Corporate Overview Discovery to Commercialization RNAi Platform January 2021 Exhibit 99.1

Forward-Looking Statements This presentation has been prepared by Dicerna Pharmaceuticals, Inc. (“we,” “us,” “our,” “Dicerna,” or the “Company”) and includes forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Examples of forward-looking statements include, among others, statements we make regarding: (i) the therapeutic and commercial potential of nedosiran, RG6346 (RO7445482), belcesiran (formerly DCR-A1AT) and the GalXC™ platform; (ii) expectations about our cash, cash equivalents and marketable securities; (iii) research and development plans and timelines, as well as regulatory pathways and plans, related to nedosiran, RG6346, belcesiran and GalXC; (iv) the potential of Dicerna’s technology and drug candidates in the Company’s research and development pipeline, including our pipeline expansion efforts and expectations; (v) the Company’s collaborations with Novo Nordisk A/S; Roche; Eli Lilly and Company; Alexion Pharmaceuticals, Inc., Boehringer Ingelheim International GmbH; and Alnylam Pharmaceuticals, Inc.; and (vi) the Company’s strategy, business plans and focus. The process by which an early-stage investigational therapy such as nedosiran and an early-stage platform such as GalXC could potentially lead to an approved product is long and subject to significant risks. Applicable risks and uncertainties include, but are not limited to, those risks identified under the heading "Risk Factors" included in the Company’s most recent Form 10-K filing and in other subsequent filings with the Securities and Exchange Commission. These risks and uncertainties include, among others, the impact to, and potential for delays in, the current and future conduct of the business of the Company, its clinical programs and operations as a result of the COVID-19 pandemic; the cost, timing and results of preclinical studies and clinical trials and other development activities; the likelihood of Dicerna’s clinical programs being executed within timelines provided and reliance on the Company’s contract research organizations and predictability of timely enrollment of subjects and patients to advance Dicerna’s clinical trials; the potential for future data to alter initial, interim and preliminary results of clinical trials, including the multidose data from the PHYOX™3 trial of nedosiran; the unpredictability of the duration and results of the regulatory review of Investigational New Drug (IND) applications and Clinical Trial Applications that are necessary to continue to advance and progress the Company’s clinical programs and the regulatory review of submissions relevant to regulatory agencies for marketing approvals, including New Drug Applications (NDAs); market acceptance for approved products and innovative therapeutic treatments; competition; the possible impairment of, inability to obtain and costs of obtaining needed intellectual property rights; possible safety or efficacy concerns that could emerge as new data are generated in R&D; that the Company may not realize the intended benefits of its collaborations; general business, financial and accounting risks; and the risks and potential outcomes from litigation. Dicerna is providing this information as of this date and does not undertake any obligation to update or revise it, whether as a result of new information, future events or circumstances or otherwise. Additional information concerning Dicerna and its business may be available in press releases or other public announcements and public filings made after the date of this information. Dicerna™, GalXC™ and PHYOX™ are trademarks of Dicerna Pharmaceuticals, Inc.

Dicerna was founded to specialize in RNAi Partner of Choice: Several large pharmas have chosen Dicerna for RNAi collaboration The RNAi Modality Has Come of Age RNAi Has Been Successful Where Traditional Modalities Have Not Gene Targeting Across Multiple Tissue Types Approved Products in Multiple Disease Areas Simple & Convenient Dosing Regimens Multiple Committed Large Pharmas

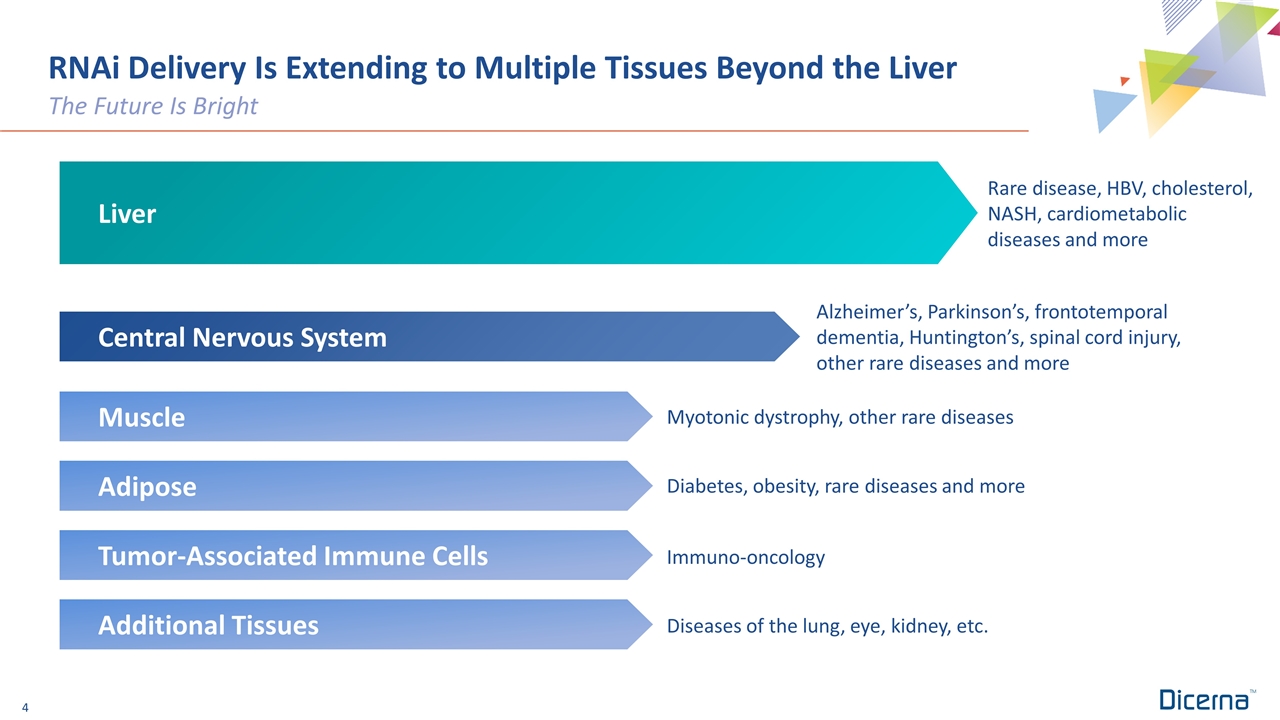

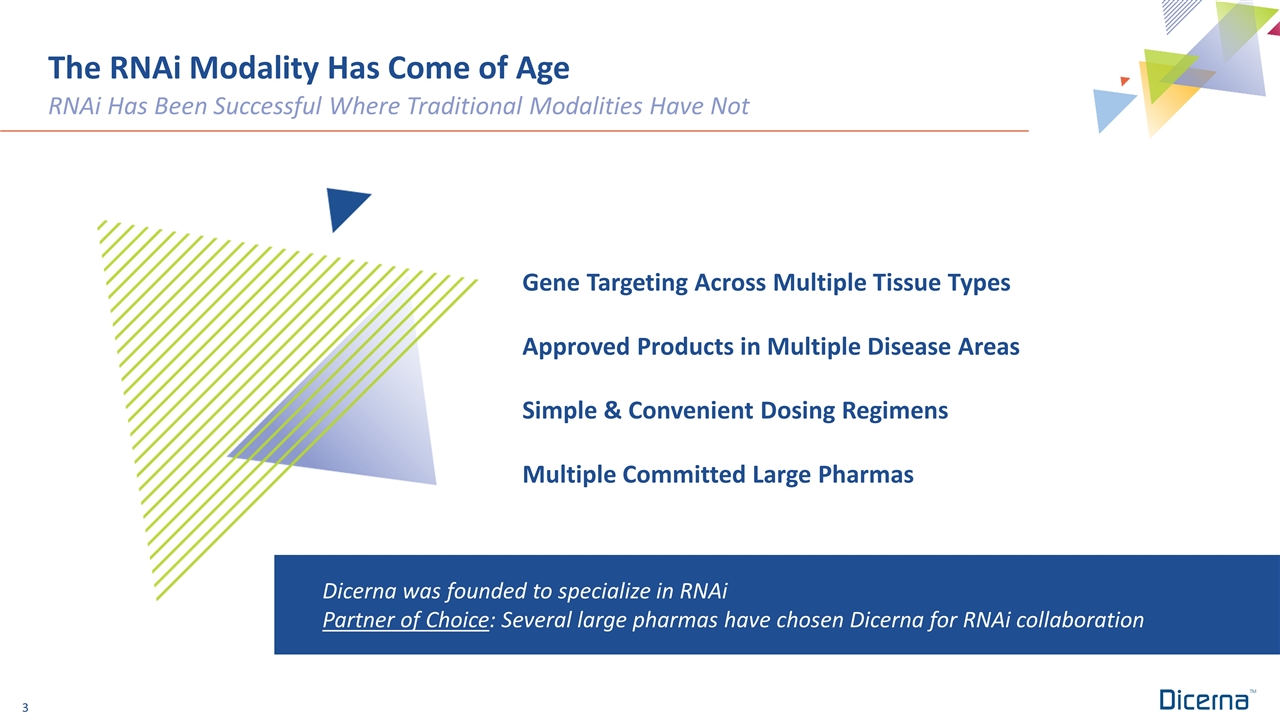

RNAi Delivery Is Extending to Multiple Tissues Beyond the Liver The Future Is Bright Alzheimer’s, Parkinson’s, frontotemporal dementia, Huntington’s, spinal cord injury, other rare diseases and more Immuno-oncology Diabetes, obesity, rare diseases and more Diseases of the lung, eye, kidney, etc. Myotonic dystrophy, other rare diseases Rare disease, HBV, cholesterol, NASH, cardiometabolic diseases and more Adipose Tumor-Associated Immune Cells Additional Tissues Muscle Central Nervous System Liver

