We are also subject to the Health, Safety and Reclamation Code for Mines in British Columbia. This code deals with environmental matters relating to the exploration and development of mineral properties. Its goals are to protect the environment through a series of regulations affecting:

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mineral activities. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our activities and know what that will involve from an environmental standpoint.

We are in compliance with the Act and will continue to comply with the Act in the future. We believe that compliance with the act will not adversely affect our business activities in the future.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only "cost and effect" of compliance with environmental regulations in British Columbia is returning the surface to its previous condition upon abandonment of the property. We cannot speculate on those costs in light of our ongoing plans for exploration. When we are ready to drill, we will notify the British Columbia Inspector of Mines. He will require a bond to be put in place to assure that the property will be restored to its original condition. We have estimated the cost of restoring the property to be between $3,000 to $9,000, depending upon the number of holes drilled.

We intend to use the services of subcontractors for manual labor exploration work on our properties.

At present, we have no employees, other than our sole officer and director. Our sole officer and director is part-time employees and will devote about 10% of his time to our operation. Our sole officer and director does not have an employment agreement with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our sole officer and director. Mr. Sarai will handle our administrative duties. Because Mr. Sarai is inexperienced with exploration, he will hire qualified persons to perform the surveying, exploration, and excavating of our property. As of today, we have not looked for or talked to any geologists or engineers who will perform work for us in the future.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

This section of the prospectus includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking states are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or out predictions.

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business activities.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals. Accordingly, we must raise cash from sources other than the sale of minerals found on the property. Our only other source for cash at this time is investment by others in our complete private placement. The cash we raised will allow us to stay in business for at least one year. Our success or failure will be determined by what we find under the ground.

To meet our need for cash we raised money from our private placement. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we do not have enough money to complete our exploration of the property, we will have to find alternative sources, like a second public offering, a private placement of securities, or loans from our officers or others.

Our sole officer and director is unwilling to make any commitment to loan us any money at this time. At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and can't raise it, we will either have to suspend activities until we do raise the cash, or cease activities entirely. Other than as described in this paragraph, we have no other financing plans.

We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. Even if we complete our current exploration program and it is successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit, a reserve.

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of this prospectus. We are not going to buy or sell any plant or significant equipment during the next twelve months. We will not buy any equipment until have located a reserve and we have determined it is economical to extract the minerals from the land.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves.

-22-

If we are unable to complete any phase of exploration because we don't have enough money, we will cease activities until we raise more money. If we can't or don't raise more money, we will cease activities. If we cease activities, we don't know what we will do and we don't have any plans to do anything.

We do not intend to hire additional employees at this time. All of the work on the property will be conduct by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Milestones

The following are our milestones:

1. April 2008 - retain our consultant to manage the exploration of the property. - Maximum cost of $15,000. Time of retention 0-90 days.

2. May 2008 to August 2008 - core drilling. Core drilling will cost $20.00 per foot. We plan to drill 15 holes to a depth of 100 feet. The total cost will be $30,000. Core drilling will be subcontracted to non-affiliated third parties. No power source is needed for core drilling. The drilling rig operates on diesel fuel. All electric power needed, for light and heating while on the property will be generated from gasoline powered generators. Time to conduct the core drilling - 120 days.

3. September 2008 to November 2008 - have an independent third party analyze the samples from the core drilling. Determine if mineralized material is below the ground. If mineralized material is found, define the body. We estimate that it will cost $4,500 to analyze the core samples and will take 30 days.

All funds for the foregoing activities have been obtained from our private placement.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from activities. We cannot guarantee we will be successful in our business activities. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we conduct research and exploration of our properties before we start production of any minerals we may find. We are seeking equity financing to provide for the capital required to implement our research and exploration phases.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our activities. Equity financing could result in additional dilution to existing shareholders.

-23-

Results of Activities

From Inception on September 12, 2006

We acquired the right to explore one property containing one claim. We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. We have staked the property and will begin our exploration in April 2008.

Liquidity and Capital Resources

As of the date of this prospectus, we have yet to generate any revenues from our business activities.

We issued 5,000,000 shares of common stock through a private placement pursuant to Regulation S of the Securities Act of 1933 to Pardeep Sarai, our sole officer and director in September 2006, in consideration of $5,000. The shares were sold to non-US persons and all transactions closed outside the United States of America. This was accounted for as a purchase of shares of common stock.

In March 2007, we completed a private placement of 4,140,000 restricted shares of common stock pursuant to Reg. S of the Securities Act of 1933 and raised $41,400. All of the shares were sold to non-US persons and all transactions closed outside the United States of America. This was accounted for as a purchase of shares of common stock.

As of February 28, 2007, our total assets were $39,827 and our total liabilities were $15,904.

MANAGEMENT

Officers and Directors

Each of our directors serves until his or her successor is elected and qualified. Each of our officers is elected by the board of directors to a term of one (1) year and serves until his or her successor is duly elected and qualified, or until he or she is removed from office. The board of directors has no nominating, auditing or compensation committees.

The name, age and position of our officers and directors are set forth below:

Name | Age | Position Held |

| | | |

Pardeep Sarai | 36 | President, Principal Executive Officer, Secretary, Treasurer, Principal Financial Officer, Principal Accounting Officer, and sole member of the Board of Directors. |

Mr. Sarai will serve until our next annual meeting of the stockholders. The Board of Directors elects officers and their terms of office are at the discretion of the Board of Directors.

