United Insurance Holdings Corporation (NASDAQ: UIHC) Investor Presentation November 11, 2021

Company Overview 2 UPC Insurance is a specialty underwriter of catastrophe exposed property insurance in the U.S. United Insurance Holding Corp. (NASDAQ: UIHC) was founded in 1999 and is the insurance holding company for 5 P&C carriers and operating affiliates operating under the brand UPC Insurance (UPC). UPC has the #1 market share of commercial residential property insurance (commercial lines) in Florida with over 6,100 policies and $411 million of premium in-force. Journey Insurance Company, our AM Best rated carrier formed in partnership with Tokio Marine Kiln, has expanded our commercial underwriting capabilities into Texas and South Carolina and is poised for profitable growth. UPC’s homeowners & fire insurance products (personal lines) are now focused on New York and 6 southeastern coastal states, with roughly 440,000 policies and $837 million of premium in-force. ¹ UIHC as of September 30, 2021 Total Assets: $3.33 billion Total Equity: $320 million Premium in-Force: $1.25 billion ¹ Employees: 469 Headquarters: St. Petersburg, FL Financial Strength Ratings: A- (Kroll) A- (AM Best) ² A (Demotech) 1 Excludes discontinued states of CT, HI, MA, NJ & RI 2 AM Best rating for Journey Insurance Company only Specialty Commercial Property Underwriters Specialty Homeowners Underwriters

Corporate Strategy 3 We seek to be a top-quartile specialty underwriter of CAT exposed property insurance Innovative Reinsurance Programs & Long- Standing Partnerships Highly Specialized Coastal Underwriter Sophisticated Risk Selection and Exposure Management Proprietary, Scalable Technology to Price & Service Risks Favorable market dynamics including hard market pricing and an improving regulatory backdrop expected to serve as a tailwind to executing our strategy and improving underwriting profitability

4 • Q3-2021 Results • Core loss of -$15.5m (-$0.36 per share) compared favorably to -$83.8m (-$1.95 per share) last year due to lower net retained losses from named windstorms. • Core income excluding named storms of $9.0m ($0.21 per share) declined from $15.0m ($0.35 per share) in 2020 due to higher reinsurance costs in the current year intended to protect capital during this transition year. • Exposure reduction and renewal rate increases continued to trend favorably producing more premium relative to risk. • Key Accomplishments • Successfully handled roughly 18,000 new hurricane claims from Ida & Nicholas. • Received rating affirmations from Demotech (A for ACIC, FSIC, IIC & UPC) and AM Best (A- for JIC but outlook changed from stable to negative). • Went live with Skyway.com, our direct-to-consumer platform, and are ready to begin active marketing for HO6 new business in Florida targeting commercial properties underwritten by American Coastal. Executive Summary

Q3-2021 Results 5 Reinsurance costs were the primary driver of the y/y decline in core earnings Q3-21 Q3-20 Change Core income (loss) (15,453)$ (83,847)$ -81.6% per diluted share (CEPS) (0.36)$ (1.95)$ Included the following items Net current year catastrophe loss & LAE incurred 37,003$ 140,001$ Net (favorable) unfavorable reserve development 1,947$ (4,213)$ Total items 38,950$ 135,788$ Core income (loss) excluding named windstorms 8,978$ 14,999$ -40.1% CEPS excluding named windstorm 0.21$ 0.35$ Gross underlying loss & LAE ratio 18.1% 23.4% (5.4) pts Gross expense ratio 21.6% 26.1% (4.5) pts Net loss & LAE ratio 67.1% 115.8% Net expense ratio 49.8% 49.0% Combined ratio 116.8% 164.8% (48.0) pts Net current year catastrophe loss & LAE incurred -24.1% -74.2% Net favorable (unfavorable) reserve development -1.3% 2.2% Underlying combined ratio 91.5% 92.8% (1.3) pts Direct and underlying results moving in the right direction

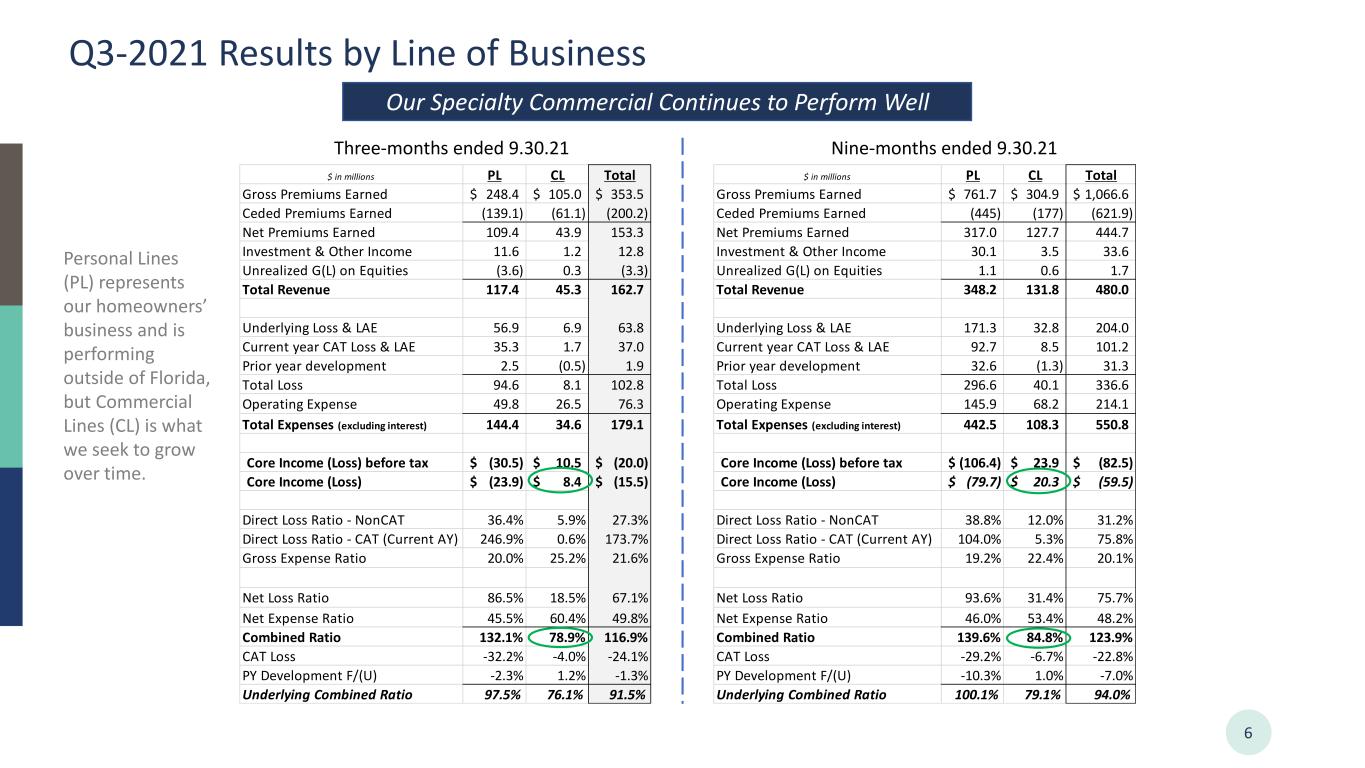

Q3-2021 Results by Line of Business 6 Our Specialty Commercial Continues to Perform Well Personal Lines (PL) represents our homeowners’ business and is performing outside of Florida, but Commercial Lines (CL) is what we seek to grow over time. $ in millions PL CL Total Gross Premiums Earned 248.4$ 105.0$ 353.5$ Ceded Premiums Earned (139.1) (61.1) (200.2) Net Premiums Earned 109.4 43.9 153.3 Investment & Other Income 11.6 1.2 12.8 Unrealized G(L) on Equities (3.6) 0.3 (3.3) Total Revenue 117.4 45.3 162.7 Underlying Loss & LAE 56.9 6.9 63.8 Current year CAT Loss & LAE 35.3 1.7 37.0 Prior year development 2.5 (0.5) 1.9 Total Loss 94.6 8.1 102.8 Operating Expense 49.8 26.5 76.3 Total Expenses (excluding interest) 144.4 34.6 179.1 Core Income (Loss) before tax (30.5)$ 10.5$ (20.0)$ Core Income (Loss) (23.9)$ 8.4$ (15.5)$ Direct Loss Ratio - NonCAT 36.4% 5.9% 27.3% Direct Loss Ratio - CAT (Current AY) 246.9% 0.6% 173.7% Gross Expense Ratio 20.0% 25.2% 21.6% Net Loss Ratio 86.5% 18.5% 67.1% Net Expense Ratio 45.5% 60.4% 49.8% Combined Ratio 132.1% 78.9% 116.9% CAT Loss -32.2% -4.0% -24.1% PY Development F/(U) -2.3% 1.2% -1.3% Underlying Combined Ratio 97.5% 76.1% 91.5% Three-months ended 9.30.21 $ in millions PL CL Total Gross Premiums Earned 761.7$ 304.9$ 1,066.6$ Ceded Premiums Earned (445) (177) (621.9) Net Premiums Earned 317.0 127.7 444.7 Investment & Other Income 30.1 3.5 33.6 Unrealized G(L) on Equities 1.1 0.6 1.7 Total Revenue 348.2 131.8 480.0 Underlying Loss & LAE 171.3 32.8 204.0 Current year CAT Loss & LAE 92.7 8.5 101.2 Prior year development 32.6 (1.3) 31.3 Total Loss 296.6 40.1 336.6 Operating Expense 145.9 68.2 214.1 Total Expenses (excluding interest) 442.5 108.3 550.8 Core Income (Loss) before tax (106.4)$ 23.9$ (82.5)$ Core Income (Loss) (79.7)$ 20.3$ (59.5)$ Direct Loss Ratio - NonCAT 38.8% 12.0% 