UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED JANUARY 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transaction period from to

COMMISSION FILE NUMBER: 333-143444

DOLLARAMA GROUP HOLDINGS L.P.

(Exact name of Registrant as specified in its charter)

Quebec, Canada

(Jurisdiction of incorporation or organization)

5805 Royalmount Avenue

Montreal, Quebec H4P 0A1

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Not Applicable

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Not Applicable

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | | Other x |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

ii

TABLE OF CONTENTS

iii

FORWARD-LOOKING STATEMENTS

This annual report filed on Form 20-F contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to financial condition, results of operations, cash flows, dividends, financing plans, business strategies, capital and other expenditure, competitive positions, availability of capital, growth opportunities for new and existing products, availability and deployment of new technologies, plans and objectives of management, mergers and acquisitions, and other matters.

Statements in this Form 20-F that are not historical facts are hereby identified as “forward-looking statements” for the purpose of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words “estimate,” “project,” “intend,” “expect,” “believe,” “plan” and similar expressions are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. In addition, other written or oral statements which constitute forward-looking statements have been made and may in the future be made by us or on our behalf, including with respect to the matters referred to above. These forward-looking statements are necessarily estimates reflecting the best judgment of senior management that rely on a number of assumptions concerning future events, many of which are outside of our control, and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in this annual report. Except for historical information contained herein, the statements in this document are forward-looking. Forward-looking statements involve known and unknown risks and uncertainties, including those that are described elsewhere in this report. Such risks and uncertainties may cause actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in consumer buying trends, consumer debt level, inflation, unemployment, currency fluctuations, market volatility, refinancing conditions, changes in inventory and equipment costs and availability, seasonal changes in customer demand, pricing actions by competitors and general changes in economic conditions, and the risks set forth in Part I of this report under Item 3D.

This annual report is that of Dollarama Group Holdings L.P. (“Holdings”). Holdings is together with its consolidated subsidiaries referred to as the “Partnership”, “we”, “us” or “our”.

GAAP AND NON-GAAP MEASURES

Unless otherwise indicated and as hereinafter provided, all financial statement data in this report has been prepared using Canadian generally accepted accounting principles (“GAAP”). Holdings’ consolidated financial statements have been prepared in accordance with Canadian GAAP. The consolidated financial statements have also been reconciled to GAAP in the United States as set out in Note 17 to the consolidated financial statements. This report makes reference to certain non-GAAP measures. These non-GAAP measures are not recognized measures under Canadian GAAP, do not have a standardized meaning prescribed by Canadian GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those Canadian GAAP measures by providing further understanding of Holdings’ results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of our financial information reported under Canadian GAAP. We use non-GAAP measures including EBITDA to provide investors with a supplemental measure of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on Canadian GAAP financial measures. We also believe that securities analysts, investors and other interested parties frequently use non-GAAP measures in the evaluation of issuers. Our management also uses non-GAAP measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess our ability to meet our future debt service, capital expenditure and working capital requirements. Non-GAAP measures are not presentations made in accordance with Canadian GAAP. For example, certain or all of the non-GAAP measures do not reflect: (a) our cash expenditures, or future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) the significant interest expense, or the cash requirements necessary to service interest or principal payments on our debt, and; (d) income tax payments that represent a reduction in cash available to us. Although we consider the items excluded in the calculation of non-GAAP measures to be unusual and less relevant to evaluate our performance, some of these items may continue to take place and accordingly may reduce the cash available to us. We refer the reader to “Selected Financial Data” for the definition and reconciliation of non-GAAP measures used and presented by Holdings to the most directly comparable GAAP measures.

We believe that the presentation of the non-GAAP measures described above is appropriate. However, these non-GAAP measures have important limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under Canadian GAAP. Because of these limitations, we primarily rely on our results as reported in accordance with Canadian GAAP and use the non-GAAP measures only as a supplement. In addition, because other companies may calculate non-GAAP measures differently than we do, they may not be comparable to similarly-titled measures reported by other companies.

1

PART I

| Item 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| Item 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

A. Selected Financial Data.

The following section presents selected historical consolidated financial data and should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and the Consolidated Financial Statements and the related notes thereto appearing elsewhere in this report. The historical consolidated financial data as at January 31, 2010 and February 1, 2009 and for the fiscal years ended February 3, 2008 (“Fiscal 2008”), February 1, 2009 (“Fiscal 2009”) and January 31, 2010 (“Fiscal 2010”) are derived from our audited consolidated financial statements, which are included elsewhere in this report. The historical consolidated financial data as of February 3, 2008 and February 4, 2007 and for the fiscal year ended February 4, 2007 (“Fiscal 2007”) are derived from our audited consolidated financial statements, which are not included in this report.

Exchange Rate Data

The following table sets forth, for each period indicated, the low and high exchange rates for $1.00 expressed in U.S. dollars, the exchange rate at the end of each period and the average of these exchange rates on the last day of each month within each period, in each case, based upon the noon buying rate in New York City for cable transfers in foreign currencies for customs purposes by the U.S. Federal Reserve Bank of New York. These rates are presented for informational purposes and are not the same as the rates that are used for purposes of translating U.S. dollars into Canadian dollars in the financial statements included herein.

| | | | | | | | | | |

| | | Year Ended

January 31,

2010 | | Year Ended

February 1,

2009 | | Year Ended

February 3,

2008 | | Year Ended

February 4,

2007 | | Year Ended

January 31,

2006 |

Low | | 0.76953 | | 0.77095 | | 0.84374 | | 0.84474 | | 0.78722 |

High | | 0.97466 | | 1.02912 | | 1.09075 | | 0.91000 | | 0.87443 |

Period end | | 0.93879 | | 0.80873 | | 1.00614 | | 0.84474 | | 0.87443 |

Average rate | | 0.88722 | | 0.92985 | | 0.94803 | | 0.88023 | | 0.82975 |

Selected Historical Consolidated Financial Data (1)

| | | | | | | | | | | | | | | | | | | | |

(Canadian dollars in thousands) | | Year Ended

January 31,

2010 | | | Year Ended

February 1,

2009 | | | Year Ended

February 3,

2008 | | | Year Ended

February 4,

2007 | | | Year Ended

January 31,

2006 | |

Statements of Earnings Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Sales | | $ | 1,253,706 | | | $ | 1,089,011 | | | $ | 972,352 | | | $ | 887,786 | | | $ | 743,278 | |

| | | | | |

Cost of sales(2)(3) | | | 810,624 | | | | 724,150 | | | | 643,579 | | | | 591,043 | | | | 512,423 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 443,082 | | | | 364,861 | | | | 328,773 | | | | 296,743 | | | | 230,855 | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

General, administrative and store operating expenses(2) | | | 262,530 | | | | 212,814 | | | | 183,571 | | | | 151,888 | | | | 123,202 | |

Amortization(4) | | | 24,919 | | | | 21,818 | | | | 18,389 | | | | 13,528 | | | | 9,782 | |

| | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 287,449 | | | | 234,632 | | | | 201,960 | | | | 165,416 | | | | 132,984 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 155,633 | | | | 130,229 | | | | 126,813 | | | | 131,327 | | | | 97,871 | |

