Investor Presentation Fourth Quarter 2018 Results February 19, 2019

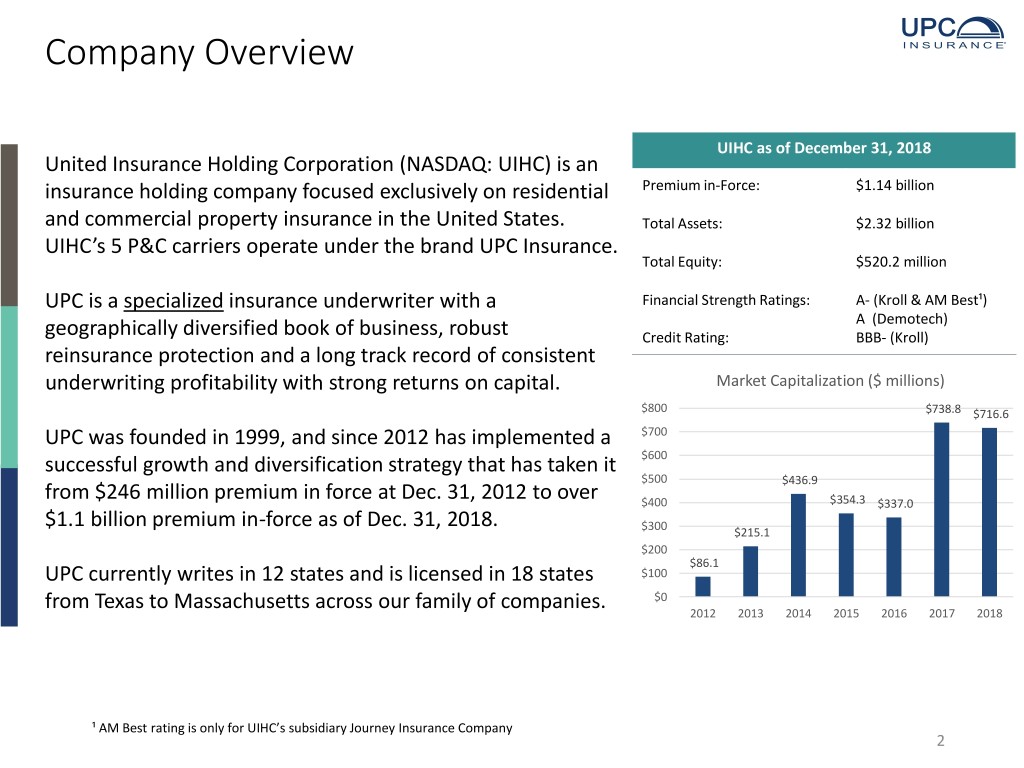

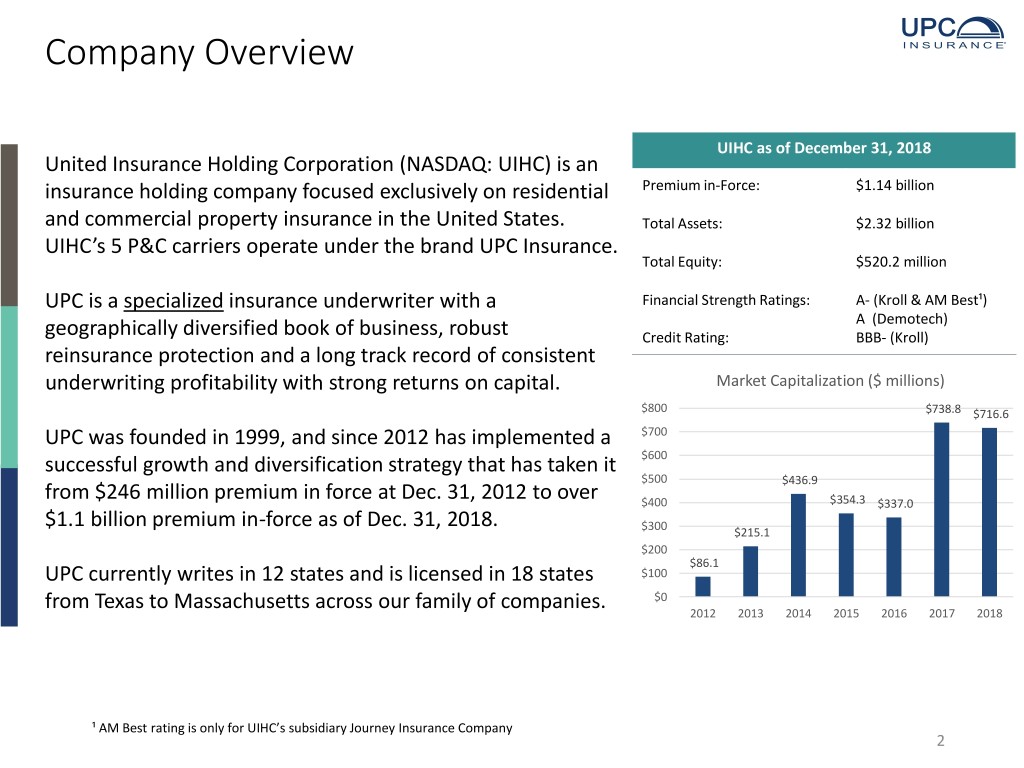

Company Overview UIHC as of December 31, 2018 United Insurance Holding Corporation (NASDAQ: UIHC) is an insurance holding company focused exclusively on residential Premium in-Force: $1.14 billion and commercial property insurance in the United States. Total Assets: $2.32 billion UIHC’s 5 P&C carriers operate under the brand UPC Insurance. Total Equity: $520.2 million UPC is a specialized insurance underwriter with a Financial Strength Ratings: A- (Kroll & AM Best¹) A (Demotech) geographically diversified book of business, robust Credit Rating: BBB- (Kroll) reinsurance protection and a long track record of consistent underwriting profitability with strong returns on capital. Market Capitalization ($ millions) $800 $738.8 $716.6 UPC was founded in 1999, and since 2012 has implemented a $700 successful growth and diversification strategy that has taken it $600 $500 $436.9 from $246 million premium in force at Dec. 31, 2012 to over $400 $354.3 $337.0 $1.1 billion premium in-force as of Dec. 31, 2018. $300 $215.1 $200 $86.1 UPC currently writes in 12 states and is licensed in 18 states $100 from Texas to Massachusetts across our family of companies. $0 2012 2013 2014 2015 2016 2017 2018 ¹ AM Best rating is only for UIHC’s subsidiary Journey Insurance Company 2

UPC’s Vision, Foundations, and Core Values OUR VISION: TO BE THE PREMIER PROVIDER OF PROPERTY INSURANCE IN CATASTROPHE-EXPOSED AREAS Our financial strength assures “A single arrow is easily broken, but our ability to pay claims not ten together.” - Japanese proverb “If you don’t trust the people you Flexible product options meet make them untrustworthy.” - Lao-Tze unique needs “You never get more from life than who you are.” - Robin Sharma Timely, fair resolution of claims “This above all: to thine own self be true.” - William Shakespeare We are easy to work with “The best time to plant a tree is 40 years ago. The second best time is today.” - Indian proverb Our sensible pricing supports “Put your head down. Keep moving everyone’s best interests forward. Never quit. You’ll be fine.” - Robert O’Neill 3

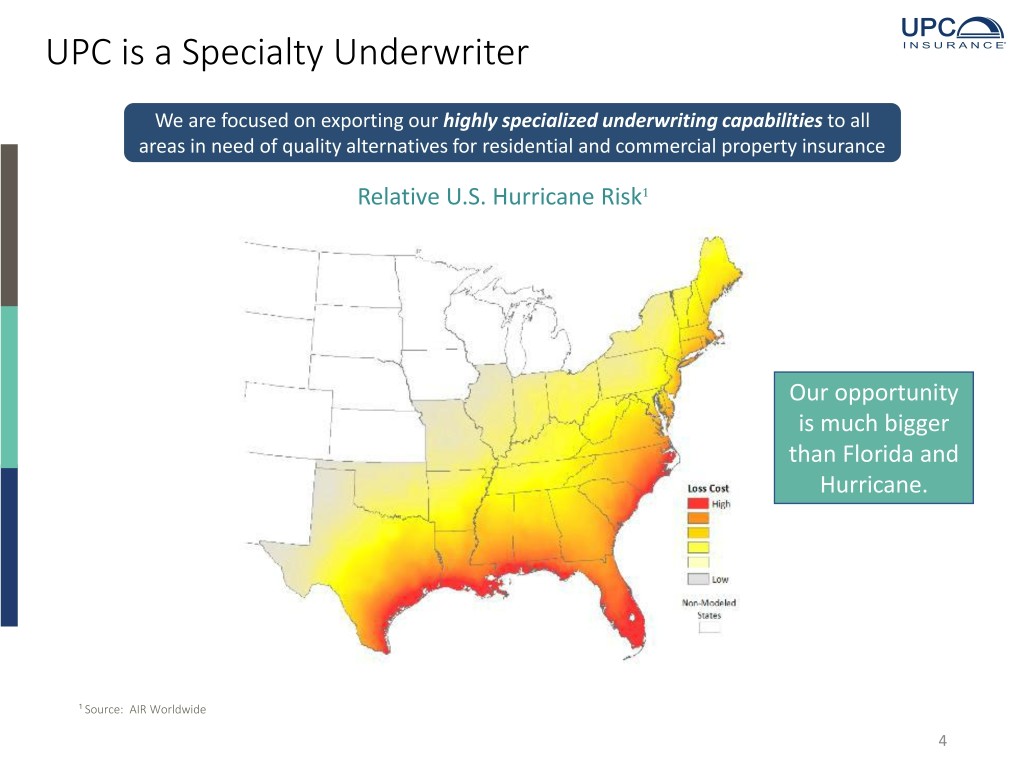

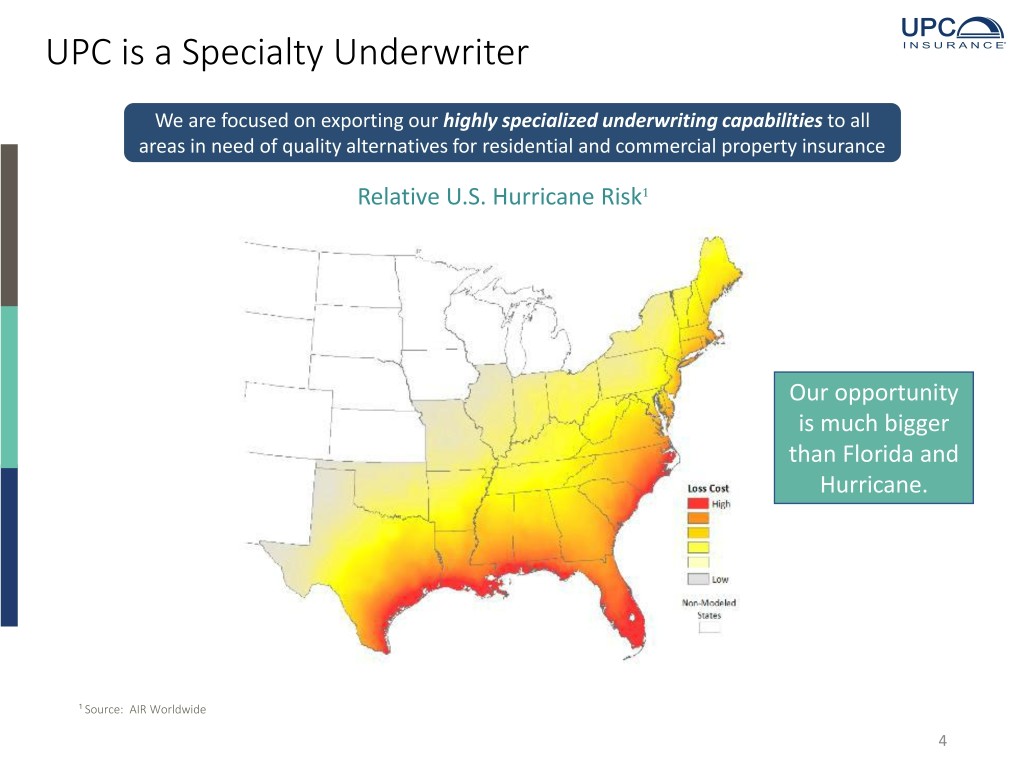

UPC is a Specialty Underwriter We are focused on exporting our highly specialized underwriting capabilities to all areas in need of quality alternatives for residential and commercial property insurance Relative U.S. Hurricane Risk¹ Our opportunity is much bigger than Florida and Hurricane. ¹ Source: AIR Worldwide 4

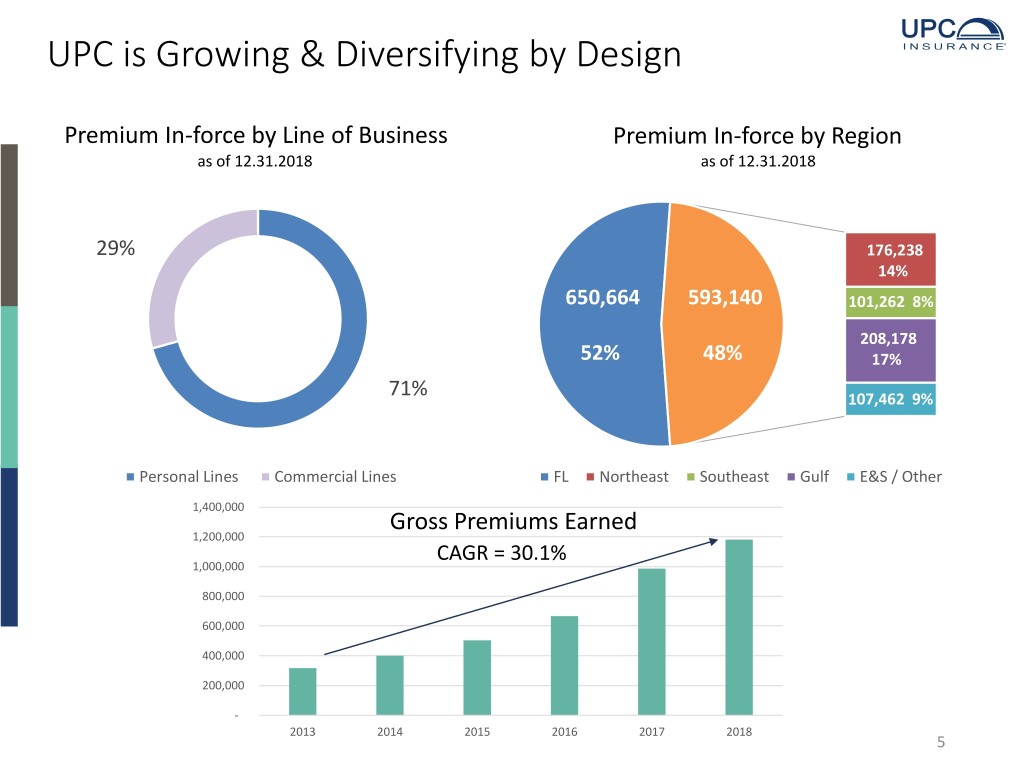

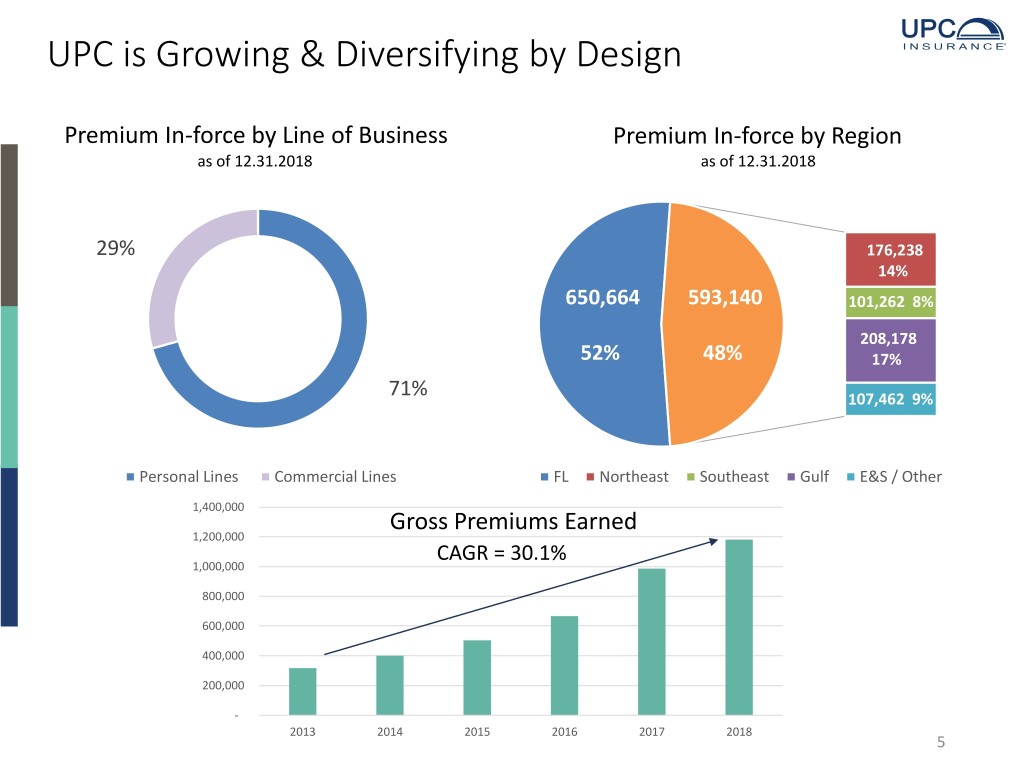

UPC is Growing & Diversifying by Design Premium In-force by Line of Business Premium In-force by Region as of 12.31.2018 as of 12.31.2018 29% 176,238 14% 650,664 593,140 101,262 8% 208,178 52% 48% 17% 71% 107,462 9% Personal Lines Commercial Lines FL Northeast Southeast Gulf E&S / Other 1,400,000 Gross Premiums Earned 1,200,000 CAGR = 30.1% 1,000,000 800,000 600,000 400,000 200,000 - 2013 2014 2015 2016 2017 2018 5

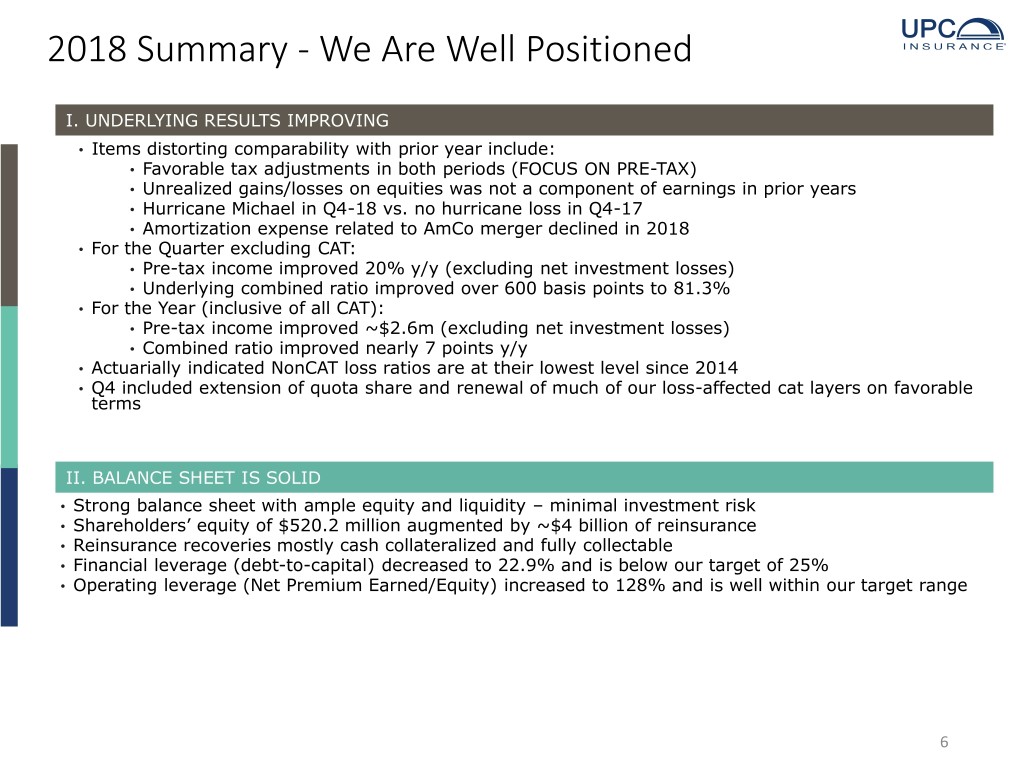

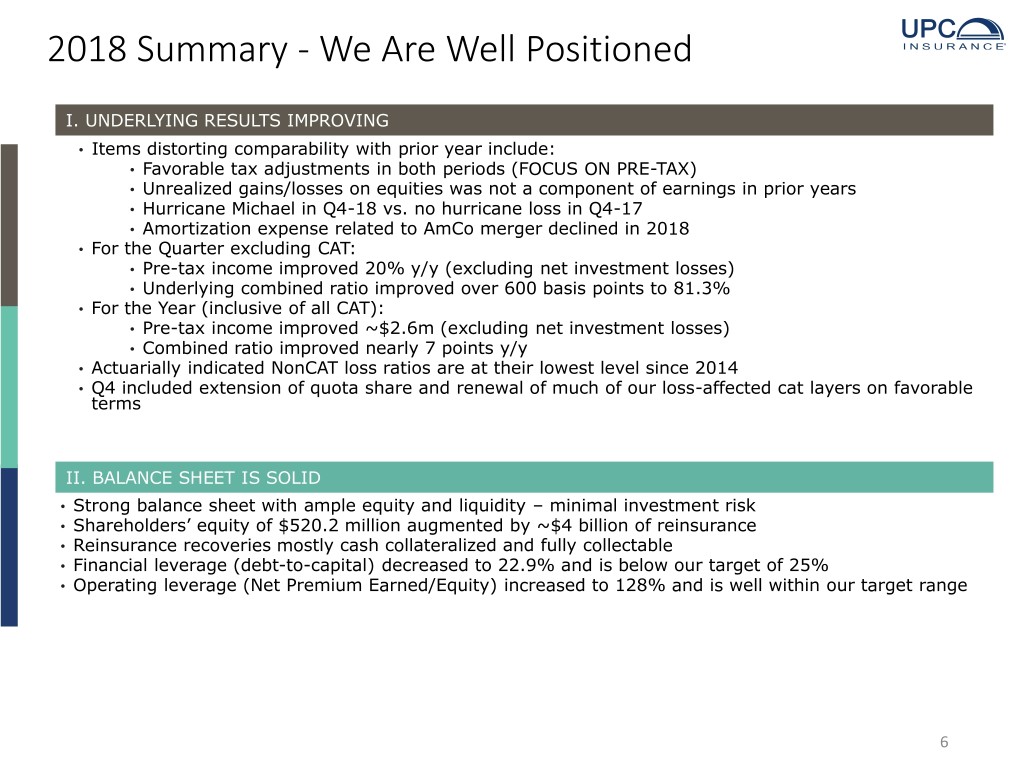

2018 Summary - We Are Well Positioned I. UNDERLYING RESULTS IMPROVING • Items distorting comparability with prior year include: • Favorable tax adjustments in both periods (FOCUS ON PRE-TAX) • Unrealized gains/losses on equities was not a component of earnings in prior years • Hurricane Michael in Q4-18 vs. no hurricane loss in Q4-17 • Amortization expense related to AmCo merger declined in 2018 • For the Quarter excluding CAT: • Pre-tax income improved 20% y/y (excluding net investment losses) • Underlying combined ratio improved over 600 basis points to 81.3% • For the Year (inclusive of all CAT): • Pre-tax income improved ~$2.6m (excluding net investment losses) • Combined ratio improved nearly 7 points y/y • Actuarially indicated NonCAT loss ratios are at their lowest level since 2014 • Q4 included extension of quota share and renewal of much of our loss-affected cat layers on favorable terms II. BALANCE SHEET IS SOLID • Strong balance sheet with ample equity and liquidity – minimal investment risk • Shareholders’ equity of $520.2 million augmented by ~$4 billion of reinsurance • Reinsurance recoveries mostly cash collateralized and fully collectable • Financial leverage (debt-to-capital) decreased to 22.9% and is below our target of 25% • Operating leverage (Net Premium Earned/Equity) increased to 128% and is well within our target range 6

