By removing the price volatility from a portion, which may be substantial, of the natural gas production from the partnerships, the managing general partner and its affiliates will reduce, but not eliminate, the potential effects of changing natural gas prices on a portion, which may be substantial, of the cash flow from the partnerships for the periods covered by the hedges. Furthermore, while intended to help reduce the effects of volatile natural gas prices, such transactions, depending on the hedging instrument used, may limit the potential gains for the partnerships if natural gas prices were to rise substantially over the price established by the hedge. Also, the partnerships could incur liability on the financial hedges. For example, a partnership would be exposed to the risk of a financial loss if any of the following occur:

See “Proposed Activities - Sale of Natural Gas and Oil Production - Natural Gas Contracts.”

If the managing general partner is not the actual operator of the well for all of the working interest owners of the well, then there is a risk that the managing general partner cannot supervise the third-party operator closely enough. For example, decisions related to the following would be made by the third-party operator and may not be in the best interests of the partnerships and you and the other investors:

Further, the third-party operator may have financial difficulties and fail to pay for materials or services on the wells it drills or operates, which would cause the partnership to incur extra costs in discharging materialmen’s and workmen’s liens. The managing general partner may not be the operator of a well for all of the working interest owners of the well if the partnership owns less than a 50% working interest in the well, or if the managing general partner acquired the working interest in the well from a third-party under arrangements that required the third-party to be named operator as one of the terms of the acquisition.

Also, each partnership will own less than 100% of the working interest in some of its wells. If a court holds you and the other third-party working interest owners of the well liable for the development and operation of a well and the third-party working interest owners do not pay their proportionate share of the costs and liabilities associated with the well, then the partnership and you and the other investor general partners also would be liable for those costs and liabilities.

If your partnership’s insurance proceeds and assets, the managing general partner’s indemnification of you and the other investor general partners, and the liability coverage provided by major subcontractors were not sufficient to satisfy the liability, then the managing general partner would call for additional funds from you and the other investor general partners to satisfy the liability. See “Actions To Be Taken By Managing General Partner To Reduce Risks of Additional Payments by Investor General Partners,” including the managing general partner’s current insurance coverage of $10 million for pollution liability, which may not be adequate. Additionally, any of the drilling hazards may result in the loss of the well and the associated revenues. Finally, an investor general partner may have liability if his partnership does not properly plug and abandon a well. See “Participation in Costs and Revenues - Costs - Operating Costs, Direct Costs, Administrative Costs and All Other Costs” relating to the costs associated with plugging and abandoning wells.

A significant financial reversal for the managing general partner could adversely affect its ability to honor these obligations.

Also, a sale of your units could create adverse tax and economic consequences for you. The sale or exchange of all or part of your units held for more than 12 months generally will result in a recognition of long-term capital gain or loss. However, previous deductions for depreciation, depletion and intangible drilling costs may be recaptured as ordinary income rather than capital gain regardless of how long you have owned your units. If you have held your units for 12 months or less, then the gain or loss generally will be short-term gain or loss. Also, your pro rata share of a partnership’s liabilities, if any, as of the date of the sale or exchange of your units must be included in the amount realized by you. Thus, the gain recognized by you may result in a tax liability greater than the cash proceeds, if any, received by you from the sale or other disposition of your units, if permitted under the partnership agreement. (See “Federal Income Tax Consequences - Disposition of Units” and “Presentment Feature.”)

On the other hand, to the extent more than the minimum subscription proceeds are received by a partnership and the number of wells drilled increases, the partnership’s overall investment return may decrease if the managing general partner is unable to find enough suitable wells to be drilled. (See “Proposed Activities - Acquisition of Leases.”) Also, to the extent a partnership’s subscription proceeds and number of wells it drills increase, greater demands will be placed on the managing general partner’s management capabilities.

In addition, the cost of drilling and completing a well is often uncertain and there may be cost overruns in drilling and completing the wells, because the wells will not be drilled and completed on a turnkey basis for a fixed price that would shift certain risks of loss from the partnerships to the managing general partner as drilling contractor. The majority of the equipment costs of each partnership’s wells will be paid by the managing general partner. However, all of the intangible drilling costs of a partnership’s wells will be charged to you and the other investors in that partnership. If a partnership incurs a cost overrun for the intangible drilling costs of a well or wells, then the managing general partner anticipates that it would use the partnership’s subscription proceeds, if available, to pay the cost overrun or advance the necessary funds to the partnership. Using subscription proceeds to pay cost overruns charged to you and the other investors under the partnership agreement will result in a partnership drilling fewer wells.

On the other hand, if the price of natural gas and oil decreases before a partnership’s wells are drilled, the drilling and completion costs of the wells to be drilled by the partnerships would, in all likelihood, not be affected since the managing general partner believes that, in the short term, drilling and completion costs are not likely to be reduced by a drop in natural gas and oil prices. Also, the reduced availability of drilling rigs and other related equipment may make it more difficult to drill a partnership’s wells in a timely manner or to comply with the prepaid intangible drilling costs rules discussed in “Federal Income Tax Consequences - Drilling Contracts.”

Thus, you do not have any geological or production information to evaluate any additional and/or substituted prospects and wells. Also, if the subscription proceeds received by a partnership are insufficient to drill all of the identified prospects, then the managing general partner will choose those prospects which it believes are most suitable for the partnership. You must rely entirely on the managing general partner to select the prospects and wells for a partnership.

In addition, the partnerships do not have the right of first refusal in the selection of prospects from the inventory of the managing general partner and its affiliates, and they may sell their prospects to other partnerships, companies, joint ventures, or other persons at any time.

Other than certain guidelines set forth in “Conflicts of Interest,” the managing general partner has no established procedures to resolve a conflict of interest. Also, the partnerships do not have an independent investment committee. Thus, certain matters, including conflicts of interest between a partnership and the managing general partner and its affiliates such as those described above or set forth in “Conflicts of Interest,” may not be resolved as favorably to you and the other investors in your partnership as they would be if there was an independent investment committee.

Further, the presentment price for your units may not reflect the full value of a partnership’s property or your units because of the difficulty in accurately estimating natural gas and oil reserves. Reservoir engineering is a subjective process of estimating underground accumulations of natural gas and oil that cannot be measured in an exact way, and the accuracy of the reserve estimate is a function of the quality of the available data and of engineering and geological interpretation and judgment. Also, the reserves and future net revenues are based on various assumptions as to natural gas and oil prices, taxes, development expenses, capital expenses, operating expenses and availability of funds. Any significant variance in these assumptions, including the price of natural gas, could materially affect the estimated quantity of the reserves. As a result, the managing general partner’s estimates are inherently imprecise and may not correspond to realizable value. Thus, the presentment price paid for your units and the amount of any partnership distributions received by you before the presentment may be less than the subscription amount you paid for your units. However, because the presentment price is a contractual price it is not reduced by discounts for minority interests and lack of marketability that generally are used to value partnership interests for tax and other purposes, but it is subject to discounts for purposes of determining present value and the amount to be paid. (See “Presentment Feature.”)

Finally, see “- An Investment in a Partnership Must be for the Long-Term Because the Units Are Illiquid and Not Readily Transferable,” above, concerning the tax effects on you of presenting your units for purchase.

The managing general partner and its affiliates will be engaged in other oil and gas activities, including other partnerships and unrelated business ventures for their own account or for the account of others, during the term of each partnership. Thus, the competition for time and services of the managing general partner and its affiliates could result in insufficient attention to the management and operation of the partnerships.

Part of the regulatory environment in which the partnerships will operate includes, in some cases, legal requirements for obtaining environmental assessments, environmental impact studies and/or plans of development before beginning drilling and production activities. In addition, the partnerships’ activities are subject to regulations regarding conservation practices and protection of correlative rights. Further, the natural gas and oil regulatory environment could change in ways that might substantially increase the financial and managerial costs of compliance with these laws and regulations and, thus, reduce the partnerships’ profitability. Furthermore, the partnerships may be put at a competitive disadvantage as compared to larger companies in the oil and gas industry that can spread these additional regulatory compliance costs over a greater number of wells. See “Competition, Markets and Regulation” for a more detailed description of the laws and regulations that affect the partnerships.

