UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Acucela Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF 2015 ANNUAL MEETING OF SHAREHOLDERSDear Acucela Inc. Shareholder:

You are cordially invited to attend our annual meeting of shareholders, or “Annual Meeting,” which will be held at our principal executive offices located at 1301 Second Avenue, Suite 4200, Seattle, Washington 98101 on June 25, 2015, at 2:00 p.m. Pacific Time for the following purposes:

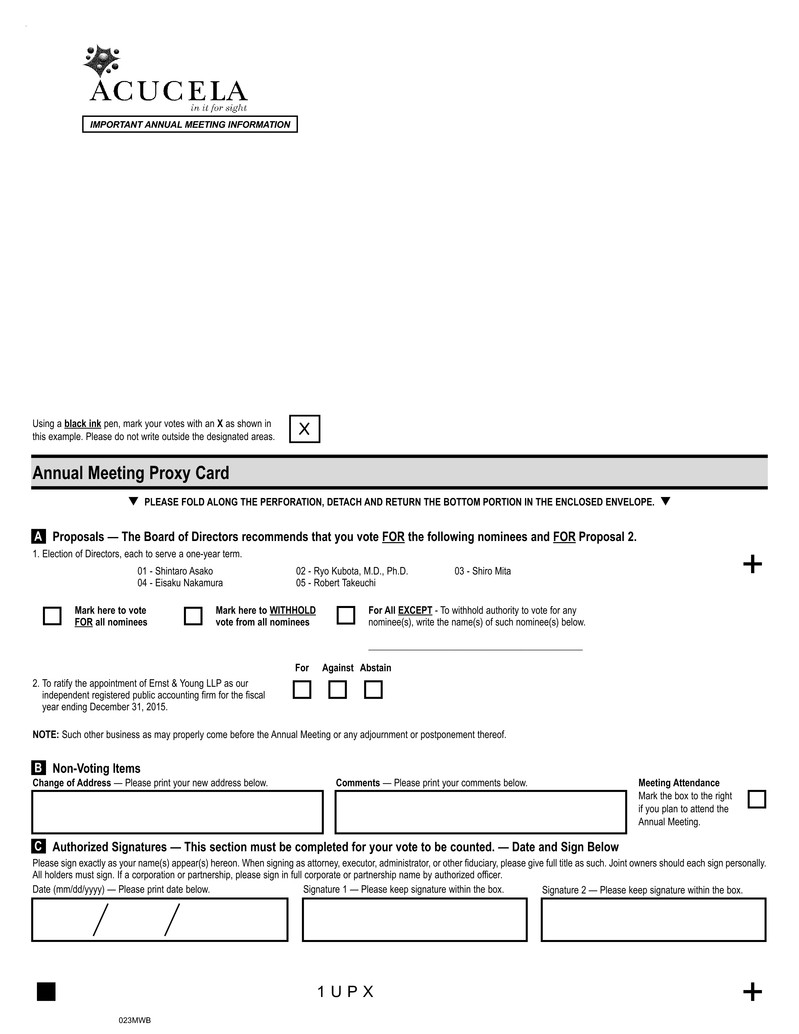

1. To elect the five nominees named in the proxy statement to Acucela’s Board of Directors; and

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015.

The shareholders will also act on any other business that may properly come before the Annual Meeting, including any adjournments or postponements of the Annual Meeting.

Any action on the items of business described above may be considered at the Annual Meeting at the scheduled time and date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. Our board of directors recommends a vote FOR the election of the nominees for director and FOR the ratification of the appointment of our independent registered public accounting firm for the year ending December 31, 2015.

Only shareholders of record on April 20, 2015, the record date for the Annual Meeting, are entitled to vote on these matters. A list of shareholders entitled to vote will be available for inspection at our offices for ten days prior to the Annual Meeting.

Your vote is important regardless of the number of shares you own or whether you plan to attend the Annual Meeting in person. Even if you plan to attend the Annual Meeting, we urge you to vote at your earliest convenience by returning the proxy card by mail in the addressed envelope enclosed for that purpose. Any shareholder attending the Annual Meeting may vote in person even if he or she has voted previously.

Details of the business to be conducted at the Annual Meeting are more fully described in the accompanying Proxy Statement

We look forward to seeing you. Thank you for your ongoing support of and interest in Acucela.

Sincerely,

Ryo Kubota, M.D., Ph.D.

Chairman, President & Chief Executive Officer

Seattle, Washington

May 29, 2015

PROXY STATEMENT

TABLE OF CONTENTS

Page

ACUCELA INC.

1301 Second Avenue, Suite 4200

Seattle, WA 98101

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

To Be Held At:

1301 Second Avenue, Suite 4200

Seattle, WA 98101

June 25, 2015

2:00 p.m. Pacific Time

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| |

| Q: | Why am I receiving these materials? |

| |

| A: | This proxy statement ("Proxy Statement") and the enclosed proxy card are first being mailed on or about May 29, 2015, to shareholders entitled to vote at the meeting. The Board of Directors of Acucela Inc. ("Acucela") has delivered these materials to you in connection with its solicitation of proxies for use at our 2015 Annual Meeting of Shareholders (the "Annual Meeting"), which will take place on Thursday, June 25, 2015, at 2:00 p.m. Pacific Time, at our corporate headquarters located at 1301 Second Avenue, Suite 4200, Seattle, Washington. Our proxy materials, which include our Annual Report on Form 10-K, may also be accessed via the Internet at http://ir.acucela.com. In accordance with rules adopted by the U.S. Securities and Exchange Commission (the "SEC"), our proxy materials posted at http://ir.acuela.com do not contain any cookies or other tracking features. |

| |

| Q: | What is included in these materials? |

| |

| A: | These materials include: |

| |

| • | Our Notice of the 2015 Annual Meeting and our Proxy Statement, which summarize the information regarding the matters to be voted on at the Annual Meeting; |

| |

| • | Our Annual Report on Form 10-K and audited financial statements for the year ended December 31, 2014; and |

| |

| Q: | What is the Proxy Card? |

| |

| A: | The proxy card enables you to appoint Ryo Kubota, M.D., Ph.D. and John Gebhart as your representatives at the Annual Meeting. By completing and returning the proxy card, you are authorizing Dr. Kubota and Mr. Gebhart to vote your shares at the Annual Meeting as you have instructed them on the proxy card. This way your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, it is a good idea to complete and return your proxy card before the date of the Annual Meeting just in case your plans change. |

| |

| Q: | What items will be voted on at the Annual Meeting? |

| |

| A: | There are two known items that will come before our shareholders at the 2015 Annual Meeting: |

| |

| • | The election to the Board of Directors of the five nominees named in this proxy statement; and |

| |

| • | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015. |

It is possible that other business may come before the Annual Meeting, although we currently are not aware of any such matters.

| |

| Q: | What are the voting recommendations of our Board? |

| |

| A: | Our Board of Directors recommends that you vote your shares “FOR” each of the named nominees to the Board and “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015. In this Proxy Statement, the terms “the Board of Directors,” “the Board,” or “our Board” refer to the Board of Directors of Acucela. |

| |

| Q: | Who may vote at the Annual Meeting? |

| |

| A: | If you owned shares of our common stock at the close of business on April 20, 2015, the record date for the Annual Meeting, you are entitled to vote those shares. On the record date, there were 35,809,467 shares of our common stock outstanding, our only class of stock having general voting rights. You have one vote for each share of common stock owned by you on the record date. |

| |

| Q: | What is the difference between holding shares as a shareholder of record or as a beneficial owner of shares held in street name? |

| |

| A: | Shareholder of Record. If you have shares registered directly in your name with our stock transfer agent, Computershare Trust Company, N.A. (“Computershare”), then you are considered the shareholder of record with respect to those shares and we sent the proxy materials directly to you. |