Other expenses: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Interest expense | | | 62,343 | | | | 61,192 | | | | 72,053 | | | | 54,852 | | | | 59,680 | |

Foreign exchange loss (gain) on derivative financial instruments and long-term debt | | | (31,108 | ) | | | 44,793 | | | | (34,411 | ) | | | 4,275 | | | | 1,508 | |

| | | | | | | | | | | | | | | | | | | | |

Earnings before income taxes | | | 124,398 | | | | 24,244 | | | | 89,171 | | | | 72,200 | | | | 36,683 | |

Income taxes | | | 293 | | | | 241 | | | | 302 | | | | 365 | | | | 1,677 | |

| | | | | | | | | | | | | | | | | | | | |

Net earnings | | $ | 124,105 | | | $ | 24,003 | | | $ | 88,869 | | | $ | 71,835 | | | $ | 35,006 | |

| | | | | | | | | | | | | | | | | | | | |

Statements of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Cash flows provided by (used in): | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 126,184 | | | $ | 117,087 | | | $ | 56,175 | | | $ | 94,387 | | | $ | 46,408 | |

Investing activities | | | (40,091 | ) | | | (49,728 | ) | | | (45,562 | ) | | | (42,517 | ) | | | (36,006 | ) |

Financing activities | | | (59,440 | ) | | | (27,472 | ) | | | (32,102 | ) | | | (35,050 | ) | | | (24,104 | ) |

Other Financial and Non-Financial Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Adjusted EBITDA(5) | | $ | 197,279 | | | $ | 158,395 | | | $ | 152,073 | | | $ | 151,904 | | | $ | 126,254 | |

Capital expenditures | | $ | 33,772 | | | $ | 40,502 | | | $ | 45,994 | | | $ | 42,695 | | | $ | 23,946 | |

Rent expense(6) | | $ | 76,277 | | | $ | 68,981 | | | $ | 58,765 | | | $ | 50,701 | | | $ | 41,146 | |

Gross margin(7) | | | 35.3 | % | | | 33.5 | % | | | 33.8 | % | | | 33.4 | % | | | 31.1 | % |

Number of stores (at end of period) | | | 603 | | | | 564 | | | | 521 | | | | 463 | | | | 398 | |

Growth of comparable store sales(7) | | | 7.9 | % | | | 3.4 | % | | | (1.5 | %) | | | 2.8 | % | | | 6.1 | % |

Ratio of earnings to fixed charges(8) | | | 2.4 | x | | | 1.3 | x | | | 2.0 | x | | | 2.0 | x | | | 1.5 | x |

2

| | | | | | | | | | | | | | | |

(Canadian dollars in thousands) | | As of

January 31,

2010 | | As of

February 1,

2009 | | As of

February 3,

2008 | | As of

February 4,

2007 | | As of

January 31,

2006 |

Balance Sheet Data: | | | | | | | | | | | | | | | |

| | | | | |

Cash and cash equivalents | | $ | 92,794 | | $ | 66,141 | | $ | 26,214 | | $ | 47,703 | | $ | 30,883 |

Merchandise inventories | | | 234,684 | | | 249,644 | | | 198,500 | | | 166,017 | | | 154,047 |

Property and equipment | | | 138,214 | | | 129,878 | | | 111,936 | | | 84,665 | | | 54,571 |

Total assets | | | 1,324,743 | | | 1,363,041 | | | 1,197,983 | | | 1,169,187 | | | 1,098,854 |

Long-term debt | | | 468,591 | | | 806,384 | | | 653,006 | | | 806,921 | | | 581,637 |

Partners’ capital | | | 691,320 | | | 436,470 | | | 331,161 | | | 259,231 | | | 401,820 |

| (1) | Holdings was created on December 8, 2006 pursuant to various agreements (the “Agreements”). The consolidated financial data as of February 4, 2007 and January 31, 2006 and for the each of the years then ended have been prepared using the continuity of interest method of accounting. The consolidated financial statements of Holdings on the date of the Agreements were in all material respects the same as those of Dollarama Group L.P. (“Group L.P.”) immediately prior to the Agreements becoming effective. Accordingly, the consolidated financial data for the year ended February 4, 2007 reflect the results of operations of Holdings for the period from December 8, 2006, the date of creation of Holdings to February 4, 2007. The consolidated financial data as of January 31, 2006 and for the period from February 1, 2006 to December 8, 2006 reflect the financial position of Group L.P. and its subsidiaries and their results of operations and cash flows. |

| (2) | Certain expenses have been reclassified between cost of sales and general, administrative and store operating expenses. All comparable figures and historical results have been recalculated accordingly. |

| (3) | See Note 17 to the Consolidated Financial Statements for a reconciliation of GAAP in Canada and the United States. |

| (4) | Amortization represents amortization of tangible and intangible assets, including amortization of favorable and unfavorable lease rights. |

| (5) | EBITDA represents net earnings (loss) before net interest expense, income taxes and amortization expense. Adjusted EBITDA represents EBITDA as further adjusted to reflect items set forth in the table below, all of which are required in determining our compliance with financial covenants under our senior secured credit facility (the “Credit Facility”). We have included EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of our operating performance and information about the calculation of some of the financial covenants that are contained in the Credit Facility. |

We believe EBITDA is an important supplemental measure of operating performance because it eliminates items that have less bearing on our operating performance and thus highlights trends in our core business that may not otherwise be apparent when relying solely on Canadian GAAP financial measures. We also believe that securities analysts, investors and other interested parties frequently use EBITDA in the evaluation of issuers, many of which present EBITDA when reporting their results. Adjusted EBITDA is a material component of the covenants imposed on us by the Credit Facility. Under the Credit Facility, we are subject to financial covenant ratios that are calculated by reference to Adjusted EBITDA.

Non-compliance with the financial covenants contained in our Credit Facility could result in a default, acceleration in the repayment of amounts outstanding under the Credit Facility, and a termination of the lending commitments under the Credit Facility. Generally, any default under the Credit Facility that results in the acceleration in the repayment of amounts outstanding under the Credit Facility would result in a default under the indenture governing the senior floating rate deferred interest notes (the “Deferred Interest Notes”). While an event of default under the Credit Facility or the indenture is continuing, we would be precluded from, among other things, paying dividends on our capital stock or borrowing under the revolving credit facility. Our management also uses EBITDA and Adjusted EBITDA in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess our ability to meet our future debt service, capital expenditure and working capital requirements and our ability to pay dividends on our capital stock.

3

EBITDA and Adjusted EBITDA are not presentations made in accordance with Canadian GAAP. EBITDA and Adjusted EBITDA have important limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under Canadian GAAP. For example, neither EBITDA nor Adjusted EBITDA reflect (a) our cash expenditures, or future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; and (d) tax payments or distributions to our parent to make payments with respect to taxes attributable to us that represent a reduction in cash available to us. Because of these limitations, we primarily rely on our results as reported in accordance with Canadian GAAP and use EBITDA and Adjusted EBITDA only supplementally. In addition, because other companies may calculate EBITDA and Adjusted EBITDA differently than we do, EBITDA may not be, and Adjusted EBITDA as presented in this report is not, comparable to similarly titled measures reported by other companies.