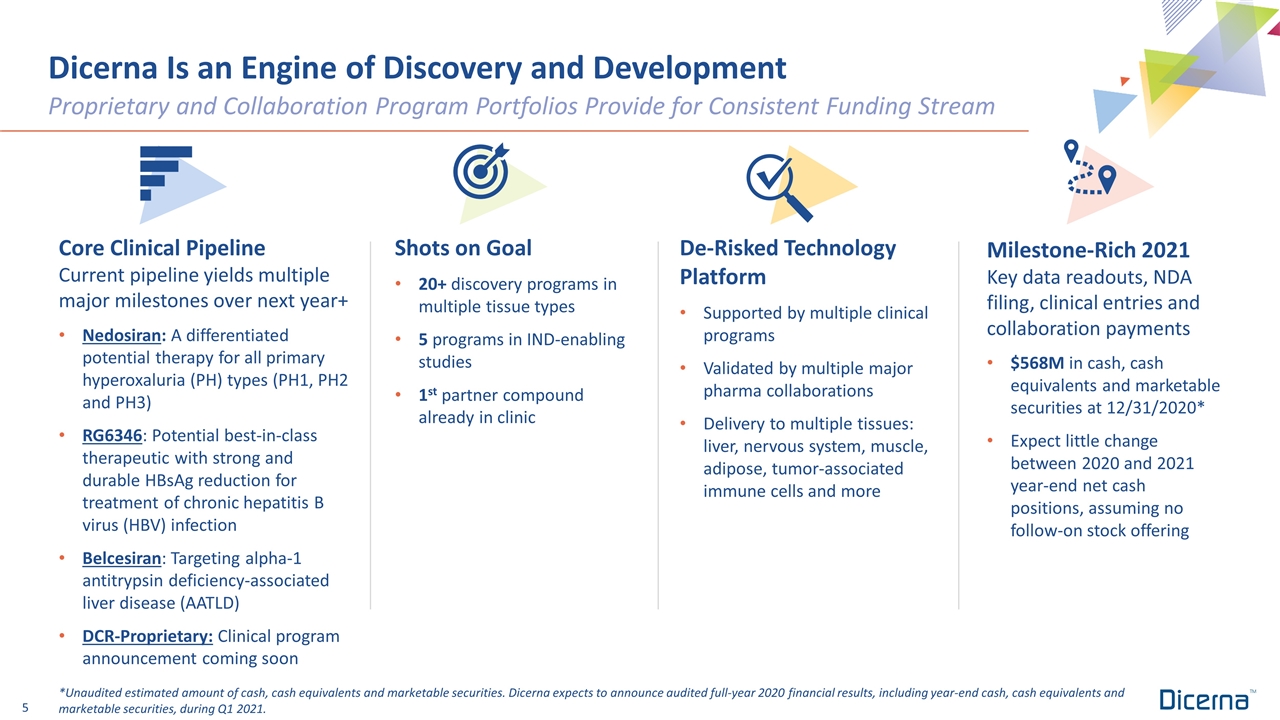

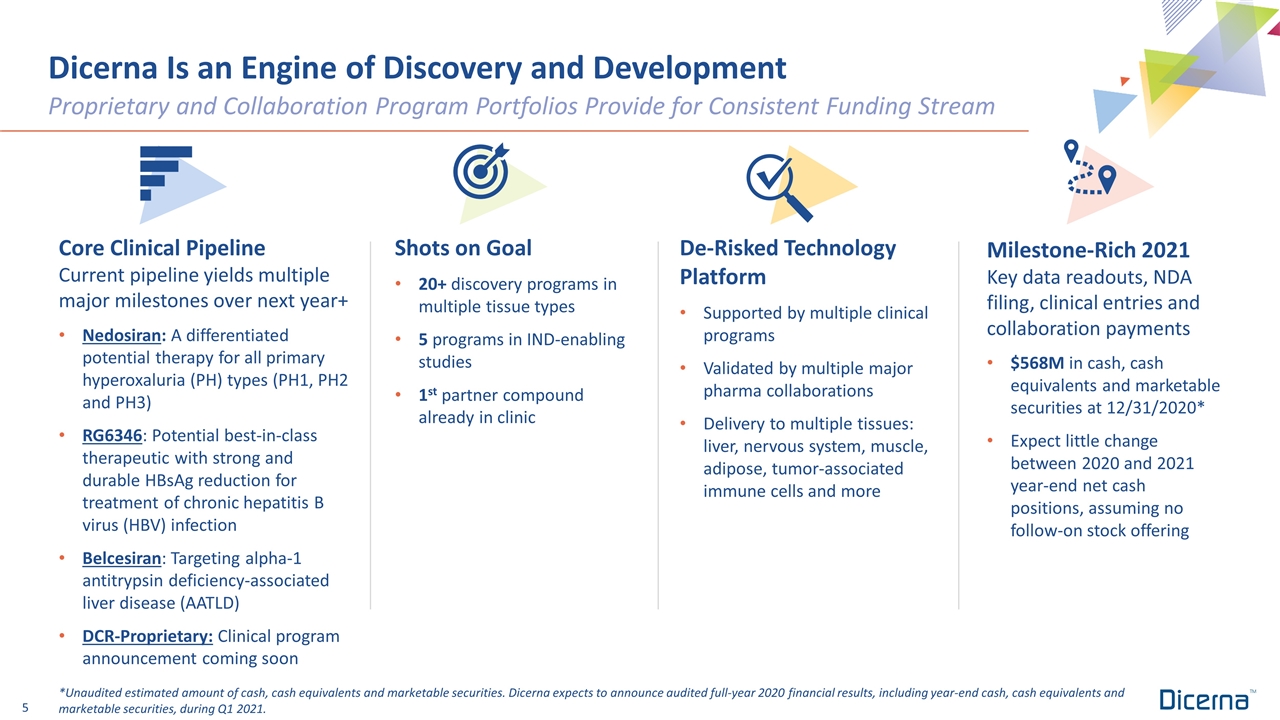

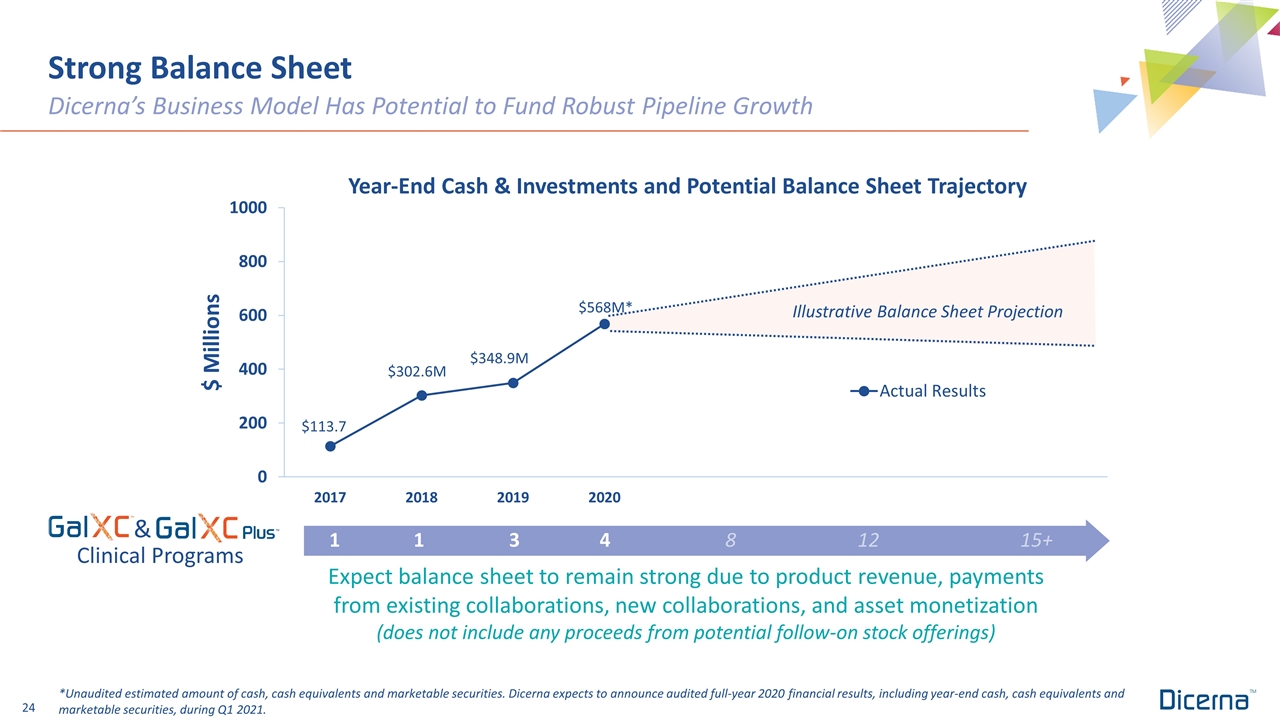

Dicerna Is an Engine of Discovery and Development Core Clinical Pipeline Current pipeline yields multiple major milestones over next year+ Nedosiran: A differentiated potential therapy for all primary hyperoxaluria (PH) types (PH1, PH2 and PH3) RG6346: Potential best-in-class therapeutic with strong and durable HBsAg reduction for treatment of chronic hepatitis B virus (HBV) infection Belcesiran: Targeting alpha-1 antitrypsin deficiency-associated liver disease (AATLD) DCR-Proprietary: Clinical program announcement coming soon Proprietary and Collaboration Program Portfolios Provide for Consistent Funding Stream Shots on Goal 20+ discovery programs in multiple tissue types 5 programs in IND-enabling studies 1st partner compound already in clinic De-Risked Technology Platform Supported by multiple clinical programs Validated by multiple major pharma collaborations Delivery to multiple tissues: liver, nervous system, muscle, adipose, tumor-associated immune cells and more Milestone-Rich 2021 Key data readouts, NDA filing, clinical entries and collaboration payments $568M in cash, cash equivalents and marketable securities at 12/31/2020* Expect little change between 2020 and 2021 year-end net cash positions, assuming no follow-on stock offering *Unaudited estimated amount of cash, cash equivalents and marketable securities. Dicerna expects to announce audited full-year 2020 financial results, including year-end cash, cash equivalents and marketable securities, during Q1 2021.

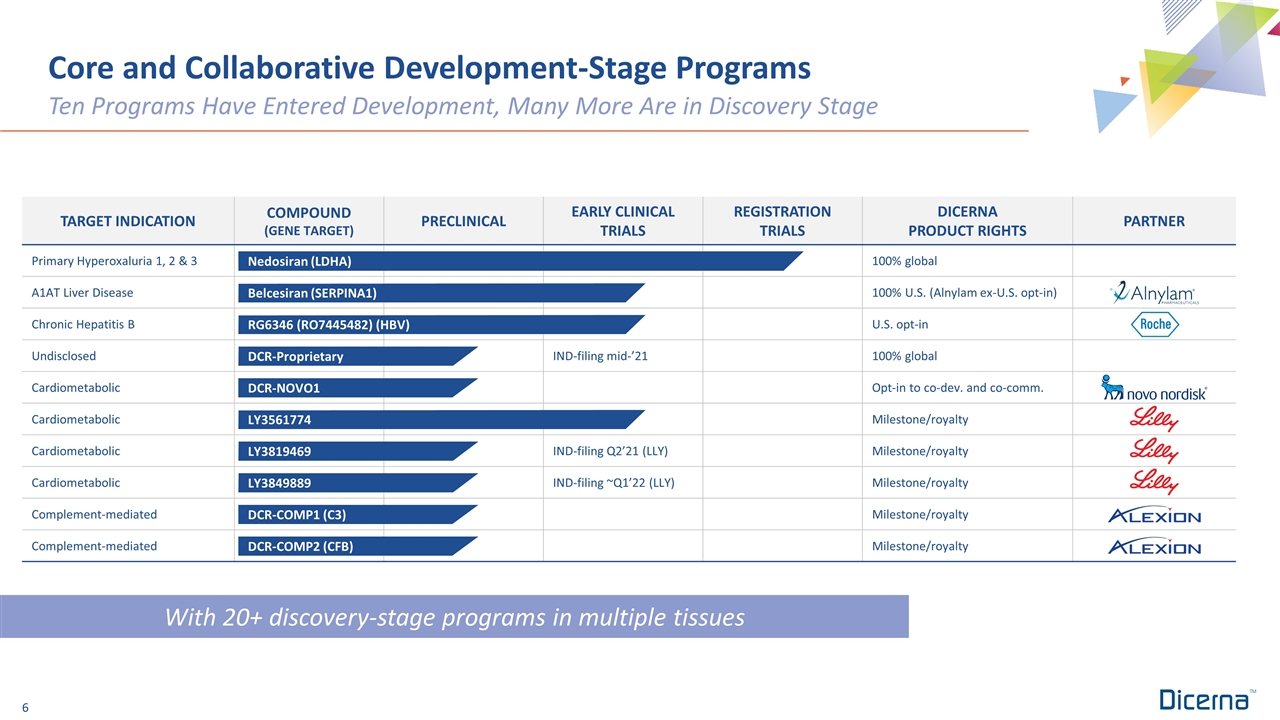

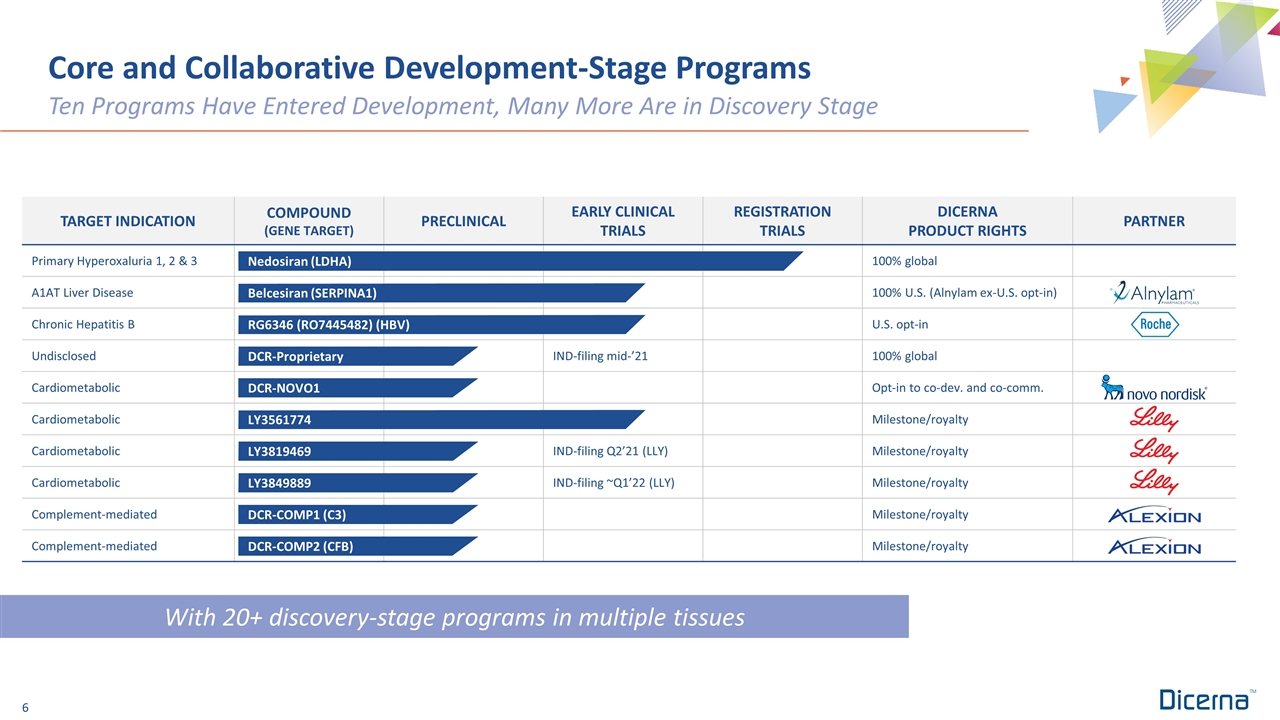

With 20+ discovery-stage programs in multiple tissues Core and Collaborative Development-Stage Programs Ten Programs Have Entered Development, Many More Are in Discovery Stage TARGET INDICATION COMPOUND (GENE TARGET) PRECLINICAL EARLY CLINICAL TRIALS REGISTRATION TRIALS DICERNA PRODUCT RIGHTS PARTNER Primary Hyperoxaluria 1, 2 & 3 100% global A1AT Liver Disease 100% U.S. (Alnylam ex-U.S. opt-in) Chronic Hepatitis B U.S. opt-in Undisclosed IND-filing mid-’21 100% global Cardiometabolic Opt-in to co-dev. and co-comm. Cardiometabolic Milestone/royalty Cardiometabolic IND-filing Q2’21 (LLY) Milestone/royalty Cardiometabolic IND-filing ~Q1’22 (LLY) Milestone/royalty Complement-mediated Milestone/royalty Complement-mediated Milestone/royalty Nedosiran (LDHA) Belcesiran (SERPINA1) DCR-Proprietary LY3819469 RG6346 (RO7445482) (HBV) DCR-COMP1 (C3) DCR-COMP2 (CFB) LY3561774 LY3849889 DCR-NOVO1

