3rd Quarter 2024 November 6th, 2024 Earnings Presentation

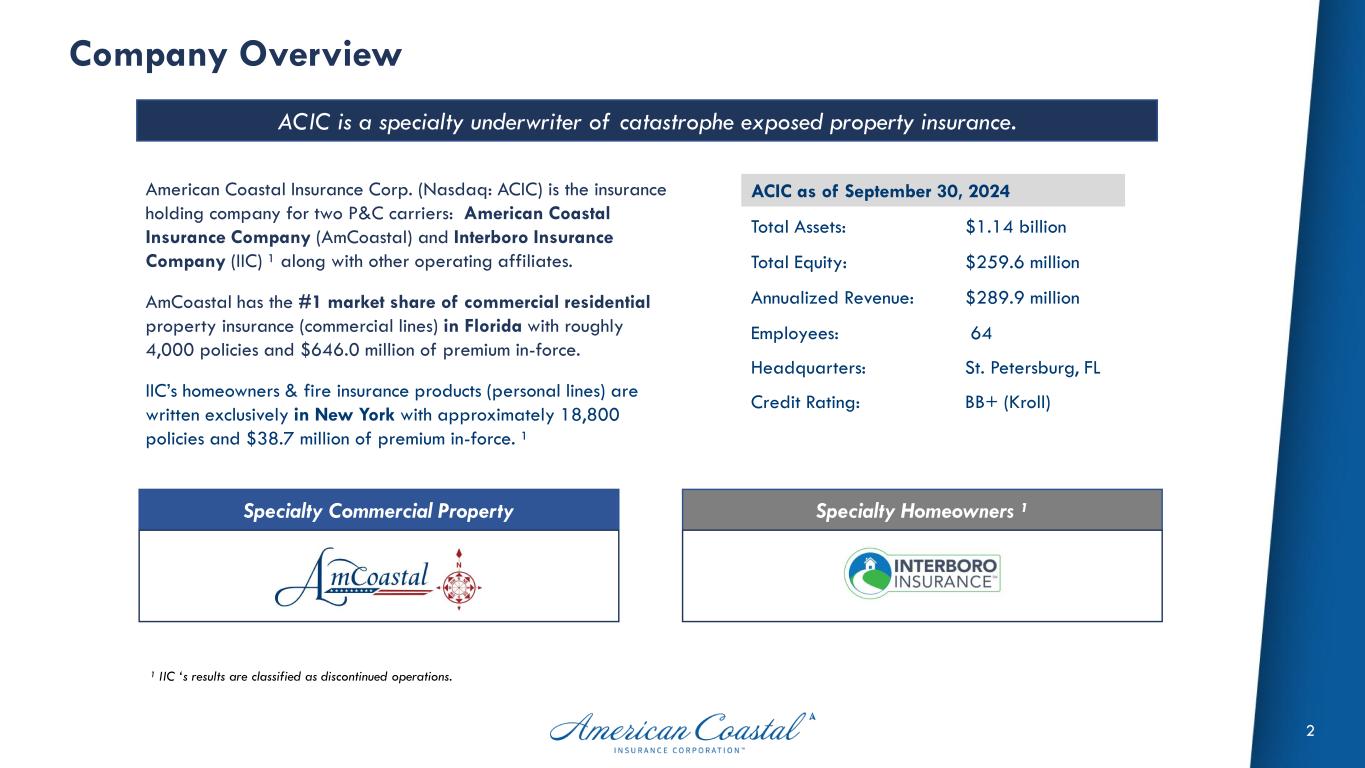

2 Company Overview ACIC is a specialty underwriter of catastrophe exposed property insurance. American Coastal Insurance Corp. (Nasdaq: ACIC) is the insurance holding company for two P&C carriers: American Coastal Insurance Company (AmCoastal) and Interboro Insurance Company (IIC) ¹ along with other operating affiliates. AmCoastal has the #1 market share of commercial residential property insurance (commercial lines) in Florida with roughly 4,000 policies and $646.0 million of premium in-force. IIC’s homeowners & fire insurance products (personal lines) are written exclusively in New York with approximately 18,800 policies and $38.7 million of premium in-force. ¹ ACIC as of September 30, 2024 Total Assets: $1.14 billion Total Equity: $259.6 million Annualized Revenue: $289.9 million Employees: 64 Headquarters: St. Petersburg, FL Credit Rating: BB+ (Kroll) Specialty Commercial Property Specialty Homeowners ¹ ¹ IIC ‘s results are classified as discontinued operations.

