United Insurance Holdings Corp. NASDAQ: UIHC UIHC to Acquire Interboro Insurance Company: Accelerating Quality Growth and Diversification October 2, 2015

2 OCTOBER 2015 INVESTOR PRESENTATION: Acquisition of Interboro Insurance Company Overview of Interboro Insurance Company Interboro Insurance Company is a New York-domiciled property/ casualty insurer authorized to do business in New York, South Carolina, Alabama, Louisiana, and Washington D.C. Over 100 years in business Products distributed through a network of over 600 independent brokers Demotech rating of A (Exceptional) UPC will acquire approximately $55.0 million of homeowners’ insurance gross written premium volume in New York and South Carolina 2014 homeowners’ GAAP loss ratio after existing reinsurance of approximately 45%

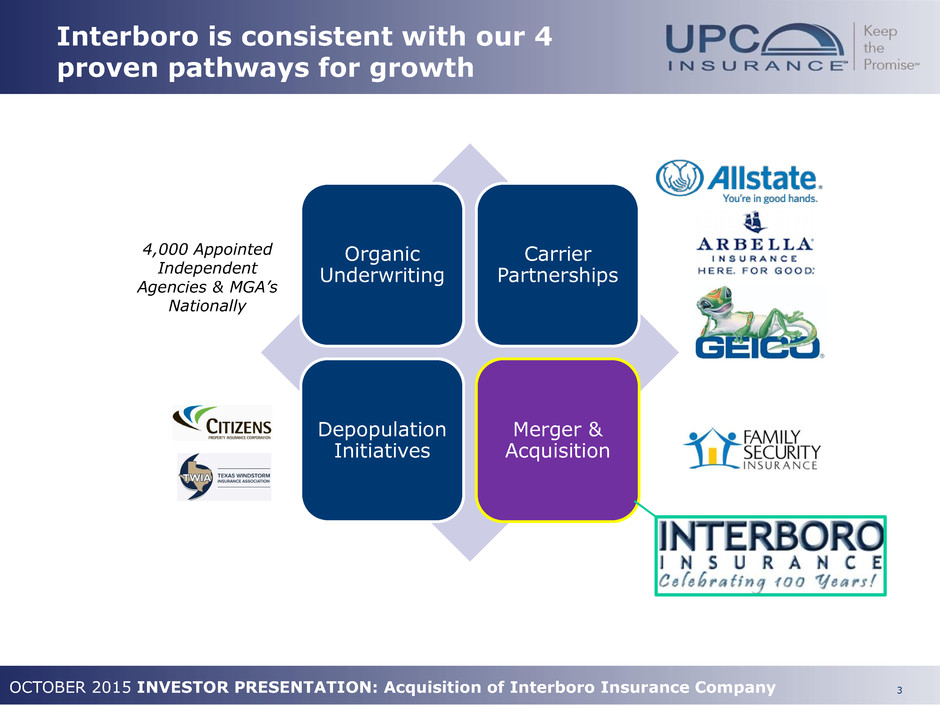

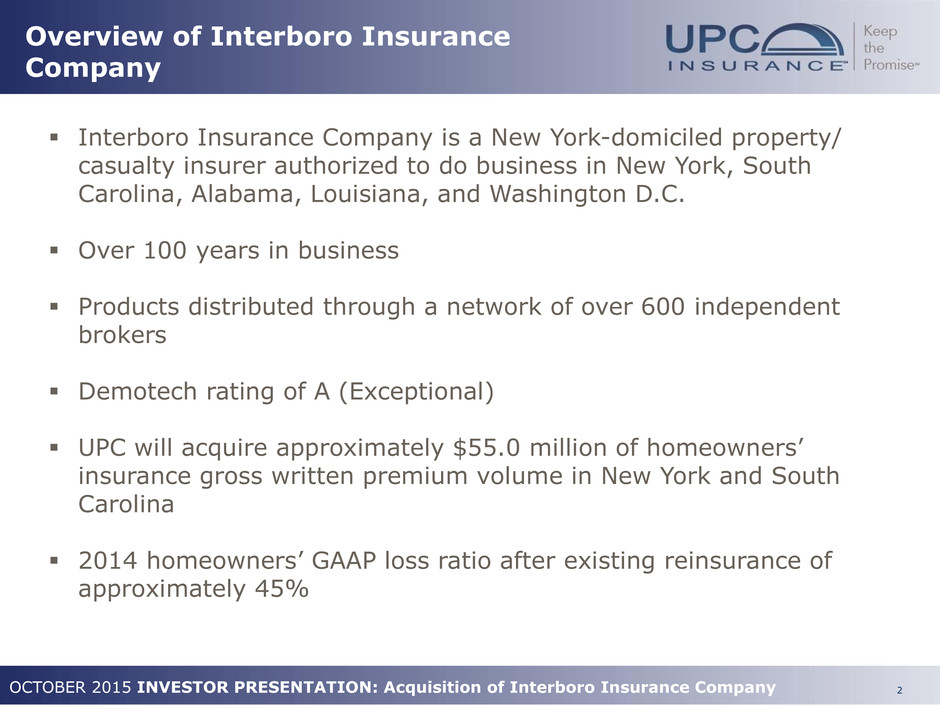

3 OCTOBER 2015 INVESTOR PRESENTATION: Acquisition of Interboro Insurance Company Interboro is consistent with our 4 proven pathways for growth Organic Underwriting Carrier Partnerships Depopulation Initiatives Merger & Acquisition 4,000 Appointed Independent Agencies & MGA’s Nationally