-24-

Background of officers and directors

Pardeep Sarai has been our president, principal executive officer, secretary, treasurer, principal financial officer, principal accounting officer and sole member of the board of directors since our inception on September 12, 2006. Since June 1995, Mr. Pardeep has been employed at Telus Communications Inc. located in Burnaby, British Columbia. During his tenure at Telus Communications, Mr. Sarai has advised and consulted on the implementation of sales and marketing initiatives. He has also been involved in the design of process improvements and service enhancements. In his position in human resources, Mr. Sarai is responsible for managing and running diagnostic solutions on behalf of the business management teams of Telus Communications.

Audit Committee Financial Expert

We do not have an audit committee financial expert. We do not have an audit committee financial expert because we believe the cost related to retaining a financial expert at this time is prohibitive. Further, because we are only beginning our commercial operations, at the present time, we believe the services of a financial expert are not warranted.

Conflicts of Interest

There are no conflicts of interest.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid by us from inception on September 12, 2006 through February 28, 2007, for our sole officer. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any. The compensation discussed addresses all compensation awarded to, earned by, or paid to our named executive officer.

Summary Compensation Table

| | | | | | | Non- | Nonqualified | | |

| | | | | | | Equity | Deferred | All | |

Name | | | | | | Incentive | Compensa- | Other | |

and | | | | Stock | Option | Plan | tion | Compen- | |

Principal | | Salary | Bonus | Awards | Awards | Compensation | Earnings | sation | Total |

Position | Year | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) |

(a)

| (b)

| (c)

| (d)

| (e)

| (f)

| (g)

| (h)

| (i)

| (j)

|

| | | | | | | | | |

Pardeep Sarai | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

President, Treasurer, | 2006 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Secretary | 2005 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| | | | | | | | | | |

We have not paid any salaries in 2007, and we do not anticipate paying any salaries at any time in 2007. We will not begin paying salaries until we have adequate funds to do so.

-25-

The following table sets forth the compensation paid by us from inception on September 12, 2006 through February 28, 2007, for each of our directors. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any. The compensation discussed addresses all compensation awarded to, earned by, or paid to our named director.

Director Compensation

| | Fees | | | | | | |

| | Earned | | | | Nonqualified | | |

| | or | | | Non-Equity | Deferred | | |

| | Paid in | Stock | Option | Incentive Plan | Compensation | All Other | |

| | Cash | Awards | Awards | Compensation | Earnings | Compensation | Total |

Name | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) |

(a)

| (b)

| (c)

| (d)

| (e)

| (f)

| (g)

| (h)

|

| | | | | | | |

Pardeep Sarai | 2007 | 0 | 0 | 0 | 0 | 0 | 0 |

Our sole director does not receive any compensation for serving as a member of the board of directors.

There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officers and directors other than as described herein.

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

As of the date hereof, we have not entered into employment contracts with any of our officers and do not intend to enter into any employment contracts until such time as is profitable to do so.

Indemnification

Under our Articles of Incorporation and Bylaws of the corporation, we may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the office or director is successful on the merits in a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney's fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

-26-

PRINCIPAL AND SELLING SHAREHOLDERS

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by each of our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The table also reflects what their ownership will be assuming completion of the sale of all shares in this offering. The stockholders listed below have direct ownership of his/her shares and possess voting and dispositive power with respect to the shares.

| | Direct Amount of | | Percent |

Name of Beneficial Owner

| Beneficial Owner

| Position

| of Class

|

Pardeep Sarai [1] | 5,000,000 | President, Principal Executive Officer, | 54.70% |

| | | and Director | |

| | | | |

| | | | |

All Officers and Directors as a | | | |

Group (1 Person) | 5,000,000 | | 54.70% |

Securities authorized for issuance under equity compensation plans.

We have no equity compensation plans.

Selling Shareholders

The following table sets forth the name of each selling shareholder, the total number of shares owned prior to the offering, the percentage of shares owned prior to the offering, the number of shares offered, and the percentage of shares owned after the offering, assuming the selling shareholder sells all of his shares and we sell the maximum number of shares.