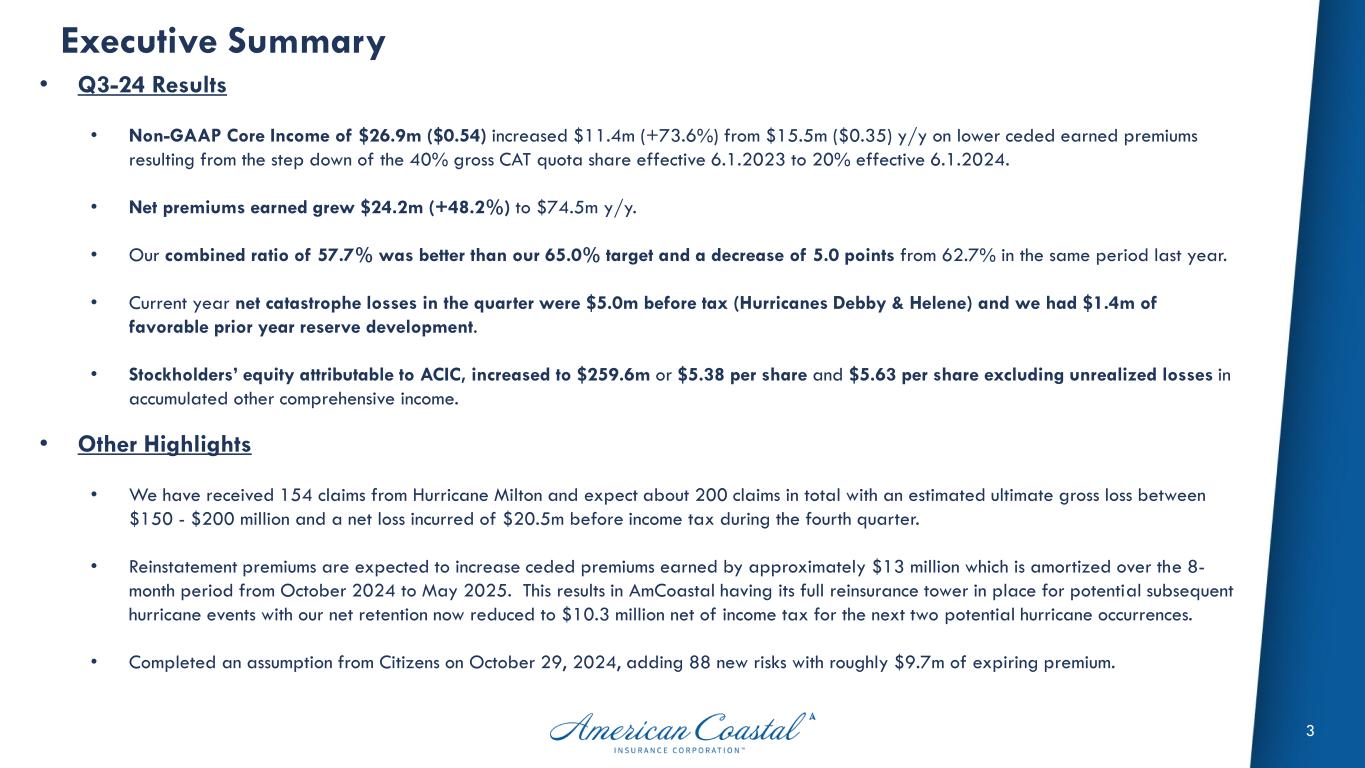

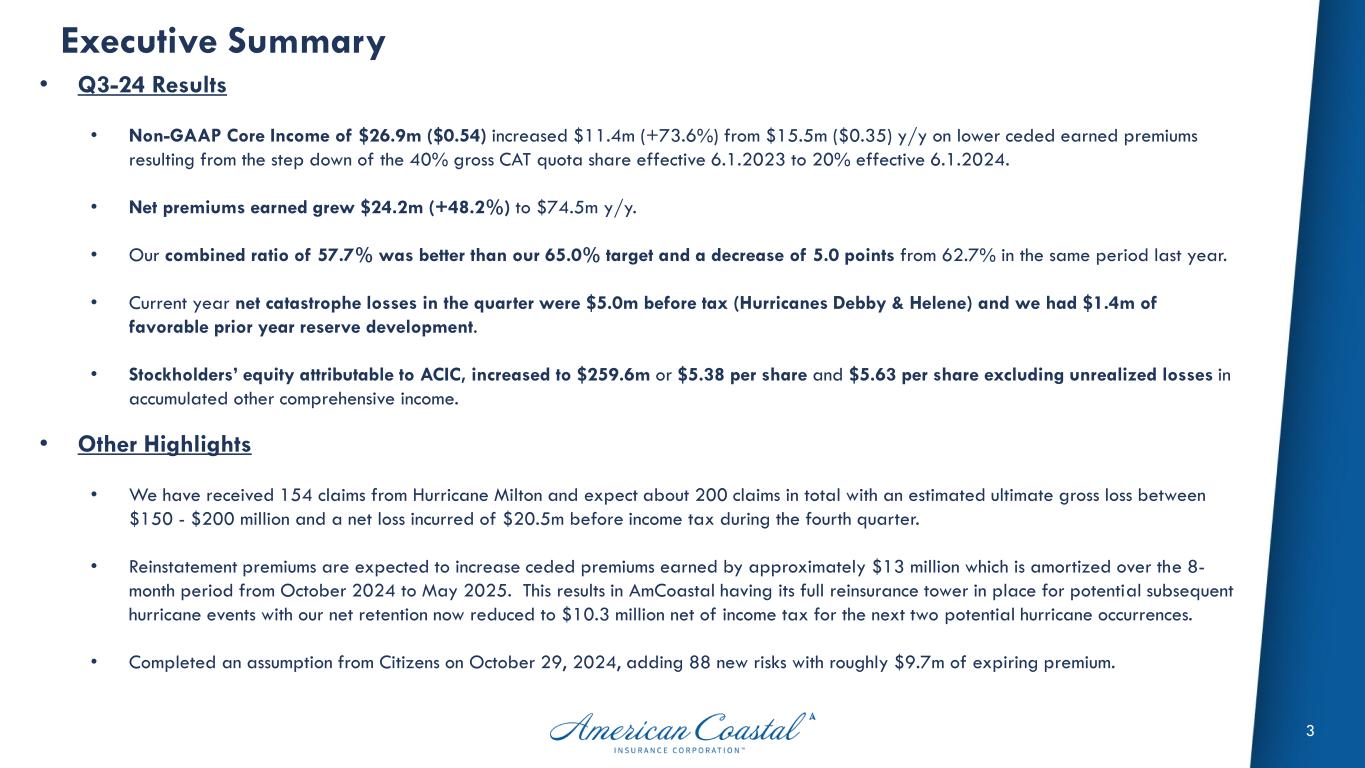

3 Executive Summary • Q3-24 Results • Non-GAAP Core Income of $26.9m ($0.54) increased $11.4m (+73.6%) from $15.5m ($0.35) y/y on lower ceded earned premiums resulting from the step down of the 40% gross CAT quota share effective 6.1.2023 to 20% effective 6.1.2024. • Net premiums earned grew $24.2m (+48.2%) to $74.5m y/y. • Our combined ratio of 57.7% was better than our 65.0% target and a decrease of 5.0 points from 62.7% in the same period last year. • Current year net catastrophe losses in the quarter were $5.0m before tax (Hurricanes Debby & Helene) and we had $1.4m of favorable prior year reserve development. • Stockholders’ equity attributable to ACIC, increased to $259.6m or $5.38 per share and $5.63 per share excluding unrealized losses in accumulated other comprehensive income. • Other Highlights • We have received 154 claims from Hurricane Milton and expect about 200 claims in total with an estimated ultimate gross loss between $150 - $200 million and a net loss incurred of $20.5m before income tax during the fourth quarter. • Reinstatement premiums are expected to increase ceded premiums earned by approximately $13 million which is amortized over the 8- month period from October 2024 to May 2025. This results in AmCoastal having its full reinsurance tower in place for potential subsequent hurricane events with our net retention now reduced to $10.3 million net of income tax for the next two potential hurricane occurrences. • Completed an assumption from Citizens on October 29, 2024, adding 88 new risks with roughly $9.7m of expiring premium.

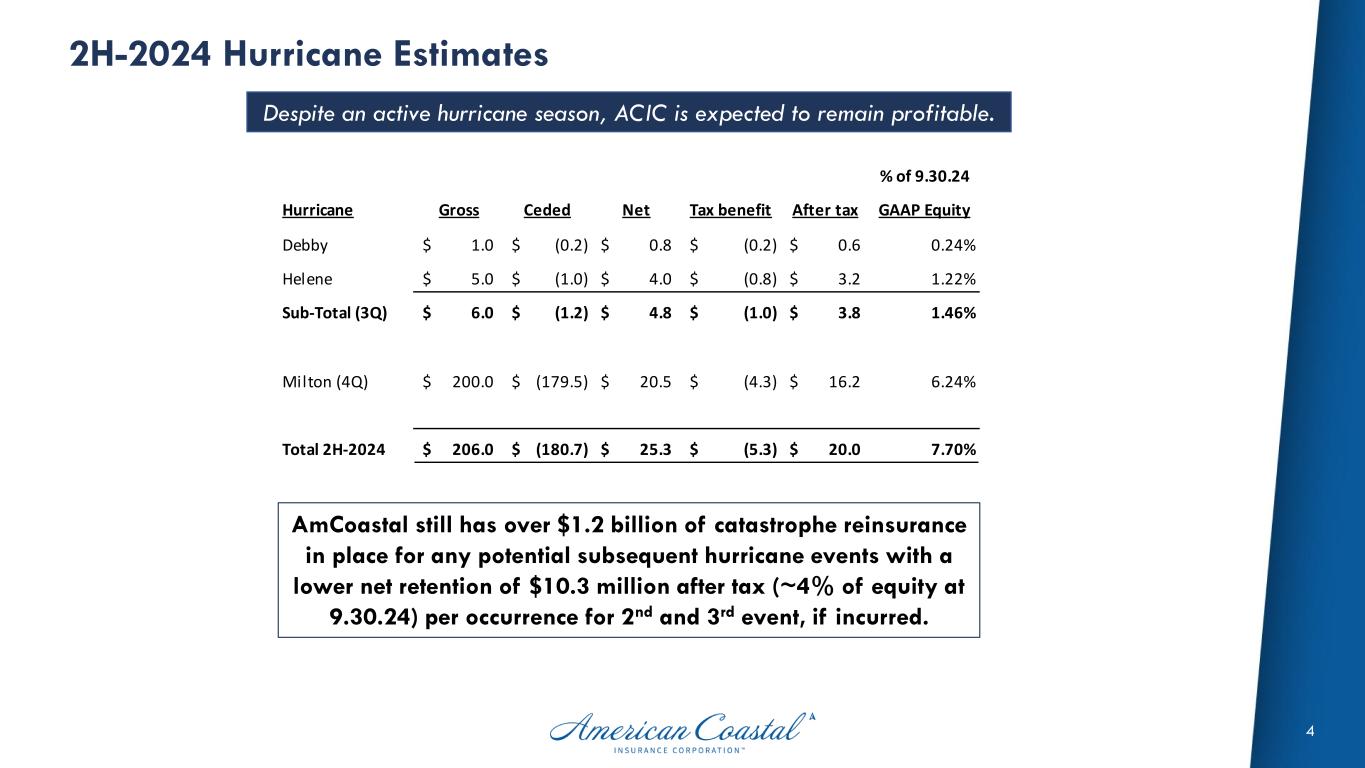

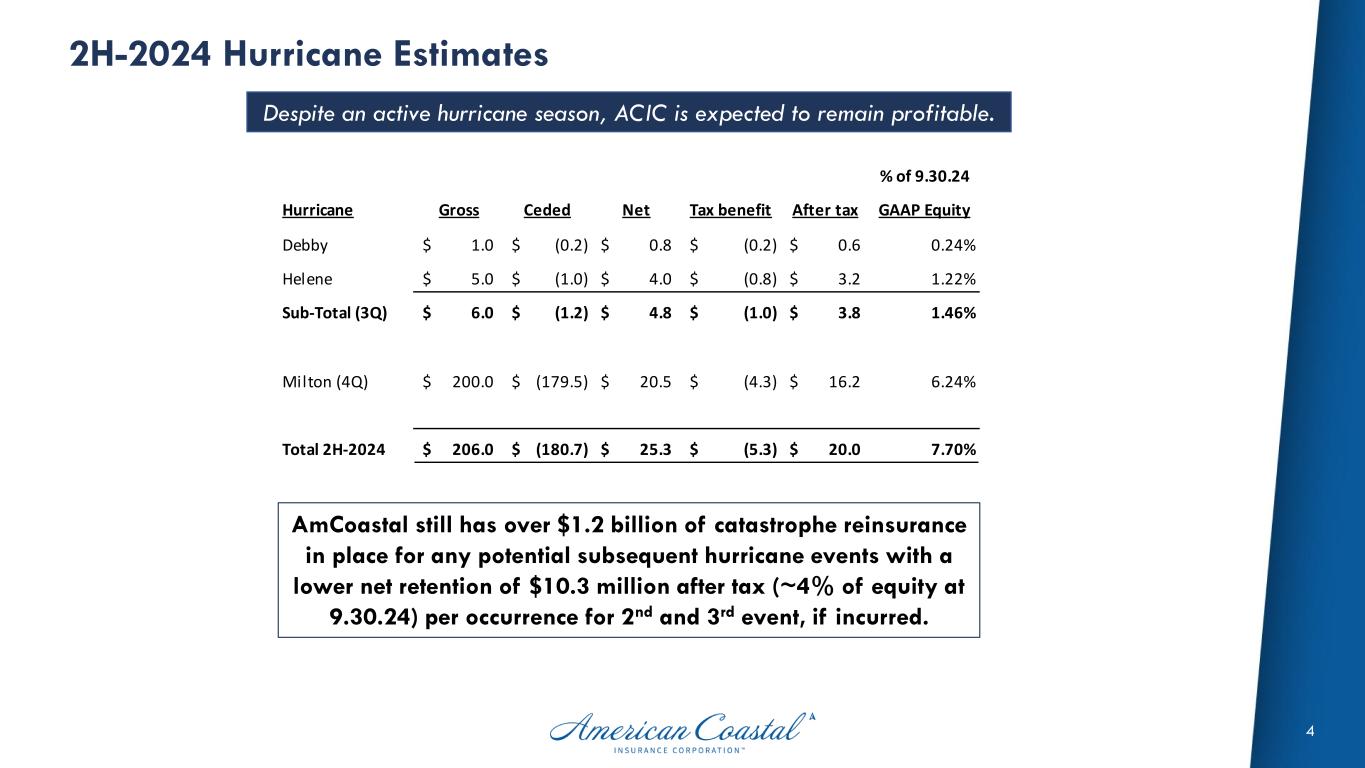

4 2H-2024 Hurricane Estimates Despite an active hurricane season, ACIC is expected to remain profitable. % of 9.30.24 Hurricane Gross Ceded Net Tax benefit After tax GAAP Equity Debby 1.0$ (0.2)$ 0.8$ (0.2)$ 0.6$ 0.24% Helene 5.0$ (1.0)$ 4.0$ (0.8)$ 3.2$ 1.22% Sub-Total (3Q) 6.0$ (1.2)$ 4.8$ (1.0)$ 3.8$ 1.46% Milton (4Q) 200.0$ (179.5)$ 20.5$ (4.3)$ 16.2$ 6.24% Total 2H-2024 206.0$ (180.7)$ 25.3$ (5.3)$ 20.0$ 7.70% AmCoastal still has over $1.2 billion of catastrophe reinsurance in place for any potential subsequent hurricane events with a lower net retention of $10.3 million after tax (~4% of equity at 9.30.24) per occurrence for 2nd and 3rd event, if incurred.

5 3Q-24 Financial Scorecard Key results all compare favorably to Raymond James’ estimates for the current period. 3Q-24 = $0.54 vs. Analyst’s Est. = $0.15 3Q-24 = $5.38 vs. Analyst’s Est. = $4.71 3Q-24 = 57.7% vs. Analyst’s Est. = 89.3% 3Q-24 = 53.8% vs. Analyst’s Est. = 13.5% Core Earnings per Share (CEPS) Book Value per Share (BVPS) Combined Ratio (CR) Core Return on Equity (CROE)