Although subscription proceeds received by a partnership in different closings may be used to pay the costs of drilling different wells depending on when the subscriptions are received, 90% of the subscription proceeds of you and the other investors in your partnership will be used to pay intangible drilling costs regardless of when you subscribe. However, the revenues from all of the wells drilled in the partnership will be commingled regardless of when you subscribe and regardless of which wells were drilled with the subscription proceeds in your closing and the results of those wells.

Also, some investors, including the managing general partner and its officers and directors as described in “Plan of Distribution,” may buy up to 5% of the total units in each partnership at discounted prices because the dealer-manager fee, the sales commission and the reimbursement for bona fide due diligence expenses will not be paid for those sales. These discounted subscription prices will reduce the amount of the subscription proceeds available to a partnership to drill wells. (See “- Spreading the Risks of Drilling Among a Number of Wells Will be Reduced if Less than the Maximum Subscription Proceeds are Received and Fewer Wells are Drilled.”) In addition, all of the investors in each partnership will share in the partnership’s production revenues with the managing general partner, based on the number of units purchased by each investor, rather than the purchase price paid by the investor for his units. Thus, investors who pay discounted prices for their units will receive higher returns on their investments in a partnership as compared to investors who pay the entire $10,000 per unit.

(See “Federal Income Tax Consequences - Limitations on Passive Activity Losses and Credits.”)

Statements, other than statements of historical facts, included in this prospectus and its exhibits address activities, events or developments that the managing general partner and the partnerships anticipate will or may occur in the future. For example, the words “believes,” “anticipates,” “will” and “expects” are intended to identify forward-looking statements. These forward-looking statements include such things as:

These statements are based on certain assumptions and analyses made by the partnerships and the managing general partner in light of their experience and their perception of historical trends, current conditions, and expected future developments. However, whether actual results will conform with these expectations is subject to a number of risks and uncertainties, many of which are beyond the control of the partnerships and the managing general partner, including, but not limited to:

Thus, all of the forward-looking statements made in this prospectus and its exhibits are qualified by these cautionary statements. There can be no assurance that actual results will conform with the managing general partner’s and the partnerships’ expectations.

Each partnership’s principal investment objectives are to invest its subscription proceeds in natural gas development wells which will:

In 2003 the top four tax brackets for individual taxpayers were reduced from 38.6% to 35%, 35% to 33%, 30% to 28%, and 27% to 25%. These changes are scheduled to expire December 31, 2010. If you are in either the 35% or 33% tax bracket, you will save approximately $3,150 or $2,970, respectively, per $10,000 unit, in federal income taxes in the year that you invest. Most states also allow this type of a deduction against the state income tax. If the partnership in which you invest begins selling natural gas and oil production from its wells in the year in which you invest, however, then you may be allocated a share of partnership income in that year that will be offset by a portion of your intangible drilling cost deduction and your share of the other partnership deductions discussed below.

Attainment of these investment objectives by a partnership will depend on many factors, including the ability of the managing general partner to select suitable wells that will be productive and produce enough revenue to return the investment made. The success of each partnership depends largely on future economic conditions, especially the future price of natural gas, which is volatile and may decrease. Also, the extent to which each partnership attains the foregoing investment objectives will be different, because each partnership is a separate business entity which:

There can be no guarantee that the foregoing objectives will be attained.

You may choose to invest in a partnership as an investor general partner so that you can receive an immediate tax deduction against any type of income. To help reduce the risk that you and other investor general partners could be required to make additional payments to the partnership, the managing general partner will take the actions set forth below.

The managing general partner’s current insurance coverage satisfies the following specifications:

Because the managing general partner is driller and operator of wells for other partnerships, the insurance available to each partnership could be substantially less if insurance claims are made in the other partnerships.

This insurance has deductibles, which would first have to be paid by a partnership, of:

The insurance also has terms, including exclusions, that are standard for the natural gas and oil industry. On request the managing general partner will provide you or your representative a copy of its insurance policies. The managing general partner will use its best efforts to maintain insurance coverage that meets its current coverage, but it may be unsuccessful if the coverage becomes unavailable or too expensive.

If you are an investor general partner and there is going to be a material adverse change in your partnership’s insurance coverage, which the managing general partner does not anticipate, then the managing general partner will notify you at least 30 days before the effective date of the change. You will then have the right to convert your units into limited partner units before the change in insurance coverage by giving written notice to the managing general partner.

Once your units are converted, which is a nontaxable event, you will have the lesser liability of a limited partner in your partnership under Delaware law for obligations and liabilities arising after the conversion. However, you will continue to have the responsibilities of a general partner for partnership liabilities and obligations incurred before the effective date of the conversion. For example, you might become liable for partnership liabilities in excess of your subscription amount during the time the partnership is engaged in drilling activities and for environmental claims that arose during drilling activities, but were not discovered until after the conversion.

The amount that may be borrowed at any one time by a partnership may not exceed an amount equal to 5% of the investors’ subscription proceeds in the partnership. However, because you do not bear the risk of repaying these borrowings with non-partnership assets, the borrowings will not increase the extent to which you are allowed to deduct your individual share of partnership losses. (See “Federal Income Tax Consequences - Tax Basis of Units” and “- ‘At Risk’ Limitation on Losses.”)

On completion of the offering of units in a partnership, the partnership’s source of funds will be as follows assuming each unit is sold for $10,000:

| · | not less than $78,847,000 if 23,654.1 units are sold. |

Thus, the total amount available to a partnership will be not less than approximately $2.7 million if 200 units are sold ranging to not less than approximately $315.4 million if 23,654.1 units are sold. Although the amount of the managing general partner’s total estimated capital contributions set forth in the “Managing General Partner Capital” table below are less than 25% of the program’s estimated total capital contributions, if the managing general partner’s actual capital contributions would be less than 25% of a partnership’s total capital contributions, the managing general partner will contribute the shortfall in cash to the partnership so that the managing general partner’s total capital contributions to the partnership will not be less than 25% of the partnership’s total capital contributions. Also, the managing general partner’s capital contribution could exceed 25% of all capital contributions based on the percentage of costs that are considered equipment costs as compared with intangible drilling costs, because the managing general partner will pay all equipment costs in excess of 10% of the subscription proceeds of you and the other investors, which may be a greater percentage of the total costs of drilling and completing the wells than anticipated, and equipment costs may increase from time-to-time at a greater rate than the intangible drilling costs that are paid by you and the other investors.

The managing general partner has made the largest single capital contribution in each of its prior partnerships and no individual investor has contributed more, although the total investor contributions in each partnership have exceeded the managing general partner’s contribution. The managing general partner also expects to make the largest single capital contribution in each of the partnerships.

Use of Proceeds

The subscription proceeds received from you and the other investors will be used by the partnership in which you invest as follows:

| · | 90% of the subscription proceeds will be used to pay 100% of the intangible drilling costs of drilling and completing the partnership’s wells; and |

| · | 10% of the subscription proceeds will be used to pay a portion of the equipment costs of drilling and completing the partnership’s wells. |

The managing general partner will contribute all of the leases to each partnership covering the acreage on which the partnership’s wells will be drilled, and pay all of the equipment costs of drilling and completing the partnership’s wells that exceed 10% of the partnership’s subscription proceeds. Thus, the managing general partner will pay the majority of each partnership’s equipment costs. The managing general partner also will be charged with 100% of the organization and offering costs for each partnership. A portion of these contributions to each partnership will be in the form of payments to itself, its affiliates and third-parties and the remainder will be in the form of services related to organizing this offering. The managing general partner will receive a credit towards its required capital contribution to each partnership for these payments and services as discussed in “Participation in Costs and Revenues.”

