Investor Presentation First Quarter 2023

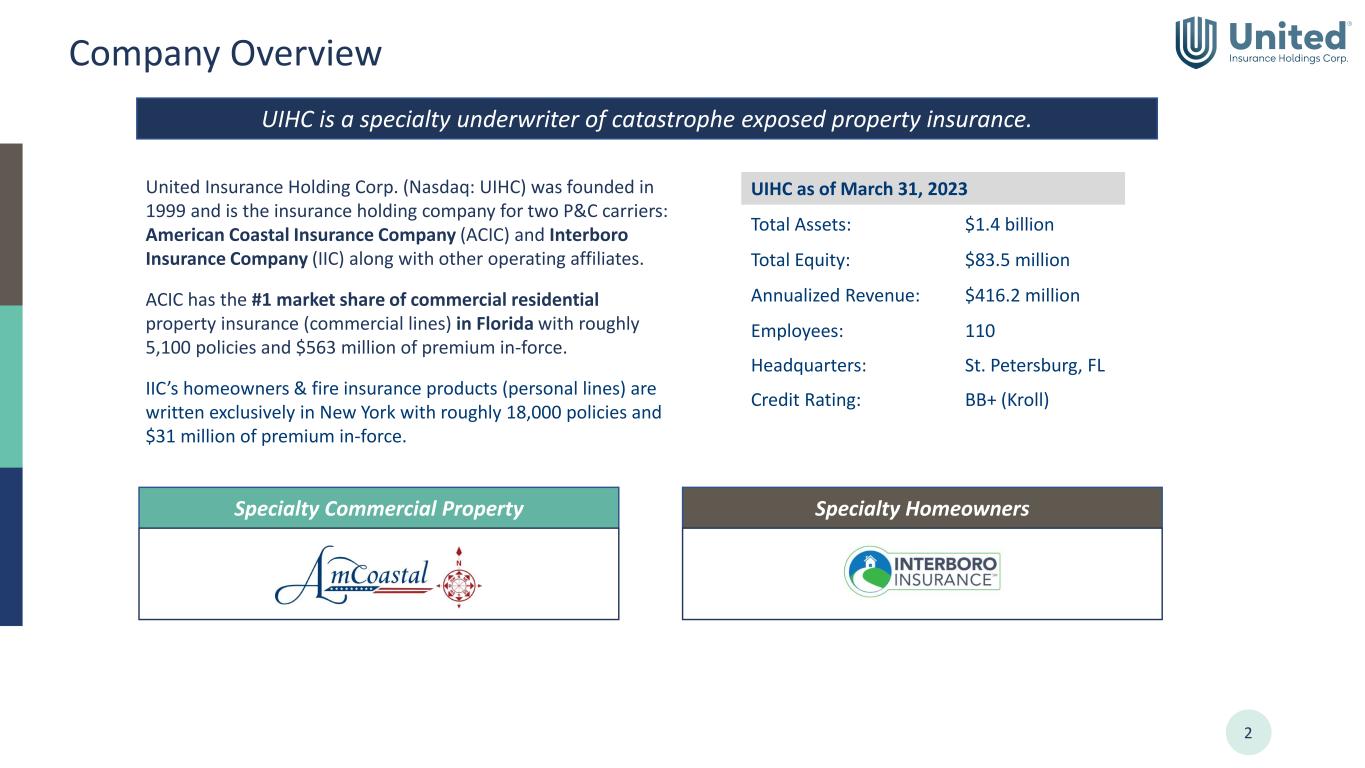

Company Overview 2 UIHC is a specialty underwriter of catastrophe exposed property insurance. United Insurance Holding Corp. (Nasdaq: UIHC) was founded in 1999 and is the insurance holding company for two P&C carriers: American Coastal Insurance Company (ACIC) and Interboro Insurance Company (IIC) along with other operating affiliates. ACIC has the #1 market share of commercial residential property insurance (commercial lines) in Florida with roughly 5,100 policies and $563 million of premium in-force. IIC’s homeowners & fire insurance products (personal lines) are written exclusively in New York with roughly 18,000 policies and $31 million of premium in-force. UIHC as of March 31, 2023 Total Assets: $1.4 billion Total Equity: $83.5 million Annualized Revenue: $416.2 million Employees: 110 Headquarters: St. Petersburg, FL Credit Rating: BB+ (Kroll) Specialty Commercial Property Specialty Homeowners

