Exhibit 99.1

TRANSITION THERAPEUTICS INC.

Annual Meeting of Shareholders

Management Information Circular

This Management Information Circular (“Circular”) is furnished in connection with the solicitation of proxies by and on behalf of the management of Transition Therapeutics Inc. (the “Corporation”) for use at the Annual Meeting of the Corporation’s shareholders to be held on December 10, 2015 at the time and place and for the purposes set out in the accompanying Notice of Annual Meeting and any adjournment thereof.

No person has been authorized to give any information or make any representation in connection with any matters to be considered at the Annual Meeting, other than as contained in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized.

November 5, 2015

TRANSITION THERAPEUTICS INC.

Notice of Annual Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Meeting”) of Transition Therapeutics Inc. (the “Corporation”) will be held at the MaRS Centre, South Tower, 101 College Street, Room CR3, Toronto, Ontario, Canada, on Thursday, December 10, 2015, at 4:00 p.m. (Toronto time), for the following purposes, to:

| 1. | receive the audited consolidated financial statements of the Corporation for the fiscal year ended June 30, 2015, together with the auditors’ report thereon; |

| 2. | elect directors of the Corporation for the ensuing year; |

| 3. | reappoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors of the Corporation for the ensuing year and to authorize the directors to fix the remuneration to be paid to the auditors; |

| 4. | approve all unallocated options, rights, or other entitlements under the Corporation’s stock option plan, as described in further detail in the accompanying Management Information Circular dated November 5, 2015; and |

| 5. | transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The Circular and the form of proxy have each been prepared for use at the Meeting. Shareholders who are unable to attend the Meeting in person are requested to date, sign and return the enclosed form of proxy in the addressed envelope provided for that purpose.

DATED as of the 5th day of November, 2015.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| |  |

| | |

| | LOUIS ALEXOPOULOS |

| | |

| | Secretary |

In order to be represented by proxy at the Meeting, you must complete, date and sign the enclosed form of proxy or other appropriate form of proxy and, in either case, (i) deliver the completed proxy to the Corporation’s Registrar and Transfer Agent, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, North Tower, Toronto, Ontario, M5J 2Y1, in the addressed envelope enclosed, or (ii) submit the completed proxy to Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, North Tower, Toronto, Ontario, M5J 2Y1 or by facsimile to facsimile number (416) 263-9524 or 1-866-249-7775, no later than 48 hours (excluding Saturdays, Sundays and holidays) preceding the date and time of the Meeting, or any adjournment or postponement thereof.

Contents

| | Page |

| | |

| SOLICITATION OF PROXIES | 1 |

| APPOINTMENT OF PROXY HOLDERS | 1 |

| REVOCABILITY OF PROXY | 2 |

| VOTING OF SHARES REPRESENTED BY MANAGEMENT PROXIES | 2 |

| VOTING SHARES AND THE PRINCIPAL HOLDERS THEREOF | 2 |

| ADVICE TO BENEFICIAL HOLDERS OF SECURITIES | 3 |

| BUSINESS OF THE MEETING | 4 |

| Consolidated Financial Statements and Auditors’ Report | 4 |

| Election of Directors | 4 |

| Appointment and Remuneration of the Auditors | 6 |

| Approval of Unallocated Stock Options | 6 |

| COMPENSATION DISCUSSION AND ANALYSIS | 7 |

| Compensation Governance | 7 |

| Chief Executive Officer’s Compensation | 9 |

| Performance Graph | 9 |

| Option-Based Awards | 9 |

| Risk Assessment and Oversight | 9 |

| Hedging Activities | 10 |

| Summary Compensation Table | 10 |

| Outstanding Option-based Awards | 10 |

| Officers - Option-Based Awards – Value Vested or Earned during the Year | 11 |

| Termination and Change of Control Benefits | 11 |

| Estimated Termination Payments | 12 |

| Compensation of Directors | 13 |

| Standard Arrangements | 13 |

| Director Share Ownership Guidelines | 13 |

| Directors – Outstanding Option-based Awards | 13 |

| Directors – Option-Based Awards – Value Vested or Earned during the Year | 14 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 14 |

| DESCRIPTION OF THE STOCK OPTION PLAN | 15 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 16 |

| INTERESTS OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 16 |

| INTERESTS OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 16 |

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 16 |

| Composition of the Board | 16 |

| Board Mandate | 17 |

| Position Descriptions | 18 |

| Orientation and Continuing Education of Board Members | 18 |

| Measures to Encourage Ethical Business Conduct | 18 |

| Nomination of Board Members | 19 |

| Determination of Compensation of Directors and Officers | 19 |

| Assessment of Directors, the Board and Board Committees | 19 |

| Director Term Limits | 20 |

| Policies Regarding Representation of Women | 20 |

| ADDITIONAL INFORMATION | 20 |

| DIRECTORS’ APPROVAL | 21 |

| APPENDIX “A” MANDATE OF THE BOARD OF DIRECTORS | A-1 |

TRANSITION THERAPEUTICS INC.

101 College Street, Suite 220

Toronto, Ontario

M5G 1L7

MANAGEMENT INFORMATION CIRCULAR

Except where indicated otherwise, the following information is dated as at November 5, 2015 and all dollar amounts are in Canadian dollars.

SOLICITATION OF PROXIES

The information contained in this Management Information Circular (the “Circular”) is furnished in connection with the solicitation of proxies by the management of Transition Therapeutics Inc. (the “Corporation”) for use at the Annual Meeting (the “Meeting”) of the holders (the “Shareholders”) of common shares (“Common Shares”) of the Corporation to be held on Thursday, December 10, 2015 at 4:00 p.m. (Toronto time) at the MaRS Centre, South Tower, 101 College Street, Room CR3, Toronto, Ontario, Canada, and at all adjournments or postponements thereof, for the purposes set forth in the Notice of Annual Meeting of Shareholders (the “Notice”).

The solicitation of proxies is being made by or on behalf of the management of the Corporation.The Corporation will bear the entire cost of solicitation of proxies including preparation, assembly, printing and mailing of this Circular, the Notice, the form of proxy and the annual report (collectively, the “Documents”). Copies of the Documents are being sent by mail to those Shareholders entitled to receive notice of the Meeting. The Documents will also be furnished to banks, securities dealers, and clearing agencies holding in their names Common Shares, beneficially owned by others to forward to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by directors, officers, or other regular employees of the Corporation. No additional compensation will be paid to directors, officers, or other regular employees for such services.

APPOINTMENT OF PROXY HOLDERS

Shareholders may vote at the Meeting in person or by proxy.The persons named in the accompanying form of proxy are executive officers of the Corporation. A Shareholder has the right to appoint a person other than the persons specified in such form of proxy (who need not be a shareholder of the Corporation) to attend and act on behalf of the Shareholder at the Meeting. To exercise this right, a Shareholder may either insert the name of the desired person in the blank space provided in the accompanying form of proxy, or complete another appropriate form of proxy.

Those Shareholders who wish to be represented by proxy, must deposit their respective forms of proxy by (i) delivering the completed proxy to the Corporation’s transfer agent, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, North Tower, Toronto, Ontario, M5J 2Y1, in the addressed envelope enclosed, or (ii) submitting the completed proxy to Computershare Investor Services LLC, Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1 or by facsimile to facsimile number (416) 263-9524 or 1-866-249-7775, no later than 48 hours (excluding Saturdays, Sundays and holidays) preceding the date and time of the Meeting, or any adjournment or postponement thereof.

REVOCABILITY OF PROXY

A Shareholder who has given a proxy may revoke it by depositing an instrument in writing executed by the Shareholder or by his attorney, authorized in writing, or if the Shareholder is a body corporate, under its corporate seal or by an officer or attorney thereof duly authorized, either at the registered office of the Corporation at any time up to 5:00 p.m. (Toronto time) on the business day immediately preceding the date of the Meeting, or any adjournment or postponement thereof, or with the Chair of the Meeting on the day of the Meeting, or any adjournment or postponement thereof, prior to the time of voting and, upon either of such deposits, the earlier proxy shall be revoked.

VOTING OF SHARES REPRESENTED BY MANAGEMENT PROXIES

The executive officers named in the enclosed form of proxy will vote the Common Shares for which they are appointed proxy holders in accordance with the instructions of the Shareholder indicated on the form of proxy. In the absence of such instructions, the executive officers named in the enclosed form of proxy intend to vote the Common Shares represented by the proxy in favour of each motion put forth by management of the Corporation.

If a Shareholder appoints a person, other than the executive officers named in the accompanying form of proxy to represent it, such person will vote the Common Shares for which they are appointed proxy holder in accordance with the instructions of the Shareholder indicated on the form of proxy. In the absence of such instructions, such person may vote the Common Shares for which they are appointed proxy holder at their discretion.

The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations of matters identified in the Notice, and with respect to any other matters, if any, which may properly come before the Meeting. At the time of printing of this Circular, management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting. However, if any such amendments, variations or other matters which are not now known to management should properly come before the Meeting, the persons named in the form of proxy will vote on such other business in accordance with their best judgment.

VOTING SHARES AND THE PRINCIPAL HOLDERS THEREOF

The authorized capital of the Corporation consists of an unlimited number of Common Shares, each carrying the right to one vote per share. As at November 5, 2015, the Corporation had 38,878,879 Common Shares outstanding. Only Shareholders of record at the close of business on November 5, 2015 (the “Record Date”) will be entitled to notice of, and to attend and vote at, the Meeting. Any transferee or person acquiring Common Shares after the Record Date may on proof of ownership of such Common Shares, make a written demand, not later than 10 days before the Meeting, to be included in the list of Shareholders entitled to vote at the Meeting, in which case the transferee will be entitled to vote his or her Common Shares at the Meeting or any adjournment or postponement thereof.

As at the date hereof, to the knowledge of the directors and executive officers of the Corporation, no person beneficially owns, directly or indirectly, or exercises control or direction over more than 10% of the issued and outstanding Common Shares, except as follows:

| Name | | Number of

Common Shares | | | Percentage

of Class | |

| Mr. Jack Schuler | | | 6,809,127 | | | | 17.5 | % |

| Mr. Larry N Feinberg | | | 4,861,321 | | | | 12.5 | % |

| FMR LLC | | | 4,109,435 | | | | 10.6 | % |

ADVICE TO BENEFICIAL HOLDERS OF SECURITIES

The information set forth in this section is provided to beneficial holders of Common Shares of the Corporation who do not hold their Common Shares in their own name (“Beneficial Shareholders”).Beneficial Shareholders should note that only proxies deposited by Shareholders whose names appearon the records of the Corporation as the registered holders of Common Shares can be recognized and acted upon at the Meeting.If Common Shares are listed in an account statement provided to a Beneficial Shareholder by a broker, then in almost all cases those Common Shares will not be registered in the Beneficial Shareholder’s name on the records of the Corporation. Such Common Shares will more likely be registered under the name of the Beneficial Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms). Common Shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, the broker/nominees are prohibited from voting Common Shares for their clients. The Corporation does not know for whose benefit the Common Shares registered in the name of CDS & Co. are held. Therefore, Beneficial Shareholders cannot be recognized at the Meeting for the purposes of voting the Common Shares in person or by way of proxy except as set forth below.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of Shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided to registered Shareholders; however, its purpose is limited to instructing the registered Shareholder how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”) in the United States and Canada. Broadridge typically applies a special sticker to proxy forms, mails those forms to the Beneficial Shareholders and requests the Beneficial Shareholders to return the proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting. A Beneficial Shareholder receiving a proxy from Broadridge cannot use that proxy to vote Common Shares directly at the Meeting as the proxy must be returned as directed by Broadridge well in advance of the Meeting in order to have the Common Shares voted.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of his broker (or agent of the broker), a Beneficial Shareholder may attend at the Meeting as proxyholder for the registered Shareholder and vote Common Shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as proxyholder for the registered Shareholder should enter their own names in the blank space on the form of proxy provided to them and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker (or agent), well in advance of the Meeting.

In addition, a proxy may be revoked by the Shareholder by executing another form of proxy bearing a later date and depositing same at the offices of the Registrar and Transfer Agent of the Corporation within the time period set out under the heading “Revocability of Proxy”, or by the Shareholder personally attending the Meeting and voting his or her Common Shares.

The Corporation does not intend to pay for intermediaries/brokers to send proxy-related materials to Beneficial Shareholders who object to their name being made known to the Corporation ("Objecting Beneficial Shareholders"). As such, if you are an Objecting Beneficial Shareholder, you will not receive the materials unless your intermediary/broker assumes the cost of delivery.

IF YOU ARE A BENEFICIAL SHAREHOLDER AND WISH TO VOTE IN PERSON AT THE MEETING, PLEASE CONTACT YOUR BROKER OR AGENT WELL IN ADVANCE OF THE MEETING TO DETERMINE HOW YOU CAN DO SO.

BUSINESS OF THE MEETING

At the Meeting, Shareholders will be asked to consider and, if deemed appropriate, to:

| 1. | receive the audited consolidated financial statements of the Corporation for the year ended June 30, 2015, together with the auditors’ report thereon; |

| 2. | elect the directors of the Corporation for the ensuing year; |

| 3. | approve the reappointment of PricewaterhouseCoopers LLP, Chartered Professional Accountants, as the auditors of the Corporation for the ensuing year and authorize the directors to fix the remuneration to be paid to the auditors; |

| 4. | approve all unallocated options, rights, or other entitlements under the Corporation’s stock option plan, as described in further detail in this Circular; and |

| 5. | transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Consolidated Financial Statements and Auditors’ Report

The Corporation’s audited consolidated financial statements for the year ended June 30, 2015, and the auditor's report thereon will be submitted at the Meeting. No vote will be taken regarding the Corporation’s audited consolidated financial statements.

Election of Directors

Five directors are proposed to be elected at the Meeting. All directors so elected will, subject to the bylaws of the Corporation and to applicable laws, hold office until the close of the next annual meeting of the Shareholders, or until their respective successors are elected or appointed.

On the recommendation of the Corporation’s Corporate Governance and Nominating Committee, the board of directors of the Corporation (the“Board”) adopted an individual voting standard for the election of directors prior to the Meeting. Under such individual voting standard, in the event that any nominee for election receives more “withheld” votes than “for” votes at any meeting at which shareholders vote on the uncontested election of directors, the Board will consider the result and, if deemed to be in the best interests of the Corporation and its shareholders, may request that such nominee tender his or her resignation from the Board in a manner that facilitates an orderly transition. It is anticipated that any decisions necessitated in the circumstances outlined in the preceding sentence will be made within 90 days, and the Board may fill any vacancy created thereby.

All of the nominees are now members of the Board and have been since the dates indicated below. The term of each current director’s appointment will expire at the Meeting.The persons designated in the enclosed form of proxy, unless instructed otherwise, intend to vote at the Meeting for the election of each of the nominees. Management of the Corporation does not contemplate that any of the nominees will be unable to serve as director, but if that should occur for any reason at or prior to the Meeting, the persons named in the enclosed form of proxy reserve the right to vote for another nominee in their discretion.

The following table sets forth for all persons proposed to be nominated by management for election as directors, their province/state and country of residence, the positions and offices with the Corporation now held by them, their present principal occupation and principal occupation for the preceding five years, the periods during which they have served as directors of the Corporation and the number of Common Shares of the Corporation beneficially owned, directly or indirectly, by each of them, or over which they exercise control or direction as of November 5, 2015.

Name and Province/State and

Country of Residence(1)(2) | | Director

Since | | Present Principal Occupation and

Principal Occupation for

Preceding Five Years | | Number of

Common Shares |

Mr. Michael Ashton(3)(4)(5)

Connecticut, USA | | December 2002 | | Director of Hikma Pharmaceuticals PLC since 2005 and independent consultant to the pharmaceutical industry since March 2006; prior thereto, Chief Executive Officer of PuriCore plc. | | 28,889 |

| | | | | | | |

Mr. Paul Baehr(3)(4)(5)

Quebec, Canada | | December 2002 | | President, Chief Executive Officer and Chairman of IBEX Technologies Inc., a publicly traded biotechnology company. | | 28,144 |

| | | | | | | |

Dr. Tony Cruz Ontario, Canada | | January 1999 | | Chairman and Chief Executive Officer of the Corporation. | | 840,147 |

| | | | | | | |

Mr. Christopher M. Henley(3)(4)(5)

Ontario, Canada | | October 2000 | | President of Henley Capital Corporation, an exempt market dealer and portfolio manager. | | 65,253 |

| | | | | | | |

Dr. Gary W. Pace(3)(4)(5)

California, USA | | January 2002 | | Dr. Pace is a Director of ResMed Inc. and Pacira Pharmaceuticals, Inc.; from 2002 to 2013, co-founder and Director of QrxPharma Ltd. | | 73,599 |

Notes:

| (1) | If the director is elected, the term of the director’s appointment will expire at the Corporation’s 2016 Annual Meeting of Shareholders. |

| (2) | All of the directors, except for Dr. Cruz, are independent directors. |

| (3) | Member of the Audit Committee. Mr. Henley is Chair of this Committee. |

| (4) | Member of the Corporate Governance and Nominating Committee. Mr. Ashton is the Chair of this Committee. |

| (5) | Member of the Compensation Committee. Mr. Baehr is Chair of this Committee. |

Corporate Cease Trade Orders or Bankruptcies

None of the above proposed directors are, or within 10 years prior to the date of this Circular have been, a director, chief executive officer or chief financial officer of any company that, while such person was acting in that capacity, was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant issuer access to any exemption under securities legislation for a period, of more than 30 consecutive days.

None of the above proposed directors are, or within 10 years prior to the date of this Circular have been, a director, chief executive officer or chief financial officer of any company that was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant issuer access to any exemption under securities legislation for a period, of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

None of the above proposed directors are, or within 10 years prior to the date of this Circular have been, a director or executive officer of any company that, while acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Personal Bankruptcies

None of the above proposed directors have, within 10 years prior to the date of this Circular, become bankrupt, made a proposal under any bankruptcy or insolvency legislation, been subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold their assets.

Penalties and Sanctions

None of the above proposed directors, within 10 years prior to the date of this Circular, have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or have entered into a settlement agreement with a securities regulatory authority, or any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Appointment and Remuneration of the Auditors

PricewaterhouseCoopers LLP, Chartered Professional Accountants, have been the auditors of the Corporation since December 2005. The Board has proposed that PricewaterhouseCoopers LLP be reappointed as the Corporation’s independent auditors for the year ending June 30, 2016 and that the Board be authorized to fix the auditors’ remuneration. A majority of the votes cast by the Shareholders represented at the Meeting is required for approval of the appointment of the Corporation’s auditors.

Unless otherwise directed, the persons named in the enclosed form of proxy intend to vote at the Meeting in favour of the reappointment of PricewaterhouseCoopers LLP as the Corporation’s auditors and the authorization of the Corporation’s directors to fix the auditors’ remuneration.

Approval of Unallocated Stock Options

The Corporation has in place a stock option plan (the “StockOptionPlan”) which was established in 1999 and last amended by approval of the Shareholders at the annual Shareholders’ meeting held on December 11, 2012. Option grants and the maximum number of Common Shares that may be issued pursuant to stock options are governed by the terms of the Stock Option Plan. Please see "Description of the Stock Option Plan" (below) for a detailed description of the Stock Option Plan.

As the Stock Option Plan is a "rolling" plan, the Toronto Stock Exchange (the "TSX") requires that all unallocated options, rights or other entitlements under the Stock Option Plan be approved by a corporation's shareholders every three years from its institution and thereafter. The unallocated options, rights or other entitlements under the Stock Option Plan were last re-approved at the 2012 annual meeting of the Corporation. As a result of the foregoing, the Corporation will place the unallocated options, rights or other entitlements under the Stock Option Plan before Shareholders for their approval at the Meeting.

The text of the proposed resolution to approve all unallocated options, rights and other entitlements thereunder (the "Stock Option Plan Resolution") is as follows:

"BE IT RESOLVED THAT:

| 1. | all unallocated options, rights or other entitlements under the Stock Option Plan (as defined in the management information circular of Transition Therapeutics Inc. (the "Corporation") dated November 5, 2015) are hereby approved, which approval shall be effective until December 10, 2018; and |

| 2. | any one director or officer of the Corporation is hereby authorized, for and on behalf of the Corporation, to execute and deliver all such documents and instruments and to do all other things as in the opinion of such director or officer may be necessary or desirable to implement these resolutions and the matters authorized hereby, such determination to be conclusively evidenced by the execution and delivery of any such document or instrument, and the taking of any such action." |

Approval of the Stock Option Plan Resolution will require the affirmative vote of a majority of the votes cast thereon at the Meeting. This approval will be effective for three years from the date of the Meeting. If approval is not obtained at the Meeting: (i) options which have not been allocated as of November 5, 2015; and (ii) options which are outstanding as of November 5, 2015 and are subsequently cancelled, terminated or exercised, will not be available for a new grant of options. Previously allocated options under the Stock Option Plan will continue to be unaffected by the approval or disapproval of the Stock Option Plan Resolution.

The Board recommends that Shareholders vote in favour of the Stock Option Plan Resolution and, unless otherwise indicated, the persons named in the enclosed form of proxy will vote in its favour.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Governance

Compensation of the executive officers is determined by the Board upon recommendations made by the Compensation Committee. The Compensation Committee is comprised of:

Mr. Michael Ashton

Mr. Paul Baehr

Mr. Christopher Henley

Dr. Gary Pace

Each member has director and officer experience with various public and private companies in the design and implementation of executive compensation plans.

The Compensation Committee exercises general responsibility regarding overall compensation of employees and executive officers of the Corporation. It annually reviews and recommends to the Board: (i) executive compensation policies, practices and overall compensation philosophy; (ii) total compensation packages for all employees who receive aggregate annual compensation in excess of $150,000; (iii) bonuses and grants of options under the Stock Option Plan; and (iv) major changes in benefit plans. Final approval of all compensation items rests with the full Board.

The Corporation’s executive compensation policies are designed to attract and retain competent individuals, be competitive with leading biotechnology companies and recognize individual and overall corporate performance. The Corporation’s policy with regard to remuneration is to review each executive officer’s remuneration on an annual basis in terms of individual and corporate performance as well as against peer company comparables to ensure that the officers are reasonably compensated. Each year, the Compensation Committee compares the total compensation of the executive officers with that of executive officers at peer surveyed biotechnology companies for reasonableness. The Compensation Committee reviews the Corporation’s peer group on an annual basis to ensure the Corporation compares itself with industry-appropriate peers of comparable size, revenue, market capitalization and stage of product pipeline. The Corporation’s peer group for fiscal 2015 consisted of the following 18 public companies:

Aeterna Zentaris Inc.

Anthera Pharmaceuticals Inc.

Catalyst Pharmaceutical Partners Inc.

Cytokinetics, Incorporated

Idera Pharmaceuticals Inc.

IntelliPharmaCeutics International Inc.

Oncolytics Biotech Inc.

Resverlogix Corp.

Synthetic Biologics Inc. | Anacor Pharmaceuticals Inc.

Athersys Inc.

Chelsea Therapeutics International Ltd.

CytRx Corporation

Insmed Incorporated

Neuralstem, Inc.

QLT Inc.

Rexahn Pharmaceuticals Inc.

Tekmira Pharmaceuticals Corporation. |

The executive officers’ compensation is composed of salaries, bonuses and stock options. The Compensation Committee balances the need for short term performance incentives in the form of cash bonuses and salary increases with long term retention/performance incentives, which consist of option grants. Base salaries and benefits are set taking into account the median of comparator companies in the Corporation’s peer group. A major portion of senior executive compensation, however, is variable; the total amount received is directly influenced by the results of the Corporation and the executive officer’s own performance.

In terms of bonuses, each year the Compensation Committee establishes overall corporate goals. In addition, the Corporation establishes individual goals with each executive officer which relate to the executive officer’s direct area of responsibility. In fiscal 2015, the maximum bonus that can be earned by the executive officers, except for the Chief Executive Officer, is 20% of base salary and the percentage of bonus achieved is based on the percentage of goals achieved with a weighting to corporate goals of 67% and to individual goals of 33%. In addition, at least 40% of the corporate goals must be achieved for any bonus to be paid out. The bonus of the Chief Executive Officer is approved by the Compensation Committee and the Board on an annual basis. A summary of the fiscal 2015 corporate goals and associated weightings are outlined in the table below:

| Corporate Performance Objectives |

| Objectives | | Associated Weighting | |

Pre-Clinical & Clinical Development | | | 60 | % |

| Partnering | | | 15 | % |

| Corporate Development & Financial | | | 25 | % |

| Total | | | 100 | % |

Stock options under the Stock Option Plan are granted by the Board, upon the recommendation of the Compensation Committee, from time to time, as the primary long term performance incentive compensation program. The Compensation Committee and the Board take into account the amount and terms of outstanding options when determining whether and how many new option grants will be made.

Chief Executive Officer’s Compensation

During the year ended June 30, 2015, the Chief Executive Officer received an increase in base salary of $12,054 from the year ended June 30, 2014. In respect of work performed during the year ended June 30, 2015, 100% of the corporate goals were achieved thus the maximum bonus entitlement of $124,158 was paid to the Chief Executive Officer.

For fiscal 2016, the Chief Executive Officer can earn a maximum bonus of 30% of his base salary and the achievement of this bonus is 100% dependent on the achievement of set corporate goals, which have been determined by the Compensation Committee and the Board.

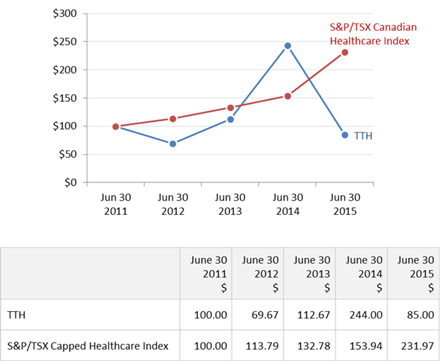

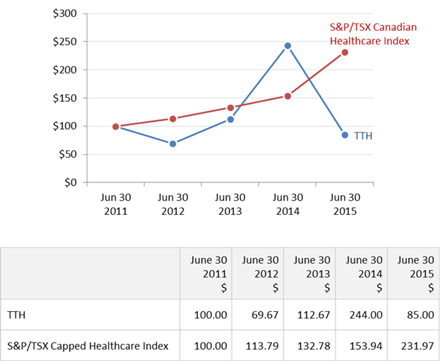

Performance Graph

The following graph compares the cumulative total Shareholder return of $100 invested in the Common Shares with the cumulative total return of the S&P/TSX Canadian Health Care Index for the period of June 30, 2011 to June 30, 2015.

Option-Based Awards

Option based awards were granted to executives, officers and directors of the Corporation during fiscal 2015. In assessing the grant of options, the Compensation Committee and the Board take into account factors such as existing grants, performance and market conditions.

Risk Assessment and Oversight

The Board does not believe that the Corporation's compensation programs encourage excessive or inappropriate risk taking as: (i) the Corporation's employees receive both fixed and variable compensation, and the fixed (salary) portion provides a steady income regardless of the stock value which allows employees to focus on the Corporation's business; and (ii) the Stock Option Plan encourages a long-term perspective due to the vesting provisions of the options.

Hedging Activities

Although the Corporation does not have a policy which prohibits any Named Executive Officer (as defined below) or director from purchasing financial instruments designed to hedge or offset a decrease in market value of equity securities granted as compensation or held by the Named Executive Officer or director, no Named Executive Officer or director has entered into any such agreement.

Summary Compensation Table

The following table provides a summary of compensation earned by the Corporation’s Named Executive Officers, as that term is defined in Form 51-102F6Statement of Executive Compensation, for 2015, 2014 and 2013.

| | | | | | | | | | | | | | | Non-equity incentive plan

compensation

($) | | | | | | | | | | |

| Name and Principal Position | | Year | | | Salary

($) | | | Share-

based

awards

($) | | | Option-

based

awards

($) | | | Annual

incentive

plans | | | Long-term

incentive

plans | | | Pension

value

($) | | | All other

compensation

($) | | | Total

compensation | |

Tony Cruz,

Chief Executive Officer | | | 2015 | | | | 413,860 | | | | — | | | | 426,755 | | | | 124,158 | | | | — | | | | — | | | | 1,350 | (3) | | | 966,123 | |

| | | | 2014 | | | | 401,806 | | | | — | | | | 664,500 | | | | 120,542 | | | | — | | | | — | | | | 1,174 | (3) | | | 1,188,022 | |

| | | | 2013 | | | | 390,103 | | | | — | | | | 198,000 | | | | 117,031 | | | | — | | | | — | | | | 1,174 | (3) | | | 706,308 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nicole Rusaw

Chief Financial Officer | | | 2015 | | | | 204,000 | | | | — | | | | 243,860 | | | | 40,800 | | | | — | | | | — | | | | — | | | | 488,660 | |

| | | | 2014 | | | | 190,962 | | | | — | | | | 221,500 | | | | 38,192 | | | | — | | | | — | | | | 1,174 | (3) | | | 451,828 | |

| | | | 2013 | | | | 185,400 | | | | — | | | | 92,400 | | | | 37,080 | | | | — | | | | — | | | | 1,174 | (3) | | | 316,054 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sawsan Abushakra

ELND005 Program Lead and Chief Medical Officer(1) | | | 2015 | | | | 481,258 | | | | — | | | | 274,343 | | | | 192,503 | | | | — | | | | — | | | | — | | | | 948,104 | |

| | | | 2014 | | | | 36,456 | | | | — | | | | 398,691 | | | | — | | | | — | | | | — | | | | — | | | | 435,147 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Earvin Liang

Senior Director Clinical Pharmacology(2) | | | 2015 | | | | 304,014 | | | | — | | | | 91,448 | | | | 91,204 | | | | — | | | | — | | | | — | | | | 486,666 | |

| | | | 2014 | | | | 23,029 | | | | — | | | | 66,449 | | | | — | | | | — | | | | — | | | | — | | | | 89,478 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Aleksandra Pastrak

Vice President Clinical Development & Medical Officer | | | 2015 | | | | 266,053 | | | | — | | | | 213,378 | | | | 53,211 | | | | — | | | | — | | | | 1,350 | (3) | | | 533,992 | |

| | | | 2014 | | | | 258,304 | | | | — | | | | 221,500 | | | | 51,661 | | | | — | | | | — | | | | 1,174 | (3) | | | 532,639 | |

| | | | 2013 | | | | 250,781 | | | | — | | | | 105,600 | | | | 50,156 | | | | — | | | | — | | | | 1,174 | (3) | | | 407,711 | |

Notes:

| (1) | Ms. Abushakra joined the Corporation on June 1, 2014 and was appointed ELND005 Program Lead and Chief Medical Officer. Ms. Abushakra’s employment with the Corporation was terminated on July 24, 2015 and as of that date, Ms. Abushakra owned 30,898 Common Shares. |

| (2) | Mr. Liang joined the Corporation on June 1, 2014 as the Senior Director Clinical Pharmacology. Mr. Liang’s employment with the Corporation was terminated on July 24, 2015 and as of that date, Mr. Liang owned 23,600 Common Shares. |

| (3) | Dr. Cruz, Dr. Pastrak and Ms. Rusaw receive subsidized parking from the Corporation and the subsidy represents the full amount of all other compensation disclosed. |

Outstanding Option-based Awards

The following table sets forth information with respect to stock option grants exercisable into Common Shares made to the Named Executive Officers, including awards granted before the most recently completed financial year, that were outstanding as at June 30, 2015:

| | | Option-based Awards | |

| Name | | Number of Securities

underlying

unexercised Options

(#) | | | Option

exercise price

($) | | | Option expiration

date | | Value of

unexercised in-

the-money

options($)(1) | |

| Tony Cruz | | | 150,000 | | | | 3.22 | | | May 26, 2021 | | | — | |

| | | | 250,000 | | | | 2.10 | | | June 1, 2022 | | | 112,500 | |

| | | | 75,000 | | | | 3.66 | | | June 19, 2023 | | | — | |

| | | | 150,000 | | | | 6.00 | | | June 12, 2024 | | | — | |

| | | | 70,000 | | | | 8.73 | | | March 31, 2025 | | | — | |

| | | | | | | | | | | | | | | |

| Nicole Rusaw | | | 16,000 | | | | 3.22 | | | May 26, 2021 | | | -— | |

| | | | 50,000 | | | | 2.10 | | | June 1, 2022 | | | 22,500 | |

| | | | 35,000 | | | | 3.66 | | | June 19, 2023 | | | — | |

| | | | 50,000 | | | | 6.00 | | | June 12, 2024 | | | — | |

| | | | 40,000 | | | | 8.73 | | | March 31, 2025 | | | — | |

| | | | | | | | | | | | | | | |

| Sawsan Abushakra | | | 90,000 | | | | 6.00 | | | June 12, 2024 | | | — | |

| | | | 45,000 | | | | 8.73 | | | March 31, 2025 | | | — | |

| | | | | | | | | | | | | | | |

| Earvin Liang | | | 15,000 | | | | 6.00 | | | June 12, 2024 | | | — | |

| | | | 15,000 | | | | 8.73 | | | March 31, 2025 | | | — | |

| | | | | | | | | | | | | | | |

| Aleksandra Pastrak | | | 85,000 | | | | 3.22 | | | May 26, 2021 | | | — | |

| | | | 100,000 | | | | 2.10 | | | June 1, 2022 | | | 45,500 | |

| | | | 40,000 | | | | 3.66 | | | June 19, 2023 | | | — | |

| | | | 50,000 | | | | 6.00 | | | June 12, 2024 | | | — | |

| | | | 35,000 | | | | 8.73 | | | March 31, 2025 | | | — | |

Note:

| (1) | Calculated based on the difference between the closing price of the Common Shares on the TSX on June 30, 2015 of $2.55 and the exercise price of the options. |

Officers - Option-Based Awards – Value Vested or Earned during the Year

The following table sets forth the aggregate dollar value that would have been realized if the options under the option-based award had been exercised by the following Named Executive Officers on the vesting date.

| Name | | Option-based awards – Value vested or

earned during the year

($)(1) | |

| Tony Cruz | | | 37,500 | |

| Nicole Rusaw | | | 12,750 | |

| Sawsan Abushakra | | | — | |

| Earvin Liang | | | — | |

| Aleksandra Pastrak | | | 15,000 | |

Note:

| (1) | All options that vested during the year were in the money based on the closing price of Common Shares on the TSX on June 30, 2015 of $2.55. |

Termination and Change of Control Benefits

The Corporation has an employment contract with Dr. Tony Cruz under which Dr. Cruz was paid a salary of $413,860 per year at the end of the most recently completed financial year. His employment contract has no fixed term and states that Dr. Cruz would be paid a severance payment of (a) 12 months’ salary if his employment with the Corporation is terminated without cause; or (b) 24 months’ salary if his employment is terminated following a change of control of the Corporation.

The Corporation also has an employment contract with Ms. Nicole Rusaw whereby Ms. Rusaw was paid a salary of $204,000 per year at the end of the most recently completed financial year. Her employment agreement has been in effect since June 21, 2005, has no fixed term and provides that she would be paid severance equal to one month’s salary for every year she has been employed by the Corporation, to a maximum of nine months, if her employment is terminated without cause.

The Corporation also has an employment contract with Dr. Aleksandra Pastrak whereby Dr. Pastrak was paid a salary of $266,053 per year at the end of the most recently completed financial year. Her employment contract has been in effect since October 19, 1999, has no fixed term and provides that she would be paid severance equal to one month’s salary for every year she has been employed by the Corporation if her employment is terminated without cause.

Dr. Sawsan Abushakra

Dr. Sawsan Abushakra's employment with the Corporation was terminated in July 2015. In connection with the termination, Dr. Abushakra was paid $127,542 (US$102,500) and continued to receive benefits for 3 months following the termination date.

Mr. Earvin Liang

Mr. Earvin Liang's employment with the Corporation was terminated in July 2015. In connection with the termination, Mr. Liang was paid $53,713 (US$43,167) and continued to receive benefits for 2 months following the termination date.

Estimated Termination Payments

The table below reflects amounts payable to the Named Executive Officers, assuming that their employment was terminated on June 30, 2015 without cause.

| Name | | Severance ($) | | | Accelerated

Vesting of Options

($) (1)(2) | | | Continuation of

Benefits ($) | | | Total ($) | |

| Tony Cruz (3) | | | 413,860 | | | | — | | | | 7,691 | | | | 421,551 | |

| Nicole Rusaw | | | 153,000 | | | | — | | | | 5,231 | | | | 158,231 | |

| Aleksandra Pastrak | | | 376,909 | | | | — | | | | 10,895 | | | | 387,804 | |

Notes:

| (1) | Values calculated based on the closing price of Common Shares on the TSX on June 30, 2015 of $2.55. |

| (2) | If the Named Executive Officers are terminated without cause and without a change in control, the vesting of the unvested options at the date of termination does not accelerate. In the event of a change in control of the Corporation, the unvested options outstanding will vest immediately. |

| (3) | If Dr. Cruz’s employment is terminated as a result of a change of control of the Corporation, without cause, total termination payment would be approximately $843,103, consisting of a severance payment of $827,721, accelerated vesting of options of nil, and benefit continuance of approximately $15,382. |

Compensation of Directors

The following table details the total compensation earned by each non-employee director during the year ended June 30, 2015:

| Name | | Fees

earned

($) | | | Option-based

awards

($)(1) | | | All other

compensation

($) | | | Total

($) | |

| Michael Ashton | | | 53,000 | | | | 109,482 | | | | — | | | | 162,482 | |

| Paul Baehr | | | 51,250 | | | | 109,482 | | | | — | | | | 160,732 | |

| Christopher Henley | | | 52,250 | | | | 109,482 | | | | — | | | | 161,732 | |

| Gary W. Pace | | | 43,000 | | | | 109,482 | | | | — | | | | 152,482 | |

Note:

| (1) | The fair value of the option awards granted during fiscal 2015 at the date of grant was estimated using the Black-Scholes option pricing model based on the following assumptions: expected option life of 8 years; volatility of 0.73429; risk free interest rate of 1.29% and dividend yield of 0%. |

Dr. Tony Cruz, Chief Executive Officer and a director of the Corporation, does not receive any compensation as a director of the Corporation, but receives compensation as an executive officer of the Corporation as detailed under the heading “Chief Executive Officer’s Compensation”. The remaining directors are not employees of the Corporation. Non-employee directors have been remunerated in the following manner.

Standard Arrangements

The Corporation has standard arrangements for its non-employee directors, which include the following:

| • | Board member annual retainer in the amount of $25,000 and an annual grant of stock options; |

| • | Committee Chair annual retainers – the Audit Committee Chair is paid $10,000 annually and the Corporate Governance and Nominating Committee and Compensation Committee Chairs are each paid $6,000 annually; |

| • | Board and Committee meeting fees are paid in the amount of $1,500 for each meeting attended and $750 for each conference call attended; |

| • | Travel fees of $1,000 for each meeting are paid to all non-employee directors who traveled from outside the Greater Toronto area to attend in person; and |

| • | All reasonable out of pocket expenses incurred by the non-employee directors in respect of their duties as directors are reimbursed by the Corporation. |

Director Share Ownership Guidelines

In March 2013, the Board adopted stock ownership guidelines for the directors of the Corporation. The Board believes that share ownership aligns the interests of its directors with the interests of the Corporation’s shareholders, promotes sound corporate governance and demonstrates a commitment to the Corporation. Each director was given a period of two years to acquire and maintain shares in the Corporation in an amount equal to the individual cash compensation received for the year ended June 30, 2013. As of the date hereof, all directors have met the minimum share ownership requirements.

Directors – Outstanding Option-based Awards

The following table sets forth information with respect to stock option grants exercisable into Common Shares made to the directors, including awards granted before the most recently completed financial year, that were outstanding as at June 30, 2015.

| | | Option-based Awards | |

| Name | | Number of

Securities

underlying

unexercised

Options

(#) | | | Option

exercise

price

($) | | | Option expiration date | | Value of unexercised

in-the-money

options($)(1) | |

| Michael Ashton | | | 15,000 | | | | 3.00 | | | June 30, 2021 | | | — | |

| | | | 15,000 | | | | 2.09 | | | June 30, 2022 | | | 6,900 | |

| | | | 15,000 | | | | 3.55 | | | June 30, 2023 | | | — | |

| | | | 15,000 | | | | 7.47 | | | June 30, 2024 | | | — | |

| | | | 15,000 | | | | 10.19 | | | June 14, 2025 | | | — | |

| | | | | | | | | | | | | | | |

| Paul Baehr | | | 15,000 | | | | 3.00 | | | June 30, 2021 | | | — | |

| | | | 15,000 | | | | 2.09 | | | June 30, 2022 | | | 6,900 | |

| | | | 15,000 | | | | 3.55 | | | June 30, 2023 | | | — | |

| | | | 15,000 | | | | 7.47 | | | June 30, 2024 | | | — | |

| | | | 15,000 | | | | 10.19 | | | June 14, 2025 | | | — | |

| | | | | | | | | | | | | | | |

| Christopher Henley | | | 15,000 | | | | 3.00 | | | June 30, 2021 | | | — | |

| | | | 15,000 | | | | 2.09 | | | June 30, 2022 | | | 6,900 | |

| | | | 15,000 | | | | 3.55 | | | June 30, 2023 | | | — | |

| | | | 15,000 | | | | 7.47 | | | June 30, 2024 | | | — | |

| | | | 15,000 | | | | 10.19 | | | June 14, 2025 | | | — | |

| | | | | | | | | | | | | | | |

| Gary W. Pace | | | 15,000 | | | | 3.00 | | | June 30, 2021 | | | — | |

| | | | 15,000 | | | | 2.09 | | | June 30, 2022 | | | 6,900 | |

| | | | 15,000 | | | | 3.55 | | | June 30, 2023 | | | — | |

| | | | 15,000 | | | | 7.47 | | | June 30, 2024 | | | — | |

| | | | 15,000 | | | | 10.19 | | | June 14, 2025 | | | — | |

Note:

| (1) | Calculated based on the difference between the closing price of the Common Shares on the TSX on June 30, 2015 of $2.55 and the exercise price of the options. |

Directors – Option-Based Awards – Value Vested or Earned during the Year

The following table sets forth for the aggregate dollar value that would have been realized if the options under the option-based awards had been exercised by the following directors on the vesting date.

| Name | | Option-based awards – Value vested or earned during the

year

($)(1) | |

| Michael Ashton | | | — | |

| Paul Baehr | | | — | |

| Christopher Henley | | | — | |

| Gary W. Pace | | | — | |

Note:

| (1) | All options that vested during the year were in the money based on the closing price of Common Shares on the TSX on June 30, 2015 of $2.55. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth information with respect to compensation plans under which equity securities are authorized for issuance as at June 30, 2015.

| Plan Category | | Number of Common

Shares to be issued

Upon Exercise of

Options | | | Weighted

Average Exercise

Plan of

Outstanding

Options | | | Number of Common Shares

Remaining Available for Future

Issuance Under Equity

Compensation Plans Excluding

Common Shares to be Issued

Upon the Exercise of Options | |

| Equity compensation plans approved by securityholders | | | 2,755,764 | | | | 4.82 | | | | 1,132,124 | |

DESCRIPTION OF THE STOCK OPTION PLAN

Pursuant to the Stock Option Plan, options may be granted to directors, officers, employees, members of the Scientific Advisory Board and consultants of the Corporation or affiliates of the Corporation (collectively, “Optionees” and each an “Optionee”). The term, exercise price, number of Common Shares covered by each option and the period during which the option is exercisable is determined by the Board at the time the options are granted, in accordance with the criteria set out in the Stock Option Plan. The Board approved an amendment to the Stock Option Plan to provide for the term of any option issued after December 7, 2010 to have a term not exceeding ten years. Options issued prior to December 7, 2010 have a term not exceeding five years. The exercise price of all future option grants will be equal to (i) the weighted average trading price for the five trading days prior to the date of grant or (ii) the price determined by the Board at the time of grant, provided that the option exercise price shall not be less than the fair market value for each Common Share on the date of the grant of such option, as determined in good faith by the Board.

The Stock Option Plan is a ten percent (10%) rolling plan and, therefore, the number of Common Shares reserved for issuance thereunder is equal to ten percent (10%) of the Corporation’s issued and outstanding Common Shares from time to time.

The Stock Option Plan provides that the number of Common Shares issuable to insiders, at any time, under all security based compensation arrangements, cannot exceed ten percent (10%) of the issued and outstanding securities and the number of Common Shares issued to insiders, within any one year period, under all security based compensation arrangements, cannot exceed ten percent (10%) of the issued and outstanding Common Shares. Under the Stock Option Plan, no Optionee shall be granted options in any twelve (12) month period, or shall hold options at any point in time, to purchase more than five percent (5%) of the number of Common Shares issued and outstanding from time to time and the total number of options granted to any employee performing investor relations activities or to any one consultant must not exceed two percent (2%) of the then issued and outstanding Common Shares of the Corporation in any twelve (12) month period.

Notwithstanding the specified expiry period of each option at the time of grant, the Stock Option Plan provides for the early expiry of options in certain circumstances. Options held by an officer or employee of the Corporation or one of its affiliates expire: (i) on the date of termination of employment if such employment is terminated for cause; (ii) ninety (90) days from the date such Optionee voluntarily ceases employment with the Corporation or one of its affiliates; (iii) twelve (12) months from the date of termination of employment by reason of death, disability, illness, retirement or early retirement; and (iv) six (6) months following termination without cause of such Optionee’s employment. Options held by a director or member of the Scientific Advisory Board of the Corporation or a consultant to the Corporation or one of its affiliates, provided such Optionee is not employed by the Corporation or one of its affiliates, expire: (i) twelve (12) months following the date such Optionee ceased to act in such capacity by reason of death, disability, illness, retirement or early retirement; and (ii) ninety (90) days from voluntarily ceasing to act in such capacity or being terminated without cause. The Stock Option Plan provides for an extended expiry date for options expiring during a black out period.

The Stock Option Plan does not contemplate granting financial assistance by the Corporation for the purchase of any options granted pursuant to the Plan. In addition, no option or interest therein is assignable or transferable other than by will or applicable laws of succession.

The Stock Option Plan provides that the Board may amend, suspend or terminate the Stock Option Plan, subject to obtaining any required regulatory approval, except that the following amendments require the approval of Shareholders:

| (a) | an increase in the maximum number of Common Shares issuable pursuant to the Stock Option Plan; |

| (b) | a reduction in the exercise price for options held by an Optionee; |

| (c) | an extension to the term of options held by insiders; |

| (d) | an increase in the maximum number of Common Shares issued or issuable to insiders pursuant to the Stock Option Plan; and |

| (e) | an amendment in the provisions of the amending procedures of the Stock Option Plan. |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

As at the date of this Circular, other than routine indebtedness as defined under applicable securities laws, no directors, executive officers or employees are indebted to the Corporation.

INTERESTS OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

For the purposes of this Circular, an “informed person” means: (i) a director or officer of the Corporation; (ii) a director or officer of a person or company that is itself an informed person; or (iii) any person or company who beneficially owns, directly or indirectly, and/or exercises control or direction over the Common Shares carrying more than 10% of the voting rights attaching all of the outstanding Common Shares.

Since the commencement of the Corporation’s financial year ended June 30, 2015, no informed person of the Corporation, nominee for director of the Corporation, nor any affiliate or associate of any informed person or nominee for director, had any material interest, direct or indirect, in any transaction or proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries.

INTERESTS OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Management of the Corporation is not aware of any material interest, direct or indirect, of any director or proposed nominee for director, or executive officer or anyone who has held office as such since the beginning of the Corporation’s last financial year or of any associate or affiliate of any of the foregoing in any matter to be acted on at the Meeting.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Composition of the Board

A majority of the Board, being four of the five members of the Board, are independent directors. These independent directors are Mr. Michael Ashton, Mr. Paul Baehr, Mr. Christopher Henley and Dr. Gary Pace. Dr. Tony Cruz is not independent as he is the Chief Executive Officer of the Corporation.

Dr. Cruz is the Chairman of the Board. As Dr. Cruz is not an independent director, Mr. Ashton has been appointed the lead director of the Board (the “Lead Director”). Dr. Cruz is responsible for chairing meetings of the Board and calls meetings of the Board as required between the regularly scheduled quarterly meetings, as issues of substance arise. The Lead Director is also the Chairman of the Corporate Governance and Nominating Committee. The Lead Director is responsible for the management, development and effective performance of the Board and provides leadership to the Board for all aspects of the Board’s work.

The Lead Director of the Board acts in an advisory capacity to the Chief Executive Officer and to other officers in all matters concerning the interests of the Board and relationships between management and the Board.

In fiscal 2015, the full Board met 12 times, excluding resolutions evidenced in writing by the signature of all the directors. Dr. Tony Cruz, Mr. Michael Ashton and Mr. Paul Baehr attended all of the meetings and Dr. Gary Pace and Mr. Christopher Henley attended 11 of the meetings.

The Board regularly holds in-camera sessions where management and non-independent Board members are excused from scheduled meetings. During fiscal 2015, four in-camera sessions were held.

The Audit, Corporate Governance and Nominating, and Compensation Committees met four times, one and three times, respectively. All of those meetings were attended by all members of the respective committees, except for Mr. Paul Baehr who attended three of the four Audit Committee meetings held.

The Board functions independently as a majority of the members of the Board are not involved in management. Also, when appropriate, the Board excuses management from meetings and conducts business and makes decisions exclusive of management.

The directors are also directors of other reporting issuers, as follows:

| Director | | Other Reporting Issuers |

| Mr. Michael Ashton | | Hikma Pharmaceuticals, PLC |

| Mr. Paul Baehr | | IBEX Technologies Inc. |

| Dr. Gary Pace | | Pacira Pharmaceuticals Inc ResMed Inc. |

Board Mandate

The Board has adopted a “Mandate for the Board” (the “Board Mandate”) which states that the Board has the responsibility to oversee the conduct of the business of the Corporation and to oversee the activities of management who are responsible for the day-to-day conduct of the business of the Corporation. The Board Mandate further states that the Board operates by delegating certain of its authorities to management and by reserving certain powers to itself. The Board retains the responsibility of managing its own affairs including selecting its Chairman, nominating candidates for election to the Board, constituting committees of the full Board and determining compensation for the directors. Subject to the Corporation’s constating documents, the Board may constitute, seek the advice of and delegate powers, duties and responsibilities to committees of the Board.

The Board Mandate further states that the Board’s fundamental objectives are to enhance and preserve long-term shareholder value, to ensure the Corporation meets its obligations on an ongoing basis and that the Corporation operates in a reliable and safe manner. The Board Mandate further states that in performing its functions, the Board should also consider the legitimate interests that other stakeholders such as employees, customers and communities may have in the Corporation. In broad terms, the stewardship of the Corporation involves the Board in strategic planning, financial reporting, risk management and mitigation, senior management determination, communication planning and internal control integrity.

The full text of the Board Mandate is attached as Appendix “A” to this Circular.

The Board may also perform any other activities consistent with its mandate, theBusiness Corporations Act (Ontario), the Corporation’s constating documents and any other governing laws as the Board determines necessary or appropriate.

Position Descriptions

The Board, as a whole, has created a written mandate for each Committee and terms of reference for the Chairman of each Committee of the Board. The terms of reference for each Committee Chairman describe the qualifications for appointment, his reporting responsibilities, the function of the Chairman and his key responsibilities.

The Board has adopted a formal position description for the Chief Executive Officer and sets objectives which the Chief Executive Officer is responsible for meeting. The Board adopts and annually reviews a strategic planning process and approves the strategic plan, which takes into account, among other things, the opportunities and risks of the business. This process is undertaken in consultation with the Chief Executive Officer.

Orientation and Continuing Education of Board Members

The Corporation currently has a process of orientation and education for new members of the Board. When a new member joins the Board, the member has a meeting with the management of the Corporation. This meeting includes an orientation of the business, strategy, financials and history of the Corporation as well as a question and answer period. The new member also meets with the Board and with each Committee, to which the new board member is appointed, to discuss with the Board/Committee its mandates, policies and procedures. New Board members are also given a copy of the Corporation’s Governance Manual, the Board Mandate and the individual Committee Mandates. Any further orientation and/or education is dependent on the needs of the new member and may include items such as formal training sessions and attendance at seminars.

Measures to Encourage Ethical Business Conduct

The Board has adopted a “Code of Business Conduct and Ethics” (the “Code”) for the directors, officers and employees of the Corporation. A person or company may obtain a copy of the Code by contacting Nicole Rusaw, Chief Financial Officer, at 101 College Street, Suite 220, Toronto, Ontario, M5G 1L7, (416) 260-7770. The Board has implemented a whistleblower policy (the “Whistleblower Policy”) whereby the Corporate Governance and Nominating Committee receives, retains, investigates and acts on complaints and concerns of employees, shareholders and members of the public (“Reports”) regarding: (a) accounting, internal accounting controls and auditing matters, including those regarding the circumvention or attempted circumvention of internal accounting controls or that would otherwise constitute a violation of the Corporation’s accounting policies (an“Accounting Allegation”); (b) compliance with legal and regulatory requirements (a“Legal Allegation”); and (c) retaliations against employees who make Accounting Allegations or Legal Allegations. Any Report that is made directly to management, whether openly, confidentially or anonymously, shall be promptly reported to the Corporate Governance and Nominating Committee and any Report, whether made to management or the Corporate Governance and Nominating Committee, will be reviewed by the Corporate Governance and Nominating Committee, which may, in its discretion, consult with any member of management who is not the subject of the Legal or Accounting Allegation and which may have appropriate expertise to assist the Corporate Governance and Nominating Committee. The identity of any person or group who makes a Report anonymously will not, unless required by a judicial or other legal process, be revealed by any member of the Corporate Governance and Nominating Committee and will remain confidential and the Corporate Governance and Nominating Committee will not make any effort, or tolerate any effort made by any other person or group, to ascertain the identity of any such person. The Whistleblower Policy forms part of the Corporation’s employee handbook.

In the event a conflict of interest arises with a director regarding a proposed transaction or agreement of the Corporation, the director will govern himself in accordance with theBusiness Corporations Act (Ontario) and abstain from voting on any such matter.

Nomination of Board Members

The Corporate Governance and Nominating Committee determines who shall be nominated for election to the Board. The Corporate Governance and Nominating Committee’s primary duties and responsibilities are to: (a) review and make recommendations to the Board in respect of the governance of the Corporation; (b) propose to the full Board nominees to the Board; (c) assess directors on an on-going basis; and (d) approve the hiring of special counsel by the other committees of the Board. The Corporate Governance and Nominating Committee is comprised entirely of independent directors: Mr. Michael Ashton, Mr. Paul Baehr, Mr. Christopher Henley and Dr. Gary Pace.

The Board reviews its size on an on-going basis, and at least annually, with a view to determining the impact of the number of directors upon effectiveness.

Determination of Compensation of Directors and Officers

The Board has a Compensation Committee with a mandate for reviewing the adequacy and form of compensation of directors and officers at least on an annual basis. The Compensation Committee reports its findings to the full Board and recommends compensation which is appropriate for the responsibilities and risks assumed by the directors. The Compensation Committee is comprised entirely of independent directors: Mr. Paul Baehr, Mr. Michael Ashton, Mr. Christopher Henley and Dr. Gary Pace.

The Compensation Committee’s primary duties and responsibilities are to review and make recommendations to the Board in respect of: (a) human resource policies, practices and structures (to monitor consistency with the Corporation’s goals and near and long term strategies, support of operational effectiveness and efficiency, and maximization of human resources potential); (b) compensation policies and guidelines; (c) management incentive and perquisite plans and any non-standard remuneration plans; (d) senior management, executive and officer appointments and their compensation; (e) management succession plans, management training and development plans, termination policies and termination arrangements; (f) the Corporation’s senior human resource (organizational) structure; and (g) Board compensation matters. The Compensation Committee makes recommendations with respect to the compensation of the executive officers and the Board to the Board, which gives final approval with respect to any executive compensation and directors’ compensation matters and issues. The Board has adopted a “Mandate for the Compensation Committee”.

Further information regarding the activities of the Compensation Committee is provided under the heading “Compensation Discussion and Analysis” (above).

Assessment of Directors, the Board and Board Committees

The Board has developed a formal questionnaire to be completed by each director on an annual basis for the purpose of formally assessing the effectiveness of the Board as a whole, committees of the Board, and the contribution of individual directors. These questionnaires, and the issues arising therefrom, are intended to be reviewed and assessed by the Lead Director on an annual basis or more frequently from time to time as the need arises. The Lead Director takes appropriate action as required based on the results obtained.

Director Term Limits

The Corporation does not impose term limits on its directors as it views term limits as an arbitrary mechanism for removing directors that could result in valuable, experienced directors being forced to leave the Board solely because of length of service. Instead, the Corporation believes that directors should be assessed based on their ability to continue to make a meaningful contribution. The annual elections by the Shareholders are a more meaningful way to evaluate the performance of directors and to make determinations about whether a director should be removed due to under-performance.

Policies Regarding Representation of Women

The Corporate Governance and Nominating Committee believes that a high performance board is comprised of directors with a wide variety of experiences, views and backgrounds which, to the extent practicable, reflects the gender, ethnic, cultural and other personal characteristics of the communities in which the Corporation operates. On that basis, the Corporate Governance and Nominating Committee seeks to identify and nominate candidates based on merit, performance and diversity.

The Corporate Governance and Nominating Committee considers gender as part of its overall recruitment and selection process in respect of its Board and senior management. However, the Board does not believe that, at this time, a formal policy will assist in the identification or selection of the best candidates nor would it further enhance gender diversity beyond the current recruitment and selection process carried out by the Corporate Governance and Nominating Committee. The Board is mindful of the benefit of diversity on the Board and senior management of the Corporation and the need to maximize the effectiveness of the Board and management and their respective decision-making abilities.

The Corporate Governance and Nominating Committee believes a high performance Board and management team will be achieved through continuously monitoring the level of female representation on the Board and in senior management positions and, where appropriate, recruiting qualified female candidates as part of the Corporation’s overall recruitment and selection process to fill Board or senior management positions, as the need arises, through vacancies, growth or otherwise. Due to the size of the Corporation and its activities, the Corporation has not yet set measurable objectives for achieving gender diversity on the Board or senior management. The Corporation will consider establishing measureable objectives in the future.

At the senior management level, two of the five (40%) members of the senior management team are female. Currently, none (0%) of the directors of the Corporation are female.

ADDITIONAL INFORMATION

Additional information relating to the Corporation is on SEDAR at www.sedar.com. Further information concerning the Audit Committee of the Corporation, including the text of the Audit Committee Charter, is included in the Annual Information Form of the Corporation for the year ended June 30, 2015 dated September 14, 2015 under the heading “Audit Committee”, which is also available on SEDAR at www.sedar.com. The Corporation’s Annual Report to Shareholders for the year ended June 30, 2015 is being mailed to shareholders of the Corporation along with this Circular. The Annual Report to Shareholders contains financial information about the Corporation including the audited consolidated financial statements and management discussion and analysis of the Corporation for the year ended June 30, 2015 and the report thereon of PricewaterhouseCoopers LLP. To request copies of the Corporation’s financial statements and management discussion and analysis, Shareholders may contact the Corporation by email at info@transitiontherapeutics.com or Nicole Rusaw, Chief Financial Officer, at 101 College Street, Suite 220, Toronto, Ontario, M5G 1L7, (416) 260-7770.

DIRECTORS’ APPROVAL

The contents and the sending of this Circular have been approved by the Board of Directors of the Corporation.

Dated as of November 5, 2015.

| |  |

| | Dr. Tony Cruz

Chief Executive Officer |

APPENDIX “A”

MANDATE OF THE BOARD OF DIRECTORS

Policy Statement

The Board of Directors (the “Board”) of Transition Therapeutics Inc. (the “Corporation”) has the responsibility to oversee the conduct of the business of the Corporation and to oversee the activities of management who are responsible for the day to day conduct of the business of the Corporation.

Composition and Operation

The Board is to be constituted of a majority of individuals who qualify as independent directors. An independent director is one who is independent of management and is free from any interest and any business or other relationship, which could or could reasonably be perceived to materially interfere with the director’s ability to act with a view to the best interest of the Corporation other than interest and relationships arising from shareholdings.

The Board operates by delegating certain of its authorities to management and by reserving certain powers to itself. The Board retains the responsibility of managing its own affairs including selecting its Chairman, nominating candidates for election to the Board, constituting committees of the full Board and determining compensation for the directors. Subject to the Corporation’s constating documents, the Board may constitute, seek the advice of and delegate powers, duties and responsibilities to committees of the Board.

Responsibilities

The Board’s fundamental objectives are to enhance and preserve long term shareholder value, to ensure the Corporation meets its obligations on an ongoing basis and that the Corporation operates in a reliable and safe manner. In performing its functions, the Board should also consider the legitimate interests its other stakeholders such as employees, creditors, partners and communities may have in the Corporation. In broad terms, the stewardship of the Corporation involves the Board in strategic planning, financial reporting, risk management and mitigation, senior management determination, communication planning and internal control integrity.

Discharge of Duties

In contributing to the Board’s discharging of its duties under this Mandate, each Member of the Board shall be obligated only to exercise the care, diligence and skill that a responsibly prudent person would exercise in comparable circumstances. Nothing in this Mandate is intended, or may be construed, to impose on any Member of the Board a standard of care or diligence that is in any way more onerous or extensive than the standard which all Board Members are otherwise subject.

Reliance on Experts

In contributing to the Board’s discharging of its duties under this Mandate, each Member shall be entitled to rely in good faith upon:

| (a) | representations made to him by an officer of the Corporation, |

| (b) | any report of a lawyer, accountant, engineer, appraiser or other person whose profession lends credibility to a statement made by any such person. |

Specific Duties

| (a) | the Board has the oversight responsibility for meeting the Corporation’s legal requirements and for properly preparing, approving and maintaining the Corporation’s documents and records. |

| (b) | The Board has the responsibility to: |

| i. | manage the business and affairs of the Corporation; |

| ii. | act honestly and in good faith with a view to the best interests of the Corporation; |

| iii. | exercise the care, diligence and skill that responsible, prudent people would exercise in comparable circumstances; and |

| iv. | act in accordance with its obligations contained in the Corporation’s constating documents and all relevant legislation and regulations. |

| (c) | The Board has the responsibility for considering the following matters as a full Board which may not be delegated to management or to a committee of the Board: |