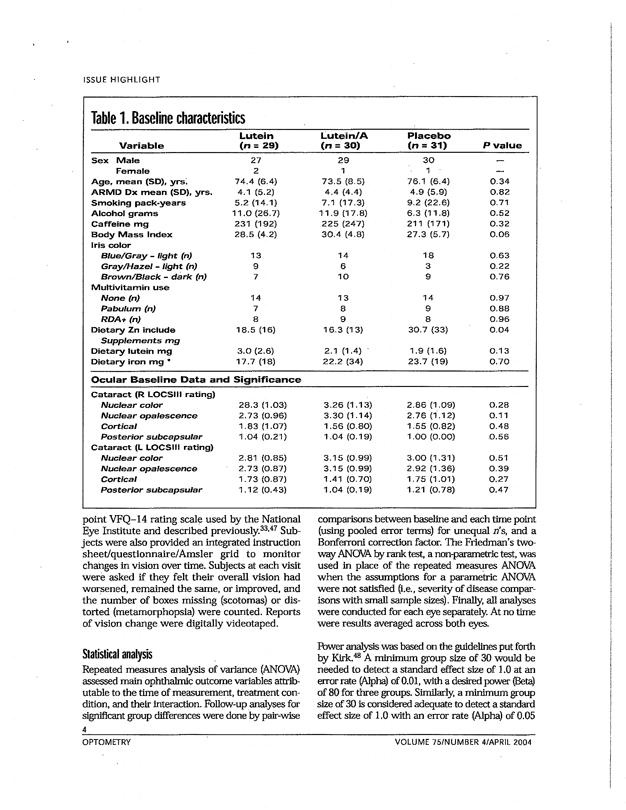

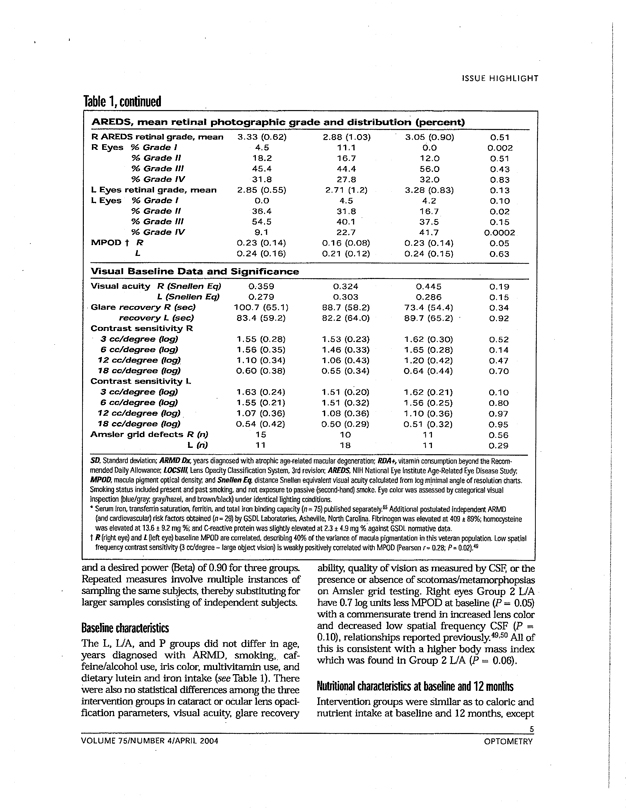

| | |

SUSAN W. WILES Direct: 312-836-4192 Facsimile: 312-275-7616 E-mail: swiles@shefskylaw.com |

|

IN REFERENCETO: 028620-01 |

August 10, 2007

Mr. H. Christopher Owings

Assistant Director

Division of Corporation Finance

United States Securities and Exchange Commission

Mail Stop 3561

100 F Street, N.E.

Washington, D.C. 20549

| | | Registration Statement on Form S-1 |

Dear Mr. Owings:

We are writing on behalf of our client, Vitacost.com, Inc. (the “Company”), in response to comments contained in your correspondence, dated July 19, 2007. The headings and paragraph numbers below correspond to the headings and paragraph numbers in your letter. In addition, for your convenience we have reproduced your comments in this letter and included our responses directly below each comment.

General

1. We note a number of blank spaces throughout your registration statement for information that you are not entitled to omit under Rule 430A, such as the anticipated price range and related information based on a bona fide estimate of the public offering within that range. Please allow us sufficient time to review your complete disclosure prior to any distribution of preliminary prospectuses.

Response: We note the Staff’s comment and respectfully submit that the requested information will be provided in a subsequent amendment. It is our intent to file the subsequent amendment with sufficient time to permit the Staff to review the disclosure before the distribution of any preliminary prospectus.

Mr. H. Christopher Owings

August 10, 2007

Page 2

Outside Front Cover Page of Prospectus

2. Please provide a bona fide estimate of the range of the maximum offering price and the maximum number of securities offered. See Item 501(b)(3) of Regulation S-K.

Response: We note the Staff’s comment and respectfully submit that the requested information will be provided in a subsequent amendment. It is our intent to file the subsequent amendment with sufficient time to permit the Staff to review the disclosure before the distribution of any preliminary prospectus.

3. You state that you expect that delivery of the shares will be made to investors “on or about , 2007.” This statement is not necessary for the protection of investors. Please delete.

Response: In response to the Staff’s comment, the sentence has been deleted.

Summary, page 1

4. Please revise the first sentence to state that the summary highlights the key aspects of the offering and eliminate the language that states that the summary “does not contain all of the information that you should consider in making your investment decision.”

Response: In response to the Staff’s comment, the requested revision has been made.

5. Please delete the last sentence in your summary that contains definitions as the meaning is clear from context.

Response: In response to the Staff’s comment, the sentence has been deleted.

6. Please tell us why you have not also included your other website www.goNSI.com in the Summary. Also tell us what, if any, difference there is between these websites and what purpose they each serve.

Response: In response to the Staff’s comment, the following disclosure has been inserted on page 52 of the prospectus:

|

We have the following websites in addition to www.vitacost.com including, www.ocupower.com, www.walkerdiet.com, www.csiskincare.com, www.health-fitness-tips.com, www.nutrals.com and www.goNSI.com. Only the www.vitacost.com and www.goNSI.com websites directly generate sales and the www.goNSI.com website generates less than 1% of our sales. |

Mr. H. Christopher Owings

August 10, 2007

Page 3

In further response to the Staff’s comments, the Company did not include the websites in the prior disclosure because only two of the Company’s seven websites generate revenue, the others are used primarily to direct traffic towww.Vitacost.com. Furthermore, thewww.goNSI.com website generates less than 1% of the Company’s sales.

Our Business, page 1

7. Please prominently disclose that your business depends on Wayne F. Gorsek, your former CEO and principal shareholder with whom you have a consulting agreement. Also disclose that in connection with your application for listing of your common stock on the Nasdaq Global Market, you were advised by Nasdaq that your listing would be considered for approval conditioned upon Mr. Gorsek’s resignation as an officer and director of the company. Disclose all judgments against him, all sections of the Securities Act he was found to have violated and fully describe the findings of the court against him.

Response: In response to the Staff’s comment, the Company has added disclosure under the caption Summary—Our Business that states that our business depends on the contributions of Mr. Gorsek and describes the material aspects of Mr. Gorsek’s past violations of the federal securities laws and the conditions to listing imposed by the Nasdaq Global Market. The Company respectfully submits that the prospectus summary, as revised, discloses the material facts relating to Mr. Gorsek’s past violations and the listing conditions imposed by the Nasdaq Global Market which are discussed in detail on pages 56-57. The Company respectfully submits that the complete description of the findings against Mr. Gorsek is not appropriate for the prospectus summary because that level of detail is not required by the prospectus summary as prescribed by Item 503(a) of Regulation S-K and the related instruction, and would result in unnecessary duplication in the prospectus since the complete disclosure is included under the caption Business—Regulatory Proceedings, and Principal Stockholders on pages 79 and 80, and because further disclosure is outside the scope of Item 401(f) of Regulation S-K since the Court findings were entered more than five years ago.

Mr. H. Christopher Owings

August 10, 2007

Page 4

8. You state you are a “leading” online retailer of a broad selection of nutritional supplements and health and wellness products. Please clarify “leading” and provide support for this statement.

Response: In response to the Staff’s comment, the word “leading” has been deleted from the sentence.

9. Please indicate where the products you sell are manufactured and identify the manufacturers.

Response: In response to the Staff’s comment, the following disclosure has been inserted on page one of the Summary:

|

All of our proprietary products are manufactured by third-party contract manufacturers, the top three of which, Health Wright Products, Nutra Manufacturing and NutriForce Nutrition, accounted for approximately 71% of our NSI finished goods in 2006. |

10. Also indicate, if true, that your vitamins, minerals, herbs and supplements generally are not regulated by the FDA and whether they may be regulated in the future.