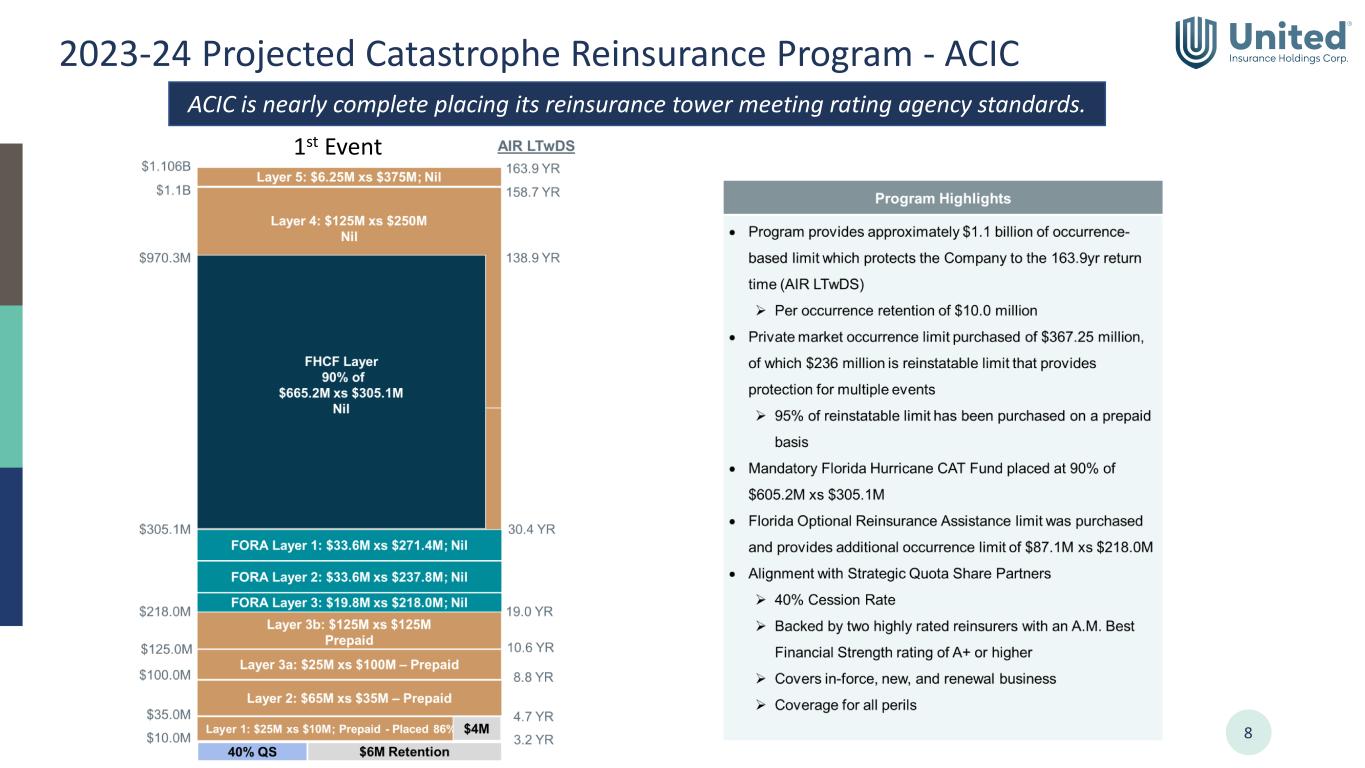

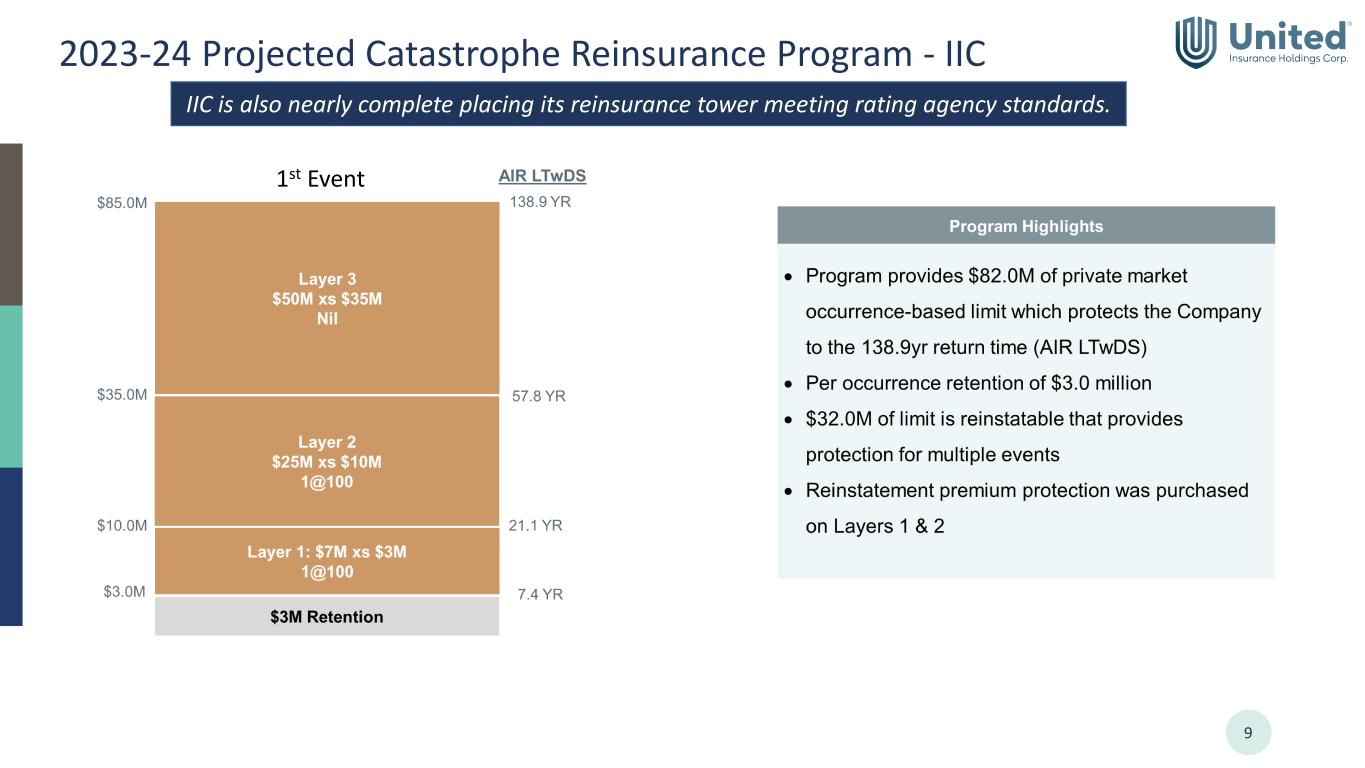

3 Executive Summary • Q1-23 Results • GAAP net income of $260.9m included a $230.3m gain from discontinued operations from de-consolidating our former affiliate United Property & Casualty Insurance Company (UPC). The prior year was recast to conform to the presentation of discontinued operations. • GAAP net income from continuing operations of $30.5m improved 563% from $4.6m last year driven by strong underwriting performance in commercial lines from ACIC. UIHC’s combined ratio of 70.5% was also a significant improvement from the prior year. • Current accident year catastrophe losses of $3.1m compared favorably to $6.6m last year, and favorable prior year reserve development of $3.2m primarily in commercial lines was also a positive contribution and consistent with the prior year. • Stockholders’ equity attributable to UIHC as of March 31, 2023, was $83.5m or $1.93 per share and $2.52 per share excluding unrealized losses in accumulated other comprehensive income. • Other Highlights • On April 19, 2023, we obtained a memorandum of understanding from the Florida Department of Financial Services (DFS) ratifying and accepting a reinsurance allocation agreement covering the 2022 core catastrophe reinsurance program previously approved by the Office of Insurance Regulation. This action provided critical clarity regarding future reinsurance recoverable for ACIC related to Hurricane Ian but did not settle reinsurance recovered by UPC on behalf of ACIC. We are working diligently with the DFS to resolve this. • We have secured 100% of the capacity needed for our new 2023-24 catastrophe reinsurance program for ACIC and are also nearing completion of IIC’s program renewal to be effective 6/1/23 and expect to announce the key details once the programs are finalized. • The Company believes these two highlights above along with other actions being taken to resolve all amounts due to and from UPC will ultimately rectify the two primary reasons identified by our independent auditor for their going concern opinion issued on April 17, 2023.

