As filed with the Securities and Exchange Commission on February 13, 2009

Registration No. 333-144677

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 7

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

COIL TUBING TECHNOLOGY HOLDINGS, INC.

(Name of issuer in its charter)

| NEVADA | 1382 | 76-0625217 |

(State or jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

19511 Wied Rd. Suite E

Spring, Texas 77388

281-651-0200

(Address and telephone number of principal executive offices

and principal place of business or intended principal place of business)

Jerry Swinford, Chief Executive Officer

19511 Wied Rd. Suite E

Spring, Texas 77388

281-651-0200

(Name, address and telephone number of agent for service)

Copies to:

| David M. Loev | | John S. Gillies |

| The Loev Law Firm, PC | | The Loev Law Firm, PC |

| 6300 West Loop South, Suite 280 | & | 6300 West Loop South, Suite 280 |

| Bellaire, Texas 77401 | | Bellaire, Texas 77401 |

| Phone: (713) 524-4110 | | Phone: (713) 524-4110 |

| Fax: (713) 524-4122 | | Fax: (713) 456-7908 |

Approximate date of proposed sale to the public: as soon as practicable after the effective date of this Registration Statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ( )

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of earlier effective registration statement for the same offering. ( )

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ( )

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ( )

If delivery of the Prospectus is expected to be made pursuant to Rule 434, check the following box. ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ |

| | |

Non-accelerated filer ¨ | Smaller reporting company ý |

CALCULATION OF REGISTRATION FEE

| Title of Each | Amount | Proposed Maximum | Proposed Maximum | Amount of |

| Class of Securities | Being | Price Per Share(1) | Aggregate Price(1) | Registration |

| To be Registered | Registered | | | Fee |

| | | | | |

| Common Stock | 20,000,000 | $0.10 | $200,000 | $61.40 |

| | | | | |

| Total | 20,000,000 | $0.10 | $200,000 | $61.40 |

(1) The shares included herein are being distributed to the stockholders of Coil Tubing Technology, Inc., a Nevada corporation. No consideration will be received by Coil Tubing Technology, Inc. in consideration of such distribution. The offering price is the stated, fixed price of $0.10 per share until the securities are quoted on the OTC Bulletin Board for the purpose of calculating the registration fee pursuant to Rule 457. This amount is only for purposes of determining the registration fee, the actual value of the securities will be based upon fluctuating market prices once the securities are quoted on the OTC Bulletin Board.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

COIL TUBING TECHNOLOGY HOLDINGS, INC.

DISTRIBUTION OF 20,000,000 SHARES OF COMMON STOCK

We are furnishing this Prospectus to the shareholders of Coil Tubing Technology, Inc., a Nevada corporation (“Coil Tubing”).

Shareholders of Coil Tubing will receive one (1) share of Coil Tubing Technology Holdings, Inc. (the “Company,” “CTTH”, “we,” and “us”) for approximately every 7.483 shares of Coil Tubing which they own on February 13, 2009, the record date of the distribution (the “Record Date” and the “Distribution”). Any fractional shares left as a result of the Distribution will be rounded up to the nearest whole share. The Distribution is expected to be effected as soon as practicable after the date the registration statement, of which this Prospectus is a part, is declared effective. Certificates representing the shares of Company common stock will be mailed to the Coil Tubing stockholders on that date or as soon thereafter as practicable. No fractional shares of Company common stock will be issued.

We are bearing all costs incurred in connection with this Distribution.

Before this offering, there has been no public market for our common stock and our common stock is not listed on any stock exchange or on the over-the-counter market. This Distribution of our common shares is the first public Distribution of our shares. It is our intention to seek a market maker to publish quotations for our shares on the OTC Electronic Bulletin Board; however, we have no agreement or understanding with any potential market maker. Accordingly, we can provide no assurance to you that a public market for our shares will develop and if so, what the market price of our shares may be. The shares registered in the Distribution will be sold at $0.10 per share until our shares are quoted on the OTC Bulletin Board, if ever, and thereafter at prevailing market prices or privately negotiated prices.

SHARES OF COIL TUBING TECHNOLOGY HOLDINGS, INC. INVOLVE A HIGH DEGREE OF RISK. WE URGE YOU TO READ THE "RISK FACTORS" SECTION BEGINNING ON PAGE 13, ALONG WITH THE REST OF THIS PROSPECTUS RELATING TO RISKS ASSOCIATED WITH THE SECURITIES REGISTERED HEREIN.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE DATE OF THIS PROSPECTUS IS ___, 2009

TABLE OF CONTENTS

| Prospectus Summary | 8 |

| Summary Financial Data | 11 |

| Risk Factors | 13 |

| The Spin-Off | 24 |

| Questions and Answers Concerning the Stock Distribution | 28 |

| Use of Proceeds | 29 |

| Dividend Policy | 29 |

| Legal Proceedings | 30 |

| Directors, Executive Officers, Promoters and Control Persons | 31 |

| Security Ownership of Certain Beneficial Owners and Management | 34 |

| Interest of Named Experts and Counsel | 37 |

| Indemnification of Directors and Officers | 37 |

| Description of Business | 38 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 51 |

| Description of Property | 54 |

| Certain Relationships and Related Transactions | 54 |

| Executive Compensation | 56 |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 60 |

| Descriptions of Capital Stock | 61 |

| Shares Available for Future Sale | 63 |

| Determination of Price | 63 |

| Market for Common Equity and Related Stockholder Matters | 64 |

| Additional Information | 64 |

| Legal Matters | 64 |

| Financial Statements | F-1 |

| Dealer Prospectus Delivery Obligation | 65 |

| Part II | 66 |

PART I

INFORMATION REQUIRED IN PROSPECTUS

Coil Tubing Technology Holdings, Inc. was formed as a Texas corporation (the “Company,” “CTTH”, “we,” and “us”) on July 2, 1999. On March 20, 2005, our then sole shareholder, Jerry Swinford, who is currently our sole officer and Director, entered into a Definitive Acquisition Purchase Agreement (the “Purchase Agreement”) with Grifco International, Inc. [GFCI.PK] (“Grifco”), pursuant to which he sold 100% of our outstanding common stock, 51,000 pre Forward Split (defined below) shares of common stock (20,000,000 shares post Forward Split) to Grifco for an aggregate price of $510,000, payable as $50,000 in cash and $460,000 worth of Grifco common stock (totaling 1,482,871shares of common stock, based on the trading price of Grifco’s common stock on the Pink Sheets trading market on the day of closing of the Purchase Agreement), of which $200,000 in stock (645,161 shares) was paid to settle an $800,000 debt owed by us to a third party, HyCoTec Investments, B.V., a Netherlands limited liability company (“HyCoTec”), and $260,000 in stock (837,710 shares ) was paid directly to Mr. Swinford. The 837,710 shares of Grifco common stock which Mr. Swinford received represented less than 5% of Grifco’s common stock. As such, Mr. Swinford did not have any control over the operations of Grifco prior to or following the parties entry into the March 2005 Purchase Agreement. Further, Mr. Swinford has not ever served as an officer or director of Grifco. Grifco held our common shares in its own name and as such, we were a wholly owned subsidiary of Grifco following the Purchase Agreement.

HyCoTec had been an investor in the Company prior to the date of the exchange and previously converted its equity interest in the Company into debt secured by the Company’s assets. Neither Mr. Swinford nor the Company had any relationship with HyCoTec other than in relation to the debt owed to HyCoTec by the Company.

Coil Tubing Technology, Inc., our Parent, Reverse Merger Transaction

Our parent, Coil Tubing, was formed as a result of a series of transactions in November and December 2005 that resulted in a reverse merger, change in domicile and name change. In November 2005, IPMC Holdings Corp., a Florida corporation (which was a delinquent filer with the Commission), we and Grifco entered into an Agreement For Exchange of Common Stock (the “Exchange Agreement”), whereby IPMC Holdings Corp. (which is a predecessor to our parent corporation, Coil Tubing) agreed to exchange 75,000,000 newly issued shares of its common stock (representing approximately 89% of IPMC Holdings Corp.’s then outstanding stock, based on 14,200,794 shares of IPMC Holdings Corp.’s outstanding common stock prior to the exchange) to Grifco for the 51,000 pre-Forward Split shares of common stock (20,000,000 shares post Forward Split, as defined below), representing 100% of our outstanding shares, which Grifco held subsequent to the Purchase Agreement (described above). As a result of the Exchange Agreement, we became a wholly owned subsidiary of IPMC Holdings Corp. and IPMC Holdings Corp. became a majority owned subsidiary of Grifco (which held 75,000,000 shares of IPMC Holdings Corp. as a result of the Exchange Agreement).