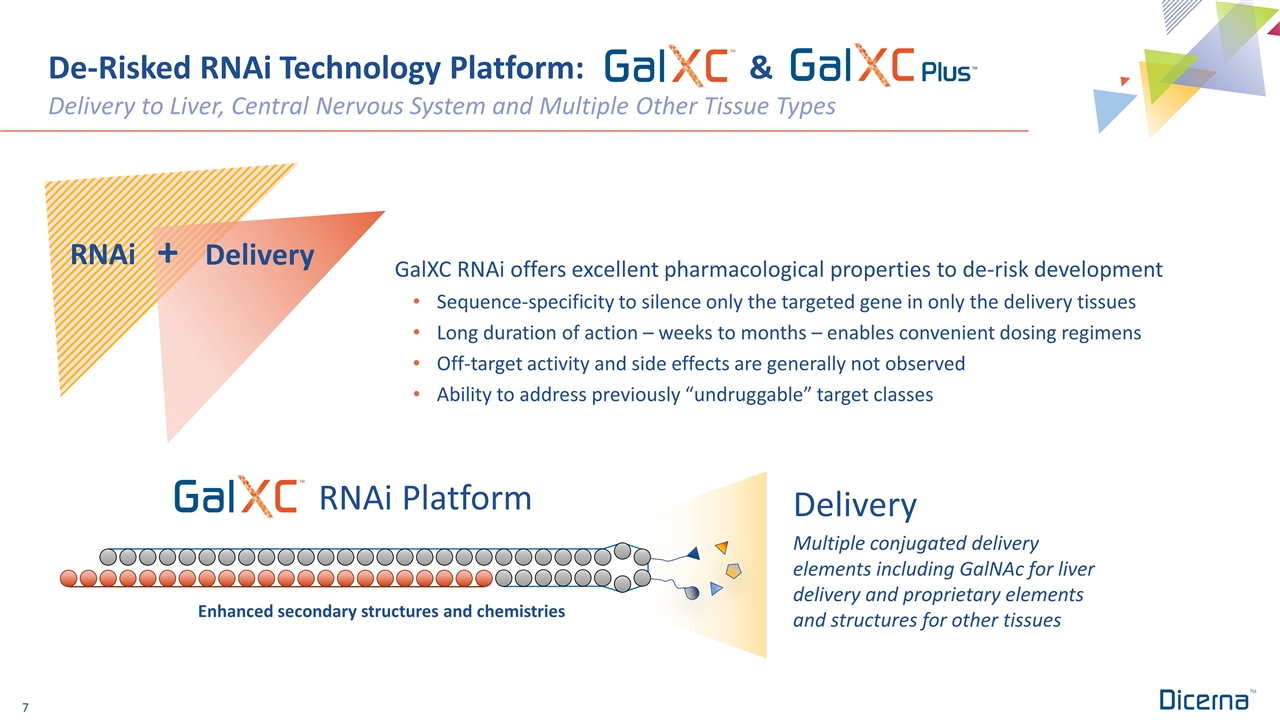

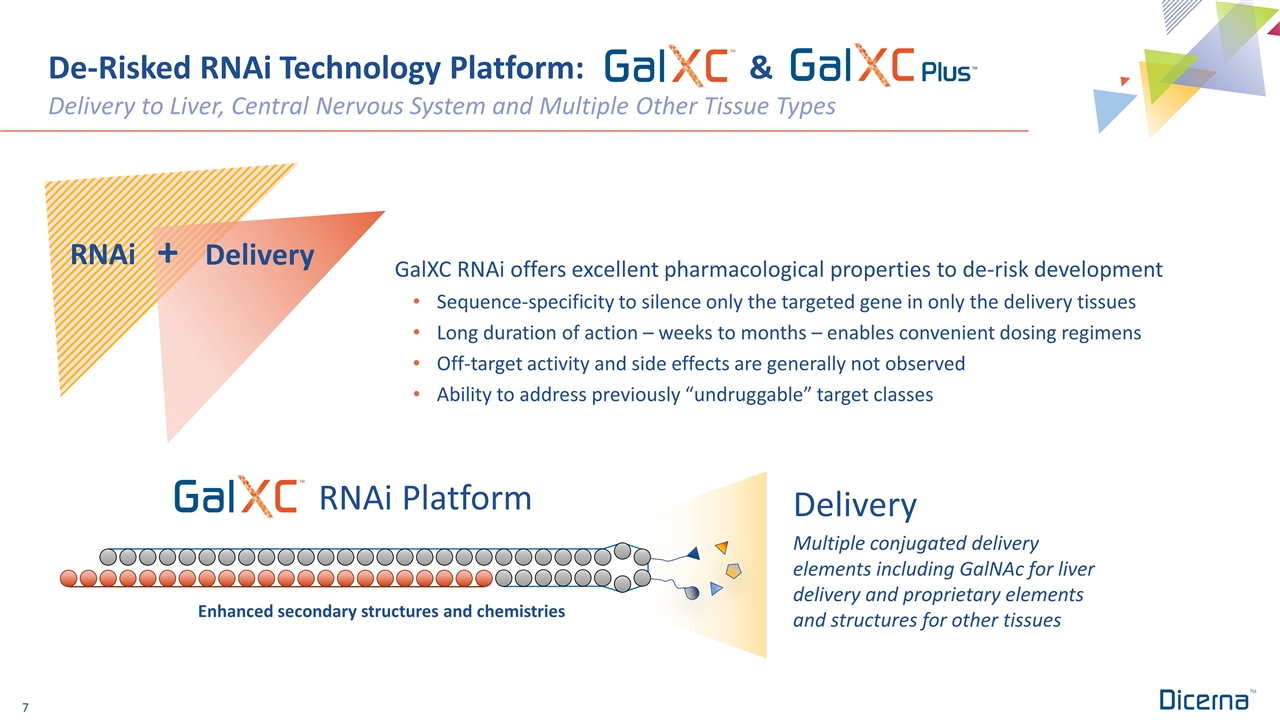

De-Risked RNAi Technology Platform: & Delivery to Liver, Central Nervous System and Multiple Other Tissue Types Enhanced secondary structures and chemistries RNAi Platform Multiple conjugated delivery elements including GalNAc for liver delivery and proprietary elements and structures for other tissues Delivery GalXC RNAi offers excellent pharmacological properties to de-risk development Sequence-specificity to silence only the targeted gene in only the delivery tissues Long duration of action – weeks to months – enables convenient dosing regimens Off-target activity and side effects are generally not observed Ability to address previously “undruggable” target classes RNAi Delivery +

Key Value Drivers Core Clinical Programs Nedosiran for PH Belcesiran for AATLD RG6346 (RO7445482) for chronic HBV Collaborative Programs Roche and Novo opt-in programs Extrahepatic Discovery Efforts Commercial Infrastructure Team and Balance Sheet

Nedosiran for the Treatment of Primary Hyperoxaluria (PH)

