Exhibit 99.3

Dollarama Inc.

Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(expressed in thousands of Canadian dollars)

Auditors’ Report

To the Shareholders of

Dollarama Inc.

We have audited the consolidated balance sheets ofDollarama Inc. as of January 31, 2010 and February 1, 2009 and the consolidated statements of earnings (loss), shareholders’ equity and cash flows for the years ended January 31, 2010 and February 1, 2009. These financial statements are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Corporation as of January 31, 2010 and February 1, 2009 and the results of its operations and its cash flows for the years ended January 31, 2010 and February 1, 2009 in accordance with Canadian generally accepted accounting principles.

Montréal, Quebec

April 8, 2010

| 1 | Chartered accountant auditor permit No. 19653 |

“PricewaterhouseCoopers” refers to PricewaterhouseCoopers LLP/s.r.l./s.e.n.c.r.l., an Ontario limited liability partnership, or, as the context requires, the PricewaterhouseCoopers global network or other member firms of the network, each of which is a separate legal entity.

Dollarama Inc.

Consolidated Balance Sheets

(expressed in thousands of Canadian dollars)

| | | | | |

| | | As of January 31, 2010 $ | | | As of February 1, 2009 $ |

| | |

Assets | | | | | |

Current assets | | | | | |

Cash and cash equivalents | | 93,057 | | | 66,218 |

Accounts receivable | | 1,453 | | | 2,998 |

Deposits and prepaid expenses | | 4,924 | | | 4,710 |

Merchandise inventories | | 234,684 | | | 249,644 |

Derivative financial instruments (note 10) | | 3,479 | | | 33,175 |

| | | | | |

| | 337,597 | | | 356,745 |

Property and equipment (note 3) | | 138,214 | | | 129,878 |

Goodwill | | 727,782 | | | 727,782 |

Other intangible assets (note 4) | | 113,302 | | | 115,210 |

Derivative financial instruments (note 10) | | 5,342 | | | 33,423 |

| | | | | |

| | 1,322,237 | | | 1,363,038 |

| | | | | |

Liabilities | | | | | |

Current liabilities | | | | | |

Accounts payable | | 31,694 | | | 39,729 |

Accrued expenses and other (note 5) | | 46,825 | | | 37,760 |

Income taxes payable | | 23,445 | | | 5,692 |

Derivative financial instruments (note 10) | | 55,194 | | | — |

Current portion of long-term debt (note 6) | | 1,925 | | | 15,302 |

| | | | | |

| | 159,083 | | | 98,483 |

Long-term debt (note 6) | | 468,591 | | | 806,384 |

Due to shareholders (note 7) | | — | | | 256,077 |

Future income taxes (note 17) | | 49,879 | | | 71,759 |

Other liabilities (note 8) | | 29,988 | | | 28,098 |

| | | | | |

| | 707,541 | | | 1,260,801 |

| | | | | |

Commitments (note 9) | | | | | |

Shareholders’ Equity | | | | | |

Capital stock (note 11) | | 518,430 | | | 35,304 |

Contributed surplus | | 17,472 | | | 10,354 |

Retained earnings | | 88,885 | | | 16,022 |

Accumulated other comprehensive income (loss) | | (10,091 | ) | | 40,557 |

| | | | | |

| | 614,696 | | | 102,237 |

| | | | | |

| | 1,322,237 | | | 1,363,038 |

| | | | | |

Approved by the Board of Directors

| | | | | | |

| | | |  | | |

| Nicholas Nomicos, Director | | | | John Swidler, Director | | |

The accompanying notes are an integral part of the consolidated financial statements.

Dollarama Inc.

Consolidated Statements of Shareholders’ Equity

(expressed in thousands of Canadian dollars)

| | | | | | | | | | | | | |

| | | Capital

stock $ | | Contributed

surplus $ | | Retained

earnings $ | | | Accumulated

other

comprehensive

income (loss) $ | | | Shareholders’

equity $ | |

| | | | | |

Balance – February 3, 2008 | | 35,304 | | 10,071 | | 31,526 | | | (4,993 | ) | | 71,908 | |

| | | | | | | | | | | | | |

Net loss for the year | | — | | — | | (15,504 | ) | | — | | | (15,504 | ) |

Other comprehensive income | | | | | | | | | | | | | |

Unrealized gain on derivative financial instruments, net of reclassification adjustments and income taxes of $21,435 | | — | | — | | — | | | 45,550 | | | 45,550 | |

| | | | | | | | | | | | | |

| | | | | |

Total comprehensive income | | | | | | | | | | | | 30,046 | |

| | | | | | | | | | | | | |

| | | | | |

Stock-based compensation (note 12) | | — | | 283 | | — | | | — | | | 283 | |

| | | | | | | | | | | | | |

| | | | | |

Balance – February 1, 2009 | | 35,304 | | 10,354 | | 16,022 | | | 40,557 | | | 102,237 | |

| | | | | | | | | | | | | |

Net earnings for the year | | — | | — | | 72,863 | | | — | | | 72,863 | |

Other comprehensive income | | | | | | | | | | | | | |

Unrealized loss on derivative financial instruments, net of reclassification adjustments and income taxes of $22,465 | | — | | — | | — | | | (50,648 | ) | | (50,648 | ) |

| | | | | | | | | | | | | |

| | | | | |

Total comprehensive income | | | | | | | | | | | | 22,215 | |

| | | | | | | | | | | | | |

| | | | | |

Stock-based compensation (note 12) | | — | | 7,118 | | — | | | — | | | 7,118 | |

| | | | | |

Issuance of common shares, net of issuance expenses of $27,775 and related income taxes of $6,455 (note 1) | | 278,680 | | — | | — | | | — | | | 278,680 | |

Conversion of amounts due to shareholders into common shares (note 11) | | 204,446 | | — | | — | | | — | | | 204,446 | |

| | | | | | | | | | | | | |

| | | | | |

Balance – January 31, 2010 | | 518,430 | | 17,472 | | 88,885 | | | (10,091 | ) | | 614,696 | |

| | | | | | | | | | | | | |

The sum of retained earnings and accumulated other comprehensive income (loss) amounted to $78,794 as of January 31, 2010 (February 1, 2009 – $56,579).

The accompanying notes are an integral part of the consolidated financial statements.

Dollarama Inc.

Consolidated Statements of Earnings (Loss)

(expressed in thousands of Canadian dollars, except per share amounts)

| | | | | | |

| | | For the year ended January 31, 2010 $ | | | For the year ended February 1, 2009 $ | |

| | |

Sales | | 1,253,706 | | | 1,089,011 | |

| | | | | | |

| | |

Cost of sales and expenses | | | | | | |

Cost of sales | | 810,624 | | | 724,157 | |

General, administrative and store operating expenses | | 264,784 | | | 214,596 | |

Amortization | | 24,919 | | | 21,818 | |

| | | | | | |

| | 1,100,327 | | | 960,571 | |

| | | | | | |

| | |

Operating income | | 153,379 | | | 128,440 | |

| | |

Interest expense on long-term debt | | 62,343 | | | 61,192 | |

Interest expense on amounts due to shareholders | | 19,866 | | | 25,709 | |

Foreign exchange loss (gain) on derivative financial instruments and long-term debt | | (31,108 | ) | | 44,793 | |

| | | | | | |

| | |

Earnings (loss) before income taxes | | 102,278 | | | (3,254 | ) |

| | |

Provision for income taxes(note 17) | | 29,415 | | | 12,250 | |

| | | | | | |

| | |

Net earnings (loss) for the year | | 72,863 | | | (15,504 | ) |

| | | | | | |

| | |

Basic net earnings (loss) per common share | | 1.41 | | | (0.36 | ) |

Diluted net earnings (loss) per common share | | 1.37 | | | (0.36 | ) |

| | | | | | |

| | |

Weighted average number of common shares outstanding during the year (note 11) | | 51,511 | | | 42,576 | |

| | | | | | |

| | |

Weighted average number of diluted common shares outstanding during the year (note 11) | | 53,049 | | | 42,576 | |

| | | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

Dollarama Inc.

