry and macroeconomic changes.

Allocation of general risk oversight functions

Board of Directors

The Board oversees management’s processes by which they identify, assess, monitor and manage the Company’s exposure to key risks to determine whether these processes are functioning as intended and seeks to ensure that risks—inherent and undertaken by us—are consistent with a level of risk that is appropriate for our Company and the achievement of our business objectives and strategies. The Board also provides direct oversight of overall strategy and navigation of industry structure changes, including at the two-day offsite annual strategy session, as

well as oversight of our capital structure and balance sheet risks, litigation management and CEO succession planning.

Audit Committee

▪Reviews processes with respect to risk assessment and risk management, including overseeing management and mitigation of financial accounting and reporting and compliance risks

▪Reviews and approves our annual internal audit plan and receives quarterly updates from the head of internal audit, who reports directly to the Audit Committee

▪Oversees compliance activities and receives quarterly updates from the Chief Ethics & Compliance Officer, who has a dotted-line reporting relationship to the Audit Committee

▪Oversees, along with the full Board, information security and technology risks, including cybersecurity risks

▪Oversees operational and strategic risks

Nominating and Corporate Governance Committee

▪Oversees independence and composition of the Board, including that the Board has the appropriate skills and competencies necessary for effective oversight

▪Oversees risks related to the reputation of the Company and potential conflicts of interest

▪Oversees and tracks emerging governance issues

▪Monitors the Company's corporate social responsibility initiatives and programs

▪Oversees the policies and principles regarding succession in the event of an emergency or the retirement of the CEO

▪Based on feedback received from our investors, in 2023 the Nominating and Corporate Governance Committee also added oversight of the Company’s political spending and lobbying activities to its annual agenda

Compensation and Talent Management Committee

▪Oversees the management of risks relating to talent, including retention and motivation

▪Oversees risks related to succession planning for the executive team (other than the CEO)

▪Overseeing risks related to or arising from our compensation policies and procedures

Management

Our CEO and other members of senior management are primarily responsible for day-to-day risk management analysis and mitigation and report to the full Board or the relevant committee regarding risk management. This responsibility is effectuated principally through Anywhere's enterprise risk management (“ERM”) program. Our ERM function coordinates with our internal audit and compliance functions to perform an annual integrated risk assessment, which identifies top enterprise risks. The program is supported by our Risk Management Committee, chaired by our General Counsel and comprised of key members of management, and plays a core role in monitoring, mitigating and managing the top enterprise risks and identifying emerging risks facing the Company. A description of the enterprise risks we have identified is included in Part I, Item 1A, “Risk Factors”, and additional information about the litigation we face can be found in Note 15, "Commitments and Contingencies—Litigation" to the consolidated financial statements, both included in our Annual Report on Form 10-K for the year ended December 31, 2023 (the "2023 Annual Report").

Oversight of Cybersecurity and Data Privacy

Our Audit Committee shares oversight responsibility with the full Board for our information security and technology risks, including cybersecurity. Anywhere’s Chief Information Security Officer (CISO) reports to the Audit Committee on a quarterly basis and once a year to the full Board on the cybersecurity program, including the Company’s cyber risks and threats, the status of projects to strengthen the Company’s information security systems, assessments of the Company’s security program and the emerging threat landscape, including the prompt notification of the Audit Committee Chair of significant cyber incidents.

We also maintain a Data Privacy Steering Committee, comprised of internal legal, risk and IT professionals, to assist management with fulfilling applicable data privacy regulations.

Assessment of Compensation-Related Risks

The Company annually assesses the risks related to or arising from our compensation policies and procedures, including the incentives they create and any factors that might encourage or discourage unnecessary or excessive risk taking. Multiple factors were considered as part of the assessment, including incentive compensation criteria and payment limits, compensation mix, number of participants and risk mitigation factors. The assessment includes internal audit, the Company’s total rewards function and the Company’s Chief People Officer.

As part of its risk oversight, the Compensation and Talent Management Committee, in consultation with the independent compensation consultant, annually reviews and discusses the Company’s assessment and the impact of the Company’s executive compensation program, and the incentives created by the compensation awards that it administers, on the Company’s risk profile as well as risks related to succession planning and talent management. The Compensation and Talent Management Committee takes the results into account in making its determinations regarding the Company’s executive compensation program and its compensation policies and procedures.