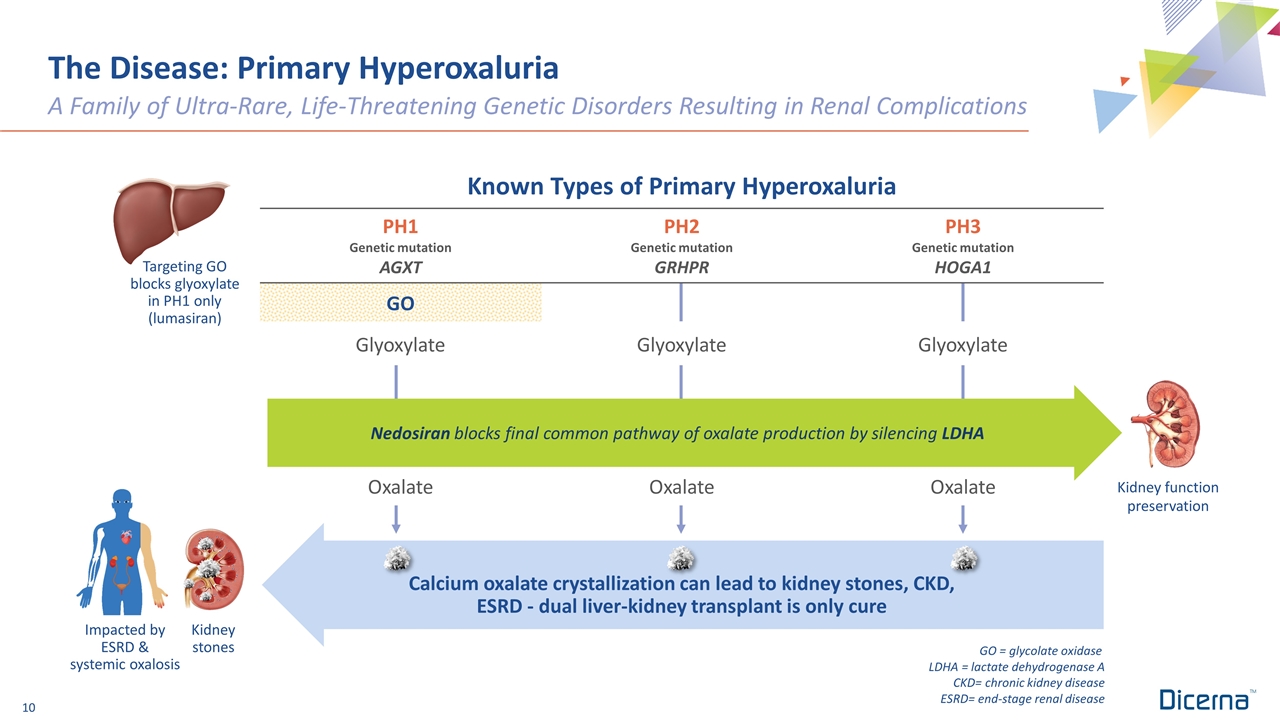

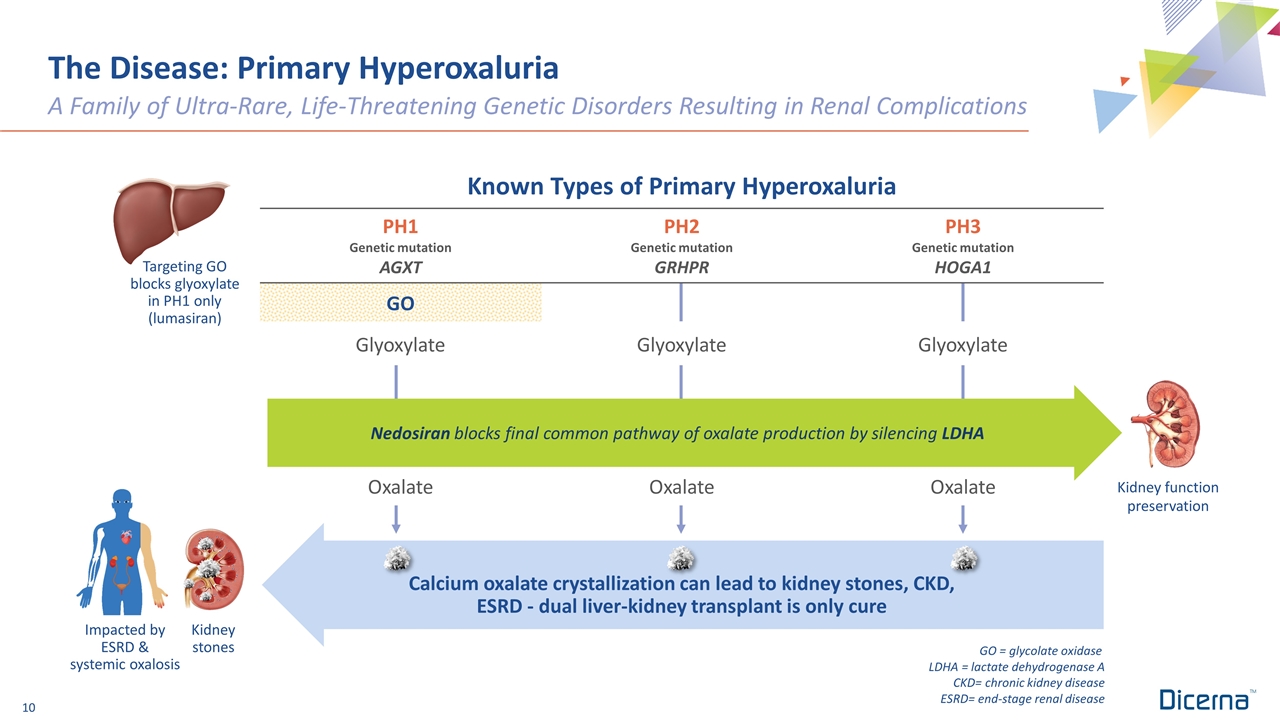

The Disease: Primary Hyperoxaluria A Family of Ultra-Rare, Life-Threatening Genetic Disorders Resulting in Renal Complications GO = glycolate oxidase LDHA = lactate dehydrogenase A CKD= chronic kidney disease ESRD= end-stage renal disease Kidney function preservation Kidney stones Impacted by ESRD & systemic oxalosis Targeting GO blocks glyoxylate in PH1 only (lumasiran) Known Types of Primary Hyperoxaluria PH1 Genetic mutation AGXT PH2 Genetic mutation GRHPR PH3 Genetic mutation HOGA1 GO Glyoxylate Glyoxylate Glyoxylate Oxalate Oxalate Oxalate Calcium oxalate crystallization can lead to kidney stones, CKD, ESRD - dual liver-kidney transplant is only cure Nedosiran blocks final common pathway of oxalate production by silencing LDHA

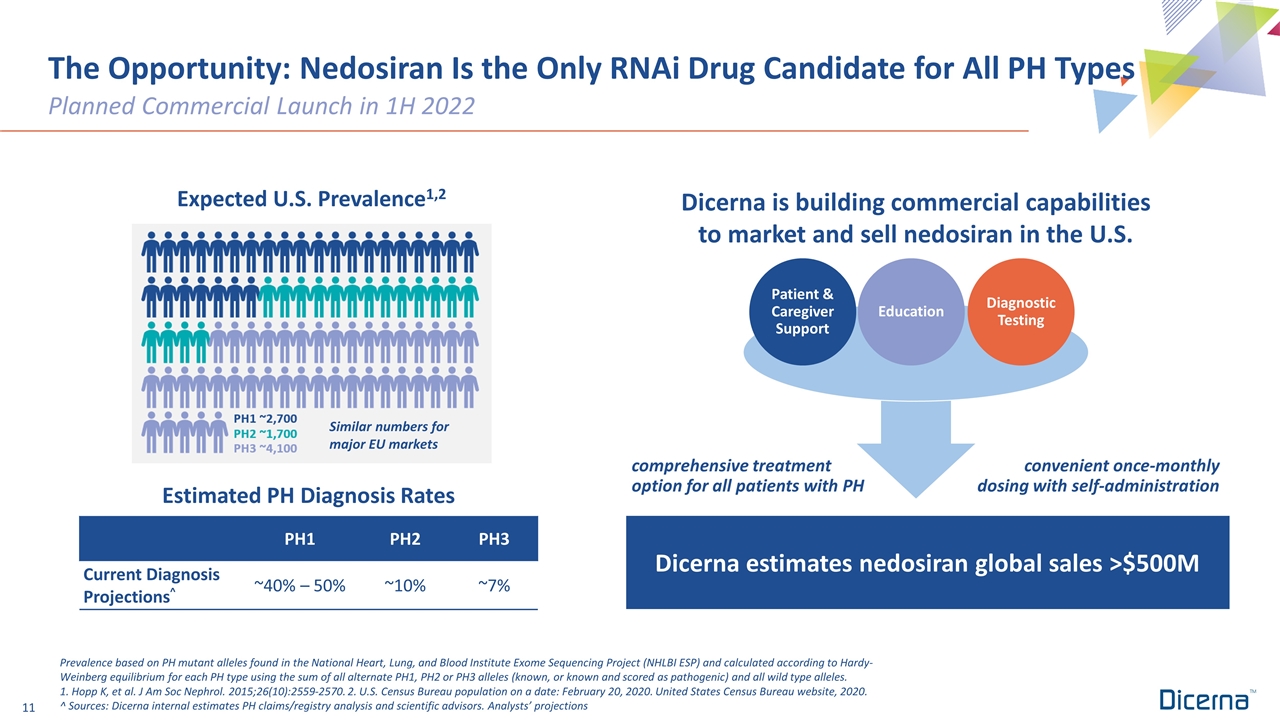

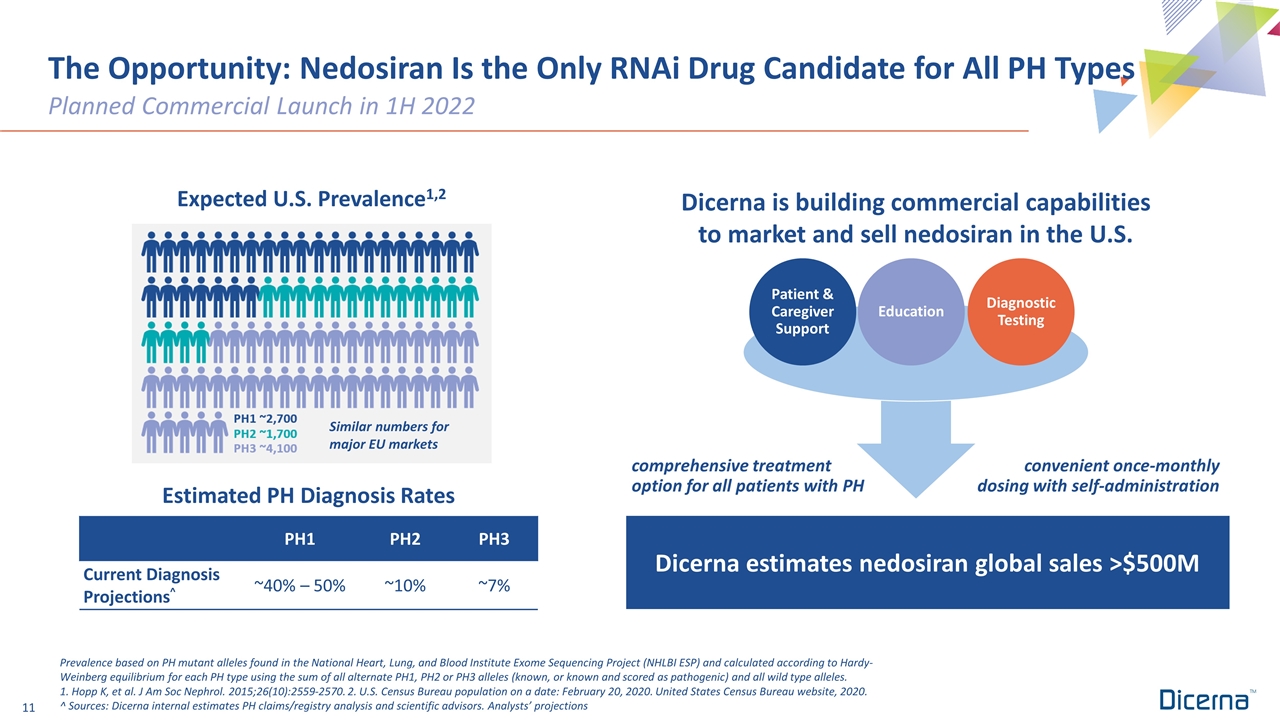

The Opportunity: Nedosiran Is the Only RNAi Drug Candidate for All PH Types Planned Commercial Launch in 1H 2022 comprehensive treatment option for all patients with PH Education Estimated PH Diagnosis Rates PH1 PH2 PH3 Current Diagnosis Projections^ ~40% – 50% ~10% ~7% Diagnostic Testing Patient & Caregiver Support Dicerna estimates nedosiran global sales >$500M Expected U.S. Prevalence1,2 Prevalence based on PH mutant alleles found in the National Heart, Lung, and Blood Institute Exome Sequencing Project (NHLBI ESP) and calculated according to Hardy-Weinberg equilibrium for each PH type using the sum of all alternate PH1, PH2 or PH3 alleles (known, or known and scored as pathogenic) and all wild type alleles. 1. Hopp K, et al. J Am Soc Nephrol. 2015;26(10):2559-2570. 2. U.S. Census Bureau population on a date: February 20, 2020. United States Census Bureau website, 2020. ^ Sources: Dicerna internal estimates PH claims/registry analysis and scientific advisors. Analysts’ projections Similar numbers for major EU markets Dicerna is building commercial capabilities to market and sell nedosiran in the U.S. convenient once-monthly dosing with self-administration

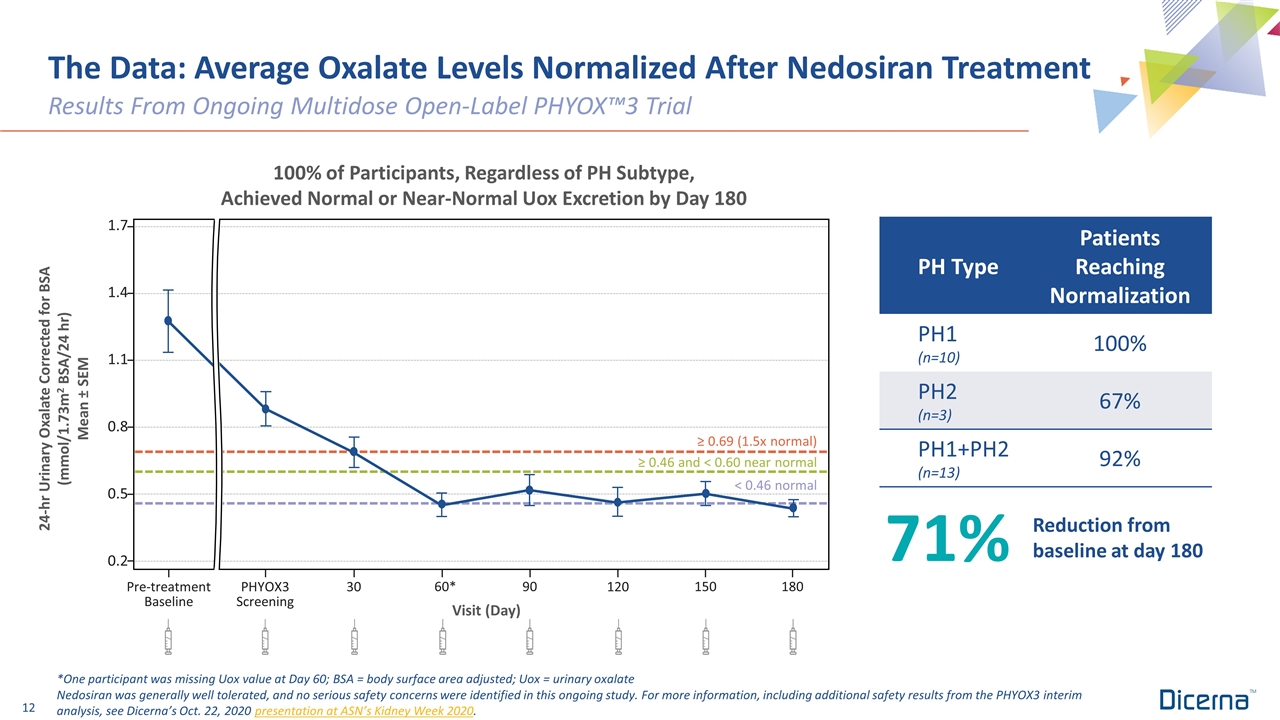

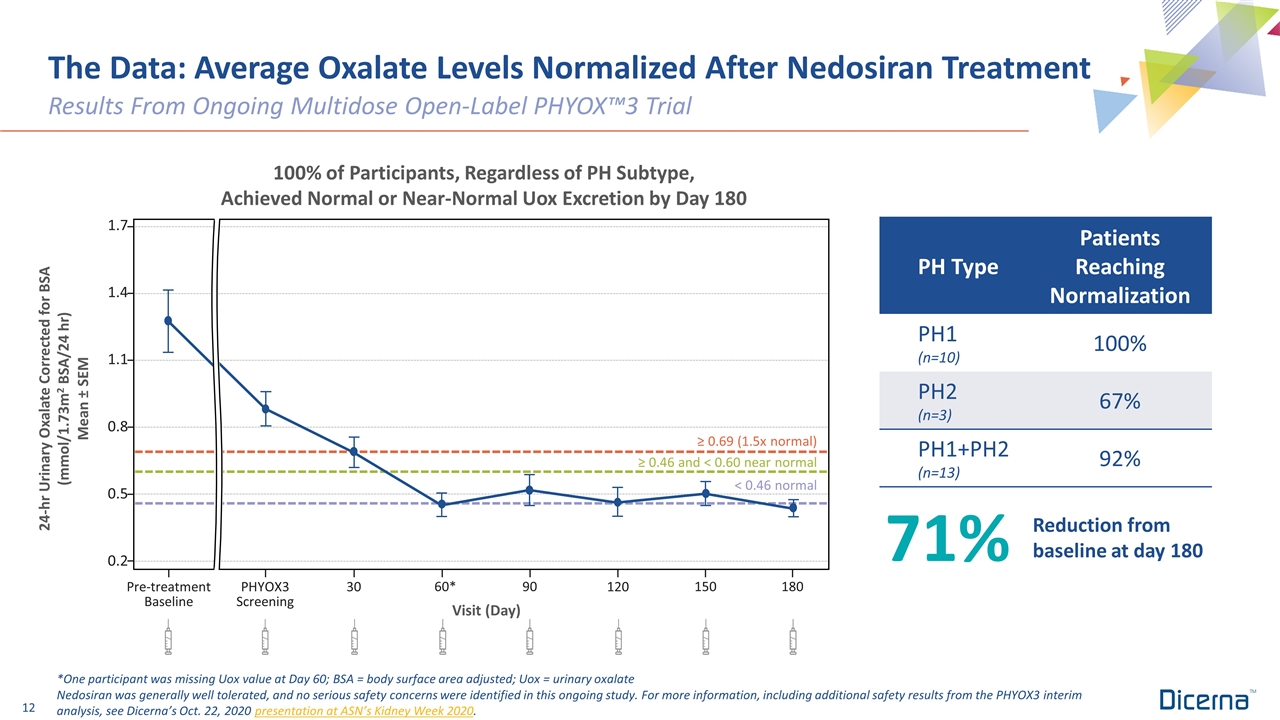

The Data: Average Oxalate Levels Normalized After Nedosiran Treatment Results From Ongoing Multidose Open-Label PHYOX™3 Trial *One participant was missing Uox value at Day 60; BSA = body surface area adjusted; Uox = urinary oxalate Nedosiran was generally well tolerated, and no serious safety concerns were identified in this ongoing study. For more information, including additional safety results from the PHYOX3 interim analysis, see Dicerna’s Oct. 22, 2020 presentation at ASN’s Kidney Week 2020. 24-hr Urinary Oxalate Corrected for BSA (mmol/1.73m2 BSA/24 hr) Mean ± SEM Pre-treatment Baseline PHYOX3 Screening 60* 90 120 150 180 Visit (Day) 30 < 0.46 normal 1.7 1.4 1.1 0.8 0.5 0.2 ≥ 0.46 and < 0.60 near normal ≥ 0.69 (1.5x normal) 100% of Participants, Regardless of PH Subtype, Achieved Normal or Near-Normal Uox Excretion by Day 180 PH Type Patients Reaching Normalization PH1 (n=10) 100% PH2 (n=3) 67% PH1+PH2 (n=13) 92% 71% Reduction from baseline at day 180

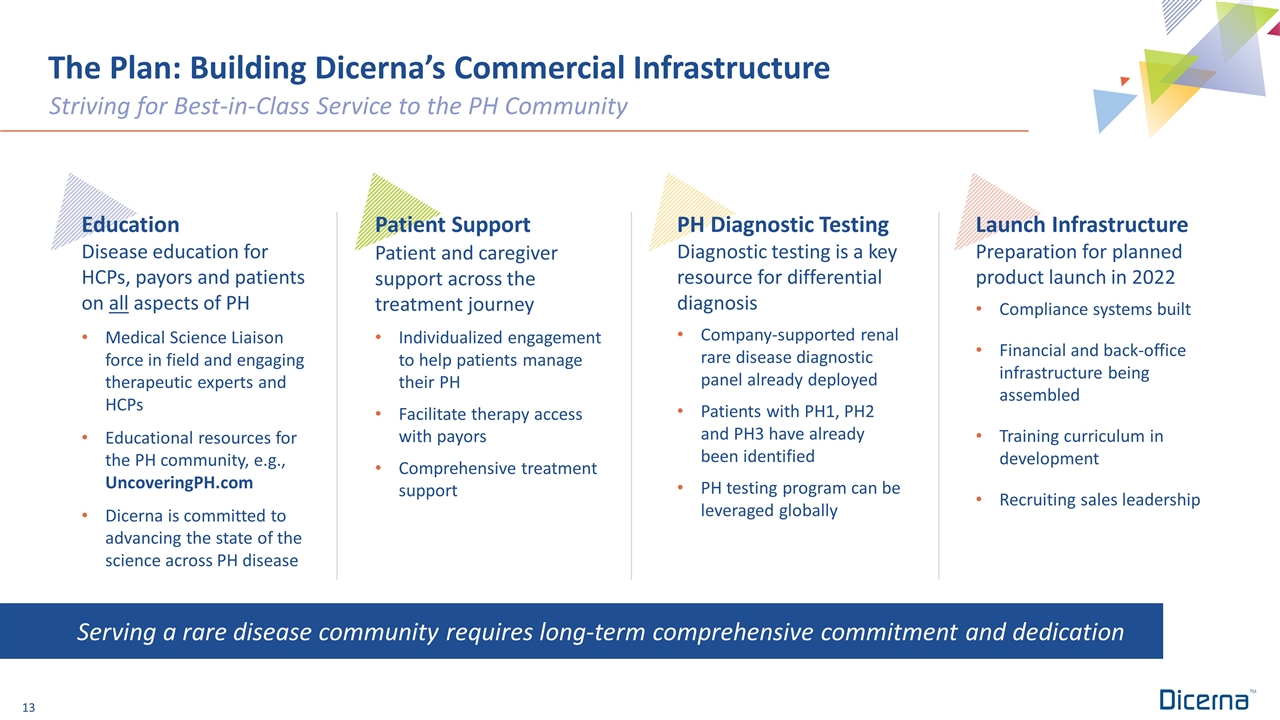

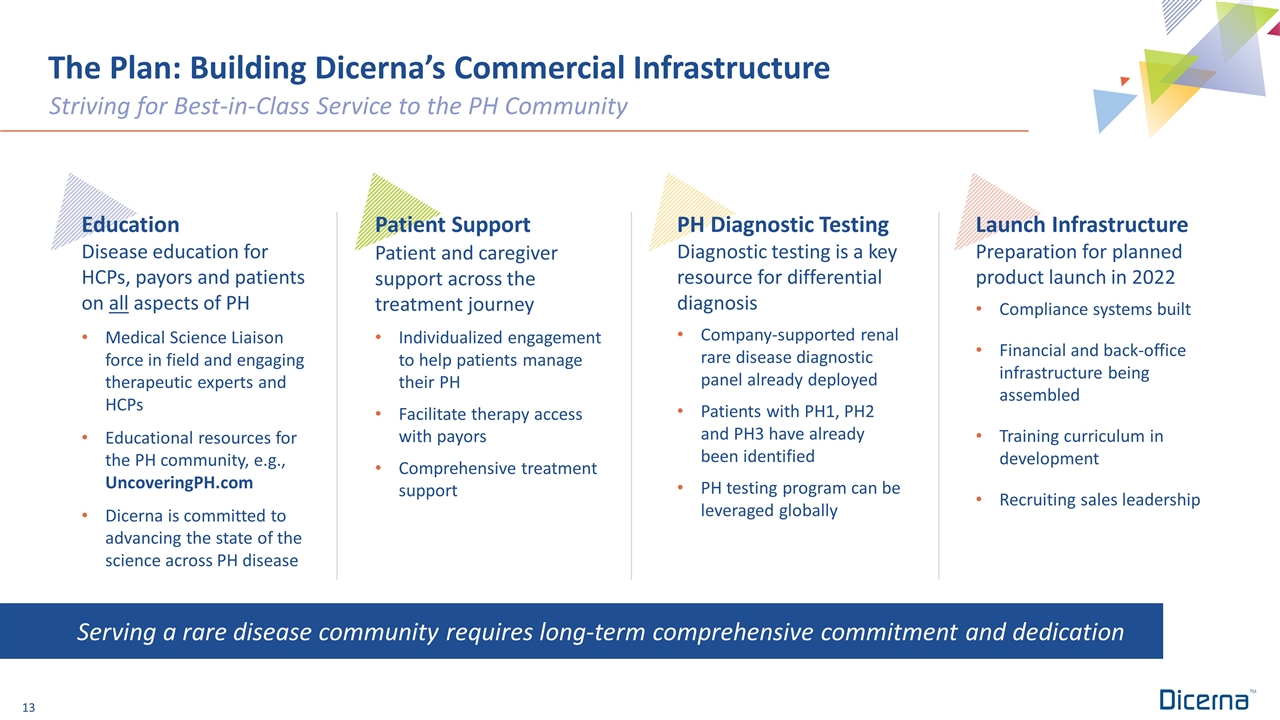

The Plan: Building Dicerna’s Commercial Infrastructure Striving for Best-in-Class Service to the PH Community Serving a rare disease community requires long-term comprehensive commitment and dedication Education Disease education for HCPs, payors and patients on all aspects of PH Medical Science Liaison force in field and engaging therapeutic experts and HCPs Educational resources for the PH community, e.g., UncoveringPH.com Dicerna is committed to advancing the state of the science across PH disease Patient Support Patient and caregiver support across the treatment journey Individualized engagement to help patients manage their PH Facilitate therapy access with payors Comprehensive treatment support PH Diagnostic Testing Diagnostic testing is a key resource for differential diagnosis Company-supported renal rare disease diagnostic panel already deployed Patients with PH1, PH2 and PH3 have already been identified PH testing program can be leveraged globally Launch Infrastructure Preparation for planned product launch in 2022 Compliance systems built Financial and back-office infrastructure being assembled Training curriculum in development Recruiting sales leadership

RG6346 (RO7445482) for the Treatment of Chronic Hepatitis B Virus (HBV) Infection

The Disease: Chronic HBV is a Severe, Global Unmet Medical Need Significant worldwide prevalence: ~292 million infected, >880,000 deaths per year Current treatments are rarely effective in achieving functional cures Collaborating with Roche to conduct Phase 2 combination clinical studies with RG6346 (RO7445482) and multiple additional mechanisms: Nucleos(t)ide (NUC), Interferon, TLR7 agonist, core inhibitor (CpAM) Dicerna “opt-in” to co-fund development for enhanced U.S. economics and co-commercialization rights Multi-billion $ opportunity HBV “decoy” particles and filaments (HBV S Antigen) and infectious viral particles from patient blood Clinicaltrials.gov NCT04225715 Sources: Polaris Observatory Collaborators. Global prevalence, treatment, and prevention of hepatitis B virus infection in 2016: a modelling study. The Lancet Gastroenterology and Hepatology. Volume 3, Issue 6, June 2018, Pages 383-403. Hepatitis B Foundation. Facts and Figures. Available at: http://www.hepb.org/what-is-hepatitis-b/what-is-hepb/facts-and-figures/. Accessed on Jan. 8, 2021.