The following tables present information concerning each partnership’s use of the proceeds provided by both you and the other investors and the managing general partner. The tables are based in part on the managing general partner’s estimate of its capital contribution to a partnership based on the applicable number of units sold as shown in the table. The managing general partner’s estimated capital contribution shown in the tables includes its credit for organization and offering costs and contributing the leases. Anthem Securities, an affiliate of the managing general partner, will be the dealer-manager of each offering and it will receive the dealer-manager fee, the sales commissions and the up to .5% reimbursement for bona fide due diligence expenses. A portion of these payments and reimbursements, including all of the reimbursement for bona fide due diligence expenses, will be reallowed by the dealer-manager to the broker/dealers, which are referred to as selling agents, as discussed in “Plan of Distribution.” Subject to the above, a partnership’s organizational costs will be paid to the managing general partner, its affiliates and various third-parties, and the intangible drilling costs and tangible costs of drilling and completing a partnership’s wells will be paid to the managing general partner as general drilling contractor and operator under the drilling and operating agreement.

The tables are presented based on:

| · | the sale of 200 units ($2 million), which is the minimum number of units for each partnership; and |

| · | the sale of 23,654.1 units ($236,541,000), which are all of the remaining unsold units from the original 40,000 units ($400 million) registered. |

Substantially all of the proceeds available to each partnership will be expended for the following purposes and in the following manner:

INVESTOR CAPITAL |

NATURE OF PAYMENT | | 200 UNITS SOLD | | % (1) | | 23,654.1 UNITS SOLD | | % (1) | |

Organization and Offering Expenses | | | | | | | | | |

| Dealer-manager fee, sales commissions and reimbursement for bona fide due diligence expenses (2) | | - 0 - | | - 0 - | | - 0 - | | - 0 - | |

| Organization costs | | - 0 - | | - 0 - | | - 0 - | | - 0 - | |

Amount Available for Investment: | | | | | | | | | |

| Intangible drilling costs (3) | | $ | 1,800,000 | | | 90% | | $ | 212,886,900 | | | 90% | |

| Equipment costs (3) | | $ | 200,000 | | | 10% | | $ | 23,654,100 | | | 10% | |

| Leases | | | - 0 - | | | - 0 - | | | - 0 - | | | - 0 - | |

Total Investor Capital | | $ | 2,000,000 | | | 100% | | $ | 236,541,000 | | | 100% | |

______________

| (1) | The percentage is based on the investors’ total subscription proceeds, and excludes the managing general partner’s estimate of its capital contributions as set forth in the “- Managing General Partner Capital” table below. |

| (2) | See “Plan of Distribution” regarding the limits on reimbursements for bona fide due diligence expenses. |

| (3) | Ninety percent of the subscription proceeds provided by you and the other investors to each partnership will be used to pay 100% of the partnership’s intangible drilling costs. Ten percent of the subscription proceeds provided by you and the other investors to each partnership will be used to pay a portion of the partnership’s equipment costs. (See “Participation in Costs and Revenues.”) The managing general partner will pay all of the remaining equipment costs of each partnership. In this regard, the managing general partner’s share of each partnership’s equipment costs as set forth in the “- Managing General Partner Capital” and the “- Total Partnership Capital” tables below is based on the managing general partner’s estimate of the average cost of drilling and completing wells in each partnership’s primary areas as discussed in “Compensation - Drilling Contracts.” |

MANAGING GENERAL PARTNER CAPITAL |

NATURE OF PAYMENT | | 200 UNITS SOLD | | % (1) | | 23,654.1 UNITS SOLD | | % (1) | |

Organization and Offering Expenses | | | | | | | | | |

| Dealer-manager fee, sales commissions and reimbursement for bona fide due diligence expenses (2) | | $ | 200,000 | | | 27.22% | | $ | 23,654,100 | | | 38.98% | |

| Organization costs (2) | | $ | 100,000 | | | 13.61% | | $ | 2,129,000 | | | 3.50% | |

Amount Available for Investment: | | | | | | | | | | | | | |

| Intangible drilling costs | | | - 0 - | | | - 0 - | | | - 0 - | | | - 0 - | |

| Equipment costs (3) | | $ | 364,765 | | | 49.64% | | $ | 34,908,043 | | | 57.52% | |

| Leases (4) | | $ | 70,009 | | | | | | (4) | | | (4) | |

Total Managing General Partner Capital | | $ | 734,774 | | | 100% | | $ | 60,691,143 | | | 100% | |

____________

| (1) | The percentage is based on the managing general partner’s estimate of its capital contributions, and excludes the investors’ total subscription proceeds set forth in the “- Investor Capital” table above. |

| (2) | As discussed in “Participation in Costs and Revenues,” if these fees, sales commissions, reimbursements and organization costs exceed 15% of the investors’ total subscription proceeds in a partnership, then the excess will be charged to the managing general partner, but will not be included as part of its capital contribution. See “Plan of Distribution” regarding the limits on reimbursements for bona fide due diligence expenses. Also, if all of the remaining units are sold the managing general partner’s organization costs may be up to 5% of the investors’ subscription proceeds, (i.e., up to $11,827,050), which is materially greater than the estimated organization costs set forth above. |

| (3) | The managing general partner’s share of equipment costs is described in “Compensation - Drilling Contracts” and “Participation in Costs and Revenues.” However, these costs will vary depending on the actual equipment costs of drilling and completing the wells. Also, see footnote (3) to the “- Investor Capital” table above. |

| (4) | Instead of contributing cash for the leases, the managing general partner will assign to each partnership the leases covering the acreage on which the partnership’s wells will be drilled. Generally, as described in “Compensation - Lease Costs,” the managing general partner’s lease costs are approximately $11,310 per prospect for the leases on which a well will be drilled to the Clinton/Medina geological formation in western Pennsylvania or the Mississippian/Upper Devonian Sandstone Reservoir in Fayette County, Pennsylvania as both are described in detail in “Proposed Activities – Primary Areas of Operations. For purposes of this table, the managing general partner’s lease costs have been quantified if the minimum offering proceeds are received, but not the maximum offering proceeds as explained below, using this amount based on its estimate of the number of net wells that will be drilled with the amount of subscription proceeds available as set forth for the minimum offering proceeds in the “- Investor Capital” table above. The actual number of net wells drilled by the partnerships is likely to vary from the managing general partner’s estimate, based primarily on where the wells are drilled and the actual costs of drilling and completing the wells. Also, the managing general partner’s lease costs on a prospect may be significantly higher than the above-referenced amount, and its credit for the leases contributed will equal its cost, unless it has a reason to believe that cost is materially more than fair market value of the property, in which case its credit for its lease contribution must not exceed fair market value. In this regard, the managing general partner’s average lease costs for a prospect drilled to the Marcellus Shale geological formation in western Pennsylvania as described in detail in “Proposed Activities – Primary Areas of Operations,” which are not currently known, will be significantly higher than $11,310 per prospect as set forth in “Compensation - Lease Costs” which will also increase the managing general partner’s capital contributions to the partnerships. |

TOTAL PARTNERSHIP CAPITAL |

NATURE OF PAYMENT | | 200 UNITS SOLD | | % (1) | | 23,654.1 UNITS SOLD | | % (1) | |

Organization and Offering Expenses | | | | | | | | | |

| Dealer-manager fee, sales commissions and reimbursement for bona fide due diligence expenses (2) | | $ | 200,000 | | | | | $ | 23,654,100 | | | 7.96% | |

| Organization costs (2) | | $ | 100,000 | | | | | $ | 2,129,000 | | | 0.72% | |

Amount Available for Investment: | | | | | | | | | | | | | |

| Intangible drilling costs (3) | | $ | 1,800,000 | | | | | $ | 212,886,900 | | | 71.62% | |

| Equipment costs (3) | | $ | 564,765 | | | | | $ | 58,562,143 | | | 19.70% | |

| Leases (4) | | $ | 70,009 | | | | | $ | (4) | | | (4) | |

Total Partnership Capital | | $ | 2,737,774 | | | 100% | | $ | 297,232,143 | | | 100% | |