Response: In response to the Staff’s comment, the following disclosure has been inserted on page one of the Summary:

|

Our products consist of vitamins, minerals, herbs and other ingredients that are classified as foods or dietary supplements and generally are not subject to pre-market regulatory approval or clearance in the U.S. by the FDA or other governmental agencies. However, the products we sell could be subject to regulation in the future. |

11. Your disclosure also contains a significant amount of unsubstantiated language such as “unique” proposition, “scientifically-formulated” proprietary products, “outstanding” values, “exceptional” customer service, “unique” proprietary formulations, “state-of-the-art” distribution facilities, “industry leading” fulfillment and customer satisfaction statistics, etc. Please generally review your document to remove language of this nature.

Response: In response to the Staff’s comment, the requested revisions have been made.

12. Similarly, here and in your Business discussion, please remove your discussion of OcuPower, as it implies your products may improve the condition of persons with incurable diseases.

Mr. H. Christopher Owings

August 10, 2007

Page 5

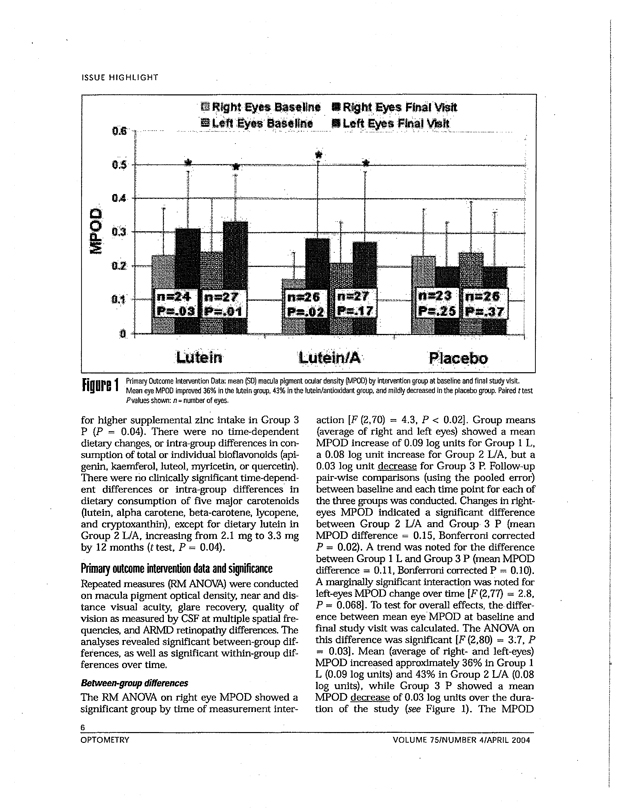

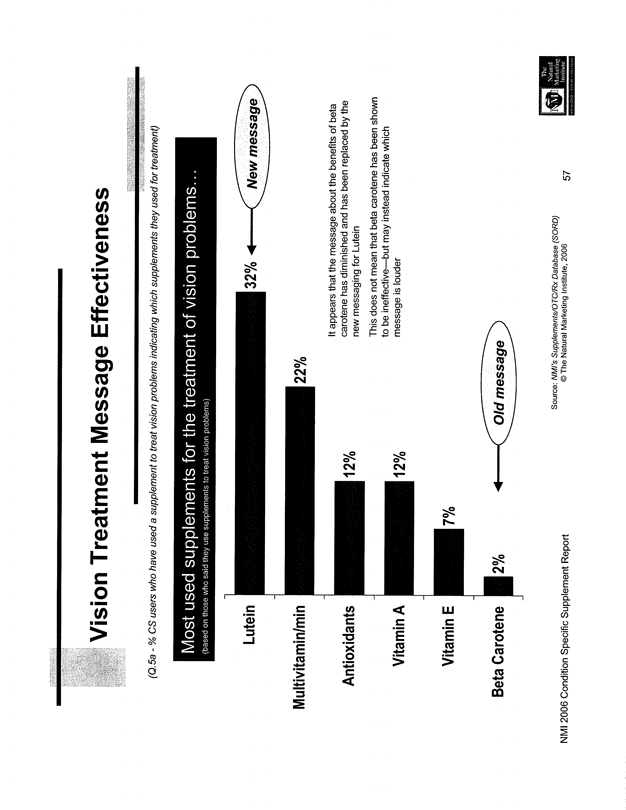

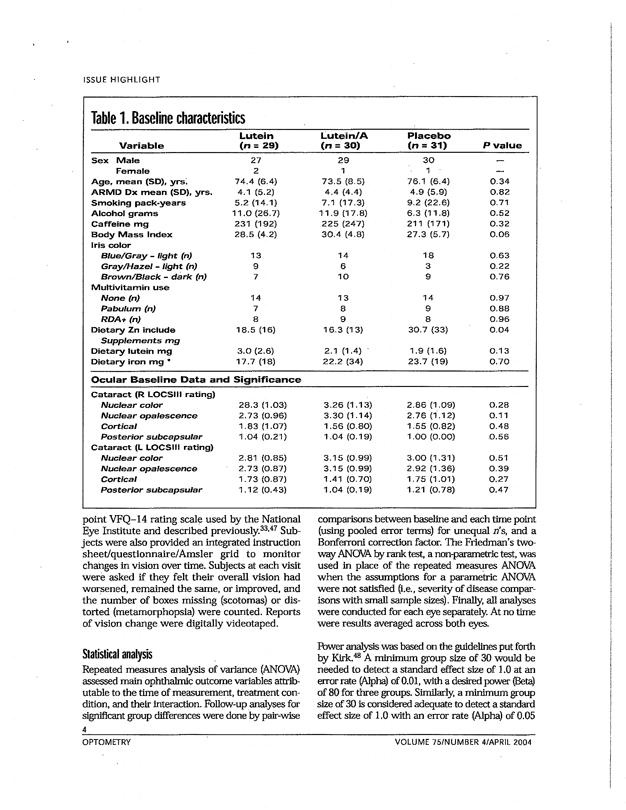

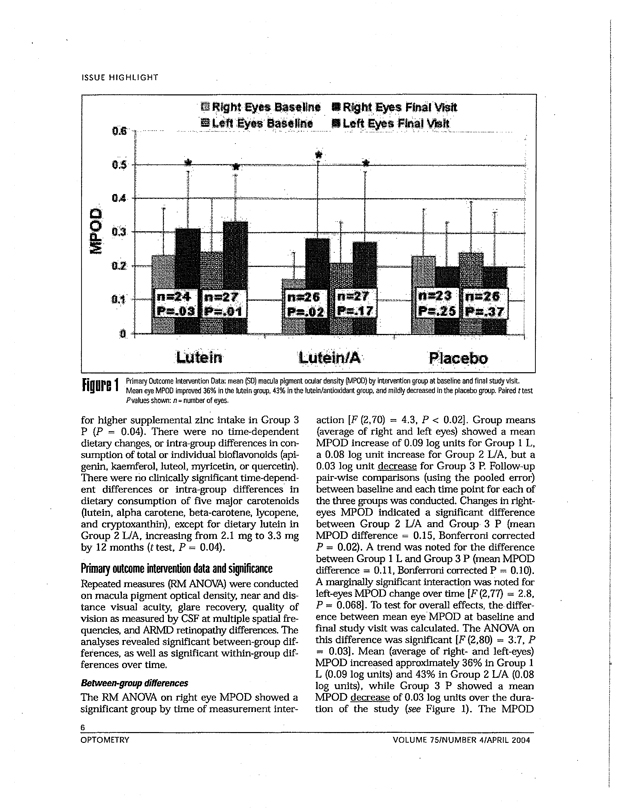

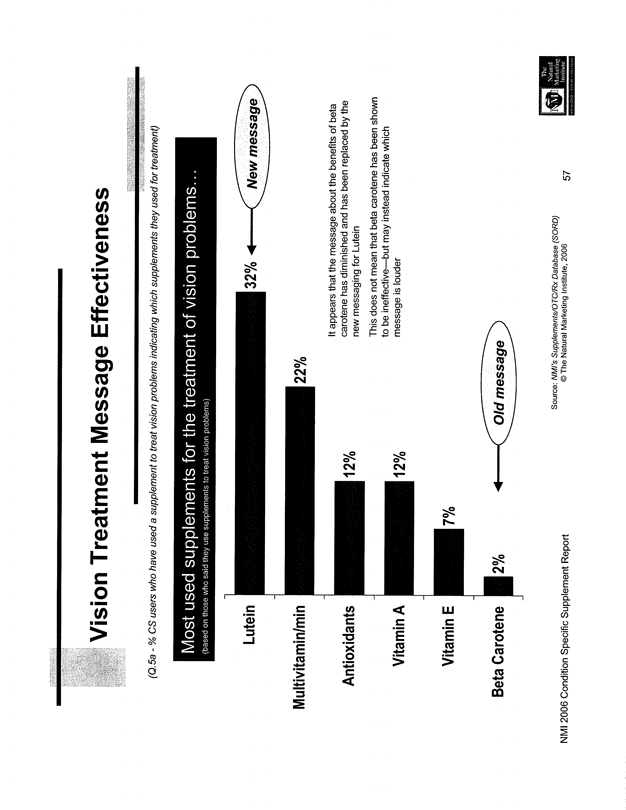

Response: In response to the Staff’s comment, enclosed with this response is a copy of the American Optometric Association Medical Journal,Optometry, which showed that Lutein, taken alone or together with other nutrients improves vision function. In further response to the Staff’s comment, the words “a disease for which there is no known cure” have been deleted from the disclosure.

