UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2014

Commission File Number: 001-33655

| Paragon Shipping Inc. |

| (Translation of registrant's name into English) |

|

| 15 Karamanli Ave., GR 166 73, Voula, Greece |

| (Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)7: ___

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

Attached to this Report on Form 6-K as Exhibit 1 is a copy of the Notice of Annual General Meeting of Shareholders and Proxy Statement of Paragon Shipping Inc. (the "Company") in connection with the Company's 2014 Annual General Meeting of Shareholders (the "Annual Meeting").

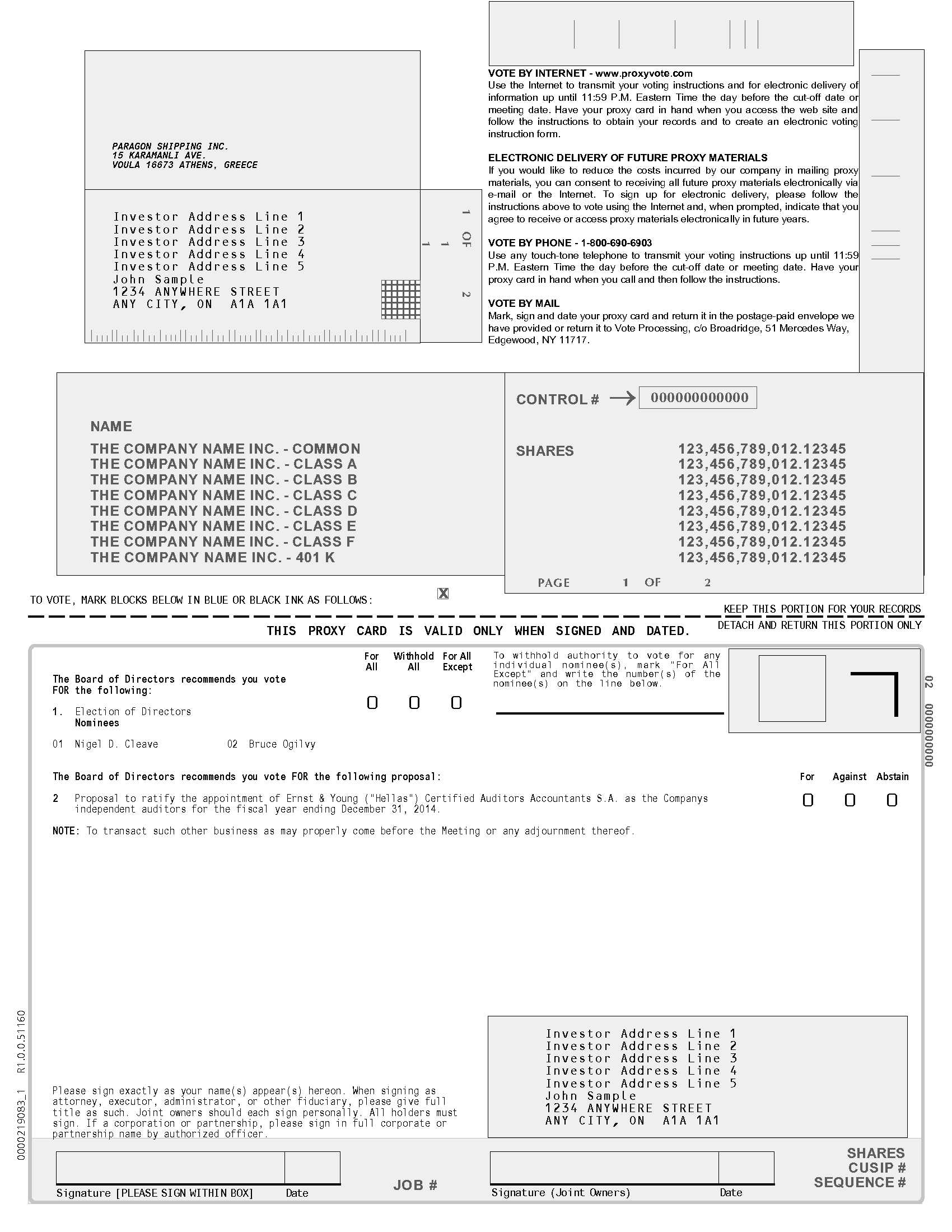

Attached to this report on Form 6-K as Exhibit 2 is the proxy card relating to the Annual Meeting.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Paragon Shipping Inc. | |

| | |

| | |

| Dated: October 1, 2014 | By: | /s/ Michael Bodouroglou | |

| Name: | Michael Bodouroglou | |

| Title: | Chief Executive Officer | |

EXHIBIT 1

September 24, 2014

TO THE SHAREHOLDERS OF

PARAGON SHIPPING INC.

Enclosed is a Notice of Annual General Meeting of Shareholders (the "Meeting") of Paragon Shipping Inc. (the "Company") which will be held at the Company's premises at 15 Karamanli Ave. 166 73 Voula, Greece, on October 22, 2014 at 12:00 p.m. local time, and related materials. The Notice of Annual General Meeting of Shareholders and related materials, including the Company's 2013 annual report containing the Company's audited financial statements for the fiscal year ended December 31, 2013 (the "2013 Annual Report"), are available on the Company's website at http://www.paragonship.com/agm-materials.php. Any shareholder may receive a hard copy of the 2013 Annual Report, free of charge upon request.

At the Meeting, shareholders of the Company will consider and vote upon proposals:

| 1 | To appoint two Class B Directors to serve until the 2017 Annual General Meeting of Shareholders ("Proposal One"); |

| 2. | To ratify the appointment of Ernst & Young (Hellas) Certified Auditors Accountants S.A. as the Company's independent auditors for the fiscal year ending December 31, 2014 ("Proposal Two"); and |

| 3. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

Adoption of Proposal One requires the affirmative vote of a plurality of the votes cast at the Meeting by the shareholders entitled to vote at the Meeting. Adoption of Proposal Two requires the affirmative vote of the majority of the shares of stock represented at the Meeting.

You are cordially invited to attend the Meeting in person. All shareholders must present a form of personal photo identification in order to be admitted to the Meeting. In addition, if your shares are held in the name of your broker, bank or other nominee and you wish to attend the Meeting, you must bring an account statement or letter from the broker, bank or other nominee indicating that you were the owner of the shares on the record date, September 10, 2014.

If you attend the Meeting, you may revoke your proxy and vote your shares in person. If your shares are held in the name of your broker, bank or other nominee and you intend to vote in person at the Meeting, you must present a legal proxy from your bank, broker or other nominee in order to vote. Shareholders should speak to their brokers, banks or other nominees in whose custody their shares are held for additional information.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION IN RETURNING YOUR EXECUTED PROXY PROMPTLY WILL BE APPRECIATED. ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED BY MANAGEMENT IN FAVOR OF ALL PROPOSALS PRESENTED IN THE PROXY STATEMENT.

| Very truly yours |

| |

| Michael Bodouroglou

Chief Executive Officer |

PARAGON SHIPPING INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 22, 2014

NOTICE IS HEREBY given that the Annual General Meeting of Shareholders (the "Meeting") of Paragon Shipping Inc. (the "Company") will be held at the Company's premises at 15 Karamanli Ave. 166 73 Voula Greece, on October 22, 2014 at 12:00 p.m. local time, for the following purposes, of which items one and two are more completely set forth in the accompanying Proxy Statement:

| 1 | To elect two Class B Directors to serve until the 2017 Annual General Meeting of Shareholders ("Proposal One"); |

| 2. | To ratify the appointment of Ernst & Young (Hellas) Certified Auditors Accountants S.A. as the Company's independent auditors for the fiscal year ending December 31, 2014 ("Proposal Two"); and |

| 3. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

The board of directors has fixed the close of business on September 10, 2014 as the record date for the determination of the shareholders entitled to receive notice and to vote at the Meeting or any adjournment thereof.

If you attend the meeting, you may revoke your proxy and vote in person. If your shares are held in the name of your broker, bank or other nominee and you intend to vote in person at the Meeting, you must present a legal proxy from your bank, broker or other nominee in order to vote. Shareholders should speak to their brokers, banks or other nominees in whose custody their shares are held for additional information.

All shareholders attending the Meeting must present a form of personal photo identification in order to be admitted to the meeting. In addition, if your shares are held in the name of your broker, bank or other nominee and you wish to attend the Meeting, you must bring an account statement or letter from the broker, bank or other nominee indicating that you were the owner of the shares on September 10, 2014.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, WHICH DOES NOT REQUIRE POSTAGE IF MAILED IN THE UNITED STATES. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION IN RETURNING YOUR EXECUTED PROXY PROMPTLY WILL BE APPRECIATED. ANY SIGNED PROXY RETURNED AND NOT COMPLETED WILL BE VOTED BY MANAGEMENT IN FAVOR OF ALL PROPOSALS PRESENTED IN THE PROXY STATEMENT.

This Notice of the Meeting, the Proxy Statement and related materials, including the Company's 2013 Annual Report, are available on the Company's website at http://www.paragonship.com/agm-materials.php. Any shareholder may receive a hard copy of the Company's 2013 Annual Report, free of charge upon request.

| By Order of the Board of Directors |

| |

| Aikaterini Stoupa

Secretary |

September 24, 2014

Voula, Greece

PARAGON SHIPPING INC.

PROXY STATEMENT

FOR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 22, 2014

________________________

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the board of directors of Paragon Shipping Inc., a Marshall Islands corporation (the "Company"), for use at the Annual General Meeting of Shareholders to be held at the Company's premises at 15 Karamanli Ave., 166 73 Voula Greece, on October 22, 2014 at 12:00 p.m. local time, or at any adjournment or postponement thereof (the "Meeting"), for the purposes set forth herein and in the accompanying Notice of Annual General Meeting of Shareholders. This Proxy Statement and the accompanying form of proxy are expected to be mailed to shareholders of the Company entitled to vote at the Meeting on or about September 24, 2014. These materials can also be found on the Company's website at http://www.paragonship.com/agm-materials.php.

VOTING RIGHTS AND OUTSTANDING SHARES

On September 10, 2014 (the "Record Date"), the Company had outstanding 24,592,142 shares of common stock, par value $0.001 per share (the "Common Shares"). Each shareholder of record at the close of business on the Record Date is entitled to one vote for each Common Share then held. One or more shareholders representing at least a majority of the shares issued and outstanding shall be a quorum for the purposes of the Meeting. The Common Shares represented by any proxy in the enclosed form will be voted in accordance with the instructions given on the proxy if the proxy is properly executed and is received by the Company prior to the close of voting at the Meeting or any adjournment or postponement thereof. Any proxies returned without instructions will be voted FOR the proposals set forth on the Notice of Annual General Meeting of Shareholders.

The Common Shares are quoted on the Nasdaq Global Market under the symbol "PRGN."

REVOCABILITY OF PROXIES

A shareholder giving a proxy may revoke it at any time before it is exercised. A proxy may be revoked by filing with the Secretary of the Company at the Company's principal executive office, 15 Karamanli Ave, GR 166 73, Voula, Greece, a written notice of revocation by a duly executed proxy bearing a later date, or by attending the Meeting and voting in person.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Company has five directors on the board of directors, which is divided into three classes. As provided in the Company's Amended and Restated Articles of Incorporation, each director is elected to serve for a three-year term and until such director's successor is duly elected and qualified, except in the event of his death, resignation, removal or earlier termination of his term of office. The term of two Class B Directors expires at the Meeting. Accordingly, the board of directors has nominated Nigel D. Cleave and Bruce Ogilvy, each of whom is a current Class B Director, for election as directors whose term would expire at the Company's 2017 Annual General Meeting of Shareholders.

Unless the proxy is marked to indicate that such authorization is expressly withheld, the persons named in the enclosed proxy intend to vote the shares authorized thereby FOR the election of the following two nominees. It is expected that each of these nominees will be able to serve, but if before the election it develops that any of the nominees is unavailable, the persons named in the accompanying proxy will vote for the election of such substitute nominee or nominees as the current board of directors may recommend.

Nominees for Election to the Company's Board of Directors

Information concerning the nominees for director of the Company is set forth below:

| Name | Age | Position |

| Nigel D. Cleave | 56 | Class B Director |

| Bruce Ogilvy | 72 | Class B Director |

Certain biographical information about each of these individuals is set forth below.

Nigel D. Cleave has served as a non-executive director of the Company since November 2006. In July 2014, Mr Cleave was appointed as a Director of Super Dragon Limited and Videotel Pte. Ltd. In January 2011, Mr. Cleave was appointed to his current position of chief executive officer of Videotel Marine Asia Limited, the leading provider of maritime blended training systems. Prior to this, Mr. Cleave held the position of chief executive officer of Elias Marine Consultants Limited, providing a broad range of professional services. In 2006, Mr. Cleave was appointed chief executive officer of PB Maritime Services Limited, a ship management and marine services company, having previously served as group managing director of Dobson Fleet Management Limited from 1993 to 2006, a ship management company based in Cyprus. From 1991 to 1993, Mr. Cleave held the position of deputy general manager at Cyprus based ship management company Hanseatic Shipping Co. Ltd. and from 1988 to 1991, held various fleet operation roles based in London. From 1975 to 1986, Mr. Cleave held various positions at The Cunard Steamship Company plc, including serving in the ranks of navigating cadet officer to second officer, as well as financial and planning assistant, assistant to the group company secretary and assistant operations manager. Mr. Cleave graduated from the Riversdale College of Technology in the United Kingdom with an O.N.C. in Nautical Science and today is a Fellow of the Chartered Institute of Shipbrokers and the Chairman of the Cayman Islands Shipowners' Advisory Council.

Bruce Ogilvy has served as a non-executive director of the Company since July 2007. From 2003 to 2005 Mr. Ogilvy served as a consultant to Stelmar Tankers (Management) Ltd. and from 1992 to 2002, he was managing director of Stelmar Tankers (U.K.) Ltd., a subsidiary of Stelmar Tankers (Management) Ltd., through which the group's commercial business, including chartering and sale and purchase activities, were carried out. In 1992, Mr. Ogilvy joined Stelios Haj-Ioannou to form Stelmar Tankers (Management) Ltd., and served on its Board of Directors from its inception to 2003. During his ten years with Stelmar Tankers (Management) Ltd., Stelmar Shipping Ltd. completed an initial public offering on the New York Stock Exchange in 2001 and a secondary listing in 2002. Prior to his association with Stelmar Tankers (Management) Ltd., Mr. Ogilvy served in various capacities, including chartering and sale and purchase activities with Shell International. Mr. Ogilvy graduated from Liverpool University, in the United Kingdom, in 1963 with a degree as Ship Master. Mr. Ogilvy served on the Council of Intertanko, an industry body that represents the interests of Independent tanker owners, since 1994 and on its Executive Board from 2003 until 2005. Mr. Ogilvy has been an active member of the Institute of Chartered Shipbrokers for over 30 years and has served as the Chairman of the Trust Fund of the Institute of Chartered Shipbrokers since September 2010 and the Vice President of the Institute of Chartered Shipbrokers since October 2012. He is also the Chairman of the Institute of Chartered Shipbrokers Education Trust Fund.

Required Vote. Approval of Proposal One will require the affirmative vote of a plurality of the votes cast at the Meeting by the holders of shares entitled to vote at the Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE IN FAVOR OF THE PROPOSED DIRECTORS. UNLESS REVOKED AS PROVIDED ABOVE, PROXIES RECEIVED BY MANAGEMENT WILL BE VOTED IN FAVOR OF THE PROPOSED DIRECTORS UNLESS A CONTRARY VOTE IS SPECIFIED.

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF

INDEPENDENT AUDITORS

The board of directors is submitting for ratification at the Meeting of the appointment of Ernst & Young (Hellas) Certified Auditors Accountants S.A. as the Company's independent auditors for the fiscal year ending December 31, 2014.

Ernst & Young (Hellas) Certified Auditors Accountants S.A. has advised the Company that the firm does not have any direct or indirect financial interest in the Company, nor has such firm had any such interest in connection with the Company during the past two fiscal years other than in its capacity as the Company's independent auditors.

All services rendered by the independent auditors are subject to review by the Company's audit committee.

Required Vote. Approval of Proposal Two will require the affirmative vote of a majority of the shares of stock represented at the Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG (HELLAS) CERTIFIED AUDITORS ACCOUNTANTS S.A. AS INDEPENDENT AUDITORS OF THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2014. UNLESS REVOKED AS PROVIDED ABOVE, PROXIES RECEIVED BY MANAGEMENT WILL BE VOTED IN FAVOR OF SUCH APPROVAL UNLESS A CONTRARY VOTE IS SPECIFIED.

SOLICITATION

The cost of preparing and soliciting proxies will be borne by the Company. Solicitation will be made primarily by mail, but shareholders may be solicited by telephone, e-mail, or personal contact.

EFFECT OF ABSTENTIONS

Abstentions will not be counted in determining whether Proposals One or Two have been approved.

OTHER MATTERS

No other matters are expected to be presented for action at the Meeting. Should any additional matter come before the Meeting, it is intended that proxies in the accompanying form will be voted in accordance with the judgment of the person or persons named in the proxy.

| By Order of the Board of Directors |

| |

| Aikaterini Stoupa

Secretary |

September 24, 2014

Voula, Greece

EXHIBIT 2