Table of Contents

As filed with the Securities and Exchange Commission on May 24, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SHG Services, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 8051 | 13-4230695 | ||

| (State of Incorporation) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

18831 Von Karman, Suite 400

Irvine, CA 92612

(949) 255-7100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William A. Mathies

President and Chief Operating Officer

SHG Services, Inc.

18831 Von Karman, Suite 400

Irvine, CA 92612

(949) 255-7100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Andor D. Terner, Esq. Robert T. Plesnarski, Esq. O’Melveny & Myers LLP 610 Newport Center Drive, 17th Floor Newport Beach, CA 92660 (949) 823-6900 | Jeffrey Bagner, Esq. Steven Epstein, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, NY 10004 (212) 859-8000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective and all conditions to the proposed transaction have been satisfied or waived.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |

Non-accelerated filer x (Do not check if smaller reporting company) | Smaller reporting company ¨ | |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price per Share(2) | Proposed Maximum Offering Price(2) | Amount of Registration Fee | ||||

Common Stock, par value $0.01 per share | 43,909,934 | N/A | $188,963,000 | $13,473.06 | ||||

| (1) | Consists of the maximum number of shares of common stock, par value $0.01 per share, of SHG Services, Inc., a Delaware corporation, that may be issuable to the holders of Sun Healthcare Group, Inc. common stock pursuant to the distribution transaction described in the proxy statement/prospectus that forms a part of this registration statement, based upon the number of shares of common stock, par value $0.01 per share, of Sun Healthcare Group, Inc. outstanding at the close of business on May 18, 2010. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f)(2) promulgated under the Securities Act of 1933, as amended, based on the book value of the net assets held or expected to be held by SHG Services, Inc. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

SHG Services, Inc. (“New Sun”), a wholly owned subsidiary of Sun Healthcare Group, Inc. (“Sun”), is filing this registration statement on Form S-1 to register the issuance of shares of its common stock, $0.01 par value per share, which will be distributed on a pro rata basis to Sun stockholders (the “Separation”). Immediately following the Separation, Sun intends to merge with and into Sabra Health Care REIT, Inc., a wholly owned subsidiary of Sun (“Sabra”), with Sabra surviving the merger and Sun stockholders receiving shares of Sabra common stock in exchange for their shares of Sun common stock (the “REIT Conversion Merger”). Concurrently with the filing of this registration statement on Form S-1, Sabra is filing a registration statement on Form S-4 (Reg. No. 333- ) to register the issuance of shares of its common stock, par value $0.01 per share, in exchange for shares of Sun common stock in connection with the REIT Conversion Merger. This registration statement also includes a proxy statement relating to a special meeting of Sun stockholders to consider and vote on the Separation and the adoption of the agreement and plan of merger to implement the REIT Conversion Merger.

Table of Contents

The information in the proxy statement/prospectus is not complete and may be changed. Neither New Sun nor Sabra may sell the securities offered by the proxy statement/prospectus until their respective registration statements are effective with the Securities and Exchange Commission. The proxy statement/prospectus is not an offer to sell these securities and neither New Sun nor Sabra is soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 24, 2010

[SUN HEALTHCARE GROUP, INC. LETTERHEAD]

, 2010

Dear Stockholder:

You are cordially invited to attend a special meeting of stockholders of Sun Healthcare Group, Inc. (“Sun”) to be held on , 2010 at at a.m., local time, and at any adjournment or postponement thereof.

On May 24, 2010, Sun announced that it intends to restructure its business by separating its real estate assets and its operating assets into the following two separate publicly traded companies (SHG Services, Inc. and Sabra Health Care REIT, Inc.), subject to the approval of its stockholders and other conditions:

| • | SHG Services, Inc., a Delaware corporation and a wholly owned subsidiary of Sun (“New Sun”), will own and continue to operate all of Sun’s operating subsidiaries. New Sun will be renamed “Sun Healthcare Group, Inc.” and the shares of New Sun common stock are expected to trade on the NASDAQ Global Select Market under the symbol “SUNH.” Sun will distribute to its stockholders on a pro rata basis all of the outstanding shares of New Sun common stock. This distribution is referred to in the proxy statement/prospectus as the “Separation.” |

| • | Sabra Health Care REIT, Inc., a Maryland corporation and a wholly owned subsidiary of Sun (“Sabra”), will own substantially all of Sun’s currently owned real property assets and will lease those assets to New Sun’s subsidiaries. Sabra expects to grow its portfolio through acquisitions as a broad-based healthcare REIT. Immediately following the Separation, Sun will be merged with and into Sabra with Sabra surviving the merger. This merger is referred to in the proxy statement/prospectus as the “REIT Conversion Merger.” The shares of Sabra common stock are expected to trade on the under the symbol “SBRA.” Sabra currently intends to qualify and elect to be treated as a real estate investment trust for U.S. federal income tax purposes commencing with its taxable year beginning on January 1, 2011. This election, together with the REIT Conversion Merger, is collectively referred to in the proxy statement/prospectus as the “REIT Conversion.” |

In connection with the Separation, Sun also intends to make a cash distribution to holders of Sun common stock of approximately $ per share, although the final amount of this cash distribution will not be determined until the time of the Separation. The issuance of shares of New Sun common stock and the cash distribution by Sun in connection with the Separation should be treated as a taxable distribution to taxable U.S. stockholders for U.S. federal income tax purposes.

The board of directors of Sun has unanimously approved the Separation and REIT Conversion Merger, and recommends that stockholders vote “FOR” the Separation and “FOR” the REIT Conversion Merger as further described in the proxy statement/prospectus.

Your vote is very important.Whether or not you plan to attend the special meeting in person, it is important that your shares be represented and voted at the special meeting. You may submit your proxy or voting instructions by completing, signing, dating and returning the proxy or voting instruction card enclosed with the proxy materials you received or by submitting your proxy or voting instructions over the Internet or by telephone. We urge you to promptly submit your proxy or voting instructions in order to ensure your representation and the presence of a quorum at the special meeting.Please note that if you do not submit a proxy or voting instruction form or do not vote in person at the special meeting, the effect will be the same as a vote against the adoption of the agreement and plan of merger to implement the REIT Conversion Merger. In addition, if you “ABSTAIN” from voting on the Separation or on the adoption of the agreement and plan of merger to implement the REIT Conversion Merger, the effect will be the same as a vote against each of these proposals.

The proxy statement/prospectus provides you with important information about the Separation and REIT Conversion. Please give this information your careful attention.In particular, you should read and consider carefully the discussion in the section entitled “Risk Factors” beginning on page22 of the proxy statement/prospectus.

Sincerely,

Richard K. Matros

Chairman and Chief Executive Officer

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved the issuance of the shares of common stock of New Sun and Sabra as described in the proxy statement/prospectus or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

The proxy statement/prospectus is dated , 2010, and is first being mailed to stockholders of Sun on or about , 2010.

Table of Contents

SUN HEALTHCARE GROUP, INC.

18831 Von Karman, Suite 400

Irvine, California 92612

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2010

To the Stockholders of Sun Healthcare Group, Inc.:

The special meeting of stockholders of Sun Healthcare Group, Inc., a Delaware corporation (“Sun”), will be held on , 2010 at at a.m., local time, and at any adjournment or postponement thereof, to consider and vote on the following matters described in the proxy statement/prospectus:

| 1. | To consider and vote upon a proposal to distribute to Sun stockholders on a pro rata basis all of the outstanding shares of common stock of SHG Services, Inc., a Delaware corporation and a wholly owned subsidiary of Sun (the “Separation”). |

| 2. | To consider and vote upon a proposal to adopt the agreement and plan of merger between Sun and Sabra Health Care REIT, Inc., a Maryland corporation and a wholly owned subsidiary of Sun (“Sabra”), which contemplates that, immediately following the Separation, Sun will be merged with and into Sabra with Sabra surviving the merger and Sun stockholders receiving shares of Sabra in exchange for their shares of Sun common stock (the “REIT Conversion Merger”). |

| 3. | To consider and vote upon a proposal to adjourn the special meeting to a later date, if necessary, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the Separation or adopt the agreement and plan of merger to implement the REIT Conversion Merger. |

| 4. | To transact such other business as may properly come before the special meeting, or any adjournments or postponements thereof. |

The Separation and REIT Conversion Merger are conditioned on approval by Sun stockholders and satisfaction or waiver of all other conditions to the transactions as described in this proxy statement/prospectus.

