UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED FEBRUARY 29, 2008

Commission file number333-143439

RIDGESTONE RESOURCES, INC.

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

1806 London Street

New Westminster, British Columbia

Canada V3M 3E3

(Address of principal executive offices, including zip code.)

(778) 227-0111

(telephone number, including area code)

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ¨ Nox |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:Yes¨ Nox |

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | | ¨ | | | | Accelerated filer | | ¨ | | |

| Non-accelerated filer | | ¨ | | | | Smaller reporting company | | x | | |

| (Do not check if a smaller reporting company) | | | | | | |

| |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).YesxNo¨ |

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as ofFebruary 29, 2008: $0.00.

| TABLE OF CONTENTS |

| |

| | | | | Page |

| | | | |

|

| |

| | | PART I | | |

| Item 1. | | Business. | | 3 |

| Item 1A. | | Risk Factors. | | 8 |

| Item 1B. | | Unresolved Staff Comments. | | 8 |

| Item 2. | | Properties. | | 8 |

| Item 3. | | Legal Proceedings. | | 12 |

| Item 4. | | Submission of Matters to a Vote of Security Holders. | | 12 |

| |

| | | PART II | | |

| Item 5. | | Market Price for the Registrant’s Common Equity, Related Stockholders Matters and Issuer | | 12 |

| | | Purchases of Equity Securities. | | |

| Item 6. | | Selected Financial Data. | | 14 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operation. | | 14 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk. | | 17 |

| Item 8. | | Financial Statements and Supplementary Data. | | 17 |

| Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | | 29 |

| |

| | | PART III | | |

| Item 9A. | | Controls and Procedures. | | 29 |

| Item 9B. | | Other Information. | | 30 |

| Item 10. | | Directors and Executive Officers, Promoters and Control Persons. | | 31 |

| Item 11. | | Executive Compensation. | | 33 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management. | | 34 |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence. | | 34 |

| Item 14. | | Principal Accounting Fees and Services. | | 35 |

| |

| | | PART IV | | |

| Item 15. | | Exhibits and Financial Statement Schedules. | | 36 |

-2-

PART I.

ITEM 1. BUSINESS.

General

We were incorporated in the State of Nevada on September 12, 2006. We are an exploration stage corporation. We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. The Mt. Grant mineral claim is comprised of 12 contiguous cells totaling 600 acres. The mineral claim area may be located on the NTS map sheet, 92P/3. At the center of the property the latitude is 51o 13' 52" N and the longitude is 121o 6' 5" W. The claim is motor vehicle accessible from the Village of 70 Mile House, British Columbia by traveling 17 miles east southeast along the Upper Loon Lake gravel ranch road to the mineral claim. We intend to explore for gold on the property. Our exploration program should take approximately 365 days, weather permitting. If we do not find mineralized material on the property, we do not know what we will do.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans. Currently, we do not intend to acquire other interests in any other mineral properties. Our business plan is solely to explore one mineral property. If we are successful in our initial endeavors, we may look at other exploration situations.

We have not conducted phase one of our exploration program, but we will continue to maintain the Ridgestone property in good standing for the time being, but will not be able to pursue exploration unless our financial circumstances change. We will seek alternative asset acquisition opportunities in order to potentially enhance shareholder value.

We are currently negotiating the possible license acquisition of a development stage company that limits emissions emanating from the Internal Combustion Engine (ICE). The company has completed its first generation Onboard Hydrogen Generating (OHG) technology that permits any ICE, independent of fuel source (gasoline, diesel, ethanol, propane, and natural gas) to operate with reduced emissions. Although negotiations with this group are in the advanced stages, there is no guarantee that they will complete an acquisition of its assets, or of any other significant assets.

Management intends to review other potential assets for acquisition.

Background

In September 2006, Pardeep Sarai, our president and sole member of the board of directors acquired one mineral property containing twelve Mineral Titles Online cells in British Columbia, Canada. British Columbia allows a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by registering the claim area on the British Columbia Mineral Titles Online system. The Mineral Titles Online system is the Internet-based British Columbia system used to register, maintain and manage the claims. A cell is an area which appears electronically on the British Columbia Internet Minerals Titles Online Grid and was formerly called a claim. A claim is a grant from the Crown of the available land within the cells to the holder to remove and sell minerals. The online grid is the geographical basis for the cell. Formerly, the claim was established by sticking stakes in the groun d to define the area and then recording the staking information. The staking system is now antiquated in British Columbia and has been replaced with the online grid. The property was registered by James McLeod, a non affiliated third party. Mr. McLeod is a self-employed contract staker and field worker residing in Vancouver, British Columbia.

-3-

The claim is recorded in the name of Mr. Sarai, one of our officers and directors, to avoid paying additional fees. Mr. McLeod, a Vancouver geologist, suggested that the property be held in Mr. Sarai’s name and we concurred therein. The property was selected by Mr. Sarai after consulting with Mr. McLeod. Mr. McLeod was paid $3,300 to stake the claim. No money was paid to Mr. Sarai to hold the claim. No money will be paid to Mr. Sarai to transfer the property to us. Mr. Sarai has executed a declaration of trust wherein he has agreed to hold the property for us and will deliver title upon our demand. Mr. Sarai has not provided us with a signed or executed bill of sale in our favor as of the date of this prospectus. Mr. Sarai will issue a bill of sale to a subsidiary corporation to be formed by us should mineralized material be discovered on the property.

Under British Columbia law, title to British Columbia mineral claims can only be held by British Columbia residents. In the case of corporations, title must be held by a British Columbia corporation. Since we are an American corporation, we can never possess legal mineral claim to the land. In order to comply with the law we would have to incorporate a British Columbia wholly owned subsidiary corporation and obtain audited financial statements. We believe those costs would be a waste of our money at this time because the legal costs of incorporating a subsidiary corporation, the accounting costs of audited financial statements for the subsidiary corporation, together with the legal and accounting costs of expanding this registration statement would cost several thousands of dollars. Accordingly, we have elected not to create the subsidiary at this time, but will do so if mineralized material is disco vered on the property.

In the event that we find mineralized material and the mineralized material can be economically extracted, we will form a wholly owned British Columbia subsidiary corporation and Mr. Sarai will convey title to the property to the wholly owned subsidiary corporation. Should Mr. Sarai transfer title to another person and that deed is recorded before we record our documents, that other person will have superior title and we will have none. If that event occurs, we will have to cease or suspend activities and we will have no cause of action against Mr. Sarai. Mr. Sarai has agreed verbally with us not to cause the title to pass to another entity.

To date we have not performed any work on the property. All Canadian lands and minerals which have not been granted to private persons are owned by either the federal or provincial governments in the name of Her Majesty Elizabeth II. Ungranted minerals are commonly known as Crown minerals. Ownership rights to Crown minerals are vested by the Canadian Constitution in the province where the minerals are located. In the case of our property, that is the province of British Columbia.

