UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

[Mark One]

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | OR |

| | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended: June 30, 2011 | Commission File Number: 001-33514 |

TRANSITION THERAPEUTICS INC.

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Jurisdiction of incorporation or organization)

101 College Street, Suite 220

Toronto, Ontario, Canada

M5G 1L7

(416) 260-7770

(Address and telephone number of Registrant’s principal executive offices)

Elie Farah

President and Chief Financial Officer

101 College Street, Suite 220

Toronto, Ontario, Canada

M5G 1L7

(416) 260-7770 Tel.

(416) 260-2886 Fax

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| Common Shares, no par value | | The NASDAQ Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of June 30, 2011: 23,217,599 shares of Common Shares were outstanding.

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | Other x |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

TABLE OF CONTENTS

| | Page |

| | |

| Introduction | 2 |

| | |

| Presentation of Financial Information | 2 |

| | |

| Currency Translation | 2 |

| | |

| Exchange Rate Data | 2 |

| | |

| Cautionary Statement Concerning Forward-Looking Statements | 3 |

| | |

| Item 1. | Identity of Directors, Senior Management and Advisers | 5 |

| | | |

| Item 2. | Offer Statistics and Expected Timetable | 5 |

| | | |

| Item 3. | Key Information | 5 |

| | | |

| Item 4. | Information on the Corporation | 13 |

| | | |

| Item 4A. | Unresolved Staff Comments | 25 |

| | | |

| Item 5. | Operating and Financial Review and Prospects | 25 |

| | | |

| Item 6. | Directors, Senior Management and Employees | 49 |

| | | |

| Item 7A. | Major Shareholders and Related Party Transactions | 57 |

| | | |

| Item 8. | Financial Information | 58 |

| | | |

| Item 9. | The Offer and Listing | 58 |

| | | |

| Item 10. | Additional Information | 59 |

| | | |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk. | 70 |

| | | |

| Item 12. | Description of Securities Other than Equity Securities. | 70 |

| | | |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies. | 71 |

| | | |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds. | 71 |

| | | |

| Item 15. | Controls and Procedures. | 71 |

| | | |

| Item 16. | [Reserved] | 72 |

| | | |

| Item 16A. | Audit committee financial expert. | 72 |

| | | |

| Item 16B. | Code of Ethics. | 72 |

| | | |

| Item 16C. | Principal Accountant Fees and Services. | 72 |

| | | |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees. | 73 |

| | | |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers. | 73 |

| | | |

| Item 16F. | Change in Registrant’s Certifying Accountant. | 73 |

| | | |

| Item 16G. | Corporate Governance. | 74 |

| | | |

| Item 17. | Financial Statements. | 75 |

| | | |

| Item 18. | Financial Statements. | 75 |

| | | |

| Item 19. | Exhibits. | 75 |

INTRODUCTION

In this annual report, where “we”, “us”, “our”, “Transition”, “Corporation” or the “Company” is used, it is referring to Transition Therapeutics Inc. and its wholly-owned subsidiaries, unless otherwise indicated. All amounts are in Canadian dollars, unless otherwise indicated.

Additional information relating to the Corporation, including the Corporation’s most recently filed Annual Information Form, can be found on SEDAR at www.sedar.com.

PRESENTATION OF FINANCIAL INFORMATION

Unless we indicate otherwise, financial information in this annual report has been prepared in accordance with Canadian generally accepted accounting principles, or Canadian GAAP. Canadian GAAP differs in some respects from United States generally accepted accounting principles, or United States GAAP, and thus our financial statements may not be comparable to the financial statements of United States companies. The principal differences in measurement and recognition as they apply to us are summarized in Note 18 to our audited consolidated financial statements included herein.

Percentages and some amounts in this annual report have been rounded for ease of presentation. Any discrepancies between totals and the sums of the amounts listed are due to rounding.

CURRENCY TRANSLATION

We present our historical financial statements in Canadian dollars, which is the reporting currency of the Corporation. All figures reported in this annual report are in Canadian dollars, except where we indicate otherwise, and are referenced as “CAD$,” “$” and “dollars”. This annual report contains a translation of some Canadian dollar amounts into United States dollars at specified exchange rates solely for your convenience. See “Exchange Rate Data” below for certain information about the rates of exchange between Canadian dollars and United States dollars.

EXCHANGE RATE DATA

The following table sets forth, for each period indicated, the low and high exchange rates for Canadian dollars expressed in United States dollars, the exchange rate at the end of such period and the average of such exchange rates on the last day of each month during such period, based on the inverse of the noon buying rate in the City of New York for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York. The exchange rates set forth below demonstrate trends in exchange rates, but the actual exchange rates used throughout this Annual Report may vary.

| | | | |

| | | | | | | | | | | | | |

| | | (CAN$ per US$) | |

| Last Five Fiscal Years | | | | | | | | | | | | |

| Fiscal Year Ended June 30, 2007 | | | 0.9404 | | | | 0.9453 | | | | 0.8882 | | | | 0.8437 | |

| Fiscal Year Ended June 30, 2008 | | | 0.9818 | | | | 1.0908 | | | | 0.9938 | | | | 0.9299 | |

| Fiscal Year Ended June 30, 2009 | | | 0.8601 | | | | 0.9985 | | | | 0.8589 | | | | 0.7695 | |

| Fiscal Year Ended June 30, 2010 | | | 0.9429 | | | | 1.0040 | | | | 0.9467 | | | | 0.8584 | |

| Fiscal Year Ended June 30, 2011 | | | 0.9642 | | | | 1.0647 | | | | 1.0012 | | | | 0.9486 | |

| Last Six Months | | | | | | | | | | | | | | | | |

| March 2011 | | | 0.9717 | | | | 0.9921 | | | | 0.9766 | | | | 0.9686 | |

| April 2011 | | | 0.9486 | | | | 0.9689 | | | | 0.9579 | | | | 0.9486 | |

| May 2011 | | | 0.9688 | | | | 0.9809 | | | | 0.9680 | | | | 0.9489 | |

| June 2011 | | | 0.9642 | | | | 0.9589 | | | | 0.9766 | | | | 0.9642 | |

| July 2011 | | | 0.9539 | | | | 0.9667 | | | | 0.9553 | | | | 0.9539 | |

| August 2011 | | | 0.9794 | | | | 0.9969 | | | | 0.9824 | | | | 0.9568 | |

Notes:

| (1) | For the years indicated, the average exchange rates are determined by averaging the exchange rates on the last business day of each month during the relevant period. For the months indicated, the average exchange rates are determined by averaging the exchange rates on each day of the month. |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This annual report contains and incorporates by reference certain forward looking statements within the meaning of applicable securities laws. Forward looking information typically contains statements with words such as “anticipate”, “believe”, “expect”, “plan”, “estimate”, “intend”, “may” or similar words suggesting future outcomes. This forward looking information is subject to various risks and uncertainties, including those discussed below, that could cause actual results and experience to differ materially from the anticipated results or other expectations expressed. Readers are cautioned not to place undue reliance on this forward looking information, which is provided as of the date of this annual report unless otherwise stated, and the Corporation will not undertake any obligation to publicly update or revise any forward looking information, whether as a result of new information, future events, or otherwise, except as required by securities laws.

Forward-looking statements in this annual report include, but are not limited to, statements with respect to: the clinical study phases of each of the Corporation’s product candidates which the Corporation expects to complete in fiscal 2012, the ability of the Corporation’s business model to maximize shareholder returns, the potential for ELND005 (AZD-103) to slow the progression of Alzheimer’s disease and improve symptoms, the timing and manner of future clinical development of ELND005 (AZD-103) performed by Elan, the global population size of those affected by Alzheimer’s disease; the demand for a product that can slow or reverse the progression of Alzheimer’s disease, the potential clinical benefit of the anti-inflammatory compounds TT-301 and TT-302, the intention of the Corporation to seek a partnership for the development of TT-301 and TT-302, the development of TT-401 and the series of preclinical compounds in-licensed from Eli Lilly and Company (“Lilly”) and their potential benefit in type 2 diabetes patients, the engagement of third party manufacturers to produce the Corporation’s drug substances and products, the intention of the Corporation to make collaborative arrangements for the marketing and distribution of its products, the impact of human capital on the growth and success of the Corporation and the Corporation’s dividend policy.

Some of the assumptions, risks and factors which could cause future outcomes to differ materially from those set forth in the forward looking information include, but are not limited to: (i) the assumption that the Corporation will be able to obtain sufficient and suitable financing to support operations, clinical trials and commercialization of products, (ii) the risk that the Corporation may not be able to capitalize on partnering and acquisition opportunities, (iii) the assumption that the Corporation will obtain favourable clinical trial results in the expected timeframe, (iv) the assumption that the Corporation will be able to adequately protect proprietary information and technology from competitors, (v) the risks relating to the uncertainties of the regulatory approval process, (vi) the impact of competitive products and pricing and the assumption that the Corporation will be able to compete in the targeted markets, and (vii) the risk that the Corporation may be unable to retain key personnel or maintain third party relationships, including relationships with key collaborators.

By its nature, forward looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections or other forward looking statements will not occur. Prospective investors should carefully consider the information contained under the heading “Risk Factors” and all other information included in or incorporated by reference in this annual report before making investment decisions with regard to the securities of the Corporation.

The section entitled “Risks Factors” discusses risks, uncertainties and factors that our management believes could cause actual results or events to differ materially from the forward-looking statements. Although we have attempted to identify important risks, uncertainties and other factors that could cause actual results or events to differ materially from those expressed or implied in the forward-looking information, there may be other factors that cause actual results or events to differ from those expressed or implied in the forward-looking information.

Forward-looking statements contained in this annual report are made as of the dates hereof, and such forward-looking statements are based on the beliefs, expectations and opinions of our management as of such date. We disclaim any obligation to update any forward-looking statements.

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

Not Applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not Applicable.

A. Selected Financial Data

The following information should be read in conjunction with the Corporation’s audited consolidated financial statements for the year ended June 30, 2011 and the related notes, which are prepared in accordance with Canadian generally accepted accounting principles. Material differences between Canadian and U.S generally accepted accounting principles are described in note 18 to the financial statements for the year ended June 30, 2011. The selection financial information includes financial information derived from the annual audited consolidated financial statements.

The following table is a summary of selected audited consolidated financial information of the Corporation for each of the five most recently completed financial years:

| | | | | | | | | | | | | | | | |

| Revenue | | $ | 29,671,150 | | | $ | 4,503,892 | | | $ | 2,513,108 | | | $ | 1,596,722 | | | $ | 683,894 | |

Net income (loss) (1) | | $ | 12,902,984 | | | $ | (19,308,910 | ) | | $ | (22,374,491 | ) | | $ | (16,119,202 | ) | | $ | (16,961,790 | ) |

| Basic and diluted net income (loss) per common share | | $ | 0.56 | | | $ | (0.83 | ) | | $ | (0.97 | ) | | $ | (0.70 | ) | | $ | (0.87 | ) |

| Total assets | | $ | 43,179,488 | | | $ | 49,659,526 | | | $ | 72,819,261 | | | $ | 94,875,961 | | | $ | 63,995,728 | |

Total long-term liabilities (2) | | $ | 45,727 | | | $ | 57,160 | | | $ | 68,592 | | | $ | 80,024 | | | $ | 91,456 | |

| Common shares outstanding | | | 23,217,599 | | | | 23,217,599 | | | | 23,215,160 | | | | 23,186,707 | | | | 21,230,741 | |

| Cash dividends declared per share | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Notes:

| (1) | Net income (loss) before discontinued operations and extraordinary items was equivalent to the net income (loss) for such periods. |

| (2) | Total long-term liabilities exclude deferred revenue, a non-financial liability. |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the following risk factors, in addition to the other information provided in this annual report and the Corporation’s other disclosure documents filed on www.sedar.com.

The Corporation will require significant additional financing and it may not have access to sufficient capital.

The Corporation anticipates that it will need additional financing in the future to fund its ongoing research and development programs and for general corporate requirements. The Corporation may choose to seek additional funding through public or private offerings, corporate collaborations or partnership arrangements. The amount of financing required will depend on many factors including the financial requirements of the Corporation to fund its research and clinical trials, and the ability of the Corporation to secure partnerships and achieve partnership milestones as well as to fund other working capital requirements. The Corporation’s ability to access the capital markets or to enlist partners is mainly dependent on the progress of its research and development and regulatory approval of its products. There is no assurance that additional funding will be available on acceptable terms, if at all.

The Corporation has a history of losses, and it has not generated any product revenue to date. It may never achieve or maintain profitability.

Since inception, the Corporation has incurred significant losses each year and expects to incur significant operating losses as the Corporation continues product research and development and clinical trials. There is no assurance that the Corporation will ever successfully commercialize or achieve revenues from sales of its therapeutic products if they are successfully developed or that profitability will ever be achieved or maintained. Even if profitability is achieved, the Corporation may not be able to sustain or increase profitability.

We are an early stage development company in an uncertain industry.

The Corporation is at an early stage of development. Preclinical and clinical trial work must be completed before our products could be ready for use within the markets we have identified. We may fail to develop any products, to obtain regulatory approvals, to enter clinical trials or to commercialize any products. We do not know whether any of our potential product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals or be capable of being manufactured at a reasonable cost. If the Corporation’s products are approved for sale, there can be no assurance that the products will gain market acceptance among consumers, physicians, patients and others in the medical community. A failure to gain market acceptance may adversely affect the revenues of the Corporation.

The Corporation is subject to a strict regulatory environment.

None of the Corporation’s product candidates have received regulatory approval for commercial sale.

Numerous statutes and regulations govern human testing and the manufacture and sale of human therapeutic products in Canada, the United States and other countries where the Corporation intends to market its products. Such legislation and regulation bears upon, among other things, the approval of protocols and human testing, the approval of manufacturing facilities, testing procedures and controlled research, review and approval of manufacturing, preclinical and clinical data prior to marketing approval including adherence to Good Manufacturing Practices (“GMP”) during production and storage as well as regulation of marketing activities including advertising and labelling.

The completion of the clinical testing of our product candidates and the obtaining of required approvals are expected to take years and require the expenditure of substantial resources. There can be no assurance that clinical trials will be completed successfully within any specified period of time, if at all. Furthermore, clinical trials may be delayed or suspended at any time by the Corporation or by regulatory authorities if it is determined at any time that patients may be or are being exposed to unacceptable health risks, including the risk of death, or that compounds are not manufactured under acceptable GMP conditions or with acceptable quality. Any failure or delay in obtaining regulatory approvals would adversely affect the Corporation’s ability to utilize its technology thereby adversely affecting operations. No assurance can be given that the Corporation’s product candidates or lead compounds will prove to be safe and effective in clinical trials or that they will receive the requisite protocol approval or regulatory approval. Furthermore, no assurance can be given that current regulations relating to regulatory approval will not change or become more stringent. There are no assurances the Corporation can scale-up, formulate or manufacture any compound in sufficient quantities with acceptable specifications for the regulatory agencies to grant approval or not require additional changes or additional trials be performed. The agencies may also require additional trials be run in order to provide additional information regarding the safety, efficacy or equivalency of any compound for which the Corporation seeks regulatory approval. Similar restrictions are imposed in foreign markets other than the United States and Canada. Investors should be aware of the risks, problems, delays, expenses and difficulties which may be encountered by the Corporation in light of the extensive regulatory environment in which the Corporation’s business operates.

Even if a product candidate is approved by the FDA or any other regulatory authority, the Corporation may not obtain approval for an indication whose market is large enough to recoup its investment in that product candidate. The Corporation may never obtain the required regulatory approvals for any of its product candidates.

The Corporation is faced with uncertainties related to its research.

The Corporation’s research programs are based on scientific hypotheses and experimental approaches that may not lead to desired results. In addition, the timeframe for obtaining proof of principle and other results may be considerably longer than originally anticipated, or may not be possible given time, resource, financial, strategic and collaborator scientific constraints. Success in one stage of testing is not necessarily an indication that the particular program will succeed in later stages of testing and development. It is not possible to predict, based upon studies in in-vitro models and in animals, whether any of the compounds made for these programs will prove to be safe, effective, and suitable for human use. Each compound will require additional research and development, scale-up, formulation and extensive clinical testing in humans. Development of these compounds will require investigations into the mechanism of action of the molecules as these are not fully understood. Unsatisfactory results obtained from a particular study relating to a program may cause the Corporation to abandon its commitment to that program or to the lead compound or product candidate being tested. The discovery of unexpected toxicities, lack of sufficient efficacy, poor physiochemical properties, unacceptable ADME (absorption, distribution, metabolism and excretion) and DMPK (drug metabolism and pharmacokinetics), pharmacology, inability to increase scale of manufacture, market attractiveness, regulatory hurdles, competition, as well as other factors, may make the Corporation’s targets, lead compounds or product candidates unattractive or unsuitable for human use, and the Corporation may abandon its commitment to that program, target, lead compound or product candidate. In addition, preliminary results seen in animal and/or limited human testing may not be substantiated in larger controlled clinical trials.

If difficulties are encountered enrolling patients in the Corporation’s clinical trials, the Corporation’s trials could be delayed or otherwise adversely affected.

Clinical trials for the Corporation’s product candidates require that the Corporation identify and enrol a large number of patients with the disorder under investigation. The Corporation may not be able to enrol a sufficient number of patients to complete its clinical trials in a timely manner. Patient enrolment is a function of many factors including, but not limited to, design of the study protocol, size of the patient population, eligibility criteria for the study, the perceived risks and benefits of the therapy under study, the patient referral practices of physicians and the availability of clinical trial sites. If the Corporation has difficulty enrolling a sufficient number of patients to conduct the Corporation’s clinical trials as planned, it may need to delay or terminate ongoing clinical trials.

Even if regulatory approvals are obtained for the Corporation’s product candidates, the Corporation will be subject to ongoing government regulation.

Even if regulatory authorities approve any of the Corporation’s human therapeutic product candidates, the manufacture, marketing and sale of such products will be subject to strict and ongoing regulation. Compliance with such regulation may be expensive and consume substantial financial and management resources. If the Corporation, or any future marketing collaborators or contract manufacturers, fail to comply with applicable regulatory requirements, it may be subject to sanctions including fines, product recalls or seizures, injunctions, total or partial suspension of production, civil penalties, withdrawal of regulatory approvals and criminal prosecution. Any of these sanctions could delay or prevent the promotion, marketing or sale of the Corporation’s products.

The Corporation may not achieve its projected development goals in the time frames announced and expected.

The Corporation sets goals for and makes public statements regarding the timing of the accomplishment of objectives material to its success, such as the commencement and completion of clinical trials, anticipated regulatory submission and approval dates and time of product launch. The actual timing of these events can vary dramatically due to factors such as delays or failures in the Corporation’s clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize its products.

There can be no assurance that the Corporation’s clinical trials will be completed, that the Corporation will make regulatory submissions or receive regulatory approvals as planned. If the Corporation fails to achieve one or more of these milestones as planned, the price of the Common Shares would likely decline.

If the Corporation fails to obtain acceptable prices or adequate reimbursement for its human therapeutic products, its ability to generate revenues will be diminished.

The Corporation’s ability to successfully commercialize its human therapeutic products will depend significantly on its ability to obtain acceptable prices and the availability of reimbursement to the patient from third-party payers, such as government and private insurance plans. While the Corporation has not commenced discussions with any such parties, these third-party payers frequently require companies to provide predetermined discounts from list prices, and they are increasingly challenging the prices charged for pharmaceuticals and other medical products. The Corporation’s human therapeutic products may not be considered cost-effective, and reimbursement to the patient may not be available or sufficient to allow the Corporation to sell its products on a competitive basis. The Corporation may not be able to negotiate favourable reimbursement rates for its human therapeutic products.

In addition, the continuing efforts of third-party payers to contain or reduce the costs of healthcare through various means may limit the Corporation’s commercial opportunity and reduce any associated revenue and profits. The Corporation expects proposals to implement similar government control to continue. In addition, increasing emphasis on managed care will continue to put pressure on the pricing of pharmaceutical and biopharmaceutical products. Cost control initiatives could decrease the price that the Corporation or any current or potential collaborators could receive for any of its human therapeutic products and could adversely affect its profitability. In addition, in Canada and in many other countries, pricing and/or profitability of some or all prescription pharmaceuticals and biopharmaceuticals are subject to government control.

If the Corporation fails to obtain acceptable prices or an adequate level of reimbursement for its products, the sales of its products would be adversely affected or there may be no commercially viable market for its products.

The Corporation may not obtain adequate protection for its products through its intellectual property.

The Corporation’s success depends, in large part, on its ability to protect its competitive position through patents, trade secrets, trademarks and other intellectual property rights. The patent positions of pharmaceutical and biopharmaceutical firms, including the Corporation, are uncertain and involve complex questions of law and fact for which important legal issues remain unresolved. The patents issued or to be issued to the Corporation may not provide the Corporation with any competitive advantage. The Corporation’s patents may be challenged by third parties in patent litigation, which is becoming widespread in the biopharmaceutical industry. In addition, it is possible that third parties with products that are very similar to the Corporation’s will circumvent its patents by means of alternate designs or processes. The Corporation may have to rely on method of use protection for its compounds in development and any resulting products, which may not confer the same protection as compounds per se. The Corporation may be required to disclaim part of the term of certain patents. There may be prior applications of which the Corporation is not aware that may affect the validity or enforceability of a patent claim. There also may be prior applications which are not viewed by the Corporation as affecting the validity or enforceability of a claim, but which may, nonetheless ultimately be found to affect the validity or enforceability of a claim. No assurance can be given that the Corporation’s patents would, if challenged, be held by a court to be valid or enforceable or that a competitor’s technology or product would be found by a court to infringe the Corporation’s patents. Applications for patents and trademarks in Canada, the United States and in foreign markets have been filed and are being actively pursued by the Corporation. Pending patent applications may not result in the issuance of patents, and the Corporation may not develop additional proprietary products which are patentable.

Patent applications relating to or affecting the Corporation’s business have been filed by a number of pharmaceutical and biopharmaceutical companies and academic institutions. A number of the technologies in these applications or patents may conflict with the Corporation’s technologies, patents or patent applications, and such conflict could reduce the scope of patent protection which the Corporation could otherwise obtain. The Corporation could become involved in interference proceedings in the United States in connection with one or more of its patents or patent applications to determine priority of invention. The Corporation’s granted patents could also be challenged and revoked in opposition proceedings in certain countries outside the United States.

In addition to patents, the Corporation relies on trade secrets and proprietary know-how to protect its intellectual property. The Corporation generally requires its employees, consultants, outside scientific collaborators and sponsored researchers and other advisors to enter into confidentiality agreements. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with the Corporation is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of the Corporation’s employees, the agreements provide that all of the technology which is conceived by the individual during the course of employment is the Corporation’s exclusive property. These agreements may not provide meaningful protection or adequate remedies in the event of unauthorized use or disclosure of the Corporation’s proprietary information. In addition, it is possible that third parties could independently develop proprietary information and techniques substantially similar to those of the Corporation or otherwise gain access to the Corporation’s trade secrets.

The Corporation currently has the right to use certain technology under license agreements with third parties. The Corporation’s failure to comply with the requirements of material license agreements could result in the termination of such agreements, which could cause the Corporation to terminate the related development program and cause a complete loss of its investment in that program.

As a result of the foregoing factors, the Corporation may not be able to rely on its intellectual property to protect its products in the marketplace.

The Corporation may infringe the intellectual property rights of others.

The Corporation’s commercial success depends significantly on its ability to operate without infringing the patents and other intellectual property rights of third parties. There could be issued patents of which the Corporation is not aware that its products infringe or patents, that the Corporation believes it does not infringe, but that it may ultimately be found to infringe. Moreover, patent applications are in some cases maintained in secrecy until patents are issued. The publication of discoveries in the scientific or patent literature frequently occurs substantially later than the date on which the underlying discoveries were made and patent applications were filed. Because patents can take many years to issue, there may be currently pending applications of which the Corporation is unaware that may later result in issued patents that its products infringe.

The biopharmaceutical industry has produced a proliferation of patents, and it is not always clear to industry participants, including the Corporation, which patents cover various types of products. The coverage of patents is subject to interpretation by the courts, and the interpretation is not always uniform. The Corporation is aware of, and has reviewed, third party patents relating to the treatment of Alzheimer’s disease, diabetes, and other relevant indication areas. In the event of infringement or violation of another party’s patent, the Corporation may not be able to enter into licensing arrangements or make other arrangements at a reasonable cost. Any inability to secure licenses or alternative technology could result in delays in the introduction of the Corporation’s products or lead to prohibition of the manufacture or sale of the products.

Patent litigation is costly and time consuming and may subject the Corporation to liabilities.

The Corporation’s involvement in any patent litigation, interference, opposition or other administrative proceedings will likely cause the Corporation to incur substantial expenses, and the efforts of its technical and management personnel will be significantly diverted. In addition, an adverse determination in litigation could subject the Corporation to significant liabilities.

The Corporation operates in a fiercely competitive business environment.

The biopharmaceutical industry is highly competitive. Competition comes from health care companies, pharmaceutical companies, large and small biotech companies, specialty pharmaceutical companies, universities, government agencies and other public and private companies. Research and development by others may render the Corporation’s technology or products non-competitive or obsolete or may result in the production of treatments or cures superior to any therapy the Corporation is developing or will develop. In addition, failure, unacceptable toxicity, lack of sales or disappointing sales or other issues regarding competitors’ products or processes could have a material adverse effect on the Corporation’s product candidates, including its clinical candidates or its lead compounds.

The market price of the Corporation’s Common Shares may experience a high level of volatility due to factors such as the volatility in the market for biotechnology stocks generally, and the short-term effect of a number of possible events.

The Corporation is a public growth company in the biotechnology sector. As frequently occurs among these companies, the market price for the Corporation’s Common Shares may experience a high level of volatility. Numerous factors, including many over which the Corporation has no control, may have a significant impact on the market price of Common Shares including, among other things, (i) clinical and regulatory developments regarding the Corporation’s products and product candidates and those of its competitors, (ii) arrangements or strategic partnerships by the Corporation, (iii) other announcements by the Corporation or its competitors regarding technological, product development, sales or other matters, (iv) patent or other intellectual property achievements or adverse developments, (v) arrivals or departures of key personnel; (vi) government regulatory action affecting the Corporation’s product candidates in the United States, Canada and foreign countries, (vii) actual or anticipated fluctuations in the Corporation’s revenues or expenses, (viii) general market conditions and fluctuations for the emerging growth and biopharmaceutical market sectors, (ix) reports of securities analysts regarding the expected performance of the Corporation, and (x) events related to threatened, new or existing litigation. Listing on NASDAQ and the TSX may increase share price volatility due to various factors including, (i) different ability to buy or sell the Corporation’s Common Shares, (ii) different market conditions in different capital markets; and (iii) different trading volume.

In addition, the stock market in recent years has experienced extreme price and trading volume fluctuations that often have been unrelated or disproportionate to the operating performance of individual companies. These broad market fluctuations may adversely affect the price of Common Shares, regardless of the Corporation’s operating performance. In addition, sales of substantial amounts of Common Shares in the public market after any offering, or the perception that those sales may occur, could cause the market price of Common Shares to decline.

Furthermore, shareholders may initiate securities class action lawsuits if the market price of the Corporation’s stock drops significantly, which may cause the Corporation to incur substantial costs and could divert the time and attention of its management.

The Corporation is highly dependent on third parties.

The Corporation is or may in the future be dependent on third parties for certain raw materials, product manufacture, marketing and distribution and, like other biotechnology and pharmaceutical companies, upon medical institutions to conduct clinical testing of its potential products. Although the Corporation does not anticipate any difficulty in obtaining any such materials and services, no assurance can be given that the Corporation will be able to obtain such materials and services.

The Corporation is subject to intense competition for its skilled personnel, and the loss of key personnel or the inability to attract additional personnel could impair its ability to conduct its operations.

The Corporation is highly dependent on its management and its clinical, regulatory and scientific staff, the loss of whose services might adversely impact its ability to achieve its objectives. Recruiting and retaining qualified management and clinical, scientific and regulatory personnel is critical to the Corporation’s success. Competition for skilled personnel is intense, and the Corporation’s ability to attract and retain qualified personnel may be affected by such competition.

The Corporation’s business involves the use of hazardous materials which requires the Corporation to comply with environmental regulation.

The Corporation’s discovery and development processes involve the controlled use of hazardous materials. The Corporation is subject to federal, provincial and local laws and regulations governing the use, manufacture, storage, handling and disposal of such materials and certain waste products. The risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of such an accident, the Corporation could be held liable for any damages that result, and any such liability could exceed the Corporation’s resources. The Corporation may not be adequately insured against this type of liability. The Corporation may be required to incur significant costs to comply with environmental laws and regulations in the future, and its operations, business or assets may be materially adversely affected by current or future environmental laws or regulations.

Legislative actions, potential new accounting pronouncements and higher insurance costs are likely to impact the Corporation’s future financial position or results of operations.

Compliance with changing regulations regarding corporate governance and public disclosure, notably with respect to internal controls over financial reporting, may result in additional expenses. Changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for companies such as ours, and insurance costs are increasing as a result of this uncertainty.

Future health care reforms may produce adverse consequences.

Health care reform and controls on health care spending may limit the price the Corporation can charge for any products and the amounts thereof that it can sell. In particular, in the United States, the federal government and private insurers have considered ways to change, and have changed, the manner in which health care services are provided. Potential approaches and changes in recent years include controls on health care spending and the creation of large purchasing groups. In the future, the U.S. government may institute further controls and different reimbursement schemes and limits on Medicare and Medicaid spending or reimbursement. These controls, reimbursement schemes and limits might affect the payments the Corporation could collect from sales of any of its products in the United States. Uncertainties regarding future health care reform and private market practices could adversely affect the Corporation’s ability to sell any products profitably in the United States. Election of new or different political or government officials in large market countries could lead to dramatic changes in pricing, regulatory approval legislation and reimbursement which could have material impact on product approvals and commercialization.

The Corporation faces an unproven market for its future products.

The Corporation believes that there will be many different applications for products successfully derived from its technologies and that the anticipated market for products under development will continue to expand. No assurance, however, can be given that these beliefs will prove to be correct due to competition from existing or new products and the yet to be established commercial viability of the Corporation’s products. Physicians, patients, formularies, third party payers or the medical community in general may not accept or utilize any products that the Corporation or its collaborative partners may develop.

The Corporation may be faced with future lawsuits related to secondary market liability.

Securities legislation in Canada has recently changed to make it easier for shareholders to sue. These changes could lead to frivolous law suits which could take substantial time, money, resources and attention or force the Corporation to settle such claims rather than seek adequate judicial remedy or dismissal of such claims.

The Corporation may encounter unforeseen emergency situations.

Despite the implementation of security measures, any of the Corporation’s, its collaborators’ or its third party service providers’ internal computer systems are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failure. Any resulting system failure, accident or security breach could result in a material disruption of the Corporation’s operations.

The Corporation’s technologies may become obsolete.

The pharmaceutical industry is characterized by rapidly changing markets, technology, emerging industry standards and frequent introduction of new products. The introduction of new products embodying new technologies, including new manufacturing processes, and the emergence of new industry standards may render the Corporation’s technologies obsolete, less competitive or less marketable.

Our product candidates may cause undesirable serious adverse events during clinical trials that could delay or prevent their regulatory authorization, approval or other permission to conduct further testing or commence commercialization.

Our product candidates in clinical development, including ELND005 (AZD-103), can potentially cause adverse events. Most recently, together with our collaborator, Elan, we completed a Phase II study that evaluated three dose groups of ELND005 (AZD-103) and a placebo group in mild to moderate Alzheimer’s disease patients. The study included four treatment arms: placebo, 250mg bid, 1000mg bid and 2000mg bid. The two high dose ELND005 (AZD-103) groups were electively discontinued in 2009 by the companies due to an observed imbalance of serious adverse events, including deaths. No causal relationship could be determined between these higher doses and the events.

Of the 351 subjects who received study drug, a total of 171 subjects received either 250mg bid or placebo, the rest were in the two discontinued high dose groups. The overall incidence of adverse events in the 250mg bid and placebo groups was 87.5% versus 91.6%; and the incidence of withdrawals due to adverse events was 10.2% versus 9.6%, respectively. The incidence of serious adverse events in the 250mg bid and placebo groups was 21.6% versus 13.3%, but the incidence of serious adverse events that were considered drug related was 2.3% and 2.4%, respectively. The total number of deaths in the study was five and four in the 1000mg bid and 2000mg bid dose groups versus one and zero in the 250mg bid and placebo groups, respectively. These deaths occurred between August 2008 and November 2009. The study’s independent safety monitoring committee reviewed the final safety results and continued to conclude that a causal relationship between the deaths and drug could not be determined.

The most common adverse events in the 250mg bid group that were >5% in incidence and double the placebo rate were: falls (12.5% vs. placebo 6%), depression (11.4% vs. placebo 4.8%), and confusional state (8% vs. placebo 3.6%). Because our product candidates have been tested in relatively small patient populations and for limited durations, additional adverse events may be observed as their development progresses.

Adverse events caused by any of our product candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other non-U.S. regulatory authorities for any or all targeted indications. This, in turn, could prevent the commercialization of our product candidates and the generation of revenues from their sale. In addition, if our product candidates receive authorization, marketing approval or other permission and we or others later identify adverse events caused by the product:

| | • | regulatory authorities may withdraw their authorization, approval, or other permission to test or market the candidate product; |

| | • | we may be required to recall the product, change the way the product is administered, conduct additional clinical trials or change the labeling of the product; |

| | • | a product may become less competitive and product sales may decrease; or |

| | • | our reputation may suffer. |

Any one or a combination of these events could prevent us from achieving or maintaining market acceptance or could substantially increase the costs and expenses of commercializing the product candidate, which in turn could delay or prevent us from generating significant revenues from the sale of such products.

We may be subject to costly product liability claims and may not have adequate insurance.

The conduct of clinical trials in humans involves the potential risk that the use of our product candidates will result in adverse effects. We currently maintain product liability insurance for our clinical trials; however, such liability insurance may not be adequate to fully cover any liabilities that arise from clinical trials of our product candidates. We may not have sufficient resources to pay for any liabilities resulting from a claim excluded from, or beyond the limit of, our insurance coverage.

U.S. holders of our common shares may suffer adverse tax consequences if we are characterized as a Passive Foreign Investment Company.

There is a risk that we will be classified as a PFIC for U.S. federal income tax purposes. Our status as

a PFIC could result in a reduction in the after-tax return to U.S. Holders of our common shares and may cause a reduction in the value of such shares. We will be classified as a PFIC for any taxable year in which (i) at least 75% of our gross income is passive income or (ii) at least 50% of the average value of all of our assets produce or are held for the production of passive income. For this purpose, passive income includes dividends, interest, royalties and rents that are not derived in the active conduct of a trade or business. Based on the projected composition of our income and valuation of our assets, we do not believe we were a PFIC for the year ended June 30, 2011 and do not believe we will be a PFIC for the year ending June 30, 2012. However, the U.S. Internal Revenue Service or a U.S. court could determine that we are a PFIC in any year. If we are classified as a PFIC, U.S. Holders of our common shares could be subject to greater U.S. income tax liability than might otherwise apply, imposition of U.S. income tax in advance of when tax would otherwise apply, and detailed tax filing requirements that would not otherwise apply. The PFIC rules are complex and U.S. Holders of our common shares are urged to consult their own tax

advisors regarding the possible application of the PFIC rules to them in their particular circumstances. See “Taxation—United States Federal Income Taxation.”

| Item 4. | Information on the Corporation |

Name, Address and Incorporation

Transition Therapeutics Inc. was incorporated pursuant to the Business Corporations Act (Ontario) on July 6, 1998 as “Transition Therapeutics and Diagnostics Inc.” The Corporation filed articles of amendment on October 12, 2000 and on October 19, 2000 to create a class of non-voting shares (the “Class B Shares”) and to amend certain attributes of its Common Shares. On November 2, 2000, the Corporation filed articles of amendment to delete its private company restrictions. On December 14, 2000, the Corporation filed articles of amendment to change its name to “Transition Therapeutics Inc.” and effect a split of its issued and outstanding Common Shares on the basis of 3.25649 Common Shares for each previously issued and outstanding Common Share. On December 14, 2004, the Corporation filed articles of amendment to eliminate the Class B Shares from its authorized capital. In July 2007, the Corporation completed the consolidation of its issued and outstanding Common Shares on the basis of one (1) post-consolidation Common Share for every nine (9) pre-consolidation Common Shares.

The Corporation’s principal and registered office is located at 101 College Street, Suite 220, Toronto, Ontario, M5G 1L7.

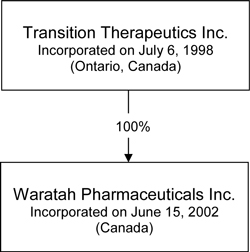

Intercorporate Relationships

The Corporation has one wholly-owned material subsidiary: Waratah Pharmaceuticals Inc. (“Waratah”), which is incorporated under the Canada Business Corporations Act.

The chart below illustrates the corporate structure:

Waratah’s principal business activity is to develop and commercialize its Alzheimer’s disease compound ELND005 (AZD103), TT-301 and TT-302 which are the anti-inflammatory compounds acquired in connection with the acquisition of NeuroMedix Inc. (“NeuroMedix”) in June 2007, and the series of compounds acquired from Eli Lilly and Company in the area of diabetes in March, 2010.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

On August 18, 2008, the Corporation announced a series of actions to strengthen the Corporation’s drug discovery group. The Corporation acquired certain assets and the exclusive rights to three drug discovery projects from Forbes Medi-Tech (Research) Inc., a wholly owned subsidiary of Forbes Medi-Tech Inc. (“Forbes”). In consideration for the acquisition of these assets and intellectual property rights, the Corporation paid US$1 million, and will potentially pay up to an additional US$6 million in contingent consideration dependent on all three technologies successfully achieving certain developmental and regulatory milestones.

In September 2008, the Corporation announced the first patient was dosed in a Phase II clinical study of gastrin analogue TT-223 in type 2 diabetes patients. The study was a randomized, double-blind, placebo-controlled, dose-ranging study to evaluate the safety, tolerability and efficacy of daily TT-223 treatments for 12 weeks with a 6-month follow-up.

On October 3, 2008, the Corporation received 23,272,633 common shares of Stem Cell Therapeutics Corp. (“Stem Cell”) pursuant to the terms of a share purchase agreement entered into on October 4, 2004. Under the terms of this agreement, the final $1,650,000 milestone payment was due from Stem Cell to the Corporation on September 30, 2008. Stem Cell elected to make this payment in the form of Stem Cell common shares from treasury.

On October 20, 2008, Elan and the Corporation announced the achievement of the patient enrolment target for a Phase II clinical study of ELND005 (AZD-103) in patients with Alzheimer’s disease.

In January 2009, the Corporation disposed of 23,272,633 common shares of Stem Cell in open market transactions over the TSX Venture Exchange which resulted in net proceeds of approximately $1.4 million.

On February 5, 2009, the Corporation announced the completion of patient enrolment for a Phase II clinical study of gastrin analogue, TT-223, in patients with type 2 diabetes.

On March 23, 2009, the Corporation announced the initiation of a Phase Ib clinical study of TT-223 in combination with a GLP-1 analogue in patients with type 2 diabetes. The study was a randomized, double-blind, placebo-controlled study in approximately 140 patients to evaluate the safety, tolerability and efficacy of daily TT-223 treatments in combination with weekly administrations of a proprietary Lilly GLP-1 analogue, for a combination treatment period of 4 weeks with a 5-month follow-up.

On April 3, 2009, the Corporation terminated the agreement with the Juvenile Diabetes Research Foundation (“JDRF”) and paid $441,455 (US$350,000) which represents the total amounts owing to the JDRF under the terms of the agreement. The Corporation and the JDRF agreed that it would be reasonable for the JDRF to reassign financial resources earmarked for development of gastrin-based therapies to another worthy research program. The Corporation has no further obligations that survive termination of the agreement.

On April 23, 2009, Elan and the Corporation announced the receipt of a key patent for Alzheimer’s Disease treatment with ELND005 (AZD-103). The United States Patent and Trademark Office issued US patent number 7,521,481 on April 21, 2009. The patent is entitled “Methods of Preventing, Treating and Diagnosing Disorders of Protein Aggregation,” and generally claims methods for treating Alzheimer’s disease comprising administering scyllo-inositol ELND005 (AZD-103). The patent will expire in the year 2025 or later due to any patent term extensions.

On July 13, 2009, Elan and the Corporation announced Phase 1 data showing ELND005 (AZD-103) achieves desired concentrations in brain tissue and cerebrospinal fluid when given orally. Preclinical data also were presented showing that ELND005 (AZD-103) administration is associated with preservation of choline acetyltransferase (ChAT), reflecting preservation of nerve cells that are critical to memory function in the brain. These results were presented at the 2009 Alzheimer’s Association International Conference on Alzheimer’s Disease (ICAD 2009) in Vienna, Austria.

On September 28, 2009, the Corporation filed a preliminary short form base shelf prospectus with securities regulatory authorities in Canada and a corresponding shelf registration statement with the United States Securities and Exchange Commission on Form F-10. The shelf prospectus has become effective and provides for the potential offering in selected Canadian provinces and the United States of up to an aggregate amount of US$75 million of the Corporation’s common shares, warrants, or a combination thereof, from time to time in one or more offerings until November 8, 2011. Utilization of the US shelf prospectus is dependent upon meeting certain market capitalization thresholds at the time of financing.

On December 15, 2009, Elan and the Corporation announced modifications to ELND005 (AZD-103) Phase II clinical trials in Alzheimer’s disease. Patients were withdrawn immediately from the study in the two higher dose groups (1000mg and 2000mg dosed twice daily). The study continued unchanged for patients who were assigned to the lower dose (250mg dosed twice daily) and placebo groups. The open label extension study was modified to dose patients only at 250mg twice daily. Greater rates of serious adverse events, including nine deaths, were observed among patients receiving the two highest doses. A direct relationship between ELND005 (AZD-103) and these deaths has not been established. The Independent Safety Monitoring Committee (“ISMC”) and both companies concurred that the tolerability and safety data are acceptable among patients receiving the 250mg dose and that the blinded study should continue for this dose and the placebo group.

In December, 2009, management assessed the development potential of the intangible assets acquired from Forbes and accordingly recognized an impairment of the intangible assets of $1,053,446.

On January 25, 2010, the Corporation announced results from a Phase II clinical study of gastrin analogue, TT-223, in patients with type 2 diabetes. Patients who received the highest daily dose of TT-223 for 12 weeks and completed the entire study without adjusting their diabetes therapies experienced a statistically significant reduction in HbA1c of 1.13%, 6 months after completing TT-223. Patients who had received placebo treatment experienced a 0.22% HbA1c reduction 6 months post-treatment. HbA1c is a reflection of a person’s average glucose level and is used by doctors as a measure of glucose management. Post prandial (after a meal) and AUC (area under the curve) glucose showed improvement versus placebo but not against baseline at 3 and 6 months post-treatment, while fasting blood glucose and mixed meal tolerance insulin parameter tests did not show improvement. No detectable changes in weight were observed. There were no treatment-related serious adverse events. The most common adverse event was nausea, which was generally mild to moderate and decreased in frequency and severity over the treatment period.

On March 3, 2010, the Corporation announced a second licensing agreement with Lilly to acquire the rights to a series of preclinical compounds in the area of diabetes. Under the licensing and collaboration agreement, the Corporation will receive exclusive worldwide rights to develop and potentially commercialize a class of compounds that, in preclinical diabetes models showed potential to provide glycemic control and other beneficial effects including weight loss.

On June 30, 2010, the Corporation announced the initiation of a Phase I clinical study of TT-301. The study is a double blind, randomized, placebo controlled study in which healthy volunteers receive placebo or escalating doses of intravenously administered TT-301. The primary objectives of the trial are to evaluate the safety, tolerability and pharmacokinetics of TT-301.

On August 9, 2010, Elan and the Corporation announced topline summary results of a Phase II study and plans for Phase III for ELND005 (AZD-103). The AD201 study did not achieve significance on co-primary outcome measures (NTB and ADCS-ACL) however; the study did identify a dose with acceptable safety and tolerability. The dose demonstrated a biological effect on amyloid beta protein in the cerebrospinal fluid and effects on clinical endpoints in an exploratory analysis. Based on the preponderance of evidence, and input from the experts in this field, the companies intend to advance ELND005 (AZD-103) into Phase III studies.

On September 17, 2010, the Corporation announced that a clinical study of gastrin analogue TT-223 in combination with a Lilly proprietary GLP-1 analogue in patients with type 2 diabetes did not meet its efficacy endpoints. Given these findings, there will be no further development of TT-223. The next generation diabetes compounds that the Corporation has in-licensed from Lilly (TT-401/402), as announced on March 3, 2010, act through a distinctly different mechanism of action from gastrin based therapies. The companies continue to work diligently on this program and the licensing arrangement is unaffected by the TT-223 clinical study results.

On December 27, 2010, the Corporation announced the modification of the ELND005 (AZD-103) collaboration agreement between Elan and the Corporation. Under the terms of the modification, in lieu of a contractually required Phase 3 milestone payment, the Corporation received from Elan a payment of US$9 million at the time of signing and will be eligible to receive a US$11 million payment upon the commencement of the next ELND005 (AZD-103) clinical trial. The Corporation also will be eligible to receive up to an aggregate of US$93 million in additional regulatory and commercial launch related milestone payments plus tiered royalties ranging from 8% to 15% based on net sales of ELND005 (AZD-103) should the drug receive the necessary regulatory approvals for commercialization. As the agreement is now a royalty arrangement, the Corporation will no longer fund the development or commercialization of ELND005 (AZD-103) and will relinquish its 30% ownership of ELND005 (AZD-103) to Elan.

Recent Developments

On July 15, 2011, Transition announced that ELND005 Phase 2 clinical trial data would be presented at the International Conference of Alzheimer's Disease (ICAD) meeting on July 18, 2011. Elan and Transition intend to share further detail regarding the Phase 2 data in a peer-reviewed publication.

BUSINESS OF THE CORPORATION

Market sizes appearing in this annual report are estimates of potential markets only. The Corporation makes no claim that such figures represent sales figures actually anticipated should the Corporation successfully develop and receive approval for any of its product candidates.

General

The Corporation is a product-focused biopharmaceutical company developing novel therapeutics for disease indications with large markets. The Corporation considers itself to be in one business segment; that is the research and development of therapeutic agents.

The Corporation’s strategic focus is on building shareholder value. To effectively achieve this, the Corporation has established a business model based on the following steps: 1) identifying attractive early stage technologies targeting large markets; 2) moving these products through the clinic to provide validation; 3) considering additional product opportunities; 4) identifying partners with the infrastructure and resources to complete late stage clinical development and product commercialization; and 5) identifying new product opportunities to replenish the Corporation’s product pipeline.

This business model allows the Corporation to maximize the return from its early stage investment and validation through partnerships with large pharmaceutical companies. These partnerships not only provide the Corporation with third party validation, but also fund the more costly later stage clinical development of its lead products and provide revenues through milestone payments, royalties and profit sharing arrangements for the future growth of the Corporation. The revenues from these partnerships may also allow the Corporation to continually replenish its product development pipeline while reducing the need to secure funding from the public markets.

The Corporation’s business model has resulted in an infrastructure that also allows the Corporation to advance several products simultaneously while controlling its burn rate. The Corporation’s small and versatile infrastructure has in part resulted from the Corporation conducting research and development internally, as well as, out-sourcing work to hospitals, universities or pharmaceutical companies.

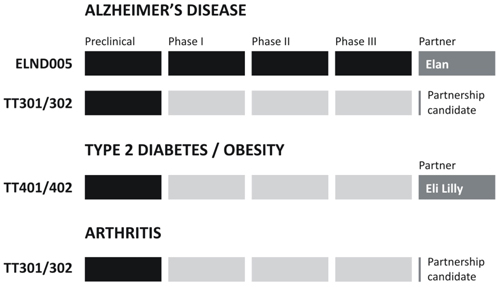

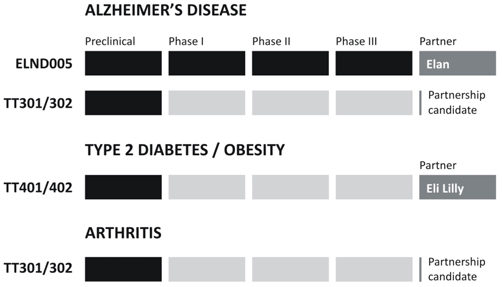

Technology

The Corporation’s technologies in development are as follows: (i) ELND005 (AZD-103) for the treatment of Alzheimer’s disease; (ii) TT-301 and TT-302 which may have a therapeutic effect on diseases including arthritis, Alzheimer’s disease, traumatic brain injury, intracerebral haemorrhage, and others, and (iii) TT401/402 for the treatment of diabetes.

ELND005 (AZD-103) Technology

The Corporation is developing disease-modifying small molecule therapeutics that act by preventing the formation of and breaking down amyloid beta peptide aggregates. The accumulation of amyloid beta has been connected to several diseases including Alzheimer’s disease, AA Amyloidosis and others.

The Product

The Alzheimer’s disease lead product, ELND005 (AZD-103), is part of an emerging class of disease-modifying drugs that have the potential to both reduce disease progression and improve symptoms such as diminished cognitive function. ELND005 (AZD-103) breaks down neuro-toxic fibrils, allowing amyloid peptides to clear the brain rather than form amyloid plaques, a hallmark pathology of Alzheimer’s disease.

The Corporation and its development partner, Elan have performed multiple Phase I studies evaluating the safety, tolerability and pharmacokinetic profile of ELND005 (AZD-103) in healthy volunteers. Approximately 110 subjects have been exposed to ELND005 (AZD-103) in multiple Phase I studies, including single and multiple ascending dosing; pharmacokinetic evaluation of levels in the brain; and CSF and plasma studies. In these studies, ELND005 (AZD-103) was safe and well-tolerated at all doses and dosing regimens examined. There were no severe or serious adverse events observed. ELND005 (AZD-103) was also shown to be orally bioavailable, to cross the blood-brain barrier and to achieve levels in the human brain and CSF that were shown to be effective in animal models for Alzheimer’s disease.

In 2007, the Corporation and Elan commenced a Phase II clinical study (AD 201) of ELND005 (AZD-103) in patients with Alzheimer’s disease. In December, 2009, Elan and the Corporation announced modifications to the AD 201 clinical trial. Patients were withdrawn immediately from the study in the two higher dose groups (1000mg and 2000mg dosed twice daily) and the study continued unchanged for patients who were assigned to the lower dose (250mg dosed twice daily) and placebo groups. The open label extension study was modified to dose patients only at 250mg twice daily. Greater rates of serious adverse events, including nine deaths, were observed among patients receiving the two highest doses. A direct relationship between ELND005 (AZD-103) and these deaths has not been established. The Independent Safety Monitoring Committee (“ISMC”) and both companies concur that the tolerability and safety data are acceptable among patients receiving the 250mg dose and that the blinded study should continue for this dose and the placebo group.

In August, 2010, Elan and the Corporation announced topline summary results of the Phase II study and plans for Phase III for ELND005 (AZD-103). The AD201 study did not achieve significance on co-primary outcome measures (NTB and ADCS-ACL) in mild to moderate patients.

The AD201 study identified a dose with acceptable safety and tolerability that achieved target drug levels in the cerebrospinal fluid. The dose demonstrated a biological effect on amyloid-beta protein in the cerebrospinal fluid and effects on clinical endpoints in an exploratory analysis. Based on the preponderance of evidence, and input from the experts in this field, the companies intend to advance ELND005 (AZD-103) into Phase III studies.

Alzheimer’s Disease – The Disease and the Market Opportunity

Alzheimer’s disease is a progressive brain disorder that gradually destroys a person’s memory and ability to learn, reason, make judgments, communicate and carry out daily activities. As Alzheimer’s disease progresses, individuals may also experience changes in personality and behaviour, such as anxiety, suspiciousness or agitation, as well as delusions or hallucinations. In late stages of the disease, individuals need help with dressing, personal hygiene, eating and other basic functions. People with Alzheimer’s disease die an average of eight years after first experiencing symptoms, but the duration of the disease can vary from three to 20 years.

The disease mainly affects individuals over the age of 65 and it is estimated over 18 million people are suffering from Alzheimer’s disease worldwide. The likelihood of developing late-onset Alzheimer’s approximately doubles every five years after age 65. By age 85, the risk reaches nearly 50 percent. In the United States, Alzheimer’s disease is the sixth leading cause of death and current direct/indirect costs of caring for an estimated 5.4 million Alzheimer’s disease patients are at least US$100 billion annually. Scientists have so far discovered one gene that increases risk for late-onset of the disease.

Current FDA approved Alzheimer’s disease medications may temporarily delay memory decline for some individuals, but none of the currently approved drugs are known to stop the underlying degeneration of brain cells. Certain drugs approved to treat other illnesses may sometimes help with the emotional and behavioral symptoms of Alzheimer’s disease. With an aging population, there is a great need for disease-modifying compounds that can slow or reverse disease progression.

TT-301 / TT-302

Pro-inflammatory cytokines are part of the body’s natural defense mechanism against infection. However, the overproduction of these cytokines can play a harmful role in the progression of many different diseases. In the last decade there have been antibody and protein therapies approved (including Enbrel, Remicade and Humira) to inhibit the activity of pro-inflammatory cytokines. Each of these therapies has made a significant impact in the treatment regimen for hundreds of thousands of patients suffering from arthritis, Crohn’s disease, and other autoimmune disorders and has annual sales in excess of US$1.5 billion. The therapeutic and commercial success of these therapies provides a strong proof of concept for the approach of targeting pro-inflammatory cytokines. Unfortunately, an antibody or protein approach is not desirable for the treatment of central nervous system (“CNS”) diseases for a variety of reasons, including an inability to sufficiently cross the blood brain barrier.

To address this large unmet medical need, the Corporation is developing a class of small molecule compounds that are designed to cross the blood brain barrier and have been shown to have an inhibitory effect on pro-inflammatory cytokines. Animal model studies have been performed demonstrating that members of this class of compounds can have a therapeutic effect on diseases including arthritis, Alzheimer’s disease, traumatic brain injury, intracerebral hemorrhage, and others.

Development of TT-301 and TT-302

The Corporation’s lead drug candidates in development are TT-301 and TT-302. These novel drug candidates are derived from a diligent drug design program engineered to produce compounds optimized to target inhibiting pro-inflammatory cytokines in the brain and periphery. Each compound is designed to cross the blood-brain-barrier and each has the flexibility to be administered by injection or orally. In preclinical studies, both TT-301/302 have shown a favorable safety profile and therapeutic window for efficacy.

In June 2010, the Corporation announced the initiation of a Phase I clinical study of TT-301 and the dosing of the first patient. The study was a double blind, randomized, placebo controlled study in which healthy volunteers received placebo or escalating doses of intravenously administered TT-301.

The Corporation is preparing to perform Phase 1 studies evaluating the safety, tolerability and pharmacokinetics of TT-301 or TT-302 when dosed orally. This next stage of development is planned for calendar 2012. As these drug candidates continue in clinical development, the Corporation may seek a partnership to access specialized expertise and resources to maximize the potential of these therapies.

Arthritis – The Disease and the Market Opportunity

There are two major forms of arthritis: rheumatoid arthritis and osteoarthritis.

Rheumatoid Arthritis

Rheumatoid arthritis is a disorder in which the body's own immune system starts to attack body tissues. The attack is not only directed at the joint but to many other parts of the body. In rheumatoid arthritis, most damage occurs to the joint lining and cartilage which eventually results in erosion of two opposing bones. Rheumatoid arthritis affects joints in the fingers, wrists, knees and elbows. Rheumatoid arthritis occurs mostly in people aged 20 and above.

About 1% of the world's population is afflicted by rheumatoid arthritis with women being three times more susceptible than men. With earlier diagnosis and aggressive treatment, many individuals can lead a decent quality of life. The drugs to treat rheumatoid arthritis range from corticosteroids to monoclonal antibodies given intravenously. The latest drugs like Remicade, Enbrel and Humira can significantly improve quality of life in the short term.

Osteoarthritis

Osteoarthritis is the most common form of arthritis affecting approximately 27 million people in the United States alone. It can affect both the larger and the smaller joints of the body, including the hands, feet, back, hip or knee. The disease is essentially one acquired from daily wear and tear of the joint; however, osteoarthritis can also occur as a result of injury. Osteoarthritis begins in the cartilage and eventually leads to the two opposing bones eroding into each other. Initially, the condition starts with minor pain while walking but soon the pain can be continuous and even occur at night. The pain can be debilitating and prevent one from doing some activities. Osteoarthritis typically affects the weight bearing joints such as the back, spine, and pelvis. Unlike rheumatoid arthritis, osteoarthritis is most commonly a disease of the elderly.

Osteoarthritis, like rheumatoid arthritis, cannot be cured but one can prevent the condition from worsening. Weight loss is the key to improving symptoms and preventing progression. Physical therapy to strengthen muscles and joints is very helpful. Pain medications are widely required by individuals with osteoarthritis. When the disease is far advanced and the pain is continuous, surgery may be an option. Unlike rheumatoid arthritis, joint replacement does help many individuals with osteoarthritis.

TT-401 / TT-402