Investor Presentation Supplement to Second Quarter 2020 Results August 5, 2020 St. Petersburg, FL

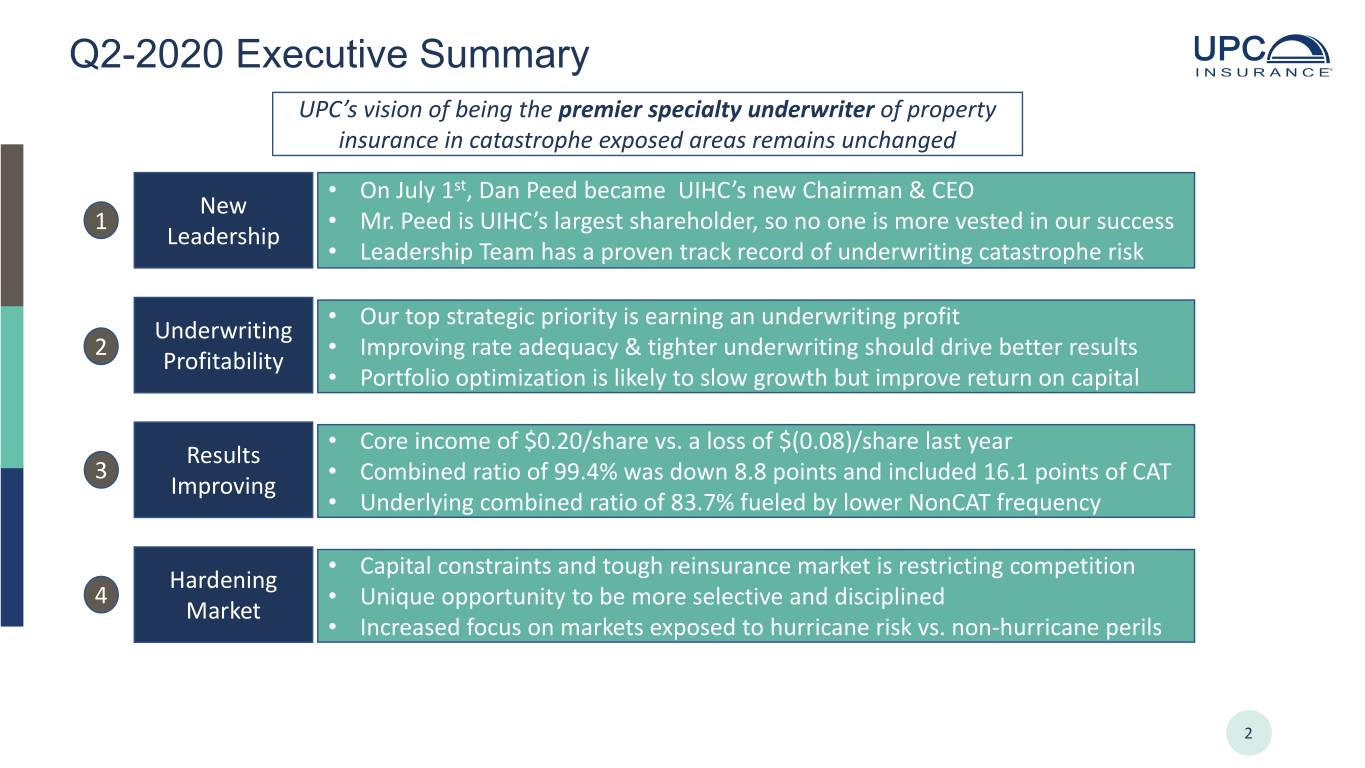

Q2-2020 Executive Summary UPC’s vision of being the premier specialty underwriter of property insurance in catastrophe exposed areas remains unchanged • On July 1st, Dan Peed became UIHC’s new Chairman & CEO New 1 • Mr. Peed is UIHC’s largest shareholder, so no one is more vested in our success Leadership • Leadership Team has a proven track record of underwriting catastrophe risk • Our top strategic priority is earning an underwriting profit Underwriting 2 • Improving rate adequacy & tighter underwriting should drive better results Profitability • Portfolio optimization is likely to slow growth but improve return on capital • Core income of $0.20/share vs. a loss of $(0.08)/share last year Results 3 • Combined ratio of 99.4% was down 8.8 points and included 16.1 points of CAT Improving • Underlying combined ratio of 83.7% fueled by lower NonCAT frequency • Capital constraints and tough reinsurance market is restricting competition Hardening 4 • Unique opportunity to be more selective and disciplined Market • Increased focus on markets exposed to hurricane risk vs. non-hurricane perils 2