In connection with the reverse merger and to convert the state of incorporation and change the name of our parent, on November 30, 2005, Coil Tubing Technologies, Inc. was formed in Nevada. On December 8, 2005, IPMC Holdings Corp. entered into a Plan and Agreement of Merger and Reorganization (the “Merger”) with Coil Tubing Technologies, Inc., pursuant to which each outstanding share of IPMC Holdings Corp. was exchanged for one share of Coil Tubing Technologies, Inc. As a result of the Merger, Coil Tubing Technology, Inc., our parent company (“Coil Tubing”), became the sole surviving corporate entity of the merger between IPMC Holdings Corp. and Coil Tubing Technologies, Inc. (taking the name “Coil Tubing Technology, Inc.” in connection with the Merger), and we became a wholly owned subsidiary of Coil Tubing. Coil Tubing Technologies, Inc. had no business or operations prior to the Merger with IPMC Holdings Corp. Coil Tubing Technologies, Inc. had only 100 outstanding shares at the time of its formation and prior to the Merger with IPMC Holdings Corp., which shares were held by Grifco’s then President, James Dial.

We had no role in the Exchange Agreement, other than in certifying certain disclosures made about the Company in the Exchange Agreement, and being the entity exchanged from Grifco to IPMC Holdings Corp. IPMC Holdings Corp. had approximately 310 shareholders of record prior to the Exchange Agreement.

The Company is not aware of the operations of IPMC Holdings Corp. immediately prior to the acquisition of IPMC Holdings Corp. by Grifco. Furthermore, Mr. Swinford does not and did not have any detailed knowledge of Grifco’s operations or the size and scope of its revenues or profit. Mr. Swinford is however, aware that Grifco had some coil tubing related business prior to the Exchange Agreement, but that such coil tubing products were not its main product line. At the time of the Exchange Agreement, it is believed that the vast majority of Grifco’s coil tubing business was conducted through the Company.

The acquisition by Grifco of IPMC Holdings Corp. was handled entirely by Grifco’s management and presumably, its counsel. Neither the current management of Coil Tubing nor the Company were involved in negotiating, drafting or finalizing the transaction or the terms of the transaction, nor was their input on the transaction sought. Grifco was the ultimate purchaser of IPMC Holdings Corp., controlled the management of, and the officers and Directors of IPMC Holdings Corp. Later, after the management of Coil Tubing was taken over by Jerry Swinford, Coil Tubing’s and the Company’s current sole officer and Director, it became clear that there were numerous issues with the Grifco/IPMC Holdings Corp. merger, including the fact that IPMC Holdings Corp. was a deficient filer with the Commission, that IPMC Holdings Corp. may have had liabilities which were unknown to Grifco at the time of the transaction, and that IPMC Holdings Corp.’s financial statements were likely unauditable. As a result, Coil Tubing and the Company obtained separate counsel to assist them with the issues created by the transaction. Mr. Swinford has no control and has never had any control over Grifco, and has historically only had limited contact with Grifco.

Coil Tubing (which was known as IPMC Holdings Corp. at the time) had 14,200,794 outstanding shares held by approximately 310 shareholders prior to entering into the Exchange Agreement. Of the 14,200,794 outstanding shares, 6,333,334 shares, representing 44.6% of Coil Tubing’s outstanding stock were held by Ramsy Holding Corp., 3,401,361 shares, representing 23.9% of Coil Tubing’s outstanding stock were held by Mercatus and Partners Ltd., and 2,223,334 shares, representing 15.7% of Coil Tubing’s outstanding stock were held by The Myrtle Heim Declaration Trust. No other shareholders accounted for more than 5% of Coil Tubing’s outstanding common stock other than the shareholders described above, and the Company has no knowledge of the beneficial owners of the shares described above.

Coil Tubing is the result of Grifco’s acquisition of IPMC Holdings Corp. and related “reverse merger.” Coil Tubing’s current management, Jerry Swinford, was not involved in negotiating or effecting the transaction. Thus, he was not aware of Coil Tubing’s reporting obligations pursuant to the Securities Act of 1934, as amended, until sometime well after the 2005 merger. As a result, Mr. Swinford did not consider Coil Tubing a reporting company until he was informed of such reporting obligations by Coil Tubing’s legal and accounting advisors, which was subsequent to the date of the Exchange Agreement.

Subsequent to the Exchange Agreement, Grifco continued to provide financial assistance to Coil Tubing in the form of cash contributions to our subsidiary, Coil Tubing Technology, Inc., a Texas corporation (“CTT Texas”), for the benefit of Coil Tubing, as the Company, through its subsidiary, CTT Texas, represented all of Coil Tubing’s operations. Such cash contributions made between November 2005 and March 2007, totaled approximately $556,000, plus advances in 2007 totaling $75,000. The advances were repaid in full in the second quarter of 2007. No additional contributions have been made by Grifco since March 2007. The contributions provided by Grifco were used by us for working capital and to pay certain expenses including legal and accounting expenses and to rebuild the Company’s machine shop, and to repair and replace certain coil tubing machinery, including the Company’s computer numerical control (“CNC”) equipment, which was damaged while under the control of Grifco.

It is believed that Grifco entered into the Exchange Agreement, because it believed that our operations would bring more value to its shareholders if we were a stand alone company with operations separate from Grifco, and we could trade our shares on a public market. It was originally anticipated that Coil Tubing would obtain audited financial statements and file a registration statement with the Securities and Exchange Commission (the “Commission”) in an effort to trade its common stock on the Over-The-Counter Bulletin Board (“OTCBB”), which it was unable to accomplish due to its deficient filings with the Commission and because it was unable to obtain audited financial statements for the period prior to the Merger. Coil Tubing was previously unable to obtain detailed historical financial information relating to prior to the Merger, and has therefore been forced to trade its shares on the Pink Sheets trading market; however, Coil Tubing has recently been able to move forward with an audit (which information is included in the consolidated audited financial statements included herein). As a result of IPMC Holdings Corp.'s deficiencies, our management decided it was in our best interests to distribute our stock to the stockholders of Coil Tubing, which it believed would provide us a better chance of trading our shares on the Over-The-Counter Bulletin Board and bring greater value to the shareholders of Coil Tubing.

Summary Material Corporate Events

In May 2007, our majority shareholder, Coil Tubing, determined it was in our best interest to redomicile from the State of Texas to the State of Nevada, and on May 24, 2007, we entered into a Plan of Conversion and filed Articles of Conversion with the Secretary of State of Texas and Nevada, shortly thereafter, to affect a conversion to a Nevada corporation (the “Conversion”). Concurrently with the Conversion, we increased our authorized shares of common stock to 500,000,000 shares, $0.001 par value per share, and authorized 10,000,000 shares of blank check preferred stock, $0.001 par value per share.

On June 19, 2007, our Board of Directors, and majority shareholder, Coil Tubing, approved a 392.1568627 for one forward stock split of our issued and outstanding stock, for all shareholders of record as of June 19, 2007 (the “Forward Split”). As a result, our issued and outstanding shares increased from 51,000 prior to the forward stock split to 20,000,000 shares subsequent to the forward stock split.

The effects of the Conversion and Forward Split have been reflected throughout this Prospectus.

On June 19, 2007, subsequent to the Forward Split, we issued 1,000,000 shares of Series A Preferred Stock in Coil Tubing Technology Holdings, Inc. to Jerry Swinford, our sole officer and Director. The Series A Preferred Stock has the right to vote, in aggregate, on all shareholder matters equal to 51% of the total vote. The Series A Preferred Stock will be entitled to this 51% voting right no matter how many shares of common stock or other voting stock of the Company are issued or outstanding in the future (the “Super Majority Voting Rights”). The Company designated the shares of Series A Preferred stock with the Super Majority Voting Rights, so that Mr. Swinford would retain control over the Company for as long as he held the Series A Preferred Stock, regardless of the number of shares of common stock of the Company which were outstanding. Mr. Swinford also holds 1,000,000 shares of Series A Preferred Stock in Coil Tubing, which shares were issued to Mr. Swinford in May 2007, as described below. Unless otherwise stated or the context would suggest otherwise, all references to the Series A Preferred Stock contained in this Registration Statement refer to the Series A Preferred Stock of the Company, and not Coil Tubing.