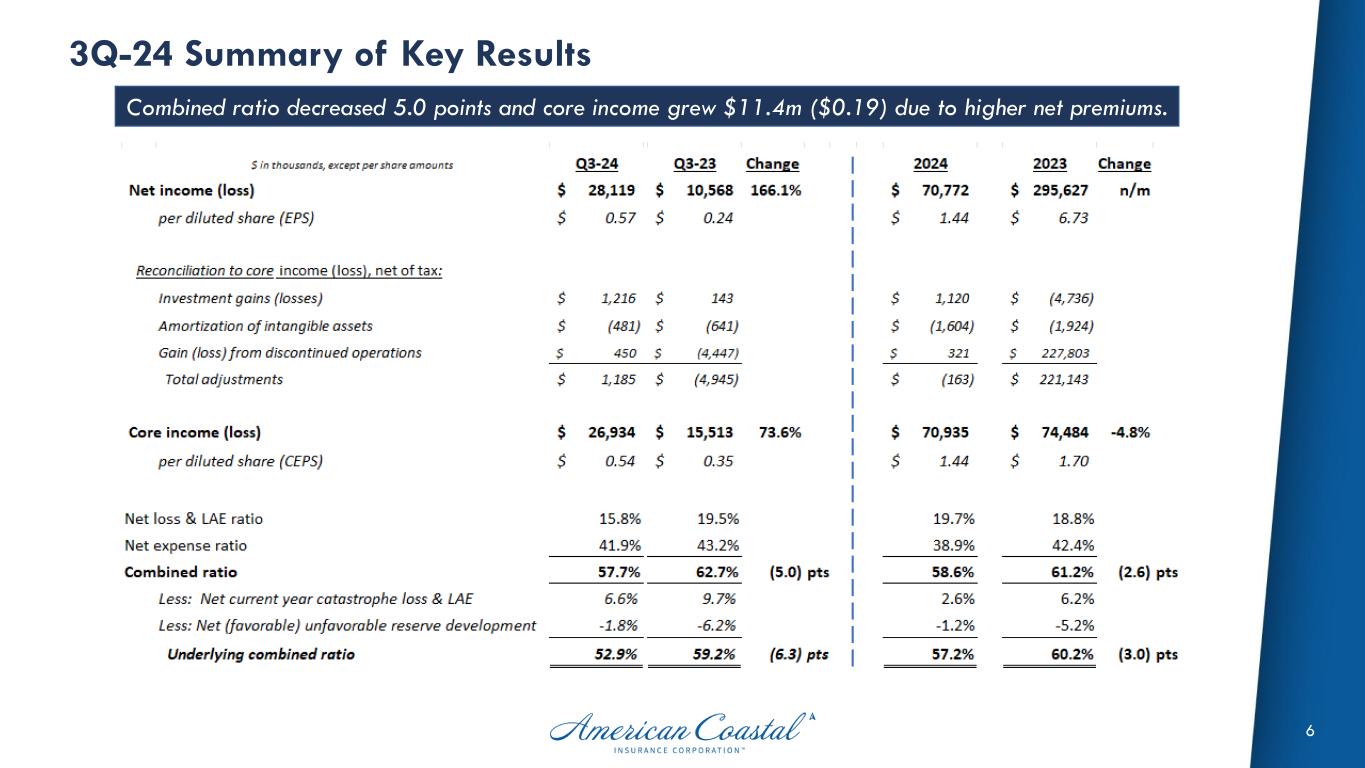

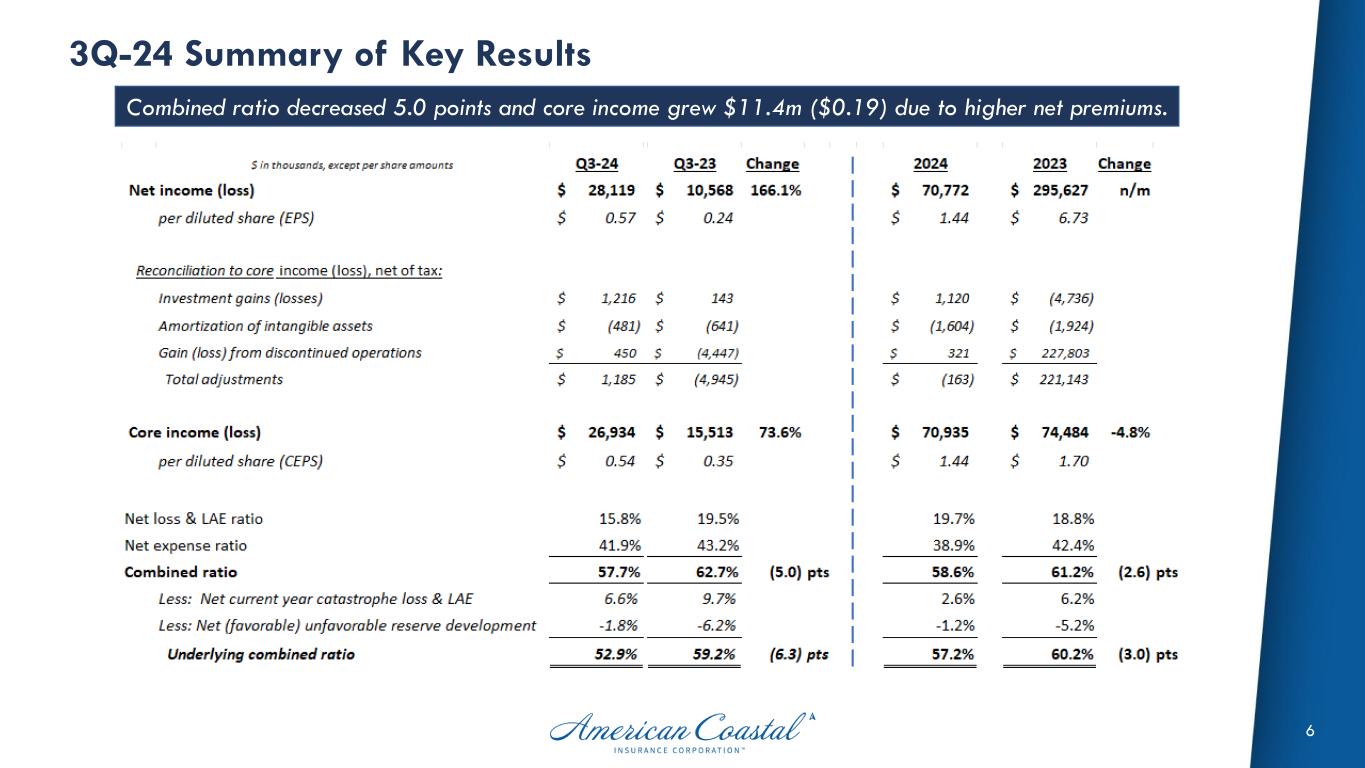

6 3Q-24 Summary of Key Results Combined ratio decreased 5.0 points and core income grew $11.4m ($0.19) due to higher net premiums.

