UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): October 31, 2008

LIHUA INTERNATIONAL, INC.

(Exact name of registrant as specified in charter)

Delaware

(State or other jurisdiction of incorporation)

000-52650 (Commission File Number) | 14-1961536 (IRS Employer Identification No.) |

| c/o Lihua Holdings Limited, Houxiang Five-Star Industry District, |

| Danyang City, Jiangsu Province, PRC. |

| |

| (Address of principal executive offices and zip code) |

| +86-511-86317399 |

| |

| (Registrant’s telephone number including area code) |

| 712 Fifth Avenue |

| New York, NY 10019 |

| |

| (Former Name and Former Address) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| £ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| £ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| £ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| £ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Explanatory Note

Lihua International, Inc. is filing this Current Report on Form 8-K/A to amend the Current Report on Form 8-K initially filed with the Securities Exchange Commission on November 7, 2008 to (i) update Item 5.01 as appropriate, including the Management’s Discussion and Analysis of Financial Conditions and Results of Operations for the three and nine months ended September 30, 2008, (ii) include the unaudited condensed and consolidated financial statements of the Company’s wholly-owned subsidiary and its operating company, Ally Profit Investments Limited, a British Virgin Islands corporation (“Ally Profit”), and its subsidiaries, as of September 30, 2008, and (iii) include the combined pro forma financial statements of Ally Profit and its subsidiaries for the period ended September 30, 2008.

Item 5.01 Changes In Control of the Registrant

On the Closing Date, we consummated the transactions contemplated by the Exchange Agreement, pursuant to which we acquired all of the issued and outstanding ordinary shares of Ally Profit in exchange for the issuance of 14,025,000 shares of our Common Stock to the Ally Profit Shareholder, representing approximately 93.5% of our issued and outstanding shares of Common Stock.

Other than the transactions and agreements disclosed in this Form 8-K, we know of no arrangements which may result in a change in control at a subsequent date.

Business Overview

We are primarily engaged in the value-added manufacturing of bimetallic composite conductor wire, such as copper clad aluminum (“CCA”) fine wire, CCA magnet wire and CCA tin plated wire and sales to distributors in the wire and cable industries and to manufacturers in the consumer electronics, white goods, automotive, utility, telecommunications and specialty cable industries. We anticipate that we will begin operations by the end of the first quarter of 2009 utilizing refined, or recycled, copper to manufacture and sell low content oxygen copper cable and copper magnet wire to our existing customer base.

Copper is one of the most widely used metals in the world. Copper’s chemical, physical and aesthetic properties make it attractive for many domestic, industrial and high-end technology applications. Some of the major uses of copper include: electronics and communications, construction, transportation, and industrial equipment. About three quarters of total copper use is accounted for by electrical uses, including power transmission and generation, building wiring, telecommunication, and electrical and electronic products, Building construction is the single largest market, followed by electronics and electronic products, transportation, industrial machinery, and consumer and general products.

In 2006, China consumed 627,000 tons more than it produced. This shortfall is satisfied through recycling of copper as well copper imports which are more expensive due to freight costs. China’s growth is expected to continue driving strong copper consumption in the coming years. These factors should contribute to the continued search and adoption of alternatives to pure copper, such as bimetallic composite conductor wire, that can meet China’s demand in a less costly manner. In addition, we will also seek to capitalize on the large demand for copper in China by entering the market as a low cost provider of pure copper products.

Growth Strategy

Our goal is to become a worldwide leader in the CCA magnet wire industry. We seek to grow our Lihua Electron business in the following manner:

| o | Manufacturing. We will strive to maintain and expand our profit margins by enhancing equipment management, optimizing processes and product structures, perfecting the supplier system and cutting production costs. |

| | |

| o | Capacity Expansion. Since our production lines have been running at full capacity for several years we intend to increase the number of production lines to better meet strong customer demand. |

Corporate Structure

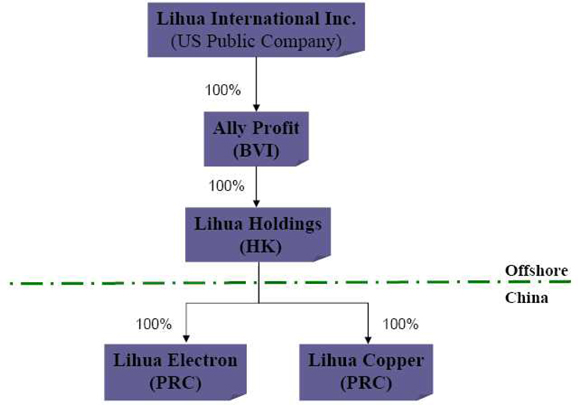

The following diagram illustrates our corporate structure:

Company Background

On October 31, 2008 we entered into the a Share Exchange Agreement (the “Exchange Agreement”) with Ally Profit Investments Limited, a British Virgin Islands company ("Ally Profit”), Magnify Wealth Enterprise Limited, the sole shareholder of Ally Profit (the “Ally Profit Shareholder”, or “Magnify Wealth”), which owns shares constituting 100% of the issued and outstanding ordinary shares of Ally Profit (the “Ally Profit Shares”), and our principal stockholders. Pursuant to the terms of the Exchange Agreement, the Ally Profit Shareholder transferred all of the Ally Profit Shares to us in exchange (the “Share Exchange”) for the issuance of 14,025,000 shares of our Common Stock, par value $0.0001 per share to the Ally Profit Shareholder. As a result of the Share Exchange, Ally Profit became our wholly-owned subsidiary and the Ally Profit Shareholder acquired approximately 93.5% of our issued and outstanding stock.

Immediately after the Share Exchange, we entered into a securities purchase agreement with certain accredited investors for the issuance and sale in a private placement of units, consisting of, in the aggregate, 6,818,182 shares of Series A Convertible Preferred Stock, par value $0.0001 per share and Series A warrants to purchase up to 1,500,000 shares of Common Stock, for aggregate gross proceeds of approximately $15,000,000.