Additionally, in July 2007, subsequent to the Forward Split and the issuance of the Series A Preferred Stock to Mr. Swinford, we issued Mr. Swinford 1,000,000 shares of common stock upon the execution of his employment agreement (described in greater detail below).

Mr. Swinford was issued an additional 1,050,000 shares of common stock in January 2009, representing 5% of our then outstanding shares of common stock, pursuant to the terms of his Employment Agreement, described below.

Summary Description of Business Activities

Our primary business is manufacturing, by outsourcing to select machine shops, specialized coil tubing tools and products which are then rented to various third parties throughout North America for use in specialized coil tubing applications.

Coiled tubing technology refers to using a long, thin, continuous string of hollow pipe that is mounted on a truck to work-over oil and gas wells. Crews lower this tubing into the well under the careful control of an operator and once in place, this pipe allows the usage of specialized tools, and the pumping of fluids such as nitrogen into the well. The tool string at the bottom of the coil is often called the bottom hole assembly (“BHA”). The BHA can range from something as simple as a jetting nozzle, for jobs involving pumping chemicals or cement through the coil, to a larger string of logging tools, depending on the operations. Coiled tubing is used for a wide range of oil field services, including but not limited to drilling, logging, cleanouts, fracturing, cementing, fishing, completion and production. The tool which generates the majority of our revenue currently is the “Rotating Tool,” which provides rotation to assist in connecting to a fish, to fish debris out of a well bore.

Description of Distribution

Coil Tubing, our parent company, has decided to distribute 20,000,000 shares consisting of our securities, as a stock dividend (the “Distribution”) to Coil Tubing shareholders of record as of February 13, 2009 (the “Record Date”). This Distribution will constitute our initial public offering. The Distribution is expected to be effected as soon as practicable after the date the registration statement, of which this Prospectus is a part, is declared effective. In connection with the Distribution, Coil Tubing will distribute one (1) share of our common stock for each approximately 7.483 shares of Coil Tubing common stock that you own on the Record Date. Certificates representing the shares of Company common stock will be mailed to the Coil Tubing stockholders on that date or as soon thereafter as practical. No fractional shares of Company common stock will be issued. You will not be charged or assessed for the shares and neither we nor Coil Tubing will receive any proceeds from the Distribution of the shares.

If you reside in a state in which the state securities laws do not permit a readily available exemption for the Distribution of the shares, Coil Tubing reserves the right to issue cash in lieu of shares, at a price of $0.01 per share.

Neither the Nasdaq Stock Market nor any national securities exchange lists the Company’s common stock. Prior to this offer, there has been no public market for the Company’s common stock. There can be no assurance that a market for such securities will develop.

We have not applied to register the shares in any state. An exemption from registration will be relied upon in the states where the shares are distributed and may only be traded in such jurisdictions after compliance with applicable securities laws. There can be no assurances that the shares will be eligible for sale or resale in such jurisdictions. We may apply to register the shares in several states for secondary trading; however we are under no requirement to do so. Rather, we retain the option and anticipate that we will pay the dividend in cash rather than in shares to holders of Coil Tubing common stock that reside in states which do not provide for an exemption from state registration for this offering.

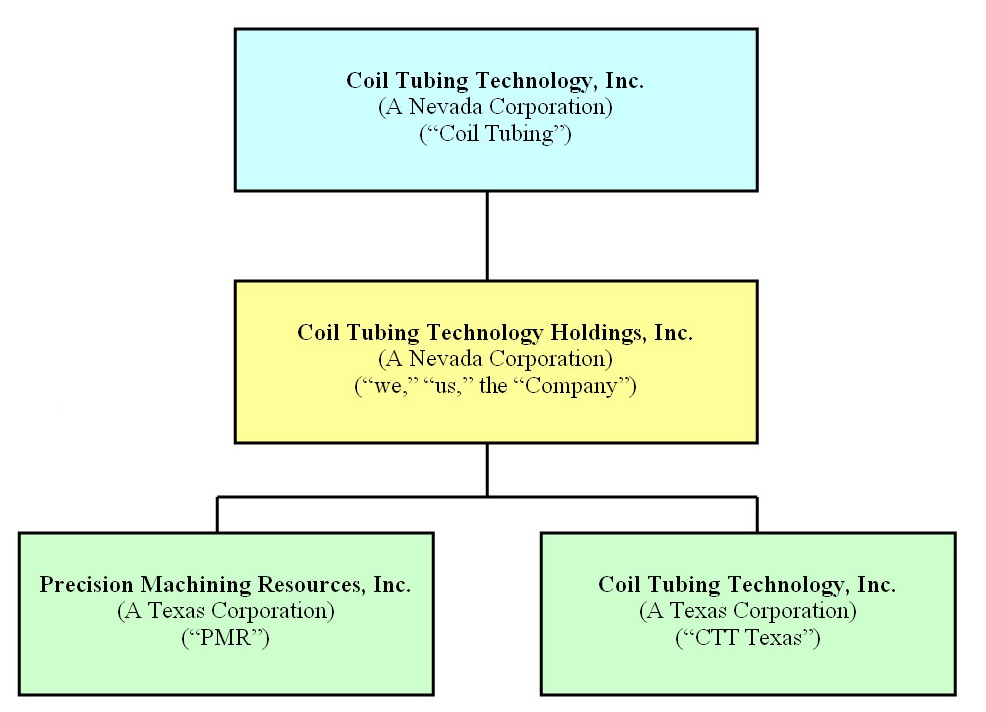

We currently have two wholly owned Texas subsidiaries, Precision Machining Resources, Inc. (“PMR”) and Coil Tubing Technology, Inc. (“CTT Texas”). The majority of our tool rental and tool production operations are run through CTT Texas. PMR owns the manufacturing equipment formerly used to produce tools used in the work-over segment of the Company’s rental business, which generally require smaller tools than other coil tubing operations. PMR also stocks coil tubing tool parts which it sells directly to other service companies, making PMR a supply and sales arm for non-proprietary tools and equipment of the Company. Unless this Registration Statement states otherwise, the discussion of our operations and our financial statements, and the use of the terms “we,” “us,” “our” and similar language, included herein include the operations of both of our wholly owned subsidiaries, PMR and CTT Texas.

The following summary is qualified in its entirety by the detailed information appearing elsewhere in this Prospectus. The securities offered hereby are speculative and involve a high degree of risk. See "Risk Factors."

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this Prospectus. To understand this offering fully, you should read the entire Prospectus carefully.

We specialize in the design and production of proprietary tools for the coil tubing industry. We concentrate on four categories of coil tubing applications: tubing fishing, tubing work over, pipeline clean out, and coil tubing drilling, which categories of applications are described in greater detail below under “Business Operations.” We have a website at www.coiltubingtechnology.com, which includes information we do not wish to be incorporated by reference into this Prospectus.

KEY FACTS ABOUT OUR COMPANY

AND THIS PROSPECTUS

| Common Stock Distributed: | 20,000,000 shares |

| | |

| Common Stock Outstanding | |

| Before The Distribution: | 22,050,000 shares |

| | |

| Common Stock Outstanding | |

| After The Distribution: | 22,050,000 shares |

| | |

| Distributing Company | Coil Tubing Technology, Inc., a Nevada corporation (“Coil Tubing”). |

| | |

| Distributed Company | Coil Tubing Technology Holdings, Inc. (the “Company,” “we,” and “us”). |

| | |

| Shares to be distributed: | Coil Tubing will distribute to its stockholders an aggregate of 20,000,000 shares of our common stock, based on 149,655,338 Coil Tubing shares outstanding on the record date, February 13, 2009 (the “Record Date” and the “Shares”). The Shares will constitute 90.7% of our outstanding shares after the Distribution. Immediately following the Distribution, Coil Tubing will not own any of our shares and we will be an independent company. The remaining 9.3% of our common stock which will not be distributed to shareholders of Coil Tubing are held by our Chief Executive Officer and Director, Jerry Swinford. Mr. Swinford also holds 1,000,000 shares of our Series A Preferred Stock, which gives him the right to vote 51% of the vote on any shareholder matter, and as such, Mr. Swinford currently controls and will continue to control after the Distribution, approximately 55.6% of our voting stock. |