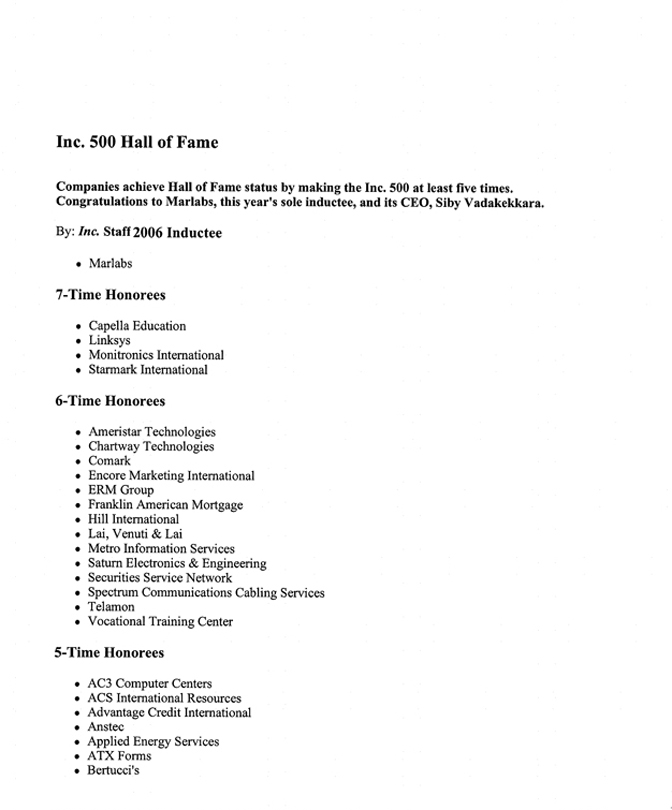

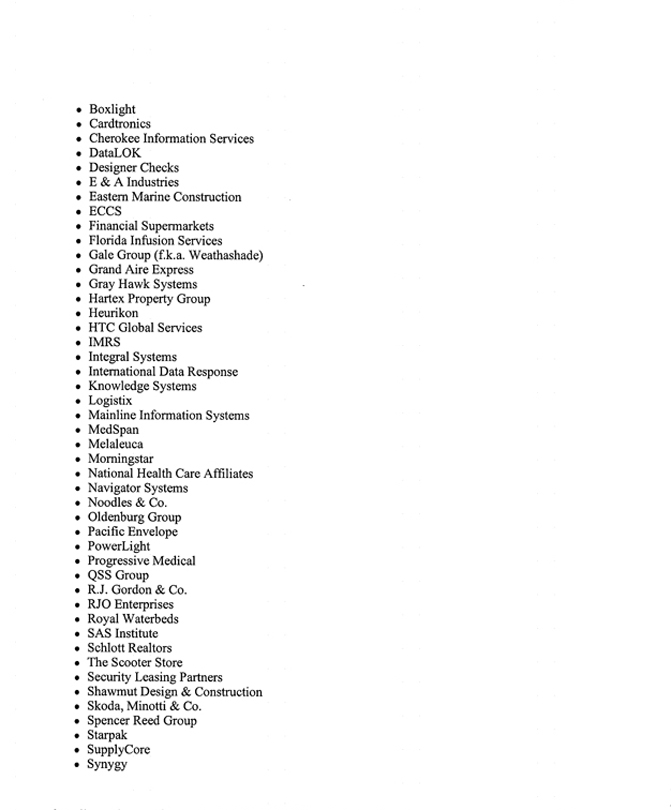

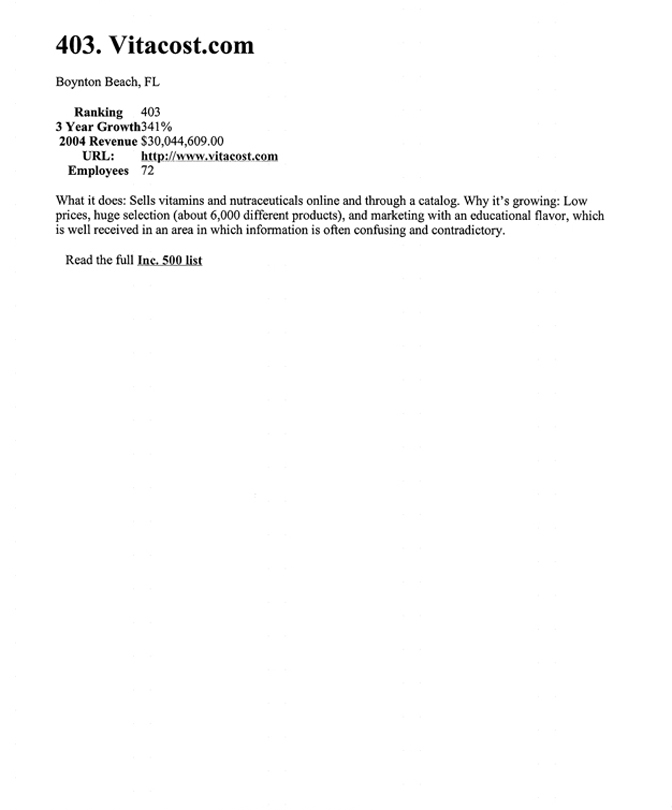

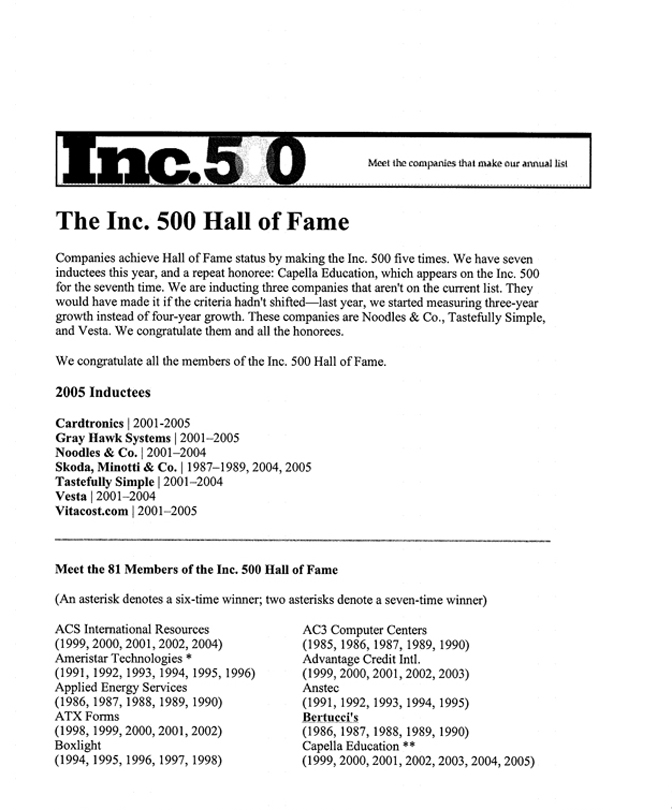

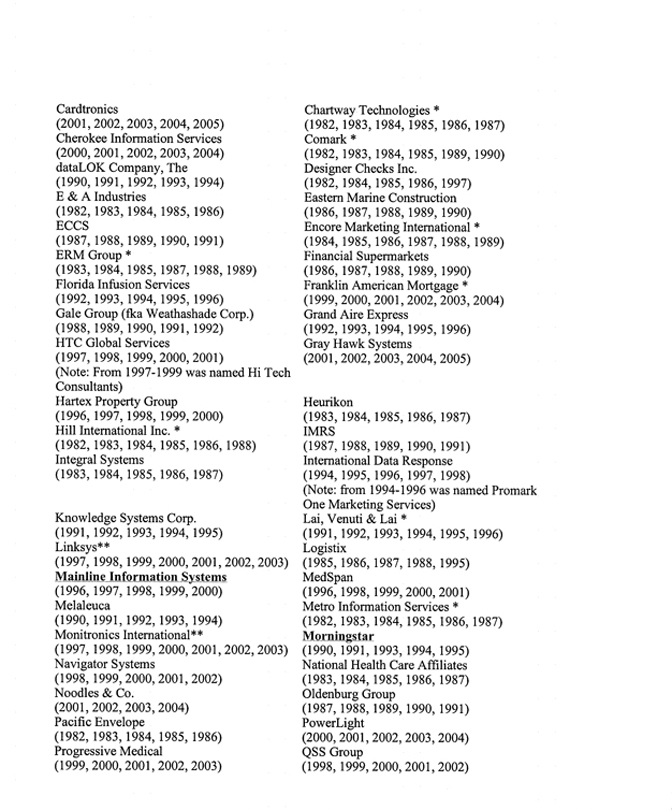

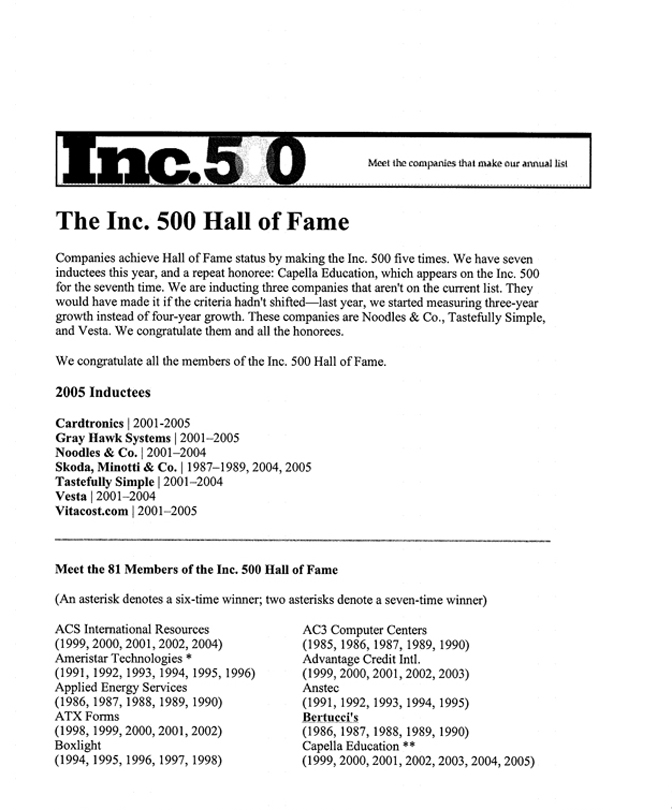

