U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2013

Commission file number: 000-53630

AMERICAN MAGNA CORP.

(Formerly known as Dakota Gold Corp.)

(Exact name of registrant as specified in its charter)

| Nevada | | 20-5859893 |

| (State of incorporation) | | (I.R.S. Employer Identification No.) |

701 N. Green Valley Parkway, Suite 200

Henderson, Nevada, 89074

(Address of principal executive offices)

(702) 990-3256

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of October 31, 2012 was approximately $445,500.

The number of shares of the issuer’s common stock issued and outstanding as of August 12, 2013 was 17,345,998 shares.

Documents Incorporated By Reference: None

TABLE OF CONTENTS

| | | Page |

| Glossary of Mining Terms | 3 |

| | | |

| PART I | | |

| | Item 1 | Business | 6 |

| | Item 1A | Risk Factors | 11 |

| | Item 1B | Unresolved Staff Comments | 20 |

| | Item 2 | Property | 21 |

| | Item 3 | Legal Proceedings | 26 |

| | Item 4 | Mine Safety Disclosures | 26 |

| | | | |

| | PART II | | |

| | Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 26 |

| | Item 6 | Selected Financial Data | 27 |

| | Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 27 |

| | Item 7A | Quantitative and Qualitative Disclosures About Market Risk. | 34 |

| | Item 8 | Financial Statements and Supplementary Data. | 34 |

| | Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 51 |

| | Item 9A | Controls and Procedures | 51 |

| | Item 9B | Other Information | 52 |

| | | | |

| | PART III | | |

| | Item 10 | Directors, Executive Officers and Corporate Governance | 53 |

| | Item 11 | Executive Compensation | 55 |

| | Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 57 |

| | Item 13 | Certain Relationships and Related Transactions, and Director Independence | 57 |

| | Item 14 | Principal Accountant Fees and Services | 58 |

| | | | |

| | PART IV | | |

| | Item 15 | Exhibits, Financial Statement Schedules | 59 |

| | | | |

| | SIGNATURES | | 61 |

Glossary of Mining Terms

Adit(s), Historic working driven horizontally, or nearly so into a hillside to explore for and exploit ore.

Ag. Elemental symbol for silver.

Auger holes. Drill hole constructed with a small portable drill rig using a hydraulic-driven auger.

Au. Elemental symbol for gold.

Felsic Tertiary Volcanic Rocks. Quartz-rich rocks derived from volcanoes and deposited between two and sixty-five million years ago.

Geochemical sampling. Sample of soil, rock, silt, water or vegetation analyzed to detect the presence of valuable metals or other metals which may accompany them.

Geologic mapping. Producing a plan and sectional map of the rock types, structure and alteration of a property.

Geophysical survey. Electrical, magnetic, gravity and other means used to detect features, which may be associated with mineral deposits

Granite. A medium to coarse crystalline rock composed primarily of the minerals quartz, plagioclase and orthoclase.

Magnetic lows. An occurrence that may be indicative of a destruction of magnetic minerals by later hydrothermal (hot water) fluids that have come up along faults. These hydrothermal fluids may in turn have carried and deposited precious metals such as gold and/or silver.

Plug. A vertical pipe-like body of magma representing a volcanic vent similar to a dome.

Quartz Stockworks. A multi-directional system of quartz veinlets.

RC holes. Short form for Reverse Circulation Drill holes. These are holes left after the process of Reverse Circulation Drilling.

Resource. An estimate of the total tons and grade of a mineral deposit defined by surface sampling, drilling and occasionally underground sampling of historic diggings when available.

Reverse circulation drilling. A less expensive form of drilling than coring that does not allow for the recovery of a tube or core of rock. The material is brought up from depth as a series of small chips of rock that are then bagged and sent in for analysis. This is a quicker and cheaper method of drilling, but does not give as much information about the underlying rocks.

Sedimentation. The process of deposition of a solid material from a state of suspension or solution in a fluid (usually air or water).

Tertiary. That portion of geologic time that includes abundant volcanism in the western U.S.

Trenching. A cost effective way of examining the structure and nature of mineral ores beneath gravel cover. It involves digging long usually shallow trenches in carefully selected areas to expose unweathered rock and allow sampling.

Tuffaceous. Pertaining to sediments which contain up to 50% tuff.

Volcanic center. Origin of major volcanic activity.

Volcanoclastic. Coarse, unsorted sedimentary rock formed from erosion of volcanic debris.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of American Magna Corp. (the “Company”, “American Magna”, or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

PART I

Item 1. Description of Business

We are engaged in natural resource exploration and anticipate acquiring, exploring, and if warranted and feasible, developing natural resource properties. Currently we are in the exploration stage and are undertaking one exploration program in Nevada.

History

American Magna Corp. (formerly known as Dakota Gold Corp.) is an exploration stage company. We were incorporated under the laws of the State of Florida on October 27, 2006 under the name Coastline Corporate Services, Inc. The Company was initially established to provide services to public companies requiring guidance and assistance in converting and filing their documents with the Securities and Exchange Commission.

On July 8, 2010 the Company’s principal shareholder entered into a Stock Purchase Agreement which provided for the sale of 600,000 shares of common stock of the Company to Daulat Nijjar. In addition, Mr. Nijjar acquired a total of 47,500 shares of common stock from three other shareholders resulting in Mr. Nijjar owning a total of 647,500 shares of common stock, or at that time, 81.7% of the issued and outstanding shares of common stock of the Company. Effective as of July 8, 2010, in connection with the share acquisition, Mr. Nijjar was appointed President, Chief Executive Officer, Chief Financial Officer, Treasurer, Director, and Chairman of the Company.

On August 16, 2010, Mr. Nijjar returned 450,000 shares of common stock to the Company for cancellation in order to reduce the number of shares issued and outstanding. Subsequent to the cancellation, the Company had 342,998 shares issued and outstanding; a number that Mr. Nijjar, who was also a director of the Company at that time, considered more in line with the Company’s business plans. Following the share cancellation, Mr. Nijjar owned 197,500 shares of common stock, or 57.6%, of the remaining 342,998 issued and outstanding shares of common stock of the Company at that time.

On August 18, 2010, Mr. Nijjar, as the holder of 197,500, or 57.6%, of the issued and outstanding shares of the Company’s common stock at that time, provided the Company with written consent in lieu of a meeting of stockholders authorizing the Company to amend the Company’s Articles of Incorporation for the purpose of changing the name of the Company from Coastline Corporate Services, Inc. to “Dakota Gold Corp”. In connection with the change of the Company’s name to Dakota Gold Corp. the Company intended to change its business to mineral resource exploration and move its domicile to Nevada. In order to undertake the name and domicile change, the Company incorporated a wholly-owned subsidiary in Nevada named Dakota Gold Corp. and merged Coastline Corporate Services, Inc. with the new subsidiary. The name and domicile change became effective on November 26, 2010 and the Company is now a Nevada corporation.

On September 10, 2010, the Company executed a property option agreement (the “Caldera Property Option Agreement”) with Zsolt Rosta, Jennifer Oliver, and Genesis Gold Corporation (the “Property Owners”) granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by the Property Owners. The property known as the Caldera Property is located in Nye County, Nevada and consisted of 32 unpatented claims (the “Caldera Property”). Upon execution of the Caldera Property Option Agreement, the Company paid the Property Owners $5,000. The Caldera Property Option Agreement required the Company to make a total of $1,975,000 in additional property option payments and incur $200,000 in exploration expenditures on the Caldera Property. On August 17, 2012, the Company terminated the Caldera Property Option Agreement. The Company has determined that the Caldera Property no longer fits with its business parameters. The Company no longer has any interest in the Caldera Property and no additional payments are required under the Caldera Property Option Agreement. As a result of such termination, the Company paid $7,000 for fees and expenses in order to maintain the property in good standing until August 2013. The Company no longer has any interest in the Caldera Property and no additional payments are required under the Caldera Property Option Agreement.

On December 2, 2010 the Company’s Board of Directors adopted a resolution to split the Company’s stock. The common stock of the Company was forward split on a 100:1 basis on the record date of December 16, 2010 and a payment date of December 17, 2010.

On March 25, 2011, the Company received a joint written consent in lieu of a meeting (the “Joint Written Consent”) from the members of the Board of Directors (the “Board”) and the holder of 197,500 (representing 57.1%) of the issued and outstanding shares of our common stock (the “Majority Stockholder”). The Joint Written Consent adopted resolutions which authorized the Company to act on a proposal to effect a reverse stock split on the issued and outstanding shares of common stock of the Company at a ratio of 1 new post reverse split common stock for each 100 outstanding pre reverse split common stock of the Company. On June 16, 2011 the reverse split was completed.

Effective as of August 31, 2011 the Board elected Mr. Bobby Nijjar President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer, Secretary, and Director of the Company. Also effective as of August 31, 2011 Mr. Daulat Nijjar resigned as President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer, Secretary, and Director of the Company. Mr. Bobby Nijjar is the son of Mr. Daulat Nijjar.

Effective August 1, 2012 the Board elected Mr. Herb Duerr President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer, and Director of the Company. Also effective as of August 1, 2012 Mr. Bobby Nijjar resigned as President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer and Treasurer of the Company. Mr. Bobby Nijjar remained as the Company’s Secretary and Director.

On August 17, 2012, the Company executed a property option agreement (the “MinQuest Agreement) with MinQuest, Inc., a natural resource exploration company (“MinQuest”),.granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by MinQuest. The property known as the Crescent Fault Property is located in Eureka County, Nevada and consists of 33 unpatented claims. Upon execution of the MinQuest Agreement, the Company paid MinQuest $5,000. The MinQuest Agreement required the Company to make $860,000 in additional property option payments and incur $3,100,000 in exploration expenditures.. On July 20, 2013, the Company terminated the MinQuest Agreement having determined that the Crescent Fault Property no longer fits its business parameters.

As a result of such termination, the Crescent Fault Property has been returned to MinQuest and the Company is responsible to pay all claim fees, payments and expenses in order to maintain the property in good standing until July 2014. It is estimated that such fees and expenses will be $5,135.

Effective July 2, 2013 the Company amended its Articles of Incorporation for the purpose of changing its name from Dakota Gold Corp. to “American Magna Corp.” In connection with the change of the Company’s name to American Magna Corp. the Company intends to change its business from an emphasis on gold exploration to magnesium exploration.

On July 19, 2013, the Company executed a property option agreement (the “DPE Agreement”) with Desert Pacific Exploration Inc., a natural resource exploration company (”DPE”), granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by DPE. The property known as the Bell Flat Project is comprised of 11 unpatented mining claims and located within Churchill County, Nevada. Upon execution of the DPE Agreement, the Company paid DPE, $5,000. The DPE Agreement requires the Company to make a total of $620,000 in additional property option payments and incur $3,000,000 in exploration expenditures. Pursuant to the DPE Agreement, Company issued 15,000,000 shares of restricted common stock to its President and CEO. The parties are discussing amendments to the property option agreement.

Business Operations

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, developing natural resource properties. Our primary focus in the natural resource sector is magnesium. We are an exploration stage company. We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

Though we have the expertise on our board of directors to take a resource property that hosts a viable ore deposit into mining production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term. Therefore, we anticipate selling or partnering any ore bodies that we may discover to a major mining company. Many major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. We believe selling or partnering a deposit found by us to these major mining companies, would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and would also provide future capital for the Company to continue operations.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property we have optioned in Nevada contains commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as fluctuation in the commodities markets, unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the selling or partnering of our property, the purchase of small interests in producing properties, the purchase of properties where feasibility studies already exist or by the optioning of natural resource exploration and development projects. To date we have one property under option. We have not yet conducted any significant exploration on the property. There has been no indication as yet that any commercially viable mineral deposits exist on this property, and there is no assurance that a commercially viable mineral deposit exists on our property. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Competition

The mineral exploration industry, in general, is intensively competitive and even if commercial quantities of ore are discovered, a ready market may not exist for sale of same. We compete with many junior exploration companies many of which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to develop, maintain or expand our business.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Government Regulation

The federal government and various state and local governments have adopted laws and regulations regarding the protection of natural resources, human health and the environment. We will be required to conduct all exploration activities in accordance with all applicable laws and regulations. These may include requiring working permits for any exploration work that results in physical disturbances to the land and locating claims, posting claims and reporting work performed on the mineral claims. The laws and regulations may tell us how and where we can explore for natural resources, as well as environmental matters relating to exploration and development. Because these laws and regulations change frequently, the costs of compliance with existing and future environmental regulations cannot be predicted with certainty.

Any exploration or production on United States Federal land will have to comply with the Federal Land Management Planning Act which has the effect generally of protecting the environment. Any exploration or production on private property, whether owned or leased, will have to comply with the Endangered Species Act and the Clean Water Act. The cost of complying with environmental concerns under any of these acts varies on a case-by-case basis. In many instances the cost can be prohibitive to development. Environmental costs associated with a particular project must be factored into the overall cost evaluation of whether to proceed with the project.

Other than the normal bonding requirements, there are no costs to us at the present time in connection with compliance with environmental laws. However, since we anticipate engaging in natural resource projects, these costs could occur at any time. Costs could extend into the millions of dollars for which we could be liable. In the event of liability, we would be entitled to contribution from other owners so that our percentage share of a particular project would be the percentage share of our liability on that project. However, other owners may not be willing or able to share in the cost of the liability. Even if liability is limited to our percentage share, any significant liability would wipe out our assets and resources.

Employees

We have commenced only limited operations. Therefore, we have no full time employees. Our officers and directors provide planning and organizational services for us on a part-time basis.

Item 1A. Risk Factors

Factors that May Affect Future Results

1. Our independent auditor has issued a going concern opinion after auditing our financial statements. Our ability to continue is dependent on our ability to raise additional capital and our operations could be curtailed if we are unable to obtain required additional funding when needed.

We will be required to expend substantial amounts of working capital in order to explore and develop our Bell Flat Project. Upon changing our business to mineral exploration we entered the exploration stage on August 1, 2010. Our operations have been funded entirely from capital raised from our private offerings of securities from March 2011 through September 2011 and from a bridge loan initially closed in August 2010. We will continue to require additional financing to execute our business strategy. We are totally dependent on external sources of financing for the foreseeable future, of which we have no commitments. We are entirely dependent on our ability to attract and receive additional funding from either the sale of securities or outside sources such as private investment or a strategic partner. We currently have no agreements or arrangements with respect to any such financing and there can be no assurance that any needed funds will be available to us on acceptable terms or at all. Our failure to raise additional funds in the future will adversely affect our business operations, and may require us to suspend our operations, As of April 30, 2013 we have incurred a net loss of $230,997 from inception of the exploration stage and used cash in operations from inception of the exploration stage of $226,445. After auditing our financial statements, our independent auditor issued a going concern opinion and our ability to continue is dependent on our ability to raise additional capital. If we are unable to obtain necessary financing, we will be required to curtail our development plans which could cause us to become dormant and our shareholders to lose their investment in our company. In addition, any additional equity financing may involve substantial dilution to our then existing stockholders.

2. We are an exploration stage company, have generated no revenues to date and have a limited operating history upon which we may be evaluated.

We were incorporated on October 26, 2006 in the State of Florida under the name Coastline Corporate Services, Inc. In 2010 we completed a name and jurisdiction change and on August 1, 2010 we became an exploration stage company. We have optioned an early stage mineral property but the property does not have any known resources or reserves. Our only other meaningful asset is approximately $3,660 in cash at April 30, 2013. Our limited operating history makes it difficult to evaluate our business on the basis of historical operations. We have no known commercially viable deposits, or “resources”, or "reserves" on our property. Therefore, determination of the existence of a resource or reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. If we fail to find a commercially viable deposit on our Property our financial condition and results of operations will suffer. If we cannot generate income from the property we will have to cease operations which will result in the loss of your investment.

We face all of the risks inherent in a new business and those risks specifically inherent in the exploration stage company, with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject. We cannot assure you that we will be able to generate revenues or profits from the operation of our business or that we will be able to generate or sustain profitability in the future.

3. We expect losses in the future because we have no revenue to offset losses.

As reflected in our financial statements we are in the exploration stage. Since entering the exploration stage on August 1, 2010, we have incurred a net loss of $230,997 and used cash in operations of $226,445. As we have no current revenue, we are expecting losses over the next 12 months because we do not have any revenues to offset the expenses associated with the development and implementation of our business plan. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

4. Our business model is unproven and our success is dependent on our ability to explore and develop our mineral property.

Our business model is to generate revenues from the sale of minerals from our optioned exploration property located in Churchill County, Nevada. We cannot guarantee that we will ever be successful in effectuating our business plan or in generating revenues in the future. The Property is at a very early stage, and our ability to generate revenue is unproven. Therefore, it is not possible for us to predict the future level of production, if any, or if we will be able to effectuate our business plan. If we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

5. Because we anticipate our operating expenses will increase prior to our earning revenues, if any, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues due to the significant amount of expenditures required to bring a property to the point where it is producing revenue. Therefore, we expect to incur significant losses into the foreseeable future. If we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations.

6. The failure to hire qualified employees or consultants would damage our business.

Due to the highly technical nature of our business, we will depend greatly on attracting and retaining experienced management and highly qualified and trained personnel. We will compete with other companies intensely for qualified and well trained professionals in our industry. If we cannot hire or retain, and effectively integrate, a sufficient number of qualified and experienced professionals, this will have a material adverse effect on our capacity to sustain and grow our business.

7. Because our President and CEO is also an owner of, and consultant to, several other exploration companies engaged in mineral exploration, a potential conflict of interest exists which could negatively impact our ability to acquire properties to explore and to run our business.

Our President and CEO owns and/or is an officer of several mineral exploration consulting businesses and may be involved in related pursuits that could present conflicts of interest with our company.. This association may give rise to inherent conflicts of interest from time to time. For example, we may be presented with an opportunity in which our officer would have to decide if the opportunity would be more appropriate for us or another company.

8. If we do not make the required option payments and property expenditure requirements mandated in the DPE Agreement with the Bell Flat Project owners we will lose our interest in the Bell Flat Project and our business may fail.

If we do not make all of the property payments or incur the required expenditures in accordance with the DPE Agreement on the Bell Flat Project we will lose our option to acquire the property and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest. Since our payment obligations are non-refundable, if we do not make any payments, we will lose any payments previously made and all our rights to the property.

9. Because of the speculative nature of exploration and development of natural resources, there is a substantial risk that our business will fail.

The search for valuable natural resources on our property is extremely risky as the exploration for natural resources is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing mines. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. Because the probability of an individual prospect ever having reserves is extremely remote, in all probability the Property does not contain any reserves, and any funds we spent on exploration will probably be lost. In such a case, we would be unable to complete our business plan.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. The risks associated with mineral exploration include:

| · | the identification of potential mineralization based on superficial analysis; |

| · | the quality of our management and our geological and technical expertise; and |

| · | the capital available for exploration and development. |

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities.

10. We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors such as other junior exploration companies or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

11. We may not have the funds to purchase all of the supplies, manpower and materials we need to begin exploration which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, manpower and certain equipment such as drill rigs, bulldozers and excavators that we might need to conduct exploration. If there is a shortage or scarcity, we cannot compete with larger companies in the exploration industry for supplies, manpower and equipment. In the event that the prices for such resources rise above our affordability levels, we may have to delay or suspend operations. In the event we are forced to limit our exploration activities, we may not find any minerals, even though our Property may contain mineralized material. Without any minerals we cannot generate revenues and shareholders may lose their investment in our company.

12. The prices of minerals are highly volatile and a decrease in mineral prices could result in us incurring losses.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of minerals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the minerals markets from the time development of a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a mineral property at a time when the price of the underlying mineral make such exploration economically feasible and, subsequently, incur losses because metals prices have decreased. Adverse fluctuations of mineral market price may force us to curtail or cease our business operations.

13. Because our business involves numerous operating hazards, we may be subject to claims of a significant size which would be costly to rectify.

Our proposed business is subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure, and craterings. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of equipment, injury or death to personnel resulting in substantial liability to us. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs and could force us to cease our operations, which will cause you a loss of your investment.

Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. We do not currently carry insurance to protect against these risks and we may not obtain such insurance in the future. Even if we do obtain insurance, the nature of these risks is such that liabilities could exceed policy limits or be excluded from coverage. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, thereby hurting our financial position, potential future earnings, and competitive positions and the cessation of our operations.

14. Failure to comply with regulations or damage to the environment from our operations may subject us to significant claims.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry since the rules and regulations frequently are amended or interpreted. We cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulation could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the cost of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and property are subject to extensive federal, state, and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released into the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas, (iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations. Non-compliance with laws, including environmental laws could result in significant costs and liabilities that would adversely affect our finances and force us to cease operations.

15. Because access to our mineral claims is limited during inclement weather conditions delays in our exploration could occur.

The business of mining for magnesium and other metals is generally subject to a number of risks and hazards including natural phenomena such as inclement weather conditions, floods, blizzards and earthquakes. Access to our mineral Property is restricted during these weather conditions. Furthermore, during the winter months exploration cannot be done on the Property. As a result, any attempt to test or explore the Property is largely limited to the times when weather conditions permits such activities. These limitations may result in significant delays in exploration efforts. Such delays may have a significant negative effect on our results of operations.

16. Our principal stockholder, who is also our chief executive officer and a director, owns a controlling interest in our voting stock and is able to influence all matters requiring shareholder approval and approval of significant corporate transactions.

Our principal shareholder beneficially owns approximately 86.5% of our outstanding common stock. As a result, this shareholder will have the ability to control substantially all matters submitted to our stockholders for approval including:

• election of our board of directors;

• removal of any of our directors;

• amendment of our Articles of Incorporation or bylaws; and

• adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

and may take actions that are contrary to your interests.

17. Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

As a result of his duties and responsibilities with the other businesses Mr. Duerr can only provide his management services to us on a part-time basis. Because we are in the early stages of our business, Mr. Duerr will not be spending all of his time working for the Company. Mr. Duerr will expend enough time to oversee the work program that has been approved by the Company. Later, if the demands of our business require additional time from Mr. Duerr, he is prepared to adjust his timetable to devote more time to our business. However, it still may not be possible for Mr. Duerr to devote sufficient time to the management of our business, as and when needed, especially if the demands of Mr. Duerr’s other interests increase. Competing demands on Mr. Duerr’s time may lead to a divergence between his interests and the interests of our shareholders.

RISK FACTORS RELATING TO OUR COMMON STOCK

18. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorizes the issuance of 100,000,000 shares of common stock, par value $.001 per share, of which 17,345,998 shares are currently issued and outstanding. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

19. Our chief executive officer who is also a director owns a controlling interest in our voting stock. .

Our chief executive officer, who is also a director, beneficially owns approximately 86.5% of our outstanding common stock. If and when he is able to sell his shares in the market, such sales within a short period of time could adversely affect the market price of our common stock if the marketplace does not orderly adjust to the increase in the number of shares in the market. This will result in a decrease in the value of your investment in the Company. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

20. Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must: (i) obtain financial information and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

21. Since our shares are quoted on the OTC Bulletin Board, sales of our shares relying upon rule 144 may depress prices in that market by a material amount.

The majority of the outstanding shares of our common stock held by present shareholders are "restricted securities" within the meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. On November 15, 2007, the Securities and Exchange Commission adopted changes to Rule 144, which, would shorten the holding period for sales by non-affiliates to six months (subject to extension under certain circumstances) and remove the volume limitations for such persons. The changes became effective in February 2008. Rule 144 provides in essence that an affiliate who has held restricted securities for a prescribed period may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed 1% of a company's outstanding common stock. The alternative average weekly trading volume during the four calendar weeks prior to the sale is not available to our shareholders being that the (“OTCBB”) is not an "automated quotation system" and, accordingly, market based volume limitations are not available for securities quoted only over the OTCBB. As a result of the revisions to Rule 144 discussed above, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for a period of six months, if the Company has filed its required reports. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of common stock of present stockholders, may have a depressive effect upon the price of the common stock in any market that may develop.

22. We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

We are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

We expect to incur significant continuing costs, including accounting fees and staffing costs, in order to maintain compliance with the internal control requirements of the Sarbanes-Oxley Act of 2002. Development of our business will necessitate ongoing changes to our internal control systems, processes and information systems. Currently, we have no employees, other than our sole officer and director. As we engage in the exploration of our mineral claim, hire employees and consultants, our current design for internal control over financial reporting will not be sufficient to enable management to determine that our internal controls are effective for any period, or on an ongoing basis. Accordingly, as we develop our business, such development and growth will necessitate changes to our internal control systems, processes and information systems, all of which will require additional costs and expenses.

In the future, if we fail to complete the annual Section 404 evaluation in a timely manner, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital.

23. Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

Because none of our directors are independent, we do not currently have independent audit or compensation committees. As a result, the directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

24. Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

Item 1B. Unresolved Staff Comments

There are no unresolved staff comments.

Item 2. Description of Property

We do not own any real property. We currently maintain our corporate office space on a shared basis at 701 N. Green Valley Parkway, Suite 200, Henderson, Nevada, 89074 pursuant to a one-year lease for $249 per month that expires in August 2013. Management believes that our office space is suitable for our current needs.

In the following discussion relating to our interests in real property, there are references to “patented” mining claims and “unpatented” mining claims. A patented mining claim is one for which the U.S. government has passed its title to the claimant, giving that person title to the land as well as the minerals and other resources above and below the surface. The patented claim is then treated like any other private land and is subject to local property taxes. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If one purchases an unpatented mining claim that is later declared invalid by the U.S. government, one could be evicted.

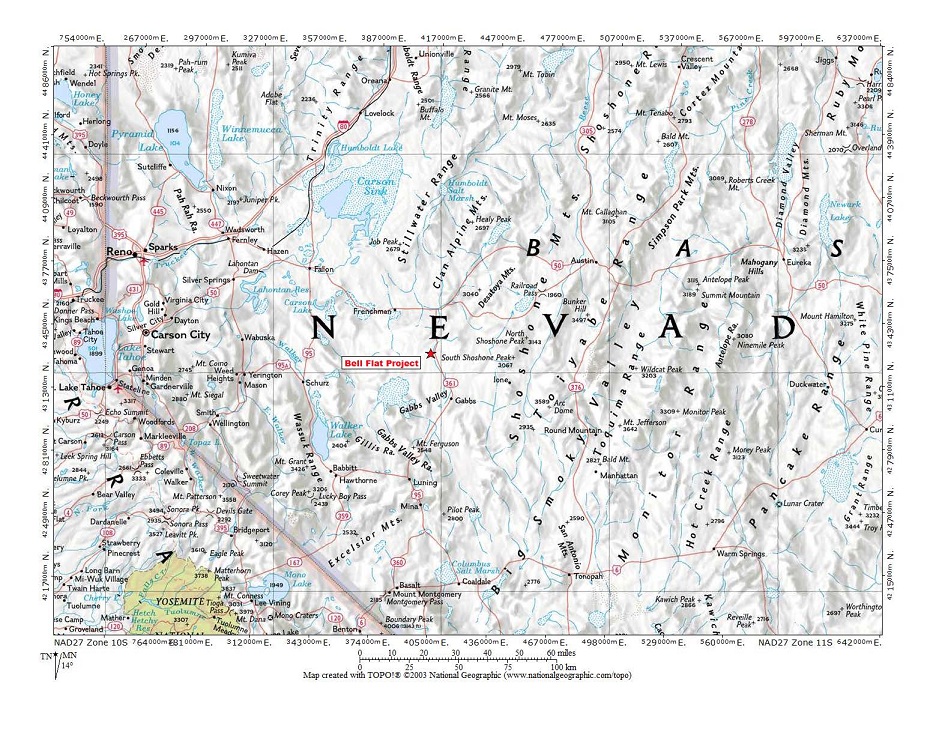

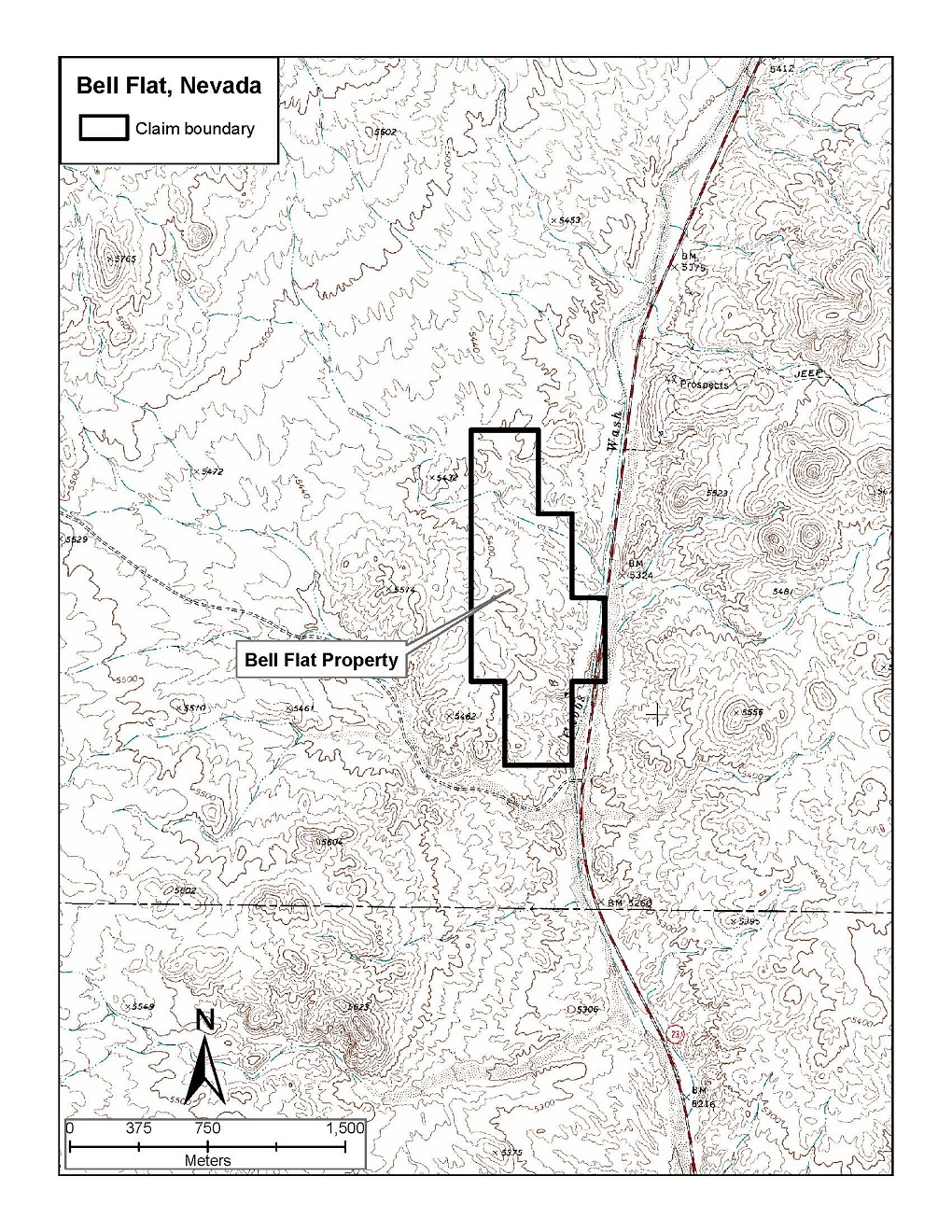

Map of our Bell Flat Project located in Churchill County, Nevada.

Bell Flat Project

Acquisition of Interest

On July19, 2013, the Company executed the DPE Agreement which granted the Company the right to acquire 100% of the mining interests of the Bell Flat Project which is located in Churchill County, Nevada and currently consists of 11 unpatented claims (the “Property”).

Annual option payments and minimum annual exploration expenditures under DPE Agreement are as noted below:

| | |

| | | Property | | | Work | |

| | | Payments | | | Expenditures | |

| Upon Execution of the Agreement | | $ | 5,000 | | | $ | - | |

| By May 21, 2014 | | | 10,000 | | | | 50,000 | |

| By May 21, 2015 | | | 15,000 | | | | 150,000 | |

| By May 21, 2016 | | | 20,000 | | | | 150,000 | |

| By May 21, 2017 | | | 30,000 | | | | 200,000 | |

| By May 21, 2018 | | | 40,000 | | | | 350,000 | |

| By May 21, 2019 | | | 50,000 | | | | 300,000 | |

| By May 21, 2020 | | | 50,000 | | | | 300,000 | |

| By May 21, 2021 | | | 50,000 | | | | 300,000 | |

| By May 21, 2022 | | | 50,000 | | | | 200,000 | |

| By May 21, 2023 | | | 50,000 | | | | 250,000 | |

| By May 21, 2024 | | | 250,000 | | | | 750,000 | |

| | | $ | 620,000 | | | $ | 3,000,000 | |

Since our payment obligations are non-refundable, if we do not make any payments under the DPE Agreement we will lose any payments made and all our rights to the Property. If all said payments under the Agreement are made, then we will acquire all mining interests in the Property. If the Company fails to make any payment when due, the DPE Agreement gives the Company a 60-day grace period to pay the amount of the deficiency. DPE retained a 3% net smelter royalty of the aggregate proceeds received by the Company from any smelter or other purchaser of any ores, concentrates, metals or other material of commercial value produced from the Property, minus the cost of transportation of the ores, concentrates or metals, including related insurance, and smelting and refining charges, including penalties. The Company shall have the one time right exercisable for 90 days following completion of the initial feasibility study to buy up to 50% of DPE’s 3% royalty interest for $3,000,000. Any exercise of its option to the Property rights under the DPE Agreement requires a yearly advance royalty payment of $20,000, up to $200,000.

The Company may use DPE for its mineral exploration expertise on the Property. Furthermore, both the Company and DPE have the right to assign, sell, mortgage or pledge their rights in the DPE Agreement or the Property. In addition, any mineral interests staked, located, granted or acquired by either the Company or DPE which are located within a 1 mile radius of the Property will be included in the option granted to the Company.

The Company has the right to assign, sell, mortgage or pledge its rights in the DPE Agreement or on the Property.. The Company can terminate the DPE Agreement at any time but must pay fees and expenses to maintain the Property in good standing for one year thereafter. The parties are discussing amendments to the property option agreement.

Description and Location of the Bell Flat Project

The Bell Flat Project is comprised of 11 unpatented mining claims covering a total of 220 acres located within the Walker Lane trend, Churchill County, Nevada. The property is located approximately 15 miles north of Gabbs, Nevada. This project represents a grass roots exploration property with no defined resource.

Exploration History of the Bell Flat Project

Historic work in the area was initiated in the early 1900’s when prospectors discovered copper oxides within an exposed granitic sill on the south end of the property. Extensive soil and rock sampling, geophysical surveys and modest drilling have identified various anomalous concentrations of elements. In particular, an area of elevated magnesium values ranging from 3 to 12 percent exist in soil samples collected during the 2006 field season. The spacing of the soil grid was completed on 100 feet intervals east-west and approximately 500 feet intervals north-south. The elevated values occur within an area 300 to 400 feet in width and over a distance of 2,500 feet in length. Any previous drill samples collected within or near the area of elevated magnesium results were not assayed for magnesium and no sample medium from the previous drilling is available for testing.

Geology of the Bell Flat Project

The Bell Flat Project encompasses a northwesterly trending structural zone which also hosts low grade gold and silver. The structure cuts Tertiary felsic volcanic rocks and Triassic sediments. The Triassic sediments are the host rock for the nearby magnesium mine located near Gabbs, Nevada. Based on geologic mapping and geochemical sampling, it is likely that hydrothermally altered dolomite carries the magnesium minerals. Shallow pits, trenches, a shaft and a few drill holes have encountered gold and silver within argillized shale and jasperoid developed along the contact of the sediments and younger volcanic rocks. Clay altered felsic volcanic tuff also contains some gold and silver. The above hydrothermally altered rocks are capped by post-mineral basalt and wind-blown sand obscuring additional potential.

Current State of Exploration

The Bell Flat Project does not have any reportable mineral resources or reserves. The Property has seen only cursory prospecting. There has been no production of metals from the Property in the past.

Geological Exploration Program

The Company has not yet undertaken any exploration on the Bell Flat Project. However, the Company is working with DPE in the preparation of a budget and exploration program.

Item 3. Legal Proceedings

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

Item 4. Mine Safety Disclosures

The Company currently has no mining operations.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Our common stock is quoted on the Over The Counter Bulletin Board (“OTCBB”) under the symbol “AMGC” (previously the Company’s stock traded under the symbol “DAKO”). The following table sets forth the quarterly high and low closing bid prices of the common stock as reported on http://finance.yahoo.com during the fiscal years ending April 30, 2013 and April 30, 2012:

| Fiscal Quarter | Bid Price Information* |

| Year | Quarter | High Bid Price | Low Bid Price |

| 2013 | Fourth Quarter | $0.05 | $0.02 |

| Third Quarter | $0.05 | $0.02 |

| Second Quarter | $0.05 | $0.02 |

| First Quarter | $0.05 | $0.02 |

| 2012 | Fourth Quarter | $0.05 | $0.03 |

| Third Quarter | $0.05 | $0.03 |

| Second Quarter | $0.05 | $0.03 |

| First Quarter | $0.11 | $0.06 |

*The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Holders

On August 12, 2013, there were approximately 34 holders of record of the Company’s common stock.

Dividends

The Company has not declared or paid any cash dividends on its common stock nor does it anticipate paying any in the foreseeable future. Furthermore, the Company expects to retain any future earnings to finance its operations and expansion. The payment of cash dividends in the future will be at the discretion of its Board of Directors and will depend upon its earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

There were no sales of unregistered securities that were not previously reported.

Purchases of Equity Securities by the Company and Affiliated Purchasers

None.

Item 6. Selected Financial Data

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

Item 7. Management’s Discussion and Analysis or Plan of Operation

Overview

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, exploiting natural resource properties. Our primary focus in the natural resource sector ismagnesium We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

In the following discussion, there are references to “unpatented” mining claims. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If you purchase an unpatented mining claim that is later declared invalid by the U.S. government, you could be evicted.

Plan of Operation

During the twelve-month period ending April 30, 2014, our objective is to commence an exploration program on the Bell Flat Project. The Company received an additional $20,000 under its related party bridge loan on August 20, 2012. The cash from this related party bridge loan is not sufficient to fund all of our planned operations for the next twelve months. The Company expects that it will need approximately $122,000 to fund its operations during the next twelve months which will include property option payments, exploration of its Property as well as the costs associated with maintaining an office and its reporting obligations as a public company. In order to develop its Property, the Company will need to obtain additional financing. Management may seek additional capital through the sale of its common stock. Although there are no assurances that management’s plans will be realized, management believes that the Company will be able to continue operations in the future.

We continue to run our operations with the use of contract operators, and as such do not anticipate a change to our company staffing levels. We remain focused on keeping the staff compliment, which currently consists of our two directors and one officer, at a minimum to conserve capital. We believe outsourcing of necessary operations continues to be the most cost effective and efficient manner of conducting the business of the Company.

We do not anticipate any equipment purchases in the twelve months ending April 30, 2014.

The following is an overview of the project work to date, as well as anticipated work for the next twelve months. Specific dates when work will begin, and how long it will take to complete each step is subject to change due to the variables of weather, availability of work crews for a particular type of work, and the results of work that is planned, the outcome of which will determine what the next step on that project will be.

Bell Flat Project

On July 19, 2013, the Company executed the DPE Agreement granting the Company the right to acquire 100% of the mining interests of the Bell Flat Project, located in Churchill County, Nevada and currently consists of 11 unpatented claims. Upon execution of the DPE Agreement, the Company paid DPE $5,000. The Agreement requires the Company to make $620,000 in additional property option payments and incur $3,000,000 in exploration expenditures on the Property by May 21, 2024.

Crescent Fault Property

On July 20, 2013, the Company terminated the Minquest Agreement. The Company has determined that the Crescent Fault Property no longer fits with its business parameters as the Company is changing its exploration emphasis from gold to magnesium.

As a result of such termination, the Crescent Fault Property has been returned to MinQuest and the Company is responsible to pay all claim fees, payments and expenses in order to maintain the property in good standing until July 2014. It is estimated that such fees and expenses will be $5,135.

Caldera Property

On August 17, 2012, the Company terminated the Caldera Property Option Agreement. The Company determined that the Caldera Property no longer fits with its business parameters.

As a result of such termination, the Caldera Property has been returned to the Property Owners and the Company paid $7,000 for fees and expenses in order to maintain the property in good standing until August 2013. The Company no longer has any interest in the Caldera Property and no additional payments are required under the Caldera Property Agreement.

Results of Operations

We did not earn any revenues during the years ended April 30, 2013 or 2012. We will be in the exploration stage of our business for an extended period of time and as a result do not anticipate earning revenues until we have developed an exploration property. We can provide no assurance that we will discover commercially exploitable levels of mineral resources on our Property, or if such resources are discovered, that we will enter into commercial production of our mineral property.

For the fiscal year ended April 30, 2013 we had a net loss of $62,951 compared to a net loss of $96,705 for the fiscal year ended April 30, 2012. The decrease in the net loss was largely a reduction in property acquisition costs as in the current year the Company paid $5,000 to MinQuest upon execution of the Crescent Fault Agreement while in the prior period the Company paid $25,000 under the Caldera Property Option Agreement. Additionally, the Company incurred $8,806 in mineral property exploration expenditures for the fiscal year ended April 30, 2013 compared to $33,376 for the fiscal year ended April 30, 2012. In fiscal 2013 the Company did not perform any significant exploration on the Crescent Fault or Caldera properties while in fiscal 2012 the Company began planning its exploration program on the Caldera Property. General and administrative expenses increased to $44,106 in fiscal 2013 from $34,191 in fiscal 2012 as a result of filing and professional fees associated with the filing of the Company’s registration statement on Form S-1 in fiscal 2013.

Liquidity and Capital Resources

We have funded our operations entirely from capital raised from our private offerings of securities from March 2011 through September 2011 and from a bridge loan. Between March 2011 and September 2011 we sold an aggregate of 2,300,000 shares of our common stock for aggregate gross proceeds of $130,000. In August 2010, we received a bridge loan (“Bridge Loan”) in the original principal amount of $80,000. which was due August 20, 2011. On August 20, 2011, the term of the loan was extended until August 20, 2012 and the principal amount was increased to $84,000. On August 27, 2012, the Company’s entered in a bridge loan agreement to extend the Bridge Loan in the original principal amount of $84,000 which was due on August 20, 2012 to August 20, 2013 and to increase the principal amount of the loan to $108,200. The loan is unsecured, bears interest at 5% per year, and may be repaid in its entirety upon 15 day’s notice to the lender.

We had cash of $3,660 and negative working capital of $111,233 as of April 30, 2013. We anticipate that we will incur the following expenses over the next twelve months:

| · | $67,000 in property option payments, annual claim filing fees, and exploration expenditures on the Company’s Bell Flat Project; |

| · | $55,000 for operating expenses, including working capital and general, legal, accounting and administrative expenses associated with reporting requirements under the Securities Exchange Act of 1934. |

Net cash used in operating activities during the fiscal year ended April 30, 2013 was $53,336 compared to $86,274 for the fiscal year ended April 30, 2012. A significant portion of the decrease was due to a decrease in the net loss to $62,951 for the fiscal year ended April 30, 2013 from $96,705 for the fiscal year ended April 30, 2012. Partially offsetting the impact of the decreased net loss was the impact of the property acquisition costs. For the fiscal year ended April 30, 2013, the Company paid $5,000 to MinQuest upon execution of the Crescent Fault Agreement while in the fiscal year ended April 30, 2012 the Company paid $25,000 under the Caldera Property Option Agreement. Changes in working capital included inflows of $1,281 and $6,128 respectively from changes in prepaid expenses for the fiscal years ended April 30, 2013 and 2012 while there were inflows of $3,295 and $165 respectively from changes in accounts payable and accrued liabilities for the fiscal years ended April 30, 2013 and 2012. There were no investing activities in either year. Financing activities for the fiscal year ended April 30, 2013 consisted of $20,000 received from the proceeds of a loan while in the fiscal year ended April 30, 2012 financing activities were the result of $100,000 received in proceeds from a private placement.

The future of the Company is dependent upon its ability to obtain future financing and upon future profitable operations from the development of its mineral property. On August 27, 2012 the Company received an additional $20,000 in proceeds from a bridge loan and on September 1, 2011 the Company received $100,000 from a private placement. The proceeds from these financings are not sufficient for all of the Company’s commitments for the next 12 months. The Company expects that it will need approximately $122,000 to fund its operations through April 30, 2014. We anticipate that in the future we will need additional funding and that such funding will be in the form of equity financing from the sale of our common stock. However, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund additional phases of the exploration program, should we decide to proceed. We do not have any arrangements in place for any future equity financing.

Going Concern Consideration

The Company incurred a net loss of $230,997 for the period from August 1, 2010 (inception of the exploration stage ) to April 30, 2013 and has no sales. Current cash available to the Company is not sufficient to continue all of our planned activities for the next twelve months. In addition, we anticipate generating losses and therefore we may be unable to continue operations in the future as a going concern. No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities that could result should we be unable to continue as a going concern.

We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Accordingly, our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

Critical Accounting Policies

The preparation of financial statements, in conformity with generally accepted accounting principles in the United States of America, requires companies to establish accounting policies and to make estimates that affect both the amount and timing of the recording of assets, liabilities, revenues and expenses. Some of these estimates require judgments about matters that are inherently uncertain and therefore actual results may differ from those estimates.

A detailed summary of all of the Company’s significant accountings policies and the estimates derived therefrom is included in Note 3 to the Company’s financial statements for the year ended April 30, 2013. While all of the significant accounting policies are important to the Company’s financial statements, the following accounting policies and the estimates derived therefrom have been identified as being critical:

· Exploration and Development Costs

· Income Taxes

Exploration and Development Costs