| | |

| Record Date: | The Record Date for the Distribution is February 13, 2009, if you own shares of common stock of Coil Tubing on the Record Date, you will receive one share of our common stock for every approximately 7.483 shares of Coil Tubing that you hold as of the Record Date. |

| | |

| Offering Price | For purposes of calculating the registration fee for the common stock included in this Prospectus, we have used an estimated price of $0.10 per share. This is an arbitrary price and we can offer no assurances that the $0.10 price bears any relation to the value of the shares as of the date of this Prospectus. |

| | |

| Distribution Date: | We currently anticipate that the Distribution will occur as soon as practicable after the date the registration statement, of which this Prospectus is a part, is declared effective. |

| | |

| Distribution | On the Distribution Date, the Distribution agent identified below will begin distributing certificates representing our common stock to Coil Tubing stockholders as of the Record Date. You will not be required to make any payment or take any other action to receive your shares of our common stock. The distributed shares of our common stock will be freely transferable unless you are one of our affiliates or an affiliate of Coil Tubing. |

| | |

| Distribution Ratio: | The distribution ratio of the Distribution will be on a one for approximately 7.483 basis, i.e., each shareholder of Coil Tubing as of the Record Date will receive one share of our common stock for every approximately 7.483 shares of Coil Tubing that they hold on the Record Date. |

| Distribution agent | Interwest Transfer Company, Inc. |

| | 1981 East Murray Holladay Road, Suite 100 |

| | P.O. Box 17136 |

| | Salt Lake City, Utah 84117 |

| | Phone: (801)272-9294 |

| | Fax: (801)277-3147 |

| | |

| Transfer Agent and Registrar for our Shares: | Interwest Transfer Company, Inc. |

| | 1981 East Murray Holladay Road, Suite 100 |

| | P.O. Box 17136 |

| | Salt Lake City, Utah 84117 |

| | Phone: (801)272-9294 |

| | Fax: (801)277-3147 |

| | |

| | |

| Offering Price: | The offering price of the shares has been arbitrarily determined by us based on estimates of the price that purchasers of speculative securities, such as the shares, will be willing to pay considering the nature and capital structure of our Company, the experience of our officers and Directors and the market conditions for the sale of equity securities in similar companies. The offering price of the shares bears no relationship to the assets, earnings or book value of us, or any other objective standard of value. We believe that no shares registered in the Distribution will be sold prior to us becoming a publicly traded company, at which time such shares will be sold based on the market price of such shares. |

| | |

| No Market: | No assurance is provided that a market will be created for our securities in the future, or at all. If in the future a market does exist for our securities, it is likely to be highly illiquid and sporadic. |

| | |

| Address: | 19511 Wied Rd, Suite E |

| | Spring, Texas 77388 |

| | |

| Telephone Number: | 281-651-0200 |

SUMMARY FINANCIAL DATA

You should read the summary financial information presented below for the periods ended December 31, 2007 and 2006 and for the nine month period ended September 30, 2008 and 2007. We derived the summary financial information from our audited financial statements for the years ended December 31, 2007 and 2006 and our unaudited financial statements for the periods ended September 30, 2008 and 2007, appearing elsewhere in this Prospectus. You should read this summary financial information in conjunction with our plan of operation, financial statements and related notes to the financial statements, each appearing elsewhere in this Prospectus.

CONSOLIDATED BALANCE SHEETS

| ASSETS | |

| | September 30, 2008 | | | December 31, 2007 | |

| | (Unaudited) | | | | |

| Current Assets | | | | | |

| Cash | $ | 276,878 | | | $ | 170,411 | |

| Accounts receivable, net | | 58,679 | | | | 215,512 | |

| Total current assets | | 335,557 | | | | 385,923 | |

| | | | | | | | |

| Rental tools, net of accumulated depreciation | | 400,475 | | | | 377,915 | |

| | | | | | | | |

| Machinery and equipment, net of accumulated depreciation | | 64,066 | | | | 47,528 | |

| | | | | | | | |

| Other assets | | 2,930 | | | | 1,800 | |

| | | | | | | | |

| Total Assets | $ | 803,028 | | | $ | 813,166 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| Current Liabilities | | | | | | | |

| Accounts payable and accrued expenses | $ | 29,175 | | | $ | 157,099 | |

| Customer deposits | | - | | | | 62,685 | |

| Total current liabilities | | 29,175 | | | | 219,784 | |

| | | | | | | | |

| Total liabilities | | 29,175 | | | | 219,784 | |

| | | | | | | | |

| Stockholders' Equity | | | | | | | |

| Preferred Stock, $0.001 par value; 10,000,000 shares authorized; 1,000,000 shares issued and outstanding, respectively | | 1,000 | | | | 1,000 | |

| Common stock at $0.001 par value; 500,000,000 shares authorized 21,000,000 shares issued and outstanding | | | | | | | |

| | | 21,000 | | | | 21,000 | |

| Additional paid-in capital | | 2,691,162 | | | | 2,191,162 | |

| Accumulated deficit | | (1,939,309 | ) | | | (1,619,780 | ) |

| Total Stockholders' Equity | | 773,853 | | | | 593,382 | |

| | | | | | | | |

| Total Liabilities and Stockholders' Equity | $ | 803,028 | | | $ | 813,166 | |

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | Nine Months Ended September 30, 2008 | | | Nine Months Ended September 30, 2007 | | | Year ended December 31, 2007 | | | Year ended December 31, 2006 (Restated) | |

| | | | | | | | | | | | | |

| Rental income | | $ | 776,224 | | | $ | 542,899 | | | $ | 900,427 | | | $ | 235,822 | |

| Cost of rental income | | | 384,998 | | | | 348,566 | | | | 549,003 | | | | 232,853 | |

| | | | | | | | | | | | | | | | | |

| Gross profit | | | 391,226 | | | | 194,333 | | | | 351,424 | | | | 2,969 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | |

| General and administrative | | | 697,697 | | | | 559,058 | | | | 773,015 | | | | 520,183 | |

| Depreciation | | | 13,058 | | | | 9,867 | | | | 11,950 | | | | 8,217 | |

| Total operating expenses | | | 710,755 | | | | 568,925 | | | | 784,965 | | | | 528,400 | |

| | | | | | | | | | | | | | | | | |

| Income (loss) | | | (319,529 | ) | | | (374,592 | ) | | | (433,541 | ) | | | (525,431 | ) |

| | | | | | | | | | | | | | | | | |

| Loss from discontinued operations | | | - | | | | (40,600 | ) | | | (40,600 | ) | | | (193,600 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | (319,529 | ) | | $ | (415,192 | ) | | $ | (474,141 | ) | | $ | (719,031 | ) |

| | | | | | | | | | | | | | | | | |

Basic and diluted loss per share: Continuing operations | | $ | (0.02 | ) | | $ | (0.02 | ) | | $ | (0.02 | ) | | $ | (0.04 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted common shares outstanding - basic and diluted | | | 21,000,000 | | | | 20,336,000 | | | | 20,684,658 | | | | 20,000,000 | |

RISK FACTORS

The securities offered herein are highly speculative. You should carefully consider the following risk factors and other information in this Prospectus. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

The Company’s business is subject to many risk factors; including the following (references to “our,” “we,” “us” and words of similar meaning in these Risk Factors refer to the Company):

WE MAY REQUIRE ADDITIONAL FINANCING TO IMPLEMENT OUR BUSINESS PLAN AND CONTINUE DEVELOPING AND MARKETING OUR ENVIRONMENTAL COMPLIANCE SYSTEMS

We have generated only limited revenues since our incorporation in July 1999. We currently believe that we will be able to continue our business operations for approximately the next three months with our current cash on hand. We anticipate the need for approximately $1,500,000 to $3,000,000 in additional funding to support the planned expansion of our operations over the next approximately 12 months. We may choose to raise additional funds in the future through sales of debt and/or equity securities to support our ongoing operations and for expansion. If we are unable to raise additional financing in the future, we may be forced to abandon or curtail our business plan, which would cause the value of our securities, if any, to decrease in value and/or become worthless.

OUR AUDITORS HAVE EXPRESSED AN OPINION THAT THERE IS SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Our auditors have expressed an opinion that there is substantial doubt about our ability to continue as a going concern primarily because we had a net loss of $474,141 and cash used in operations of $231,784 , for the year ended December 31, 2007. The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. The financial statements do not include any adjustments that might result from our inability to continue as a going concern. If we are unable to continue as a going concern, our securities will become worthless.

