4th Quarter 2024 February 27, 2025 Earnings Presentation

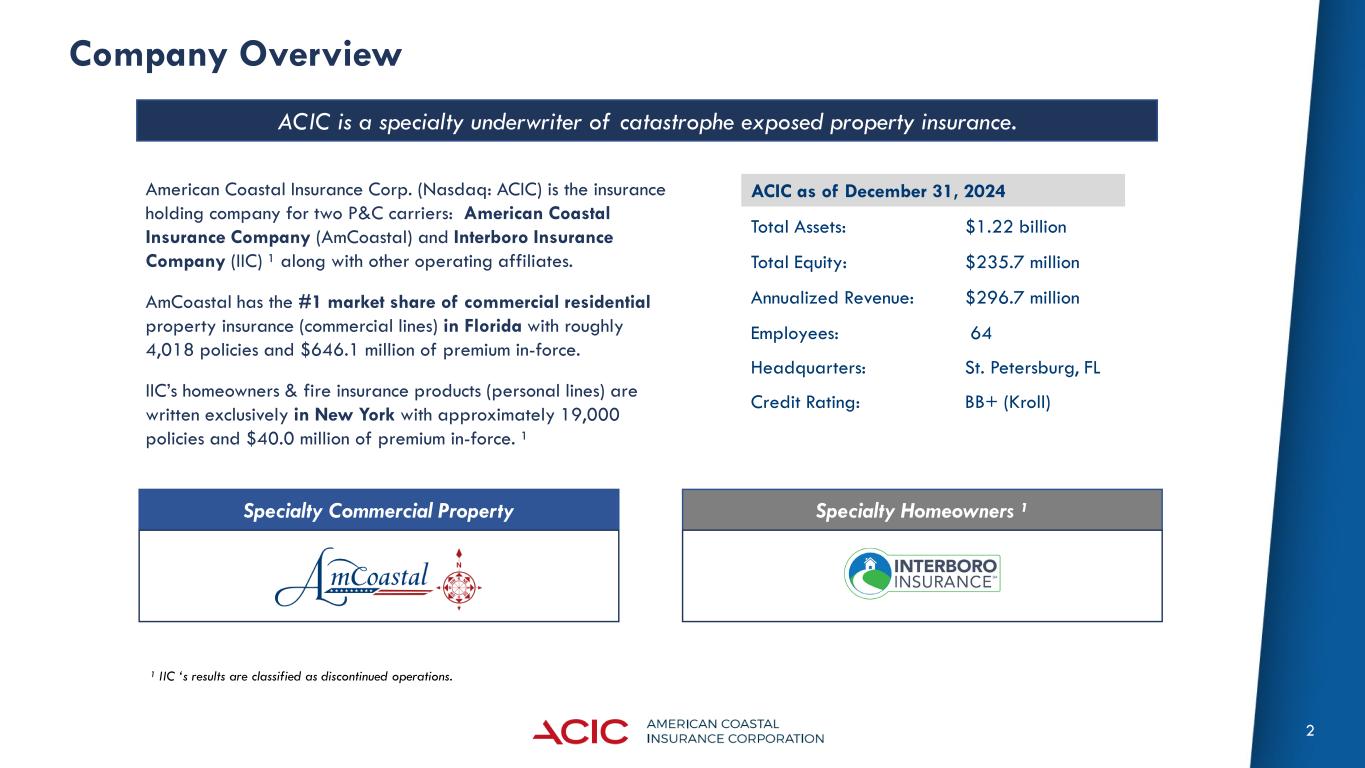

2 Company Overview ACIC is a specialty underwriter of catastrophe exposed property insurance. American Coastal Insurance Corp. (Nasdaq: ACIC) is the insurance holding company for two P&C carriers: American Coastal Insurance Company (AmCoastal) and Interboro Insurance Company (IIC) ¹ along with other operating affiliates. AmCoastal has the #1 market share of commercial residential property insurance (commercial lines) in Florida with roughly 4,018 policies and $646.1 million of premium in-force. IIC’s homeowners & fire insurance products (personal lines) are written exclusively in New York with approximately 19,000 policies and $40.0 million of premium in-force. ¹ ACIC as of December 31, 2024 Total Assets: $1.22 billion Total Equity: $235.7 million Annualized Revenue: $296.7 million Employees: 64 Headquarters: St. Petersburg, FL Credit Rating: BB+ (Kroll) Specialty Commercial Property Specialty Homeowners ¹ ¹ IIC ‘s results are classified as discontinued operations.