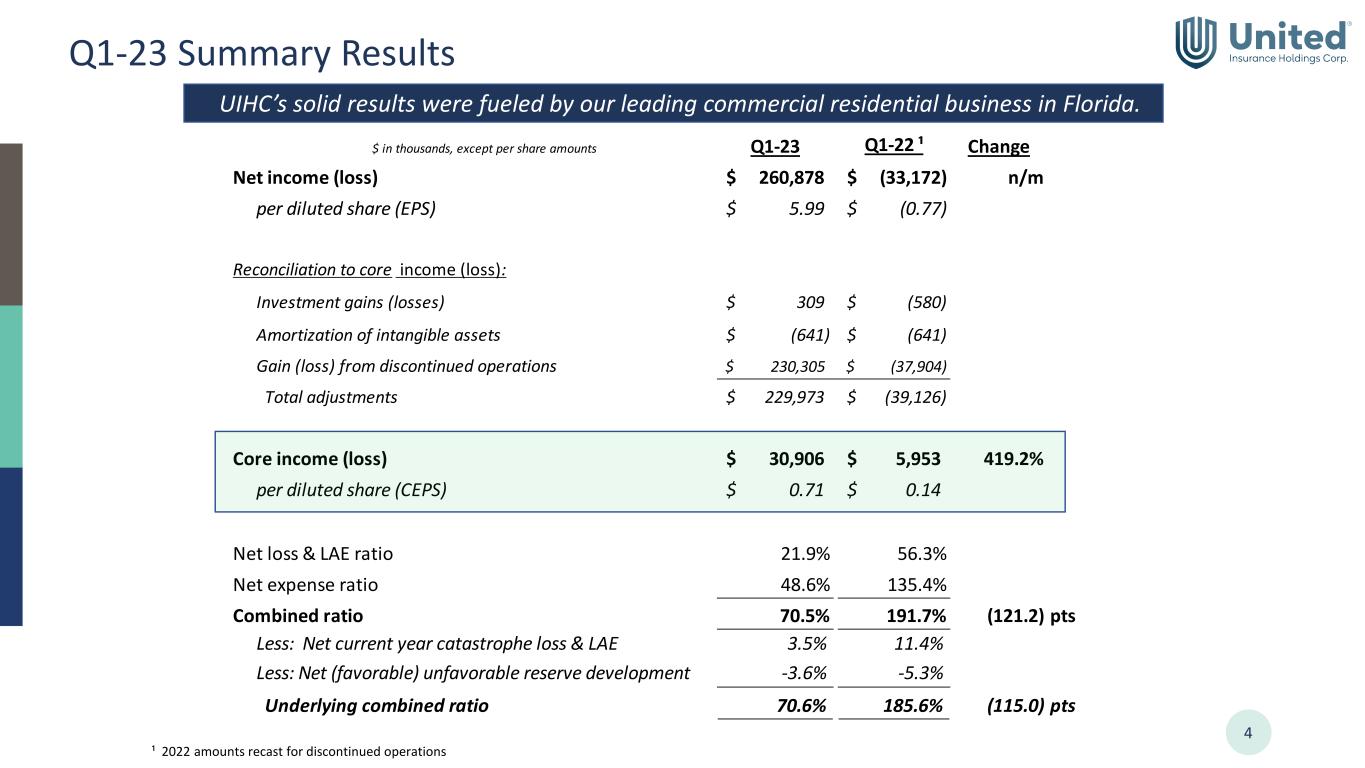

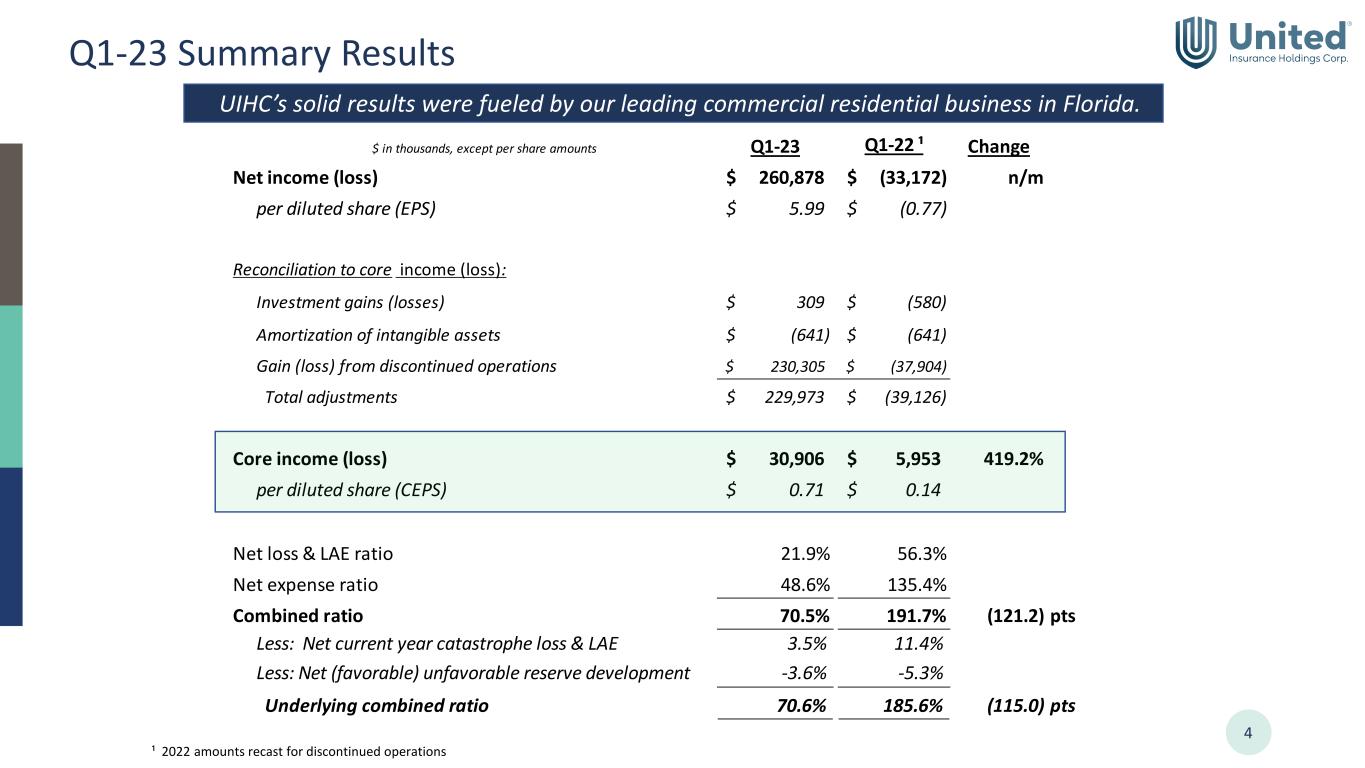

Q1-23 Summary Results 4 UIHC’s solid results were fueled by our leading commercial residential business in Florida. ¹ 2022 amounts recast for discontinued operations $ in thousands, except per share amounts Q1-23 Q1-22 ¹ Change Net income (loss) 260,878$ (33,172)$ n/m per diluted share (EPS) 5.99$ (0.77)$ Reconciliation to core income (loss): Investment gains (losses) 309$ (580)$ Amortization of intangible assets (641)$ (641)$ Gain (loss) from discontinued operations 230,305$ (37,904)$ Total adjustments 229,973$ (39,126)$ Core income (loss) 30,906$ 5,953$ 419.2% per diluted share (CEPS) 0.71$ 0.14$ Net loss & LAE ratio 21.9% 56.3% Net expense ratio 48.6% 135.4% Combined ratio 70.5% 191.7% (121.2) pts Less: Net current year catastrophe loss & LAE 3.5% 11.4% Less: Net (favorable) unfavorable reserve development -3.6% -5.3% Underlying combined ratio 70.6% 185.6% (115.0) pts

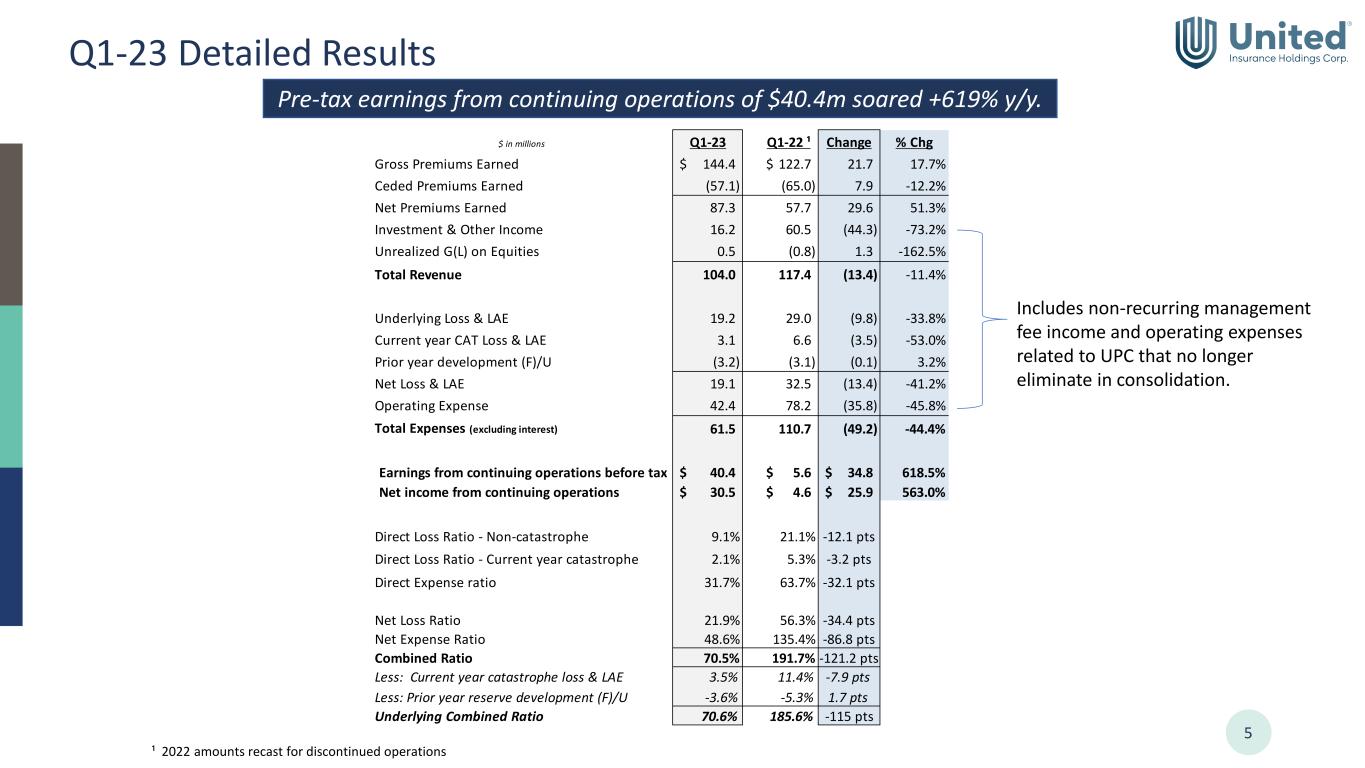

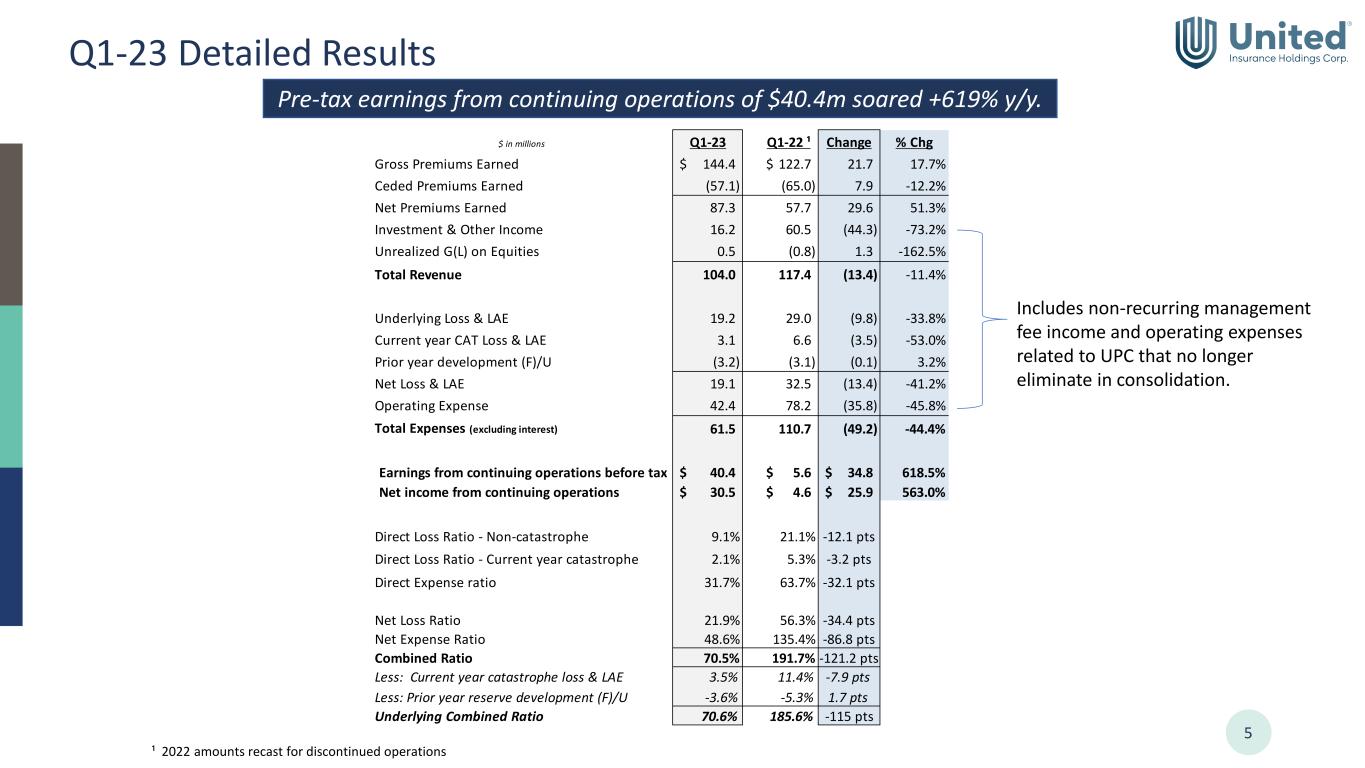

Q1-23 Detailed Results 5 Pre-tax earnings from continuing operations of $40.4m soared +619% y/y. ¹ 2022 amounts recast for discontinued operations Includes non-recurring management fee income and operating expenses related to UPC that no longer eliminate in consolidation. $ in millions Q1-23 Q1-22 ¹ Change % Chg Gross Premiums Earned 144.4$ 122.7$ 21.7 17.7% Ceded Premiums Earned (57.1) (65.0) 7.9 -12.2% Net Premiums Earned 87.3 57.7 29.6 51.3% Investment & Other Income 16.2 60.5 (44.3) -73.2% Unrealized G(L) on Equities 0.5 (0.8) 1.3 -162.5% Total Revenue 104.0 117.4 (13.4) -11.4% Underlying Loss & LAE 19.2 29.0 (9.8) -33.8% Current year CAT Loss & LAE 3.1 6.6 (3.5) -53.0% Prior year development (F)/U (3.2) (3.1) (0.1) 3.2% Net Loss & LAE 19.1 32.5 (13.4) -41.2% Operating Expense 42.4 78.2 (35.8) -45.8% Total Expenses (excluding interest) 61.5 110.7 (49.2) -44.4% Earnings from continuing operations before tax 40.4$ 5.6$ 34.8$ 618.5% Net income from continuing operations 30.5$ 4.6$ 25.9$ 563.0% Direct Loss Ratio - Non-catastrophe 9.1% 21.1% -12.1 pts Direct Loss Ratio - Current year catastrophe 2.1% 5.3% -3.2 pts Direct Expense ratio 31.7% 63.7% -32.1 pts Net Loss Ratio 21.9% 56.3% -34.4 pts Net Expense Ratio 48.6% 135.4% -86.8 pts Combined Ratio 70.5% 191.7% -121.2 pts Less: Current year catastrophe loss & LAE 3.5% 11.4% -7.9 pts Less: Prior year reserve development (F)/U -3.6% -5.3% 1.7 pts Underlying Combined Ratio 70.6% 185.6% -115 pts

