Smart Solutions. Powerful Products. Confidential Smart Solutions. Powerful Products. Forum Energy Technologies Global Hunter Securities 100 Energy Conference 26 June 2012

Smart Solutions. Powerful Products. Confidential Forward Looking Statements The statements made during this presentation, including the answers to your questions, include information that we believe to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements involve risk and uncertainties that may cause actual results or events to differ materially from those expressed or implied in such statements. Those risks include, among other things, matters that we have described in our earnings release and in our filings with the Securities and Exchange Commission. We do not undertake any ongoing obligation, other than that imposed by law, to publicly update or revise any forward-looking statements to reflect future events, information, or circumstances that arise after this presentation. In addition, this presentation contains time sensitive information that reflects management's best judgment only as of the date of this presentation. 2

Smart Solutions. Powerful Products. Confidential circle6 Global oilfield products and equipment company circle6 Leveraged to attractive secular growth trends ‒ Deepwater ‒ Well complexity ‒ Service intensity circle6 Competing in consolidated markets circle6 High percentage of revenue from activity-based, consumable products circle6 Strong platform for growth from multiple avenues Forum Energy Technologies Investment Thesis 3

Smart Solutions. Powerful Products. Confidential Subsea Construction & Development Well Construction & Completion Production Infrastructure Stimulation & Intervention Markets and Key Customers We Serve Exposure to multiple large areas of industry spending 4 Drilling

Smart Solutions. Powerful Products. Confidential Subsea Technologies Drilling Technologies Production Equipment Drilling and Subsea Production and Infrastructure Valve Solutions Downhole Technologies circle6 Organized into two divisions, each focused on key industry growth trends circle6 Six product lines aligned with customers and end-users circle6 Balanced mix of capital equipment and consumable products Flow Equipment circle6 From the reservoir to the wellhead circle6 On the drilling rig and below the surface circle6 From wellhead to the refinery circle6 In the production and transportation line Organization 5 Subsea Drilling Completion Production Infrastructure

Smart Solutions. Powerful Products. Confidential circle6 Leading provider of deepwater remote operating vehicles ‒ Construction class; observation class; specialty vehicles circle6 Subsea tooling, components and positioning systems circle6 Strong secular trends in the deepwater ‒ Development activity barb2right growing subsea well count ‒ ROV fleet renewal cycle ‒ Subsea pipeline, fiber-optic, and offshore windfarms circle6 Premium provider of offshore, downhole well construction tools Deepwater Development Subsea capital equipment & downhole consumables 6 Subsea Technologies Downhole Technologies

Smart Solutions. Powerful Products. Confidential Subsea Technologies Widest range of remote operating vehicles in the industry 7

Smart Solutions. Powerful Products. Confidential circle6 Leading brands of downhole tools ‒ Davis-Lynch™ cementing tools and Cannon™ protection systems ‒ Core focus on well integrity circle6 Leveraged to well complexity trends ‒ Increasing number of highly deviated well paths ‒ Growth in downhole gauges, injections lines, ESP artificial lift circle6 Rig capital equipment focused on tubular handling ‒ Rig upgrade and retrofit market ‒ Increased speed, automation, and safety around tubulars Increasing Well Complexity Downhole consumables & drilling rig capital equipment 8 Downhole Technologies Drilling Technologies

Smart Solutions. Powerful Products. Confidential circle6 High wear rate consumables related to well stimulation ‒ Replacement treating iron and pressure control valves ‒ Recertification and refurbishment channel to market circle6 Strong service intensity trends ‒ “Manufacturing of wells” ‒ Completion intensity: increasing lateral lengths & stages per well ‒ Drilling intensity: increasing wells drilled per rig per year circle6 Drilling rig consumable products ‒ Manual and powered handling tools Service Intensity Fracturing consumables & drilling rig consumables 9 Flow Equipment Drilling Technologies

Smart Solutions. Powerful Products. Confidential circle6 Broad offering of valves circle6 Strong infrastructure tailwinds ‒ Pipeline Safety Act ‒ Canadian heavy oil sands process facilities ‒ Petrochemical complex revival circle6 Oil and liquids need for surface process equipment ‒ Shift to liquids rich and oil basins ‒ High revenue per well opportunity Unconventional Infrastructure Valves & production capital equipment 10 Valve Solutions Production Equipment

Smart Solutions. Powerful Products. Confidential DRILLINGSUBSEA WELL CONSTRUCTION & COMPLETION PRODUCTION & PROCESS INFRASTRUCTURE STIMULATION & INTERVENTION V&M segment PCS segment (NATCO)Surface Technologies segmentDPS segment Subsea Technologies segment (ROVs) Rig Technology segment Oil & Gas segment Competing in Consolidated Markets Focused on areas with few large, well capitalized competitors ROVs & Related Subsea Products & Services Tubular Handling Tools & Equipment Downhole Tools Consumable Flow Iron & Related Services Surface Production Equipment Up, Mid, Downstream Valves 11

Smart Solutions. Powerful Products. Confidential circle6 Products consumed or worn out during the well construction and completion process, or related to the ongoing operation of large energy transmission and processing infrastructure circle6 Purchases often associated with our customers’ operating expense budgets Weighted Towards Consumables Activity-based revenue drivers Consumable Products & Aftermarket 53% Capital Products & Equipment 40% Rental 4% Other 3% Downhole Technologies Valve Solutions Flow Equipment Drilling Technologies Subsea Technologies Production Equipment Capital Equipment Orientation Consumable Products Orientation Mix of Consumables & Capital Equipment 12 Note: Chart shows pro-forma for all acquisitions closed during 2011, as a % of the aggregate revenue for 2011. Percent of 2011 Pro Forma Revenue

Smart Solutions. Powerful Products. Confidential circle6 Multiple avenues of growth across our lines of business ‒ Market share gains ‒ New product commercialization ‒ Geographic expansion: Bakken, Brazil, Australia, etc. circle6 Productivity improvements in manufacturing, distribution and supply chain circle6 Long term enhancement of revenue driver mix ‒ Increase international and offshore content ‒ Preserve mix of consumable products versus capital equipment circle6 Complementary acquisition program Growth Company Focused on organic growth prospects 13

Smart Solutions. Powerful Products. Confidential Subsea Technologies Drilling Technologies Downhole Technologies Flow Equipment Production Equipment Drilling and Subsea Segment Production and Infrastructure Segment Valve Solutions Subsea Drilling Completion Production Infrastructure Focused Acquisition Program M&A as a strategic core competency circle6 Significant acquisition program in 2011 ‒ Created two new business lines to gain exposure to the growth trend in the completions sector ‒ Extended our subsea and drilling offering with three acquisitions circle6 Ongoing efforts ‒ Product line extensions within our existing six business lines ‒ Value oriented with compelling opportunity to enhance acquired business ‒ Focused on the subsea and completion areas 14

Smart Solutions. Powerful Products. Confidential Subsea 18% Drilling Capital Equipment 8% Drilling Consumables 18%Well Construction & Completion 11% Stimulation & Intervention 16% Production 15% Infrastructure 14% Land 76% Offshore 24% Sources of Revenue As a percent of 2011 pro forma sales Note: Charts show pro-forma for all acquisitions closed during 2011, as a % of the aggregate revenue for 2011. Purchase Cycle Well Cycle Land / Offshore Geography Consumable, Parts & Aftermarket 53% Capital Products & Equipment 40% Rental 4% Other 3% 15 United States 61% Europe Africa 14% Canada 9% Asia Pacific 8% Latin America 4% Middle East 4%

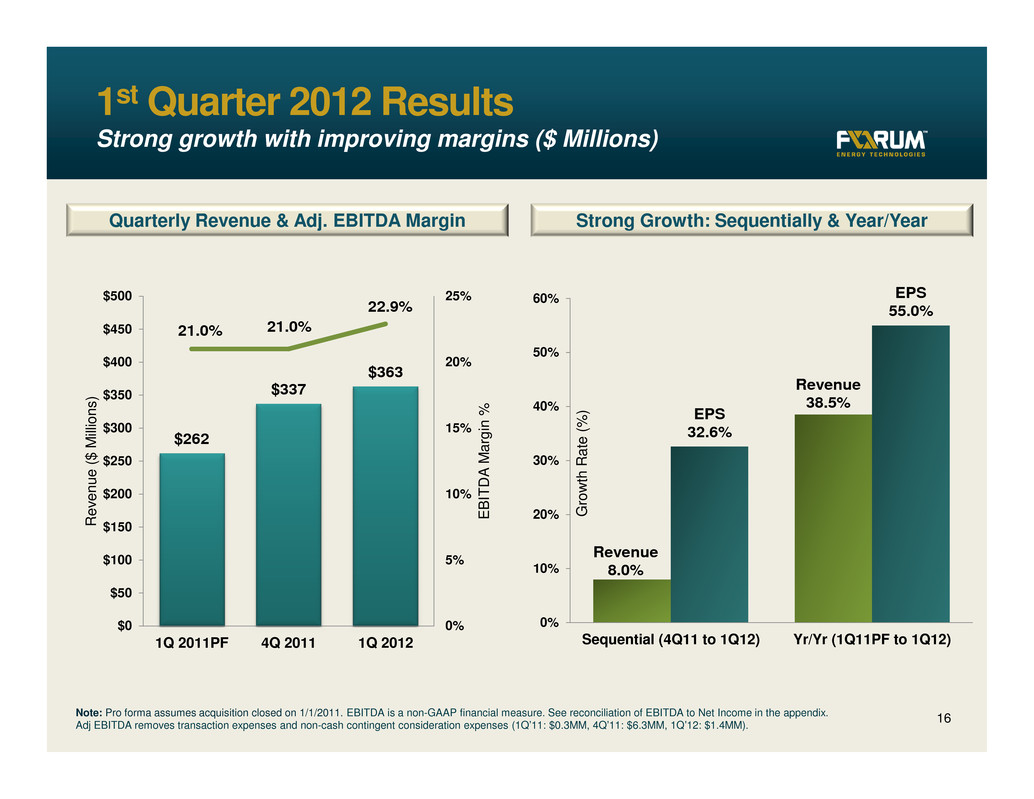

Smart Solutions. Powerful Products. Confidential 1st Quarter 2012 Results Strong growth with improving margins ($ Millions) Strong Growth: Sequentially & Year/YearQuarterly Revenue & Adj. EBITDA Margin $262 $337 $363 21.0% 21.0% 22.9% 0% 5% 10% 15% 20% 25% $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 1Q 2011PF 4Q 2011 1Q 2012 E B I T D A M a r g i n % R e v e n u e ( $ M i l l i o n s ) Revenue 8.0% Revenue 38.5% EPS 32.6% EPS 55.0% 0% 10% 20% 30% 40% 50% 60% Sequential (4Q11 to 1Q12) Yr/Yr (1Q11PF to 1Q12) G r o w t h R a t e ( % ) Note: Pro forma assumes acquisition closed on 1/1/2011. EBITDA is a non-GAAP financial measure. See reconciliation of EBITDA to Net Income in the appendix. Adj EBITDA removes transaction expenses and non-cash contingent consideration expenses (1Q’11: $0.3MM, 4Q’11: $6.3MM, 1Q’12: $1.4MM). 16

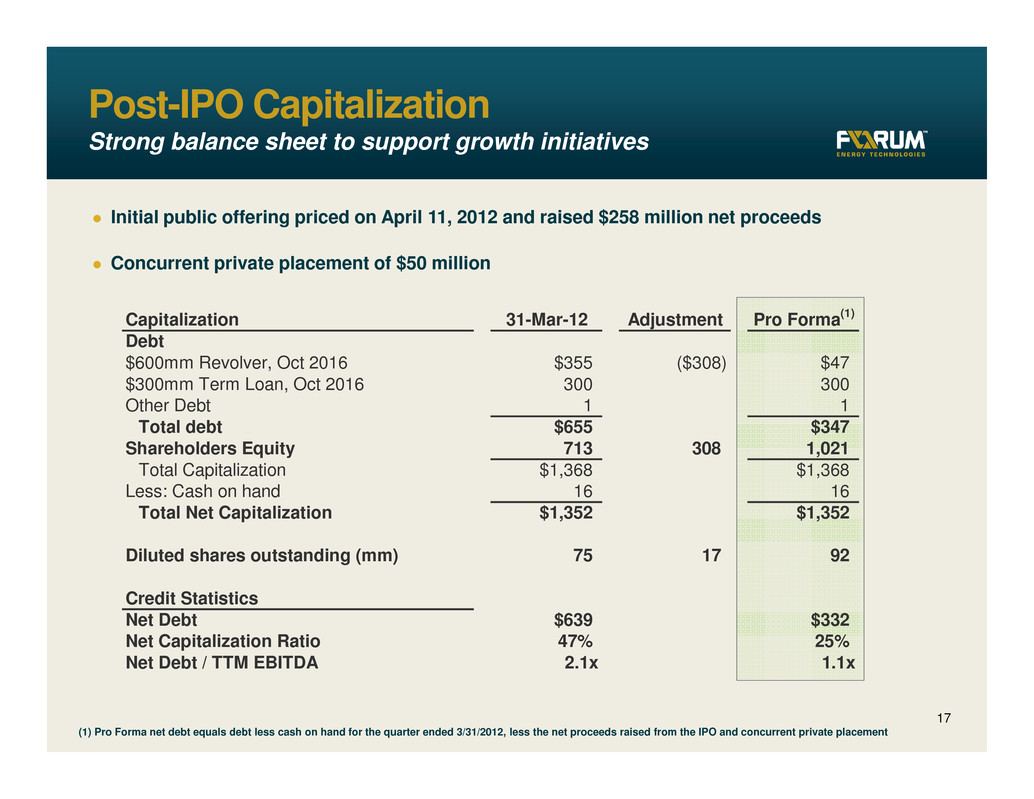

Smart Solutions. Powerful Products. Confidential Capitalization 31-Mar-12 Adjustment Pro Forma(1) Debt $600mm Revolver, Oct 2016 $355 ($308) $47 $300mm Term Loan, Oct 2016 300 300 Other Debt 1 1 Total debt $655 $347 Shareholders Equity 713 308 1,021 Total Capitalization $1,368 $1,368 Less: Cash on hand 16 16 Total Net Capitalization $1,352 $1,352 Diluted shares outstanding (mm) 75 17 92 Credit Statistics Net Debt $639 $332 Net Capitalization Ratio 47% 25% Net Debt / TTM EBITDA 2.1x 1.1x Post-IPO Capitalization Strong balance sheet to support growth initiatives 17 circle6 Initial public offering priced on April 11, 2012 and raised $258 million net proceeds circle6 Concurrent private placement of $50 million (1) Pro Forma net debt equals debt less cash on hand for the quarter ended 3/31/2012, less the net proceeds raised from the IPO and concurrent private placement

Smart Solutions. Powerful Products. Confidential Summary Large cap capabilities, small cap growth 18 circle6 Global oilfield products and equipment company circle6 Leveraged to attractive secular growth trends ‒ Deepwater ‒ Well complexity ‒ Service intensity circle6 Competing in consolidated markets circle6 High percentage of revenue from activity-based, consumable products circle6 Strong platform for growth from multiple avenues

Smart Solutions. Powerful Products. Confidential Smart Solutions. Powerful Products. Questions?

Smart Solutions. Powerful Products. Confidential Smart Solutions. Powerful Products. Appendix Rescue SubmarineVMAX™ Simulation Station

Smart Solutions. Powerful Products. ConfidentialROV Components Drilling & Subsea Division Subsea Technologies Specialty Vehicles Tether Management Systems Largest range of ROVs in industry Perry™ and Sub-Atlantic™ ROV Technology ROVDrill™ Subsea Coring Tool VMax™ Simulation Systems Global ROV Market (Douglas Westwood) Source: (1) Douglas-Westwood, “The World ROV Market Report 2011-2015” 21 0 20 40 60 80 100 120 140 160 180 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 R O V D a y s ( 0 0 0 s ) $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 R O V E x p e n d i t u r e ( $ M i l l i o n s ) RM: Re pa ir & Ma inte nanc e DS : Subse a DV Wells DS : E&A We lls CS : Trunkline Insta lla tion CS : FP SO Mooring & Risers CS : Subse a P roce ssing CS : TMFJ CS : Umbilic a ls & Flowline s CS : Subse a Tre es ROV Expenditure

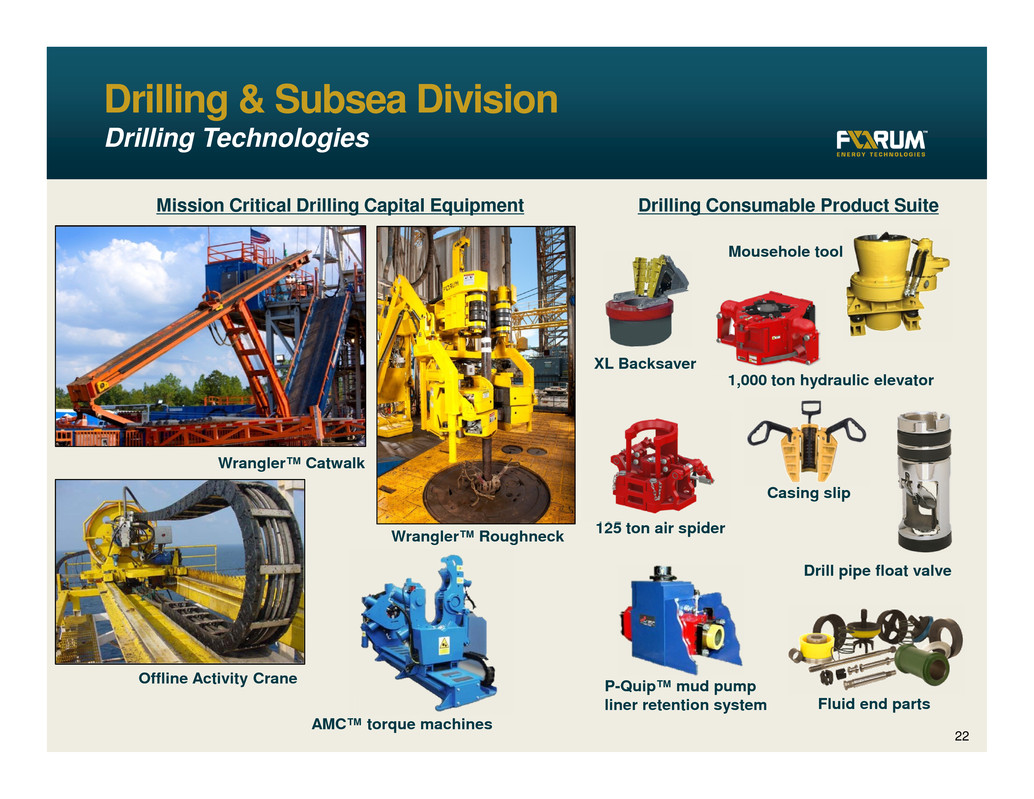

Smart Solutions. Powerful Products. Confidential Drilling & Subsea Division Drilling Technologies XL Backsaver P-Quip™ mud pump liner retention system 1,000 ton hydraulic elevator 125 ton air spider Casing slip Drilling Consumable Product Suite Drill pipe float valve Mousehole tool Wrangler™ Roughneck Wrangler™ Catwalk AMC™ torque machines Mission Critical Drilling Capital Equipment Offline Activity Crane Fluid end parts 22

Smart Solutions. Powerful Products. Confidential Davis-Lynch™ Casing & Cementing Technology Drilling & Subsea Division Downhole Technologies Cannon™ Protection Systems circle6 Customized and standard circle6 Control lines for Electric Submersible Pumps (“ESP”) and Sub-Surface Safety Valves circle6 Intelligent well completion installations circle6 Oil sands gauge protection for “SAG-D” wells Downhole Completion Tools Source: (1) Spears & Associates – 2010 “Oilfield Market Report,” casing hardware market by revenue. Trusted Name in a Consolidated Market1 Frank's Casing 3% Ray Oil Tools 3% Others 21% Weatherford 46% Halliburton 15% Davis-Lynch 12% 23

Smart Solutions. Powerful Products. Confidential 24 Production & Infrastructure Division Flow Equipment 24

Smart Solutions. Powerful Products. Confidential Production & Infrastructure Division Production Equipment 25

Smart Solutions. Powerful Products. Confidential Two piece trunnion valves for the shale markets Production & Infrastructure Division Valve Solutions Specified ball valve of choice for the US Strategic Petroleum Reserve Preferred valve supplier to leading Canadian oil sands producers 26

Smart Solutions. Powerful Products. Confidential circle6 Cris Gaut, Chairman & CEO − President (Drilling & Evaluation), CFO – Halliburton − Co-COO & CFO – ENSCO circle6 Charles Jones, President of Drilling and Subsea − President & CEO – Forum Oilfield Technologies − COO - Hydril circle6 Wendell Brooks, President of Production and Infrastructure − President & CEO – Allied Technology − Group Director Well Support – Wood Group circle6 James Harris, Chief Financial Officer − CFO – Forum Oilfield Technologies − Controller – Baker Hughes circle6 Jim McCulloch, General Counsel − General Counsel – GlobalSantaFe Senior Management Executive team has an average of 30+ yrs of industry experience 27

Smart Solutions. Powerful Products. Confidential Cris Gaut, FET Chairman & CEO ‒ President (Drilling & Evaluation) and CFO – Halliburton ‒ ENSCO Franklin Myers ‒ Chief Financial Officer, Cameron ‒ General Counsel, Baker Hughes Evelyn Angelle, Halliburton ‒ Chief Accounting Officer, Halliburton ‒ Ernst & Young Louis A. Raspino ‒ President & CEO, Pride International ‒ Sr VP & CFO, Grant Prideco David Baldwin, SCF Partners ‒ Managing Director, SCF Partners ‒ Union Pacific Drilling John Schmitz, Select Energy Services ‒ Chairman & CEO, Select Energy Services ‒ HEP Oil Company John A. Carrig ‒ President & COO, ConocoPhillips ‒ Chief Financial Officer, Conoco Phillips Terence O’Toole, Tinicum ‒ Managing Member, Tinicum Partnership ‒ Goldman, Sachs & Co. Mike McShane, Advent International ‒ President & CEO, Grant Prideco ‒ BJ Services Company Andrew L. Waite, SCF Partners ‒ Managing Director, SCF Partners ‒ Simmons & Company ‒ Royal Dutch Shell Board of Directors 28

Smart Solutions. Powerful Products. Confidential circle6 Forum’s Drilling product offering evolution ‒ Began as a drilling consumables offering ‒ Mix of capital equipment and consumables ‒ 13 acquisitions since 2005 barb2right “one face to the customer” circle6 Centralized engineering, distribution, sales circle6 Building the Wrangler™ product and brand ‒ Complete redesign to suit today’s enhanced capability needs ‒ Land & high spec jackup market barb2right enhancement & safety ‒ Dramatic margin improvement from a purpose built greenfield facility ‒ Over 600 in the field barb2right largest installed based globally circle6 New products: Wrangler Roughneck and Lightweight 1,000 Ton Spider Organic Growth Case Study Building a world class hydraulic catwalk 29 Catwalk in Monterrey, Mexico

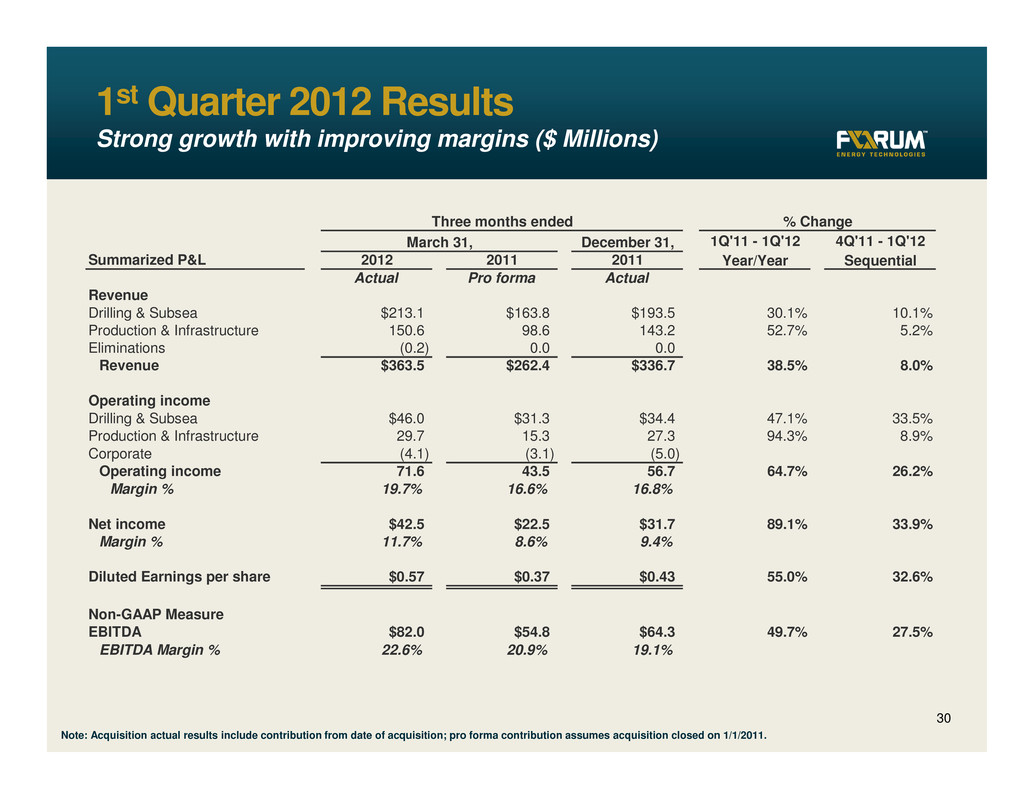

Smart Solutions. Powerful Products. Confidential 1st Quarter 2012 Results Strong growth with improving margins ($ Millions) Note: Acquisition actual results include contribution from date of acquisition; pro forma contribution assumes acquisition closed on 1/1/2011. 30 Three months ended % Change March 31, December 31, 1Q'11 - 1Q'12 4Q'11 - 1Q'12 Summarized P&L 2012 2011 2011 Year/Year Sequential Actual Pro forma Actual Revenue Drilling & Subsea $213.1 $163.8 $193.5 30.1% 10.1% Production & Infrastructure 150.6 98.6 143.2 52.7% 5.2% Eliminations (0.2) 0.0 0.0 Revenue $363.5 $262.4 $336.7 38.5% 8.0% Operating income Drilling & Subsea $46.0 $31.3 $34.4 47.1% 33.5% Production & Infrastructure 29.7 15.3 27.3 94.3% 8.9% Corporate (4.1) (3.1) (5.0) Operating income 71.6 43.5 56.7 64.7% 26.2% Margin % 19.7% 16.6% 16.8% Net income $42.5 $22.5 $31.7 89.1% 33.9% Margin % 11.7% 8.6% 9.4% Diluted Earnings per share $0.57 $0.37 $0.43 55.0% 32.6% Non-GAAP Measure EBITDA $82.0 $54.8 $64.3 49.7% 27.5% EBITDA Margin % 22.6% 20.9% 19.1%

Smart Solutions. Powerful Products. Confidential Non-GAAP Measures This presentation contains “non-GAAP financial measures” as defined in Item 10 of Regulation S-K of the Exchange Act. The non-GAAP financial measures reflect earnings before interest, taxes, depreciation and amortization expense (“EBITDA”). A reconciliation of EBITDA to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”) is included in the appendix of this presentation. The Company believes the presentation of EBITDA is useful to the Company's investors because EBITDA is an appropriate measure of evaluating the Company's operating performance and liquidity that reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company's securities and making strategic acquisitions. In addition, EBITDA is a widely used benchmark in the investment community. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the Company's financial results prepared in accordance with GAAP. 31

Smart Solutions. Powerful Products. Confidential Reconciliation of Non-GAAP Measures 32 Forum Energy Technologies, Inc. Reconciliation of GAAP to non-GAAP financial information (Unaudited) Three months ended March 31, 2012 March 31, 2011 December 31, 2011 (in thousands of dollars) Actual Actual Pro forma Actual EBITDA reconciliation Net income attributable to common stockholders $ 42,482 $ 12,369 $ 22,463 $ 31,729 Interest expense 5,786 3,240 9,233 5,809 Depreciation and amortization 11,825 7,857 11,300 12,829 Income tax expense 21,885 6,930 11,780 13,934 EBITDA $ 81,978 $ 30,396 $ 54,776 $ 64,301