WE MAY HAVE DIFFICULTY OBTAINING FUTURE FUNDING SOURCES, IF NEEDED, AND WE MAY HAVE TO ACCEPT TERMS THAT WOULD ADVERSELY AFFECT SHAREHOLDERS

We will need to raise funds from additional financing. We have no commitments for any financing and any financing commitments may result in dilution to our existing stockholders. We may have difficulty obtaining additional funding, and we may have to accept terms that would adversely affect our stockholders. For example, the terms of any future financings may impose restrictions on our right to declare dividends or on the manner in which we conduct our business. Additionally, we may raise funding by issuing convertible notes, which if converted into shares of our common stock would dilute our then shareholders interests. Lending institutions or private investors may impose restrictions on a future decision by us to make capital expenditures, acquisitions or significant asset sales. If we are unable to raise additional funds, we may be forced to curtail or even abandon our business plan.

WE LACK A SIGNIFICANT OPERATING HISTORY FOCUSING ON OUR CURRENT BUSINESS STRATEGY WHICH YOU CAN USE TO EVALUATE US, MAKING SHARE OWNERSHIP IN OUR COMPANY RISKY

Our Company lacks a long standing operating history focusing on our current business strategy which investors can use to evaluate our Company’s previous earnings. Therefore, ownership in our Company is risky because we have no significant business history and it is hard to predict what the outcome of our business operations will be in the future.

WE HAVE ESTABLISHED PREFERRED STOCK WHICH CAN BE DESIGNATED BY THE COMPANY'S BOARD OF DIRECTORS WITHOUT SHAREHOLDER APPROVAL AND THE BOARD ESTABLISHED SERIES A PREFERRED STOCK, WHICH GIVES THE HOLDERS MAJORITY VOTING POWER OVER THE COMPANY.

The Company has 10,000,000 shares of preferred stock authorized. The shares of preferred stock of the Company may be issued from time to time in one or more series, each of which shall have a distinctive designation or title as shall be determined by the Board of Directors of the Company ("Board of Directors") prior to the issuance of any shares thereof. The preferred stock shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof as adopted by the Board of Directors. On June 19, 2007, the Company's Board of Directors approved the issuance of 1,000,000 shares of Series A Preferred Stock to our Chief Executive Officer and sole Director, Jerry Swinford. The 1,000,000 shares of Series A Preferred Stock have the right, voting in aggregate, to vote on all shareholder matters equal to fifty-one percent (51%) of the total vote. For example, if there are 22,050,000 shares of the Company's common stock issued and outstanding at the time of a shareholder vote, the holders of Series A Preferred Stock, voting separately as a class, will have the right to vote an aggregate of 22,950,000 shares, out of a total number of 45,000,000 shares voting. Because the Board of Directors is able to designate the powers and preferences of the preferred stock without the vote of a majority of the Company's shareholders, shareholders of the Company will have no control over what designations and preferences the Company's preferred stock will have. The holders of the shares of Series A Preferred Stock will exercise voting control over the Company. As a result of this, the Company's shareholders will have no control over the designations and preferences of the preferred stock and as a result the operations of the Company.

JERRY SWINFORD, OUR CHIEF EXECUTIVE OFFICER AND SOLE DIRECTOR CAN VOTE A MAJORITY OF OUR COMMON STOCK AND CAN EXERCISE CONTROL OVER CORPORATE DECISIONS.

Jerry Swinford, our Chief Executive Officer and sole Director holds 2,050,000 shares of our common stock and 1,000,000 shares of our Series A Preferred Stock, which preferred stock gives him the right to vote in aggregate, 51% of our outstanding shares of common stock on all shareholder votes. Accordingly, Mr. Swinford will exercise control in determining the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations, the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Swinford may differ from the interests of the other stockholders and thus result in corporate decisions that are adverse to other shareholders.

WE RELY ON OUR SOLE OFFICER AND DIRECTOR, JERRY SWINFORD, AND IF HE WERE TO LEAVE OUR COMPANY OUR BUSINESS PLAN COULD BE ADVERSELY EFFECTED

We rely on Jerry Swinford, our Chief Executive Officer and President for the success of our Company. Mr. Swinford has an employment agreement with us, currently effective until December 31, 2009, which employment agreement provides Mr. Swinford an additional option for an additional year (which is described in greater detail below). The Company also holds a $650,000 life insurance policy on Mr. Swinford. Mr. Swinford’s experience and input creates the foundation for our business and he is responsible for the direction and control over the Company’s development activities. Moving forward, should he be lost for any reason, the Company will incur costs associated with recruiting a replacement and any potential delays in operations which this may cause. If we are unable to replace Mr. Swinford with another individual suitably trained in coil tubing technology we may be forced to scale back or curtail our business plan. As a result, if we were to lose the services of Mr. Swinford for any reason, your securities in our Company could become devalued.

MR. SWINFORD WILL RETAIN THE RIGHTS TO AND OWNERSHIP OF ANY INVENTIONS HE MAY DISCOVER, ORIGINATE OR INVENT, EITHER ALONE OR WITH OTHERS PURSUANT TO HIS EMPLOYMENT AGREEMENT.

Pursuant to Mr. Swinford’s Employment Agreement with us, as amended, whereby he serves as our Chief Executive Officer, Mr. Swinford will retain the rights and ownership of any discoveries, inventions, improvements, designs and innovations relating to the business of the Company (the “Inventions”), whether or not patentable, copyrightable or reduced to writing that he may discover, invent or originate during the term of the Employment Agreement. While Mr. Swinford has also agreed pursuant to a Waiver of Royalties agreement to waive any royalties that he may be due for such Inventions during the term of his employment, if Mr. Swinford were to leave the Company for any reason, he would retain the ownership of any Inventions he created and we could either be forced to pay Mr. Swinford substantial royalty fees and/or cease using such Inventions. Finally, Mr. Swinford will retain ownership of the Inventions, and we will not receive any benefit if the license agreement is terminated and such Inventions are sold by Mr. Swinford or licensed to any other companies. There is a risk that if Mr. Swinford were to leave the Company, that the royalty payments due on the Inventions (including those patents held by Mr. Swinford which we are already using, described in greater detail below under “Patents, Trademarks and Licenses”) may be too expensive for us to afford, and we may be forced to curtail or abandon our business operations.

WE FACE CORPORATE GOVERNANCE RISKS AND NEGATIVE PERCEPTIONS OF INVESTORS ASSOCIATED WITH THE FACT THAT WE CURRENTLY HAVE ONLY ONE OFFICER AND DIRECTOR.

Jerry Swinford is our sole officer and Director. As such, he has significant control over our business direction. Additionally, as he is our only Director, there are no other members of the Board of Directors available to second and/or approve related party transactions involving Mr. Swinford, including the compensation Mr. Swinford is paid and the employment agreements we enter into with Mr. Swinford. Additionally, there is no segregation of duties between officers because Mr. Swinford is our sole officer, and as such, he is solely responsible for the oversight of our accounting functions. Therefore, investors may perceive that because no other Directors are approving related party transactions involving Mr. Swinford and no other officers are approving our financial statements that such transactions are not fair to the Company and/or that such financial statements may contain errors. The price of our common stock may be adversely affected and/or devalued compared to similarly sized companies with multiple officers and Directors due to the investing public’s perception of limitations facing our company due to the fact that we only have one officer and director.

COIL TUBING SHAREHOLDERS MAY WANT TO SELL THEIR DISTRIBUTED SHARES IMMEDIATELY AFTER THEY ARE RECEIVED IN THE SPIN-OFF DISTRIBUTION AND THIS COULD ADVERSELY AFFECT THE MARKET FOR OUR SECURITIES

Coil Tubing will distribute 20,000,000 shares of our common stock to its shareholders in the spin-off Distribution. The Coil Tubing shareholders that will now be our shareholders may not be interested in retaining their investment in us. Since Coil Tubing shareholders will receive registered shares in the Distribution, they will generally be free to resell their shares immediately upon receipt. However, shareholders of Coil Tubing or us who are affiliates of us or Coil Tubing will receive restricted shares of our common stock, which will be subject to the volume limitation provisions of Rule 144. If any number of the Coil Tubing shareholders offers their shares for sale, the market for our securities could be adversely affected.

STATE SECURITIES LAWS MAY LIMIT SECONDARY TRADING, WHICH MAY RESTRICT THE STATES IN WHICH AND CONDITIONS UNDER WHICH YOU CAN SELL SHARES.

Secondary trading in our common stock will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

WE HAVE ARRANGEMENTS IN PLACE WITH VARIOUS MANUFACTURERS TO BUILD AND PRODUCE OUR PRODUCTS, AND IF THE DEMAND FOR THOSE MANUFACTURERS’ SKILLS INCREASES, THE COST OF PRODUCING OUR PRODUCTS MAY INCREASE, CAUSING OUR PROFITS (IF ANY) TO DECREASE.

We currently have a number of arrangements with various manufacturing shops which manufacture our Coil Tubing Technology tools and equipment. In the event that the demand for those manufacturers’ time and unique skills increase, we may be forced to pay more money to have our products manufactured. If this were to happen, we may be forced to charge more for our products, which may cause the demand for our products and consequently our sales to decrease, which would likely cause any securities which you hold to decrease as well. Additionally, if the materials which our products are made from, including steel, increase in cost, it could similarly cause increases in the cost of manufacturing our products, which could force us to increase the prices we charge for our products, which could cause the demand for such products to decline.

OUR FUTURE SUCCESS AND PROFITABILITY MAY BE ADVERSELY AFFECTED IF WE OR OUR SUPPLIERS FAIL TO DEVELOP AND INTRODUCE NEW AND INNOVATIVE PRODUCTS AND SERVICES THAT APPEAL TO OUR CUSTOMERS.

The oil and gas drilling industry is characterized by continual technological developments that have resulted in, and likely will continue to result in, substantial improvements in the scope and quality of oilfield chemicals, drilling and artificial lift products and services and product function and performance. As a result, our future success depends, in part, upon our and our suppliers’ continued ability to develop and introduce new and innovative products and services in order to address the increasingly sophisticated needs of our customers and anticipate and respond to technological and industry advances in the oil and gas drilling industry in a timely manner. If we or our suppliers fail to successfully develop and introduce new and innovative products and services that appeal to our customers, or if new companies or our competitors offer such products and services, our revenue and profitability may suffer.

OUR ABILITY TO GROW AND COMPETE IN THE FUTURE WILL BE ADVERSELY AFFECTED IF ADEQUATE CAPITAL IS NOT AVAILABLE.

The ability of our business to grow and compete depends on the availability of adequate capital, which in turn depends in large part on our cash flow from operations and the availability of equity and debt financing. Our cash flow from operations may not be sufficient or we may not be able to obtain equity or debt financing on acceptable terms or at all to implement our growth strategy. As a result, adequate capital may not be available to finance our current growth plans, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business.

WE DO NOT CURRENTLY HAVE INSURANCE POLICIES AND COULD THEREFORE SUFFER LIABILITY FOR RISKS ASSOCIATED WITH OUR OPERATIONS.

Our operations are subject to hazards inherent in the oil and gas industry, such as, but not limited to, accidents, blowouts, explosions, fires, oil and chemical spills and other hazards. These conditions can cause personal injury or loss of life, damage to property, equipment and the environment, and suspension of oil and gas operations of our customers. Litigation arising from a catastrophic occurrence at a location where our equipment, products or services are being used may result in us being named as a defendant in lawsuits asserting large claims. We do not currently have insurance for our operations because of the high premium costs. As a result, losses and liabilities arising from uninsured events could have a material adverse effect on our business, financial condition and results of operations.

IF WE ARE UNABLE TO ADEQUATELY PROTECT OUR INTELLECTUAL PROPERTY RIGHTS OUR BUSINESS IS LIKELY TO BE ADVERSELY AFFECTED.

We rely on a combination of patents, trademarks, non-disclosure agreements and other security measures to establish and protect our proprietary rights. The measures we have taken or may take in the future may not prevent misappropriation of our proprietary information or prevent others from independently developing similar products or services, designing around our proprietary or patented technology or duplicating our products or services. Furthermore, some of our intellectual property rights are only protected by patent applications filed by Mr. Swinford, and he may choose to not move forward with those patent applications in the future. Finally, Mr. Swinford’s patent applications may not be granted in the future. In the event that Mr. Swinford does not move forward with the patent applications and/or does not obtain registration of those patents, we will have a diminished ability to protect our proprietary technology, which could cause us to spend substantial funds in connection with litigation and/or may force us to curtail or abandon our business activities.

A SIGNIFICANT AMOUNT OF OUR REVENUES ARE DUE TO ONLY A SMALL NUMBER OF CUSTOMERS, AND IF WE WERE TO LOSE ANY OF THOSE CUSTOMERS, OUR RESULTS OF OPERATIONS WOULD BE ADVERSELY AFFECTED.

For the year ended December 31, 2007, we had three customers, Weatherford International, Owen Oil Tools and Thru Tubing Solutions, a Division of Rollins Corporation who accounted for 61%, 15% and 10% of our net sales, respectively. For the year ended December 31, 2006, we had three customers, Thru Tubing Solutions, a division of Rollins Corporation, Weatherford International, and Specialty Tools Inc., which accounted for 30%, 27%, and 13% percent of our net sales, respectively. As a result, the majority of revenues for the years ended December 31, 2007 and 2006 were due to only a small number of customers, and we anticipate this trend continuing moving forward. Additionally, we do not have any contracts in place with any of our customers and instead operate purchase order to purchase order with such customers. As a result, a termination in relationship or a reduction in orders from these customers could have a materially adverse effect on our results of operations and could force us to curtail or abandon our current business operations.

A SIGNIFICANT AMOUNT OF OUR REVENUES COME FROM ENTITIES WHICH ARE ALSO OUR COMPETITORS, AND IF WE WERE TO LOSE ANY OF THOSE CUSTOMERS, OR THEY WERE TO CREATE PRODUCTS TO DIRECTLY COMPETE WITH OURS, OUR RESULTS OF OPERATIONS WOULD BE ADVERSELY AFFECTED.

For the year ended December 31, 2007, a significant portion of our revenues, approximately 71%, came from Weatherford International and Thru Tubing Solutions, a Division of Rollins Corporation, which are also competitors of us. While such companies do not currently compete directly for our products, they offer similar products. If either of those entities, or any other entity which is a customer of ours, creates products in the future which directly compete with ours, such entities will likely cease using our services and our revenues could be adversely affected. Similarly, we could lose additional customers to such directly competing competitors, which would further cause a decrease in our results of operations.

OUR REVENUES ARE SUBJECT TO SEASONAL RULES AND REGULATIONS, SUCH AS THE FROST LAWS ENACTED BY SEVERAL STATES AND CANADA, WHICH COULD CAUSE OUR OPERATIONS TO BE SUBJECT TO WIDE SEASONAL VARIATIONS.

Certain states which experience below freezing temperatures during the winter months, and Canada have enacted Frost Laws, which put maximum weight limits on certain public roads during the coldest months of the years, to help prevent damage to the roads caused by frost heaves. As a result, our revenues may be limited in such cold weather states (and Canada) by such Frost Laws and our results of operations for those winter months may be substantially less than our results of operations during the summer months. We currently rent tools in California, Utah, West Texas, South Texas, East Texas, Louisiana, and Canada and for use on the North Sea in Norway. As a result, our results of operations for one quarterly period may not give an accurate projection of our results of operations for the entire fiscal year and/or may vary significantly from one quarter to the other.

WE MAY NOT BE ABLE TO SUCCESSFULLY MANAGE OUR GROWTH, WHICH COULD LEAD TO OUR INABILITY TO IMPLEMENT OUR BUSINESS PLAN.

Our growth is expected to place a significant strain on our managerial, operational and financial resources, especially considering that we currently only have one executive officer and Director. Further, as we enter into additional contracts, we will be required to manage multiple relationships with various consultants, businesses and other third parties. These requirements will be exacerbated in the event of our further growth or in the event that the number of our drilling and/or extraction operations increases. Our systems, procedures and/or controls may not be adequate to support our operations or that our management will be able to achieve the rapid execution necessary to successfully implement our business plan. If we are unable to manage our growth effectively, our business, results of operations and financial condition will be adversely affected, which could lead to us being forced to abandon or curtail our business plan and operations.

OUR SOLE OFFICER AND DIRECTOR IS ALSO THE SOLE OFFICER AND DIRECTOR OF OUR PARENT, COIL TUBING, AND AS SUCH, MAY NOT BE ABLE TO DEVOTE SUFFICIENT TIME TO OUR OPERATIONS.

Jerry Swinford, our sole officer and Director is also the sole officer and Director of Coil Tubing, our Parent. As such and because Mr. Swinford spends approximately 40 hours per week on Company matters and approximately 5 to 10 hours per week on matters relating to Coil Tubing, he may not be able to devote a sufficient amount of time to our operations. This may be exacerbated by the fact that he is currently our only officer and Director. Furthermore, because we operate in the coil tubing industry (as does Coil Tubing, although Coil Tubing currently has no operations separate from the Company) there may be conflicts between suppliers, contracts, agreements, use of patents and/or other business relations between Coil Tubing and us. Additionally, investors should keep in mind that there are no policies in place in regard to the allocation of corporate opportunities between us, Coil Tubing or Mr. Swinford personally.

WE MAY BE LATE IN FILING OUR PERIODIC REPORTS OR MAY NOT BE ABLE TO FILE OUR PERIODIC REPORTS AS WE ONLY HAVE ONE OFFICER AND DIRECTOR, WHO IS ALSO THE SOLE OFFICER AND DIRECTOR OF OUR PARENT COMPANY, COIL TUBING, WHICH IS DELINQUENT IN ITS FILINGS.

Our sole officer and Director, Jerry Swinford, is also the sole officer and Director of Coil Tubing, which is currently deficient in its filing obligations with the SEC, and has been delinquent since approximately May 2003 (when it was still IPMC Holdings Corp. (as described in greater detail below under “Description of Business”)). Although Mr. Swinford, with the assistance of legal and accounting professionals, has previously tried to obtain the required financial information to file Coil Tubing’s delinquent periodic filings with the SEC, he has not been able to obtain that information. As such, Coil Tubing remains deficient in its current and periodic filings with the SEC, and is not likely to, and currently has no plans to ever file such deficient reports. As a result of Coil Tubing’s deficient filings, Coil Tubing’s shareholders do not have any current financial or other information regarding Coil. Further, as Mr. Swinford is also the sole officer and Director of the Company, the Company will have similar current and periodic reporting obligations with the SEC following the effectiveness of the Registration Statement. Thus, there is a risk that the Company may not meet these filing obligations and that investors similarly may not receive current information regarding their investment in the Company. If this were to occur it may be difficult if not impossible for investors to sell their shares in the Company, we could be delisted from any market or exchange on which our common stock then trades, if any, and the value of our common stock could become worthless.

RISKS RELATED TO OUR INDUSTRY

VOLATILITY OR DECLINE IN OIL AND NATURAL GAS PRICES MAY RESULT IN REDUCED DEMAND FOR OUR PRODUCTS AND SERVICES WHICH MAY ADVERSELY AFFECT OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATION.

The markets for oil and natural gas have historically been extremely volatile. We anticipate that these markets will continue to be volatile in the future. Although oil and gas prices have increased significantly in recent years, there can be no guarantees that these prices will remain at current levels. Such volatility in oil and gas prices, or the perception by our customers of unpredictability in oil and natural gas prices, affects the spending patterns in our industry. The demand for our products and services is, in large part, driven by current and anticipated oil and gas prices and the related general levels of production spending and drilling activity. In particular, volatility or a decline in oil and gas prices may cause a decline in exploration and drilling activities. This, in turn, could result in lower demand for our products and services and may cause lower prices for our products and services. As a result, volatility or a prolonged decline in oil or natural gas prices may adversely affect our business, financial condition and results of operations.

COMPETITION FROM NEW AND EXISTING COMPETITORS WITHIN OUR INDUSTRY COULD HAVE AN ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS.

The oil and gas industry is highly competitive and fragmented. Our principal competitors include numerous small coil tubing companies capable of competing effectively in our markets on a local basis as well as a number of large coil tubing companies that possess substantially greater financial and other resources than we do. Furthermore, we face competition from companies working to develop advanced oil and gas technology which would compete with us and other coil tubing companies. Additionally, our larger competitors may be able to devote greater resources to developing, promoting and selling their products and services. We may also face increased competition due to the entry of new competitors including current suppliers that decide to sell or rent their coil tubing products and services directly. As a result of this competition, we may experience lower sales if our prices are undercut or advanced technology is brought to market which accomplishes greater results on average than our technology, which would likely have an adverse effect on our results of operations and force us to curtail or abandon our current business plan.

OUR RESULTS OF OPERATIONS MAY BE NEGATIVELY AFFECTED BY SUSTAINED DOWNTURNS OR SLUGGISHNESS IN THE ECONOMY, INCLUDING REDUCTIONS IN DEMAND OR LOW LEVELS IN THE MARKET PRICES OF COMMODITIES, ALL OF WHICH ARE BEYOND OUR CONTROL.

Sustained downturns in the economy generally affect the markets in which we operate and negatively influence our operations. Declines in demand for oil and gas as a result of economic downturns may reduce our cash flows, especially if our customers reduce exploration and production activities and, therefore, use of our products.

Lower demand for oil and gas and lower prices for oil and gas result from multiple factors that affect the markets which consume our products and services:

| | • | supply of and demand for energy commodities, including any decreases in the production of oil and gas which could negatively affect the demand for oil and gas in general, and as a result the need for our coil tubing technology; |

| | | |

| | • | general economic conditions, including downturns in the United States, Canada or other economies which affect energy consumption particularly in which sales to industrial or large commercial customers which could negatively affect the demand for oil and gas in general, and as a result the need for our coil tubing technology; and |

| | | |

| | • | federal, state and foreign energy and environmental regulations and legislation, which could make oil and gas exploration more costly, which could in turn drive down demand for oil and gas, and which could in turn reduce the demand for our technology and cause our revenues to decrease. |

THE LONG-TERM FINANCIAL CONDITION OF OUR BUSINESSES IS DEPENDENT ON THE CONTINUED AVAILABILITY OF OIL AND GAS RESERVES.

Our businesses are dependent upon the continued availability of oil production and reserves. Low prices for oil and gas, regulatory limitations, or the lack of available capital for these projects could adversely affect the development of additional reserves and production, and, therefore, demand for our products and services.

OUR BUSINESS IS SUBJECT TO EXTENSIVE REGULATION THAT AFFECTS OUR OPERATIONS AND COSTS.

Our assets and operations are subject to regulation by federal, state and local authorities, including regulation by FERC and regulation by various authorities under federal, state and local environmental laws. Regulation affects almost every aspect of our businesses, including, among other things, our ability to determine the terms and rates of services provided by some of our businesses; make acquisitions; issue equity or debt securities; and pay dividends. Changes in such regulations may affect our capacity to conduct this business effectively and sustain or increase profitability.

RISKS RELATING TO THE SPIN-OFF

WE MAY BE UNABLE TO ACHIEVE SOME OR ALL OF THE BENEFITS THAT WE EXPECT TO ACHIEVE FROM OUR SEPARATION FROM COIL TUBING.

We may not be able to achieve the full strategic and financial benefits that we expect will result from our separation from Coil Tubing or such benefits may be delayed or may not occur at all. For example, analysts and investors may not regard our corporate structure as clearer and simpler than the current Coil Tubing corporate structure or place a greater value on our Company as a stand-alone company than on our businesses being a part of Coil Tubing. As a result, in the future the aggregate market price of Coil Tubing’s common stock and our common stock as separate companies may be less than the market price per share of Coil Tubing’s common stock had the separation and distribution not occurred.

WE ARE BEING SEPARATED FROM COIL TUBING, OUR PARENT COMPANY, AND, THEREFORE, WE HAVE A LIMITED OPERATING HISTORY AS A SEPARATE COMPANY, AND NO HISTORY AS A SEPARATE REPORTING COMPANY UNTIL THIS REGISTRATION STATEMENT FILING.

The historical and financial information included in this information statement does not necessarily reflect the financial condition, results of operations or cash flows that we would have achieved as a separate publicly-traded company during the periods presented or those that we will achieve in the future primarily as a result of the following factors:

| | • | Since November 2005, our business has in part been operated by Coil Tubing as part of its broader corporate organization, rather than as a separate, publicly-traded company; and |

| | • | Other significant changes may occur in our cost structure, management, financing and business operations as a result of our operating as a company separate from Coil Tubing. |

THE DISTRIBUTION OF OUR SHARES MAY RESULT IN TAX LIABILITY.

You may be required to pay income tax on the value of your shares of common stock received in connection with the spin-off Distribution. This Distribution may be taxable to you as a dividend and/or as a capital gain, depending upon the extent of your basis in Coil Tubing stock which you hold. You are advised to consult your own tax advisor as to the specific tax consequences of the Distribution. Shareholders are also encouraged to read “Federal Income Tax Consequences of the Distribution” and “Federal Income Tax Consequences to Shareholders” below, which contain important tax disclosures relating to the Distribution.

THE DISTRIBUTION MAY CAUSE THE TRADING PRICE OF COIL TUBING’S COMMON STOCK TO DECLINE.

Following the Distribution, Coil Tubing expects that its common stock will continue to be quoted and traded on the Pink Sheets under the symbol “CTBG.” A trading market may not continue for the shares of Coil Tubing’s common stock or even develop for our shares. As a result of the Distribution, the trading price of Coil Tubing’s common stock may be substantially lower following the Distribution than the trading price of Coil Tubing’s common stock immediately prior to the Distribution. The closing price of Coil Tubing’s common stock was approximately $0.06 at December 31, 2008, $0.06 at September 30, 2008, $0.048 at June 30, 2008, $0.057 at March 31, 2008, $0.03 at December 31, 2007, $0.034 at September 28, 2007, $0.031 at June 29, 2007, $0.022 at March 30, 2007, and $0.0275 at December 29, 2006.

Further, the combined trading prices of Coil Tubing’s common stock and our common stock after the Distribution may be less than the trading price of Coil Tubing’s common stock immediately prior to the Distribution.

THE LACK OF A BROKER OR DEALER TO CREATE OR MAINTAIN A MARKET IN OUR STOCK COULD ADVERSELY IMPACT THE PRICE AND LIQUIDITY OF OUR SECURITIES.

We have no agreement with any broker or dealer to act as a market maker for our securities and as a result, we may not be successful in obtaining any market makers. Thus, no broker or dealer will have an incentive to make a market for our stock. The lack of a market maker for our securities could adversely influence the market for and price of our securities, as well as your ability to dispose of, or to obtain accurate information about, and/or quotations as to the price of, our securities.

RISKS RELATING TO OUR SECURITIES

WE LACK A MARKET FOR OUR COMMON STOCK, WHICH MAKES OUR SECURITIES VERY SPECULATIVE

We currently lack a market for the Company’s common stock. Because of this, it is hard to determine exactly how much our securities are worth. As a result of the lack of market, it is hard to judge how much the securities you may purchase as a result of this Prospectus are worth and it is possible that they will become worthless.

WE HAVE NOT PAID ANY CASH DIVIDENDS IN THE PAST AND HAVE NO PLANS TO ISSUE CASH DIVIDENDS IN THE FUTURE, WHICH COULD CAUSE THE VALUE OF OUR COMMON STOCK TO HAVE A LOWER VALUE THAN OTHER SIMILAR COMPANIES WHICH DO PAY CASH DIVIDENDS.

We have not paid any cash dividends on our common stock to date and do not anticipate any cash dividends being paid to holders of our common stock in the foreseeable future. While our dividend policy will be based on the operating results and capital needs of the business, it is anticipated that any earnings will be retained to finance our future expansion. As we have no plans to issue cash dividends in the future, our common stock could be less desirable to other investors and as a result, the value of our common stock may decline, or fail to reach the valuations of other similarly situated companies who have historically paid cash dividends in the past.

IF THERE IS A MARKET FOR OUR COMMON STOCK, OUR STOCK PRICE MAY BE VOLATILE.

If there's a market for our common stock, we anticipate that such market would be subject to wide fluctuations in response to several factors, including, but not limited to:

| | (1) | actual or anticipated variations in our results of operations; |

| | (2) | our ability or inability to generate new revenues; |

| | (3) | increased competition; and |

| | (4) | conditions and trends in the oil and gas industry and/or the market for coil tubing technology products and tools in general. |

Further, if our common stock is traded on the over the counter bulletin board, as is our intention, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our common stock.

INVESTORS MAY FACE SIGNIFICANT RESTRICTIONS ON THE RESALE OF OUR COMMON STOCK DUE TO FEDERAL REGULATIONS OF PENNY STOCKS.

Once our common stock is quoted on the OTC Bulletin Board, it will be subject to the requirements of Rule 15(g)9, promulgated under the Securities Exchange Act as long as the price of our common stock is below $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock. Generally, the Commission defines a penny stock as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. The required penny stock disclosures include the delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market.

WE HAVE BEEN FORCED TO BRING SUIT AGAINST OUR FORMER LARGEST SHAREHOLDER, GRIFCO INTERNATIONAL, INC., ITS PRESIDENT AND THE DEPOSITORY TRUST & CLEARING CORPORATION WHICH WILL IMPACT OUR OPERATIONS

As is more fully described below under Legal Proceedings, on July 30, 2008, the Company, Coil Tubing and our and Coil Tubing’s President, Jerry Swinford (“Plaintiffs”) filed a lawsuit against Grifco International, Inc. (“Grifco”), the Depository Trust & Clearing Corporation (DTCC/DTC ) and the President of Grifco, James Dial (“Defendants”). The case is pending as Cause No. 08-07-07397-CV in Montgomery County Texas, District Court, 9th Judicial District. The suit stems from Grifco’s stock distribution of 75,000,000 shares of Coil Tubing’s common stock in August 2007 ("Grifco Distribution").

Grifco left certain shareholders out of the Grifco Distribution and/or did not provide certain of its shareholders with the proper number of shares of Coil Tubing's common stock based on its previous disclosures and the record date of its spin-off. Additionally, there is an undisclosed number of shares outstanding held in certificate form, which were not included in the Grifco Distribution. As a result, there is uncertainty as to the identity of certain of Coil Tubing’s shareholders, as there may be additional shareholders of Grifco, which are due shares of Coil Tubing, and which should therefore participate in our Distribution, but which are not properly reflected in Coil Tubing’s shareholders reports. As part of the litigation, the Plaintiffs have sought damages and have sought declaration of the shareholders as of the record date of the distribution and our rights and obligations to those shareholders.

The Plaintiffs believe that all the Defendants were aware or should have been aware that a shortfall in the Grifco Distribution might occur, but negligently allowed the stock distribution to go forward. The failure to properly effect the Grifco Distribution was the result of the Defendants' action or inactions. As a result, the Company believes that the outcome of the litigation may be that the Company receives damages and other equitable relief. The Company does not believe that it will have any liability and/or be required to take any actions itself to address the issues related to the Grifco Distribution, but instead believes that any issues will need to be addressed directly by the Defendants.

The Company has and expects to continue to expend funds on the litigation which will negatively impact the results of its operations. The Court recently granted Plaintiffs' Temporary Injunction and denied Defendant's Motion to Dismiss. There are, however, no assurances as to the final outcome of the litigation.

THE SPIN-OFF

Twenty million (20,000,000) shares of our common stock will be distributed by Coil Tubing to its shareholders (the “Distribution”) as of February 13, 2009 (the “Record Date”). This equates to one share of our common stock distributed for each approximately 7.483 shares of common stock held by each shareholder of Coil Tubing as of the Record Date. Fractional shares will be rounded up to the nearest whole share. The spin-off is being undertaken by Coil Tubing to afford us the opportunity to obtain audited financial statements and trade our common stock on the Over-The-Counter Bulletin Board, instead of the Pink Sheets, where Coil Tubing currently trades. Coil Tubing has been unable to obtain audited financial statements to date, and by distributing shares of our stock to its shareholders, we are able to become a fully reporting company and move forward with the registration of the shares disclosed herein, and the planned future trading of our common stock on the Over-The-Counter Bulletin Board. As a result of the spin-off, we will be a stand alone company. We also plan to take steps to quote our securities on the Over-The-Counter Bulletin Board subsequent to the Distribution, as we believe that this will improve our access to the capital markets for additional growth capital. However, an active market for our securities may not develop following the Distribution, if ever.

The Distribution is expected to be effected as soon as practicable after the date the registration statement, of which this Prospectus is a part, is declared effective. Certificates representing the shares of Company common stock will be mailed to the Coil Tubing stockholders on that date or as soon thereafter as practicable. No fractional shares of Company common stock will be issued.