Investor Presentation First Quarter 2019 Results May 7, 2019

Q1 2019 Financial Highlights 3.31.19 3.31.18 Total Assets $2.22 b $2.06b BVPS $12.52 $12.52 Gross Written Premium $318.6 m $279.6m Net Income $9.5 m $ 8.4m Core Income $3.2 m $ 17.0m Core ROAE (annualized) 2.4% 13.2% Combined Ratio 103.8% 102.1% Underlying Combined Ratio 94.1% 92.4% 2

Q1-19 Executive Summary I. REVENUE HIGHLIGHTS • Gross Premiums Written of $318.6m were up $38.9m (+14%) y/y • Personal Property was 66.1% and Commercial 33.9% • Growth driven by Florida ($17.6m or +11.2%) & the NE region ($6.9m or +19.7%) • Gross Premiums Earned of $311.8m increased $32.9m (+12%) y/y • Ceded Premiums Earned of $131m rose $14.8m (+13%) y/y • The increase included non-recurring charges related to: • A 2018 FHCF reinsurance cost adjustment of $3.4m • Reinstatement premiums of $1.7m related to 2018 non-hurricane CAT loss development II. LOSS & EXPENSE HIGHLIGHTS • Net loss & LAE of $104.5m increased $27.3m (+35.3%) y/y • Gross Loss Ratio was 33.5%, up 5.8 points • Net Loss Ratio was 57.8%, up 10.3 points • Net catastrophe losses of $11.7m added 6.5 points to the net loss ratio • Driven by 8 new events during Q1 with gross losses of approximately $27.4m (vs. $31.3m in Q1-18) • $12.4m ceded to the aggregate reinsurance program (vs. $19.2m in Q1-18) • Prior year unfavorable reserve development of $5.6m primarily related to: • A December 2018 non-PCS CAT event in Florida • Underlying loss & LAE was $87.2m, up $15.6m (+21.8%) y/y • Driven by personal lines, primarily higher severity • All other non-loss operating expenses were $85.5m, a decrease of -$5.8m (-6.4%) y/y III. REINSURANCE RENEWAL & AOB REFORM • Elected 90% from the FHCF at March 1, 2019 to mitigate capacity and pricing uncertainty • Returned to the CAT Bond market with Armor Re II for $200m layer • Florida Senate Bill 122 intended to curb AOB fraud proposed to become effective July 1, 2019 • Long-term this is appears to be good legislation and will help reduce rate needs in Florida 3

