Fidelity® International Credit Central Fund

Semi-Annual Report

June 30, 2021

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

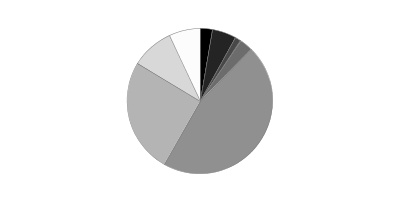

Geographic Diversification (% of fund's net assets)

| As of June 30, 2021 |

| | United Kingdom | 23.0% |

| | Netherlands | 12.1% |

| | Germany | 10.6% |

| | United States of America | 8.2% |

| | Luxembourg | 7.7% |

| | France | 7.7% |

| | Ireland | 6.6% |

| | Switzerland | 4.0% |

| | Italy | 3.8% |

| | Other | 16.3% |

Percentages are based on country or territory of incorporation and include the effect of futures contracts, options and swaps, as applicable. Foreign currency contracts and other assets and liabilities are included within United States of America, as applicable.

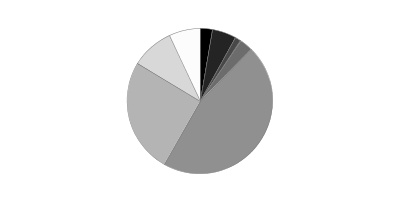

Quality Diversification (% of fund's net assets)

| As of June 30, 2021 |

| | U.S. Government and U.S. Government Agency Obligations | 2.8% |

| | AAA | 5.3% |

| | AA | 1.4% |

| | A | 2.9% |

| | BBB | 45.8% |

| | BB and Below | 25.5% |

| | Not Rated | 9.3% |

| | Short-Term Investments and Net Other Assets | 7.0% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Asset Allocation (% of fund's net assets)

| As of June 30, 2021*,** |

| | Corporate Bonds | 54.1% |

| | Foreign Government and Government Agency Obligations | 7.3% |

| | U.S. Government and Government Agency Obligations | 2.8% |

| | Preferred Securities | 28.8% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 7.0% |

* Futures and Swaps - 15.0%

** Foreign Currency Contracts - (63.8)%

Schedule of Investments June 30, 2021 (Unaudited)

Showing Percentage of Net Assets

| Nonconvertible Bonds - 54.1% | | | |

| | | Principal Amount(a) | Value |

| Argentina - 0.2% | | | |

| YPF SA 4% 2/12/26 (b)(c) | | $1,207,685 | $1,010,349 |

| Australia - 1.3% | | | |

| AusNet Services Holdings Pty Ltd. 1.625% 3/11/81 (Reg. S) (d) | EUR | 500,000 | 602,980 |

| Leighton Finance U.S.A. Pty Ltd. 1.5% 5/28/29 (Reg. S) | EUR | 2,600,000 | 3,131,019 |

| QBE Insurance Group Ltd. 6.75% 12/2/44 (Reg. S) (d) | | 2,200,000 | 2,491,500 |

|

| TOTAL AUSTRALIA | | | 6,225,499 |

|

| Bailiwick of Guernsey - 0.3% | | | |

| Sirius Real Estate Ltd. 1.125% 6/22/26 (Reg. S) | EUR | 1,200,000 | 1,418,062 |

| Bailiwick of Jersey - 1.4% | | | |

| Heathrow Funding Ltd.: | | | |

| 2.625% 3/16/28 (Reg. S) | GBP | 1,600,000 | 2,226,542 |

| 7.125% 2/14/24 | GBP | 2,785,000 | 4,397,642 |

|

| TOTAL BAILIWICK OF JERSEY | | | 6,624,184 |

|

| Cayman Islands - 0.7% | | | |

| Alibaba Group Holding Ltd. 2.125% 2/9/31 | | 200,000 | 196,026 |

| Southern Water Services Finance Ltd. 1.625% 3/30/27 (Reg. S) | GBP | 2,300,000 | 3,168,291 |

|

| TOTAL CAYMAN ISLANDS | | | 3,364,317 |

|

| Denmark - 0.8% | | | |

| Danske Bank A/S 2.25% 1/14/28 (Reg. S) (d) | GBP | 1,945,000 | 2,760,267 |

| Vestas Wind Systems A/S 2.75% 3/11/22 (Reg. S) | EUR | 697,000 | 836,385 |

|

| TOTAL DENMARK | | | 3,596,652 |

|

| France - 3.8% | | | |

| Ceetrus SA 2.75% 11/26/26 (Reg. S) | EUR | 1,100,000 | 1,423,003 |

| Iliad SA: | | | |

| 0.625% 11/25/21 (Reg. S) | EUR | 2,800,000 | 3,325,950 |

| 0.75% 2/11/24 (Reg. S) | EUR | 6,500,000 | 7,695,167 |

| 1.5% 10/14/24 (Reg. S) | EUR | 800,000 | 961,818 |

| Lagardere S.C.A. 1.625% 6/21/24 (Reg. S) | EUR | 2,600,000 | 3,084,183 |

| Societe Generale: | | | |

| 4.25% 4/14/25 (c) | | 200,000 | 217,179 |

| 4.75% 11/24/25 (c) | | 975,000 | 1,087,176 |

|

| TOTAL FRANCE | | | 17,794,476 |

|

| Germany - 2.8% | | | |

| ACCENTRO Real Estate AG 3.625% 2/13/23 (Reg. S) | EUR | 2,215,000 | 2,495,288 |

| Bayer AG: | | | |

| 2.375% 4/2/75 (Reg. S) (d) | EUR | 7,140,000 | 8,586,019 |

| 3.75% 7/1/74 (Reg. S) (d) | EUR | 200,000 | 250,490 |

| ZF Finance GmbH 2% 5/6/27 (Reg. S) | EUR | 1,200,000 | 1,430,015 |

|

| TOTAL GERMANY | | | 12,761,812 |

|

| Greece - 0.2% | | | |

| Alpha Bank AE 4.25% 2/13/30 (Reg. S) (d) | EUR | 750,000 | 868,377 |

| Ireland - 6.1% | | | |

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust 6.5% 7/15/25 | | 1,100,000 | 1,290,204 |

| AIB Group PLC 1.875% 11/19/29 (Reg. S) (d) | EUR | 3,985,000 | 4,842,957 |

| Bank Ireland Group PLC: | | | |

| 1.375% 8/11/31 (Reg. S) (d) | EUR | 3,000,000 | 3,538,098 |

| 2.375% 10/14/29 (Reg. S) (d) | EUR | 2,835,000 | 3,504,980 |

| 3.125% 9/19/27 (Reg. S) (d) | GBP | 3,675,000 | 5,175,590 |

| Cloverie PLC 4.5% 9/11/44 (Reg. S) (d) | | 6,507,000 | 7,032,414 |

| Ryanair DAC 0.875% 5/25/26 (Reg. S) | EUR | 2,650,000 | 3,152,619 |

|

| TOTAL IRELAND | | | 28,536,862 |

|

| Italy - 2.9% | | | |

| Aeroporti di Roma SPA: | | | |

| 1.625% 2/2/29 (Reg. S) | EUR | 450,000 | 561,360 |

| 1.75% 7/30/31 (Reg. S) | EUR | 700,000 | 864,159 |

| Enel SpA 3.375% (Reg. S) (d)(e) | EUR | 1,970,000 | 2,584,120 |

| UniCredit SpA: | | | |

| 2.731% 1/15/32 (Reg. S) (d) | EUR | 4,305,000 | 5,217,824 |

| 6.572% 1/14/22 (c) | | 4,240,000 | 4,370,855 |

|

| TOTAL ITALY | | | 13,598,318 |

|

| Luxembourg - 4.4% | | | |

| ADLER Group SA: | | | |

| 1.875% 1/14/26 (Reg. S) | EUR | 6,200,000 | 7,196,119 |

| 2.25% 4/27/27 (Reg. S) | EUR | 800,000 | 933,891 |

| Alpha Trains Finance SA 2.064% 6/30/30 | EUR | 2,534,000 | 3,141,909 |

| Blackstone Property Partners Europe LP: | | | |

| 1% 5/4/28 (Reg. S) | EUR | 3,950,000 | 4,657,684 |

| 1.4% 7/6/22 (Reg. S) | EUR | 610,000 | 731,014 |

| 1.75% 3/12/29 (Reg. S) | EUR | 1,300,000 | 1,599,928 |

| GTC Aurora Luxembourg SA 2.25% 6/23/26 (Reg. S) | EUR | 1,900,000 | 2,262,928 |

|

| TOTAL LUXEMBOURG | | | 20,523,473 |

|

| Mexico - 1.9% | | | |

| Gruma S.A.B. de CV 4.875% 12/1/24 (Reg. S) | | 690,000 | 765,167 |

| Petroleos Mexicanos: | | | |

| 2.5% 11/24/22 (Reg. S) | EUR | 159,000 | 190,514 |

| 6.5% 3/13/27 | | 7,485,000 | 7,956,555 |

|

| TOTAL MEXICO | | | 8,912,236 |

|

| Netherlands - 3.8% | | | |

| CTP BV: | | | |

| 0.5% 6/21/25 (Reg. S) | EUR | 1,600,000 | 1,889,368 |

| 0.625% 11/27/23 (Reg. S) | EUR | 2,200,000 | 2,636,062 |

| Demeter Investments BV 5.75% 8/15/50 (Reg. S) (d) | | 5,225,000 | 5,908,242 |

| Deutsche Annington Finance BV 5% 10/2/23 (c) | | 950,000 | 1,028,685 |

| Technip Energies NV 1.125% 5/28/28 | EUR | 2,800,000 | 3,316,727 |

| Teva Pharmaceutical Finance Netherlands III BV 1.25% 3/31/23 (Reg. S) | EUR | 1,650,000 | 1,912,467 |

| Wabtec Transportation Netherlands BV 1.25% 12/3/27 | EUR | 800,000 | 956,227 |

|

| TOTAL NETHERLANDS | | | 17,647,778 |

|

| Portugal - 0.3% | | | |

| Fidelidade-Companhia de Seguros SA 4.25% 9/4/31 (Reg. S) (d) | EUR | 1,100,000 | 1,319,833 |

| Sweden - 1.4% | | | |

| Akelius Residential Property AB 3.875% 10/5/78 (Reg. S) (d) | EUR | 1,800,000 | 2,257,024 |

| Samhallsbyggnadsbolaget I Norden AB 1.75% 1/14/25 (Reg. S) | EUR | 3,235,000 | 4,017,516 |

|

| TOTAL SWEDEN | | | 6,274,540 |

|

| Switzerland - 2.1% | | | |

| Credit Suisse Group AG: | | | |

| 4.194% 4/1/31 (c)(d) | | 2,000,000 | 2,247,657 |

| 6.5% 8/8/23 (Reg. S) | | 6,850,000 | 7,566,784 |

|

| TOTAL SWITZERLAND | | | 9,814,441 |

|

| United Kingdom - 18.0% | | | |

| Anglian Water (Osprey) Financing PLC 2% 7/31/28 (Reg. S) (f) | GBP | 675,000 | 934,600 |

| Barclays PLC 2% 2/7/28 (Reg. S) (d) | EUR | 850,000 | 1,033,282 |

| BAT International Finance PLC 2.25% 6/26/28 (Reg. S) | GBP | 3,450,000 | 4,782,647 |

| Imperial Tobacco Finance PLC 3.5% 7/26/26 (c) | | 15,082,000 | 16,145,461 |

| InterContinental Hotel Group PLC: | | | |

| 3.375% 10/8/28 (Reg. S) | GBP | 5,430,000 | 8,112,420 |

| 3.75% 8/14/25 (Reg. S) | GBP | 250,000 | 375,642 |

| John Lewis PLC 6.125% 1/21/25 | GBP | 4,681,000 | 7,288,697 |

| Lloyds Banking Group PLC 1.985% 12/15/31 (d) | GBP | 1,500,000 | 2,086,841 |

| M&G PLC 6.5% 10/20/48 (Reg. S) (d) | | 200,000 | 237,050 |

| Marks & Spencer PLC: | | | |

| 3.75% 5/19/26 (Reg. S) | GBP | 600,000 | 861,981 |

| 4.5% 7/10/27 (Reg. S) | GBP | 2,420,000 | 3,580,879 |

| Rolls-Royce PLC: | | | |

| 3.375% 6/18/26 | GBP | 3,820,000 | 5,270,995 |

| 3.625% 10/14/25 (c) | | 2,345,000 | 2,374,313 |

| 5.75% 10/15/27 (Reg. S) | GBP | 100,000 | 151,399 |

| Royal Bank of Scotland Group PLC: | | | |

| 2.105% 11/28/31 (Reg. S) (d) | GBP | 2,450,000 | 3,405,373 |

| 3.622% 8/14/30 (Reg. S) (d) | GBP | 650,000 | 958,948 |

| SSE PLC 4.75% 9/16/77 (Reg. S) (d) | | 9,240,000 | 9,556,285 |

| Travis Perkins PLC 4.5% 9/7/23 (Reg. S) | GBP | 1,050,000 | 1,548,691 |

| Tritax EuroBox PLC 0.95% 6/2/26 (Reg. S) | EUR | 780,000 | 923,075 |

| Virgin Money UK PLC: | | | |

| 2.625% 8/19/31 (Reg. S) (d) | GBP | 1,100,000 | 1,542,358 |

| 3.125% 6/22/25 (Reg. S) (d) | GBP | 1,400,000 | 2,031,890 |

| 5.125% 12/11/30 (Reg. S) (d) | GBP | 1,500,000 | 2,313,158 |

| Vodafone Group PLC: | | | |

| 2.625% 8/27/80 (Reg. S) (d) | EUR | 1,350,000 | 1,656,703 |

| 6.25% 10/3/78 (Reg. S) (d) | | 2,055,000 | 2,269,542 |

| Whitbread PLC 3.375% 10/16/25 (Reg. S) | GBP | 2,800,000 | 4,108,702 |

|

| TOTAL UNITED KINGDOM | | | 83,550,932 |

|

| United States of America - 1.7% | | | |

| BAT Capital Corp. 3.557% 8/15/27 | | 1,100,000 | 1,177,938 |

| Ford Motor Credit Co. LLC: | | | |

| 2.748% 6/14/24 | GBP | 1,700,000 | 2,383,893 |

| 4.535% 3/6/25 | GBP | 200,000 | 296,372 |

| MPT Operating Partnership LP/MPT Finance Corp. 2.5% 3/24/26 | GBP | 2,700,000 | 3,804,267 |

|

| TOTAL UNITED STATES OF AMERICA | | | 7,662,470 |

|

| TOTAL NONCONVERTIBLE BONDS | | | |

| (Cost $242,659,667) | | | 251,504,611 |

|

| U.S. Government and Government Agency Obligations - 2.8% | | | |

| U.S. Treasury Obligations - 2.8% | | | |

| U.S. Treasury Bonds: | | | |

| 2.5% 2/15/45 (g) | | $59,000 | $63,835 |

| 3% 5/15/47 (g) | | 297,000 | 353,163 |

| U.S. Treasury Notes: | | | |

| 0.75% 3/31/26 (g)(h) | | 12,220,000 | 12,165,105 |

| 2.625% 2/15/29 (g) | | 220,000 | 241,244 |

| | | | 12,823,347 |

| TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS | | | |

| (Cost $12,751,354) | | | 12,823,347 |

|

| Foreign Government and Government Agency Obligations - 7.3% | | | |

| Germany - 5.3% | | | |

| German Federal Republic: | | | |

| 0% 11/15/27 (Reg. S) | EUR | $1,260,000 | $1,540,250 |

| 0% 2/15/31 (Reg. S) | EUR | 700,000 | 850,284 |

| 0% 5/15/35 (Reg. S) | EUR | 18,585,000 | 22,066,692 |

| 2.5% 7/4/44 | EUR | 150,000 | 272,821 |

|

| TOTAL GERMANY | | | 24,730,047 |

|

| United Kingdom - 2.0% | | | |

| United Kingdom, Great Britain and Northern Ireland: | | | |

| 0.625% 7/31/35 (Reg. S) | GBP | 520,000 | 677,364 |

| 1.25% 10/22/41 (Reg. S) | GBP | 1,550,000 | 2,157,217 |

| 1.75% 9/7/37 (Reg. S) (g) | GBP | 3,005,000 | 4,544,897 |

| 1.75% 1/22/49(Reg. S) (g) | GBP | 1,040,000 | 1,611,202 |

| 3.25% 1/22/44 | GBP | 200,000 | 387,155 |

|

| TOTAL UNITED KINGDOM | | | 9,377,835 |

|

| TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS | | | |

| (Cost $34,953,859) | | | 34,107,882 |

|

| Preferred Securities - 28.8% | | | |

| Australia - 1.3% | | | |

| QBE Insurance Group Ltd.: | | | |

| 5.25% (Reg. S) (d)(e) | | 2,430,000 | 2,579,704 |

| 5.875% (c)(d)(e) | | 3,305,000 | 3,633,789 |

|

| TOTAL AUSTRALIA | | | 6,213,493 |

|

| Canada - 0.9% | | | |

| Bank of Nova Scotia: | | | |

| 4.65% (d)(e) | | 2,395,000 | 2,479,218 |

| 4.9% (d)(e) | | 1,380,000 | 1,519,515 |

|

| TOTAL CANADA | | | 3,998,733 |

|

| France - 3.9% | | | |

| BNP Paribas SA 6.625% (Reg. S) (d)(e) | | 2,150,000 | 2,394,878 |

| Danone SA 1.75% (Reg. S) (d)(e) | EUR | 4,500,000 | 5,467,050 |

| EDF SA 5.25% (Reg. S) (d)(e) | | 8,620,000 | 9,209,946 |

| Societe Generale 7.875% (Reg. S) (d)(e) | | 800,000 | 896,494 |

|

| TOTAL FRANCE | | | 17,968,368 |

|

| Germany - 2.5% | | | |

| Bayer AG 2.375% 11/12/79 (Reg. S) (d) | EUR | 9,500,000 | 11,442,081 |

| Ireland - 0.5% | | | |

| AIB Group PLC 6.25% (Reg. S) (d)(e) | EUR | 1,620,000 | 2,187,672 |

| Italy - 0.9% | | | |

| Enel SpA 2.5% (Reg. S) (d)(e) | EUR | 3,450,000 | 4,342,964 |

| Luxembourg - 3.3% | | | |

| Aroundtown SA 3.375% (Reg. S) (d)(e) | EUR | 6,200,000 | 7,765,331 |

| CPI Property Group SA 3.75% (Reg. S) (d)(e) | EUR | 1,900,000 | 2,250,925 |

| Grand City Properties SA 1.5% (Reg. S) (d)(e) | EUR | 4,800,000 | 5,565,725 |

|

| TOTAL LUXEMBOURG | | | 15,581,981 |

|

| Netherlands - 8.3% | | | |

| AerCap Holdings NV 5.875% 10/10/79 (d) | | 4,550,000 | 4,796,794 |

| AT Securities BV 5.25% (Reg. S) (d)(e) | | 2,250,000 | 2,461,247 |

| Deutsche Annington Finance BV 4% (Reg. S) (d)(e) | EUR | 2,000,000 | 2,462,710 |

| Stichting AK Rabobank Certificaten 2.1878% (Reg. S) (d)(e)(i) | EUR | 1,450,075 | 2,312,833 |

| Telefonica Europe BV 2.625% (Reg. S) (d)(e) | EUR | 4,200,000 | 5,098,110 |

| Volkswagen International Finance NV: | | | |

| 2.5%(Reg. S) (d)(e) | EUR | 495,000 | 599,512 |

| 2.7%(Reg. S) (d)(e) | EUR | 13,000,000 | 16,083,817 |

| 3.875% (Reg. S) (d)(e) | EUR | 3,700,000 | 4,876,396 |

|

| TOTAL NETHERLANDS | | | 38,691,419 |

|

| Spain - 0.5% | | | |

| Banco Bilbao Vizcaya Argentaria SA 5.875% (Reg. S) (d)(e) | EUR | 1,800,000 | 2,307,503 |

| Sweden - 1.8% | | | |

| Heimstaden Bostad AB 3.248% (Reg. S) (d)(e) | EUR | 4,710,000 | 5,845,962 |

| Samhallsbyggnadsbolaget I Norden AB 2.624% (Reg. S) (d)(e) | EUR | 2,000,000 | 2,387,733 |

|

| TOTAL SWEDEN | | | 8,233,695 |

|

| Switzerland - 1.9% | | | |

| Credit Suisse Group AG 7.5% (Reg. S) (d)(e) | | 7,230,000 | 8,050,165 |

| UBS Group AG 7% (Reg. S) (d)(e) | | 500,000 | 588,909 |

|

| TOTAL SWITZERLAND | | | 8,639,074 |

|

| United Kingdom - 3.0% | | | |

| Aviva PLC 6.125% (d)(e) | GBP | 3,900,000 | 5,983,327 |

| Barclays Bank PLC 7.625% 11/21/22 | | 1,881,000 | 2,067,447 |

| Barclays PLC 7.125% (d)(e) | GBP | 200,000 | 316,948 |

| HSBC Holdings PLC 6.375% (d)(e) | | 3,050,000 | 3,449,278 |

| SSE PLC 3.74% (Reg. S) (d)(e) | GBP | 1,550,000 | 2,279,950 |

|

| TOTAL UNITED KINGDOM | | | 14,096,950 |

|

| TOTAL PREFERRED SECURITIES | | | |

| (Cost $126,816,304) | | | 133,703,933 |

| | | Shares | Value |

|

| Money Market Funds - 6.9% | | | |

| Fidelity Cash Central Fund 0.06% (j) | | | |

| (Cost $32,174,882) | | 32,168,449 | 32,174,882 |

| Purchased Swaptions - 0.0%(k) | | | | |

| | | Expiration Date | Notional Amount | Value |

| Put Options - 0.0% | | | | |

| Option with an exercise rate of 2.75% on a credit default swap with BNP Paribas SA to buy protection on the 5-Year iTraxx Europe Crossover Series 35 Index expiring September 2021, paying 5% quarterly. | | 9/15/21 | EUR 44,950,000 | $241,782 |

| TOTAL PURCHASED SWAPTIONS | | | | |

| (Cost $723,430) | | | | 241,782 |

| TOTAL INVESTMENT IN SECURITIES - 99.9% | | | | |

| (Cost $450,079,496) | | | | 464,556,437 |

| NET OTHER ASSETS (LIABILITIES) - 0.1% | | | | 331,102 |

| NET ASSETS - 100% | | | | $464,887,539 |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) |

| Purchased | | | | | |

| Bond Index Contracts | | | | | |

| ASX 10 Year Treasury Bond Index Contracts (Australia) | 26 | Sept. 2021 | $2,753,002 | $14,461 | $14,461 |

| Eurex Euro-Bobl Contracts (Germany) | 13 | Sept. 2021 | 2,067,889 | 1,259 | 1,259 |

| Eurex Euro-Bund Contracts (Germany) | 50 | Sept. 2021 | 10,233,615 | 40,883 | 40,883 |

| Eurex Euro-Buxl 30 Year Bond Contracts (Germany) | 27 | Sept. 2021 | 6,506,779 | 121,568 | 121,568 |

| TME 10 Year Canadian Note Contracts (Canada) | 130 | Sept. 2021 | 15,261,052 | 170,534 | 170,534 |

| TOTAL BOND INDEX CONTRACTS | | | | | 348,705 |

| Treasury Contracts | | | | | |

| CBOT 2-Year U.S. Treasury Note Contracts (United States) | 8 | Sept. 2021 | 1,762,563 | (2,516) | (2,516) |

| CBOT 5-Year U.S. Treasury Note Contracts (United States) | 244 | Sept. 2021 | 30,116,844 | (43,006) | (43,006) |

| CBOT Long Term U.S. Treasury Bond Contracts (United States) | 99 | Sept. 2021 | 15,914,250 | 502,520 | 502,520 |

| CBOT Ultra 10-Year U.S. Treasury Note Contracts (United States) | 151 | Sept. 2021 | 22,227,672 | 411,318 | 411,318 |

| CBOT Ultra Long Term U.S. Treasury Bond Contracts (United States) | 118 | Sept. 2021 | 22,737,125 | 1,060,444 | 1,060,444 |

| TOTAL TREASURY CONTRACTS | | | | | 1,928,760 |

|

| TOTAL PURCHASED | | | | | 2,277,465 |

|

| Sold | | | | | |

| Bond Index Contracts | | | | | |

| ICE Long Gilt Contracts (United Kingdom) | 108 | Sept. 2021 | 19,137,679 | (143,509) | (143,509) |

| TOTAL FUTURES CONTRACTS | | | | | $2,133,956 |

The notional amount of futures purchased as a percentage of Net Assets is 27.9%

The notional amount of futures sold as a percentage of Net Assets is 4.1%

For the period, the average monthly notional amount at value for futures contracts in the aggregate was $141,960,166.

| Forward Foreign Currency Contracts | | | | | | |

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation/(Depreciation) |

| GBP | 119,000 | USD | 164,758 | JPMorgan Chase Bank, N.A. | 7/1/21 | $(145) |

| GBP | 973,000 | USD | 1,344,725 | JPMorgan Chase Bank, N.A. | 7/2/21 | 1,226 |

| USD | 49,258 | CAD | 61,000 | JPMorgan Chase Bank, N.A. | 7/2/21 | 48 |

| EUR | 3,021,000 | USD | 3,610,817 | JPMorgan Chase Bank, N.A. | 8/5/21 | (26,093) |

| EUR | 587,000 | USD | 701,151 | State Street Bank And Tr Co | 8/5/21 | (4,616) |

| GBP | 119,000 | USD | 165,489 | Royal Bank Of Canada | 8/5/21 | (860) |

| GBP | 206,000 | USD | 286,457 | State Street Bank And Tr Co | 8/5/21 | (1,469) |

| USD | 61,667 | CAD | 76,000 | Goldman Sachs Bank USA | 8/5/21 | 358 |

| USD | 917,821 | EUR | 768,000 | Bank Of America, N.A. | 8/5/21 | 6,511 |

| USD | 141,941,179 | EUR | 118,932,000 | Citibank, N.A. | 8/5/21 | 816,270 |

| USD | 490,608 | EUR | 411,000 | Citibank, N.A. | 8/5/21 | 2,914 |

| USD | 828,818 | EUR | 696,000 | JPMorgan Chase Bank, N.A. | 8/5/21 | 2,943 |

| USD | 197,763 | EUR | 166,000 | JPMorgan Chase Bank, N.A. | 8/5/21 | 787 |

| USD | 88,638,893 | GBP | 63,608,000 | Citibank, N.A. | 8/5/21 | 641,487 |

| USD | 121,848 | GBP | 88,000 | JPMorgan Chase Bank, N.A. | 8/5/21 | 106 |

| USD | 1,657,215 | GBP | 1,199,000 | JPMorgan Chase Bank, N.A. | 8/5/21 | (1,522) |

| USD | 69,943,000 | EUR | 58,515,996 | JPMorgan Chase Bank, N.A. | 9/17/21 | 444,692 |

| TOTAL FORWARD FOREIGN CURRENCY CONTRACTS | | | | | | $1,882,637 |

| | | | | | Unrealized Appreciation | 1,917,342 |

| | | | | | Unrealized Depreciation | (34,705) |

For the period, the average contract value for forward foreign currency contracts was $337,092,161. Contract value represents contract amount in United States dollars plus or minus unrealized appreciation or depreciation, respectively

Swaps

| Underlying Reference | Maturity Date | Clearinghouse / Counterparty | Fixed Payment Received/(Paid) | Payment Frequency | Notional Amount | Value | Upfront Premium Received/(Paid) | Unrealized Appreciation/(Depreciation) |

| Credit Default Swaps | | | | | | | | |

| Buy Protection | | | | | | | | |

| Akzo Nobel NV | Jun. 2024 | Citibank, N.A. | (1%) | Quarterly | EUR 5,250,000 | $(158,608) | $101,542 | $(57,066) |

| Assicurazioni Generali SpA | Jun. 2026 | BNP Paribas SA | (1%) | Quarterly | EUR 1,700,000 | (42,474) | 42,530 | 56 |

| Assicurazioni Generali SpA | Jun. 2026 | BNP Paribas SA | (1%) | Quarterly | EUR 2,000,000 | (49,970) | 49,836 | (134) |

| BMW Finance NV | Jun. 2026 | Citibank, N.A. | (1%) | Quarterly | EUR 3,650,000 | (130,734) | 111,324 | (19,410) |

| Barclays PLC | Jun. 2026 | JPMorgan Chase Bank, N.A. | (1%) | Quarterly | EUR 3,700,000 | (106,072) | 94,248 | (11,824) |

| Daimler AG | Jun. 2026 | Citibank, N.A. | (1%) | Quarterly | EUR 3,700,000 | (109,422) | 88,078 | (21,344) |

| Deutsche Bank AG | Jun. 2026 | Citibank, N.A. | (1%) | Quarterly | EUR 3,750,000 | (56,932) | 7,686 | (49,246) |

| Gas Natural Capital Markets SA | Jun. 2022 | Goldman Sachs Bank USA | (1%) | Quarterly | EUR 1,800,000 | (19,220) | 6,474 | (12,746) |

| Sanpaolo SpA | Jun. 2026 | JPMorgan Chase Bank, N.A. | (1%) | Quarterly | EUR 3,700,000 | (90,548) | 69,657 | (20,891) |

| Shell International Finance BV | Jun. 2026 | Citibank, N.A. | (1%) | Quarterly | EUR 3,650,000 | (127,268) | 125,875 | (1,393) |

| Standard Chartered Bank | Jun. 2022 | Goldman Sachs Bank USA | (1%) | Quarterly | EUR 920,000 | (9,290) | (2,604) | (11,894) |

| Volvo Treas AB | Jun. 2024 | Citibank, N.A. | (1%) | Quarterly | EUR 850,000 | (23,424) | 12,468 | (10,956) |

|

| TOTAL CREDIT DEFAULT SWAPS | | | | | | $(923,962) | $707,114 | $(216,848) |

|

For the period, the average monthly notional amount for swaps in the aggregate was $31,178,847.

Currency Abbreviations

CAD – Canadian dollar

EUR – European Monetary Unit

GBP – British pound

USD – U.S. dollar

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Amount is stated in United States dollars unless otherwise noted.

(b) Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $32,115,464 or 6.9% of net assets.

(d) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(e) Security is perpetual in nature with no stated maturity date.

(f) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(g) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $2,898,121.

(h) Security or a portion of the security has been segregated as collateral for open bi-lateral over-the-counter (OTC) swaps. At period end, the value of securities pledged amounted to $205,082.

(i) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(j) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(k) For the period, the average monthly notional amount for purchased swaptions was $51,268,443.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $11,627 |

| Fidelity Securities Lending Cash Central Fund | 1 |

| Total | $11,628 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.06% | $53,135,260 | $90,251,767 | $111,212,189 | $44 | $-- | $32,174,882 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 0.06% | -- | 390,343 | 390,343 | -- | -- | -- | 0.0% |

| Total | $53,135,260 | $90,642,110 | $111,602,532 | $44 | $-- | $32,174,882 | |

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Corporate Bonds | $251,504,611 | $-- | $251,504,611 | $-- |

| U.S. Government and Government Agency Obligations | 12,823,347 | -- | 12,823,347 | -- |

| Foreign Government and Government Agency Obligations | 34,107,882 | -- | 34,107,882 | -- |

| Preferred Securities | 133,703,933 | -- | 133,703,933 | -- |

| Money Market Funds | 32,174,882 | 32,174,882 | -- | -- |

| Purchased Swaptions | 241,782 | -- | 241,782 | -- |

| Total Investments in Securities: | $464,556,437 | $32,174,882 | $432,381,555 | $-- |

| Derivative Instruments: | | | | |

| Assets | | | | |

| Futures Contracts | $2,322,987 | $2,322,987 | $-- | $-- |

| Forward Foreign Currency Contracts | 1,917,342 | -- | 1,917,342 | -- |

| Total Assets | $4,240,329 | $2,322,987 | $1,917,342 | $-- |

| Liabilities | | | | |

| Futures Contracts | $(189,031) | $(189,031) | $-- | $-- |

| Forward Foreign Currency Contracts | (34,705) | | (34,705) | |

| Swaps | (923,962) | -- | (923,962) | -- |

| Total Liabilities | $(1,147,698) | $(189,031) | $(958,667) | $-- |

| Total Derivative Instruments: | $3,092,631 | $2,133,956 | $958,675 | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of June 30, 2021. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| Credit Risk | | |

| Purchased Swaptions(a) | $241,782 | $0 |

| Swaps(b) | 0 | (923,962) |

| Total Credit Risk | 241,782 | (923,962) |

| Foreign Exchange Risk | | |

| Forward Foreign Currency Contracts(c) | 1,917,342 | (34,705) |

| Total Foreign Exchange Risk | 1,917,342 | (34,705) |

| Interest Rate Risk | | |

| Futures Contracts(d) | 2,322,987 | (189,031) |

| Total Interest Rate Risk | 2,322,987 | (189,031) |

| Total Value of Derivatives | $4,482,111 | $(1,147,698) |

(a) Gross value is included in the Statement of Assets and Liabilities in the investments, at value line-item.

(b) For bi-lateral over-the-counter (OTC) swaps, reflects gross value which is presented in the Statement of Assets and Liabilities in the bi-lateral OTC swaps, at value line-items.

(c) Gross value is presented in the Statement of Assets and Liabilities in the unrealized appreciation/depreciation on forward foreign currency contracts line-items.

(d) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in Total accumulated earnings (loss).

The following table is a summary of the Fund's derivatives inclusive of potential netting arrangements.

| Counterparty | Value of Derivative Assets | Value of Derivative Liabilities | Collateral Received(a) | Collateral Pledged(a) | Net(b) |

| Citibank, N.A. | $1,460,671 | $(606,388) | $-- | $-- | $854,283 |

| JPMorgan Chase Bank, N.A. | 449,802 | (224,380) | -- | -- | 225,422 |

| BNP Paribas SA | 241,782 | (92,444) | -- | -- | 149,338 |

| Bank Of America, N.A. | 6,511 | -- | -- | -- | 6,511 |

| Goldman Sachs Bank USA | 358 | (28,510) | -- | -- | (28,152) |

| Royal Bank Of Canada | -- | (860) | -- | -- | (860) |

| State Street Bank And Tr Co | -- | (6,085) | -- | -- | (6,085) |

| Exchange Traded Futures | 2,322,987 | (189,031) | -- | -- | 2,133,956 |

| Total | $4,482,111 | $(1,147,698) | | | |

(a) Reflects collateral received from or pledged to an individual counterparty, excluding any excess or initial collateral amounts.

(b) Net represents the receivable / (payable) that would be due from / (to) the counterparty in an event of default. Netting may be allowed across transactions traded under the same legal agreement with the same legal entity. Please refer to Derivative Instruments - Risk Exposures and the Use of Derivative Instruments section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | June 30, 2021 (Unaudited) |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $417,904,614) | $432,381,555 | |

| Fidelity Central Funds (cost $32,174,882) | 32,174,882 | |

| Total Investment in Securities (cost $450,079,496) | | $464,556,437 |

| Foreign currency held at value (cost $638,716) | | 636,946 |

| Unrealized appreciation on forward foreign currency contracts | | 1,917,342 |

| Receivable for fund shares sold | | 47,097 |

| Dividends receivable | | 5,707 |

| Interest receivable | | 3,347,996 |

| Distributions receivable from Fidelity Central Funds | | 1,001 |

| Receivable for daily variation margin on futures contracts | | 345,285 |

| Total assets | | 470,857,811 |

| Liabilities | | |

| Payable for investments purchased | | |

| Regular delivery | $3,931,966 | |

| Delayed delivery | 928,331 | |

| Unrealized depreciation on forward foreign currency contracts | 34,705 | |

| Payable for fund shares redeemed | 141,522 | |

| Bi-lateral OTC swaps, at value | 923,962 | |

| Other payables and accrued expenses | 9,786 | |

| Total liabilities | | 5,970,272 |

| Net Assets | | $464,887,539 |

| Net Assets consist of: | | |

| Paid in capital | | $456,245,374 |

| Total accumulated earnings (loss) | | 8,642,165 |

| Net Assets | | $464,887,539 |

| Net Asset Value, offering price and redemption price per share ($464,887,539 ÷ 4,532,346 shares) | | $102.57 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended June 30, 2021 (Unaudited) |

| Investment Income | | |

| Dividends | | $2,403,154 |

| Interest | | 3,037,022 |

| Income from Fidelity Central Funds (including $1 from security lending) | | 11,628 |

| Income before foreign taxes withheld | | 5,451,804 |

| Less foreign taxes withheld | | (43,570) |

| Total income | | 5,408,234 |

| Expenses | | |

| Custodian fees and expenses | $11,893 | |

| Independent directors' fees and expenses | 590 | |

| Miscellaneous | 4 | |

| Total expenses before reductions | 12,487 | |

| Expense reductions | (58) | |

| Total expenses after reductions | | 12,429 |

| Net investment income (loss) | | 5,395,805 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 7,175,388 | |

| Fidelity Central Funds | 44 | |

| Forward foreign currency contracts | 3,570,562 | |

| Foreign currency transactions | (65,422) | |

| Futures contracts | (6,937,509) | |

| Swaps | (81,282) | |

| Total net realized gain (loss) | | 3,661,781 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (14,421,867) | |

| Forward foreign currency contracts | 3,055,197 | |

| Assets and liabilities in foreign currencies | (186,457) | |

| Futures contracts | 2,183,964 | |

| Swaps | (115,822) | |

| Total change in net unrealized appreciation (depreciation) | | (9,484,985) |

| Net gain (loss) | | (5,823,204) |

| Net increase (decrease) in net assets resulting from operations | | $(427,399) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended June 30, 2021 (Unaudited) | Year ended December 31, 2020 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $5,395,805 | $11,558,318 |

| Net realized gain (loss) | 3,661,781 | (3,700,232) |

| Change in net unrealized appreciation (depreciation) | (9,484,985) | 24,258,098 |

| Net increase (decrease) in net assets resulting from operations | (427,399) | 32,116,184 |

| Distributions to shareholders | (6,736,862) | (20,857,055) |

| Affiliated share transactions | | |

| Proceeds from sales of shares | 22,226,726 | 186,892,372 |

| Reinvestment of distributions | 6,736,862 | 20,857,055 |

| Cost of shares redeemed | (12,859,629) | (73,603,628) |

| Net increase (decrease) in net assets resulting from share transactions | 16,103,959 | 134,145,799 |

| Total increase (decrease) in net assets | 8,939,698 | 145,404,928 |

| Net Assets | | |

| Beginning of period | 455,947,841 | 310,542,913 |

| End of period | $464,887,539 | $455,947,841 |

| Other Information | | |

| Shares | | |

| Sold | 217,394 | 1,810,524 |

| Issued in reinvestment of distributions | 65,956 | 202,349 |

| Redeemed | (125,651) | (705,114) |

| Net increase (decrease) | 157,699 | 1,307,759 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity International Credit Central Fund

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | |

| | 2021 | 2020 | 2019 | 2018 | 2017 A |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $104.23 | $101.26 | $94.83 | $99.80 | $100.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | 1.207 | 3.060 | 2.744 | 2.597 | 1.214 |

| Net realized and unrealized gain (loss) | (1.344) | 5.002 | 9.957 | (3.725) | .970 |

| Total from investment operations | (.137) | 8.062 | 12.701 | (1.128) | 2.184 |

| Distributions from net investment income | (.549) | (3.418) | (3.022)C | (2.398) | (.922) |

| Distributions from net realized gain | (.974) | (1.674) | (3.040)C | (1.444) | (.415) |

| Tax return of capital | – | – | (.209) | – | (1.047) |

| Total distributions | (1.523) | (5.092) | (6.271) | (3.842) | (2.384) |

| Net asset value, end of period | $102.57 | $104.23 | $101.26 | $94.83 | $99.80 |

| Total ReturnD,E | (.12)% | 8.11% | 13.57% | (1.13)% | 2.20% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .01%H | .01% | .01% | .01% | .01%H |

| Expenses net of fee waivers, if any | .01%H | .01% | .01% | .01% | .01%H |

| Expenses net of all reductions | .01%H | .01% | .01% | .01% | .01%H |

| Net investment income (loss) | 2.38%H | 2.97% | 2.72% | 2.66% | 2.17%H |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $464,888 | $455,948 | $310,543 | $172,196 | $106,300 |

| Portfolio turnover rateI | 70%H | 67% | 84% | 85% | 85%H |

A For the period June 13, 2017 (commencement of operations) to December 31, 2017.

B Calculated based on average shares outstanding during the period.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2021

1. Organization.

Fidelity International Credit Central Fund (the Fund) is a fund of Fidelity Central Investment Portfolios II LLC (the LLC) and is authorized to issue an unlimited number of shares. Shares of the Fund are only offered to other investment companies and accounts managed by Fidelity Management & Research Company LLC (FMR), or its affiliates (the Investing Funds). The LLC is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware Limited Liability Company.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio(a) |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% to .01% |

(a) Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Directors (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, foreign government and government agency obligations, preferred securities and U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. Swaps are marked-to-market daily based on valuations from third party pricing vendors, registered derivatives clearing organizations (clearinghouses) or broker-supplied valuations. These pricing sources may utilize inputs such as interest rate curves, credit spread curves, default possibilities and recovery rates. When independent prices are unavailable or unreliable, debt securities and swaps may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. For foreign debt securities, when significant market or security specific events arise, valuations may be determined in good faith in accordance with procedures adopted by the Board. Debt securities and swaps are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

The U.S. dollar value of foreign currency contracts is determined using currency exchange rates supplied by a pricing service and are categorized as Level 2 in the hierarchy. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Options traded over-the-counter are valued using vendor or broker-supplied valuations and are categorized as Level 2 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of June 30, 2021 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Realized gains and losses on foreign currency transactions arise from the disposition of foreign currency, realized changes in the value of foreign currency between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on transaction date and the U.S. dollar equivalent of the amounts actually received or paid. Unrealized gains and losses on assets and liabilities in foreign currencies arise from changes in the value of foreign currency, and from assets and liabilities denominated in foreign currencies, other than investments, which are held at period end.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, swaps, foreign currency transactions, passive foreign investment companies (PFIC), market discount and losses deferred due to wash sales, futures transactions and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $22,911,610 |

| Gross unrealized depreciation | (4,439,023) |

| Net unrealized appreciation (depreciation) | $18,472,587 |

| Tax cost | $449,883,595 |

The Fund elected to defer to its next fiscal year approximately $6,96,264 of ordinary losses recognized during the period November 1, 2020 to December 31, 2020.

Delayed Delivery Transactions and When-Issued Securities. During the period, certain Funds transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. Securities purchased on a delayed delivery or when-issued basis are identified as such in the Schedule of Investments. Compensation for interest forgone in the purchase of a delayed delivery or when-issued debt security may be received. With respect to purchase commitments, each applicable Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Payables and receivables associated with the purchases and sales of delayed delivery securities having the same coupon, settlement date and broker are offset. Delayed delivery or when-issued securities that have been purchased from and sold to different brokers are reflected as both payables and receivables in the Statement of Assets and Liabilities under the caption "Delayed delivery", as applicable. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts, forward foreign currency contracts, options and swaps. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns, to gain exposure to certain types of assets, to facilitate transactions in foreign-denominated securities and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risks:

| Credit Risk | Credit risk relates to the ability of the issuer of a financial instrument to make further principal or interest payments on an obligation or commitment that it has to the Fund.

|

| Foreign Exchange Risk | Foreign exchange rate risk relates to fluctuations in the value of an asset or liability due to changes in currency exchange rates.

|

| Interest Rate Risk | Interest rate risk relates to the fluctuations in the value of interest-bearing securities due to changes in the prevailing levels of market interest rates. |

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Derivative counterparty credit risk is managed through formal evaluation of the creditworthiness of all potential counterparties. On certain OTC derivatives such as forward foreign currency contracts, options and bi-lateral swaps, the Fund attempts to reduce its exposure to counterparty credit risk by entering into an International Swaps and Derivatives Association, Inc. (ISDA) Master Agreement with each of its counterparties. The ISDA Master Agreement gives the Fund the right to terminate all transactions traded under such agreement upon the deterioration in the credit quality of the counterparty beyond specified levels. The ISDA Master Agreement gives each party the right, upon an event of default by the other party or a termination of the agreement, to close out all transactions traded under such agreement and to net amounts owed under each transaction to one net payable by one party to the other. To mitigate counterparty credit risk on bi-lateral OTC derivatives, the Fund receives collateral in the form of cash or securities once the Fund's net unrealized appreciation on outstanding derivative contracts under an ISDA Master Agreement exceeds certain applicable thresholds, subject to certain minimum transfer provisions. The collateral received is held in segregated accounts with the Fund's custodian bank in accordance with the collateral agreements entered into between the Fund, the counterparty and the Fund's custodian bank. The Fund could experience delays and costs in gaining access to the collateral even though it is held by the Fund's custodian bank. The Fund's maximum risk of loss from counterparty credit risk related to bi-lateral OTC derivatives is generally the aggregate unrealized appreciation and unpaid counterparty payments in excess of any collateral pledged by the counterparty to the Fund. The Fund may be required to pledge collateral for the benefit of the counterparties on bi-lateral OTC derivatives in an amount not less than each counterparty's unrealized appreciation on outstanding derivative contracts, subject to certain minimum transfer provisions, and any such pledged collateral is identified in the Schedule of Investments. Exchange-traded futures contracts are not covered by the ISDA Master Agreement; however counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade. A summary of the Fund's derivatives inclusive of potential netting arrangements is presented at the end of the Schedule of Investments.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Net Realized Gain (Loss) and Change in Net Unrealized Appreciation (Depreciation) on Derivatives. The table below, which reflects the impacts of derivatives on the financial performance of the Fund, summarizes the net realized gain (loss) and change in net unrealized appreciation (depreciation) for derivatives during the period as presented in the Statement of Operations.

| Primary Risk Exposure / Derivative Type | Net Realized Gain (Loss) | Change in Net Unrealized Appreciation (Depreciation) |

| Credit Risk | | |

| Purchased Options | $(1,202,046) | $(410,237) |

| Swaps | (81,282) | (115,822) |

| Total Credit Risk | (1,283,328) | (526,059) |

| Foreign Exchange Risk | | |

| Forward Foreign Currency Contracts | 3,570,562 | 3,055,197 |

| Total Foreign Exchange Risk | 3,570,562 | 3,055,197 |

| Interest Rate Risk | | |

| Futures Contracts | (6,937,509) | 2,183,964 |

| Total Interest Rate Risk | (6,937,509) | 2,183,964 |

| Totals | $(4,650,275) | $4,713,102 |

A summary of the value of derivatives by primary risk exposure as of period end is included at the end of the Schedule of Investments.

Forward Foreign Currency Contracts. Forward foreign currency contracts represent obligations to purchase or sell foreign currency on a specified future date at a price fixed at the time the contracts are entered into. The Fund used forward foreign currency contracts to facilitate transactions in foreign-denominated securities and to manage exposure to certain foreign currencies.

Forward foreign currency contracts are valued daily and fluctuations in exchange rates on open contracts are recorded as unrealized appreciation or (depreciation) and reflected in the Statement of Assets and Liabilities. When the contract is closed, the Fund realizes a gain or loss equal to the difference between the closing value and the value at the time it was opened. Non-deliverable forward foreign currency exchange contracts are settled with the counterparty in cash without the delivery of foreign currency. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on forward foreign currency contracts during the period is presented in the Statement of Operations.

Any open forward foreign currency contracts at period end are presented in the Schedule of Investments under the caption "Forward Foreign Currency Contracts." The contract amount and unrealized appreciation (depreciation) reflects each contract's exposure to the underlying currency at period end.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the bond market and fluctuations in interest rates.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

Options. Options give the purchaser the right, but not the obligation, to buy (call) or sell (put) an underlying security or financial instrument at an agreed exercise or strike price between or on certain dates. Options obligate the seller (writer) to buy (put) or sell (call) an underlying instrument at the exercise or strike price or cash settle an underlying derivative instrument if the holder exercises the option on or before the expiration date. The Fund uses OTC options, such as swaptions, which are options where the underlying instrument is a swap, to manage its exposure to potential credit events.

Upon entering into an options contract, a fund will pay or receive a premium. Premiums paid on purchased options are reflected as cost of investments and premiums received on written options are reflected as a liability on the Statement of Assets and Liabilities. Certain options may be purchased or written with premiums to be paid or received on a future date. Options are valued daily and any unrealized appreciation (depreciation) is reflected on the Statement of Assets and Liabilities. When an option is exercised, the cost or proceeds of the underlying instrument purchased or sold is adjusted by the amount of the premium. When an option is closed the Fund will realize a gain or loss depending on whether the proceeds or amount paid for the closing sale transaction is greater or less than the premium received or paid. When an option expires, gains and losses are realized to the extent of premiums received and paid, respectively. The net realized and unrealized gains (losses) on purchased options are included in the Statement of Operations in net realized gain (loss) and change in net unrealized appreciation (depreciation) on investment securities. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on written options are presented in the Statement of Operations.

Any open options at period end are presented in the Schedule of Investments under the captions "Purchased Options," "Purchased Swaptions," "Written Options" and "Written Swaptions," as applicable.

Writing puts and buying calls tend to increase exposure to the underlying instrument while buying puts and writing calls tend to decrease exposure to the underlying instrument. For purchased options, risk of loss is limited to the premium paid, and for written options, risk of loss is the change in value in excess of the premium received.

Swaps. A swap is a contract between two parties to exchange future cash flows at periodic intervals based on a notional principal amount. A bi-lateral OTC swap is a transaction between a fund and a dealer counterparty where cash flows are exchanged between the two parties for the life of the swap.

Bi-lateral OTC swaps are marked-to-market daily and changes in value are reflected in the Statement of Assets and Liabilities in the bi-lateral OTC swaps at value line items. Any upfront premiums paid or received upon entering a bi-lateral OTC swap to compensate for differences between stated terms of the swap and prevailing market conditions (e.g. credit spreads, interest rates or other factors) are recorded in net unrealized appreciation (depreciation) in the Statement of Assets and Liabilities and amortized to realized gain or (loss) ratably over the term of the swap. Any unamortized upfront premiums are presented in the Schedule of Investments.

Payments are exchanged at specified intervals, accrued daily commencing with the effective date of the contract and recorded as realized gain or (loss). Some swaps may be terminated prior to the effective date and realize a gain or loss upon termination. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on swaps during the period is presented in the Statement of Operations.

Any open swaps at period end are included in the Schedule of Investments under the caption "Swaps".

Credit Default Swaps. Credit default swaps enable the Fund to buy or sell protection against specified credit events on a single-name issuer or a traded credit index. Under the terms of a credit default swap the buyer of protection (buyer) receives credit protection in exchange for making periodic payments to the seller of protection (seller) based on a fixed percentage applied to a notional principal amount. In return for these payments, the seller will be required to make a payment upon the occurrence of one or more specified credit events. The Fund enters into credit default swaps as a seller to gain credit exposure to an issuer and/or as a buyer to obtain a measure of protection against defaults of an issuer. Periodic payments are made over the life of the contract by the buyer provided that no credit event occurs.

For credit default swaps on most corporate and sovereign issuers, credit events include bankruptcy, failure to pay or repudiation/moratorium. For credit default swaps on corporate or sovereign issuers, the obligation that may be put to the seller is not limited to the specific reference obligation described in the Schedule of Investments. For credit default swaps on asset-backed securities, a credit event may be triggered by events such as failure to pay principal, maturity extension, rating downgrade or write-down. For credit default swaps on asset-backed securities, the reference obligation described represents the security that may be put to the seller. For credit default swaps on a traded credit index, a specified credit event may affect all or individual underlying securities included in the index.

As a seller, if an underlying credit event occurs, the Fund will pay a net settlement amount of cash equal to the notional amount of the swap less the recovery value of the reference obligation or underlying securities comprising an index. Only in the event of the industry's inability to value the underlying asset will the Fund be required to take delivery of the reference obligation or underlying securities comprising an index and pay an amount equal to the notional amount of the swap.

As a buyer, if an underlying credit event occurs, the Fund will receive a net settlement amount of cash equal to the notional amount of the swap less the recovery value of the reference obligation or underlying securities comprising an index. Only in the event of the industry's inability to value the underlying asset will the Fund be required to deliver the reference obligation or underlying securities comprising an index in exchange for payment of an amount equal to the notional amount of the swap.

Typically, the value of each credit default swap and credit rating disclosed for each reference obligation in the Schedule of Investments, where the Fund is the seller, can be used as measures of the current payment/performance risk of the swap. As the value of the swap changes as a positive or negative percentage of the total notional amount, the payment/performance risk may decrease or increase, respectively. In addition to these measures, the investment adviser monitors a variety of factors including cash flow assumptions, market activity and market sentiment as part of its ongoing process of assessing payment/performance risk.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, U.S. government securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity International Credit Central Fund | 173,108,933 | 144,291,741 |

6. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. Fidelity Management & Research Company LLC (the investment adviser) provides the Fund with investment management services. The Fund does not pay any fees for these services. Pursuant to the Fund's management contract, the investment adviser receives a monthly management fee that represents a portion of the management fees it receives from the Investing Funds. In addition, under an expense contract, the investment adviser also pays all other expenses of the Fund, excluding custody fees, the compensation of the independent Directors, and certain miscellaneous expenses such as proxy and shareholder meeting expenses.

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

Other. During the period, the investment adviser reimbursed the Fund for certain losses as follows:

| | Amount ($) |

| Fidelity International Credit Central Fund | 1,709 |

7. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| Fidelity International Credit Central Fund | $– | $– | $– |

8. Expense Reductions.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses by $58.

9. Other.

Fund's organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.