AmCo Holding Company Consolidated Financial Statements for the reporting period ending March 31, 2017

Table of Contents Financial Statements Consolidated Balance Sheets (Unaudited) 1 Consolidated Statements of Comprehensive Income (Unaudited) 2 Consolidated Statements of Cash Flows (Unaudited) 3 Notes to the Consolidated Financial Statements (Unaudited) 4

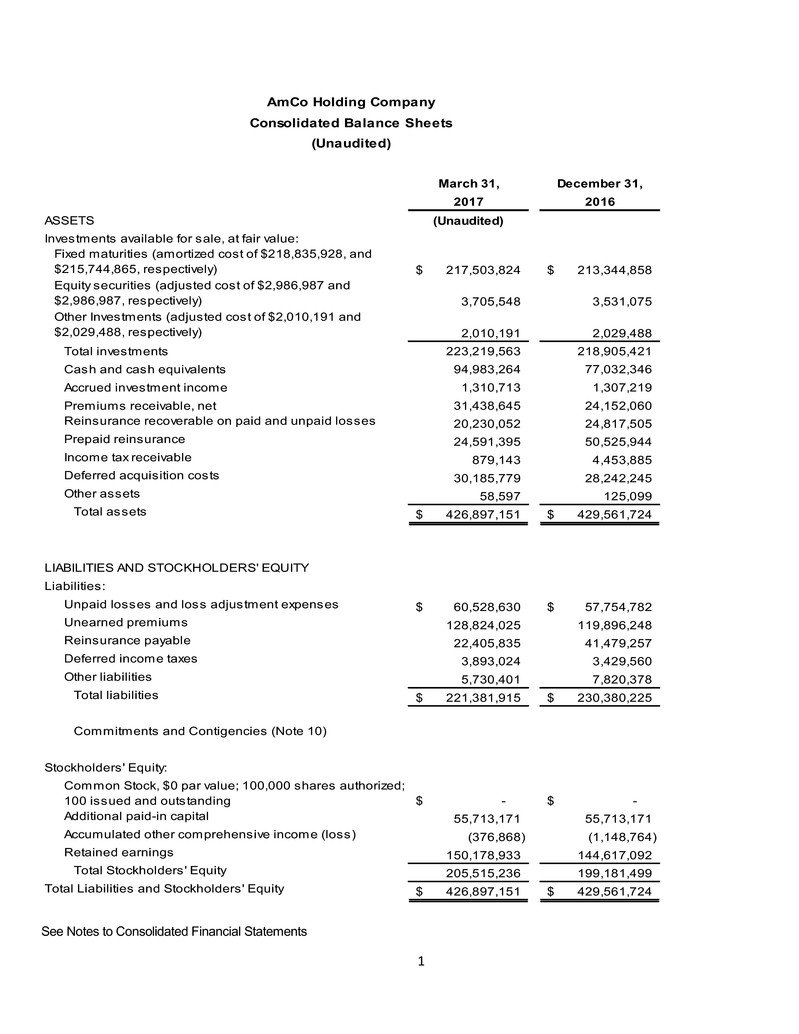

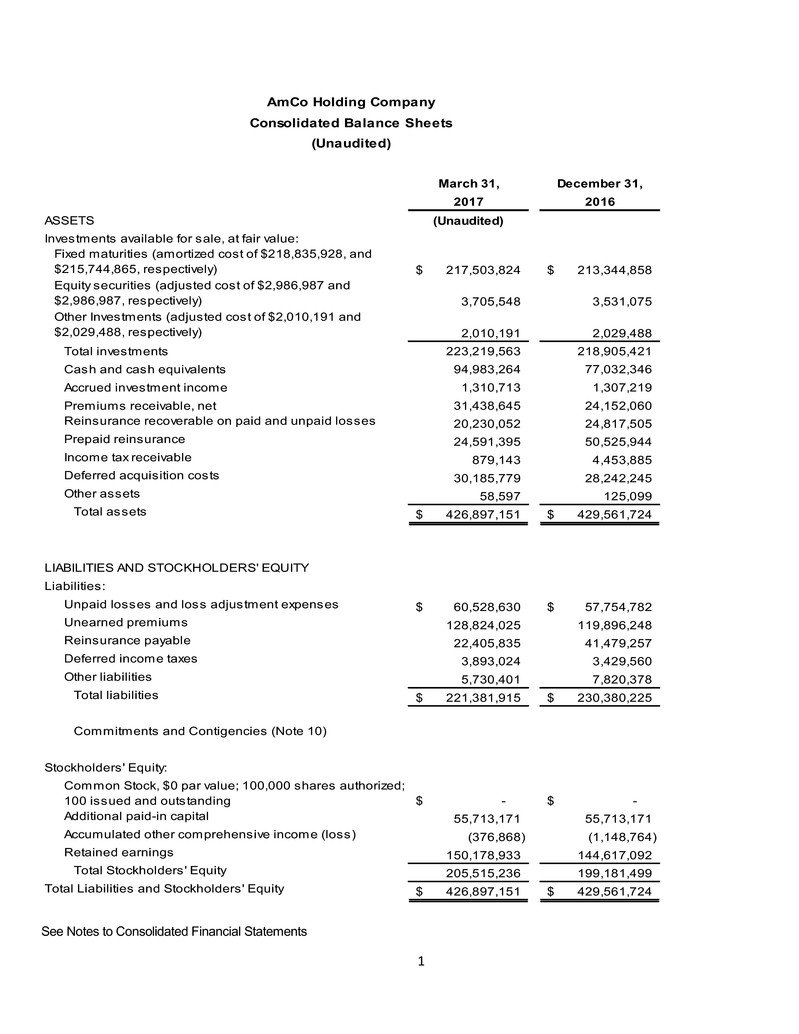

1 March 31, December 31, 2017 2016 ASSETS (Unaudited) Investments available for sale, at fair value: Fixed maturities (amortized cost of $218,835,928, and $215,744,865, respectively) 217,503,824$ 213,344,858$ Equity securities (adjusted cost of $2,986,987 and $2,986,987, respectively) 3,705,548 3,531,075 Other Investments (adjusted cost of $2,010,191 and $2,029,488, respectively) 2,010,191 2,029,488 Total investments 223,219,563 218,905,421 Cash and cash equivalents 94,983,264 77,032,346 Accrued investment income 1,310,713 1,307,219 Premiums receivable, net 31,438,645 24,152,060 Reinsurance recoverable on paid and unpaid losses 20,230,052 24,817,505 Prepaid reinsurance 24,591,395 50,525,944 Income tax receivable 879,143 4,453,885 Deferred acquisition costs 30,185,779 28,242,245 Other assets 58,597 125,099 Total assets 426,897,151$ 429,561,724$ LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Unpaid losses and loss adjustment expenses 60,528,630$ 57,754,782$ Unearned premiums 128,824,025 119,896,248 Reinsurance payable 22,405,835 41,479,257 Deferred income taxes 3,893,024 3,429,560 Other liabilities 5,730,401 7,820,378 Total liabilities 221,381,915$ 230,380,225$ Commitments and Contigencies (Note 10) Stockholders' Equity: Common Stock, $0 par value; 100,000 shares authorized; 100 issued and outstanding -$ -$ Additional paid-in capital 55,713,171 55,713,171 Accumulated other comprehensive income (loss) (376,868) (1,148,764) Retained earnings 150,178,933 144,617,092 Total Stockholders' Equity 205,515,236 199,181,499 Total Liabilities and Stockholders' Equity 426,897,151$ 429,561,724$ AmCo Holding Company Consolidated Balance Sheets (Unaudited) See Notes to Consolidated Financial Statements

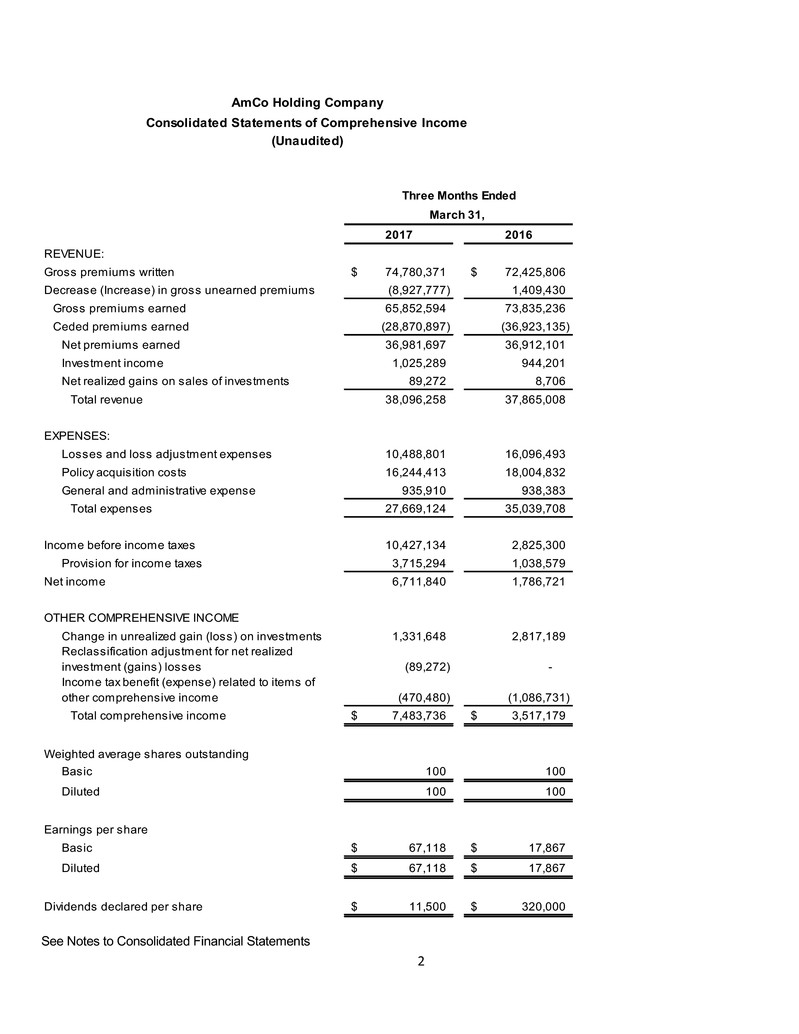

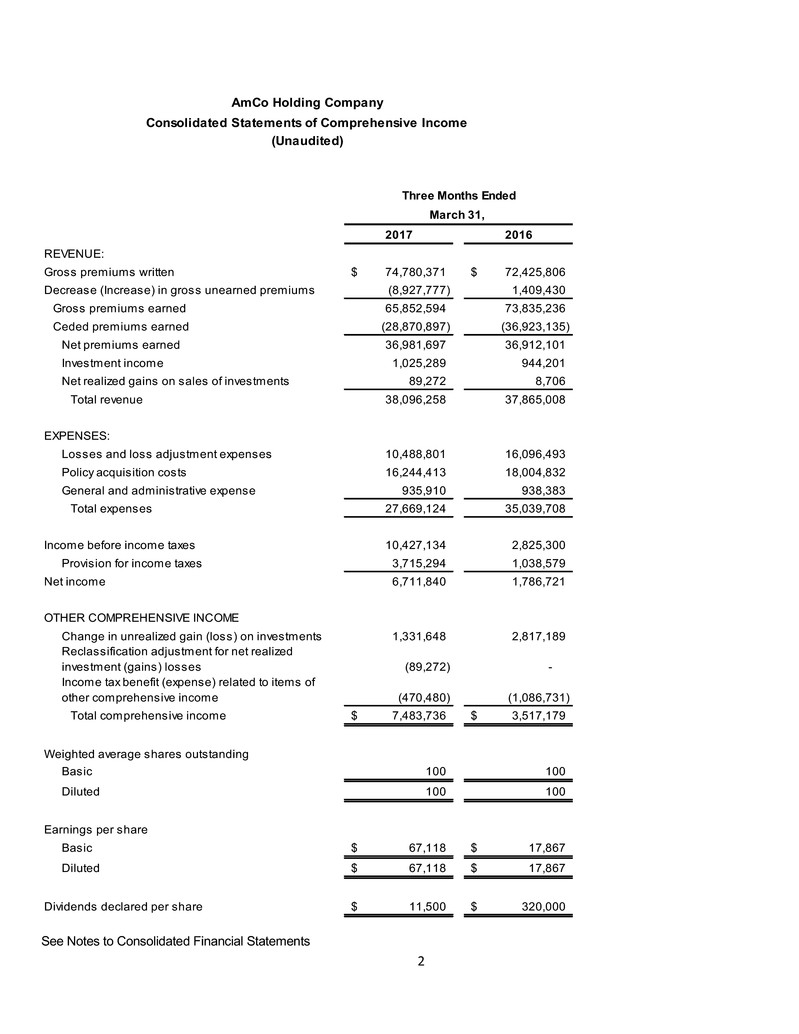

2 2017 2016 REVENUE: Gross premiums written 74,780,371$ 72,425,806$ Decrease (Increase) in gross unearned premiums (8,927,777) 1,409,430 Gross premiums earned 65,852,594 73,835,236 Ceded premiums earned (28,870,897) (36,923,135) Net premiums earned 36,981,697 36,912,101 Investment income 1,025,289 944,201 Net realized gains on sales of investments 89,272 8,706 Total revenue 38,096,258 37,865,008 EXPENSES: Losses and loss adjustment expenses 10,488,801 16,096,493 Policy acquisition costs 16,244,413 18,004,832 General and administrative expense 935,910 938,383 Total expenses 27,669,124 35,039,708 Income before income taxes 10,427,134 2,825,300 Provision for income taxes 3,715,294 1,038,579 Net income 6,711,840 1,786,721 OTHER COMPREHENSIVE INCOME Change in unrealized gain (loss) on investments 1,331,648 2,817,189 Reclassification adjustment for net realized investment (gains) losses (89,272) - Income tax benefit (expense) related to items of other comprehensive income (470,480) (1,086,731) Total comprehensive income 7,483,736$ 3,517,179$ Weighted average shares outstanding Basic 100 100 Diluted 100 100 Earnings per share Basic 67,118$ 17,867$ Diluted 67,118$ 17,867$ Dividends declared per share 11,500$ 320,000$ Three Months Ended March 31, AmCo Holding Company Consolidated Statements of Comprehensive Income (Unaudited) See Notes to Consolidated Financial Statements

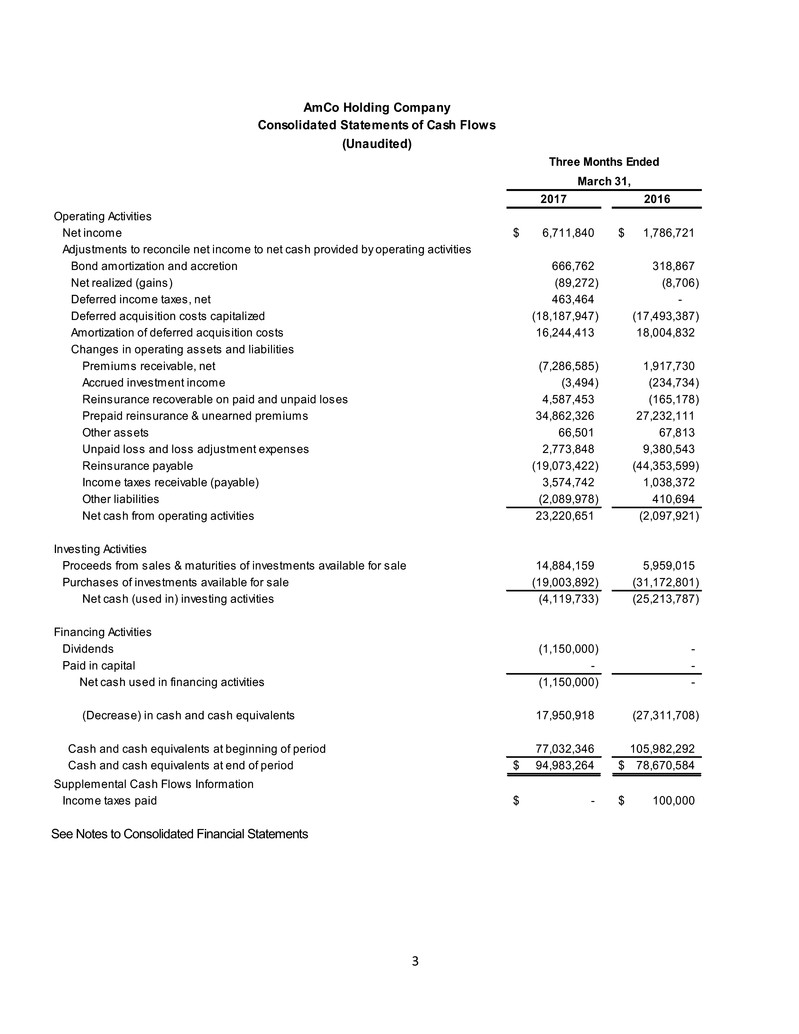

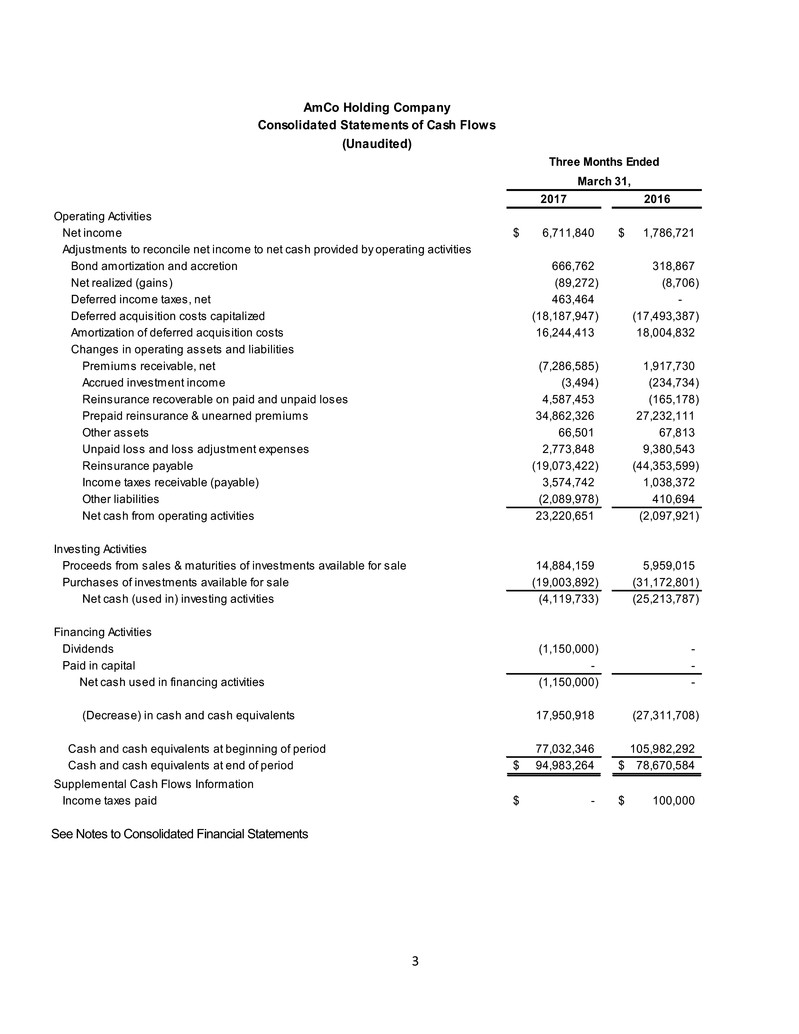

3 2017 2016 Operating Activities Net income 6,711,840$ 1,786,721$ Adjustments to reconcile net income to net cash provided by operating activities Bond amortization and accretion 666,762 318,867 Net realized (gains) (89,272) (8,706) Deferred income taxes, net 463,464 - Deferred acquisition costs capitalized (18,187,947) (17,493,387) Amortization of deferred acquisition costs 16,244,413 18,004,832 Changes in operating assets and liabilities Premiums receivable, net (7,286,585) 1,917,730 Accrued investment income (3,494) (234,734) Reinsurance recoverable on paid and unpaid loses 4,587,453 (165,178) Prepaid reinsurance & unearned premiums 34,862,326 27,232,111 Other assets 66,501 67,813 Unpaid loss and loss adjustment expenses 2,773,848 9,380,543 Reinsurance payable (19,073,422) (44,353,599) Income taxes receivable (payable) 3,574,742 1,038,372 Other liabilities (2,089,978) 410,694 Net cash from operating activities 23,220,651 (2,097,921) Investing Activities Proceeds from sales & maturities of investments available for sale 14,884,159 5,959,015 Purchases of investments available for sale (19,003,892) (31,172,801) Net cash (used in) investing activities (4,119,733) (25,213,787) Financing Activities Dividends (1,150,000) - Paid in capital - - Net cash used in financing activities (1,150,000) - (Decrease) in cash and cash equivalents 17,950,918 (27,311,708) Cash and cash equivalents at beginning of period 77,032,346 105,982,292 Cash and cash equivalents at end of period 94,983,264$ 78,670,584$ Supplemental Cash Flows Information Income taxes paid -$ 100,000$ March 31, Three Months Ended AmCo Holding Company Consolidated Statements of Cash Flows (Unaudited) See Notes to Consolidated Financial Statements

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 4 1. Description of Business AmCo Holding Company (“Company” or “AmCo"), is wholly owned by RDX Holding, LLC (“RDX”), a Delaware limited liability company formed on June 1, 2015. Previously, the Company was owned by BB&T Corporation (“BB&T”). See Note 6 Related Parties for a discussion regarding the change in ownership that occurred during 2015. The Company was incorporated in North Carolina on June 1, 2007. The Company owns American Coastal Insurance Company (“ACIC”), which is licensed in the State of Florida and has provided commercial multi-peril property insurance, including wind, for residential condominium associations since 2007. The Company has been writing Allied Lines since 2011. AmRisc, LLC (“AmRisc”), a Managing General Underwriter, handles the underwriting, claims processing, premium collection and reinsurance review for the Company. The Company also owns BlueLine Cayman Holdings, a Cayman Islands holding company that owns BlueLine Re. BlueLine Re is a protected cell (also known as a separate account) of Horseshoe Re Limited. Horseshoe Re Limited is a licensed Bermuda Class 3 separate account reinsurer incorporated under a Bermuda Private Act. The Company acquired BlueLine Cayman Holdings to participate in the AmRisc excess and surplus book of business through BlueLine Re. Effective June 1, 2016, the Company entered into a quota share reinsurance agreement through BlueLine Re with Lexington Insurance Company, a subsidiary of American International Group, Inc., to participate in the AmRisc excess and surplus book of business. The AmRisc excess and surplus book of business consists of commercial property and related coverages throughout the United States. The Company attempts to mitigate its exposure to losses from storms by purchasing catastrophe reinsurance coverage. However, a catastrophe, depending on its path and severity, could result in losses to the Company exceeding its reinsurance protection and could have a material adverse effect on the financial condition and results of operations of the Company. The Company has purchased catastrophe reinsurance protection based upon expected losses during hurricane season, which are derived from sophisticated models approved for use in the State of Florida. Further detail regarding the Company’s reinsurance programs can be found in Note 8. The Company also purchases catastrophe reinsurance coverage for its participation in the excess and surplus market through BlueLine Re. The Company has purchased catastrophe reinsurance protection based upon expected losses which are derived from sophisticated models. Further detail regarding the Company’s reinsurance programs can be found in Note 8. 2. Basis of Presentation The accompanying consolidated financial statements have been prepared in conformity with generally accepted accounting principles (“GAAP”) in the United States of America. While preparing the consolidated financial statements, management has made estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities, and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ materially from those estimates.

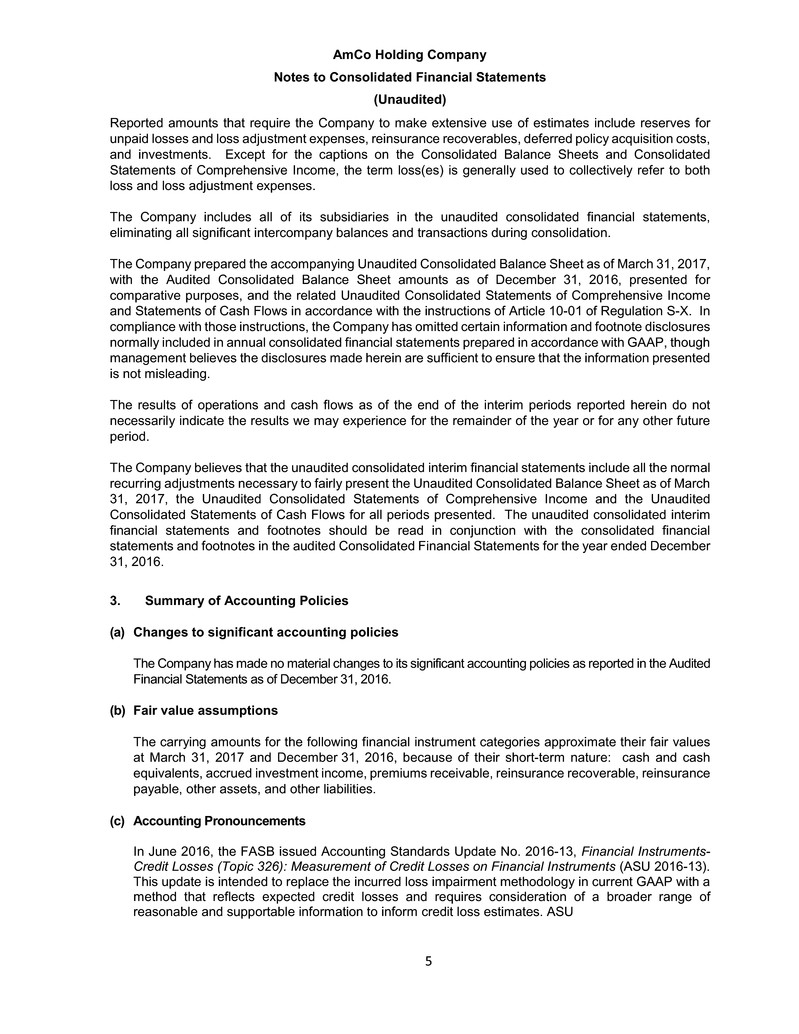

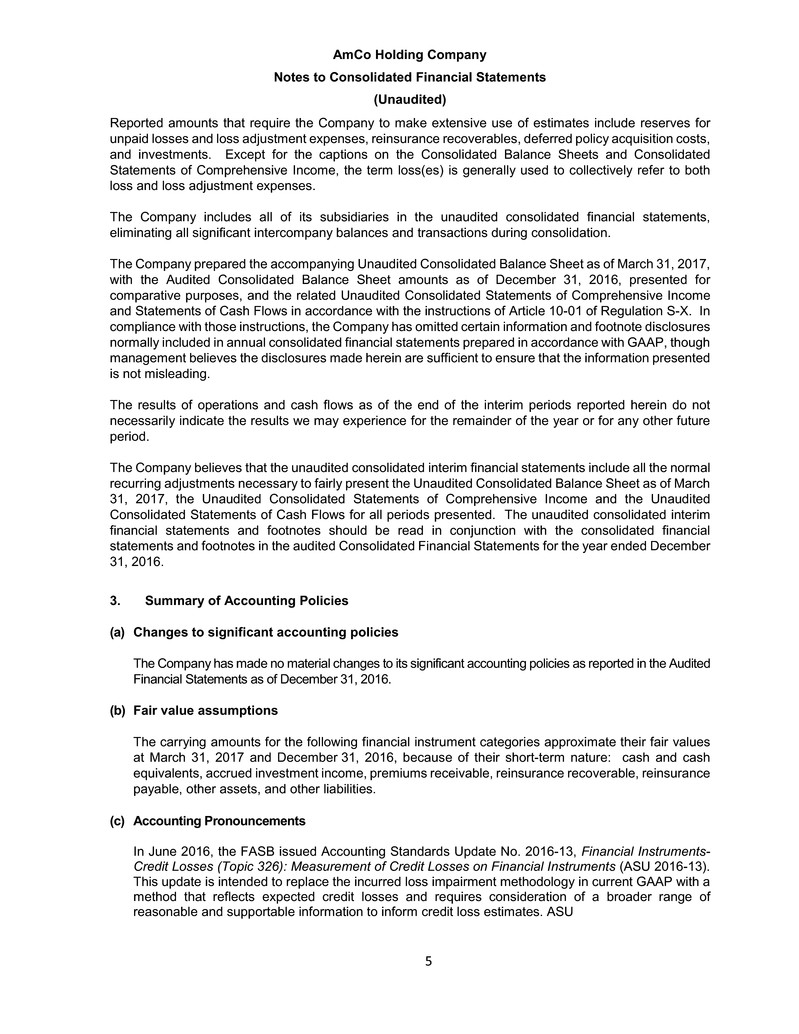

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 5 Reported amounts that require the Company to make extensive use of estimates include reserves for unpaid losses and loss adjustment expenses, reinsurance recoverables, deferred policy acquisition costs, and investments. Except for the captions on the Consolidated Balance Sheets and Consolidated Statements of Comprehensive Income, the term loss(es) is generally used to collectively refer to both loss and loss adjustment expenses. The Company includes all of its subsidiaries in the unaudited consolidated financial statements, eliminating all significant intercompany balances and transactions during consolidation. The Company prepared the accompanying Unaudited Consolidated Balance Sheet as of March 31, 2017, with the Audited Consolidated Balance Sheet amounts as of December 31, 2016, presented for comparative purposes, and the related Unaudited Consolidated Statements of Comprehensive Income and Statements of Cash Flows in accordance with the instructions of Article 10-01 of Regulation S-X. In compliance with those instructions, the Company has omitted certain information and footnote disclosures normally included in annual consolidated financial statements prepared in accordance with GAAP, though management believes the disclosures made herein are sufficient to ensure that the information presented is not misleading. The results of operations and cash flows as of the end of the interim periods reported herein do not necessarily indicate the results we may experience for the remainder of the year or for any other future period. The Company believes that the unaudited consolidated interim financial statements include all the normal recurring adjustments necessary to fairly present the Unaudited Consolidated Balance Sheet as of March 31, 2017, the Unaudited Consolidated Statements of Comprehensive Income and the Unaudited Consolidated Statements of Cash Flows for all periods presented. The unaudited consolidated interim financial statements and footnotes should be read in conjunction with the consolidated financial statements and footnotes in the audited Consolidated Financial Statements for the year ended December 31, 2016. 3. Summary of Accounting Policies (a) Changes to significant accounting policies The Company has made no material changes to its significant accounting policies as reported in the Audited Financial Statements as of December 31, 2016. (b) Fair value assumptions The carrying amounts for the following financial instrument categories approximate their fair values at March 31, 2017 and December 31, 2016, because of their short-term nature: cash and cash equivalents, accrued investment income, premiums receivable, reinsurance recoverable, reinsurance payable, other assets, and other liabilities. (c) Accounting Pronouncements In June 2016, the FASB issued Accounting Standards Update No. 2016-13, Financial Instruments- Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (ASU 2016-13). This update is intended to replace the incurred loss impairment methodology in current GAAP with a method that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. ASU

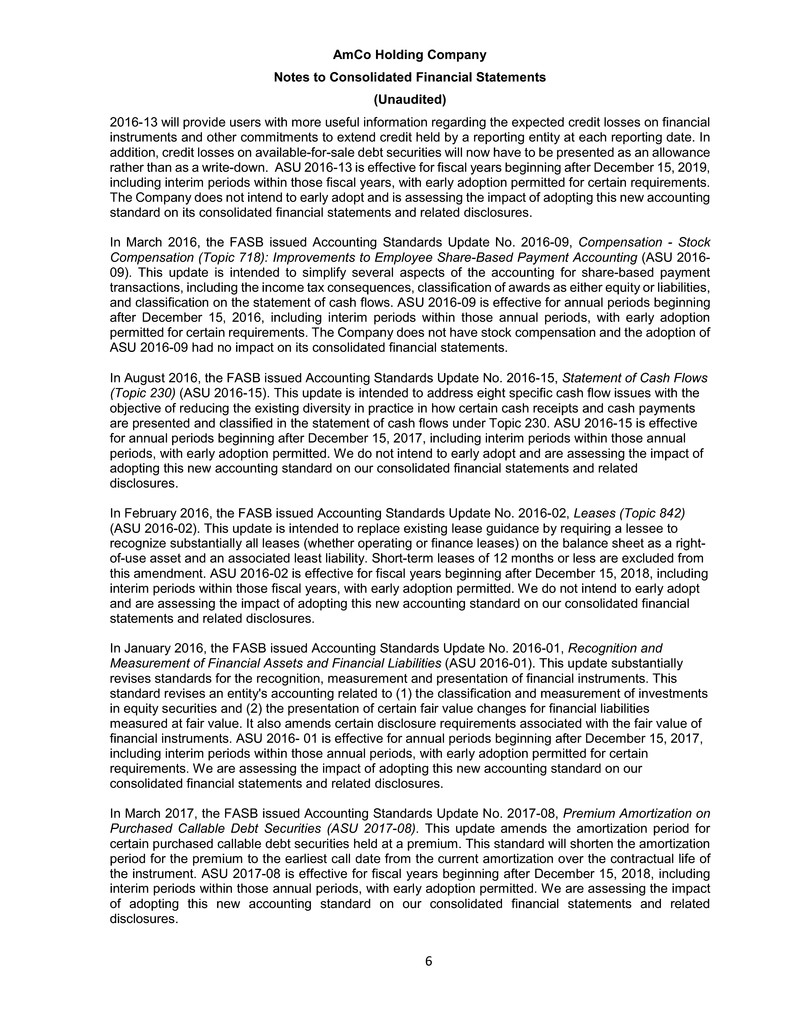

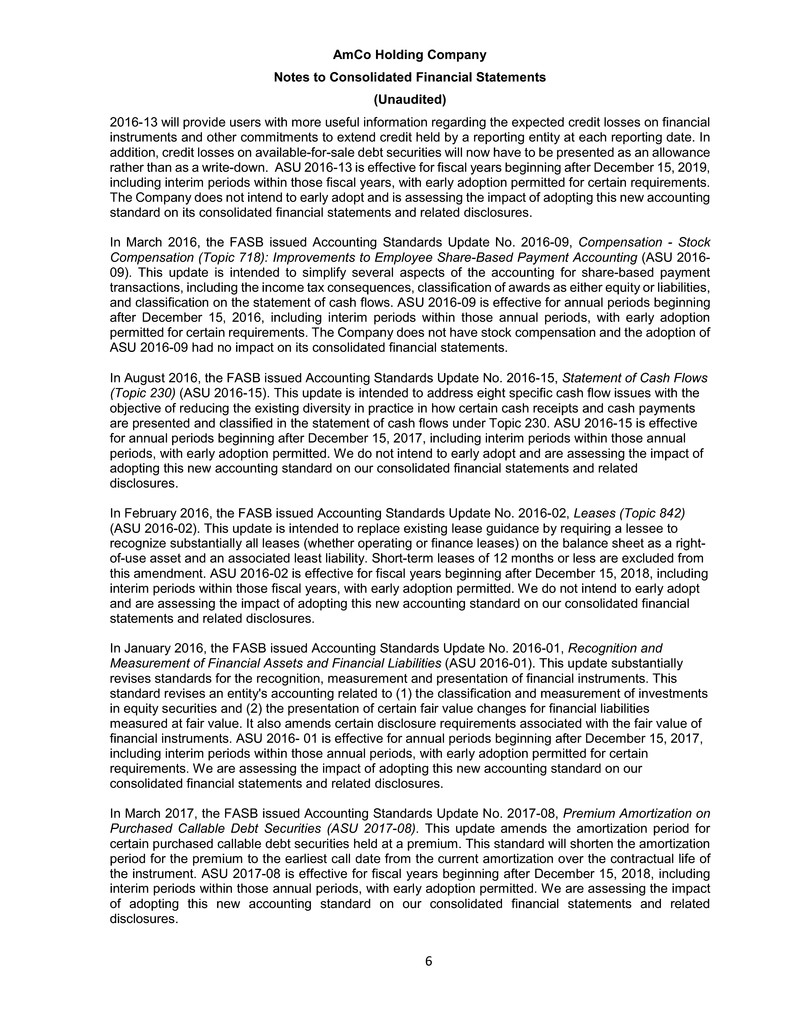

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 6 2016-13 will provide users with more useful information regarding the expected credit losses on financial instruments and other commitments to extend credit held by a reporting entity at each reporting date. In addition, credit losses on available-for-sale debt securities will now have to be presented as an allowance rather than as a write-down. ASU 2016-13 is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years, with early adoption permitted for certain requirements. The Company does not intend to early adopt and is assessing the impact of adopting this new accounting standard on its consolidated financial statements and related disclosures. In March 2016, the FASB issued Accounting Standards Update No. 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (ASU 2016- 09). This update is intended to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. ASU 2016-09 is effective for annual periods beginning after December 15, 2016, including interim periods within those annual periods, with early adoption permitted for certain requirements. The Company does not have stock compensation and the adoption of ASU 2016-09 had no impact on its consolidated financial statements. In August 2016, the FASB issued Accounting Standards Update No. 2016-15, Statement of Cash Flows (Topic 230) (ASU 2016-15). This update is intended to address eight specific cash flow issues with the objective of reducing the existing diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows under Topic 230. ASU 2016-15 is effective for annual periods beginning after December 15, 2017, including interim periods within those annual periods, with early adoption permitted. We do not intend to early adopt and are assessing the impact of adopting this new accounting standard on our consolidated financial statements and related disclosures. In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases (Topic 842) (ASU 2016-02). This update is intended to replace existing lease guidance by requiring a lessee to recognize substantially all leases (whether operating or finance leases) on the balance sheet as a right- of-use asset and an associated least liability. Short-term leases of 12 months or less are excluded from this amendment. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, with early adoption permitted. We do not intend to early adopt and are assessing the impact of adopting this new accounting standard on our consolidated financial statements and related disclosures. In January 2016, the FASB issued Accounting Standards Update No. 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities (ASU 2016-01). This update substantially revises standards for the recognition, measurement and presentation of financial instruments. This standard revises an entity's accounting related to (1) the classification and measurement of investments in equity securities and (2) the presentation of certain fair value changes for financial liabilities measured at fair value. It also amends certain disclosure requirements associated with the fair value of financial instruments. ASU 2016- 01 is effective for annual periods beginning after December 15, 2017, including interim periods within those annual periods, with early adoption permitted for certain requirements. We are assessing the impact of adopting this new accounting standard on our consolidated financial statements and related disclosures. In March 2017, the FASB issued Accounting Standards Update No. 2017-08, Premium Amortization on Purchased Callable Debt Securities (ASU 2017-08). This update amends the amortization period for certain purchased callable debt securities held at a premium. This standard will shorten the amortization period for the premium to the earliest call date from the current amortization over the contractual life of the instrument. ASU 2017-08 is effective for fiscal years beginning after December 15, 2018, including interim periods within those annual periods, with early adoption permitted. We are assessing the impact of adopting this new accounting standard on our consolidated financial statements and related disclosures.

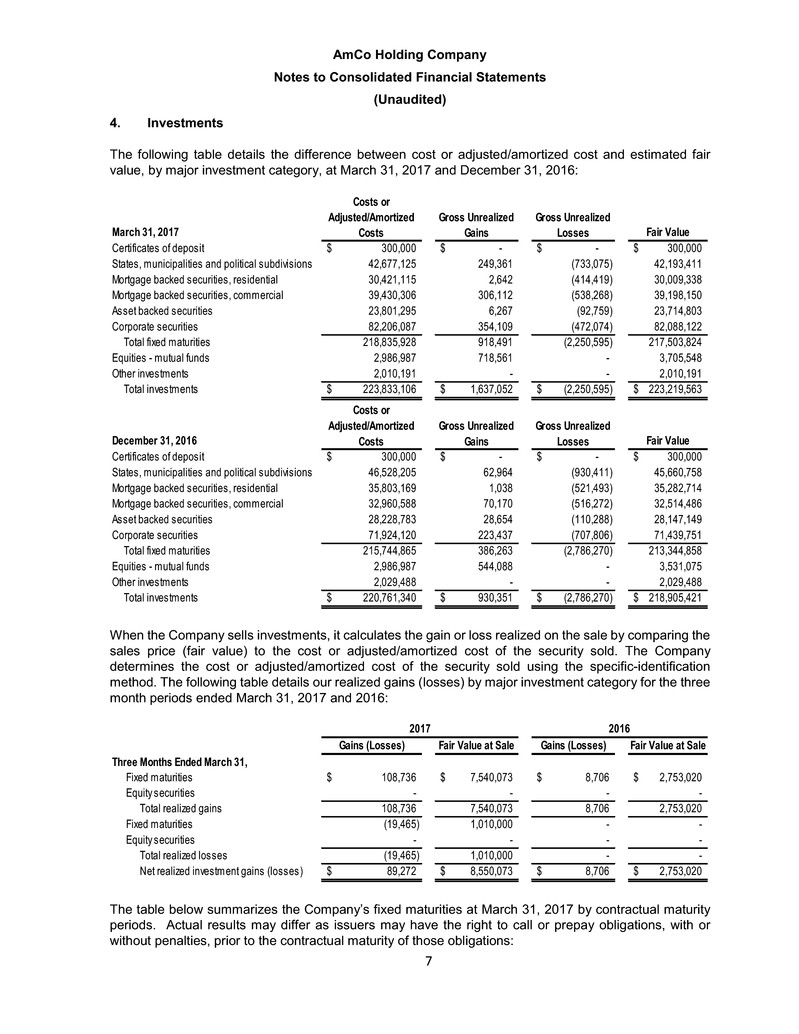

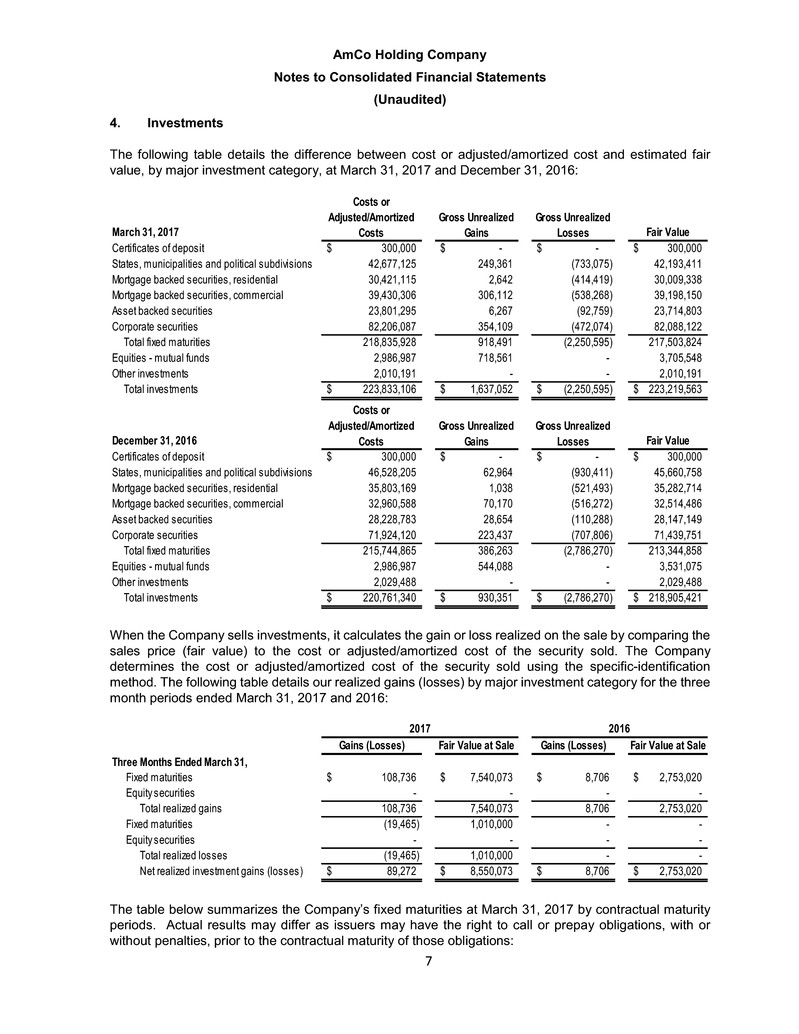

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 7 4. Investments The following table details the difference between cost or adjusted/amortized cost and estimated fair value, by major investment category, at March 31, 2017 and December 31, 2016: March 31, 2017 Fair Value Certificates of deposit 300,000$ -$ -$ 300,000$ States, municipalities and political subdivisions 42,677,125 249,361 (733,075) 42,193,411 Mortgage backed securities, residential 30,421,115 2,642 (414,419) 30,009,338 Mortgage backed securities, commercial 39,430,306 306,112 (538,268) 39,198,150 Asset backed securities 23,801,295 6,267 (92,759) 23,714,803 Corporate securities 82,206,087 354,109 (472,074) 82,088,122 Total fixed maturities 218,835,928 918,491 (2,250,595) 217,503,824 Equities - mutual funds 2,986,987 718,561 - 3,705,548 Other investments 2,010,191 - - 2,010,191 Total investments 223,833,106$ 1,637,052$ (2,250,595)$ 223,219,563$ December 31, 2016 Fair Value Certificates of deposit 300,000$ -$ -$ 300,000$ States, municipalities and political subdivisions 46,528,205 62,964 (930,411) 45,660,758 Mortgage backed securities, residential 35,803,169 1,038 (521,493) 35,282,714 Mortgage backed securities, commercial 32,960,588 70,170 (516,272) 32,514,486 Asset backed securities 28,228,783 28,654 (110,288) 28,147,149 Corporate securities 71,924,120 223,437 (707,806) 71,439,751 Total fixed maturities 215,744,865 386,263 (2,786,270) 213,344,858 Equities - mutual funds 2,986,987 544,088 - 3,531,075 Other investments 2,029,488 - - 2,029,488 Total investments 220,761,340$ 930,351$ (2,786,270)$ 218,905,421$ Gross Unrealized Losses Gross Unrealized Losses Gross Unrealized Gains Gross Unrealized Gains Costs or Adjusted/Amortized Costs Costs or Adjusted/Amortized Costs When the Company sells investments, it calculates the gain or loss realized on the sale by comparing the sales price (fair value) to the cost or adjusted/amortized cost of the security sold. The Company determines the cost or adjusted/amortized cost of the security sold using the specific-identification method. The following table details our realized gains (losses) by major investment category for the three month periods ended March 31, 2017 and 2016: Gains (Losses) Fair Value at Sale Gains (Losses) Fair Value at Sale Three Months Ended March 31, Fixed maturities 108,736$ 7,540,073$ 8,706$ 2,753,020$ Equity securities - - - - Total realized gains 108,736 7,540,073 8,706 2,753,020 Fixed maturities (19,465) 1,010,000 - - Equity securities - - - - Total realized losses (19,465) 1,010,000 - - Net realized investment gains (losses) 89,272$ 8,550,073$ 8,706$ 2,753,020$ 20162017 The table below summarizes the Company’s fixed maturities at March 31, 2017 by contractual maturity periods. Actual results may differ as issuers may have the right to call or prepay obligations, with or without penalties, prior to the contractual maturity of those obligations:

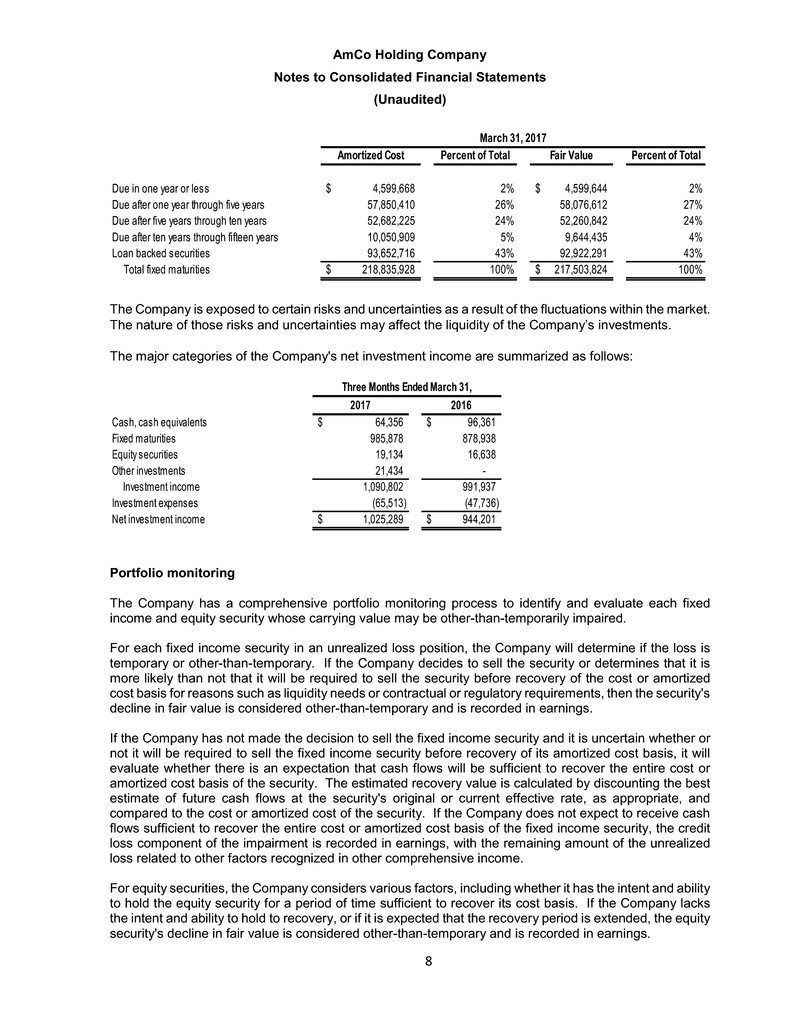

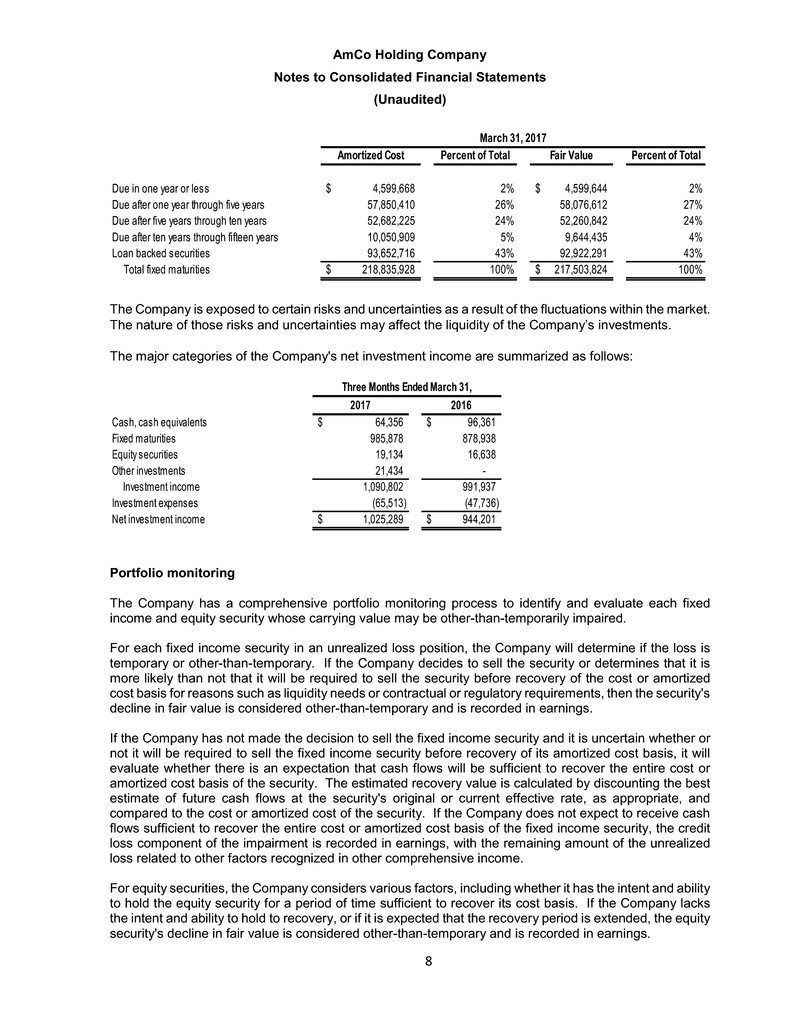

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 8 Amortized Cost Percent of Total Fair Value Percent of Total Due in one year or less 4,599,668$ 2% 4,599,644$ 2% Due after one year through five years 57,850,410 26% 58,076,612 27% Due after five years through ten years 52,682,225 24% 52,260,842 24% Due after ten years through fifteen years 10,050,909 5% 9,644,435 4% Loan backed securities 93,652,716 43% 92,922,291 43% Total fixed maturities 218,835,928$ 100% 217,503,824$ 100% March 31, 2017 The Company is exposed to certain risks and uncertainties as a result of the fluctuations within the market. The nature of those risks and uncertainties may affect the liquidity of the Company’s investments. The major categories of the Company's net investment income are summarized as follows: 2017 2016 Cash, cash equivalents 64,356$ 96,361$ Fixed maturities 985,878 878,938 Equity securities 19,134 16,638 Other investments 21,434 - Investment income 1,090,802 991,937 Investment expenses (65,513) (47,736) Net investment income 1,025,289$ 944,201$ Three Months Ended March 31, Portfolio monitoring The Company has a comprehensive portfolio monitoring process to identify and evaluate each fixed income and equity security whose carrying value may be other-than-temporarily impaired. For each fixed income security in an unrealized loss position, the Company will determine if the loss is temporary or other-than-temporary. If the Company decides to sell the security or determines that it is more likely than not that it will be required to sell the security before recovery of the cost or amortized cost basis for reasons such as liquidity needs or contractual or regulatory requirements, then the security's decline in fair value is considered other-than-temporary and is recorded in earnings. If the Company has not made the decision to sell the fixed income security and it is uncertain whether or not it will be required to sell the fixed income security before recovery of its amortized cost basis, it will evaluate whether there is an expectation that cash flows will be sufficient to recover the entire cost or amortized cost basis of the security. The estimated recovery value is calculated by discounting the best estimate of future cash flows at the security's original or current effective rate, as appropriate, and compared to the cost or amortized cost of the security. If the Company does not expect to receive cash flows sufficient to recover the entire cost or amortized cost basis of the fixed income security, the credit loss component of the impairment is recorded in earnings, with the remaining amount of the unrealized loss related to other factors recognized in other comprehensive income. For equity securities, the Company considers various factors, including whether it has the intent and ability to hold the equity security for a period of time sufficient to recover its cost basis. If the Company lacks the intent and ability to hold to recovery, or if it is expected that the recovery period is extended, the equity security's decline in fair value is considered other-than-temporary and is recorded in earnings.

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 9 The portfolio monitoring process includes a quarterly review of all securities to identify instances where the fair value of a security compared to its cost or amortized cost (for fixed income securities) or cost (for equity securities) is below established thresholds. The process also includes the monitoring of other impairment indicators such as ratings, ratings downgrades and payment defaults. The securities identified, in addition to other securities for which there may be a concern, are evaluated for potential other-than-temporary impairment using all reasonably available information relevant to the collectability or recovery of the security. Inherent in the evaluation of other-than-temporary impairment for these fixed income and equity securities are assumptions and estimates about the financial condition and future earnings potential of the issue or issuer. Some of the factors that may be considered in evaluating whether a decline in fair value is other-than-temporary are: (1) the financial condition, near-term and long- term prospects of the issue or issuer, including relevant industry specific market conditions and trends, geographic location and implications of rating agency actions and offering prices; (2) the specific reasons that a security is in an unrealized loss position, including overall market conditions which could affect liquidity; and (3) the length of time and extent to which the fair value has been less than amortized cost or cost. The following table presents an aging of the Company’s unrealized investment losses by investment class: Fair Value Gross Unrealized Losses Fair Value Gross Unrealized Losses March 31, 2017 Asset backed 17,764,027$ (77,178)$ 1,384,621$ (15,580)$ CMO 20,935,150 (461,306) 530,268 (2,433) Corporate 29,983,053 (461,050) 1,288,313 (13,664) Mortgage backed 32,377,878 (484,533) 860,207 (5,063) Muni 15,600,992 (729,788) - - Total fixed maturities 116,661,100 (2,213,855) 4,063,409 (36,740) Mutual Funds - - - - Total 116,661,100$ (2,213,855)$ 4,063,409$ (36,740)$ December 31, 2016 Asset backed 8,809,086$ (101,226)$ 1,241,650$ (9,062)$ CMO 25,462,651 (515,643) 255,305 (628) Corporate 36,095,053 (690,205) 1,284,790 (17,601) Mortgage backed 28,871,439 (511,527) 2,207,815 (9,966) Muni 33,612,836 (930,412) - - Total fixed maturities 132,851,065 (2,749,013) 4,989,560 (37,257) Mutual Funds - - - - Total 132,851,065$ (2,749,013)$ 4,989,560$ (37,257)$ Twelve Months or MoreLess Than Twelve Months The Company determined during its quarterly evaluations of securities for impairment that no investments held in debt and equity securities reflected an unrealized loss position that would be considered other- than-temporarily impaired. The issuers of the Company’s debt securities continue to make interest payments on a timely basis and there is no intent to sell nor is it likely that the Company would be required to sell the debt securities before the recovery of its amortized cost basis. The near-term prospects of all the issuers of the equity securities currently held indicate that the company could recover its cost basis. During the three months ended March 31, 2017 and 2016, the Company recorded no other-than- temporary impairment charges.

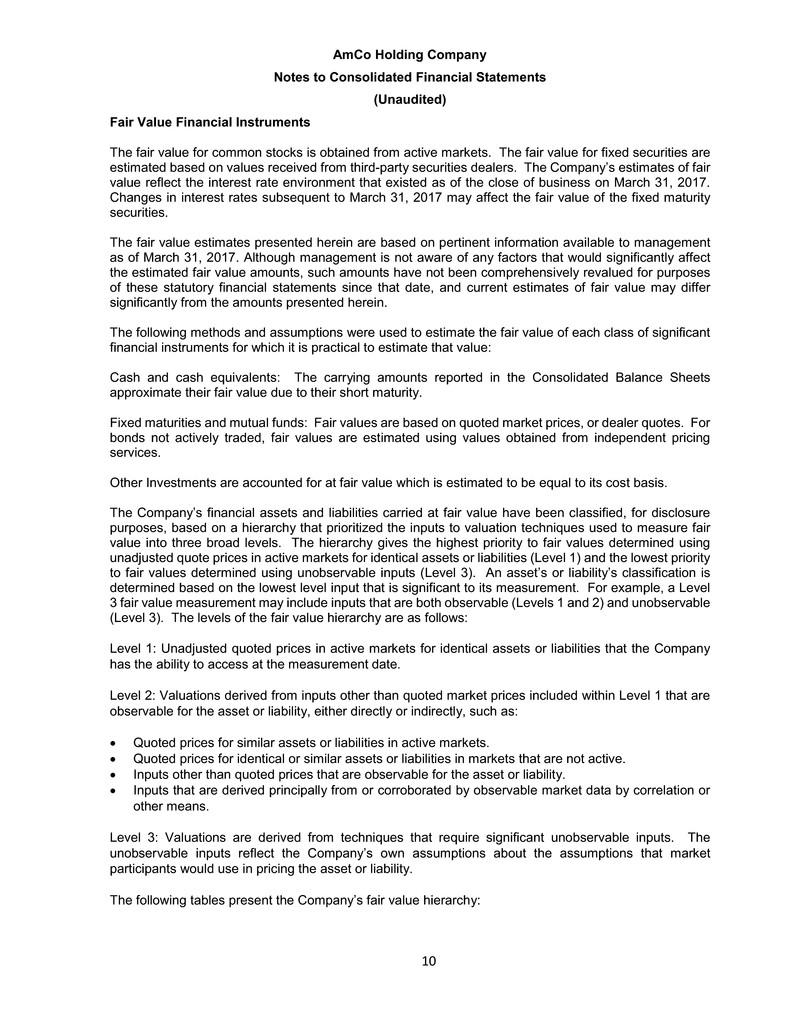

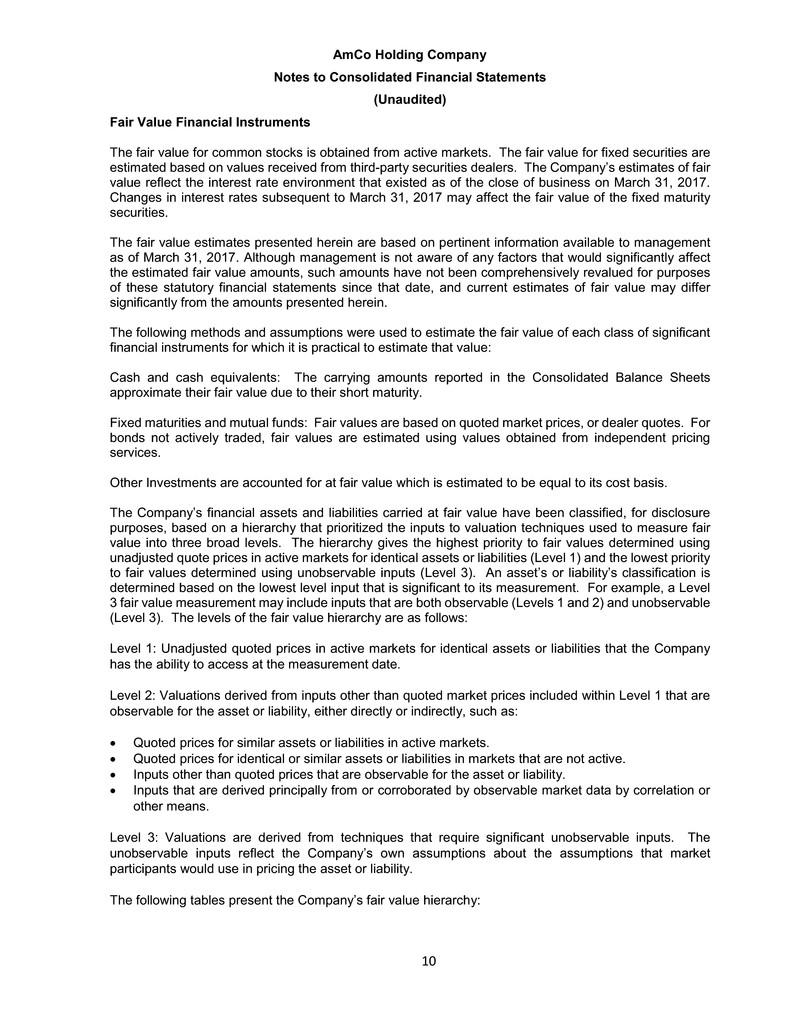

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 10 Fair Value Financial Instruments The fair value for common stocks is obtained from active markets. The fair value for fixed securities are estimated based on values received from third-party securities dealers. The Company’s estimates of fair value reflect the interest rate environment that existed as of the close of business on March 31, 2017. Changes in interest rates subsequent to March 31, 2017 may affect the fair value of the fixed maturity securities. The fair value estimates presented herein are based on pertinent information available to management as of March 31, 2017. Although management is not aware of any factors that would significantly affect the estimated fair value amounts, such amounts have not been comprehensively revalued for purposes of these statutory financial statements since that date, and current estimates of fair value may differ significantly from the amounts presented herein. The following methods and assumptions were used to estimate the fair value of each class of significant financial instruments for which it is practical to estimate that value: Cash and cash equivalents: The carrying amounts reported in the Consolidated Balance Sheets approximate their fair value due to their short maturity. Fixed maturities and mutual funds: Fair values are based on quoted market prices, or dealer quotes. For bonds not actively traded, fair values are estimated using values obtained from independent pricing services. Other Investments are accounted for at fair value which is estimated to be equal to its cost basis. The Company’s financial assets and liabilities carried at fair value have been classified, for disclosure purposes, based on a hierarchy that prioritized the inputs to valuation techniques used to measure fair value into three broad levels. The hierarchy gives the highest priority to fair values determined using unadjusted quote prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to fair values determined using unobservable inputs (Level 3). An asset’s or liability’s classification is determined based on the lowest level input that is significant to its measurement. For example, a Level 3 fair value measurement may include inputs that are both observable (Levels 1 and 2) and unobservable (Level 3). The levels of the fair value hierarchy are as follows: Level 1: Unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. Level 2: Valuations derived from inputs other than quoted market prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, such as: Quoted prices for similar assets or liabilities in active markets. Quoted prices for identical or similar assets or liabilities in markets that are not active. Inputs other than quoted prices that are observable for the asset or liability. Inputs that are derived principally from or corroborated by observable market data by correlation or other means. Level 3: Valuations are derived from techniques that require significant unobservable inputs. The unobservable inputs reflect the Company’s own assumptions about the assumptions that market participants would use in pricing the asset or liability. The following tables present the Company’s fair value hierarchy:

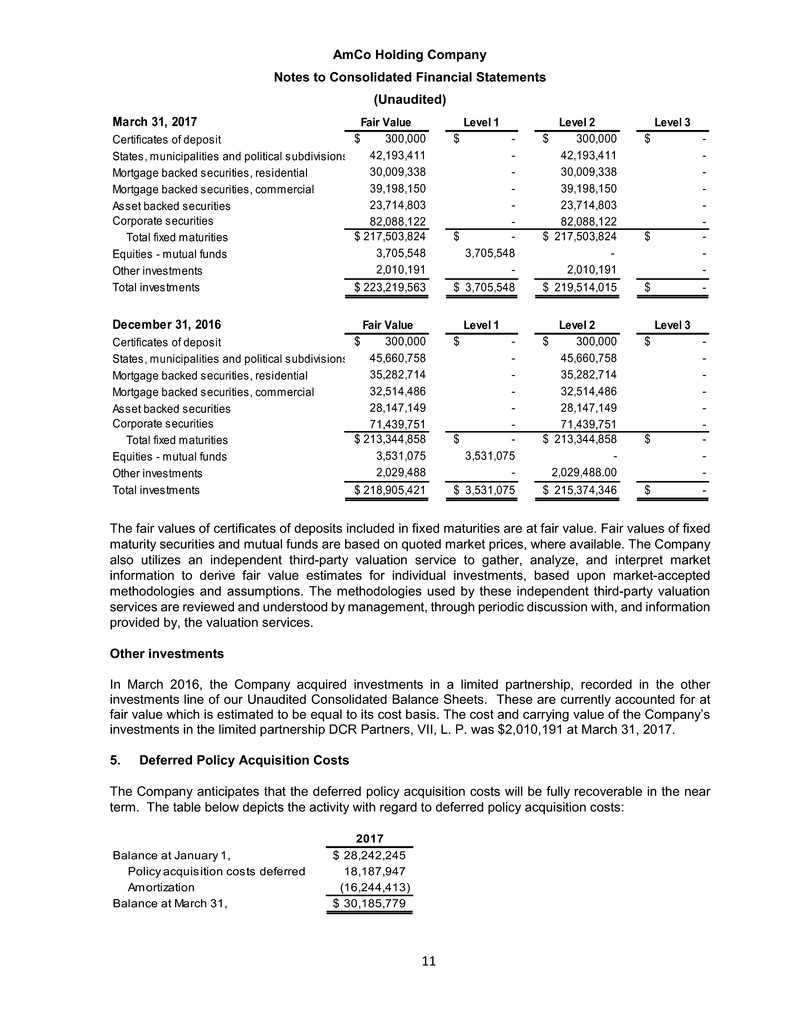

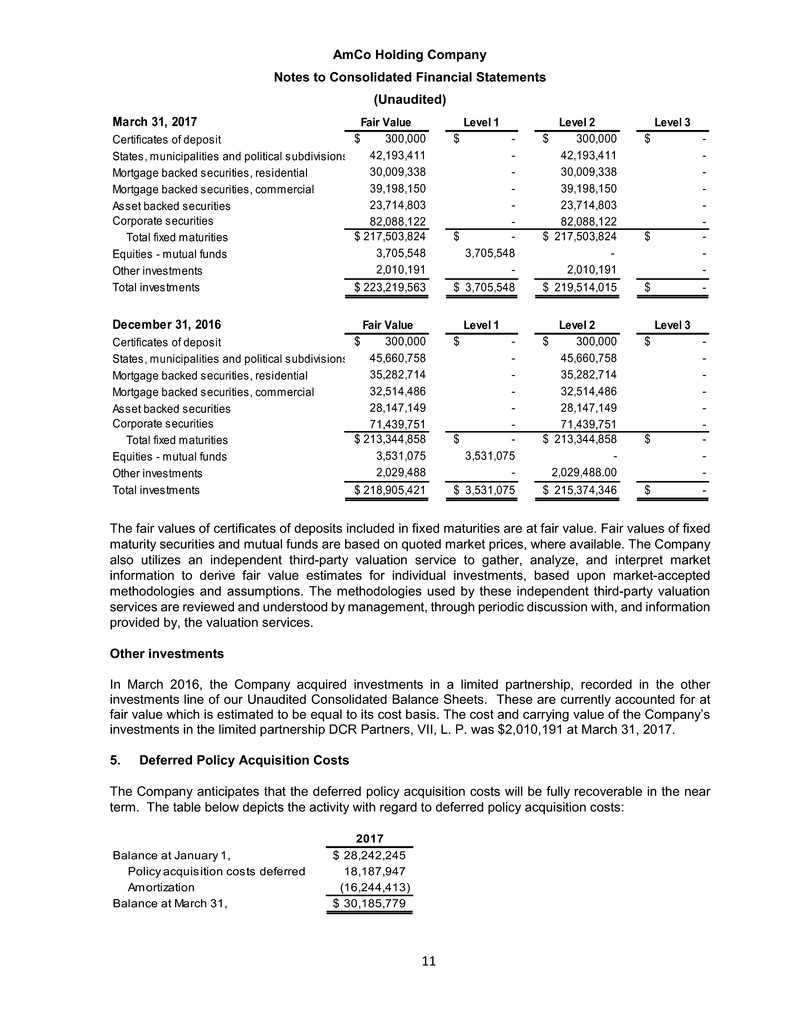

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 11 March 31, 2017 Fair Value Level 1 Level 2 Level 3 Certificates of deposit $ 300,000 $ - $ 300,000 $ - States, municipalities and political subdivisions 42,193,411 - 42,193,411 - Mortgage backed securities, residential 30,009,338 - 30,009,338 - Mortgage backed securities, commercial 39,198,150 - 39,198,150 - Asset backed securities 23,714,803 - 23,714,803 - Corporate securities 82,088,122 - 82,088,122 - Total fixed maturities $ 217,503,824 $ - $ 217,503,824 $ - Equities - mutual funds 3,705,548 3,705,548 - - Other investments 2,010,191 - 2,010,191 - Total investments $ 223,219,563 $ 3,705,548 $ 219,514,015 $ - December 31, 2016 Fair Value Level 1 Level 2 Level 3 Certificates of deposit $ 300,000 $ - $ 300,000 $ - States, municipalities and political subdivisions 45,660,758 - 45,660,758 - Mortgage backed securities, residential 35,282,714 - 35,282,714 - Mortgage backed securities, commercial 32,514,486 - 32,514,486 - Asset backed securities 28,147,149 - 28,147,149 - Corporate securities 71,439,751 - 71,439,751 - Total fixed maturities $ 213,344,858 $ - $ 213,344,858 $ - Equities - mutual funds 3,531,075 3,531,075 - - Other investments 2,029,488 - 2,029,488.00 - Total investments $ 218,905,421 $ 3,531,075 $ 215,374,346 $ - The fair values of certificates of deposits included in fixed maturities are at fair value. Fair values of fixed maturity securities and mutual funds are based on quoted market prices, where available. The Company also utilizes an independent third-party valuation service to gather, analyze, and interpret market information to derive fair value estimates for individual investments, based upon market-accepted methodologies and assumptions. The methodologies used by these independent third-party valuation services are reviewed and understood by management, through periodic discussion with, and information provided by, the valuation services. Other investments In March 2016, the Company acquired investments in a limited partnership, recorded in the other investments line of our Unaudited Consolidated Balance Sheets. These are currently accounted for at fair value which is estimated to be equal to its cost basis. The cost and carrying value of the Company’s investments in the limited partnership DCR Partners, VII, L. P. was $2,010,191 at March 31, 2017. 5. Deferred Policy Acquisition Costs The Company anticipates that the deferred policy acquisition costs will be fully recoverable in the near term. The table below depicts the activity with regard to deferred policy acquisition costs: 2017 Balance at January 1, 28,242,245$ Policy acquisition costs deferred 18,187,947 Amortization (16,244,413) Balance at March 31, 30,185,779$

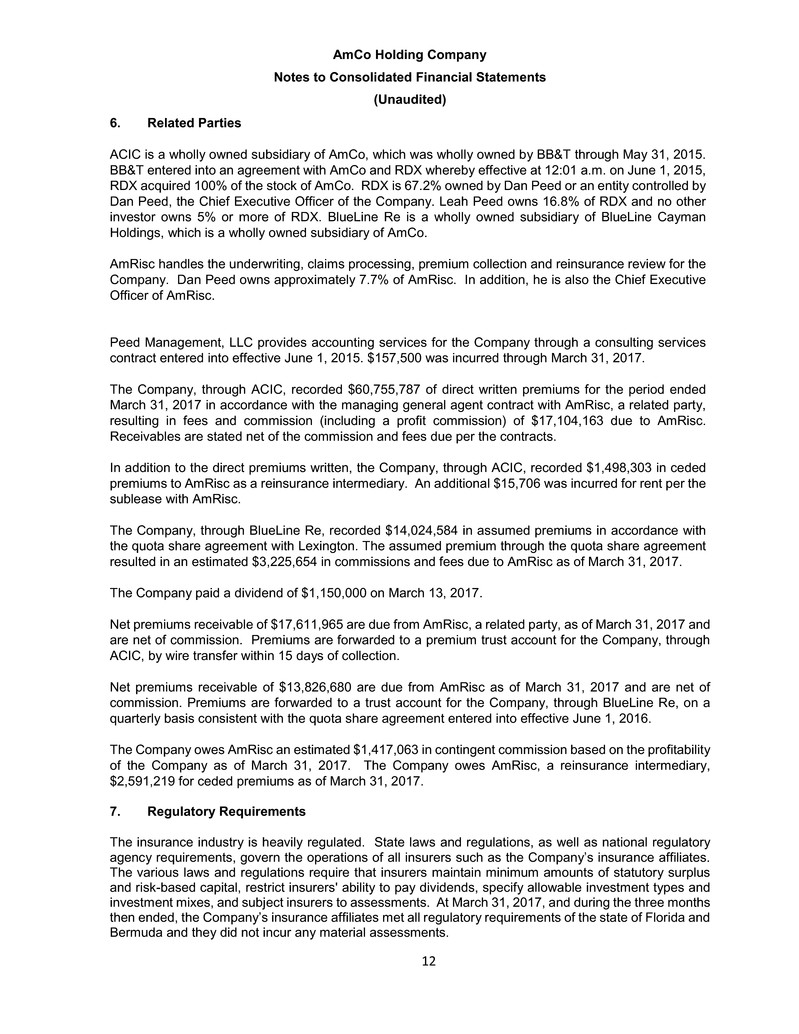

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 12 6. Related Parties ACIC is a wholly owned subsidiary of AmCo, which was wholly owned by BB&T through May 31, 2015. BB&T entered into an agreement with AmCo and RDX whereby effective at 12:01 a.m. on June 1, 2015, RDX acquired 100% of the stock of AmCo. RDX is 67.2% owned by Dan Peed or an entity controlled by Dan Peed, the Chief Executive Officer of the Company. Leah Peed owns 16.8% of RDX and no other investor owns 5% or more of RDX. BlueLine Re is a wholly owned subsidiary of BlueLine Cayman Holdings, which is a wholly owned subsidiary of AmCo. AmRisc handles the underwriting, claims processing, premium collection and reinsurance review for the Company. Dan Peed owns approximately 7.7% of AmRisc. In addition, he is also the Chief Executive Officer of AmRisc. Peed Management, LLC provides accounting services for the Company through a consulting services contract entered into effective June 1, 2015. $157,500 was incurred through March 31, 2017. The Company, through ACIC, recorded $60,755,787 of direct written premiums for the period ended March 31, 2017 in accordance with the managing general agent contract with AmRisc, a related party, resulting in fees and commission (including a profit commission) of $17,104,163 due to AmRisc. Receivables are stated net of the commission and fees due per the contracts. In addition to the direct premiums written, the Company, through ACIC, recorded $1,498,303 in ceded premiums to AmRisc as a reinsurance intermediary. An additional $15,706 was incurred for rent per the sublease with AmRisc. The Company, through BlueLine Re, recorded $14,024,584 in assumed premiums in accordance with the quota share agreement with Lexington. The assumed premium through the quota share agreement resulted in an estimated $3,225,654 in commissions and fees due to AmRisc as of March 31, 2017. The Company paid a dividend of $1,150,000 on March 13, 2017. Net premiums receivable of $17,611,965 are due from AmRisc, a related party, as of March 31, 2017 and are net of commission. Premiums are forwarded to a premium trust account for the Company, through ACIC, by wire transfer within 15 days of collection. Net premiums receivable of $13,826,680 are due from AmRisc as of March 31, 2017 and are net of commission. Premiums are forwarded to a trust account for the Company, through BlueLine Re, on a quarterly basis consistent with the quota share agreement entered into effective June 1, 2016. The Company owes AmRisc an estimated $1,417,063 in contingent commission based on the profitability of the Company as of March 31, 2017. The Company owes AmRisc, a reinsurance intermediary, $2,591,219 for ceded premiums as of March 31, 2017. 7. Regulatory Requirements The insurance industry is heavily regulated. State laws and regulations, as well as national regulatory agency requirements, govern the operations of all insurers such as the Company’s insurance affiliates. The various laws and regulations require that insurers maintain minimum amounts of statutory surplus and risk-based capital, restrict insurers' ability to pay dividends, specify allowable investment types and investment mixes, and subject insurers to assessments. At March 31, 2017, and during the three months then ended, the Company’s insurance affiliates met all regulatory requirements of the state of Florida and Bermuda and they did not incur any material assessments.

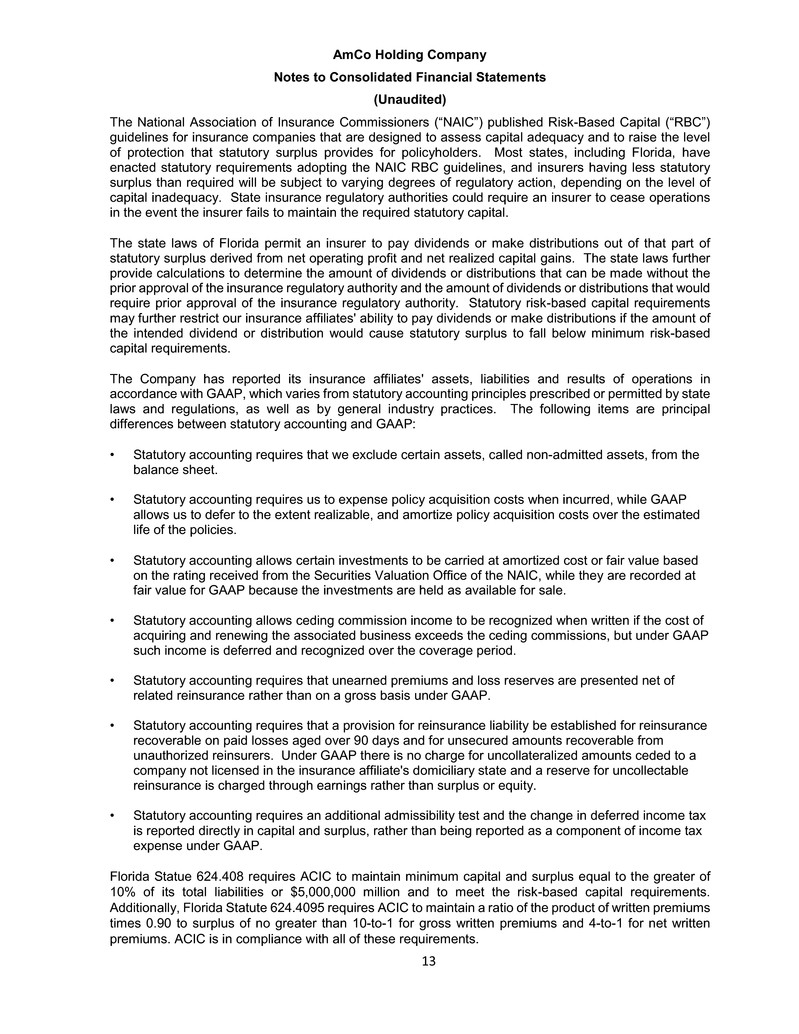

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 13 The National Association of Insurance Commissioners (“NAIC”) published Risk-Based Capital (“RBC”) guidelines for insurance companies that are designed to assess capital adequacy and to raise the level of protection that statutory surplus provides for policyholders. Most states, including Florida, have enacted statutory requirements adopting the NAIC RBC guidelines, and insurers having less statutory surplus than required will be subject to varying degrees of regulatory action, depending on the level of capital inadequacy. State insurance regulatory authorities could require an insurer to cease operations in the event the insurer fails to maintain the required statutory capital. The state laws of Florida permit an insurer to pay dividends or make distributions out of that part of statutory surplus derived from net operating profit and net realized capital gains. The state laws further provide calculations to determine the amount of dividends or distributions that can be made without the prior approval of the insurance regulatory authority and the amount of dividends or distributions that would require prior approval of the insurance regulatory authority. Statutory risk-based capital requirements may further restrict our insurance affiliates' ability to pay dividends or make distributions if the amount of the intended dividend or distribution would cause statutory surplus to fall below minimum risk-based capital requirements. The Company has reported its insurance affiliates' assets, liabilities and results of operations in accordance with GAAP, which varies from statutory accounting principles prescribed or permitted by state laws and regulations, as well as by general industry practices. The following items are principal differences between statutory accounting and GAAP: • Statutory accounting requires that we exclude certain assets, called non-admitted assets, from the balance sheet. • Statutory accounting requires us to expense policy acquisition costs when incurred, while GAAP allows us to defer to the extent realizable, and amortize policy acquisition costs over the estimated life of the policies. • Statutory accounting allows certain investments to be carried at amortized cost or fair value based on the rating received from the Securities Valuation Office of the NAIC, while they are recorded at fair value for GAAP because the investments are held as available for sale. • Statutory accounting allows ceding commission income to be recognized when written if the cost of acquiring and renewing the associated business exceeds the ceding commissions, but under GAAP such income is deferred and recognized over the coverage period. • Statutory accounting requires that unearned premiums and loss reserves are presented net of related reinsurance rather than on a gross basis under GAAP. • Statutory accounting requires that a provision for reinsurance liability be established for reinsurance recoverable on paid losses aged over 90 days and for unsecured amounts recoverable from unauthorized reinsurers. Under GAAP there is no charge for uncollateralized amounts ceded to a company not licensed in the insurance affiliate's domiciliary state and a reserve for uncollectable reinsurance is charged through earnings rather than surplus or equity. • Statutory accounting requires an additional admissibility test and the change in deferred income tax is reported directly in capital and surplus, rather than being reported as a component of income tax expense under GAAP. Florida Statue 624.408 requires ACIC to maintain minimum capital and surplus equal to the greater of 10% of its total liabilities or $5,000,000 million and to meet the risk-based capital requirements. Additionally, Florida Statute 624.4095 requires ACIC to maintain a ratio of the product of written premiums times 0.90 to surplus of no greater than 10-to-1 for gross written premiums and 4-to-1 for net written premiums. ACIC is in compliance with all of these requirements.

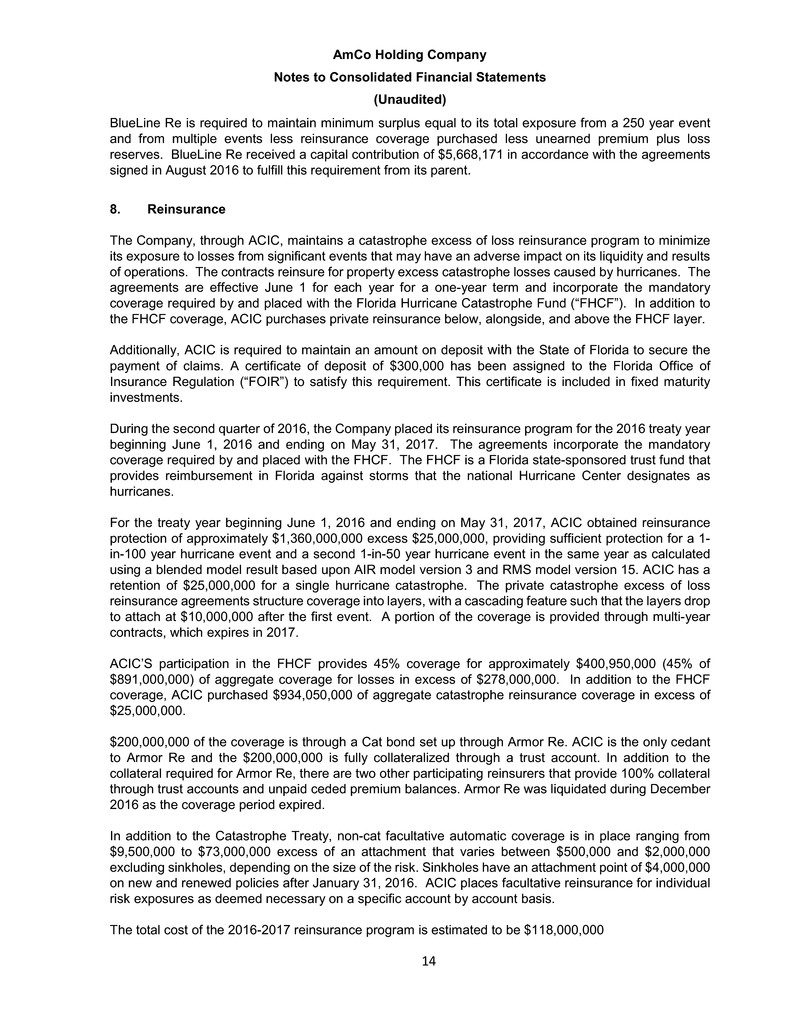

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 14 BlueLine Re is required to maintain minimum surplus equal to its total exposure from a 250 year event and from multiple events less reinsurance coverage purchased less unearned premium plus loss reserves. BlueLine Re received a capital contribution of $5,668,171 in accordance with the agreements signed in August 2016 to fulfill this requirement from its parent. 8. Reinsurance The Company, through ACIC, maintains a catastrophe excess of loss reinsurance program to minimize its exposure to losses from significant events that may have an adverse impact on its liquidity and results of operations. The contracts reinsure for property excess catastrophe losses caused by hurricanes. The agreements are effective June 1 for each year for a one-year term and incorporate the mandatory coverage required by and placed with the Florida Hurricane Catastrophe Fund (“FHCF”). In addition to the FHCF coverage, ACIC purchases private reinsurance below, alongside, and above the FHCF layer. Additionally, ACIC is required to maintain an amount on deposit with the State of Florida to secure the payment of claims. A certificate of deposit of $300,000 has been assigned to the Florida Office of Insurance Regulation (“FOIR”) to satisfy this requirement. This certificate is included in fixed maturity investments. During the second quarter of 2016, the Company placed its reinsurance program for the 2016 treaty year beginning June 1, 2016 and ending on May 31, 2017. The agreements incorporate the mandatory coverage required by and placed with the FHCF. The FHCF is a Florida state-sponsored trust fund that provides reimbursement in Florida against storms that the national Hurricane Center designates as hurricanes. For the treaty year beginning June 1, 2016 and ending on May 31, 2017, ACIC obtained reinsurance protection of approximately $1,360,000,000 excess $25,000,000, providing sufficient protection for a 1- in-100 year hurricane event and a second 1-in-50 year hurricane event in the same year as calculated using a blended model result based upon AIR model version 3 and RMS model version 15. ACIC has a retention of $25,000,000 for a single hurricane catastrophe. The private catastrophe excess of loss reinsurance agreements structure coverage into layers, with a cascading feature such that the layers drop to attach at $10,000,000 after the first event. A portion of the coverage is provided through multi-year contracts, which expires in 2017. ACIC’S participation in the FHCF provides 45% coverage for approximately $400,950,000 (45% of $891,000,000) of aggregate coverage for losses in excess of $278,000,000. In addition to the FHCF coverage, ACIC purchased $934,050,000 of aggregate catastrophe reinsurance coverage in excess of $25,000,000. $200,000,000 of the coverage is through a Cat bond set up through Armor Re. ACIC is the only cedant to Armor Re and the $200,000,000 is fully collateralized through a trust account. In addition to the collateral required for Armor Re, there are two other participating reinsurers that provide 100% collateral through trust accounts and unpaid ceded premium balances. Armor Re was liquidated during December 2016 as the coverage period expired. In addition to the Catastrophe Treaty, non-cat facultative automatic coverage is in place ranging from $9,500,000 to $73,000,000 excess of an attachment that varies between $500,000 and $2,000,000 excluding sinkholes, depending on the size of the risk. Sinkholes have an attachment point of $4,000,000 on new and renewed policies after January 31, 2016. ACIC places facultative reinsurance for individual risk exposures as deemed necessary on a specific account by account basis. The total cost of the 2016-2017 reinsurance program is estimated to be $118,000,000

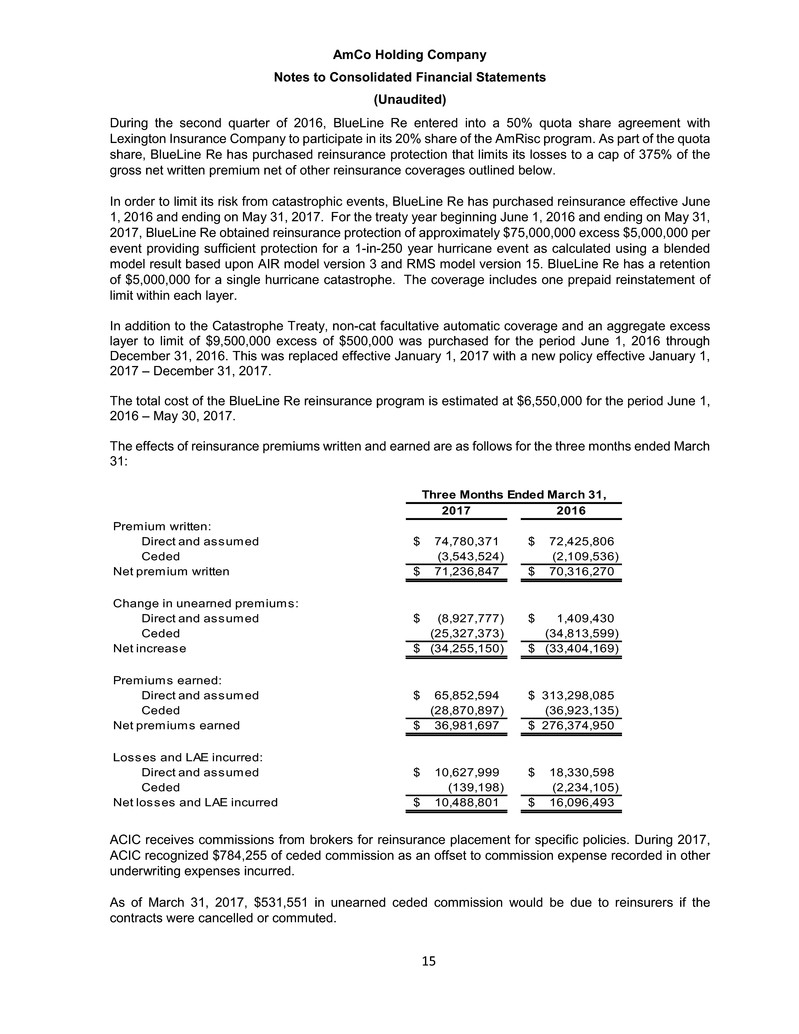

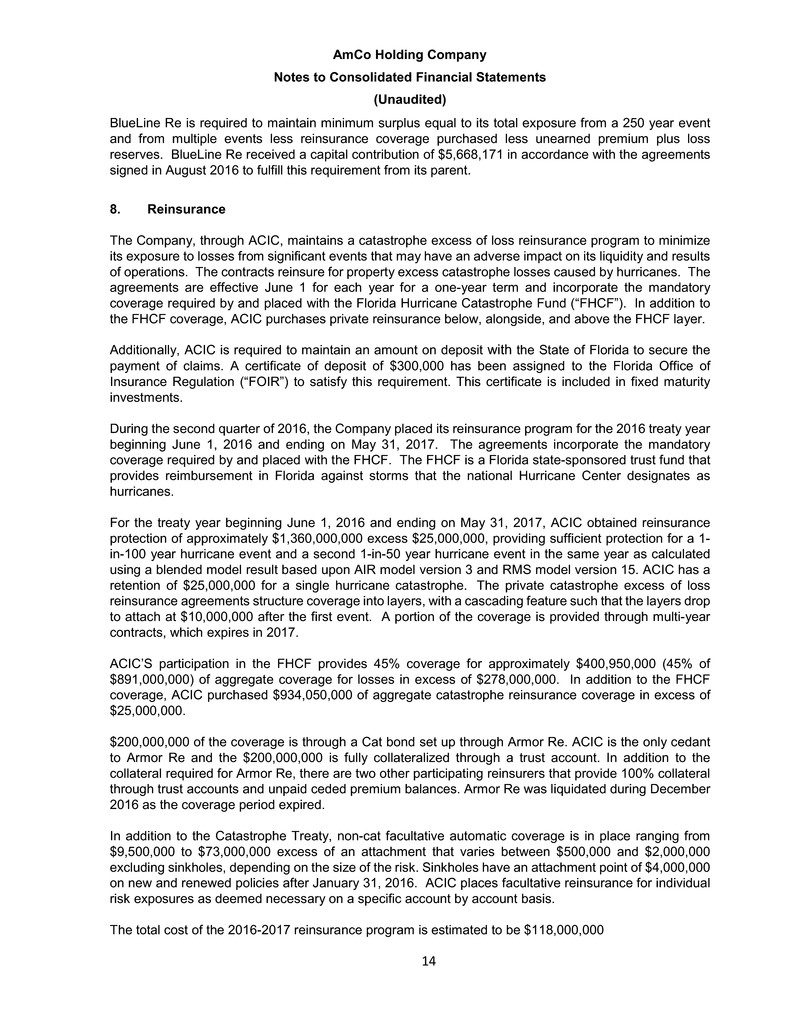

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 15 During the second quarter of 2016, BlueLine Re entered into a 50% quota share agreement with Lexington Insurance Company to participate in its 20% share of the AmRisc program. As part of the quota share, BlueLine Re has purchased reinsurance protection that limits its losses to a cap of 375% of the gross net written premium net of other reinsurance coverages outlined below. In order to limit its risk from catastrophic events, BlueLine Re has purchased reinsurance effective June 1, 2016 and ending on May 31, 2017. For the treaty year beginning June 1, 2016 and ending on May 31, 2017, BlueLine Re obtained reinsurance protection of approximately $75,000,000 excess $5,000,000 per event providing sufficient protection for a 1-in-250 year hurricane event as calculated using a blended model result based upon AIR model version 3 and RMS model version 15. BlueLine Re has a retention of $5,000,000 for a single hurricane catastrophe. The coverage includes one prepaid reinstatement of limit within each layer. In addition to the Catastrophe Treaty, non-cat facultative automatic coverage and an aggregate excess layer to limit of $9,500,000 excess of $500,000 was purchased for the period June 1, 2016 through December 31, 2016. This was replaced effective January 1, 2017 with a new policy effective January 1, 2017 – December 31, 2017. The total cost of the BlueLine Re reinsurance program is estimated at $6,550,000 for the period June 1, 2016 – May 30, 2017. The effects of reinsurance premiums written and earned are as follows for the three months ended March 31: 2017 2016 Premium written: Direct and assumed 74,780,371$ 72,425,806$ Ceded (3,543,524) (2,109,536) Net premium written 71,236,847$ 70,316,270$ Change in unearned premiums: Direct and assumed (8,927,777)$ 1,409,430$ Ceded (25,327,373) (34,813,599) Net increase (34,255,150)$ (33,404,169)$ Premiums earned: Direct and assumed 65,852,594$ 313,298,085$ Ceded (28,870,897) (36,923,135) Net premiums earned 36,981,697$ 276,374,950$ Losses and LAE incurred: Direct and assumed 10,627,999$ 18,330,598$ Ceded (139,198) (2,234,105) Net losses and LAE incurred 10,488,801$ 16,096,493$ Three Months Ended March 31, ACIC receives commissions from brokers for reinsurance placement for specific policies. During 2017, ACIC recognized $784,255 of ceded commission as an offset to commission expense recorded in other underwriting expenses incurred. As of March 31, 2017, $531,551 in unearned ceded commission would be due to reinsurers if the contracts were cancelled or commuted.

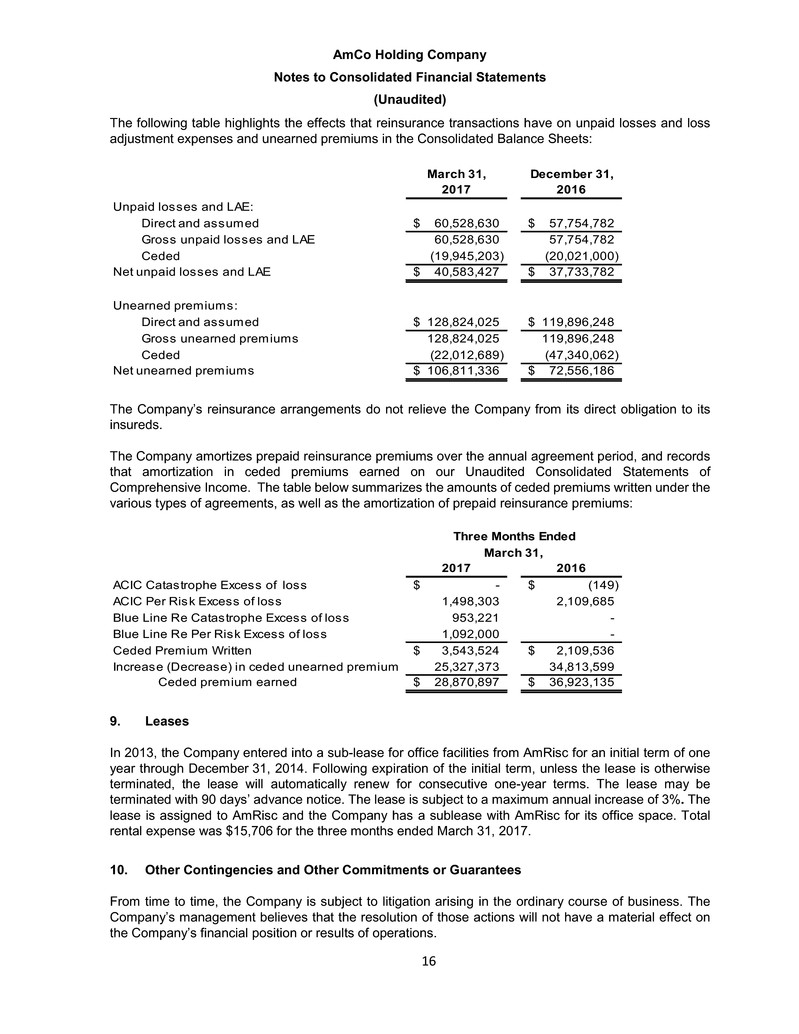

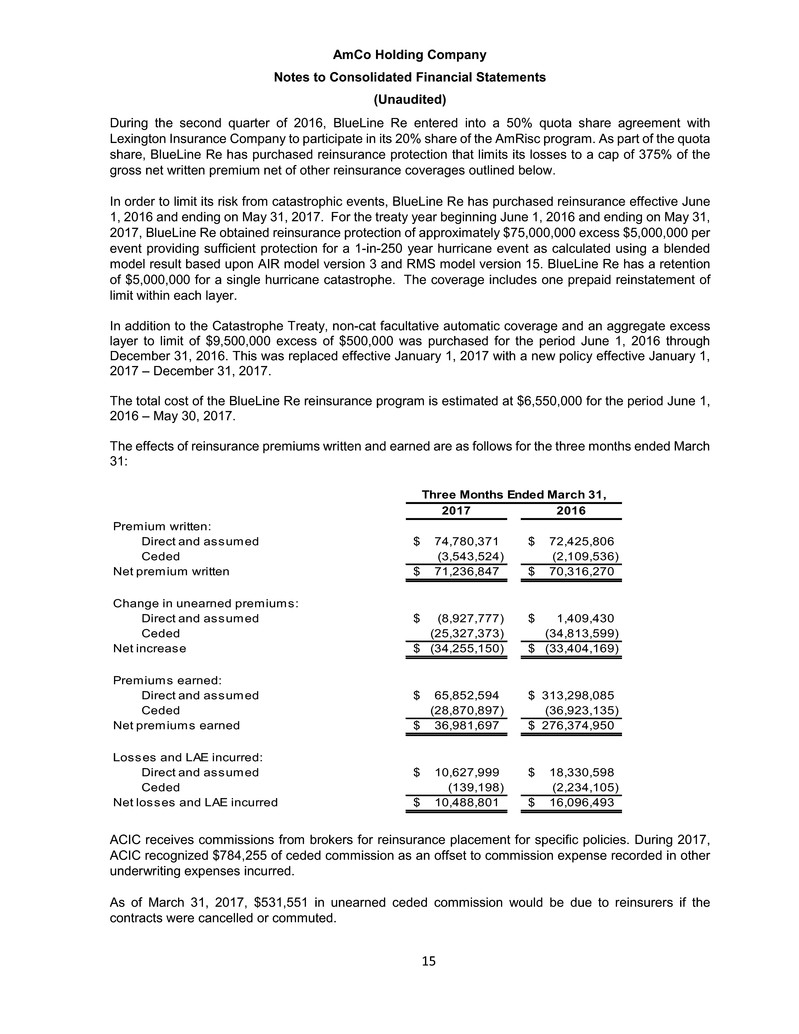

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 16 The following table highlights the effects that reinsurance transactions have on unpaid losses and loss adjustment expenses and unearned premiums in the Consolidated Balance Sheets: March 31, December 31, 2017 2016 Unpaid losses and LAE: Direct and assumed 60,528,630$ 57,754,782$ Gross unpaid losses and LAE 60,528,630 57,754,782 Ceded (19,945,203) (20,021,000) Net unpaid losses and LAE 40,583,427$ 37,733,782$ Unearned premiums: Direct and assumed 128,824,025$ 119,896,248$ Gross unearned premiums 128,824,025 119,896,248 Ceded (22,012,689) (47,340,062) Net unearned premiums 106,811,336$ 72,556,186$ The Company’s reinsurance arrangements do not relieve the Company from its direct obligation to its insureds. The Company amortizes prepaid reinsurance premiums over the annual agreement period, and records that amortization in ceded premiums earned on our Unaudited Consolidated Statements of Comprehensive Income. The table below summarizes the amounts of ceded premiums written under the various types of agreements, as well as the amortization of prepaid reinsurance premiums: 2017 2016 ACIC Catastrophe Excess of loss -$ (149)$ ACIC Per Risk Excess of loss 1,498,303 2,109,685 Blue Line Re Catastrophe Excess of loss 953,221 - Blue Line Re Per Risk Excess of loss 1,092,000 - Ceded Premium Written 3,543,524$ 2,109,536$ Increase (Decrease) in ceded unearned premium 25,327,373 34,813,599 Ceded premium earned 28,870,897$ 36,923,135$ March 31, Three Months Ended 9. Leases In 2013, the Company entered into a sub-lease for office facilities from AmRisc for an initial term of one year through December 31, 2014. Following expiration of the initial term, unless the lease is otherwise terminated, the lease will automatically renew for consecutive one-year terms. The lease may be terminated with 90 days’ advance notice. The lease is subject to a maximum annual increase of 3%. The lease is assigned to AmRisc and the Company has a sublease with AmRisc for its office space. Total rental expense was $15,706 for the three months ended March 31, 2017. 10. Other Contingencies and Other Commitments or Guarantees From time to time, the Company is subject to litigation arising in the ordinary course of business. The Company’s management believes that the resolution of those actions will not have a material effect on the Company’s financial position or results of operations.

AmCo Holding Company Notes to Consolidated Financial Statements (Unaudited) 17 11. Subsequent Events In preparation of the consolidated financial statements and related disclosures, the Company evaluated events and transactions subsequent to the balance sheet date through May 26, 2017, which is the date the consolidated financial statements were available to be issued. On August 17, 2016, the Company entered into an agreement and plan of merger by which UIHC acquired the Company from RDX through a series of mergers. The FOIR provided consent to the transaction in February 2017 and UIHC shareholder approval of the transaction occurred in February 2017. The transaction was completed on April 3, 2017.