The board of directors of Sun has fixed the close of business on , 2010 as the record date for determining stockholders entitled to receive notice of and vote at the special meeting and at any adjournment or postponement thereof. At the close of business on the record date, there were shares of Sun common stock outstanding and entitled to vote.

All stockholders are cordially invited to attend the special meeting in person. Whether or not you plan to attend the special meeting, you are urged to promptly submit your proxy or voting instructions. If you attend the special meeting and wish to vote your own shares in person, you may withdraw your proxy at that time.

For the Board of Directors,

Michael T. Berg

Secretary

�� , 2010

After careful consideration, the board of directors of Sun has unanimously determined that the Separation and REIT Conversion Merger are advisable and in the best interests of Sun and you, the Sun stockholders.The board of directors of Sun unanimously recommends that you vote “FOR” the Separation, “FOR” the adoption of the agreement and plan of merger to implement the REIT Conversion Merger and “FOR” the adjournment of the special meeting to a later date, if necessary, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the Separation or adopt the agreement and plan of merger to implement the REIT Conversion Merger.

Important Notice Regarding the Availability of Proxy Materials for Sun’s Special Meeting of Stockholders to Be Held on , 2010.The accompanying proxy statement/prospectus is available atwww.sunh.com.

Table of Contents

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates important information about Sun Healthcare Group, Inc. (“Sun”) that is not included in or delivered with this proxy statement/prospectus. For a listing of the documents incorporated by reference into this proxy statement/prospectus, see “Where You Can Find More Information.” You may obtain these documents through the website of the Securities and Exchange Commission (the “SEC”) atwww.sec.gov. You may also request a copy of these documents at no cost by writing or telephoning Sun at:

Sun Healthcare Group, Inc.

101 Sun Avenue, N.E.

Albuquerque, New Mexico 87109

(505) 468-2341

Attention: Investor Relations

To obtain timely delivery of such information, you must request such information no later than , 2010.

i

Table of Contents

ii

Table of Contents

| Page | ||

| 54 | ||

| 56 | ||

| 57 | ||

| 58 | ||

| 59 | ||

| 60 | ||

U.S. Federal Income Tax Consequences of the REIT Conversion Merger | 61 | |

| 62 | ||

| 72 | ||

| 74 | ||

| 74 | ||

| 74 | ||

| 75 | ||

| 75 | ||

| 75 | ||

| 76 | ||

| 76 | ||

| 77 | ||

| 77 | ||

| 79 | ||

| 80 | ||

| 81 | ||

| 81 | ||

| 83 | ||

| 83 | ||

| 83 | ||

| 85 | ||

| 85 | ||

| 86 | ||

| 86 | ||

| 86 | ||

| 86 | ||

| 87 | ||

| 88 | ||

SABRA PRO FORMA CAPITALIZATION AND SUPPLEMENTAL PRO FORMA FINANCIAL INFORMATION | 89 | |

NEW SUN UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS | 90 | |

| 97 | ||

SABRA AUDITED BALANCE SHEET OF ASSETS TO BE CONTRIBUTED AND LIABILITIES TO BE ASSUMED | 104 | |

| 105 | ||

| 106 | ||

| 139 | ||

| 140 | ||

Information Regarding Directors and Executive Officers of New Sun | 140 | |

| 140 | ||

| 143 | ||

| 144 |

iii

Table of Contents

| Page | ||

| 145 | ||

Stockholder and Interested Party Communications with Directors | 146 | |

| 147 | ||

Information Regarding Directors and Executive Officers of Sabra | 147 | |

| 147 | ||

| 148 | ||

| 148 | ||

| 149 | ||

Stockholder and Interested Party Communications with Directors | 150 | |

| 151 | ||

| 153 | ||

| 176 | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 177 | |

| 181 | ||

| 183 | ||

| 187 | ||

| 196 | ||

| 206 | ||

| 206 | ||

| 206 | ||

| 206 | ||

| 207 |

iv

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement/prospectus and the documents incorporated by reference herein contain forward-looking statements and information. Any statements that do not relate to historical or current facts or matters are forward-looking statements.

Examples of forward-looking statements include all statements regarding the expected future financial position, results of operations, cash flows, liquidity, financing plans, business strategy, budgets, the impact of reductions in reimbursements and other changes in government reimbursement programs, the timing and impact of the Separation and REIT Conversion, the expected amounts and timing of dividends and distributions, the expected or intended tax treatment for the Separation and REIT Conversion and transactions related thereto, the outcome and costs of litigation, projected expenses and capital expenditures, growth opportunities, plans and objectives of management for future operations and compliance with and changes in governmental regulations. You can identify some of the forward-looking statements by the use of forward-looking words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “should,” “may” and other similar expressions, although not all forward-looking statements contain these identifying words.

You are cautioned that any forward-looking statements made in this proxy statement/prospectus or the documents incorporated by reference herein are not guarantees of future performance and that you should not place undue reliance on any of such forward-looking statements. The forward-looking statements are based on the information currently available and are applicable only as of the date on the cover of this proxy statement/prospectus or, in the case of forward-looking statements incorporated by reference, as of the date of the filing that includes the forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that may cause actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. You should carefully consider the risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements, including those set forth under the heading “Risk Factors” and those described in Sun’s filings with the SEC, including Sun’s Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and Sun’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2010. None of Sun, New Sun or Sabra intend, nor do they undertake any obligation, to update the forward-looking statements to reflect future events or circumstances.

v

Table of Contents

STRUCTURE OF THE SEPARATION AND REIT CONVERSION MERGER

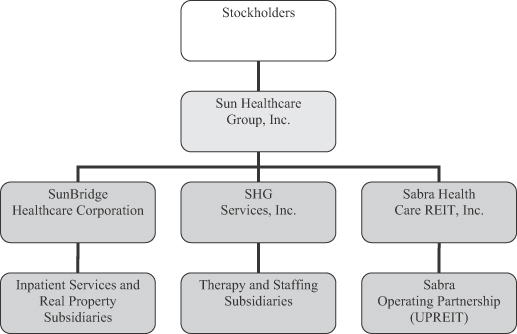

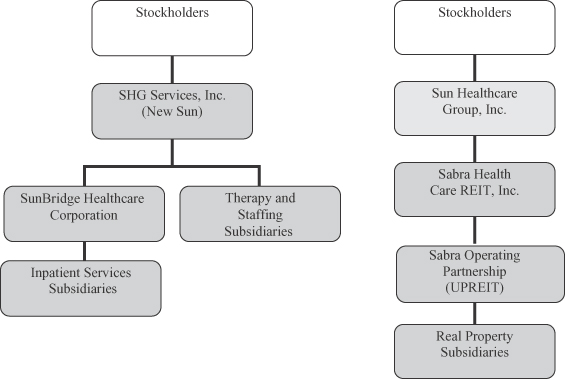

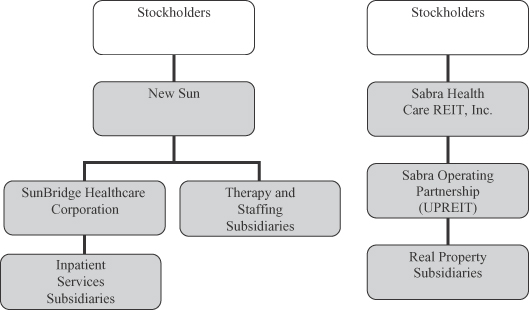

In order to help you better understand the structure of the Separation and REIT Conversion Merger, the charts below illustrate, in simplified form, the organizational structure of Sun Healthcare Group, Inc., SHG Services, Inc. and Sabra Health Care REIT, Inc. as they exist currently, and as they will exist immediately following the Separation and immediately following the REIT Conversion Merger:

Current

vi

Table of Contents

After the Separation

After the REIT Conversion Merger

vii

Table of Contents

| Q: | What transactions are being proposed? |

| A: | The board of directors of Sun has approved a plan to restructure its business by separating its real estate assets and its operating assets into two separate publicly traded companies. This plan consists of the following key transactions: |

| • | reorganizing, through a series of internal corporate restructurings, such that: |

| • | substantially all of Sun’s owned real property and mortgage indebtedness owed to third parties will be held or assumed by Sabra Health Care REIT, Inc., a Maryland corporation and a wholly owned subsidiary of Sun (“Sabra”), or by one or more subsidiaries of Sabra; and |

| • | all of Sun’s operations and other assets and liabilities will be held or assumed by SHG Services, Inc. (to be renamed “Sun Healthcare Group, Inc.”), a Delaware corporation and a wholly owned subsidiary of Sun (“New Sun”), or by one or more subsidiaries of New Sun; |

| • | New Sun and Sabra entering into certain agreements with each other, including multiple master lease agreements (the “Lease Agreements”), which will set forth the material terms pursuant to which New Sun will lease from Sabra all of the real property that Sabra will own immediately following the restructuring of Sun’s business, (representing 93 of the 205 properties that New Sun will lease and operate immediately following the Separation (as defined below)); |

| • | Sun distributing to its stockholders on a pro rata basis all of the outstanding shares of New Sun common stock (this distribution is referred to in this proxy statement/prospectus as the “Separation”); |

| • | Sun merging with and into Sabra, with Sabra surviving the merger as a Maryland corporation and Sun stockholders receiving shares of Sabra common stock in exchange for their shares of Sun common stock (this merger is referred to in this proxy statement/prospectus as the “REIT Conversion Merger”); and |

| • | Sabra qualifying and electing to be treated as a real estate investment trust (“REIT”) for U.S. federal income tax purposes, which is currently expected to occur commencing with its taxable year beginning on January 1, 2011 (this election, together with the REIT Conversion Merger, is collectively referred to in this proxy statement/prospectus as the “REIT Conversion”). |

| Q: | How will the Separation work? |

| A: | As part of the restructuring of Sun’s business described above, all of Sun’s operations and assets that are not held by New Sun or its subsidiaries (other than substantially all of its owned real property) will be transferred to New Sun or one or more of its subsidiaries. New Sun will retain ownership of administrative office buildings in Albuquerque, New Mexico (the “New Sun Retained Properties”). Substantially all of Sun’s liabilities, other than indebtedness and other liabilities related to the real property to be owned by Sabra, will be liabilities of New Sun and its subsidiaries. All of the outstanding shares of New Sun common stock will be distributed by Sun to its stockholders on a pro rata basis. Cash will be paid in lieu of fractional shares. |

| Q: | How will the REIT Conversion work? |

| A: | All of Sun’s owned real property (excluding the New Sun Retained Properties) will be transferred to Sabra or one or more of its subsidiaries. Sabra will assume the liabilities of Sun, including mortgage indebtedness owed to third parties, that are related to the real property to be owned by Sabra. Immediately following the Separation, Sun will merge with and into Sabra, with Sabra surviving the REIT Conversion Merger. In accordance with the Internal Revenue Code of 1986, as amended (the “Code”), Sabra currently intends to qualify and elect to be treated as a REIT for U.S. federal income tax purposes commencing with its taxable year beginning on January 1, 2011. |

1

Table of Contents

| Q: | What is a REIT? |

| A: | A REIT is a company that derives most of its income from real estate mortgages or real property. If a corporation qualifies and elects to be treated as a REIT, it generally will not be subject to U.S. federal corporate income taxes on income that it currently distributes to its stockholders. A company’s qualification as a REIT depends on its ability to meet on a continuing basis various tests under the Code relating to, among other things, the sources of its gross income, the composition and value of its assets, its distribution levels to its stockholders and the diversity of ownership of its stock. |

| Q: | Why is Sun proposing the Separation and REIT Conversion? |

| A: | The board of directors of Sun believes that the Separation and REIT Conversion will create two focused companies—one that will concentrate on providing quality care to residents and patients and the other that will concentrate on building a strong healthcare real property company. The board of directors of Sun believes that the two separate public companies will: |

| • | more readily enable Sun stockholders to maximize their investment in Sun; |

| • | provide the flexibility to each company to optimize its capital structure and focus on its core competencies; |

| • | better position Sabra to realize the full value of its portfolio of healthcare properties and to strategically expand its business in the healthcare sector beyond Sun’s portfolio of properties while affording Sabra stockholders the benefit of a tax-advantaged REIT security; and |

| • | enable New Sun to pursue its growth strategies with significantly less debt on its balance sheet. |

For a further discussion of the reasons for the proposed restructuring of Sun’s business, see “The Proposals—Background and Reasons for the Separation and REIT Conversion.”

| Q: | When will the Separation and REIT Conversion Merger occur? |

| A: | The Separation and REIT Conversion Merger are expected to occur on or about , 2010. The board of directors of Sun will set the record date for the Separation after the special meeting. The REIT Conversion Merger is expected to occur immediately following the Separation. The timing of the Separation and REIT Conversion Merger will ultimately depend upon the satisfaction or waiver of certain conditions, including obtaining stockholder approval of the Separation and REIT Conversion Merger. |

Sun reserves the right to abandon, defer or modify the Separation and REIT Conversion Merger at any time, even if Sun stockholders approve the Separation and REIT Conversion Merger. Sun may not proceed with the Separation and REIT Conversion Merger if the board of directors of Sun determines for any reason that these transactions are no longer in the best interests of Sun and its stockholders.

| Q: | What will be the relationship of New Sun and Sabra following the Separation and REIT Conversion Merger? |

| A: | To govern their ongoing relationship, New Sun and Sabra will enter into certain agreements on or prior to the distribution date for the Separation. These agreements include: (i) a distribution agreement, providing for certain organizational matters, the mechanics related to the Separation and REIT Conversion Merger as well as other ongoing obligations of New Sun and Sabra (the “Distribution Agreement”), (ii) the Lease Agreements, (iii) an agreement relating to tax allocation matters (the “Tax Allocation Agreement”), and (iv) an agreement pursuant to which New Sun will provide certain services to Sabra on a transitional basis until Sabra can provide these services to itself or retain a third party to provide these services (the “Transition Services Agreement”). |

2

Table of Contents

Two members of the board of directors of Sun, Michael J. Foster and Milton J. Walters, will be directors of both New Sun and Sabra. No other person will be a director, executive officer or other employee of both New Sun and Sabra. See “Relationship Between New Sun and Sabra After the Separation and REIT Conversion Merger.”

| Q: | What will I receive in connection with the Separation and REIT Conversion Merger? |

| A: | As a result of the Separation, you will be entitled to receive shares of New Sun common stock for each share of Sun common stock held by you on the record date for the Separation. In addition, Sun intends to make a cash distribution to holders of Sun common stock on the record date for the Separation of approximately $ per share resulting in an aggregate cash distribution of approximately $13 million. The final amount of this cash distribution will not be determined until the time of the Separation. |

In addition, your Sun common stock will automatically convert in the REIT Conversion Merger into shares of Sabra common stock for each share of Sun common stock held by you at the effective time of the REIT Conversion Merger.

| Q: | Will I receive fractional shares of New Sun common stock or Sabra common stock in connection with the Separation and REIT Conversion Merger? |

| A: | No fractional shares of New Sun common stock or Sabra common stock will be issued in connection with the Separation and REIT Conversion Merger. Instead, American Stock Transfer & Trust Company, LLC (“American Stock Transfer”), who will serve as the distribution agent for the Separation and as the exchange agent for the REIT Conversion Merger, will aggregate all fractional shares that would otherwise have been distributed to Sun stockholders into whole shares, sell these whole shares in the open market at prevailing market prices and distribute the net cash proceeds from these sales to those stockholders who would have been entitled to receive fractional shares. This payment will be made from these sales on a pro rata basis based on the fractional interest in a share of New Sun common stock or Sabra common stock, as applicable, that the stockholder would have otherwise been entitled to receive. The amount of the cash payment will depend on the prices at which the aggregated fractional shares are sold by American Stock Transfer and the timing of such payment will be based upon the time that will be necessary for American Stock Transfer to sell these shares in an orderly manner. New Sun will be responsible for the payment of any brokerage or other fees in connection with the sale of aggregated fractional shares of New Sun common stock and Sabra will be responsible for the payment of any brokerage or other fees in connection with the sale of aggregated fractional shares of Sabra common stock. Recipients of cash in lieu of fractional shares will not be entitled to any interest on payments made in lieu of fractional shares. |

| Q: | Will I still own my shares of Sun after the completion of the transactions? |

| A: | No. You will receive shares of New Sun common stock as a result of the Separation and, upon the completion of the REIT Conversion Merger, your existing shares of Sun common stock will automatically convert into shares of Sabra common stock. |

| Q: | Should I send in my stock certificates now? |

| A: | No. If the proposals are approved at the special meeting and the Separation and REIT Conversion Merger are thereafter completed, you will not be required to return your stock certificates representing shares of Sun common stock in order to receive your shares of New Sun common stock or Sabra common stock. Neither New Sun nor Sabra expects to issue physical certificates for the shares you will receive in connection with the Separation or REIT Conversion Merger in exchange for your shares of Sun common stock, even if you currently hold a physical certificate. Instead, New Sun and Sabra will electronically issue shares of New Sun common stock and Sabra common stock to you or to your bank, broker or other nominee on your behalf by way of direct registration in book-entry form. Any physical certificates representing shares of Sun common stock will be deemed cancelled and will no longer represent any ownership interest. |

3

Table of Contents

| Q: | How will the rights of Sun stockholders change following the Separation and REIT Conversion Merger? |

| A: | Upon the Separation, Sun stockholders as of the record date for the Separation will also become stockholders of New Sun. The rights of the stockholders of New Sun following the Separation will be governed by the Delaware General Corporation Law (the “DGCL”) and the provisions of the certificate of incorporation and bylaws of New Sun as described in this proxy statement/prospectus. As a Delaware corporation, Sun is also governed by the DGCL. New Sun’s certificate of incorporation and bylaws will be substantially similar to Sun’s existing amended and restated certificate of incorporation and bylaws. |

Following the REIT Conversion Merger, Sun stockholders will become stockholders of Sabra and their rights will be governed by the Maryland General Corporation Law (the “MGCL”) and the provisions of Sabra’s charter and bylaws as described in this proxy statement/prospectus. One of the primary differences between Sun’s existing amended and restated certificate of incorporation and Sabra’s charter is that Sabra’s charter will contain transfer and ownership restrictions on the percentage of outstanding shares of its stock that a person may own or acquire. These restrictions are intended to assist Sabra in qualifying and maintaining its qualification as a REIT for U.S. federal income tax purposes. Under Sabra’s charter, subject to certain limitations, no person or entity may beneficially own, or be deemed to own by virtue of the applicable constructive ownership provisions of the Code, more than 9.9% in value or number of shares, whichever is more restrictive, of Sabra’s outstanding common stock. For a more detailed discussion of the material differences between the current rights of Sun stockholders and the rights those stockholders would have as stockholders of Sabra following the REIT Conversion Merger, see “Comparative Rights of Sabra and Sun Stockholders.”

| Q: | What are the U.S. federal income tax consequences of the Separation to holders of Sun common stock? |

| A: | The Separation should be treated as a taxable distribution under Section 301 of the Code. Accordingly, the fair market value of the shares of New Sun common stock (including fractional shares for which Sun stockholders receive cash) and the cash distributed in connection with the Separation to a U.S. holder (as defined in the section titled “Certain U.S. Federal Income Tax Consequences”) should be treated as a dividend to the extent of the U.S. holder’s share of the current and accumulated earnings and profits of Sun (i.e. Sabra following the REIT Conversion Merger), as determined under U.S. federal income tax principles, which may be taxable to non-corporate U.S. holders at a reduced rate of 15%. To the extent the fair market value of the shares of New Sun common stock (including fractional shares for which Sun stockholders receive cash) and the cash received in connection with the Separation by a U.S. holder exceeds the U.S. holder’s share of the earnings and profits of Sun (i.e., Sabra following the REIT Conversion Merger), as determined under U.S. federal income tax principles, the excess first will be treated as a tax-free return of capital to the extent, generally, of the U.S. holder’s adjusted tax basis in Sun common stock, and any remaining excess will be treated as capital gain. In addition, a U.S. holder’s tax basis in New Sun common stock received in the Separation will be equal to its fair market value at the time of the Separation and the holding period in the New Sun common stock received in the Separation will begin the day after the Separation. |

All holders of shares of Sun common stock should read “Certain U.S. Federal Income Tax Consequences—U.S. Federal Income Tax Consequences of the Separation” for a more complete discussion of the U.S. federal income tax consequences of the Separation and “Certain U.S. Federal Income Tax Consequences—U.S. Federal Income Tax Considerations Relating to New Sun” for a more complete discussion of the U.S. federal income tax consequences of the acquisition, ownership and disposition of New Sun common stock that will be received in the Separation. All holders of shares of Sun common stock are urged to consult with their tax advisors regarding the tax consequences of the Separation to them, including the effects of U.S. federal, state and local, non-U.S. and other tax laws.

4

Table of Contents

| Q: | What are the U.S. federal income tax consequences of the REIT Conversion Merger to holders of Sun common stock? |

| A: | The receipt of Sabra common stock in exchange for Sun common stock in the REIT Conversion Merger should not cause recognition of gain or loss for U.S. federal income tax purposes to U.S. holders with respect to such exchange, except with respect to cash received in lieu of a fractional share of Sun common stock. |

All holders of shares of Sun common stock should read “Certain U.S. Federal Income Tax Consequences—U.S. Federal Income Tax Consequences of the REIT Conversion Merger” for a more complete discussion of the U.S. federal income tax consequences of the REIT Conversion Merger and “Certain U.S. Federal Income Tax Consequences—U.S. Federal Income Tax Considerations Relating to Sabra” for a discussion of the U.S. federal income tax consequences of the acquisition, ownership and disposition of Sabra common stock that will be received in the REIT Conversion Merger. In addition, all holders of shares of Sun common stock are urged to consult with their tax advisors regarding the tax consequences of the REIT Conversion to them, including the effects of U.S. federal, state and local, non-U.S. and other tax laws.

| Q: | When will I be able to trade shares of New Sun common stock or shares of Sabra common stock? |

| A: | It is expected that, upon completion of the Separation and REIT Conversion Merger, the shares of New Sun common stock will trade on the NASDAQ Global Select Market under the symbol “SUNH” and the shares of Sabra common stock will trade on the under the symbol “SBRA.” |

Shares of New Sun common stock are expected to trade on a “when-issued” basis beginning on or shortly before the record date for the Separation and continuing through the distribution date for the Separation. “When-issued” trading in the context of the Separation refers to a sale or purchase effected on or before the date of the Separation and made conditionally because the securities of New Sun have not yet been distributed. “When-issued” trades are generally expected to settle within three trading days after the distribution date for the Separation. You may trade this entitlement to receive New Sun common stock, without the Sun common stock you own, on the “when-issued” market. On the first trading day following the distribution date for the Separation, “when-issued” trading with respect to New Sun common stock will end and “regular trading” will begin.

| Q: | What will be the composition of the board of directors and management of each of New Sun and Sabra following the Separation and REIT Conversion Merger? |

| A: | The Chief Executive Officer of New Sun will be William A. Mathies, currently the President and Chief Operating Officer of SunBridge Healthcare Corporation (“SunBridge”), Sun’s inpatient services subsidiary. Other than Richard K. Matros, the current Chief Executive Officer of Sun, the remaining Sun management team will be the management team of New Sun, including L. Bryan Shaul, who will be the Chief Financial Officer. The members of the existing board of directors of Sun will become the members of the board of directors of New Sun, except that Mr. Matros will be replaced on the board by Mr. Mathies. |

Sabra will be led by Mr. Matros as Chairman and Chief Executive Officer. Sabra anticipates that Harold W. Andrews, Jr., a finance professional who has extensive real estate ownership experience as well as extensive experience with healthcare providers, will become its Chief Financial Officer. Sabra’s board of directors will consist of Mr. Matros, two members of the board of directors of Sun, Michael J. Foster and Milton J. Walters, who will also be New Sun directors, and other directors not affiliated with Sun or New Sun. These other directors will be appointed by the board of directors of Sabra prior to the Separation and REIT Conversion Merger.

5

Table of Contents

| Q: | How will the Separation and REIT Conversion Merger affect options to purchase shares of Sun common stock and shares subject to stock units or restricted stock units? |

| A: | Except as described below for Mr. Matros, Sun options, whether vested or unvested, and unvested restricted stock units of Sun are expected to be converted, and adjusted as described below, into awards with respect to shares of New Sun common stock. The number of shares subject to and the exercise price of each converted option, and the number of shares subject to each unvested restricted stock unit, will be adjusted to preserve the same intrinsic value of the awards that existed immediately prior to the Separation and REIT Conversion Merger. These converted awards will otherwise have the same general terms and conditions as the outstanding Sun awards, including the applicable vesting conditions. Each Sun restricted stock unit which has vested but the payment of which has been deferred to a later date is expected to be converted into an award with respect to the same number of shares of New Sun common stock and Sabra common stock that a Sun stockholder will receive for each share of Sun common stock in connection with the Separation and REIT Conversion Merger. The unvested Sun options and restricted stock units held by Mr. Matros will be terminated for no consideration, while vested options held by Mr. Matros are expected to terminate for no consideration if they are not exercised prior to or within up to three months following the Separation and REIT Conversion Merger. It is expected that the termination of the existing Sun awards held by Mr. Matros will be taken into account by Sabra’s compensation committee when determining the amount of Sabra equity awards to be initially granted to Mr. Matros. |

| Q: | Why did Sun adopt a stockholder rights agreement, and will the stockholder rights agreement continue at New Sun and Sabra after completion of the transactions? |

| A: | Sabra may not qualify for REIT status if a single stockholder owned 10% or more of Sun common stock immediately prior to the Separation and REIT Conversion Merger. The stockholder rights agreement (the “Rights Plan”) was adopted to discourage third parties from exceeding this ownership limitation and will terminate upon the earlier of the effective time of the REIT Conversion Merger or May 24, 2011. Accordingly, the Rights Plan will not continue in respect of shares of New Sun common stock or shares of Sabra common stock. Neither New Sun nor Sabra will initially have a stockholder rights agreement and neither has plans to adopt one, although each of their respective boards of directors could make the determination at a future date to adopt a stockholder rights agreement. Sabra’s charter will contain restrictions on the transfer and ownership of its stock. See “Description of Sabra Stock—Restrictions on Transfer and Ownership of Sabra Stock.” |

| Q: | Will New Sun and Sabra have any debt? |

| A: | Yes. Immediately prior to the Separation, Sun’s outstanding 9.125% senior subordinated notes and the outstanding term loans under Sun’s existing credit facility will be repaid from the net proceeds of indebtedness to be incurred by New Sun and Sabra of up to $ and $ , respectively, together with cash on hand. The amount of the indebtedness to be incurred by New Sun and Sabra will depend on the cash position of Sun immediately prior to the Separation. Sun’s cash position at that time will include the net proceeds expected to be received by Sun from a public offering of Sun common stock. The terms and structure of the indebtedness to be incurred by New Sun and Sabra have not yet been determined. In addition, following the Separation, New Sun will have mortgage indebtedness to third parties of $6.2 million and Sabra will have mortgage indebtedness to third parties of $164.0 million. For additional information relating to these financing arrangements, see “Description of Material Indebtedness.” |

| Q: | Who will pay the costs of the Separation and REIT Conversion Merger? |

| A: | New Sun will pay all costs associated with the Separation and REIT Conversion Merger that are incurred prior to the Separation, except that Sabra will bear all costs of the Separation and REIT Conversion Merger |

6

Table of Contents

| specifically identifiable to it, including the costs incurred by Sabra in entering into the financing transactions described under the caption “Description of Material Indebtedness.” All costs relating to the Separation or REIT Conversion Merger incurred after the Separation will be borne by the party incurring such costs. |

| Q: | What items of business am I being asked to vote on at the special meeting? |

| A: | At the special meeting, you will be asked to consider and vote on the following proposals: |

| • | a proposal to approve the Separation (Proposal No. 1); |

| • | a proposal to adopt the agreement and plan of merger by and between Sun and Sabra to implement the REIT Conversion Merger (Proposal No. 2); and |

| • | a proposal to adjourn the special meeting to a later date, if necessary, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the Separation and adopt the agreement and plan of merger to implement the REIT Conversion Merger (Proposal No. 3). |

| Q: | What will be the effect on the proposals if the Separation or the REIT Conversion Merger is not approved by Sun stockholders? |

| A: | A condition to each of the Separation and REIT Conversion Merger is that both transactions have been approved by Sun stockholders. Even if stockholder approval of the Separation has been obtained, the Separation will not proceed unless all other required conditions to the Separation have been satisfied or waived, including the satisfaction or waiver of all required conditions to the REIT Conversion Merger. Similarly, even if stockholder approval of the REIT Conversion Merger has been obtained, the REIT Conversion Merger will not proceed unless the Separation has been completed and all other required conditions to the REIT Conversion Merger have been satisfied or waived. |

| Q: | How does the board of directors of Sun recommend that I vote? |

| A: | The board of directors of Sun has unanimously approved the Separation and the REIT Conversion Merger and has determined that these actions are advisable and in the best interests of Sun and its stockholders. The board of directors of Sun unanimously recommends that you vote your shares “FOR” approval of the Separation, “FOR” adoption of the agreement and plan of merger to implement the REIT Conversion Merger and “FOR” the adjournment proposal. |

| Q: | What votes are required? |

| A: | The Separation. The affirmative vote of a majority of the outstanding shares of Sun common stock present, either in person or represented by proxy, at the special meeting and entitled to vote on the proposal is required to approve the Separation. If you “ABSTAIN” from voting on approval of the Separation, the effect will be the same as a vote against the Separation. |

The REIT Conversion Merger. The affirmative vote of a majority of the outstanding shares of Sun common stock entitled to vote at the special meeting is required to adopt the agreement and plan of merger to implement the REIT Conversion Merger. If you do not submit a proxy or voting instruction form or do not vote in person at the special meeting, or if you “ABSTAIN” from voting on adoption of the agreement and plan of merger, the effect will be the same as a vote against the adoption of the agreement and plan of merger.

Adjournment of the special meeting. The affirmative vote of a majority of the outstanding shares of Sun common stock present, either in person or represented by proxy, at the special meeting and entitled to vote on the proposal is required to adjourn the special meeting to a later date, if necessary, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the Separation and adopt

7

Table of Contents

the agreement and plan of merger to implement the REIT Conversion Merger. If you “ABSTAIN” from voting on approval of the adjournment, the effect will be the same as a vote against the adjournment of the special meeting.

| Q: | How many shares of Sun common stock must be present or represented to conduct business at the special meeting? |

| A: | The holders of a majority in voting power of the outstanding shares of Sun common stock entitled to vote at the special meeting will constitute a quorum for the transaction of business at the special meeting and any adjournments or postponements thereof. If you submit a proxy or voting instructions, your shares will be counted for purposes of determining the presence of a quorum, even if you “ABSTAIN” from voting your shares on the proposals. If a quorum is not present at the special meeting, the special meeting may be adjourned until a quorum is obtained. |

| Q: | Who is entitled to vote at the special meeting? |

| A: | Only stockholders of record at the close of business on , 2010, the record date for the special meeting, will be entitled to notice of and to vote at the special meeting. At the close of business on the record date for the special meeting, shares of Sun common stock were outstanding and entitled to vote. |

As of the close of business on the record date for the special meeting, executive officers and directors of Sun held an aggregate of shares of Sun common stock, which represents approximately % of all shares entitled to vote at the special meeting.

| Q: | What is the difference between a “stockholder of record” and a “beneficial stockholder”? |

| A: | Whether you are a stockholder of record or a beneficial stockholder depends on how you hold your shares of Sun common stock. |

Stockholders of Record. If your shares of Sun common stock are registered directly in your name with Sun’s transfer agent, American Stock Transfer, you are considered the stockholder of record with respect to those shares, and the proxy materials for the special meeting are being mailed to you directly by Sun.

Beneficial Stockholders. Most of Sun’s stockholders hold their shares through a bank, broker or other nominee (that is, in “street name”) rather than directly in their own name. If you hold your shares of Sun common stock in street name, you are a “beneficial stockholder,” and the proxy materials are being mailed to you by the organization holding your shares. This organization, or its nominee, is considered the stockholder of record for purposes of voting at the special meeting. As a beneficial stockholder, you have the right to instruct that organization on how to vote the shares held in your account.

| Q: | May I vote in person? |

| A: | If you are a stockholder of record as of the close of business on the record date for the special meeting, you may attend the special meeting and vote your shares of Sun common stock in person rather than signing and returning your proxy card or otherwise providing your proxy instructions. Your name will be verified against the list of stockholders of record on the record date for the special meeting prior to your being admitted to the special meeting. |

If you are a beneficial stockholder, you are also invited to attend the special meeting but you may not vote these shares of Sun common stock in person at the special meeting unless you obtain a “legal proxy” from the bank, broker or other nominee, giving you the right to vote the shares at the special meeting. You will be asked to provide proof of beneficial ownership on the record date for the special meeting, such as your most

8

Table of Contents

recent account statement, a copy of the voting instruction card provided by your bank, broker or other nominee, or other similar evidence of ownership, prior to your being admitted to the special meeting.

If you do not comply with the procedures outlined above, you will not be admitted to the special meeting.Even if you plan to attend the special meeting, it is recommended that you submit your proxy or voting instructions in advance of the special meeting as described below so that your vote will be counted if you later decide not to attend the special meeting.

| Q: | How can I vote my shares without attending the special meeting? |

| A: | Whether you are a stockholder of record or a beneficial stockholder, you may direct how your shares of Sun common stock are voted without attending the special meeting. If you are a stockholder of record, you may submit a proxy to instruct how your shares of Sun common stock are to be voted at the special meeting. You can submit a proxy by mail by completing, signing, dating and returning the proxy card enclosed with the proxy materials you received or by telephone or Internet by following the instructions provided on the proxy card. If you are a beneficial stockholder, you may submit voting instructions to your bank, broker or other nominee to instruct how your shares of Sun common stock are to be voted at the special meeting. Your voting instructions can be submitted by mail by completing, signing, dating and returning the voting instruction form enclosed with the proxy materials you received or by telephone or Internet, if those voting options are available to you, by following the instructions provided on the voting instruction form. |

| Q: | May I change or revoke my proxy or voting instructions? |

| A: | You have the power to revoke or change your proxy or voting instructions before your shares of Sun common stock are voted at the special meeting. If you are a stockholder of record, you may do this by submitting a written notice of revocation to Sun’s Secretary, by submitting a duly executed written proxy bearing a date that is later than the date of your original proxy or by submitting a later dated proxy electronically via the Internet or by telephone. A previously submitted proxy will not be voted if the stockholder of record who executed it is present at the special meeting and votes the shares of Sun common stock represented by the proxy in person at the special meeting. If you are a beneficial stockholder, you may change your vote by submitting new voting instructions to your bank, broker or other nominee, or, if you have obtained a legal proxy from your bank, broker or other nominee giving you the right to vote your shares of Sun common stock, by attending the special meeting and voting in person. Please note that attendance at the special meeting will not by itself constitute revocation of a proxy. |

| Q: | How will my shares be voted if I do not provide specific instructions in the proxy or voting instruction form I submit? |

| A: | If you submit a proxy or voting instruction form but do not indicate your specific voting instructions on one or more of the proposals listed in the notice of the special meeting, your shares of Sun common stock will be voted as recommended by the board of directors of Sun on those proposals and, in the case of a proxy, as the proxyholders may determine in their discretion with respect to any other matters properly presented for a vote at the special meeting. |

| Q: | If my shares are held in “street name” by a bank, broker or other nominee, how will my shares be voted? |

| A: | You should instruct your bank, broker or other nominee how to vote your shares of Sun common stock, following the directions provided to you. If you do not instruct your broker, your broker will generally not have the discretion to vote your shares of Sun common stock without your instructions on matters that are not considered routine. Sun believes that the Separation proposal, the REIT Conversion Merger proposal and the proposal to adjourn the special meeting are each considered not to be routine matters. Therefore, |

9

Table of Contents

| your broker cannot vote shares of Sun common stock that it holds in “street name” on any of the proposals unless you return the voting instruction form you received from your broker. Accordingly, Sun does not believe that there will be any broker non-votes occurring in connection with any of the proposals at the special meeting. Please note, however, that if you properly return the voting instruction form to your broker but do not indicate how you want your shares of Sun common stock to be voted, Sun believes your shares of Sun common stock generally will be voted “FOR” all of the proposals listed in the notice for the special meeting. |

| Q: | Am I entitled to dissenters’ or appraisal rights? |

| A: | Under Delaware law, you are not entitled to dissenters’ or appraisal rights in connection with the Separation or the REIT Conversion Merger. |

| Q: | What if I want to transfer my shares of Sun common stock? |

| A: | You should consult with your financial advisor, such as your broker, bank or tax advisor. Sun, New Sun and Sabra make no recommendations concerning the purchase, retention or sale of shares of Sun common stock or of the New Sun common stock or Sabra common stock you will receive if the Separation and REIT Conversion Merger are completed. |

The record date for the special meeting is earlier than the record date for the Separation and the effective time of the REIT Conversion Merger. Therefore, if you sell your shares of Sun common stock after the record date of the special meeting, but prior to the distribution date for the Separation or the effective time of the REIT Conversion Merger, you will retain the right to vote at the special meeting, but the right to receive New Sun common stock in connection with the Separation and Sabra common stock in connection with the REIT Conversion Merger will transfer with the shares of Sun common stock.

| Q: | As a Sun stockholder, what should I consider in deciding whether to vote in favor of the Separation and the REIT Conversion Merger? |

| A: | You should carefully review this proxy statement/prospectus, including the section entitled “Risk Factors” which sets forth certain risks and uncertainties related to the Separation and REIT Conversion Merger and certain risks and uncertainties to which New Sun and Sabra will be subject if these transactions are implemented. |

| Q: | Who is paying for this proxy solicitation? |

| A: | Sun is making this solicitation and will pay the entire cost of preparing and distributing these proxy materials and soliciting proxies. In addition to these mailed proxy materials, Sun’s directors, executive officers and other employees may also solicit proxies or votes in person, by telephone or by other means of communication. Directors, executive officers and employees will not be paid any additional compensation for soliciting proxies. Sun will also reimburse banks, brokers and other nominees for their costs in forwarding proxy materials to Sun’s beneficial stockholders. |

| Q: | Who can help answer my questions? |

| A: | If you have any questions or need further assistance in voting your shares of Sun common stock, or if you need additional copies of this proxy statement/prospectus or the proxy card, please contact: |

Sun Healthcare Group, Inc.

101 Sun Avenue, N.E.

Albuquerque, New Mexico 87109

Attention: Investor Relations

Telephone number: (505) 468-2341

10

Table of Contents

This summary highlights selected information contained or incorporated by reference in this proxy statement/prospectus and may not contain all of the information that is important to you. This summary is not intended to be complete and reference is made to, and this summary is qualified in its entirety by, the more detailed information contained or incorporated by reference in this proxy statement/prospectus. To fully understand the restructuring of Sun’s business, including the Separation and REIT Conversion, and for a more complete description of the terms of the Separation and REIT Conversion, you should read carefully this proxy statement/prospectus, together with the documents referred to in this proxy statement/prospectus. Unless the context otherwise requires, references in this proxy statement/prospectus to “Sun” shall be deemed to refer to Sun Healthcare Group, Inc. prior to the consummation of the Separation and REIT Conversion Merger.

Information about the Companies

Sun Healthcare Group, Inc.

18831 Von Karman, Suite 400

Irvine, CA 92612

(949) 255-7100

Sun Healthcare Group, Inc. (NASDAQ GS: SUNH) is referred to in this proxy statement/prospectus as Sun. Sun, through its subsidiaries, provides nursing, rehabilitative and related specialty healthcare services principally to the senior population in the United States. Sun’s core business is providing, through its subsidiaries, inpatient services, primarily through 183 skilled nursing centers, 14 assisted and independent living centers and eight mental health centers as of March 31, 2010. As of that date, Sun’s centers had 23,205 licensed beds located in 25 states, of which 22,423 were available for occupancy. Of the 205 centers operated by Sun’s subsidiaries as of March 31, 2010, 112 properties were leased and 93 properties were owned by Sun’s subsidiaries. Sun’s subsidiaries also provide rehabilitation therapy services to affiliated and non-affiliated centers and medical staffing and other ancillary services primarily to non-affiliated centers and other third parties. For the year ended December 31, 2009, Sun’s total net revenues from continuing operations were $1.9 billion. For the three months ended March 31, 2010, Sun’s total net revenues from continuing operations were $0.5 billion.

Business Segments

Sun’s subsidiaries currently engage in the following three principal business segments:

| • | inpatient services, primarily skilled nursing centers; |

| • | rehabilitation therapy services; and |

| • | medical staffing services. |

Inpatient services. Sun operates its healthcare facilities through SunBridge and other subsidiaries. Sun’s skilled nursing centers provide services that include daily nursing, therapeutic rehabilitation, social services, housekeeping, nutrition and administrative services for individuals requiring certain assistance for activities in daily living. Rehab Recovery Suites, which specialize in Medicare and managed care patients, are located in 65 of Sun’s skilled nursing centers, and 46 of Sun’s skilled nursing centers contain wings dedicated to the care of residents afflicted with Alzheimer’s disease. Sun’s assisted living centers provide services that include minimal nursing assistance, housekeeping, nutrition, laundry and administrative services for individuals requiring minimal assistance for activities in daily living. Sun’s independent living centers provide services that include security, housekeeping, nutrition and limited laundry services for individuals requiring no assistance for activities in daily living. Sun’s mental health centers provide a range of inpatient and outpatient behavioral health services for adults and children through specialized treatment programs. Sun also provides hospice services, including

11

Table of Contents

palliative care, social services, pain management and spiritual counseling, through its subsidiary SolAmor Hospice Corporation (“SolAmor”), in eight states for individuals facing end of life issues. Sun generated 89.1%, 88.6%, and 87.8% of its total net revenues from continuing operations through inpatient services in 2009, 2008, and 2007, respectively.

Rehabilitation therapy services. Sun provides rehabilitation therapy services through SunDance Rehabilitation Corporation (“SunDance”). SunDance provides a broad array of rehabilitation therapy services, including speech pathology, physical therapy and occupational therapy. As of March 31, 2010, SunDance provided rehabilitation therapy services to 468 centers in 36 states, 337 of which were operated by nonaffiliated parties and 131 of which were operated by affiliates. In most of Sun’s 74 healthcare centers for which SunDance does not provide rehabilitation therapy services, those services are provided by staff employed by the centers, although some centers engage third-party therapy companies for such services. Sun generated 5.6%, 4.9%, and 5.3% of its total net revenues from continuing operations through rehabilitation therapy services in 2009, 2008, and 2007, respectively.

Medical staffing services. Sun provides temporary medical staffing in 44 states through CareerStaff Unlimited, Inc. (“CareerStaff”). For the year ended December 31, 2009, CareerStaff derived 56.1% of its revenues from hospitals and other providers, 24.7% from skilled nursing centers, 15.3% from schools and 3.9% from prisons. CareerStaff provides (i) licensed therapists skilled in the areas of physical, occupational and speech therapy, (ii) nurses, (iii) pharmacists, pharmacist technicians and medical imaging technicians, (iv) physicians and (v) related medical personnel. Sun generated 5.3%, 6.5%, and 6.9% of its total net revenues from continuing operations through medical staffing services in 2009, 2008, and 2007, respectively.

SHG Services, Inc.

18831 Von Karman, Suite 400

Irvine, CA 92612

(949) 255-7100

SHG Services, Inc. is referred to in this proxy statement/prospectus as New Sun. New Sun is a wholly owned subsidiary of Sun which, as a result of the restructuring of Sun’s business described in this proxy statement/prospectus, is expected to hold or assume immediately prior to the Separation, directly or indirectly through its subsidiaries, all of Sun’s operations and other assets and liabilities (other than substantially all of Sun’s owned real property). New Sun will also own the New Sun Retained Properties. Following the Separation, New Sun will be renamed “Sun Healthcare Group, Inc.” and through its subsidiaries, will continue to provide the same nursing, rehabilitative and related specialty healthcare services provided by Sun immediately prior to the Separation and will continue to engage in Sun’s three principal business segments of inpatient services, rehabilitation therapy services and medical staffing services. Shares of New Sun common stock are expected to trade on the NASDAQ Global Select Market under the symbol “SUNH.”

Sabra Health Care REIT, Inc.

18831 Von Karman, Suite 400

Irvine, CA 92612

(949) 255-7100

Sabra Health Care REIT, Inc. is referred to in this proxy statement/prospectus as Sabra. Sabra is a wholly owned subsidiary of Sun which, as a result of the restructuring of Sun’s business described in this proxy statement/prospectus, is expected to hold immediately prior to the Separation, directly or indirectly through its subsidiaries, substantially all of Sun’s owned real property, other than the New Sun Retained Properties. The owned real property to be held by Sabra includes fixtures and certain personal property associated with the real property. Pursuant to the Lease Agreements, Sabra will lease those assets to New Sun’s subsidiaries. Following the

12

Table of Contents

consummation of the REIT Conversion Merger, Sabra currently intends to qualify and elect to be treated as a REIT for U.S. federal income tax purposes commencing with its taxable year beginning on January 1, 2011. Sabra expects to grow its portfolio through acquisitions as a broad-based healthcare REIT. As Sabra acquires additional properties, it expects to diversify by geography, asset class and tenant within the healthcare sector. Shares of Sabra common stock are expected to trade on the under the symbol “SBRA.”

Risks Associated with the Separation and REIT Conversion

The Separation and REIT Conversion pose a number of risks to Sun stockholders. Sun stockholders will be receiving shares of New Sun and Sabra common stock as a result of the Separation and REIT Conversion Merger. After the Separation and REIT Conversion Merger, each of New Sun and Sabra will be subject to various risks associated with their respective businesses. These risks are discussed in greater detail under the caption “Risk Factors.” You should read and consider all of these risks carefully.

The Special Meeting of Sun Stockholders

Date, Time and Place.The special meeting of Sun stockholders will be held on , 2010, at at a.m. local time, and at any adjournment or postponement thereof.

Purpose of the Special Meeting.At the special meeting, Sun’s stockholders will be asked to consider and vote upon (i) a proposal to approve the Separation; (ii) a proposal to adopt the agreement and plan of merger by and between Sun and Sabra to implement the REIT Conversion Merger; and (iii) a proposal to adjourn the special meeting to a later date, if necessary, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the Separation and adopt the agreement and plan of merger to implement the REIT Conversion Merger.

Record Date; Shares Entitled to Vote; Quorum. Only stockholders of record at the close of business on , 2010, the record date for the special meeting, will be entitled to notice of and to vote at the special meeting. At the close of business on the record date for the special meeting, shares of Sun common stock were outstanding and entitled to vote. As of the close of business on the record date for the special meeting, executive officers and directors of Sun held an aggregate of shares of Sun common stock, which represents approximately % of all shares of Sun common stock entitled to vote at the special meeting. The presence in person or by proxy of the holders of a majority in voting power of the outstanding shares of Sun common stock entitled to vote at the special meeting will constitute a quorum for the transaction of business at the meeting and any adjournments or postponements thereof.

Vote Required

The Separation.The affirmative vote of a majority of the outstanding shares of Sun common stock present, either in person or represented by proxy, at the special meeting and entitled to vote on the proposal is required to approve the Separation. If you “ABSTAIN” from voting on approval of the Separation, the effect will be the same as a vote against the Separation.

The REIT Conversion Merger.The affirmative vote of a majority of the outstanding shares of Sun common stock entitled to vote at the special meeting is required to adopt the agreement and plan of merger to implement the REIT Conversion Merger. If you do not submit a proxy or voting instruction form or do not vote in person at the special meeting, or if you “ABSTAIN” from voting on adoption of the agreement and plan of merger, the effect will be the same as a vote against the adoption of the agreement and plan of merger.

Adjournment of the Special Meeting. The affirmative vote of a majority of the outstanding shares of Sun common stock present, either in person or represented by proxy, at the special meeting and entitled to vote on the

13

Table of Contents

proposal is required to adjourn the special meeting to a later date, if necessary, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the Separation and adopt the agreement and plan of merger to implement the REIT Conversion Merger. If you “ABSTAIN” from voting on approval of the adjournment, the effect will be the same as a vote against the adjournment of the special meeting.

Overview of the Separation and REIT Conversion

Pursuant to the restructuring plan approved by the board of directors of Sun to separate Sun’s real estate assets and its operating assets into two publicly traded companies, Sun will reorganize, through a series of internal corporate restructurings. After the restructuring, Sabra or one or more of its subsidiaries will hold substantially all of Sun’s owned real property (excluding the New Sun Retained Properties). Sabra will assume the liabilities, including the mortgage indebtedness, of Sun that are related to the real property to be owned by it. All of Sun’s operations and other assets and liabilities will be held or assumed by New Sun or by one or more of its subsidiaries. New Sun and Sabra will enter into certain agreements, including the Lease Agreements pursuant to which subsidiaries of New Sun will lease from Sabra all of the real property that Sabra will own immediately following the restructuring of Sun’s business.

Upon satisfaction or waiver of the conditions to the Separation and REIT Conversion Merger, Sun will distribute to its stockholders on a pro rata basis all of the outstanding shares of New Sun common stock. Sun will then merge with and into Sabra, with Sabra surviving the merger as a Maryland corporation and Sun stockholders receiving shares of Sabra common stock in exchange for their shares of Sun common stock. In each case, cash will be paid in lieu of fractional shares. The Separation and REIT Conversion Merger are expected to occur on or about , 2010. Sabra currently intends to qualify and elect to be treated as a REIT for U.S. federal income tax purposes commencing with its taxable year beginning on January 1, 2011.

Following the REIT Conversion, Sabra intends to be a self-managed and self-administered REIT. Sabra intends to operate through an umbrella partnership (commonly referred to as an UPREIT) structure in which substantially all of its properties and assets would be held by Sabra Health Care Limited Partnership, a Delaware limited partnership, of which Sabra is the sole general partner.

Background and Reasons for the Separation and REIT Conversion

The board of directors of Sun believes that the Separation and REIT Conversion Merger will create two focused companies—one that will concentrate on providing quality care to residents and patients and the other that will concentrate on building a diversified healthcare real property company. The board of directors of Sun believes that the two separate public companies will:

| • | more readily enable Sun stockholders to maximize their investment in Sun; |

| • | provide the flexibility to each company to optimize its capital structure and focus on its core competencies; |

| • | better position Sabra to realize the full value of its portfolio of healthcare properties and to strategically expand it in the healthcare sector beyond Sun’s portfolio of properties while affording Sabra stockholders the benefit of a tax-advantaged REIT security; and |

| • | enable New Sun to pursue its growth strategies with significantly less debt on its balance sheet. |

Relationship Between New Sun and Sabra After the Separation and REIT Conversion Merger

To govern their ongoing relationship, New Sun and Sabra or their respective subsidiaries, as applicable, will enter into the Distribution Agreement, the Lease Agreements, the Tax Allocation Agreement and the Transition

14

Table of Contents

Services Agreement on or prior to the distribution date of the Separation. Although it is expected that the agreements between New Sun and Sabra will contain terms and conditions that generally are consistent with current market terms and conditions, because these agreements are being negotiated in the context of the Separation, the terms and conditions in the agreements may be different than those that either Sabra or New Sun may have obtained from unaffiliated parties. See “Risk Factors—New Sun and Sabra may have been able to receive better terms from unaffiliated third parties than the terms they receive in agreements entered into in connection with the Separation.”

Each of New Sun and Sabra will adopt certain policies to minimize potential conflicts of interest that may result from the service of Mr. Foster and Mr. Walters on the boards of directors of each of Sabra and New Sun. No other person will be a director, executive officer or other employee of both New Sun and Sabra.

Description of Material Indebtedness

Immediately prior to the Separation, New Sun and Sabra expect to incur indebtedness of up to $ and $ , respectively. The amount of the indebtedness to be incurred by New Sun and Sabra will depend on the cash position of Sun immediately prior to the Separation. The terms and structure of the indebtedness to be incurred by New Sun and Sabra have not yet been determined. It is anticipated that the debt agreements will contain customary covenants that will include restrictions on each of New Sun’s and Sabra’s ability to make acquisitions and other investments, pay dividends, incur additional indebtedness and make capital expenditures. In addition, following the Separation, New Sun will have mortgage indebtedness to third parties of $6.2 million and Sabra will have mortgage indebtedness to third parties of $164.0 million. For additional information relating to these financing arrangements, see “Description of Material Indebtedness.”

Accounting Treatment for the Separation and REIT Conversion