Beneficial Owner of Shares Held in Street Name. If you have shares held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and proxy materials were forwarded to you by that organization. The organization holding the shares in your account is considered the shareholder of record with respect to those shares for the purpose of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares it holds in your account.

| |

| A: | If you are a shareholder of record, you may vote by returning an enclosed proxy card or by voting in person at the Annual Meeting. If you own your shares through a brokerage account or in another nominee form, you must provide instructions to the broker or nominee as to how your shares should be voted. Your broker or nominee will generally provide you with the appropriate forms at the time you receive this Proxy Statement. If you own your shares through a brokerage account or nominee, you cannot vote in person at the Annual Meeting unless you receive a proxy from the broker or the nominee. |

| |

| Q: | May I change my vote or revoke my proxy? |

| |

| A: | Yes. If you change your mind after you have sent in your proxy card and wish to revote, you may do so by following these procedures: |

| |

| • | Send in another signed proxy card with a later date; |

| |

| • | Send a letter revoking your vote or proxy to our Corporate Secretary at our offices in Seattle, Washington; or |

| |

| • | Attend the Annual Meeting and vote in person. |

We will tabulate the latest valid vote or instruction that we receive from you.

| |

| Q: | How do I vote in person? |

| |

| A: | If you plan to attend the Annual Meeting and vote in person, we will give you a ballot when you arrive. If your shares are held in the “street name” of your brokerage firm, bank or other organization, you must obtain a “legal proxy” from the organization that holds your shares. You should contact your account executive about obtaining a legal proxy. |

| |

| Q: | What happens if I do not give specific voting instructions? |

| |

| A: | Shareholders of Record. If you are a shareholder of record and you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by our Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to all other matters properly presented for a vote at the Annual Meeting, including without limitation whether to postpone or adjourn the Annual Meeting. |

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in “street name” and you do not provide the organization that holds your shares with specific voting instructions, then the organization that holds your shares may generally vote on “discretionary” matters but cannot vote on “non-discretionary” matters.

If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-discretionary matter, then the organization will inform our Inspector of Elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Please provide voting instructions to the organizations that hold your shares by carefully following their instructions.

| |

| Q: | Which ballot measures are considered “discretionary” or “non-discretionary?” |

| |

| A: | Proposal 1 (election of five directors) is a “non-discretionary” item. If you do not instruct your broker how to vote with respect to this proposal, then your broker may not vote on such proposal and your shares will be counted as “broker non-votes.” Broker non-votes will have no effect on the outcome of Proposal 1 since the five directors who receive the greatest number of affirmative votes will be elected to the Board. Proposal 2 (ratification of independent registered public accounting firm) is considered a “discretionary” item and your broker may vote on this proposal. |

| |

| Q: | What is the effect of withholding votes or abstaining? |

| |

| A: | You can withhold your vote for any nominee in the election of directors or you may abstain on votes for other proposals. Abstentions are counted for purposes of determining whether a quorum is present. |

For Proposal 1 (election of five directors), if you elect to withhold your vote for any of our director nominees, your vote will have no impact on the election of directors since the five directors who receive the greatest number of affirmative votes will be elected to the Board.

Proposal 2 (ratification of independent registered public accounting firm) will be adopted if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal. Since abstentions are not treated as votes cast for or against a proposal, an abstention regarding Proposal 2 will have no effect on the outcome of the proposal.

| |

| Q: | What is the quorum requirement for the Annual Meeting? |

| |

| A: | The quorum requirement for holding the Annual Meeting and transacting business is a majority of the outstanding shares entitled to be voted. The shares may be present in person or represented by proxy at the Annual Meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. |

| |

| Q: | What vote is required to approve each proposal? |

| |

| A. | Proposal 1: Election of Directors, Each to Serve a One-Year Term. |

The five nominees for director who receive the most votes “for” election will be elected, assuming the presence of a quorum. Accordingly, if you do not vote for a nominee, do not instruct your broker how to vote for a nominee or if you indicate “withhold authority to vote” for a nominee, your vote will not count either “for” or “against” the nominee.

Proposal 2: To Ratify the Appointment of Ernst & Young LLP as Our Independent Registered Public Accounting Firm for the Year Ending December 31, 2015.

To be approved, the number of votes cast in favor must exceed the number of votes cast against. If you do not vote or if you abstain from voting, it will have no effect on this proposal, assuming the presence of a quorum.

| |

| Q: | Who will count the vote? |

| |

| A: | Representatives of Computershare will serve as the Inspector of Elections and count the votes. |

| |

| Q: | Is voting confidential? |

| |

| A: | We keep all the proxies, ballots and voting tabulations private as a matter of practice. We let only our Inspector of Elections examine these documents. Our Inspector of Elections will not disclose your vote to our management unless it is necessary to meet legal |

requirements. Our Inspector of Elections will forward to our management, however, any written comments that you make on the proxy card or elsewhere.

| |

| Q: | Who pays the costs of soliciting proxies for the Annual Meeting? |

| |

| A: | We will pay all the costs of soliciting these proxies. In addition to soliciting proxies by distributing these proxy materials, our officers and employees may also solicit proxies by telephone, by fax, by mail, via the Internet or other electronic means of communication, or in person. No additional compensation will be paid to officers or employees for their assistance in soliciting proxies. We will reimburse banks, brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to you. |

| |

| Q: | I receive multiple copies of the proxy materials. What does that mean? |

| |

| A: | This generally means your shares are registered differently or are held in more than one account. Please provide voting instructions for all proxy cards that you receive. |

If your shares are registered directly in your name, you may be receiving more than one copy of the proxy materials because our transfer agent has more than one account for you with slightly different versions of your name, such as different first names (“James” and “Jim,” for example) or with and without middle initials. If this is the case, you can contact our transfer agent and consolidate your accounts under one name.

| |

| Q: | What if I need to change my account name, have moved and need to change my mailing address, or have other questions about my Acucela stock? |

| |

| A: | You may contact our transfer agent, Computershare by calling: 877-373-6374 (for foreign investors, 201-680-6578), 800-231-5469 (TDD for hearing-impaired in the United States) or 201-680-6610 (TDD for hearing impaired for foreign investors), visit its website at: www.computershare.com/investor, or write to: Computershare, Shareholder Relations, P.O. Box 30170, College Station, TX 77842-3170. |

| |

| Q: | How can I find the voting results of the Annual Meeting? |

| |

| A: | We will report the voting results in a Form 8-K within four business days after the end of the Annual Meeting. |

| |

| Q: | Whom should I call if I have any questions? |

| |

| A: | If you have any questions about the Annual Meeting or voting, please contact Tim Kerber at 206-805-3963. |

PROPOSAL 1 - ELECTION OF DIRECTORS

Our Bylaws provide that our Board shall consist of no less than one and no more than seven members, with the exact number of members within the variable range to be fixed from time to time by resolution of the Board. Currently, our Board is fixed at five members. As of May 1, 2015, all five directors on our Board serve with terms ending at the Annual Meeting. The Board has nominated Mr. Asako, Dr. Kubota, Mr. Mita, Mr. Nakamura and Mr. Takeuchi for re-election to the Board, each to hold office until the Annual Meeting in 2016 and until his successor has been elected and qualified or until his earlier resignation or removal.

We know of no reason why any nominee may be unable to serve as a director. If any nominee becomes unable to serve, your proxy may vote for another nominee proposed by the Board, or the Board my reduce the number of directors to be elected. If any director resigns, dies or is otherwise unable to serve out his or her term, or the Board increases the number of directors, then the Board may fill the vacancy.