A reconciliation of net earnings (loss) to EBITDA and to Adjusted EBITDA is included below:

| | | | | | | | | | | | | | | | |

(Canadian dollars in thousands) | | Year Ended

January 31,

2010 | | | Year Ended

February 1,

2009 | | Year Ended

February 3,

2008 | | | Year Ended

February 4,

2007 | | Year Ended

January 31,

2006 |

Net earnings | | $ | 124,105 | | | $ | 24,003 | | $ | 88,869 | | | $ | 71,835 | | 35,006 |

Income taxes | | | 293 | | | | 241 | | | 302 | | | | 365 | | 1,677 |

Interest expense | | | 62,343 | | | | 61,192 | | | 72,053 | | | | 54,852 | | 59,680 |

Amortization | | | 24,919 | | | | 21,818 | | | 18,389 | | | | 13,528 | | 9,782 |

| | | | | | | | | | | | | | | | |

EBITDA | | | 211,660 | | | | 107,254 | | | 179,613 | | | | 140,580 | | 106,145 |

Foreign exchange loss (gain) on derivative financial instruments and long-term debt | | | (31,108 | ) | | | 44,793 | | | (34,411 | ) | | | 4,275 | | 1,508 |

Deferred lease inducements(a) | | | 2,139 | | | | 2,276 | | | 2,312 | | | | 3,318 | | 2,427 |

Non-cash stock compensation expense(b) | | | 748 | | | | 741 | | | 1,312 | | | | 537 | | 598 |

Management fees and out-of-pocket expenses(c) | | | 2,505 | | | | 3,331 | | | 3,247 | | | | 3,194 | | 3,554 |

Fee paid in connection with the termination of the management agreement (d) | | | 5,000 | | | | — | | | — | | | | — | | — |

Performance related stock compensation expense (e) | | | 4,852 | | | | — | | | — | | | | — | | — |

Severance (f) | | | 1,483 | | | | — | | | — | | | | — | | — |

Transition reserve expenses(g) | | | — | | | | — | | | — | | | | — | | 2,285 |

Amortization of inventory step-up(h) | | | — | | | | — | | | — | | | | — | | 9,737 |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 197,279 | | | $ | 158,395 | | $ | 152,073 | | | $ | 151,904 | | 126,254 |

| | | | | | | | | | | | | | | | |

| (a) | Represents an adjustment for non-cash straight-line rent expense. |

| (b) | Represents an adjustment of non-cash stock-based compensation expense. |

| (c) | Reflects the management fees incurred and paid or payable to Bain Capital Partners, LLC, including out of pocket expenses. |

| (d) | The management agreement was terminated concurrent with the IPO (as defined below). |

| (e) | Reflects the stock compensation expense related to performance vesting clauses that were triggered by the IPO. |

| (f) | Represents an adjustment relating to one-time severance costs. |

| (g) | Represents the elimination of certain transition-related expenses incurred in connection with the purchase, on November 18, 2004, by Dollarama L.P. (sponsored by an entity formed by Bain Capital Partners, LLC) of substantially all of the assets of S. Rossy Inc. and Dollar A.M.A. Inc. relating to the Dollarama business (the “Acquisition”) which have not been capitalized in purchase accounting or as debt issuance costs, primarily relating to non-recurring legal and accounting fees. |

| (h) | Represents the elimination of incremental cost of sales from November 18, 2004 to October 31, 2005 resulting from amortization of the step-up in fair value of the merchandise inventory balance following the application of purchase accounting to the Acquisition. |

4

A reconciliation of Adjusted EBITDA to cash flows from operating activities is included:

| | | | | | | | | | | | | | | | | | | |

(Canadian dollars in thousands) | | Year Ended

January 31,

2010 | | | Year Ended

February 1,

2009 | | | Year Ended

February 3,

2008 | | | Year Ended

February 4,

2007 | | Year Ended

January 31,

2006 | |

Adjusted EBITDA | | $ | 197,279 | | | $ | 158,395 | | | $ | 152,073 | | | $ | 151,904 | | $ | 126.254 | |

Interest expense(c) | | | (44,156 | ) | | | (34,630 | ) | | | (65,7133 | ) | | | (50,498 | | | (45,547 | ) |

Cash foreign exchange gain (loss) on derivative financial instruments and long-term debt(a) | | | (25,976 | ) | | | 14,282 | | | | (9,618 | ) | | | 6,089 | | | (443 | ) |

Cash income taxes | | | (293 | ) | | | (241 | ) | | | (302 | ) | | | (365 | | | (1,677 | ) |

Deemed interest repaid | | | (8,288 | ) | | | (1,129 | ) | | | (1,083 | ) | | | — | | | — | |

Deferred tenant allowances and leasing costs | | | 3,437 | | | | 2,068 | | | | 3,356 | | | | 3,574 | | | 2,685 | |

Amortization of deferred tenant allowances and leasing costs | | | (1,370 | ) | | | (1,098 | ) | | | (863 | ) | | | (429 | | | (220 | ) |

Management fees and out-of-pocket expenses(b) | | | (2,505 | ) | | | (3,331 | ) | | | (3,247 | ) | | | (3,194 | | | (3,554 | ) |

Fee paid in connection with the termination of the management agreement(b) | | | (5,000 | ) | | | — | | | | — | | | | — | | | — | |

Severance (b) | | | (1,483 | ) | | | — | | | | — | | | | — | | | — | |

Other | | | (1 | ) | | | 61 | | | | 197 | | | | 45 | | | (4 | ) |

Transition reserve expenses(d) | | | — | | | | — | | | | — | | | | — | | | (2,285 | ) |

Amortization of inventory step-up(e) | | | — | | | | — | | | | — | | | | — | | | (9,737 | ) |

| | | | | | | | | | | | | | | | | | | |

| | | 111,644 | | | | 134,377 | | | | 74,800 | | | | 107,126 | | | 65,472 | |

Changes in non-cash operating elements of working capital | | | 14,540 | | | | (17,290 | ) | | | (18,625 | ) | | | (12,739 | | | (19,064 | ) |

| | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 126,184 | | | $ | 117,087 | | | $ | 56,175 | | | $ | 94,387 | | $ | 46,408 | |

| | | | | | | | | | | | | | | | | | | |

| (a) | Represents the cash gain (loss) portion of the foreign exchange loss on long-term debt and change in fair value of derivative financial instruments. |

| (b) | Represents adjustments made in order to calculate Adjusted EBITDA. See footnotes to the prior reconciliation table in this note 4. |

| (c) | Represents interest expense net of amortization of debt issue costs and capitalized interest. |

| (d) | Represents the elimination of certain transition-related expenses incurred in connection with the Acquisition which have not been capitalized in purchase accounting or as debt issuance costs, primarily relating to non-recurring legal and accounting fees. |

| (e) | Represents the elimination of incremental cost of sales from November 18, 2004 to October 31, 2005 resulting from amortization of the step-up in fair value of the merchandise inventory balance following the application of purchase accounting to the Acquisition. |

| (6) | Rent expense represents (i) basic rent expense on a straight-line basis and (ii) contingent rent expense, net of amortization of inducements received from landlords. |

| (7) | Gross margin represents gross profit as a percentage of sales. Comparable store sales is a measure of the percentage increase or decrease of the sales of stores open for at least 13 complete months relative to the same period in the prior year. To provide more meaningful results, we measure comparable store sales over periods containing an integral number of weeks beginning on a Monday and ending on a Sunday that best approximate the fiscal period to be analyzed. |

| (8) | For purposes of calculating the ratio of earnings to fixed charges, earnings represent the sum of earnings before income taxes, fixed charges and amortization of capitalized interest, less capitalized interest. Fixed charges consist of interest expense, capitalized interest, and the portion of operating rental expense which management believes is representative of the interest component of rent expense. |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

5

D. Risk Factors

Risks Related to Our Business

As a dollar store, we are particularly vulnerable to future increases in operating and merchandise costs.