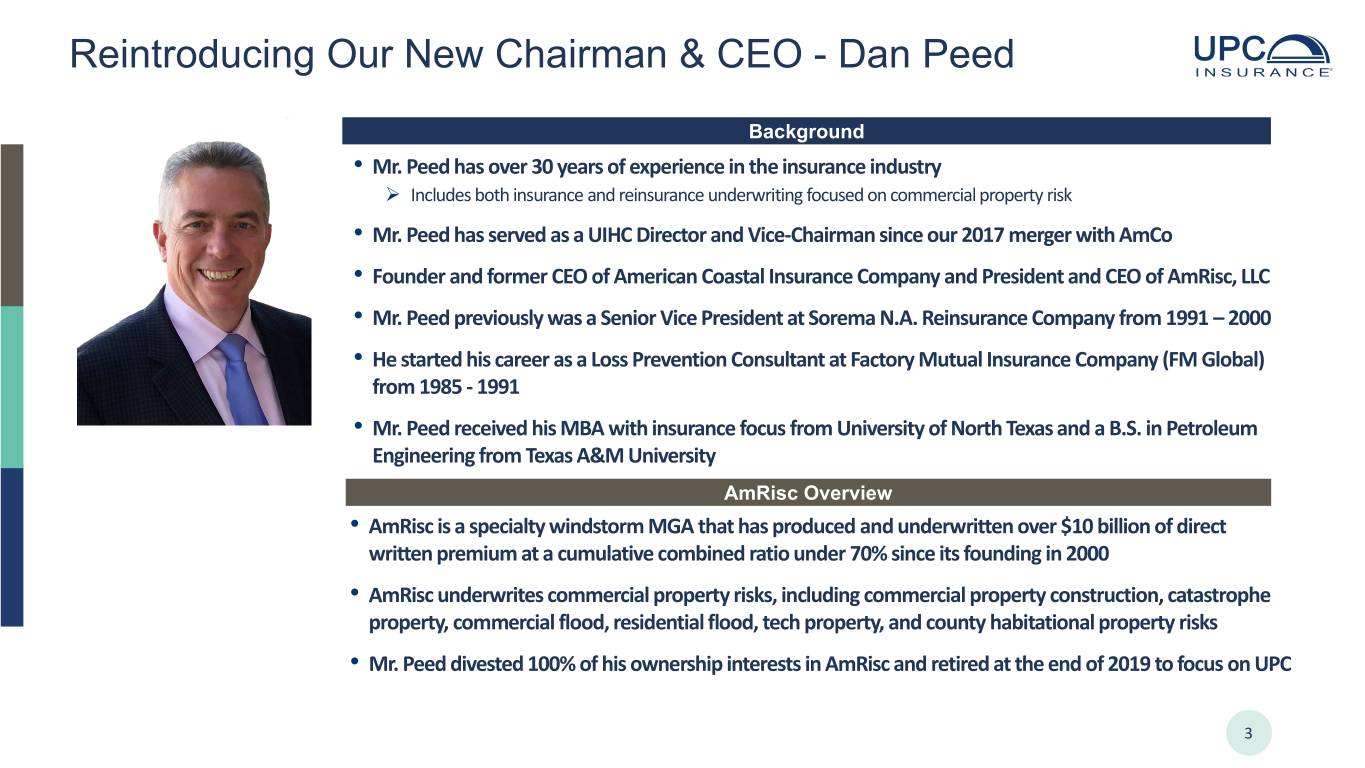

Reintroducing Our New Chairman & CEO - Dan Peed Background • Mr. Peed has over 30 years of experience in the insurance industry Includes both insurance and reinsurance underwriting focused on commercial property risk • Mr. Peed has served as a UIHC Director and Vice-Chairman since our 2017 merger with AmCo • Founder and former CEO of American Coastal Insurance Company and President and CEO of AmRisc, LLC • Mr. Peed previously was a Senior Vice President at Sorema N.A. Reinsurance Company from 1991 – 2000 • He started his career as a Loss Prevention Consultant at Factory Mutual Insurance Company (FM Global) from 1985 - 1991 • Mr. Peed received his MBA with insurance focus from University of North Texas and a B.S. in Petroleum Engineering from Texas A&M University AmRisc Overview • AmRisc is a specialty windstorm MGA that has produced and underwritten over $10 billion of direct written premium at a cumulative combined ratio under 70% since its founding in 2000 • AmRisc underwrites commercial property risks, including commercial property construction, catastrophe property, commercial flood, residential flood, tech property, and county habitational property risks • Mr. Peed divested 100% of his ownership interests in AmRisc and retired at the end of 2019 to focus on UPC 3

Summary of Operating Results Almost all key metrics improved in Q2-2020 compared to the prior year Q2-2020 Q2-2019 Change Core income $ 8,816 $ (3,459) 354.9% per diluted share (CEPS) $ 0.20 $ (0.08) CEPS excluding named windstorm $ 0.30 $ (0.08) Included the following items Net current year catastrophe loss & LAE incurred $ 29,799 $ 15,802 Net (favorable) unfavorable reserve development $ (823) $ 15,332 Total items $ 28,976 $ 31,134 Gross underlying loss & LAE ratio 21.1% 25.8% (4.7) pts Gross expense ratio 24.0% 27.2% (3.1) pts Net loss & LAE ratio 54.8% 61.1% Net expense ratio 44.6% 47.1% Combined ratio 99.4% 108.1% (8.8) pts Net current year catastrophe loss & LAE incurred -16.1% -8.3% 16.1 points of CAT hurt an Net favorable (unfavorable) reserve development 0.4% -8.1% otherwise solid quarter Underlying combined ratio 83.7% 91.8% (8.1) pts Core income increased $12.3m year over year, despite retaining $14.0m more in CAT losses in the current quarter 4

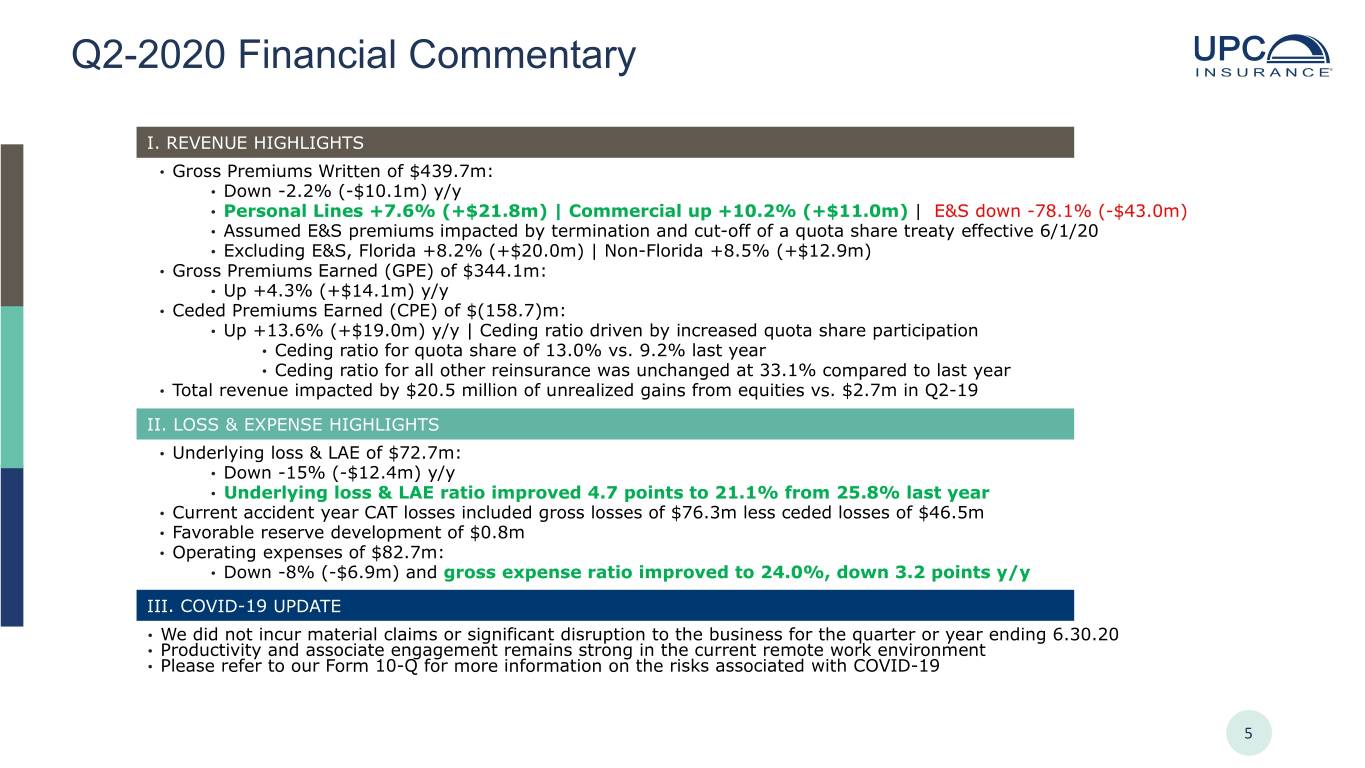

Q2-2020 Financial Commentary I. REVENUE HIGHLIGHTS • Gross Premiums Written of $439.7m: • Down -2.2% (-$10.1m) y/y • Personal Lines +7.6% (+$21.8m) | Commercial up +10.2% (+$11.0m) | E&S down -78.1% (-$43.0m) • Assumed E&S premiums impacted by termination and cut-off of a quota share treaty effective 6/1/20 • Excluding E&S, Florida +8.2% (+$20.0m) | Non-Florida +8.5% (+$12.9m) • Gross Premiums Earned (GPE) of $344.1m: • Up +4.3% (+$14.1m) y/y • Ceded Premiums Earned (CPE) of $(158.7)m: • Up +13.6% (+$19.0m) y/y | Ceding ratio driven by increased quota share participation • Ceding ratio for quota share of 13.0% vs. 9.2% last year • Ceding ratio for all other reinsurance was unchanged at 33.1% compared to last year • Total revenue impacted by $20.5 million of unrealized gains from equities vs. $2.7m in Q2-19 II. LOSS & EXPENSE HIGHLIGHTS • Underlying loss & LAE of $72.7m: • Down -15% (-$12.4m) y/y • Underlying loss & LAE ratio improved 4.7 points to 21.1% from 25.8% last year • Current accident year CAT losses included gross losses of $76.3m less ceded losses of $46.5m • Favorable reserve development of $0.8m • Operating expenses of $82.7m: • Down -8% (-$6.9m) and gross expense ratio improved to 24.0%, down 3.2 points y/y III. COVID-19 UPDATE • We did not incur material claims or significant disruption to the business for the quarter or year ending 6.30.20 • Productivity and associate engagement remains strong in the current remote work environment • Please refer to our Form 10-Q for more information on the risks associated with COVID-19 5