Nominees to the Board of Directors

The nominees, and their ages, occupations and length of board service as of May 1, 2015, are:

|

| | | | | | |

| Name of Director/Nominee | | Age | | Principal Occupation | | Director Since |

| Shintaro Asako | | 40 | | Chief Executive Officer of DeNA West | | Nominee |

| Ryo Kubota, M.D., Ph.D. | | 48 | | President, Chief Executive Officer and Chairman of Acucela Inc. | | June 2002 |

| Shiro Mita | | 63 | | President and Chief Executive Officer of M's Science Corporation | | May 2015 |

| Eisaku Nakamura | | 53 | | Former Director and General Manager of Bio Sight Capital Co. | | May 2015 |

| Robert Takeuchi | | 58 | | President of RT Consulting, Inc. | | May 2015 |

Director Qualifications

The following paragraphs provide information as of the date of this Proxy Statement about each director. The information presented includes information each director has given us about his age, all positions he holds, his principal occupation and business experience for the past five years, the names of other publicly held companies of which he currently serves as a director or has served as a director during the past five years, and a description of the specific experience, qualifications, attributes or skills that led to the conclusion that the person should serve as a director of our company.

Information about the number of shares of common stock beneficially owned by each director appears under the heading "Our Common Stock Ownership." There are no family relationships among any of the directors and executive officers of Acucela.

Our Board believes that our directors should have the experience and skill set in order to be able to contribute to our overall corporate goals. Since our common stock is traded on the Mothers market of the Tokyo Stock Exchange and the majority of our public float is held by investors in Japan, we also endeavor to find directors with an understanding of the Japanese financial markets.

Our Board believes that our director nominees represent a desirable mix of backgrounds, skills and experiences. Additionally, our Board believes that the specific leadership skills and other experiences of the nominees described below, particularly in the areas of biotechnology, senior executive leadership, investment management, international business, capital markets and finance, provide Acucela with the perspective and judgment necessary to guide our strategies and monitor their execution.

Shintaro Asako

Shintaro Asako, age 40, is the Chief Executive Officer of DeNA West since 2013. Before moving to the role of Chief Executive Officer, he was Chief Financial Officer of DeNA West from 2011 to 2013. Previously, Mr. Asako was Chief Financial Officer of MediciNova, Inc. from 2005 to 2011. From 1998 to 2005, Mr. Asako held various positions at KPMG LLP and Arthur Anderson LLP, providing a variety of audit, tax, and business consulting services to multinational clients. Mr. Asako is a graduate of the Leventhal School of Accounting at the University of Southern California and is a certified public accountant of the state of California. We believe Mr. Asako should serve as a member of our Board based on his executive management experience as well as a strong background in finance and financial accounting, including those regulations for publicly listed companies in the US and Japan.

Ryo Kubota, M.D., Ph.D.

Ryo Kubota, M.D., Ph.D., age 48, is our founder, and since May 1, 2015, has served as our President and Chief Executive Officer. He has also served as a director since June 2002 and Chairman of the Board since April 2005. Additionally, he previously served as our President from June 2002 until September 2014, our Chief Executive Officer from June 2002 until December 2014, our Treasurer from June 2002 to August 2006, and as our Secretary from June 2002 to September 2002, November 2002 to August 2006, and March 2007 to July 2011. Prior to founding Acucela Inc., Dr. Kubota worked in the ophthalmology field, including serving as an instructor at Keio University and as an Acting Assistant Professor at the University of Washington School of Medicine. Dr. Kubota holds an M.D. and a Ph.D. in medicine from Keio University. Dr. Kubota has been board certified in ophthalmology by the Japanese Ophthalmological Association since 1996 and is a member of the American Academy of Ophthalmology, the Association for Research in Vision and Ophthalmology, and the Japanese Ophthalmology Society. Since 2008, Dr. Kubota has been a director of the Japan-America Society of the State of Washington. We believe Dr. Kubota should serve on our Board due to the perspective and experience he brings to our Board as our founder, which adds historical knowledge, scientific leadership, ophthalmic industry expertise, partnering leadership and continuity to our Board.

Shiro Mita

Shiro Mita, age 63, is the President and Chief Executive Officer of M’s Science Corporation since November 2000. Previously, Dr. Mita was the Executive Director of Drug Discovery at Santen Pharmaceuticals Co., Ltd from 1995 to 2000. Dr. Mita has a Ph.D. in Pharmaceutical Science from Tokyo University, after which he entered the School of Medicine of Keio University as a Research Associate. Dr. Mita obtained a Post-Doctoral Fellowship in cancer biology from the University of Washington in Seattle. He has been a member of the board of directors of Santen Pharmaceutical Co., Ltd from 1989 to 2000. Dr. Mita brings to the Board extensive experience in the biotechnology and pharmaceutical fields, both as a researcher and an executive officer.

Eisaku Nakamura

Eisaku Nakamura, age 53, served as Director and General Manager of Bio Sight Capital Co., Ltd from September 2006 to June 2010 and as Chief Executive Officer and President of Berevno Corporation from April 2001 to March 2006. Mr. Nakamura has also served as an outside director on the boards of CanBas Corporation (March 2002 to September 2009), Activus Pharma Co. Ltd. (October 2010 to September 2013) and Koinobori Associates Inc. (September 2013 to present). Mr. Nakamura brings to the Board relevant investment management and capital markets experience, which we believe will be important as Acucela continues to grow.

Robert Takeuchi

Robert Takeuchi, age 58, is the President of RT Consulting, Inc. since 2004. Mr. Takeuchi was also President of SOFTBANK Finance, America Corporation from 1998 through 2004, Treasurer and Secretary of SOFTBANK Finance, America Corporation from 1996 through 1998 and a Director of International Equity Sales at Credit Suisse First Boston from 1988 through 1996. Mr Takeuchi has served on the board of directors of SBI Investment Co., Ltd. from 2004 to 2013 and on Quark Pharmaceuticals, Inc. from 2010 to 2013. Mr. Takeuchi obtained a B.A. in Economics from the University of California, Los Angeles in 1979. Mr. Takeuchi brings to the Board significant capital market, private equity and investment advisory experience.

The election of directors at the Annual Meeting is an uncontested election.

BOARD RECOMMENDATION: THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF ALL NOMINEES FOR DIRECTOR.

CORPORATE GOVERNANCE AND BOARD MATTERS

Our Board of Directors oversees our business and affairs and monitors the performance of our management. In accordance with corporate governance principles, our Board does not involve itself in day-to-day operations.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions, and other policies for the governance of Acucela. Our Corporate Governance Guidelines are available on the Investor Relations section of our website, which is located at http://ir.acucela.com, by clicking on “Corporate Governance.” The Corporate Governance Guidelines are reviewed periodically by our nominating committee and changes are recommended to our Board as warranted.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our Board is free to choose its chairman in any way that it considers in the best interests of our company. Our Board believes that we and our shareholders currently are best served by having Dr. Kubota serve as Chairman as well as Chief Executive Officer. By combining these positions, Dr. Kubota serves as a bridge between the Board and the operating organization and, with his historical knowledge and operational expertise, provides critical leadership for the strategic initiatives and challenges of the future.

During those periods in which the positions of Chairman and Chief Executive Officer are combined, the independent directors appoint an independent director as a Lead Independent Director. Prior to May 1, 2015, Glen Sato served as our Lead Independent Director. Since Mr. Sato was removed as a director by our shareholders at a special shareholder meeting held on May 1, 2015 (the "Special Meeting"), the Board currently does not have a director serving as Lead Independent Director but intends to appoint one of its independent members to that role in the near future.