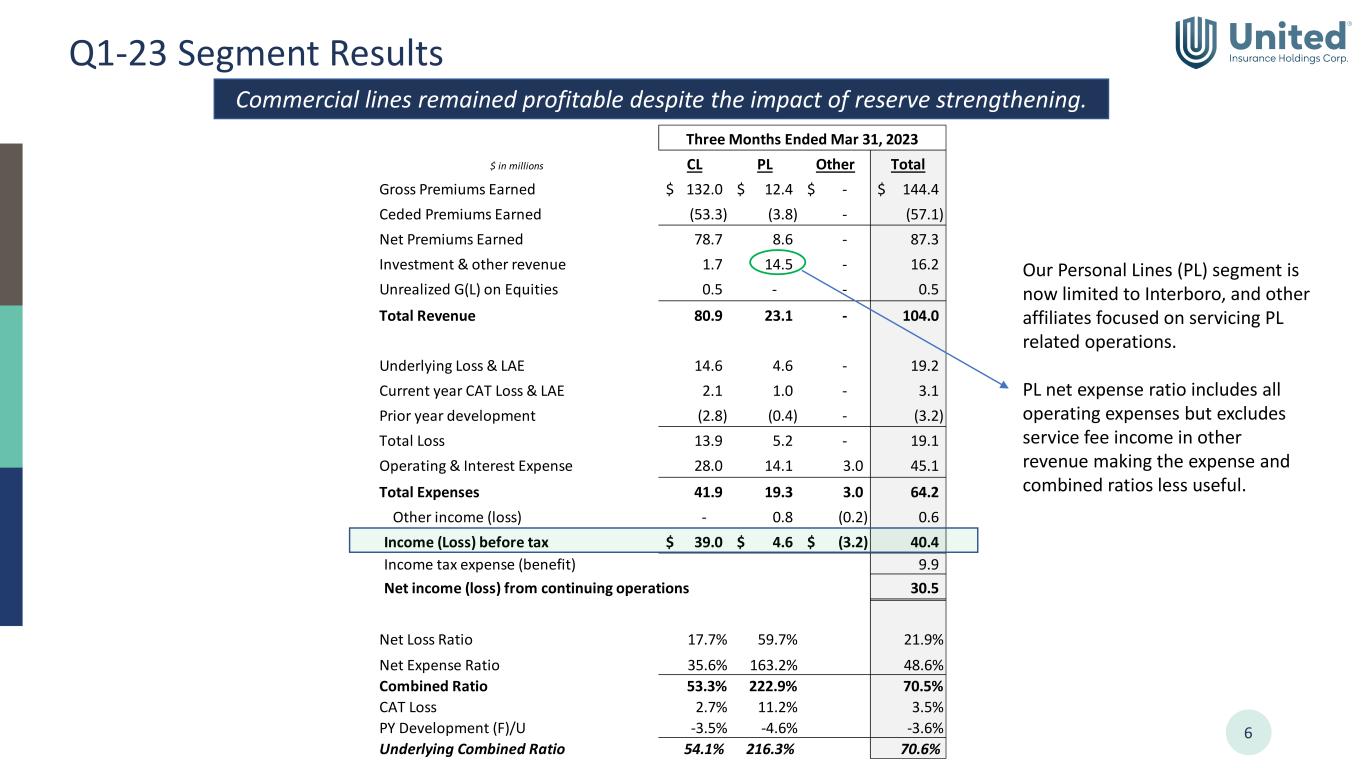

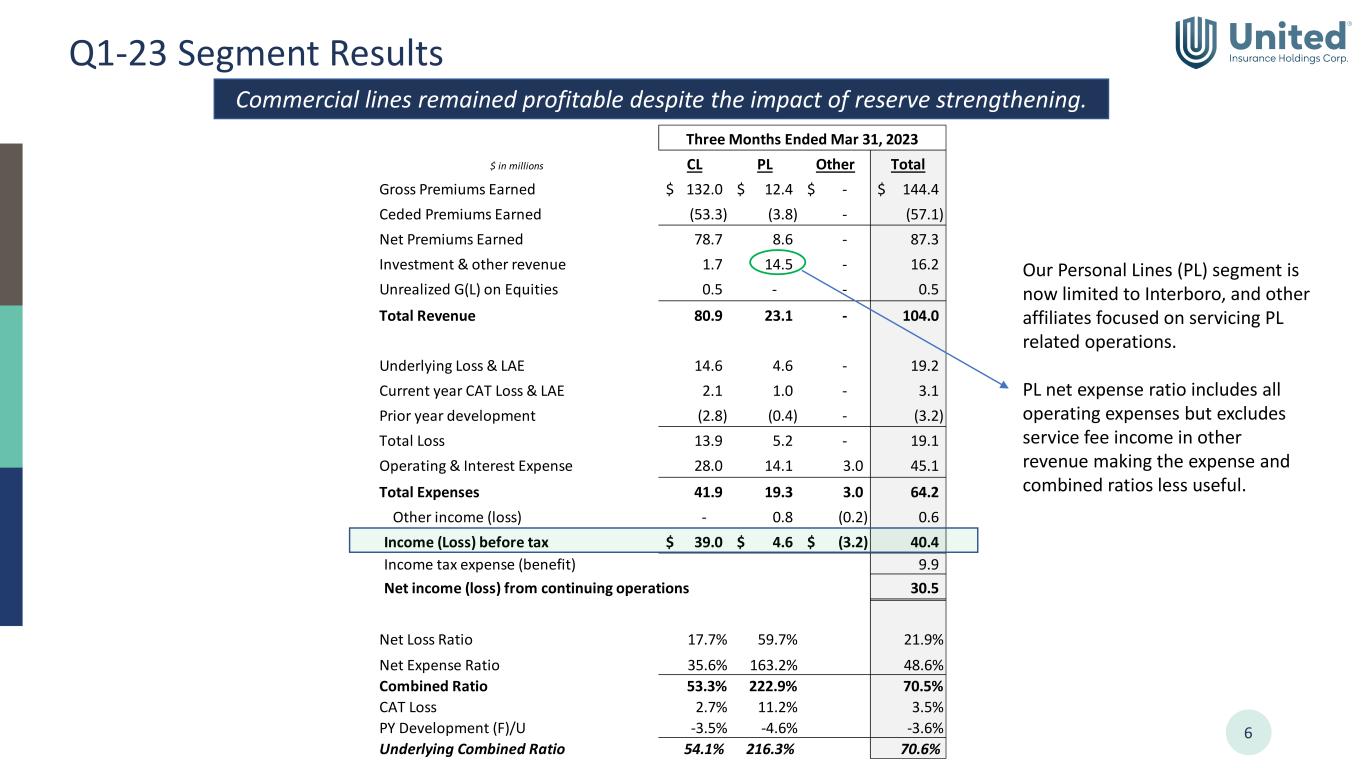

Q1-23 Segment Results 6 Commercial lines remained profitable despite the impact of reserve strengthening. Our Personal Lines (PL) segment is now limited to Interboro, and other affiliates focused on servicing PL related operations. PL net expense ratio includes all operating expenses but excludes service fee income in other revenue making the expense and combined ratios less useful. $ in millions CL PL Other Total Gross Premiums Earned 132.0$ 12.4$ -$ 144.4$ Ceded Premiums Earned (53.3) (3.8) - (57.1) Net Premiums Earned 78.7 8.6 - 87.3 Investment & other revenue 1.7 14.5 - 16.2 Unrealized G(L) on Equities 0.5 - - 0.5 Total Revenue 80.9 23.1 - 104.0 Underlying Loss & LAE 14.6 4.6 - 19.2 Current year CAT Loss & LAE 2.1 1.0 - 3.1 Prior year development (2.8) (0.4) - (3.2) Total Loss 13.9 5.2 - 19.1 Operating & Interest Expense 28.0 14.1 3.0 45.1 Total Expenses 41.9 19.3 3.0 64.2 Other income (loss) - 0.8 (0.2) 0.6 Income (Loss) before tax 39.0$ 4.6$ (3.2)$ 40.4 Income tax expense (benefit) 9.9 Net income (loss) from continuing operations 30.5 Net