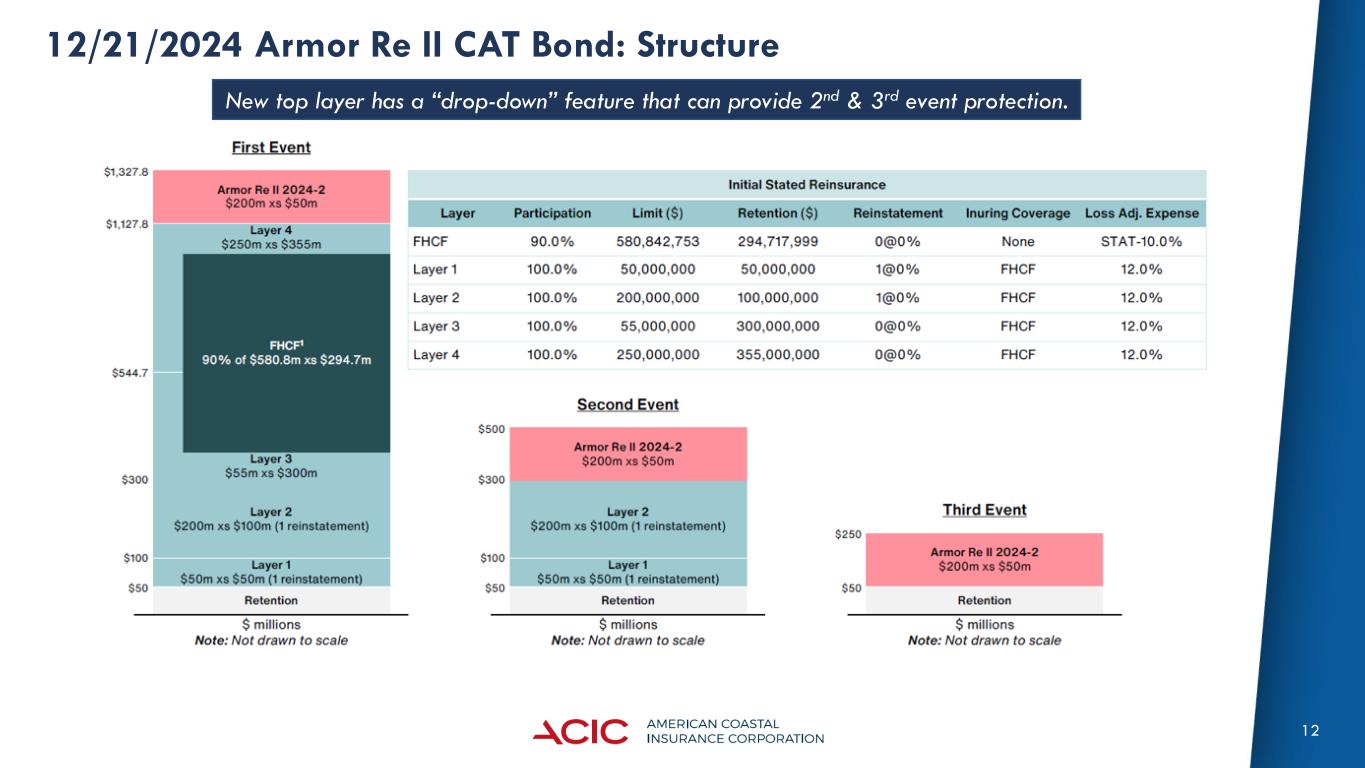

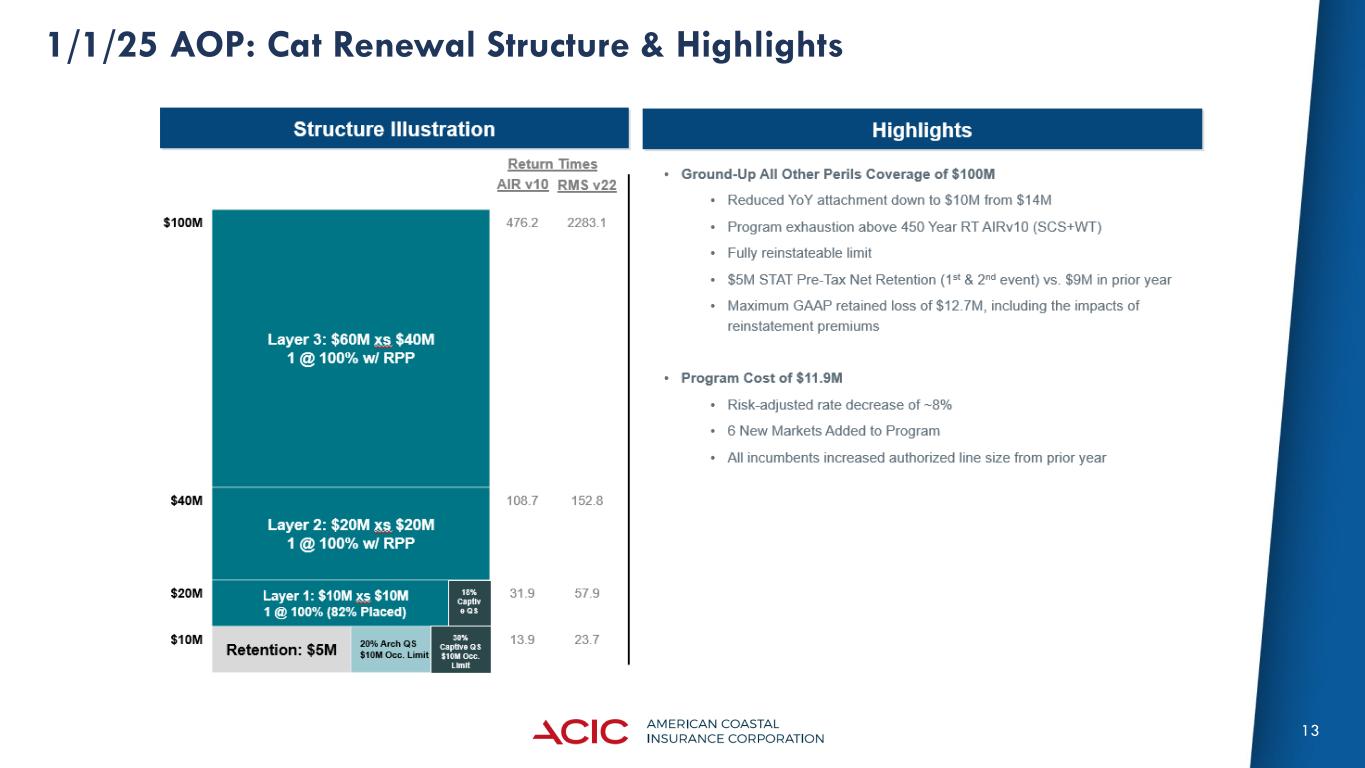

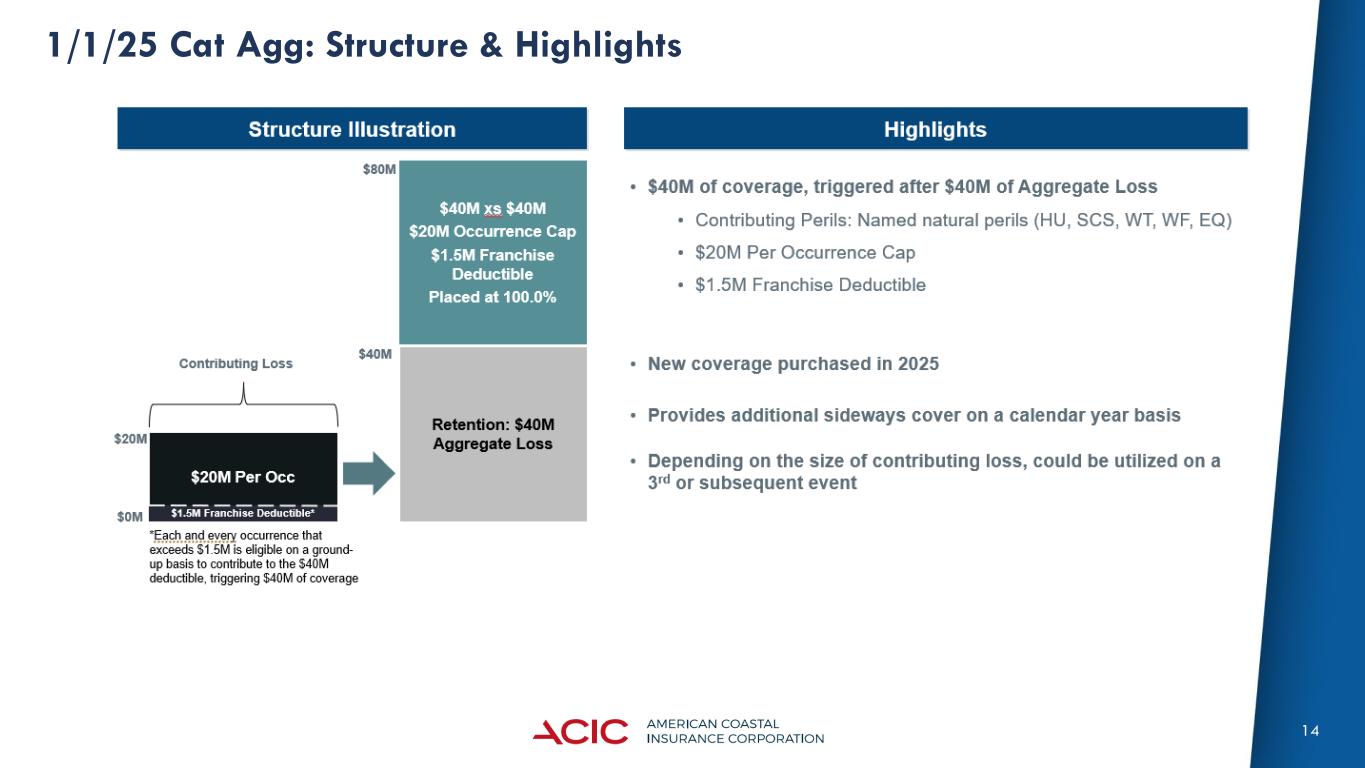

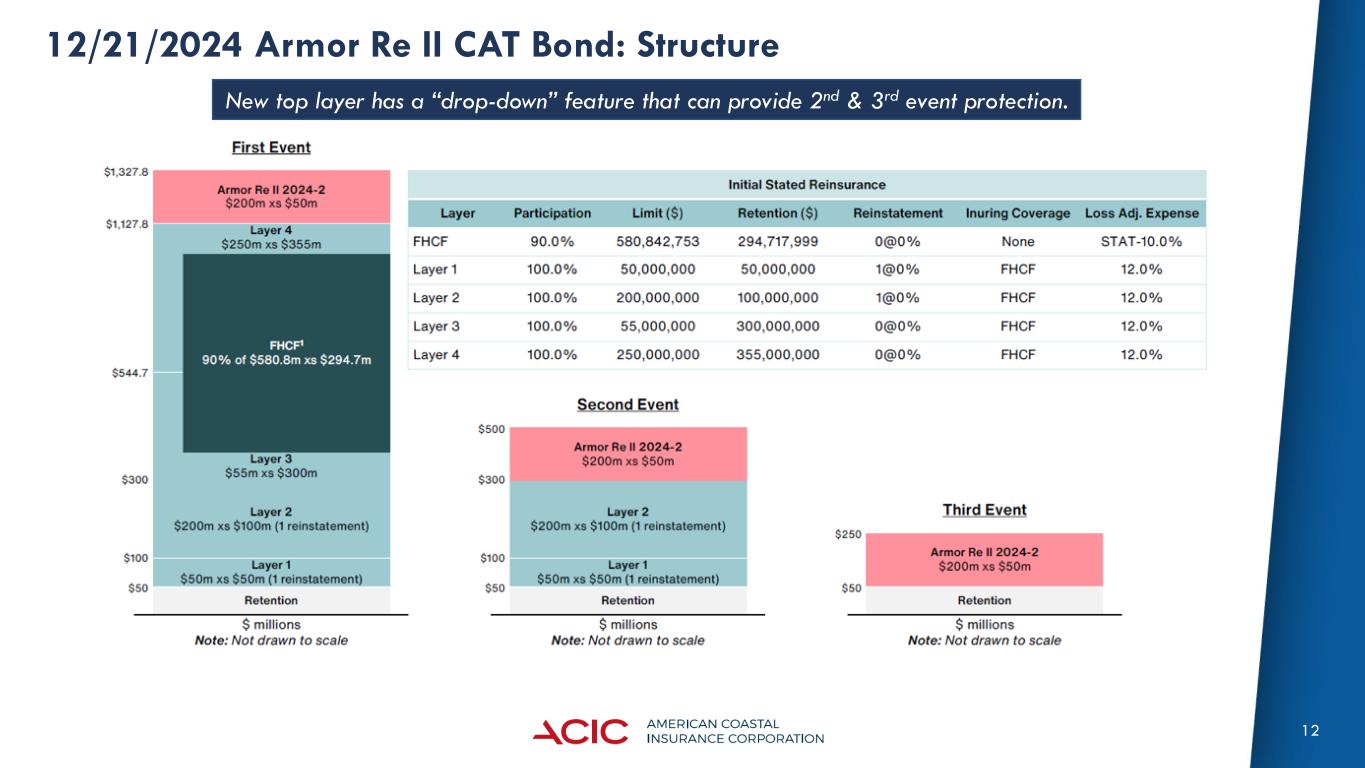

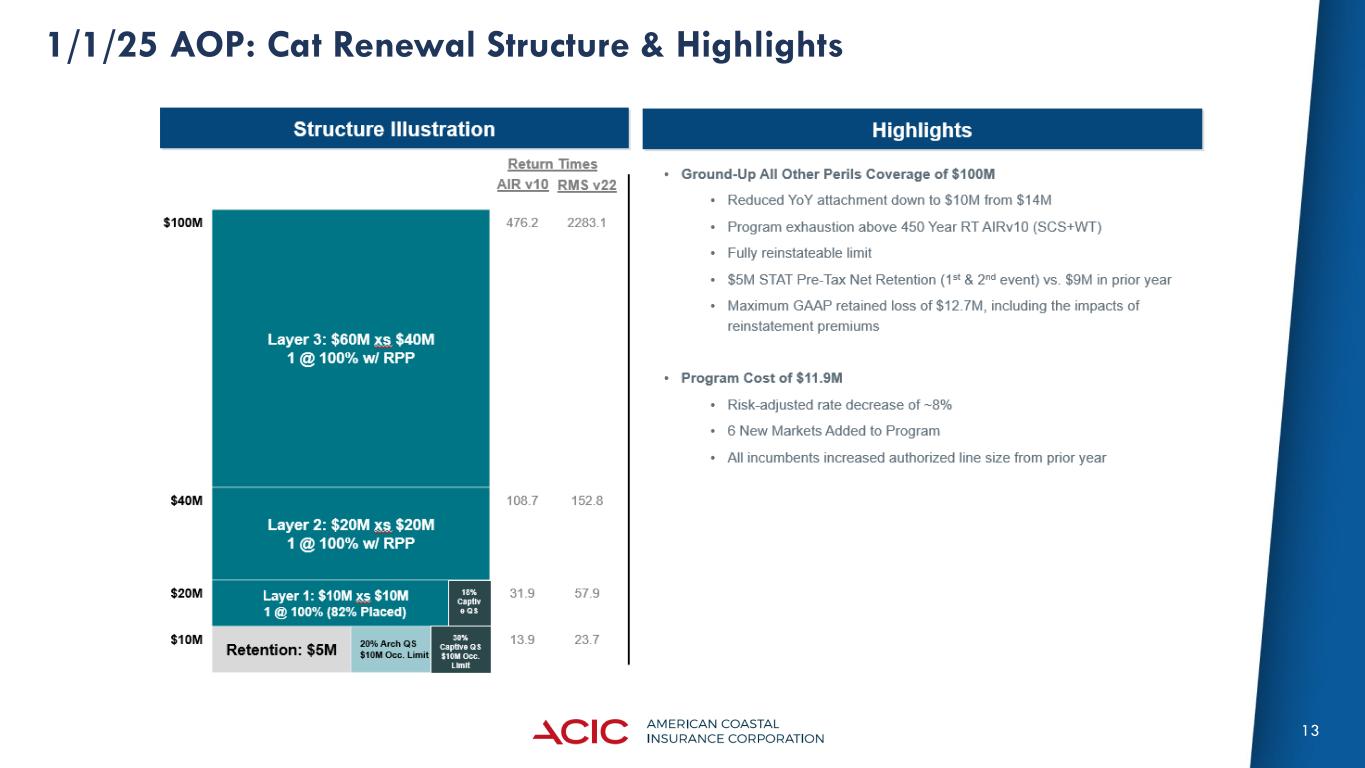

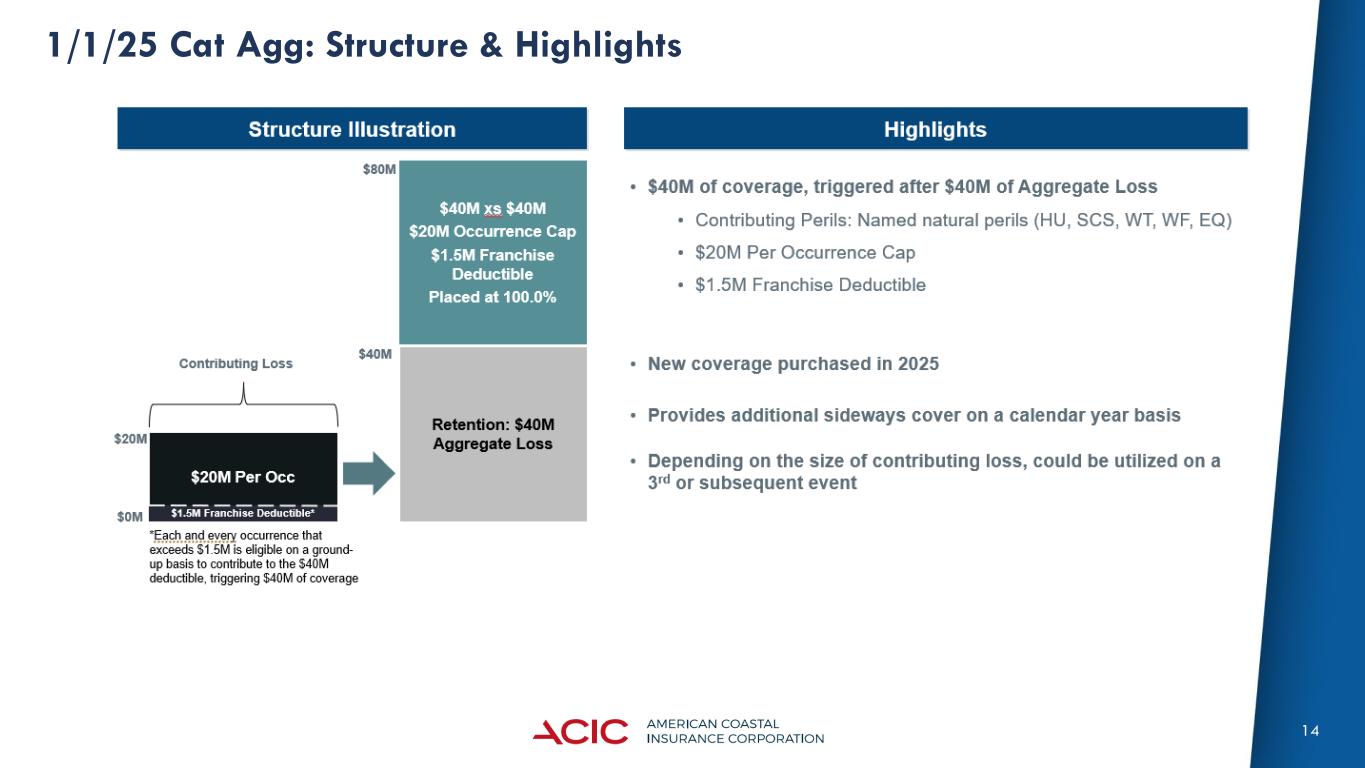

3 Executive Summary • Q4-24 Results • Non-GAAP Core Income of $6.0m ($0.12) decreased $12.0m (-66.7%) from $18.0m ($0.39) y/y on higher incurred losses resulting from Hurricane Milton and higher policy acquisition costs due to lower ceding commission income, offset by lower ceded earned premiums resulting from the step down of the 40% gross CAT quota share effective 6.1.2023 to 20% effective 6.1.2024. • Net premiums earned grew $24.4m (+49.7%) to $73.5m y/y. • Our