The position and role of the Lead Independent Director is intended to facilitate communication between the Board and the Chief Executive Officer and other members of management. The Lead Independent Director has the following duties:

| |

| • | To organize, convene and preside over executive sessions of the non-management and independent directors and promptly communicate approved messages and directives to the Chief Executive Officer. |

| |

| • | To preside at all meetings of the Board at which the Chairman is not available. |

| |

| • | To collect and communicate to the Chief Executive Officer the views and recommendations of the independent directors, relating to his or her performance. |

| |

| • | To perform such other duties and responsibilities as may be assigned from time-to-time by the independent directors. |

The Board believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of the Board and sound corporate governance policies and practices.

Independence

Our common stock is listed on the Mothers market of the Tokyo Stock Exchange. Because our common stock is not listed on a U.S. national securities exchange or an inter-dealer quotation system, the rules of the SEC require that we identify which of our directors is independent using a definition for independence for directors of a national securities exchange or inter-dealer quotation system which has requirements that a majority of the Board be independent. Based upon information requested from and provided by each director and director nominee concerning his background, employment and affiliations, including family relationships, with us, our senior management and our independent registered public accounting firm, our Board has determined that Mr. Kitao, Mr. Mita, Mr. Nakamura, and Mr. Takeuchi are independent directors under standards established by the New York Stock Exchange, or the "NYSE" and that Mr. Asako will be considered an independent director upon election to the board.

Meetings and Attendance

Our Board held sixteen meetings during 2014. Dr. Kubota, our only current incumbent director who served on the Board during 2014, attended at least 75% of the aggregate number of (i) the meetings of the Board and (ii) the meetings of the committees on which he served.

Director Attendance at Annual Meetings

Our policy is to invite and encourage each member of our Board to be present at our annual meetings of shareholders. One of our directors attended our 2014 Annual Meeting.

The Committees of the Board

Our Board has established an audit committee, a compensation committee and a nominating committee. The composition and responsibilities of each committee are described below. Copies of the charters for each committee are available without charge, upon request in writing to Acucela Inc., 1301 Second Avenue, Suite 4200, Seattle, Washington 98101, Attn: Investor Relations or on the Investors portion of our website at http://ir.acucela.com. Members serve on these committees until their resignations or until otherwise determined by our Board.

Audit Committee. Our audit committee is currently comprised of Eisaku Nakamura, who is the chair of the audit committee, and Robert Takeuchi, both of whom have served on the committee since May 1, 2015. Prior to that time, our audit committee was comprised of Glen Sato and Michael Schutzler who were both removed from the Board by our shareholders at the Special Meeting. The composition of our audit committee meets the requirements for independence under applicable NYSE and SEC rules and regulations. Our Board has determined that none of the current members of the audit committee qualifies as an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act. Given the close proximity of the Annual Meeting to the recently completed Special Meeting, the Board has not had an opportunity to properly review candidates for Board membership who would meet this definition of an audit committee financial expert. Additionally, the Board has determined that although none of its current audit committee members meet the definition of an audit committee financial expert under the relevant SEC regulations, that each current member has sufficient experience and expertise to fulfill their responsibility to the Board and to Acucela's shareholders. All audit services to be provided to us and all permissible non audit services to be provided to us by our independent registered public accounting firm will be approved in advance by our audit committee. Our audit committee recommended, and our Board adopted, a charter for our audit committee, which is posted on our website at http://ir.acucela.com. Our audit committee, among other things:

| |

| • | selects a firm to serve as our independent registered public accounting firm to audit our financial statements and determines the compensation for our independent registered public accounting firm; |

| |

| • | reviews annual and quarterly financial statements, management discussion and analysis of financial results or other information submitted to the SEC or appropriate Japanese regulatory authorities or released to the public, including those rendered by the independent public accountants; |

| |

| • | helps to ensure the independence of our independent registered public accounting firm; |

| |

| • | discusses the scope and results of the audit with our independent registered public accounting firm, and reviews, with management and our independent accountants, our interim and year end operating results, our financial statements, our accounting and financial reporting processes, and the integrity of our financial statements; |

| |

| • | develops procedures for employees to submit concerns anonymously about questionable accounting or audit matters and our treatment of such submitted concerns; |

| |

| • | ensures that management has the proper review system in place to ensure that our financial statements, reports and other financial information disseminated to governmental organizations and the public satisfy legal requirements; |

| |

| • | resolves disagreements between management and our independent registered public accountants; |

| |

| • | oversees our compliance with legal and regulatory requirements and compliance with ethical standards adopted by us; |

| |

| • | considers the adequacy of our internal controls regarding finance and accounting; |

| |

| • | discusses our policies with respect to risk assessment and risk management; |

| |

| • | reviews, in consultation with our independent registered public accounting firm, the integrity of Acucela's financial reporting process; |

| |

| • | reviews, in consultation with our legal counsel, disclosure of legal matters including related-party transactions between management and principal shareholders that could have a significant impact on our financial statements; |

| |

| • | consults periodically with our independent registered public accounting firm, out of the presence of management, about internal controls and the completeness and accuracy of our financial statements; and |

| |

| • | reviews and approves (or, as permitted, preapproves) all audit and non-audit services to be performed by our independent registered public accounting firm. |

Our audit committee met nine times during 2014.

Compensation Committee. During 2014, our compensation committee was comprised of Glen Sato and Michael Schutzler who were both removed as directors at the Special Meeting. The Board has not had the opportunity to appoint new members to the compensation committee since the Special Meeting, but intends to do so shortly after the completion of the Annual Meeting in accordance with the provisions of our amended and restated compensation committee charter (the "Compensation Committee Charter"). The Compensation Committee Charter provides that our compensation committee must consist of at least two directors who meet the requirements for independence under applicable NYSE and SEC rules and regulations. The purpose of our compensation committee is to discharge the responsibilities of our Board relating to compensation of our executive officers. Our Compensation Committee Charter is posted on our website at http://ir.acucela.com. Our compensation committee, among other things:

| |

| • | reviews and determines, or makes recommendations to our Board regarding, the compensation of our executive officers; |

| |

| • | reviews our major compensation related risk exposure and the steps management has take to monitor or mitigate such exposure; |

| |

| • | evaluates the performance of our chief executive officer; |

| |

| • | administers our stock and equity incentive plans; |

| |

| • | reviews and approves corporate goals and objectives relevant to the compensation of our executive officers and evaluates the performance of our executive officers in light of these goals and objectives; |

| |

| • | recommends to the Board the form and amount of compensation to be paid or awarded to our non-employee directors; |

| |

| • | reviews our public disclosures concerning executive and director compensation in our reports filed with the SEC; |

| |

| • | assesses the independence of each compensation consultant, legal counsel and other advisors to the compensation committee; |

| |

| • | reviews and makes recommendations to our Board with respect to incentive compensation and equity plans; and |

| |

| • | establishes and reviews general policies relating to compensation and benefits of our employees. |

Under the Compensation Committee Charter, our compensation committee has the sole authority to determine all aspects of executive compensation, although its current practice is to review and recommend to the Board compensation packages for executive officers and to make recommendations to the Board regarding the compensation of non-employee directors. In addition, our current policy requires that equity compensation awards to executive officers must be approved by the Board. Additionally, our compensation committee also reviews compensation practices and trends to assess the adequacy and competitiveness of our executive compensation programs. Although our compensation committee may form and delegate authority to subcommittees when appropriate, or to one or more members of the committee, our compensation committee does not delegate any of its powers and authority with respect to executive

compensation. Further, although our compensation committee consults with both our Chief Executive Officer and Vice President of Human Resources in establishing the compensation paid to our executive officers, all compensation decisions are ultimately decided by the compensation committee outside the presence of such executive officers.

During 2014, our Compensation Committee reviewed and made recommendations to the Board regarding compensation for non-employee directors using a process similar to the one used for determining compensation for our executive officers.

Under the Compensation Committee Charter, our compensation committee has the authority to retain outside counsel or other advisors. Pursuant to that authority, our compensation committee retained an independent compensation consultant, Radford, an Aon Hewitt Company ("Radford"), to provide advice and ongoing recommendations on executive and non-employee director compensation matters for 2015 and 2014. Fees paid to Radford by the Company were less than $120,000 for 2014. Radford representatives meet with our compensation committee from time to time at regular and special meetings to identify companies similar to Acucela in terms of industry, number of employees, location and market capitalization (the "Peer Group"). Once the Board has determined the appropriate companies to include in the Peer Group, Radford provides compensation levels for various executive and director positions. Benchmarking compensation against the Peer Group allows the compensation committee to determine appropriate levels of compensation to stay competitive in the search for and retention of executives and non-employee directors. Radford provides these services to assist our compensation committee in satisfying its responsibilities and will undertake no projects for management without our compensation committee's approval. The decision to retain Radford was not made or recommended by management.

Our compensation committee met eight times during 2014.

Nominating Committee. During 2014, the nominating committee was comprised of Michael Schutzler and Peter Kresel who were both removed as directors by our shareholders at the Special Meeting. The Board has not had the opportunity to appoint new members to the nominating committee since the Special Meeting, but intends to do so shortly after the completion of the Annual Meeting in accordance with the provisions of our nominating committee charter (the "Nominating Committee Charter"). The Nominating Committee Charter provides that the nominating committee shall consist of a minimum of two non-employee directors. The Board also strives to ensure that the members of our nominating committee meet the requirements for independence under applicable NYSE and SEC rules and regulations. Our Nominating Committee Charter is posted on our website at http://ir.acucela.com. Our nominating committee, among other things:

| |

| • | establishes and recommends to the Board criteria for the selection of new directors to become members of the Board; |

| |

| • | identifies, evaluates and recommends nominees to our Board and its committees; |

| |

| • | evaluates the performance of our Board and of individual directors; |

| |

| • | considers and makes recommendations to our Board regarding the size and composition of the Board and its committees; |

| |

| • | reviews related party transactions and proposed waivers of our code of conduct; |

| |

| • | considers questions of independence and possible conflicts of interest of directors, director candidates and executive officers; |

| |

| • | reviews developments in corporate governance practices; |

| |

| • | evaluates the adequacy of our corporate governance practices and reporting; and |

| |

| • | makes recommendations to our Board concerning corporate governance matters. |

Our nominating committee met two times during 2014. Candidates for nomination to our Board are usually selected by our Board based on the recommendation of the nominating committee in accordance with the Nominating Committee Charter, our articles of incorporation and bylaws, our corporate governance guidelines, and any criteria adopted by the Board regarding director candidate qualifications. Since the Board has not had an opportunity to appoint new members to the nominating committee since the Special Meeting, the director nominees for the Annual Meeting were nominated directly by the Board without any recommendation from the

nominating committee. However, the Board anticipates that once members of the Board are selected to serve on the nominating committee, the nominating committee will again function to recommend candidates for nomination to the Board.

To date, our Board has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory and Tokyo Stock Exchange listing requirements and the provisions of our articles of incorporation, bylaws, corporate governance guidelines, and charters of our committees. In addition, neither the Board nor the nominating committee has a formal policy with regard to the consideration of diversity in identifying nominees. The Board’s policy is to encourage selection of directors who will contribute to our overall corporate goals. The nominating committee may from time to time review and recommend to the Board the desired qualifications, expertise and characteristics of directors, including such factors as business experience, diversity, and personal skills in technology, finance, marketing, international business, understanding of Japanese financial markets, financial reporting and other areas that are expected to contribute to an effective Board. Exceptional candidates who do not meet all of these criteria may still be considered. In evaluating potential candidates for the Board, the nominating committee considers these factors in the light of the specific needs of the Board at that time.

Our nominating committee has two principal methods for identifying potential Board candidates (other than those proposed by our shareholders, as discussed below). First, the nominating committee will solicit ideas for possible candiates from a number of sources, including other members of the Board, senior executives, individuals personally known to Board members and research. Additionally, the nominating committee may, from time to time, use its authority under the Nominating Committeee Charter to retain, at our expense, one or more search firms to identify candidates (and to approve such firms' fees and other retention terms). The nominating committee did not retain a search firm during fiscal 2014 or 2015.

The nominating committee will also consider candidates for director recommended by shareholders and will evaluate those candidates using the criteria set forth above. Shareholders seeking to do so should provide the information set forth in our bylaws regarding director nominations. Shareholders should accompany their recommendations with a sufficiently detailed description of the candidate’s background and qualifications to allow the nomination committee to evaluate the candidate in light of the criteria described above, a document signed by the candidate indicating his or her willingness to serve if elected and evidence of the nominating shareholder’s ownership of our common stock, as well as the other information required by our bylaws. Such recommendation and documents should be submitted in writing to Vice President of Human Resources, Acucela Inc., 1301 Second Avenue, Suite 4200, Seattle, WA 98101, and addressed to the attention of the Nominating Committee.

Board’s Role in Risk Oversight

The Board is actively involved in the oversight of our risk management process. The Board does not have a standing risk management committee, but administers this oversight function directly through the Board as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. In particular, our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking, our nominating committee monitors our major legal compliance risk exposures and our program for promoting and monitoring compliance with applicable legal and regulatory requirements and our Board is responsible for monitoring and assessing strategic risk exposure, and other risks not covered by our committees.

The full Board, or the appropriate committee, receives reports on risks facing our company from our Chief Executive Officer or other members of management to enable it to understand our risk identification, risk management and risk mitigation strategies.

Communications

Shareholders may communicate with the Board by sending written correspondence to: Board of Directors, c/o Chief Financial Officer, Acucela Inc., 1301 Second Avenue, Suite 4200, Seattle, WA 98101. Communications are distributed to the Board, or to any individual directors as appropriate, depending on the facts and circumstances outlined in the communication. The Board has instructed the Chief Financial Officer to review all correspondence and to determine, in his or her discretion, whether matters submitted are appropriate for Board consideration. In particular, the Board has directed that communications such as product or commercial inquiries or complaints,

résumé and other job inquiries, surveys and general business solicitations or advertisements should not be forwarded to the Board. In addition, material that is unduly hostile, threatening, illegal, patently offensive or similarly inappropriate or unsuitable will be excluded, with the provision that any communication that is filtered out must be made available to any independent director upon request. The Chief Financial Officer may forward certain communications elsewhere in the company for review and possible response.

Compensation of Directors

In general, we compensate our non-employee directors with a combination of cash and equity awards. In 2014, we paid each non-employee director an annual retainer fee of $7,500 and an annual retainer of $2,500 to each director who served as a committee chair. Except in the case of Mr. Kresel, a former director, we granted to each of our non-employee directors in 2014 options to purchase up to 7,500 shares of our common stock as compensation for service on the Board as well as options to purchase up to 2,500 shares of our common stock to each non-employee director who also served as a committee chair in 2014.

For 2015, the Board utilized research performed by Radford (as described above in The Committees of the Board, Compensation Committee section) to benchmark our director compensation. In order to bring compensation up to a commensurate level based on the Board's duties in governing a public company, the Board decided in January 2015 to offer the following compensation to our non-employee directors who begin serving on the Board after the Annual Meeting:

|

| | | | | | |

| Position | | Committee | | Retainer |

| Board Chair | | | | $ | 25,000 |

|

| Board Member | | | | 35,000 |

|

| Committee Chair | | Audit | | 15,000 |

|

| Committee Chair | | Compensation | | 10,000 |

|

| Committee Chair | | Nominating/Governance | | 6,500 |

|

| Committee Member | | Audit | | 7,500 |

|

| Committee Member | | Compensation | | 5,000 |

|

| Committee Member | | Nominating/Governance | | 3,000 |

|

In addition, we will offer our non-employee directors an equity package, consisting of an option grant to purchase up to 6,000 shares of our common stock and a restricted stock unit ("RSU") award of 3,000 shares of our common stock, and, after a director has served on our Board for at least 12 months, a recurring annual equity package, consisting of an option grant to purchase up to 4,000 shares of our common stock and an RSU award of 2,000 shares of our common stock.

Non-employee directors will receive no other form of remuneration, perquisites or benefits, but will be reimbursed for their expenses to attend meetings, including travel, meal and other expenses.

The following table provides information regarding the compensation awarded to, earned by or paid to our non-employee directors during the fiscal year ended December 31, 2014. All compensation paid to Dr. Kubota and Mr. O'Callaghan, our only employee directors in 2014, is set forth in the tables below under "Executive Compensation—Summary Compensation." The non-employee director compensation paid to Mr. O'Callaghan in 2014 prior to his appointment as an executive officer of Acucela is reported under the column captioned "All Other Compensation" in the Summary Compensation Table presented in that section.

Director Compensation

|

| | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in Cash | | Option

Awards(1) | | All Other

Compensation | | Total |

| Peter A. Kresel | | $ | 22,750 |

| | $ | — |

| (2) | $ | — |

| | $ | 22,750 |

|

| Glen Y. Sato | | 30,000 |

| | 57,250 |

| (3) | — |

| | 87,250 |

|

| Michael Schutzler | | 23,250 |

| | 45,800 |

| (4) | — |

| | 69,050 |

|

_____________________

| |

| (1) | The amounts in this column represent the aggregate grant date fair values for stock option awards, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 ("FASB ASC Topic 718") for awards granted during the current year. For a discussion of valuation assumptions, see Note 8 to our financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. |

(2) Mr. Kresel did not receive a stock grant due to his consulting agreement with the Company.

| |

| (3) | In May 2014, we granted to Glen Sato options to purchase up to 12,500 shares of our common stock at an exercise price of $7.78 per share. Mr. Sato's option awards vest in equal monthly installments over one year from the vesting commencement date of May 22, 2013 in accordance with our practices for annual option grants. |

| |

| (4) | In May 2014, we granted to Michael Schutzler options to purchase up to 10,000 shares of our common stock at an exercise price of $7.78 per share. Mr. Schutzler’s option award vests in equal monthly installments over one year from the vesting commencement date of May 22, 2013 in accordance with our practices for annual option grants. |

The aggregate number of shares subject to outstanding stock option awards held by each of our non-employee directors as of December 31, 2014 were as follows:

|

| | |

| Name | | Aggregate Number of Shares

Underlying Outstanding Stock

Option Awards |

| Peter A. Kresel | | 20,000 |

| Glen Y. Sato | | 52,500 |

| Michael Schutzler | | 32,500 |

None of Messrs. Sato, Schutzler or Kresel, who were removed as directors by our shareholders at the Special Meeting, received any fees in connection with such removal.

PROPOSAL 2 - TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2015

The audit committee has retained Ernst & Young LLP to serve as our independent registered public accounting firm to conduct an audit of our financial statements for the 2015 fiscal year, and the Board has directed that our management submit the selection of Ernst & Young LLP for ratification by the shareholders at the Annual Meeting. In retaining Ernst & Young LLP, the audit committee considered carefully Ernst & Young LLP’s performance for us in that capacity since its retention in 2009, its independence with respect to the services to be performed and its general reputation for adherence to professional auditing standards.

Selection of our independent registered public accounting firm is not required to be submitted to a vote of the shareholders for ratification. The Sarbanes-Oxley Act of 2002 requires the audit committee to be directly responsible for the appointment, compensation and oversight of the audit work of the independent registered public accounting firm. The Board is, however, submitting this matter to the shareholders as a matter of good corporate practice. If the shareholders fail to vote on an advisory basis in favor of ratifying this selection, the audit committee will reconsider whether to retain Ernst & Young LLP, and may retain that firm or another firm without re-submitting the matter to our shareholders. Even if the shareholders vote on an advisory basis in favor of ratifying the appointment, the audit committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of us and our shareholders.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Services and Fees

The following table lists the fees for services rendered by Ernst & Young LLP for 2013 and 2014 (in thousands):

|

| | | | | | | | |

| Services | | 2014 | | 2013 |

| Audit Fees | | $ | 596 |

| | $ | 1,820 |

|

| Audit-Related Fees | | $ | — |

| | $ | — |

|

| Tax Fees | | $ | 76 |

| | $ | 13 |

|

| All Other Fees | | $ | — |

| | $ | — |

|

| Total | | $ | 672 |

| | $ | 1,833 |

|

_____________________

Audit Fees. Consists of fees associated with the audit of our annual financial statements, the reviews of our interim financial statements, and the issuance of consents and comfort letters in connection with registration statements.

Audit-Related Fees. Consists of fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements, including accounting consultations, and are not reported under “Audit Fees.”

Tax Fees. Consists of fees for tax compliance, tax advice and tax planning.

All Other Fees. Consists of fees associated with permitted corporate finance assistance and permitted advisory services, none of which were provided by our independent auditors during the last two fiscal years.

Ernst & Young LLP to date has not performed any non-audit services for us.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered

public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

All of the services relating to the fees described in the table above were approved by our audit committee.

BOARD RECOMMENDATION: THE BOARD RECOMMENDS THAT YOU VOTE "FOR PROPOSAL 2 TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2015.

OUR COMMON STOCK OWNERSHIP

The following table shows, as of May 15, 2015, the number of shares of our common stock beneficially owned by the following persons:

| |

| • | each person we know beneficially owns more than five percent of any class of our voting stock; |

| |

| • | each of our current directors and nominees; |

| |

| • | each of our named executive officers; and |

| |

| • | all of our directors and executive officers as a group. |

Unless otherwise noted, the address of each beneficial owner listed in the table is Acucela Inc., 1301 Second Avenue, Suite 4200, Seattle, Washington 98101-3805.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us or publicly disclosed, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws where applicable.

Applicable percentage ownership is based on 36,465,439 shares of common stock outstanding as of May 15, 2015. Shares of our common stock subject to options or restricted stock units that are currently exercisable or vested or exercisable or vesting within 60 days of May 15, 2015 are deemed to be outstanding and to be beneficially owned by the person holding the option for the purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