___________

| (1) | The percentage is based on investors’ total subscription proceeds in the “- Investor Capital” table above, and the managing general partner’s estimate of its capital contributions in the “- Managing General Partner Capital” table above. |

| (2) | As discussed in “Participation in Costs and Revenues,” if these fees, sales commissions, reimbursements and organization costs exceed 15% of the investors’ total subscription proceeds in a partnership, then the excess will be charged to the managing general partner, but will not be included as part of its capital contribution. See “Plan of Distribution” regarding the limits on reimbursements for bona fide due diligence expenses. Also, if all of the remaining units are sold the managing general partner’s organization costs may be up to 5% of the investors’ subscription proceeds, which is materially greater than the estimated organization costs set forth above. |

| (3) | The managing general partner’s share of equipment costs is described in “Compensation - Drilling Contracts” and “Participation in Costs and Revenues.” Although these costs will vary depending on the actual equipment costs of drilling and completing the wells, 90% of the subscription proceeds provided by you and the other investors will be used to pay intangible drilling costs and 10% will be used to pay equipment costs. Also, see footnote (3) to the “- Investor Capital” table, above. |

| (4) | Instead of contributing cash for the leases, the managing general partner will assign to each partnership the leases covering the acreage on which that partnership’s wells will be drilled as set forth in footnote (4) to the “- Managing General Partner Capital” table above. |

COMPENSATION

The items of compensation to be paid to the managing general partner and its affiliates from each partnership are set forth below. Also, following the narrative discussion for all items of compensation is a tabular presentation based on the narrative discussion. Most of these items of compensation depend on how many wells a partnership drills and how much of the working interest in each of the wells is owned by the partnership. In this regard, the managing general partner estimates that approximately 7 gross wells, which will be approximately 6.19 net wells, will be drilled if the minimum required subscription proceeds of $2 million are received by a partnership, and approximately 536 gross and net wells will be drilled, in the aggregate, if subscription proceeds of $236,541,000 are received by a partnership or the partnerships. A gross well is a well in which a partnership owns a working interest. This is compared with a net well, which is the sum of the fractional working interests owned in the gross wells. For example, a 50% working interest owned in three wells is three gross wells, but 1.5 net wells.

If $236,541,000 is raised, which represents the subscription proceeds from the Program’s remaining unsold units after Atlas Resources Public #17-2007(A) L.P. closed on December 31, 2007, the managing general partner has provided its estimate of:

| · | the number of wells that will be drilled by the Program, which is composed of Atlas Resources Public #17-2008(B) L.P. and Atlas Resources Public #17-2008(C) L.P., if units are offered in Atlas Resources Public #17-2008(C) L.P.; |

| · | the Program’s weighted average cost to drill and complete a well in each of the four primary drilling areas other than north central Tennessee; |

| · | the Program’s weighted average cost to drill and complete one well, based on the estimate of the number of wells that will be drilled and completed in each of the primary areas other than north central Tennessee; and |

| · | the managing general partner’s estimated compensation from the Program for its services as general drilling contractor and operator during the drilling operations for all of the estimated number of wells other than lease costs for wells drilled in the Marcellus Shale primary area. (See “Compensation - Lease Costs” and “ - Drilling Contracts.”) |

However, these estimates by the managing general partner are based on certain assumptions including, but not limited to, the following:

| · | the number of Program wells that will be drilled and completed in each primary area other than north central Tennessee; |

| · | the amount of subscription proceeds received by Atlas Resources Public #17-2008(B) L.P. and Atlas Resources Public #17-2008(C) L.P., if units are offered in Atlas Resources Public #17-2008(C) L.P.; |

| · | the cost of equipment and services to be provided by both third-party and affiliated subcontractors, and |

| · | a partnership’s percentage of the working interest in the wells and prospects in each primary area. |

The actual results of each partnership’s drilling activities will be different from the managing general partner’s assumptions and estimates for various reasons, including those set forth in “Risk Factors - Risks Related to an Investment in a Partnership - The Partnerships Do Not Own Any Prospects, the Managing General Partner Has Complete Discretion to Select Which Prospects Are Acquired By a Partnership, and The Possible Lack of Information for a Majority of the Prospects Decreases Your Ability to Evaluate the Feasibility of a Partnership.” Thus, the actual results of the drilling operations of the partnership in which you invest, including the amount of the managing general partner’s compensation from your partnership for serving as general drilling contractor and operator during your partnership’s drilling operations, will vary from the managing general partner’s assumptions and estimated well costs, and the variations could be material.

Dealer-Manager Fees

Subject to certain exceptions described in “Plan of Distribution,” Anthem Securities, the dealer-manager and an affiliate of the managing general partner, will receive on each unit sold to an investor:

| · | a 2.5% dealer-manager fee; |

| · | a 7% sales commission; and |

| · | an up to .5% reimbursement of the selling agents’ bona fide due diligence expenses. |

Assuming the above amounts are paid for all units sold, the dealer-manager will receive:

| · | $200,000 if subscription proceeds of $2 million are received by a partnership; and |

| · | $23,654,100 if subscription proceeds of $236,541,000 are received by one or both of the partnerships. |

All of the reimbursement of the selling agents’ bona fide due diligence expenses, and generally all of the sales commissions, will be reallowed to the selling agents. A portion of the 2.5% dealer-manager fee will be reallowed to the wholesalers who are associated with the managing general partner and registered through Anthem Securities for subscriptions obtained through their efforts. Also, a portion of the dealer-manager fee may be reallowed to the selling agents as described in “Plan of Distribution.” The dealer-manager will retain any of the compensation which is not reallowed. See “Management” for the ownership of Anthem Securities.

Natural Gas and Oil Revenues

Subject to the managing general partner’s subordination obligation, the investors and the managing general partner will share in each partnership’s revenues in the same percentages as their respective capital contributions bear to the total partnership capital contributions for that partnership except that the managing general partner will receive an additional 7% of that partnership’s revenues. However, the managing general partner’s total revenue share may not exceed 40% of that partnership’s revenues regardless of the amount of its capital contribution.

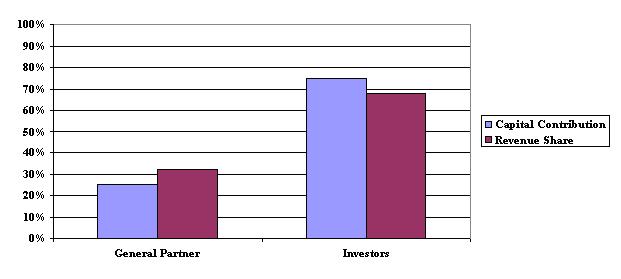

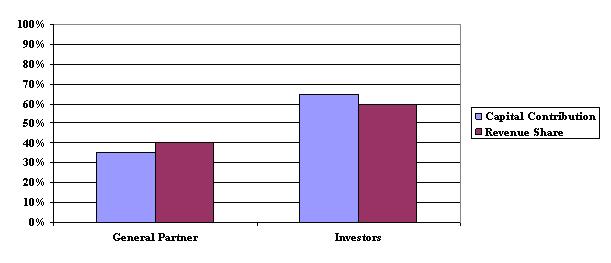

For example, if the managing general partner contributes the minimum of 25% of a partnership’s total capital contributions and the investors contribute 75% of the partnership’s total capital contributions, then the managing general partner will receive 32% of the partnership’s revenues and the investors will receive 68% of the partnership’s revenues as shown by the bar chart set forth below.