| | | | | Percentage |

| | | | | of shares |

| | | | | owned after the |

| | Total number of | Percentage of | Number of | offering assuming |

| | shares owned | shares owned | shares being | all of the share are |

Name | prior to offering | prior to offering | offered | sold in the offering |

| | | | | |

Bains, Sukhjit | 90,000 | 0.985% | 90,000 | 0% |

Bal, Parveen | 90,000 | 0.985% | 90,000 | 0% |

Barbour, Doug | 90,000 | 0.985% | 90,000 | 0% |

Bodwal, Sanjeev | 90,000 | 0.985% | 90,000 | 0% |

Brewer, Phil | 90,000 | 0.985% | 90,000 | 0% |

Brown, Charles | 90,000 | 0.985% | 90,000 | 0% |

Chatur, Aman | 90,000 | 0.985% | 90,000 | 0% |

Cheema, Jagjit | 90,000 | 0.985% | 90,000 | 0% |

Chikalia, Aneesha | 90,000 | 0.985% | 90,000 | 0% |

Chudha, Teenum | 90,000 | 0.985% | 90,000 | 0% |

Daniels, Jacki | 90,000 | 0.985% | 90,000 | 0% |

-15-

Dhami, Ravina | 90,000 | 0.985% | 90,000 | 0% |

Dhillon, Karamjeet | 90,000 | 0.985% | 90,000 | 0% |

Fenton, Sam | 90,000 | 0.985% | 90,000 | 0% |

Grewal, Balkar | 90,000 | 0.985% | 90,000 | 0% |

Grewal, Dharminder | 90,000 | 0.985% | 90,000 | 0% |

Groves, Grant | 90,000 | 0.985% | 90,000 | 0% |

Hall, Simon | 90,000 | 0.985% | 90,000 | 0% |

Hutchings, Tony | 90,000 | 0.985% | 90,000 | 0% |

Kayani, Yasir | 90,000 | 0.985% | 90,000 | 0% |

Kotadia, Amin | 90,000 | 0.985% | 90,000 | 0% |

Kotadia, Mariam | 90,000 | 0.985% | 90,000 | 0% |

Kullar, Monika | 90,000 | 0.985% | 90,000 | 0% |

Lach, Marzena | 90,000 | 0.985% | 90,000 | 0% |

Malik, Sajid | 90,000 | 0.985% | 90,000 | 0% |

Manokaran, Sangar | 90,000 | 0.985% | 90,000 | 0% |

Mukhida, Zameer | 90,000 | 0.985% | 90,000 | 0% |

Mukhida, Aaleed | 90,000 | 0.985% | 90,000 | 0% |

Nagra, Kulbir | 90,000 | 0.985% | 90,000 | 0% |

Nankivell, Chris | 90,000 | 0.985% | 90,000 | 0% |

Nasu, Janet | 90,000 | 0.985% | 90,000 | 0% |

Pasha, Mohammed | 90,000 | 0.985% | 90,000 | 0% |

Paul, Rajesh | 90,000 | 0.985% | 90,000 | 0% |

Pooni, Randeep | 90,000 | 0.985% | 90,000 | 0% |

Pooni, Robert | 90,000 | 0.985% | 90,000 | 0% |

Randhawa, Inderjit | 90,000 | 0.985% | 90,000 | 0% |

Reehal, Gary | 90,000 | 0.985% | 90,000 | 0% |

Sadhra, Shender | 90,000 | 0.985% | 90,000 | 0% |

Sandhu, Sukhvir | 90,000 | 0.985% | 90,000 | 0% |

Sandhu, Pardeep | 90,000 | 0.985% | 90,000 | 0% |

Sandhu, Raman | 90,000 | 0.985% | 90,000 | 0% |

Shah, Neil | 90,000 | 0.985% | 90,000 | 0% |

Surface, Emma | 90,000 | 0.985% | 90,000 | 0% |

Tanguay, Karamjit | 90,000 | 0.985% | 90,000 | 0% |

Ward, Emma | 90,000 | 0.985% | 90,000 | 0% |

Warshaw, Tanya | 90,000

| 0.985%

| 90,000

| 0%

|

| | 4,140,000

| 45.30%

| 4,140,000

| 0%

|

We issued 4,140,000 shares of common stock as restricted securities pursuant to Reg. S of the Securities Act of 1933 in that all of the sales took place outside the United States of America with non-US persons.

The following is a summary of the issuances of all shares pursuant to Reg. S of the Act.

a) | In September 2006, we issued 5,000,000 shares of common stock to Pardeep Sarai, our sole officer and director in consideration of $0.001 per share or a total of $5,000. |

| | |

b) | In March 2007, we issued 4,140,000 shares of common stock to forty-six individuals in consideration of $0.01 per share or a total of $41,400. The 4,140,000 shares so issued are being registered in this offering. |

-28-

Future Sales of Shares

A total of 9,140,000 shares of common stock are issued and outstanding. Of the 9,140,000 shares outstanding, all are restricted securities as defined in Rule 144 of the Securities Act of 1933. 4,140,000 are being offered for sale by the selling shareholders in this offering.

Shares purchased in this offering, which will be immediately resalable without restriction of any kind.

DESCRIPTION OF SECURITIES

Common Stock

Our authorized capital stock consists of 100,000,000 shares of common stock, $0.00001 par value per share. The holders of our common stock:

* | have equal ratable rights to dividends from funds legally available if and when declared by our board of directors; |

* | are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; |

| | |

* | do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and |

| | |

* | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

All shares of common stock now outstanding are fully paid for and non-assessable and all shares of common stock which are the subject of this offering, when issued, will be fully paid for and non-assessable. We refer you to our Articles of Incorporation, Bylaws and the applicable statutes of the state of Nevada for a more complete description of the rights and liabilities of holders of our securities.

Non-cumulative voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors.

Cash dividends

As of the date of this prospectus, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

-29-

Preferred Stock

We are authorized to issue 100,000,000 shares of preferred stock with a par value of $0.00001 per share. The terms of the preferred shares is at the discretion of the board of directors. Currently no preferred shares are issued and outstanding.

Anti-takeover provisions

There are no Nevada anti-takeover provisions that may have the affect of delaying or preventing a change in control.