In the nineteenth century, the practice of reserving the minerals from fee simple Crown grants was established. Legislation now ensures that minerals are reserved from Crown land dispositions. The result is that the Crown is the largest mineral owner in Canada, both as the fee simple owner of Crown lands and through mineral reservations in Crown grants. Most privately held mineral titles are acquired directly from the Crown. Our property is one such acquisition. Accordingly, fee simple title to our property resides with the Crown. That means that the Crown owns the surface and minerals.

Our claim is a mineral lease issued pursuant to the British Columbia Mineral Act. The lessee has exclusive rights to mine and recover all of the minerals contained within the surface boundaries of the lease continued vertically downward.

The property is unencumbered, that is there are no claims, liens, charges or liabilities against the property, and there are no competitive conditions, that is the action of some unaffiliated third party, that could affect the property. Further, there is no insurance covering the property and we believe that no insurance is necessary since the property is unimproved and contains no buildings or improvements.

-4-

To date we have not performed any work on the property. Accordingly, there is no assurance that a commercially viable mineral deposit, a reserve, exists in the property; in fact, the likelihood that a commercially viable mineral deposit exists is remote.

There are no native land claims that affect title to the property. We have no plans to try to interest other companies in the property if mineralization is found. If mineralization is found, we will try to develop the property ourselves.

Mr. McLeod suggested purchasing the claim to Mr. Sarai. Mr. Sarai, after reviewing the matter with Mr. McLeod, agreed and accordingly it was decided to proceed with the project as discussed herein.

Our Proposed Exploration Program

We are prospecting for gold. Our target is mineralized material. Our success depends upon finding mineralized material. Mineralized material is a mineralized body which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we do not find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease activities and you will lose your investment. We anticipate being able to delineate a mineralized body, if one exists, within nine months of beginning exploration.

We do not own any interest in any property, but merely have the right to conduct exploration activities on one property.

In addition, we may not have enough money to complete our exploration of the property. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and cannot raise it, we will have to suspend or cease activities.

We must conduct exploration to determine what amount of minerals, if any, exist on the property and if any minerals which are found can be economically extracted and profitably processed.

The property is undeveloped raw land. To our knowledge, no previous exploration activities have taken place on the property. The only event that has occurred is the staking of the property by Mr. McLeod, a physical examination of the property and five days of staking and prospecting. Mr. McLeod examined the surface and took samples. The samples did not reveal anything. Mr. McLeod used a hammer, pick and sack to take samples. While Mr. McLeod is a geologist, he is not an engineer, and accordingly his area of expertise is limited to geological matters. Mr. McLeod did not use any previous filed reports on the property. Before gold retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized mat erial will not exceed the price at which we can sell the mineralized material. We cannot predict what that will be until we find mineralized material.

We do not know if we will find mineralized material.

Our exploration program is designed to economically explore and evaluate the property.

We do not claim to have any minerals or reserves whatsoever at this time on any of the property.

-5-

We intend to implement an exploration program which consists of core sampling. Core sampling is the process of drilling holes to a depth of up to 1,400 feet in order to extract a samples of earth. Mr. Sarai and the consultant we hire will determine where drilling will occur on the property. The samples will be tested to determine if mineralized material is located on the property. Based upon the tests of the core samples, we will determine if we will terminate activities; proceed with additional exploration of the property; or develop the property.

We estimate the cost of core sampling will be $20 per foot drilled. A drilling rig is required to take the core samples. The cost of the drilling rig is included in the drilling cost per foot. We will drill approximately 1,000 linear feet or ten holes. We estimate that it will take up to three months to drill the holes to a depth of 100 feet. We will pay an exploration consultant up to a maximum of $5,000 per month for his services during the three month period or a total of $15,000. The consultant will be responsible for managing the project, supervising the core sampling, and hiring subcontractors to perform work on the property. Our employees will not have involvement in the work performed, but will be overseeing everything. The total cost for analyzing the core samples will be $3,000.

The breakdown of estimated times and dollars was made by Mr. Sarai in consultation with Mr. McLeod.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves.

If we are unable to complete exploration because we do not have enough money, we will cease activities until we raise more money. If we cannot or do not raise more money, we will cease activities. If we cease activities, we don't know what we will do and we don't have any plans to do anything else.

We cannot provide you with a more detailed discussion of how our exploration program will work and what we expect will be our likelihood of success. That is because we have a piece of raw land and we intend to look for mineralized material. We may or may not find any mineralized material. We hope we do, but it is impossible to predict the likelihood of such an event.

We do not have any plan to make our company to revenue generation. That is because we have not found economic mineralization yet and it is impossible to project revenue generation from nothing.

We completed our public offering on March 7, 2007 by raising $41,400. Work on our property can only be performed approximately five to six months out of the year. This is because rain and snow cause the roads leading to our claims to be impassible during six to seven months of the year. When roads are impassible, we are unable to conduct exploration operations on the property which will delay the generation of possible revenues by us. Therefore, we plan on beginning our exploration work in the late spring of 2008.

If we do not find mineralized material on the property, Mr. Sarai will allow the claim to expire and we will cease activities.

Competitive Factors

The gold mining industry is fragmented. We compete with other exploration companies looking for gold. We are one of the smallest exploration companies in existence. We are an infinitely small participant in the gold mining market. While we compete with other exploration companies, there is no competition for the exploration or removal or mineral from our property. Readily available gold markets exist in Canada and around the world for the sale of gold. Therefore, we will be able to sell any gold that we are able to recover.

-6-

Regulations

Our mineral exploration program is subject to the British Columbia Mineral Tenure Act Regulation. This act sets forth rules for

| * | locating claims |

| |

| * | working claims |

| |

| * | reporting work performed |

| |

We are also subject to the British Columbia Mineral Exploration Code which tells us how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our activities. These regulations will not impact our exploration activities. The only current costs we anticipate at this time are reclamation costs. Reclamation costs are the costs of restoring the property to its original condition should mineralized material not be found. We estimate that it will cost between $3,000 and $9,000 to restore the property to its original condition, should mineralized material not be found. The variance is based upon the number of holes that are drilled by us.

Environmental Law

We are also subject to the Health, Safety and Reclamation Code for Mines in British Columbia. This code deals with environmental matters relating to the exploration and development of mineral properties. Its goals are to protect the environment through a series of regulations affecting:

| 1. | Health and Safety |

| |

| 2. | Archaeological Sites |

| |

| 3. | Exploration Access |

| |

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mineral activities. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our activities and know what that will involve from an environmental standpoint.

We are in compliance with the Act and will continue to comply with the Act in the future. We believe that compliance with the act will not adversely affect our business activities in the future.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only “cost and effect” of compliance with environmental regulations in British Columbia is returning the surface to its previous condition upon abandonment of the property. We cannot speculate on those costs in light of our ongoing plans for exploration. When we are ready to drill, we will notify the British Columbia Inspector of Mines. He will require a bond to be put in place to assure that the property will be restored to its original condition. We have estimated the cost of restoring the property to be between $3,000 to $9,000, depending upon the number of holes drilled.

-7-

Subcontractors

We intend to use the services of subcontractors for manual labor exploration work on our properties.

Employees and Employment Agreements

At present, we have no employees, other than our sole officer and director, Mr Sarai. Mr. Sarai is a part-time employee and will devote about 10% of his time to our operation. Mr. Sarai does not have an employment agreement with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our sole officer and director. Mr. Sarai will handle our administrative duties. Because Mr. Sarai is inexperienced with exploration, he will hire qualified persons to perform the surveying, exploration, and excavating of our property. As of today, we have not looked for or talked to any geologists or engineers who will perform work for us in the future.

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 2. PROPERTIES.

Claims

We own no property, but merely the right to explore the Mt. Grant claim. The following is a list of tenure numbers, name of the claim, date of recording and expiration date of claim which we intend to explore:

| Tenure No. | | Name | | Recording | | Expiration |

| 541555 | | Mt. Grant | | September 18, 2006 | | September 18, 2008 |

The property was selected because gold and platinum have been discovered in the area.

The Mt. Grant property consists of one located mineral claim comprising a total of 12 contiguous 3X4 block.

Location and Access

The Mt. Grant mineral claim is comprised of 12 contiguous cells totaling 600 acres. The mineral claim area may be located on the NTS map sheet, 92P/3. At the center of the property the latitude is 51o 13' 52" N and the longitude is 121o 6'5" W. The claim is motor vehicle accessible from the Village of 70 Mile House, British Columbia by traveling 17 miles east southeast along the Upper Loon Lake gravel ranch road to the mineral claim.