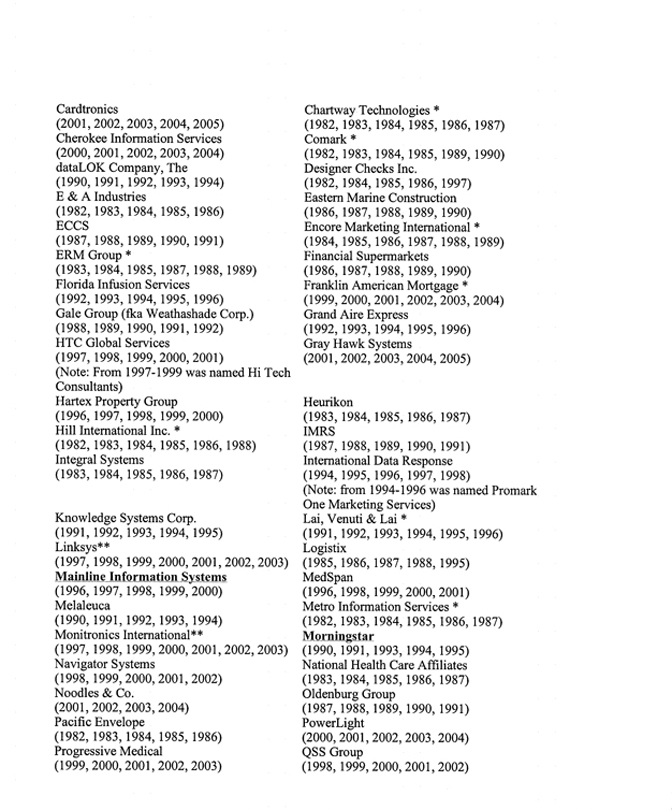

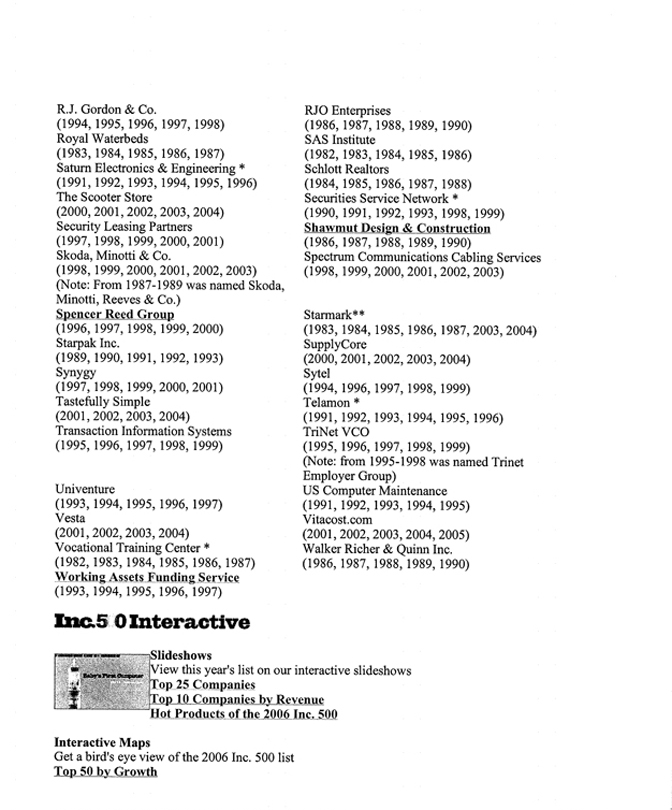

13. Please furnish us a copy of the Inc, magazine article to which you make reference.

Response: In response to the Staff’s comment, enclosed is a copy of the referencedInc. Magazine article.

