Investor Presentation 2nd Quarter 2019 July 31, 2019 St. Petersburg, FL

Financial Highlights 6.30.19 6.30.18 Total Assets $2.70 b $2.32b BVPS $12.54 $12.72 Gross Written Premium $768.3 m $664.3m Net Income $8.7 m $ 23.1m Core Income ($0.3) m $ 33.3m Core ROAE (annualized) (0.1)% 12.4% Combined Ratio 106.0% 95.0% Underlying Combined Ratio 93.0% 88.5% 2

Q2-2019 Executive Summary I. REVENUE HIGHLIGHTS • Gross Premiums Written of $449.8m: • Up +17% (+$65.1m) y/y • Commercial lines up +28% (+$35.9m) | Personal Lines +11% (+$29.2m) • Florida +19% (+$38.2m) | Non-Florida +12% (+$16.8m) • Gross Premiums Earned (GPE) of $330.0m: • Up +14% (+$40.4m) y/y • Ceded Premiums Earned (CPE) of $139.6m: • Up +18% (+$21.3m) y/y • Increased quota share participation from 20.0% to 22.5% for both UPC & FSIC at 6.1.19 • Quota share CPE was $30.3m (9.2% of GPE) for Q2-19 vs. $25.2m (8.7% of GPE) in Q2-18 II. LOSS & EXPENSE HIGHLIGHTS • Underlying loss & LAE of $85.1m: • Up +18% (+13.0m) y/y due to higher severity from commercial E&S (+$7.7m of y/y increase) • Underlying loss & LAE ratio increased 0.9 points to 25.8% from 24.9% in Q2-18 • Current accident year CAT losses of $15.8m (8.3% of net premiums earned) in the quarter driven by: • 16 new events in Q2-19 with gross incurred CAT losses of $51.6m • PCS events 1921 & 1927 hit our $15m non-hurricane CAT retention in Q2-19 • YTD gross CAT losses in the current accident year increased to $79m vs. $55m in 1H-18 • Operating expenses of $89.6m: • Up +23% (+$16.8m) driving the gross expense ratio up 2.1 points y/y • YTD gross expense ratio declined 0.1 point to 26.9% vs. 27.0% in the 1H-18 III. RESERVE DEVELOPMENT • $15.3m of adverse development (8.1% of net premiums earned) in the quarter was: • 56% CAT and 44% NonCAT vs. Q1-19 which was all CAT driven • Primarily from Florida personal lines on the 2018 accident year • Driven mainly by late reported claims, litigation and AOB activity • We do not expect 1H19 adverse development to persist based on reserve action taken and new legislation 3

Revenue Growth by Line/Region All Regions and Lines Grew ~ 16% in the 1H-19 Personal Lines +13% 21% 14% Strong double digit organic growth across 19% the board 14% 11% 4

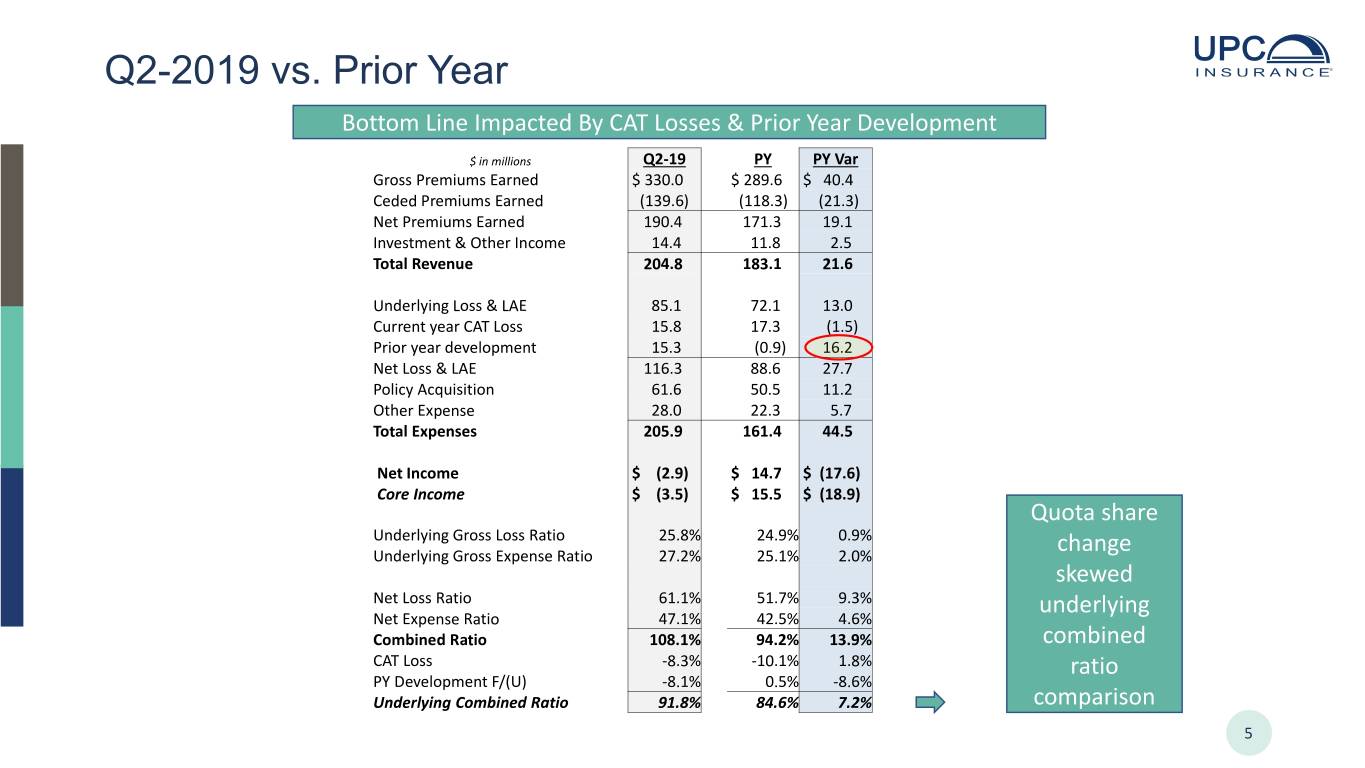

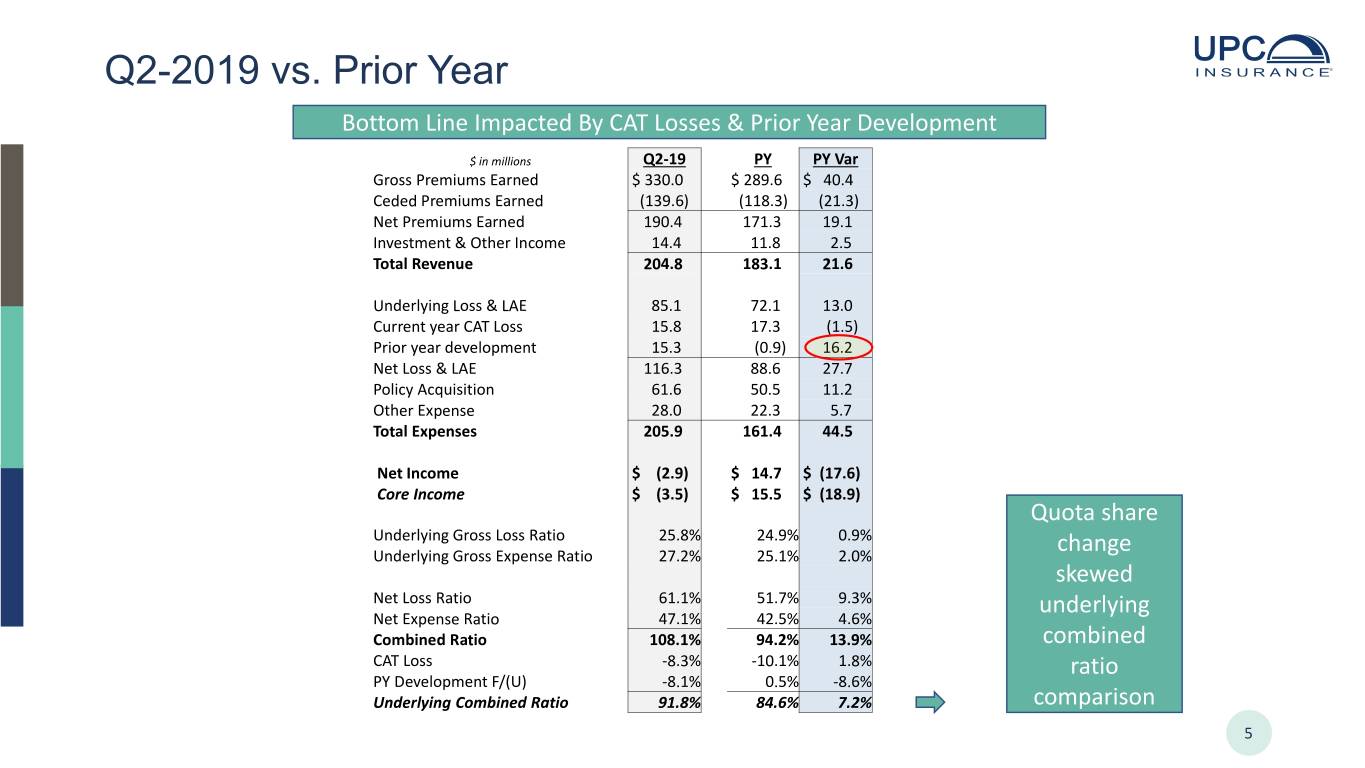

Q2-2019 vs. Prior Year Bottom Line Impacted By CAT Losses & Prior Year Development $ in millions Q2-19 PY PY Var Gross Premiums Earned $ 330.0 $ 289.6 $ 40.4 Ceded Premiums Earned (139.6) (118.3) (21.3) Net Premiums Earned 190.4 171.3 19.1 Investment & Other Income 14.4 11.8 2.5 Total Revenue 204.8 183.1 21.6 Underlying Loss & LAE 85.1 72.1 13.0 Current year CAT Loss 15.8 17.3 (1.5) Prior year development 15.3 (0.9) 16.2 Net Loss & LAE 116.3 88.6 27.7 Policy Acquisition 61.6 50.5 11.2 Other Expense 28.0 22.3 5.7 Total Expenses 205.9 161.4 44.5 Net Income $ (2.9) $ 14.7 $ (17.6) Core Income $ (3.5) $ 15.5 $ (18.9) Quota share Underlying Gross Loss Ratio 25.8% 24.9% 0.9% Underlying Gross Expense Ratio 27.2% 25.1% 2.0% change skewed Net Loss Ratio 61.1% 51.7% 9.3% underlying Net Expense Ratio 47.1% 42.5% 4.6% Combined Ratio 108.1% 94.2% 13.9% combined CAT Loss -8.3% -10.1% 1.8% ratio PY Development F/(U) -8.1% 0.5% -8.6% Underlying Combined Ratio 91.8% 84.6% 7.2% comparison 5

Prior Year Development Summary Florida Personal Lines drove the Prior Year Reserve Development All States FL Non-FL Q1 was 100% CAT Driven vs. Q2 2013 & Prior $ (11) $ 224 $ (235) 2014 $ (117) $ (55) $ (62) which was 56% CAT / 44% 2015 $ 342 $ 366 $ (24) NonCAT 2016 $ 899 $ 672 $ 228 2017 $ 419 $ 3,011 $ (2,592) 2018 $ 19,990 $ 15,010 $ 4,981 YTD Total $ 21,523 $ 19,228 $ 2,295 Q1-19 Q2-19 6.30.19 CAT 6,264 8,654 14,917 NonCAT (629) 6,681 6,051 United P&C and Family Security’s Personal Lines 8,242 13,281 21,523 Commercial (2,608) 2,053 (555) homeowners business in Florida is driving ~89% of the development YTD at 6.30.19 6

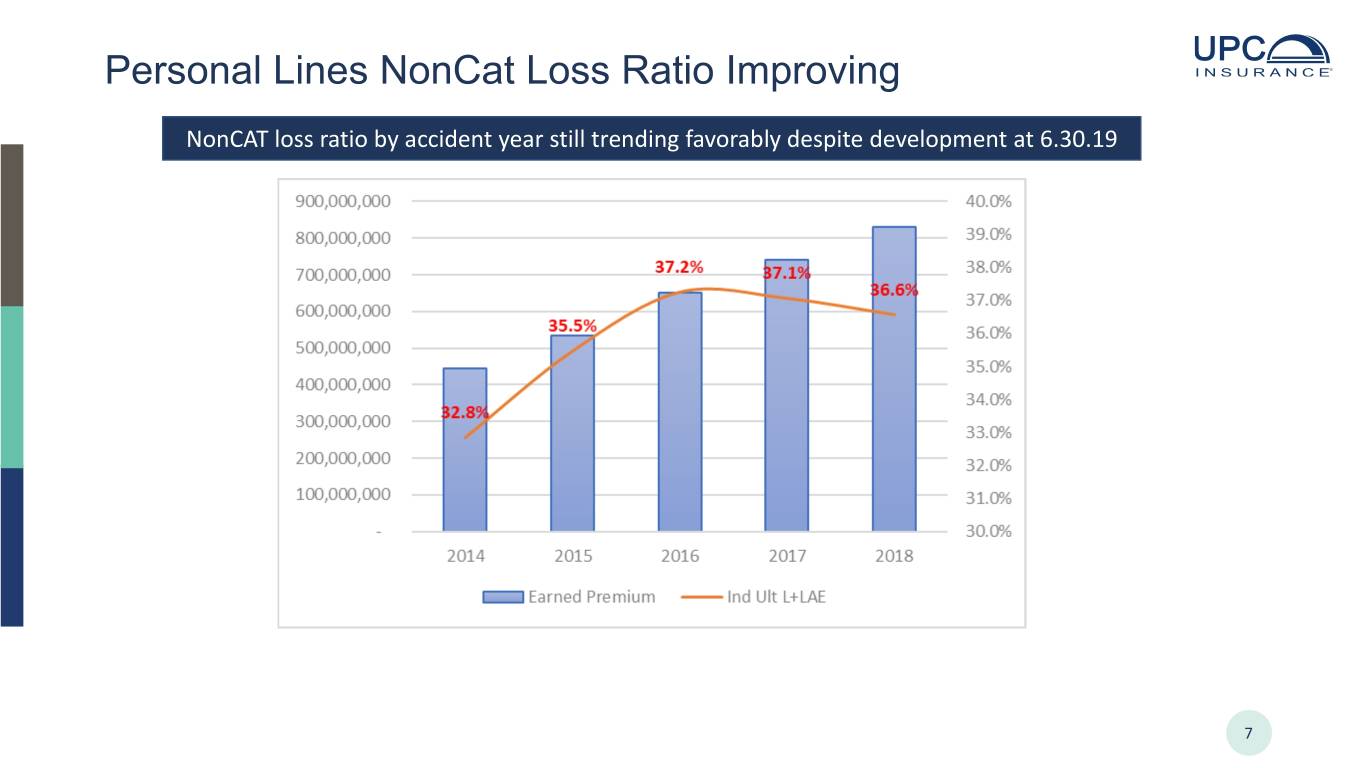

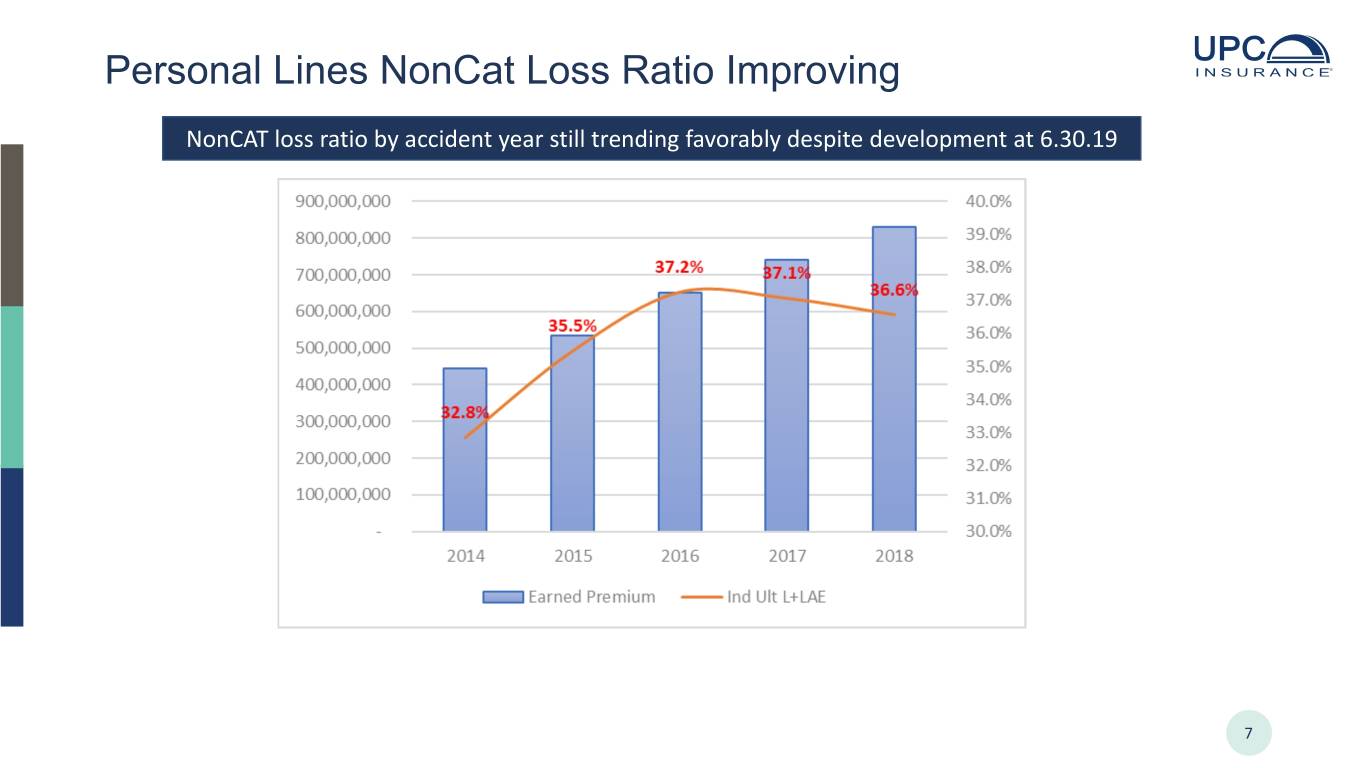

Personal Lines NonCat Loss Ratio Improving NonCAT loss ratio by accident year still trending favorably despite development at 6.30.19 7

Growth & Profit Improvement Actions • Rate changes • Approved = +9.2% FSIC-FL (6/1/19) and 5% UPC-NY (4/1/19) • Pending = +13.3% UPC-FL (est. 10/1/19) and +12.5% FSIC-FL (est. 10/1/19 new & 11/1/19 renewal) • Underwriting changes • Aerial imagery and AI technology being used to evaluate roof shape and condition • Home Self Inspection (HSI) now mandatory in all states • Predictive analytics model used to re-underwrite Rhode Island and being rolled out to all states • Claims handling improvements • Cycle times getting faster • Claims closed without payment are increasing • Continuing to insource desk and field adjusting services to improve quality and lower cost • Marketing/expense actions • Reduction of agent overrides based on loss ratio • Termination of poor performing agents 8

Florida Rate Changes 3 FL Rate Changes Effective in 2019 Will Generate Approximately $39M in Additional Premium CURRENT Approved EXPECTED PREMIUM IMPACT In-force In-force Renewal Rate Adjusted Adjusted Renewal Premium Adjusted P&L Policies Premium Retention Premium Average Change Retention PIF Premium Impact Average Impact FSIC-FL 105,146 $ 148,525 88.4% $ 131,366 $ 1,413 9.2% 85.0% 89,374 $ 137,861 4.9% $ 1,543 $ 6,495 Proposed EXPECTED PREMIUM IMPACT Rate Adjusted Adjusted Renewal Premium Adjusted P&L Change Retention PIF Premium Impact Average Impact 12.5% 82.0% 86,220 $ 148,219 12.8% $ 1,719 $ 16,853 CURRENT Proposed EXPECTED PREMIUM IMPACT In-force In-force Renewal Rate Adjusted Adjusted Renewal Premium Adjusted P&L Policies Premium Retention Premium Average Change Retention PIF Premium Impact Average Impact UPC-FL 105,459 $ 212,589 85.4% $ 181,611 $ 2,016 13.3% 82.0% 86,476 $ 197,507 8.8% $ 2,284 $ 15,896 9

Predictive Analytics Model – Back Test & RI Validation Estimated Non Cat Total Total Total Estimated Estimated Combined Action Non-CAT Inc Loss Cat Incurred Cat Incurred Incurred Non-CAT CAT Total Total Loss Loss Reinsurance Combined Ratio w 27% Estimated State Company Level EP EHY Incurred Loss Ratio Loss Loss Ratio Loss Ratio Freq Freq Freq Severity Cost Ratio Ratio Ratio Expense Profit/Loss All All A 598,502,954 345,813 155,838,941 26.0% 53,952,748 9.0% 35.1% 4.3% 1.5% 5.8% 20,901 607 35.1% 26.7% 61.8% 88.8% 67,063,696 All All B 181,961,046 119,311 68,734,110 37.8% 26,892,375 14.8% 52.6% 4.8% 1.8% 6.6% 24,259 801 52.6% 38.1% 90.7% 117.7% (32,144,833) All All C 55,569,813 50,139 27,705,576 49.9% 13,944,443 25.1% 75.0% 5.2% 2.3% 7.4% 23,069 831 75.0% 46.5% 121.4% 148.4% (26,896,575) Total 1,046,146,393 312,259,922 29.8% 116,303,729 11.1% 41.0% Total Excl C Policies 990,576,580 284,554,346 28.7% 102,359,286 10.3% 39.1% • Back test identified $55.5M of EP that adversely impacted LR • Non-Cat by 1.1 pts • Cat by 0.8 pts • Improved both AOP and CAT Frequency • Rhode Island – demonstrable loss cost improvement using model selection 10