3rd Quarter 2023 November 13th, 2023 Earnings Presentation

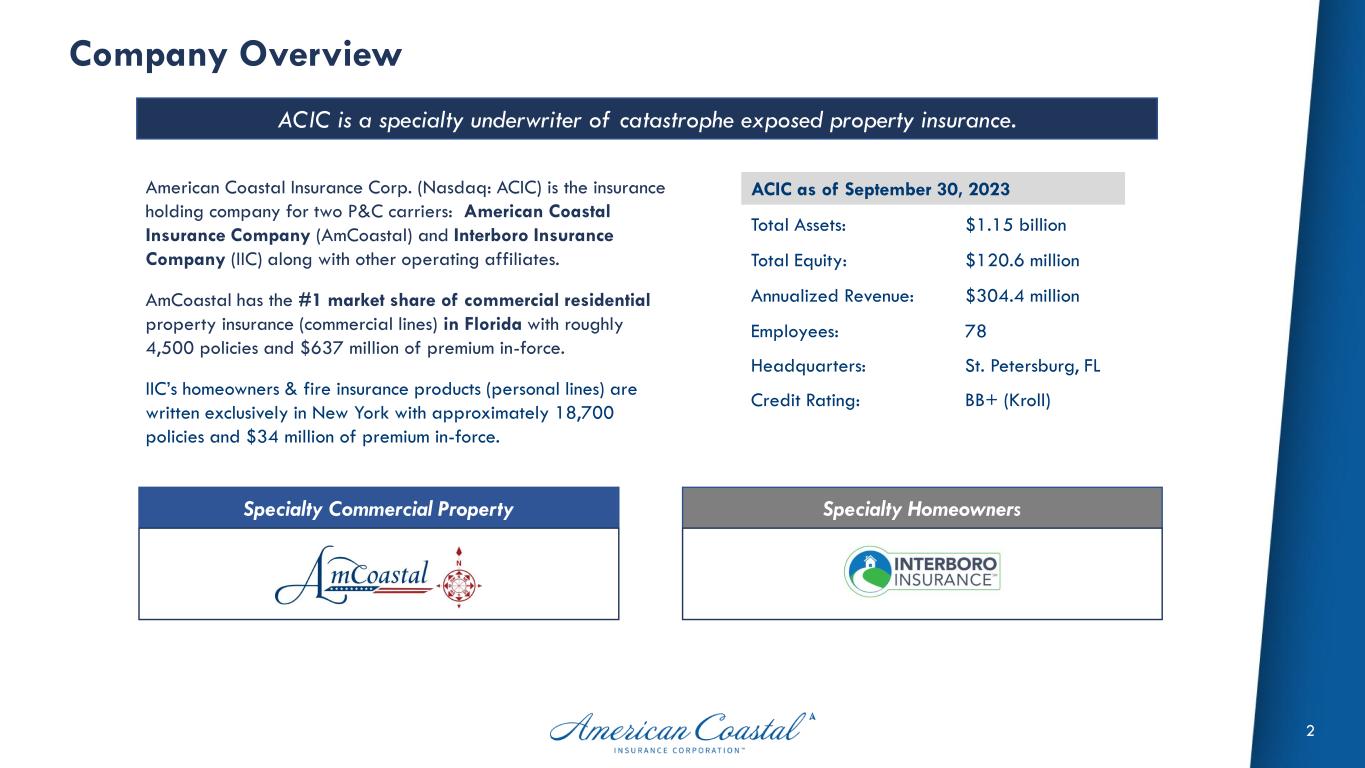

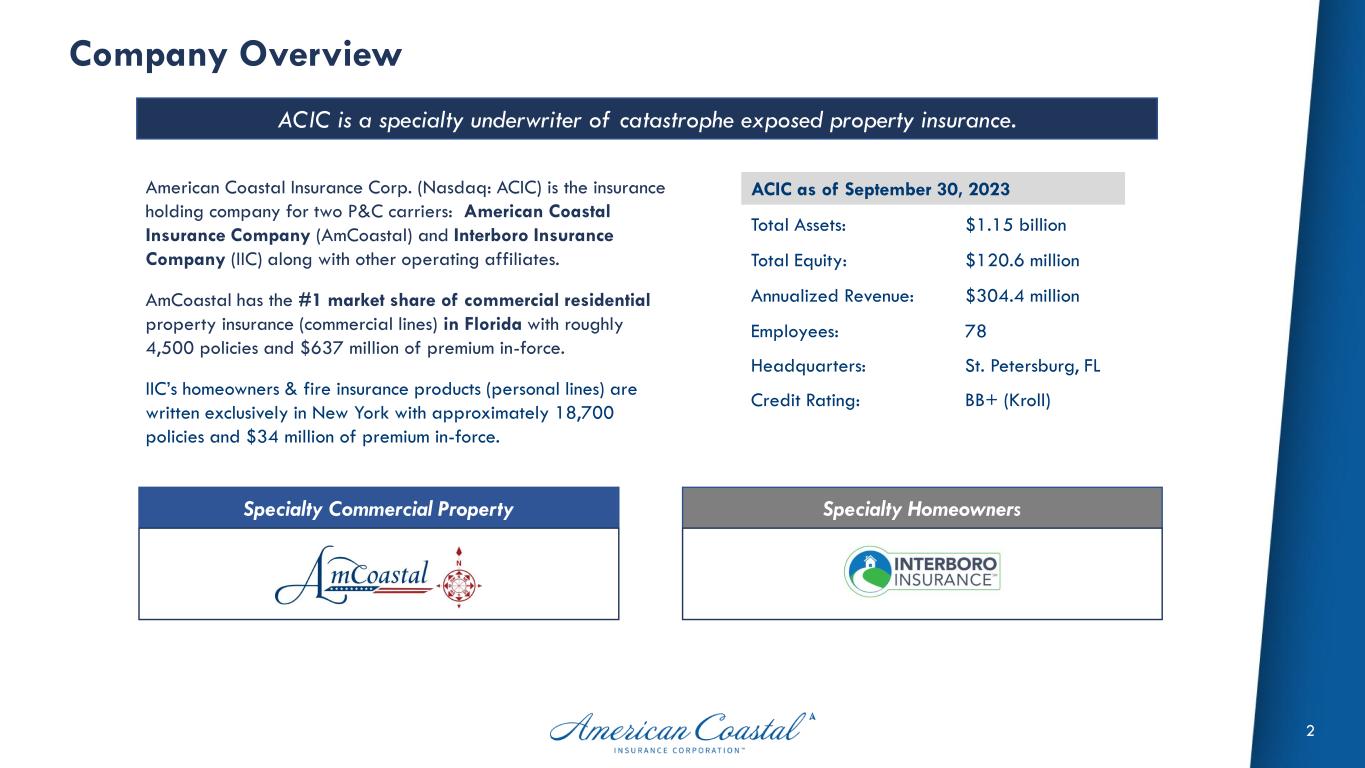

2 Company Overview ACIC is a specialty underwriter of catastrophe exposed property insurance. American Coastal Insurance Corp. (Nasdaq: ACIC) is the insurance holding company for two P&C carriers: American Coastal Insurance Company (AmCoastal) and Interboro Insurance Company (IIC) along with other operating affiliates. AmCoastal has the #1 market share of commercial residential property insurance (commercial lines) in Florida with roughly 4,500 policies and $637 million of premium in-force. IIC’s homeowners & fire insurance products (personal lines) are written exclusively in New York with approximately 18,700 policies and $34 million of premium in-force. ACIC as of September 30, 2023 Total Assets: $1.15 billion Total Equity: $120.6 million Annualized Revenue: $304.4 million Employees: 78 Headquarters: St. Petersburg, FL Credit Rating: BB+ (Kroll) Specialty Commercial Property Specialty Homeowners

3 Executive Summary • Q3-23 Results • Non-GAAP Core Income of $14.9m ($0.34) increased $32.9m (+182%) from a core loss of -$18.1m (-$0.42) y/y on higher gross premiums earned combined with lower catastrophe losses and operating expenses. • Net income from continuing operations of $14.4m ($0.33) improved $41.8m (+152%) from a net loss of -$27.5m (-$0.64) last year due primarily to Hurricane Ian in 2022. Our combined ratio of 68.7% improved over 70 points from 139.3% in the same period last year. • Gross premiums earned of $165.8m grew $27.4m (+20%) y/y due to improving rate adequacy in commercial lines. • Current year net catastrophe losses of $5.8m included $2.5m from Hurricane Idalia and $3.3m of reserve strengthening on prior quarter PCS events that was partially offset by $3.3m of favorable prior year reserve development in the current period. • Stockholders’ equity attributable to ACIC as of September 30, 2023, increased to $120.6m or $2.78 per share and $3.33 per share excluding unrealized losses in accumulated other comprehensive income. • Other Highlights • Our name changed from United Insurance Holdings Corp. (Nasdaq: UIHC) to American Coastal Insurance Corp. with our new ticker symbol (Nasdaq: ACIC) becoming effective on August 15, 2023. • At the end of the third quarter, the Company launched an at-the-market (ATM) common stock offering. We expect to sell 1-3 million shares over time and use the proceeds to support growth and optimize our reinsurance costs via utilization of our captive. • On October 11, 2023, Kroll Bond Rating Agency affirmed ratings for ACIC and its key operating subsidiaries and moved their outlook from negative to stable.