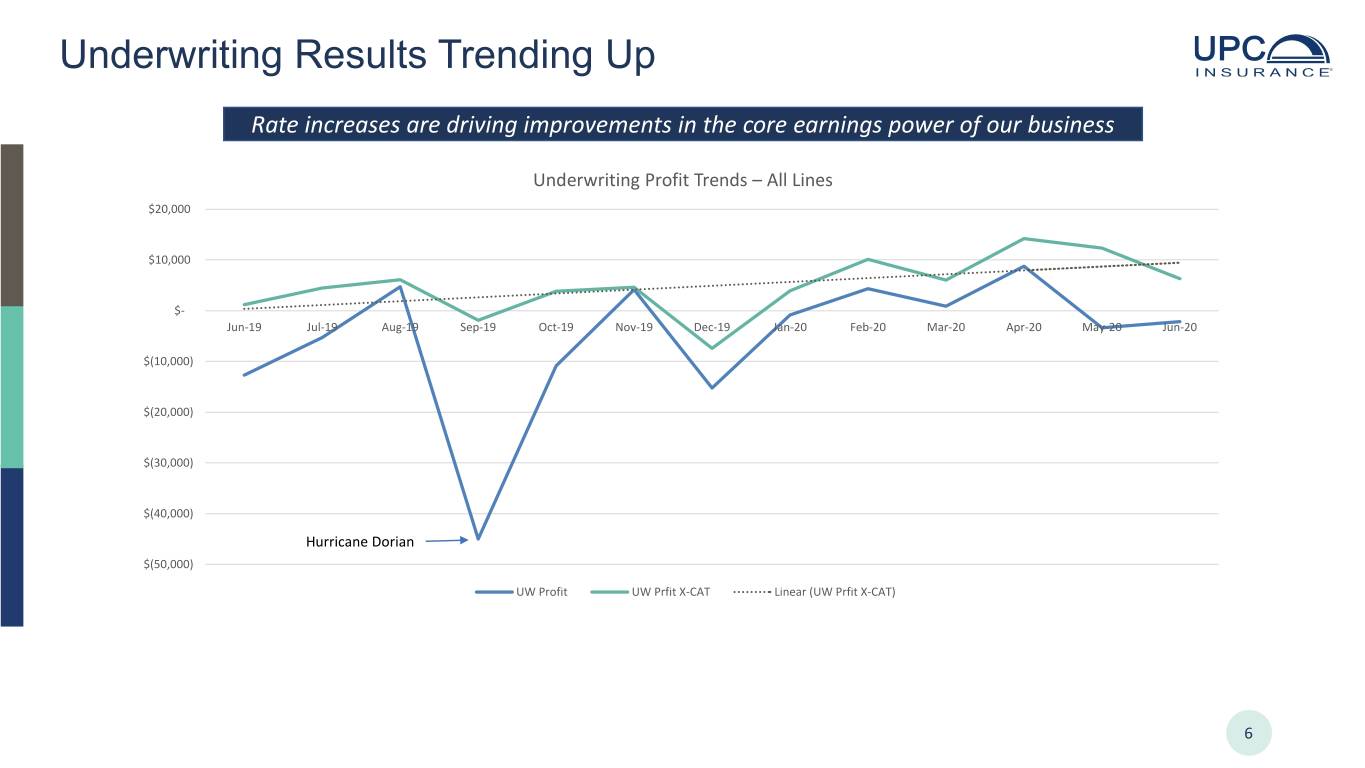

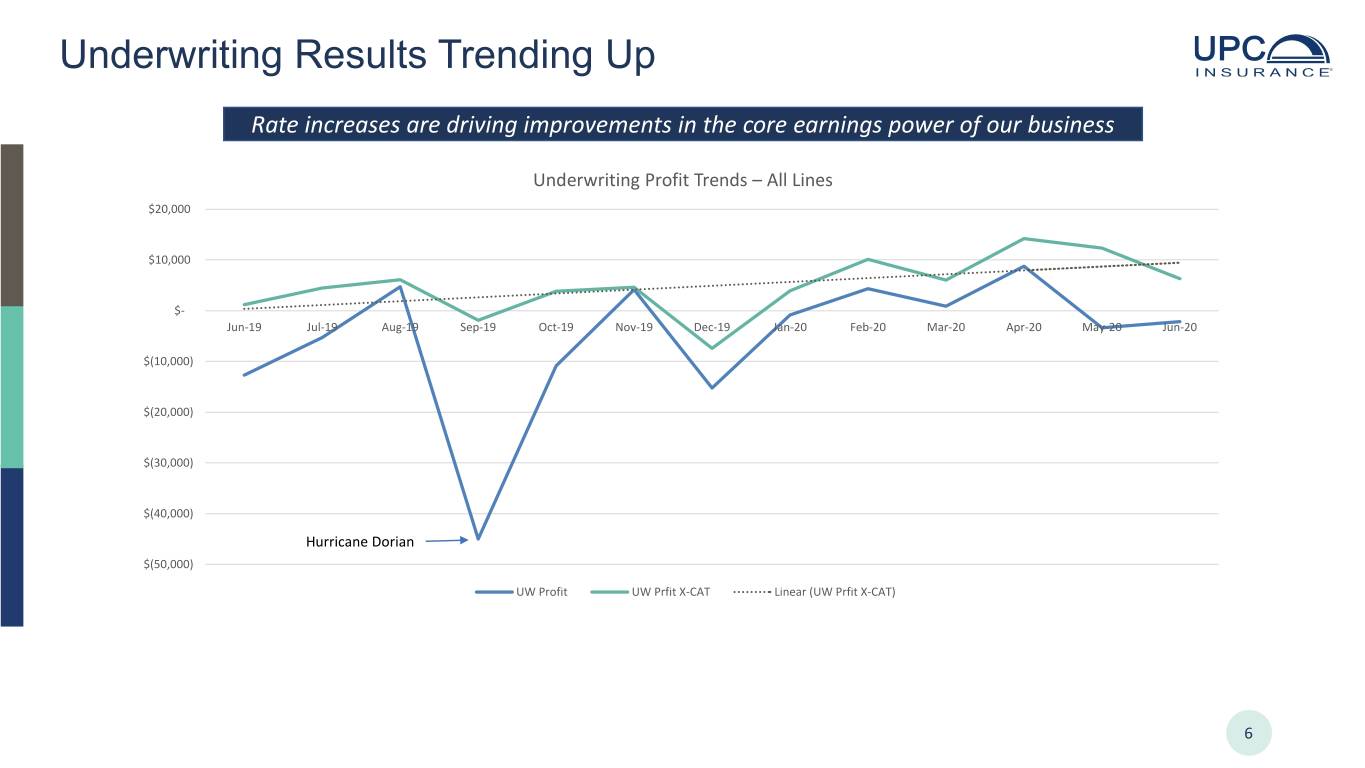

Underwriting Results Trending Up Rate increases are driving improvements in the core earnings power of our business Underwriting Profit Trends – All Lines $20,000 $10,000 $- Jun-19 Jul-19 Aug-19 Sep-19 Oct-19 Nov-19 Dec-19 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 $(10,000) $(20,000) $(30,000) $(40,000) Hurricane Dorian $(50,000) UW Profit UW Prfit X-CAT Linear (UW Prfit X-CAT) 6