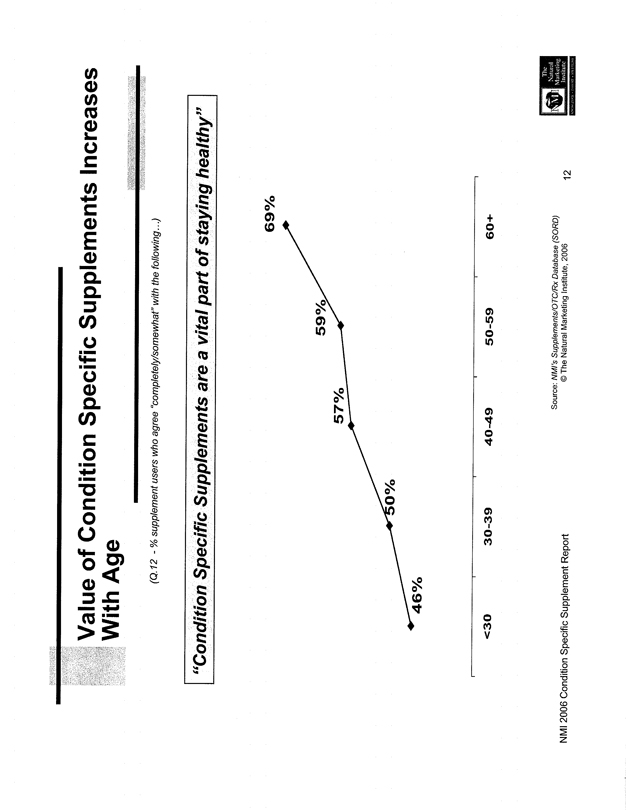

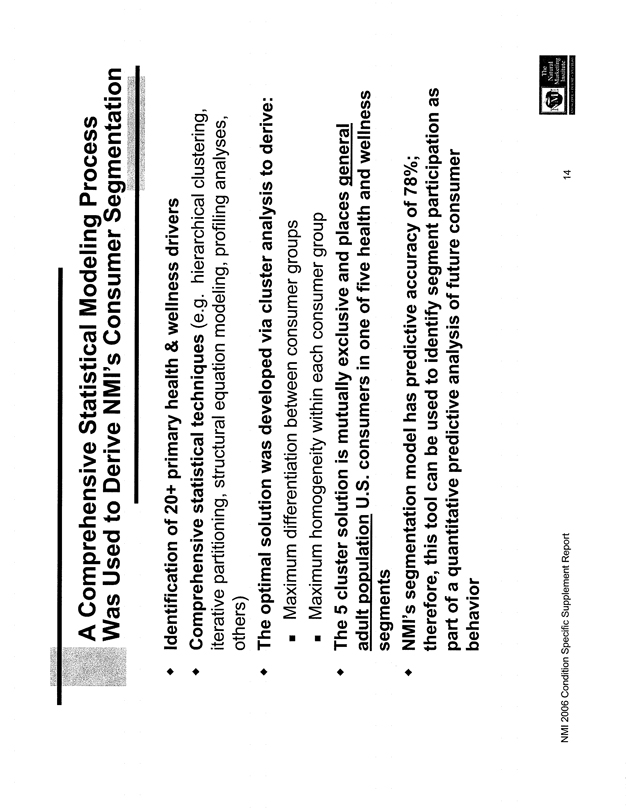

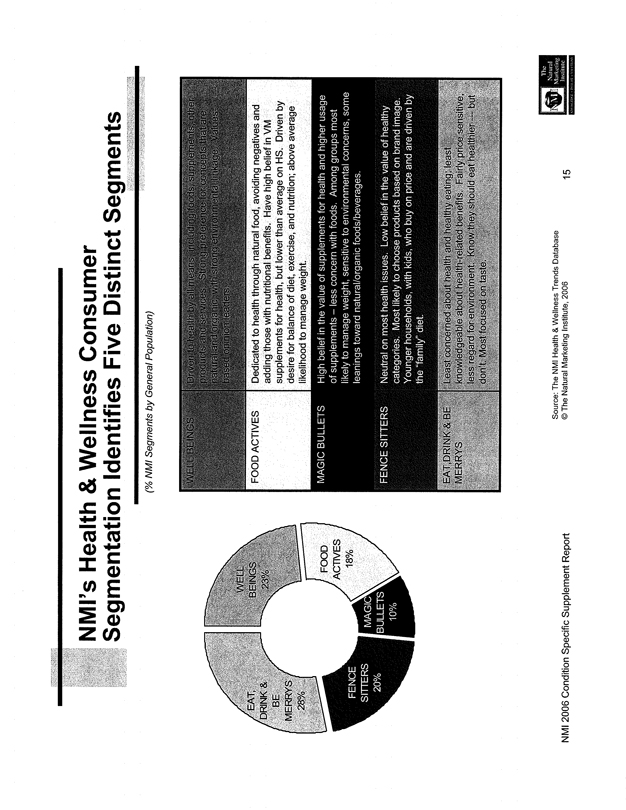

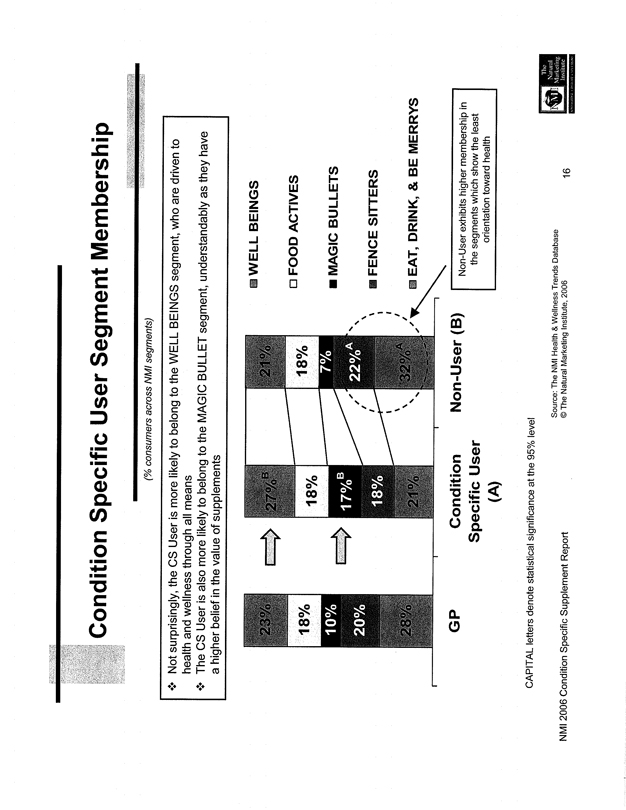

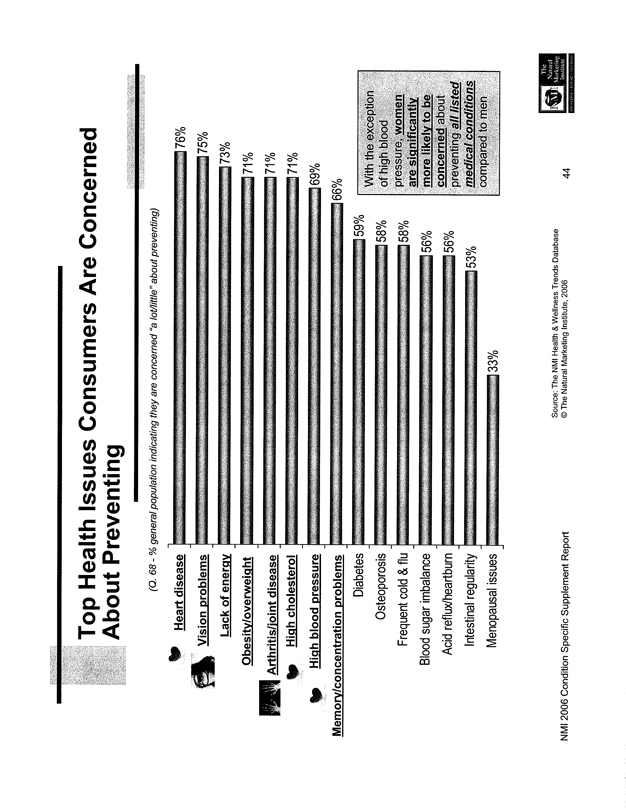