Reports

After we complete this offering, we will not be required to furnish you with an annual report. Further, we will not voluntarily send you an annual report. We will be required to file reports with the SEC under section 15(d) of the Securities Act. The reports will be filed electronically. The reports we will be required to file are Forms 10-KSB, 10-QSB, and 8-K. You may read copies of any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that will contain copies of the reports we file electronically. The address for the Internet site is www.sec.gov.

Stock transfer agent

Our stock transfer agent for our securities is Empire Stock Transfer, Inc., 7251 West Lake Mead Boulevard, Las Vegas, Nevada 89128 and its telephone number is (702) 562-4091.

CERTAIN TRANSACTIONS

We issued 5,000,000 shares of common stock to Mr. Sarai in September 2006, in consideration of $5,000.

Mr. Sarai allows us to use a portion of his home as our office on a rent free basis.

As of February 28, 2007, we owed Mr. Sarai, our sole officer and director, $604 for advances made to us. This amount is unsecured, bears no interest with no specific terms of repayment.

LITIGATION

We are not a party to any pending litigation and none is contemplated or threatened.

-30-

EXPERTS

Our financial statements for the period from inception to February 28, 2007, included in this prospectus have been audited by Michael T. Studer CPA, P.C., 18 East Sunrise Highway, Suite 311 Freeport, New York 11520, as set forth in their report included in this prospectus. Its report is given upon its authority as an expert in accounting and auditing.

LEGAL MATTERS

Conrad C. Lysiak, Attorney at Law, 601 West First Avenue, Suite 903, Spokane, Washington 99201, telephone (509) 624-1475 has acted as our legal counsel.

FINANCIAL STATEMENTS

Our fiscal year end is February 28. We will provide audited financial statements to our stockholders on an annual basis; the statements will be audited by a firm of Certified Public Accountants.

Audited financial statements for September 12, 2006 (inception) to February 28, 2007 immediately follow:

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-1 |

| | Balance Sheet | F-2 |

| | Statement of Operations | F-3 |

| | Statement of Stockholders' Equity | F-4 |

| | Statement of Cash Flows | F-5 |

NOTES TO FINANCIAL STATEMENTS | F-6 |

-31-

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Ridgestone Resources, Inc.

I have audited the accompanying balance sheet of Ridgestone Resources, Inc. (the Company), an exploration stage company, as of February 28, 2007 and the related statements of operations, stockholders' equity and cash flows for the period September 12, 2006 (inception) to February 28, 2007. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Ridgestone Resources, Inc., an exploration stage company, as of February 28, 2007 and the results of its operations and its cash flows for the period September 12, 2006 (inception) to February 28, 2007 in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements referred to above have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company's present financial situation raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to this matter are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Michael T. Studer CPA P.C.

MICHAEL T. STUDER CPA P.C.

Freeport, New York

May 25, 2007

F-1

-32-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Balance Sheets

(Expressed in US Dollars)

|

| | | |

| | | |

| | | February 28, |

| | | 2007

|

| | | |

ASSETS | | |

Current Assets | | |

| | Cash and cash equivalents | $ | 39,827

|

Total Current Assets | | 39,827 |

| | | | | |

| | Other assets

|

| -

|

| | | |

Total Assets

| $

| 39,827

|

| | | |

| | | |

| | | |

| | |

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY) | | |

Current Liabilities | | |

| | Accounts payable and accrued liabilities | $ | 15,300 |

| | Due to related parties

|

| 604

|

Total current liabilities

|

| 15,904

|

| | | | | |

| | | | | |

Stockholders' Equity | | |

| | Prefereed Stock, $0.00001 par value; | | |

| | | authorized 100,000,000 shares, none issued and outstanding | | - |

| | Common Stock, $0.00001 par value; | | |

| | | authorized 100,000,000 shares, | | |

| | | issued (or in process of issuance) and outstanding 8,870,000 shares | | 89 |

| | Additional paid-in capital | | 35,611 |

| | Deficit accumulated during the exploration stage

|

| (11,777)

|

Total stockholders' equity

|

| 23,923

|

Total Liabilities and Stockholders' Equity

| $

| 39,827

|

See notes to financial statements.

F-2

-33-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Statement of Operations

(Expressed in US Dollars)

|

| | | |

| | | |

| | | Period from September 12, 2006 (Date of Inception) To February 28, 2007

|

| | | |

| | | |

| | | |

Revenue

| $

| -

|

| | | |

Costs and expenses | | |

| | General and administrative expenses | | 8,447 |

| | Impairment of mineral property costs | | 3,300 |

| | Mineral property exploration and carrying costs

|

| 30

|

Total costs and expenses

|

| 11,777

|

| | | | | |

Net Loss

| $

| (11,777)

|

| | | | | |

Net loss per share | | |

| | Basic and diluted

| $

| (0.00)

|

| | | | | |

| | | | | |

Weighted Average Shares Outstanding | | |

| | Basic and Diluted

|

| 4,821,000

|

See notes to financial statements.