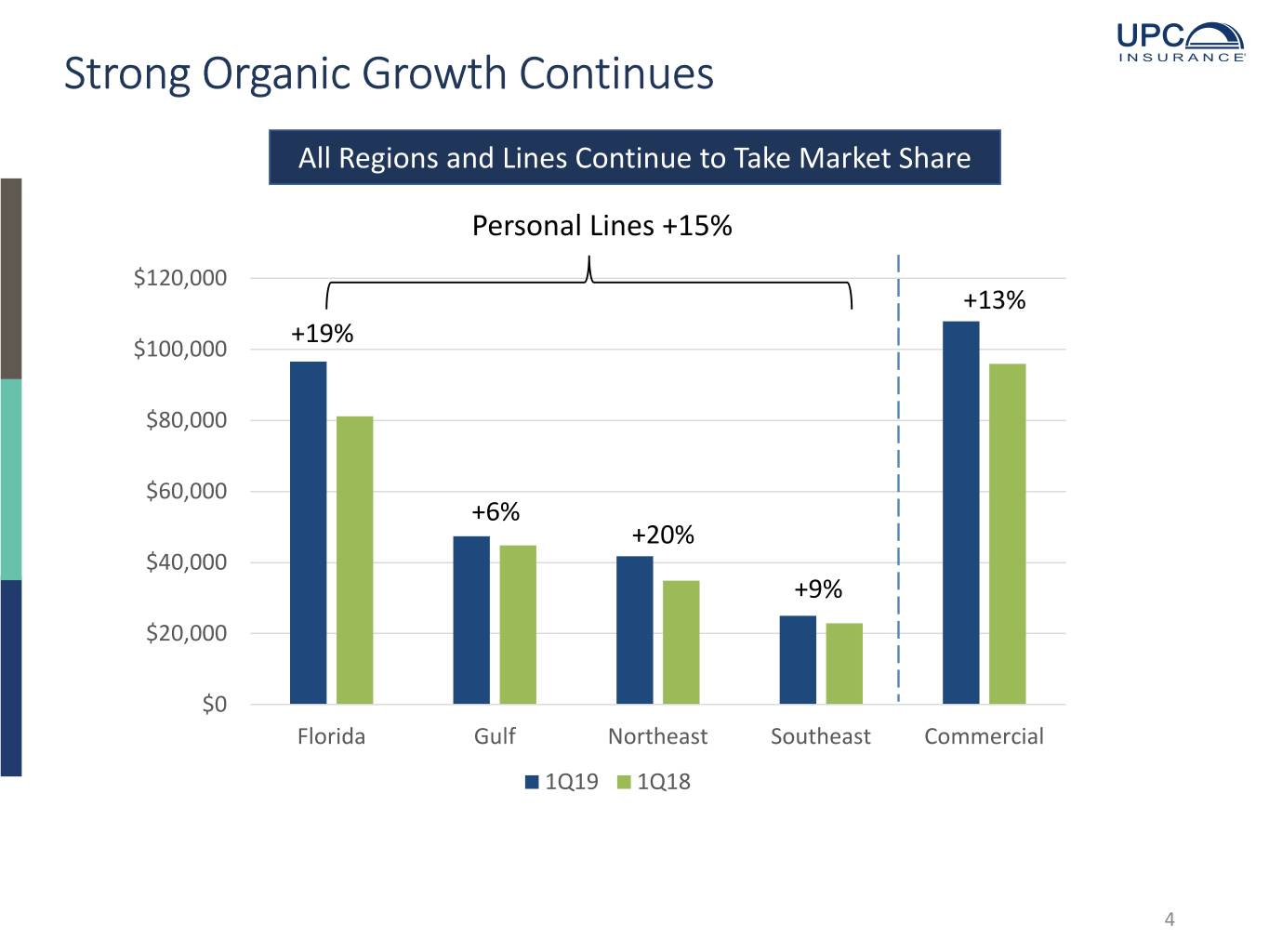

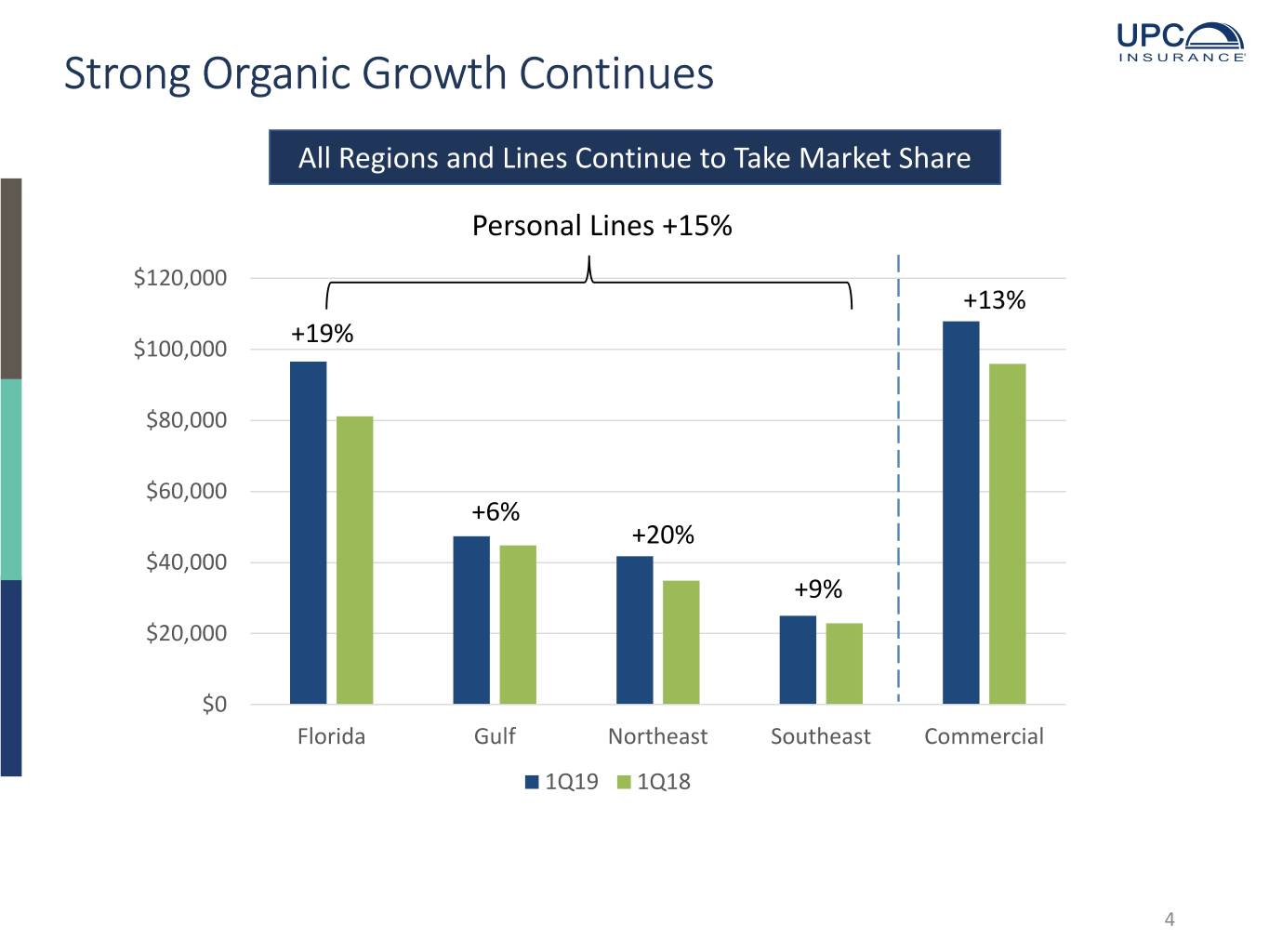

Strong Organic Growth Continues All Regions and Lines Continue to Take Market Share Personal Lines +15% $120,000 +13% +19% $100,000 $80,000 $60,000 +6% +20% $40,000 +9% $20,000 $0 Florida Gulf Northeast Southeast Commercial 1Q19 1Q18 4