Consolidated Statements of Cash Flows

(expressed in thousands of Canadian dollars)

| | | | | | |

| | | For the year ended January 31, 2010 $ | | | For the year ended February 1, 2009 $ | |

| | |

Operating activities | | | | | | |

Net earnings (loss) for the year | | 72,863 | | | (15,504 | ) |

Adjustments for | | | | | | |

Amortization of property and equipment | | 25,327 | | | 22,310 | |

Amortization of intangible assets | | 1,737 | | | 2,267 | |

Change in fair value of derivatives | | 46,287 | | | (84,437 | ) |

Amortization of debt issue costs | | 8,439 | | | 5,802 | |

Deemed interest on debt repayments | | (8,288 | ) | | (1,129 | ) |

Foreign exchange loss (gain) on long-term debt | | (103,371 | ) | | 143,512 | |

Amortization of unfavourable lease rights | | (2,145 | ) | | (2,759 | ) |

Deferred lease inducements | | 2,139 | | | 2,276 | |

Deferred leasing costs | | (157 | ) | | (575 | ) |

Amortization of deferred leasing costs | | 328 | | | 245 | |

Deferred tenant allowances | | 3,594 | | | 2,643 | |

Amortization of deferred tenant allowances | | (1,698 | ) | | (1,343 | ) |

Stock-based compensation | | 5,600 | | | 741 | |

Capitalized interest on long-term debt | | 9,748 | | | 20,760 | |

Capitalized interest expense on amounts due to shareholders | | 18,451 | | | 23,852 | |

Future income taxes | | 5,479 | | | 9,136 | |

Other | | (1 | ) | | 38 | |

| | | | | | |

| | 84,332 | | | 127,835 | |

Changes in non-cash working capital components (note 15) | | 38,154 | | | (12,179 | ) |

| | | | | | |

| | 122,486 | | | 115,656 | |

| | | | | | |

| | |

Investing activities | | | | | | |

Purchase of property and equipment | | (33,772 | ) | | (40,502 | ) |

Proceeds on disposal of property and equipment | | 110 | | | 189 | |

Net settlement of derivative financial instruments (note 10) | | (6,429 | ) | | (9,415 | ) |

| | | | | | |

| | (40,091 | ) | | (49,728 | ) |

| | | | | | |

| | |

Financing activities | | | | | | |

Repayment of amounts due to shareholders | | (70,082 | ) | | — | |

Increase in common shares | | 272,224 | | | — | |

Debt issue costs | | — | | | (208 | ) |

Repayment of long-term debt | | (257,698 | ) | | (25,791 | ) |

| | | | | | |

| | (55,556 | ) | | (25,999 | ) |

| | | | | | |

| | |

Increase in cash and cash equivalents | | 26,839 | | | 39,929 | |

| | |

Cash and cash equivalents – Beginning of year | | 66,218 | | | 26,289 | |

| | | | | | |

| | |

Cash and cash equivalents – End of year | | 93,057 | | | 66,218 | |

| | | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| 1 | Basis of presentation, nature of business, initial public offering and reorganization |

Basis of presentation and nature of business

Dollarama Capital Corporation was formed on October 20, 2004 under the Canada Business Corporations Act. On September 8, 2009, Dollarama Capital Corporation changed its name to Dollarama Inc. (the “Corporation”). The consolidated financial statements have been prepared in accordance with Canadian generally accepted accounting principles (“GAAP”) and reflect the financial position, results of operations and cash flows of the Corporation and its subsidiaries, all of which are wholly owned.

The Corporation operates dollar stores in Canada that sell all items for $2 or less. As of January 31, 2010, its retail operations are carried on in every Canadian province. The retail operations’ corporate headquarters, distribution centre and warehouses are located in the Montréal area, Canada. The Corporation manages its business on the basis of one reportable segment.

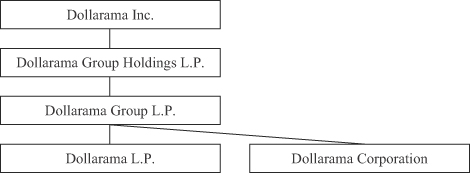

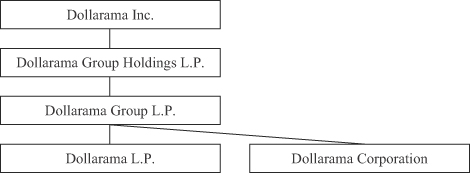

The significant entities within the legal structure of the Corporation are as follows:

Dollarama Group Holdings L.P. is a co-issuer of the senior subordinated deferred interest notes, as further described in note 6(c).

Dollarama Group L.P. has a senior secured credit facility as further described in note 6(b).

Dollarama L.P. and Dollarama Corporation operate the chain of stores and perform related logistical and administrative support activities.

(1)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

Initial public offering

On October 16, 2009, the Corporation completed its initial public offering by issuing 17,142,857 common shares at a price of $17.50 per common share, resulting in net proceeds of $272,223,983 after deducting the underwriters’ fees and other expenses related to the offering. In addition, certain shareholders of the Corporation granted to the underwriters an over-allotment option, which was fully exercised to purchase from such shareholders 2,571,428 common shares. The Corporation did not receive any proceeds from the sale of these common shares by the selling shareholders; however, the Corporation has paid the related underwriters’ fees which amounted to $2,700,000.

Reorganization

Immediately before the closing of the initial public offering referred to above, the Corporation amalgamated with 4513631 Canada Inc., its controlling shareholder. The authorized share capital of the amalgamated corporation consists of an unlimited number of common shares and preferred shares.

On amalgamation 4513631 Canada Inc. had no significant liabilities other than promissory notes which were paid on the closing of the initial public offering and did not own any significant assets other than the junior subordinated notes, the Class A preferred shares, the Class A common shares and the Class C preferred shares issued by the Corporation.

Upon amalgamation, the junior subordinated notes and all the issued and outstanding common and preferred shares of the Corporation and 4513631 Canada Inc. were converted into common shares of Dollarama Inc., and the Corporation assumed the promissory notes referred to above. The promissory notes amounting to $70,082,000 were repaid on October 16, 2009, concurrently with the initial public offering.

| 2 | Summary of significant accounting policies |

Use of estimates

The preparation of financial statements in accordance with Canadian GAAP requires the use of estimates that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the balance sheet date and the reported amounts of revenue and expense items for the reporting period. On an ongoing basis, management reviews its estimates, including those related to the net realizable value of merchandise inventories, useful lives of property and equipment, impairment of long-lived assets and goodwill, income taxes and fair value of financial instruments, based on currently available information. Actual results could differ from those estimates.

Cash and cash equivalents

Cash and cash equivalents include highly liquid investments with original maturities from date of purchase of three months or less.

(2)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

Merchandise inventories

Merchandise inventories at the distribution centre, warehouses and stores are stated at the lower of cost and net realizable value. Cost is determined on a weighted average cost basis and is assigned to store inventories using the retail inventory method. Costs of inventory include amounts paid to suppliers, duties and freight into the warehouses as well as costs directly associated with warehousing and distribution.

Property and equipment

Property and equipment are carried at cost and amortized over the estimated useful lives of the assets as follows:

| | |

Under the declining balance method | | |

Computer equipment | | 30% |

Vehicles | | 30% |

| |

Under the straight-line method | | |

Store and warehouse equipment | | 8-10 years |

Computer software | | 5 years |

Leasehold improvements | | Term of lease |

Goodwill

Goodwill is tested for impairment annually or when events or changes in circumstances indicate that it may be impaired. A Step I impairment test of the goodwill of the Corporation’s reporting unit is accomplished mainly by determining whether the fair value of the reporting unit exceeds its net carrying amount as of the assessment date. If the fair value is greater than the net carrying amount, no impairment is necessary. In the event that the net carrying amount of the reporting unit exceeds the sum of the discounted estimated cash flows, a Step II impairment test must be performed whereby the fair value of the reporting unit’s goodwill must be estimated to determine if it is less than its net carrying amount. Fair value of goodwill in the Step II impairment test is estimated in the same way as goodwill was determined at the date of the acquisition in a business combination, that is, the excess of the fair value of the reporting unit over the fair value of the identifiable net assets of the reporting unit. The Corporation conducts its annual impairment test as of the balance sheet date.

Trade name

Trade name is recorded at cost and is not subject to amortization. It is tested for impairment annually or more frequently if events or circumstances indicate that it may be impaired. The impairment test consists of a comparison of the fair value, based on discounted estimated cash flows related to the trade name, with its carrying amount. If the fair value is greater than the carrying amount, no impairment is necessary. If the carrying amount exceeds the fair value, an impairment loss shall be recognized in an amount equal to that excess. The Corporation conducts its annual impairment test as of the balance sheet date.

(3)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

Favourable and unfavourable lease rights

Favourable and unfavourable lease rights represent the fair value of lease rights as established on the date of their acquisition or assumption and are amortized on a straight-line basis over the terms of the related leases.

Covenants not to compete

The covenants not to compete is amortized on a straight-line basis over the terms of the agreement.

Deferred leasing instruments

Deferred leasing costs and deferred tenant allowances are recorded on the balance sheet and amortized using the straight-line method over the term of the respective lease.

Debt issue costs

Debt issue costs are deducted from the carrying value of the related debt and are accounted for at amortized cost using the effective interest method.

Operating leases

The Corporation recognizes rental expense incurred and inducements received from landlords on a straight-line basis over the term of the lease. Any difference between the calculated expense and the amounts actually paid is reflected as deferred lease inducements in the Corporation’s balance sheet. Contingent rental expense is recognized when the achievement of specified sales targets is considered probable.

Impairment of long-lived assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Impairment is assessed by comparing the carrying amount of an asset with the expected future net undiscounted cash flows from its use together with its residual value. If such asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value.

Revenue recognition

The Corporation recognizes revenue at the time the customer tenders payment for and takes possession of the merchandise. All sales are final.

Cost of sales

The Corporation includes the cost of merchandise inventories, procurement, warehousing and distribution costs, and certain occupancy costs in its cost of sales.

(4)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

General, administrative and store operating expenses

The Corporation includes store and head office salaries and benefits, repairs and maintenance, professional fees, store supplies and other related expenses in general, administrative and store operating expenses.

Pre-opening costs

Costs associated with the opening of new stores are expensed as incurred.

Vendor rebates

The Corporation records vendor rebates, consisting of volume purchase rebates, when it is probable that they will be received and the amount is reasonably estimable. The rebates are recorded as a reduction of inventory purchases and are reflected as a reduction of cost of sales.

Advertising costs

The Corporation expenses advertising costs as incurred. Advertising costs for the year ended January 31, 2010 amounted to $630,000 (February 1, 2009 – $1,953,000).

Employee future benefits

The Corporation offers a group defined contribution pension plan to eligible employees whereby it matches an employee’s contributions of up to 3% of the employee’s salary. The pension expense for the year ended January 31, 2010 amounted to $1,132,000 (February 1, 2009 – $1,153,000).

Income taxes

The Corporation uses the asset and liability method in accounting for income taxes. According to this method, future income taxes are determined using the difference between the accounting and tax bases of assets and liabilities. Future income tax assets and liabilities are measured using substantively enacted tax rates in effect in the year in which these temporary differences are expected to be recovered or settled. Future income tax assets are recognized when it is more likely than not that the assets will be realized.

Foreign currency transactions

Monetary assets and liabilities denominated in foreign currencies are translated at year-end exchange rates, while non-monetary assets and liabilities are translated at historical rates. Revenues and expenses are translated at prevailing market rates in the recognition period. The resulting exchange gains or losses are recorded in the consolidated statement of earnings.

Derivative financial instruments

The Corporation uses derivative financial instruments in the management of its foreign currency and interest rate exposures.

(5)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

When hedge accounting is used, the Corporation documents relationships between the hedging instruments and the hedged items, as well as its risk management objective and strategy for undertaking various hedge transactions. This process includes linking derivatives to specific assets and liabilities on the balance sheet or to specific firm commitments or forecasted transactions. The Corporation also assesses whether the derivatives that are used in hedging transactions are effective in offsetting changes in cash flows of hedged items.

Foreign exchange forward contracts and foreign currency swap agreements

The Corporation has significant cash flows and long-term debt denominated in US dollars. It uses foreign exchange forward contracts and foreign currency swap agreements to mitigate risks from fluctuations in exchange rates. All forward contracts and swap agreements are used for risk management purposes. Some forward contracts are designated as cash flow hedges of specific anticipated transactions. Under the cash flow hedge model, the fair values of the foreign exchange forward contracts are recorded in “Accumulated other comprehensive income” and reclassified to the consolidated statement of earnings when the related hedged item is recorded in earnings.

Foreign exchange forward contracts are classified as current assets or liabilities on the consolidated balance sheet.

Interest rate swap agreements

The Corporation’s interest rate risk is primarily in relation to its floating rate borrowings. The Corporation has entered into swap agreements to mitigate this risk.

Others

In the event a derivative financial instrument designated as a hedge is terminated or ceases to be effective prior to maturity, related realized and unrealized gains or losses are deferred under assets or liabilities and recognized in earnings in the period in which the underlying original hedged transaction is recognized. In the event a designated hedged item is sold, extinguished or matures prior to the termination of the related derivative financial instrument, any realized or unrealized gain or loss on such derivative financial instrument is recognized in earnings.

Derivative financial instruments which are not designated as hedges or have ceased to be effective prior to maturity are recorded at their estimated fair values under assets or liabilities, with changes in their estimated fair values recorded in earnings.

Stock-based compensation

The Corporation has outstanding common shares options.

The common shares options are considered equity awards. Accordingly, the Corporation recognizes a compensation expense based on the fair value of the options at the grant date. The options vest in tranches (graded vesting), and accordingly, the expense is recognized using the accelerated expense attribution method over the vesting period.

(6)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

When the vesting of an award is contingent upon the attainment of performance conditions, the Corporation recognizes the expense based on management’s best estimate of the outcome of the conditions and consequently the number of options that are expected to vest. When awards are forfeited because service or performance conditions are not met, any expense previously recorded is reversed in the period of forfeiture.

Preferred shares

Prior to the reorganization described in note 1, the Corporation had Class A, B and C preferred shares which were classified as liabilities within the balance sheet line “Due to shareholders” and which were recorded at their redemption value.

Earnings per common share

Earnings per common share are determined using the weighted average number of common shares outstanding during the year. Diluted earnings per common share are determined using the treasury stock method to evaluate the dilutive effect of stock options, convertible instruments and equivalents, when applicable. Under this method, instruments with a dilutive effect, basically when the average market price of a share for the period exceeds the exercise price, are considered to have been exercised at the beginning of the period (or at the time of issuance, if later) and the proceeds received are considered to have been used to redeem common shares at the average market price during the period.

Comparative figures

To conform with the basis of presentation adapted in the current year, certain figures previously reported have been reclassified.

Changes in accounting policies during the year

Goodwill and intangible assets

Canadian Institute of Chartered Accountants (“CICA”) Handbook Section 3064, “Goodwill and Intangible Assets”, replaces Section 3062, “Goodwill and Other Intangible Assets”, and establishes standards for the recognition, measurement and disclosure of goodwill and intangible assets. The provisions relating to the definition and initial recognition of intangible assets are equivalent to the corresponding provisions of International Accounting Standard (“IAS”) 38, “Intangible Assets”. Section 1000, “Financial Statement Concepts”, has been amended to clarify criteria for recognition of an asset. Section 3450, “Research and Development Costs”, has been replaced by guidance in Section 3064. CICA Emerging Issues Committee Abstract 27, “Revenues and Expenditures During the Pre-operating Period”, is no longer applicable for entities that have adopted Section 3064. Accounting Guideline 11, “Enterprises in the Development Stage”, has been amended to delete references to deferred costs and to provide guidance on development costs as intangible assets under Section 3064. This Section was adopted as of February 2, 2009 with no impact on the consolidated financial statements.

(7)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

Accounting changes

In June 2009, the CICA amended Section 1506, “Accounting Changes”, to exclude from the scope of this Section changes in accounting policies upon the complete replacement of an entity’s primary basis of accounting. This amendment is effective for years beginning after July 1, 2009. This amendment was early adopted as of January 31, 2010 with no impact on the consolidated financial statements.