Loss Ratio 17.7% 59.7% 21.9% Net Expense Ratio 35.6% 163.2% 48.6% Combined Ratio 53.3% 222.9% 70.5% CAT Loss 2.7% 11.2% 3.5% PY Development (F)/U -3.5% -4.6% -3.6% Underlying Combined Ratio 54.1% 216.3% 70.6% Three Months Ended Mar 31, 2023

Balance Sheet Highlights 7 Stockholders’ equity and BVPS were restored to positive amounts upon de-consolidation of our former affiliate UPC. Mar. 31, Dec. 31, ($ in thousands, except per share amounts) 2023 2022 ¹ % Variance Selected Balance Sheet Data Cash & investments 372,721$ 340,905$ 9.3% Unpaid loss & LAE reserves 748,365$ 842,958$ -11.2% Financial debt 148,438$ 148,355$ 0.1% Accumulated other comprehensive income (loss) (25,629)$ (30,947)$ -17.2% Stockholders' equity attributable to UIHC 83,488$ (182,039)$ n/m Total capital 231,926$ (33,684)$ n/m Leverage Ratios Debt-to-total capital 64.0% n/m n/m Net premiums earned-to-stockholders' equity (annualized) 418.4% n/m n/m Per Share Data Common shares outstanding 43,274,359 43,280,173 0.0% Book value per common share 1.93$ (4.21)$ n/m Underlying book value per common share 2.52$ (3.49)$ n/m ¹ 2022 amounts recast for discontinued operations