Prior to the Share Exchange, we were a “blank check” company with nominal assets. We were incorporated in the State of Delaware on January 24, 2006 for the purpose of raising capital to be used to merge, acquire, or enter into a business combination with an operating business. Ally Profit was incorporated in the British Virgin Islands on March 12, 2008 under the Business Companies Act, 2004. In June 2008, Ally Profit became the parent holding company of a group of companies comprised of Lihua Holdings Limited, a company organized under the laws of Hong Kong, which is the 100% shareholder of each of Lihua Electron and Jiangsu Lihua Copper, each a limited liability company organized under the existing laws of the Peoples Republic of China Lihua Electron, together with Lihua Copper are, the “PRC Subsidiaries”).

As a result of the Share Exchange, Ally Profit became our wholly owned subsidiary and we acquired the business and operations of Ally Profit and its PRC Subsidiaries. Lihua Electron is a leading value-added manufacturer of bimetallic composite conductor wire, such as copper clad aluminum (“CCA”) fine wire, CCA magnet wire and CCA tin plated wire. Lihua Electron sells to distributors in the wire and cable industries and to manufacturers in the consumer electronics, white goods, automotive, utility, telecommunications and specialty cable industries. Lihua Copper, our other PRC subsidiary, which we anticipate will begin operations by the end of the first quarter 2009, will utilize refined, or recycled, copper to manufacture and sell low content oxygen copper cable and copper magnet wire to Lihua Electron’s existing customer base.

Industry and Market Overview

Copper is one of the most widely used metals in the world. Copper’s chemical, physical and aesthetic properties make it attractive for many domestic, industrial and high-end technology applications. Some of the major uses of copper include: electronics and communications, construction, transportation, and industrial equipment. About three quarters of total copper use is accounted for by electrical uses, including power transmission and generation, building wiring, telecommunication, and electrical and electronic products, Building construction is the single largest market, followed by electronics and electronic products, transportation, industrial machinery, and consumer and general products.

The following chart illustrates world copper production by product type in 2006:

From 2002 to 2007, the global refined usage of copper has grown approximately 3.1% per year. The continued urbanization of China and India should provide strong demand for copper over the foreseeable future. According to the “China Economic Review,” China, with a forecasted GDP growth of approximately 8% to 9% in 2009, should lead this trend. China’s economic growth and urbanization continue to drive solid demand for copper, which is estimated to double by 2015 to 8 million tons. According to Standard Chartered Bank, China is the world’s largest consumer of copper. In 2007, China’s refined copper consumption grew 13% from 2006 to 4 million tons, representing 22% of global consumption. Based on data provided by the International Copper Study Group (“ICSG”), China’s mine production totaled 844,000 tons of copper in 2006, which is approximately 5.6% of world production. In 2006, China consumed 627,000 tons more than it produced. This shortfall is satisfied through recycling of copper as well copper imports which are more expensive due to freight costs. China’s growth is expected to continue driving strong copper consumption in the coming years. These factors should contribute to the continued search and adoption of alternatives to pure copper that can meet China’s demand in a less costly manner.

Pure copper wire has historically been the dominant product for use in the wire and cable industry due to its electrical conductivity and corrosion resistance. However, due in part to rising copper prices, constrained copper supply and the search for lighter alternatives to pure copper, end-user manufacturers in the industry have begun pursuing and adopting alternative technologies.

Magnet Wire Market

In 2006, the world consumed over $10 billion worth of magnet wire which is primarily used in motors, transformers and other common electrical parts. According to Gobi International, China has the largest demand for magnet wire which is forecasted to grow by 38.3% from 2007 to 2012, the highest among all major economies. Bimetallic materials are an ideal substitute for pure copper or more specifically, for magnet wire that can satisfy China’s demand. Bimetallic materials have been in existence for decades, but until recently they have only been selectively adopted due to higher production costs and historically low copper prices. However, as the price of copper has increased in recent years, companies have started to use bimetallics and learn about their benefits. Based on data provided by the London Metal Exchange, the average annual price of copper has surged by over 300% between 2002 and 2007. During this same period the price of aluminum, however, has increased by less than 150%. This price differential has made bimetallic wires, especially CCA wires that contain an aluminum core, an inexpensive alternative. Aside from the price advantage, bimetallic wires also offer greater value to end-users compared to traditional copper wires by weighing less while retaining the corrosion resistance and electrical conductivity of pure copper wires.

Lihua Copper will seek to capitalize on the large demand for copper in China by entering the market as a low cost provider of pure copper products. Copper is among the few materials that does not degrade or lose its chemical or physical properties in the recycling process. As such, copper is one of the most recycled of all metals. Copper scrap derives from either metals discarded in semi fabrication or finished product manufacturing processes or obsolete end-of-life products. Refined copper production attributable to recycled scrap feed, classified as “secondary copper production,” utilizes processes similar to those employed for primary production. It produces recycled, or refined, copper that cannot be distinguished from primary copper once reprocessed. Therefore, recycling has the potential to extend the use of copper, resulting in energy savings, and contributing to provide a sustainable source of metal for future generations. The ICSG believes that assuming an average life span of 30 years for most copper-based products, copper’s truer recycling rate could be as high as 85%. This demonstrates the high potential and sustainability of copper recycling as a necessary and beneficial complement to primary copper production.

In recent decades, an increasing emphasis has been placed on the sustainability of material uses in which the concept of reuse and recycling of metals plays an important role in the material choice and acceptance of products. This trend is very likely to continue and will have a major impact on future copper consumption. According to the ICSG, 34% of copper consumption came from recycled copper in 2005. It is also estimated that in 2006, at the refinery level, secondary copper refined production may have reached around 15% of total copper refined production. Considering the highly cost-efficient nature of secondary copper production, it should be reasonable to expect that percentage to grow in the future.

Lihua Electron operates in the bimetallic wire manufacturing industry. The bimetallic wire industry can be characterized as fast-growing on a worldwide basis and specifically in China where there is considerable fragmentation. A significant barrier to entry into this industry is technology specifically with respect to drawing, annealing and coating the CCA wire. For many product offerings, there is significant differentiation among industry participants from a manufacturing, technological and quality standpoint.

Because of the benefits of bimetallic wire, we believe there are substantial opportunities to capture increasing market share in applications that have historically been dominated by traditional copper wire. As a bimetallic value-added manufacturer with leading technologies, increasing capacity, and a management team with over 75 years of copper industry experience, we believe we are well positioned to capitalize on the growing bimetallic demand worldwide.