Financial instruments – Disclosures

In June 2009, the CICA amended Section 3862, “Financial Instruments – Disclosures”, to include additional disclosure requirements about fair value measurement for financial instruments and liquidity risk disclosures. These amendments require a three-level hierarchy that reflects the significance of the inputs used in making the fair value measurements. Fair values of assets and liabilities included in Level 1 are determined by reference to quoted prices in active markets for identical assets and liabilities. Assets and liabilities in Level 2 include valuations using inputs other than the quoted prices for which all significant inputs are based on observable market data, either directly or indirectly. Level 3 valuations are based on inputs that are not based on observable market data. The adoption of amended Section 3862 as of January 31, 2010 had no impact on the consolidated financial statements.

Future accounting standards not yet applied

Business combinations, consolidated financial statements and non-controlling interests

CICA Handbook Section 1582, “Business Combinations”; Section 1601, “Consolidated Financial Statements”; and Section 1602, “Non-controlling Interests”; replace Section 1581, “Business Combinations”, and Section 1600, “Consolidated Financial Statements”, and establish a new section for accounting for a non-controlling interest in a subsidiary. These sections provide the Canadian equivalent to International Financial Reporting Standard 3, “Business Combinations (January 2008)”, and IAS 27, “Consolidated and Separate Financial Statements (January 2008)”. Section 1582 is effective for business combinations for which the acquisition date is on or after the first quarter beginning on January 31, 2011 with early adoption permitted. Sections 1601 and 1602 apply to interim and annual consolidated financial statements relating to years beginning on January 31, 2011 with early adoption permitted. The Corporation is assessing the impact of these new standards.

(8)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | | | | | |

| | | 2010 |

| | | Cost $ | | Accumulated amortization $ | | Net $ |

| | | |

Store and warehouse equipment | | 123,475 | | 46,567 | | 76,908 |

Leasehold improvements | | 79,993 | | 28,061 | | 51,932 |

Computer software | | 14,712 | | 8,455 | | 6,257 |

Computer equipment | | 3,142 | | 1,365 | | 1,777 |

Vehicles | | 2,681 | | 1,341 | | 1,340 |

| | | | | | |

| | 224,003 | | 85,789 | | 138,214 |

| | | | | | |

| | | | | | |

| | | 2009 |

| | | Cost $ | | Accumulated amortization $ | | Net $ |

| | | |

Store and warehouse equipment | | 105,844 | | 32,331 | | 73,513 |

Leasehold improvements | | 66,527 | | 20,875 | | 45,652 |

Computer software | | 13,698 | | 5,426 | | 8,272 |

Computer equipment | | 2,001 | | 1,043 | | 958 |

Vehicles | | 2,493 | | 1,010 | | 1,483 |

| | | | | | |

| | 190,563 | | 60,685 | | 129,878 |

| | | | | | |

| | | | | | |

| | | 2010 |

| | | Cost $ | | Accumulated amortization $ | | Net $ |

| | | |

Trade name | | 108,200 | | — | | 108,200 |

Favourable lease rights | | 20,862 | | 17,521 | | 3,341 |

Covenants not to compete | | 400 | | 298 | | 102 |

Deferred leasing costs | | 2,550 | | 891 | | 1,659 |

| | | | | | |

| | 132,012 | | 18,710 | | 113,302 |

| | | | | | |

(9)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | | | | | |

| | | 2009 |

| | | Cost $ | | Accumulated amortization $ | | Net $ |

| | | |

Trade name | | 108,200 | | — | | 108,200 |

Favourable lease rights | | 20,862 | | 15,842 | | 5,020 |

Covenants not to compete | | 400 | | 240 | | 160 |

Deferred leasing costs | | 2,393 | | 563 | | 1,830 |

| | | | | | |

| | 131,855 | | 16,645 | | 115,210 |

| | | | | | |

The weighted average amortization periods (expressed in number of years) are as follows:

| | |

Favourable lease rights | | 9.4 |

Covenants not to compete | | 7.0 |

Deferred leasing costs | | 9.8 |

Amortization of other intangible assets for the next five years is approximately as follows:

| | |

| | | $ |

| |

2011 | | 1,681 |

2012 | | 1,344 |

2013 | | 862 |

2014 | | 478 |

2015 | | 352 |

| 5 | Accrued expenses and other |

| | | | |

| | | 2010 $ | | 2009 $ |

| | |

Compensation and benefits | | 19,597 | | 12,265 |

Interest | | 2,152 | | 13,053 |

Inventory in transit | | 5,321 | | 1,974 |

Rent | | 4,607 | | 3,754 |

Sales tax | | 5,366 | | 1,352 |

Other | | 9,782 | | 5,362 |

| | | | |

| | 46,825 | | 37,760 |

| | | | |

(10)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

Long-term debt outstanding consists of the following:

| | | | | | | |

| | | Note | | | 2010 $ | | 2009 $ |

| | | |

Term bank loan (US$234,325,000; 2009 – US$236,760,000), maturing in November 2011, repayable in quarterly capital instalments of US$608,000. Advances under the term bank loan bear interest at rates ranging from 0.75% to 1.0% per annum above the bank’s prime rate. However, borrowings under the term bank loan by way of LIBOR loans bear interest at rates ranging from 1.75% to 2.0% per annum above the bank’s LIBOR | | 6 | (b) | | 250,564 | | 290,386 |

Senior subordinated deferred interest notes (US$212,169,000; 2009 – US$203,449,000), maturing in August 2012, interest accrues semi-annually in arrears at a rate per annum equal to 6-month LIBOR plus 5.75%, increasing to 6.25% in December 2008 and 6.75% in December 2009 | | 6 | (c) | | 226,872 | | 249,530 |

Senior subordinated notes, repaid during the year | | 6 | (a) | | — | | 245,300 |

Term bank loan, repaid during the year | | 6 | (b) | | — | | 53,195 |

| | | | | | | |

| | | | | 477,436 | | 838,411 |

Less: Current portion | | | | | 1,925 | | 15,302 |

| | | | | | | |

| | | | | 475,511 | | 823,109 |

Less: Debt issue costs and discount | | | | | 6,920 | | 16,725 |

| | | | | | | |

| | | | | 468,591 | | 806,384 |

| | | | | | | |

| | a) | Senior subordinated notes (the “Notes”) |

On November 17, 2009, the Corporation redeemed all of the issued and outstanding Notes in the aggregate principal amount of US$200,000,000 in accordance with section 5(a) of the Notes and section 3.01(a) of the Indenture at a redemption price equal to 104.438% (US$208,876,000) of the principal amounts of such Notes, plus accrued and unpaid interest up to November 17, 2009. As a result, an additional expense of US$8,876,000 ($9,183,000 using the exchange rate as of the transaction date) has been recorded as a redemption premium in interest expense.

Prior to their redemption, the Notes were converted into Canadian dollars at the foreign exchange rates prevailing at the balance sheet date. As a result, a foreign exchange gain of $35,200,000 was recorded in earnings under “Foreign exchange loss (gain) on derivative financial instruments and long-term debt” for the period of February 2, 2009 to November 17, 2009 (2009 – loss of $46,500,000).

(11)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | b) | Senior secured credit facility |

Dollarama Group L.P. has a senior secured revolving credit facility amounting to $75,000,000 and consisting of revolving credit loans, bankers’ acceptances, swing line loans and a letter-of-credit facility. Borrowings under swing line loans are limited to $10,000,000 and the letter-of-credit facility is limited to $25,000,000. As of January 31, 2010, there were no borrowings under this facility. The senior secured credit facility also includes term bank loans. Borrowings under the term bank loans amounted to $250,564,000 as of January 31, 2010 (February 1, 2009 – $343,581,000) and letters of credit issued for the purchase of inventories amounting to $1,312,000 (February 1, 2009 – $2,170,000). Subject to certain exceptions and reductions in the total lease-adjusted leverage ratio, the term bank loans require payment of 100% of net cash proceeds on certain sales of assets, 100% of net cash proceeds on issuance of certain new indebtedness, 50% of net proceeds of a public offering or private placement, and 50% of annual excess cash flow (as defined in the credit agreement).

The term bank loan of US$234,325,000 (February 1, 2009 – US$236,759,000) has been converted into Canadian dollars at foreign exchange rates prevailing at the balance sheet dates and a foreign exchange gain of $36,821,000 (February 1, 2009 – loss of $55,624,000) has been included in the consolidated statements of earnings in “Foreign exchange loss (gain) on derivative financial instruments and long-term debt”.

The credit facilities are subject to the customary terms and conditions for loans of this nature, including limits on incurring additional indebtedness and granting liens or selling assets without the consent of the lenders. The credit facilities are also subject to the maintenance of a maximum lease adjusted leverage ratio test and a minimum interest coverage ratio test. The credit facilities may, in certain circumstances, restrict Dollarama Group L.P.’s ability to pay distributions, including limiting distributions, unless sufficient funds are available for the repayment of indebtedness and the payment of interest expenses and taxes.

Failure to comply with the terms of the credit facilities would entitle the lenders to accelerate all amounts outstanding under the credit facilities, and upon such acceleration, the lenders would be entitled to begin enforcement procedures against the assets of Dollarama Group L.P., including accounts receivable, inventories and equipment. The lender would then be repaid from the proceeds of such enforcement proceedings, using all available assets. Only after such repayment, and the payment of any other secured and unsecured creditors, would the holders of units receive any proceeds from the liquidation of the assets of Dollarama Group L.P. As of January 31, 2010, Dollarama Group L.P. was in compliance with these covenants.

(12)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | c) | Senior subordinated deferred interest notes (the “Deferred Interest Notes”) |

The Deferred Interest Notes were issued at 99% of face value and are senior unsecured obligations of Dollarama Group Holdings L.P. and Dollarama Group Holdings Corporation and are structurally subordinated in right of payment to all existing and future debt and other liabilities of Dollarama Group Holdings L.P.’s subsidiaries. On each interest payment date, Dollarama Group Holdings L.P. and Dollarama Group Holdings Corporation may elect to pay interest in cash or defer the payment of interest, and interest shall accrue on such deferred interest for subsequent interest periods. Dollarama Group Holdings L.P. and Dollarama Group Holdings Corporation may redeem some or all of the Deferred Interest Notes at the following redemption prices (expressed as percentages of principal plus deferred interest) plus accrued and unpaid interest, if any, to the redemption date:

| | |

| | | Redemption

price % |

Years commencing December 15, 2009 | | 101.00 |

December 15, 2010 and thereafter | | 100.00 |

Following a change in control, Dollarama Group Holdings L.P. will be required to offer to purchase all Deferred Interest Notes at a price of 101% of their principal amount plus deferred interest plus any accrued and unpaid interest, if any, to the date of the purchase.

The Deferred Interest Notes are subject to the customary covenants restricting Dollarama Group Holdings L.P.’s and Dollarama Group Holdings Corporation’s ability to, among other things, incur additional debt, pay dividends and make other restricted payments, create liens, consolidate, merge or enter into business combinations, or sell assets.

The Deferred Interest Notes have been translated into Canadian dollars at the foreign exchange rates prevailing at the balance sheet dates and a foreign exchange gain of $31,798,000 (February 1, 2009 – loss of $43,746,000) has been included in the consolidated statements of earnings (loss) in “Foreign exchange loss (gain) on derivative financial instruments and long-term debt.”

| | d) | As collateral for the long-term debt, the Corporation has pledged substantially all of its assets. |

| | e) | As of January 31, 2010, the fair value of long-term debt amounted to $474,291,000. |

The fair value of long-term debt, including the portion due within one year, is principally based on prices obtained on the quoted markets and from a third party broker.

(13)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | f) | Principal repayments on long-term debt due in each of the next three years are approximately as follows: |

| | |

| | | $ |

2011 | | 1,925 |

2012 | | 248,639 |

2013 | | 226,872 |

| | g) | As described in (b) and (c) above, certain restrictions exist regarding the transfer of funds in the form of loans, advances or cash dividends (defined as “Restricted Payments”) to and from Dollarama Group Holdings L.P. and Dollarama Group L.P. Virtually all operations of the Corporation are conducted through its indirect subsidiary, Dollarama L.P., and consequently, the capacity to make Restricted Payments to the Corporation depends on the capacity of Dollarama Group L.P. and Dollarama Group Holdings L.P. to make Restricted Payments. As of January 31, 2010, the net assets of Dollarama Group L.P. amounted to $917.7 million, of which $747.6 million was restricted from payments. Subject to limitations imposed by the indenture governing the Deferred Interest Notes, as of January 31, 2010, Dollarama Group Holdings L.P.’s net assets amounted to $691.3 million, of which $619.4 million was restricted from payments. |

Amounts due to shareholders and number of shares outstanding are as follows:

| | | | | | | | |

| | | 2010 | | 2009 |

| | | Number

of shares | | $ | | Number

of shares | | $ |

Junior Subordinated Notes | | n/a | | — | | n/a | | 116,262 |

Class A preferred shares | | | | — | | 20,964,958 | | 32,108 |

Class B preferred shares | | | | — | | 24,681,726 | | 37,802 |

Class C preferred shares | | | | — | | 55,552,551 | | 64,902 |

Accrued interest | | n/a | | — | | n/a | | 5,003 |

| | | | | | | | |

| | | | — | | | | 256,077 |

| | | | | | | | |

As described in note 1, as of the date of the closing of the initial public offering, the junior subordinated notes and all the issued and outstanding common and preferred shares of the Corporation (other than the junior subordinated notes and shares held by 4513631 Canada Inc. which have been cancelled for no consideration) and 4513631 Canada Inc. were converted into common shares of Dollarama Inc., and the Corporation assumed promissory notes in the amount of $70,082,000, which were repaid on October 16, 2009, concurrently with the closing of the initial public offering.

(14)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | | | |

| | | 2010 $ | | 2009 $ |

Unfavourable lease rights, (including accumulated amortization of $15,777,000; 2009 – $13,633,000) | | 4,288 | | 6,432 |

Deferred lease inducements | | 12,903 | | 10,764 |

Deferred tenant allowances (including accumulated amortization of $4,852,000; 2009 – $3,154,000) | | 12,797 | | 10,902 |

| | | | |

| | 29,988 | | 28,098 |

| | | | |

As of January 31, 2010, contractual obligations for operating leases amounted to approximately $567,599,000. The leases extend over various periods up to the year 2024.

The basic annual rent, exclusive of contingent rentals, for the next five years and thereafter is as follows:

| | |

| | | $ |

2011 | | 75,514 |

2012 | | 70,567 |

2013 | | 65,635 |

2014 | | 61,072 |

2015 | | 56,227 |

Thereafter | | 238,584 |

The rent and contingent rent expense of operating leases for stores, warehouses, the distribution centre and corporate headquarters included in the consolidated statements of earnings (loss) are as follows:

| | | | |

| | | 2010 $ | | 2009 $ |

Basic rent | | 73,979 | | 67,142 |

Contingent rent | | 2,298 | | 1,839 |

| | | | |

| | 76,277 | | 68,981 |

| | | | |

(15)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| 10 | Derivative financial instruments |

A summary of the aggregate contractual or notional amounts, balance sheet location and estimated fair values of derivative financial instruments as of January 31, 2010 and February 1, 2009 is as follows:

| | | | | | | | | |

| | | As of January 31, 2010 |

| | | Contractual

nominal

value US$ | | Balance sheet location | | Fair value –

Asset

(liability) $ | | | Nature of hedging

relationship |

Hedging instruments | | | | | | | | | |

Foreign exchange forward contracts | | 125,000 | | Current assets | | 3,479 | | | Cash flow hedge |

Foreign exchange forward contracts | | 130,000 | | Current liabilities | | (9,889 | ) | | Cash flow hedge |

| | | | | | | | | |

| | 255,000 | | | | (6,410 | ) | | |

| | | | |

Non-hedging instruments | | | | | | | | | |

Foreign currency and interest rate swaps | | 234,300 | | Current liabilities | | (32,759 | ) | | |

Foreign currency swap agreements | | 70,000 | | Long-term assets | | 5,342 | | | |

Foreign currency swap agreements | | 143,000 | | Current liabilities | | (12,546 | ) | | |

| | | | | | | | | |

| | 702,300 | | | | (46,373 | ) | | |

| | | | | | | | | |

| |

| | | As of February 1, 2009 |

| | | Contractual

nominal

value US$ | | Balance sheet location | | Fair value –

Asset $ | | | Nature of hedging

relationship |

Hedging instruments | | | | | | | | | |

Foreign exchange forward contracts | | 174,000 | | Current assets | | 33,175 | | | Cash flow hedge |

Foreign currency swap agreements | | 200,000 | | Long-term assets | | 25,447 | | | Cash flow hedge |

| | | | | | | | | |

| | 374,000 | | | | 58,622 | | | |

Non-hedging instruments | | | | | | | | | |

Foreign currency and interest rate swap agreements | | 236,700 | | Long-term assets | | 7,976 | | | |

| | | | | | | | | |

| | 610,700 | | | | 66,598 | | | |

| | | | | | | | | |

(16)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | | | | |

| | | As of

January 31,

2010 $ | | | As of

February 1,

2009 $ |

| | |

Derivative financial instruments | | | | | |

Current assets | | 3,479 | | | 33,175 |

Long-term assets | | 5,342 | | | 33,423 |

Current liabilities | | (55,194 | ) | | — |

| | | | | |

| | (46,373 | ) | | 66,598 |

| | | | | |

The Corporation is exposed to certain risks relating to its ongoing business operations. The primary risks managed by using derivative financial instruments are currency risk and interest rate risk. Foreign exchange forward contracts are entered into to manage the currency fluctuation risk associated with forecasted US-dollar merchandise purchases sold in the stores. Foreign currency swap agreements and foreign currency and interest rate swaps are entered into to manage currency fluctuation risk and interest rate risk associated with the Corporation’s US dollar borrowings.

The Corporation formally documents the relationship between the hedging instruments and the hedged items, as well as its risk management objectives and strategies for undertaking the hedge transactions.

Derivative financial instruments are classified as held for trading or designated as hedging instruments. The derivative financial instruments are recorded at fair value determined using market prices. All gains and losses from changes in fair value of derivative financial instruments not designated as hedges are recognized in earnings. The Corporation has designated its derivatives as hedges of the variability in highly probable future cash flows attributable to a recognized asset or liability or a forecasted transaction (cash flow hedges). All gains and losses from changes in fair value of derivative financial instruments designated as cash flow hedges are recorded in accumulated other comprehensive income (loss) and reclassified to earnings when the associated gains (losses) on the related hedged items are recognized.

(17)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | | | | | | | | | | | | | | | | | | | |

| | | 2010 | |

| | | | | Impact on

balance sheet | | | Pre-tax impact

on other

comprehensive loss | | | Impact on

earnings | | | Impact on cash flows | |

| | | Note | | Change in fair

value during

the year on

investment,

long-term debt

and derivative

financial

instruments $ | | | Unrealized loss

on derivative

financial

instruments net of

reclassification

adjustment $ | | | Foreign

exchange gain

(loss) on long-term debt and derivative

financial

instruments $ | | | Change in

fair value of

derivative

financial

instruments $ | | | Foreign

exchange

gain (loss)

on long-

term debt $ | | | Net

settlement of

derivative

financial

instruments $ | |

| | | | | | | |

Investment and long-term debt | | | | | | | | | | | | | | | | | | | | |

Senior subordinated notes | | 6(a) | | 35,200 | | | — | | | 35,200 | | | — | | | (35,200 | ) | | — | |

Term B loan | | 6(b) | | 36,821 | | | — | | | 36,821 | | | — | | | (36,821 | ) | | — | |

Senior subordinated deferred interest notes | | 6(c) | | 31,798 | | | — | | | 31,798 | | | — | | | (31,798 | ) | | — | |

Short-term investment (classified as cash and cash equivalents) | | | | 2,812 | | | — | | | 2,812 | | | — | | | — | | | — | |

Other foreign exchange gain | | | | — | | | — | | | 1,386 | | | — | | | 448 | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | | 108,017 | | | — | | | (103,371 | ) | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Derivative financial instruments | | | | | | | | | | | | | | | | | | | | |

Hedging | | | | | | | | | | | | | | | | | | | | |

Foreign exchange forward contracts, net of reclassification | | 10(b) | | (39,585 | ) | | (39,585 | ) | | — | | | — | | | | | | — | |

Impact of lag on foreign exchange forward contracts | | 10(b) | | | | | (24,899 | ) | | — | | | (24,899 | ) | | — | | | — | |

Foreign currency swap agreements | | 10(c) | | (43,708 | ) | | (6,048 | ) | | (37,660 | ) | | 37,660 | | | — | | | — | |

Reclassification under discontinuance of hedge relationship | | 10(c) | | | | | (2,581 | ) | | 2,581 | | | (2,581 | ) | | — | | | — | |

Realized gain (loss) on foreign currency swap agreement interest payments | | 10(c) | | | | | — | | | 177 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | (73,113 | ) | | (34,902 | ) | | 10,180 | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Non-hedging | | | | | | | | | | | | | | | | | | | | |

Foreign currency and interest rate swap agreements | | 10(a) | | (40,735 | ) | | — | | | (40,735 | ) | | 40,735 | | | — | | | — | |

Materialized loss on early settlement of derivative | | 10(c) | | 6,429 | | | — | | | — | | | — | | | — | | | (6,429 | ) |

Foreign currency swap agreements | | 10(c) | | 4,628 | | | — | | | 4,628 | | | (4,628 | ) | | — | | | — | |

Foreign exchange forward contracts – Not under hedge accounting | | 10(b) | | — | | | — | | | (4,314 | ) | | — | | | — | | | — | |

Realized loss on foreign currency and interest rate swap interest payments | | 10(a) | | — | | | — | | | (1,586 | ) | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | | (42,007 | ) | | 36,107 | | | — | | | (6,429 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | (73,113 | ) | | 31,108 | | | 46,287 | | | (103,371 | ) | | (6,429 | ) |

| | | | | | | | | | | | | | | | | | | | |

(18)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | | | | | | | | | | | | | | | | | | |

| | | 2009 | |

| | | | | Impact on

balance sheet | | | Pre-tax impact

on other

comprehensive loss | | Impact on

earnings | | | Impact on cash flows | |

| | | Note | | Change in fair

value during

the year on

long-term debt

and derivative

financial

instruments $ | | | Unrealized gain

on derivative

financial

instruments net of

reclassification

adjustment $ | | Foreign

exchange gain

(loss) on long-term debt and derivative

financial

instruments $ | | | Change in

fair value of

derivative

financial

instruments $ | | | Foreign

exchange

gain (loss) on

long-term

debt $ | | | Net

settlement

of

derivative

financial

instruments $ | |

| | | | | | | |

Long-term debt | | | | | | | | | | | | | | | | | | | |

Senior subordinated notes | | 6(a) | | (46,500 | ) | | — | | (46,500 | ) | | — | | | 46,500 | | | — | |

Term B loan | | 6(b) | | (55,624 | ) | | — | | (55,624 | ) | | — | | | 55,624 | | | — | |

Senior subordinated deferred interest notes | | 6(c) | | (43,746 | ) | | — | | (43,746 | ) | | — | | | 43,746 | | | — | |

Other foreign exchange loss on revaluation | | | | — | | | — | | (339 | ) | | — | | | (2,358 | ) | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | (146,209 | ) | | — | | | 143,512 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Derivative financial instruments | | | | | | | | | | | | | | | | | | | |

Hedging | | | | | | | | | | | | | | | | | | | |

Foreign exchange forward contracts, net of reclassification | | 10(b) | | 37,682 | | | 37,682 | | — | | | — | | | — | | | — | |

Impact lag on foreign exchange forward contracts | | 10(b) | | — | | | 23,749 | | — | | | 23,749 | | | — | | | — | |

Foreign currency swap agreements | | 10(c) | | 50,338 | | | 3,838 | | 46,500 | | | (42,916 | ) | | — | | | — | |

Settlement of derivatives | | | | 14,035 | | | 1,716 | | 2,512 | | | (2,512 | ) | | — | | | (9,807 | ) |

Other materialized loss on early settlement of derivatives | | 10(c) | | — | | | — | | (3,584 | ) | | (3,584 | ) | | — | | | — | |

Realized gain on foreign currency agreement interest payments | | 10(c) | | — | | | — | | (498 | ) | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | 66,985 | | 44,930 | | | (25,263 | ) | | — | | | (9,807 | ) |

| | | | | | | | | | | | | | | | | | | |

Non-hedging | | | | | | | | | | | | | | | | | | | |

Foreign currency and interest rate swap agreements | | 10(a) | | 48,693 | | | — | | 48,693 | | | (46,969 | ) | | — | | | — | |

Settlement of foreign currency and interest rate swap agreements | | 10(a) | | 10,089 | | | — | | 12,205 | | | (12,205 | ) | | — | | | 2,116 | |

Other materialized loss on early settlement of derivative | | | | — | | | — | | (1,724 | ) | | — | | | — | | | (1,724 | ) |

Realized loss on foreign currency and interest rate swap interest payments | | 10(a) | | — | | | — | | (2,688 | ) | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | 56,486 | | | (59,174 | ) | | — | | | 392 | |

| | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 66,985 | | (44,793 | ) | | (84,437 | ) | | 143,512 | | | (9,415 | ) |

| | | | | | | | | | | | | | | | | | | |

| | a) | Foreign currency and interest rate swap agreements |

The Corporation enters into swap agreements consisting of a combination of a foreign currency swap and an interest rate swap that are undertaken to address two risks with its US-dollar LIBOR-based term bank loan (note 6).

(19)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

As of January 31, 2010, the various swap agreements called for the Corporation to exchange the following amounts:

| | | | | | |

| | | Interval

| | Amount

paid by

Corporation CA$ | | Amount

received

from

lenders US$ |

January 31, 2011 | | One time | | 139,392 | | 116,588 |

November 17, 2011 | | One time | | 134,565 | | 112,596 |

April 30, 2009 to October 31, 2011

(in the aggregate) | | Quarterly | | 6,074 | | 5,069 |

| | | | | | |

Total | | | | 280,031 | | 234,255 |

| | | | | | |

As of February 1, 2009, the various swap agreements called for the Corporation to exchange the following amounts:

| | | | | | |

| | | Interval | | Amount

paid by

Corporation CA$ | | Amount

received

from

lenders US$ |

January 29, 2010 | | One time | | 85,771 | | 71,943 |

January 31, 2011 | | One time | | 139,392 | | 116,588 |

November 17, 2011 | | One time | | 50,297 | | 41,912 |

April 30, 2009 to October 31, 2011

(in the aggregate) | | Quarterly | | 7,446 | | 6,212 |

| | | | | | |

Total | | | | 282,906 | | 236,655 |

| | | | | | |

Changes in fair value of the foreign currency and interest rate swap agreements are reported in earnings under “Foreign exchange loss (gain) on derivative financial instruments and long-term debt”. Accordingly, for the year ended January 31, 2010, a loss of $40,735,000 (February 1, 2009, a gain of $60,898,000) was recorded to earnings.

Furthermore, the settlement of US$47,370,000 for CA$56,844,000 on the swap agreements entered into by the Corporation on December 18, 2008 resulted in a net cash outflow of $1,724,000.

| | b) | Foreign exchange forward contracts |

As of January 31, 2010, the Corporation was party to foreign exchange forward contracts to purchase US$255,000,000 for CA$269,385,000 (February 1, 2009 – US$174,000,000 for CA$179,977,000), maturing between February 2010 and November 2010.

(20)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

In addition to the fair value of the foreign exchange forward contracts representing a loss of $6,410,000 as of January 31, 2010 (February 1, 2009 – gain of $33,175,000), “Accumulated other comprehensive income (loss)” includes a loss of $7,242,000 (February 1, 2009 – gain of $17,657,000) on foreign exchange forward contracts settled before January 31, 2010 but which will be reported in earnings based on the recognition of the related inventory in earnings.

| | c) | Foreign currency swap agreements |

In August 2005, the Corporation entered into two foreign currency swap agreements with its lenders which were undertaken to mitigate foreign exchange risk associated with the principal and interest payments on the US$200,000,000 senior subordinated notes (note 6). The swap agreements call for the Corporation to exchange fixed amounts as follows:

| | | | | | |

| Date | | Interval | | Amount

paid by

Corporation | | Amount

received

from lender |

| | | |

August 12, 2005 | | One time | | US$200,000 | | CA$240,200 |

August 15, 2008 | | One time | | CA$84,070 | | US$70,000 |

August 15, 2012 | | One time | | CA$156,130 | | US$130,000 |

February 15, 2006 | | One time | | CA$10,171 | | US$9,023 |

August 15, 2006 to August 15, 2008 | | Semi-annual | | CA$3,340 | | US$3,106 |

August 15, 2006 to August 15, 2012 | | Semi-annual | | CA$6,534 | | US$5,769 |

In July 2008, the Corporation entered into a foreign currency swap agreement with its lenders to replace the existing foreign currency swap agreement which had a maturity date of August 15, 2008. The new swap agreement calls for the Corporation to exchange fixed amounts, as indicated in the following table:

| | | | | | |

| Date | | Interval | | Amount paid by

Corporation | | Amount received from lender |

| | | |

August 15, 2008 | | Onetime | | US$70,000 | | CA$70,679 |

August 15, 2012 | | One time | | CA$70,679 | | US$70,000 |

February 15, 2009 to August 15, 2012 | | Semi-annual | | CA$3,191 | | US$3,106 |

In addition, the foreign currency swap agreement which expired on August 15, 2008 no longer qualified as a cash flow hedge starting in July 2008. On August 15, 2008, the settlement of this instrument resulted in a net cash outflow of $9,807,000, which corresponded to the fair value of this swap at that time. The fair value of the swap was $(14,035,000) as of February 3, 2008.

Furthermore, the settlement of US$70,000,000 for CA$70,679,000 on the swap agreement entered into by the Corporation in July 2008 resulted in a net cash outflow of $3,584,000.

(21)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

Until October 16, 2009, the fair value of the foreign currency swap agreements (the “Derivatives”) was recorded in accumulated other comprehensive income. A portion of the changes in the fair value of the Derivatives (representing the offsetting impact on the conversion of the Notes from US dollars to Canadian dollars at the balance sheet date) was reclassified from accumulated other comprehensive income to earnings under “Foreign exchange loss (gain) on derivative financial instruments and long-term debt”. Accordingly, for the period from February 2, 2009 to October 16, 2009, a loss of $37,660,000 (52-week period ended February 1, 2009 – gain of $46,500,000) was reclassified from accumulated other comprehensive income to earnings.

On October 16, 2009, the Corporation notified the Notes holders that it would redeem all of the issued and outstanding Notes. As a result, it was no longer probable that the anticipated hedge transaction linked to the Derivatives would occur, and the hedge relationship between the Notes and the Derivatives was discontinued on that date. Accordingly, as of October 16, 2009, a gain of $2,581,000 has been reclassified from accumulated other comprehensive income to earnings. From October 16, 2009 forward, as the derivatives are no longer accounted for under the hedge accounting model, changes in the fair value of the derivatives are recorded in earnings of the period under “Foreign exchange loss (gain) on derivative financial instruments and long-term debt”. A gain of $4,628,000 on the swaps was recorded in income for the period of October 16, 2009 to January 31, 2010.

On November 17, 2009, the Corporation modified its swap agreement mentioned above to better mitigate the risk surrounding the outstanding debt following the reimbursement of the Notes. The modification of the swap agreement resulted in a net cash outflow of $6,429,000 by the Corporation. As a result, the current swap agreements call for the Corporation to exchange the following fixed amounts:

| | | | | | | | |

Date | | Interval | | Amount

paid by

Corporation | | Amount

received

from lender |

| | | |

August 15, 2012 | | One time | | CA$ | 164,150 | | US$ | 143,000 |

As described in note 1, as of the date of the closing of the initial public offering, the Corporation reorganized its capital structure. As a result of the reorganization, the Corporation has the following capital structure:

| | | Unlimited number of common shares, voting and participating, without par value Unlimited number of preferred shares, without par value, non-voting and non-participating |

Prior to the reorganization, the authorized capital stock of the Corporation was composed of Class A and B common shares, and Class A, B and C preferred shares.

(22)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| | b) | The table below summarizes the number of common and preferred shares issued before and after the reorganization and the effect of the reorganization on the capital structure of the Corporation. |

| | | | | | | | | | | | | | | | |

| | | Number of units | | | Amount |

| | | Before reorganization | | | After

reorganization | | Before reorganization | | | After

reorganization |

| | | Class A | | | Class B | | | Common

shares | | Class A $ | | | Class B $ | | | Common

shares $ |

Balance – February 3, 2008 | | 33,929,931 | | | 8,645,886 | | | — | | 33,930 | | | 1,374 | | | — |

| | | | | | | | | | | | | | | | |

Balance – February 1, 2009 | | 33,929,931 | | | 8,645,886 | | | — | | 33,930 | | | 1,374 | | | — |

Conversion of Class A and B common shares into common shares of Dollarama Inc. | | (33,929,931 | ) | | (8,645,886 | ) | | 42,575,817 | | (33,930 | ) | | (1,374 | ) | | 35,304 |

Stock split (1:03 for 1:00) | | — | | | — | | | 1,290,689 | | — | | | — | | | — |

Conversion of junior subordinated notes | | — | | | — | | | 7,105,503 | | — | | | — | | | 124,346 |

Conversion of Class A preferred shares | | — | | | — | | | 2,204,995 | | — | | | — | | | 38,587 |

Conversion of Class B preferred shares | | — | | | — | | | 2,372,074 | | — | | | — | | | 41,513 |

Issuance of common shares, net of issuance cost and taxes | | — | | | — | | | 17,142,857 | | — | | | — | | | 278,680 |

| | | | | | | | | | | | | | | | |

Balance – January 31, 2010 | | — | | | — | | | 72,691,935 | | — | | | — | | | 518,430 |

| | | | | | | | | | | | | | | | |

| | | | | | | |

| | | 2010 $ | | 2009 $ | |

Net earnings (loss) for the year | | | 72,863 | | | (15,504 | ) |

| | | | | | | |

Weighted average number of common shares outstanding (thousands) | | | 51,511 | | | 42,576 | |

Effect of dilutive options (thousands) | | | 1,538 | | | — | |

| | | | | | | |

Weighted average number of diluted common shares outstanding (thousands) | | | 53,049 | | | 42,576 | |

| | | | | | | |

Basic net earnings (loss) per common share | | $ | 1.41 | | $ | (0.36 | ) |

Diluted net earnings (loss) per common share | | $ | 1.37 | | $ | (0.36 | ) |

| | | | | | | |

The following provides the options that could potentially dilute basic earnings (loss) per common share in the future but were not included in the computation of diluted earnings (loss) per common share because to do so would have been anti-dilutive:

| | | | |

| | | January 31,

2010 $ | | February 1,

2009 $ |

Options – Service | | 2,000 | | 880,422 |

Options – Performance | | — | | 1,760,844 |

(23)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

| 12 | Stock-based compensation |

Up to October 16, 2009, the Corporation had a management stock option plan (the “Old Plan”) whereby managers, directors and employees of the Corporation were eligible to be granted stock options to acquire shares of Dollarama Inc.

On October 16, 2009, the Corporation completed a reorganization of its capital structure immediately followed by an initial public offering. Concurrently, the Corporation established a new management option plan (the “New Plan”) whereby managers, directors and employees of the Corporation may be granted stock options to acquire shares of Dollarama Inc. Under the New Plan, the number and characteristics of stock options granted are determined by the Board of Directors of the Corporation, and the options will have a life not exceeding 10 years.

All of the outstanding options previously granted under the Old Plan were exchanged for options issued under the New Plan. The exchange has not resulted in any incremental value being awarded to the option holders. As a result of the initial public offering completed by the Corporation, the Performance Conditions were fulfilled, and as such, an expense of $4,938,000 was recorded during the year ended January 31, 2010.

Under the New Plan, the following types of option are available:

| | a) | Options with service requirements (“Service Conditions”) |

These options were granted to purchase an equivalent number of common shares. The options vest at a rate of 20% annually on the anniversary of the grant date.

| | b) | Options with service and performance requirements (“Performance Conditions”) |

These options were granted to purchase an equivalent number of common shares. The options become eligible to vest annually from the date of grant at a rate of 20% when the performance conditions are met.

| | | | | | | | | | | | | | | | |

| | | Number of

common share options | | | Weighted

average

purchase

price $ | | Number of

preferred share options | | | Weighted

average

purchase

price $ |

| | | Service | | | Performance | | | | Service | | | Performance | | |

Outstanding – February 3, 2008 | | 880,422 | | | 1,760,844 | | | 3.24 | | 2,513,462 | | | 5,026,924 | | | 0.88 |

| | | | | | | | | | | | | | | | |

| | | | | | |

Outstanding – February 1, 2009 | | 880,422 | | | 1,760,844 | | | 3.24 | | 2,513,462 | | | 5,026,924 | | | 0.88 |

Granted before October 16, 2009 | | 35,121 | | | 70,242 | | | 11.20 | | 100,274 | | | 200,548 | | | 1.56 |

Forfeited before October 16, 2009 | | (35,344 | ) | | (212,062 | ) | | 1.00 | | (100,900 | ) | | (605,398 | ) | | — |

| | | | | | | | | | | | | | | | |

| | | | | | |

Outstanding – October 16, 2009 | | 880,199 | | | 1,619,024 | | | 3.80 | | 2,512,836 | | | 4,622,074 | | | 0.93 |

Impact of reorganization (stock split) | | 26,683 | | | 49,081 | | | | | — | | | — | | | |

Impact of New Plan | | 241,503 | | | 444,216 | | | 9.66 | | (2,512,836 | ) | | (4,622,074 | ) | | 0.93 |

Granted after October 16, 2009 | | 17,934 | | | — | | | 18.05 | | — | | | — | | | — |

| | | | | | | | | | | | | | | | |

| | | | | | |

Outstanding – January 31, 2010 | | 1,166,319 | | | 2,112,321 | | | 5.02 | | — | | | — | | | — |

| | | | | | | | | | | | | | | | |

| | | | | | |

Exercisable – January 31, 2010 | | 998,377 | | | 1,812,307 | | | | | — | | | — | | | |

| | | | | | | | | | | | | | | | |

(24)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)

The weighted average remaining contractual terms of all options outstanding and of exercisable options as of January 31, 2010 and February 1, 2009 were 5.5 years and 6.4 years respectively

The total intrinsic value for the common share options fully vested as of January 31, 2010 is $45,168,000 (February 1, 2009 – $2,269,000; February 3, 2008 – $1,719,000). The total intrinsic value for the preferred share options fully vested as of January 31, 2010 is nil since all the preferred share options under the Old Plan were exchanged for common share options under the New Plan in 2010 (February 1, 2009 – $1,162,599; February 3, 2008 – $665,461).

The Corporation has recognized a stock-based compensation expense of $5,600,000 for the year ended January 31, 2010 (February 1, 2009 – $741,000; February 3, 2008 – $1,312,000) relating to the options with Service and Performance Conditions (no amount recorded in 2009 and 2008 periods for options with Performance Conditions). In addition, on October 16, 2009, with the occurrence of the reorganization (note 1), an amount of $1,518,000 relating to the options on the preferred shares was reclassified from accounts payable to contributed surplus in the balance sheet.

The total compensation costs related to non-vested awards not yet recognized as of January 31, 2010 amounted to $544,000 for options with Service Conditions and $489,000 for options with Performance Conditions.

Capital is defined as long-term debt, due to shareholders, shareholders’ equity excluding accumulated other comprehensive income (loss) and the fair value of the foreign currency swap agreements when they qualify as cash flow hedges.

| | | | | |

| | | 2010 $ | | 2009 $ | |

Long-term debt, including current portion | | 470,516 | | 821,686 | |

Foreign currency swap agreements | | — | | (25,447 | ) |

Due to shareholders | | — | | 256,077 | |

Shareholders’ equity* | | 624,787 | | 61,680 | |

| | | | | |

Total capital | | 1,095,303 | | 1,113,996 | |

| | | | | |

| | * | Excluding accumulated other comprehensive income (loss) |

The Corporation’s objectives when managing capital are to:

| | • | | provide a strong capital base so as to maintain investor, creditor and market confidence and to sustain future development of the business; |

| | • | | maintain a flexible capital structure that optimizes the cost of capital at acceptable risk and preserves the ability to meet financial obligations; and |

| | • | | ensure sufficient liquidity to pursue its organic growth strategy. |

(25)

Dollarama Inc.

Notes to Consolidated Financial Statements

January 31, 2010 and February 1, 2009

(tabular amounts expressed in thousands of Canadian dollars, unless otherwise noted)