31.2% Direct Loss Ratio - CAT (Current AY) 104.0% 5.3% 75.8% Gross Expense Ratio 19.2% 22.4% 20.1% Net Loss Ratio 93.6% 31.4% 75.7% Net Expense Ratio 46.0% 53.4% 48.2% Combined Ratio 139.6% 84.8% 123.9% CAT Loss -29.2% -6.7% -22.8% PY Development F/(U) -10.3% 1.0% -7.0% Underlying Combined Ratio 100.1% 79.1% 94.0% Nine-months ended 9.30.21

7 1. Increased Rate Adequacy a) 2020 rate actions averaged ~ 11% across the personal lines portfolio b) 2021 rate actions averaged ~ 14% across the personal lines portfolio through September c) Commercial lines rate increases averaged ~ 19% during Q3-2021 2. Focused on Risk Selection a) Increasing coverage to be no less than 100% of estimated replacement costs to drive proper insurance-to-value b) Restricted new business through tighter eligibility guidelines c) Developed a new proprietary AI tool to enhance renewal underwriting capabilities based on expected profitability 3. Reduced Risk Exposure a) Total insured value decreased ~ $96 billion (-25%) from 9/30/20 to 9/30/21 b) Scheduled additional non-renewals for further PML reduction by 9/30/22 c) Working on a potential sale of Interboro that would reduce TIV by another $33 billion and allow us to reallocate that capital 4. Improved Operating Efficiency a) Reduced personal lines policy acquisition costs by cutting agent commissions up to 3 points b) Redomiciled Family Security from Hawaii to Florida saving ~ $5m annually c) Discontinued 17 of 42 (40%) of personal lines products representing less than 1% of premium 5. Enhanced Distribution System a) Terminated 3,4000 independent agents to foster a “fewer and deeper” strategy with our best partners b) Restricted use of comparative raters c) Launched our new direct-to-consumer channel: www.skyway.com Underwriting Improvement Initiatives Action already taken over the past year is moving us toward underwriting profitability

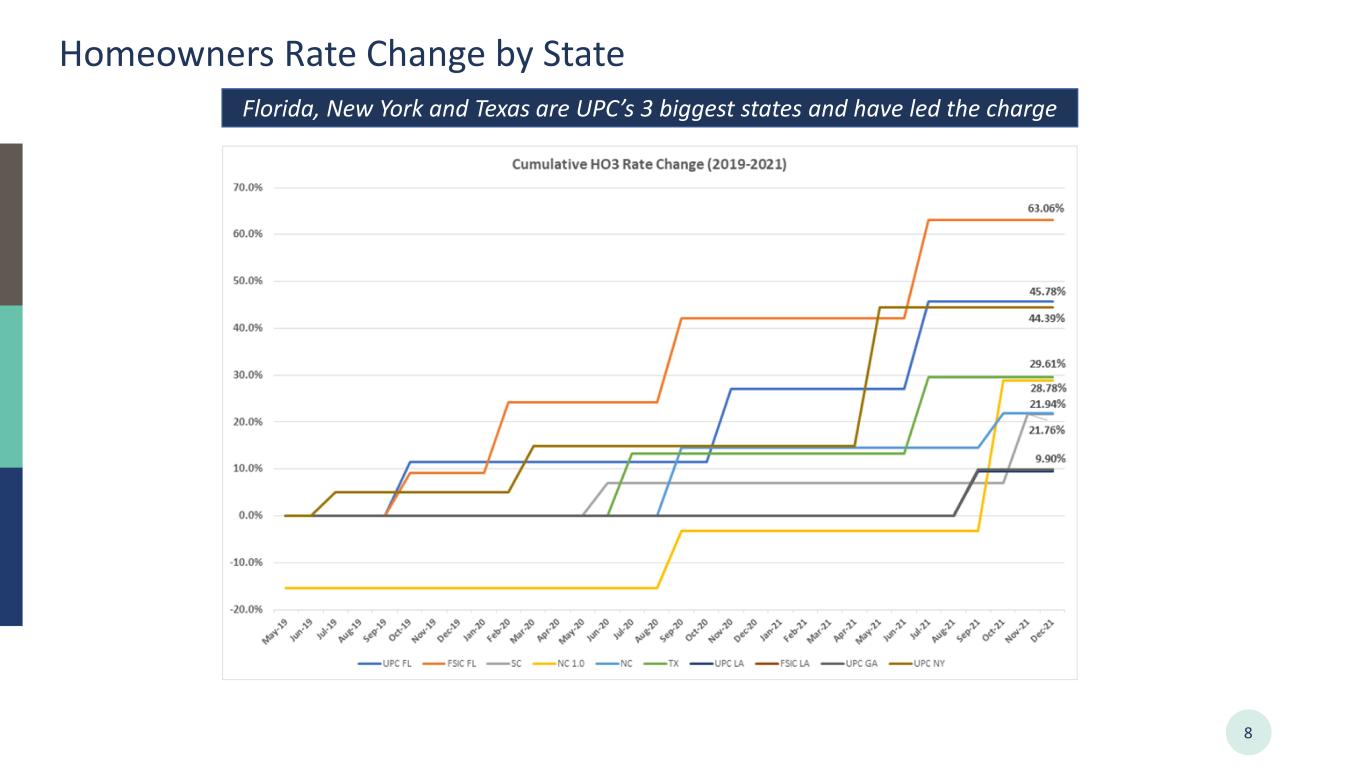

Homeowners Rate Change by State 8 Florida, New York and Texas are UPC’s 3 biggest states and have led the charge

9 Renewal Rate Change is Significant Retention remains ~90% despite underwriting actions taken to improve results Q3 was our largest rate change to date

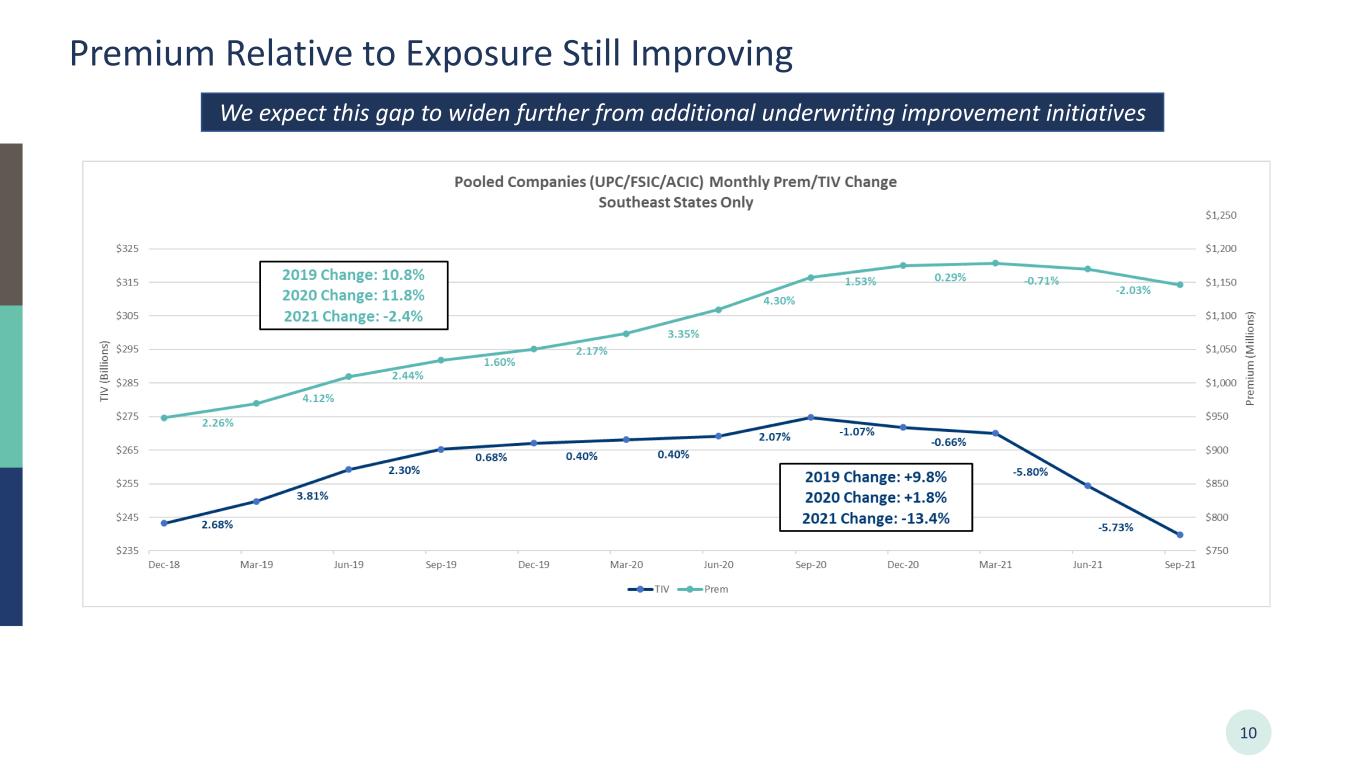

Premium Relative to Exposure Still Improving 10 We expect this gap to widen further from additional underwriting improvement initiatives

