Exhibit 99.1

ANNUAL INFORMATION FORM

Fiscal Year Ended February 28, 2014

May 29, 2014

TABLE OF CONTENTS

Basis of Presentation | 1 | |||

Cautionary Note Regarding Forward-Looking information | 1 | |||

Corporate Structure | 4 | |||

General Development of the Business | 6 | |||

Recent Developments | 13 | |||

Business of the Corporation | 20 | |||

Risk Factors | 42 | |||

Dividends | 58 | |||

Description of the Share Capital | 58 | |||

Market for Securities | 60 | |||

Directors and Officers | 60 | |||

Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 63 | |||

Legal Proceedings and Regulatory Actions | 64 | |||

Interest of Management and Others in Material Transactions | 64 | |||

Transfer Agents and Registrars | 64 | |||

Material Contracts | 64 | |||

Interest of Experts | 64 | |||

Report on Audit Committee | 64 | |||

Additional Information | 66 | |||

Schedule “A” Charter of the Audit Committee of the Board of Directors | A-1 |

BASIS OF PRESENTATION

As used in this annual information form, or AIF, unless the context otherwise requires, references to “Neptune”, the “Corporation”, “we”, “us”, “our” or similar terms refer to Neptune Technologies & Bioressources Inc. and its subsidiaries, references to “Acasti” refer to Acasti Pharma Inc. and references to “NeuroBio” refer to NeuroBioPharm Inc.

Market data and certain industry data and forecasts included in this AIF were obtained from internal company surveys, market research, publicly available information, reports of governmental agencies and industry publications and surveys. Neptune has relied upon industry publications as its primary sources for third-party industry data and forecasts. Industry surveys, publications and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Neptune has not independently verified any of the data from third-party sources, nor has Neptune ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which Neptune believes to be reliable based upon management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, Neptune does not know what assumptions regarding general economic growth were used in preparing the forecasts cited in this AIF. While Neptune is not aware of any misstatements regarding Neptune’s industry data presented herein, Neptune’s estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this AIF. While Neptune believes its internal business research is reliable and market definitions are appropriate, neither such research nor definitions have been verified by any independent source. This AIF may only be used for the purpose for which it has been published.

Unless otherwise noted, in this annual information form, all information is presented as of February 28, 2014. All references in this annual information form to “dollars”, “CDN$” and “$” refer to Canadian dollars, and references to “US$” refer to United States dollars, unless otherwise expressly stated.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This AIF contains certain information that may constitute forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of U.S. federal securities laws, both of which we refer to as forward-looking information. Forward-looking information can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not statements about the present or historical facts. Forward-looking information in this AIF includes, but is not limited to, information or statements about:

| • | Neptune’s ability to finalize reconstruction of its production facility, the timing and cost of completion of the reconstruction project, and the amount of production capacity for krill oil products at the new production facility; |

| • | Neptune’s ability to obtain all necessary operating permits from the Québec Ministry of Sustainable Development, Environment and the Fight Against Climate Change (the “Ministry of Environment”) and theCommission de la santé et de la sécurité du travail (the “CSST”) to start production at its new production facility; |

| • | Neptune’s ability to commission and complete the start-up and ramp-up of production at its new production facility; |

| • | Neptune’s ability to generate revenue through production at its new production facility; |

| • | Neptune’s ability to maintain and develop its existing third party supply and production agreements on terms favourable to Neptune; |

1

| • | Neptune’s ability to obtain financing, on terms favourable to Neptune to implement its operating and growth strategy; |

| • | Neptune’s ability to recover additional insurance proceeds relating to the incident at its production plant under its various insurance policies; |

| • | Neptune’s ability to regain lost customers and re-establish itself in the nutraceutical market; |

| • | Neptune’s ability to oppose or settle notices allegingnon-compliance by the Ministry of Environment and the CSST and any other proceedings brought by other parties relating to the November 2012 incident at its former operating facility; |

| • | Neptune’s ability, and the ability of its distribution partners, to continue to commercialize krill oil products, including Neptune Krill Oil (“NKO®”) and ECOKRILL Oil (“EKO™”) and to regain and maintain its market share position for krill oil products; |

| • | Neptune’s ability to continue to invest in product development and trials; |

| • | plans of Neptune’s subsidiaries, Acasti and NeuroBio, to conduct new clinical trials for product candidates, including the timing and results of these clinical trials; |

| • | Neptune’s ability to maintain and defend its intellectual property rights in NKO® and EKO™ and in its product candidates; |

| • | the ability of Neptune’s subsidiaries, Acasti and NeuroBio, to commercialize other product candidates in the United States, Canada and internationally; |

| • | the timing of the receipt of royalty payments under the terms of Neptune’s settlement agreements; |

| • | Neptune’s estimates of the size of the potential markets for NKO® and EKO™ and its product candidates and the rate and degree of market acceptance of EKO™ and NKO® and its product candidates; |

| • | Neptune’s abitlity to use the net proceeds from its latest public offering for the purposes identified in Neptune’s propsectus supplement dated February 28, 2014; |

| • | the health benefits of NKO® and EKO™ and Neptune’s product candidates as compared to other products in the nutraceutical and pharmaceutical markets; |

| • | Neptune’s expectations regarding its financial performance, including its revenues, expenses, gross margins, liquidity, capital resources and capital expenditures; and |

| • | Neptune’s expectations regarding its significant impairment losses and future write-downs, charge-offs or impairment losses. |

Although the forward-looking information is based upon what we believe are reasonable assumptions, no person should place undue reliance on such information since actual results may vary materially from the forward-looking information. Certain key assumptions made in providing the forward-looking information include the following:

| • | Neptune will obtain all required operating permits to resume operations at the new production facility by approximately early June 2014; |

| • | the start-up and ramp-up period and performance of the new production facility will be consistent with management’s expectations; |

| • | sales objectives for its krill oil products assume that Neptune will be able to maintain customer relationships and that demand for its products will continue; |

2

| • | customer demand for Neptune’s products, particularly NKO®, will be consistent with or stronger than pre-November 2012 levels; |

| • | Neptune’s business plan to focus on the production of its lead products, NKO® and EKO™, will not be substantially modified; |

| • | capital derived from future financings will be available to Neptune on terms that are favourable; |

| • | Neptune will be able to protect its intellectual property; and |

| • | Neptune will be able to continue to meet the continued listing requirements of the NASDAQ Stock Market and the Toronto Stock Exchange. |

In addition, the forward-looking information is subject to a number of known and unknown risks, uncertainties and other factors, including those described in this AIF under the heading “Risk Factors”, many of which are beyond our control, that could cause actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking information, including, without limitation:

| • | the heavy dependence of the Corporation’s future prospects on the timely and successful reconstruction of its production plant; |

| • | the need for the Corporation to obtain all required operating permits to resume its production; |

| • | the Corporation’s need for additional funding; |

| • | the Corporation’s potential inability to recover all of the insurance proceeds it has claimed; |

| • | possibility that new claims or lawsuits relating to the plant explosion may be brought against the Corporation; |

| • | the Corporation’s potential inability to restore or grow its customer base; |

| • | the Corporation’s reliance on a limited number of distributors and significant concentration of accounts receivables; |

| • | the fact that the Corporation has suffered significant impairment losses and its assets may be subject to future write-downs, charge-offs or impairment losses; |

| • | the Corporation may lose its control of Acasti; |

| • | the Corporation’s history of net losses and inability to achieve profitability to date; |

| • | NKO® and EKO™ may not be successfully commercialized; |

| • | changes in regulatory requirements and interpretations of regulatory requirements; |

| • | the Corporation’s reliance on third parties for the manufacture, supply and distribution of its products and for the supply of raw materials; |

| • | the Corporation’s ability to manage its growth efficiently; |

| • | the Corporation’s ability to further penetrate core or new markets; |

| • | the Corporation’s ability to attract and retain skilled labor; |

| • | the Corporation’s ability to attract, hire and retain key management and personnel; |

3

| • | the success of current and future clinical trials by the Corporation and its subsidiaries; |

| • | the Corporation’s ability to achieve its publicly announced milestones on time or at all; |

| • | product liability lawsuits could be brought against the Corporation and its subsidiaries; |

| • | intense competition from other companies in the pharmaceutical and nutraceutical industry; |

| • | the Corporation’s ability to secure and defend its intellectual property rights; and |

| • | the fact that the Corporation does not currently intend to pay any cash dividends on the Common Shares in the foreseeable future. |

Consequently, all the forward-looking information is qualified by this cautionary statement and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operations. Accordingly, you should not place undue reliance on the forward-looking information. Except as required by applicable law, Neptune does not undertake to update or amend any forward-looking information, whether as a result of new information, future events or otherwise. All forward-looking information is made as of the date of this AIF.