Our ability to provide quality merchandise at low price points is subject to a number of factors that are beyond our control, including merchandise costs, foreign exchange rate fluctuations, increases in rent and occupancy costs, inflation and increases in labor (including any increases in the minimum wage) and fuel costs, all of which may reduce our profitability and have an adverse impact on our cash flows. In the past as a single fixed price retailer, we were unable to pass cost increases to our customers by increasing the price of our merchandise. As such, we have attempted to offset cost increases in one area of our operations by finding cost savings or operating efficiencies in another.

We believe that our additional fixed price points of $1.25, $1.50 and $2.00 will give us some flexibility to address cost increases by adjusting our selling price on certain items. There is, however, no guarantee that our customers will be willing to purchase products at increased prices or that we will be successful in offsetting costs in a meaningful way given the limited range of prices which we offer. Furthermore, there has historically been a time lag before any cost increases could be passed on to our customers. There can be no assurance that we will be able to pass on any cost increases to our customers.

Foreign exchange rate fluctuations, in particular, have a material impact on our operating and merchandise costs. This is because while our sales are in Canadian dollars, we have been increasing our purchases of merchandise from low-cost overseas suppliers, principally in China. In Fiscal 2010, direct sourcing from overseas suppliers accounted for more than 53% of our purchases. Our results of operations are particularly sensitive to the fluctuation of the Chinese renminbi against the U.S. dollar and the fluctuation of the U.S. dollar against the Canadian dollar because we purchase a majority of our imported merchandise from suppliers in China using U.S. dollars. For example, if the Chinese renminbi were to appreciate against the U.S. dollar, our cost of merchandise purchased in China would increase, which would have a negative impact on our margins, profitability and cash flows. If the U.S. dollar appreciates against the Canadian dollar at the same time, the negative impact would be further exacerbated. We enter into U.S. dollar currency hedging to reduce the risk associated with currency fluctuations. Currency hedging entails a risk of illiquidity and, to the extent that the U.S. dollar depreciates against the Canadian dollar, the risk of using hedges could result in losses greater than if the hedging had not been used. Hedging arrangements may have the effect of limiting or reducing the total returns to the Partnership if management’s expectations concerning future events or market conditions prove to be incorrect. In addition, the costs associated with a hedging program may outweigh the benefits of the arrangements in such circumstances. Labor shortages may reduce our ability to have a competitive labor cost. Fuel cost increases or surcharges could also increase our transportation costs and therefore impact our profitability. In addition, inflation and adverse economic developments in Canada, where we both buy and sell merchandise, and in China and other parts of Asia, where we buy a large portion of our imported merchandise, can have a negative impact on our margins, profitability and cash flows. If we are unable to predict and respond promptly to these or other similar events that may increase our operating and merchandise costs, our results of operations and cash flows will be adversely affected.

We may not be able to refresh our merchandise as often as we have done so in the past.

We adjust our merchandise mix periodically based on the results of internal analysis as slow-selling items are discontinued and replaced as warranted. Our success, therefore, depends in large part on our ability to continually find, select and purchase quality merchandise at attractive prices in order to replace underperforming goods. We typically do not enter into long-term contracts for the purchase or development of merchandise and must continually seek out buying opportunities from both our existing suppliers and new sources, for which we compete with other multi-price dollar stores, variety and discount stores and mass merchants. Although we believe that we have strong and long-standing relationships with our suppliers, we may not be successful in maintaining a continuing and increasing supply of quality merchandise at attractive prices. If we cannot find or purchase the necessary amount of competitively priced merchandise to replace goods that are outdated or unprofitable, our results of operations and cash flows will be adversely affected.

An increase in the cost or a disruption in the flow of our imported goods may significantly affect our sales and profits and have an adverse impact on our cash flows.

One of our key business strategies is to source quality merchandise directly from the lowest cost supplier. As a result, we rely heavily on imported goods, principally from China. Imported goods are generally less expensive than domestic goods and contribute significantly to our favorable profit margins. Merchandise imported directly from overseas manufacturers and agents accounted for more than 53% of our total purchases during Fiscal 2010. We expect direct imports to continue to account for approximately 45% to 60% of our total purchases. Our imported merchandise could become more expensive or unavailable for a number of reasons, including (a) disruptions in the flow of imported goods due to factors such as raw material shortages or an increase in prices, work stoppages, factory closures, suppliers going out of business, inflation, strikes, and political unrest in foreign countries, (b) problems with oceanic shipping, including shipping container shortages, (c) economic crises and international disputes, such as China’s claims to sovereignty over Taiwan, (d) increases in the cost of purchasing or shipping foreign merchandise resulting from a failure of Canada to maintain normal trade relations with foreign countries we deal with, (e) import duties, import quotas, and other trade sanctions, and (f) increases in shipping rates imposed by foreign countries we deal with. The development of one or more of these factors could

6

adversely affect our operations in a material way. If imported merchandise becomes more expensive or unavailable, we may not be able to transition to alternative sources in time to meet our demands. Products from alternative sources may also be of lesser quality and more expensive than those we currently import. A disruption in the flow of our imported merchandise or an increase in the cost of those goods due to these or other factors would significantly decrease our sales and profits and have an adverse impact on our cash flows.

Political and economic instability in the countries in which foreign suppliers are located, the financial instability of suppliers, suppliers’ failure to meet our supplier standards, issues with labor practices of our suppliers or labor problems they may experience (such as strikes), the availability and cost of raw materials to suppliers, merchandise quality or safety issues, currency exchange rates, transport availability and cost, inflation, and other factors relating to our suppliers and the countries in which they are located or from which they import are beyond our control and could have negative implications for us. In addition, the United States’ foreign trade policies, tariffs and other impositions on imported goods, trade sanctions imposed on certain countries, the limitation on the importation of certain types of goods or of goods containing certain materials from other countries and other factors relating to foreign trade are beyond our control. Disruptions due to labor stoppages, strikes or slowdowns, or other disruptions involving our vendors or the transportation and handling industries also may negatively affect our ability to receive merchandise and thus may negatively affect sales. These and other factors affecting our suppliers and our access to products could adversely affect our business and financial results. As we increase our imports of merchandise from foreign vendors, the risks associated with foreign imports will increase.

All of our vendors and their products must comply with applicable product safety laws. If we do not have adequate insurance or contractual indemnification available, product liability claims relating to products that are recalled, defective or otherwise harmful could have a material adverse effect on our business, reputation and financial results. Our ability to obtain indemnification from foreign suppliers may be hindered by the manufacturers’ lack of understanding of Canadian product liability or other laws, which may make it more likely that we be required to respond to claims or complaints from customers as if we were the manufacturer of the products. This could adversely affect our reputation and our litigation expenses could increase, each of which could have an adverse effect on our business, reputation and financial results.

We are dependent upon the smooth functioning of our distribution network.

We must constantly replenish depleted inventory through deliveries of merchandise to our four warehouses, our distribution center and our stores, and from our warehouses and distribution center to our stores by various means of transportation, including shipments by sea, train and truck on the roads and highways of Canada. Long-term disruptions to our warehouses and distribution center and to the national and international transportation infrastructure that lead to delays or interruptions of service would adversely affect our business. Similarly, extreme weather conditions can affect the planned receipt of inventory and the distribution of merchandise and may have an adverse effect on our business and financial results.

General economic conditions and volatility in the worldwide economy has adversely affected consumer spending, which may negatively affect our business and financial results.

Current economic conditions or a further deterioration in the Canadian economy may adversely affect the spending of our customers, which would likely result in lower sales than expected on a quarterly or annual basis. Future economic conditions affecting disposable consumer income, such as employment levels, consumer debt levels, lack of available credit, business conditions, fuel and energy costs, interest rates, and tax rates, could also adversely affect our business and financial results by reducing consumer spending or causing customers to shift their spending to other products. We may be sensitive to reductions in consumer spending because we generally have limited flexibility to reduce our prices to maintain or attract additional sales in an economic downturn.

In addition, current global economic conditions and uncertainties, the potential impact of the current recession, the potential for additional failures or realignments of financial institutions, and the related impact on available credit may affect us and our suppliers and other business partners, landlords, and customers in an adverse manner including, but not limited to, reducing access to liquid funds or credit (including through the loss of one or more financial institutions that are a part of our revolving credit facility), increasing the cost of credit, limiting our ability to manage interest rate risk, increasing the risk of bankruptcy of our suppliers, landlords or counterparties to or other financial institutions involved in our credit facilities and our derivative and other contracts, increasing the cost of goods to us, and other impacts which we are unable to fully anticipate. One of our key strategies is to source quality merchandise directly from the lowest cost supplier. Thus supplier plant closures or increases in costs of merchandise due to economic conditions may adversely affect our business and financial results.

Our level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our debt obligations.

We are highly leveraged. As of January 31, 2010, we had long-term debt excluding financing costs of $477.4 million. Our high degree of leverage could have important consequences, including the following:

| | • | | a substantial portion of our cash flows from operations will be dedicated to the payment of principal and interest on our indebtedness and other financial obligations and will not be available for other purposes, including funding our operations and capital expenditures for projects such as a new warehouse or distribution center, new store openings, and future business opportunities; |

7

| | • | | the debt service requirements of our other indebtedness and lease expense could make it more difficult for us to make payments on our debt; |

| | • | | our ability to obtain additional financing for working capital and general corporate or other purposes may be limited; |

| | • | | certain of our borrowings, including the Deferred Interest Notes and borrowings under our Credit Facility, are at variable rates of interest, exposing us to the risk of increased interest rates; |

| | • | | our debt level may limit our flexibility in planning for, or reacting to, changes in our business and in our industry in general, placing us at a competitive disadvantage compared to our competitors that have less debt; and |

| | • | | our leverage may make us vulnerable to a downturn in general economic conditions and adverse industry conditions. |

We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under such indebtedness.

Our ability to make scheduled payments on or to refinance our debt obligations and to make distributions to enable us to service our debt obligations depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business, and other factors beyond our control, including fluctuations in interest rates, market liquidity conditions, increased operating costs, and trends in our industry. If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital, or restructure or refinance our indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In such circumstances, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. The Credit Facility restricts the ability of Group L.P. and its restricted subsidiaries, and the indenture governing the Deferred Interest Notes (the “Deferred Interest Notes Indenture”) restricts the ability of Holdings and its restricted subsidiaries to dispose of assets and restrict the use of the proceeds from asset dispositions. We may not be able to consummate those dispositions or to obtain the proceeds which could be realized from them and these proceeds may not be adequate to meet any debt service obligations then due.

Despite current indebtedness levels, we may still be able to incur substantially more debt, which could further exacerbate the risks described above.

We may be able to incur substantial additional indebtedness in the future. Although the Credit Facility and the Deferred Interest Notes Indenture contain restrictions on the incurrence of additional indebtedness, such restrictions are subject to a number of qualifications and exceptions, and under certain circumstances, indebtedness incurred in compliance with such restrictions could be substantial. In addition, our subsidiaries may, under certain circumstances and subject to receipt of additional commitments from existing lenders or other eligible institutions, request additional term loan tranches or increases to the revolving loan commitments by an aggregate amount of up to $150 million (or the U.S. dollar equivalent thereof). If our current debt levels are increased, the related risks that we now face could intensify.

The terms of the Credit Facility and the Deferred Interest Notes Indenture impose significant operating restrictions, which may prevent us from pursuing certain business opportunities and taking certain actions that may be in our interest.

Our Credit Facility contains various covenants that limit our ability to engage in specified types of transactions. These covenants limit our ability to, among other things:

| | • | | incur, assume, or guarantee additional debt and issue or sell preferred stock; |

| | • | | pay dividends on, redeem or repurchase our capital stock; |

| | • | | make capital expenditures; |

8

| | • | | create or permit certain liens; |

| | • | | use the proceeds from sales of assets and subsidiary stock; |

| | • | | create or permit restrictions on the ability of our restricted subsidiaries to pay dividends or make other distributions to us; |

| | • | | enter into transactions with affiliates; |

| | • | | conduct certain business activities; |

| | • | | consolidate or merge or sell all or substantially all of our assets; and |

| | • | | prepay, redeem or repurchase certain indebtedness. |

In addition, the Credit Facility also requires Group L.P. to comply on a quarterly basis with certain financial covenants, including a maximum lease-adjusted leverage ratio test and a minimum interest coverage ratio test.

The Deferred Interest Notes Indenture also contains various covenants that limit our ability to engage in specified types of transactions. These covenants limit our ability to, among other things:

| | • | | incur, assume, or guarantee additional debt and issue or sell preferred stock; |

| | • | | pay dividends on, redeem or repurchase our capital stock; |

| | • | | create or permit certain liens; |

| | • | | use the proceeds from sales of assets and subsidiary stock; |

| | • | | create or permit restrictions on the ability of our restricted subsidiaries to pay dividends or make other distributions to us; |

| | • | | enter into transactions with affiliates; |

| | • | | conduct certain business activities; |

| | • | | consolidate or merge or sell all or substantially all of our assets; and |

| | • | | prepay, redeem or repurchase certain indebtedness. |

Under the Credit Facility, the occurrence of specified change of control events will cause an event of default. Change of control events include if certain “permitted holders” (being funds advised by Bain Capital Partners, LLC (“Bain Capital”) and certain original management shareholders, unless management shareholders hold more than 30% of the voting stock of Dollarama Holdings L.P. (“Holdings L.P.”) or more voting stock in Holdings L.P. than funds advised by Bain Capital, in which case they are not included as permitted holders for this purpose) cease to hold a majority, directly or indirectly, of Holdings L.P.’s voting stock; unless, following such event, (i) no other person or group of persons (other than “permitted holders”) becomes the beneficial owner of more than 35%, directly or indirectly, (or, if higher, the percentage then held by such permitted holders) of Holdings L.P.’s voting stock, and, (ii) a majority of Holdings L.P.’s board of directors continues to be directors that were recommended for nomination for election by the Holdings L.P.’s board of directors, in which case such event shall not be considered a change of control.

Under the Deferred Interest Notes Indenture, if specified change of control events occur, we will be required to offer to repurchase all outstanding notes under the applicable indenture at a price equal to 101% of their principal amount plus accrued and unpaid interest, if any. Change of control events include a sale of substantially all of our assets (other than to certain “permitted holders” being funds advised by Bain Capital and certain original management shareholders, unless management shareholders hold more voting stock of Holdings L.P. or the Partnership than funds advised by Bain Capital, in which case they are no longer considered permitted holders), the acquisition by a person or group of persons (other than permitted holders) of at least 50%, directly or indirectly, of the voting power of the Partnership or Holdings L.P. or a majority of the Partnership’s directors ceasing to be directors

9

that were nominated for election, or whose nomination for election was previously approved, by the Partnership’s board of directors. Our failure to repurchase these notes upon a change of control would cause an event of default under the indenture governing the Deferred Interest Notes upon a change of control because we may not have sufficient financial resources to purchase all of the notes that are tendered upon a change of control. Further, we will be contractually restricted under the terms of our Credit Facility from repurchasing all of the notes tendered by holders upon a change of control. Accordingly, we may not be able to satisfy such obligations to purchase the notes unless we are able to refinance or obtain waivers under the Credit Facility. Our failure to repurchase these notes upon a change of control would cause an event of default under the indenture governing the Deferred Interest Notes. This may also cause a cross-default under the Credit Facility.

These restrictions may prevent us from taking actions that we believe would be in the best interest of our business, and may make it difficult for us to successfully execute our business strategy or effectively compete with companies that are not similarly restricted.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

A portion of our indebtedness, including our Deferred Interest Notes and the borrowings under the Credit Facility, is at variable rates of interest and exposes us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash flows would decrease.

There is no guarantee that our strategy to introduce products between the $1.00 and $2.00 dollar price range will continue to be successful.

On February 2, 2009, we introduced additional price points of $1.25, $1.50 and $2.00. We believe that these multiple price points will allow us to offer more value and higher quality goods to our customers. There is, however, no guarantee that our customers will continue to purchase our products priced above the $1.00 price point or that we will be able to continue to offer the same quality and variety of products at the same price-points, which would negatively affect our business and financial results.

Our private brands may not achieve or maintain broad market acceptance.

We carry a substantial number of private brand items. We believe that our success in maintaining broad market acceptance of our private brands depends on many factors, including pricing, quality and customer perception. We may not achieve or maintain our expected sales for our private brands. As a result, our business and financial results could be adversely affected.

We may be unable to obtain additional capacity for our warehouse and distribution centers.

We may need additional warehouse and distribution center capacity in the coming years following future store openings. However, under our current expansion plan, we believe our existing distribution network currently has the capacity to cost-effectively service more than 150 additional stores. If we are unable to locate sites for new warehouses and distribution centers or unable to launch warehouses or distribution centers on a timely basis, we may not be able to successfully execute our growth strategy.

Our sales may be affected by weather conditions or seasonal fluctuations.

Weather conditions can affect the timing of consumer spending and have an impact on our retail sales. Moreover, the different holidays like Christmas, Easter, Valentine’s Day and Halloween have a positive impact on our retail sales. Historically, our highest sales results have occurred during the fourth quarter, which includes the holiday selling season. During Fiscal 2010, approximately 29.0% of our sales were generated in the fourth quarter. Accordingly, weather conditions or a failure to anticipate the impact that holidays may have on our operations could have an adverse effect on our business and financial results.

Competition in the retail industry could limit our growth opportunities and reduce our profitability.

The retail business is highly competitive. We operate in the value retail industry, which is competitive with respect to price, store location, merchandise quality, assortment and presentation, in-stock consistency, and customer service. This competitive environment subjects us to the risk of adverse impact to our financial performance because of the lower prices, and thus the lower margins, required to maintain our competitive position. Also, companies operating in our industry (due to customer demographics and other factors) may have limited ability to increase prices in response to increased costs (including, but not limited to, vendor price increases). This limitation may adversely affect our margins and financial performance. We compete for customers, employees, store sites, products and services and in other important aspects of our business with many other local, regional and national retailers. We compete with multi-price dollar stores, variety and discount stores and mass merchants. These other competitors compete in a variety of ways, including aggressive promotional activities, merchandise selection and availability, services offered to customers, location,

10

store hours, in-store amenities and price. If we fail to respond effectively to competitive pressures and changes in the retail markets, it could adversely affect our business and financial results. Some of our competitors in the retail industry are much larger and have substantially greater resources than we do, and we remain vulnerable to the marketing power and high level of consumer recognition of major mass merchants, and to the risk that these mass merchants or others could venture into our market segment in a significant way. In addition, we expect that our expansion plans, as well as the expansion plans of other dollar stores, will increasingly bring us into direct competition with them. Competition may also increase because there are no significant economic barriers to other companies opening dollar stores.

Our business is dependent on our ability to obtain competitive pricing and other terms from our suppliers and the timely receipt of inventory.

We believe that we have good relations with our suppliers and that we are generally able to obtain competitive pricing and other terms from suppliers. However, we buy products on an order-by-order basis and have very few long-term purchase contracts or other assurances of continued product supply or guaranteed product cost. If we fail to maintain good relations with our suppliers, or if our suppliers’ product costs are increased as a result of prolonged or repeated increases in the prices of certain raw materials, we may not be able to obtain attractive pricing, in which case our profit margins may be reduced and our results of operations may be adversely affected. In addition, if we are unable to receive merchandise from our suppliers on a timely basis because of interruptions in production or other reasons that are beyond our control, our business and financial results may be adversely affected.

We may be unable to renew our store, warehouse and distribution center leases or find other locations or leases on favorable terms.

As of January 31, 2010, we leased all our stores from unaffiliated third parties, except 18 of our stores leased from entities controlled by Larry Rossy. Approximately 11%, 9% and 9% of our store leases with third party lessors will expire in fiscal year 2011, fiscal year 2012, and fiscal year 2013, respectively. As of January 31, 2010, we leased all of our warehouses and our distribution centre from entities controlled by Larry Rossy. Our warehouse leases will expire in fiscal year 2024 and our distribution centre lease will expire in fiscal year 2024. Unless the terms of our leases are extended, the properties, together with any improvements that we have made, will revert to the property owners upon expiration of the lease terms. As the terms of our leases expire, we may not be able to renew these leases or find alternative store locations that meet our needs on favorable terms or at all. If we are unable to renew a significant number of our expiring leases or to promptly find alternative store locations that meet our needs, our profitability and cash flows may be materially adversely affected. Furthermore, many leases provide that the landlord may increase the rent over the term of the lease. Most leases require us to pay a variety of costs such as cost of insurance, taxes, maintenance and utilities. We generally cannot cancel these leases. If an existing or future store is not profitable, and we decide to close it, we may nonetheless be committed to perform our obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term.

If we experience significant disruptions in our information technology systems, our business and financial results may be adversely affected.

We depend on our information technology systems for the efficient functioning of our business, including accounting, data storage, purchasing and inventory management, and store communications systems. Our enterprise-wide software solution enables management to better and more efficiently conduct our operations and gather, analyze, and assess information across all business segments and geographic locations. However, difficulties with the hardware and software platform could disrupt our operations, including our ability to timely ship and track product orders, project inventory requirements, manage our supply chain, and otherwise adequately service our customers, which would have an adverse effect on our business and financial results. In the event we experience significant disruptions with our information technology system, we may not be able to fix our systems in an efficient and timely manner. Accordingly, such events may disrupt or reduce the efficiency of our entire operation and have a material adverse effect on our results of operations and cash flows. Costs associated with potential interruptions to our information systems could be significant.

We may not be able to successfully execute our growth strategy, particularly outside of our core markets of Ontario and Québec.

We have experienced substantial growth during the past several years, opening an average of 43 net new stores per year since fiscal year 2002, and we plan to continue to open new stores in the near future. Our ability to successfully execute our growth strategy will depend largely on our ability to successfully open and operate new stores, particularly outside of our traditional core markets of Ontario and Québec, which, in turn, will depend on a number of factors, including whether we can:

| | • | | supply an increasing number of stores with the proper mix and volume of merchandise; |

11

| | • | | hire, train, and retain an increasing number of qualified employees at affordable rates of compensation; |

| | • | | locate, lease, build out, and open stores in suitable locations on a timely basis and on favorable economic terms; |

| | • | | expand into new geographic markets, where we have limited or no presence; |

| | • | | expand within our traditional core markets of Ontario and Québec, where new stores may draw sales away from our existing stores; |

| | • | | successfully compete against local competitors; and |

| | • | | build, expand and upgrade warehouses and distribution centers and internal store support systems in an efficient, timely and economical manner. |

Any failure by us to achieve these goals could adversely affect our ability to continue to grow.

We may not be able to achieve the anticipated growth in sales and operating income when we open new stores.

If our planned expansion occurs as anticipated, our store base will include a relatively high proportion of stores with relatively short operating histories. Comparable store sales may be negatively affected when stores are opened or expanded near existing stores. If our new stores on average fail to achieve results comparable to our existing stores, our planned expansion could produce a decrease in our overall sales per square foot and store-level operating margins.

Our profitability may be negatively affected by inventory shrinkage.

We are subject to the risk of inventory loss, administrative or operator errors, including mislabeling, theft and fraud. We have experienced inventory shrinkage in the past, and we cannot assure you that incidences of inventory loss and theft will decrease in the future or that the measures we are taking or the initiatives we implemented will effectively address the problem of inventory shrinkage. Although some level of inventory shrinkage is a necessary and unavoidable cost of doing business, if we were to experience higher rates of inventory shrinkage or incur increased security costs to combat inventory theft, our business and financial results could be affected adversely.

We are subject to environmental regulations, and compliance with such regulations could require us to make expenditures.

Under various federal, provincial, and local environmental laws and regulations, current or previous owners or occupants of property may become liable for the costs of investigating, removing and monitoring any hazardous substances found on the property. These laws and regulations often impose liability without regard to fault.

Certain of the facilities that we occupy have been in operation for many years and, over such time, we and the prior owners or occupants of such properties may have generated and disposed of materials which are or may be considered hazardous. Accordingly, it is possible that additional environmental liabilities may arise in the future as a result of any generation and disposal of such hazardous materials. Although we have not been notified of, and are not aware of, any current environmental liability, claim, or non-compliance, we could incur costs in the future related to our properties in order to comply with, or address any violations under, environmental laws and regulations.

In the ordinary course of our business, we sometimes use, store, handle or dispose of household products and cleaning supplies that are classified as hazardous materials under various environmental laws and regulations. We cannot predict the environmental laws or regulations that may be enacted in the future or how existing or future laws and regulations will be administered or interpreted. Compliance with more stringent laws or regulations, as well as more vigorous enforcement policies of the regulatory agencies or stricter interpretations of existing laws and regulations, may require additional expenditures by us which could vary substantially from those currently anticipated.

Failure to attract and retain qualified employees while controlling labor costs, as well as other labor issues, could adversely affect our business and financial results.

Our future growth and performance depends on our ability to attract, retain and motivate qualified employees, many of whom are in positions with historically high rates of turnover. Our ability to meet our labor needs, while controlling our labor costs, is subject to many external factors, including the competition for and availability of qualified personnel in a given market, unemployment levels within those markets, prevailing wage rates, minimum wage laws, health and other insurance costs and changes in employment and labor legislation (including changes in the process for our employees to join a union) or other workplace

12

regulation (including changes in entitlement programs such as health insurance and paid leave programs). While we believe we pay our employees fair wages, to the extent a significant portion of our employee base unionizes, or attempts to unionize, our business could be disrupted and, to the extent such attempts are successful, our labor costs could increase. Our ability to pass along labor costs is constrained.

Also, our stores are managed through a network of geographically dispersed management personnel. Our inability to effectively and efficiently operate our stores, including the ability to control losses resulting from inventory and cash shrinkage, may negatively affect our sales and/or operating margins.

If we lose the services of our senior executives who possess specialized market knowledge and technical skills, it could reduce our ability to compete, to manage our operations effectively, or to develop new products and services.

Many of our senior executives have extensive experience in our industry and with our business, products, and customers. Since we are managed by a small group of senior executive officers, the loss of the technical knowledge, management expertise and knowledge of our operations of one or more members of our core management team, including Larry Rossy, our CEO and the grandson of our founder, Neil Rossy, our Chief Merchandising Officer and the son of Larry Rossy, Geoffrey Robillard, our Senior Vice President, Import Division, and Stéphane Gonthier, our Chief Operating Officer (“COO”), could result in a diversion of management resources, as the remaining members of management would need to cover the duties of any senior executive who leaves us and would need to spend time usually reserved for managing our business to search for, hire and train new members of management. The loss of some or all of our senior executives could negatively affect our ability to develop and pursue our business strategy, which could adversely affect our business and financial results.

Fluctuations in the value of the Canadian dollar in relation to the U.S. dollar may impact our operating and financial results and may affect the comparability of our results between financial periods.

Exchange rate fluctuations could have an adverse effect on our results of operations and ability to service our U.S. dollar-denominated debt. The majority of our debt and over 50% of our purchases are in U.S. dollars while the majority of our sales and operating expenses are in Canadian dollars. Therefore, a fluctuation in the exchange rate of the Canadian dollar versus the U.S. dollar would affect the cash needed to service our U.S. dollar-denominated debt and the related hedge instruments and, in addition, our gross margins would be impacted. For the purposes of financial reporting, any change in the value of the Canadian dollar against the U.S. dollar during a given financial reporting period would result in a foreign currency loss or gain on the translation of U.S. dollar denominated debt and our related hedge instruments into Canadian dollars under Canadian generally accepted accounting principles. Consequently, our reported earnings could fluctuate materially as a result of foreign exchange translation gains or losses and may not be comparable from period to period.

Litigation may adversely affect our business and financial results.

Our business is subject to the risk of litigation by employees, customers, consumers, suppliers, competitors, shareholders, government agencies, or others through private actions, class actions, administrative proceedings, regulatory actions or other litigation, including, in the case of administrative proceedings, as a result of reviews by taxation authorities. The outcome of litigation, particularly class action lawsuits, regulatory actions and intellectual property claims, is difficult to assess or quantify. Claimants in these types of lawsuits or claims may seek recovery of very large or indeterminate amounts, and the magnitude of the potential loss relating to these lawsuits or claims may remain unknown for substantial periods of time. In addition, certain of these lawsuits or claims, if decided adversely to us or settled by us, may result in liability material to our financial statements as a whole or may negatively affect our operating results if changes to our business operations are required. Also, in connection with the Partnership’s business activities, the Partnership is subject to reviews by taxation authorities. There is no assurance that any such reviews will not result in taxation authorities challenging any of our tax filings. The cost to defend future litigation may be significant. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid or whether we are ultimately found liable. As a result, litigation may adversely affect our business and financial results.

We are subject to the risk of product liability claims and product recalls.

The Partnership sells products produced by third party manufacturers. Some of these products may expose the Partnership to product liability claims relating to personal injury, death or property damage caused by such products, any may require the Partnership to take actions. One or more of our suppliers might not adhere to product safety requirements or our quality control standards, and we might not identify the deficiency before merchandise ships to our stores. If our suppliers are unable or unwilling to recall products failing to meet our quality standards, we may be required to remove merchandise from our shelves or recall those products at a substantial cost to us. Product recalls, withdrawals or replacements may harm the Partnership’s reputation and acceptance of its products by customers, which may adversely affect our business and financial results. Product recalls, withdrawals, or replacements

13

may also increase the amount of competition that the Partnership faces. Some competitors may attempt to differentiate themselves from the Partnership by claiming that their products are produced in a manner or geographic area that is insulated from the issues that preceded the recalls, withdrawals, or replacements of the Partnership’s products. Although the Partnership maintains liability insurance to mitigate potential claims, the Partnership cannot be certain that its coverage will be adequate for liabilities actually incurred or that insurance will continue to be available on economically reasonable terms or at all. Product liability claims and product recalls, withdrawals or replacements could adversely affect the Partnership’s business and financial results.

Our current insurance program may expose us to unexpected costs and negatively affect our financial results.

Our insurance coverage reflects deductibles, self-insured retentions, limits of liability and similar provisions that we believe are prudent based on the dispersion of our operations. However, there are types of losses we may incur but against which we cannot be insured or which we believe are not economically reasonable to insure, such as losses due to acts of war, employee and certain other crime and some natural disasters. If we incur these losses and they are material, our business could suffer. Certain material events may result in sizable losses for the insurance industry and adversely impact the availability of adequate insurance coverage or result in excessive premium increases. To offset negative insurance market trends, we may elect to self insure, accept higher deductibles or reduce the amount of coverage in response to these market changes. In addition, we self insure a significant portion of expected losses under our workers’ compensation, automobile liability, general liability and group health insurance programs. Unanticipated changes in any applicable actuarial assumptions and management estimates underlying our recorded liabilities for these losses, including expected increases in medical and indemnity costs, could result in materially different amounts of expense than expected under these programs, which could have an adverse effect on our financial results. Although we continue to maintain property insurance for catastrophic events, we are effectively self-insured for property losses up to the amount of our deductibles. If we experience a greater number of these losses than we anticipate, our financial results could be adversely affected.

We may not be able to protect our trademarks and other proprietary rights.

We believe that our trademarks and other proprietary rights are important to our success and our competitive position. Accordingly, we protect our trademarks and proprietary rights. However, the actions taken by us may be inadequate to prevent imitation of our products and concepts by others or to prevent others from claiming violations of their trademarks and proprietary rights by us. In addition, our intellectual property rights may not have the value that we believe they have. If we are unsuccessful in protecting our intellectual property rights, or if another party prevails in litigation against us relating to our intellectual property rights, the value and adequacy of our brand recognition could be diminished causing customer confusion and adversely affecting our sales and profitability and we may incur significant costs and may be required to change certain aspects of our operations.

Natural disasters, unusual weather, pandemic outbreaks, boycotts and geo-political events or acts of terrorism could adversely affect our operations and financial results.

The occurrence of one or more natural disasters, such as hurricanes and earthquakes, unusually adverse weather, pandemic outbreaks, boycotts and geo-political events, such as civil unrest in countries in which our suppliers are located and acts of terrorism, or similar disruptions could adversely affect our operations and financial results. These events could result in physical damage to one or more of our properties, increases in fuel or other energy prices, the temporary or permanent closure of one or more of our stores or warehouses or distribution centers, delays in opening new stores, the temporary lack of an adequate workforce in a market, the temporary or long-term disruption in the supply of products from some local and overseas suppliers, the temporary disruption in the transport of goods from overseas, delay in the delivery of goods to our warehouses, distribution centers or stores, the temporary reduction in the availability of products in our stores and disruption to our information systems. These factors could otherwise disrupt and adversely affect our operations and financial results.

We face risks related to protection of customers’ credit card data.

We transmit confidential credit card information in connection with our credit card pilot project. Third parties may have the technology or know-how to breach the security of this customer information, and our security measures and those of our technology vendors may not effectively prevent others from obtaining improper access to this information. Any security breach could expose us to risks of data loss, litigation and liability and could seriously disrupt our operations and any resulting negative publicity could significantly harm our reputation.

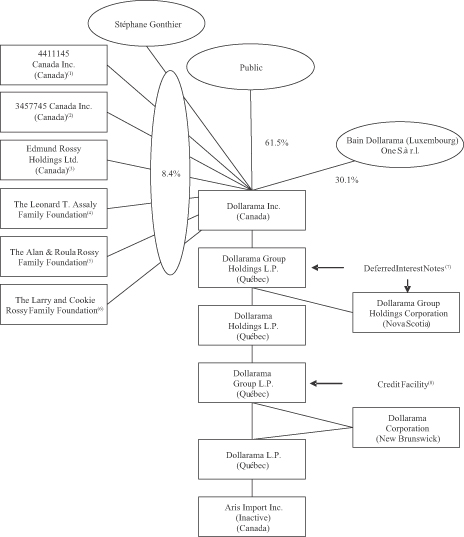

Influence by Existing Shareholders of Dollarama Inc.

Based on share ownership as of the date hereof, Bain Capital beneficially owns or controls, directly or indirectly, 22,037,446 common shares of our parent Dollarama Inc. (“Common Shares”), which in the aggregate represents approximately 30.1% of Dollarama Inc.’s issued and outstanding Common Shares, Larry Rossy and The Larry and Cookie Rossy Family Foundation beneficially own or control, in the aggregate, directly or indirectly, 4,407,230 Common Shares, which represent approximately 6.0% of our Common Shares. As a result, if some of these persons or entities act together, they have the ability to control or significantly influence all matters submitted to

14