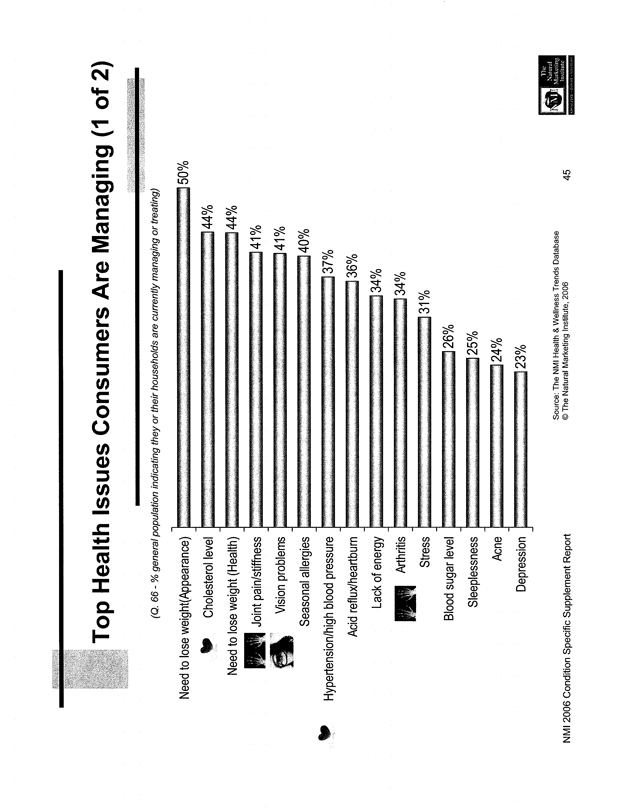

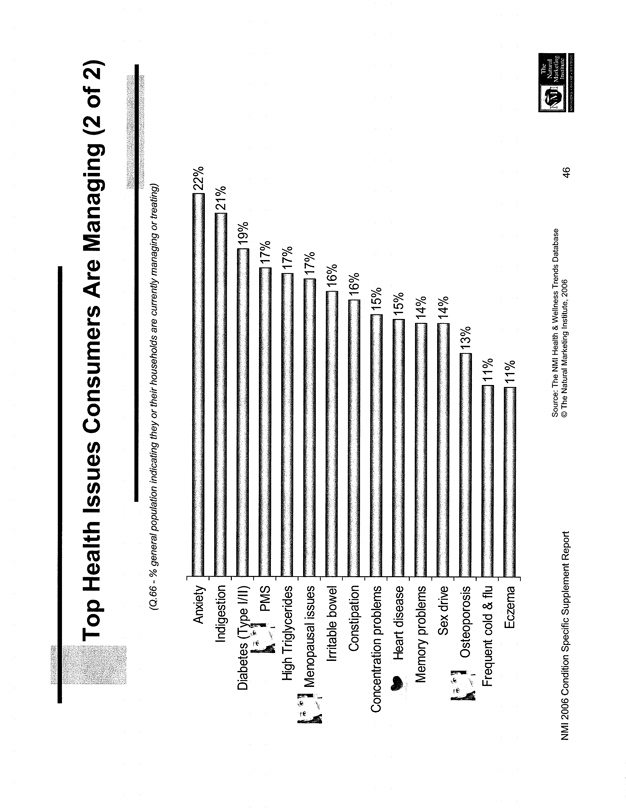

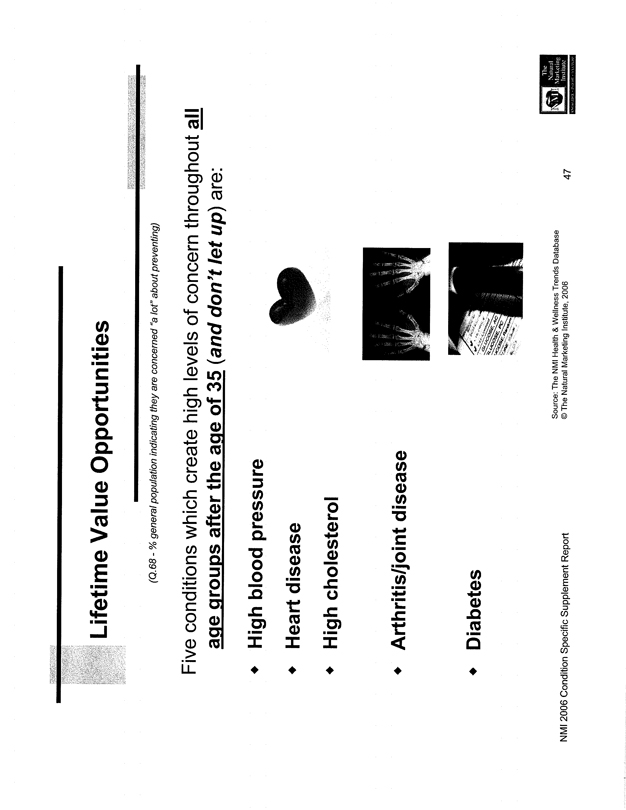

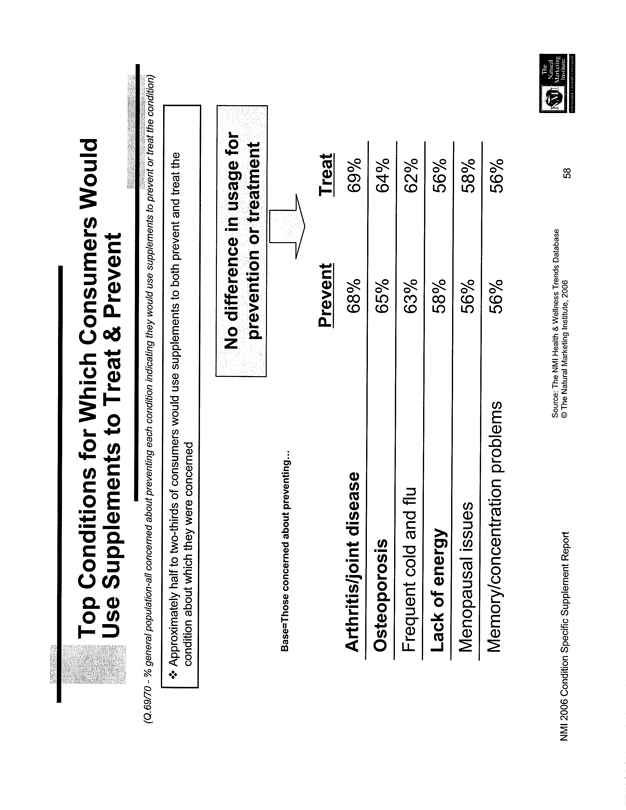

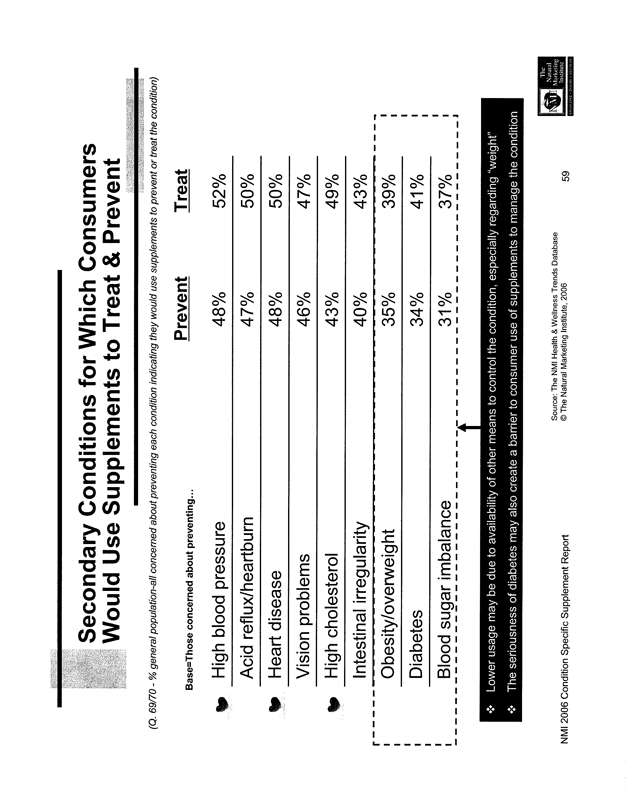

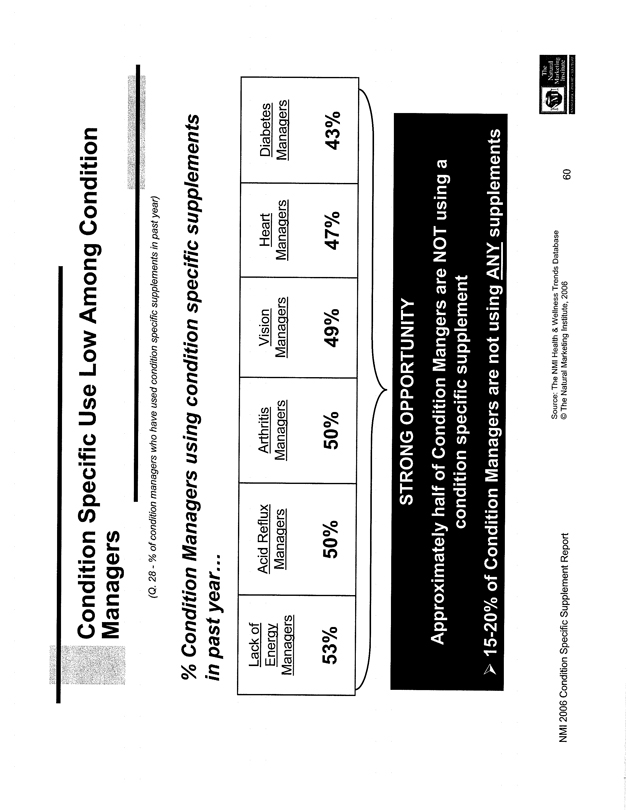

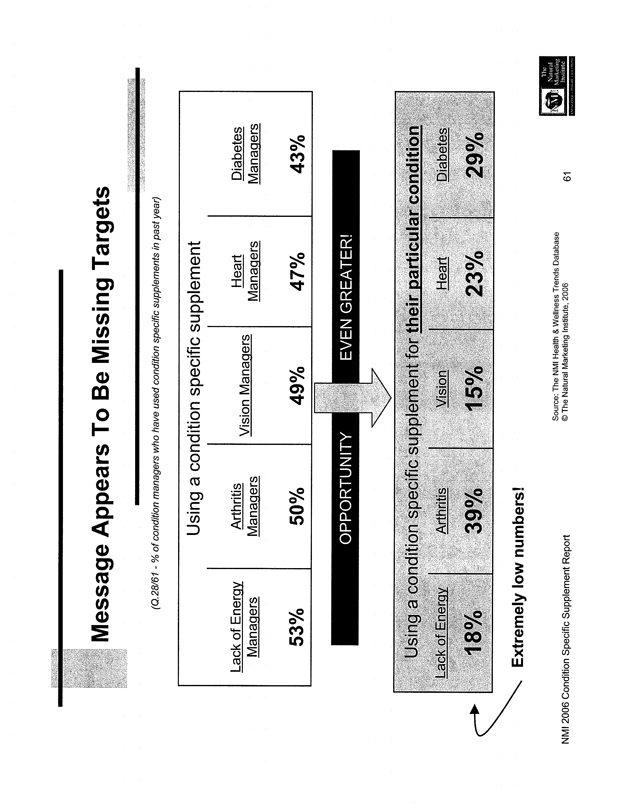

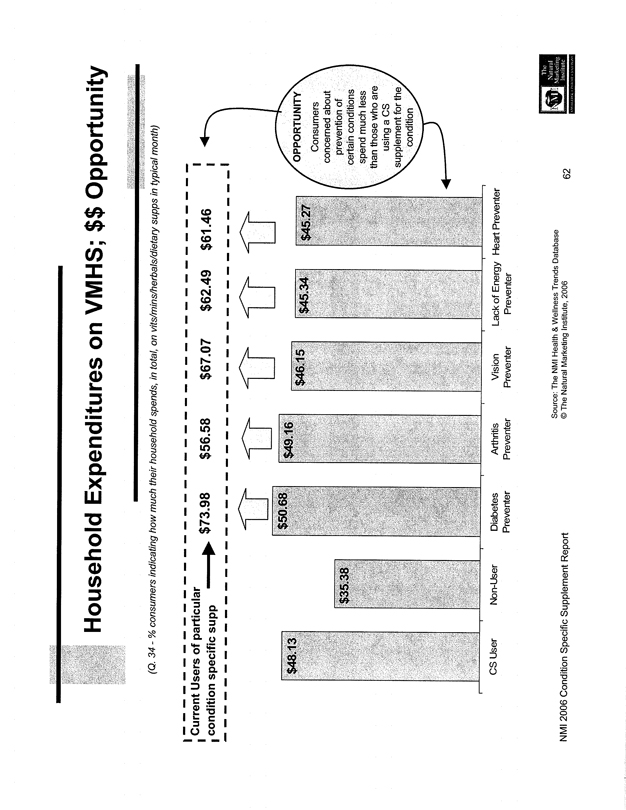

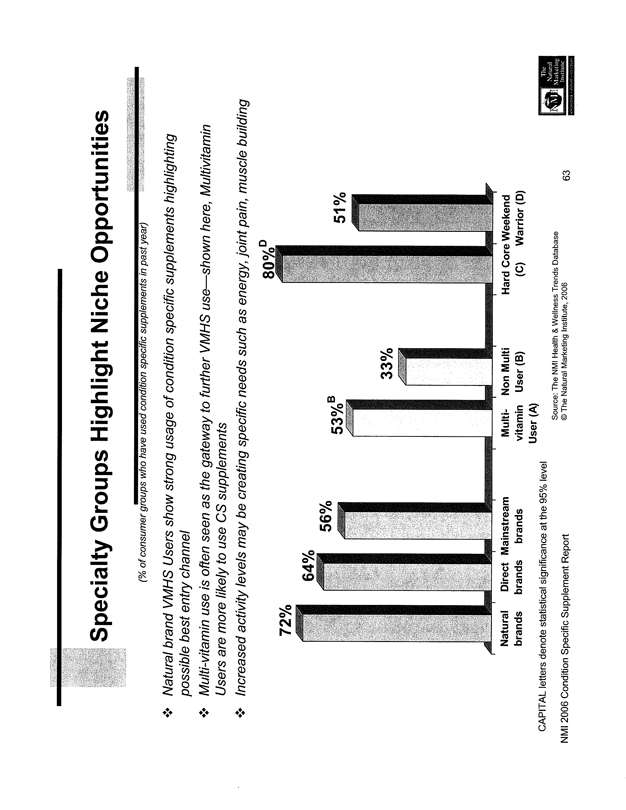

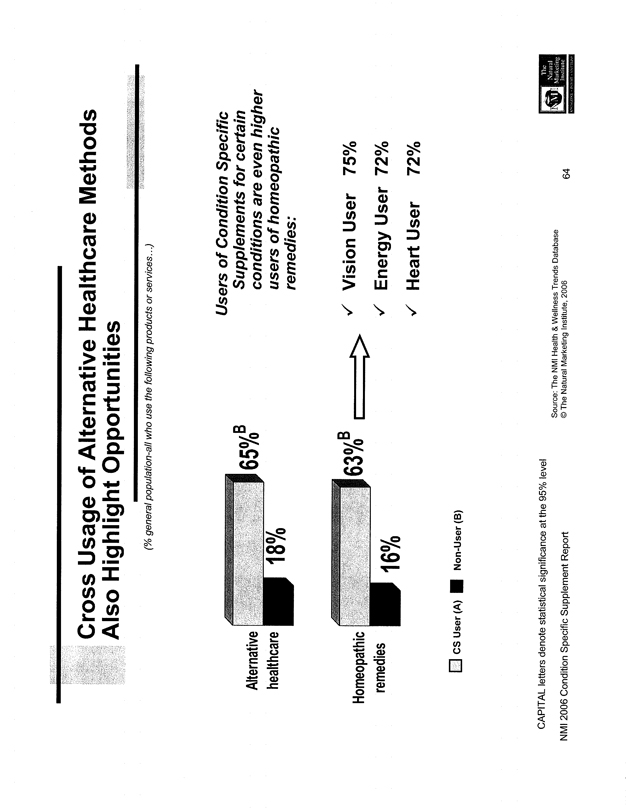

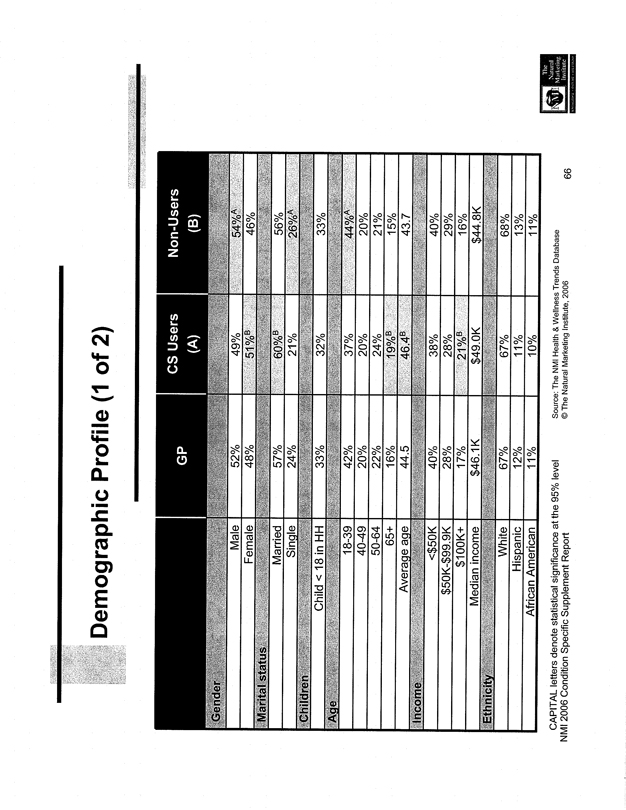