F-3

-34-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Statement of Stockholders' Equity

For the Period September 12, 2006 (Inception) to February 28, 2007

(Expressed in US Dollars)

|

| | | | | | | | | | | | |

| | | | | | | | | | Deficit Accumulated | | |

| | | | Common Stock, | Additional | | During the | | |

| | | | $0.00001 par value | | paid-in | | Exploration | | |

| | | | Shares

| | Amount

| | capital

| | Stage

| | Total

|

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Common shares sold for cash at $0.001 per share | 5,000,000 | $ | 50 | $ | 4,950 | $ | - | $ | 5,000 |

Common shares sold for cash at | | | | | | | | | |

| | $0.01 per share, less offering costs of $12,500 | 3,870,000 | | 39 | | 26,161 | | - | | 26,200 |

Donated services and expenses | - | | - | | 4,500 | | - | | 4,500 |

Net Loss

| -

|

| -

|

| -

|

| (11,777)

|

| (11,777)

|

Balance - February 28, 2007

| 8,870,000

| $

| 89

| $

| 35,611

| $

| (11,777)

| $

| 23,923

|

See notes to financial statements.

F-4

-35-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Statement of Cash Flows

(Expressed in US Dollars)

|

| | | |

| | | Period from September 12, 2006 (Date of Inception) To February 28, 2007 |

| | | |

Cash Flows from Operating Activities | | |

| | Net loss | $ | (11,777) |

| | Adjustments to reconcile net loss | | |

| | | to net cash provided by (used for) operating activities | | |

| | | Impairment of mineral property costs | | 3,300 |

| | | Donated services and expenses | | 4,500 |

| | Change in operating assets and liabilities: | | |

| | | Accounts payable and accrued liabilities | | 15,300 |

| | | Due to related parties

|

| 604

|

Net cash provided by (used for) operating activities

|

| 11,927

|

| | | | | |

Cash Flows from Investing Activities | | |

| | Mineral property acquisition costs

|

| (3,300)

|

Net cash provided by (used for) investing activities

|

| (3,300)

|

| | | | |

Cash Flows from Financing Activities | | |

| | Proceeds from sales of common stock | | 43,700 |

| | Offering costs incurred

|

| (12,500)

|

| | | | | |

Net cash provided by financing activities

|

| 31,200

|

| | | | | |

Increase in cash | | 39,827 |

| | | | | |

Cash - beginning of period

|

| -

|

| | | | | |

Cash - end of period

| $

| 39,827

|

| | | | | |

Supplemental disclosures of cash flow information: | | |

| | Interest paid | $ | -

|

| | Income taxes paid | $ | -

|

See notes to financial statements.

F-5

-36-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

February 28, 2007

(Expressed in US dollars)

Note 1. Exploration Stage Company |

| | |

| | The Company was incorporated in the State of Nevada on September 12, 2006. The Company is an Exploration Stage Company, as defined by Statement of Financial Accounting Standard ("SFAS") No.7 "Accounting and Reporting by Development Stage Enterprises". The Company's principal business is the acquisition and exploration of mineral resources. The Company has not presently determined whether its properties contain mineral reserves that are economically recoverable. |

| | |

| | These financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has never generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, confirmation of the Company's interests in the underlying properties, and the attainment of profitable operations. As at February 28, 2007, the Company has accumulated losses of $11,777 since inception. These factors raise substantial doubt regarding the Company's ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of rec orded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. |

| | |

| | The Company is planning to file a SB-2 Registration Statement on Form SB-2 with the United States Securities and Exchange Commission to register for sale the 4,140,000 shares of common stock owned by nonaffiliates of the Company. The Company will not receive any proceeds from the shares sold by the selling stockholders. |

| | |

Note 2. Summary of Significant Accounting Policies |

| | |

| | a) | Basis of Presentation |

| | | These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in US dollars. The Company's fiscal year-end is February 28. |

| | | |

| | b) | Use of Estimates |

| | | The preparation of financial statements in accordance with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses in the reporting period. The Company regularly evaluates estimates and assumptions related to deferred income tax asset valuations and loss contingencies. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company's estimates. To the extent there are material differences betwee n the estimates and the actual results, future results of operations will be affected. |

| | | |

| | c) | Basic and Diluted Net Earnings (Loss) Per Share |

| | | The Company computes net earnings (loss) per share in accordance with SFAS No. 128, "Earnings per Share". SFAS No. 128 requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive. |

F-6

-37-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

February 28, 2007

(Expressed in US dollars) |

Note 2. Summary of Significant Accounting Policies (continued) |

| | |

| | d) | Comprehensive Loss |

| | | SFAS No. 130, "Reporting Comprehensive Income," establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. As at February 28, 2007, the Company has no items that represent a comprehensive loss and, therefore, has not included a schedule of comprehensive loss in the financial statements. |

| | | |

| | e) | Cash and Cash Equivalents |

| | | The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents. |

| | | |

| | f) | Mineral Property Costs |

| | | The Company has been in the exploration stage since its inception on September 12, 2006 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized when incurred using the guidance in EITF 04-02, "Whether Mineral Rights Are Tangible or Intangible Assets". The Company assesses the carrying costs for impairment under SFAS 144, "Accounting for Impairment or Disposal of Long Lived Assets" at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently aba ndoned or impaired, any capitalized costs will be charged to operations. |

| | | |

| | g) | Financial Instruments |

| | | The fair values of financial instruments, which include cash, accounts payable, accrued liabilities and due to related parties were estimated to approximate their carrying values due to the immediate or short-term maturity of these financial instruments. The Company's operations are in Canada which results in exposure to market risks from changes in foreign currency rates. The financial risk is the risk to the Company's operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk. |

| | | |

| | h) | Offering Costs |

| | | Offering costs represent legal fees incurred in connection with the Company's planned filing of a Registration Statement on Form SB-2 to register the 4,140,000 shares of common stock sold by the Company to nonaffiliates through March 7, 2007. These costs have been charged to additional paid-in capital. |

| | | |

| | i) | Income Taxes |

| | | Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. The Company has adopted SFAS No. 109 "Accounting for Income Taxes" as of its inception. Pursuant to SFAS No. 109 the Company is required to compute tax asset benefits for net operating losses carried forward. Potential benefit of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years. |

| | | |

| | j) | Foreign Currency Translation |

| | | The Company's functional and reporting currency is the United States dollar. Monetary assets and liabilities denominated in foreign currencies are translated in accordance with SFAS No. 52 "Foreign Currency Translation", using the exchange rate prevailing at the balance sheet date. Gains and losses arising on settlement of foreign currency denominated transactions or balances are included in the determination of income. Foreign currency transactions are primarily undertaken in Canadian dollars. The Company has not, to the date of these financials statements, entered into derivative instruments to offset the impact of foreign currency fluctuations. |

F-7

-38-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

February 28, 2007

(Expressed in US dollars)

| | k) | Stock-based Compensation |

| | | The Company records stock-based compensation in accordance with SFAS No. 123R "Share Based Payments", using the fair value method. The Company has not issued any stock options since its inception. |

| | | |

| | l) | Recent Accounting Pronouncements |

| | | In February 2007, the Financial Accounting Standards Board (FASB) issued SFAS No. 159, "The Fair Value Option for Financial Assets and Financial Liabilities - Including an Amendment of FASB Statement No. 115". This statement permits entities to choose to measure many financial instruments and certain other items at fair value. Most of the provisions of SFAS No. 159 apply only to entities that elect the fair value option. However, the amendment to SFAS No. 115 "Accounting for Certain Investments in Debt and Equity Securities" applies to all entities with available-for-sale and trading securities. SFAS No. 159 is effective as of the beginning of an entity's first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provision of SFAS No. 157, "Fair Value Measurements". The adoption of this statement is not expected to have a material effect on the Company's financial statements. |

| | | |

| | | In September 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB Statements No. 87, 88, 106, and 132(R)". This statement requires employers to recognize the overfunded or underfunded status of a defined benefit postretirement plan (other than a multiemployer plan) as an asset or liability in its statement of financial position and to recognize changes in that funded status in the year in which the changes occur through comprehensive income of a business entity or changes in unrestricted net assets of a not-for-profit organization. This statement also requires an employer to measure the funded status of a plan as of the date of its year-end statement of financial position, with limited exceptions. The provisions of SFAS No. 158 are effective for employers with publicly traded equity securities as of the end of the fiscal year ending after December 15, 2006. The adoption of this statement did not have a material effect on the Company's reported financial position or results of operations. |

| | | |

| | | In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements". The objective of SFAS No. 157 is to increase consistency and comparability in fair value measurements and to expand disclosures about fair value measurements. SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS No. 157 applies under other accounting pronouncements that require or permit fair value measurements and does not require any new fair value measurements. The provisions of SFAS No. 157 are effective for fair value measurements made in fiscal years beginning after November 15, 2007. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations. |

| | | |

| | | In June 2006, the FASB issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statements No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes by prescribing a two-step method of first evaluating whether a tax position has met a more likely than not recognition threshold and second, measuring that tax position to determine the amount of benefit to be recognized in the financial statements. FIN 48 provides guidance on the presentation of such positions within a classified statement of financial position as well as on derecognition, interest and penalties, accounting in interim periods, disclosure, and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations. |

| | |

Note 3. Related Party Balances/Transactions |

| |

| | a) | The Company receives office space and services from its president at no cost to the Company. For accounting purposes, the estimated fair value of these donated services ($250 per month for the office space, $500 per month for the services) is included in general and administrative expenses and additional paid-in capital is increased by the same amounts. For the period ended February 28, 2007, the Company expensed $1,500 in donated rent and $3,000 in donated services. |

| | | |

| | b) | As at February 28, 2007, the Company is indebted to the President of the Company for $604, representing expenses paid on behalf of the Company. This amount is unsecured, non-interest bearing and has no repayment terms. |

F-8

-39-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

February 28, 2007

(Expressed in US dollars)

| | c) | On September 19, 2006, the Company issued 5,000,000 shares of common stock at $0.001 per share to the President of the Company for cash proceeds of $5,000. |

| |

Note 4. Mineral Property |

| |

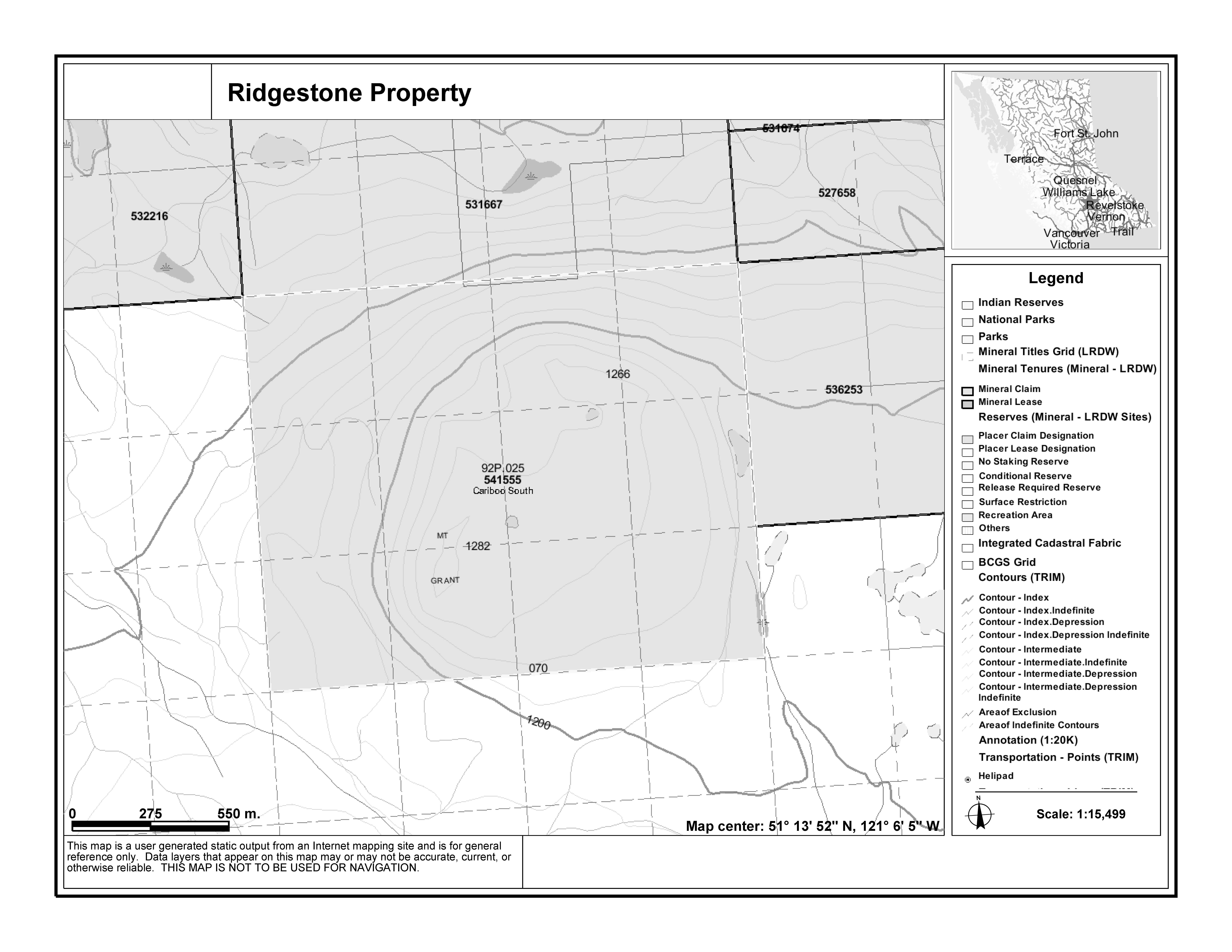

| | On September 21, 2006, the Company acquired a 100% interest in a Mineral Claim located in British Columbia, Canada, in consideration for $3,300. The claims are registered in the name of the President of the Company, who has executed a trust agreement whereby the President agreed to hold the claims in trust on behalf of the Company. There are situations that could prevent the Company from obtaining clear title to the mineral claims such as the bankruptcy or death of the President. The cost of the mineral property was initially capitalized. At February 28, 2007, the Company recognized an impairment loss of $3,300, as it has not yet been determined whether there are proven or probable reserves on the property. |

| |

Note 5. Common Stock |

| |

| | a) | On September 19, 2006, the Company issued 5,000,000 shares of common stock at $0.001 per share to the President of the Company for cash proceeds of $5,000. |

| | | |

| | b) | During the period ended February 28, 2007, the Company accepted stock subscriptions for 3,870,000 shares of common stock at $0.01 per share for cash proceeds of $38,700. The shares were issued on March 7, 2007. |

| |

Note 6. Commitment |

| |

| | The Company entered into an agreement dated September 19, 2006 to pay legal fees of up to $25,000 with respect to its incorporation and the preparation and filing of an SB-2 Registration Statement. The Company was to pay $15,000 upon commencement of services (which was paid in March 2007) and is obligated to pay an additional $10,000 once the SB-2 Registration Statement has been declared effective. The $15,000 costs incurred through February 28, 2007 has been charged $12,500 to additional paid-in capital and $2,500 to general and administrative expenses. |

| |

Note 7. Income Taxes |

| |

| | Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. At February 28, 2007, the Company has a net operating loss carryforward of approximately $5,000, which expires in 2027. Pursuant to SFAS No. 109 the Company is required to compute tax asset benefits for net operating losses carried forward. Potential benefit of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years. |

| |

| | The components of the net deferred tax asset at February 28, 2007 consists of: |