On the other hand, if the managing general partner contributes 35% of a partnership’s total capital contributions and the investors contribute 65% of the partnership’s total capital contributions, then the managing general partner will receive 40% of the partnership’s revenues, not 42%, because its revenue share cannot exceed 40% of the partnership’s revenues, and the investors will receive 60% of the partnership’s revenues as shown by the bar chart set forth below.

As noted above, up to 50% of the managing general partner’s revenue share from each partnership is subject to its subordination obligation as described in “Participation in Costs and Revenues - Subordination of Portion of Managing General Partner’s Net Revenue Share” and the accompanying tables. For example, if the managing general partner’s revenue share is 35% of the partnership’s revenues, then up to 17.5% of the managing general partner’s partnership net production revenues could be used for its subordination obligation.

Lease Costs

Under the partnership agreement the managing general partner will contribute to each partnership all the undeveloped leases necessary to cover each of the partnership’s prospects. The managing general partner will receive a credit to its capital account equal to:

| · | the cost of the leases; or |

| · | the fair market value of the leases if the managing general partner has reason to believe that cost is materially more than the fair market value. |

In the primary drilling areas of the Clinton/Medina geological formation in western Pennsylvania and the Mississippian/Upper Devonian Sandstone Reservoir in Fayette County, Pennsylvania as both are described in detail in “Proposed Activities - Primary Areas of Operations,” the managing general partner’s estimated lease costs are approximately $11,310 per prospect assuming a partnership acquires 100% of the working interest in the prospect, which the managing general partner believes is less than fair market value based on information it has concerning lease costs of third-party operators in the Appalachian Basin. Notwithstanding, the managing general partner’s lease costs on a prospect may be significantly higher than this amount, and in that event the managing general partner’s credit to its capital contribution to the partnership and its capital account under the partnership agreement will be the greater amount. The cost of the leases includes a portion of the managing general partner’s reasonable, necessary and actual expenses for geological, engineering, drafting, accounting, legal and other like services allocated to the leases in conformity with generally accepted accounting principles and industry standards. In this regard, the managing general partner anticipates that wells will be drilled to the Marcellus Shale geological formation in western Pennsylvania as described in detail in “Proposed Activities - Primary Areas of Operations.” The managing general partner further anticipates that its lease costs in the Marcellus Shale primary area, which are not currently known, will be significantly higher than $11,310 per prospect. As is the case with the other primary areas, the managing general partner will average the cost of its leases in the Marcellus Shale primary area, which it believes will be less than fair market value based on information it has concerning lease costs of third-party operators in the Appalachian Basin.

The managing general partner’s credit for its lease costs for a prospect will be proportionally reduced to the extent a partnership acquires less than 100% of the working interest in the prospect. In this regard, a working interest generally means an interest in the lease under which the owner of the working interest must pay some portion of the cost of development, operation, or maintenance of the well. The managing general partner estimates that its total credit for lease costs in the Clinton/Medina and Fayette County primary areas will be:

| · | $70,009 if subscription proceeds of $2 million are received, which is 6.19 net wells times $11,310 per prospect; and |

| · | $5,383,560 if subscription proceeds of $236,541,000 are received, which is 476 net wells in the Clinton/Medina and Fayette county primary areas times $11,310 per prospect. |

However, because the managing general partner also expects that the partnerships will drill approximately 60 gross and net wells in the Marcellus Shale primary area where the lease costs are not currently known, the partnerships’ actual average lease costs per prospect will be substantially higher than $11,310 and the managing general partner’s total compensation will be greater than the amount set forth above.

With respect to the Mississippian Carbonate and Devonian Shale reservoirs in Tennessee, if wells will be drilled in that primary area, the managing general partner anticipates that the partnerships’ average lease costs also will be $11,310 per prospect, assuming 100% of the working interest in the leases is acquired by a partnership, which the managing general partner believes will be less than fair market value in the Tennessee primary area based on information it has concerning lease costs of third-party operators in the Appalachian Basin.

Drilling a partnership’s wells also may provide the managing general partner with offset prospects to be drilled by allowing it to determine at the partnership’s expense the value of adjacent acreage in which the partnership would not have any interest. Further, the managing general partner may drill wells on leases that are scheduled to expire in order to prevent the expiration of the lease.

Drilling Contracts

Each partnership will enter into the drilling and operating agreement with the managing general partner to drill and complete that partnership’s wells for an amount equal to the sum of the following items: (i) the cost of permits, supplies, materials, equipment, and all other items used in the drilling and completion of a well provided by third-parties, or if the foregoing items are provided by affiliates of the managing general partner, then those items will be charged at competitive rates; (ii) fees for third-party services; (iii) fees for services provided by the managing general partner’s affiliates, which will be charged at competitive rates; (iv) an administration and oversight fee of $15,000 per well, which is $60,000 per well in the Marcellus Shale primary area in western Pennsylvania, which will be charged to you and the other investors as part of each well’s intangible drilling costs and the portion of equipment costs paid by you and the other investors; and (v) a mark-up in an amount equal to 15% of the sum of (i), (ii), (iii) and (iv), above, for the managing general partner’s services as general drilling contractor. Notwithstanding, if the managing general partner drills a well for a partnership that it determines is not an average well in the area because of the well’s depth, complexity associated with either drilling or completing the well or as otherwise determined by the managing general partner, the administration and oversight fee for the well described in §4.02(d)(1)(iv) of the partnership agreement may be increased to a competitive rate as determined by the managing general partner. In this regard, the managing general partner has determined that the administration and oversight fee for a well drilled to the Marcellus Shale should be higher than the wells drilled in the other primary areas in western Pennsylvania, because a well drilled to the Marcellus Shale will be drilled substantially deeper, which makes the well more complex to drill and complete and takes a longer period of time to drill and complete. In addition, based on those factors the managing general partner has determined that an additional charge of $45,000 per well is reasonable and competitive.

The managing general partner has determined that this is a competitive rate based on:

| · | information it has concerning drilling rates of third-party operators in the Appalachian Basin; |

| · | the estimated costs of non-affiliated persons to drill and equip wells in the Appalachian Basin as reported for 2004 in a survey prepared by the Independent Petroleum Association of America; and |

| · | information it has concerning increases in drilling costs in the area since 2004. |

If this rate subsequently exceeds competitive rates available from non-affiliated persons in the area engaged in the business of rendering or providing comparable services or equipment, then the rate will be adjusted to the competitive rate. Additionally, the 15% mark-up will not be increased by the managing general partner during the term of the partnership.

During drilling operations, the managing general partner’s duties as operator and general drilling contractor will include:

| · | making the necessary arrangements for drilling and completing partnership wells and related facilities for which it has responsibility under the drilling and operating agreement; |

| · | managing and conducting all field operations in connection with drilling, testing, and equipping the wells; and |

| · | making the technical decisions required in drilling and completing the wells. |

See “Proposed Activities - Drilling and Completion Activities; Operation of Producing Wells” for a more detailed discussion of the services to be provided to the partnerships by the managing general partner as general drilling contractor. The managing general partner expects to subcontract some of the actual drilling and completion of each partnership’s wells to third-parties selected by it as well as to its affiliates. The managing general partner may not benefit by interpositioning itself between the partnership and the actual provider of drilling contractor services, and may not profit by drilling in contravention of its fiduciary obligations to the partnership. However, the managing general partner’s affiliates may charge a competitive rate if they meet the requirements described in “Conflicts of Interest - Conflicts Regarding Transactions with the Managing General Partner and its Affiliates.”

The cost of each partnership well includes all of the ordinary costs of drilling, testing and completing the well. This includes the cost of the following items with respect to each natural gas well, which will be the classification of the majority of the wells:

| · | multiple completions, which generally means treating separately all potentially productive geological formations in an attempt to enhance the natural gas production from the well; |

| · | installing gathering lines of up to 2,500 feet per well to connect the well’s natural gas production to a pipeline; and |

| · | the necessary surface facilities for producing natural gas from the well. |

The amount paid to the managing general partner for drilling and completing a partnership well will be proportionately reduced to the extent the partnership acquires less than 100% of the working interest in the prospect. In addition, the amount of compensation that the managing general partner could earn as a result of these arrangements depends on many other factors as well, including the following:

| · | where the wells are drilled and their depths; |

| · | the method used to complete the well; and |

| · | the number of wells drilled. |

The managing general partner’s estimated average cost for a partnership to drill and complete one net well in each of the primary areas other than north central Tennessee, which includes the portion of equipment costs (“Tangible Costs”) paid by the managing general partner, but does not include the lease costs or organization and offering costs paid or contributed to the partnerships by the managing general partner, is set forth in the table below:

Primary Area (1) | | Administration and Oversight Fee | | Total Estimated Weighted Average Cost Per Net Well, Excluding Lease Costs, But Including 15% Mark-Up and Administration and Oversight Fee | | Estimated % | | Estimated % ofIntangible Costs of Well | |

(1) Clinton/Medina Geological Formation in Western Pennsylvania | | $ | 15,700 | | $ | 375,585 | | | 23.48% | | | | |

(2) Mississippian/Upper Devonian Sandstone Reservoirs, Fayette County, Pennsylvania | | $ | 15,700 | | $ | 369,146 | | | | | | | |

(3) Marcellus Shale in Western Pennsylvania | | $ | 62,241 | | $ | 1,579,494 | | | | | | | |

_____________________

| (1) | A partnership’s cost of drilling and completing any given well in the primary areas described above, excluding lease costs, may be considerably more or less than the amounts estimated by the managing general partner as described above, depending primarily on the area where the well is situated and unanticipated cost overruns. In this regard, the managing general partner anticipates that approximately 36% of the remaining subscription proceeds in Atlas Resources Public #17-2008(B) L.P. and Atlas Resources Public #17-2008(C) L.P., if units are offered in Atlas Resources Public #17-2008(C) L.P., will be expended on drilling wells to the Marcellus Shale, although at the date of this prospectus only 12 Marcellus Shale prospects have been specified in Appendix A. |

Assuming the maximum subscription proceeds of $236,541,000 are received by the Program’s partnership or partnerships, the managing general partner anticipates that the partnerships’ weighted average cost of drilling and completing approximately 536 gross and net wells, excluding lease costs, but including the portion of Tangible Costs paid by the managing general partner, will be approximately $506,435 per net Program well, which includes the administration and oversight fee of $15,000 per well, which is $60,000 per well in the Marcellus Shale primary area, and the 15% mark-up per well paid to the managing general partner for its services as general drilling contractor, which are included as part of the intangible drilling costs and the portion of the equipment costs of the well charged to the investors. This estimate also was based on the managing general partner’s estimate of:

| · | the number of wells that will be drilled in each area by the partnership or partnerships; |

| · | the percentage of working interest that the partnership or partnerships will acquire in the prospects in each area; and |

| · | the estimated drilling and completion costs of the wells to be drilled by the partnership or partnerships, which are different for wells in each area, primarily because of different depths of the wells and different completion methods. |

Thus, the managing general partner’s estimated weighted average cost of drilling and completing one net Program well as set forth above will vary from the actual weighted average cost of the cost of drilling and completing wells in each of the primary areas other than north central Tennessee, and for each partnership’s wells as a whole. Based on the assumptions and the estimated weighted average cost for one net Program well as set forth above, the managing general partner expects that its weighted average administration and oversight fee will be approximately $20,161 per net Program well and its weighted average 15% mark-up will be approximately $57,562 per net Program well, for a total of $77,723 per net Program well, with respect to the intangible drilling costs and the portion of equipment costs paid by you and the other investors. Also, the total of the managing general partner’s weighted average administration and oversight fee and 15% mark-up will be less if only the minimum subscription proceeds are received by a partnership than if the maximum subscriptions are received, primarily because if only the minimum subscription proceeds are received the managing general partner anticipates that the partnership’s wells will be situated in only the Clinton/Medina Geological Formation in western Pennsylvania and the Mississippian/Upper Devonian Sandstone Reservoirs, Fayette County, Pennsylvania primary drilling areas. The actual compensation received by the managing general partner as a result of each partnership’s drilling operations will vary from these estimates, and the managing general partner anticipates that the partnerships will acquire less than 100% of the working interest in some of their respective prospects.

Subject to the foregoing, the managing general partner estimates that its administration and oversight fee and its 15% mark-up paid by you and the other investors will be:

| · | $353,721 if subscription proceeds of $2 million are received, which does not include any Marcellus Shale wells and is 6.19 net wells, times $57,144; and |

| · | $41,659,528 if subscription proceeds of $236,541,000 are received, which is 536 net wells, times $77,723. |

Additionally, affiliates of the managing general partner will provide subcontracting services, equipment and materials in drilling, completing or operating the partnership’s wells for which they will receive competitive rates, because they meet the requirements described in “Conflicts of Interest - Conflicts Regarding Transactions with the Managing General Partner and its Affiliates.” Thus, the total compensation paid to the managing general partner and its affiliates per net well will be greater than the estimated amount to be paid to the managing general partner as described above to the extent compensation is paid by the partnerships to the managing general partner’s affiliates for services, equipment or supplies they provide to the partnerships.

The managing general partner’s estimated weighted average cost of $506,435 for one net Program well to be drilled and completed as discussed above consists of intangible drilling costs of approximately $397,287 (78.45%); and equipment costs of approximately $109,148 (21.55%).

Per Well Charges

Under the drilling and operating agreement the managing general partner, as operator of the wells, will receive the following compensation from each partnership when the wells begin producing natural gas or oil:

| · | reimbursement at actual cost for all direct expenses incurred on behalf of the partnership; and |

| · | well supervision fees at a competitive rate for operating and maintaining the wells during producing operations. |

The direct expenses are third-party expenses such as water hauling and chart calibration.

Currently the competitive rate for well supervision fees is $392 per well per month in the primary and secondary areas discussed in “Proposed Activities.” The well supervision fees will be proportionately reduced to the extent the partnership acquires less than 100% of the working interest in the well. Also, the managing general partner’s well supervision fees may be adjusted annually beginning with the first calendar year after a partnership closes for inflation since January 1, 2007. If the managing general partner’s well supervision fee would exceed a competitive rate in the area where the well is situated, then the rate will be adjusted to the competitive rate. Conversely, if in the future the managing general partner’s well supervision fee set forth above would be less than a competitive rate in the area where the well is situated, then regardless of the inflation adjustment, the rate may be increased automatically to the competitive rate from time to time by the managing general partner, as operator, as determined in its sole discretion. The managing general partner may not benefit by interpositioning itself between the partnership and the actual provider of operator services. In no event will any consideration received for operator services be duplicative of any consideration or reimbursement received under the partnership agreement.

The well supervision fee covers all normal and regularly recurring operating expenses for the production, delivery, and sale of natural gas and oil, such as:

| · | well tending, routine maintenance, and adjustment; |

| · | reading meters, recording production, pumping, maintaining appropriate books and records; and |

| · | preparing reports to the partnership and to government agencies. |

The well supervision fees do not include costs and expenses related to:

| · | the purchase of equipment, materials, or third-party services; |

| · | rebuilding of access roads. |

These costs will be charged to a partnership at the invoice cost of the materials purchased or the third-party services performed.