|

| | | | | | |

| | | Number | | Percent |

| 5% Shareholders | | | | |

SBI Holdings, Inc. (1) | | 7,752,425 |

| | 21.3 | % |

Otsuka Pharmaceutical Co., Ltd. (2) | | 3,403,163 |

| | 9.3 | % |

| Officers and Directors | | | | |

| Shintaro Asako | | 800 |

| | * |

|

Hien DeYoung (3) | | 38,465 |

| | * |

|

| Ryo Kubota | | 10,250,654 |

| (4) | 28.1 | % |

| Yoshitaka Kitao | | 204,800 |

| | * |

|

| Dr. Shiro Mita | | 200 |

| | * |

|

| Eisaku Nakamura | | 800 |

| | * |

|

| Robert Takeuchi | | — |

| | * |

|

| John Gebhart | | — |

| | * |

|

| Steven Tarr | | 358,692 |

| (5) | 1.0 | % |

| Edward Danse | | 118,369 |

| (6) | * |

|

| All executive officers and directors as a group (10 persons) | | 10,971,980 |

| | 30.1 | % |

_____________________

| |

| * | Represents beneficial ownership of less than 1%. |

| |

| (1) | Based solely on Schedule 13D/A filed on April 8, 2015 by SBI Holdings, Inc., SBI Capital Management Co., Ltd., SBI Investment Co., Ltd., SBI Incubation Co., Ltd., Trans-Science No. 2A Investment Limited Partnership, SBI Transscience Co., Ltd., BIOVISION Life Science Fund No.1, SBI BB Media Investment Limited Partnership, SBI Bio Life Science Investment LPS, SBI BB Mobile Investment LPS, SBI Phoenix No. 1 Investment LPS, and SBI Broadband Fund No. 1 Limited Partnership. SBI Holdings, Inc., a corporation organized in Japan (“SBI Holdings”), is the parent company of the SBI Group, a financial services group in Japan. Acucela common stock is held directly by SBI Incubation Co., Ltd., Trans-Science No. 2A Investment Limited Partnership, BIOVISION Life Science Fund No.1, SBI Bio Life Science Investment LPS, SBI BB Mobile Investment LPS, and SBI Phoenix No. 1 Investment LPS (collectively, the “Direct Holders”). Each is a corporation or private investment fund organized in Japan. SBI Incubation Co., Ltd. is an indirect wholly-owned subsidiary of SBI Holdings. SBI Transscience Co., Ltd., a private investment fund organized in Japan and a subsidiary of SBI Holdings is the sole general partner of Trans-Science No. 2A Investment Limited Partnership. SBI Capital Management Co., Ltd., a corporation organized in Japan (“SBI Capital Management”), is a wholly-owned subsidiary of SBI Holdings. SBI Investment Co., Ltd., a corporation organized in Japan (“SBI Investment”), is a wholly-owned subsidiary of SBI Capital Management. SBI Investment is the sole general partner or the sole liquidator of BIOVISION Life Science Fund No.1, SBI BB Media Investment Limited Partnership, SBI Bio Life Science Investment LPS, SBI BB Mobile Investment LPS, SBI Phoenix No. 1 Investment LPS, and SBI Broadband Fund No. 1 Limited Partnership.The executive officers of SBI Holdings are Kenji Hirai, Masayuki Yamada, Hideo Nakamura, Makoto Miyazaki, and Kazuhito Uchio. The directors of SBI Holdings are Yoshitaka Kitao, Katsuya Kawashima, Takashi Nakagawa, Tomoya Asakura, Shumpei Morita, Peilung Li, Masato Takamura, Satofumi Kawata, Masaki Yoshida, Kiyoshi Nagano, Keiji Watanabe, Akihiro Tamaki, Masanao Marumono, Teruhide Sato, and Kazuhiro Nakatsuka. Each of the above individuals disclaims beneficial ownership of the Acucela common stock, except to the extent of such individual’s pecuniary interest therein. The address for each of these entities is Izumi Garden Tower 19F, 1-6-1 Roppongi, Minato-ku, Tokyo 106-6019, Japan. |

| |

| (2) | Represents 1,888,011 shares owned by Otsuka Pharmaceutical Co., Ltd. and 1,515,152 shares owned by Otsuka Pharmaceutical Factory, Inc. The address for Otsuka Pharmaceutical Co., Ltd. is 2-9, Kanda Tsukasa-machi, Chiyoda-ku, Tokyo 101-8535, Japan. The address for Otsuka Pharmaceutical Factory, Inc. is 115 Kuguhara, Tateiwa, Muya-cho, Naruto, Tokushima 772-8601, Japan. |

| |

| (3) | Includes 31,200 shares of common stock issuable upon exercise of options that are exercisable within 60 days of May 15, 2015 and 7,265 shares of common stock owned by Ms. DeYoung. Ms. DeYoung was terminated on May 15, 2015. |

| |

| (4) | Includes 10,000 shares of common stock issuable upon exercise of options that are exercisable within 60 days of May 15, 2015. |

| |

| (5) | In connection with his appointment as the Company’s Chief Operating Officer, the Company’s board of directors awarded Mr. Tarr 358,692 restricted shares of common stock. The Company has the ability to repurchase 100% of the restricted stock awarded to Mr. Tarr if his employment is terminated prior to the one year anniversary of the grant date, and 75% of the shares of restricted stock thereafter on a decreasing percentage on a monthly pro rata basis over the following three years, with the repurchase capability terminating four years from the award grant date, subject to full accelerated ownership upon the occurrence of both a Change in Control of the Company (as defined in his employment agreement) and termination of Mr. Tarr’s employment with the Company within 12 months of such Change in Control, either by the Company without Cause or by Mr. Tarr for Good Reason (both as defined in Mr. Tarr’s employment agreement). |

| |

| (6) | In connection with his appointment as the Company’s Chief Business Officer, the Company’s board of directors awarded Mr. Danse 118,369 shares of restricted stock. The Company has the ability to repurchase 100% of the restricted stock awarded to Mr. Danse if his employment is terminated prior to the one year anniversary of the grant date, and 75% of the shares of restricted stock thereafter on a decreasing percentage on a monthly pro rata basis over the following three years, with the repurchase capability terminating four years from the award grant date, subject to full accelerated ownership upon the occurrence of both a Corporate Transaction (as defined in the Acucela 2014 Equity Incentive Plan) and termination of Mr. Danse’s employment with the Company within 12 months of the Corporate Transaction by the Company without Cause or by Mr. Danse for Good Reason (both as defined in Mr. Danse’s employment agreement). |

INFORMATION REGARDING EQUITY COMPENSATION PLANS

The following table presents information as of December 31, 2014 with respect to compensation plans under which shares of our common stock may be issued. |

| | | | | | | | | |

| | Number of Securities to be Issued Upon Exercise of Outstanding Options | | Weighted Average Exercise Price of Outstanding Options | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) |

| Plan Category | (a) | | (b) | | (c) |

| Equity compensation plans approved by shareholders | 375,956 |

| | $ | 8.45 |

| | 2,329,629 |

|

| Equity compensation plans not approved by shareholders | — |

| | $ | — |

| | — |

|

| Total | 375,956 |

| | $ | 8.45 |

| | 2,329,629 |

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, requires that our directors, executive and other specified officers and greater-than-10% shareholders file reports with the SEC on their initial beneficial ownership of our common stock and any subsequent changes. They must also provide us with copies of the reports.

We are required to tell you in this Proxy Statement if we know about any failure to report as required. We reviewed copies of all reports furnished to us and obtained written representations that no other reports were required. Based solely on this review, we believe that all of the reporting persons complied with their filing requirements for 2014 except that three Forms 4s reflecting a grant of options to Brian O’Callaghan, Michael Schutzler, and Glen Sato were filed late.

EXECUTIVE OFFICERS

The following table lists our executive officers, who will serve in the capacities noted until their successors are duly appointed, and their respective ages as of May 15, 2015:

|

| | | | |

| Name | | Age | | Position |

| Ryo Kubota, M.D., Ph.D. | | 48 | | Chairman, Chief Executive Officer and President |

| Edward Danse | | 62 | | Chief Business Officer |

| John Gebhart | | 60 | | Chief Financial Officer |

| Steven Tarr | | 61 | | Chief Operating Officer |

| Dewey Blocker, Jr. | | 50 | | Vice President Finance, Treasurer and Secretary |

_____________________

Ryo Kubota, M.D., Ph.D. is our founder and on May1, 2015, was appointed our Chief Executive Officer and President. Additional background information about Dr. Kubota is included above under "Proposal 1: Election of Directors."