Net operating loss carryforward | $ | 1,750 |

Valuation allowance | | (1,750) |

| | | |

Total | $ | - |

| | A reconciliation of the expected income tax expense (benefit) computed by applying the statutory income tax rate to income (loss) before income taxes to the provision for (benefit from) income taxes follows: |

F-9

-40-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

February 28, 2007

(Expressed in US dollars)

Income tax expense (benefit) at statutory rate | $ | (4,122) |

Tax effect of nondeductible general and administrative expenses | | 2,372 |

Change in valuation allowance | | 1,750

|

| | | |

Provision for (benefit from) income taxes | $ | -

|

| | Current United States income tax laws limit the amount of loss available to be offset against future taxable income when a substantial change in ownership occurs. Therefore, the amount available to offset future taxable income may be limited. |

| |

Note 8. Subsequent Event |

| | |

| | Subsequent to February 28, 2007, the Company accepted additional stock subscriptions for 270,000 shares of common stock at $0.01 per share for cash proceeds of $2,700. The shares were issued on March 7, 2007. |

F-10

-41-

Until _______________, 2007, ninety days after the date of this prospectus, all dealers effecting transactions in our registered securities, whether or not participating in this distribution, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

-42-

PART II. INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 24. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

The only statute, charter provision, bylaw, contract, or other arrangement under which any controlling person, director or officer of the registrant is insured or indemnified in any manner against any liability which he may incur in his capacity as such, is as follows:

| | 1 | Article XII of the Articles of Incorporation of the company, filed as Exhibit 3.1 to our Form SB-2 registration statement. |

| | 2 | Article X of the Bylaws of the company, filed as Exhibit 3.2 to our Form SB-2 registration statement. |

| | 3 | Nevada Revised Statutes, Chapter 78. |

The general effect of the foregoing is to indemnify a control person, officer or director from liability, thereby making the company responsible for any expenses or damages incurred by such control person, officer or director in any action brought against them based on their conduct in such capacity, provided they did not engage in fraud or criminal activity.

ITEM 25. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION.

The estimated expenses of the offering, all of which are to be paid by the registrant, are as follows:

SEC Registration Fee | $ | 1.27 |

Printing Expenses | $ | 100.00 |

Accounting/Administrative Fees and Expenses | $ | 4,398.73 |

Blue Sky Fees/Expenses | $ | 0.00 |

Legal Fees/ Expenses | $ | 25,000.00 |

Escrow fees/Expenses | $ | 0.00 |

Transfer Agent Fees | $ | 0.00 |

Miscellaneous Expenses

| $

| 0.00

|

TOTAL

| $

| 29,500.00

|

-43-

ITEM 26. RECENT SALES OF UNREGISTERED SECURITIES.

Since inception, the registrant has sold the following securities which were not registered under the Securities Act of 1933, as amended.

a) | In September 2006, we issued 5,000,000 shares of common stock to Mr. Pardeep Sarai in consideration of $0.001 per share or a total of $5,000.00. |

| | |

b) | In March 2007, we issued 4,140,000 shares of common stock to forty-six individuals in consideration of $0.01 per share or a total of $41,400. |

We issued the foregoing 9,140,000 shares of common stock as restricted securities pursuant to Reg. S of the Securities Act of 1933 in that all of the sales took place outside the United States of America with non-US persons.

ITEM 27. EXHIBITS.

The following exhibits are filed with this Form SB-2 registration statement:

Exhibit No. | Document Description |

| | |

3.1 | Articles of Incorporation |

3.2 * | Bylaws |

4.1 * | Specimen Stock Certificate |

5.1 * | Opinion of Conrad C. Lysiak, Attorney at Law |

10.1 * | Trust Agreement |

23.1 * | Consent of Michael T. Studer CPA, P.C. |

23.2 * | Consent of Conrad C. Lysiak |

* Previously filed.

-44-

ITEM 28. UNDERTAKINGS.

We hereby undertake:

(1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

| | (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| |

| | (ii) | To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective Registration Statement; and |

| |

| | (iii) | To include any additional or changed material information on the plan of distribution. |

| |

(2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time to be the initial bona fide offering thereof. |

| |

(3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| |

(4) | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. |

-45-

(5) | For determining any liability under the Securities Act of 1933: |

| |

| | (i) | we shall treat the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by us under Rule 424(b)(1), or (4) or 497(h) under the Securities Act as part of this registration statement as of the time the Commission declared it effective. For determining any liability under the Securities Act of 1933, we shall treat each post-effective amendment that contains a form of prospectus as a new registration statement for the securities offered in the registration statement, and that offering of the securities at that time as the initial bona fide offering of those securities. |

| |

| | (ii) | we shall treat each prospectus filed by us pursuant to Rule 424(b)(3) as part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement. Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registra tion statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or |

| |

| | (iii) | we shall treat each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

-46-

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing of this Form SB-2 Registration Statement and has duly caused this Form SB-2 Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in New Westminster, British Columbia, Canada on this 13th of June, 2007.

| RIDGESTONE RESOURCES, INC. |

| | |

| | BY: | PARDEEP SARAI |

| | | Pardeep Sarai |

| | | President, Principal Executive Officer, Secretary, Treasurer, Principal Financial Officer, Principal Accounting Officer, and sole member of the Board of Directors |

-47-