The managing general partner estimates that it will receive well supervision fees for a partnership’s first 12 months of operation after all of the wells have been placed in production of:

| · | $29,118 if subscription proceeds of $2 million are received, which is 6.19 net wells at $392 per well per month; and |

| · | $2,521,344 if subscription proceeds of $236,541,000 million are received, which is 536 net wells at $392 per well per month. |

Gathering Fees

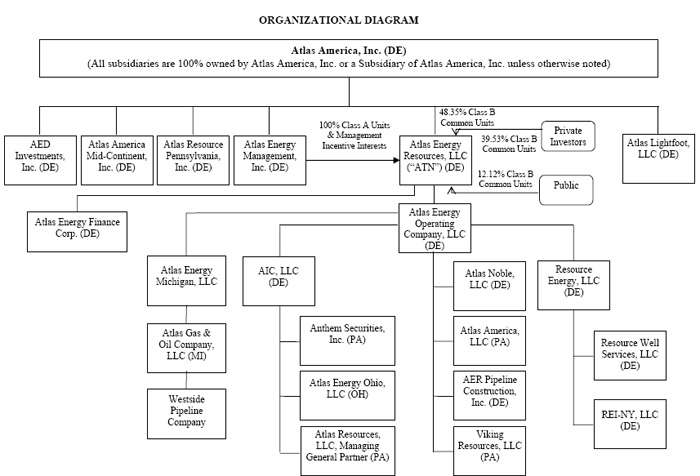

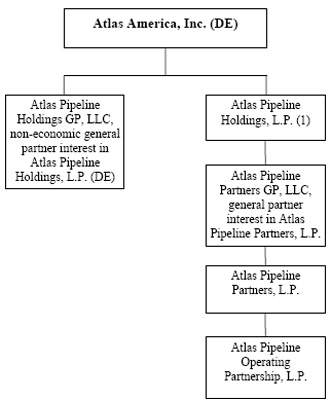

Under the partnership agreement the managing general partner will be responsible for gathering and transporting the natural gas produced by the partnerships to interstate pipeline systems, local distribution companies, and/or end-users in the area (the “gathering services”). The managing general partner anticipates that it will use the gathering system owned by Atlas Pipeline Partners for the majority of the partnerships’ natural gas production as described in “Proposed Activities - Sale of Natural Gas and Oil Production - Gathering of Natural Gas.” The managing general partner’s affiliate, Atlas America, Inc., which is sometimes referred to in this prospectus as “Atlas America,” or another affiliate controls and manages the gathering system for Atlas Pipeline Partners. (See “Management - Organizational Diagram and Security Ownership of Beneficial Owners.”) Also, Atlas America and the managing general partner’s affiliates, Resource Energy, LLC, sometimes referred to in this prospectus as “Resource Energy,” and Viking Resources LLC, sometimes referred to in this prospectus as “Viking Resources,” which are sometimes referred to collectively in this prospectus as the “Atlas Entities,” and do not include the partnerships, have an agreement with Atlas Pipeline Partners under which generally all of the gas produced by their affiliated partnerships, which does include the partnerships, will be gathered and transported through the gathering system owned by Atlas Pipeline Partners, and that the Atlas Entities must pay the greater of $.35 per mcf or 16% of the gross sales price for each mcf transported by these affiliated partnerships through Atlas Pipeline Partners’ gathering system. Gross sales price means the price that is actually received, adjusted to take into account proceeds received or payments made pursuant to hedging arrangements. Subject to the agreement with Atlas Pipeline Partners described above, in providing the gathering services the managing general partner may use gathering systems owned by Atlas Pipeline Partners, independent third-parties and/or affiliates of Atlas America other than Atlas Pipeline Partners.

Each partnership will pay a gathering fee directly to the managing general partner at competitive rates for the gathering services. The gathering fee paid by the partnership to the managing general partner may be increased from time-to-time by the managing general partner, in its sole discretion, but may not be increased beyond competitive rates as determined by the managing general partner. Currently, the managing general partner has determined that the competitive rate in each of its primary and secondary areas where it drills its wells as described in “Proposed Activities” is an amount equal to 13% of the gross sales price received by each partnership for its natural gas.

The payment of a competitive fee to the managing general partner for its gathering services will be subject to the following conditions:

| · | If the gathering system owned by Atlas Pipeline Partners is used by a partnership, then the managing general partner will apply the gathering fee it receives from the partnership towards the payments owed by the Atlas Entities under their agreement with Atlas Pipeline Partners. |

| · | If a third-party gathering system is used by a partnership, the managing general partner will pay all of the gathering fee it receives from the partnership to the third-party gathering the natural gas. The managing general partner may not retain the excess of any gathering fees it receives from the partnership over the payments it makes to third-party gas gatherers. If the third-party’s gathering system charges more than an amount equal to 13% of the gross sales price, then the managing general partner’s gathering fee charged to a partnership will be the actual transportation and compression fees charged by the third-party gathering system with respect to the partnership’s natural gas in the area. |

| · | If both a third-party gathering system and the Atlas Pipeline Partners gathering system (or a gas gathering system owned by an affiliate of Atlas America other than Atlas Pipeline Partners) are used by a partnership, then the managing general partner will receive an amount equal to 13% of the gross sales price for the natural gas transported by the segment provided by the Atlas Pipeline Partners gathering system (or a gas gathering system owned by an affiliate of Atlas America other than Atlas Pipeline Partners), plus the amount charged by the third-party gathering system for the natural gas transported by the segment provided by the third-party. |

Finally, in connection with the Knox project in the Mississippian and Devonian Shale Reservoirs in the Anderson, Campbell, Morgan, Roane and Scott Counties, Tennessee area, as discussed in “Proposed Activities - Primary Areas of Operations - Mississippian Carbonate and Devonian Shale Reservoirs in Anderson, Campbell, Morgan, Roane and Scott Counties, Tennessee,” a partnership will deliver natural gas into a gathering system provided by Knox Energy, which is referred to as the Coalfield Pipeline. The Coalfield Pipeline will receive gathering fees of $.55 per mcf plus fees for compression, which it may increase from time-to-time. See “Proposed Activities - Interests of Parties.”

If the Coalfield Pipeline does not have sufficient capacity to compress and transport the natural gas produced from a partnership’s wells as determined by Atlas America, then Atlas America or an affiliate other than Atlas Pipeline Partners may construct an additional gathering system and/or enhancements to the Coalfield Pipeline. On completion of the construction, Atlas America will transfer its ownership in the additional gathering system and/or enhancements to the owners of the Coalfield Pipeline, which will then pay Atlas America an amount equal to $.12 per mcf of natural gas transported through the newly constructed and/or enhanced gathering system. If the events described above occur, Coalfield Pipeline will pay this amount to Atlas America from the gathering and compression fees it charges to a partnership. The managing general partner’s gathering fee in this area also will be 13% of the gross sales price of the partnership’s natural gas, but will be increased to include the amount of the Coalfield Pipeline fees, if greater, all of which the managing general partner will then pay to the Coalfield Pipeline.

The actual amount of gathering fees to be paid by a partnership to the managing general partner cannot be quantified, because the volume of natural gas that will be produced and transported from the partnership’s wells cannot be predicted.

Interest and Other Compensation

The managing general partner or an affiliate will have the right to charge a competitive rate of interest on any loan it may make to or on behalf of a partnership. If the managing general partner provides equipment, supplies, and other services to a partnership, then it may do so at competitive industry rates. The managing general partner will determine competitive industry rates for equipment, supplies and other services by conducting a survey of the interest and/or fees charged by unaffiliated third-parties in the same geographic area engaged in similar businesses. If possible, the managing general partner will contact at least two unaffiliated third-parties, however, the managing general partner will have sole discretion in determining the amount to be charged a partnership.