combined ratio of 91.9% was impacted by Hurricane Milton, which drove 27.8 points of this ratio. Our Non-GAAP underlying combined ratio (which excludes current catastrophe losses and PY development) was 65.9%. FY24 ended with a combined ratio of 67.5%. • Current year net catastrophe losses in the quarter were $20.4m before tax (Hurricane Milton) and we had $1.3m of favorable prior year reserve development. • Stockholders’ equity attributable to ACIC, decreased $23.9 million from September 30, 2024, to $235.7m or $4.89 per share and $5.21 per share excluding unrealized losses in accumulated other comprehensive income. This was driven by the $0.50 special dividend declared during the fourth quarter. • Other Highlights • We successfully launched our new apartment product, having bound 19 policies with $2.3m of premium as of February 25, 2025. • Successful placement of an additional Catastrophe Bond effective December 20, 2024, which was oversubscribed and provides an additional $200 million in cascading coverage up to a third event. • In addition to the renewal of our January 1, 2025, AOP CAT and February 1, 2025, Excess Per Risk programs at a lower risk-adjusted cost, we placed a new catastrophe aggregate excess of loss agreement (CAT AGG), providing $40m of aggregate limit excess of $40m from all catastrophe perils for the full year ending December 31, 2025 to reduce potential earnings volatility from increased frequency.

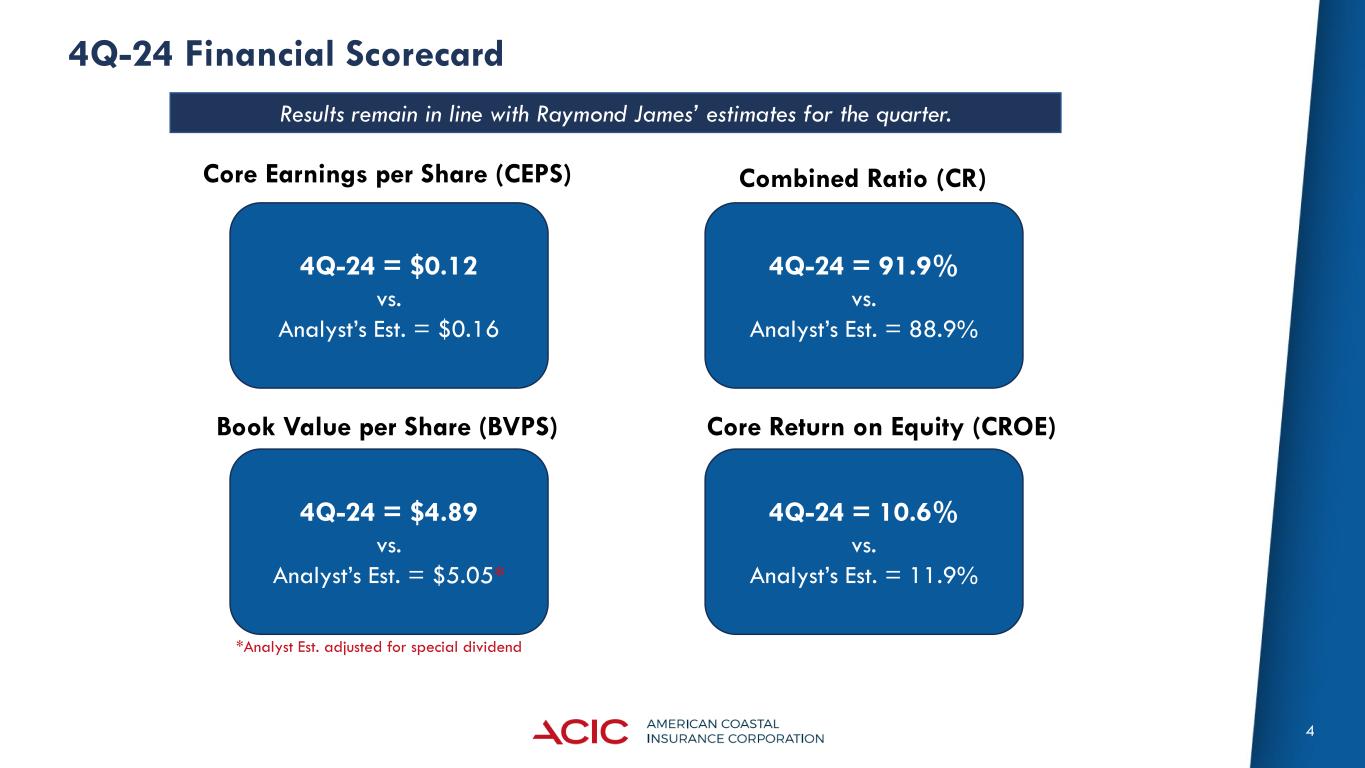

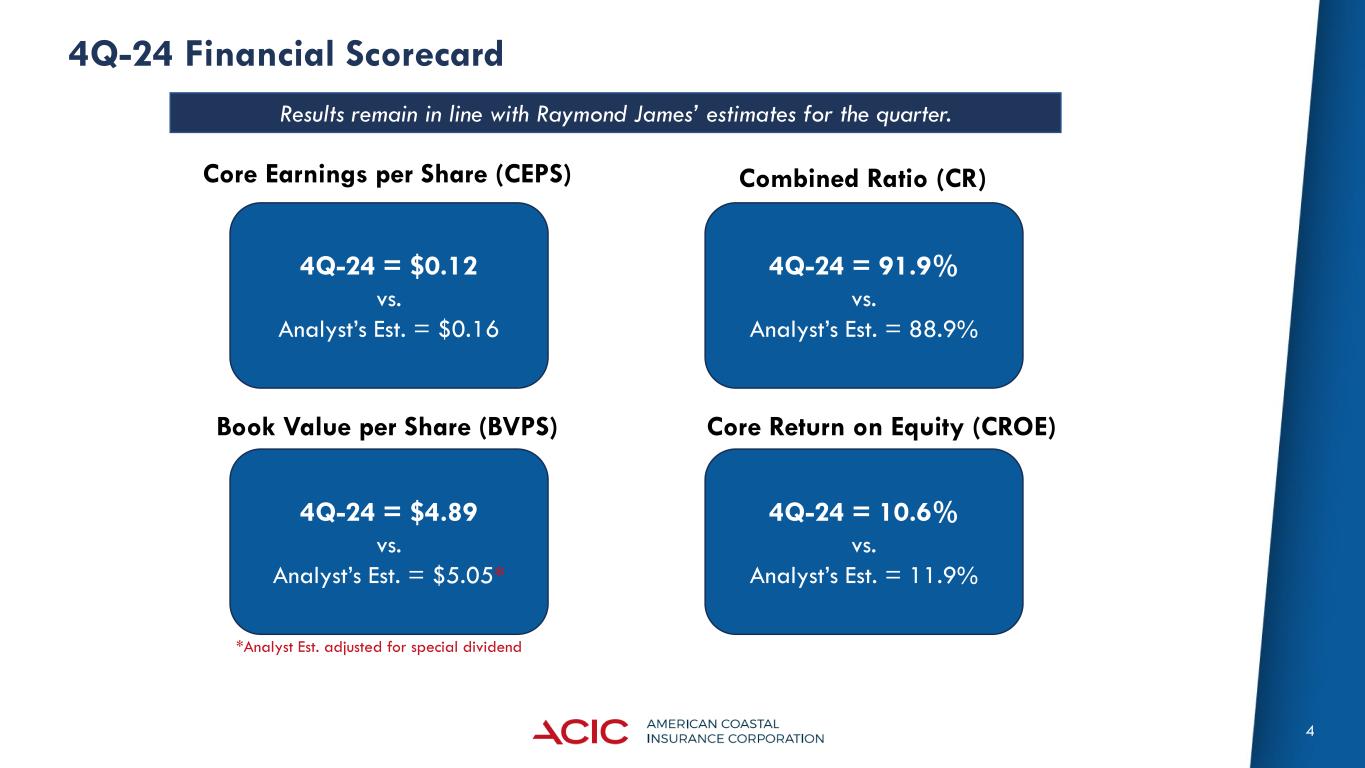

4 4Q-24 Financial Scorecard Results remain in line with Raymond James’ estimates for the quarter. 4Q-24 = $0.12 vs. Analyst’s Est. = $0.16 4Q-24 = $4.89 vs. Analyst’s Est. = $5.05* 4Q-24 = 91.9% vs. Analyst’s Est. = 88.9% 4Q-24 = 10.6% vs. Analyst’s Est. = 11.9% Core Earnings per Share (CEPS) Book Value per Share (BVPS) Combined Ratio (CR) Core Return on Equity (CROE) *Analyst Est. adjusted for special dividend

5 4Q-24 Summary of Key Results A profitable Q4 and our FY24 combined ratio ended near our 65% target, despite the impact of Hurricane Milton

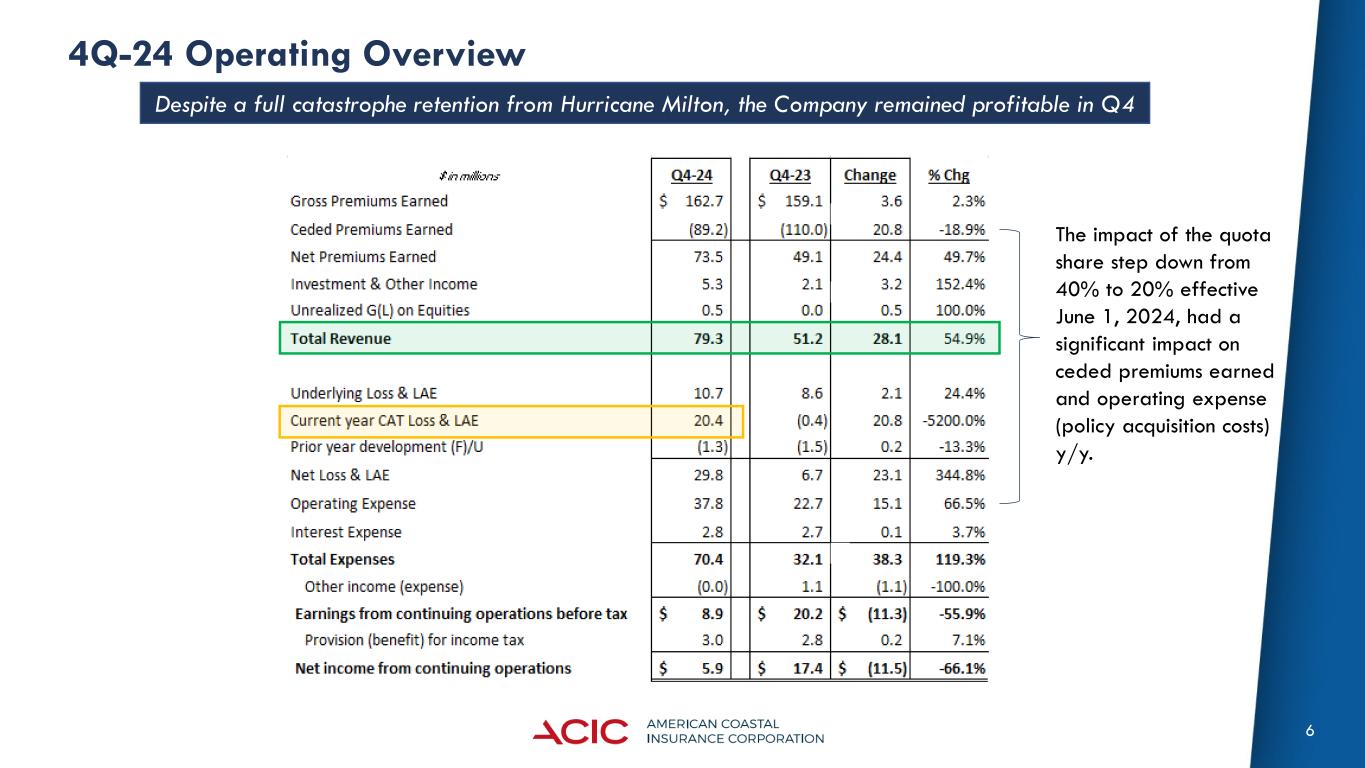

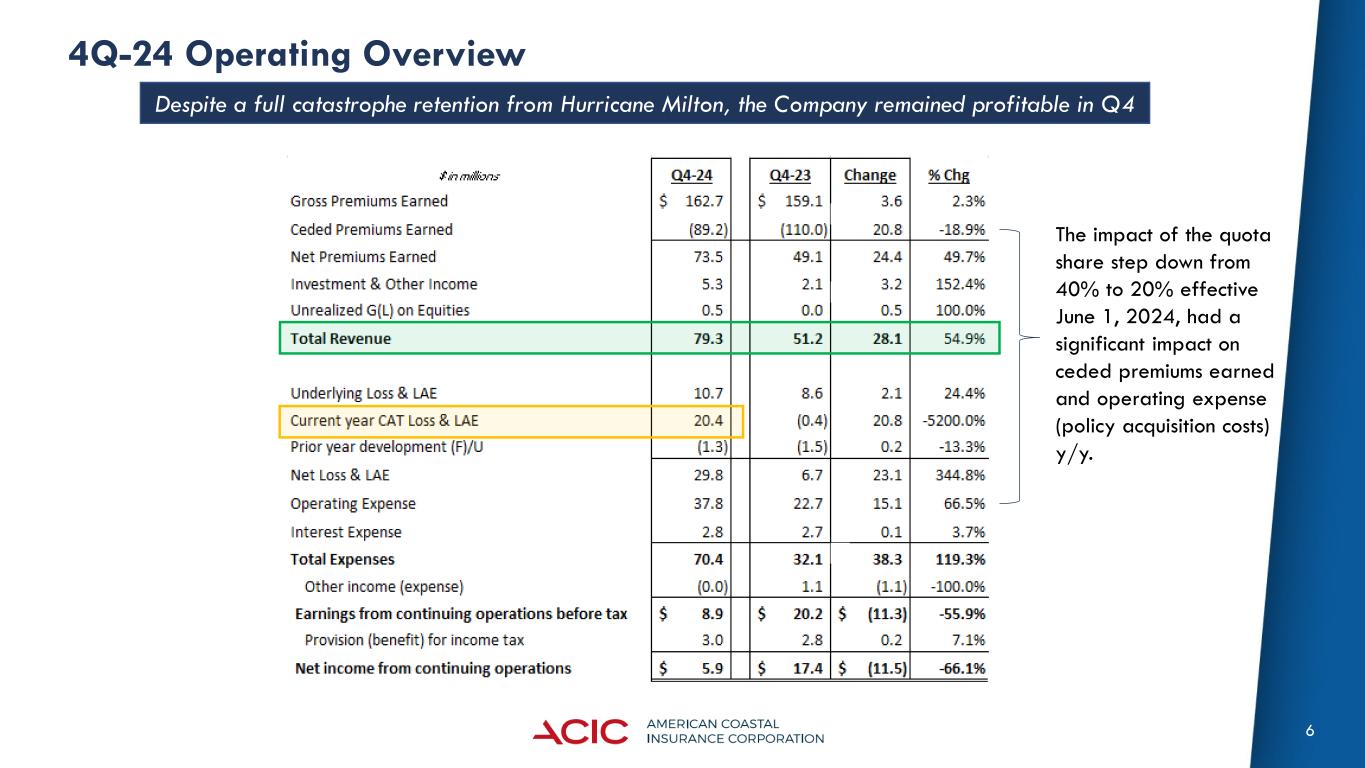

6 4Q-24 Operating Overview Despite a full catastrophe retention from Hurricane Milton, the Company remained profitable in Q4 The impact of the quota share step down from 40% to 20% effective June 1, 2024, had a significant impact on ceded premiums earned and operating expense (policy acquisition costs) y/y.

7 Balance Sheet Highlights Strong underwriting results have improved our financial strength and allowed us to pay a $0.50 special dividend, despite an active hurricane season.

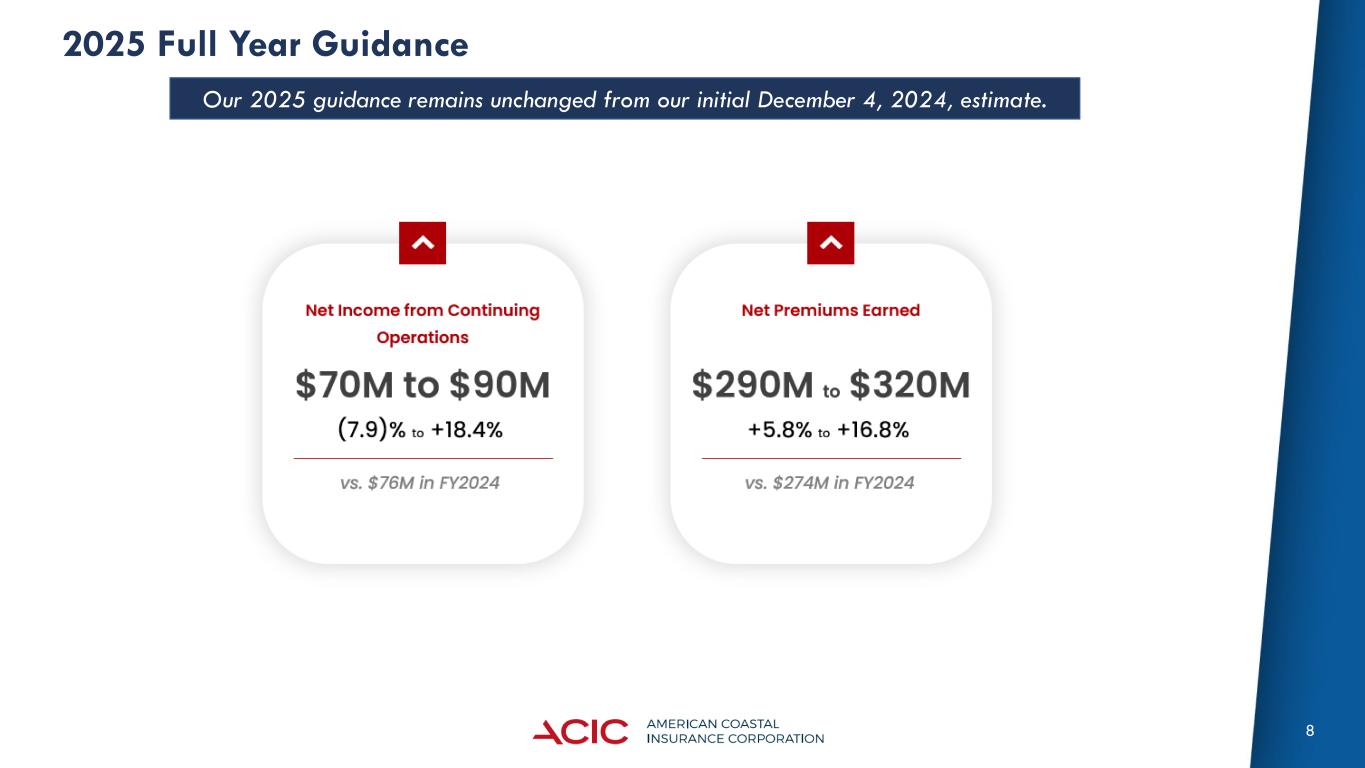

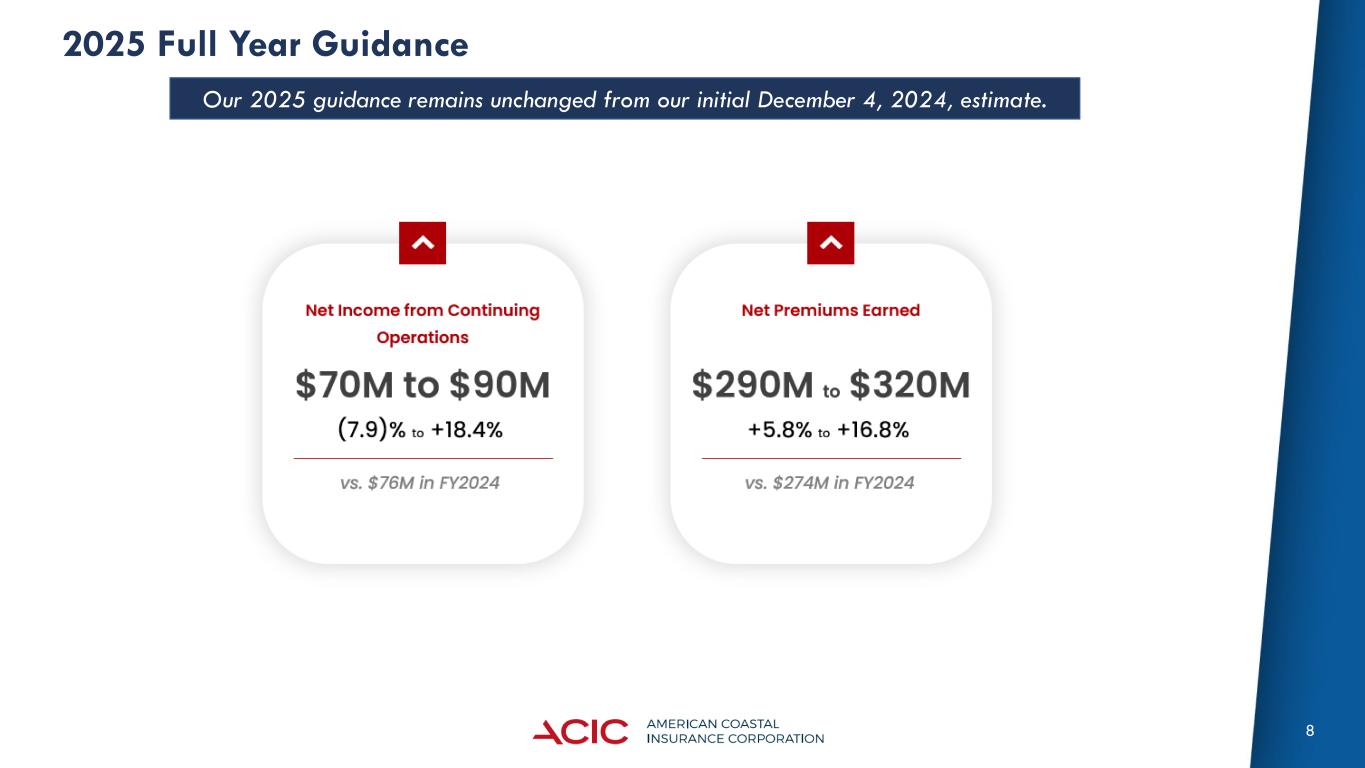

8 2025 Full Year Guidance Our 2025 guidance remains unchanged from our initial December 4, 2024, estimate.

9 Investment Portfolio Overview • The Company continues to hold high quality fixed income investments to mitigate market risk. • The Company continues to add to its investment positions in anticipation of future cash yields decreasing.

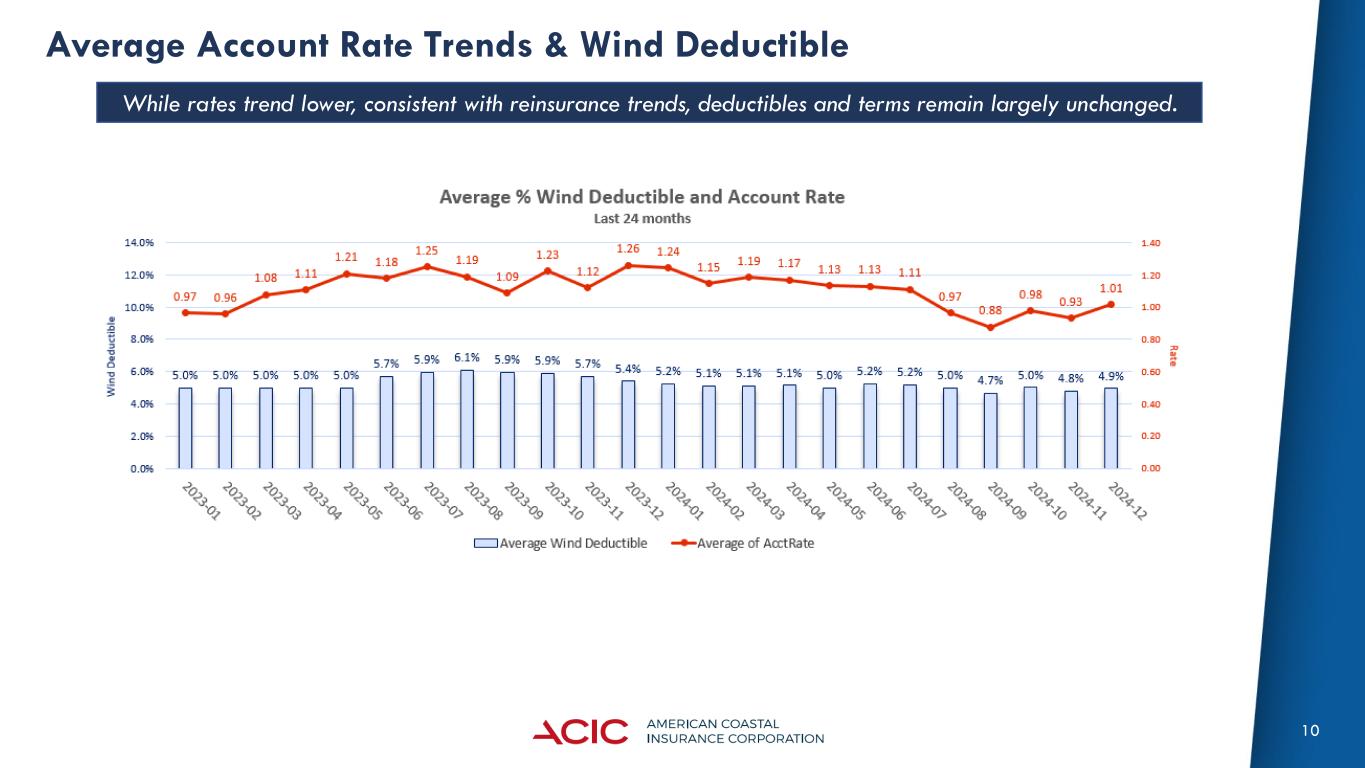

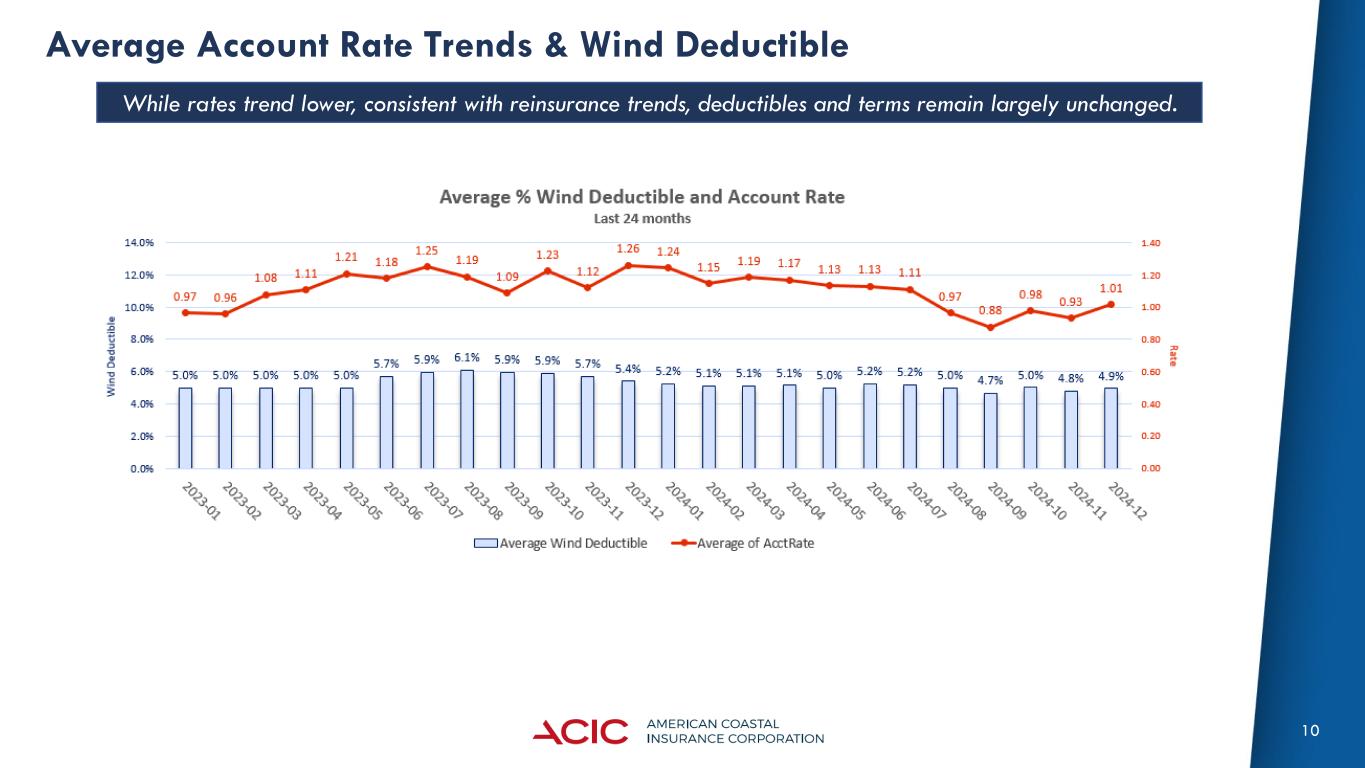

10 Average Account Rate Trends & Wind Deductible While rates trend lower, consistent with reinsurance trends, deductibles and terms remain largely unchanged.

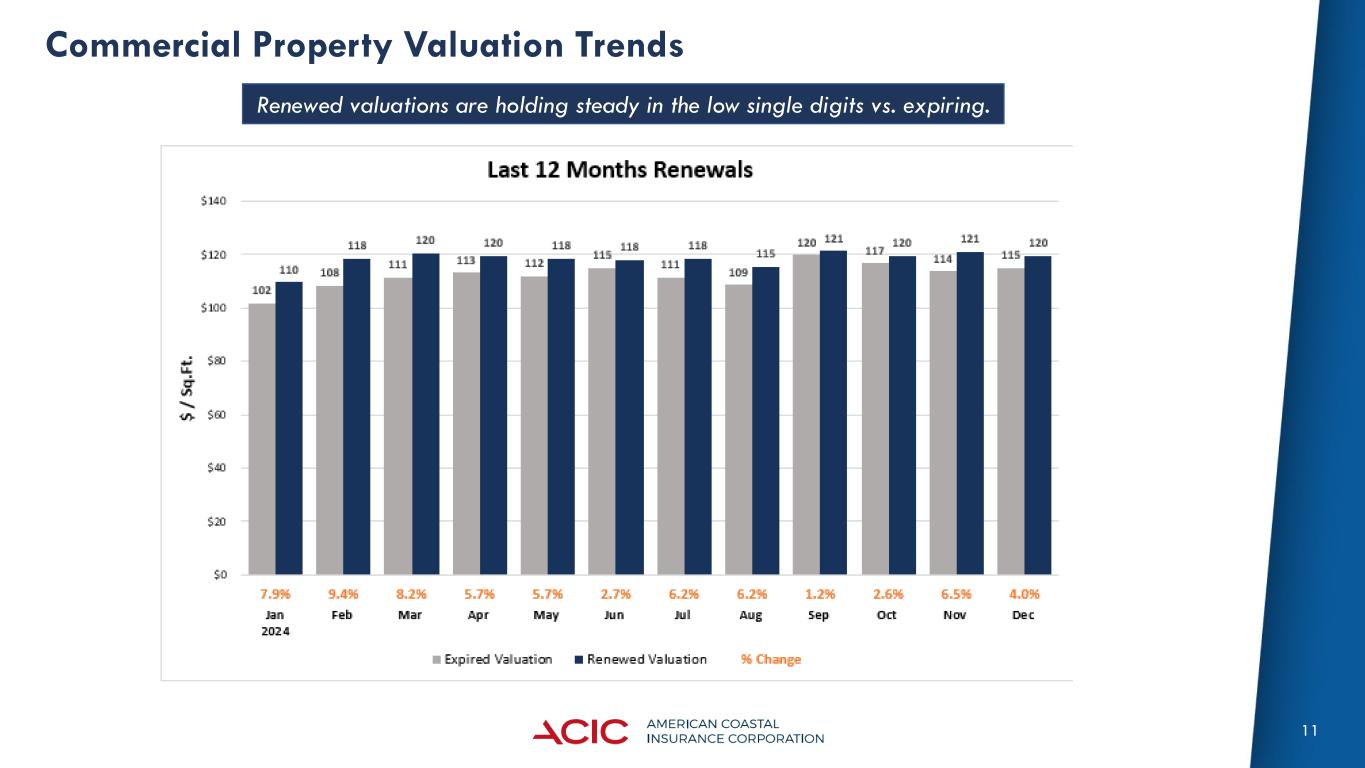

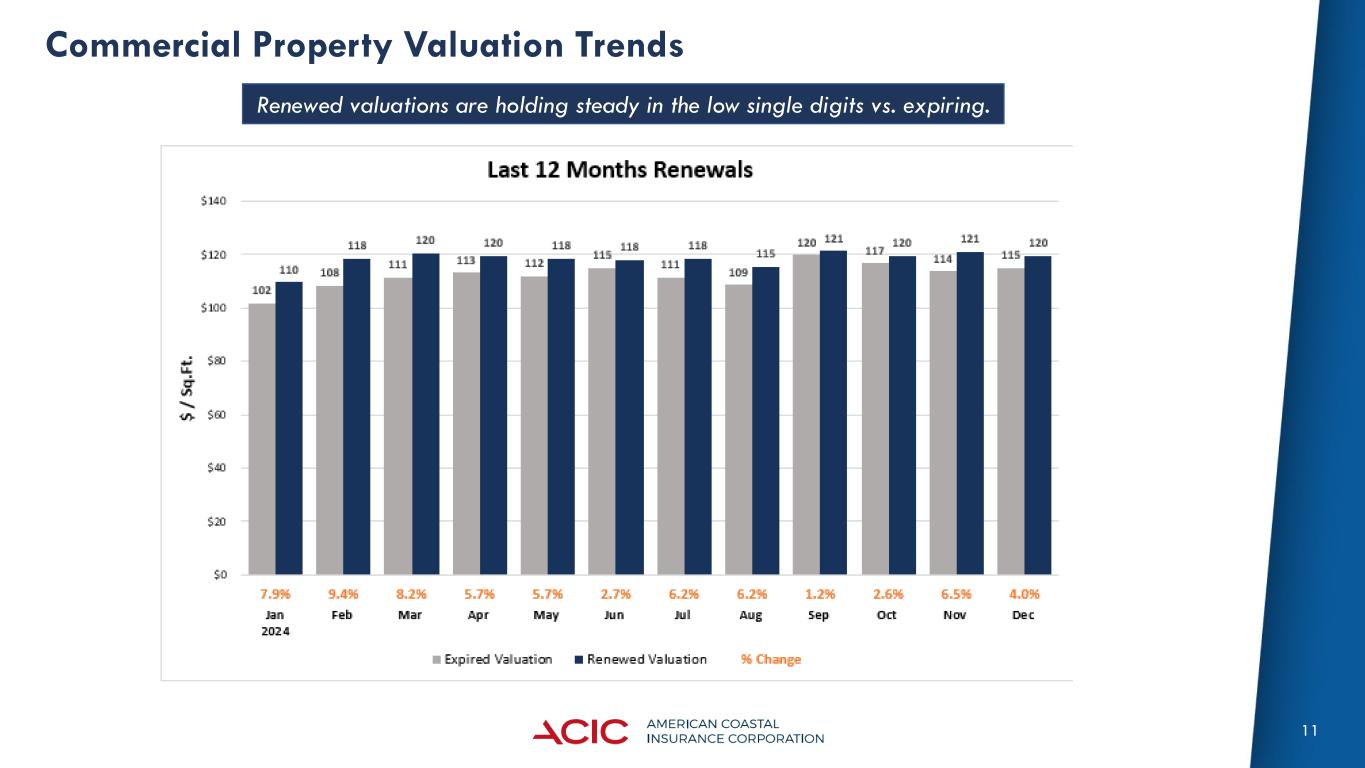

11 Commercial Property Valuation Trends Renewed valuations are holding steady in the low single digits vs. expiring.

12 12/21/2024 Armor Re II CAT Bond: Structure New top layer has a “drop-down” feature that can provide 2nd & 3rd event protection.

13 1/1/25 AOP: Cat Renewal Structure & Highlights

14 1/1/25 Cat Agg: Structure & Highlights

15 2/1/25 Auto Fac: Structure & Highlights

16 Cautionary Statements This presentation and the accompanying remarks contain "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management’s current beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate" or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions, including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report in Form 10-K for the year ended December 31, 2024 and 2023. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. These measures should be considered supplementary to our results of operations and financial condition that are presented in accordance with GAAP and should not be viewed as a substitute for GAAP measures. See our earnings release, Form 10-K , Form 10-Q and Form 10-Q/A for further information regarding these non-GAAP financial measures.