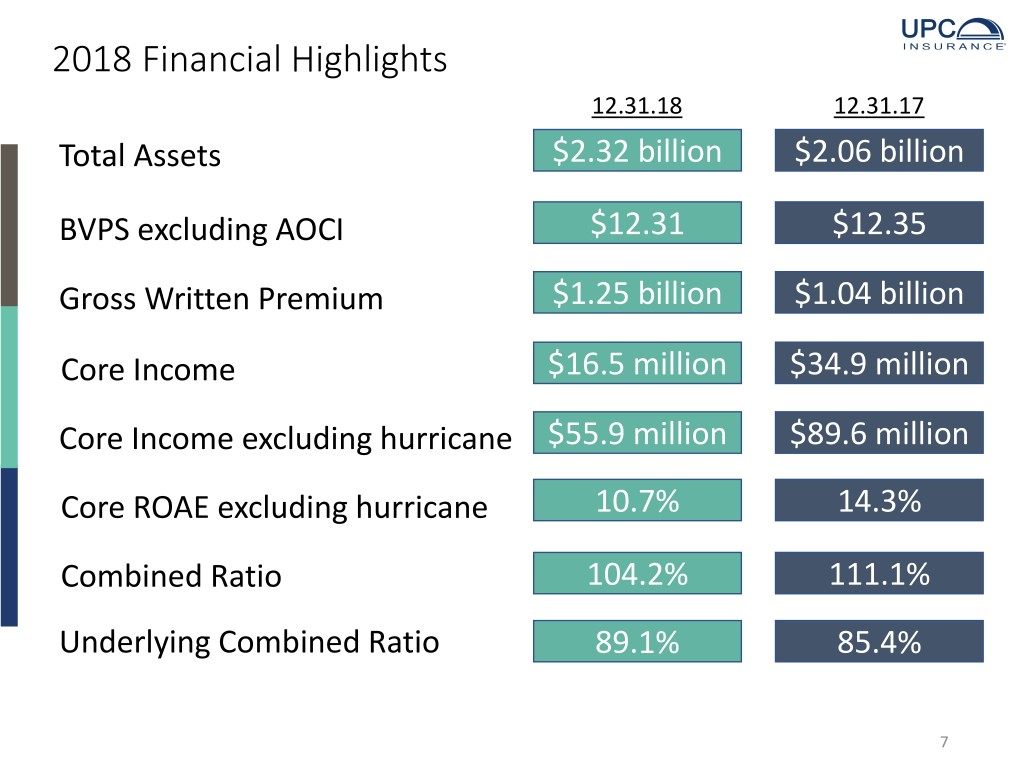

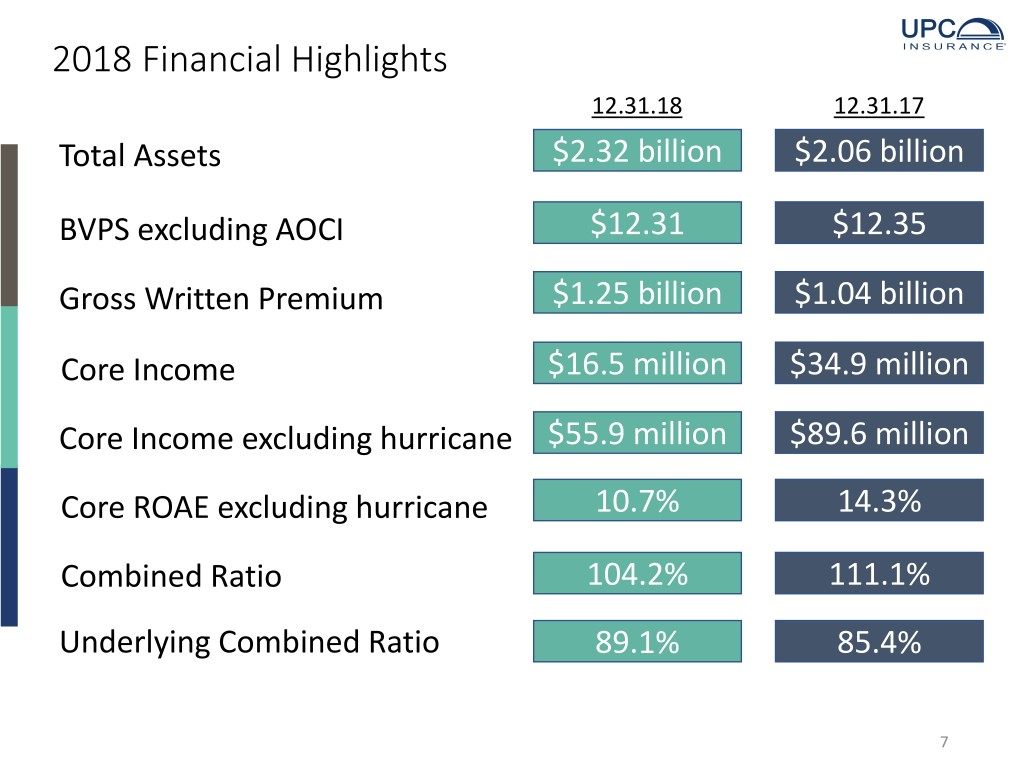

2018 Financial Highlights 12.31.18 12.31.17 Total Assets $2.32 billion $2.06 billion BVPS excluding AOCI $12.31 $12.35 Gross Written Premium $1.25 billion $1.04 billion Core Income $16.5 million $34.9 million Core Income excluding hurricane $55.9 million $89.6 million Core ROAE excluding hurricane 10.7% 14.3% Combined Ratio 104.2% 111.1% Underlying Combined Ratio 89.1% 85.4% 7

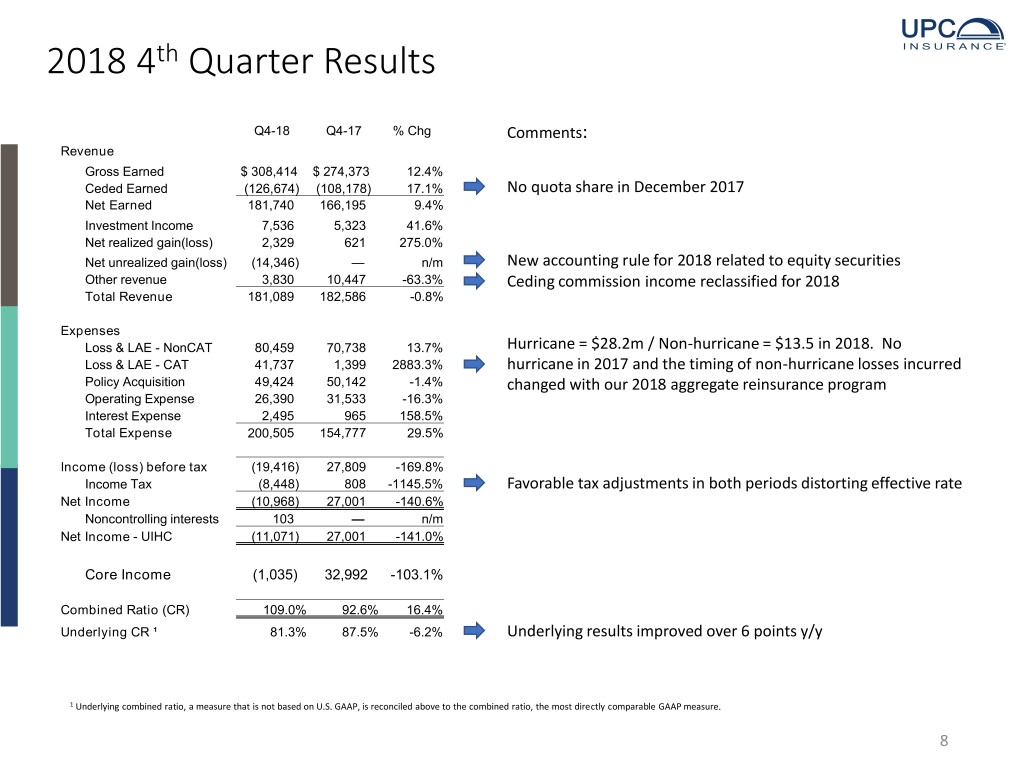

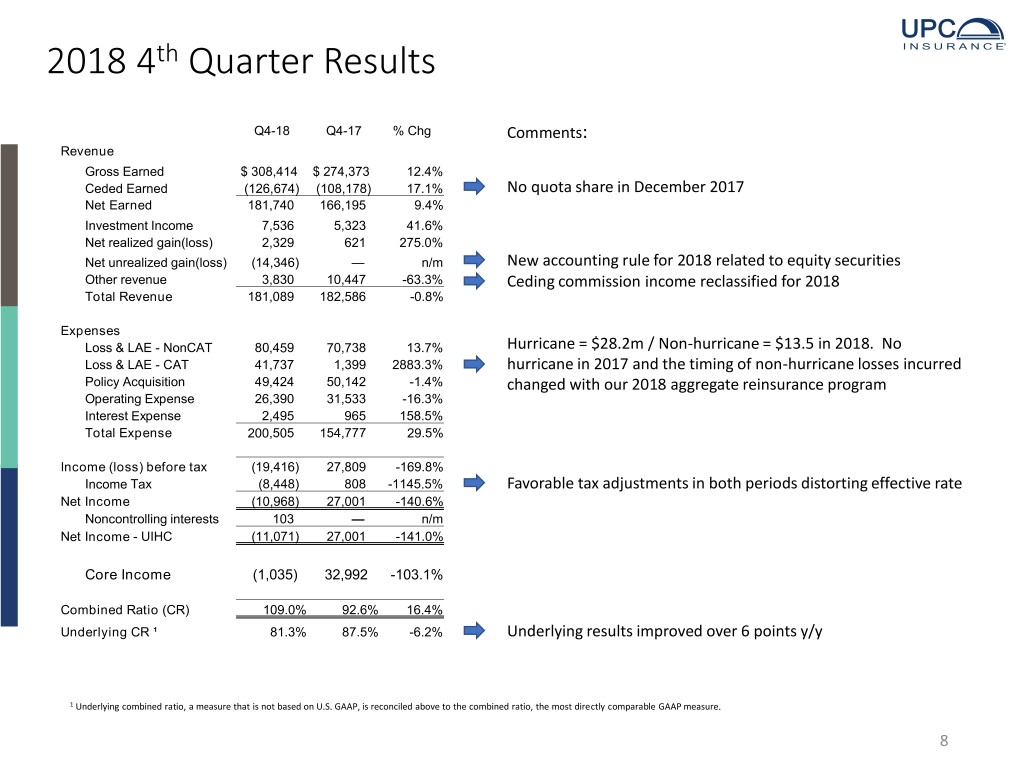

2018 4th Quarter Results Q4-18 Q4-17 % Chg Comments: Revenue Gross Earned $ 308,414 $ 274,373 12.4% Ceded Earned (126,674) (108,178) 17.1% No quota share in December 2017 Net Earned 181,740 166,195 9.4% Investment Income 7,536 5,323 41.6% Net realized gain(loss) 2,329 621 275.0% Net unrealized gain(loss) (14,346) — n/m New accounting rule for 2018 related to equity securities Other revenue 3,830 10,447 -63.3% Ceding commission income reclassified for 2018 Total Revenue 181,089 182,586 -0.8% Expenses Loss & LAE - NonCAT 80,459 70,738 13.7% Hurricane = $28.2m / Non-hurricane = $13.5 in 2018. No Loss & LAE - CAT 41,737 1,399 2883.3% hurricane in 2017 and the timing of non-hurricane losses incurred Policy Acquisition 49,424 50,142 -1.4% changed with our 2018 aggregate reinsurance program Operating Expense 26,390 31,533 -16.3% Interest Expense 2,495 965 158.5% Total Expense 200,505 154,777 29.5% Income (loss) before tax (19,416) 27,809 -169.8% Income Tax (8,448) 808 -1145.5% Favorable tax adjustments in both periods distorting effective rate Net Income (10,968) 27,001 -140.6% Noncontrolling interests 103 — n/m Net Income - UIHC (11,071) 27,001 -141.0% Core Income (1,035) 32,992 -103.1% Combined Ratio (CR) 109.0% 92.6% 16.4% Underlying CR ¹ 81.3% 87.5% -6.2% Underlying results improved over 6 points y/y 1 Underlying combined ratio, a measure that is not based on U.S. GAAP, is reconciled above to the combined ratio, the most directly comparable GAAP measure. 8

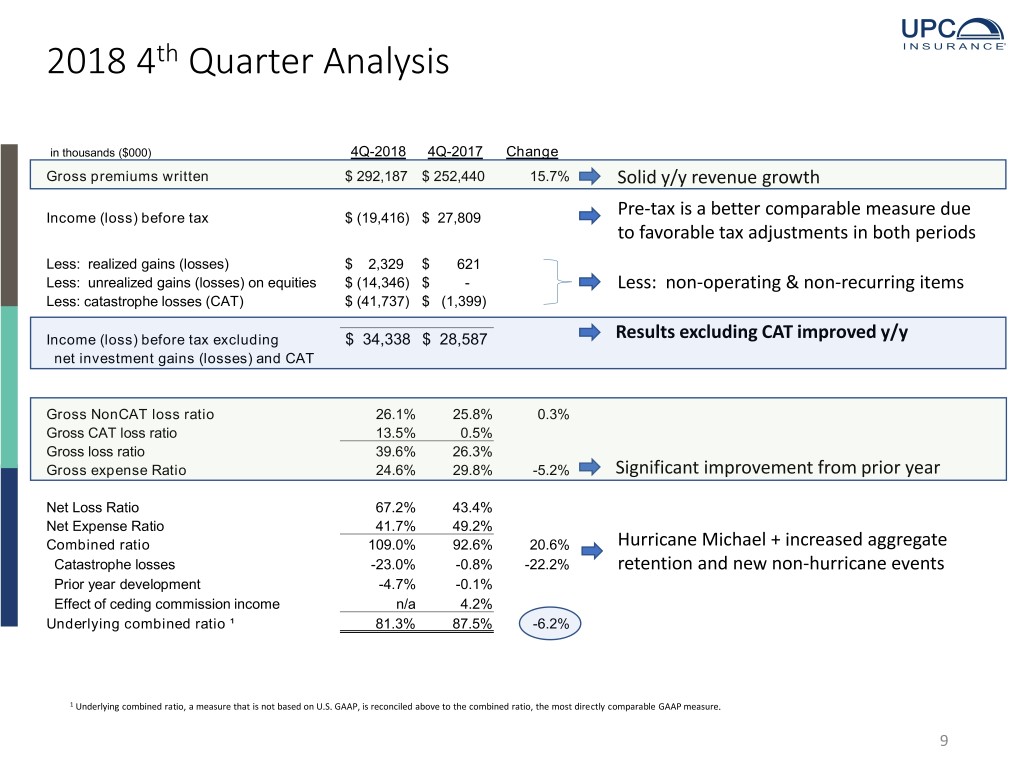

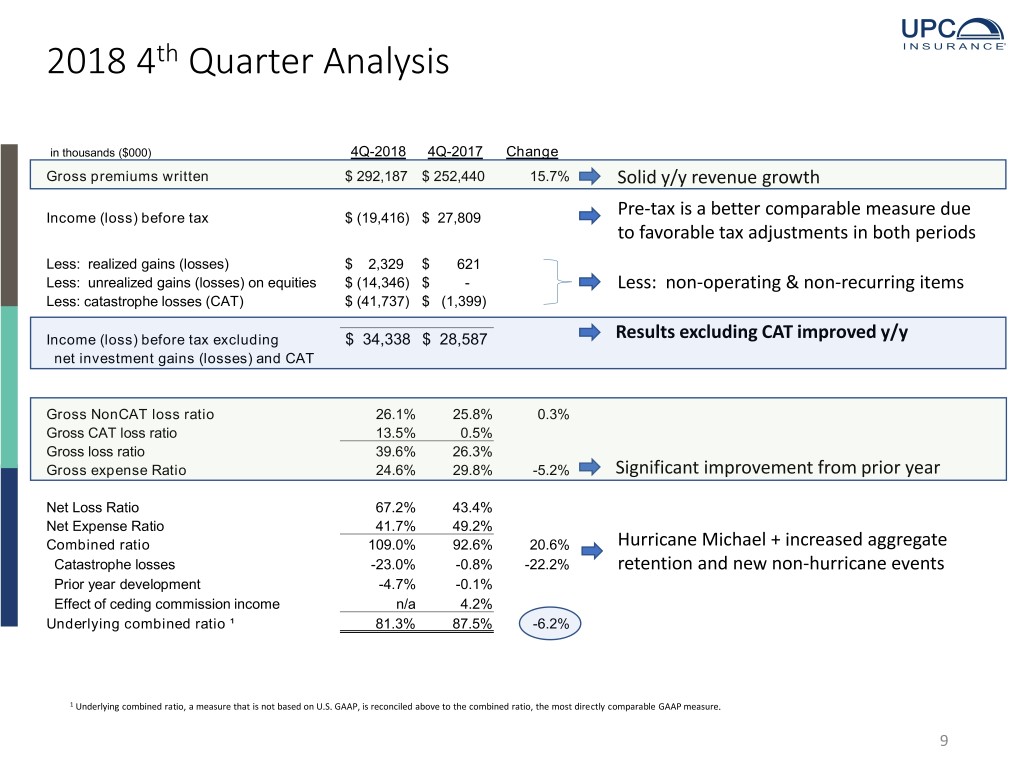

2018 4th Quarter Analysis in thousands ($000) 4Q-2018 4Q-2017 Change Gross premiums written $ 292,187 $ 252,440 15.7% Solid y/y revenue growth Income (loss) before tax $ (19,416) $ 27,809 Pre-tax is a better comparable measure due to favorable tax adjustments in both periods Less: realized gains (losses) $ 2,329 $ 621 Less: unrealized gains (losses) on equities $ (14,346) $ - Less: non-operating & non-recurring items Less: catastrophe losses (CAT) $ (41,737) $ (1,399) Income (loss) before tax excluding $ 34,338 $ 28,587 Results excluding CAT improved y/y net investment gains (losses) and CAT Gross NonCAT loss ratio 26.1% 25.8% 0.3% Gross CAT loss ratio 13.5% 0.5% Gross loss ratio 39.6% 26.3% Gross expense Ratio 24.6% 29.8% -5.2% Significant improvement from prior year Net Loss Ratio 67.2% 43.4% Net Expense Ratio 41.7% 49.2% Combined ratio 109.0% 92.6% 20.6% Hurricane Michael + increased aggregate Catastrophe losses -23.0% -0.8% -22.2% retention and new non-hurricane events Prior year development -4.7% -0.1% Effect of ceding commission income n/a 4.2% Underlying combined ratio ¹ 81.3% 87.5% -6.2% 1 Underlying combined ratio, a measure that is not based on U.S. GAAP, is reconciled above to the combined ratio, the most directly comparable GAAP measure. 9

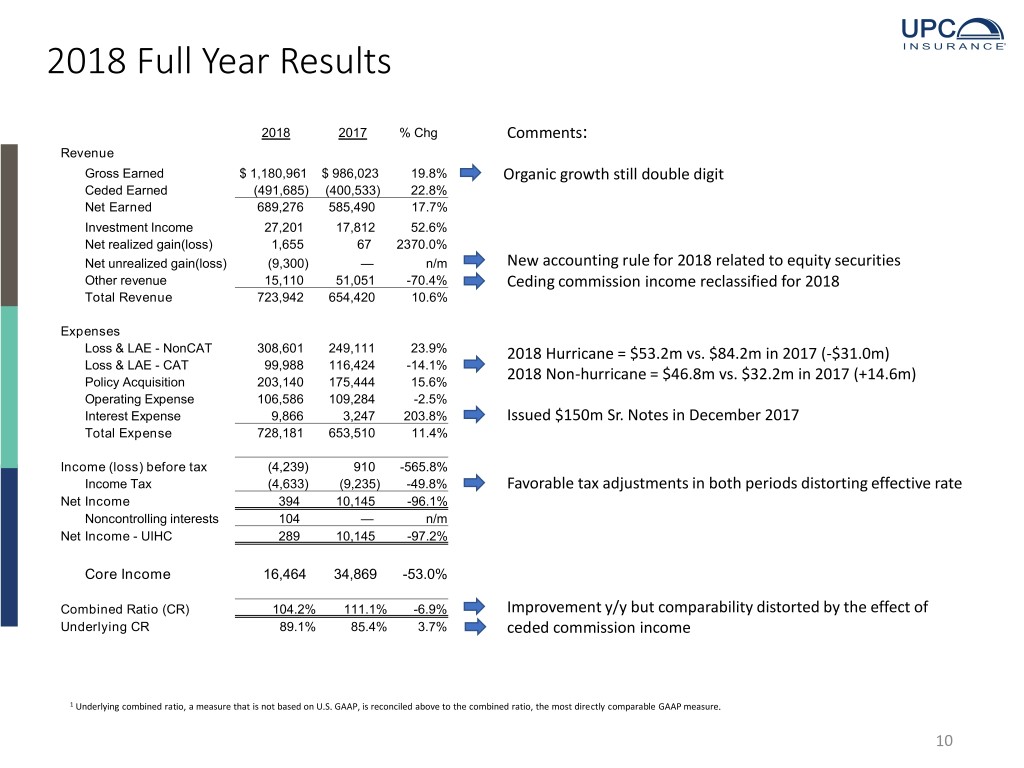

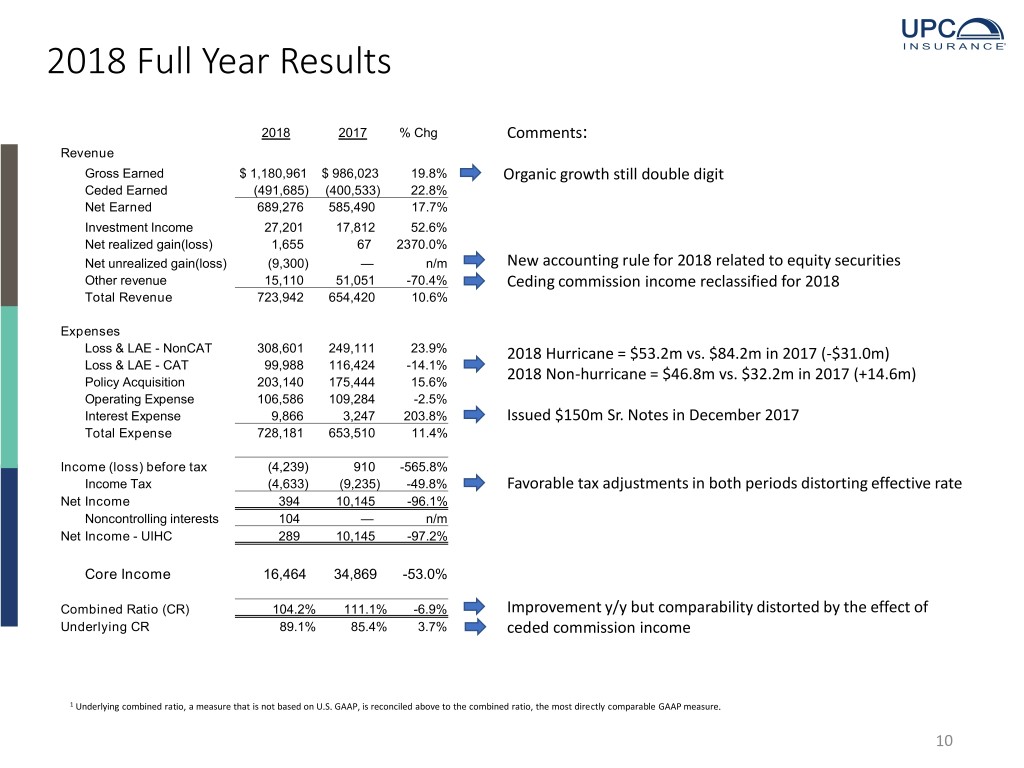

2018 Full Year Results 2018 2017 % Chg Comments: Revenue Gross Earned $ 1,180,961 $ 986,023 19.8% Organic growth still double digit Ceded Earned (491,685) (400,533) 22.8% Net Earned 689,276 585,490 17.7% Investment Income 27,201 17,812 52.6% Net realized gain(loss) 1,655 67 2370.0% Net unrealized gain(loss) (9,300) — n/m New accounting rule for 2018 related to equity securities Other revenue 15,110 51,051 -70.4% Ceding commission income reclassified for 2018 Total Revenue 723,942 654,420 10.6% Expenses Loss & LAE - NonCAT 308,601 249,111 23.9% 2018 Hurricane = $53.2m vs. $84.2m in 2017 (-$31.0m) Loss & LAE - CAT 99,988 116,424 -14.1% Policy Acquisition 203,140 175,444 15.6% 2018 Non-hurricane = $46.8m vs. $32.2m in 2017 (+14.6m) Operating Expense 106,586 109,284 -2.5% Interest Expense 9,866 3,247 203.8% Issued $150m Sr. Notes in December 2017 Total Expense 728,181 653,510 11.4% Income (loss) before tax (4,239) 910 -565.8% Income Tax (4,633) (9,235) -49.8% Favorable tax adjustments in both periods distorting effective rate Net Income 394 10,145 -96.1% Noncontrolling interests 104 — n/m Net Income - UIHC 289 10,145 -97.2% Core Income 16,464 34,869 -53.0% Combined Ratio (CR) 104.2% 111.1% -6.9% Improvement y/y but comparability distorted by the effect of Underlying CR 89.1% 85.4% 3.7% ceded commission income 1 Underlying combined ratio, a measure that is not based on U.S. GAAP, is reconciled above to the combined ratio, the most directly comparable GAAP measure. 10

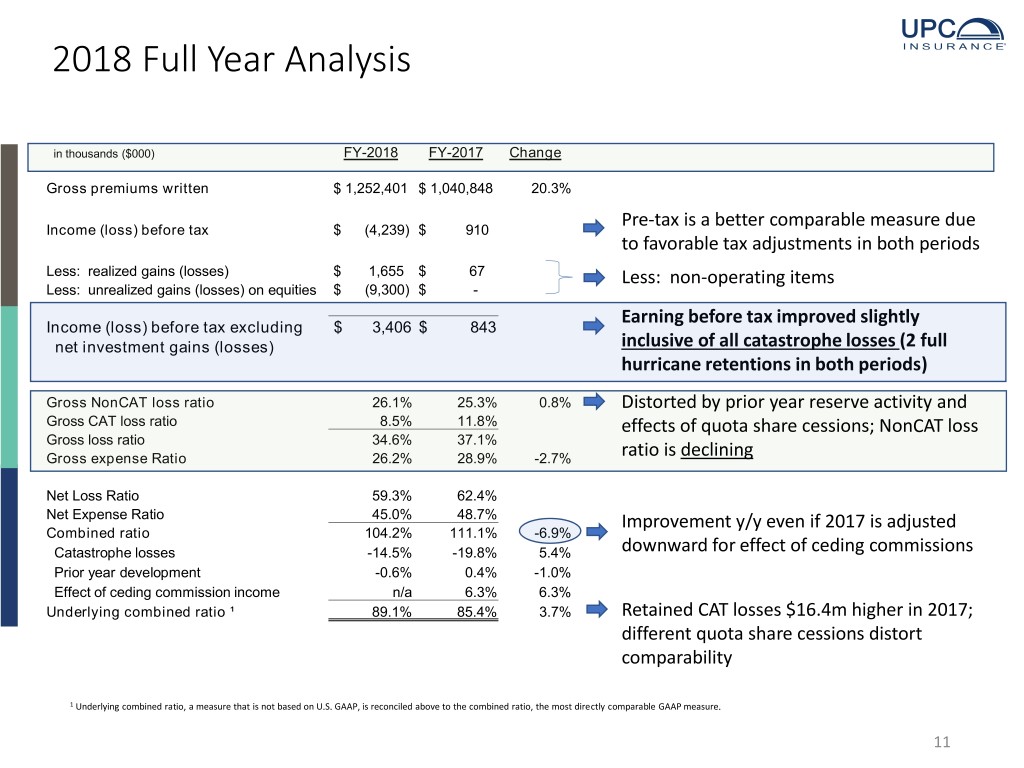

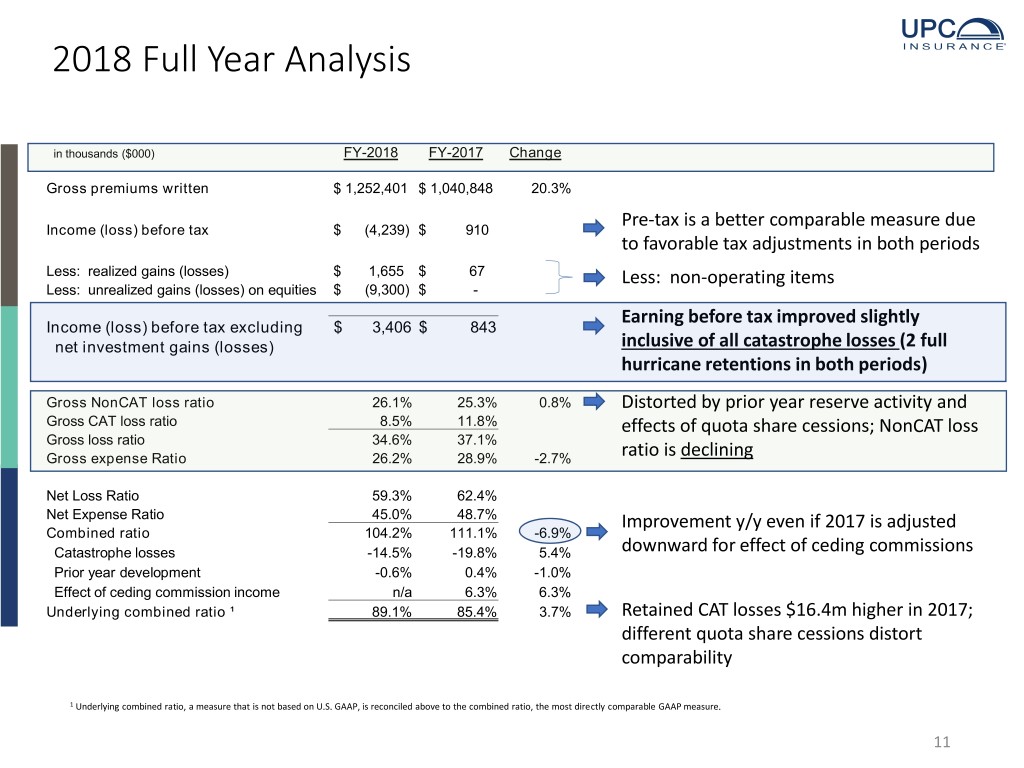

2018 Full Year Analysis in thousands ($000) FY-2018 FY-2017 Change Gross premiums written $ 1,252,401 $ 1,040,848 20.3% Pre-tax is a better comparable measure due Income (loss) before tax $ (4,239) $ 910 to favorable tax adjustments in both periods Less: realized gains (losses) $ 1,655 $ 67 Less: non-operating items Less: unrealized gains (losses) on equities $ (9,300) $ - Earning before tax improved slightly Income (loss) before tax excluding $ 3,406 $ 843 net investment gains (losses) inclusive of all catastrophe losses (2 full hurricane retentions in both periods) Gross NonCAT loss ratio 26.1% 25.3% 0.8% Distorted by prior year reserve activity and Gross CAT loss ratio 8.5% 11.8% effects of quota share cessions; NonCAT loss Gross loss ratio 34.6% 37.1% Gross expense Ratio 26.2% 28.9% -2.7% ratio is declining Net Loss Ratio 59.3% 62.4% Net Expense Ratio 45.0% 48.7% Improvement y/y even if 2017 is adjusted Combined ratio 104.2% 111.1% -6.9% Catastrophe losses -14.5% -19.8% 5.4% downward for effect of ceding commissions Prior year development -0.6% 0.4% -1.0% Effect of ceding commission income n/a 6.3% 6.3% Underlying combined ratio ¹ 89.1% 85.4% 3.7% Retained CAT losses $16.4m higher in 2017; different quota share cessions distort comparability 1 Underlying combined ratio, a measure that is not based on U.S. GAAP, is reconciled above to the combined ratio, the most directly comparable GAAP measure. 11

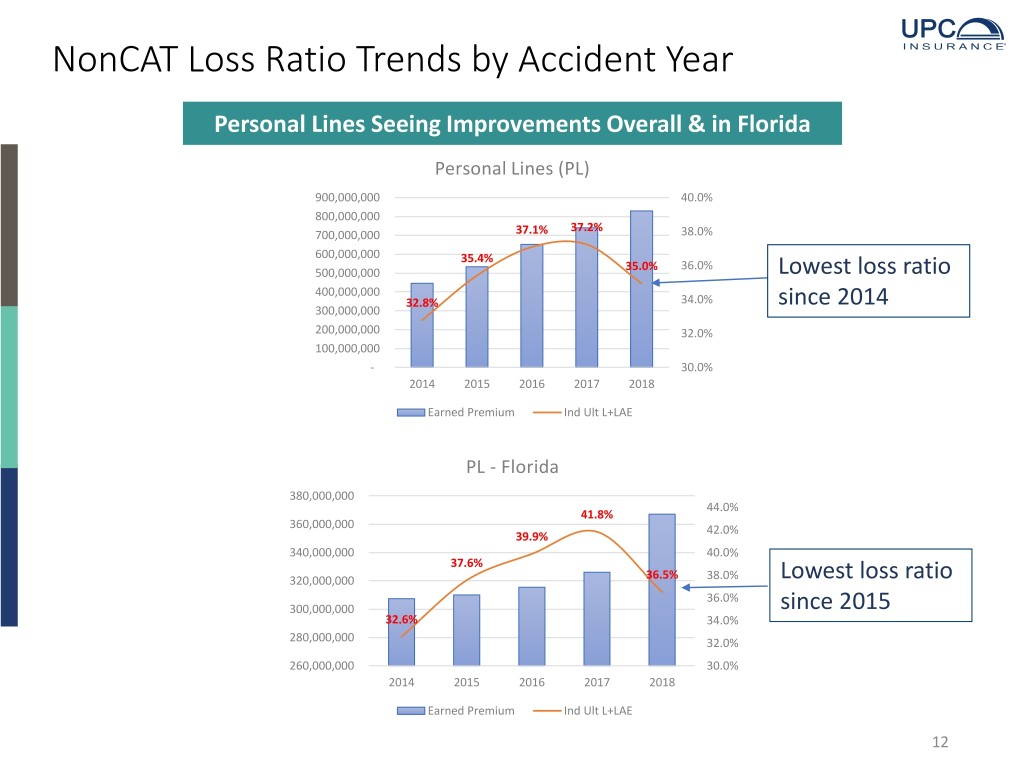

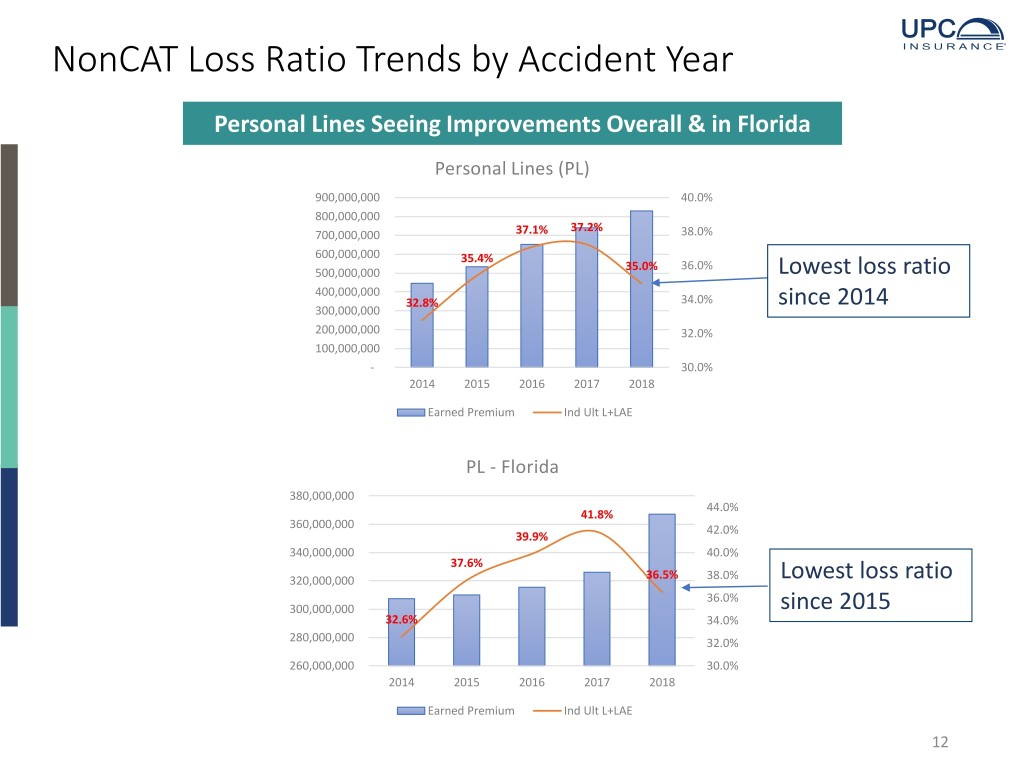

NonCAT Loss Ratio Trends by Accident Year Personal Lines Seeing Improvements Overall & in Florida Personal Lines (PL) 900,000,000 40.0% 800,000,000 37.2% 700,000,000 37.1% 38.0% 600,000,000 35.4% 35.0% 36.0% 500,000,000 Lowest loss ratio 400,000,000 32.8% 34.0% since 2014 300,000,000 200,000,000 32.0% 100,000,000 - 30.0% 2014 2015 2016 2017 2018 Earned Premium Ind Ult L+LAE PL - Florida 380,000,000 44.0% 41.8% 360,000,000 42.0% 39.9% 340,000,000 40.0% 37.6% 320,000,000 36.5% 38.0% Lowest loss ratio 36.0% 300,000,000 since 2015 32.6% 34.0% 280,000,000 32.0% 260,000,000 30.0% 2014 2015 2016 2017 2018 Earned Premium Ind Ult L+LAE 12

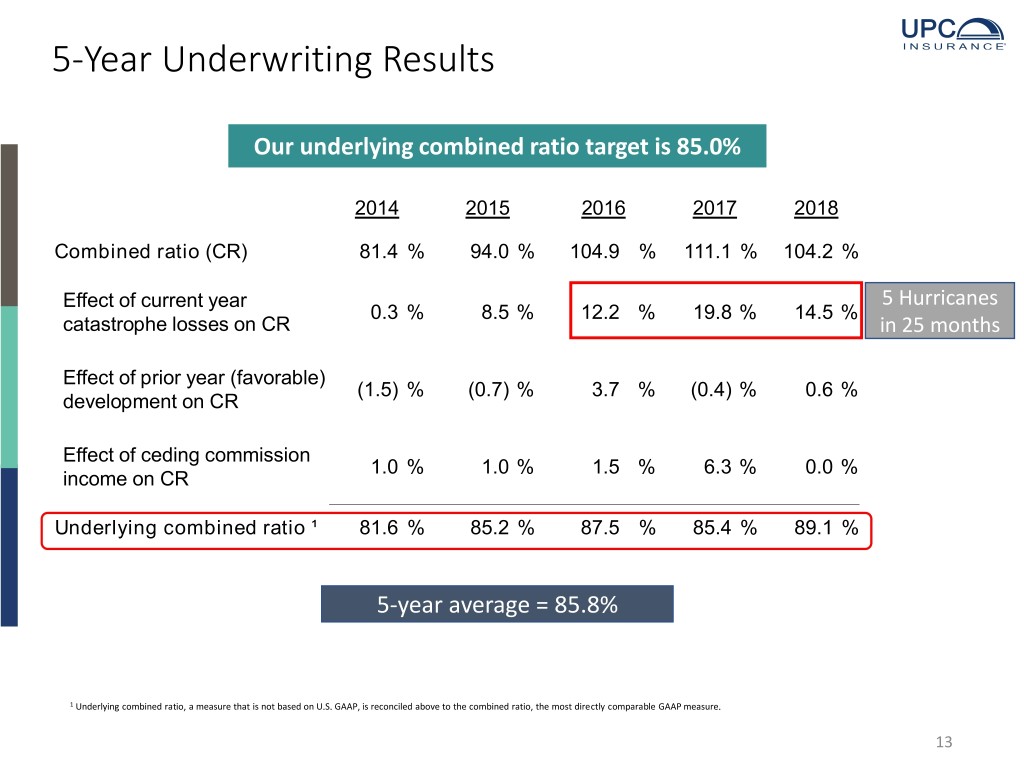

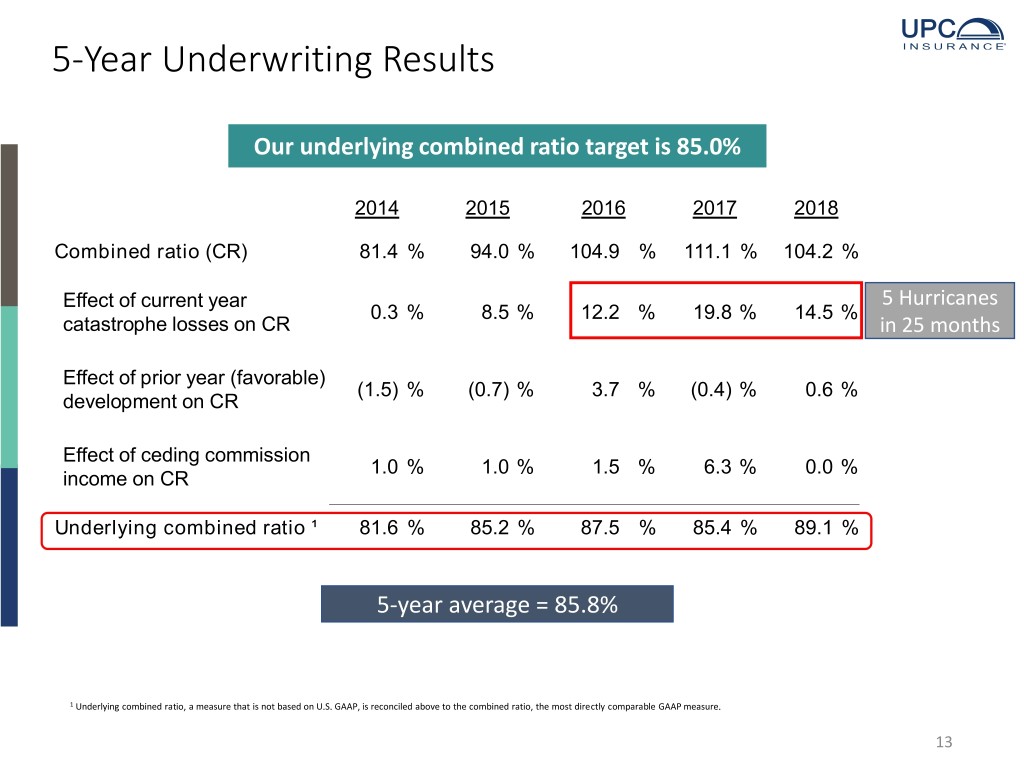

5-Year Underwriting Results Our underlying combined ratio target is 85.0% 2014 2015 2016 2017 2018 Combined ratio (CR) 81.4 % 94.0 % 104.9 % 111.1 % 104.2 % Effect of current year 5 Hurricanes 0.3 % 8.5 % 12.2 % 19.8 % 14.5 % catastrophe losses on CR in 25 months Effect of prior year (favorable) (1.5) % (0.7) % 3.7 % (0.4) % 0.6 % development on CR Effect of ceding commission 1.0 % 1.0 % 1.5 % 6.3 % 0.0 % income on CR Underlying combined ratio ¹ 81.6 % 85.2 % 87.5 % 85.4 % 89.1 % 5-year average = 85.8% 1 Underlying combined ratio, a measure that is not based on U.S. GAAP, is reconciled above to the combined ratio, the most directly comparable GAAP measure. 13

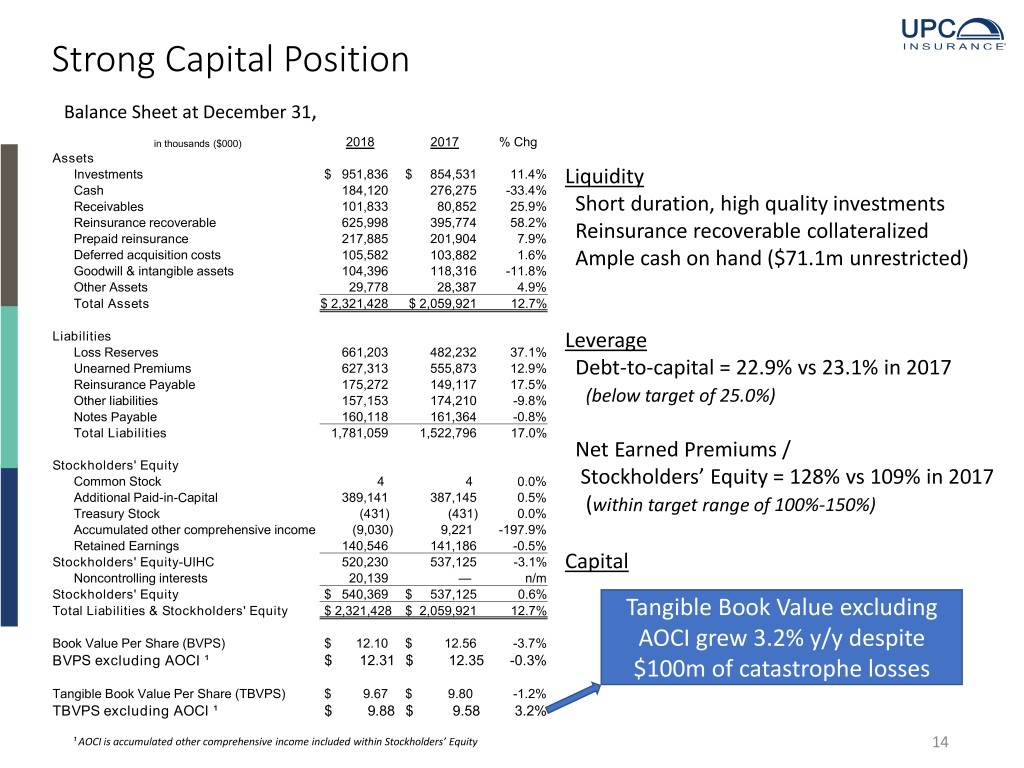

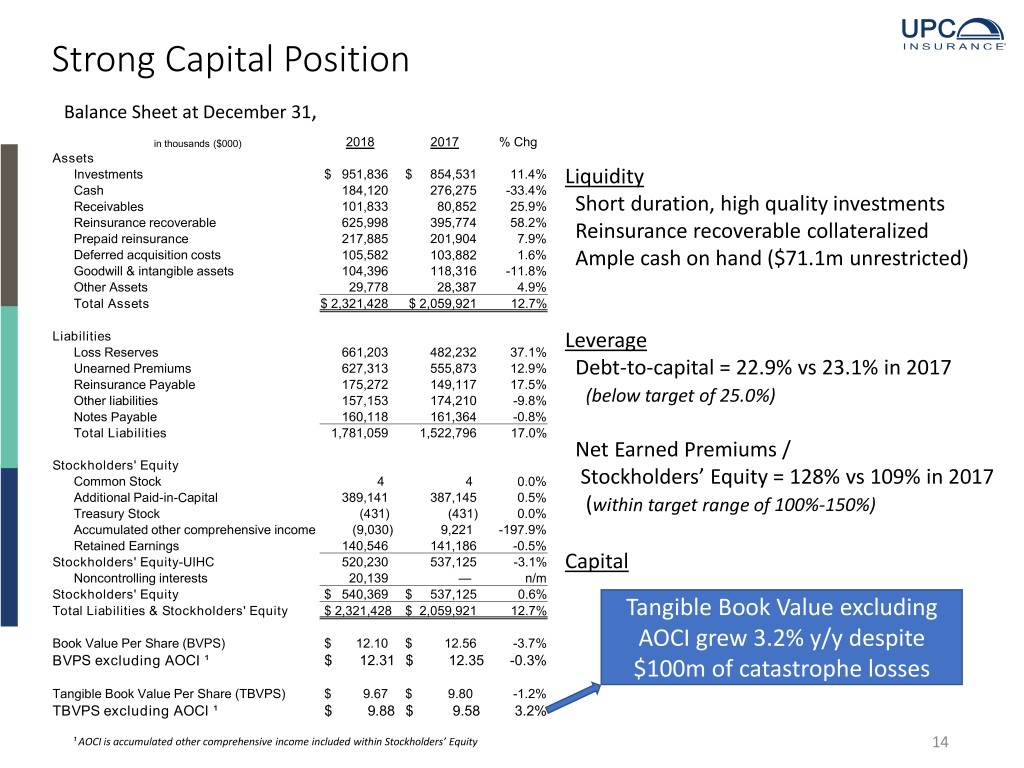

Strong Capital Position Balance Sheet at December 31, in thousands ($000) 2018 2017 % Chg Assets Investments $ 951,836 $ 854,531 11.4% Liquidity Cash 184,120 276,275 -33.4% Receivables 101,833 80,852 25.9% Short duration, high quality investments Reinsurance recoverable 625,998 395,774 58.2% Prepaid reinsurance 217,885 201,904 7.9% Reinsurance recoverable collateralized Deferred acquisition costs 105,582 103,882 1.6% Ample cash on hand ($71.1m unrestricted) Goodwill & intangible assets 104,396 118,316 -11.8% Other Assets 29,778 28,387 4.9% Total Assets $ 2,321,428 $ 2,059,921 12.7% Liabilities Leverage Loss Reserves 661,203 482,232 37.1% Unearned Premiums 627,313 555,873 12.9% Debt-to-capital = 22.9% vs 23.1% in 2017 Reinsurance Payable 175,272 149,117 17.5% Other liabilities 157,153 174,210 -9.8% (below target of 25.0%) Notes Payable 160,118 161,364 -0.8% Total Liabilities 1,781,059 1,522,796 17.0% Net Earned Premiums / Stockholders' Equity Common Stock 4 4 0.0% Stockholders’ Equity = 128% vs 109% in 2017 Additional Paid-in-Capital 389,141 387,145 0.5% Treasury Stock (431) (431) 0.0% (within target range of 100%-150%) Accumulated other comprehensive income (9,030) 9,221 -197.9% Retained Earnings 140,546 141,186 -0.5% Stockholders' Equity-UIHC 520,230 537,125 -3.1% Capital Noncontrolling interests 20,139 — n/m Stockholders' Equity $ 540,369 $ 537,125 0.6% Total Liabilities & Stockholders' Equity $ 2,321,428 $ 2,059,921 12.7% Tangible Book Value excluding Book Value Per Share (BVPS) $ 12.10 $ 12.56 -3.7% AOCI grew 3.2% y/y despite BVPS excluding AOCI ¹ $ 12.31 $ 12.35 -0.3% $100m of catastrophe losses Tangible Book Value Per Share (TBVPS) $ 9.67 $ 9.80 -1.2% TBVPS excluding AOCI ¹ $ 9.88 $ 9.58 3.2% ¹ AOCI is accumulated other comprehensive income included within Stockholders’ Equity 14

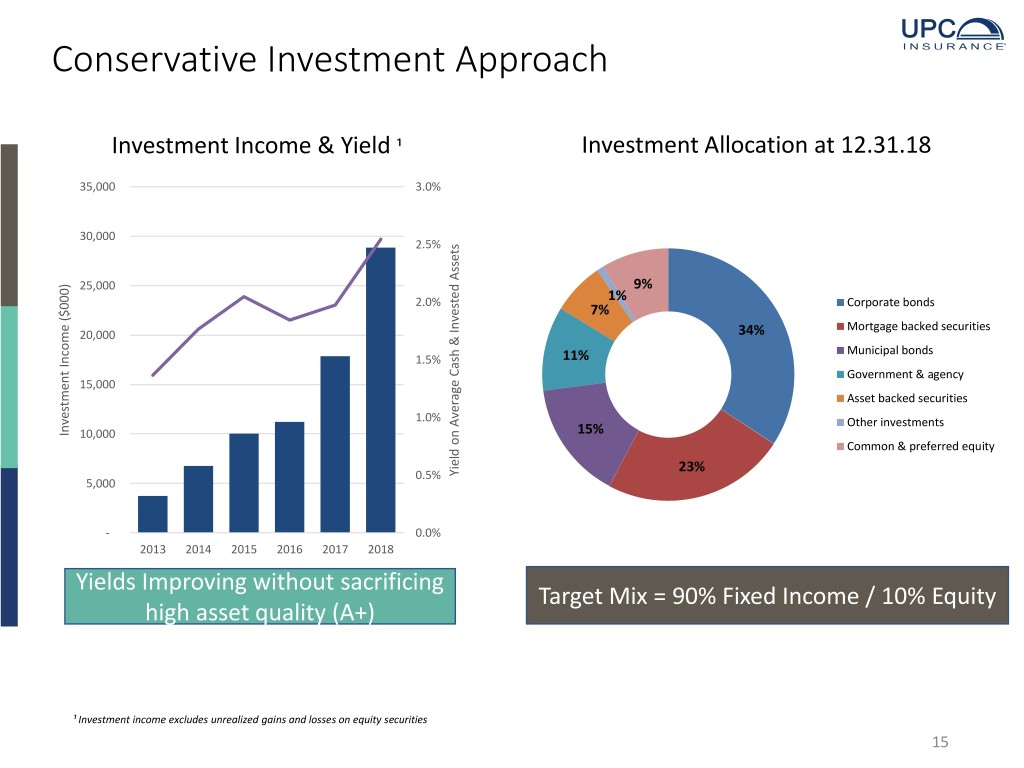

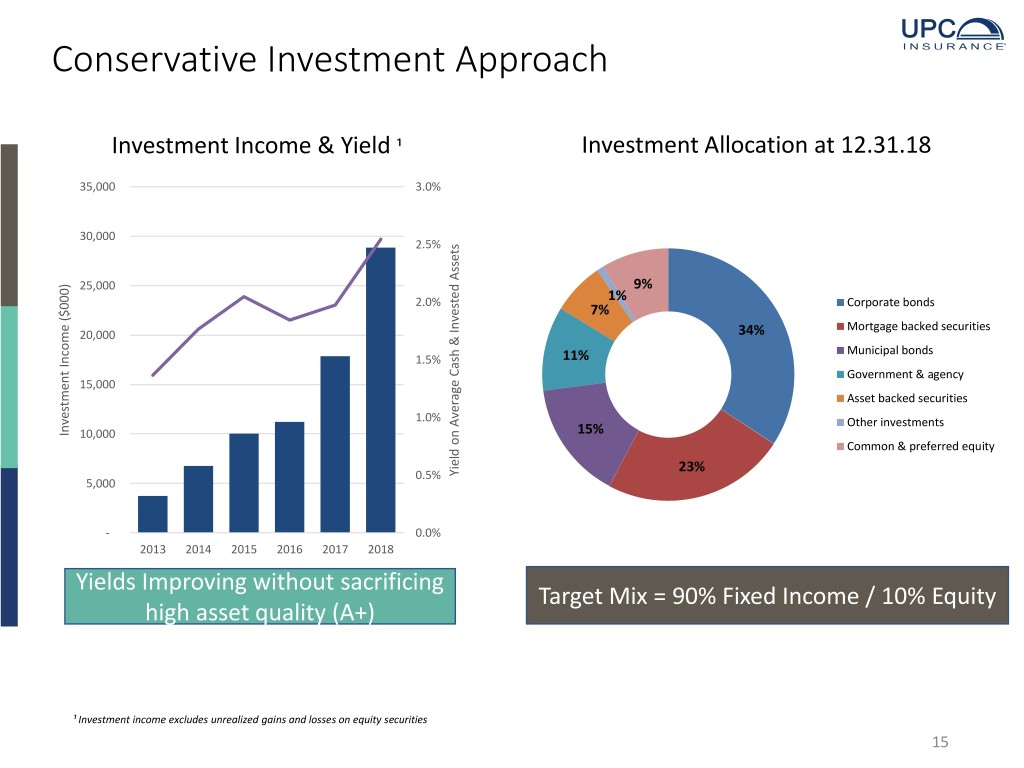

Conservative Investment Approach Investment Income & Yield ¹ Investment Allocation at 12.31.18 35,000 3.0% 30,000 2.5% 25,000 9% 2.0% 1% Corporate bonds 7% Mortgage backed securities 20,000 34% Municipal bonds 1.5% 11% Government & agency 15,000 Asset backed securities 1.0% Other investments Investment Investment Income ($000) 10,000 15% Common & preferred equity 23% 0.5% Yield onAverage Cash Invested & Assets 5,000 - 0.0% 2013 2014 2015 2016 2017 2018 Yields Improving without sacrificing Target Mix = 90% Fixed Income / 10% Equity high asset quality (A+) ¹ Investment income excludes unrealized gains and losses on equity securities 15

Components of Earnings Before Tax Core Underwriting & Investments Drive Returns in the Long-term 130,000 80,000 30,000 -20,000 -70,000 -120,000 2012 2013 2014 2015 2016 2017 2018 Core Underwriting Gain Investment Income CAT Losses Reserve Development Unrealized Losses on Equities 16

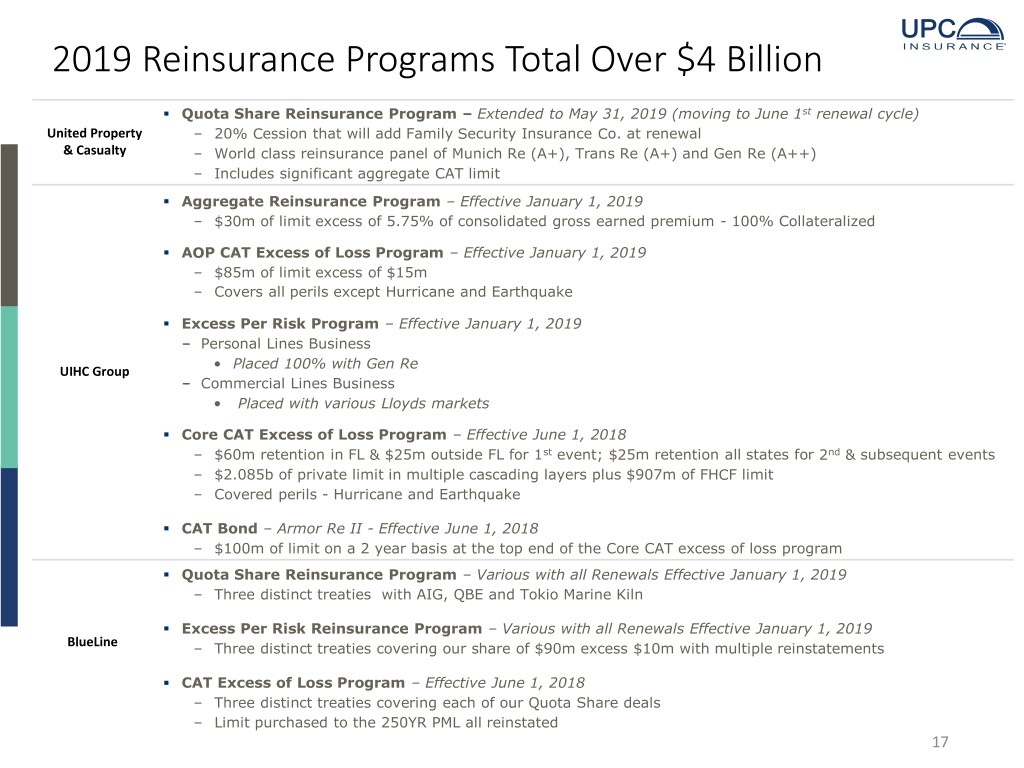

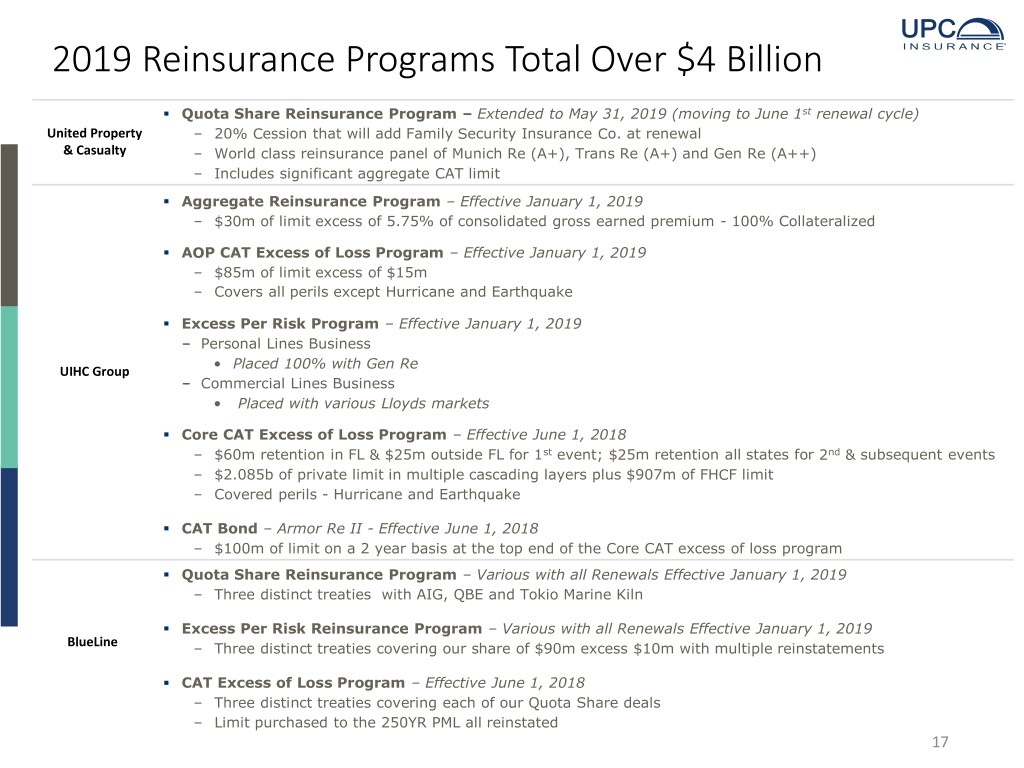

2019 Reinsurance Programs Total Over $4 Billion ▪ Quota Share Reinsurance Program – Extended to May 31, 2019 (moving to June 1st renewal cycle) United Property ‒ 20% Cession that will add Family Security Insurance Co. at renewal & Casualty ‒ World class reinsurance panel of Munich Re (A+), Trans Re (A+) and Gen Re (A++) ‒ Includes significant aggregate CAT limit ▪ Aggregate Reinsurance Program – Effective January 1, 2019 ‒ $30m of limit excess of 5.75% of consolidated gross earned premium - 100% Collateralized ▪ AOP CAT Excess of Loss Program – Effective January 1, 2019 ‒ $85m of limit excess of $15m ‒ Covers all perils except Hurricane and Earthquake ▪ Excess Per Risk Program – Effective January 1, 2019 – Personal Lines Business • Placed 100% with Gen Re UIHC Group – Commercial Lines Business • Placed with various Lloyds markets ▪ Core CAT Excess of Loss Program – Effective June 1, 2018 ‒ $60m retention in FL & $25m outside FL for 1st event; $25m retention all states for 2nd & subsequent events ‒ $2.085b of private limit in multiple cascading layers plus $907m of FHCF limit ‒ Covered perils - Hurricane and Earthquake ▪ CAT Bond – Armor Re II - Effective June 1, 2018 ‒ $100m of limit on a 2 year basis at the top end of the Core CAT excess of loss program ▪ Quota Share Reinsurance Program – Various with all Renewals Effective January 1, 2019 ‒ Three distinct treaties with AIG, QBE and Tokio Marine Kiln ▪ Excess Per Risk Reinsurance Program – Various with all Renewals Effective January 1, 2019 BlueLine ‒ Three distinct treaties covering our share of $90m excess $10m with multiple reinstatements ▪ CAT Excess of Loss Program – Effective June 1, 2018 ‒ Three distinct treaties covering each of our Quota Share deals ‒ Limit purchased to the 250YR PML all reinstated 17

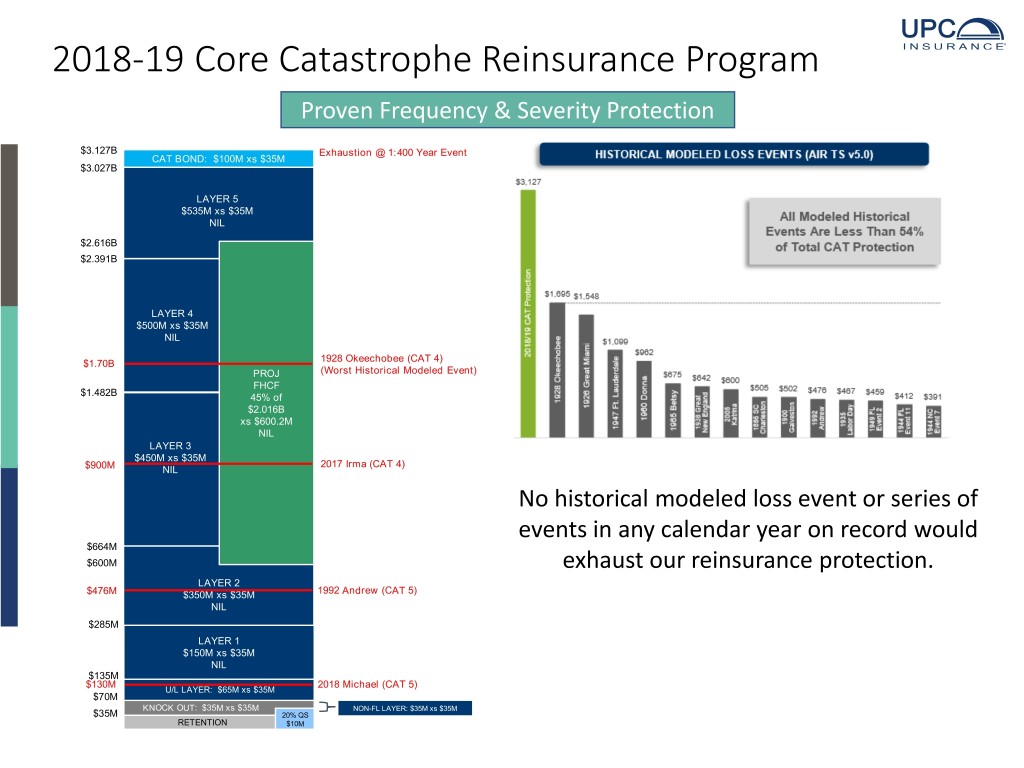

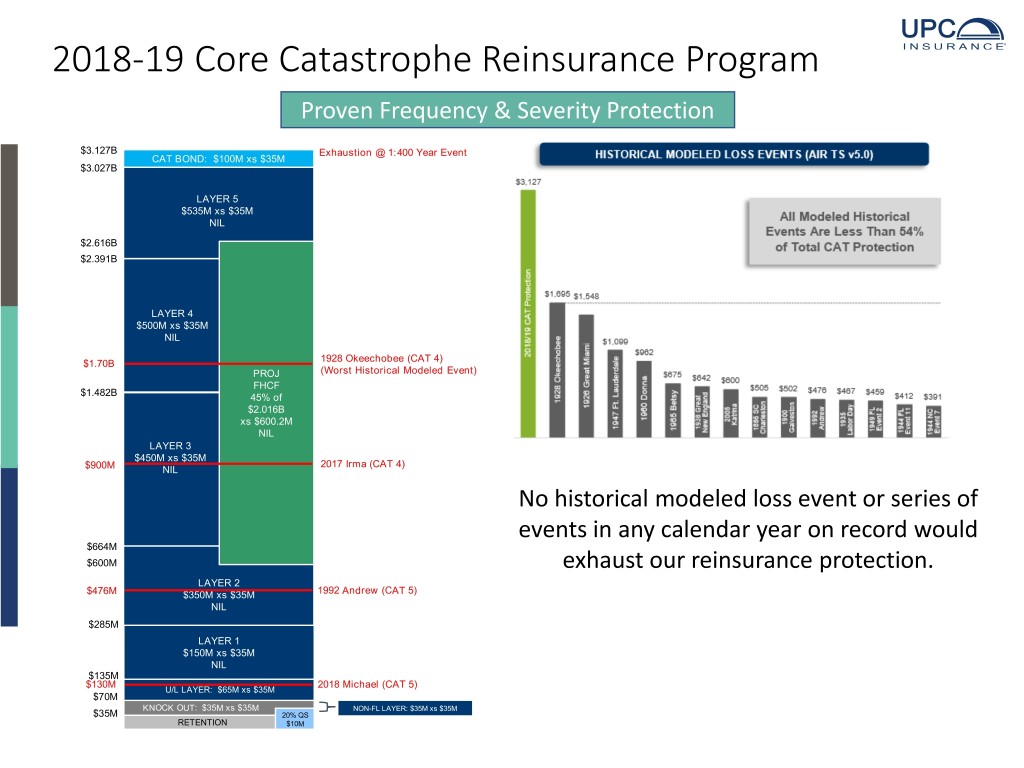

2018-19 Core Catastrophe Reinsurance Program Proven Frequency & Severity Protection $3.127B Exhaustion @ 1:400 Year Event CAT BOND: $100M xs $35M $3.027B LAYER 5 $535M xs $35M NIL $2.616B $2.391B LAYER 4 $500M xs $35M NIL 1928 Okeechobee (CAT 4) $1.70B PROJ (Worst Historical Modeled Event) FHCF $1.482B 45% of $2.016B xs $600.2M NIL LAYER 3 $450M xs $35M 2017 Irma (CAT 4) $900M NIL No historical modeled loss event or series of events in any calendar year on record would $664M $600M exhaust our reinsurance protection. LAYER 2 $476M $350M xs $35M 1992 Andrew (CAT 5) NIL $285M LAYER 1 $150M xs $35M NIL $135M $130M 2018 Michael (CAT 5) U/L LAYER: $65M xs $35M $70M KNOCK OUT: $35M xs $35M NON-FL LAYER: $35M xs $35M $35M 20% QS RETENTION $10M 18

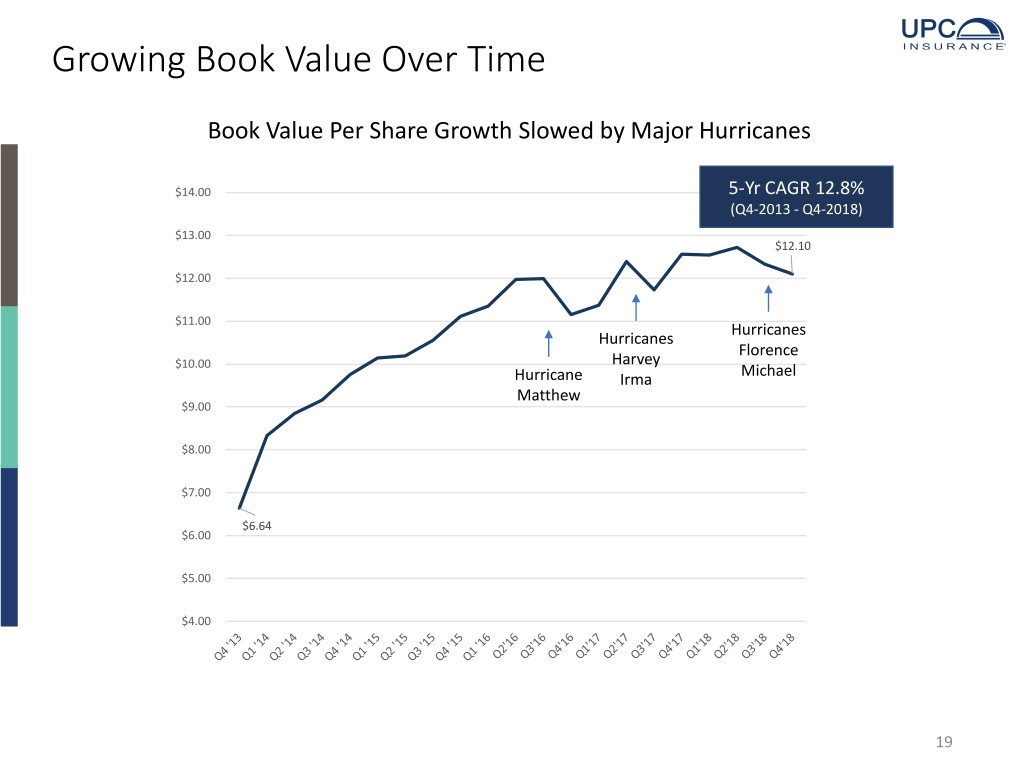

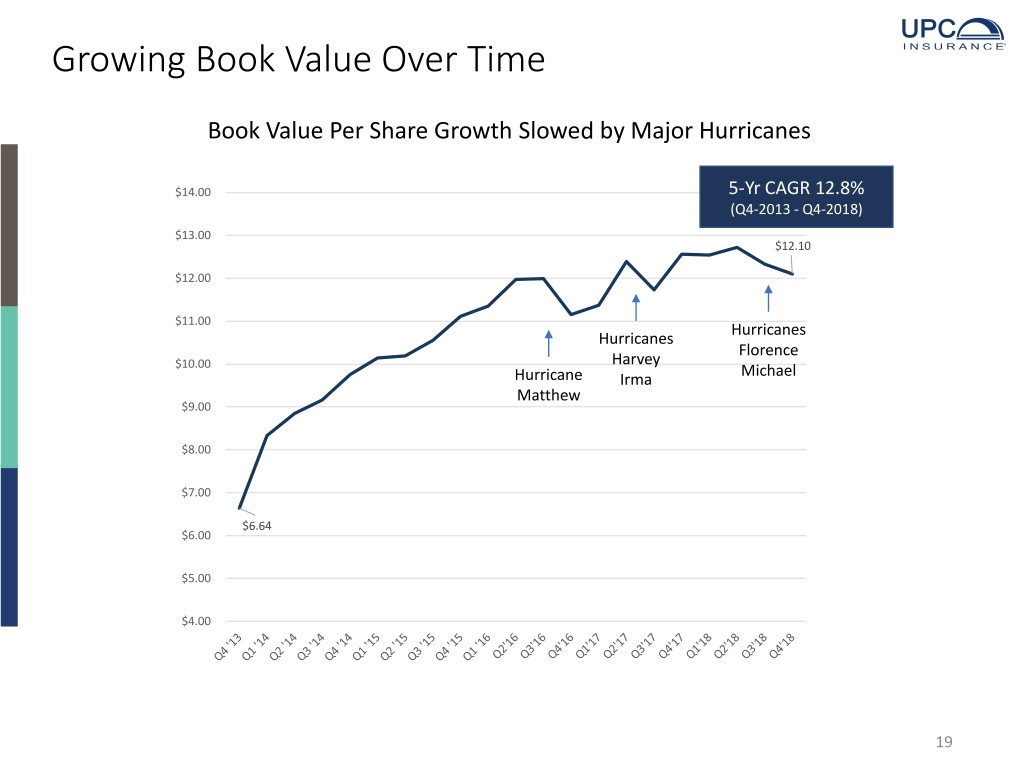

Growing Book Value Over Time Book Value Per Share Growth Slowed by Major Hurricanes $14.00 5-Yr CAGR 12.8% (Q4-2013 - Q4-2018) $13.00 $12.10 $12.00 $11.00 Hurricanes Hurricanes Florence Harvey $10.00 Michael Hurricane Irma Matthew $9.00 $8.00 $7.00 $6.64 $6.00 $5.00 $4.00 19

Value Creation Initiatives ENHANCE THE CUSTOMER EXPERIENCE • New Policy & Claims systems • Insource customer-facing functions • Claims TPA • Explore AI and machine learning solutions BROADEN THE CUSTOMER BASE • Leverage the AM Best Rating • Open new markets & distribution channels • Seek new and expand existing product offerings • New partnerships ENHANCE PROFITABILITY • Rate increases as needed • Increased automation and operating efficiency • Enhanced use of predictive analytics and technology-based underwriting • Re-underwriting and agent terminations in underperforming locations • Insourcing of most claims staff reduces leakage STRENGTHEN THE HIRING AND RETENTION PROCESS • Hire Director of Training, Culture & Leadership Development • UPC’s culture is a competitive strength • Expand UPC University, our internal training organization • Continue to provide competitive compensation and innovative benefits 20

Cautionary Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report on Form 10-K for the year ended December 31, 2017. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See the Appendix section of this presentation for further information regarding these non-GAAP financial measures. The information in this presentation is confidential. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited. 21