Estimate of Administrative Costs and Direct Costs to be Borne by the Partnerships

The managing general partner and its affiliates will receive from each partnership a nonaccountable, fixed payment reimbursement for their administrative costs, which has been determined by the managing general partner to be $75 per well per month. This payment per well is subject to the following:

| · | it will not be increased in amount during the term of the partnership; |

| · | it will be proportionately reduced to the extent the partnership acquires less than 100% of the working interest in the well; |

| · | it will be the entire payment to reimburse the managing general partner for the partnership’s administrative costs; and |

| · | it will not be received for plugged or abandoned wells. |

The managing general partner estimates that the nonaccountable, fixed payment reimbursement for administrative costs allocable to a partnership’s first 12 months of operation after all of its wells have been placed into production will not exceed approximately:

| · | $5,571 if subscription proceeds of $2 million are received, which is 6.19 net wells at $75 per well per month; and |

| · | $482,400 if subscription proceeds of $236,541,000 million are received, which is 536 net wells at $75 per well per month. |

Direct costs will be determined by the managing general partner, in its sole discretion, including the provider of the services or goods and the amount of the provider’s compensation. Direct costs will be billed directly to and paid by each partnership to the extent practicable. The anticipated direct costs set forth below for a partnership’s first 12 months of operation after all of its wells have been placed into production may vary from the estimates shown for numerous reasons that cannot accurately be predicted. These reasons include:

| · | the number of the partnership’s investors; |

| · | the number of wells drilled by the partnership; |

| · | the partnership’s degree of success in its activities; |

| · | the extent of any production problems encountered by the partnership; |

| · | various other factors involving the administration of the partnership. |

| | | Minimum | | Maximum | |

| | | Subscriptions | | Subscriptions | |

| | | of $2 million | | | |

Direct Costs | | | | | |

| External Legal | | $ | 6,000 | | $ | 28,000 | |

| Accounting Fees for Audit and Tax Preparation | | | 25,000 | | | 135,000 | |

| Independent Engineering Reports | | | 1,500 | | | 5,000 | |

| TOTAL | | $ | 32,500 | | $ | 168,000 | |

__________

| (1) | This assumes two partnerships are formed as described below in “Terms of the Offering - Subscription to a Partnership.” |

Set forth below is a tabular presentation of the narrative discussion of the compensation set forth above. In all cases, the tabular presentation is subject to the discussion set forth above.

Offering Stage |

Entity receiving compensation | | Type and method of compensation | | Estimated amount |

| | | | | |

| Anthem Securities, Inc. | | Dealer-Manager Fees. Subject to certain exceptions described in “Plan of Distribution,” Anthem Securities, the dealer-manager and an affiliate of the managing general partner, will receive on each unit sold to an investor: · a 2.5% dealer-manager fee; · a 7% sales commission; and · up to a .5% reimbursement of the selling agents’ bona fide due diligence expenses. | | Assuming the above amounts are paid for the dealer-manager fee and the sales commissions, the dealer-manager will receive: · $200,000 if subscription proceeds of $2 million are received by a partnership; and · $23,654,100 if subscription proceeds of $236,541,000 are received by the partnership or partnerships. |

Drilling Stage |

Entity receiving compensation | | Type and method of compensation | | Estimated amount |

| | | | | |

| Managing general partner and its affiliates | | Lease Costs. Under the partnership agreement the managing general partner will contribute to each partnership all the undeveloped leases necessary to cover each of the partnership’s prospects. The managing general partner will receive a credit to its capital account equal to: · the cost of the leases; or · the fair market value of the leases if the managing general partner has reason to believe that cost is materially more than the fair market value. | | Based on the assumptions and the estimated average lease costs described in “Compensation - Lease Costs” for the leases on which a well will be drilled to the Clinton/Medina geological formation in western Pennsylvania and the Mississippian/Upper Devonian Sandstone Reservoir in Fayette County, Pennsylvania as both are described in detail in “Proposed Activities - Primary Areas of Operations,” the managing general partner estimates that its total credit for lease costs in these primary areas will be: · $70,009 if subscription proceeds of $2 million are received, which is 6.19 net wells times $11,310 per prospect; and · $5,383,650 if subscription proceeds of $236,541,000 are received, which is 476 net wells times $11,310 per prospect. However, because the managing general partner also expects that the partnerships will drill approximately 60 gross and net wells in the Marcellus Shale primary area where the lease costs are not currently known, the partnerships’ actual average lease costs per prospect will be substantially higher than $11,310 and the managing general partner’s total compensation will be greater than the amount set forth above. |

| Managing general partner and its affiliates | | Drilling Contracts. Each partnership will enter into the drilling and operating agreement with the managing general partner to drill and complete each partnership’s wells for an amount equal to the sum of the following items: (i) the cost of permits, supplies, materials, equipment, and all other items used in the drilling and completion of a well provided by third-parties, or if the foregoing items are provided by affiliates of the managing general partner, then those items will be charged at competitive rates; (ii) fees for third-party services; (iii) fees for services provided by the managing general partner’s affiliates, which will be charged at competitive rates; (iv) an administration and oversight fee of $15,000 per well, which is $60,000 per well in the Marcellus Shale primary area in western Pennsylvania, which will be charged to you and the other investors as part of each well’s intangible drilling costs and the portion of equipment costs paid by you and the other investors; and (v) a mark-up in an amount equal to 15% of the sum of (i), (ii), (iii) and (iv), above, for the managing general partner’s services as general drilling contractor. Additionally, if the managing general partner drills a well for the partnership that it determines is not an average well in the area because of the well’s depth, complexity associated with either drilling or completing the well or as otherwise determined by the managing general partner, the administration and oversight fee for the well described in §4.02(d)(1)(iv) of the partnership agreement may be increased to a competitive rate as determined by the managing general partner. Also the total of the managing general partner’s weighted average administration and oversight fee and 15% mark-up will be less if only the minimum subscription proceeds are received by a partnership than if the maximum subscriptions are received primarily because if only the minimum subscription proceeds are received, the managing general partner anticipates that the partnership’s wells will be situated in only the Clinton/Medina Geological Formation in western Pennsylvania and the Mississippian/Upper Devonian Sandstone Reservoirs, Fayette County, Pennsylvania primary drilling areas. | | Based on the assumptions and the estimated weighted average cost for one net Program well as set forth in “- Drilling Contracts” above, the managing general partner estimates that its administration and oversight fee of $15,000 per well, which is $60,000 per well in the Marcellus Shale primary area, and its 15% mark-up paid by you and the other investors will be: · $353,721 if subscription proceeds of $2 million are received, which does not include any Marcellus Shale wells and is 6.19 net wells, times $57,144; and · $41,659,528 if subscription proceeds of $236,541,000 are received, which is 536 net wells, times $77,723. Additionally, affiliates of the managing general partner will provide subcontracting services, equipment and materials in drilling, completing or operating the partnership’s wells for which they will receive competitive rates, because they meet the requirements described in “Conflicts of Interest - Conflicts Regarding Transactions with the Managing General Partner and its Affiliates.” Thus, the total compensation paid to the managing general partner and its affiliates per net well will be greater than the estimated amount to be paid to the managing general partner as described above to the extent compensation is paid by the partnerships to the managing general partner’s affiliates for services, equipment or supplies they provide to the partnerships. |

Operational Stage |

Entity receiving compensation | | Type and method of compensation | | Estimated amount |

| Managing general partner and its affiliates | | Natural Gas and Oil Revenues. Subject to the managing general partner’s subordination obligation, the investors and the managing general partner will share in each partnership’s revenues in the same percentages as their respective capital contributions bear to the total capital contributions to that partnership, except that the managing general partner will receive an additional 7% of that partnership’s revenues. However, the managing general partner’s total revenue share may not exceed 40% of that partnership’s revenues regardless of the amount of its capital contribution. | | For example, if the managing general partner contributes the minimum of 25% of the partnership’s total capital contributions and the investors contribute 75% of the partnership’s total capital contributions, then the managing general partner will receive 32% of the partnership’s revenues and the investors will receive 68% of the partnership’s revenues. On the other hand, if the managing general partner contributes 35% of the partnership’s total capital contributions and the investors contribute 65% of the partnership’s total capital contributions, then the managing general partner will receive 40% of the partnership’s revenues, not 42%, because its revenue share cannot exceed 40% of the partnership’s revenues, and the investors will receive 60% of the partnership’s revenues. |