Products

Lihua Electron Products

Lihua Electron is engaged in the manufacture and sale of bimetallic composite conductor wire, such as CCA fine wire, CCA magnet wire and CCA tin plated wire. CCA is an electrical conductor consisting of an outer sleeve of copper that is metallurgically bonded to a solid aluminum core. Over the past five years CCA has become a viable and popular alternative to pure copper wire. In comparison with solid copper wire, CCA raw material normally costs 35% to 40% less per ton. Additionally, CCA and pure copper raw materials are both purchased based on weight. Since aluminum accounts for approximately eighty six percent (86%) by volume of CCA wire each ton of CCA wire can yield 2.5 times more length than each ton of solid copper wire. This phenomenon results from the fact that aluminum is much less dense than copper, and thus has a greater volume per ton then that of pure copper.

CCA combines the conductivity and corrosion resistance of copper with the light weight and relatively low cost of aluminum, making it uniquely suited for many electrical applications where the ratio of weight to conductivity is important. In many applications, it is a more robust conductor than aluminum alone.

Our CCA products are a cost effective substitute for pure copper wire in a wide variety of applications such as wire and cable, consumer electronic products, white goods, automotive parts, utility applications, telecommunications, and specialty cables.

We customize our products based on customer specifications. Customer specifications depend on the end use of the CCA wire, but are primarily determined based upon two measurements, the thickness of the copper layer on the aluminum core and the diameter of the CCA wire. Based on the thickness of the copper layer, CCA is divided into two types, 10% and 15%. The 10% CCA is primarily used in high frequency signal transmissions, such as cable television transmission and cellular phone signals, while the 15% CCA is used in generators and other non-signal transmission applications. CCA can be made in various diameters. The typical customer specifications for our CCA products range from 0.04 mm to 1.96 mm.

Currently, Lihua Electron has the following product lines:

| · | CCA fine wire |

| o | Used in computers, shielding, cell phones and automobiles |

| · | CCA magnet wire |

| o | Used in small electronic motors, small size transformers, water pumps and meters |

| · | CCA tin plated wire |

| o | Used in audio and video components |

Anticipated Lihua Copper Products

By the end of the first quarter 2009, Lihua Copper will begin manufacturing refined copper, which is also referred to as low content oxygen copper (“LCOC”). Lihua Copper will use recycled copper as its raw material to manufacture and sell LCOC cable, LCOC fine wire and LCOC magnet wire to Lihua Electron’s customers.

Lihua Copper’s LCOC recycled copper utilizes our patented cleaning process followed by a traditional smelting process, which results in copper with 99.96% purity. Typically, recycled copper produces a purity of 99.90% to 99.92%. Because our LCOC has a higher level of purity, it has a wider range of potential end uses typically reserved for new pure copper. In a follow-on, value-added process, we will use our LCOC copper wire as the basis for magnet wire and fine wire and market it to Lihua Electron’s current customer base.

We expect that Lihua Copper will manufacture the following products:

| · | LCOC cable |

| o | Used for: |

| § | telephone drop wire and conductors |

| § | electric utilities; transmission lines, grid wire, fence and structured grounds |

| § | industrial drop wire, magnet wire, battery cables, automotive wiring harnesses |

| § | electronics; radio frequency shielding |

| · | LCOC fine wire |

| · | LCOC magnet wire |

| o | Used in electronic motors, transformers, water pumps, and meters in the automobile, energy, industrial, commercial, and residential industries. |

Raw Materials and Suppliers

We obtain the CCA raw material needed for Lihua Electron’s products from several suppliers. We generally pass the cost of our raw materials to our customers. Although competitors often experience substantial delays for the CCA raw material, our reliance on multiple high quality suppliers has limited the frequency and length of such delays and has therefore minimized the disruption of our business operations. We believe that if any of the suppliers listed below are unable to provide us with the product, we have a sufficient number of alternative suppliers from whom we can purchase products at substantially the same cost.

Lihua Electron primarily purchases its CCA from the following suppliers:

| | | Fushi International (Dalian) Bimetallic Cable Co., Ltd. |

| | | Soviet Cloud Electricity Limited Company |

| | | Jiangsu Heyang Wire and Cable Co., Ltd. |

| | | Changzhou Jieer Letter Composition Metal Material Limited Company |

| | | Suzhou Guoxin Wire and Cable Technology Limited Company |

Lihua Copper will use scrap copper in its production of two types of recycled copper: LCOC cable and LCOC magnet wire. We believe that we will have access to an adequate supply of scrap copper on satisfactory commercial terms due to the numerous scrap dealers located throughout Guangdong Province in the PRC.

Manufacturing/Production Process

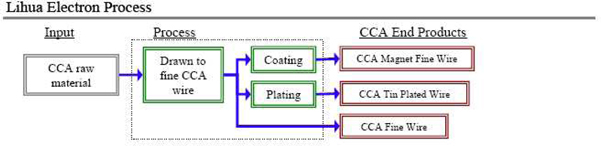

CCA Products

Manufacturing our CCA end products involves drawing the CCA raw material to a finished diameter. This drawing process is complex and utilizes our proprietary trade secrets to ensure that the CCA wire has a consistent cross section throughout the wire and maintains the original bimetallic bond from the CCA raw material. The drawing process entails multiple steps such as heat treating, annealing, baking, cooling, quenching and spooling as may be necessary depending on wire diameter and other customer specifications. The fine CCA wire is either sold as a finished good to customers or coated and further processed to become CCA magnet wire.

The following illustration is a simplified outline of our process:

Our production procedures are designed to maximize capacity utilization and ensure the most efficient and cost-effective production possible. We utilize custom manufactured machinery for which we hold design patents.

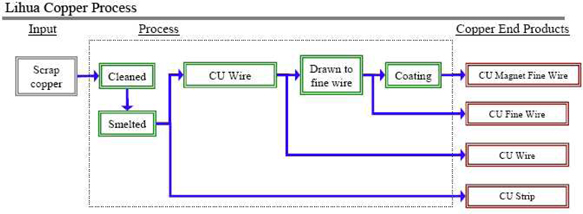

Low Content Oxygen Copper

When we begin production of our low content oxygen copper, we will obtain scrap copper from copper recyclers. Using our patented technology, we will clean and smelt the scrap copper to produce low content oxygen copper.

The following illustration is a simplified outline of our process:

Sales, Marketing and Distribution

In China, we target our sales efforts primarily in the coastal provinces of Guangdong, Fujian, Zhejiang, Jiangsu and Shanghai areas, where the majority of our customers are located. We have a sales staff of approximately 30 employees. We maintain nine sales offices in China, including three in Guangdong, two in Zhejiang, one in Linan, one in Fujian, one in Shangdong, and one in Anhui. We also derive approximately three percent of our sales from www.alibaba.com, which is an online marketplace for both international and domestic manufacturers and trading companies in a variety of industries. Our company website, www.dylihua.com, allows us to receive electronic orders through the Alibaba trading site. We participate in industry expositions throughout China through which we showcase and provide information on our many products and services.

In 2006 and 2007, our products were mainly exported through several Chinese trading companies. In 2008, through our participation on Alibaba, we began to establish trade partnerships abroad and directly export our products internationally. Presently, our international sales account for approximately five percent of our total sales. We currently have customers in Brazil, India, Pakistan and Vietnam. We have begun to establish trade partnerships and directly export our products to these countries and regions. We can deliver to most of our international customers within 48 hours after receiving their orders. We have a small fleet of trucks that deliver merchandise to customers located within three hours from Danyang, where our manufacturing headquarters are located. Alternatively, we contract with independent third-party trucking companies to deliver our products when necessary.

Seasonality

Consumer electronics, white goods, automotive, utility, telecommunications and specialty cable markets in the PRC, have historically experienced a slowdown in demand during the first quarter due to the Chinese New Year holiday. There is also modest seasonality during the hot summer months as the significant heat generated from the manufacturing process forces a slow down in output. However, due to the organic expansion in our production capabilities over the past two years, we have yet to experience significant seasonality fluctuations in our revenues or operating and net income.

Competition

Our sales are predominantly in the PRC, and as a result, our primary competitors are PRC domestic companies. Since our current international sales only comprise approximately five percent of our total sales, we face competition to a lesser degree with international companies. Our major PRC domestic competitors are listed below by business segment:

| Lihua Electron Competitors | | | | |

| Name | | Est. Capacity | | Products |

| Changzhou Wujin Chengtian Electronics CO.,LTD | | 100 metric tons per month | | CCA fine and Magnet |

| Linan Jiapeng Metal Co., Ltd | | 50 metric tons per month | | CCA fine and Magnet |

| Nanjing Haochuang Metal Co., Ltd | | 50 metric tons per month | | CCA fine and Magnet |

| Yixing City Shengbao Co., Ltd | | 70 metric tons per month | | Pure CU / CCA fine/Magnet |

| Lihua Copper Competitors | | | | |

| Name | | Est. Capacity | | Products |

| Xinghua Fangqiang Jidian Co., Ltd | | 20,000 M/T per year | | Oxygen free fine wire |

| Danyang Pure Copper Co., Ltd | | 15,000 M/T per year | | Oxygen free fine wire |

| Wujiang Jingcheng Diangong Co., Ltd | | 18,000 M/T per year | | Magnet wire |

| Nantong Yili Magnetic Wire Co., Ltd | | 4,000 M/T per year | | Magnet wire |

| Hengtong Copper Co., Ltd | | 50,000 M/T per year | | 8mm low content oxygen copper cable |

| Tiantong Copper Co., Ltd | | 20,000 M/T per year | | 8mm low content oxygen copper cable |

| Huihong Metal Co., Ltd | | 8,000 M/T per year | | 8mm low content oxygen copper cable |

| Jiangsu Yiyuan Group | | 20,000 M/T per year | | Oxygen free fine wire |

Competitive Advantages

Competition in the bimetallic industry, particularly in the PRC, can be characterized by rapid growth and a concentration of manufacturers. We believe we differentiate ourselves by offering superior product quality, timely delivery and better value. We believe we have the following advantages over our competitors:

| | the performance and cost effectiveness of our products relative to those of our competitors; |

| | |

| | our ability to manufacture and deliver products in required volumes, on a timely basis, and at competitive prices; |

| | |

| | the superior quality and reliability of our products; |

| | |

| | our customer support capabilities, from both an engineering and an operational perspective; |

| | |

| | excellence and flexibility in operations; |

| | |

| | effectiveness of customer service and our ability to send experienced operators and engineers as well as a seasoned sales force to assist our customers; and |

| | |

| | overall management capability. |

Growth Strategy

Our goal is to become a worldwide leader in the CCA magnet wire industry. We seek to grow our Lihua Electron business in the following manner:

| | Manufacturing . We will strive to maintain and expand our profit margins by enhancing equipment management, optimizing processes and product structures, perfecting the supplier system and cutting production costs. |

| | |

| | Capacity Expansion . Since our production lines have been running at full capacity for several years we intend to increase the number of production lines to better meet strong customer demand. |

Research and Development

In the fiscal years ended December 31, 2007 and 2006, we spent $56,143, and $32,504, respectively, on research and development. We are dedicated to improving our current products and to developing new technologies that will improve the performance and capabilities of bimetallic materials and recycled copper wires.

Intellectual Property

We have obtained IP protection in China for certain of our production processes and devices. We continually seek ways to improve our patented processes and, through our research and development department, we anticipate continuing our development of proprietary intellectual properties. Our current production processes and devices for which we have patent protection are:

| Name of IP right | | Application Number | | Company | | Date of Application | | Status of Application |

| 1. The production process for copper clad aluminum magnet wire | | 200710131529.7 | | Lihua Electron | | September 4, 2007 | | Patent pending |

| | | | | | | | | |

| 2. An aluminum-magnesium copper plating production process | | 200810023487. | | Lihua Electron | | April 16, 2008 | | Patent pending |

| | | | | | | | | |

| 3. An oxygen-free copper rod pressure cut off device | | 200820034139.8 | | Lihua Copper | | April 16, 2008 | | Patent pending |

| | | | | | | | | |

| 4. A copper cleaning liquid | | 200810023488.4 | | Lihua Copper | | April 16, 2008 | | Patent pending |

We cannot ensure that any patent applications filed by us in the future will be approved, nor can we be sure that any of our existing patents or any patents granted to us will be useful in protecting our processes and devices.

Customers

We do not have any customer to whom the sales of our products exceed 10% of our total revenue. Our products are widely dispersed in the market, so we do not depend on a single customer or a few customers to generate revenue.

The table below sets forth our top five customers based on percentage of total revenue for the three months ended September 30, 2008 and the industry in which they focus.

| TOP FIVE CUSTOMERS (Industry Focus) | | % of Net Sales | |

| Customer 1 (Home Appliance) | | | 10.40 | % |

| Customer 2 (Marine wire) | | | 7.29 | % |

| Customer 3 (Electronic Tool) | | | 6.64 | % |

| Customer 4 (Electronic Motor) | | | 5.80 | % |

| Customer 5 (Electronic Motor) | | | 5.10 | % |

| Top Five Customers as % of Total: | | | 35.23 | % |

Government Regulation

Our manufacturing operations are subject to numerous laws, regulations, rules and specifications relating to human health and safety and the environment. These laws and regulations address and regulate, among other matters, wastewater discharge, air quality and the generation, handling, storage, treatment, disposal and transportation of solid and hazardous wastes and releases of hazardous substances into the environment. We are in compliance in all material respects with such laws, regulations, rules, specifications and have obtained all material permits, approvals and registrations relating to human health and safety and the environment. In addition, third parties and governmental agencies in some cases have the power under such laws and regulations to require remediation of environmental conditions and, in the case of governmental agencies, to impose fines and penalties. We make capital expenditures from time to time to stay in compliance with applicable laws and regulations.

Environmental Compliance

We are subject to environmental regulations that are generally applicable to manufacturing companies in the PRC and in the US. We are also subject to periodic inspection by environment regulators and must follow specific procedures in some of our processes. We have not violated environmental regulations or approved practices either in the PRC or in the US.

As our businesses may generate waste water, toxic and hazardous substances as well as other industrial wastes, we are required to comply with all national and local regulations in China regarding protection of the environment. The Environmental Protection Law of the PRC provides the basic legal framework for the environmental requirements of the production and sale of electron products, and its implementation regulations set out detailed implementation rules. We believe that we are in compliance with the current material environmental protection requirements.

Legal Proceedings

From time to time, we may become involved in lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time which may harm our business. To date, we are not aware of any such legal proceedings or claims against us or our subsidiaries.

Employees

We have 210 full-time employees located at our executive office in Danyang City, and 30 full time sales employees located in various sales offices. We believe our relations with our employees are good.

Property

In China, there is no private land ownership. Under PRC law, all land in the PRC is owned by the government, which grants a "land use right" to an individual or entity after payment is made to the government. The "land use right" allows the holder the right to use the land for a specified long-term period.

Lihua Electron owns 15.7 acres (10466.72 square meters) of land use rights located in Danyang City, HouXiang Zhen, Five-Star Village, Five-Star Industrial Park. Lihua Electron has land use rights for a period of 50 years. Lihua Electron’s production plant and executive office is located at this site. The total area occupied is 8,824.81 square meters.

Lihua Copper owns 100 acres (66,666.67 square meters) of land use rights also located in Danyang City, HouXiang Zhen, Five-Star Village, Five-Star Industrial Park. Lihua Copper has land use right for a period of 50 years. We currently have production plants, office buildings and an integrated dormitory on this site.

We believe our real property is adequate to meet our current needs.

Risk Factors

Risks Related to Our Business

We have a limited operating history.

Our limited operating history and the early stage of development of the CCA industry in which we operate makes it difficult to evaluate our business and future prospects. Although our revenues have grown rapidly, we cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in operating losses.

We will continue to encounter risks and difficulties in implementing our business model, including potential failure to:

| | · | increase awareness of our products, protect our reputation and develop customer loyalty; |

| | | |

| | · | manage our expanding operations and service offerings, including the integration of any future acquisitions; |

| | · | maintain adequate control of our expenses; and |

| | · | anticipate and adapt to changing conditions in the markets in which we operate as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

Quarterly operating results may fluctuate.

Our quarterly results of operations may fluctuate as a result of a number of factors, including fluctuation in the demand for and shipments of our products and changes in the prices of copper which directly affect the prices of our products and may influence the demand for our products. Therefore, quarter-to-quarter comparisons of results of operations have been and will be impacted by the volume of such orders and shipments. In addition, our operating results could be adversely affected by the following factors, among others, such as variations in the mix of product sales, price changes in response to competitive factors, increases in raw material costs and other significant costs, increases in utility costs (particularly electricity) and interruptions in plant operations resulting from the interruption of raw material supplies and other factors.

Fluctuating copper prices impact our business and operating results.

Copper prices, which have increased quite rapidly over the past several years, have recently declined over 50% and may vary significantly in the future because the copper industry is highly volatile and cyclical in nature. This affects our business both positively and negatively - as our products are a substitute for pure copper wire, higher prices increase demand for CCA products, while lower copper prices can decrease demand for CCA products. Numerous factors, most of which are beyond our control, influence copper price. These factors include general economic conditions, industry capacity utilization, import duties and other trade restrictions. We cannot predict copper prices in the future or the effect of fluctuations in the costs of copper on our future operating results. We mitigate the impact of changing raw material prices by passing changes in prices to our customers by adjusting prices daily to reflect changes in raw material prices, as is customary in the industry. We may not be able to adjust our product prices rapidly enough in the short-term to recover the costs of increases in raw materials. Our future profitability may be adversely affected to the extent we are unable to pass on higher raw material costs to our customers.

We may encounter substantial competition in our business and our failure to compete effectively may adversely affect our ability to generate revenue.

The CCA industry is becoming increasingly competitive. The principal elements of competition in the bimetallic industry are, in our opinion, pricing, product availability and quality. In periods of reduced demand for our products, we can either choose to maintain market share by reducing our selling prices to meet competition or maintain selling prices, which may sacrifice market share. Sales and overall profitability would be reduced under either scenario. In addition, we cannot assure you that additional competitors will not enter our existing markets, or that we will be able to compete successfully against existing or new competition.

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop as we expect, it may be necessary for us to finance and manage expansion in an orderly fashion. In addition, we may face challenges in managing expanding product offerings. Such eventualities will increase demands on our existing management and facilities. Failure to manage this growth and expansion could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies.

Shortages or disruptions in the availability of raw materials could have a material adverse effect on our business.

We expect that raw materials of CCA and recycled copper will continue to account for a significant portion of our cost of goods sold in the future. The prices of raw materials fluctuate because of general economic conditions, global supply and demand and other factors causing monthly variations in the costs of our raw materials purchases. The macro-economic factors, together with labor and other business interruptions experienced by certain suppliers, have contributed to periodic shortages in the supply of raw materials, and such shortages may increase in the future. If we are unable to procure adequate supplies of raw material to meet our future production needs and customer demand, shortages could result in a material loss of customers and revenues and adversely impact our results of operations. In addition, supply shortages or disruptions or the loss of suppliers may cause us to procure our raw materials from less cost effective sources and may have a material adverse affect on our business, revenues and results of operations.

We depend on a few suppliers for a significant portion of our principal raw materials and we do not have any long-term supply contracts. Interruptions of production at our key suppliers may affect our results of operations and financial performance.

We rely on a limited number of suppliers for most of the raw materials we use. Interruptions or shortages of supplies from our key suppliers of raw materials could disrupt production or impact our ability to increase production and sales. We do not have long-term or volume purchase agreements with most of our suppliers. Identifying and accessing alternative sources may increase our costs. Interruptions at our key suppliers could negatively impact our results of operations, financial performance and the price of our Common Stock.

Due to increased volatility of raw material prices, the timing lag between the raw material purchase and product pricing can negatively impact our profitability.

Volatility in the prices of raw materials, among other factors, may adversely impact our ability to accurately forecast demand and may have a material adverse impact on our results of operations.

Increases in raw materials prices will increase our need for working capital.

As the prices of raw materials increase, our working capital requirements increase. Increases in our working capital requirements can materially adversely impact our results of operations, our cash flow and our available liquidity to fund other business needs. Furthermore, there is no assurance we would be able to finance additional working capital requirements or finance such working capital requirements on favorable terms. If we were unable to obtain financing on favorable terms, our business and results of operations may be adversely affected. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” below.

Increases in raw materials prices may increase credit and default risk with respect to our customers.

Increases in the price of our products, as raw material prices rise, may place additional demands on the working capital and liquidity needs of our customers. Accordingly, our customers’ cash flow may be negatively impacted which may have an adverse affect on the timing and amount of payment on our accounts receivable, which would in turn, negatively affect our results of operations.

If the CCA industry does not grow as we expect or grows at a slower speed than we expect, our sales and profitability may be materially adversely affected.

We derive most of our profits from sales of our products in China. The continued development of our business depends, in large part, on continued growth in the bimetallic industry in China. Although China’s CCA industry has grown rapidly in the past, it may not continue to grow at the same growth rate in the future or at all. Any reduced demand for our products, any downturn or other adverse changes in China’s CCA or related industries could severely impact the profitability of our business.

Potential environmental liability could have a material adverse effect on our operations and financial condition.

As a manufacturer, we are subject to various Chinese environmental laws and regulations on air emission, waste water discharge, solid wastes and noise. Although we believe that our operations are in substantial compliance with current environmental laws and regulations, we may not be able to comply with these regulations at all times as the Chinese environmental legal regime is evolving and becoming more stringent. Therefore, if the Chinese government imposes more stringent regulations in the future, we may have to incur additional and potentially substantial costs and expenses in order to comply with new regulations, which may negatively affect our results of operations. Further, no assurance can be given that all potential environmental liabilities have been identified or properly quantified or that any prior owner, operator, or tenant has not created an environmental condition unknown to us. If we fail to comply with any of the present or future environmental regulations in any material aspects, we may suffer from negative publicity and may be required to pay substantial fines, suspend or even cease operations.

We face intense competition and many of our competitors have substantially greater resources than we have.

Our competitors may have greater market recognition and substantially greater financial, technical, marketing, distribution, purchasing, manufacturing, personnel and other resources than we do. Furthermore, some of our competitors have manufacturing and sales forces that are geographically diversified, allowing them to reduce transportation expenses, tariff costs and currency fluctuations for certain customers in markets where their facilities are located. We might lose some of our current or future business to these competitors or be forced to reduce our margins to retain or acquire that business, which could decrease our revenues or slow our future revenue growth and lead to a decline in profitability. Further, to the extent that, whether as a result of the increased cost of copper, the relative strength of the Chinese currency, shipping costs or other factors, we are not able to price our products competitively, our ability to sell our products in both the Chinese domestic and the international markets will suffer.

Key employees are essential to growing our business.

Mr. Jianhua Zhu, Mrs. Yaying Wang and Mr. Roy Yu and other senior management personnel are essential to our ability to continue to grow our business. Mr. Zhu, Mrs. Wang and Mr. Yu have established relationships within the industries in which we operate. If any of them were to leave us, our growth strategy might be hindered, which could limit our ability to increase revenue.

In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

We may need additional financing, which may not be available to find such financing on satisfactory terms or at all.

Our capital requirements may be accelerated as a result of many factors, including timing of development activities, underestimates of budget items, unanticipated expenses or capital expenditures, future product opportunities with collaborators, future licensing opportunities and future business combinations. Consequently, we may need to seek additional debt or equity financing, which may not be available on favorable terms, if at all, and which may be dilutive to our stockholders.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we may incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to our stockholders' interest in bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

If we fail to adequately protect or enforce our intellectual property rights, or to secure rights to patents of others, the value of our intellectual property rights could diminish.

Our success, competitive position and future revenues will depend in part on our ability to obtain and maintain patent protection for our products, methods, processes and other technologies, to preserve our trade secrets, to prevent third parties from infringing on our proprietary rights and to operate without infringing the proprietary rights of third parties.

To date, we have filed four patent applications to the State Intellectual Property Office of the PRC. However, we cannot predict the degree and range of protection patents will afford us against competitors. Third parties may find ways to invalidate or otherwise circumvent our proprietary technology. Third parties may attempt to obtain patents claiming aspects similar to our patent applications. If we need to initiate litigation or administrative proceedings, such actions may be costly whether we win or lose.

Our success also depends on the skills, knowledge and experience of our scientific and technical personnel, consultants, advisors, licensors and contractors. To help protect our proprietary know-how and inventions for which patents may be unobtainable or difficult to obtain, we rely on trade secret protection and confidentiality agreements. If any of our intellectual property is disclosed, our value would be significantly impaired, and our business and competitive position would suffer.

If we infringe the rights of third parties, we could be prevented from selling products, forced to pay damages and compelled to defend against litigation.

If our products, methods, processes and other technologies infringe proprietary rights of other parties, we could incur substantial costs, and may have to obtain licenses (which may not be available on commercially reasonable terms, if at all), redesign our products or processes, stop using the subject matter claimed in the asserted patents, pay damages, or defend litigation or administrative proceedings, which may be costly whether it wins or loses. All of the above could result in a substantial diversion of valuable management resources.

We believe we have taken reasonable steps, including comprehensive internal and external prior patent searches, to ensure we have freedom to operate and that our development and commercialization efforts can be carried out as planned without infringing others’ proprietary rights. However, we cannot guarantee that no third party patent has been filed or will be filed that may contain subject matter of relevance to our development, causing a third party patent holder to claim infringement. Resolving such issues has traditionally resulted, and could in our case result, in lengthy and costly legal proceedings, the outcome of which cannot be predicted accurately.

We have never paid cash dividends and are not likely to do so in the foreseeable future.

We have never declared or paid any cash dividends on our Common Stock. We currently intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

We do not have a majority of independent directors serving on our board of directors, which could present the potential for conflicts of interest.

We do not have a majority of independent directors serving on our board of directors. In the absence of a majority of independent directors, our executive officers could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between us and our stockholders, generally, and the controlling officers, stockholders or directors.

One investor owns a large percentage of our outstanding stock and could significantly influence the outcome of actions.

Currently, Mr. Chu Fu Ho, the sole shareholder of Magnify Wealth Enterprise Limited, beneficially owns approximately 92.4% of our outstanding common stock. As a result, Mr. Chu will be able to exercise significant influence over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, such as a merger or other sale of our company or its assets. This concentration of ownership will limit your ability to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control over us. For more information regarding the ownership of our outstanding stock by our executive officers and directors and their affiliates, please see the section titled “Security Ownership of Certain Beneficial Owners and Management” below.

If we are unable to maintain appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud.

As a public company, we have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to comply with Sarbanes-Oxley and meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the SEC, have required changes in corporate governance practices of public companies. We expect these new rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Associated With Doing Business In China

There are substantial risks associated with doing business in China, as set forth in the following risk factors.

Our operations and assets in China are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under our current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

We derive a substantial portion of our sales from China.

Substantially all of our sales are generated from China. We anticipate that sales of our products in China will continue to represent a substantial proportion of our total sales in the near future. Any significant decline in the condition of the PRC economy could adversely affect consumer demand of our products, among other things, which in turn would have a material adverse effect on our business and financial condition.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese renminbi into foreign currencies and, if Chinese renminbi were to decline in value, reducing our revenue in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in China use their local currency as their functional currencies. Substantially all of our revenue and expenses are in Chinese renminbi. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of renminbi to the U.S. dollar had generally been stable and the renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese renminbi to the U.S. dollar. Under the new policy, Chinese renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese renminbi against the U.S. dollar. We can offer no assurance that Chinese renminbi will be stable against the U.S. dollar or any other foreign currency.

The income statements of our operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of Chinese renminbi into foreign currency for current account items, conversion of Chinese renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or SAFE, which is under the authority of the People’s Bank of China. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or that Chinese regulatory authorities will not impose greater restrictions on the convertibility of Chinese renminbi in the future. Because a significant amount of our future revenue may be in the form of Chinese renminbi, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in Chinese renminbi to fund our business activities outside of China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations

We may have limited legal recourse under PRC law if disputes arise under our contracts with third parties.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our new business ventures are unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under PRC law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we can not assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Due to various restrictions under PRC laws on the distribution of dividends by our PRC operating companies, we may not be able to pay dividends to our stockholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended and The Wholly-Foreign Owend Enterprise Law Implementing Rules (1990), as amended contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises, such as Lihua Electron and Lihua Copper, may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, Lihua Electron and Lihua Copper are required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the profits of Lihua Electron and Lihua Copper.

Changes in foreign exchange regulations in the PRC may affect our ability to pay dividends in foreign currency or conduct other foreign exchange business.

The Renminbi is not a freely convertible currency currently, and the restrictions on currency exchanges may limit our ability to use revenues generated in RMB to fund our business activities outside the PRC or to make dividends or other payments in United States dollars. The PRC government strictly regulates conversion of RMB into foreign currencies. Over the years, foreign exchange regulations in the PRC have significantly reduced the government’s control over routine foreign exchange transactions under current accounts. In the PRC, the State Administration for Foreign Exchange, or the SAFE, regulates the conversion of the RMB into foreign currencies. Pursuant to applicable PRC laws and regulations, foreign invested enterprises incorporated in the PRC are required to apply for “Foreign Exchange Registration Certificates.” Currently, conversion within the scope of the “current account” (e.g. remittance of foreign currencies for payment of dividends, etc.) can be effected without requiring the approval of SAFE. However, conversion of currency in the “capital account” (e.g. for capital items such as direct investments, loans, securities, etc.) still requires the approval of SAFE.

PRC regulations relating to mergers and acquisitions of domestic enterprises by foreign investors may increase the administrative burden we face and create regulatory uncertainties.

On August 8, 2006, six PRC regulatory agencies, namely, the PRC Ministry of Commerce, or MOFCOM, the State Assets Supervision and Administration Commission, or SASAC, the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission, or CSRC, and the State Administration of Foreign Exchange, or SAFE, jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule, which became effective on September 8, 2006. The M&A Rule purports, among other things, to require offshore special purpose vehicles, or SPVs, formed for overseas listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange.

On September 21, 2006, pursuant to the M&A Rule and other PRC laws and regulations, the CSRC, in its official website, promulgated relevant guidance with respect to the issues of listing and trading of domestic enterprises’ securities on overseas stock exchanges (the “Administrative Permits”), including a list of application materials with respect to the listing on overseas stock exchanges by SPVs.