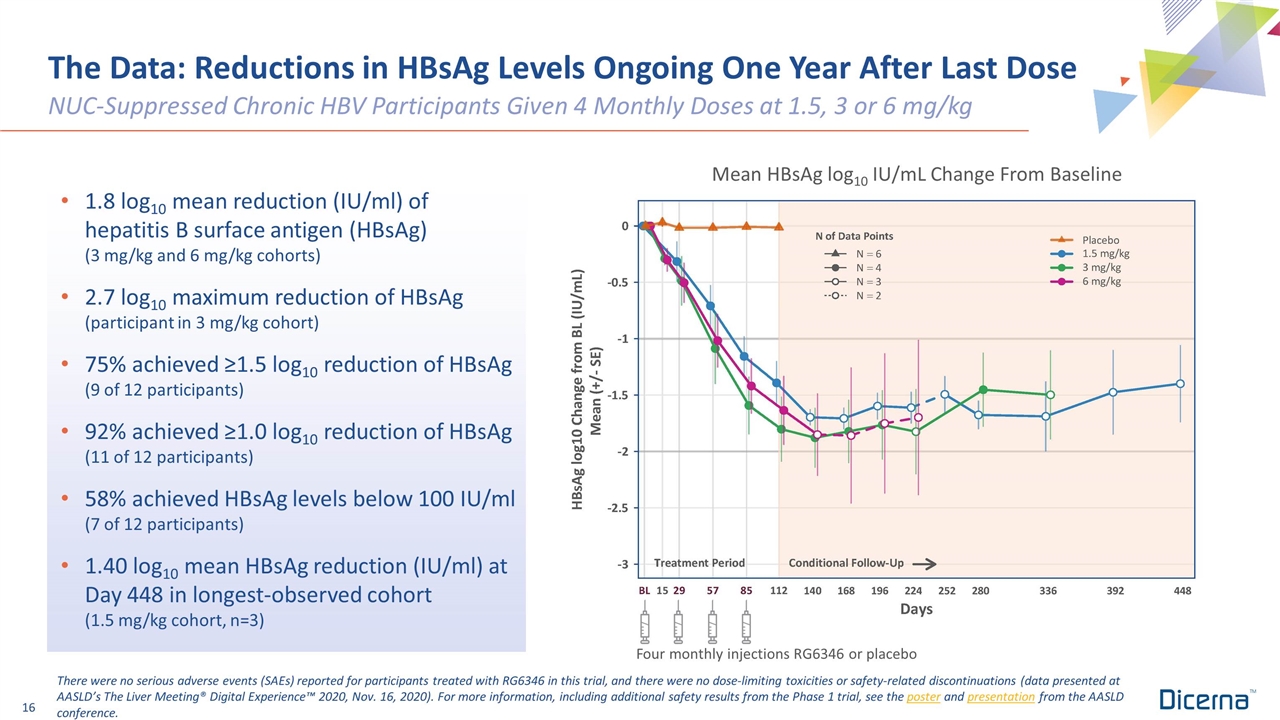

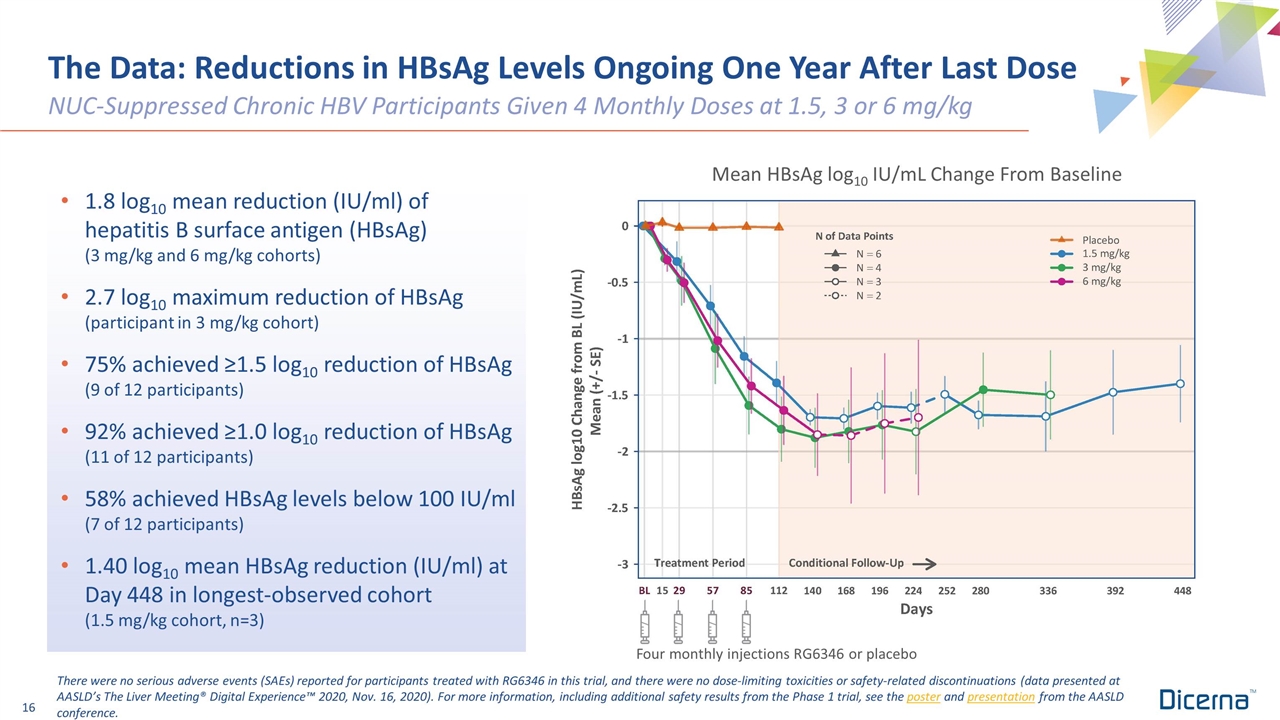

Mean HBsAg log10 IU/mL Change From Baseline The Data: Reductions in HBsAg Levels Ongoing One Year After Last Dose NUC-Suppressed Chronic HBV Participants Given 4 Monthly Doses at 1.5, 3 or 6 mg/kg 1.8 log10 mean reduction (IU/ml) of hepatitis B surface antigen (HBsAg) (3 mg/kg and 6 mg/kg cohorts) 2.7 log10 maximum reduction of HBsAg (participant in 3 mg/kg cohort) 75% achieved ≥1.5 log10 reduction of HBsAg (9 of 12 participants) 92% achieved ≥1.0 log10 reduction of HBsAg (11 of 12 participants) 58% achieved HBsAg levels below 100 IU/ml (7 of 12 participants) 1.40 log10 mean HBsAg reduction (IU/ml) at Day 448 in longest-observed cohort (1.5 mg/kg cohort, n=3) There were no serious adverse events (SAEs) reported for participants treated with RG6346 in this trial, and there were no dose-limiting toxicities or safety-related discontinuations (data presented at AASLD’s The Liver Meeting® Digital Experience™ 2020, Nov. 16, 2020). For more information, including additional safety results from the Phase 1 trial, see the poster and presentation from the AASLD conference. Four monthly injections RG6346 or placebo

Belcesiran for the Treatment of Alpha-1 Antitrypsin Deficiency-Associated Liver Disease (AATLD)

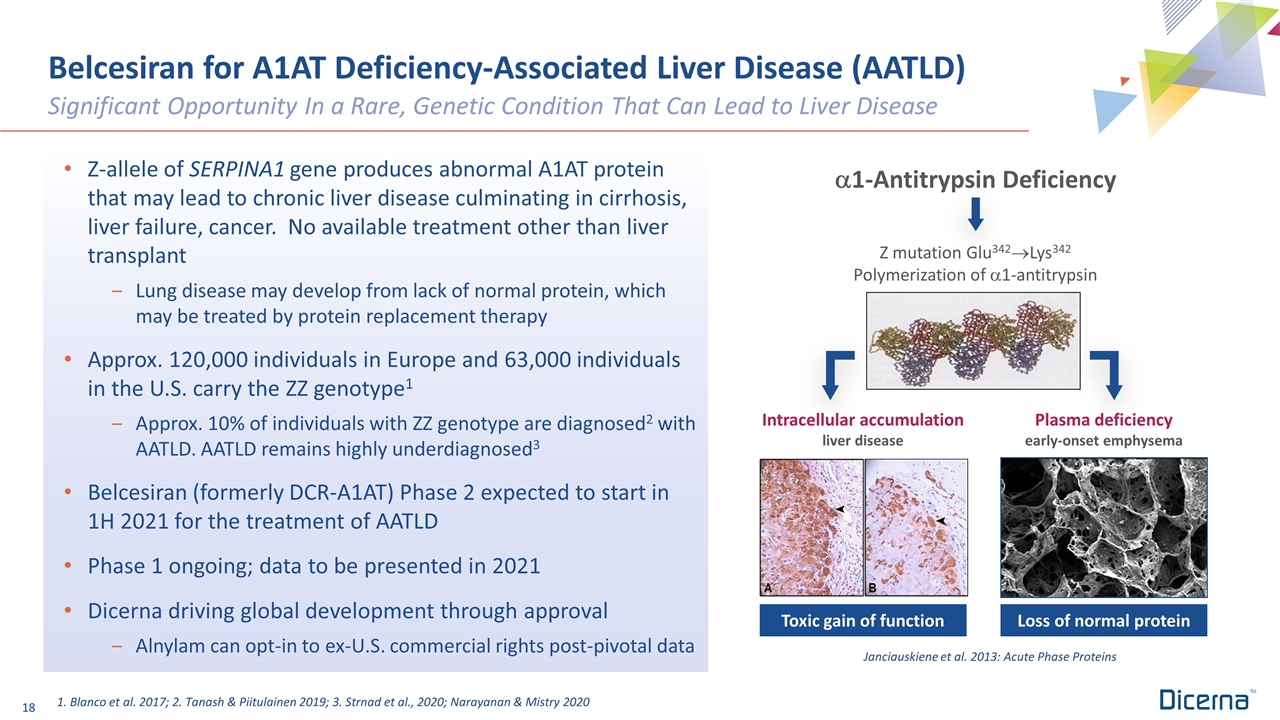

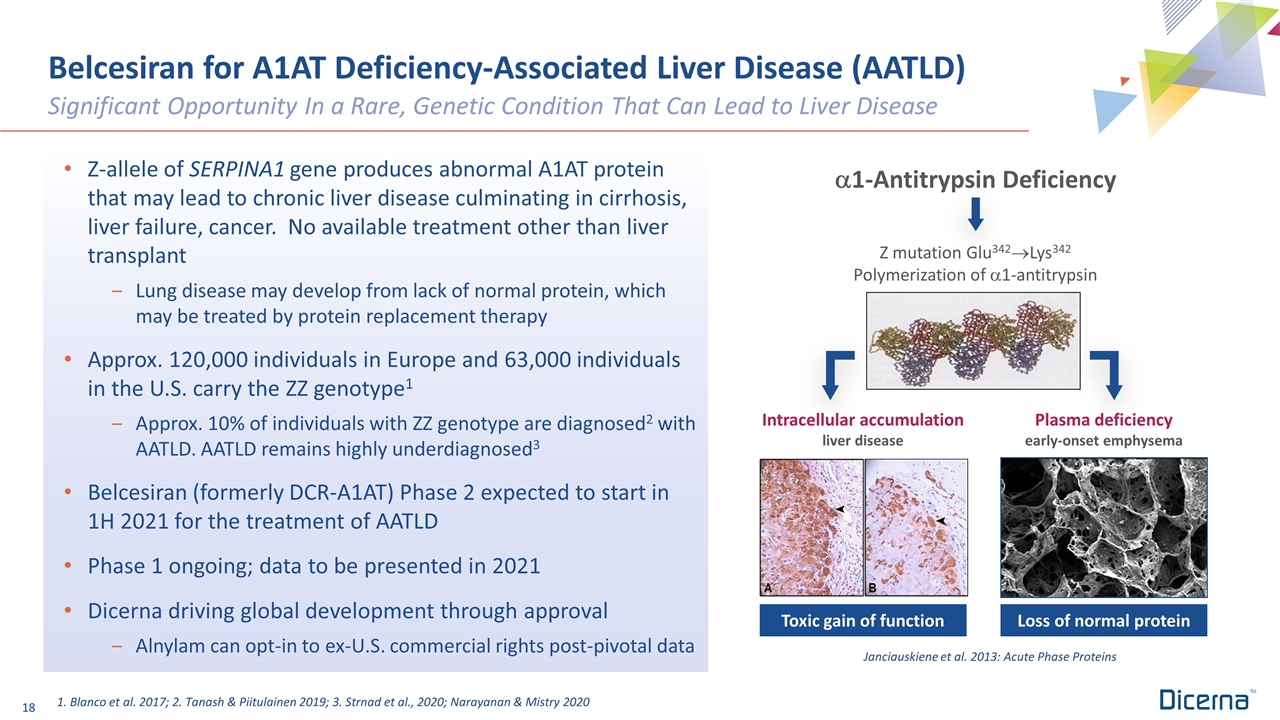

Belcesiran for A1AT Deficiency-Associated Liver Disease (AATLD) Significant Opportunity In a Rare, Genetic Condition That Can Lead to Liver Disease Z-allele of SERPINA1 gene produces abnormal A1AT protein that may lead to chronic liver disease culminating in cirrhosis, liver failure, cancer. No available treatment other than liver transplant Lung disease may develop from lack of normal protein, which may be treated by protein replacement therapy Approx. 120,000 individuals in Europe and 63,000 individuals in the U.S. carry the ZZ genotype1 Approx. 10% of individuals with ZZ genotype are diagnosed2 with AATLD. AATLD remains highly underdiagnosed3 Belcesiran (formerly DCR-A1AT) Phase 2 expected to start in 1H 2021 for the treatment of AATLD Phase 1 ongoing; data to be presented in 2021 Dicerna driving global development through approval Alnylam can opt-in to ex-U.S. commercial rights post-pivotal data 1. Blanco et al. 2017; 2. Tanash & Piitulainen 2019; 3. Strnad et al., 2020; Narayanan & Mistry 2020 Janciauskiene et al. 2013: Acute Phase Proteins Loss of normal protein Toxic gain of function a1-Antitrypsin Deficiency Z mutation Glu342®Lys342 Polymerization of a1-antitrypsin Intracellular accumulation liver disease Plasma deficiency early-onset emphysema