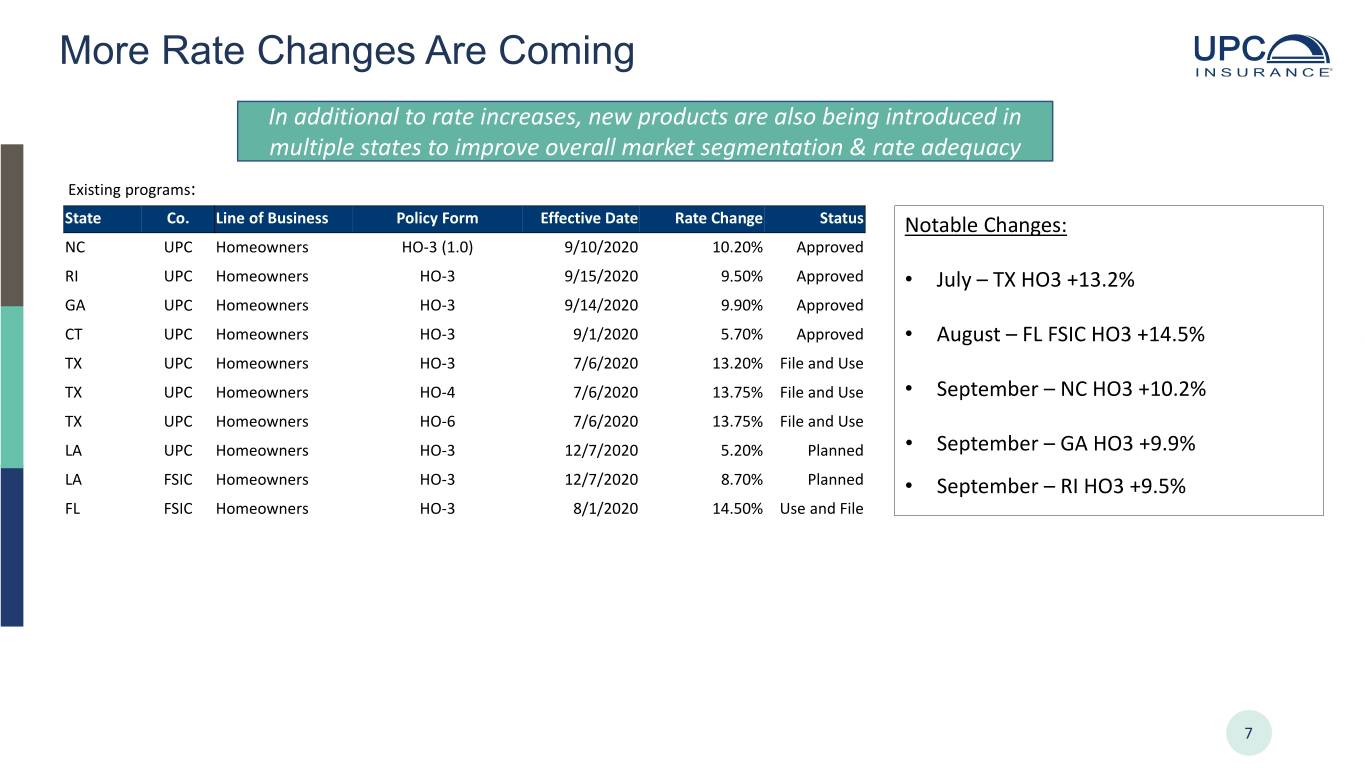

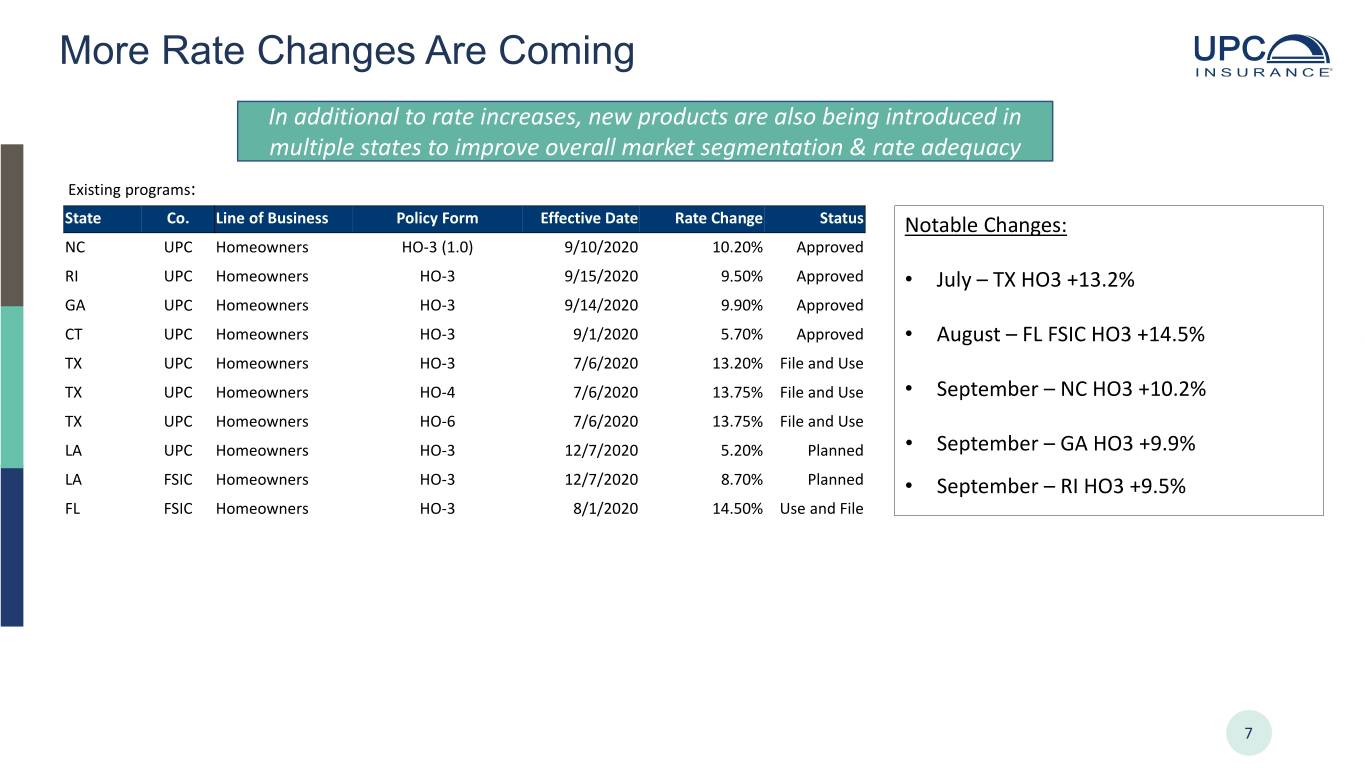

More Rate Changes Are Coming In additional to rate increases, new products are also being introduced in multiple states to improve overall market segmentation & rate adequacy Existing programs: State Co. Line of Business Policy Form Effective Date Rate Change Status Notable Changes: NC UPC Homeowners HO-3 (1.0) 9/10/2020 10.20% Approved RI UPC Homeowners HO-3 9/15/2020 9.50% Approved • July – TX HO3 +13.2% GA UPC Homeowners HO-3 9/14/2020 9.90% Approved CT UPC Homeowners HO-3 9/1/2020 5.70% Approved • August – FL FSIC HO3 +14.5% TX UPC Homeowners HO-3 7/6/2020 13.20% File and Use TX UPC Homeowners HO-4 7/6/2020 13.75% File and Use • September – NC HO3 +10.2% TX UPC Homeowners HO-6 7/6/2020 13.75% File and Use LA UPC Homeowners HO-3 12/7/2020 5.20% Planned • September – GA HO3 +9.9% LA FSIC Homeowners HO-3 12/7/2020 8.70% Planned • September – RI HO3 +9.5% FL FSIC Homeowners HO-3 8/1/2020 14.50% Use and File 7

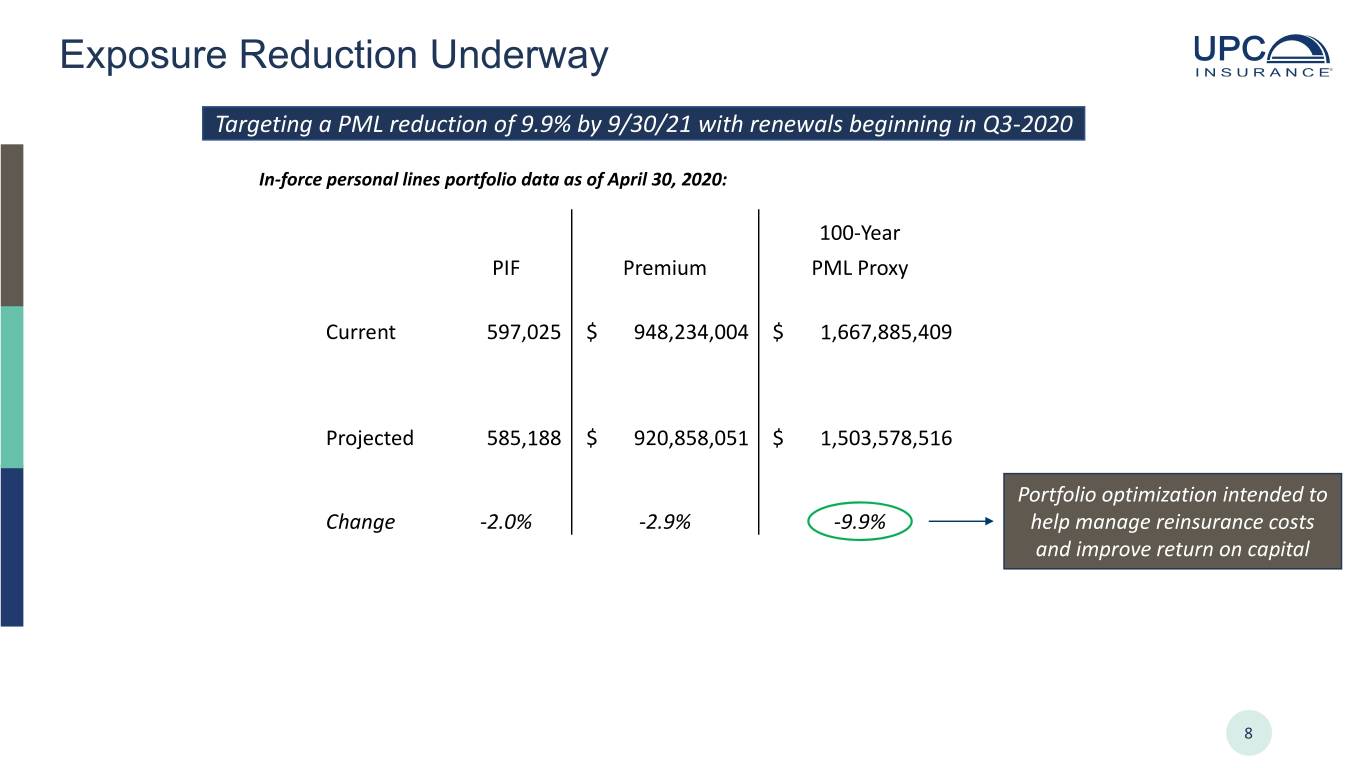

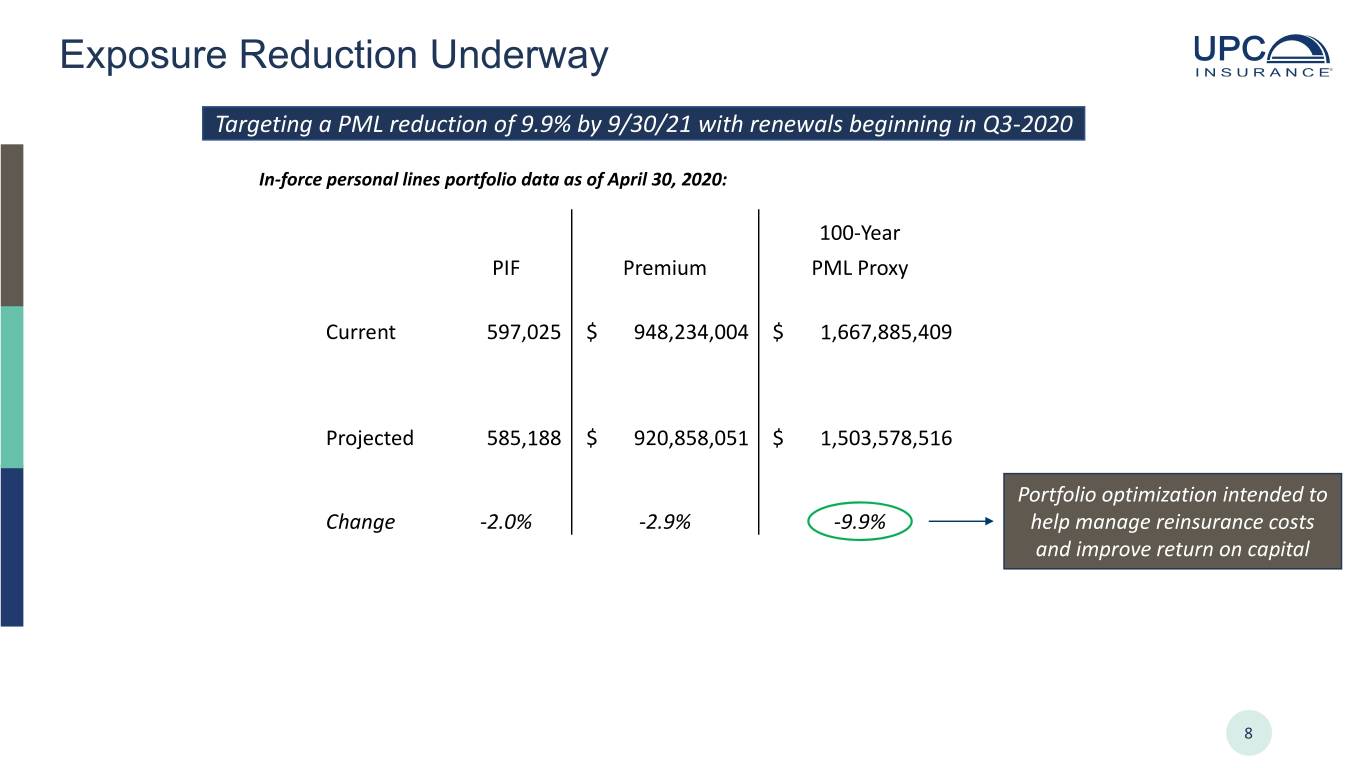

Exposure Reduction Underway Targeting a PML reduction of 9.9% by 9/30/21 with renewals beginning in Q3-2020 In-force personal lines portfolio data as of April 30, 2020: 100-Year PIF Premium PML Proxy Current 597,025 $ 948,234,004 $ 1,667,885,409 Projected 585,188 $ 920,858,051 $ 1,503,578,516 Portfolio optimization intended to Change -2.0% -2.9% -9.9% help manage reinsurance costs and improve return on capital 8

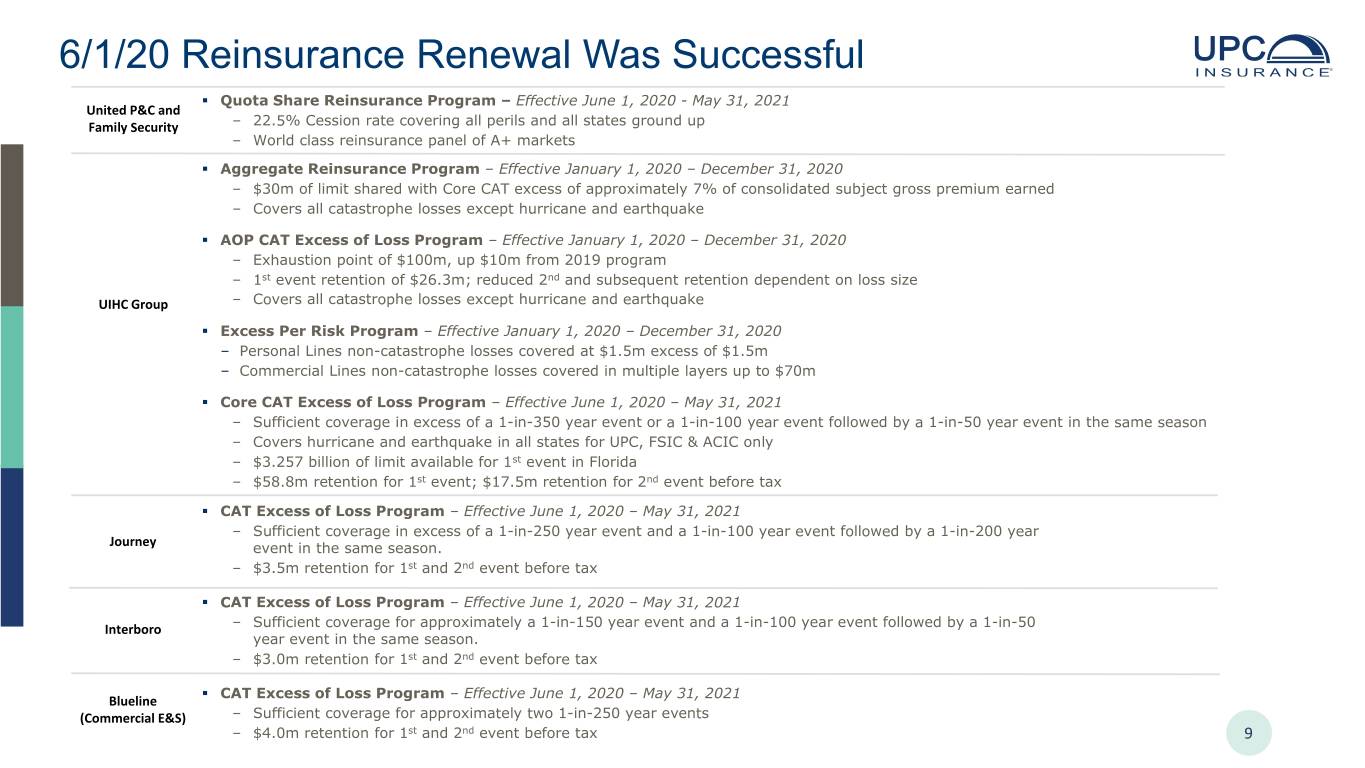

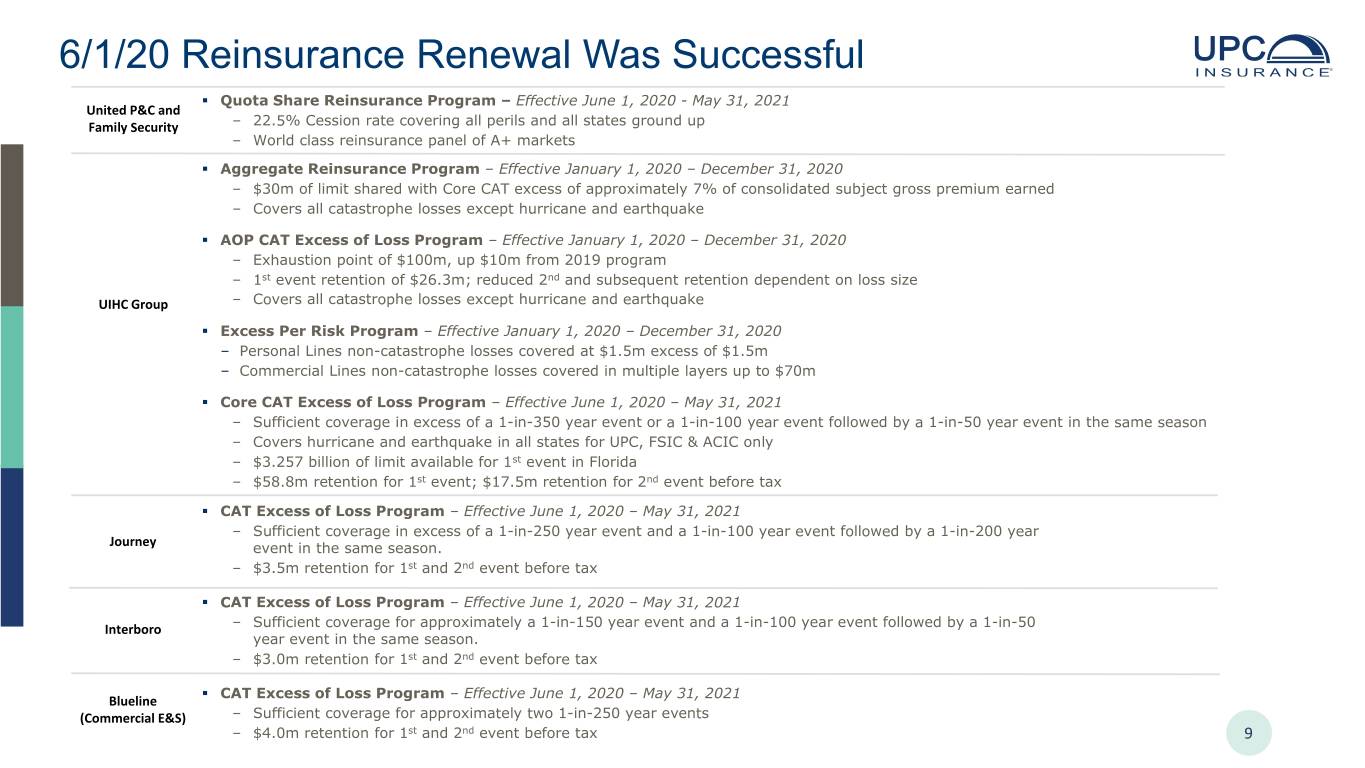

6/1/20 Reinsurance Renewal Was Successful . Quota Share Reinsurance Program – Effective June 1, 2020 - May 31, 2021 United P&C and Family Security ‒ 22.5% Cession rate covering all perils and all states ground up ‒ World class reinsurance panel of A+ markets . Aggregate Reinsurance Program – Effective January 1, 2020 – December 31, 2020 ‒ $30m of limit shared with Core CAT excess of approximately 7% of consolidated subject gross premium earned ‒ Covers all catastrophe losses except hurricane and earthquake . AOP CAT Excess of Loss Program – Effective January 1, 2020 – December 31, 2020 ‒ Exhaustion point of $100m, up $10m from 2019 program ‒ 1st event retention of $26.3m; reduced 2nd and subsequent retention dependent on loss size UIHC Group ‒ Covers all catastrophe losses except hurricane and earthquake . Excess Per Risk Program – Effective January 1, 2020 – December 31, 2020 – Personal Lines non-catastrophe losses covered at $1.5m excess of $1.5m – Commercial Lines non-catastrophe losses covered in multiple layers up to $70m . Core CAT Excess of Loss Program – Effective June 1, 2020 – May 31, 2021 ‒ Sufficient coverage in excess of a 1-in-350 year event or a 1-in-100 year event followed by a 1-in-50 year event in the same season ‒ Covers hurricane and earthquake in all states for UPC, FSIC & ACIC only ‒ $3.257 billion of limit available for 1st event in Florida ‒ $58.8m retention for 1st event; $17.5m retention for 2nd event before tax . CAT Excess of Loss Program – Effective June 1, 2020 – May 31, 2021 ‒ Sufficient coverage in excess of a 1-in-250 year event and a 1-in-100 year event followed by a 1-in-200 year Journey event in the same season. ‒ $3.5m retention for 1st and 2nd event before tax . CAT Excess of Loss Program – Effective June 1, 2020 – May 31, 2021 ‒ Sufficient coverage for approximately a 1-in-150 year event and a 1-in-100 year event followed by a 1-in-50 Interboro year event in the same season. ‒ $3.0m retention for 1st and 2nd event before tax . CAT Excess of Loss Program – Effective June 1, 2020 – May 31, 2021 Blueline (Commercial E&S) ‒ Sufficient coverage for approximately two 1-in-250 year events ‒ $4.0m retention for 1st and 2nd event before tax 9

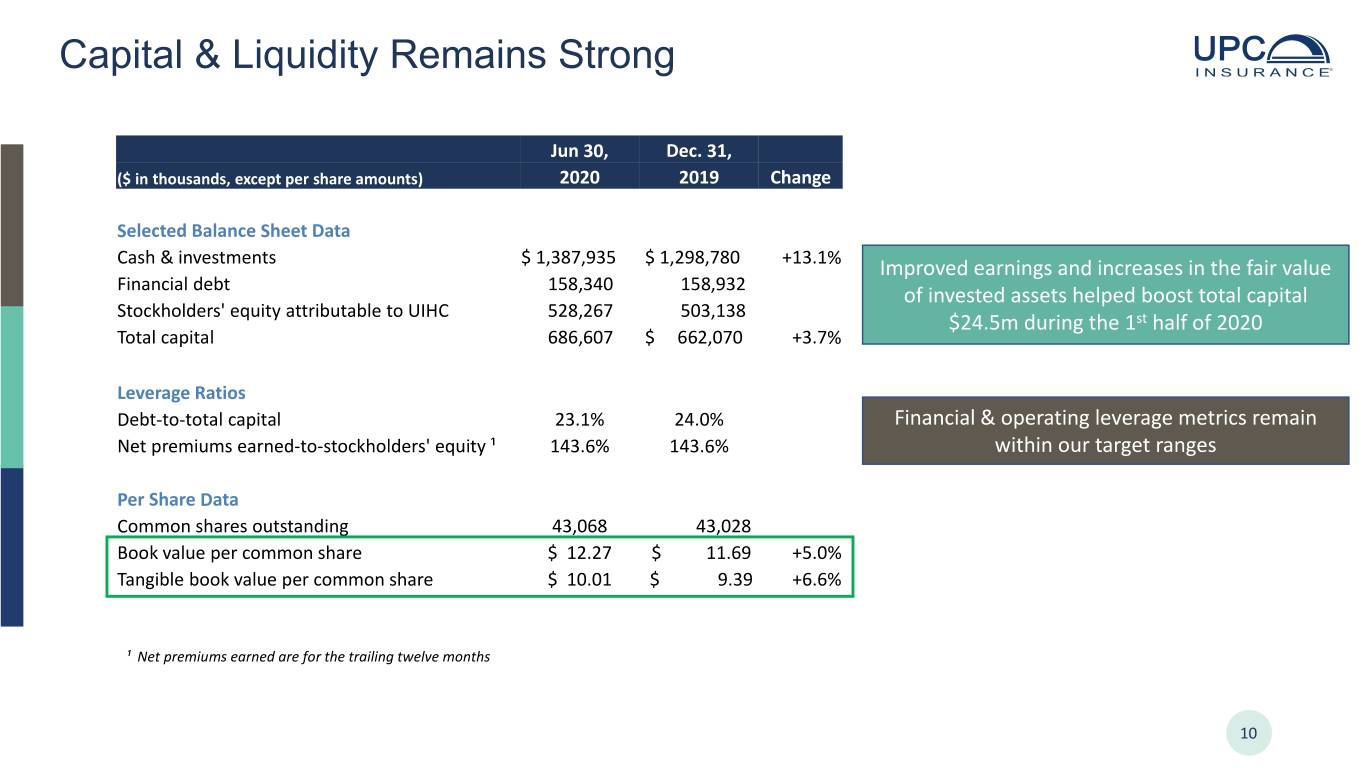

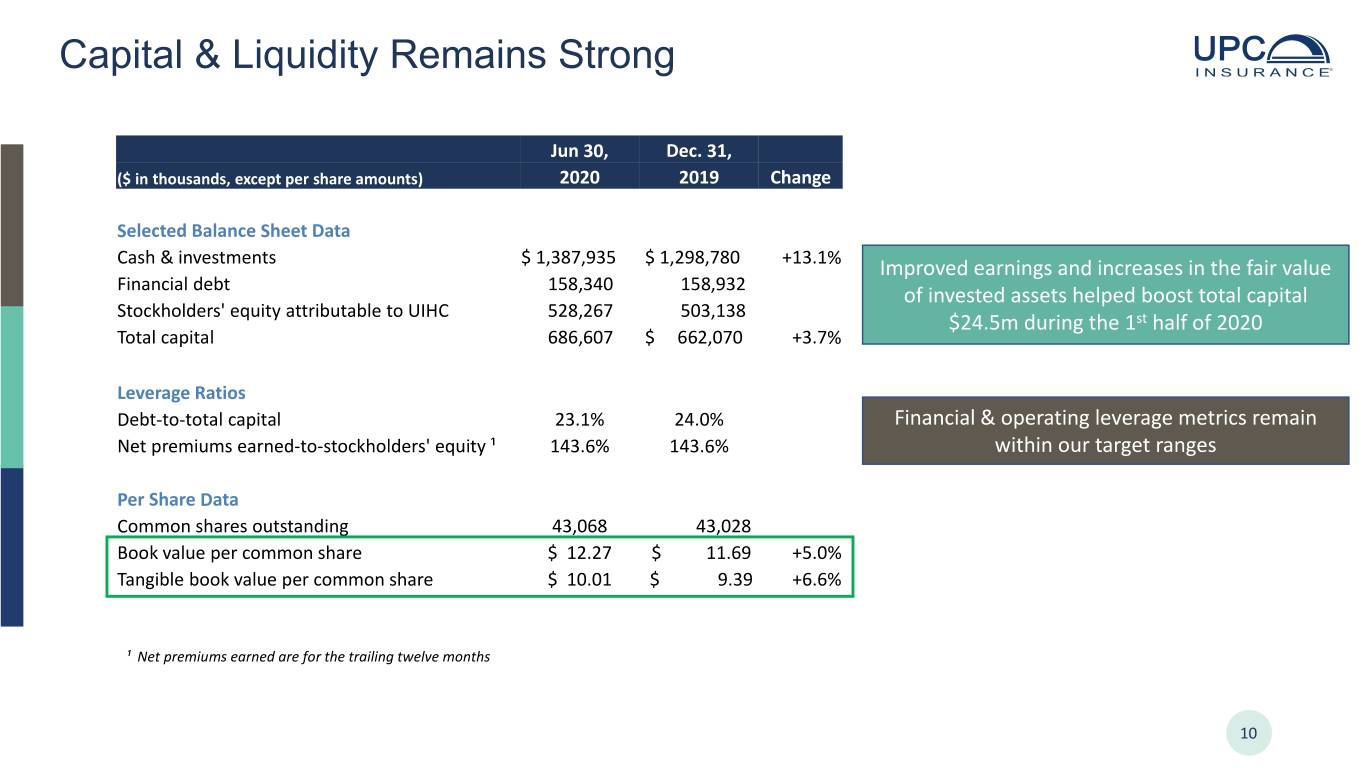

Capital & Liquidity Remains Strong Jun 30, Dec. 31, ($ in thousands, except per share amounts) 2020 2019 Change Selected Balance Sheet Data Cash & investments $ 1,387,935 $ 1,298,780 +13.1% Improved earnings and increases in the fair value Financial debt 158,340 158,932 of invested assets helped boost total capital Stockholders' equity attributable to UIHC 528,267 503,138 $24.5m during the 1st half of 2020 Total capital 686,607 $ 662,070 +3.7% Leverage Ratios Debt-to-total capital 23.1% 24.0% Financial & operating leverage metrics remain Net premiums earned-to-stockholders' equity ¹ 143.6% 143.6% within our target ranges Per Share Data Common shares outstanding 43,068 43,028 Book value per common share $ 12.27 $ 11.69 +5.0% Tangible book value per common share $ 10.01 $ 9.39 +6.6% ¹ Net premiums earned are for the trailing twelve months 10

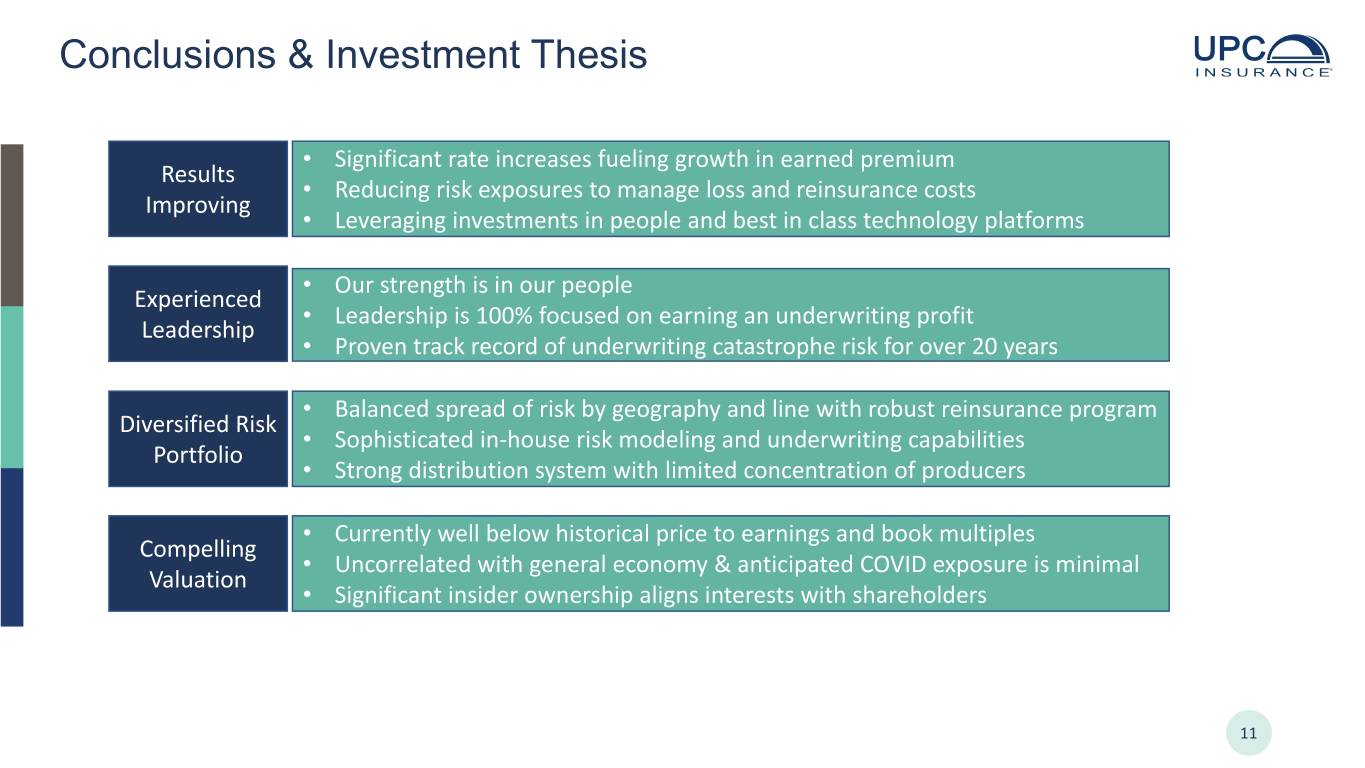

Conclusions & Investment Thesis • Significant rate increases fueling growth in earned premium Results • Reducing risk exposures to manage loss and reinsurance costs Improving • Leveraging investments in people and best in class technology platforms • Our strength is in our people Experienced • Leadership is 100% focused on earning an underwriting profit Leadership • Proven track record of underwriting catastrophe risk for over 20 years • Balanced spread of risk by geography and line with robust reinsurance program Diversified Risk • Sophisticated in-house risk modeling and underwriting capabilities Portfolio • Strong distribution system with limited concentration of producers • Currently well below historical price to earnings and book multiples Compelling • Uncorrelated with general economy & anticipated COVID exposure is minimal Valuation • Significant insider ownership aligns interests with shareholders 11

Cautionary Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report in Form 10-K for the year ended December 31, 2019 and Form 10-Q for the periods ending March 31, 2020 and June 30, 2020. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See the Appendix section of this presentation for further information regarding these non-GAAP financial measures. The information in this presentation is confidential. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited. 12