CORPORATE STRUCTURE

Corporation Overview

Neptune was incorporated on October 9, 1998 pursuant to a certificate of incorporation issued under Part 1A of theCompanies Act(Québec). On February 14, 2011, theBusiness Corporations Act(Québec) came into effect and replaced theCompanies Act(Québec). Neptune is now governed by theBusiness Corporations Act(Québec). On May 30, 2000, the articles of the Corporation were amended in order to proceed with the restructuring of the Corporation’s capital stock and to convert its then issued and outstanding shares into newly-created classes of shares. The Corporation’s articles were also amended on May 31, 2000 to create Series A Preferred Shares. On August 29, 2000, the Corporation converted all its issued and outstanding Class A shares into Class B subordinate shares. On September 25, 2000, the Corporation further amended its share capital to eliminate its Class A shares and converted its Class B subordinate shares into common shares. On May 11, 2001, the Corporation amended its articles of incorporation to repeal the restrictions with respect to closed companies. On November 1, 2013, the Corporation amended its articles of incorporation to reflect certain changes to items relating to board matters.

Neptune’s head office and registered office is located at 545, Promenade du Centropolis, Suite 100, Laval, Québec, Canada, H7T 0A3. The Corporation’s website address iswww.neptunebiotech.com. The Corporation is also the owner of the websiteswww.mynko.com andwww.neptunekrilloil.com.

Intercorporate Relationships

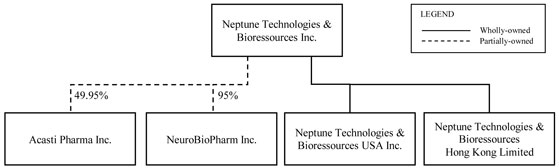

Neptune has two wholly-owned subsidiaries, Neptune Technologies & Bioressources USA Inc., or Neptune USA, and Neptune Technologies & Bioressources Hong Kong Limited, or Neptune Hong Kong, and two subsidiaries, Acasti and NeuroBio. As of the date of this AIF, Neptune owns 49.07% of the voting rights attached to the securities of Acasti and 95% of the voting rights attached to the securities of NeuroBio. See “Corporate Structure—Corporate Structure Diagram”.

Acasti was incorporated on February 1, 2002 pursuant to a certificate of incorporation issued under Part 1A of theCompanies Act(Québec) under the name 9113-0310 Québec Inc. and, prior to its partial spin-off in 2008, was a wholly-owned subsidiary of Neptune. The common shares of Acasti are listed and posted for trading on the TSX Venture Exchange, or TSXV, under the symbol “APO” and on the NASDAQ Stock Market, or NASDAQ, under the symbol “ACST”. Acasti is a company involved in the pharmaceutical industry.

4

NeuroBio was incorporated on October 15, 2008 pursuant to a certificate of incorporation issued under Part 1A of theCompanies Act(Québec) under the name Neurovimer Pharma Inc. NeuroBio is also a company involved in the pharmaceutical industry.

Neptune USA was incorporated on June 1, 2006 under the laws of the State of Delaware and Neptune Hong Kong was incorporated on May 3, 2012 under the laws of Hong Kong. Neptune USA and Neptune Hong Kong do not carry on an active business at this time.

Corporate Structure Diagram

As of the date of this AIF, Neptune owns 51,942,183 Class A shares of Acasti, which are common shares, representing 49.07% of Class A shares issued and outstanding and 49.07% of the voting rights attached to the securities of Acasti. Acasti Class A shares (common shares) are voting, participating and with no par value. Neptune also owns 592,500 common share purchase warrants of Acasti. See “General Development of the Business—Fiscal Year Ended February 28, 2014”.

As of the date of this AIF, Neptune holds 95% of the voting rights attached to the securities of NeuroBio through the holding of 6,500,990 Class A subordinate voting shares of NeuroBio, representing approximately 76% of the Class A subordinate voting shares issued and outstanding, 2,475,000 Class B multiple voting shares of NeuroBio, representing 99% of Class B multiple voting shares issued and outstanding, 17,325,000 Class G non-voting shares of NeuroBio, representing 99% of Class G non-voting shares issued and outstanding, and 25,740,000 Class H subordinate voting shares of NeuroBio, representing 99% of Class H subordinate voting shares issued and outstanding. As of the date of this AIF, Neptune also holds warrants of NeuroBio, namely 1,940,000 Series 2011-1 warrants, 1,885,574 Series 2011-2 warrants and 46,246 Series 2011-3 warrants to purchase 3,871,820 Class A subordinate voting shares of NeuroBio. On October 31, 2012, 2,000,000 Class A subordinate voting shares and 4,000,000 Series 2011-1 warrants of NeuroBio held by Neptune were distributed to Neptune’s shareholders by way of a dividend-in-kind. See “General Development of the Business—Fiscal Year Ended February 28, 2013”.

Reorganization of the Share Capital of NeuroBio

On April 12, 2011, NeuroBio proceeded with the following transactions affecting its capital structure: (i) NeuroBio consolidated all classes of its capital stock on a 2:1 basis; (ii) NeuroBio exchanged the resulting 50 Class A shares for 1,000 new Class A subordinate voting shares, 26,000,000 Class H subordinate voting shares redeemable for $0.45 per share and 6,000,000 Series 2011-1 warrants; (iii) NeuroBio exchanged the resulting 17,500,000 Class C non-voting shares, 3,500,000 Series 4 warrants and 1,500,000 Series 5 warrants for 17,500,000 Class G non-voting shares redeemable for $0.20 per share, 3,450,075 Series 2011-2 warrants and 8,050,175 Series 2011-3 warrants; and (iv) NeuroBio converted its accounts payable to Neptune in the amount of approximately $850,000 into 8,500,000 Class A subordinate voting shares.

The purpose of the transaction was to establish and freeze the estimated fair value of NeuroBio for its shareholder. Following the transaction, the valuation of the Class A subordinate voting shares was determined by the last transaction of NeuroBio; which is the conversion of its account payable to Neptune into 8,500,000 Class A subordinate voting shares, at $0.10 per share.

5

On March 18, 2014, NeuroBrio extended the time of expiry of its Series 2011-1 warrants from April 12, 2014 to April 12, 2015, barring the earlier listing of Class A shares on a recognized stock exchange.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

Fiscal Year Ended February 29, 2012

During the fiscal year ended February 29, 2012, Neptune continued its investor relations efforts to increase Neptune’s visibility toward the investment community in Canada and the United States, with the objective of reaching higher trading volumes. Neptune presented at the 23rd annual Roth OC Growth Stock Conference in California. Over 400 companies selected by Roth Capital Partners were presenting at the conference and over 1,000 buy-side investors attended the conference. On the research and development front, Neptune presented at the 2011 Scientific Sessions of the American Heart Association its clinical results on the absorption of NKO® compared to competitive products. Neptune sustained its research initiatives by investing in product development, preclinical and clinical studies to validate the health benefits of its products.

On May 3, 2011, Neptune completed a non-brokered private placement of $12,438,000 through the offering of common shares at a price of $2.15 (US$2.25) plus 25% warrant coverage at $2.65 (US$2.75). In total, Neptune issued 5,787,057 common shares and 1,446,265 warrants. Following the end of the first quarter, officers and directors of Neptune exercised 550,000 options a strike price of $2.60, representing an amount of $1,430,000 in aggregate cash proceeds.

Also in May 2011, Neptune announced that it and its marine derived products successfully completed an extensive review of key environmental claims by NSF International. See “Business of the Corporation—Supply of Krill”.

In the second quarter, Neptune appointed Raj Nakra Associates as an agent for the Indian market. Neptune also finalized agreements with two major U.S. distributors to sell NKO® through their well-established network of U.S. national retailers and wholesalers.

On November 28, 2011, Neptune’s common shares started trading on the TSX following Neptune’s migration from the TSXV. In December 2011, Neptune announced the first phase of the currently underway expansion project of its Sherbrooke plant. See “Business of theCorporation - Manufacturing and Facilities”.

In September 2011, Neptune announced the conclusion of a memorandum of understanding, or MOU, with Shanghain KaiChuang Deep Sea Fisheries Co., Ltd., or SKFC, to form a 50/50 joint venture named Neptune-SKFC Biotechnology, to manufacture and commercialize Neptune’s krill products in Asia. The MOU is still subject to further negotiations and to approval by the boards of each party as well as by Chinese regulators. There has been no significant developtment since the conclusion of the MOU in September 2011 and there are no guaratees that the joint venture ever materialized.

On October 4, 2011, the Corporation filed Complaints against Aker Biomarine ASA, Aker Biomarine Antarctic USA Inc. and Schiff Nutrition International Inc. (collectively “Aker”) and against Enzymotec Limited, Enzymotec USA Inc., Mercola.com Health Resources, LLC and Azantis Inc (collectively “Enzymotec”). Both Complaints were for the infringement of the Corporation’s US patent 8,030,348 and for damages. See “Business of theCorporation - Economic Dependence/Litigation”.

On December 21, 2011, the Corporation received a motion filed by the University of Sherbrooke, asking the Court to order the transfer of certain intellectual property to Neptune. See “Business of the Corporation—Economic Dependence/Litigation”.

6

Fiscal Year Ended February 28, 2013

Prior to the incident that destroyed Neptune’s production plant located in Sherbrooke, Québec on November 8, 2012, the Corporation continued to expand its customer base worldwide and revenue growth was driven by repeat demand from existing customers and incoming demand from new customers from North America, Europe and Australia.

In the first quarter, from March 11 to 14, 2012, Neptune attended the 24th annual Roth OC Growth Stock Conference in California. Neptune also took that opportunity to make a presentation at The Ritz Carlton in Laguna Niguel, California on March 12, 2012 in front of a large number of buy-side investors.

The Corporation presented novel innovative product opportunities customized for dietary supplements, functional and medical foods and introduced a new pipeline of novel formulations containing its proprietary marine omega-3 phospholipids enhanced with validated bioactive ingredients targeted to specific health applications to its clientele in Engredea/Natural Products Expo West in Anaheim on March 9th-11th, 2012 and in Vitafoods Europe in Geneva on May 22nd-24th, 2012.

Also on March 27, 2012, Neptune entered into a multi-year partnership with former NFL (National Football League) Super Bowl Champion and Hall-of Fame quarterback, John Elway. John Elway retired in 1999 and statistically was the second most prolific passer in NFL history. He is currently Executive Vice President of Football Operations for the Denver Broncos in addition to being part owner of four successful Elway’s Restaurants and the same number of automobile dealerships bearing his name. The compensation package is a combination of cash payment as well as stock options over the contractual period.

On May 10, 2012, Mr. Elway along with Neptune’s team, attended the SupplySide MarketPlace Trade show at the Javits Center in New York City. Mr. Elway took this opportunity to meet with investors and partners and also stopped at Neptune’s booth to meet with participants at the show. This was the first of many public appearances of John Elway as Neptune’s ambassador.

On April 11, 2012, Neptune’s Board of Directors, as part of its annual review of direct and indirect remunerations, confirmed the grants of a total of 1,580,000 incentive stock options of Neptune and 730,000 rights on NeuroBio warrants held by Neptune to employees, executive officers and directors. Neptune incentive stock options have an exercise price of $3.15 and a 3 year maturity. Rights on NeuroBio warrants have an aggregate exercise price $0.75 and maturities of April 12, 2016, and were subject to shareholder approval, which was obtained on June 21, 2012. Insiders have been granted a total of 800,000 Neptune incentive stock options, and 435,000 rights on NeuroBio warrants.

On April 26, 2012, the Corporation granted one three-year warrant to purchase 1,000,002 common shares to a consultant under a financial consulting agreement. The warrants will be exercisable at a price of US$5.00 per share until June 15, 2015. The warrant shall be subject to vesting in six equal instalments of 166,667 warrant shares, the first vesting being on the date of issuance and the remaining vesting being respectively on the last day of each quarter. The financial consulting agreement came to term on April 26, 2013.

On May 22, 2012, Neptune filed for Reexamination the Aker Biomarine’s granted Australian patent (AU2008231570). Neptune also communicated its conclusion that Aker’s patent had no impact on its position as the leading krill oil provider to the Australian market. Neptune also reaffirmed that it firmly believes that Aker’s patent is invalid. Specifically, there are clear disclosures in prior printed publications and patents, some of which predate Aker’s application by almost twenty years, which teach exactly what Aker claims to have invented. Furthermore, and tellingly, it is noted that both the United States and European Patent Offices have rejected these claims, or narrower versions thereof, for lack of novelty and obviousness. Accordingly, in light of the prior printed publications and patents put forth in this Reexamination Request, Neptune believes the Australian Patent Office (the “APO”) will reconsider its grant of Aker’s patent and declare the recently-issued claims to be unpatentable.

Also on May 22, 2012, following an audit by an auditor recognized by Friend of the Sea, or FOS, Neptune became the first krill oil manufacturer entitled to use the “Friend of the Sea” environmental certification. See “Business of the Corporation—Supply of Krill”.

7

On May 23, 2012, Neptune announced that Dr. Harlan Waksal, Executive Vice-President, Business & Scientific Affairs of Acasti, was appointed to the Corporation’s Board of Director. Dr. Harlan Waksal is a retired physician, founder of Imclone System Inc. in which he has been involved as the President, Chief Executive Officer, Chief Operating Officer and Executive Vice-President from 1987 to 2003. Imclone System has developed and obtained approval for a new targeted biologic cancer therapy known as Erbitux and was later acquired by Eli Lily for $6.5 billion US in October 2008. Dr. Harlan Waksal currently sits on the Board of Directors of Oberlin College and Senesco Technologies, is the author of over 50 scientific publications and has been the author of multiple patents and patents applications.

On June 7, 2012, the Corporation announced that the U.S. Patent & Trademark Office, or USPTO, allowed one of its continuation patent applications, number 13/189,714, which claims the benefit of Neptune’s U.S. Patent No. 8,030,348. This continuation application contains claims to further embodiments of the inventions that were disclosed in the ‘348 Patent; specifically to krill extracts comprising a phospholipid suitable for human consumption. These claims cover a number of krill oil products presently sold in the U.S. market. The continuation application, which was filed less than a year ago, was allowed by the USPTO after a thorough examination. During prosecution, Neptune provided the USPTO with a substantial volume of prior art references and other materials, including the papers from re-examination requests filed by Aker Biomarine ASA directed to the ‘348 Patent and a related Neptune patent, and the oppositions being undertaken on related Neptune patents in Europe and Australia.

On August 28, 2012, the Corporation and its subsidiary Acasti announced the extension of the relationship with The Howard Group as the companies’ investor relations consultant. Since 1988, The Howard Group has provided comprehensive investor and financial relations, business development solutions and in-depth strategic planning to public companies. The Howard Group is associated with the Insight Limited Partnership II, which invests in micro and small cap companies. Traditional and new online initiatives will be directed at the investment community and investing public on behalf of Neptune and Acasti to increase the following and participation of the market in those two corporations. The term of the IR Agreement is for a period of 12 months. In addition to a fee of $6,000 per month, The Howard Group has been granted options to purchase an aggregate total of 50,000 common shares of Neptune at a price of $5.00 per share and 50,000 common shares of Acasti a price of $2.50. The options will vest in equal amounts over an 18 months term.

On September 7, 2012, Neptune announced that its board of directors had approved the distribution of 2,000,000 units of NeuroBio owned by Neptune pro rata to the holders of record of common shares of Neptune as at October 15, 2012 by way of a dividend-in-kind. The dividend was distributed on October 31, 2012 and each shareholder on the dividend record date received one unit for each lot of approximately 29.27 common shares of Neptune held. Each unit consisted of one class A subordinate voting share of NeuroBio and two series 2011-1 warrants and the estimated fair market value of the unit was approximately $0.10 per unit. Each full warrant entitles its holder to purchase one class A subordinate voting share of NeuroBio at a price of $0.40 plus a transfer premium of $0.35 payable to Neptune upon exercise with each warrant expiring on the occurrence of the earliest of the two following events: (i) fifteen days after the listing of the class A subordinate voting shares on a recognized stock exchange; or (ii) April 12, 2014. The terms applicable to the distribution of the dividend were described in the final prospectus filed by NeuroBio on September 5, 2012 with the securities commissions and other similar regulatory authorities in each of the provinces and territories of Canada. After the distribution of the dividend-in-kind, Neptune’s ownership interest in NeuroBio class A shares was reduced to 76% from 99%. At such time, Neptune still owned 96% of all voting rights in NeuroBio.

On October 2, 2012, Neptune announced that the U.S. Patent & Trademark Office granted its new patent, US 8,278,351. The continuation patent claims the benefit of another of Neptune’s U.S. Patents, No. 8,030,348, (the “348 Patent”) and contains claims to krill extracts comprising a phospholipid suitable for human consumption. These new claims cover all of Neptune’s products, including the NKO® brand, and a number of krill oil products currently sold in the U.S. market. This new issued patent was granted after a thorough examination by the USPTO, including consideration of the papers from the re-examination requests filed by Aker Biomarine ASA regarding Neptune patents related to the ‘351 patent. The continuation patent, filed about a year ago, was allowed by the USPTO after a thorough examination which included a review of a substantial volume of prior art references and other materials, including the papers from the re-examination requests filed by Aker Biomarine ASA directed to the Patent and a related Neptune patent in the U.S., as well as the oppositions being undertaken on related Neptune patents in Europe and Australia.

8

The same day, Neptune announced that it had filed a second patent infringement lawsuit in the United States District Court for the District of Delaware alleging infringement of its recently issued continuation patent against Aker. Neptune has also filed a separate infringement action against Enzymotec. In addition to seeking monetary damages for all of the above defendants infringement of the ’351 Patent, Neptune is also requesting injunctive relief to prevent the Defendants from continuing to infringe Neptune’s patent. Should Neptune prevail in securing the requested injunctions, it would prevent the Defendants from manufacturing, using, offering for sale, selling and/or importing into the United States infringing krill oils.

Also on October 2, 2012, Neptune announced the closing of its Public Offering of US$34.1 million of common shares pursuant to which Neptune issued 7,318,000 common shares at US$4.10 per share. Prior to the closing, the underwriters exercised their over-allotment option to purchase an additional 989,762 common shares, resulting in a total of 8,307,762 common shares being issued on the day of the closing for gross proceeds of approximately US$34.1 million. The common shares were issued in the United States pursuant to Neptune’s effective shelf registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”) and in Canada pursuant to a final short form base shelf prospectus filed with the securities regulatory authorities in the Provinces of Québec, Ontario, Manitoba, Alberta and British Columbia.

On November 6, 2012, Neptune hosted its 1st Annual Charity Poker Game at the Venetian Hotel in Las Vegas, prior to the SupplySide West Tradeshow. The game featured guest of honor John Elway, former Denver Broncos quarterback and Hall of Famer. Proceeds for the event were for the benefit of Vitamin Angels, a non-profit organization dedicated to reducing child mortality worldwide by connecting children in need with micronutrients.

In the afternoon of November 8, 2012, an explosion and fire destroyed Neptune’s production plant located in Sherbrooke, Québec, Canada.

On December 4, 2012, Neptune announced that it had entered into a prepayment agreement with Acasti pursuant to which Acasti exercised its option under its exclusive technology license agreement dated August 7, 2008 entered into with Neptune to pay in advance all of the future royalties payable to Neptune under the license agreement. The prepayment had the effect of increasing Neptune’s equity participation in Acasti (from approximately 57% to approximately 61%), after Neptune obtained the required approvals, by the issuance of 6,750,000 Class A shares in the share capital of Acasti, issued at a price of $2.30 per share, upon the exercise of a warrant delivered to Neptune at the signature of the prepayment agreement. This reflected a prepayment value, determined with the assistance of outside valuation specialists, using the pre-established prepayment formula set forth in the license agreement, that amounts to approximately $15.5 million. The prepayment and the issuance of the shares to Neptune received the approval of the TSXV and of the disinterested shareholders of Acasti (excluding Neptune and non-arm’s length parties to Neptune) at the June 27, 2013 annual meeting of shareholders of Acasti. Acasti is no longer required to pay any royalties to Neptune under the License Agreement during its term for the use of Neptune’s intellectual property under license.

In January 2013, the Board of Directors approved an equity incentive plan for employees, directors and consultants subject to the approval of the Toronto Stock Exchange and the shareholders of the Corporation at their next annual meeting. The plan provides for the issuance of restricted share units, performance share units, restricted shares, deferred share units or other share-based awards, under restricted conditions as may be determined by the Board of Directors. Upon fulfillment of the restricted conditions, as the case may be, the plan provides for settlement of the award through shares. At February 28, 2013, no instruments were issued by the Corporation under this plan.

On January 18, 2013 Neptune received a first interim insurance payment of $6 million further to the explosion that destroyed Neptune’s production plant. Neptune has insurance coverage in place covering among other things property damage, business interruption and general liability up to specified amounts and subject to limited deductibles and certain exclusions. Neptune is pursuing the balance of its insurance claim and will record any additional recovery if and when received.

On January 24, 2013, Neptune announced that the USPTO had allowed a second continuation patent application, application number 13/545,830, which claims the benefit of Neptune 348 Patent and 351 Patent. This second continuation application contains only a single claim, which is directed to a capsule comprising an Antarctic krill oil extract comprising a phospholipid suitable for human consumption. This claim covers most, if not all, krill oil products presently sold in the U.S. market. This second continuation application was allowed by the USPTO

9

after a thorough examination. During prosecution, Neptune provided the USPTO with all prior art references and other materials, including all the documents referred to in all of the re-examination requests filed by Aker Biomarine ASA directed to the ‘348 and ‘351 Patents, as well as all the documents relating to the oppositions currently underway on related Neptune patents in Australia.

On January 24, 2013, Neptune also announced that, effective January 23, 2013, Henri Harland, President and Chief Executive Officer of Neptune, would assume for an interim period of time, during the implementation of Neptune’s Plan, the functions and responsibilities held previously by Michel Chartrand, as Chief Operating Officer, who would continue to hold office as member of the Board of Director. Neptune also confirmed that its directors, senior management and employees had accepted salary reductions of 20% for an interim period during the implementation of Neptune’s plan to resume production.

On January 30, 2013, Neptune announced that it had filed a complaint under Section 337 of the US Tariff Act of 1930 with the United States International Trade Commission (the “ITC”), alleging that Aker; Enzymotec; and Olympic Seafood AS, Olympic Biotec Ltd., Rimfrost USA, LLC, Bioriginal Food & Science Corp. and Avoca, Inc., a division of Pharmachem Laboratories Inc. (collectively “Rimfrost”) are engaging in unfair trade practices by, at least, the importation, sale for importation, and sale after importation of certain krill-based products, namely krill paste and krill oils, that directly or indirectly infringe one or more claims of Neptune’s 351 Patent. On April 15, 2013, the ITC voted to institute an investigation of alleged patent infringements by Aker; Enzymotec and Rimfrost.

On February 26, 2013, Neptune announced that the USPTO had granted to Neptune a new continuation patent (the 675 Patent). This new patent claims the benefit of Neptune 348 Patent and 351 Patent. The 675 Patent contains a single claim directed to a capsule comprising an Antarctic krill oil extract comprising a phospholipid suitable for human consumption. This claim covers most, if not all, krill oil products presently sold in the U.S. market, as well as the pharmaceutical concentrates of Neptune’s subsidiaries Acasti and NeuroBio. Following this decision, Neptune filed an amended complaint in the ITC to add allegations of infringement of the 675 Patent against all of the proposed respondents, including Aker, Enzymotec and Rimfrost. Accordingly, Neptune had requested and was granted by the ITC a postponement of the deadline by which the ITC will decide whether to institute an investigation.

Fiscal Year Ended February 28, 2014

On March 14, 2013, Neptune announced that Dr. Harlan Waksal, member of the Board and executive VP, Business and Scientific Operations at Neptune’s subsidiary Acasti, would be presenting at the 25th Annual ROTH Conference on March 19, 2013.

On April 10, 2013, Neptune announced that the dismissal of Neptune’s appeal related to its European patent EP 1417211, by the European Patent Office’s (the “EPO”) Technical Appeal Board had no impact on its international patent strategy. The EPO’s Technical Appeal Board was solely concerned with the issue of flavanoids in krill extracts and did not address phospholipid compositions, which form a large part of Neptune’s extensive international patent portfolio. The decision of the EPO’s Technical Appeal Board did not affect ongoing disputes, including the filing with the ITC as the patent in question concerned flavonoids rather than phospholipids. The impact of the decision was also limited by the fact that Europe is the only jurisdiction where Neptune’s patent portfolio includes flavonoids.

On April 15, 2013. Neptune’s subsidiary, Acasti, announced that the ITC had decided to institute an investigation of alleged patent infringements by Aker, Enzymotec and Rimfrost. The investigation was instituted on the basis of the complaint filed with the ITC earlier in 2013 alleging violations by the respondents regarding the importation and sale of certain omega-3 extracts in the United States. Neptune and Acasti requested that the ITC issue an exclusion order and cease and desist order to ban the importation and sale of infringing extracts and products.

On May 15, 2013, Neptune announced that the Class Action Lawsuit alleging violations of the Securities Act of 1934 brought by Robbins Geller Rudman & Dowd LLP was voluntarily dismissed by the plaintiffs without prejudice. See “Business of the Corporation—Economic Dependence/Litigation—Class Action Suit”.

10

On May 22, 2013, Neptune announced initiatives to ensure effective management through a difficult period and remained focussed on three key priorities for restoring and ramping up its long-term supply chain. These priorities included rebuilding its production facility, establishing third party manufacturing partnerships and securing the supply of raw materials. The necessary permits to commence the reconstruction of the plant were received and Neptune announced that it was going to make use of the adjacent expansion facility to reconstruct an operational plant. In conjunction with the reconstruction of the production facility, Neptune began taking steps to secure and increase its long-term supply chain through third party manufacturing agreements in order to safeguard future operations. Three confirmed options for suppliers had been identified by Neptune at this point and Neptune continued to explore partnerships to allow it to provide supply to customers in the interim.

On May 27, 2013, reconstruction of Neptune’s production facility began and Neptune announced that it had hired an engineering firm, an architect and a plant manager.

On July 12, 2013, Neptune announced that it had acquired, through the exercise of a previously issued warrant, 6,750,000 Class A common shares in the capital of Acasti. The shares were acquired at a price of CDN$2.30 per share which reflected a total exercise price of CDN$15.5 million. The warrant was delivered to Neptune pursuant to a royalty prepayment agreement between Neptune and Acasti dated December 4, 2012 under which Acasti had been granted the option to pay in advance all of the future royalties payable under its exclusive technology license. As a result of Acasti exercising this option, it was relieved of its obligation to pay royalties to Neptune under the license agreement in question. The exercise of the warrant meant an increase in Neptune’s equity participation in Acasti from approximately 57% to approximately 60%. Both the prepayment agreement and the issuance of shares to Neptune were approved by the TSX Venture Exchange and the disinterested shareholders of Acasti at the annual shareholders meeting of Acasti held on June 27, 2013.

On July 16, 2013, Neptune announced that the Canadian Intellectual Property Office granted Neptune a composition patent, number CA 2,493,888, covering omega-3 phospholipids comprising polyunsaturated fatty acids.(“PUFAs”) The patent was granted for the Canadian market and will remain valid until 2022. This patent covers novel omega-3 phospholipid compositions which are suitable for human consumption, both synthetic and natural. The patent protects Neptune’s krill oil, namely NKO®, and also covers oils and powders extracted from krill and any marine or aquatic biomass containing marine phospholipids bonded to EPA or DHA.

On August 26, 2013, Neptune announced that it received an additional $5 million in insurance recoveries related to the November 2012 incident which destroyed the production facility bringing the total insurance recoveries to approximately $12 million. This additional sum further solidified Neptune’s ability to continue to implement its action plan to resume operations.

On September 2, 2013, Neptune announced that it had reached a settlement with respondents Rimfrost, resolving the ITC investigation related to infringement of Neptune’s composition of matter patents. As part of the settlement, Neptune granted a world-wide, non-exclusive, royalty-bearing licence to these settling respondents, allowing them to market and sell nutraceutical products containing components extracted from krill. The respondents in question also agreed to pay Neptune an additional royalty amount for the manufacture and sale of krill products prior to the effective license commencement date. Neptune also agreed to dismiss a related patent infringement case against Rimfrost filed in March of 2013. Moreover, on October 2, 2013, Neptune signed a strategic non-exclusive krill oil manufacturing and supply agreement with Rimfrost giving Neptune the right to purchase, at a preferred price, up to 800,000 kg of commodity grade krill oil during the first three-year term of the renewable agreement. Under the agreement, Neptune has agreed to purchase certain minimum quantities of commodity grade krill oil from Rimfrost in 2013 and 2014, which purchases may be deferred to the following calendar years.

On November 4, 2013, Neptune finalized a secured financing of $12.5 million with IQ, a government sponsored corporation whose mission is to contribute to Québec’s economic development in accordance with the Government of Québec’s economic policy, to partially fund the reconstruction of its production facility (which includes a security interest over all assets, including the Corporation’s intellectual property). The IQ secured loan has an annual interest rate of 7.0% and a two-year grace period for the start of principal repayment from the first disbursement date, following which the loan will be payable in equal monthly instalments over a four year period. The loan is repayable at any time without penalty. IQ disbursed the loan to reimburse Neptune’s reconstruction expenses. To date, Neptune has received approximately $8.5 million from IQ and expects to receive an additional $4.0 million which will be used to pay expenses incurred in connection with the reconstruction of the new production facility.

11

As part of the IQ loan, Neptune issued to IQ 750,000 common share purchase warrants at an exercise price of $3.37 per warrant. The number of warrants will vest on a prorata basis according to the amount disbursed by IQ on each disbursement date. At February 28, 2014, 511,995 warrants had vested.

On November 5, 2013, Neptune announced the appointment Reed V. Tuckson, M.D, the Managing Director of Tuckson Health Connections LLC, to its Board of Directors which increased the number of independent members to 4 out of a total of 6 board members.

On November 8, 2013, Neptune announced its intention to oppose a statement of offense issued by the CSST, the province of Québec’s commission charged with overseeing health and safety in the workplace. The CSST issued a statement seeking payment of approximately $64,500 before the completion of its investigation into the cause the explosion at Neptune’s production facility. Neptune maintained that it had adhered to best practices and procedures regarding workplace safety at all times and offered its continued cooperation with the CSST as their investigation continued. On November 12, 2013, Neptune entered a not guilty plea with respect to the statement of offense from the CSST.

On November 12, 2013, Neptune announced the inter partes request made by Aker BioMarine AS for the review of one of Neptune’s patents by the USPTO. The patent in question, US Patent No. 8,383,675, was one of the two patents being defended by Neptune against Aker and Enzymotec before the ITC. Despite this request for review, Neptune continued to focus on preparing to try its case before the ITC.

On November 13, 2013, Neptune hosted its Second Annual Charity Poker Game at the Venetian Hotel in Las Vegas, prior to the SupplySide West Tradeshow. The game featured guest of honor John Elway, former Denver Broncos quarterback and Hall of Famer. Proceeds of the event benefitted Vitamin Angels, a non-profit organization dedicated to reducing child mortality worldwide by connecting children in need with micronutrients.

On November 28, 2013, Neptune signed a legally binding term sheet with Aker with a view of finalizing the dismissal of all Aker respondents from the ITC investigation brought by Neptune and Acasti, as well as the dismissal of all lawsuits brought by Neptune against Aker and companies in its value chain.

On December 3, 2013, Neptune announced that it had acquired for investment purposes securities of Acasti in connection with the closing of Acasti’s public offering. Neptune acquired 592,500 units at a price of US$1.25 per unit for total consideration of US$740,625. Each unit consists of one class A common share and one common share purchase warrant of Acasti. Each warrant entitles its holder to purchase one class A common share at an exercise price of US$1.50 per share, subject to adjustment at any time until December 3, 2018. Following the closing, Neptune was the beneficial owner and controlled 51,942,183 class A common shares and 592,500 common share purchase warrants of Acasti.

On December 16, 2013, Neptune announced that the administrative law judge presiding over the pending ITC investigation involving Neptune, Acasti and Enzymotec granted the parties’ joint motion to stay the proceedings for thirty days. The motion to stay was filed because the parties had agreed to a settlement term sheet with the hope of concluding a binding settlement agreement before the expiration of the stay. Neptune has entered into a settlement agreement with all the other respondents named in the ITC investigation and motions to terminate the investigation as to those respondents have been submitted.

On December 17, 2013, Neptune announced that it had concluded a settlement and license agreement with Aker. As part of the settlement, Neptune granted a world-wide, non-exclusive, royalty-bearing license to Aker to market and sell nutraceutical products in the licensed countries. Pursuant to the terms of the settlement, royalty levels depend on the outcome of the review proceedings being conducted before the USPTO regarding Neptune’s 351 Patent. Aker also agreed to pay a non-refundable one-time payment to Neptune for the manufacture and sale of krill products prior to the effective USPTO decision date.

12

On December 19, 2013, Neptune announced the appointment of Jerald J. Wenker, President and COO of Dermalogica, as a special advisor to the Board of Directors as well as his acceptance of the nomination for election to serve on the Board of Directors of Neptune.

On January 9, 2014, Neptune announced that it had received New Food Raw Material certification in China after no quality or safety concerns were found by China’s National Health and Family Planning Commission allowing Neptune to sell its krill oil nutraceutical products in China.

On February 14, 2014, Neptune announced that it had not been able to arrive at a final settlement agreement with Enzymotec that would resolve the ITC investigation into the infringement of Neptune’s composition of matter patents, and related federal court matters. Despite the presiding administrative law judge granting an extended stay through February 5, 2014, no settlement could be achieved as the parties reached an impasse on certain fundamental settlement terms, including terms that had already been agreed to in the term sheet. Neptune and Enzymotec agreed to participate in the ITC’s mediation program in a final attempt to reach a mutually satisfactory agreement. See “Business of the Corporation—Economic Dependence/Litigation—Enzymotec Limited and others”.

On February 18, 2014, Neptune announced the appointment of John Moretz, President and CEO of Moretz Marketing LLC and managing director of Kathy Ireland, LLC, as special advisor to the Board of Directors as well as his acceptance of the nomination for election to serve on Board of Directors of Neptune.

On February 27, 2014, Neptune announced that it had began an underwritten public offering of its common shares in the United States and Canada pursuant to the effective shelf registration statement filed with the SEC and a final short form base shelf prospectus filed the securities regulators in the provinces of Québec, Ontario, Manitoba, Alberta and British Columbia. Roth Capital Partners and Euro Pacific Canada Inc. acted as joint book-running managers and National Securities Corporation acted as lead manager for the offering. The offering of 10,000,000 newly issued common shares were priced at US$2.50 per share on February 28, 2014. See “Recent Developments—Financing of the New Production Facility Reconstruction and Insurance Proceeds”.

RECENT DEVELOPMENTS

New Production Facility Reconstruction and Operations

Neptune is in the process of completing the reconstruction of its sole manufacturing facility, located in Sherbrooke, Quebec, Canada. When completed, and operating at full capacity, the new production facility is expected to produce approximately 150,000 kilograms of krill oil products annually, with production of NKO® being prioritized to meet customer demand.

Prior to commencing operations at the new production facility, Neptune is required to obtain the following two permits:

| • | a certificate of authorization required under theEnvironment Quality Act (Québec) from the Ministry of Environment relating to environmental matters at the new production facility; and |

| • | alevée d’interdiction de démarrer, or permit to lift the prohibition to begin operations, from the CSST relating to safety in the workplace requirements. |

Neptune is working closely with the Ministry of Environment and the CSST to finalize the securing of the operating permits. Neptune expects to begin production once the remaining two permits are obtained. Based on the current status of its exchanges with the Ministry of Environment and the CSST, Neptune expects that the required permits will be obtained and production will commence by approximately early June 2014.

Neptune has received the authorization of its Emergency Response Plan (ERP) from the City of Sherbrooke Fire and Rescue Service, relating to the new production facility’s fire safety and emergency evacuation plan and on-site fire security equipment. No further approvals are required from the City of Sherbrooke Fire and Rescue Service for production to resume.

13

At the time of the November 2012 plant explosion, Neptune was in the process of constructing an expansion facility for its plant. The expansion facility sustained limited damage in the explosion and the plant reconstruction has resulted in the expansion facility becoming the new base for the Corporation’s main production facility. As the initial intended use of the expansion facility has changed, plant modifications and additional purchases to replace equipment lost in the incident were required. As a result, the initial $21 million estimated cost of the expansion project has been revised to approximately $48.3 million, up from the amount of approximately $45 million that was previously disclosed. To date, Neptune has funded approximately $43.3 million of the total estimated cost through:

| • | insurance recoveries (approximately $17.5 million received to date), see “Recent Developments—Financing of the New Production Facility Reconstruction and Insurance Proceeds”; |

| • | a loan of $12.5 million from IQ (approximately $8.5 million disbursed to date with the balance of the loan expected to be received following the submission by the Corporation of its audited report on the admissible expenses), see “General Development of the Business—Fiscal Year Ended February 28, 2014”; |

| • | an interest free loan of $3.5 million from Canada Economic Development (“CED”) (approximately $3.0 million disbursed to date with the balance of the loan expected to be received following the submission by the Corporation of the reports required by CED), |

| • | certain amounts received from settlement agreements relating to intellectual property matters, and |

| • | Neptune’s working capital. |

New Production Facility Ramp-Up Period

Neptune expects that upon the commissioning of the new production facility, a start-up and ramp-up period will be required before full production capacity will be achievable. The ramp-up period is expected to be completed in three phases over a period of three months, with each phase lasting one month. During this ramp-up period, Neptune expects to progressively increase production in each of the three phases to an annual production capacity of 50,000, 100,000 and 150,000 kilograms of krill oil products respectively, until the new production facility’s full commercial annual production capacity of krill oil is reached.

Human Resources

Neptune is currently employing 117 employees. Most key employees have been retained and a few management and production employees remain to be hired by the Corporation. Neptune does not anticipate any problems in hiring the remaining employees in a timely manner. See “Business of the Corporation—Employees”.

On April 28, 2014, Neptune announced the resignation of Mr. Henri Harland as President and Chief Executive Officer of Neptune. Neptune has begun the search for a new President and Chief Executive Officer. During the interim period, Neptune continues to be managed by a management and operations committee under the leadership of Neptune’s Chief Financial Officer, Mr. André Godin.

On May 29, 2014, Henri Harland, the former President and Chief Executive Officer of the Corporation filed a lawsuit against the Corporation, Neptune and NeuroBioPharm in connection with his departure as President and Chief Executive Officer of each of Neptune, Acasti and NeuroBioPharm. Among other things, Mr. Harland alleged that his resignation occurred as a result of a constructive dismissal and is seeking approximately $8.5 million in damages, interest and costs. In addition, Mr. Harland is seeking from Neptune, Acasti and NeuroBioPharm, as applicable, the issuance of 500,000 shares of each of Neptune, Acasti and NeuroBioPharm as well as two blocks of 1,000,000 call options each on the shares held by Neptune in Acasti and NeuroBioPharm. As a result of the lawsuit, Mr. Harland was requested to resign as Director of the Corporation. The following day, Neptune and its subsidiaries jointly announced that they believed the claim as formulated was without merit or cause, they will vigorously defend the lawsuit and will take any steps necessary to protect their interests.

Financing of the New Production Facility Reconstruction and Insurance Proceeds

On November 4, 2013, Neptune finalized a secured financing of $12.5 million with IQ, a government sponsored corporation whose mission is to contribute to Québec’s economic development in accordance with the Government of Québec’s economic policy, to partially fund the reconstruction of its production facility (which includes a security interest over all assets, including the Corporation’s intellectual property). The IQ secured loan has an annual interest rate of 7.0% and a two-year grace period for the start of principal repayment from the first disbursement date, following which the loan will be payable in equal monthly instalments over a four year period. The loan is repayable at any time without penalty. IQ disbursed the loan to reimburse Neptune’s reconstruction expenses. To date, Neptune has received approximately $8.5 million from IQ and expects to receive an additional $4.0 million which will be used to pay expenses incurred in connection with the reconstruction of the new production facility. As part of the IQ loan, the Corporation granted warrants to purchase 750,000 common shares of the Corporation to IQ. The warrants will be exercisable at an exercise price of $3.37 per warrant. The warrants will vest on a project driven basis concurrently with each loan disbursement date prorated according to the amount disbursed by IQ. At February 28, 2014, 511,995 warrants had vested.

14

On March 6, 2014, Neptune announced the closing of a public offering for gross proceeds of approximately US$28.75 million. Neptune intends to allocate the net proceeds from the offering for sales, marketing and distribution of its krill oil products, to support NeuroBio, in the development and validation of its product candidates, to finance the ramp-up of its production facility, to maintain, manage and develop its intellectual property portfolio and to protect it against infringement by third parties and for general corporate and other working capital purposes.

On April 4, 2014, Neptune announced the closing of a private placement of CAD$2,503,320 of common shares of Neptune at a price of CAD$2.76 per share resulting in a total issuance of 907,000 shares. The shares were all qualified under Quebec Stock Savings Plan II (“QSSP II”) and were issued to the Fiera Capital QSSP II Investment Fund Inc. and Cote 100 Inc., that acquired 725,000 and 182,000 shares respectively. The shares could not be qualified under the QSSP II and subscribed for by the Funds under the Neptune’s public offering completed on March 5, 2014, because of the particular requirements of the QSSP II. Other than the qualification of the shares, the terms of the shares issued are the same as those of the common shares of Neptune issued as part of the public offering.

Since November 2012, Neptune has received insurance recoveries totalling $17.5 million. Although its new production facility is operational, Neptune is still pursuing the balance of its insurance claim and will record any additional recovery if and when received.

Since the November 2012 plant explosion, management has periodically reevaluated the need to recognize impairment losses as information becomes available. An additional impairment loss related to property, plant and equipment of approximately $1.2 million was identified during the ongoing process of the reconstruction of the Corporation’s plant, related financing and insurance recoveries, and was recorded in the Corporation’s financial statements. See “Risk Factors—The Corporation suffered significant impairment losses and its assets may be subject to future write-downs, charge-offs or impairment losses.”

Incident Investigation, Environmental Matters and Site Clean-Up

On May 8, 2014, the CSST released its report in connection with its ongoing investigation to determine the cause of the November 2012 explosion at Neptune’s production plant. Although the CSST’s report highlights that the exact cause of the incident could not be identified, the CSST identified as potential causes that could explain the incident the following principal factors: deficiencies in the design and control of the production process, the classification of the old production facility and deficiencies in the management of health and safety issues. The CSST’s report makes no mention of additional fines or penalties against Neptune beyond the November 5, 2013 statement of offence described below. Following the November 2012 incident, Neptune offered its full cooperation to the CSST and continues to work with the CSST, including by implementing recommendations and corrective measures sought by the CSST, towards completing its new state of the art production facility and making operations at its new production facility as safe as possible.

On November 5, 2013, Neptune received a statement of offense issued by the CSST seeking payment of a fine of approximately $64,500 in connection with the incident. On November 12, 2013, Neptune entered a not guilty plea with respect to the statement of offense from the CSST.

On November 16, 2012, following the incident at the plant, Neptune received from the Ministry of Environment a notice alleging non-compliance by Neptune with environmental regulations relating to equipment specifications. The Ministry of Environment’s notice alleged that Neptune had modified certain of its equipment without notifying the Ministry of Environment and that its plant production capacity was above the permitted limit in the certificate of authorization issued by the Ministry of Environment. Neptune is cooperating with the Ministry of Environment with the view to settling the notice alleging the non-compliance. The Ministry of Environment’s investigation is ongoing and representatives of Neptune have met with inspectors from the Ministry of Environment.

15

Neptune also provided to the Ministry of Environment a dismantling and clean-up plan for the destroyed plant, accompanied by an environmental monitoring program for soil, surface water and groundwater quality. To date, the destroyed plant has been dismantled and the required clean-up of the premises in accordance with Ministry of Environment standards, which includes the removal of 130 metric tons of contaminated soil from the site further to environmental studies performed by independent environmental consultants retained by Neptune, is in its advanced stages and the Corporation anticipates it will be completed by mid-2014.

Activities of Neptune’s Subsidiaries—Acasti and NeuroBio

Acasti Pharma Inc.

Acasti initiated two Phase II clinical trials in Canada (the COLT trial and the TRIFECTA trial) designed to evaluate the safety and efficacy of CaPre® for the management of mild to moderate hypertriglyceridemia (high triglycerides with levels ranging from 200 to 499 mg/dL) and severe hypertriglyceridemia (high triglycerides with levels over 500 mg/dL). Due to a recent decision of the U.S. Food and Drug Administration’s (the “FDA”) not to grant authorization to commercialize a competitor’s drug in the mild to moderate patient population before the demonstration of clinical outcome benefits, Acasti is reassessing its clinical strategy and may put a primary and first focus on the severe hypertriglyceridemia population.

COLT Trial

On August 13, 2013, Acasti announced the completion and results of its open-label Phase II COLT trial (clinical trial.gov identifier NCT01516151). The final results of the COLT trial indicated that CaPre® was safe and effective in reducing triglycerides in patients with mild to severe hypertriglyceridemia with significant mean (average) triglyceride reductions above 20% after 8 weeks of treatment with daily doses of both 4.0g and 2.0g. Demographics and baseline characteristics of the patient population were balanced in terms of age, race and gender. A total of 288 patients were enrolled and randomized and 270 patients completed the study, which exceeded the targeted number of evaluable patients. From this patient population, approximately 90% had mild to moderate hypertriglyceridemia. CaPre® was safe and well tolerated. The proportion of patients treated with CaPre® that experienced one or more adverse events in the COLT trial was similar to that of the standard of care group (30.0% versus 34.5%, respectively). A substantial majority of adverse events were mild (82.3%) and no severe treatment-related adverse effects have been reported.

The COLT trial met its primary objective showing CaPre® to be safe and effective in reducing triglycerides in patients with mild to severe hypertriglyceridemia. After only a 4-week treatment, CaPre® achieved a statistically significant triglyceride reduction as compared to standard of care alone. Patients treated with 4.0g of CaPre® per day over 4 weeks reached a mean triglyceride decrease of 15.4% from baseline and a mean improvement of 18.0% over the standard of care. Results also showed increased benefits after 8 weeks of treatment, with patients on a daily dose of 4.0g of CaPre® registering a mean triglyceride decrease of 21.6% from baseline and a statistically significant mean improvement of 14.4% over the standard of care. It is noteworthy that a mean triglyceride reduction of 7.1% was observed for the standard of care group at week 8, which may be explained by lipid lowering medication adjustments during the study, which was allowed to be administered in the standard of care group alone.

Moreover, after 8 weeks of treatment, patients treated with 1.0g for the first 4 weeks of treatment and 2.0g for the following 4 weeks showed a statistically significant triglycerides mean improvement of 16.2% over the standard of care, corresponding to a 23.3% reduction for the 1.0-2.0g daily dose as compared to a 7.1% reduction for the standard of care. After 8 weeks of treatment, patients treated with 2.0g of CaPre® for the entire 8 weeks showed statistically significant triglycerides mean improvements of -14.8% over the standard of care, corresponding to a 22.0% reduction for the 2.0g as compared to a 7.1% reduction for the standard of care. Also, after 8 weeks of treatment, patients treated with 4.0g for the entire 8 weeks showed statistically significant triglycerides, non-HDL-C (non-high density lipoprotein, which includes all cholesterol contained in the bloodstream except HDL-C (high density lipoprotein (good cholesterol)) and HbA1C (haemoglobin A1C) mean improvements of, respectively, 14.4% and 9.8% and 15.0% as compared to standard of care. The 4.0g group mean improvements in (i) triglycerides of 14.4% corresponds to a reduction of 21.6% as compared to a reduction of a 7.1% for the standard of care group, (ii) non-HDL-C of 9.8% corresponds to a reduction of 12.0% as compared to a reduction of 2.3% for the standard of care group, and (iii) HbA1C of 15.0% corresponds to a reduction of 3.5% as compared to an increase of 11.5% for the standard of care group. In addition, all combined doses of CaPre® showed a statistically significant treatment effect on HDL-C levels, with an increase of 7.4% as compared to standard of care. Trends (p-value < 0.1) were also noted on patients treated with 4.0g of CaPre® for the entire 8-week treatment period with mean reduction of total

16

cholesterol of 7.0% and increase of HDL-C levels of 7.7% as compared to the standard of care. Furthermore, after doubling the daily dosage of CaPre® after an initial period of 4 weeks, the results indicate a dose response relationship corresponding to a maintained and improved efficacy of CaPre® after an 8-week period. The efficacy of CaPre® at all doses in reducing triglyceride levels and increased effect with dose escalation suggests that CaPre® may be titrable, allowing physicians to adjust dosage in order to better manage patients’ medical needs. In addition, the results of the COLT trial indicate that CaPre® has no significant deleterious effect on LDL-C (bad cholesterol) levels.

Further details on Acasti’s COLT Trial are available in Acasti’s prospectus dated October 25, 2013, which can be accessed online atwww.sedar.com, under the heading “Acasti’s Business – Clinical and Nonclinical Research – Clinical – COLT Trial”.

TRIFECTA Trial

The TRIFECTA trial (clinical trial.gov identifier NCT01455844), a 12-week, randomized, double-blind, placebo-controlled study, is designed to assess the effect of CaPre®, at a dose of 1.0 or 2.0g, on fasting plasma triglycerides as compared to a placebo in patients with mild to severe hypertriglyceridemia. A total of 366 patients have been randomized over the 429 planned protocol (342 evaluable patients).

Similar to the COLT trial, the primary objective of the TRIFECTA trial is to evaluate the effect of CaPre® on fasting plasma triglycerides in patients with triglycerides between 2.28 and 10.0 mmol/L (200-877 mg/dL) and to assess the tolerability and safety of CaPre®. The secondary objectives of the TRIFECTA trial are to evaluate the effect of CaPre® on fasting plasma triglycerides in patients with triglycerides between 2.28 and 5.69 mmol/L (200-499 mg/dL); to evaluate the dose dependent effect on fasting plasma triglycerides in patients with triglycerides > 5.7 and <10 mmol/L (500-877 mg/dL); to evaluate the effect of CaPre® in patients with mild to moderate hypertriglyceridemia and severe hypertriglyceridemia on fasting plasma levels of LDL-C (direct measurement), and on fasting plasma levels of HDL-C, non-HDL-C, hs-CRP and omega-3 index.

On December 20, 2012, the TRIFECTA trial completed an interim analysis. The review committee made up of medical physicians assembled to evaluate the progress of the TRIFECTA trial reviewed the interim analysis relative to drug safety and efficacy and unanimously agreed that the study should continue as planned. All committee members agreed that there were no toxicity issues related to the intake of CaPre® and that the signals of a possible therapeutic effect, noted as reduction of triglycerides in the groups evaluated, were reassuring and sufficiently clinically significant to allow the further continuation of the TRIFECTA trial. The data was provided to the committee members blind, meaning that the identity of the three groups was not revealed. Since the data revealed a possible therapeutic effect without any safety concerns, the committee decided that it was not necessary to unblind the data. The number of targeted patients evaluable as per protocol has been reached. Acasti is currently evaluating efficacy and safety of CaPre® for the treatment of patients with mild to severe hypertriglyceridemia, which is the primary objective of the study. A secondary objective of the study was to assess the efficacy of CaPre® in two distinct patient populations: those with mild to moderate hypertriglyceridemia and those with severe hypertriglyceridemia. Based on patient information currently available, the Corporation does not expect the sample size to be large enough to conclude on the efficacy of CaPre® on severe hypertriglyceridemia as part of the TRIFECTA trial. Acasti does not expect the FDA to request efficacy data on patients with severe hypertriglyceridemia before granting permission to conduct a phase III trial. Acasti believes the trial will be completed by the end of the second quarter of calendar 2014 and results will be available at a future date yet to be determined.

PK Trial

On November 11, 2013, Acasti announced that it submitted an investigational new drug application to the FDA to initiate a PK (pharmacokinetic) trial of CaPre® in the United States. The proposed PK trial is an open-label, randomized, multiple-dose, single-center, parallel-design study to evaluate blood profiles and bioavailability of omega-3 phospholipids on healthy volunteers taking single and multiple daily oral doses of 1.0g, 2.0g and 4.0g of CaPre®. Acasti expects that the duration of the PK trial would likely be over a 30-day period and involve the enrollment of approximately 42 healthy subjects.

17

On January 9, 2014, Acasti announced that the FDA granted Acasti approval to conduct its PK trial, having found no objections with the proposed PK trial design, protocol or safety profile of CaPre®. Acasti also announced that Quintiles, the world’s largest provider of biopharmaceutical development and commercial outsourcing services, has been hired to conduct the PK trial. Acasti expects results of its PK trial to be available by mid to late 2014.

Next Steps

Acasti is corresponding with the FDA and has responded to the FDA’s recommendations regarding its upcoming IND filing for its phase III clinical trial of CaPre® in the United States. The FDA has invited Acasti to formally request an end of phase II/pre phase III meeting to allow them to provide feedback on the submission and to address specific questions for which Acasti is seeking approval and final response from the FDA. Acasti intends to seek such meeting as soon as TRIFECTA trial results are available.

Acasti intends to conduct a phase III clinical trial in the United States, with potentially a few Canadian clinical trial sites, in a patient population with very high triglycerides (>500 mg/dL). This study would constitute the primary basis of an efficacy claim for CaPre® in an NDA submission for severe hypertriglyceridemia. Acasti is also evaluating the possibility of submitting a Special Protocol Assessment (“SPA”) to the FDA in order to form the basis for the design of its intended Phase III clinical trial. An SPA is a declaration from the FDA that an uncompleted Phase III trial’s design, clinical endpoints, and statistical analyses are acceptable for FDA approval. A request would be submitted for the protocol at least 90 days prior to the anticipated start of the Phase III clinical trial.

In addition to conducting and completing the TRIFECTA, PK and a Phase III clinical trial, Acasti expects that additional time and capital will be required to complete the filing of a NDA to obtain FDA approval for CaPre® in the United States before reaching commercialization, which may initially be only for the treatment of severe hypertriglyceridemia. The FDA may require Acasti to conduct additional clinical studies to obtain FDA approval for the treatment of mild to moderate hypertriglyceridemia, which may include a cardiovascular outcomes study.

Public Offering and Private Placement of Units of Acasti