Corporate Collaborations

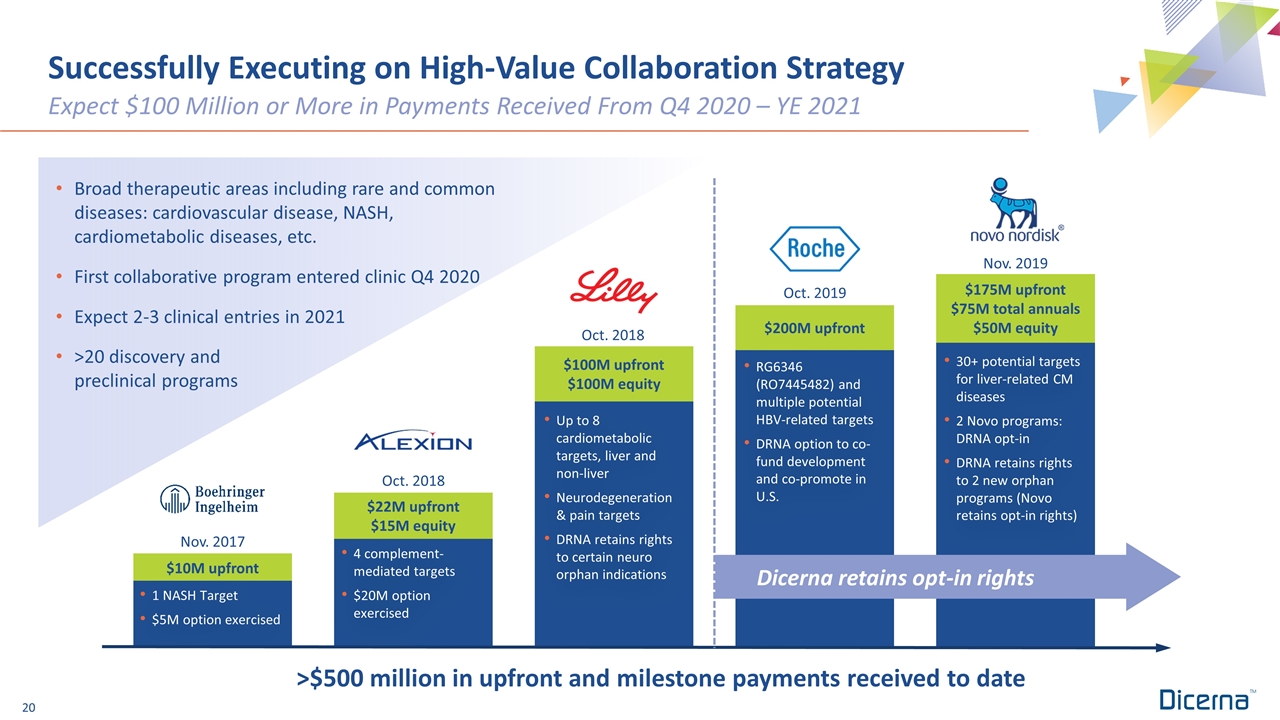

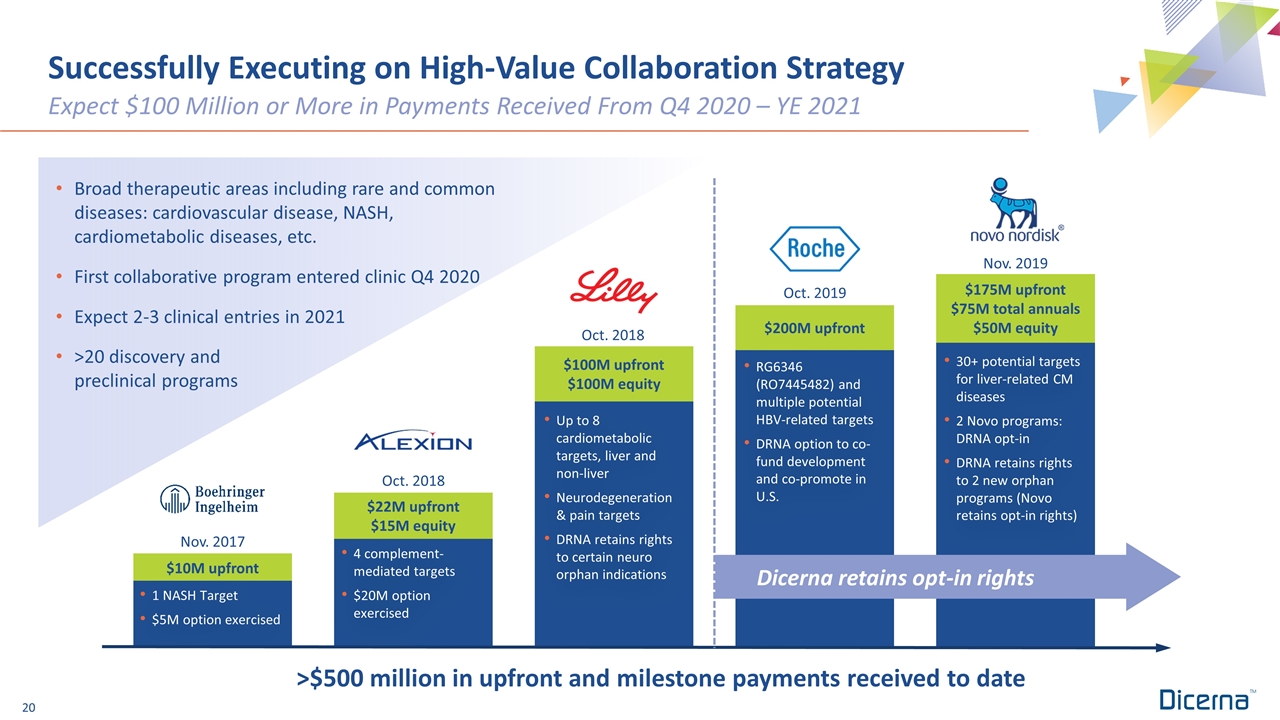

Successfully Executing on High-Value Collaboration Strategy Broad therapeutic areas including rare and common diseases: cardiovascular disease, NASH, cardiometabolic diseases, etc. First collaborative program entered clinic Q4 2020 Expect 2-3 clinical entries in 2021 >20 discovery and preclinical programs Expect $100 Million or More in Payments Received From Q4 2020 – YE 2021 $175M upfront $75M total annuals $50M equity $200M upfront $100M upfront $100M equity 1 NASH Target $5M option exercised $10M upfront $22M upfront $15M equity Nov. 2017 Oct. 2018 Oct. 2018 Oct. 2019 Nov. 2019 Dicerna retains opt-in rights 4 complement-mediated targets $20M option exercised Up to 8 cardiometabolic targets, liver and non-liver Neurodegeneration & pain targets DRNA retains rights to certain neuro orphan indications RG6346 (RO7445482) and multiple potential HBV-related targets DRNA option to co-fund development and co-promote in U.S. 30+ potential targets for liver-related CM diseases 2 Novo programs: DRNA opt-in DRNA retains rights to 2 new orphan programs (Novo retains opt-in rights) >$500 million in upfront and milestone payments received to date

Extrahepatic Platform

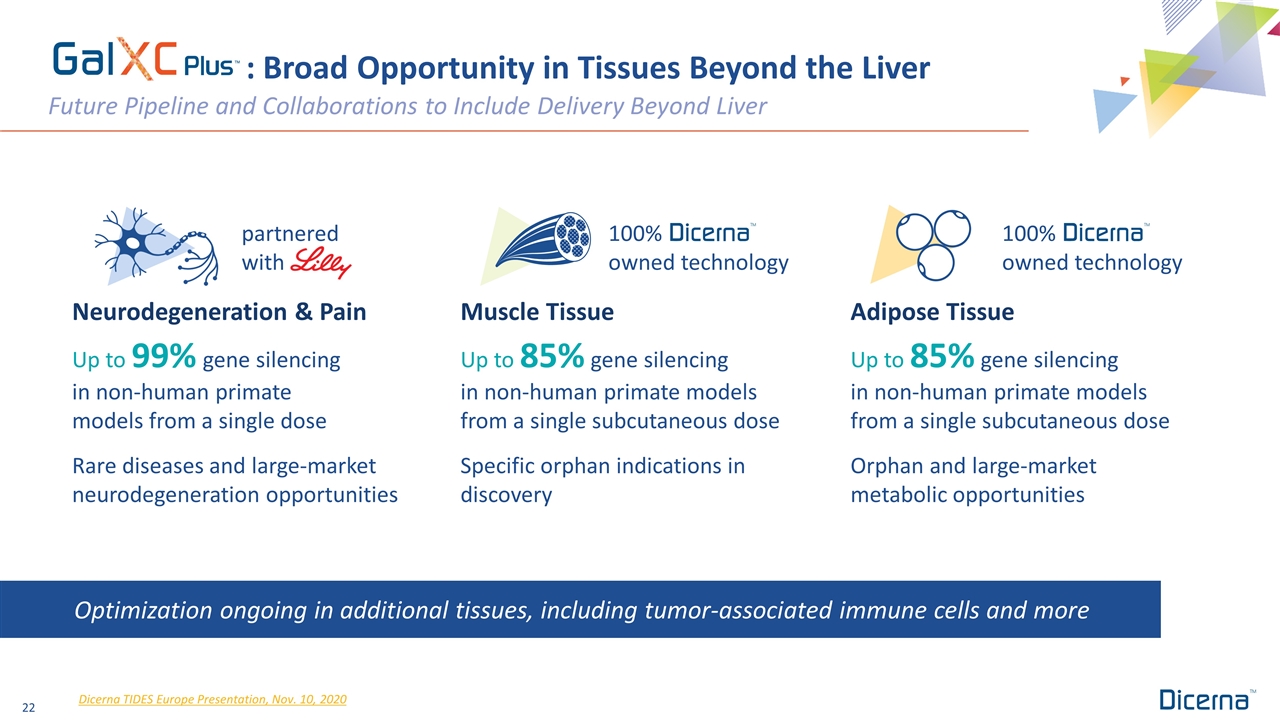

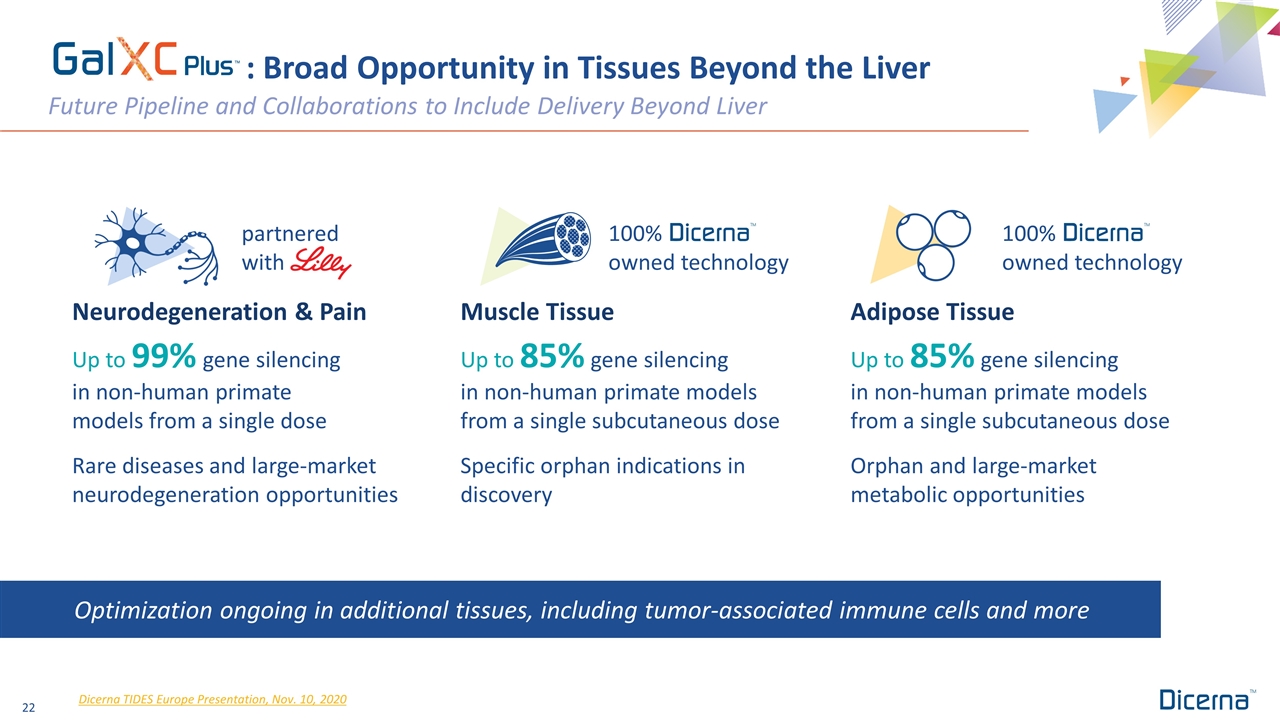

: Broad Opportunity in Tissues Beyond the Liver Future Pipeline and Collaborations to Include Delivery Beyond Liver Dicerna TIDES Europe Presentation, Nov. 10, 2020 100% owned technology Up to 99% gene silencing in non-human primate models from a single dose Rare diseases and large-market neurodegeneration opportunities Up to 85% gene silencing in non-human primate models from a single subcutaneous dose Specific orphan indications in discovery Up to 85% gene silencing in non-human primate models from a single subcutaneous dose Orphan and large-market metabolic opportunities Optimization ongoing in additional tissues, including tumor-associated immune cells and more partnered with Neurodegeneration & Pain 100% owned technology Muscle Tissue Adipose Tissue

Management Team Leading Experts in RNAi Technology, Clinical, Regulatory and Commercial Operations Douglas M. Fambrough, Ph.D. President and Chief Executive Officer Douglas Pagán Chief Financial Officer Rob Ciappenelli Chief Commercial Officer Shreeram Aradhye, M.D. EVP, Chief Medical Officer Bob D. Brown, Ph.D. EVP R&D, Chief Scientific Officer Jim Weissman EVP, Chief Operating Officer Ling Zeng, J.D. Chief Legal Officer & Secretary Jennifer Lockridge, Ph.D. SVP, Program Development James Powell SVP, Technical Operations Regina DeTore Paglia Chief Human Resources Officer Dicerna founder Sirna Therapeutics Whitehead/Broad Institute Ph.D., UC Berkeley Joined Dicerna in 2012 VP, BD of MannKind Corp Pfizer, Pharmacia Joined Dicerna in 2020 CMO & Global Head Med. Affairs, Novartis Pharma M.D., All India Institute of Medical Sciences Joined Dicerna in 2020 CFO, KSQ Therapeutics CFO, Paratek MBA, Columbia University Joined Dicerna in 2019 Global Head Commercial, Momenta US Head Commercial Ops, Shire MBA, Harvard University Joined Dicerna in 2008 VP, Research & Technology; Director of Biology, Genta Ph.D., UC Berkeley Joined Dicerna in 2020 Deputy Head of M&A, Novartis VP, GC for Europe, Bausch JD, Georgetown University Joined Dicerna in 2016 Sirna Therapeutics Ribozyme Ph.D., Oregon Health Sciences Joined Dicerna in 2017 General Manager, Oligo manufacturing Agilent Eyetech Joined Dicerna in 2019 SVP, HR, Paratek SVP, HR, Myriant Corp MA, Framingham State

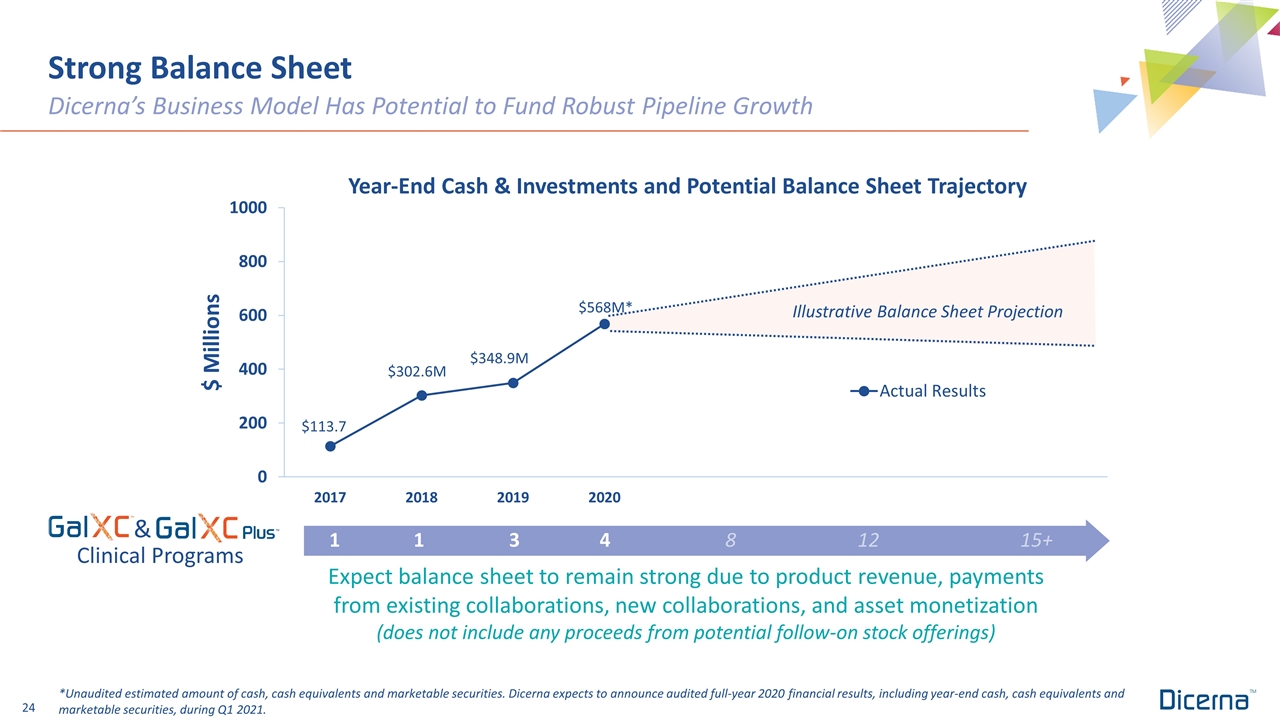

Strong Balance Sheet Dicerna’s Business Model Has Potential to Fund Robust Pipeline Growth Expect balance sheet to remain strong due to product revenue, payments from existing collaborations, new collaborations, and asset monetization (does not include any proceeds from potential follow-on stock offerings) 1 13481215+ $568M* *Unaudited estimated amount of cash, cash equivalents and marketable securities. Dicerna expects to announce audited full-year 2020 financial results, including year-end cash, cash equivalents and marketable securities, during Q1 2021. $348.9M $302.6M $113.7 Illustrative Balance Sheet Projection & Clinical Programs

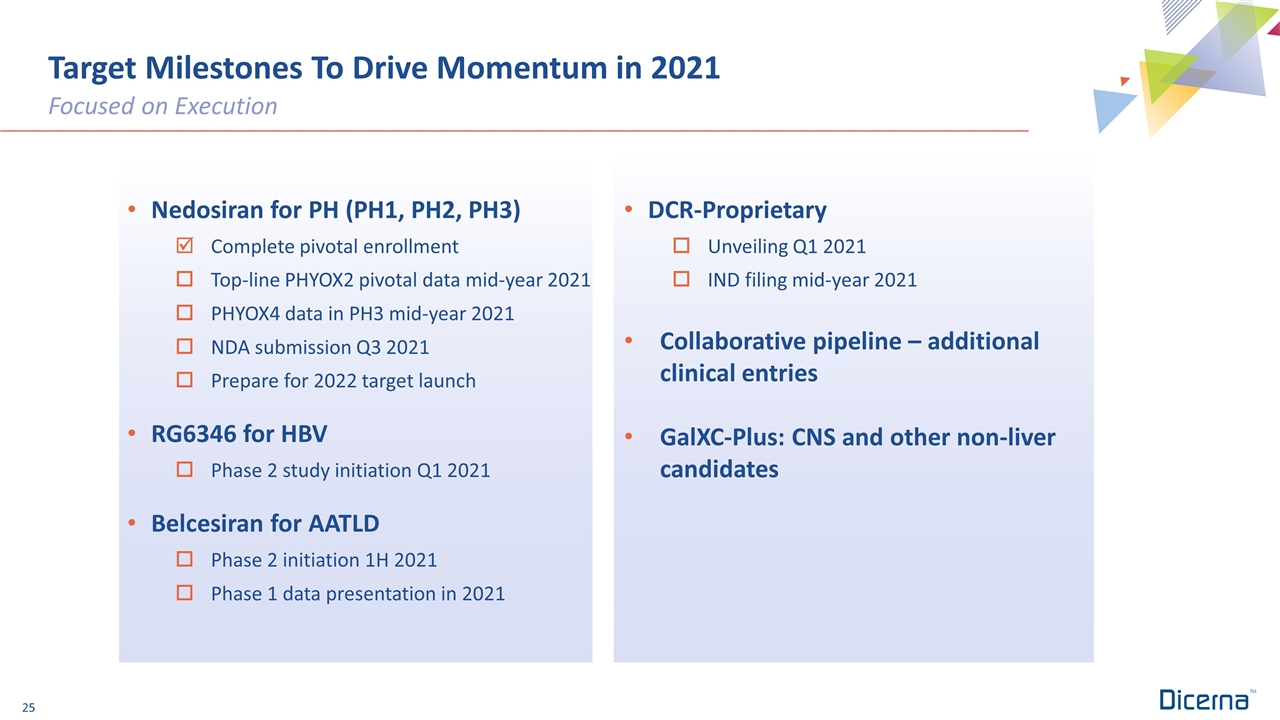

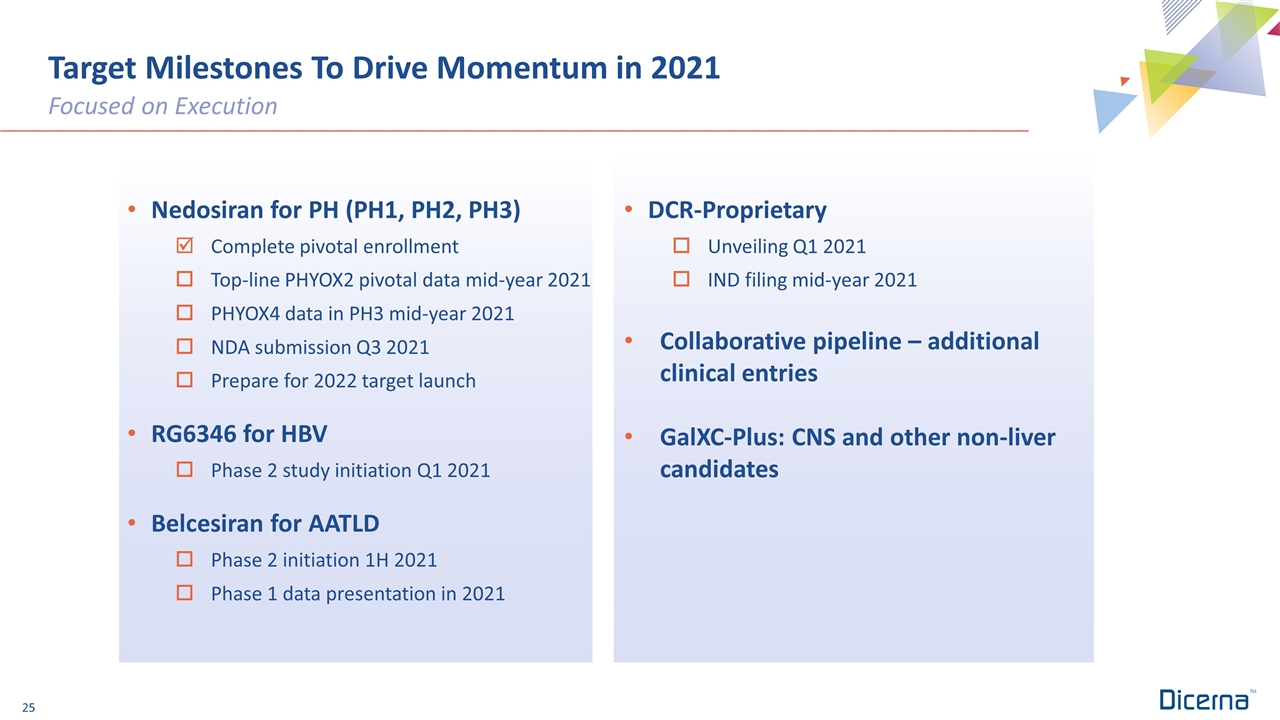

Target Milestones To Drive Momentum in 2021 Focused on Execution Nedosiran for PH (PH1, PH2, PH3) Complete pivotal enrollment Top-line PHYOX2 pivotal data mid-year 2021 PHYOX4 data in PH3 mid-year 2021 NDA submission Q3 2021 Prepare for 2022 target launch RG6346 for HBV Phase 2 study initiation Q1 2021 Belcesiran for AATLD Phase 2 initiation 1H 2021 Phase 1 data presentation in 2021 DCR-Proprietary Unveiling Q1 2021 IND filing mid-year 2021 Collaborative pipeline – additional clinical entries GalXC-Plus: CNS and other non-liver candidates