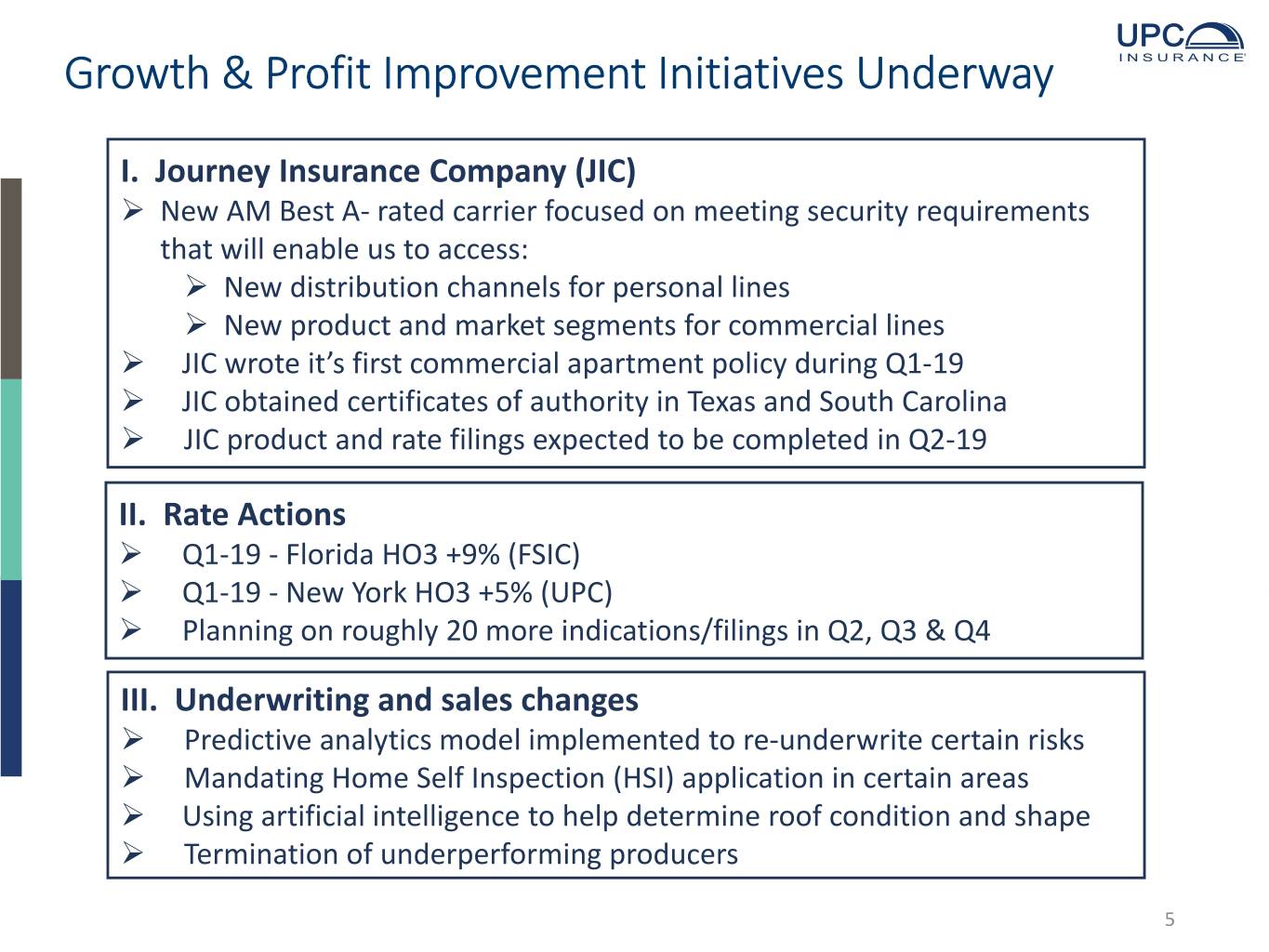

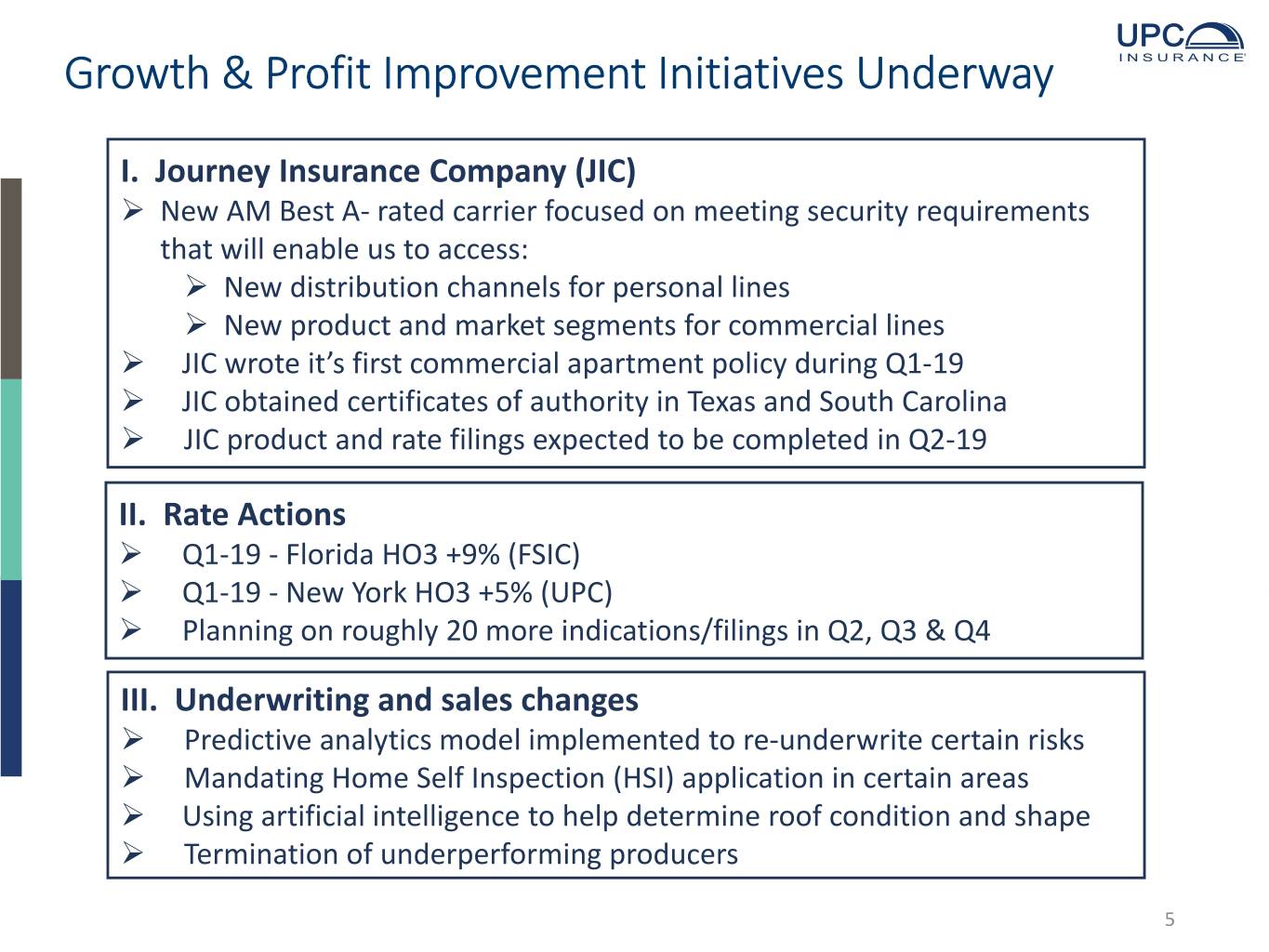

Growth & Profit Improvement Initiatives Underway I. Journey Insurance Company (JIC) New AM Best A- rated carrier focused on meeting security requirements that will enable us to access: New distribution channels for personal lines New product and market segments for commercial lines JIC wrote it’s first commercial apartment policy during Q1-19 JIC obtained certificates of authority in Texas and South Carolina JIC product and rate filings expected to be completed in Q2-19 II. Rate Actions Q1-19 - Florida HO3 +9% (FSIC) Q1-19 - New York HO3 +5% (UPC) Planning on roughly 20 more indications/filings in Q2, Q3 & Q4 III. Underwriting and sales changes Predictive analytics model implemented to re-underwrite certain risks Mandating Home Self Inspection (HSI) application in certain areas Using artificial intelligence to help determine roof condition and shape Termination of underperforming producers 5

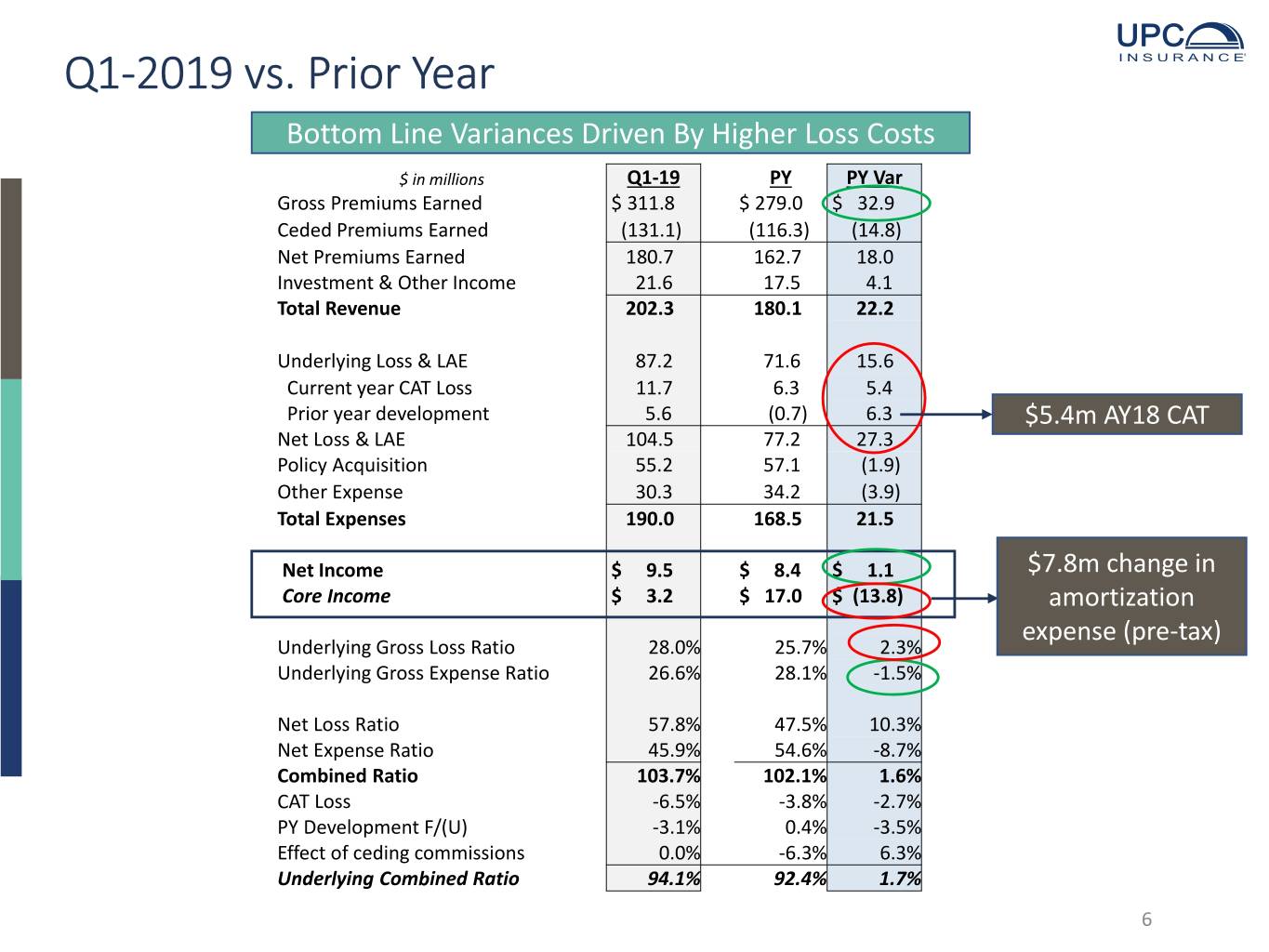

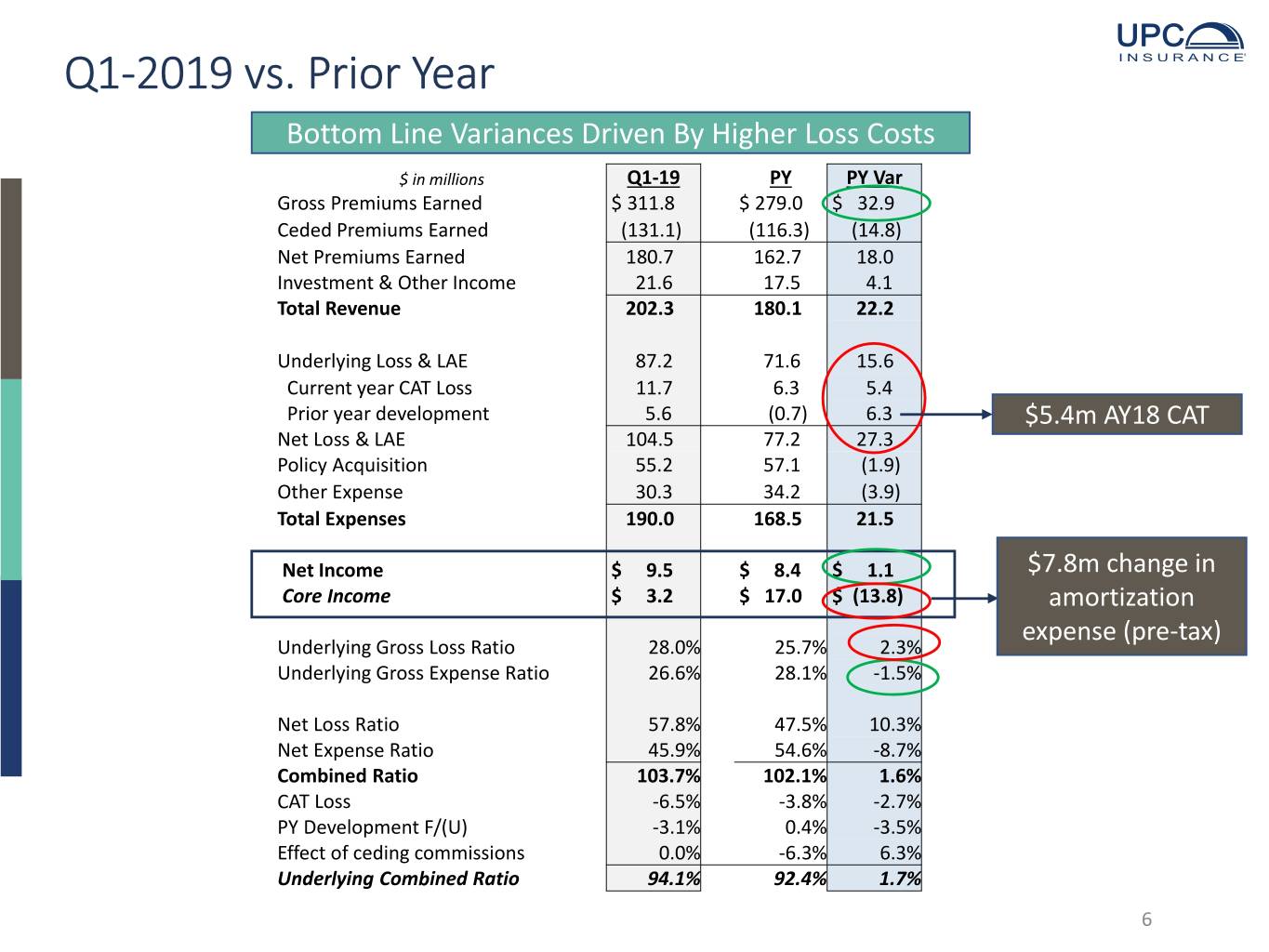

Q1-2019 vs. Prior Year Bottom Line Variances Driven By Higher Loss Costs $ in millions Q1-19 PY PY Var Gross Premiums Earned $ 311.8 $ 279.0 $ 32.9 Ceded Premiums Earned (131.1) (116.3) (14.8) Net Premiums Earned 180.7 162.7 18.0 Investment & Other Income 21.6 17.5 4.1 Total Revenue 202.3 180.1 22.2 Underlying Loss & LAE 87.2 71.6 15.6 Current year CAT Loss 11.7 6.3 5.4 Prior year development 5.6 (0.7) 6.3 $5.4m AY18 CAT Net Loss & LAE 104.5 77.2 27.3 Policy Acquisition 55.2 57.1 (1.9) Other Expense 30.3 34.2 (3.9) Total Expenses 190.0 168.5 21.5 Net Income $ 9.5 $ 8.4 $ 1.1 $7.8m change in Core Income $ 3.2 $ 17.0 $ (13.8) amortization expense (pre-tax) Underlying Gross Loss Ratio 28.0% 25.7% 2.3% Underlying Gross Expense Ratio 26.6% 28.1% -1.5% Net Loss Ratio 57.8% 47.5% 10.3% Net Expense Ratio 45.9% 54.6% -8.7% Combined Ratio 103.7% 102.1% 1.6% CAT Loss -6.5% -3.8% -2.7% PY Development F/(U) -3.1% 0.4% -3.5% Effect of ceding commissions 0.0% -6.3% 6.3% Underlying Combined Ratio 94.1% 92.4% 1.7% 6

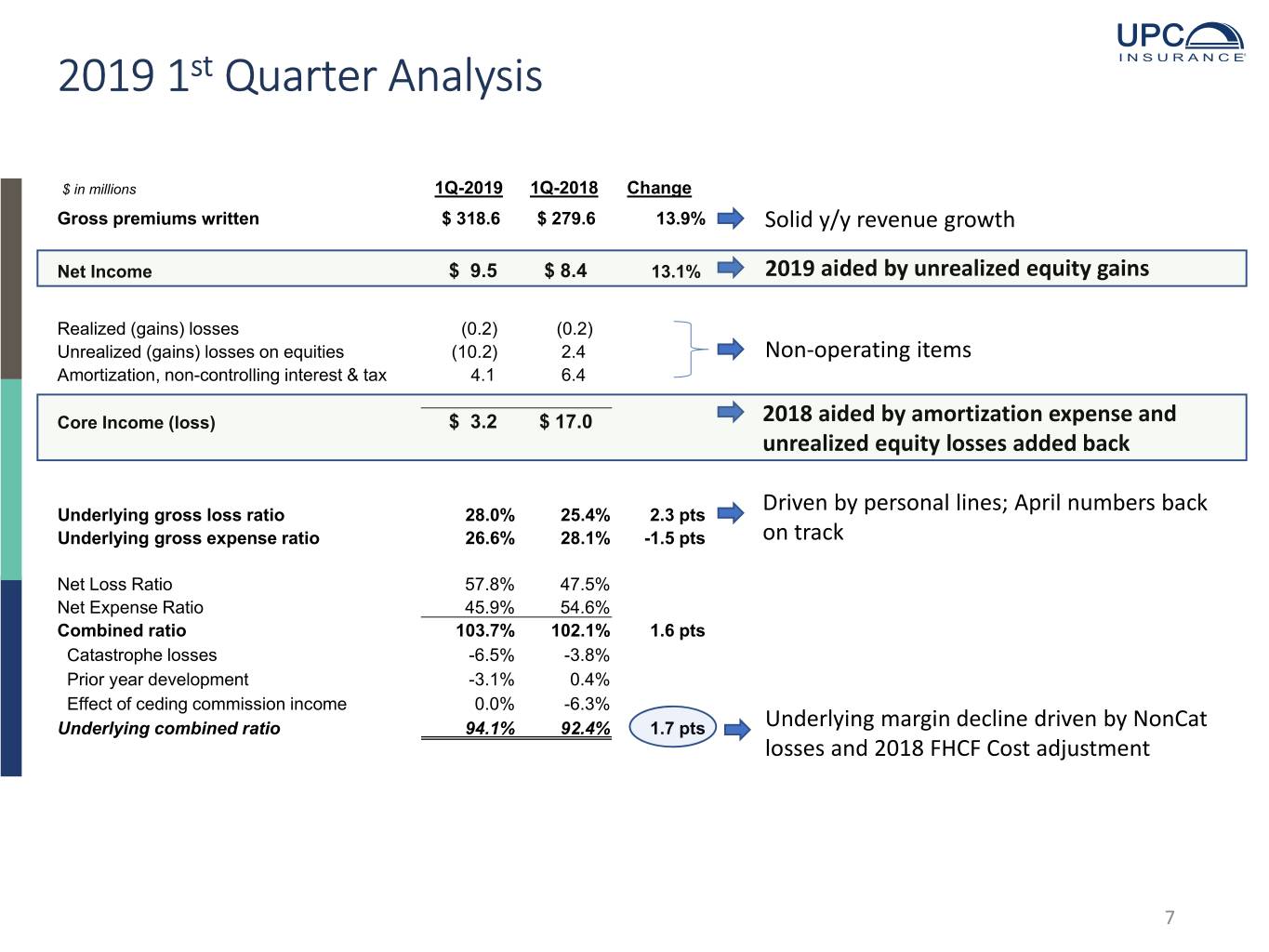

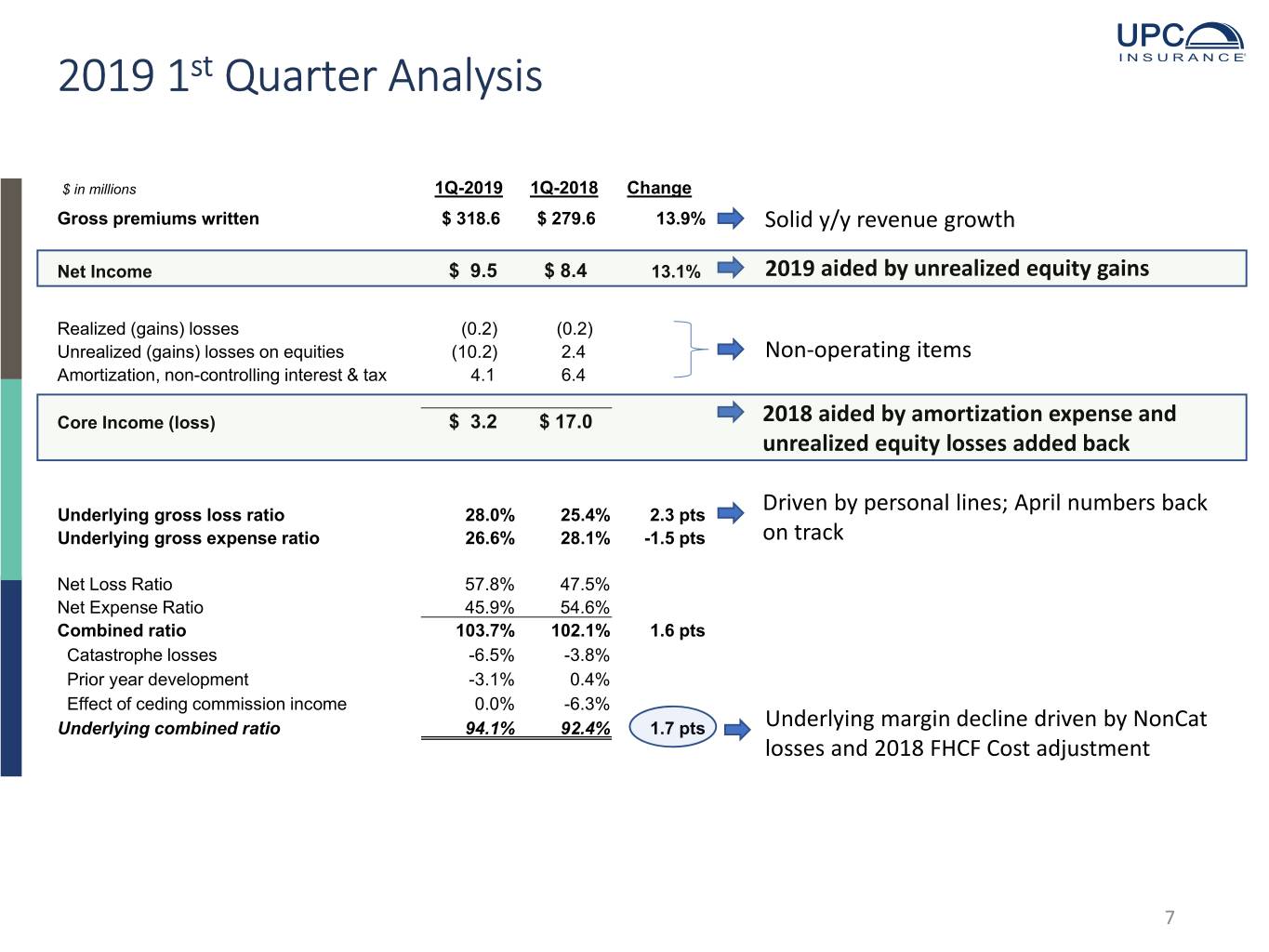

2019 1st Quarter Analysis $ in millions 1Q-2019 1Q-2018 Change Gross premiums written $ 318.6 $ 279.6 13.9% Solid y/y revenue growth Net Income $ 9.5 $ 8.4 13.1% 2019 aided by unrealized equity gains Realized (gains) losses (0.2) (0.2) Unrealized (gains) losses on equities (10.2) 2.4 Non-operating items Amortization, non-controlling interest & tax 4.1 6.4 Core Income (loss) $ 3.2 $ 17.0 2018 aided by amortization expense and unrealized equity losses added back Driven by personal lines; April numbers back Underlying gross loss ratio 28.0% 25.4% 2.3 pts Underlying gross expense ratio 26.6% 28.1% -1.5 pts on track Net Loss Ratio 57.8% 47.5% Net Expense Ratio 45.9% 54.6% Combined ratio 103.7% 102.1% 1.6 pts Catastrophe losses -6.5% -3.8% Prior year development -3.1% 0.4% Effect of ceding commission income 0.0% -6.3% Underlying combined ratio 94.1% 92.4% 1.7 pts Underlying margin decline driven by NonCat losses and 2018 FHCF Cost adjustment 7

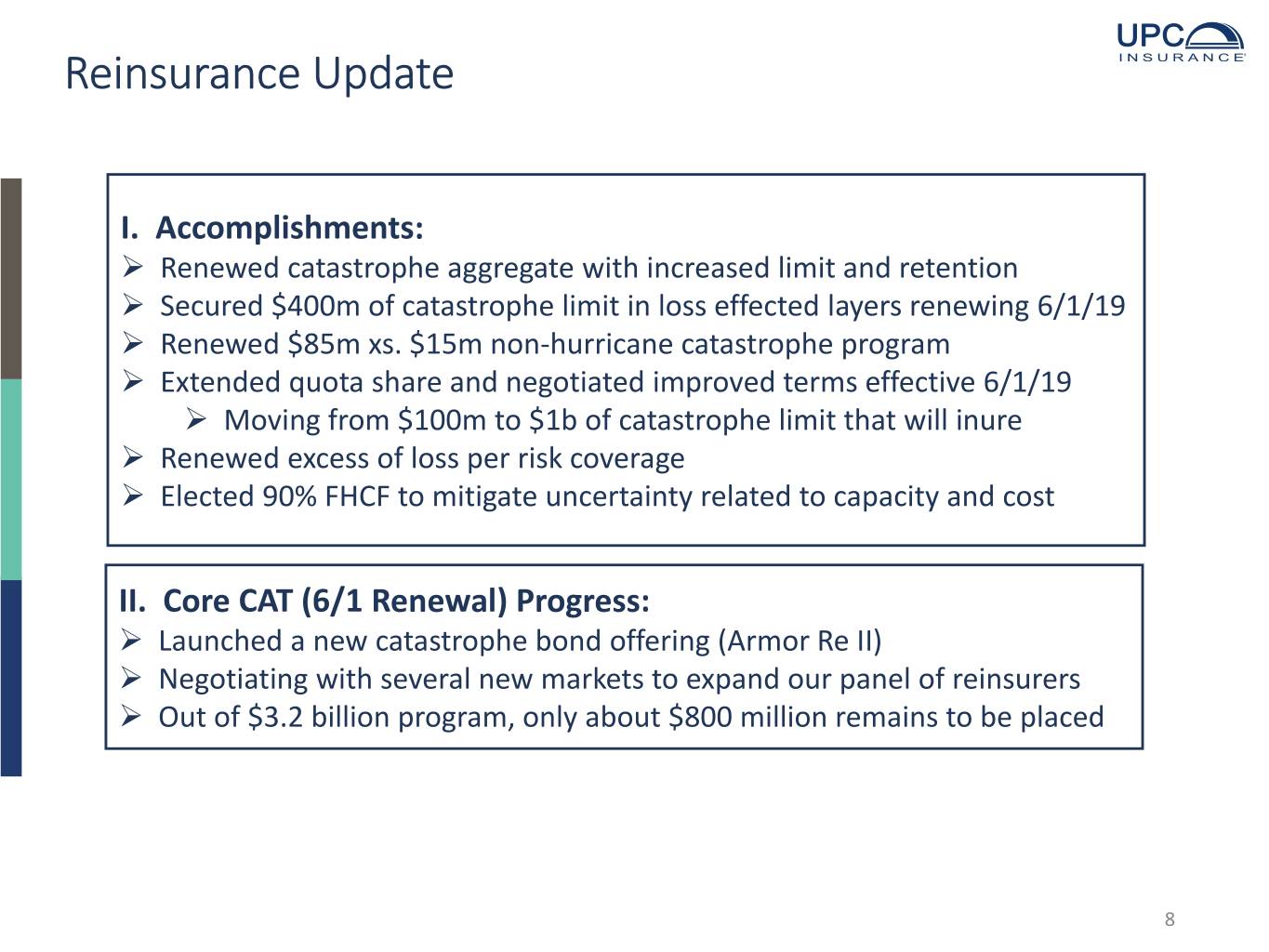

Reinsurance Update I. Accomplishments: Renewed catastrophe aggregate with increased limit and retention Secured $400m of catastrophe limit in loss effected layers renewing 6/1/19 Renewed $85m xs. $15m non-hurricane catastrophe program Extended quota share and negotiated improved terms effective 6/1/19 Moving from $100m to $1b of catastrophe limit that will inure Renewed excess of loss per risk coverage Elected 90% FHCF to mitigate uncertainty related to capacity and cost II. Core CAT (6/1 Renewal) Progress: Launched a new catastrophe bond offering (Armor Re II) Negotiating with several new markets to expand our panel of reinsurers Out of $3.2 billion program, only about $800 million remains to be placed 8

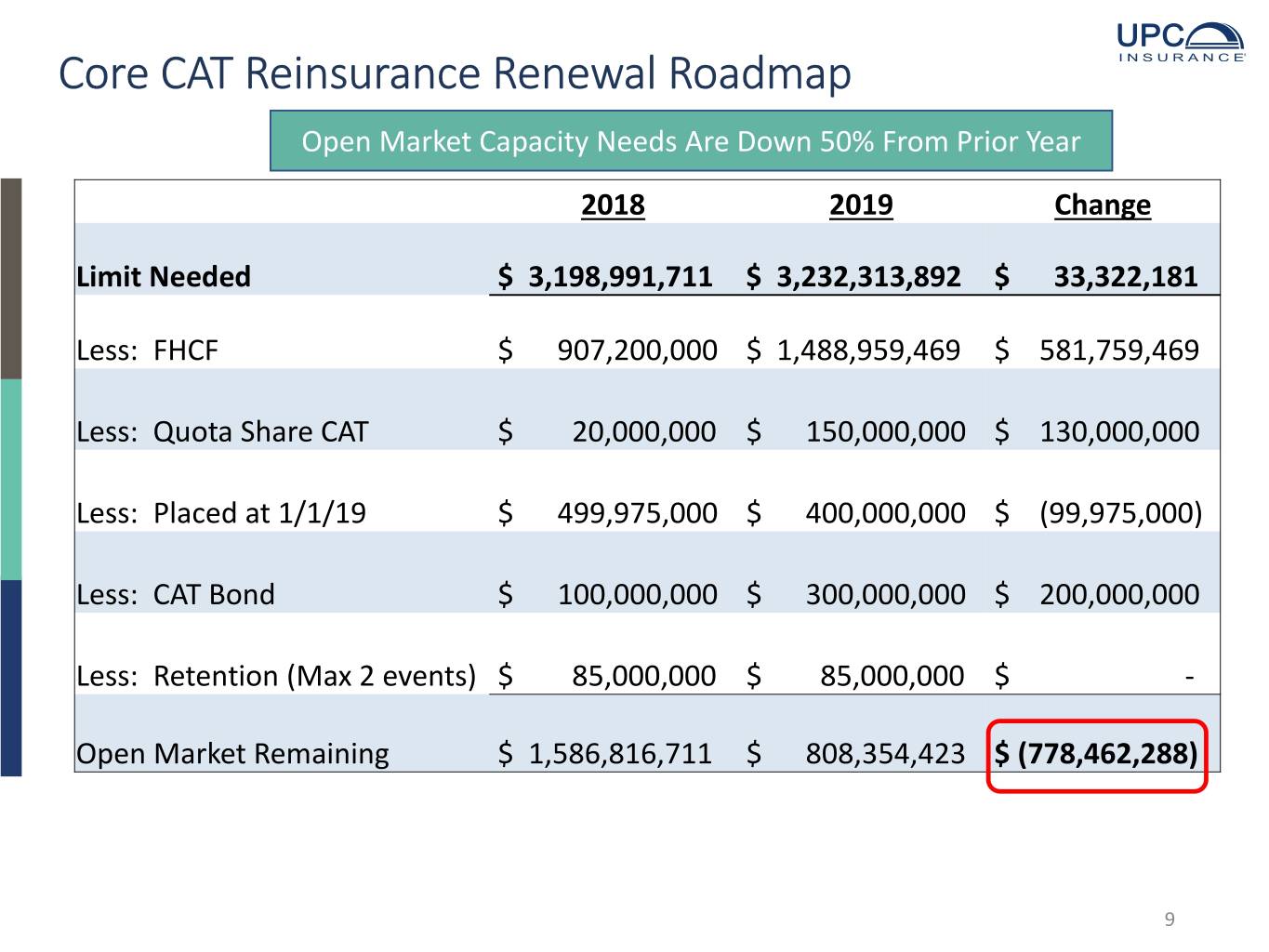

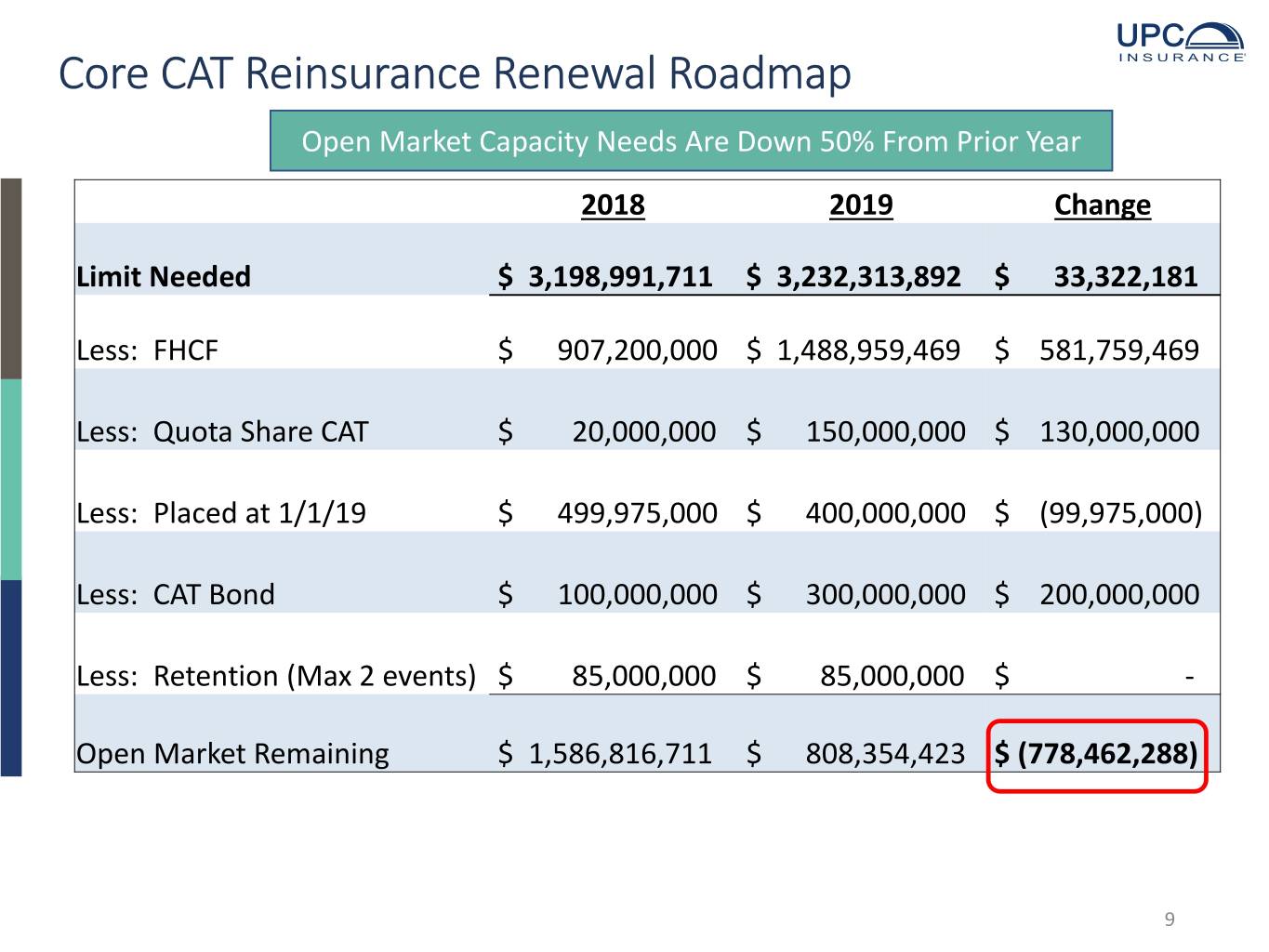

Core CAT Reinsurance Renewal Roadmap Open Market Capacity Needs Are Down 50% From Prior Year 2018 2019 Change Limit Needed $ 3,198,991,711 $ 3,232,313,892 $ 33,322,181 Less: FHCF $ 907,200,000 $ 1,488,959,469 $ 581,759,469 Less: Quota Share CAT $ 20,000,000 $ 150,000,000 $ 130,000,000 Less: Placed at 1/1/19 $ 499,975,000 $ 400,000,000 $ (99,975,000) Less: CAT Bond $ 100,000,000 $ 300,000,000 $ 200,000,000 Less: Retention (Max 2 events) $ 85,000,000 $ 85,000,000 $ - Open Market Remaining $ 1,586,816,711 $ 808,354,423 $ (778,462,288) 9

Cautionary Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report on Form 10-K for the year ended December 31, 2018. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See the Appendix section of this presentation for further information regarding these non-GAAP financial measures. The information in this presentation is confidential. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited. 11