Exhibit 99.2

Premier Residential and Commercial Property and Casualty Insurance

Serving Coastal States Since 1999

The UPC Difference

We have written $2.7 billion in premiums and paid over $1 billion in claims while maintaining consistent profitability and financial strength.

DEEP EXPERIENCE

| | • | | Proven leader in the world’s peak exposure zone for hurricane risk |

| | • | | Anti-fragility demonstrated during 26 different catastrophic events since 1999 |

HUGE MARKET OPPORTUNITY

| | • | | Significant, permanent dislocation/lack of capacity in windstorm-exposed markets |

| | • | | Small market share needed to generate significant premium growth and volume |

| | • | | Ninth in Florida and 31st nationally in home premium, with production in only nine states |

PREMIER LEADERSHIP TEAM

| | • | | Stability and continuity at the Board and Senior Leadership levels |

| | • | | Added Legal, Actuarial, Sales and Underwriting talent in 2014 to support growth |

CONSERVATIVELY CAPITALIZED

| | • | | Strong balance sheet with ample equity and liquidity – minimal financial leverage and investment risk |

| | • | | Internal capital augmented by $1.25 billion of reinsurance with minimal credit risk |

| | • | | Conservative reserving philosophy |

PROVEN EXECUTION

| | • | | Licensed in 18 of 19 initial target markets |

| | • | | Developed and implementing proprietary product and pricing philosophy (UPC 1.0) |

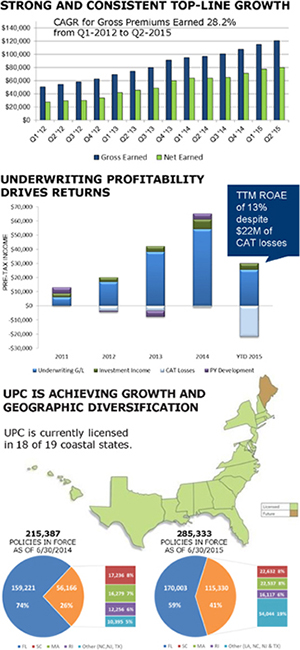

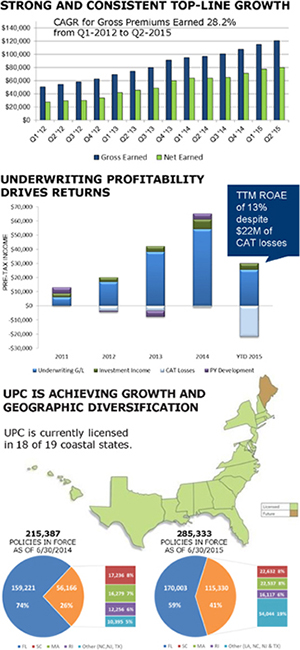

| | • | | Diversification accelerating with 76% of all new policies coming from outside Florida in 2015 |

CONSISTENTLY STRONG FINANCIAL RESULTS

| | • | | Profitable in 15 of 16 years since inception |

| | • | | ROAE over 20% each of past two years; YTD 06/30/2015 underlying combined ratio of 86.9% |

| VISION: | To be the premier provider of property insurance in catastrophe-exposed areas |

|

| web: investors.upcinsurance.com email: ir@upcinsurance.com |

Superior Financial Strength and Stability

GAAP EQUITY IN EXCESS OF $200 MILLION

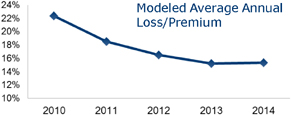

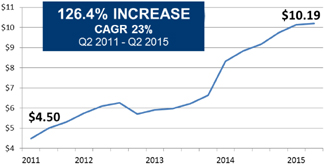

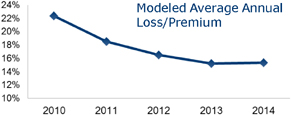

QUALITY GROWTH IMPROVING KEY RISK METRIC

SIGNIFICANT HISTORICAL EVENT EFFECTS ON UPC

| | | | | | | | | | | | | | | | |

| | | Est.

Industry | | | Est. UPC | | | UPC

Proforma | | | UPC

Proforma | |

| Historical | | Gross

Loss | | | Gross

Loss2 | | | 2015

Net Inc.3 | | | Risk-

Adjusted | |

| Event | | ($ billion) | | | ($ million) | | | ($ million) | | | ROAE3 | |

SEVERITY (Single Event) | | | | | |

Andrew (1992) | | $ | 55 | | | $ | 161 | | | $ | 18.5 | | | | 8.7 | % |

Katrina (2005) | | $ | 39 | | | $ | 207 | | | $ | 29.0 | | | | 13.3 | % |

Galveston (1900) | | $ | 39 | | | $ | 128 | | | $ | 29.0 | | | | 13.3 | % |

New England (1938) | | $ | 33 | | | $ | 142 | | | $ | 29.0 | | | | 13.3 | % |

| |

FREQUENCY (Multiple Events) | | | | | |

Andrew + Katrina | | $ | 94 | | | $ | 303 | | | $ | 15.4 | | | | 7.3 | % |

Galveston + N.E. | | $ | 72 | | | $ | 325 | | | $ | 25.8 | | | | 11.9 | % |

Betsy + Donna | | $ | 73 | | | $ | 702 | | | $ | 25.8 | | | | 11.9 | % |

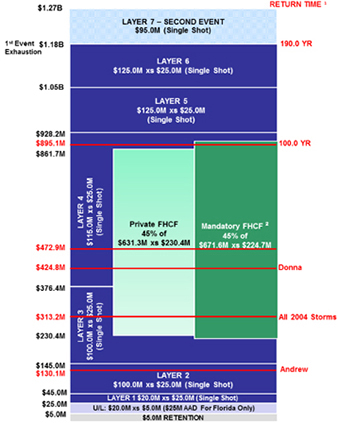

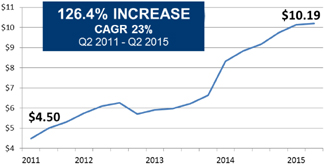

Severity Protection

Since 1900, there has never been a hurricane that would have exhausted UPC’s 2015 catastrophe reinsurance program.

Frequency Protection

Neither of the two most active seasons on record (2004 and 2005) would exhaust UPC’s 2015 catastrophe reinsurance program.

| 2 | AIR Worldwide’s estimated insured industry loss includes losses from personal and commercial lines. |

| 3 | Raymond James estimate as of 8/5/2015 less after-tax impact of actual, estimated and modeled catastrophe losses during 2015. |

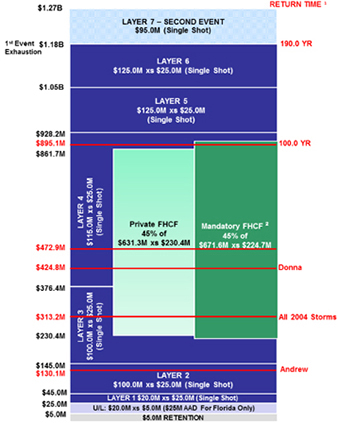

BOOK VALUE PER SHARE GROWTH

PRUDENT RISK TRANSFER KEY TO UPC STRATEGY

More than $1.2 billion of coverage for any number of events until exhausted.

| 1 | Return time shown using AIRv15 LT no DS based on projected 9/30/2015 exposures. |

web: investors.upcinsurance.com email: ir@upcinsurance.com