Based on these reviews and procedures, the Company has concluded that its compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

Ad Hoc Special Committee Oversight of Litigation and Debt Transactions

In 2023, the Board also made frequent use of an Ad Hoc Special Committee to focus on litigation management and related risk mitigation strategies. The Committee met frequently with the outside counsel, the General Counsel and other advisors with expertise in managing unique and contingent liabilities, and was kept informed and advised on the overall strategies as well as the nationwide settlement of the sell-side antitrust litigation, as further described in our Form 8-K filed October 6, 2023.

The Ad Hoc Special Committee also provided oversight of the debt exchange transactions, and recommended Board approval after six meetings with its own independent outside counsel, advisors and management. In connection with the debt exchange transactions, the Audit Committee also approved the Related Person transaction with Angelo Gordon (as defined herein). See "Related Person Transactions" on page 25 for more information. Environmental, Social & Governance Program

Board Oversight. Since 2020, the Nominating and Corporate Governance Committee has overseen the Company’s Environmental, Social and Governance, or ESG, initiatives, with the full Board receiving an annual report on the Company’s progress on ESG matters. In 2023, the Nominating and Corporate Governance Committee and/or Board met to discuss ESG matters on a quarterly basis.

The Nominating and Corporate Governance Committee focuses on the ESG-related topics with the most impact at Anywhere as well as ESG trends, including with respect to reporting requirements. Members of management with responsibilities and expertise in ESG-related topics, including human resources, corporate governance and compliance, work with our Executive Committee and Board to report on our key ESG-related initiatives and metrics.

The Nominating and Corporate Governance Committee also reviews Anywhere's corporate responsibility report, which is released on an annual basis and can be accessed under the Investors link, ESG page on our website at www.anywhere.re.

Governance. The Company and Board have historically focused on governance topics, including Board and management structure, best corporate governance practices, director independence, risk management, transparent and accurate information disclosure and strong auditing and compliance. Based on feedback received from our investors, in 2023 the Nominating and Corporate Governance Committee also added oversight of the Company’s political spending and lobbying activities to its annual agenda. Our key governance practices are outlined throughout this "Corporate Governance" section.

Social. We place a substantial emphasis on strengthening our relationships, both internally with our workforce and externally with our customers and communities, to create enterprise value and drive our strategic business objectives, with a particular focus on diversity, equity and inclusion. Internally, we continue to build an inclusive culture through our eight long-standing Employee Resource Groups, or ERGs, each with its own executive sponsor, as well as through structured mentorship programs and our inaugural "Week of Understanding" with over 4,000 participants. Our continued improvement in our pipeline of diverse leaders and improved retention rates of diverse employees are evidence that our inclusive culture is strengthening our workforce.

| | | | | | | | |

| | |

| | Almost half of our Executive Committee identifies as female and/or a person of color |

| | |

Externally, we have identified the powerful growth potential of diverse real estate markets and franchise owners, and have increasingly focused on our Inclusive Leadership Program, designed to support entrepreneurs from historically underrepresented populations in the real estate industry, and have seen higher than average growth among those owners in the program.

Anywhere is also a proud sponsor and partner of several national real estate associations that promote the advancement of diverse homeownership through empowering diverse real estate professionals.

| | | | | | | | |

| | |

| | In 2023, we achieved an 88% employee engagement score and an 84% response rate |

| | |

Environment. We are proud of our actions to address our limited environmental footprint. Substantially all of our properties are leased commercial space, and from December 31, 2019 to December 31, 2023, we decreased our leased-office footprint by approximately 31% which resulted in significant reductions in our greenhouse gas (GHG) emissions.

Our headquarters building interior is LEED Gold certified and the building’s exterior is LEED Silver certified, in each case by the Green Building Certification Institute. In addition, our move away from on-premises data centers has also decreased our environmental impact.

Succession Planning

The Board, either directly or through its committees, is responsible for the development, implementation and periodic review of a succession plan for our Chief Executive Officer and the other executive officer members of our Executive Committee, including an emergency succession plan in the event of an unexpected disability or inability of our Chief Executive Officer to perform his duties.

The November 2023 joint meeting of the Board and the Compensation and Talent Management Committee focused on talent and succession for the executive team. The meeting also included a review of broader business and corporate talent.

The Board, the Compensation and Talent Management Committee and Nominating and Corporate Governance Committee coordinate with respect to the Company's programs and plans in the areas of talent development, succession planning, and corporate social responsibility initiatives.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that, along with the charters of the Board Committees, Director Independence Criteria, Code of Ethics for Employees and Code of Business Conduct and Ethics for Directors, provide the framework for our governance. Our directors complete a biennial ethics training course. The governance rules for companies listed on the NYSE and those contained in SEC rules and regulations are reflected in the guidelines. The Board reviews these principles and other aspects of governance periodically. The Corporate Governance Guidelines are available under the Investors link, Governance page of our website at www.anywhere.re.

Director Service on Other Public Company Boards

Our Board believes that service on other public company boards provides Directors with valuable governance and leadership experience that benefits the Company.

At the same time, our Board recognizes that it is critical that Directors dedicate sufficient time and attention to their service on Anywhere's Board.

Accordingly, under the Corporate Governance Guidelines, Directors must have the time and ability to make a constructive contribution to the Board as well as a clear commitment to fulfilling the fiduciary duties required of Directors and serving the interests of the Company’s stockholders.

Unless explicitly approved by the Board:

▪Directors who also serve as CEO (or an equivalent position) may not serve on more than two other boards of public companies.

▪Other Directors may not serve on more than four other boards of public companies.

▪Directors on the Audit Committee may not serve on the audit committees of more than three public companies, including the Company.

Our Board believes that each of our Directors has demonstrated the ability to devote sufficient time and attention to fulfill the responsibilities required of a Director of Anywhere, and all Directors are in compliance with this policy.

Prior to recommending a candidate as a nominee for director, the Nominating and Corporate Governance Committee reviews the other commitments of such candidate (including service and leadership positions on public boards) and considers whether such obligations may interfere with the candidate's Board duties.

Director Independence

The Board adopted the Director Independence Criteria summarized below for its evaluation of the materiality of Director relationships with us. The Director Independence Criteria are available under the Investors link, Governance page of our website at www.anywhere.re.

Pursuant to the Board's annual review of the independence of the Directors, the Board affirmatively determined that, under NYSE listing standards and our Director Independence Criteria:

▪All of the members of our Board are Independent Directors, other than our CEO; and

▪All members of the Audit Committee, Compensation and Talent Management Committee, Nominating and Corporate Governance Committee and Product and Technology Committee are Independent Directors.

In making these determinations, the Board took into consideration the following transactions, which they determined were not material to either the Company or the Director:

▪All transactions in which we and any Director had an interest, including those discussed under "Related Person Transactions." For purposes of evaluating Mr. Lenz's independence, Board too into consideration the Private Exchange with Angelo, Gordon & Co., L.P. ("Angelo Gordon"), an affiliate of TPG GPA A, LLC, a principal stockholder of the Company, and the Cooperation Agreement with Angelo Gordon, each as defined and more fully described in "Related Person Transactions."

▪All transactions where Directors utilize the brokerage services of our company owned brokerages and/or our franchisees in the purchase or sale of residential real estate and/or the Company's title and settlement services in the ordinary course and on similar terms to those offered to unrelated third parties in similar transactions.

▪In the fourth quarter of 2023, the Company amended its sublease agreement with Transcend Capital Advisors, an entity affiliated with Mr. Niederauer, to sublease approximately 3,600 square feet of office space at the Company's headquarters, renewable every 90 days.

▪Prior to Mr. Koehler joining our Board, the Company and Equifax Inc., Mr. Koehler’s employer from June 2018 through March 2024, were party to agreements (which have been renewed over time) for certain tools, credit reports and information with respect to unemployment claims.

Board and Committee Leadership Structure

Michael J. Williams became our Independent Chairman on December 31, 2017. Mr. Williams previously served as the Board's Lead Independent Director (from late 2013) and has been a Director since 2012.

The Board has no fixed policy on the separation of the CEO and Chairman roles, and our Bylaws allow for these roles to be either combined or separated. This flexibility allows our Board to choose a different Board leadership structure if and when it believes it is in the best interests of the Company based on current circumstances. In making this determination, the Board considers a number of factors, including the position and direction of the Company, the specific needs of our business, and the constitution of the Board and management team.

The Board currently believes that the separation of the CEO and Chairman roles is the most effective leadership structure for the Company at this time, as it allows Mr. Schneider to focus on the day-to-day management of the business and on executing our strategic priorities, while allowing Mr. Williams to focus on leading the Board, providing its advice and counsel to Mr. Schneider, and facilitating the Board’s independent oversight of management.

The CEO communicates weekly with the Chairman and on a regular basis with other Directors. The Chairman regularly holds one-on-one calls with the other Independent Directors to solicit feedback after Board meetings held throughout the year and provides that feedback to the CEO.

The Board will continue to regularly review its leadership structure and exercise its discretion in recommending an appropriate and effective framework on a case-by-case basis, taking into consideration the needs of the Board and the Company at such time.

In his capacity as Independent Chairman of the Board, Mr. Williams:

▪presides at all meetings of the Board and stockholders;

▪acts as an adviser to Mr. Schneider on strategic aspects of the CEO role with frequent and regular consultations on major developments and decisions germane to the Board's oversight responsibilities;

▪serves as a liaison between the CEO and the other members of the Board, including eliciting feedback from the Committee Chairs and Directors throughout the year and providing feedback to the CEO;

▪coordinates with Directors between meetings and encourages and facilitates active participation of all Directors;

▪sets Board meeting schedules and agendas in consultation with the CEO and corporate secretary;

▪reviews Board materials, including drafts of key presentations and consultations with members of senior management;

▪has the authority to call meetings of the Independent Directors or of the entire Board;

▪leads the Board Investor Outreach program; and

▪monitors and coordinates with management on corporate governance issues and developments.

While the Corporate Governance Guidelines do not mandate rotation of committee assignments or chairs, the Board may take such action from time to time if it believes that rotation is likely to improve committee performance.

When assigning committee memberships as well as designating committee chairs, the Board takes into account the recommendation of the Nominating and Corporate Governance Committee and each Director’s knowledge, interests, and areas of expertise.

Upon the recommendation of the Nominating and Corporate Governance Committee, in May 2023, the Board determined to:

▪designate Mr. Espe as Chair of the Nominating and Corporate Governance Committee, with Mr. Williams, the former Chair of the Nominating and Corporate Governance Committee continuing service on the Nominating and Corporate Governance Committee; and

▪add Mr. Perry to the Compensation and Talent Management Committee.

Annual Board and Committee Evaluations

The Board recognizes that a robust and constructive performance evaluation process is an essential component of Board effectiveness.

Confidential annual Board evaluations are overseen by our Chairman of the Board, while the Chairs of our standing committees oversee the evaluation of their respective committees.

Tailored questions are designed to solicit Board and committee feedback on critical Board topics, including composition, culture, focus, strategy, risk, talent, process, and access.

Results of the evaluations are discussed by the Board and each committee in executive session and have led to substantive changes in practice.

Recent examples include:

▪adding Egbert Perry, CEO of Integral LLC and former Chair of Fannie Mae, to the Board and Compensation and Talent Management Committee; and

▪adding more outside speakers to speak on larger industry topics, including sessions since June 2022 with a representative from a leading investment banking firm and Fannie Mae's Chief Economist.

The Nominating and Corporate Governance Committee periodically reviews the form and process for Board and committee self-evaluations.

The Chairman of the Board also consults with each Director on a quarterly basis during one-on-one telephonic meetings at which Directors are able to further share their views on matters related to the Board and the Company. Key themes raised at these meetings or during Board and Committee sessions are also summarized by the Chairman of the Board and conveyed on a regular basis to the other Directors and management. When appropriate, the Chairman of the Board incorporates real-time evaluation topics and feedback into regular sessions of the Board.

Executive Sessions of Independent Directors

The Independent Directors met without any members of management present in executive session at more than half of the Board meetings held in 2023. During 2023, Mr. Williams, the Independent Chairman of the Board, chaired these sessions. Committees of the Board also regularly hold executive sessions without management present. These sessions are led by the Committee Chairs.

Communications with the Board and Directors

Stockholders and other parties interested in communicating directly with the Board, an individual Independent Director or the Independent Directors as a group may do so by writing our Corporate Secretary at anywhereboard@anywhere.re or Anywhere Real Estate Inc., 175 Park Avenue, Madison, New Jersey 07940. The Corporate Secretary will forward the correspondence only to the intended recipients. However, prior to forwarding any correspondence, the Corporate Secretary will review it and, in her discretion, not forward correspondence deemed to be of a commercial nature or otherwise not appropriate for review by the Directors.

Committee Membership

The following chart provides the membership of our standing committees as of December 31, 2023 (in addition, the Board appointed an Ad Hoc Special Committee, which met frequently in 2023, as further described in "Oversight of Risk Management—Ad Hoc Special Committee Oversight of Litigation and Debt Transactions"):

| | | | | | | | | | | | | | |

Director (1) | Audit

Committee | Compensation & Talent Management Committee | Nominating & Corporate Governance Committee | Product &

Technology Committee |

| Fiona P. Dias | — | M | — | M |

| Matthew J. Espe | — | M | C | — |

| V. Ann Hailey | M | — | M | — |

| Bryson R. Koehler | M | — | — | M |

| Joseph Z. Lenz | — | — | — | — |

| Duncan L. Niederauer | — | — | M | M |

| Egbert L.J. Perry | — | M | — | — |

| Ryan Schneider | — | — | — | — |

| Enrique Silva | — | C | — | — |

| Sherry M. Smith | M | M | — | — |

| Christopher S. Terrill | — | — | M | C |

| Felicia Williams | C | — | — | — |

| Michael J. Williams | M | — | M | — |

| Meetings held in 2023 | 11 | 6 | 7 | 4 |

M = Member C = Chair

(1)Each member of each Committee is an Independent Director; see "Board and Committee Leadership Structure" above for additional information.

(2)Mr. Lenz joined the Board in February 2024 and does not currently serve on any committee of the Board.

During 2023, the full Board held 14 meetings, five of which were full meetings that included regular committee sessions, one of which was a two-day strategy session and the balance of which were update meetings to review Company performance and recent developments.

Each Director nominated for election attended at least 75% of the aggregate total number of meetings of the Board and the committees of the Board on which the Director served in 2023.

Directors fulfill their responsibilities not only by attending Board and committee meetings and reviewing meeting materials, but also through communication with the Independent Chairman and the CEO and other members of management relative to matters of mutual interest and concern to Anywhere.

Directors have also attended employee and ERG meetings, Company conferences and other strategic events, both in-person and virtually, which allows them to meet with a variety of members of management and to gain a deeper understanding of Company operations.

Director Attendance at Annual Meeting of Stockholders

As provided in the Board's Corporate Governance Guidelines, Directors are expected to attend our annual meeting of stockholders absent exceptional cause. At the 2023 Annual Meeting of Stockholders, which was held in a virtual-only format, all of our Directors were in attendance except one Director who was absent due to an administrative oversight.

Committees of the Board

The current function of each standing Board Committee is described below. The Charter for each committee is available under the Investors link, Governance page on our website at www.anywhere.re. In addition to the Company's standing committees, the Board has a long-standing practice of appointing ad hoc committees from time to time in the event of a significant, complex or quickly evolving issue facing the Company, where the Board believes the Company would benefit from a dedicated committee of Directors to focus on, and agilely manage, the issue. See "Oversight of Risk Management—Ad Hoc Special Committee Oversight of Litigation and Debt Transactions" for more information on our latest ad hoc committee.

Audit Committee

The purpose of the Audit Committee is to assist the Board in fulfilling its responsibility to oversee management regarding:

▪systems of internal control over financial reporting and disclosure controls and procedures;

▪the integrity of the financial statements;

▪the qualifications, engagement, compensation, independence and performance of the independent auditors and the internal audit function;

▪compliance with legal and regulatory requirements and the Company's ethics program;

▪review of material related party transactions; and

▪compliance with, adequacy of, and any requests for written waivers sought with respect to any executive officer or Director under, the code of ethics.

The Audit Committee is charged with reviewing our policies with respect to risk assessment and risk management, including overseeing management of financial accounting and reporting and compliance risks, and steps undertaken by management to control these risks. The Audit Committee shares oversight responsibility with the full Board for our information security and technology risks, including cybersecurity and data privacy, as well as legal risks.

The Board has direct oversight of operational and strategic risks while the Compensation and Talent Management Committee addresses compensation, talent management and succession planning related risks. For a more detailed discussion of the oversight of risk management, see "Oversight of Risk Management." All members of the Audit Committee are Independent Directors under the Board's Director Independence Criteria and applicable SEC and NYSE listing standards. The Board in its business judgment has determined that all members of the Audit Committee are financially literate, knowledgeable and qualified to review financial statements in accordance with applicable listing standards. The Board has also determined that each member of the Audit Committee (Felicia Williams, V. Ann Hailey, Bryson R. Koehler, Sherry M. Smith and Michael J. Williams) is an audit committee financial expert within the meaning of applicable SEC rules.

Compensation and Talent Management Committee

The purpose of the Compensation and Talent Management Committee is to:

▪oversee management compensation policies and practices, including, without limitation, reviewing and approving, or recommending to the Board:

◦the compensation of our CEO and other executive officers;

◦management incentive policies and programs;

◦compensation peer group;

◦Company compensation philosophy;

◦equity compensation programs; and

◦stock ownership and clawback policies;

▪review and make recommendations to the Nominating and Corporate Governance Committee with respect to the compensation and stock ownership policies for Directors;

▪provide oversight concerning selection of officers and severance plans and policies;

▪review and discuss with management the Company's compensation discussion and analysis that is included in this proxy statement; and