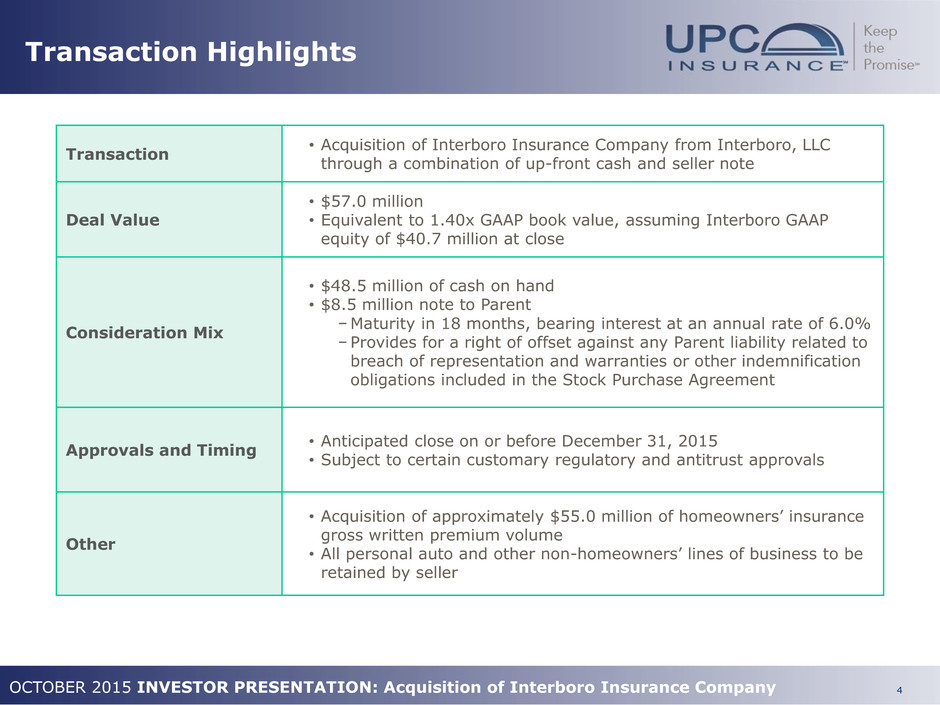

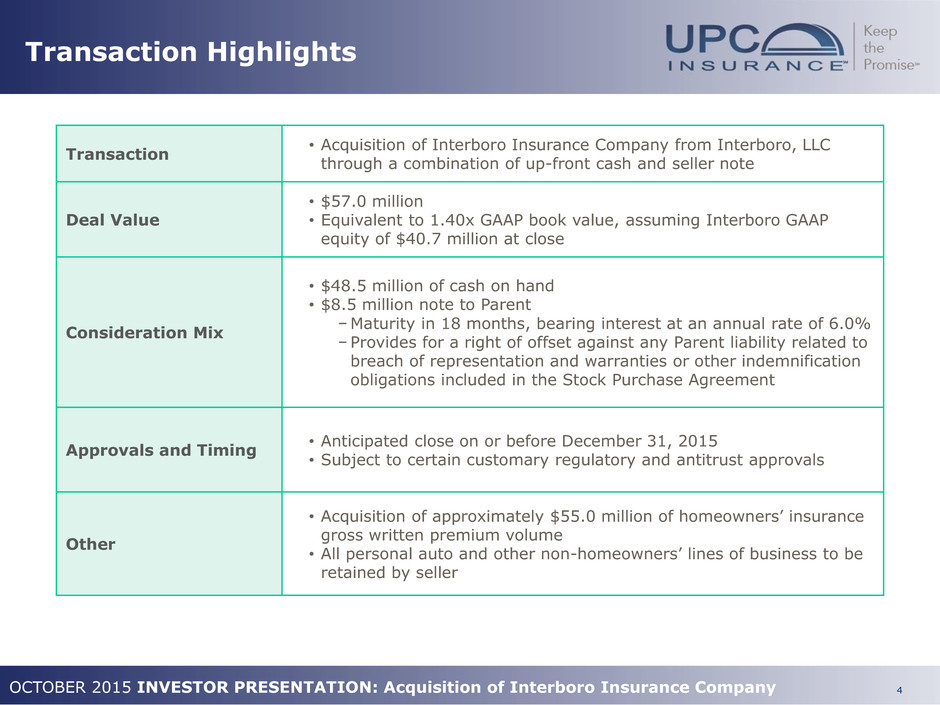

4 OCTOBER 2015 INVESTOR PRESENTATION: Acquisition of Interboro Insurance Company Transaction Highlights Transaction • Acquisition of Interboro Insurance Company from Interboro, LLC through a combination of up-front cash and seller note Deal Value • $57.0 million • Equivalent to 1.40x GAAP book value, assuming Interboro GAAP equity of $40.7 million at close Consideration Mix • $48.5 million of cash on hand • $8.5 million note to Parent −Maturity in 18 months, bearing interest at an annual rate of 6.0% − Provides for a right of offset against any Parent liability related to breach of representation and warranties or other indemnification obligations included in the Stock Purchase Agreement Approvals and Timing • Anticipated close on or before December 31, 2015 • Subject to certain customary regulatory and antitrust approvals Other • Acquisition of approximately $55.0 million of homeowners’ insurance gross written premium volume • All personal auto and other non-homeowners’ lines of business to be retained by seller

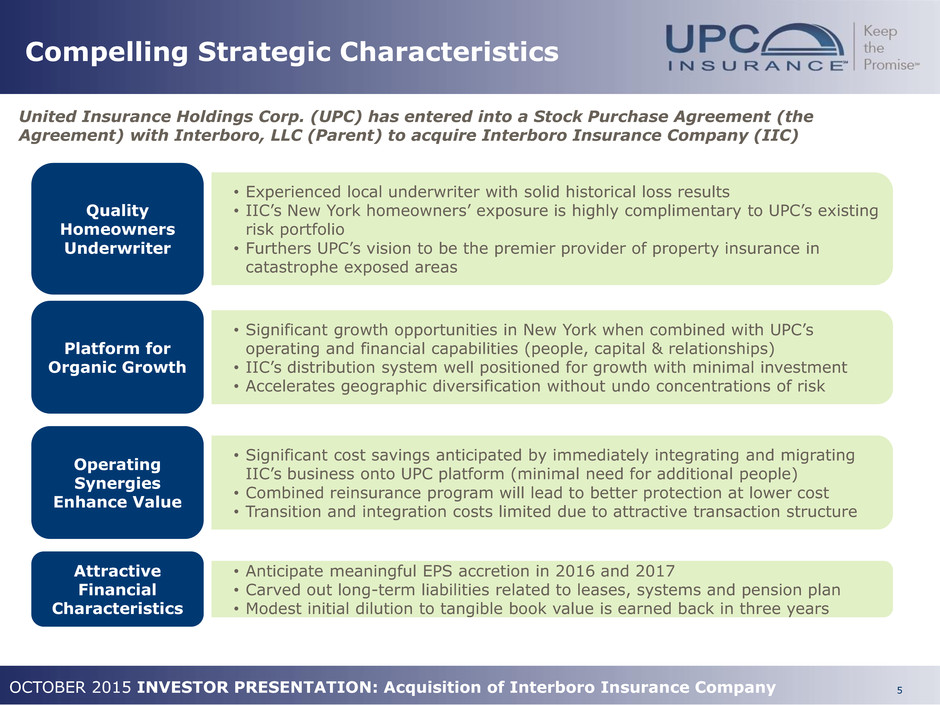

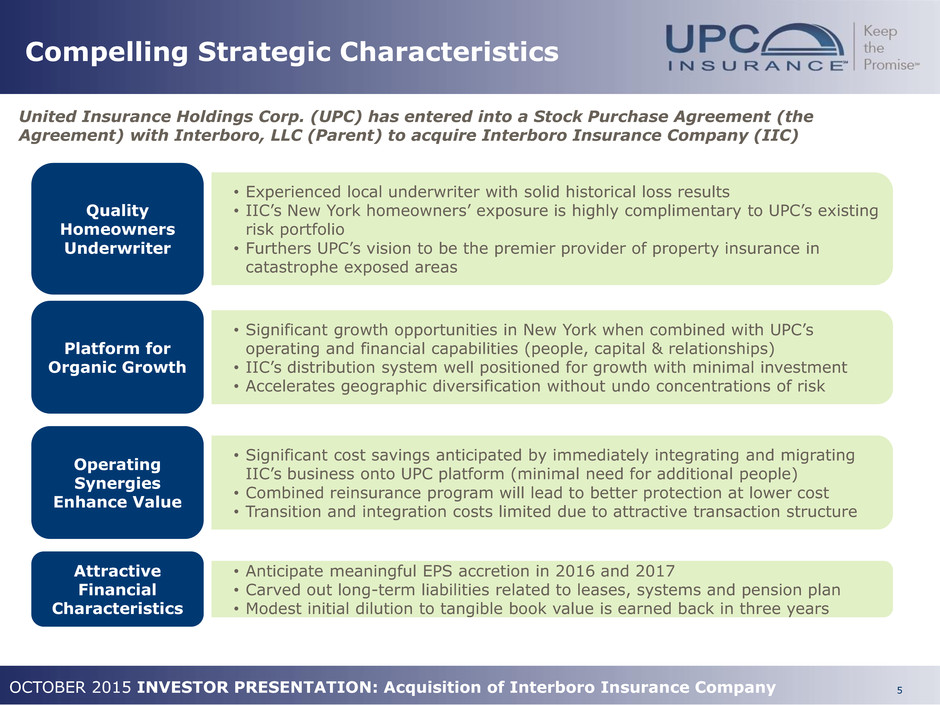

5 OCTOBER 2015 INVESTOR PRESENTATION: Acquisition of Interboro Insurance Company Compelling Strategic Characteristics Quality Homeowners Underwriter Platform for Organic Growth Operating Synergies Enhance Value Attractive Financial Characteristics • Experienced local underwriter with solid historical loss results • IIC’s New York homeowners’ exposure is highly complimentary to UPC’s existing risk portfolio • Furthers UPC’s vision to be the premier provider of property insurance in catastrophe exposed areas • Anticipate meaningful EPS accretion in 2016 and 2017 • Carved out long-term liabilities related to leases, systems and pension plan • Modest initial dilution to tangible book value is earned back in three years • Significant growth opportunities in New York when combined with UPC’s operating and financial capabilities (people, capital & relationships) • IIC’s distribution system well positioned for growth with minimal investment • Accelerates geographic diversification without undo concentrations of risk • Significant cost savings anticipated by immediately integrating and migrating IIC’s business onto UPC platform (minimal need for additional people) • Combined reinsurance program will lead to better protection at lower cost • Transition and integration costs limited due to attractive transaction structure United Insurance Holdings Corp. (UPC) has entered into a Stock Purchase Agreement (the Agreement) with Interboro, LLC (Parent) to acquire Interboro Insurance Company (IIC)

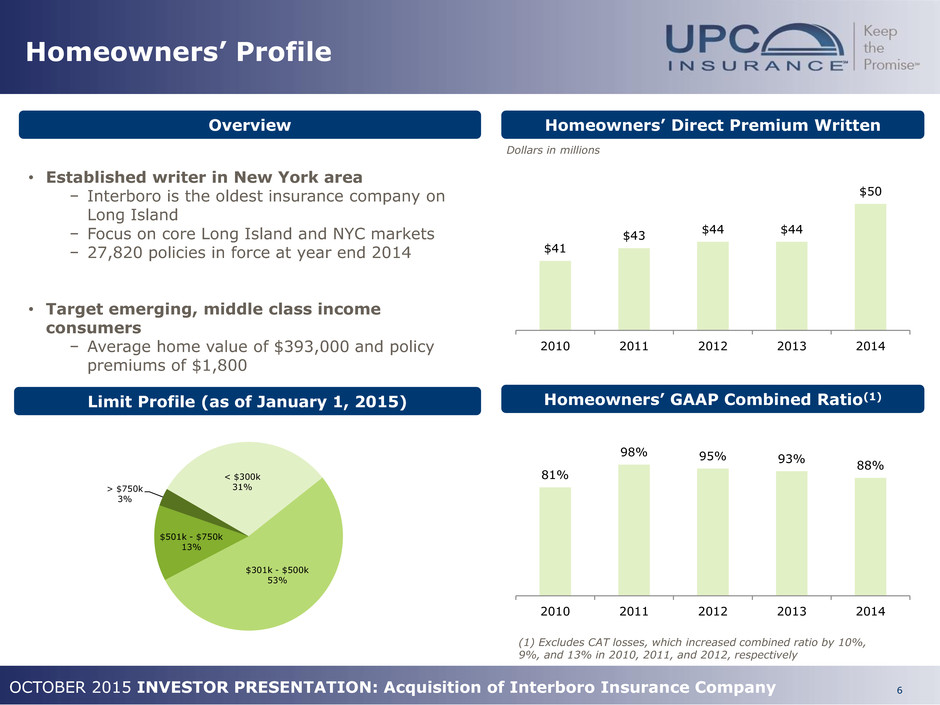

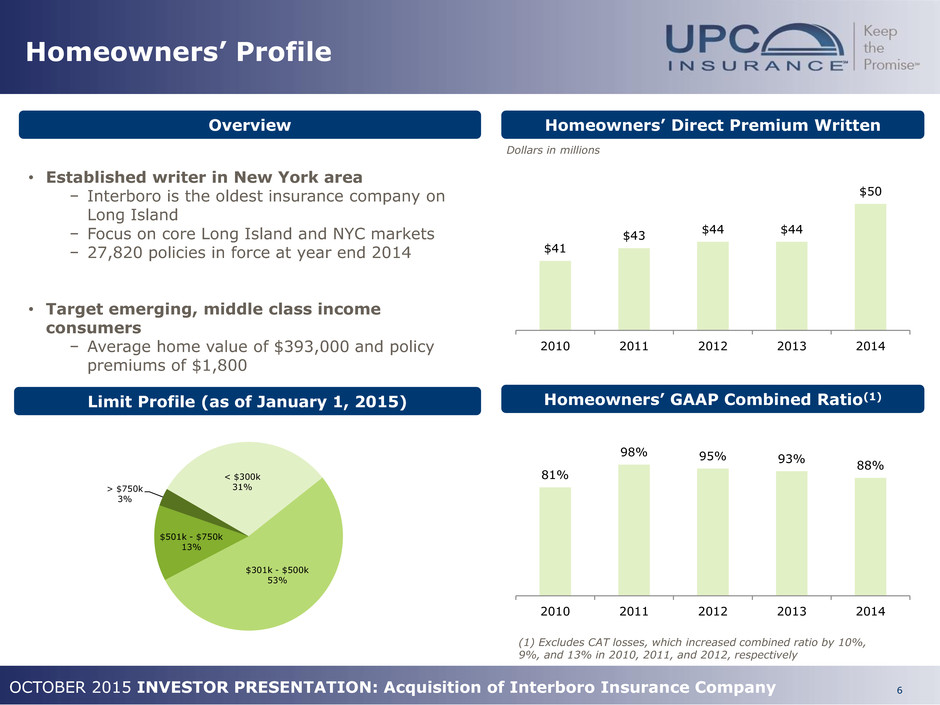

6 OCTOBER 2015 INVESTOR PRESENTATION: Acquisition of Interboro Insurance Company 81% 98% 95% 93% 88% 2010 2011 2012 2013 2014 Homeowners’ Profile Homeowners’ Direct Premium Written Homeowners’ GAAP Combined Ratio(1) Dollars in millions $41 $43 $44 $44 $50 2010 2011 2012 2013 2014 Overview • Established writer in New York area − Interboro is the oldest insurance company on Long Island − Focus on core Long Island and NYC markets − 27,820 policies in force at year end 2014 • Target emerging, middle class income consumers − Average home value of $393,000 and policy premiums of $1,800 (1) Excludes CAT losses, which increased combined ratio by 10%, 9%, and 13% in 2010, 2011, and 2012, respectively Limit Profile (as of January 1, 2015) < $300k 31% $301k - $500k 53% $501k - $750k 13% > $750k 3%

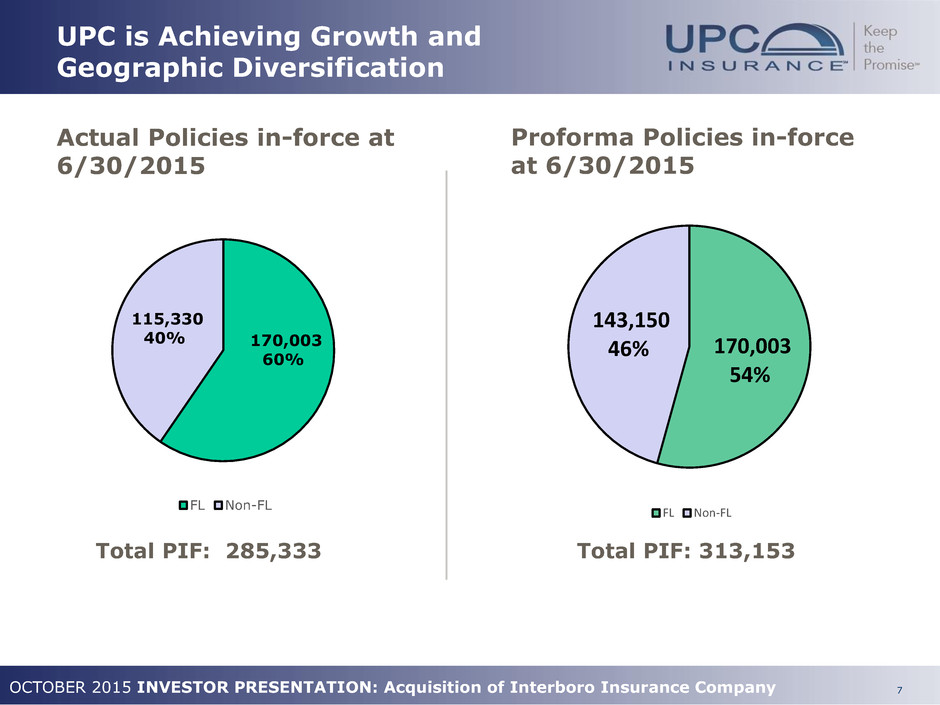

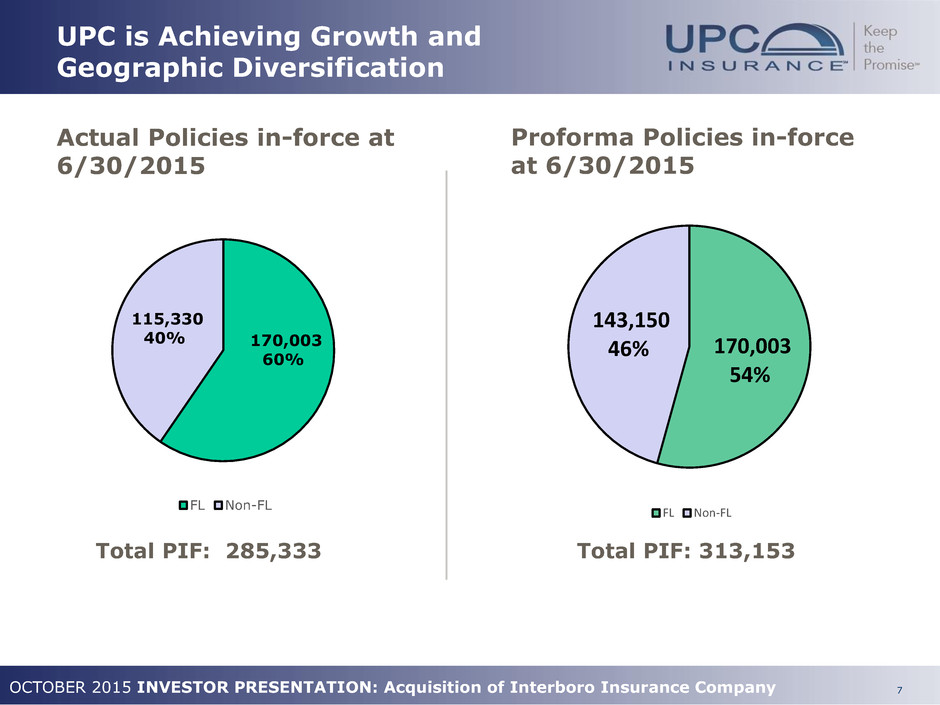

7 OCTOBER 2015 INVESTOR PRESENTATION: Acquisition of Interboro Insurance Company UPC is Achieving Growth and Geographic Diversification Actual Policies in-force at 6/30/2015 Total PIF: 285,333 Total PIF: 313,153 Proforma Policies in-force at 6/30/2015 170,003 54% 143,150 46% FL Non-FL 170,003 60% 115,330 40% FL Non-FL

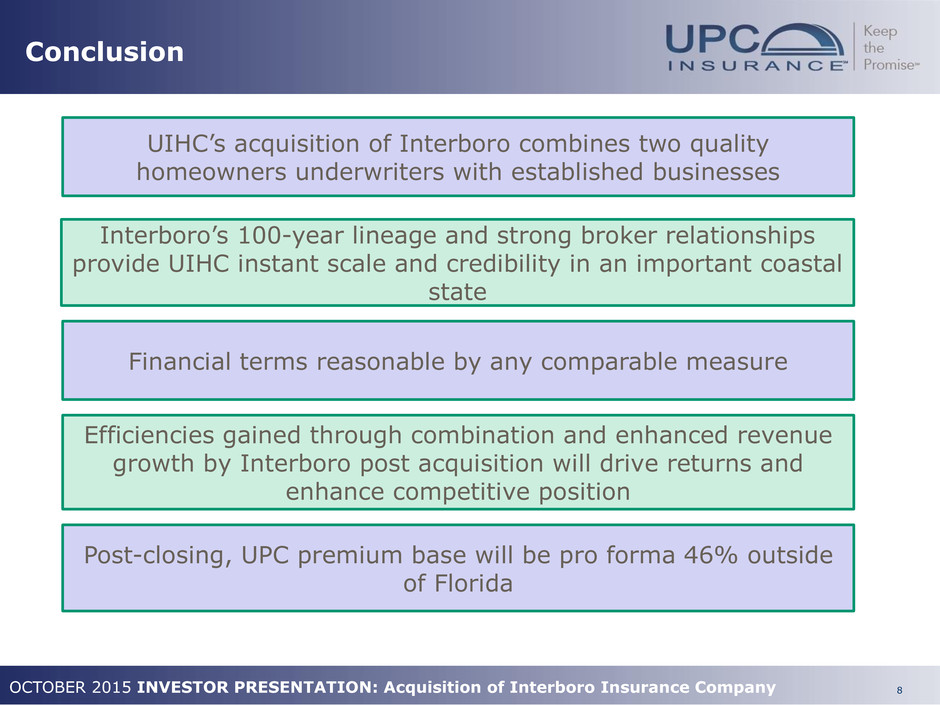

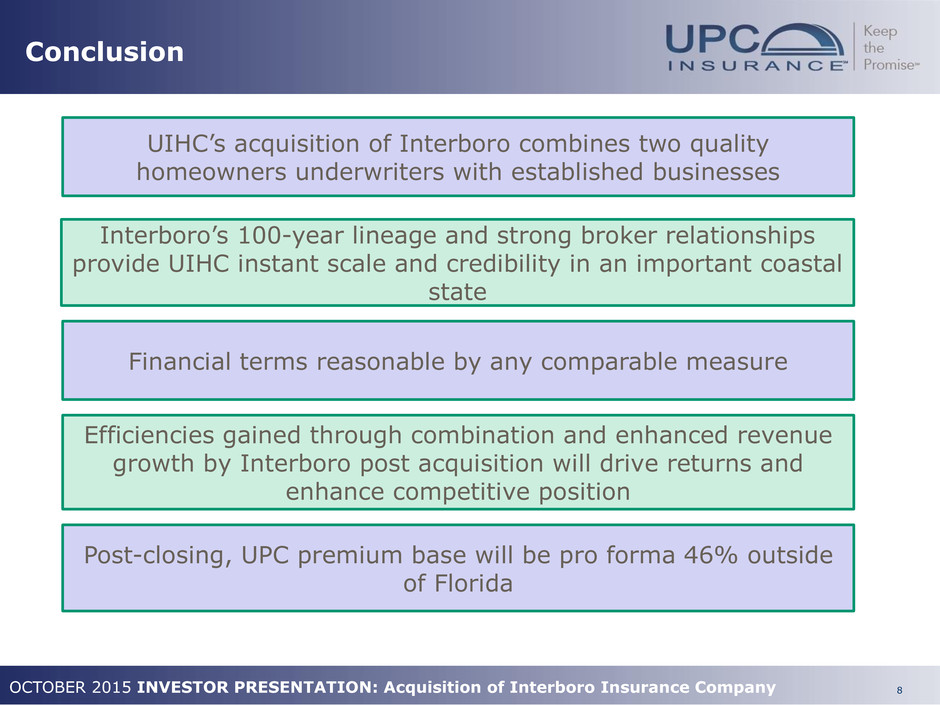

8 OCTOBER 2015 INVESTOR PRESENTATION: Acquisition of Interboro Insurance Company Conclusion UIHC’s acquisition of Interboro combines two quality homeowners underwriters with established businesses Interboro’s 100-year lineage and strong broker relationships provide UIHC instant scale and credibility in an important coastal state Financial terms reasonable by any comparable measure Efficiencies gained through combination and enhanced revenue growth by Interboro post acquisition will drive returns and enhance competitive position Post-closing, UPC premium base will be pro forma 46% outside of Florida

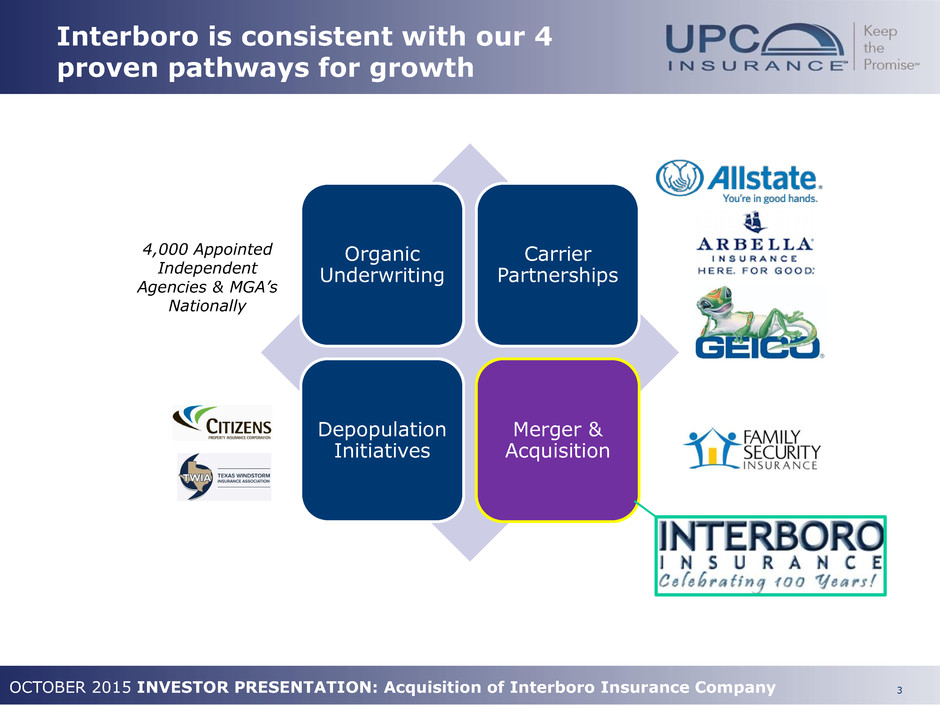

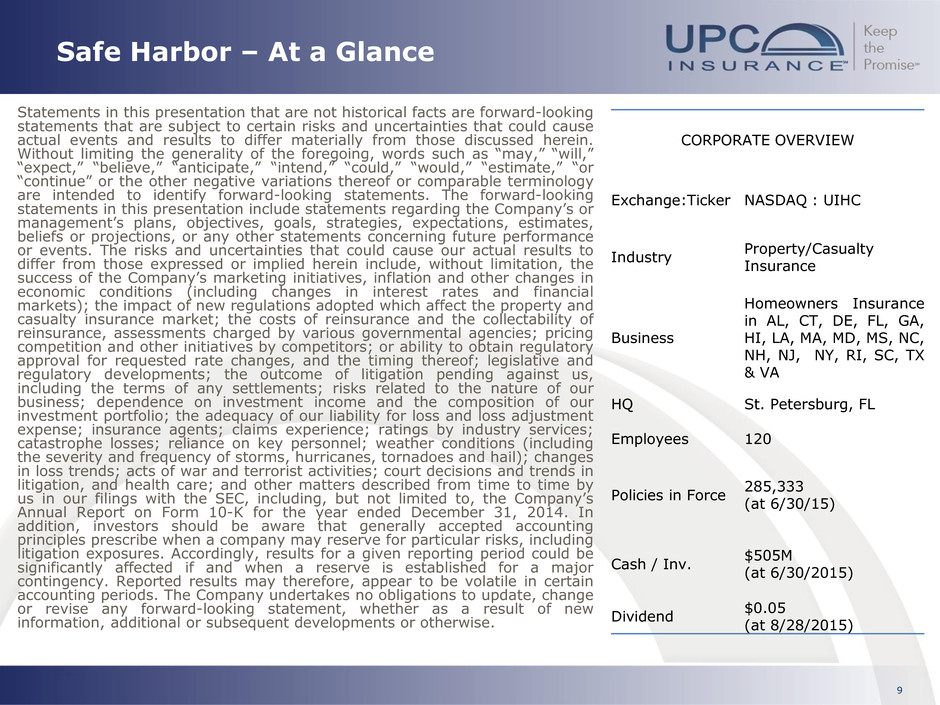

9 Safe Harbor – At a Glance Statements in this presentation that are not historical facts are forward-looking statements that are subject to certain risks and uncertainties that could cause actual events and results to differ materially from those discussed herein. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “or “continue” or the other negative variations thereof or comparable terminology are intended to identify forward-looking statements. The forward-looking statements in this presentation include statements regarding the Company’s or management’s plans, objectives, goals, strategies, expectations, estimates, beliefs or projections, or any other statements concerning future performance or events. The risks and uncertainties that could cause our actual results to differ from those expressed or implied herein include, without limitation, the success of the Company’s marketing initiatives, inflation and other changes in economic conditions (including changes in interest rates and financial markets); the impact of new regulations adopted which affect the property and casualty insurance market; the costs of reinsurance and the collectability of reinsurance, assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; or ability to obtain regulatory approval for requested rate changes, and the timing thereof; legislative and regulatory developments; the outcome of litigation pending against us, including the terms of any settlements; risks related to the nature of our business; dependence on investment income and the composition of our investment portfolio; the adequacy of our liability for loss and loss adjustment expense; insurance agents; claims experience; ratings by industry services; catastrophe losses; reliance on key personnel; weather conditions (including the severity and frequency of storms, hurricanes, tornadoes and hail); changes in loss trends; acts of war and terrorist activities; court decisions and trends in litigation, and health care; and other matters described from time to time by us in our filings with the SEC, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. In addition, investors should be aware that generally accepted accounting principles prescribe when a company may reserve for particular risks, including litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when a reserve is established for a major contingency. Reported results may therefore, appear to be volatile in certain accounting periods. The Company undertakes no obligations to update, change or revise any forward-looking statement, whether as a result of new information, additional or subsequent developments or otherwise. CORPORATE OVERVIEW Exchange:Ticker NASDAQ : UIHC Industry Property/Casualty Insurance Business Homeowners Insurance in AL, CT, DE, FL, GA, HI, LA, MA, MD, MS, NC, NH, NJ, NY, RI, SC, TX & VA HQ St. Petersburg, FL Employees 120 Policies in Force 285,333 (at 6/30/15) Cash / Inv. $505M (at 6/30/2015) Dividend $0.05 (at 8/28/2015)

10 Definitions of Non-GAAP Measures We believe that investors’ understanding of UPC Insurance’s performance is enhanced by our disclosure of the following non-GAAP measures. Our methods for calculating these measures may differ from those used by other companies and therefore comparability may be limited. Combined ratio excluding the effects of current year catastrophe losses, prior year development from lines in run-off and prior year development (underlying combined ratio) is a non-GAAP ratio, which is computed as the difference between four GAAP operating ratios: the combined ratio, the effect of current year catastrophe losses on the combined ratio, the effect of development from lines in run-off and prior year development on the combined ratio. We believe that this ratio is useful to investors and it is used by management to reveal the trends in our business that may be obscured by current year catastrophe losses, losses from lines in run-off and prior year development. Current year catastrophe losses cause our loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant impact on the combined ratio. Prior year development from lines in run-off is caused by unexpected development from our commercial auto product that is no longer offered by the Company. Prior year development is unexpected loss development on historical reserves. We believe it is useful for investors to evaluate these components separately and in the aggregate when reviewing our performance. The most direct comparable GAAP measure is the combined ratio. The underlying combined ratio should not be considered as a substitute for the combined ratio and does not reflect the overall profitability of our business.