-8-

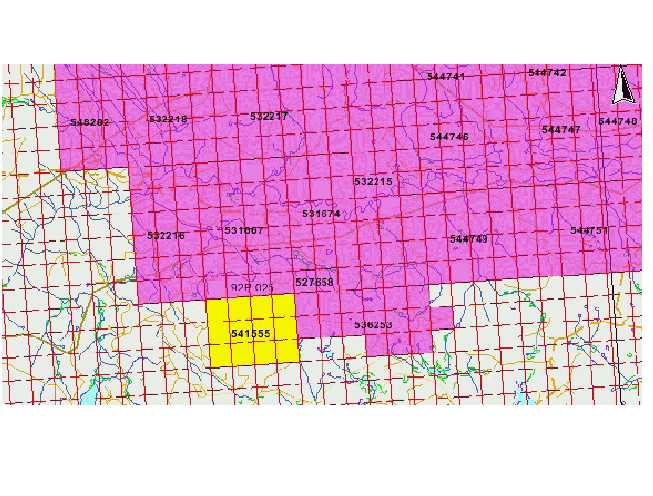

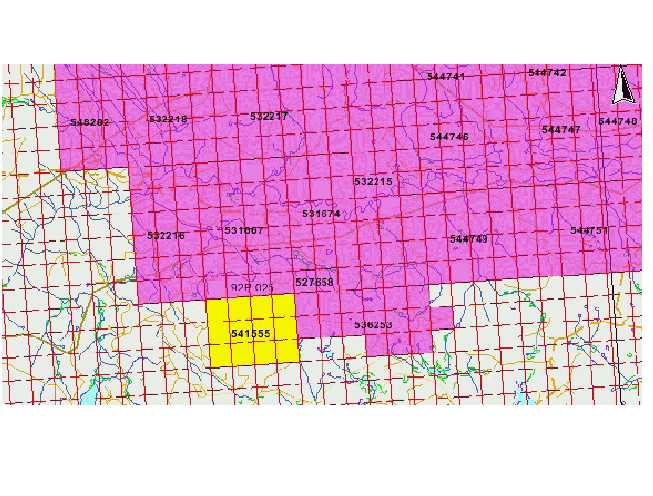

Map One

-9-

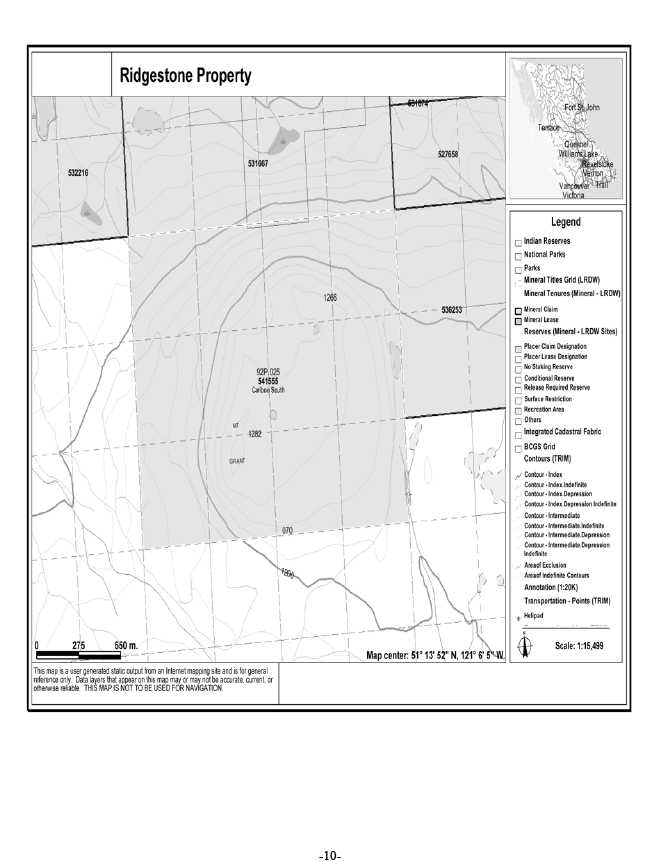

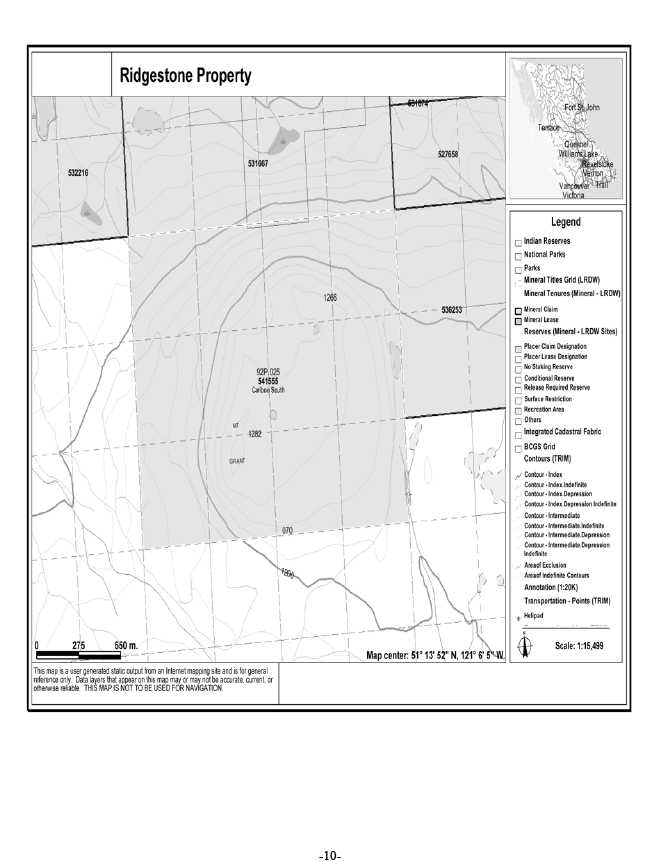

Map Two

Physiography

The Mt. Grant property lies in the interior plateau of the province and within the Cariboo Parkland biotic or life zone of British Columbia. The area experiences about 20" - 30" of precipitation annually of which about 25% may occur as a snow equivalent. The summers can experience hot weather while the winters are generally more severe than the dry belt to the east and can last from November through March. Much of this area of the interior plateau, with its rolling hills, hosts clusters of lodgepole pine with similar stands of aspen. Douglas fir and Engelmann spruce round out the other conifer cover, but in lesser abundance. The general area supports an active logging industry. Mining holds a historical and contemporary place in the development and economic well being of the area.

The Town of 100 Mile House and the City of Kamloops, British Columbia lie 46 miles and 86 miles by road southwest and southeast of the Mt. Grant mineral claim, respectively. Each offer much of the necessary infrastructure required to base and carry-out an exploration program, including accommodations, communications, equipment and supplies. Kamloops, British Columbia is highway accessible from Vancouver, British Columbia in a few hours by traveling over the Coquihalla highway. Kamloops has a good airport and the overnight Greyhound bus service is a popular way to send-in samples and to receive additional equipment and supplies.

The claim area ranges in elevation from 3,800 feet to 4,216 feet mean sea level, the high point being Mt. Grant. The physiographic setting of the property can be described as rounded, open range pockets among the clusters of conifer comprised of evergreens and aspens in a plateau setting. The area has been surficially altered both by the erosional and the depositional or drift cover effects of glaciation. Thickness of drift cover in the valleys may vary considerably. Fresh water lakes and small streams are abundant in the area.

Regional Geology

The area is seen to be underlain by rock units ranging in age from the Pennsylvanian to the Miocene and being mainly of volcanic origin, although some of the older units are of intrusive and sedimentary origin. The older units are only found along the deep incisions found along some of the deeper creek valleys, i.e. the Deadman River and Loon Creek. The younger Eocene - Miocene aged volcanic flow rock units are observed in the area and alkali basalt flows of Miocene age occur as cap rocks in the general area.

Local Geology

The local geological portrays the extensiveness of the basalt flows in the southern part of the pervasive and widespread occurrences to the north, an area covering thousands of square miles. Olivine basalt occurrences appear along the Bonaparte River, Loon Creek and the Deadman River valleys and arrived at an estimated thickness of approximately 1,600 feet. They are thought to lie upon faulted bedrock of Pennsylvanian age and younger.

Property Geology

The geology of the Mt. Grant property area may be described as being overlain by generally thick Tertiary basalt flows of Eocene - Miocene age. The olivine basalts of the Chasm Formation are the youngest rocks found on the property and throughout the local area. These flows have covered the next youngest units of the Deadman River Formation that hosts the ash and diatomaceous earth occurrences, as well as other water borne younger sediments, such as siltstone, shale, sandstone and conglomerate.

-11-

Mineralization

Places within the general area pyrite-pyrrhotite-chalcopyrite mineralization as mesothermal replacements or vein-type of occurrences that lie peripheral to the porphyry-type occurrence in the volcanic tuffs (as volcanic skarn). These occurrences appear in the massive volcanic units and in medium grain-sized intrusive rock within steeply dipping to vertical fissure/fault zones with some dissemination in the adjacent wallrock. Alteration accompanying the pyritization is often observed as epidote-chlorite-calcite or as a propylitic assemblage.

History of Previous Work

To our knowledge, there has never been exploration activity on the property.

ITEM 3. LEGAL PROCEEDINGS.

We are not presently a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

During the fourth quarter, there were no matters submitted to a vote of our shareholders.

| | | PART II |

| |

| ITEM 5. | | MARKET PRICE FOR THE REGISTRANT’S COMMON EQUITY, RELATEDSTOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our shares are traded on the Bulletin Board operated by the Federal Industry Regulatory Authority under the symbol “RDTR.” A summary of trading by quarter for 2007 fiscal years is as follows:

| | | High Bid | | Low Bid |

| | | | |

|

| Fourth Quarter 12-01-07 to 2-29-08 | | $0 | | $0 |

| Third Quarter 9-01-07 to 11-30-07 | | $0 | | $0 |

| Second Quarter 6-01-07 to 8-31-07 | | $0 | | $0 |

| First Quarter 3-01-07 to 5-31-07 | | $0 | | $0 |

| |

| Fourth Quarter 12-01-06 to 2-28-07 | | $0 | | $0 |

| Third Quarter 9-01-06 to 11-30-06 | | $0 | | $0 |

| Second Quarter 6-01-06 to 8-31-06 | | $0 | | $0 |

| First Quarter 3-01-06 to 5-31-06 | | $0 | | $0 |

On May 17, 2008, we completed a seven-for-one stock split. The par value of the common stock will remain $0.00001 per share and the number of authorized shares of common stock and preferred stock will remain 100,000,000 shares each. The information contained in this report reflects the stock split.

In September 2006, we issued a total of 35,000,000 shares of restricted common stock to our sole officer and director in consideration of $5,000.

-12-

In March 2007, we issued 28,980,000 shares of common stock to forty-six individuals in consideration of $0.00143 per share or a total of $41,400. All of the shares were issued pursuant to Regulation S of the Securities Act of 1933 in that all of the shares were sold outside the United States of America to non-US persons. Further, no commissions were paid to anyone in connection with the sale of the shares and general solicitation was made to anyone.

Cash Dividends

As of the date of this report, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Section Rule 15(g)of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended, and Rules 15g-1 through 15g-6, and 15g-9 promulgated thereunder. They impose additional sales practice requirements on broker-dealers who sell our securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses).

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules.

Rule 15g-2 declares unlawful broker-dealer transactions in penny stocks unless the broker-dealer has first provided to the customer a standardized disclosure document.

Rule 15g-3 provides that it is unlawful for a broker-dealer to engage in a penny stock transaction unless the broker-dealer first discloses and subsequently confirms to the customer current quotation prices or similar market information concerning the penny stock in question.

Rule 15g-4 prohibits broker-dealers from completing penny stock transactions for a customer unless the broker-dealer first discloses to the customer the amount of compensation or other remuneration received as a result of the penny stock transaction.

Rule 15g-5 requires that a broker-dealer executing a penny stock transaction, other than one exempt under Rule 15g-1, disclose to its customer, at the time of or prior to the transaction, information about the sales persons compensation.

Rule 15g-6 requires broker-dealers selling penny stocks to provide their customers with monthly account statements.

Rule 15g-9 requires broker-dealers to approve the transaction for the customer’s account; obtain a written agreement from the customer setting forth the identity and quantity of the stock being purchased; obtain from the customer information regarding his investment experience; make a determination that the investment is suitable for the investor; deliver to the customer a written statement for the basis for the suitability determination; notify the customer of his rights and remedies in cases of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker-dealers and their associated persons.

The application of the penny stock rules may affect your ability to resell your shares.

-13-

Securities authorized for issuance under equity compensation plans

We do not have any equity compensation plans and accordingly we have no securities authorized for issuance thereunder.

ITEM 6. SELECTED FINANCIAL DATA.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| ITEM 7. | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION ANDRESULTS OF OPERATIONS. |

This section of the report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business activities.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals. Accordingly, we must raise cash from sources other than the sale of minerals found on the property. Our only other source for cash at this time is investment by others in our complete private placement. The cash we raised will allow us to stay in business for at least one year. Our success or failure will be determined by what we find under the ground.

To meet our need for cash we raised money from our private placement. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we do not have enough money to complete our exploration of the property, we will have to find alternative sources, like a second public offering, a private placement of securities, or loans from our officers or others.

Our sole officer and director is unwilling to make any commitment to loan us any money at this time. At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and can't raise it, we will either have to suspend activities until we do raise the cash, or cease activities entirely. Other than as described in this paragraph, we have no other financing plans.

We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. Even if we complete our current exploration program and it is successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit, a reserve.

-14-

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of this report. We are not going to buy or sell any plant or significant equipment during the next twelve months. We will not buy any equipment until have located a reserve and we have determined it is economical to extract the minerals from the land.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves.

If we are unable to complete any phase of exploration because we don’t have enough money, we will cease activities until we raise more money. If we can’t or don’t raise more money, we will cease activities. If we cease activities, we don’t know what we will do and we don’t have any plans to do anything.

We do not intend to hire additional employees at this time. All of the work on the property will be conduct by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Milestones

The following are our milestones:

1. Spring 2008 - We will retain a consultant to manage the exploration of the property. There are a number of mining consultants located in Vancouver, British Columbia that we intend to interview. At this time, we have not hired a consultant. We believe that the cost will run between $5,000 and $15,000. We are allowing 90 days to interview and hire our consultant.

2. Summer 2008 - core drilling. Core drilling will cost $20 per foot. We plan to drill 15 holes to a depth of 100 feet. The total cost will be $30,000. Core drilling will be subcontracted to non-affiliated third parties. No power source is needed for core drilling. The drilling rig operates on diesel fuel. All electric power needed, for light and heating while on the property will be generated from gasoline powered generators. Time to conduct the core drilling - 120 days.

3. Fall 2008 - have an independent third party analyze the samples from the core drilling. Determine if mineralized material is below the ground. If mineralized material is found, define the body. We estimate that it will cost $4,500 to analyze the core samples and will take 30 days.

All funds for the foregoing activities have been obtained from our private placement.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from activities. We cannot guarantee we will be successful in our business activities. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we conduct research and exploration of our properties before we start production of any minerals we may find. We are seeking equity financing to provide for the capital required to implement our research and exploration phases.

-15-

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our activities. Equity financing could result in additional dilution to existing shareholders.

Results of Activities

From Inception on September 12, 2006

We acquired the right to explore one property containing twelve cells. We do not own any interest in any property, but merely have the right to conduct exploration activities on one property. We have staked the property and will begin our exploration in the Spring of 2008.

Liquidity and Capital Resources

As of the date of this report, we have yet to generate any revenues from our business activities.

We issued 35,000,000 shares of common stock through a private placement pursuant to Regulation S of the Securities Act of 1933 to Pardeep Sarai, our sole officer and director in September 2006, in consideration of $5,000. The shares were sold to non-US persons and all transactions closed outside the United States of America. This was accounted for as a purchase of shares of common stock.

In March 2007, we completed a private placement of 28,980,000 restricted shares of common stock pursuant to Reg. S of the Securities Act of 1933 and raised $41,400. All of the shares were sold to non-US persons and all transactions closed outside the United States of America. This was accounted for as a purchase of shares of common stock.

As of February 29, 2008, our total assets were $688 and our total liabilities were $12,673.

Recent accounting pronouncements

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, "The Fair Value Option for Financial Assets and Financial Liabilities - Including an amendment of FASB Statement No. 115" (hereinafter "SFAS No. 159"). This statement permits entities to choose to measure many financial instruments and certain other items at fair value. The objective is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. This Statement is expected to expand the use of fair value measurement, which is consistent with the Board's long-term measurement objectives for accounting for financial instruments. This statement is effective as of the beginning of an entity's first fiscal year that begins after November 15, 2007, although earlier adoption is permitted. Management has not determined the effect that adopting this statement would have on the Company's financial condition or results of operation.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106, and 132(R)”. This statement requires employers to recognize the overfunded or underfunded status of a defined benefit postretirement plan (other than a multiemployer plan) as an asset or liability in its statement of financial position and to recognize changes in that funded status in the year in which the changes occur through comprehensive income of a business entity or changes in unrestricted net assets of a not-for-profit organization. This statement also requires an employer to measure the funded status of a plan as of the date of its year- end statement of financial position, with limited exceptions. The provisions of SFAS No. 158 are effective for employers with publicly traded equity securities as of the end of the fiscal year ending after December 15, 2006. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations.

-16-

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements”. The objective of SFAS No. 157 is to increase consistency and comparability in fair value measurements and to expand disclosures about fair value measurements. SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS No. 157 applies under other accounting pronouncements that require or permit fair value measurements and does not require any new fair value measurements. The provisions of SFAS No. 157 are effective for fair value measurements made in fiscal years beginning after November 15, 2007. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations.

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB InterpretationNo. 48,“Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statements No. 109”. FIN 48 clarifies the accounting for uncertainty in income taxes by prescribing a two-step method of first evaluating whether a tax position has met a more likely than not recognition threshold and second, measuring that tax position to determine the amount of benefit to be recognized in the financial statements. FIN 48 provides guidance on the presentation of such positions within a classified statement of financial position as well as on derecognition, interest and pen alties, accounting in interim periods, disclosure, and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| ITEM 8. | | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. | | |

| |

| Audit Opinion | | F-1 |

| Balance Sheets | | F-2 |

| Statements of Operations | | F-3 |

| Statement of Stockholders’ Equity | | F-4 |

| Statements of Cash Flows | | F-5 |

| Notes to Financial Statements | | F-6 |

-17-

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

'To the Board of Directors and Stockholders of

Ridgestone Resources, Inc.

I have audited the accompanying balance sheets of Ridgestone Resources, Inc. (the Company), an exploration stage company, as of February 29, 2008 and 2007 and the related statements of operations, stockholders’ equity and cash flows for the year ended February 29, 2008, for the period September 12, 2006 (inception) to February 28, 2007, and for the period September 12, 2006 (inception) to February 29, 2008. These financial statements are the responsibility of the Company’s management. My responsibility is to express an opinion on these financial statements based on my audits.

I conducted my audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audits provide a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Ridgestone Resources, Inc., an exploration stage company, as of February 29, 2008 and 2007 and the results of its operations and its cash flows for the year ended February 29, 2008, for the period September 12, 2006 (inception) to February 28, 2007, and for the period September 12, 2006 (inception) to February 29, 2008 in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements referred to above have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company’s present financial situation raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to this matter are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MICHAEL T. STUDER CPA P.C.

Michael T. Studer CPA P.C. |

Freeport, New York

May 21, 2008

F-1

-18-

| Ridgestone Resources, Inc. | | | | | | |

| (An Exploration Stage Company) | | | | | | |

| Balance Sheets | | | | | | |

| (Expressed in US Dollars) | | | | | | |

| |

| |

| | | February 29, | | | February 28, | |

| | | 2008 | | | 2007 | |

| |

| ASSETS |

| Current Assets | | | | | | |

| Cash | $ | 688 | | $ | 39,827 | |

| Total Assets | $ | 688 | | $ | 39,827 | |

| |

| |

| |

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current Liabilities | | | | | | |

| Accounts payable and accrued liabilities | $ | 6,163 | | $ | 15,300 | |

| Due to related parties | | 6,510 | | | 604 | |

| Total current liabilities | | 12,673 | | | 15,904 | |

| |

| |

| Stockholders' Equity | | | | | | |

| Preferred Stock, $0.00001 par value; | | | | | | |

| authorized 100,000,000 shares, none issued and outstanding | | - | | | - | |

| Common Stock, $0.00001 par value; authorized 100,000,000 shares, | | | | | | |

| issued and outstanding | | | | | | |

| 63,980,000 and 62,090,000 shares , respectively | | 91 | | | 89 | |

| Additional paid-in capital | | 37,309 | | | 35,611 | |

| Deficit accumulated during the exploration stage | | (49,385 | ) | | (11,777 | ) |

| Total stockholders' equity | | (11,985 | ) | | 23,923 | |

| Total Liabilities and Stockholders' Equity | $ | 688 | | $ | 39,827 | |

| |

| See notes to financial statements. | | | | | | |

F-2

-19-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Statements of Operations

(Expressed in US Dollars)

| | | | | | Period from | | | | Period from | | |

| | | | | | September 12, | | | | September 12, | | |

| | | | | | 2006 (Date of | | | | 2006 (Date of | | |

| | For the year | | | | Inception) To | | | | Inception) To | | |

| | ended February | | | | February 28, | | | | February 29, | | |

| | 29, 2008 | | | | 2007 | | | | 2008 | | |

| Revenue | $ | - | | | $ | - | | $ | | - | | |

| | |

| Costs and expenses | | | | | | | | | | | | |

| General and administrative expenses | | 36,571 | | | | 8,447 | | | | 45,018 | | |

| Impairment of mineral property costs | | - | | | | 3,300 | | | | 3,300 | | |

| Mineral property exploration and carrying costs | | 1,037 | | | | 30 | | | | 1,067 | | |

| Total costs and expenses | | 37,608 | | | | 11,777 | | | | 49,385 | | |

| Net Loss | $ | (37,608 | ) | | | (11,777 | ) | $ | | (49,385 | ) | |

| | |

| Net loss per share | | | | | | | | | | | | |

| Basic and diluted | $ | (0.00 | ) | | $ | (0.00 | ) | | | | | |

| | |

| | |

| Weighted Average Shares Outstanding | | | | | | | | | | | | |

| Basic and Diluted | | 63,945,000 | | | | 33,747,000 | | | | | | |

| | |

| See notes to financial statements. | | | | | | | | | | | | |

F-3

-20-

| Ridgestone Resources, Inc. | | | | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | | | | |

| Statement of Stockholders' Equity | | | | | | | | | | | | |

| For the Period September 12, 2006 (Inception) to February 29, 2008 | | | | | | | | | |

| (Expressed in US Dollars) | | | | | | | | | | | | |

| |

| |

| | | | | | | | | | Deficit | | | |

| | | | | | | | | | Accumulated | | | |

| | Common Stock, | | | Additional | | | During the | | | |

| | $0.00001 par value | | | paid-in | | | Exploration | | | |

| | Shares | | Amount | | | capital | | | Stage | | Total | |

| |

| |

| Commonsharessold for cash at $0.00014 per | 35,000,000 | $ | 350 | $ | | 4,950 | | $ | - $ | | 5,300 | |

| share | | | | | | | | | | | | |

| Common shares sold for cash at $0.00143 per | | | | | | | | | | | | |

| share, less offering costs of $12,500 | 27,090,000 | | 39 | | | 26,161 | | | - | | 26,200 | |

| Donated services and expenses | - | | - | | | 4,500 | | | - | | 4,500 | |

| Net Loss | - | | - | | | - | | | (11,777 | ) | (11,777 | ) |

| |

| Balance - February 28, 2007 | 62,090,000 | | 389 | | | 35,611 | | | (11,777 | ) | 24,223 | |

| Common stock issued for cash at 0.00143 per | | | | | | | | | | | | |

| share less offering costs of $10,000 | 1,890,000 | | 2 | | | (7,302 | ) | | - | | (7,300 | ) |

| Donated services and expenses | - | | - | | | 9,000 | | | - | | 9,000 | |

| Net Loss | - | | - | | | - | | | (37,608 | ) | (37,608 | ) |

| |

| Balance - February 29, 2008 | 63,980,000 | $ | 391 | $ | | 37,309 | | $ | (49,385 | ) $ | (11,685 | ) |

See notes to financial statements.

F-4

-21-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

Statements of Cash Flows

(Expressed in US Dollars)

| | | | | | | Period from | | | Period from | |

| | | | | | | September 12, | | | September 12, | |

| | | | | | | 2006 (Date of | | | 2006 (Date of | |

| | | | For the year | | | Inception) To | | | Inception) To | |

| | | | ended February | | | February 28, | | | February 29, | |

| | | | 29, 2008 | | | 2007 | | | 2008 | |

| |

| |

| | Cash Flows from Operating Activities | | | | | | | | | |

| | Net loss | $ | (37,608 | ) | $ | (11,777 | ) | $ | (49,385 | ) |

| | Adjustments to reconcile net loss | | | | | | | | | |

| | to net cash provided by (used for) operating | | | | | | | | | |

| | activities | | | | | | | | | |

| | Donated services and expenses | | 9,000 | | | 4,500 | | | 13,500 | |

| | Impairment of mineral property costs | | - | | | 3,300 | | | 3,300 | |

| | Change in operating assets and liabilities: | | | | | | | | | |

| | Accounts payable and accrued liabilities | | (9,137 | ) | | 15,300 | | | 6,163 | |

| | Due to related parties | | 5,906 | | | 604 | | | 6,510 | |

| | Net cash provided by (used for) operating activities | | (31,839 | ) | | 11,927 | | | (19,912 | ) |

| |

| | Cash Flows from Investing Activities | | | | | | | | | |

| | Mineral property acquisition costs | | - | | | (3,300 | ) | | (3,300 | ) |

| | Net cash provided by (used for) investing activities | | - | | | (3,300 | ) | | (3,300 | ) |

| |

| | Cash Flows from Financing Activities | | | | | | | | | |

| | Proceeds from sales of common stock | | 2,700 | | | 43,700 | | | 46,400 | |

| | Offering costs incurred | | (10,000 | ) | | (12,500 | ) | | (22,500 | ) |

| | Net cash provided by (used for) financing activities | | (7,300 | ) | | 31,200 | | | 23,900 | |

| |

| |

| | Increase in cash | | (39,139 | ) | | 39,827 | | | 688 | |

| |

| | Cash - beginning of period | | 39,827 | | | - | | | - | |

| |

| | Cash - end of period | $ | 688 | | $ | 39,827 | | $ | 688 | |

| |

| |

| | Supplemental disclosures of cash flow information: | | | | | | | | | |

| | Interestpaid | $ | - | | $ | - | | $ | - | |

| | Incometaxespaid | $ | - | | $ | - | | $ | - | |

| |

| | See notes to financial statements. | | | | | | | | | |

F-5

-22-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2008

Note 1. Exploration Stage Company

The Company was incorporated in the State of Nevada on September 12, 2006. The Company is an Exploration Stage Company, as defined by Statement of Financial Accounting Standard (“SFAS”) No.7 “Accounting and Reporting by Development Stage Enterprises”. The Company’s principal business is the acquisition and exploration of mineral resources. The Company has not presently determined whether its properties contain mineral reserves that are economically recoverable.

These financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has never generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. As at February 29, 2008, the Company has accumulated losses of $49,385 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Note 2. Summary of Significant Accounting Policies

| a) | Basis of Presentation |

| |

| | These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in US dollars. The Company’s fiscal year-end is February 28. |

| |

| b) | Use of Estimates |

| |

| | The preparation of financial statements in accordance with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses in the reporting period. The Company regularly evaluates estimates and assumptions related to deferred income tax asset valuations and loss contingencies. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Com pany’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. |

| |

F-6

-23-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2008

| c) | Basic and Diluted Net Earnings (Loss) Per Share |

| |

| | The Company computes net earnings (loss) per share in accordance with SFAS No. 128, "Earnings per Share". SFAS No. 128 requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or wa rrants. Diluted EPS excludes all dilutive potential shares if their effect is anti dilutive. |

| |

| d) | Comprehensive Loss |

| |

| | SFAS No. 130, “Reporting Comprehensive Income,” establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. As at February 29, 2008, the Company has no items that represent a comprehensive loss and, therefore, has not included a schedule of comprehensive loss in the financial statements. |

| |

| e) | Cash and Cash Equivalents |

| |

| | The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents. |

| |

| f) | Mineral Property Costs |

| |

| | The Company has been in the exploration stage since its inception on September 12, 2006 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized when incurred using the guidance in EITF 04-02, “Whether Mineral Rights Are Tangible or Intangible Assets”. The Company assesses the carrying costs for impairment under SFAS 144, “Accounting for Impairment or Disposal of Long Lived Assets” at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations. |

| |

| g) | Financial Instruments |

| |

| | The fair values of financial instruments, which include cash, accounts payable, accrued liabilities and due to related parties were estimated to approximate their carrying values due to the immediate or short-term maturity of these financial instruments. The Company’s operations are in Canada which results in exposure to market risks from changes in foreign currency rates. The financial risk is the risk to the Company’s operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk. |

| |

F-7

-24-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2008

| h) | Offering Costs |

| |

| | Offering costs represent legal fees incurred in connection with the Company’s planned filing of a Registration Statement on Form SB-2 to register the 28,980,000 post-split shares of common stock sold by the Company to nonaffiliates through March 7, 2007. These costs have been charged to additional paid-in capital. |

| |

| i) | Income Taxes |

| |

| | Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. The Company has adopted SFAS No. 109 “Accounting for Income Taxes” as of its inception. Pursuant to SFAS No. 109 the Company is required to compute tax asset benefits for net operating losses carried forward. Potential benefit of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years. |

| |

| j) | Foreign Currency Translation |

| |

| | The Company’s functional and reporting currency is the United States dollar. Monetary assets and liabilities denominated in foreign currencies are translated in accordance with SFAS No. 52 “Foreign Currency Translation”, using the exchange rate prevailing at the balance sheet date. Gains and losses arising on settlement of foreign currency denominated transactions or balances are included in the determination of income. Foreign currency transactions are primarily undertaken in Canadian dollars. The Company has not, to the date of these financials statements, entered into derivative instruments to offset the impact of foreign currency fluctuations. |

| |

| k) | Stock-based Compensation |

| |

| | The Company records stock-based compensation in accordance with SFAS No. 123R “Share Based Payments”, using the fair value method. The Company has not issued any stock options since its inception. |

| |

| l) | Recent Accounting Pronouncements |

| |

| | In December 2007, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 141 (revised 2007), “Business Combinations”. SFAS No. 141 (revised 2007) establishes principles and requirements for how the acquirer of a business recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree. The statement also provides guidance for recognizing and measuring the goodwill acquired in the business combination and determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. SFAS No. 141 (revised 2007) applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations. |

| |

| | In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements-an amendment of ARB No. 51”. SFAS No. 160 establishes accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. The adoption of this statement is not expected to have a material effect on the Company's future reported financial position or results of operations. |

| |

F-8

-25-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2008

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FASB Statement No. 115”. This statement permits entities to choose to measure many financial instruments and certain other items at fair value. Most of the provisions of SFAS No. 159 apply only to entities that elect the fair value option. However, the amendment to SFAS No. 115 “Accounting for Certain Investments in Debt and Equity Securities” applies to all entities with available-for-sale and trading securities. SFAS No. 159 is effectiv e as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provision of SFAS No. 157, “Fair Value Measurements”. The adoption of this statement did not have a material effect on the Company's financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements”. The objective of SFAS No. 157 is to increase consistency and comparability in fair value measurements and to expand disclosures about fair value measurements. SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS No. 157 applies under other accounting pronouncements that require or permit fair value measurements and does not require any new fair value measurements. The provisions of SFAS No. 157 are effective for fair value measurements made in fiscal years beginning after November 15, 2007. The adoption of this statement is not expected to have a material e ffect on the Company's future reported financial position or results of operations.

In June 2006, the FASB issued FASB Interpretation No. 48,“Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statements No. 109”. FIN 48 clarifies the accounting for uncertainty in income taxes by prescribing a two-step method of first evaluating whether a tax position has met a more likely than not recognition threshold and second, measuring that tax position to determine the amount of benefit to be recognized in the financial statements. FIN 48 provides guidance on the presentation of such positions within a classified statement of financial position as well as on derecognition, interest and penalties, accounting in interim periods, disclosure, and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006. The adopti on of this statement did not have a material effect on the Company's future reported financial position or results of operations.

Note 3. Related Party Balances/Transactions

| a) | The Company receives office space and services from its president at no cost to the Company. For accounting purposes, the estimated fair vale of these donated services ($250 per month for the office space, $500 per month for the services) is included in general and administrative expenses and additional paid-in capital is increased by the same amounts. For the year ended February 29, 2008, the Company expensed $3,000 in donated rent and $6,000 in donated services. |

| |

| b) | As at February 29, 2008, the Company is indebted to the President of the Company for $6,510, representing expenses paid on behalf of the Company. This amount is unsecured, non-interest bearing and has no repayment terms. |

| |

| c) | On September 19, 2006, the Company issued 35,000,000 shares of common stock at $0.00014 per share to the President of the Company for cash proceeds of $5,000. |

| |

F-9

-26-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2008

Note 4. Mineral Property

On September 21, 2006, the Company acquired a 100% interest in a Mineral Claim located in British Columbia, Canada, in consideration for $3,300. The claims are registered in the name of the President of the Company, who has executed a trust agreement whereby the President agreed to hold the claims in trust on behalf of the Company. There are situations that could prevent the Company from obtaining clear title to the mineral claims such as the bankruptcy or death of the President. The cost of the mineral property was initially capitalized. At February 29, 2008, the Company recognized an impairment loss of $3,300, as it had not yet been determined whether there are proven or probable reserves on the property.

Note 5. Common Stock

| a) | On September 19, 2006, the Company issued 35,000,000 shares of common stock at $0.00014 per share to the President of the Company for cash proceeds of $5,000. |

| |

| b) | During the period ended February 28, 2007, the Company accepted stock subscriptions for 27,090,000 shares of common stock at $0.00143 per share for cash proceeds of $38,700. The shares were issued on March 7, 2007. |

| |

| c) | In March 2007, the Company accepted stock subscriptions for 1,890,000 shares of common stock at $0.00143 per share for cash proceeds of $2,700. |

| |

| d) | On June 18, 2007, the Securities and Exchange Commission declared effective the Company’s registration statement on Form SB-2 to register for sale the 28,980,000 post-split shares of common stock owned by its stockholders other than the president. The Company will not receive any proceeds from such sales. |

| |

Note 6. Income Taxes

Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. At February 29, 2008, the Company has a net operating loss carryforward of $35,885, which expires in 2027. Pursuant to SFAS No. 109 the Company is required to compute tax asset benefits for net operating losses carried forward. Potential benefit of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years.

The components of the net deferred tax asset consist of:

| | | February 29, | | | February 28, | |

| | | 2008 | | | 2007 | |

| | | | | | |

| Net operating loss carryforward | $ | 12,560 | | $ | 2,547 | |

| Valuation allowance | | (12,560 | ) | | (2,547 | ) |

| |

| Total | $ | - | | $ | - | |

F-10

-27-

Ridgestone Resources, Inc.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

February 29, 2008

A reconciliation of the expected income tax expense (benefit) computed by applying the United States statutory income tax rate to income (loss) before income taxes to the provision for (benefit from) income taxes follows

| | | | | | Period | |

| | | | | | September 12, | |

| | | Year Ended | | | 2006 to | |

| | | February 29, | | | February 28, | |

| | | 2008 | | | 2007 | |

| |

| Income tax expense (benefit) at statutory rate of 35% | $ | (13,163 | ) | $ | (4,122 | ) |

| Tax effect of nondeductible donated services | | | | | | |

| and expenses | | 3,150 | | | 1,575 | |

| Change in valuation allowance | | 10,013 | | | 2,547 | |

| |

| Provision for (benefit from) income taxes | $ | - | | $ | - | |

Current United States income tax laws limit the amount of loss available to be offset against future taxable income when a substantial change in ownership occurs. Therefore, the amount available to offset future taxable income may be limited.

Note 7. Stock Split

On May 14, 2008, the Company’s board of directors declared a seven–for-one common stock split to be effected on May 28, 2008. The par value of the common stock will remain $0.00001 per share and the number of authorized shares of common stock and preferred stock will remain 100,000,000 shares each. The financial statements have been retroactively adjusted to reflect this stock split.

F-11

-28-

| ITEM 9. | | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

There have been no disagreements on accounting and financial disclosures from the inception of our company through the date of this Form 10-K. Our financial statements for the period from inception to February 29, 2008, included in this report have been audited by Michael T. Studer CPA, P.C., 18 East Sunrise Highway, Suite 311 Freeport, New York 11520, as set forth in this annual report.

PART III

ITEM 9A. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

We maintain “disclosure controls and procedures,” as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”), that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. We conducted an evaluation (the “Evaluation”), under the supervision and with the participation of our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the design and operation of our disclosure controls and procedures (“Disclosure Controls”) as of the end of the period covered by this report pursuant to Rule 13a-15 of the Exchange Act. Based on this Evaluation, our CEO and CFO concluded that our Disclosure Controls were effective as of the end of the period covered by this report.

Changes in Internal Controls

We have also evaluated our internal controls for financial reporting, and there have been no significant changes in our internal controls or in other factors that could significantly affect those controls subsequent to the date of their last evaluation.

Limitations on the Effectiveness of Controls