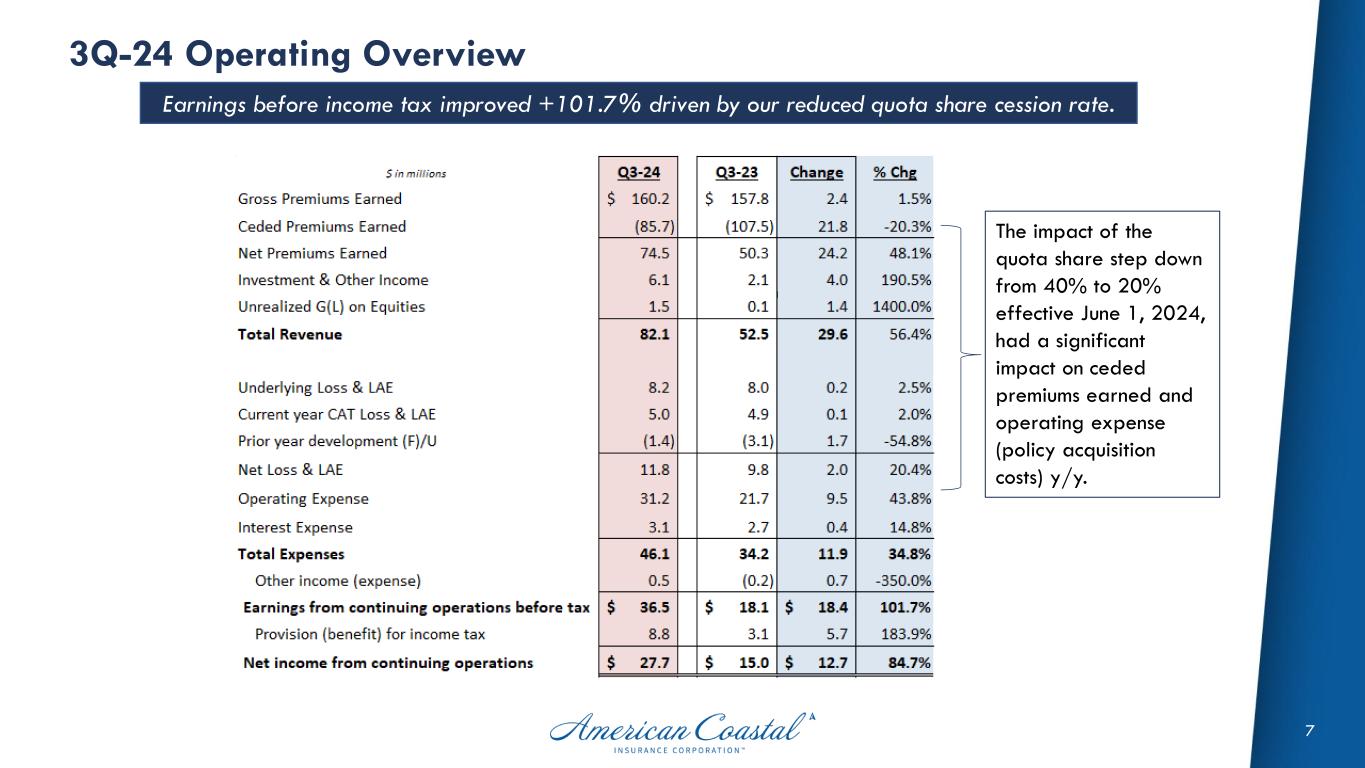

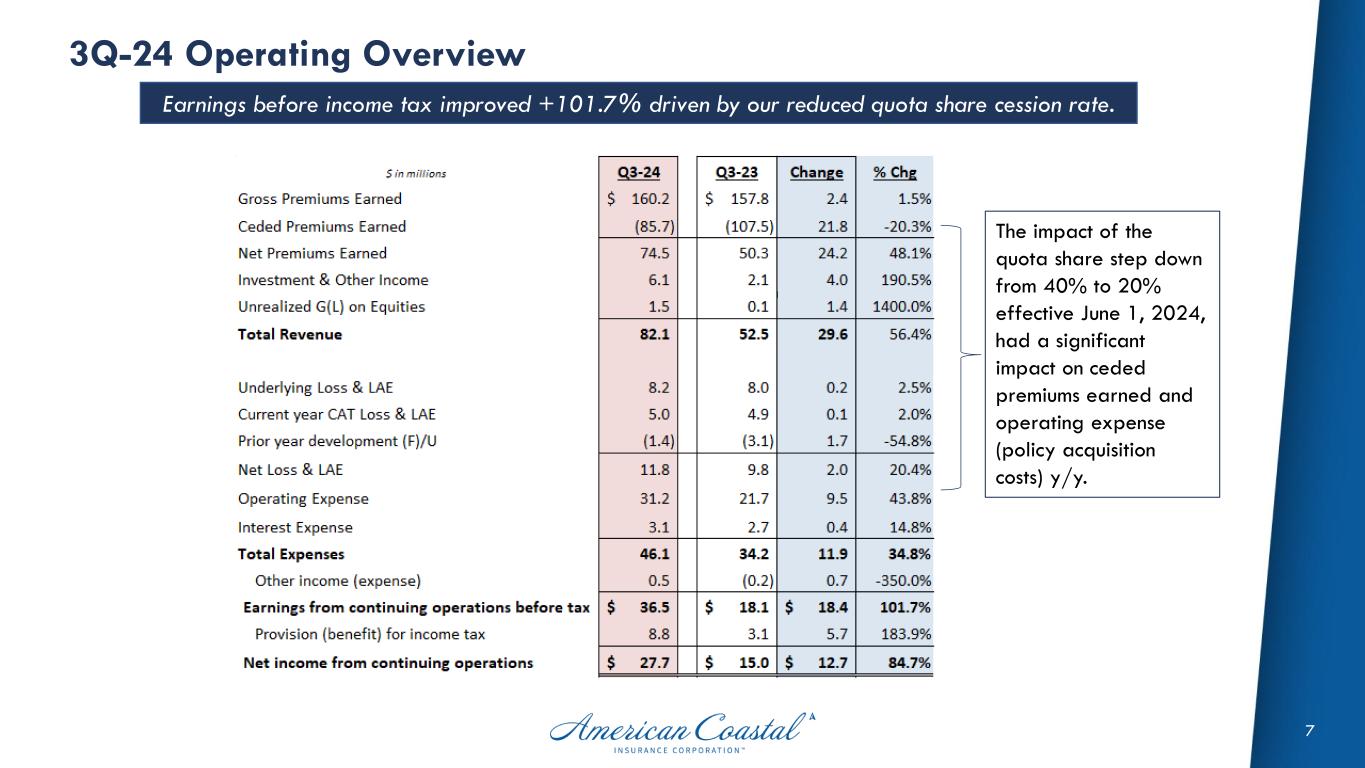

7 3Q-24 Operating Overview Earnings before income tax improved +101.7% driven by our reduced quota share cession rate. The impact of the quota share step down from 40% to 20% effective June 1, 2024, had a significant impact on ceded premiums earned and operating expense (policy acquisition costs) y/y.

8 2024 Full Year & 4Q-24 Guidance We expect to be profitable in the fourth quarter, despite the impact of Hurricane Milton. Estimated range of Net Income from Continuing Operations ¹ Estimated range of Net Premiums Earned ¹ Low High Low High ¹ Estimates include net incurred losses of $16.2 million, net of tax impacts, from Hurricane Milton impacting current year earnings and approximately $5 million of additional ceded premiums earned impacting current year net premiums earned, whereas ACIC did not incur any hurricane losses or reinsurance reinstatement premiums in 2023. FY-24 E 75.0$ - 80.0$ FY-24 E 270.0$ - 280.0$ FY-23 A FY-23 A Y/Y Change (10.2)$ - (5.2)$ Y/Y Change 7.9$ - 17.9$ % Change -11.9% - -6.1% % Change 3.0% - 6.8% 4Q-24 E 4.6$ - 9.6$ 4Q-24 E 69.5$ - 79.5$ 4Q-23 A 4Q-23 A Y/Y Change (10.1)$ - (5.1)$ Y/Y Change 9.9$ - 19.9$ % Change -68.9% - -34.7% % Change 16.6% - 33.3% $85.2 $262.1 $59.6$14.7

9 Balance Sheet Highlights Liquidity & Equity have improved significantly since year-end driven by strong underwriting results. Sep 30, Dec. 31, YTD ($ in thousands, except per share amounts) 2024 2023 % Change Selected Balance Sheet Data Cash & investments 630,867$ 311,874$ 102.3% Accumulated other comprehensive income (loss) (11,617)$ (17,137)$ -32.2% Unpaid loss & LAE reserves 194,678$ 347,738$ -44.0% Reinsurance recoverable 147,325$ 340,820$ -56.8% Net Loss & LAE reserves 47,353$ 6,918$ 584.5% Financial debt 148,937$ 148,688$ 0.2% Stockholders' equity attributable to ACIC 259,582$ 168,765$ 53.8% Total capital 408,519$ 317,453$ 28.7% Leverage Ratios Debt-to-total capital 36.5% 46.8% -22.2% Net premiums earned-to-stockholders' equity (annualized) 103.0% 158.4% -35.0% Per Share Data Common shares outstanding 48,204,962 46,777,006 3.1% Book value per common share 5.38$ 3.61$ 49.3% Underlying book value per common share 5.63$ 3.97$ 41.6% Tangible book value per common share 4.00$ 2.14$ 87.2% Underlying tangible book value per common share 4.24$ 2.50$ 69.4%

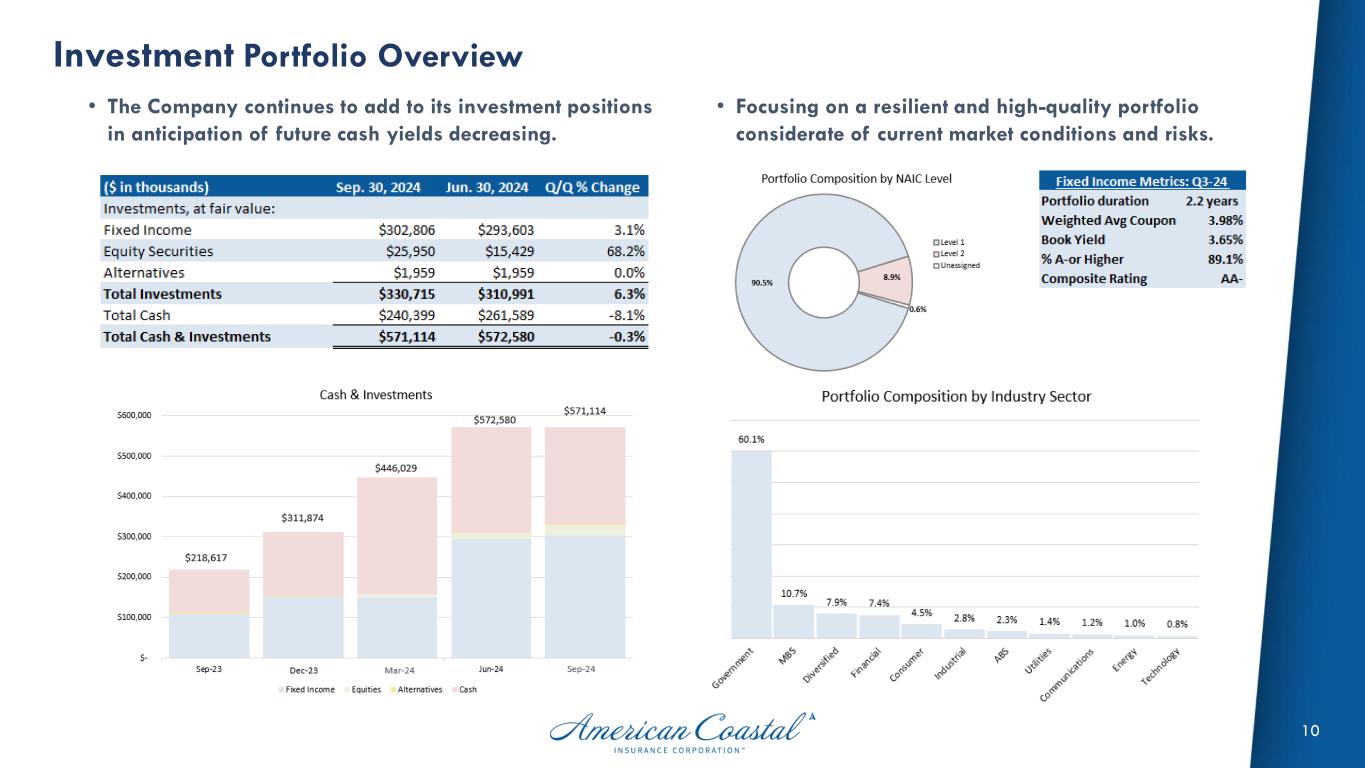

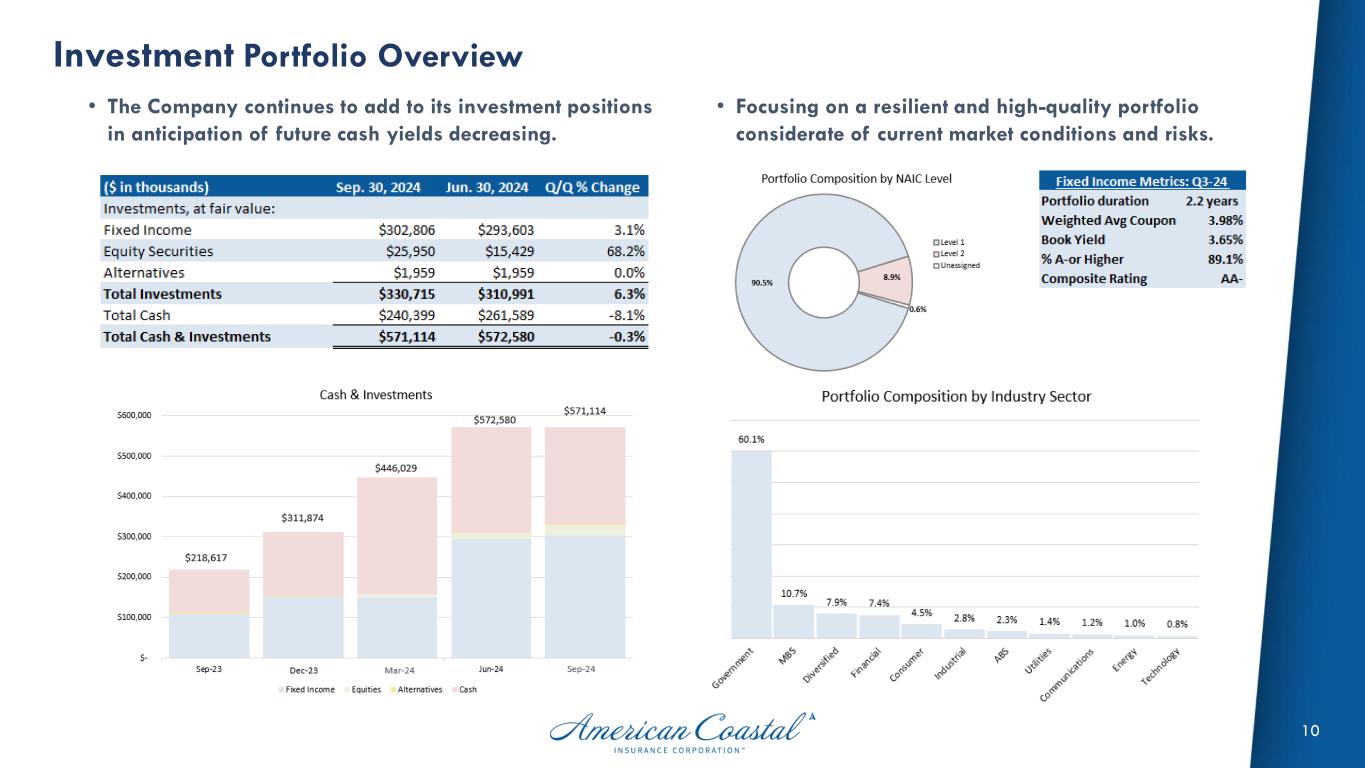

10 Investment Portfolio Overview • Focusing on a resilient and high-quality portfolio considerate of current market conditions and risks. • The Company continues to add to its investment positions in anticipation of future cash yields decreasing.

11 Commercial Property Valuation Trends Valuation changes are slowing down as inflationary pressure moderates.

12 Cautionary Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report in Form 10-K for the year ended December 31, 2022 and 2023 and our Form 10-Q for the periods ending March 31, 2023 (Form 10-Q/A), June 30, 2023, September 30, 2023, March 31, 2024, June 30, 2024 and September 30, 2024, including amendments and recast results. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See our earnings release, Form 10-K , Form 10-Q, and Form 10-Q/A for further information regarding these non-GAAP financial measures.