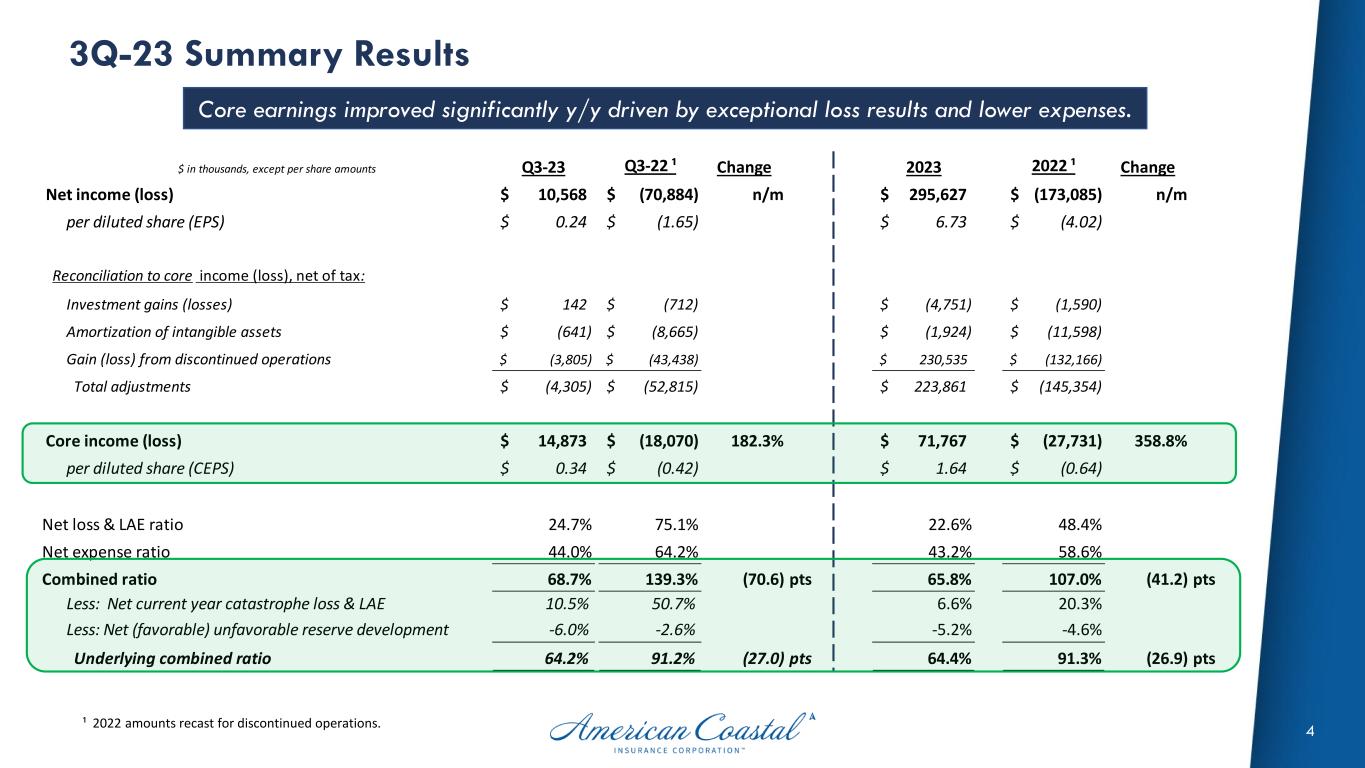

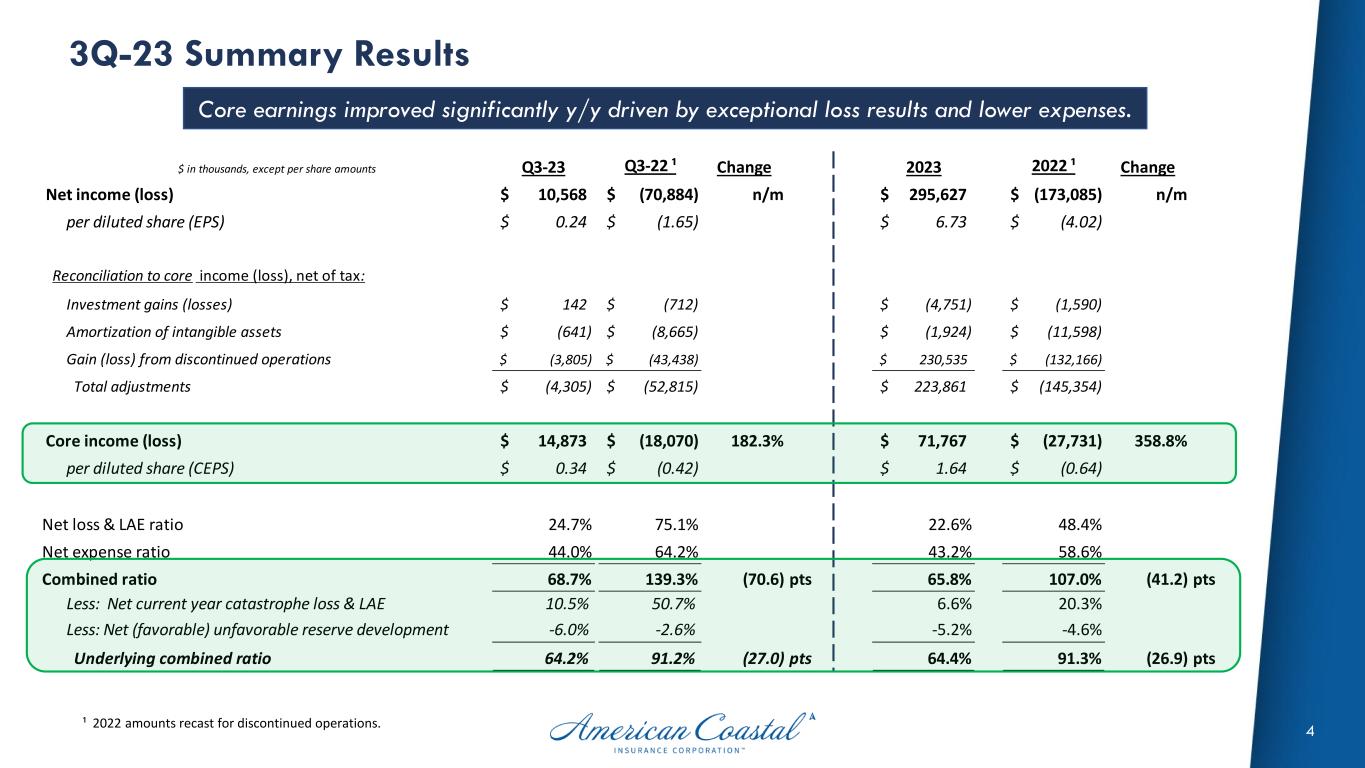

4 3Q-23 Summary Results Core earnings improved significantly y/y driven by exceptional loss results and lower expenses. ¹ 2022 amounts recast for discontinued operations. $ in thousands, except per share amounts Q3-23 Q3-22 ¹ Change 2023 2022 ¹ Change Net income (loss) 10,568$ (70,884)$ n/m 295,627$ (173,085)$ n/m per diluted share (EPS) 0.24$ (1.65)$ 6.73$ (4.02)$ Reconciliation to core income (loss), net of tax: Investment gains (losses) 142$ (712)$ (4,751)$ (1,590)$ Amortization of intangible assets (641)$ (8,665)$ (1,924)$ (11,598)$ Gain (loss) from discontinued operations (3,805)$ (43,438)$ 230,535$ (132,166)$ Total adjustments (4,305)$ (52,815)$ 223,861$ (145,354)$ Core income (loss) 14,873$ (18,070)$ 182.3% 71,767$ (27,731)$ 358.8% per diluted share (CEPS) 0.34$ (0.42)$ 1.64$ (0.64)$ Net loss & LAE ratio 24.7% 75.1% 22.6% 48.4% Net expense ratio 44.0% 64.2% 43.2% 58.6% Combined ratio 68.7% 139.3% (70.6) pts 65.8% 107.0% (41.2) pts Less: Net current year catastrophe loss & LAE 10.5% 50.7% 6.6% 20.3% Less: Net (favorable) unfavorable reserve development -6.0% -2.6% -5.2% -4.6% Underlying combined ratio 64.2% 91.2% (27.0) pts 64.4% 91.3% (26.9) pts

