As filed with the Securities and Exchange Commission on April 18, 2013

Registration No. 333-________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of Registrant as specified in its charter)

_________________________________

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________________________

Paragon Shipping Inc.

(Exact name of Registrant as specified in its charter)

Republic of The Marshall Islands (State or other jurisdiction of incorporation or organization) | 4412 (Primary Standard Industrial Classification Code Number) | N/A (I.R.S. Employer Identification No.) |

Paragon Shipping, Inc. 15, Karamanli Avenue Voula, 16673 Athens, Greece (011) (30) (210) 8914 600 (Address and telephone number of Registrant's principal executive offices) | Seward & Kissel LLP Attention: Gary J. Wolfe, Esq. One Battery Park Plaza New York, New York 10004 (212) 574-1223 (Name, address and telephone number of agent for service) |

_________________________________

Copies to:

Gary J. Wolfe, Esq. Edward S. Horton, Esq. Seward & Kissel LLP One Battery Park Plaza New York, New York 10004 (212) 574-1223 (telephone number) (212) 480-8421 (facsimile number) _________________________________ |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

_________________________________

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) |

| Class A Common Shares, $0.001 par value per share | $7,440,000 | $1,015 |

Preferred Share Purchase Rights(3) | - | - |

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the "Securities Act"). |

| (2) | Includes common shares, if any, that may be sold pursuant to the underwriters' over-allotment option. |

| (3) | Pursuant to Rule 457(p) under the Securities Act, an aggregate of $1,015 of the registration fee paid hereunder is offset by the registration fee previously paid by the Registrant to register securities unsold under the Registrant's Registration Statement on Form F-1 (File No. 333-185467) filed with the Securities and Exchange Commission on December 13, 2012. |

| (3) | Preferred share purchase rights are not currently separable from the Class A common shares and are not currently exercisable. The value attributable to the preferred share purchase rights, if any, will be reflected in the market price of the Class A common shares. |

| _________________________________ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell the securities described in this document until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 18, 2013

PRELIMINARY PROSPECTUS

2,000,000 Common Shares

Paragon Shipping Inc.

We are offering 2,000,000 of our Class A common shares, or the common shares, in this offering. Each common share sold in this offering includes a preferred share purchase right that trades with the common shares.

As of the date of this prospectus, our common shares traded on the New York Stock Exchange under the symbol "PRGN." Effective as of the open of trading on April 19, 2013, our common shares are expected to cease trading on the New York Stock Exchange and commence trading on the Nasdaq Global Market under the symbol "PRGN." On April 17, 2013, the last reported sale price of our common shares on the New York Stock Exchange was $3.76 per share.

Investing in our common shares involves risks. See "Risk Factors" beginning on page 10 of this prospectus and in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012, filed on April 3, 2013, and incorporated by reference herein.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

We have granted the underwriters an option to purchase up to additional common shares at the public offering price less underwriting discounts and commissions to cover over-allotments.

The underwriters expect to deliver the shares on or about , 2013.

________________________

________________________

The date of this prospectus is , 2013.

TABLE OF CONTENTS

| 1 | |

| RISK FACTORS | 10 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 14 |

| USE OF PROCEEDS | 15 |

| CAPITALIZATION | 16 |

| SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA | 18 |

| PRICE RANGE OF OUR COMMON SHARES | 20 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 21 |

| CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS | 22 |

| THE DRYBULK SHIPPING INDUSTRY | 28 |

| DESCRIPTION OF CAPITAL STOCK | 47 |

| SHARES ELIGIBLE FOR FUTURE SALE | 54 |

| REPUBLIC OF THE MARSHALL ISLANDS COMPANY CONSIDERATIONS | 56 |

| UNDERWRITING | 60 |

| OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION | 63 |

| ENFORCEABILITY OF CIVIL LIABILITIES | 64 |

| LEGAL MATTERS | 65 |

| EXPERTS | 65 |

| WHERE YOU CAN FIND MORE INFORMATION | 65 |

| DOCUMENTS INCORPORATED BY REFERENCE | 66 |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with additional or different information. If any person provides you with different or inconsistent information, you should not rely upon it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date. Information contained on our website, www.paragonship.com, does not constitute part of this prospectus.

PROSPECTUS SUMMARY

This section summarizes some of the information that is contained in or incorporated by reference in this prospectus. As an investor or prospective investor, you should review carefully the more detailed information that appears later in this prospectus and the information incorporated by reference in this prospectus, including the section entitled "Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2012, which was filed with the Securities and Exchange Commission, or the SEC, on April 3, 2013.

Unless expressly stated otherwise, all references in this prospectus to "we," "us," "our," the "Company" or similar references mean Paragon Shipping Inc. and its subsidiaries. In addition, we use the term deadweight, or dwt, in describing the size of vessels. Dwt expressed in metric tons, each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry.

Our Company

We are a global provider of shipping transportation services. We specialize in transporting drybulk cargoes, including such commodities as iron ore, coal, grain and other materials, along worldwide shipping routes.

As of the date of this prospectus, our operating fleet consists of eight Panamax drybulk carriers, two Supramax drybulk carriers and three Handysize drybulk carriers with an aggregate capacity of approximately 816,472 dwt and an average age of 7.2 years.

Prior to April 2011, we owned and operated three containerships. In the second quarter of 2011, we sold to Box Ships Inc., or Box Ships, our wholly-owned subsidiary at the time, our three containerships. Box Ships completed its initial public offering in April 2011, and we continue to own 3,437,500 common shares of Box Ships, which, as of the date of this prospectus, represented approximately 13.8% of the issued and outstanding common shares of Box Ships.

In addition, we have agreed to acquire one Handysize newbuilding drybulk carrier that we expect to take delivery of in the fourth quarter of 2013 and two 4,800 TEU newbuilding containerships, which we expect to be delivered in the second quarter of 2014. We have granted Box Ships the option to acquire our newbuilding containerships by way of a novation of the relevant construction contract from us at any time prior to the applicable vessel's delivery to us or purchase of such vessel at any time after its delivery to us, so long as the vessel is owned by us at such time.

Allseas Marine S.A., or Allseas, provides commercial and technical management services for our fleet, pursuant to long-term management agreements between Allseas and each of our vessel-owning subsidiaries. Technical management services include, among other things, arranging for and managing crews, vessel maintenance, drydocking, repairs, insurance, maintaining regulatory and classification society compliance and providing technical support. Commercial management services include, among other things, negotiating charters for our vessels, monitoring various types of charters, monitoring the performance of our vessels, locating, purchasing, financing and negotiating the purchase and sale of our vessels, obtaining insurance for our vessels and finance and accounting functions. In addition, we have entered in to an accounting agreement with Allseas, pursuant to which Allseas provides us with financial accounting and financial reporting services.

Allseas also provides commercial and technical management services for Box Ships' fleet, as well as financial accounting and financial reporting services for Box Ships.

Allseas, a Liberian corporation based in Athens, Greece, was formed in 2000 as a ship management company and is wholly-owned by our Chairman, President and Chief Executive Officer, Mr. Michael Bodouroglou. We believe that Allseas has established a reputation in the international shipping industry for operating and maintaining a fleet with high standards of performance, reliability and safety.

Our Fleet

The following table presents certain information concerning our fleet as of the date of this prospectus:

1

Operating Drybulk fleet

Vessel Name and Type | DWT | Year Built | Charter Type | Charterer Name | Gross Daily Charter Rate (1) | Re-delivery from Charterer (2) | |

Earliest | Latest | ||||||

| Panamax | |||||||

Dream Seas | 75,151 | 2009 | Period | Intermare Transport GmbH | $20,000 | May 2013 | Aug. 2013 |

Coral Seas (3) | 74,477 | 2006 | Period | Morgan Stanley Capital Group Inc. | $12,000 | Dec. 2013 | Mar. 2014 |

Golden Seas (4) | 74,475 | 2006 | Period | Mansel Ltd. | $12,250 | Sept. 2013 | Dec. 2013 |

Pearl Seas | 74,483 | 2006 | Period | Cargill International S.A. | $12,125 | Sept. 2013 | Jan. 2014 |

Diamond Seas | 74,274 | 2001 | Period | DS Norden A/S | $ 8,750 | Apr. 2013 | Apr. 2013 |

Deep Seas (5) | 72,891 | 1999 | Period | Morgan Stanley Capital Group Inc. | $11,000 | July 2014 | Oct. 2014 |

Calm Seas | 74,047 | 1999 | Period | Intermare Transport GmbH | $11,800 | Oct. 2013 | Mar. 2014 |

Kind Seas | 72,493 | 1999 | Period | Torm A/S | $ 8,500 | Apr. 2013 | May 2013 |

| Total Panamax | 592,291 | ||||||

| Supramax | |||||||

Friendly Seas | 58,779 | 2008 | Period | Western Bulk Carriers A/S | $10,700 | Aug. 2013 | Feb. 2014 |

Sapphire Seas | 53,702 | 2005 | Period | Nordic Bulk Carriers A/S | $11,100 | May 2013 | May 2013 |

| Total Supramax | 112,481 | ||||||

| Handysize | |||||||

Prosperous Seas (6) | 37,293 | 2012 | Period | Cargill International S.A. | $12,125 | Mar. 2014 | July 2014 |

Precious Seas (6) | 37,205 | 2012 | Period | Cargill International S.A. | $12,125 | May 2014 | Sept. 2014 |

Priceless Seas | 37,202 | 2013 | Spot | Trafigura | - | May 2013 | May 2013 |

| Total Handysize | 111,700 | ||||||

| Total | 816,472 | ||||||

| (1) | Daily charter hire rates in this table do not reflect commissions, which are payable by us to third party chartering brokers and Allseas, ranging from 1.25% to 6.25%, including the 1.25% to Allseas. |

| (2) | The date range provided represents the earliest and latest date on which the charterer may redeliver the vessel to us upon expiration of the charter. |

| (3) | The charterers have an option to extend the term of the charter for an additional 11 to 13 months at a gross daily rate of $14,500. |

| (4) | The charterers have the option to extend the term of the charter for an additional 11 to 13 months at a gross daily rate of $13,000, plus 50% profit sharing with the charterers based on the Baltic Panamax Average Time Charter Routes, less 2.0%. |

| (5) | In addition to the gross daily rate of $11,000, the charter provides for 50% profit sharing with the charterers based on the Baltic Panamax Average Time Charter Routes, less 8.75%. The charterers also have the option to extend the term of the charter for an additional 11 to 13 months at a gross daily rate of $14,000. |

| (6) | The charterers have the option to extend the term of the charter for an additional 11 to 14 months at a gross daily rate of $15,500. |

2

Handysize Drybulk Newbuildings we have agreed to acquire

| Vessel Name | DWT | Shipyard | Expected Shipyard Delivery |

Hull no. 625 | 37,200 | Zhejiang Ouhua Shipbuilding | Q4 2013 |

| Total | 37,200 |

Containership Newbuildings we have agreed to acquire

| Vessel Name | TEU | Shipyard | Expected Shipyard Delivery |

Hull no. 656 (1) | 4,800 | Zhejiang Ouhua Shipbuilding | Q2 2014 |

Hull no. 657 (1) | 4,800 | Zhejiang Ouhua Shipbuilding | Q2 2014 |

| Total | 9,600 |

____________

(1) We have granted Box Ships the option to acquire this containership by way of a novation of the construction contract from us at any time prior to the vessel's delivery to us, or purchase of the vessel at any time after its delivery to us, so long as the vessel is owned by us at such time. In addition, we have granted Box Ships a right of first offer on any proposed sale, transfer or other disposition of the vessel.

Our Competitive Strengths

We believe that we possess a number of competitive strengths in our industry, including:

Modern and diversified fleet. We operate a modern and diversified fleet of drybulk carriers, which currently consists of eight Panamax drybulk carriers, two Supramax drybulk carriers and three Handysize drybulk carriers. Our fleet had an average age of 7.2 years as of the date of this prospectus, compared to an average age of the worldwide drybulk carrier fleet of approximately 9.8 years as of the same date. We believe that owning a modern, well-maintained fleet reduces operating costs, improves safety and provides us with a competitive advantage in securing favorable time charter and spot employment. Furthermore, a diversified drybulk carrier fleet enables us to serve our customers in both major and minor bulk trades.

Combined fleet employment. Most of our vessels are currently employed on short to medium term fixed rate time charters with an average remaining duration of four months, assuming no exercise of any options to extend the durations of the charters, with expirations ranging from April 2013 to November 2015, including the exercise of applicable extension options. In addition, as of the date of this prospectus, we employed one of our vessels on a short-term voyage charter. Depending on market conditions, we may decide to employ more of our vessels on short-term voyage charters, which generally last for periods of ten days to four months, to be in a position to take advantage of any strengthening of the spot market. Drybulk carriers operating in the spot market may generate increased or decreased profit margins during periods of improvement or deterioration in freight (or charter) rates, while drybulk carriers operating on fixed employment contracts, which can last up to several years, provide more predictable cash flows. We believe that this employment strategy allows us to opportunistically pursue market conditions and take advantage of potential future improvements in the drybulk charter market.

Strong customer relationships with reputable charterers. Our management team and Allseas have established relationships with leading charterers and a number of chartering, sales and purchase brokerage houses around the world. Allseas and its affiliates have maintained relationships with major national and private industrial users, commodity producers and traders, including Cargill International, Glencore International, Intermare Transport, and Morgan Stanley Capital Group, which have repeatedly chartered vessels managed by Allseas. We intend to continue to adhere to the highest standards with regards to reliability, safety and operational excellence.

3

Experienced management team. Our Chairman, President and Chief Executive Officer has more than 35 years of experience in the shipping industry, and our Chief Financial Officer has over 19 years of shipping and finance experience. Our Chief Operating Officer has 25 years of shipping experience and has been working with our Chief Executive Officer for the last 17 years. The members of our management team have developed strong industry relationships with leading charterers, shipbuilders, insurance underwriters, protection and indemnity associations and financial institutions.

Experienced and dependable fleet manager. We believe Allseas has established its reputation as an experienced and dependable vessel operator without compromising on safety, maintenance and operating performance. No vessels managed by Allseas have suffered a total loss, constructive total loss or caused any material environmental damage. Our Chairman, President and Chief Executive Officer and the sole shareholder of Allseas, Mr. Michael Bodouroglou, since owning Allseas and its predecessor company, has managed more than 50 vessels since the companies' inception and has assembled a management team of senior executive officers and key employees with decades of experience in all aspects of vessel operations and maintenance.

Our Business Strategy

Our strategy is to continue to invest in the drybulk carrier industry, to generate stable cash flows through time charters and to grow through timely and selective acquisitions. As part of our strategy, we intend to:

Focus on all segments of the drybulk carrier sector. As of the date of this prospectus, our fleet consisted of eight Panamax drybulk carriers, two Supramax drybulk carriers and three Handysize drybulk carriers with an aggregate capacity of approximately 816,472 dwt and an average age of 7.2 years. We plan to continue to develop a diversified fleet of drybulk carriers in various size categories, including Capesize, Panamax, Supramax and Handysize. Larger drybulk carriers, such as Capesize and Panamax vessels, have historically experienced a greater degree of freight rate volatility, while smaller drybulk carriers, such as Supramax and Handysize vessels, have historically experienced greater charter rate stability. Furthermore, we believe a diversified drybulk carrier fleet will enable us to serve our customers in both major and minor bulk trades, and to gain a worldwide presence in the drybulk carrier market by assembling a fleet capable of servicing virtually all major ports and routes used for the seaborne transportation of key commodities and raw materials. Our vessels are able to trade worldwide in a multitude of trade routes carrying a wide range of cargoes for a number of industries.

Pursue an appropriate balance of time and spot charters. Most of our vessels are currently employed on fixed rate time charters with an average remaining duration of four months, assuming no exercise of any options to extend the durations of the charters, with expirations ranging from April 2013 to November 2015, including the exercise of applicable extension options. In addition, as of the date of this prospectus, we employed one of our vessels on a short-term voyage charter. Historically, we have employed our vessels primarily under one and two year time charters that we believe provide us with a stable cash flow base and high utilization rates, while limiting our exposure to charter rate volatility. We believe factors governing the supply of and demand of drybulk carriers may cause charter rates for drybulk carriers to strengthen in the near term, thereby providing us opportunities to renew our time charters or enter into new time charters at similar or higher rates following the expiration of their respective terms. When our vessels are not employed on time charters, our management team plans to balance the mix of time charters and spot charters in order to permit us to opportunistically pursue market conditions while allowing us to maintain stable cash flows.

Grow through timely and selective newbuilding and secondhand vessel acquisitions. We intend to further grow our fleet in addition to the one newbuilding Handysize drybulk carrier and two newbuilding containerships we have agreed to purchase through timely and selective acquisitions of newbuilding and secondhand drybulk carriers. We believe new developments in vessel design and construction, "Eco Design," and the historically low newbuilding and secondhand prices present opportunities for timely and selective growth. We will seek to identify potential vessel acquisition candidates among various size categories of drybulk carriers.

4

Limit amount of indebtedness to moderate levels. We intend to limit the amount of indebtedness that we have outstanding at any time to relatively moderate levels. We expect to draw our available borrowing capacity amounting to $33.8 million as of the date of this prospectus, provided we meet the conditions precedent, as well as enter into additional commercial bank loans if necessary and use cash generated from operating activities, to finance the completion of our newbuilding program and future vessel acquisitions. We intend to repay our acquisition-related debt from time to time with the net proceeds of future equity issuances in order to retain financial flexibility.

Continue to operate a modern, high-quality fleet. We intend to maintain a modern, high quality fleet through our technical and commercial manager's rigorous and comprehensive maintenance and inspection program. In addition, we intend to limit our acquisitions to vessels that meet these rigorous industry standards and certification requirements.

Industry Overview

Recent Trends in the Drybulk Sector

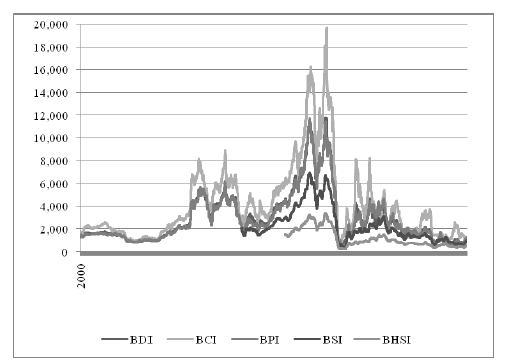

Drybulk carriers represent the most efficient and often the only means of transporting large volumes of basic commodities over long distances. In 2012 seaborne drybulk cargo trade was 3.46 billion tons and it accounted for approximately 36% of total seaborne trade. Between 2000 and 2012, seaborne dry cargo trade grew at a compound annual growth rate, or CAGR, of 4.0%, making it one of the fastest growing trade sectors of international shipping.

Drybulk Trade Development: 2000 to 2012

(Million Tons)

Source: Drewry

Large and consistent increases in seaborne drybulk trade have been seen in the last decade as a result of Chinese demand for imported basis raw materials, especially iron ore. Although the growth in trade was stalled in 2009 due to the downturn in the global economy, it has since returned to most drybulk commodities. In 2012 seaborne drybulk trade increased by 6% over 2011 levels.

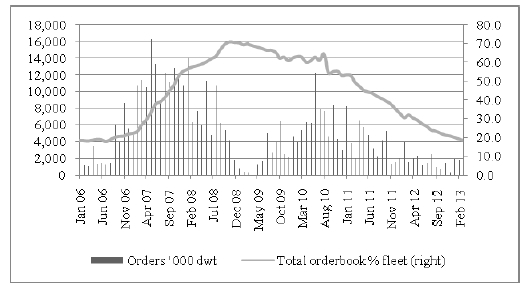

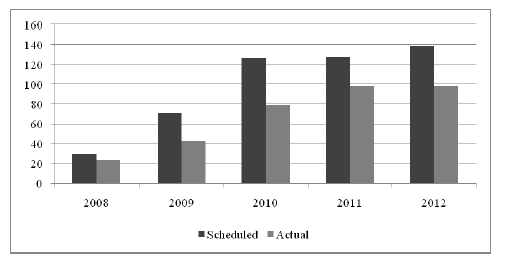

The growth in trade and ship demand has prompted a rapid expansion of the drybulk fleet and since 2008, supply has grown faster than demand, which in turn has led to weakness in freight rates and vessel values. At its peak in 2008, the drybulk orderbook for new vessels was close to 70% of the capacity of the existing fleet at that time. However, a weak freight market and lack of finance has led to a sharp reduction in the number of new orders placed and in March 2013, the drybulk orderbook had fallen to just 18% of the existing fleet. According to Drewry Shipping Consultants Ltd, or Drewry, this is important, as it points to supply growth moderating in the future. For the moment, freight rates and secondhand values remain at low levels, but Drewry expects that conditions are being laid for a recovery in the market.

5

Drybulk Orders and Drybulk Orderbook as % Existing Fleet

Source: Drewry

Recent Developments

Debt Restructuring

Due to the intense fluctuation in the drybulk charter market and related fluctuation in vessel values, we were not in compliance with several financial and security coverage ratio covenants contained in our loan and credit facilities during 2012, and as such, we have deposited additional security to cure the shortfall in the security cover required to be maintained under the relevant facilities, obtained waivers of the relevant covenant breaches, entered into amendments to or refinanced the affected debt, as discussed below.

In 2012, we entered into supplemental agreements and, subject to certain conditions, agreed to amended terms with (i) Unicredit Bank AG in respect of our loan agreement dated November 19, 2007, (ii) the Bank of Scotland plc in respect of our loan agreement dated December 4, 2007, (iii) The Governor and Company of the Bank of Ireland, or the Bank of Ireland, in respect of our loan agreement dated March 30, 2009, and (iv) HSBC Bank Plc in respect of our loan agreement dated July 2, 2010. Pursuant to these agreements, we obtained waivers of certain financial and security cover ratio covenant breaches and agreed to the relaxation of several financial and security coverage ratio covenants, the deferral of a portion of our scheduled quarterly installments and, in the case of the loan agreements with the Bank of Ireland and the Bank of Scotland, the extension of the loan agreements to the second quarter of 2017 and to the third quarter of 2015, respectively. In addition, in respect to the loan agreement with the Bank of Scotland, we agreed to a payment of $2.8 million in order to facilitate the full and final settlement of the portion of the loan of one of the syndicate members equal to $4.7 million. We refer to the amendments described above collectively as our debt restructuring program.

Several of the agreements in our debt restructuring program were subject to a number of conditions, including (i) the entry into definitive documentation, (ii) an equity increase of $10.0 million within 90 days after the signing of such definitive documentation and (iii) all lenders agreeing to similar restructuring terms and granting similar waivers of covenant breaches and terms.

Subsequent to December 31, 2012, we finalized the definitive documentation with the remaining of our lenders, Commerzbank AG, HSH Nordbank AG and Nordea Bank Finland Plc, relating to our debt restructuring program. In addition, we received the additional $10.0 million in equity required to finalize our debt restructuring program through the issuance of 4,901,961 common shares to Innovation Holdings S.A., or Innovation Holdings, a company controlled by our Chairman, President and Chief Executive Officer, in a private placement that closed on December 24, 2012.

Accordingly, subsequent to December 31, 2012, all conditions required to complete our debt restructuring program were satisfied with retroactive effect as of December 31, 2012 and thus, our debt restructuring program is finalized and effective from December 31, 2012.

6

Following the finalization of our debt restructuring program and after giving effect to the respective supplemental and restating agreements, we regained compliance with all covenants with respect to our loan and credit facilities.

For further information relating to our loan and credit facilities, please see Note 9 to our consolidated financial statements included in our Annual Report for the year ended December 31, 2012, filed with the SEC on April 3, 2013 and incorporated by reference herein.

Loan to Affiliate

On March 11, 2013, we agreed to amend the terms of our loan agreement with Box Ships relating to an unsecured loan of up to $30.0 million that we agreed to provide to Box Ships in May 2011 for the purpose of partly financing the acquisition of Box Ships' initial fleet and for general corporate purposes, of which $13.0 million was outstanding as of the date of this prospectus. Under the terms of the amended agreement, the maturity of the loan has been extended from April 19, 2013 to April 19, 2014 and during the remaining term of the loan, Box Ships is required to make quarterly principal installment payments in the amount of $1.0 million each, commencing on April 19, 2013, with a final balloon payment of $9.0 million due on the maturity date. In consideration of the amendment of the loan agreement, Box Ships agreed to pay an amendment fee of $65,000 and to increase the margin from 4.0% to 5.0%.

Transfer to Nasdaq Global Market

Effective April 19, 2013, our common shares are expected to cease trading on the New York Stock Exchange and commence trading on the Nasdaq Global Market under the symbol "PRGN." We are voluntarily transferring the listing of our common shares to the Nasdaq Global Market, as we believe this action will help us achieve greater long-term flexibility and cost efficiency.

Corporate Structure

We were incorporated under the laws of the Republic of the Marshall Islands on April 26, 2006. Our executive offices are located at 15 Karamanli Ave, GR 166 73, Voula, Greece. Our telephone number at that address is +30 210 891 4600. We also maintain a website at www.paragonship.com. Information contained on our website does not constitute part of this prospectus.

We own our vessels through separate wholly-owned subsidiaries that are incorporated in Liberia or the Republic of the Marshall Islands.

Risk Factors

We face a number of risks associated with our business and industry and must overcome a variety of challenges to utilize our strengths and implement our business strategy. These risks include, among others, changes in the drybulk shipping market, including supply and demand, charter hire and utilization rates, and commodity prices; increased costs of compliance with regulations affecting the drybulk shipping industry; a downturn in the global economy; hazards inherent in the drybulk shipping industry and marine operations resulting in liability for personal injury or loss of life, damage to or destruction of property and equipment, pollution or environmental damage; inability to comply with loan covenants; inability to finance newbuilding and other capital projects; and inability to successfully employ our vessels.

This is not a comprehensive list of risks to which we are subject, and you should carefully consider all the information in this prospectus and the documents incorporated by reference herein in connection with your ownership of our common shares. In particular, we urge you to carefully consider the risk factors set forth in the section of this prospectus entitled "Risk Factors" beginning on page 10 and under the heading "Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2012, filed on April 3, 2013.

7

The Offering

| Common shares offered by us | 2,000,000 common shares. |

| Common shares to be outstanding immediately after this offering, assuming no exercise of the underwriters' overallotment option(1) | 13,361,442 common shares. |

| Over-allotment option | We have granted the underwriters a 30-day option to purchase up to an additional 300,000 common shares at the public offering price less underwriting discounts and commissions to cover any over-allotments. |

| Use of Proceeds | Based on the last reported sale price of our common shares, on the Nasdaq Global Market, on , 2013, of $ per share, we expect that the net proceeds of this offering to us, after deducting discounts and commissions payable to the underwriters and other expenses related to the offering payable by us, will be approximately $ million (or approximately $ million if the underwriters exercise their over-allotment option in full). We intend to use the net proceeds to us of this offering for general corporate purposes, including newbuilding and secondhand vessel acquisitions. Please read "Use of Proceeds." |

| Preferred share purchase rights | We entered into a Stockholders Rights Agreement, dated as of January 4, 2008, as amended, or the Rights Agreement, with Computershare Trust Company, N.A., as Rights Agent. Pursuant to this Rights Agreement, each of our common shares includes one right, or right, that entitles the holder to purchase from us a unit consisting of one one-thousandth of a preferred share at a purchase price of $75.00 per unit, subject to specified adjustments. Until a right is exercised, the holder of a right will have no rights to vote or receive dividends or any other stockholder rights. |

| Listing | As of the date of this prospectus, our common shares traded on the New York Stock Exchange under the symbol "PRGN." Effective with the open of trading on April 19, 2013, our common shares are expected to cease trading on the New York Stock Exchange and commence trading on the Nasdaq Global Market under the symbol "PRGN." |

| Risk Factors | Investing in our common shares involves substantial risk. You should carefully consider all the information in this prospectus prior to investing in our common shares. In particular, we urge you to consider carefully the factors set forth in the section of this prospectus entitled "Risk Factors" beginning on page 10 and under the heading "Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2012, filed with the SEC on April 3, 2013. |

______________

(1) Includes 40,000 common shares to be issued to Loretto under the agreement we have entered into with Allseas and Loretto Finance Inc., or Loretto, a wholly owned subsidiary of Allseas and a Marshall Islands corporation that is controlled by Mr. Bodouroglou and members of his family, pursuant to which we have agreed, among other things, to issue to Loretto, at no cost to Loretto, additional common shares equal to 2.0% of the total number of common shares we issue pursuant to any equity offerings we make.

8

Summary Financial Information

The following tables set forth our summary consolidated financial data and other operating data, which are stated in U.S. dollars, other than share data, as of and for the years ended December 31, 2008, 2009, 2010, 2011 and 2012. The summary data is derived from our audited consolidated financial statements and notes thereto, which have been prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP.

Our audited consolidated statements of operations, shareholders' equity and cash flows for the years ended December 31, 2010, 2011 and 2012, and the consolidated balance sheets at December 31, 2011 and 2012, together with the notes thereto, are included in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012, filed with the SEC on April 3, 2013 and incorporated by reference herein. The following data should be read in conjunction with "Item 5. Operating and Financial Review and Prospects," the consolidated financial statements, related notes and other financial information included elsewhere in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012.

Following the 10-for-1 reverse stock split effectuated on November 5, 2012, pursuant to which every ten shares of our common stock issued and outstanding were converted into one share of common stock, all share and per share amounts disclosed in the tables below and in our consolidated financial statements included in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012 have been retroactively restated to reflect this change in capital structure.

| Year ended December 31, | ||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| INCOME STATEMENT DATA | ||||||||||||||||||||

(Expressed in United States Dollars, except for share data) | ||||||||||||||||||||

| Net revenue | $ | 161,137,646 | $ | 152,747,121 | $ | 111,700,109 | $ | 86,907,967 | $ | 50,300,679 | ||||||||||

| Operating income / (loss) | 94,682,596 | 79,268,499 | 34,121,346 | (275,225,740 | ) | 2,293,932 | ||||||||||||||

| Net income / (loss) available to Class A common shares | 69,229,461 | 65,678,614 | 22,895,280 | (283,498,759 | ) | (17,557,125 | ) | |||||||||||||

| Earnings / (loss) per Class A common share, diluted | $ | 25.60 | $ | 16.94 | $ | 4.43 | $ | (47.61 | ) | $ | (2.84 | ) | ||||||||

| Weighted average number of Class A common shares, diluted | 2,701,001 | 3,802,652 | 4,981,272 | 5,793,792 | 6,035,910 | |||||||||||||||

| Dividends declared per Class A common share | $ | 18.75 | $ | 2.00 | $ | 2.00 | $ | 0.50 | — | |||||||||||

Year ended December 31, | ||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| OTHER FINANCIAL DATA | ||||||||||||||||||||

| (Expressed in United States Dollars) | ||||||||||||||||||||

| Net cash from operating activities | $ | 83,474,314 | $ | 80,406,754 | $ | 60,613,801 | $ | 45,467,429 | $ | 13,376,809 | ||||||||||

| Net cash (used in) / from investing activities | (78,072,478 | ) | (40,500,000 | ) | (142,151,113 | ) | 43,673,793 | (15,702,244 | ) | |||||||||||

| Net cash from / (used in) financing activities | 31,711,279 | 25,611,672 | (17,634,931 | ) | (109,365,640 | ) | 5,438,803 | |||||||||||||

| As of December 31, | ||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| BALANCE SHEET DATA | ||||||||||||||||||||

| (Expressed in United States Dollars) | ||||||||||||||||||||

| Total current assets | $ | 72,274,712 | $ | 190,049,436 | $ | 55,503,278 | $ | 37,457,564 | $ | 31,333,204 | ||||||||||

| Total assets | 742,421,254 | 812,692,848 | 821,276,010 | 432,073,937 | 419,974,902 | |||||||||||||||

| Total current liabilities | 69,219,899 | 78,990,340 | 45,212,355 | 40,486,845 | 21,971,886 | |||||||||||||||

| Long-term debt | 334,335,000 | 270,235,000 | 282,757,012 | 169,096,000 | 181,114,926 | |||||||||||||||

| Total liabilities | 433,989,975 | 356,427,030 | 330,804,343 | 210,849,790 | 204,454,389 | |||||||||||||||

| Total shareholders' equity / net assets | $ | 308,431,279 | $ | 456,265,818 | S | 490,471,667 | $ | 221,224,147 | $ | 215,520,513 | ||||||||||

9

RISK FACTORS

An investment in our common shares involves risks and uncertainties. You should carefully consider the risks described below and discussed under the caption "Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2012, filed with the SEC on April 3, 2013 and incorporated by reference herein, as well as the other information included in this prospectus before deciding to invest in our common shares.

Risks Relating to Our Common Shares

The continued downturn in the drybulk carrier charter market has had a significant adverse impact on the market price of our common shares and may affect our ability to maintain our listing on the Nasdaq Global Market or any other securities exchange on which our common shares may be traded.

As of the date of this prospectus, our common shares traded on the New York Stock Exchange under the symbol "PRGN." Effective with the open of trading on April 19, 2013, our common shares are expected to cease trading on the New York Stock Exchange and commence trading on the Nasdaq Global Market under the symbol "PRGN." The continued weakness in the drybulk charter market has caused the price of our common shares to decline significantly since 2008. In November 2012, we conducted a 10-for-1 reverse stock split of our issued and outstanding common shares in order to continue to meet the minimum continued listing standards of the New York Stock Exchange. Further declines in the trading price of our common shares may cause us to fail to meet certain of the continuing listing standards of the Nasdaq Global Market, which could result in the delisting of our common shares. If our shares cease to be traded on the Nasdaq Global Market or another national securities exchange, the price at which you may be able to sell your common shares of the Company may be significantly lower than their current trading price or you may not be able to sell them at all. The failure of our common shares to be listed on the Nasdaq Global Market or another national securities exchange may also result in defaults under our loan and credit facilities. We are currently in compliance with all applicable New York Stock Exchange and Nasdaq listing standards.

Following the completion of this offering, our Chairman, President and Chief Executive Officer will continue to have the power to exert considerable influence over us and may be able to control the outcome of matters on which our shareholders are entitled to vote, which may limit your ability to influence our actions.

As of the date of this prospectus, our Chairman, President and Chief Executive Officer beneficially owned a total of 6,400,364 common shares, or approximately 56.5% of our outstanding common shares, all of which are held indirectly through Innovation Holdings S.A., or Innovation Holdings, a Marshall Islands company beneficially owned and controlled by Mr. Bodouroglou, and Loretto. Following the completion of this offering, Mr. Michael Bodouroglou is expected to beneficially own a total of 6,440,364 of our common shares, or approximately 48.2% of our outstanding common shares (or 6,446,364 common shares, or approximately 47.2% of our outstanding common shares, if the underwriters exercise their over-allotment option in full), which includes shares to be issued to Loretto under the agreement we have entered into with Allseas and Loretto, pursuant to which we have agreed, among other things, to issue to Loretto, at no cost to Loretto, additional common shares equal to 2.0% of the number of shares we issue pursuant to any equity offering we make. Due to the number of shares Mr. Bodouroglou is expected to own after giving effect to this offering, Mr. Bodouroglou will continue to have the power to exert considerable influence over our actions and may control the outcome of matters on which our shareholders are entitled to vote, including the election of our directors and other significant corporate actions. The interests of Mr. Bodouroglou as a shareholder may be different from your interests.

Future sales or other issuances of our common shares could cause the market price of our common shares to decline and shareholders may experience dilution as a result of our on-going agreement to issue common shares to Loretto Finance Inc.

Following the completion of this offering, we will have 13,361,442 common shares outstanding (or 13,667,442 common shares outstanding if the underwriters exercise their over-allotment option in full), which includes shares to be issued to Loretto under the agreement we have entered into with Allseas and Loretto discussed below. In order to finance the currently contracted and future growth of our fleet, we may have to incur additional indebtedness and/or sell additional equity securities. Future common share issuances, directly or indirectly through convertible or exchangeable securities, options or warrants, will generally dilute the ownership interests of our existing common shareholders, including their relative voting rights, and could require substantially more cash to maintain the then existing level, if any, of our dividend payments to our common shareholders, as to which no assurance can be given. Preferred shares, if issued, will generally have a preference on dividend payments, which could prohibit or otherwise reduce our ability to pay dividends to our common shareholders. Any future debt we incur will be senior in all respects to our common shares, will generally include financial and operating covenants with which we must comply and will include acceleration provisions upon defaults thereunder, including our failure to make any debt service payments thereunder or possibly under other debt. Because our decision to issue equity securities or incur debt in the future will depend on a variety of factors, including market conditions and other matters that are beyond our control, we cannot predict or estimate the timing, amount or form of our capital raising activities in the future. Future sales or other issuances of a substantial number of common shares or other securities in the public market or otherwise, or the perception that these sales could occur, may depress the market price for our common shares. These sales or issuances could also impair our ability to raise additional capital through the sale of our equity securities in the future.

10

In order to incentivize Allseas' continued services to us, we have entered into a tripartite agreement with Allseas and Loretto, pursuant to which in the event of a capital increase, an equity offering, including this offering, or the issuance of common shares to a third party or third parties in the future, other than common shares issued pursuant to our equity incentive plan, we have agreed to issue, at no cost to Loretto, additional common shares to Loretto in an amount equal to 2% of the total number of common shares issued pursuant to such capital increase, equity offering or third party issuance, as applicable. After giving effect to the issuance to Loretto of 40,000 common shares as a result of this offering, or 2% of the total number of common shares offered hereby (or 46,000 common shares if the underwriters' overallotment option is exercised in full), Loretto is expected to own a total of 254,258 of our common shares (or 260,258 of our common shares if the underwriters' overallotment option is exercised in full).

In addition, after giving effect to this offering, our Chairman, President and Chief Executive Officer, Mr. Michael Bodouroglou, is expected to beneficially own 6,440,364 of our common shares, or 48.2% of our outstanding common shares (or 47.2% of our outstanding common shares if the underwriters exercise their over-allotment option in full), including the 254,258 common shares expected to be owned by Loretto (or 260,258 common shares if the underwriters' overallotment option is exercised in full) discussed above and the shares held by Innovation Holdings, discussed below. The common shares beneficially owned by Mr. Bodouroglou are "restricted securities" within the meaning of Rule 144 under the U.S. Securities Act of 1933, as amended, or the Securities Act, and may not be transferred unless they have been registered under the Securities Act or an exemption from registration is available. Upon satisfaction of certain conditions, Rule 144 permits the sale of certain amounts of restricted securities six months following the date of acquisition of the restricted securities from us.

We have entered into a registration rights agreement, dated December 24, 2012, with Innovation Holdings, a Marshall Islands corporation controlled by Mr. Bodouroglou, pursuant to which we have granted Innovation Holdings the right, subject to certain terms and conditions, to require us to register under the Securities Act up to 4,901,961 common shares held by Innovation Holdings for offer and sale to the public, including by way of an underwritten public offering.

As our common shares become eligible for sale under Rule 144, or if Innovation Holdings exercises its registration rights pursuant to the registration rights agreement discussed above, the volume of sales of our common shares on the Nasdaq Global Market or such other securities exchange on which our common shares are listed may increase, which could reduce the market value of our common shares.

We cannot assure you that an active and liquid public market for our common shares will continue.

As of the date of this prospectus, our common shares traded on the New York Stock Exchange under the symbol "PRGN." Effective with the open of trading on April 19, 2013, our common shares are expected to cease trading on the New York Stock Exchange and commence trading on the Nasdaq Global Market under the symbol "PRGN." We cannot assure you that an active and liquid public market for our common shares will continue. Since 2008, the U.S. stock market has experienced extreme price and volume fluctuations. In addition, the seaborne transportation industry has been highly unpredictable and volatile. If the volatility in the market or the drybulk industry continues or worsens, it could have an adverse effect on the market price of our common shares and may impact a potential sale price if holders of our common shares decide to sell their shares.

11

The market price of our common shares may be influenced by many factors, many of which are beyond our control, including those described under the caption "Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2012 and the following:

| · | actual or anticipated variations in our operating results; |

| · | changes in our cash flow or earnings estimates; |

| · | publication of research reports about us or the industry in which we operate; |

| · | fluctuations in the seaborne transportation industry, including fluctuations in the drybulk market |

| · | increases in market interest rates that may lead purchasers of common shares to demand a higher expected yield which, would mean our share price would fall; |

| · | changes in applicable laws or regulations, court rulings and enforcement and legal actions; |

| · | changes in market valuations of similar companies; |

| · | announcements by us or our competitors of significant contracts, acquisitions or capital commitments; |

| · | adverse market reaction to any increased indebtedness we incur in the future; |

| · | additions or departures of key personnel; |

| · | actions by institutional shareholders; |

| · | speculation in the press or investment community; |

| · | terrorist attacks; |

| · | economic and regulatory trends; and |

| · | general market conditions. |

As a result of these and other factors, investors in our common shares may not be able to resell their shares at or above the price they paid for such shares. These broad market and industry factors may materially reduce the market price of our common shares, regardless of our operating performance.

12

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes "forward-looking statements," as defined by U.S. federal securities laws, with respect to our financial condition, results of operations and business and our expectations or beliefs concerning future events. Words such as, but not limited to, "believe," "expect," "anticipate," "estimate," "intend," "plan," "targets," "projects," "likely," "will," "would," "could" and similar expressions or phrases may identify forward-looking statements.

All forward-looking statements involve risks and uncertainties. The occurrence of the events described, and the achievement of the expected results, depend on many events, some or all of which are not predictable or within our control. Actual results may differ materially from expected results.

In addition, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include; (i) the strength of world economies; (ii) fluctuations in currencies and interest rates; (iii) general market conditions, including fluctuations in charter hire rates and vessel values; (iv) changes in demand in the drybulk shipping industry, including the market for our vessels; (v) changes in our operating expenses, including bunker prices, dry-docking and insurance costs; (vi) changes in governmental rules and regulations or actions taken by regulatory authorities; (vii) potential liability from pending or future litigation; (viii) general domestic and international political conditions; (ix) potential disruption of shipping routes due to accidents or political events; (x) the availability of financing and refinancing; (xi) vessel breakdowns and instances of off-hire; and (xii) other important factors described from time to time in the reports filed by us with the SEC.

We have based these statements on assumptions and analyses formed by applying our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. All future written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation, and specifically decline any obligation, except as required by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur.

See the section entitled "Risk Factors," on page 10 of this prospectus and in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012, filed with the SEC on April 3, 2013 and incorporated by reference herein, for a more complete discussion of these risks and uncertainties and for other risks and uncertainties. These factors and the other risk factors described in this prospectus are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. Consequently, there can be no assurance that actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

13

USE OF PROCEEDS

Based on the last reported sale price of our common shares on the Nasdaq Global Market on , 2013, of $ per share, we expect that the net proceeds of this offering to us, after deducting discounts and commissions payable to the underwriters and other expenses related to the offering, will be approximately $ million (or approximately $ million if the underwriters exercise their over-allotment option in full).

We intend to use the net proceeds to us of this offering for general corporate purposes, including newbuilding and secondhand vessel acquisitions.

14

CAPITALIZATION

The following table sets forth our capitalization at December 31, 2012:

| · | On an actual basis; |

| · | On an as adjusted basis to give effect to the following transactions, which occurred during the period from January 1, 2013 to April 17, 2013: |

| o | the scheduled repayment of $4,006,813 in outstanding indebtedness under our secured loan agreements; |

| o | the issuance of 98,039 common shares on February 15, 2013 for no cash consideration to Loretto at a grant date fair value of $3.425 per share; |

| o | the issuance of an aggregate of 222,000 restricted common shares on February 25, 2013 to our Chairman, President and Chief Executive Officer, our Chief Financial Officer and certain other employees of our Manager at a grand date fair value of $2.71 per share. |

| · | on an as further adjusted basis to give effect to the following transactions: |

| o | the issuance and sale of 2,000,000 of our common shares pursuant to this prospectus at an assumed offering price of $ per share, which was the last reported closing price of our common shares on the Nasdaq Global Market on , 2013, resulting in net proceeds of approximately $ million, after deducting estimated expenses related to this offering of $ million payable by us and the underwriting discounts and commissions of approximately $ million; and |

| o | our obligation to issue 40,000 shares of common stock for no cash consideration to Loretto, representing 2% of the total number of common shares issued and sold pursuant to this prospectus, assuming no exercise of the underwriters' over-allotment option. |

As of December 31, 2012, we had $17.7 million in cash and cash equivalents and $10.0 million in current and non-current restricted cash. On an "as further adjusted" basis, as described above and taking into account the starting cash balance of December 31, 2012, cash and cash equivalents amounts to approximately $ million and restricted cash amounts to $10.0 million.

There have been no significant adjustments to our capitalization since December 31, 2012, as so adjusted. You should read the information below in connection with the section of this prospectus entitled "Use of Proceeds," and our audited consolidated financial statements and notes thereto included in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012, filed with the SEC on April 3, 2013 and incorporated by reference herein.

15

| As of December 31, 2012 | ||||||||||||

| Actual | As Adjusted | As Further Adjusted | ||||||||||

| Capitalization: | ||||||||||||

| Total debt (1)(2)(3) | $ | 195,542,176 | $ | 191,535,363 | $ | |||||||

| Preferred shares, $0.001 par value; 25,000,000 shares authorized, none issued, actual, as adjusted and as further adjusted | - | - | ||||||||||

| Class A common shares, $0.001 par value; 750,000,000 shares authorized 11,001,403 shares issued and outstanding actual, 11,321,442 shares issued and outstanding as adjusted, 13,361,442 shares issued and outstanding as further adjusted | 11,001 | 11,321 | ||||||||||

| Class B common shares, $0.001 par value; 5,000,000 authorized; none issued and outstanding | - | - | ||||||||||

| Additional paid-in capital | 460,094,256 | 460,429,942 | ||||||||||

| Accumulated other comprehensive loss | (627,104 | ) | (627,104 | ) | ||||||||

| Accumulated deficit | (243,957,640 | ) | (244,293,646 | ) | ||||||||

| Total shareholders' equity | 215,520,513 | 215,520,513 | ||||||||||

| Total capitalization | $ | 411,062,689 | $ | 407,055,876 | $ | |||||||

_________________

| (1) | All of our indebtedness is secured and guaranteed. |

| (2) | Total debt does not include the fair value of the derivative liabilities designated as hedging instruments, which was $0.7 million as of December 31, 2012. |

| (3) | Does not include any future amounts we may draw under the Nordea loan facility dated May 5, 2011 (please see Note 9 to our consolidated financial statements included in our annual report on Form 20-F for the fiscal year ended December 31, 2012, filed with the SEC on April 3, 2013 and incorporated by reference herein). |

16

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our selected consolidated financial data and other operating data, which are stated in U.S. dollars, other than share data, as of and for the years ended December 31, 2008, 2009, 2010, 2011 and 2012. The selected data is derived from our audited consolidated financial statements and notes thereto, which have been prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP.

Our audited consolidated statements of operations, shareholders' equity and cash flows for the years ended December 31, 2010, 2011 and 2012, and the consolidated balance sheets at December 31, 2011 and 2012, together with the notes thereto, are included in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012, filed with the SEC on April 3, 2013 and incorporated by reference herein. The following data should be read in conjunction with "Item 5. Operating and Financial Review and Prospects," the consolidated financial statements, related notes and other financial information included elsewhere in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012.

Following the 10-for-1 reverse stock split effectuated on November 5, 2012, pursuant to which every ten shares of our common stock issued and outstanding were converted into one share of common stock, all share and per share amounts disclosed in the tables below and in our consolidated financial statements included in our Annual Report on Form 20-F for the fiscal year ended December 31, 2012 have been retroactively restated to reflect this change in capital structure.

| Year ended December 31, | ||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| INCOME STATEMENT DATA | ||||||||||||||||||||

(Expressed in United States Dollars, Except for share data) | ||||||||||||||||||||

| Net revenue | $ | 161,137,646 | $ | 152,747,121 | $ | 111,700,109 | $ | 86,907,967 | $ | 50,300,679 | ||||||||||

| Operating income / (loss) | 94,682,596 | 79,268,499 | 34,121,346 | (275,225,740 | ) | 2,293,932 | ||||||||||||||

| Comprehensive income / (loss) | 69,229,461 | 65,678,614 | 22,895,280 | (283,498,759 | ) | (18,184,229 | ) | |||||||||||||

| Net income / (loss) available to Class A common shares | 69,229,461 | 65,678,614 | 22,895,280 | (283,498,759 | ) | (17,557,125 | ) | |||||||||||||

| Earnings / (loss) per Class A common share, basic | $ | 25.79 | $ | 16.94 | $ | 4.43 | $ | (47.61 | ) | $ | (2.84 | ) | ||||||||

| Earnings / (loss) per Class A common share, diluted | $ | 25.60 | $ | 16.94 | $ | 4.43 | $ | (47.61 | ) | $ | (2.84 | ) | ||||||||

| Weighted average number of Class A common shares, basic | 2,681,992 | 3,802,652 | 4,981,272 | 5,793,792 | 6,035,910 | |||||||||||||||

| Weighted average number of Class A common shares, diluted | 2,701,001 | 3,802,652 | 4,981,272 | 5,793,792 | 6,035,910 | |||||||||||||||

| Dividends declared per Class A common share | $ | 18.75 | $ | 2.00 | $ | 2.00 | $ | 0.50 | — | |||||||||||

| Year ended December 31, | ||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| OTHER FINANCIAL DATA | ||||||||||||||||||||

| (Expressed in United States Dollars) | ||||||||||||||||||||

| Net cash from operating activities | $ | 83,474,314 | $ | 80,406,754 | $ | 60,613,801 | $ | 45,467,429 | $ | 13,376,809 | ||||||||||

| Net cash (used in) / from investing activities | (78,072,478 | ) | (40,500,000 | ) | (142,151,113 | ) | 43,673,793 | (15,702,244 | ) | |||||||||||

| Net cash from / (used in) financing activities | 31,711,279 | 25,611,672 | (17,634,931 | ) | (109,365,640 | ) | 5,438,803 | |||||||||||||

17

| As of December 31, | ||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| BALANCE SHEET DATA | ||||||||||||||||||||

| (Expressed in United States Dollars) | ||||||||||||||||||||

| Total current assets | $ | 72,274,712 | $ | 190,049,436 | $ | 55,503,278 | $ | 37,457,564 | $ | 31,333,204 | ||||||||||

| Total assets | 742,421,254 | 812,692,848 | 821,276,010 | 432,073,937 | 419,974,902 | |||||||||||||||

| Total current liabilities | 69,219,899 | 78,990,340 | 45,212,355 | 40,486,845 | 21,971,886 | |||||||||||||||

| Long-term debt | 334,335,000 | 270,235,000 | 282,757,012 | 169,096,000 | 181,114,926 | |||||||||||||||

| Total liabilities | 433,989,975 | 356,427,030 | 330,804,343 | 210,849,790 | 204,454,389 | |||||||||||||||

| Capital stock | 2,714 | 5,119 | 5,587 | 6,090 | 11,001 | |||||||||||||||

| Total shareholders' equity / net assets | 308,431,279 | 456,265,818 | 490,471,667 | 221,224,147 | 215,520,513 | |||||||||||||||

18

PRICE RANGE OF OUR COMMON SHARES

Our common shares commenced trading on the Nasdaq Global Market on August 9, 2007 under the symbol "PRGN." On March 24, 2010, our common shares stopped trading on the Nasdaq Global Market and commenced trading on the New York Stock Exchange under the symbol "PRGN." Effective with the open of trading on April 19, 2013, our common shares are expected to cease trading on the New York Stock Exchange and commence trading on the Nasdaq Global Market under the symbol "PRGN." The following table sets forth the high and low closing prices for each of the periods indicated for our common shares, as adjusted for the 10-for-1 reverse stock split effective November 5, 2012.

| High | Low | |||||||

For the year ended December 31, | ||||||||

| 2008 | $ | 218.00 | $ | 23.70 | ||||

| 2009 | $ | 61.20 | $ | 28.70 | ||||

| 2010 | $ | 51.60 | $ | 33.90 | ||||

| 2011 | $ | 34.40 | $ | 5.90 | ||||

| 2012 | $ | 9.50 | $ | 1.97 | ||||

| High | Low | |||||||

| For the quarter ended | ||||||||

| March 31, 2011 | $ | 34.40 | $ | 28.50 | ||||

| June 30, 2011 | $ | 30.80 | $ | 18.90 | ||||

| September 30, 2011 | $ | 20.20 | $ | 7.90 | ||||

| December 31, 2011 | $ | 12.00 | $ | 5.90 | ||||

| March 31, 2012 | $ | 9.50 | $ | 5.70 | ||||

| June 30, 2012 | $ | 8.20 | $ | 5.20 | ||||

| September 30, 2012 | $ | 5.60 | $ | 4.10 | ||||

| December 31, 2012 | $ | 4.60 | $ | 1.97 | ||||

| March 31, 2013 | $ | 5.44 | $ | 2.56 | ||||

| High | Low | |||||||

| For the month ended | ||||||||

| October 2012 | $ | 4.60 | $ | 3.80 | ||||

| November 2012 | $ | 3.80 | $ | 2.19 | ||||

| December 2012 | $ | 2.60 | $ | 1.97 | ||||

| January 2013 | $ | 4.42 | $ | 2.56 | ||||

| February 2013 | $ | 3.89 | $ | 2.66 | ||||

| March 2013 | $ | 5.44 | $ | 2.86 | ||||

| April 2013 (1) | $ | 5.17 | $ | 3.62 | ||||

__________

(1) For the period from April 1, 2013 to April 16, 2013.

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common shares as of April 16, 2013, held by (i) the owners of more than five percent of outstanding common shares that we are aware of and (ii) the total number of common shares owned by our executive officers and directors.

Beneficial ownership is determined in accordance with the SEC's rules. In computing percentage ownership of each person, common shares subject to options held by that person that are currently exercisable or convertible, or exercisable or convertible within 60 days of April 16, 2013, are deemed to be beneficially owned by that person. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. All of our shareholders, including the shareholders listed in the table below, are entitled to one vote for each common share held.

| Name and Address of Beneficial Owner (1) | Number of Shares Owned | Percent of Class (2) | ||

| Michael Bodouroglou (3) | 6,400,364 | 56.5% | ||

All officers and directors, other than Michael Bodouroglou, as a group | * | * |

| *Less than one percent. |

| (1) | Unless otherwise indicated, the business address of each beneficial owner identified is c/o Paragon Shipping Inc., 15 Karamanli Avenue, GR 16673, Voula, Greece. |

| (2) | Percentage amounts based on 11,321,442 common shares outstanding as of April 16, 2013. | |

| (3) | Mr. Bodouroglou beneficially owns 6,186,106 of these shares through Innovation Holdings, a company beneficially owned and controlled by Mr. Bodouroglou and members of his family, including the 4,901,961 shares issued in connection with the $10.0 million private placement as discussed in "B. Related Party Transactions—$10.0 Million Private Placement" below, and 214,258 of these shares through Loretto, a wholly owned subsidiary of Allseas that is controlled by Mr. Bodouroglou and members of his family. The percentage of our common shares that Mr. Michael Bodouroglou beneficially owns increased from 19.7% as of April 26, 2012 to 56.5% as of April 16, 2013, primarily due to the acquisition by Innovation Holdings of 4,901,961 common shares in the private placement that closed on December 24, 2012. In addition, Innovation Holdings was also awarded 200,000 common shares pursuant to an award granted under the Plan on February 25, 2013. Furthermore, Loretto received 98,039 common shares from April 26, 2012 to April 2, 2013, pursuant to the agreement we have entered into with Loretto and Allseas described in "Certain Relationships and Related Party Transactions—Agreements with Allseas—Agreement with Loretto." |

As of April 16, 2013, we had 45 shareholders of record, ten of which were located in the United States and held an aggregate of 4,855,792 of our common shares, representing 42.9% of our outstanding common shares. However, one of the U.S. shareholders of record is CEDE & CO., a nominee of The Depository Trust Company, which held 4,855,301 of our common shares as of April 16, 2013. Accordingly, we believe that the shares held by CEDE & CO. include common shares beneficially owned by both holders in the United States and non-U.S. beneficial owners. We are not aware of any arrangements the operation of which may at a subsequent date result in our change of control.

20

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

Agreements with Allseas

Management Agreements

We have entered into separate management agreements with Allseas for each of the vessels in our operating fleet, pursuant to which Allseas is responsible for the commercial and technical management functions of our fleet. Commercial management includes, among other things, negotiating charters for our vessels, monitoring various types of charters, monitoring the performance of our vessels under charter, locating, purchasing, financing and negotiating the purchase and sale of our vessels, obtaining insurance for our vessels and finance and accounting functions. Technical management services include, among other things, arranging for and managing crews, vessel maintenance, dry-docking, repairs, insurance, maintaining regulatory and classification society compliance and providing technical support. Our Chairman, President and Chief Executive Officer, Mr. Michael Bodouroglou, is the sole shareholder of Allseas.

Under the terms of the management agreements, Allseas has agreed to use its best efforts to provide technical and commercial management services upon our request in a commercially reasonable manner and may provide these services directly to us or subcontract for certain of these services with other entities. Allseas has in-house technical management capabilities, which it continues to expand. Allseas remains responsible for any subcontracted services under the management agreements. We have agreed to indemnify Allseas for losses it incurs in connection with the provision of these services, excluding losses caused by the gross negligence or willful misconduct of Allseas, its employees, subcontractors or agents. Under the agreements, Allseas' liability for losses caused solely by its gross negligence or willful default, or that of its employees, agents or subcontractors, is limited to ten times the annual management fee payable under the management agreements, except where such loss resulted from Allseas' intentional or reckless act or omission.

Each management agreement has an initial term of five years and automatically renews for additional five-year periods, unless in each case, at least 30 days' advance written notice of termination is given by either party.

Under the management agreements as amended effective June 1, 2010, the terms of which were approved by our independent directors, Allseas is entitled to a technical management fee of €620 (or $818.03 based on the Euro/U.S. dollar exchange rate of €1.0000:$1.3194 as of December 31, 2012) per vessel per day, payable on a monthly basis in advance, pro rata for the calendar days the vessels are owned by us. The technical management fee is subject to annual adjustments based on the official Eurozone inflation rate. Effective June 1, 2012, Allseas' management fee was adjusted to €652.02 (or $860.28 based on the Euro/U.S. dollar exchange rate of €1.0000:$1.3194 as of December 31, 2012) per vessel per day in accordance with the agreement. Allseas is also entitled to receive (i) a fee equal to 1.25% of the gross freight, demurrage and charter hire collected from the employment of our vessels, (ii) a fee equal to 1.0% calculated on the price as stated in the relevant memorandum of agreement for any vessel bought, constructed or sold on our behalf, (iii) a lump sum fee of $15,000 for pre-delivery services, including legal fees, crewing and manning fees, manual preparation costs and other expenses related to preparing the vessel for delivery, rendered during the period from the date a memorandum of agreement is signed for the purchase of any such vessel, until the delivery date; and (iv) a superintendent fee of €500 (or $659.70 based on the Euro/U.S. dollar exchange rate of €1.0000:$1.3194 as of December 31, 2012) per day for each day in excess of five days per calendar year for which a superintendent performed on site inspection.

We have also entered into management agreements with Allseas relating to the supervision of each of our contracted newbuilding vessels, pursuant to which Allseas is entitled to: (i) a flat fee of $375,000 per vessel for the first 12 month period commencing from the respective steel cutting date of each vessel and thereafter the flat fee will be paid on a pro rata basis until the vessels' delivery to us; (ii) a daily fee of €115 (or $151.73 based on the Euro/U.S. dollar exchange rate of €1.0000:$1.3194 as of December 31, 2012) per vessel commencing from the date of the vessel's shipbuilding contract until we accept delivery of the respective vessel; and (iii) €500 (or $659.70 based on the Euro/U.S. dollar exchange rate of €1.0000:$1.3194 as of December 31, 2012) per day for each day in excess of five days per calendar year for which a superintendent performed on site inspection. The term of the management agreements expires on the completion of the construction and delivery of the vessels to us and the agreements may be terminated by either party upon 30 days' advance written notice.

Additional vessels that we may acquire in the future may be managed by Allseas or unaffiliated management companies.

21

Compensation Agreement

On January 3, 2010, we entered into a compensation agreement with Allseas, whereby in the event that Allseas is involuntarily terminated as the manager of our fleet, we shall compensate Allseas with a sum equal to (i) three years of management fees and commissions, based on the fleet at the time of termination; and (ii) €3.0 million (or $4.0 million based on the Euro/U.S. dollar exchange rate of €1.0000:$1.3194 as of December 31, 2012). The agreement shall continue for so long as Allseas serves as the commercial and technical manager of our fleet and may be terminated at any time by the mutual agreement of the parties or by either party in the event of a material breach of the terms and provisions by the other party.

Administrative Services Agreement

On November 12, 2008, we entered into an administrative service agreement with Allseas, pursuant to which Allseas provides telecommunication services, secretarial and reception personnel and equipment, security facilities, office cleaning services and information technology services. Allseas is entitled to reimbursement on a quarterly basis of all costs and expenses incurred in connection with the provisions of its services under the agreement. During the years ended December 31, 2010, 2011 and 2012, we paid $31,867, $33,207 and $36,085, respectively, under this agreement.

Accounting Agreement