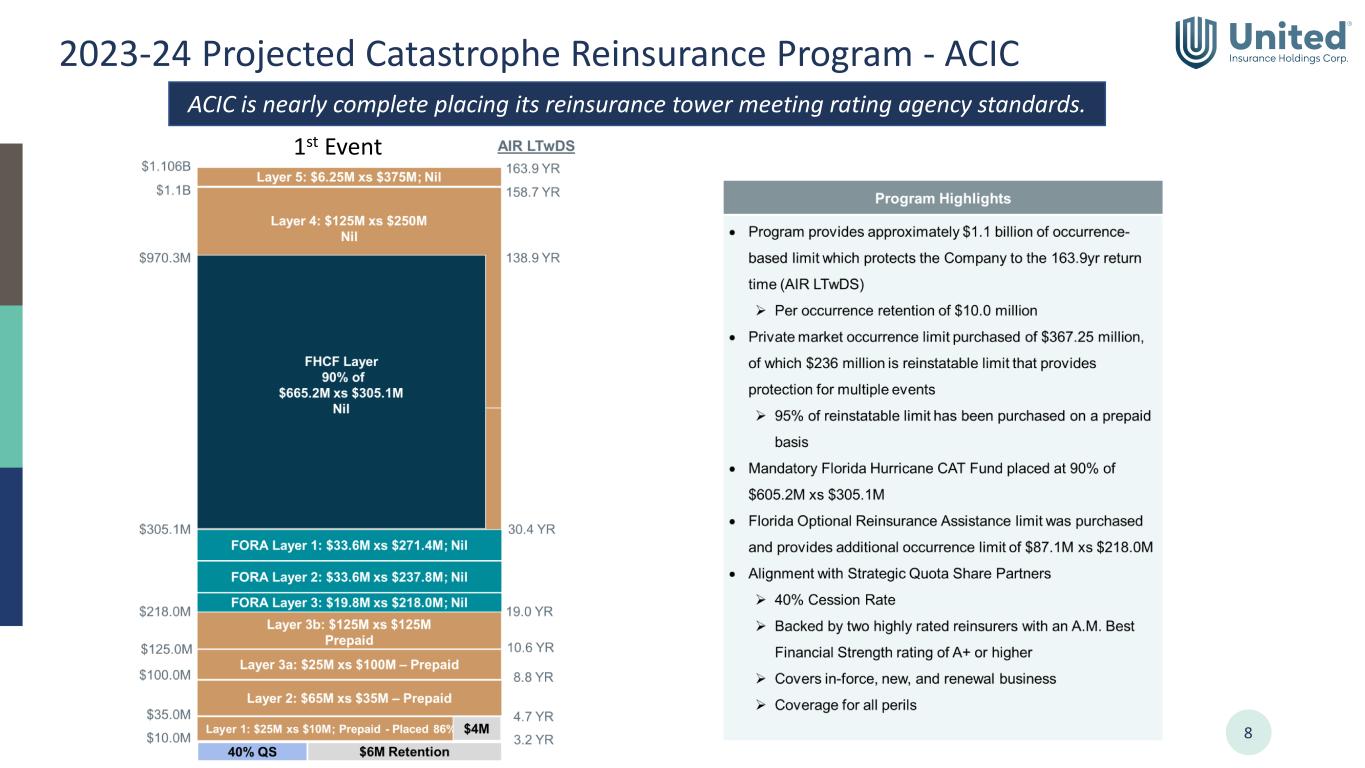

2023-24 Projected Catastrophe Reinsurance Program - ACIC 8 ACIC is nearly complete placing its reinsurance tower meeting rating agency standards. 1st Event

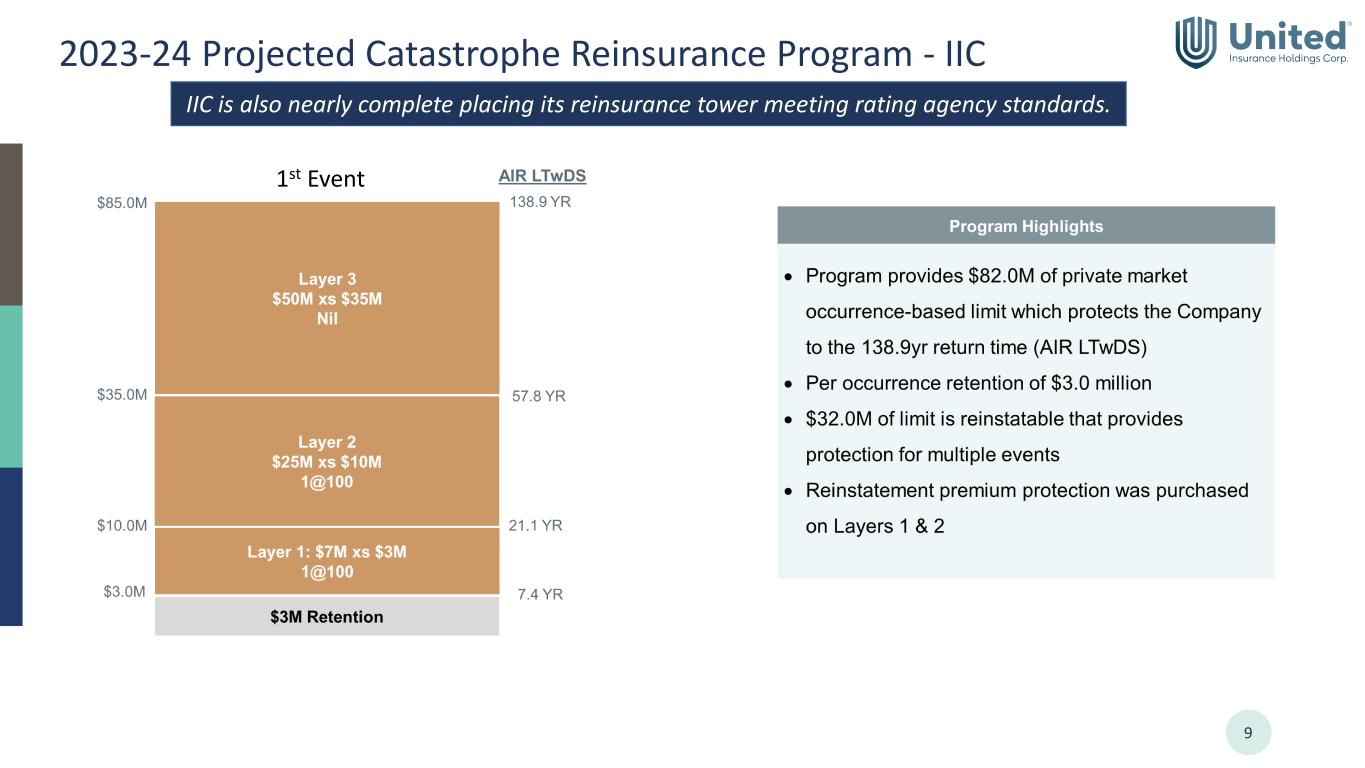

2023-24 Projected Catastrophe Reinsurance Program - IIC 9 IIC is also nearly complete placing its reinsurance tower meeting rating agency standards. 1st Event

Cautionary Statements 10 This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report in Form 10-K for the year ended December 31, 2021 and 2022 and our Form 10-Q for the periods ending March 31, 2022, June 30, 2022, September 30, 2022, and March 31, 2023. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See our earnings release, Form 10-K ,and Form 10-Q for further information regarding these non-GAAP financial measures. The information in this presentation is confidential. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited.