UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2012

Commission File Number: 001-33655

| Paragon Shipping Inc. |

| (Translation of registrant's name into English) |

| |

| 15 Karamanli Ave., GR 166 73, Voula, Greece |

| (Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)7: ___

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

Attached as Exhibit 1.1 to this Report on Form 6-K is a copy of the Articles of Amendment to the Amended and Restated Articles of Incorporation of Paragon Shipping Inc. (the "Company") filed with the Registrar of Corporations of the Republic of the Marshall Islands to effect a one-for-ten reverse stock split of the Company's issued and outstanding common stock, par value $0.001 per share, on November 5, 2012 (the "Reverse Stock Split").

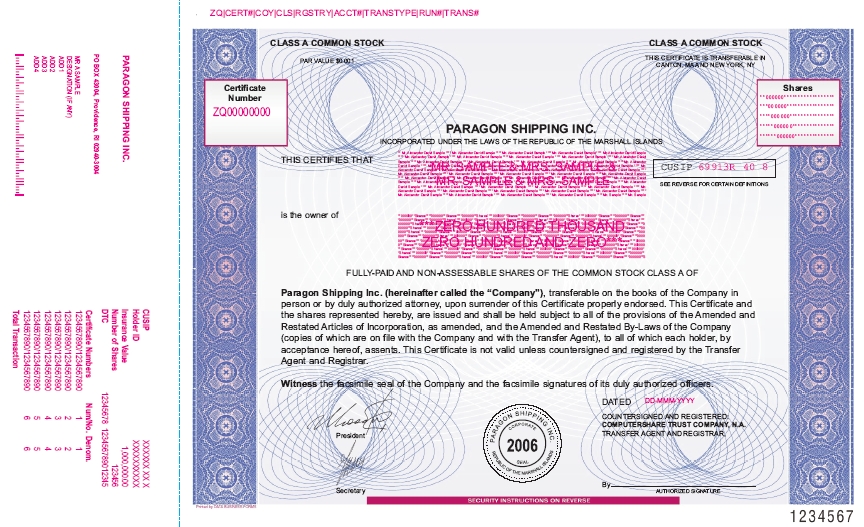

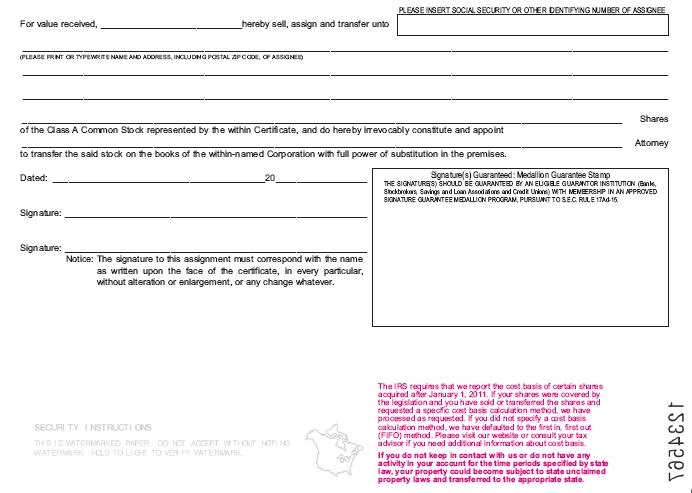

Attached as Exhibit 2.1 to this Report on Form 6-K is a copy of the new form of share certificate for the Company's post-Reverse Stock Split shares of common stock.

Attached as Exhibit 99.1 to this Report on Form 6-K is a copy of the press release issued by the Company on November 5, 2012 announcing the effectiveness of the Reverse Stock Split.

This Report on Form 6-K and the exhibits attached hereto are hereby incorporated by reference into the Company's Registration Statement on Form F-3 (Registration No. 333-164370) and prospectus supplement filed with the U.S. Securities and Exchange Commission on October 12, 2010.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Paragon Shipping Inc. | |

| | | |

| | | |

| Dated: November 6, 2012 | By: | /s/ Michael Bodouroglou | |

| | Name: | Michael Bodouroglou | |

| | Title: | Chief Executive Officer | |

Exhibit 1.1

ARTICLES OF AMENDMENT OF

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF

PARAGON SHIPPING INC.

PURSUANT TO SECTION 90 OF

THE MARSHALL ISLANDS BUSINESS CORPORATIONS ACT

I, Michael Bodouroglou, as the Chief Executive Officer of Paragon Shipping Inc., a corporation incorporated under the laws of the Republic of the Marshall Islands (the "Corporation"), for the purpose of amending the Amended and Restated Articles of Incorporation of said Corporation pursuant to Section 90 of the Business Corporations Act, as amended, hereby certify:

| | 1. | The name of the Corporation is: Paragon Shipping Inc. |

| | 2. | The Articles of Incorporation were filed with the Registrar of Corporations as of April 26, 2006, and were subsequently amended on October 26, 2006. |

| | 3. | The Articles of Incorporation, as amended, were amended and restated on November 20, 2006 and April 7, 2010. |

| | 4. | Article D of the Amended and Restated Articles of Incorporation is hereby amended by adding the following paragraph: |

"Reverse Stock Split. Effective as of the close of trading on the New York Stock Exchange on the first business day after date these Articles of Amendment are filed with the Registrar of Corporations of the Republic of the Marshall Islands (the "Effective Date"), the Corporation shall effect a one-for-ten reverse stock split as to its issued and outstanding common stock, par value $0.001 per share, pursuant to which each ten shares of the Corporation's common stock, par value $0.001 per share, issued and outstanding or held by the Corporation as treasury stock shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one share of common stock, par value $0.001 per share, of the Corporation. No fractional shares shall be issued and, in lieu thereof, holders of the Corporation's common stock, par value $0.001 per share, shall receive a cash payment in an amount equal to the fraction to which the holder would otherwise be entitled multiplied by the closing price of the Corporation's common stock on the New York Stock Exchange on the last trading day prior to the Effective Date, as adjusted for the reverse stock split as appropriate or, if such price is not available, a price determined by the Corporation's Board of Directors. As a result of the reverse stock split, the number of issued and outstanding shares of the Corporation's common stock, par value $0.001 per share, shall decrease from 60,994,464 shares to 6,099,446 shares, as adjusted for the cancellation of fractional shares. The reverse stock split shall not change the number of registered shares of common stock, par value $0.001 per share, the Company is authorized to issue or the par value of the common stock. The stated capital of the Company shall be reduced from $60,994.47 to $6,099.45, as adjusted for the cancellation of the fractional shares and the amount of $54,895.02, as adjusted for the cancellation of fractional shares, shall be allocated to surplus."

| | 4. | All of the other provisions of the Amended and Restated Articles of Incorporation shall remain unchanged. |

| | 5. | This amendment to the Amended and Restated Articles of Incorporation was authorized by vote of the holders of a majority of all outstanding shares of the Corporation with a right to vote thereon at the annual general meeting of shareholders of the Corporation held on October 24, 2012. |

IN WITNESS WHEREOF, I have executed this Amendment to the Amended and Restated Articles of Incorporation on this 2nd day of November, 2012.

| | /s/ Michael Bodouroglou |

| | Name: Michael Bodouroglou |

| | Title: Chief Executive Officer |

Exhibit 2.1

Exhibit 99.1

PARAGON SHIPPING ANNOUNCES EFFECTIVENESS OF

ONE-FOR-TEN REVERSE STOCK SPLIT

ATHENS, Greece (November 5, 2012) - Paragon Shipping Inc. (NYSE: PRGN) ("Paragon Shipping" or the "Company"), today announced that the previously announced one-for-ten reverse stock split of the Company's issued and outstanding shares of common stock, par value $0.001 per share (the "Common Stock"), became effective after the close of trading today. The Company's Common Stock will commence trading on a split-adjusted basis on the New York Stock Exchange ("NYSE") upon the open of trading on November 6, 2012. The Common Stock will continue trading on the NYSE under the symbol "PRGN" but will trade under a new CUSIP number, 69913R 408.

The reverse stock split was previously approved by the Company's board of directors and by shareholders at the 2012 Annual General Meeting of Shareholders held on October 24, 2012.

Upon effectiveness of the reverse stock split, each ten (10) shares of the Company's issued and outstanding Common Stock was automatically and without any action on the part of the respective holders thereof combined and converted into one (1) issued and outstanding share of Common Stock. This reduced the number of issued and outstanding shares of the Company's Common Stock from approximately 61.0 million to approximately 6.1 million. The reverse stock split affected all issued and outstanding shares of the Company's Common Stock, as well as Common Stock underlying stock options outstanding immediately prior to the effectiveness of the reverse stock split. The number of authorized shares of the Company's Common Stock was not affected by the reverse split.

No fractional shares were issued in connection with the reverse stock split. Shareholders who would have otherwise held a fractional share of the Company's Common Stock as a result of the reverse stock split will receive a cash payment in lieu of such fractional share.

Shareholders holding physical share certificates will receive instructions from the Company's exchange agent, Computershare Trust Company, N.A., regarding the process for exchanging their shares. Shareholders with shares held in book-entry form or through a bank, broker, or other nominee are not required to take any action and will see the impact of the reverse stock split reflected in their accounts after November 5, 2012. Beneficial holders may contact their bank, broker, or nominee for more information.

About Paragon Shipping Inc.

Paragon Shipping is a Marshall Islands-based international shipping company with executive offices in Athens, Greece, specializing in the transportation of drybulk cargoes. The Company's current fleet consists of twelve drybulk vessels with a total carrying capacity of 779,270 dwt. In addition, the Company's current newbuilding program consists of two Handysize drybulk carriers and two 4,800 TEU Containerships. Paragon Shipping has granted Box Ships Inc., an affiliated company, the option to acquire its two Containerships under construction. For more information, visit: www.paragonship.com (the information contained on the Company's website does not constitute part of this press release).

Forward-Looking Statements

Certain statements in this press release are "forward-looking statements" within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are based on our current expectations and beliefs and are subject to a number of risk factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Such risks and uncertainties include without limitation the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand for drybulk shipping capacity, changes in our operating expenses, including bunker prices, drydocking and insurance costs, the market for our vessels, availability of financing and refinancing, charter counterparty performance, ability to obtain financing and comply with covenants in such financing arrangements, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires and other factors, as well as other risks that have been included in filings with the Securities and Exchange Commission, all of which are available at www.sec.gov.

Contacts

Paragon Shipping Inc.

info@paragonship.com

Allen & Caron Inc.

Rudy Barrio

r.barrio@allencaron.com

(212) 691-8087

Len Hall (Media)

len@allencaron.com

(949) 474-4300