Edward Danse was appointed our Chief Business Officer on May 1, 2015. Prior to his appointment as our Chief Business Officer, Mr. Danse served as President of Replenish, Inc., the developer of a novel MicroPump for retinal drug delivery, where he was responsible for leading a restructuring, recapitalization and technology transfer to that company’s global partner. From 2005 to 2014, Mr. Danse served as President and CEO of Neurotech Pharmaceuticals, Inc. In 2006, he transitioned Neurotech from a Paris to a Delaware-based corporate domicile, and restructured and recapitalized the company. Subsequently, he was instrumental in the development of two transformational products that address neovascular age-related macular degeneration and glaucoma. Mr. Danse has development and commercial experience which spans over 30 years in ophthalmology. Previously he was President and CEO of ISTA Pharmaceuticals Inc. and was responsible for taking that company public (NASDAQ) in 2000. Mr. Danse has also held various senior positions at Allergan where he was responsible for establishing a high-growth, profitable business operation in Japan, China and the rest of Asia, including the consummation of several successful corporate acquisitions. His early career was spent in business development roles at Coopervision, Bausch & Lomb and Schering-Plough. Mr. Danse holds an M.B.A. in international management from Thunderbird School of Global Management in Glendale, AZ.

John Gebhart was appointed our Chief Financial Officer on May 1, 2015. Prior to joining Acucela, Mr. Gebhart was Chief Financial Officer for Qliance Medical Management Inc., a leader in direct primary care services, from 2012 to 2015, he where he led that company’s financial and operations functions during a period of significant growth. From 2004 through 2012 he operated an independent consultancy providing project management and interim executive services to a variety of health services and technology companies including Remote Medical International, Ventripoint, PhysioSonics, Carena, Clarity Health, Nexcura, and DS-IQ. Mr. Gebhart has worked in emerging health and technology companies for more than 30 years in the roles of CFO, COO, and CEO. He began his career as a CPA with Ernst & Young and received his MBA from Pepperdine University in Malibu, CA.

Steven Tarr was appointed our Chief Operating Officer on May 1, 2015. Mr. Tarr has extensive experience providing senior executive leadership to a wide range of industries including global telecommunications, health care and education ranging from Fortune 500 corporations to startups. Mr. Tarr has deep expertise in scaling a growing business as well as in revitalizing large companies and is a member of the National Association of Corporate Directors. Mr. Tarr most recently served as Executive Vice President and Chief Information Officer at Emeritus Senior Living Inc. (acquired by Brookdale Senior Living Inc. in July 2014) from 2013 to 2014, where he directed industry-leading technology initiatives. Prior to Emeritus, Mr. Tarr was the principal at Steve Tarr Consulting since 2005, where he worked directly with chief executive officers to define innovative technology-based and customer-focused business strategies. Mr. Tarr led transformation initiatives at a number of health care organizations including Santa Clara Valley Health System, Scottsdale Lincoln Health Network, and University of Washington Medicine. Mr. Tarr was also Chief Information Officer at Northwest Hospital and Medical Center from 2007 to 2009. Dr. Tarr holds a Ph.D. in Systems Science from Portland State University, focused on the systems dynamics of integrating new technology into an organization, an M.S. in Computer Science from Washington State University and a B.S. in General Biology from Washington State University.

Dewey Blocker, Jr. has served as our Vice President of Finance since March 24, 2015. Mr. Blocker joined Acucela in 2008 as Director of Finance and in 2010 was promoted to Senior Director of Finance. Prior to joining the Company, Mr. Blocker was the Chief

Financial Officer for Ivey Imaging and before that spent five years as a Senior Financial Analyst with ICOS Corporation, a biopharmaceutical company. Mr. Blocker earned a B.A. degree from Washington State University and an M.B.A. degree from Seattle University.

EXECUTIVE COMPENSATION

Summary Compensation

The following table provides information regarding all compensation awarded to, earned by or paid to our named executive officers for all services rendered in all capacities to us during 2014 and 2013. Our named executive officers for 2014 include our principal executive officer and for 2014, our two most highly compensated executive officers (other than our principal executive officer) serving as such at December 31, 2014, and our former chief financial officer who would have been one of our most highly compensated executive officers (other than our principal executive officer) but for the fact that he was not serving as an executive officer at December 31, 2014. We refer to these four executive officers as our named executive officers.

Summary Compensation Table

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and principal position | | Year | | Salary | | Bonus | | Stock

Awards(1) | | Option

Awards | | Non-Equity

Incentive

Plan Com-

pensation(2) | | All Other

Compen-

sation | | Total(3) |

| Ryo Kubota, M.D., Ph.D. | | | | | | | | | | | | | | | | |

Chairman, President and Chief Executive Officer (4) | | 2014 | | $ | 492,312 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 0 |

| | $ | 127,697 |

| (5) | $ | 620,009 |

|

| | | 2013 | | 485,016 |

| | 36,885 |

| (6) | 456,360 |

| | — |

| | 232,800 |

| | 804,776 |

| (7) | 2,015,837 |

|

| Brian O'Callaghan | | | | | | | | | | | | | | | | |

Former Chief Executive Officer, President and Interim Chief Financial Officer (8) | | 2014 | | 162,075 |

| (9) | — |

| | — |

| | — |

| | — |

| | 168,381 |

| (10) | 330,456 |

|

| | | 2013 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Hien DeYoung | | | | | | | | | | | | | | | | |

Former Vice President Human

Resources 11 | | 2014 | | 263,424 |

| | — |

| | — |

| | — |

| | 86,206 |

| | 18,491 |

| (12) | 368,121 |

|

| | | 2013 | | 259,512 |

| | — |

| | — |

| | — |

| | 78,113 |

| | 17,056 |

| (13) | 354,681 |

|

| David L. Lowrance | | | | | | | | | | | | | | | | |

| Former Chief Financial Officer | | 2014 | | 226,579 |

| (14) | — |

| | — |

| | — |

| | — |

| | 91,128 |

| (15) | 317,707 |

|

| | | 2013 | | 308,544 |

| | — |

| | — |

| | — |

| | 108,453 |

| | 18,626 |

| (16) | 435,623 |

|

_____________________

| |

| (1) | The amount in this column represents the aggregate grant date fair value of the stock awards, computed in accordance with FASB ASC Topic 718, issued to Dr. Kubota for fiscal year 2013. See note 8 to our audited financial statements contained in our annual report on Form 10-K for the year ended December 31, 2014 for a discussion of all assumptions made in determining the grant date fair values. |

| |

| (2) | The amounts in this column represent total performance-based bonuses under our Acucela Incentive Program earned for services rendered in fiscal years 2014 and 2013. |

| |

| (3) | The amounts in this column represent the sum of the compensation amounts reflected in the other columns of this table. |

| |

| (4) | Dr. Kubota served as our President until September 8, 2014, Chief Executive Officer from June 2002 until December 2014, and Chairman since April 2005. On May 1, 2015, Dr. Kubota returned to the office of Chief Executive Officer and President. |

| |

| (5) | Represents perquisites and personal benefits received during 2014 associated with our rental of a corporate apartment in Tokyo, Japan of $107,324 and payment of commuting and parking costs of $4,670 and $15,703 of insurance premiums. |

| |

| (6) | Pursuant to our Acucela Incentive Program, our compensation committee used its discretion to approve a cash bonus in the amount of $36,885 to Dr. Kubota in recognition of his accomplishments as our Chief Executive Officer in 2013. |

| |

| (7) | Includes $456,360 in amounts paid by us to discharge Dr. Kubota’s indebtedness under promissory notes used to fund his purchase of shares of our common stock (see footnote 1) pursuant to our employment agreement with Dr. Kubota, gross-ups of $329,790 for the payment of taxes due in connection with these payments, $13,991 for the payment of insurance premiums, and $4,635 for payment of commuting and parking costs. |