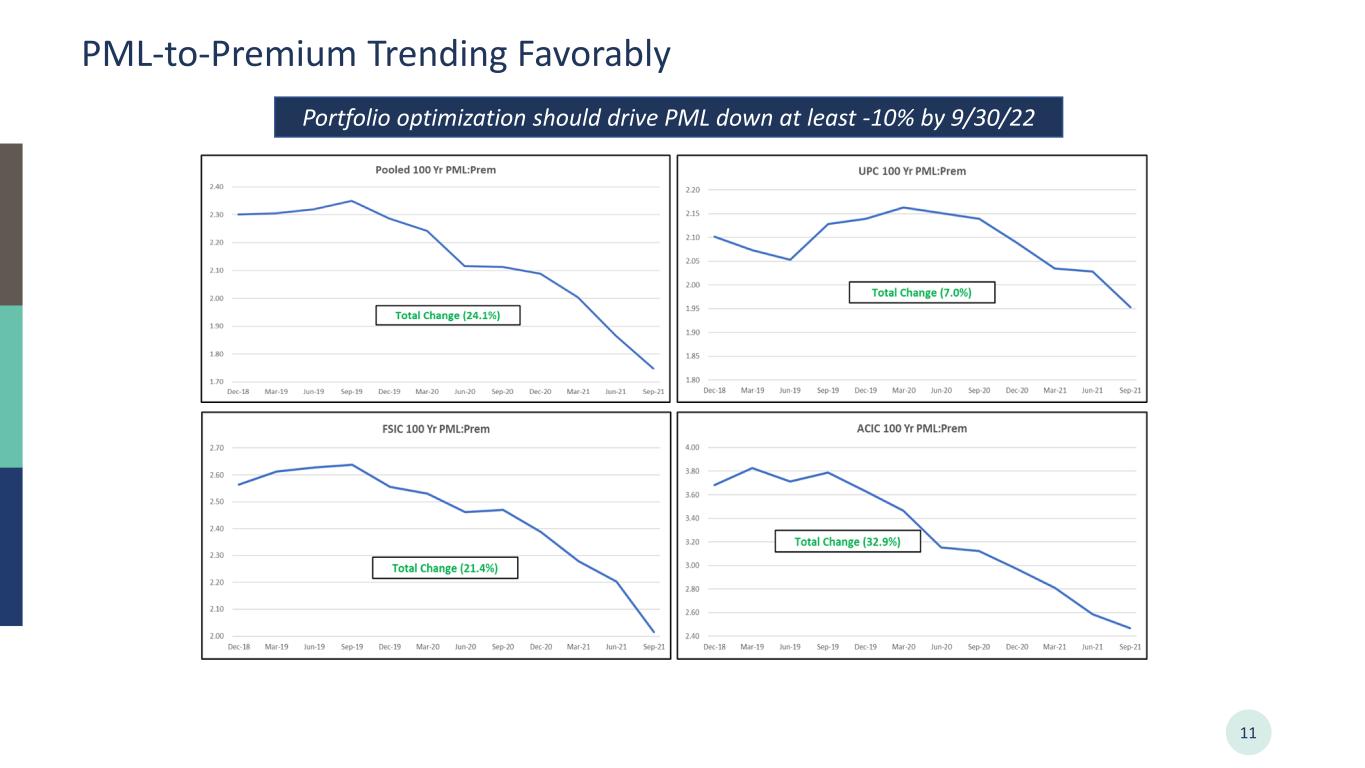

11 PML-to-Premium Trending Favorably Portfolio optimization should drive PML down at least -10% by 9/30/22

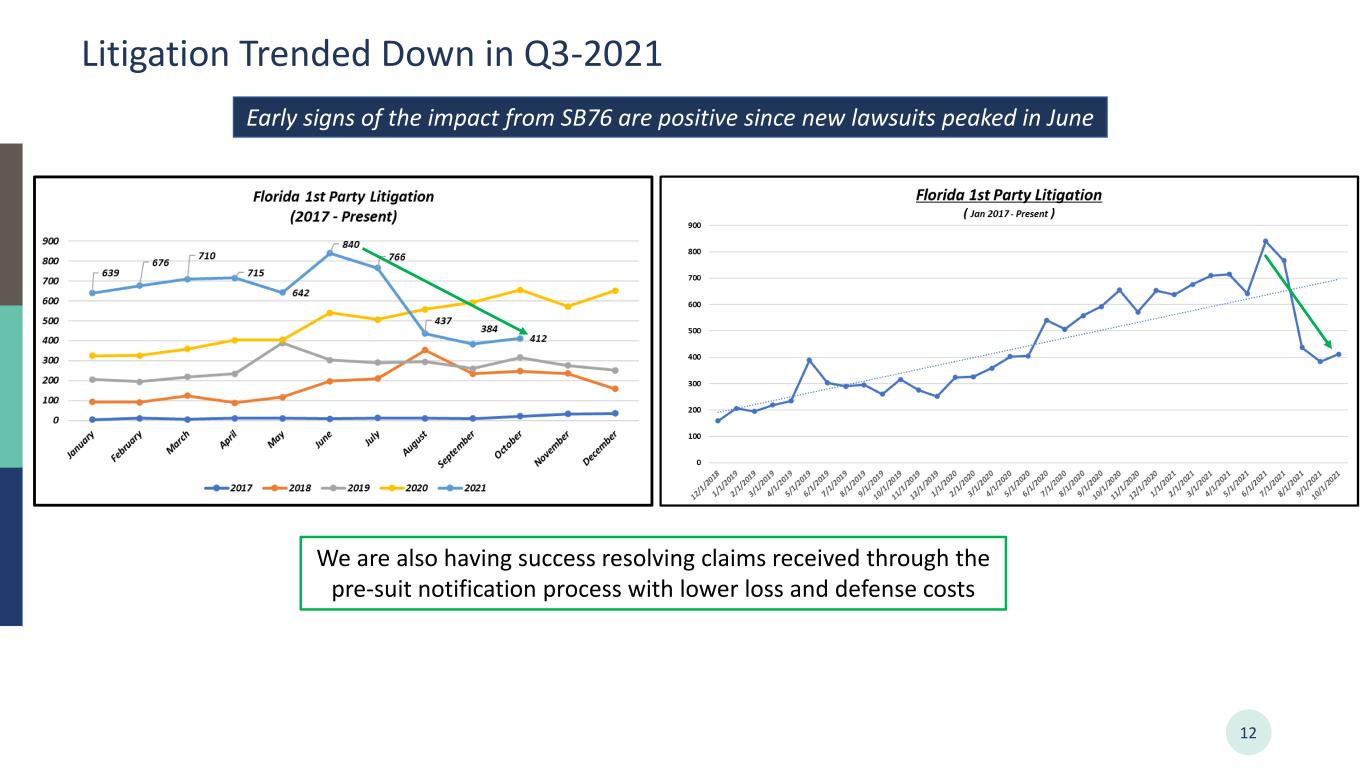

12 Litigation Trended Down in Q3-2021 Early signs of the impact from SB76 are positive since new lawsuits peaked in June We are also having success resolving claims received through the pre-suit notification process with lower loss and defense costs

Final Thoughts 13 Leadership changes made & corrective action plan is in place and working Rate increases are significant and acquisition costs have been cut Lower CAT retentions will limit further capital erosion Exposure management will continue to reduce TIV & PML Return to profitability is expected in Q4-21 & FY 2022 Rule #1 - Underwriting profitability. Rule #2 – See Rule #1.

Cautionary Statements 14 This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report in Form 10-K for the year ended December 31, 2019 and 2020 and our Form 10-Q for the periods ending March 31, 2021, June 30, 2021 and September 30, 2021, once available. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See our earnings release, Form 10-K ,and Form 10-Q for further information regarding these non-GAAP financial measures. The information in this presentation is confidential. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited.