1

A-Power Energy Generation Systems, Ltd.

NASDAQ: APWR

May 2008

2

Safe Harbor

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995, about A-Power Energy Generation Systems (“A-Power”), Head Dragon Holdings (“HDH”),

and Liaoning GaoKe Energy Group (“GaoKe”). Forward looking statements are statements that are not historical

facts. Such forward-looking statements, based upon the current beliefs and expectations of A-Power

management, are subject to risks and uncertainties, which could cause actual results to differ from the forward

looking statements. The following factors, among others, could cause actual results to differ from those set forth

in the forward-looking statements: business conditions in China, changing interpretations of generally accepted

accounting principles; outcomes of government reviews; continued compliance with government regulations;

legislation or regulatory environments, requirements or changes adversely affecting the businesses in which A-

Power, HDH, and GaoKe are engaged; fluctuations in customer demand; management of rapid growth;

competition from other providers of power generation and grid development; timing approval and market

acceptance of new products introduction; general economic conditions; geopolitical events and regulatory

changes, as well as other relevant risks will be detailed in future filings with the Securities and Exchange

Commission. The information set forth herein should be read in light of such risks. Neither A-Power, HDH, nor

GaoKe assume any obligation to update the information contained in this presentation.

3

A-Power Energy Generation Systems, Ltd

Overview

A-Power Energy Generation Systems began trading on

NASDAQ on January 22, 2008

Cash balance as of December 31, 2007 of $36M

Does not include paid-in-capital of ~$34M and another ~$58M from

warrant conversion in Q1 2008

$15M Bridge Loan paid off in January 2008 - now debt-free

Currently ~32.7M common shares outstanding, market cap of

~$660M

4

Ownership Structure

A-Power Energy Generation Systems, Ltd.

BVI company listed on NASDAQ

Head Dragon Holdings, Ltd.

Hong Kong company 100% owned by A-Power

Liaoning GaoKe Energy Group (“GaoKe”)

PRC company 100% owned by Head Dragon

5

Liaoning GaoKe Energy Group

Formed in 2003 to become the Leading Alternative Power

Company in China

Established to capitalize on the substantial inefficiencies and

drawbacks of China’s and SE Asia’s central power systems

Currently the leading provider of “local” distributed power generation

and micro power networks in China

Has a large clean energy technology portfolio

Includes wind, solar, hydro, ground source heat pumps, biomass, etc.

Has formed JV’s with top Chinese research institutions (Tsinghua University and China

Sciences Academy)

6

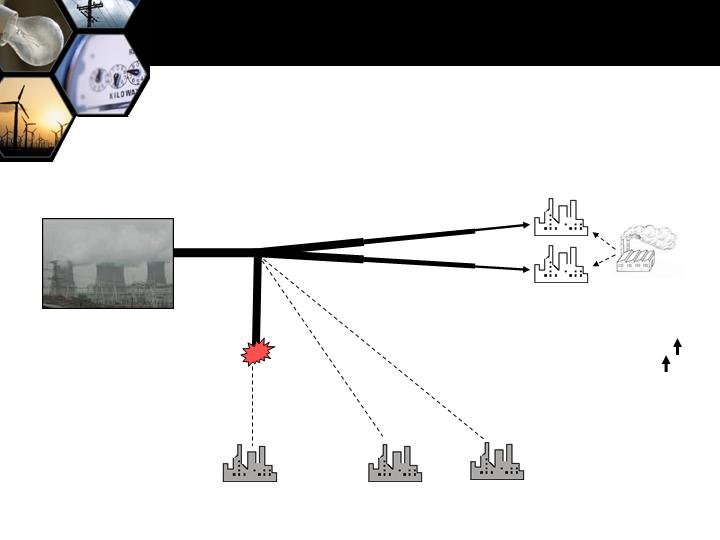

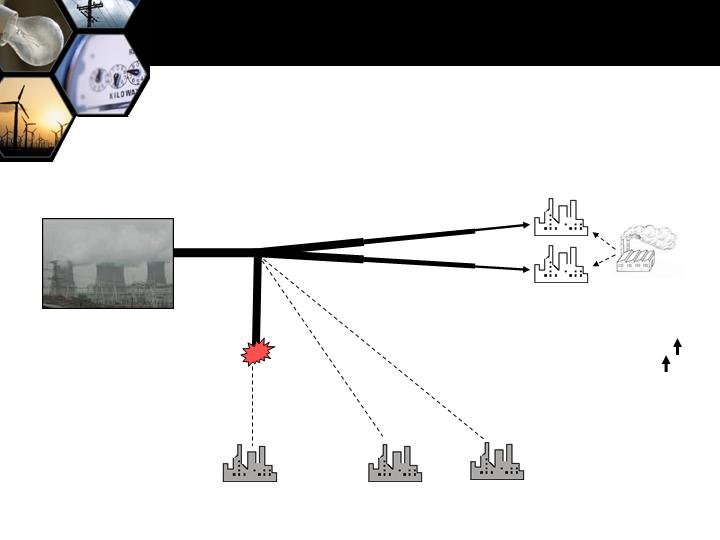

Basis for Forming GaoKe

Inefficient, “Dirty” Power Generation

Frequent Blackouts

Power Loss Due to

Transporting Over Long

Distances

Frequent & Time

Consuming Repairs

High Cost Power

(Demand > Supply)

Heat Purchased

from Local

Suppliers

Pollution

Cost

MAJOR PROBLEMS with Traditional Central Power

Generation in China / SE Asia

7

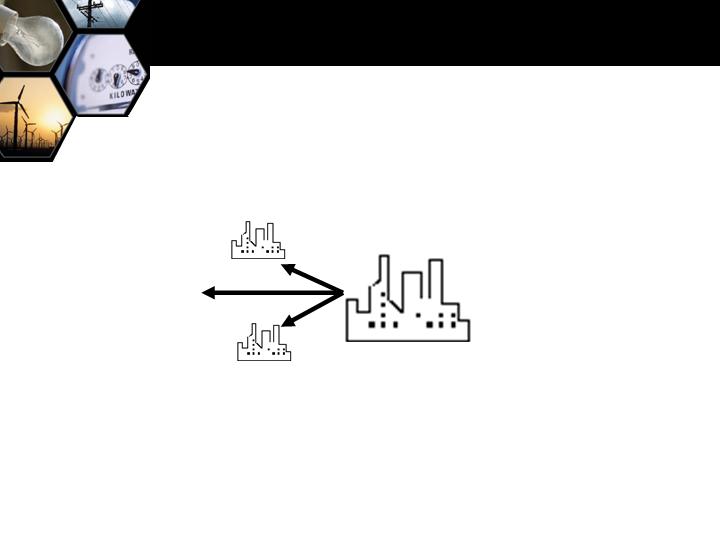

GaoKe’s Solution = Local, Distributed

Power Generation

EFFICIENT, “GREEN” POWER

Use factory byproducts (excess steam) to create cheap, on-site power & free heat

> 80% efficiency, vs. 20-40% for traditional power

Excess power generated

can be sold to local users

via a micro grid or to the

national grid

RELIABLE

Eliminates reliance on national grid with its frequent blackouts

System localization makes it easier to maintain and less vulnerable to disruptions

ECONOMICAL

Power is 1/3-1/5 the cost of

national grid power

No need to buy heat from a

3rd party

System pay-back 2-5 years

8

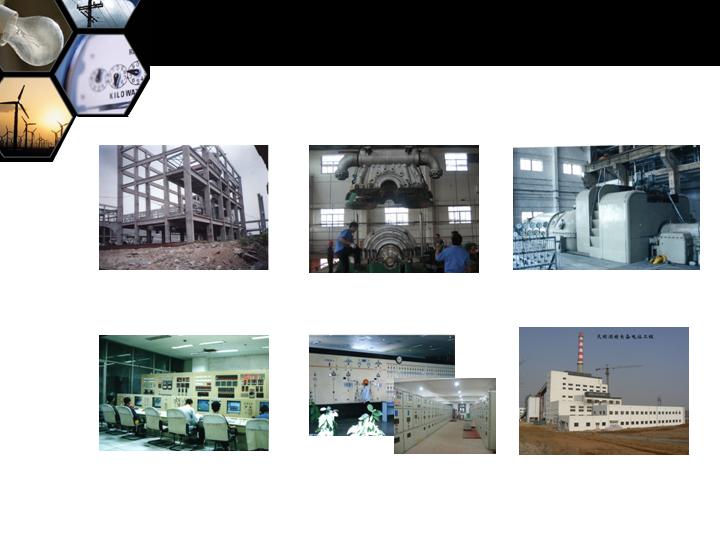

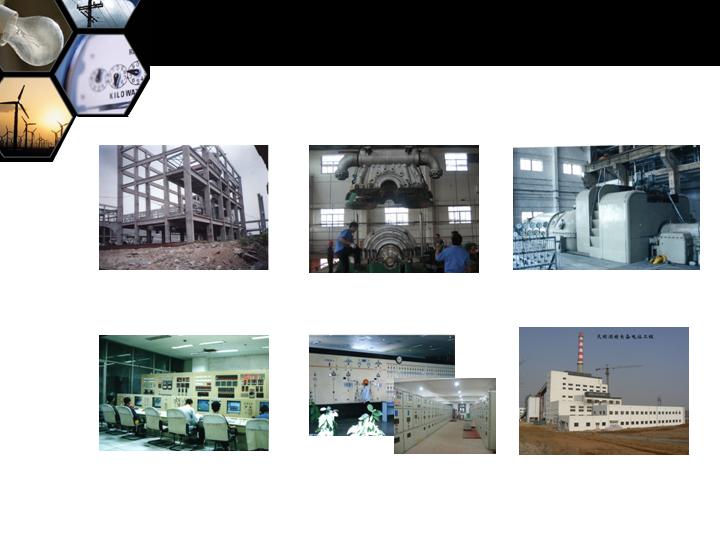

GaoKe’s Distributed Power

Generation System (DG)

Steel Framing / Design Phase

Turbine Installation

Generator & Turbine

Steam Boiler Control Room

Power / Heat Control Room

Completed DG Factory

9

Distributed Power Generation

Market - China

HUGE market potential

Recent 5-Year Plan promotes distributed power generation to

help alleviate the national power supply shortage

Historically, facilities in China did not install distributed power generation

systems due to state-owned power company resistance

Government policy support changes dynamics of PRC’s entire power

industry

Dramatically increased interest in distributed power generation

PRC government estimates that spending on new power

generation in China will be at least $65-$78 billion per year for the

next 4 years

10

GaoKe’s Competitive Advantages in the

Distributed Power Generation Business

ONLY private company permitted to provide all aspects of distributed

power generation system development in China (design, construct, install & test)

Large state-owned (SOE’s) power companies are “allowed” to develop distributed

power generation and micro power grids, but do not

1.

SOE’s have enough trouble keeping up with China’s growing power needs

2.

SOE’s focus on developing large power plants for the national grid

3.

SOE’s lack the know-how to successfully develop efficient distributed systems

ONLY company with successful distributed generation experience in

China

GaoKe’s systems have ranged from 6MW to 300MW in size

1. 75% of customers are factories (steel, chemical, pharmaceutical, food processing,

ethanol, paper, cement, etc.)

2. 25% of customers are stand-alone facilities providing power and heat to new

development zones in rural or urban areas

3. > 80% of customers are privately-owned companies

11

Government Restrictions

China’s power industry is highly regulated, which limits competition

Experience in China’s Market

GaoKe’s systems can be installed quickly and operate efficiently

Thorough understanding of regulations and approval processes in China

Know-How and Proprietary Processes

Proprietary know-how balances input of steam, air and water to maximize

system efficiency

Scalable platform that can be implemented with minimal adjustments

80% of the design of a second system in any industry can be adapted from previously system

60% of the design of a first system in a new industry can be adapted from the platform

Employs its own programming for automated control software to remotely

and continuously monitor system performance

GaoKe’s Competitive Advantages in the

Distributed Power Generation Business

12

Distributed Power Generation

Market – SE Asia

Inefficient and insufficient power generation throughout SE Asia

Local engineering companies lack experience and expertise to

develop efficient distributed power generation and micro power grids

Substantial interest in “green” energy

Governments do not want to ignore the environment during their rapid

industrial expansion

GaoKe has been approached to implement systems in India,

Thailand, Malaysia and Indonesia

13

Accelerated Entry into International Markets

Recently Signed an Agreement to Acquire Liaoning International

Construction & Engineering Group

One of a limited number of Class-A construction license holders in China

-Authorized to construct energy and infrastructure projects of any size

Significant domestic and international experience in constructing power plants

and infrastructure projects

-Track record in Africa, Eastern Europe and the Asia-Pacific region

Significant financial growth

-$70m revenue, $2.3 Million net income in 2006 (audited)

-$93m revenue, $3.0 Million net income in 2007 (unaudited)

Benefits from the Acquisition

Will accelerate A-Power’s entry into international markets

Expansion of A-Power’s existing technical and project management capability

Accretive acquisition with profit margins that are expected to increase to

A-Power’s level over time

14

More About GaoKe

Attracts and retains the best engineering talent in China

Company provides higher pay, more benefits to retain the best engineering talent available

Presently employs >150 qualified engineers who cost only ~1/5 of Western engineers

Substantial growth since inception expected to accelerate

After-tax earnings have grown from ~US$0.6 million in 2003 to ~US$16.8 million in 2007

Additional “green” energy technologies are also being commercialized

Includes wind, biomass, heat pump and hydro power

Engineering services company led by CEO Mr. Jinxiang Lu

A leader in China’s power industry for over 30 years

Pioneered China’s distributed power generation industry

Began developing distributed generation in the 1980s after becoming

frustrated with the inefficiencies of the central grid system

15

New Energy Technology Development

JV with the China Science Academy in Guangzhou

Most renowned research institution in Asia for developing new energy

technologies

Substantial expertise in wind, solar, magnetic, geothermal, tidal, and biomass

All new technology will be owned 70% by Gaoke and 30% by the Science

Academy

R&D Center at Tsinghua University in Beijing

The most distinguished university of scientific research in China

R & D Center focused on developing new technology and processes for

Gaoke’s distributed generation systems

Also has substantial expertise in wind turbine technology

16

Wind Energy Business

Upside: GaoKe has recently entered into agreements to license

leading state-of-the-art European wind turbine technology

License agreement with Fuhrlander AG of Germany to produce and sell

its 2.5MW wind turbine in China

Fuhrlander’s 2.5MW turbine is the largest commercialized land-based turbine

in the world

Over 160 meters tall (comparable to a 45 story building)

Blades are ~40 meters long with diameter of ~80 meters

Each turbine produces > 6 million kWh of clean power each year

Sales price in China anticipated to be RMB 20-24 million ($2.7 - $3.2 million)

GaoKe has already received LOIs for 380 of these 2.5MW wind turbines

17

Wind Energy Business

License agreement with Norwin A/S of Denmark to produce and sell its 750 kW

and 225 kW wind turbines

Norwin is a leading European developer of wind turbines and recently served as a lead

contractor in the construction of the Bahrain World Trade Center

750kW turbine Includes proprietary technology not currently being

used in China that allows for a more efficient connection to the grid

Ideal for wind farms with low-level wind conditions

Sales price in China for a 750 kW system anticipated to be ~US$500,000

Setting up a new wind technology R&D center with Norwin in Shenyang

Will combine expertise of Norwin and GaoKe

Bahrain WTC

18

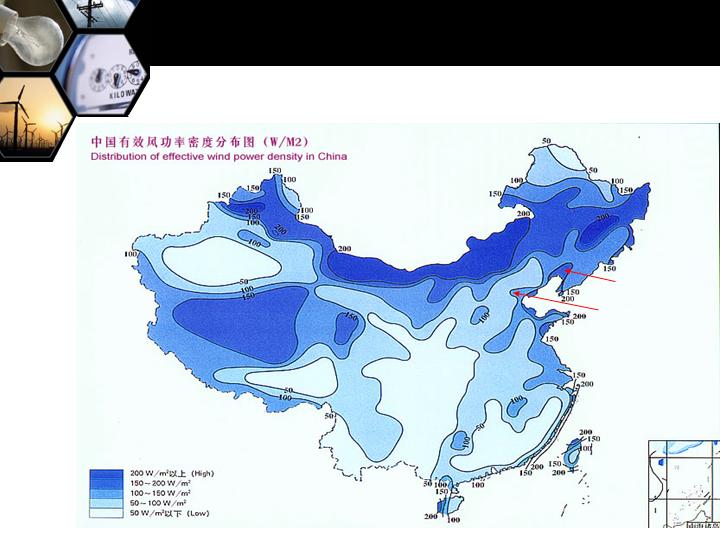

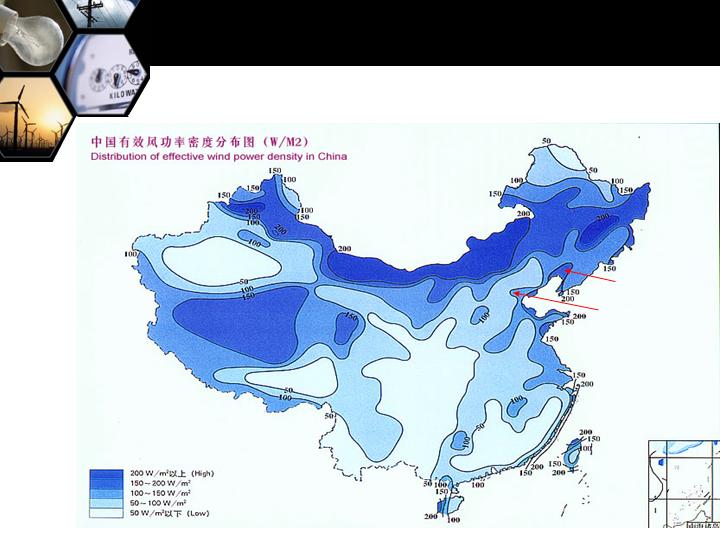

China’s Wind Energy Market

Substantial growth in energy from wind

2.2 GW, or less than 1%, of China’s total energy production in 2006 was from wind

China’s government plans 100 GW of wind energy production by 2020 (15% of

China’s projected energy output at that time), or 120GW if with state subsidy incentives

Equals 100 nuclear plants or more than total generation capacity in France

World total wind capacity of 94 GW by 2007 (Germany 20, USA 12)

Substantial PRC government promotion occurring to reach goal

Requires state-owned power companies to purchase 100% of energy produced from

wind farms under long-term (20-30 year) contracts

Requires all wind turbines installed in China to be assembled in China and 70% of

components to be assembled/produced domestically (up from 10-20% of components

historically)

Mandates major domestic energy companies, including the five largest power generating

groups, to invest a growing proportion of their earnings in developing new wind farms

China’s wind turbine production market is still in its infancy

Limited wind technology base and only a few capable domestic producers

The largest wind turbine produced domestically is 1.5 MW

19

GaoKe’s Wind Energy Business

GaoKe’s New Wind Turbine Production Facility

Expected to complete 1st phase of construction and begin producing wind turbines in mid-2008

20

Why GaoKe Will Succeed in the Wind Business

Shenyang

Beijing

21

Why GaoKe Will Succeed in the Wind Business

L

Has licensed advanced European wind technology

Capitalize on second-mover advantage

Learned from mistakes of Chinese companies that rushed into wind business &

underestimated the highly technical nature of wind turbine production

Partnered with licensors to assist with the entire process

Includes selection of component suppliers, design and operation of assembly facility, installation of

turbines, follow up maintenance, etc.

Strategic location

Shenyang is a major industrial center with many component and steel suppliers

Close proximity to many projected large wind farms

Good access to highways and local ports

Strong relationships in China’s main wind farm provinces

Extensive experience with governments and state-owned power companies in windy N. China

Has rights to 7 future wind farm sites in Inner Mongolia and Liaoning Province

Combined capacity of the 7 areas is over 2 GW

22

In USD Millions

GaoKe’s Historical

U.S. GAAP Financials

2003

2004

2005

2006

2007

Revenue

17.7

40.5

75.5

98.7

152.5

YOY % Increase

129%

86%

31%

55%

Income

0.6

2.5

4.7

7.7

16.8

YOY % Increase

56%

88%

62%

119%

23

Backlog

Dec 31

2004

Dec 31

2005

Dec 31

2006

Dec 31

2007

Apr 16

2008

Contract

Backlog

65.2

61.2

269.0

398.2

700.0

In USD Millions

24

Owners of GaoKe, on an all-or-none-basis each year, will be issued 1.0

million shares of common stock if they achieve after-tax profits in the

following amounts for 2007, 2008, and 2009, and 2.0 million shares of

common stock each year if they receive after-tax profits in the following

amounts for 2010, 2011, and 2012:

Incentive Based Compensation

Year Ending 12/31

After-Tax Profit (USD)

Shares O/S

2007

$ 14,000,000

32.7M

2008

$ 19,000,000

33.7M

2009

$ 29,000,000

34.7M

2010

$ 44,000,000

35.7M

2011

$ 63,000,000

37.7M

2012

$ 87,000,000

39.7M

2013

41.7M

25

Cap Table

As of March 31, 2008

32,706,938

Total

19,706,938

Public

13,000,000

Management

Common Shares

26

Tax Holiday and 2008 Guidance

Applicable

Tax Rate

25%

15%

0%

2012 -

2009-2011

2007-2008

Management 2008 Forecast: $35-45 million Net Income,

or approx. $1.20 EPS

27

Summary

Experienced Management Team

Profitable & Cash Flow Positive

Leading Company in China’s Distributed Power Generation Market

Recently began receiving Central Government support

Potential market size estimated at $6.5-$7.8 billion per year

High barriers to entry

Substantial existing contracts

Entering China’s Surging Wind Market

Licensed wind turbine technology from leading European wind companies

A-Power’s wind production facility expected to be completed in mid-2008

Already received LOIs for 380 2.5MW wind turbines

Significant Other Upside

International expansion

China’s other alternative energy markets