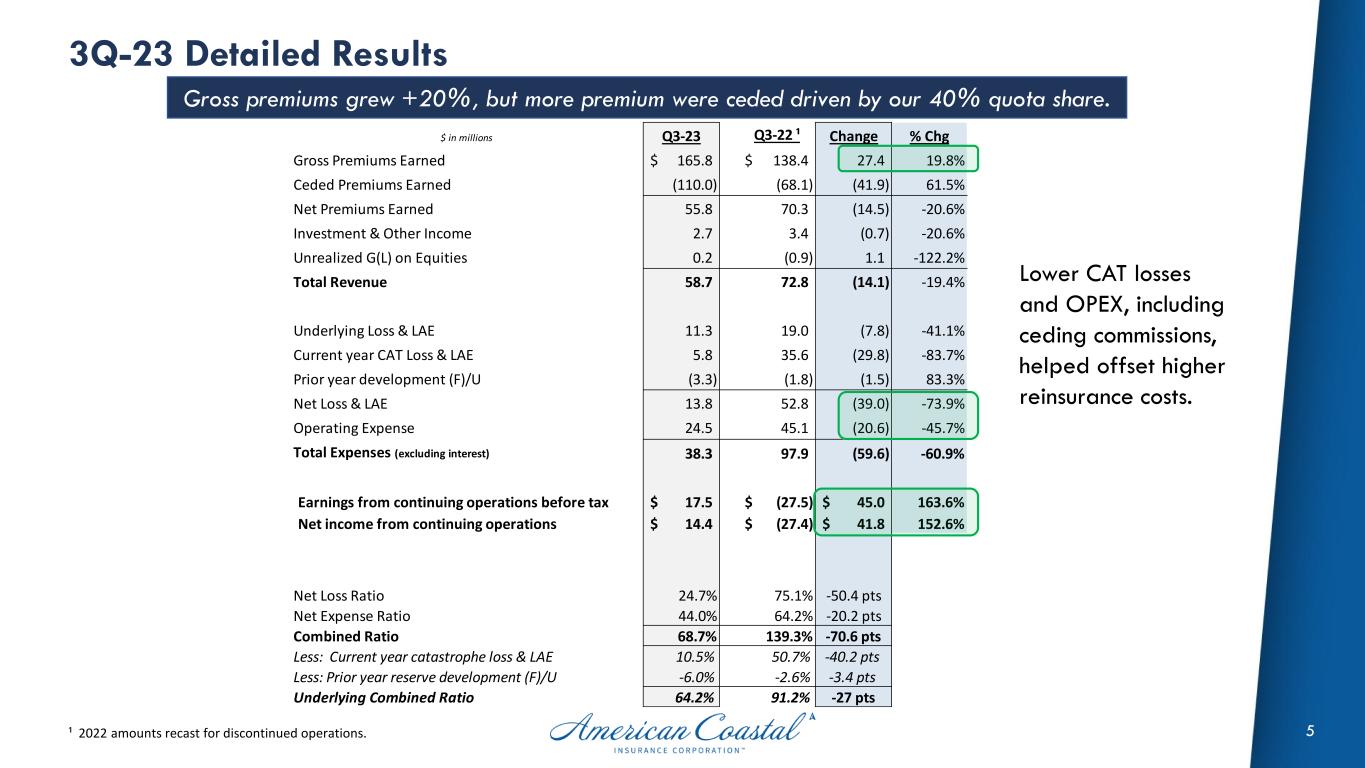

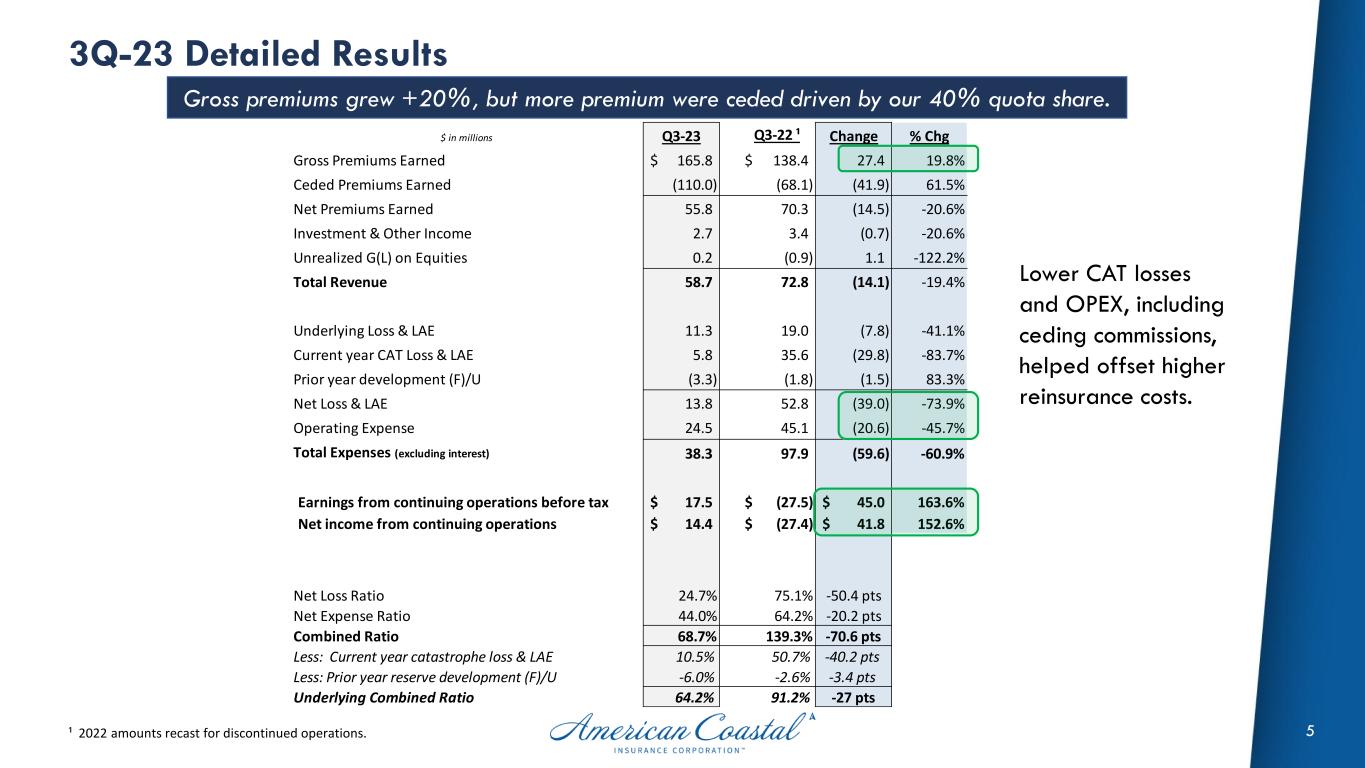

5 3Q-23 Detailed Results Gross premiums grew +20%, but more premium were ceded driven by our 40% quota share. ¹ 2022 amounts recast for discontinued operations. $ in millions Q3-23 Q3-22 ¹ Change % Chg Gross Premiums Earned 165.8$ 138.4$ 27.4 19.8% Ceded Premiums Earned (110.0) (68.1) (41.9) 61.5% Net Premiums Earned 55.8 70.3 (14.5) -20.6% Investment & Other Income 2.7 3.4 (0.7) -20.6% Unrealized G(L) on Equities 0.2 (0.9) 1.1 -122.2% Total Revenue 58.7 72.8 (14.1) -19.4% Underlying Loss & LAE 11.3 19.0 (7.8) -41.1% Current year CAT Loss & LAE 5.8 35.6 (29.8) -83.7% Prior year development (F)/U (3.3) (1.8) (1.5) 83.3% Net Loss & LAE 13.8 52.8 (39.0) -73.9% Operating Expense 24.5 45.1 (20.6) -45.7% Total Expenses (excluding interest) 38.3 97.9 (59.6) -60.9% Earnings from continuing operations before tax 17.5$ (27.5)$ 45.0$ 163.6% Net income from continuing operations 14.4$ (27.4)$ 41.8$ 152.6% Net Loss Ratio 24.7% 75.1% -50.4 pts Net Expense Ratio 44.0% 64.2% -20.2 pts Combined Ratio 68.7% 139.3% -70.6 pts Less: Current year catastrophe loss & LAE 10.5% 50.7% -40.2 pts Less: Prior year reserve development (F)/U -6.0% -2.6% -3.4 pts Underlying Combined Ratio 64.2% 91.2% -27 pts Lower CAT losses and OPEX, including ceding commissions, helped offset higher reinsurance costs.

6 3Q-23 Segment Results Commercial residential continues to hit on all cylinders and rate action on personal lines is being taken. CL – Commercial lines PL – Personal lines $ in millions CL PL Other Total CL PL Other Total Gross Premiums Earned 157.8$ 8.0$ -$ 165.8$ 435.6$ 32.8$ -$ 468.4$ Ceded Premiums Earned (107.5) (2.4) - (110.0) (232.7) (9.5) - (242.1) Net Premiums Earned 50.3 5.5 - 55.8 202.9 23.4 - 226.3 Investment & other revenue 1.9 0.8 - 2.7 (1.2) 2.4 - 1.2 Unrealized G(L) on Equities 0.2 0.0 - 0.2 0.8 0.0 - 0.8 Total Revenue 52.3 6.4 - 58.7 202.5 25.8 - 228.3 Underlying Loss & LAE 8.0 3.2 - 11.3 38.0 9.8 - 47.8 Current year CAT Loss & LAE 4.9 1.0 - 5.8 13.2 1.8 - 15.0 Prior year development (3.1) (0.2) - (3.3) (11.2) (0.5) - (11.7) Total Loss 9.8 3.9 - 13.8 40.0 11.1 - 51.1 Operating & Interest Expense 16.6 7.7 3.0 27.2 72.2 24.8 9.0 106.0 Total Expenses 26.4 11.6 3.0 41.0 112.2 35.9 9.0 157.1 Other income (loss) - (0.2) - (0.2) - 1.4 (0.2) 1.2 Income (Loss) before tax 25.9$ (5.5)$ (3.0)$ 17.5 90.2$ (8.7)$ (9.2)$ 72.4 Income tax expense (benefit) 3.1 7.3 Net income (loss) from continuing operations 14.4 65.1 Net Loss Ratio 19.5% 71.2% 24.7% 19.7% 47.6% 22.6% Net Expense Ratio 33.0% 138.1% 44.0% 35.6% 105.9% 43.2% Combined Ratio 52.5% 209.3% 68.7% 55.3% 153.5% 65.8% CAT Loss 9.7% 17.2% 10.5% 6.5% 7.8% 6.6% PY Development (F)/U -6.2% -4.4% -6.0% -5.5% -1.9% -5.2% Underlying Combined Ratio 48.9% 196.5% 64.2% 54.3% 147.7% 64.4% Three Months Ended Sep 30, 2023 Nine Months Ended Sep 30, 2023 The Company has executed a non- binding term sheet with a confidential third-party to acquire IIC at GAAP book value at the time of closing. We expect the sale to be completed in 2024.

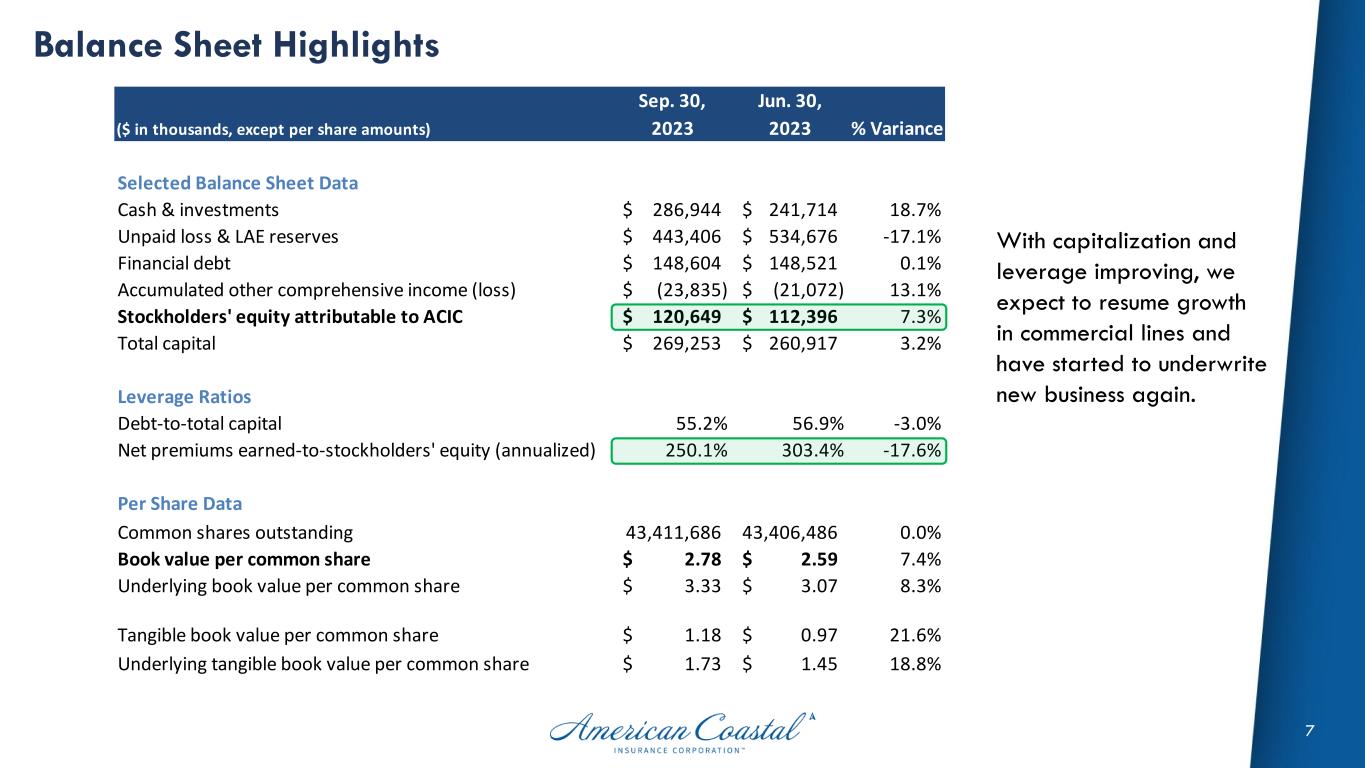

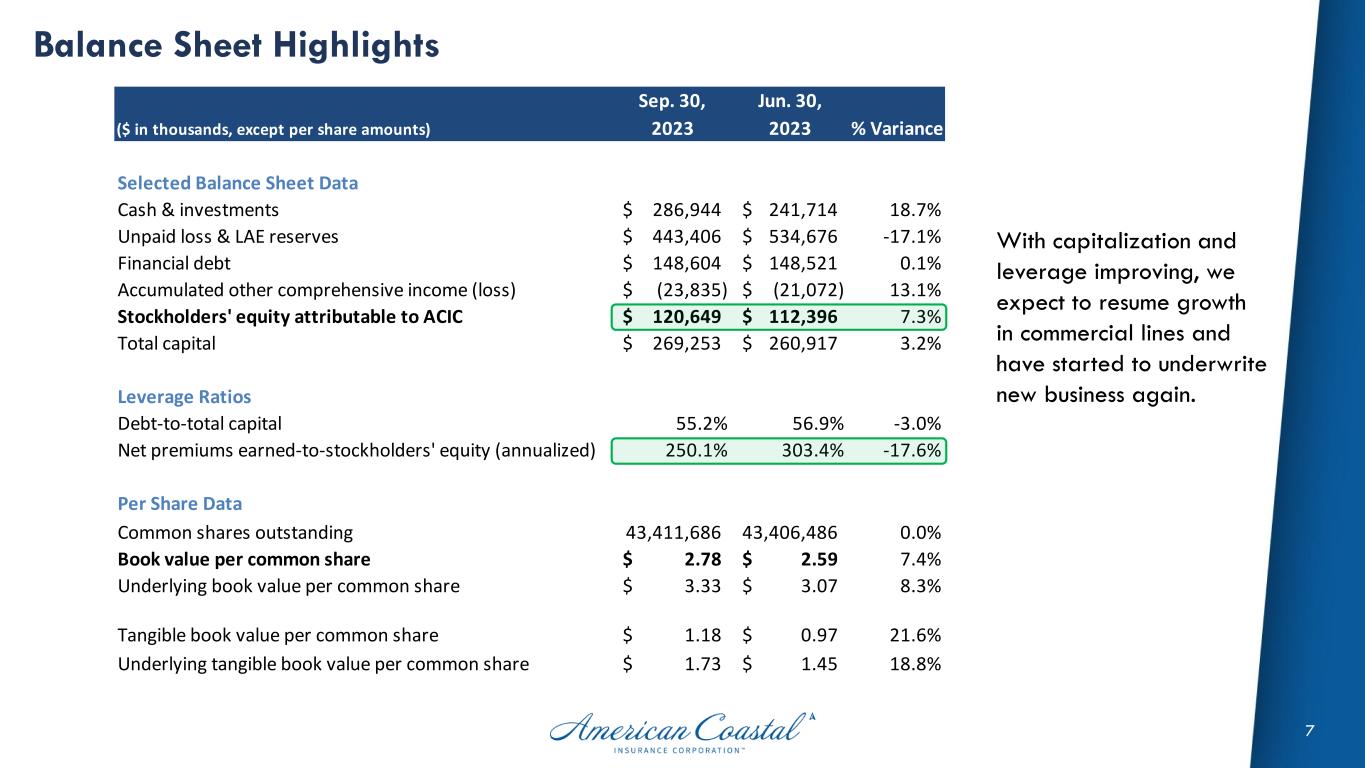

7 Balance Sheet Highlights With capitalization and leverage improving, we expect to resume growth in commercial lines and have started to underwrite new business again. Sep. 30, Jun. 30, ($ in thousands, except per share amounts) 2023 2023 % Variance Selected Balance Sheet Data Cash & investments 286,944$ 241,714$ 18.7% Unpaid loss & LAE reserves 443,406$ 534,676$ -17.1% Financial debt 148,604$ 148,521$ 0.1% Accumulated other comprehensive income (loss) (23,835)$ (21,072)$ 13.1% Stockholders' equity attributable to ACIC 120,649$ 112,396$ 7.3% Total capital 269,253$ 260,917$ 3.2% Leverage Ratios Debt-to-total capital 55.2% 56.9% -3.0% Net premiums earned-to-stockholders' equity (annualized) 250.1% 303.4% -17.6% Per Share Data Common shares outstanding 43,411,686 43,406,486 0.0% Book value per common share 2.78$ 2.59$ 7.4% Underlying book value per common share 3.33$ 3.07$ 8.3% Tangible book value per common share 1.18$ 0.97$ 21.6% Underlying tangible book value per common share 1.73$ 1.45$ 18.8%

8 Premium & Exposure Trends Rate relative to risk continues to improve setting the stage for Premium & TIV growth in future periods. Commercial Lines Premium & Total Insured Value (TIV) In-force +36% -14% Risk Reward

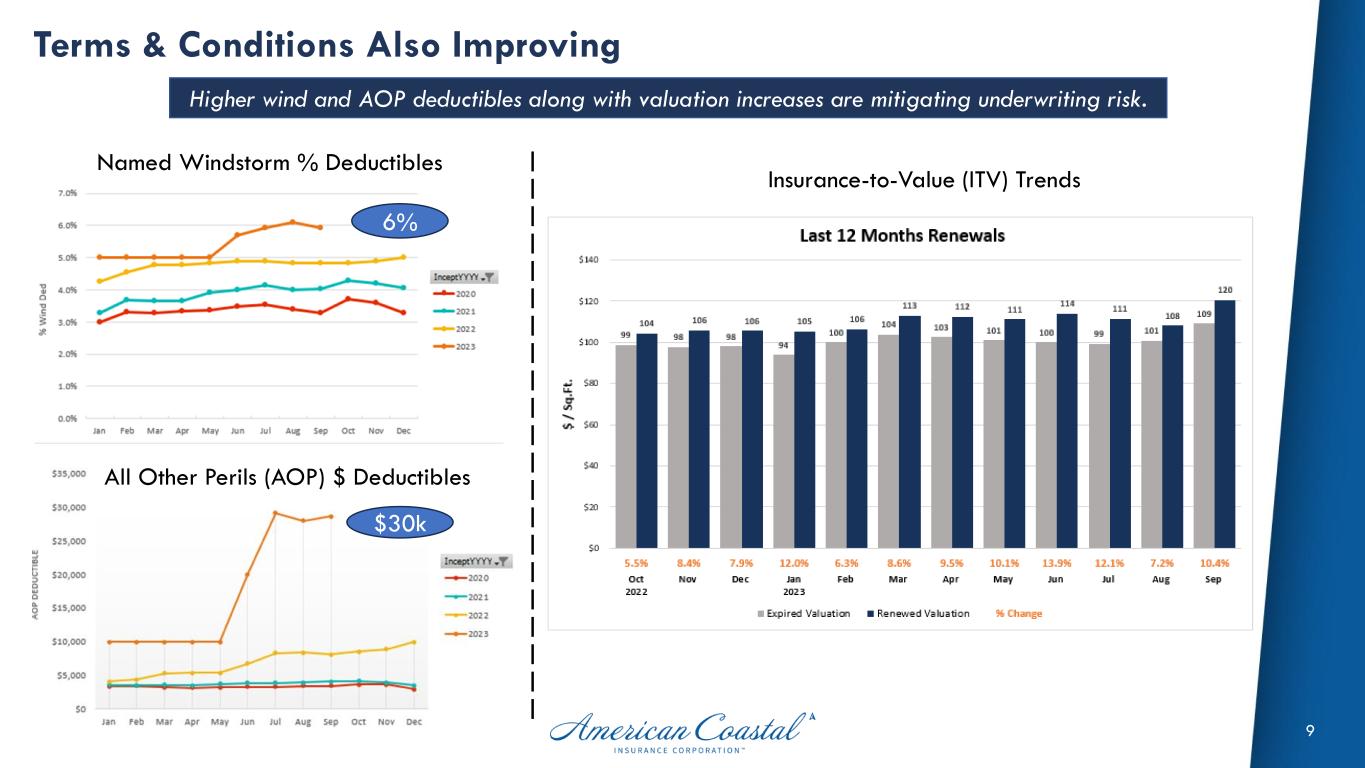

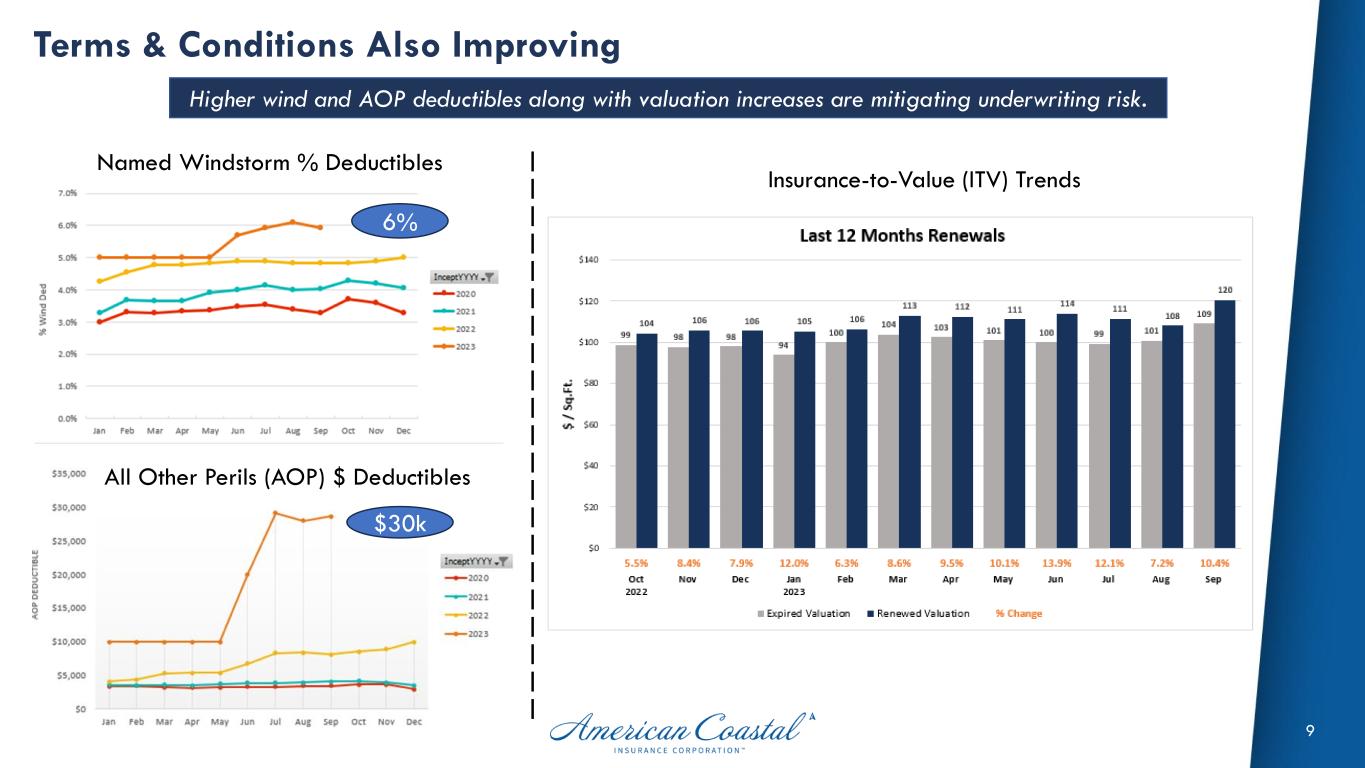

9 Terms & Conditions Also Improving Higher wind and AOP deductibles along with valuation increases are mitigating underwriting risk. Named Windstorm % Deductibles All Other Perils (AOP) $ Deductibles Insurance-to-Value (ITV) Trends 6% $30k

10 Cautionary Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report in Form 10-K for the year ended December 31, 2021 and 2022 and our Form 10-Q for the periods ending March 31, 2022, June 30, 2022, September 30, 2022, March 31, 2023 (Form 10-Q/A), June 30, 2023, and September 30, 2023 including amendments. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See our earnings release, Form 10-K , Form 10-Q, and Form 10-Q/A for further information regarding these non-GAAP financial measures.