Based on our understanding of current PRC Laws, we are not sure whether the M&A Rule would require us or our entities in China to obtain the CSRC approval in connection with the transaction contemplated by the Exchange Agreement in connection with the share exchange.

Further, if the PRC government finds that we or our Chinese shareholders did not obtain the CSRC approval, which CSRC may think we should have obtained before our executing the Exchange Agreement, we could be subject to severe penalties. The M&A Rule does not stipulate the specific penalty terms, so we are not able to predict what penalties we may face, and how such penalties will affect our business operations or future strategy.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

We are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

Future inflation in China may inhibit our ability to conduct business in China .

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

We may have difficulty establishing adequate management, legal and financial controls in the PRC.

The PRC historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. We may have difficulty establishing adequate management, legal and financial controls in the PRC.

Risks Related to the Common Stock

If we do not timely file and have declared effective the registration statement pursuant to the Private Placement, we will be subject to liquidated damages.

In connection with the Private Placement, we entered into a Registration Rights Agreement. Under this agreement, we are obligated to file a registration statement providing for the resale of shares underlying the Preferred Shares and Warrants issued in the Private Placement. Pursuant to the Registration Rights Agreement, we agreed to file and have declared effective the Registration Statements by certain dates. Although we believe that we will be able to take all steps necessary to permit the SEC to declare the Registration Statements effective timely, it is possible that the SEC may, by application of policies or procedures that vary from past policies and procedures, delay the effectiveness of the Registration Statements or make it impractical for us to respond to the SEC in a manner that permits us to declare the Registration Statements effective. We will pay liquidated damages of 1% of the dollar amount of the shares registered in the Registration Statement for each 30 day period the Registration Statement is not declared effective, payable in cash, up to a maximum of 10%.

When the Registration Statement becomes effective, there will be a significant number of shares of Common Stock eligible for sale, which could depress the market price of such stock.

Following the effective date of the Registration Statement, a large number of shares of Common Stock will become available for sale in the public market if our Common Stock is trading at such time, which could harm the market price of the stock. Further, shares may be offered from time to time in the open market pursuant to Rule 144, and these sales may have a depressive effect as well.

There may not be sufficient liquidity in the market for our securities in order for investors to sell their securities.

There is currently no public market for our Common Stock and there can be no assurance that a trading market will develop further or be maintained in the future. As of December 12, 2008, we had approximately 12 shareholders of record of our Common Stock.

The market price of our common stock may be volatile.

If a public market develops for our common stock on the OTC Bulletin Board or on a national securities exchange, trading in our Common Stock may be highly volatile. Some of the factors that may materially affect the future market price of our common stock are beyond our control, such as changes in any financial estimates by industry and securities analysts, conditions or trends in the industry in which we operate or sales of our common stock. These factors may materially adversely affect the market price of our common stock, regardless of our performance. In addition, the public stock markets have experienced extreme price and trading volume volatility. This volatility has significantly affected the market prices of securities of many operating performance of the specific companies. These broad market fluctuations may adversely affect the market price of our common stock.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,” “Lihua believes,” “management believes” and similar language. Except for the historical information contained herein, the matters discussed in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report are forward-looking statements that involve risks and uncertainties. The factors listed in the section captioned “Risk Factors,” as well as any cautionary language in this report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from those projected. Except as may be required by law, we undertake no obligation to update any forward-looking statement to reflect events after the date of this Form 8-K/A.

OVERVIEW

On October 31, 2008 we entered into the a Share Exchange Agreement (the “Exchange Agreement”) with Ally Profit Investments Limited, a British Virgin Islands company ("Ally Profit”), Magnify Wealth Enterprise Limited, the sole shareholder of Ally Profit (the “Ally Profit Shareholder”, or “Magnify Wealth”), which owns shares constituting 100% of the issued and outstanding ordinary shares of Ally Profit (the “Ally Profit Shares”), and our principal stockholders. Pursuant to the terms of the Exchange Agreement, the Ally Profit Shareholder transferred all of the Ally Profit Shares to us in exchange (the “ Share Exchange ”) for the issuance of 14,025,000 shares of our Common Stock, par value $0.0001 per share to the Ally Profit Shareholder. As a result of the Share Exchange, Ally Profit became our wholly-owned subsidiary and the Ally Profit Shareholder acquired approximately 93.5% of our issued and outstanding stock.

Immediately after the Share Exchange, we entered into a securities purchase agreement with certain accredited investors for the issuance and sale in a private placement of units, consisting of, in the aggregate, 6,818,182 shares of Series A Convertible Preferred Stock, par value $0.0001 per share and Series A warrants to purchase up to 1,500,000 shares of Common Stock, for aggregate gross proceeds of approximately $15,000,000.

As a result of the Share Exchange, Ally Profit became our wholly owned subsidiary and we acquired the business and operations of Ally Profit and its PRC Subsidiaries. Danyang Lihua Electron Co., Ltd (“Lihua Electron”) is a leading value-added manufacturer of bimetallic composite conductor wire, such as copper clad aluminum (“CCA”) fine wire, CCA magnet wire and CCA tin plated wire. Lihua Electron sells to distributors in the wire and cable industries and to manufacturers in the consumer electronics, white goods, automotive, utility, telecommunications and specialty cable industries. Jiangsu Lihua Copper Industry Co., Ltd. (“Lihua Copper”), the Company’s other PRC subsidiary, which the Company anticipates will begin operations by the end of the first quarter 2009, will utilize refined, or recycled, copper to manufacture and sell low content oxygen copper cable and copper magnet wire to Lihua Electron’s existing customer base.

The "Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth below is prepared using the consolidated financial statements of our wholly-owned subsidiary, Ally Profit Investment Limited and its subsidiaries, Lihua Holdings Limited, a Hong Kong company, Lihua Electron, and Lihua Copper for the fiscal years ended December 31, 2007 and 2006 and the three and nine months ended September 30, 2008 and 2007, set forth elsewhere in this prospectus. The results of operations and financial condition for those periods do not reflect Lihua International on an as-consolidated basis.

RESULTS OF OPERATIONS