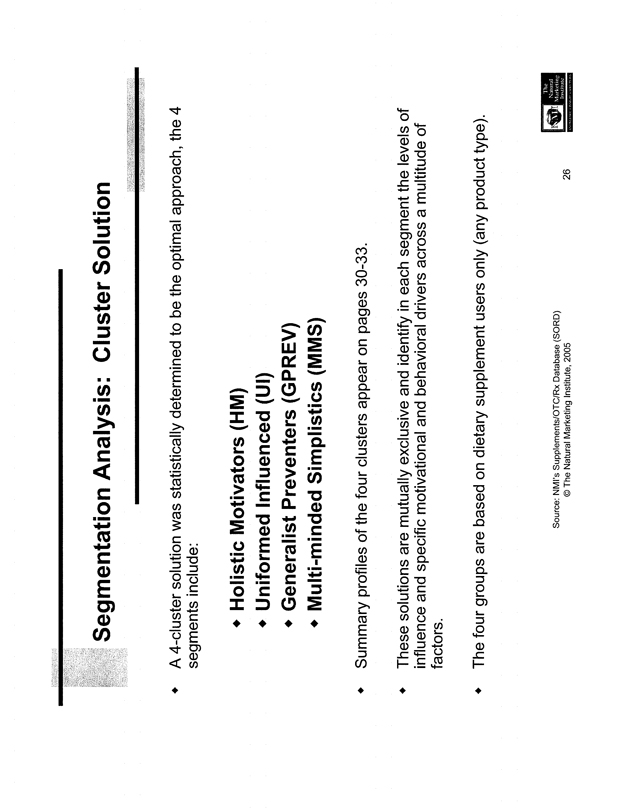

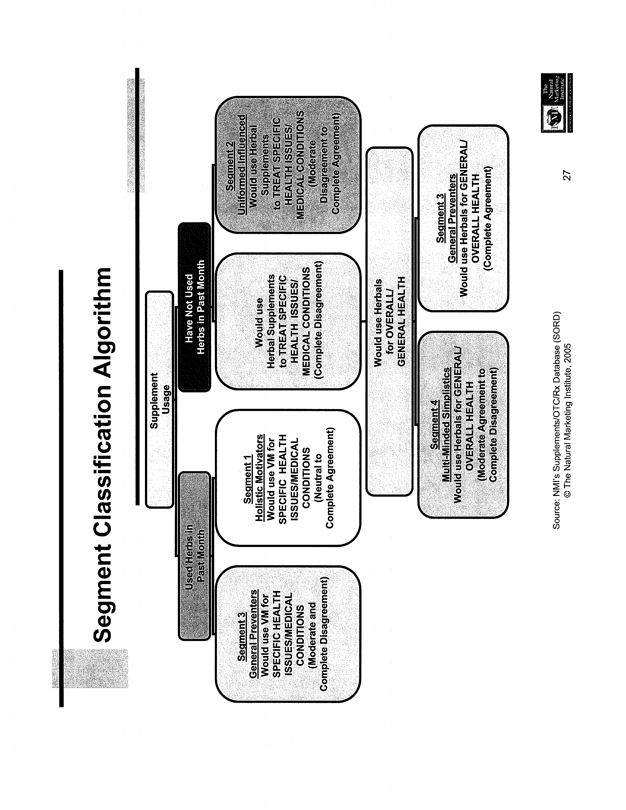

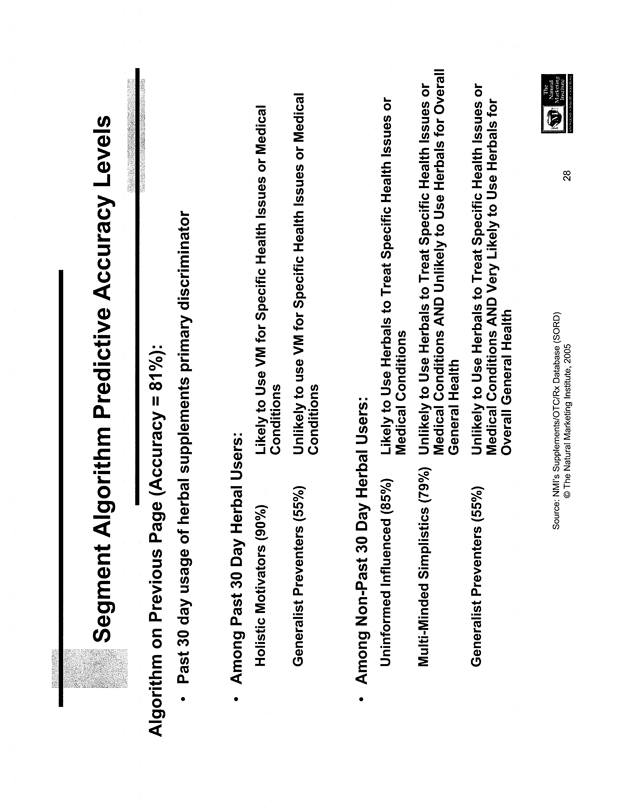

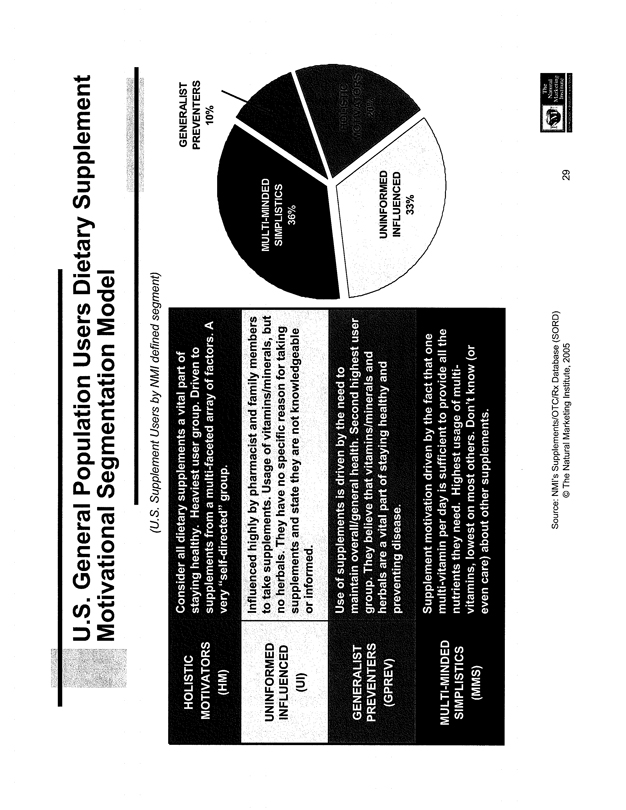

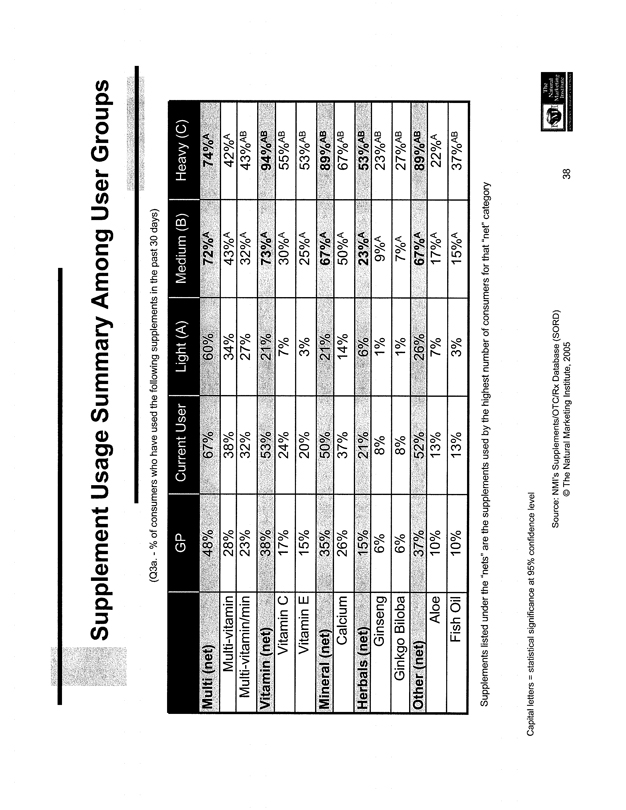

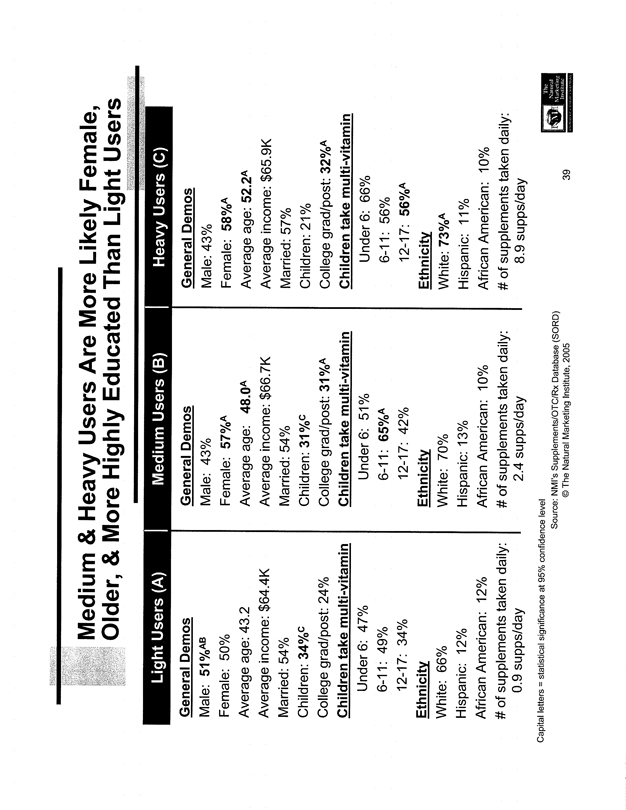

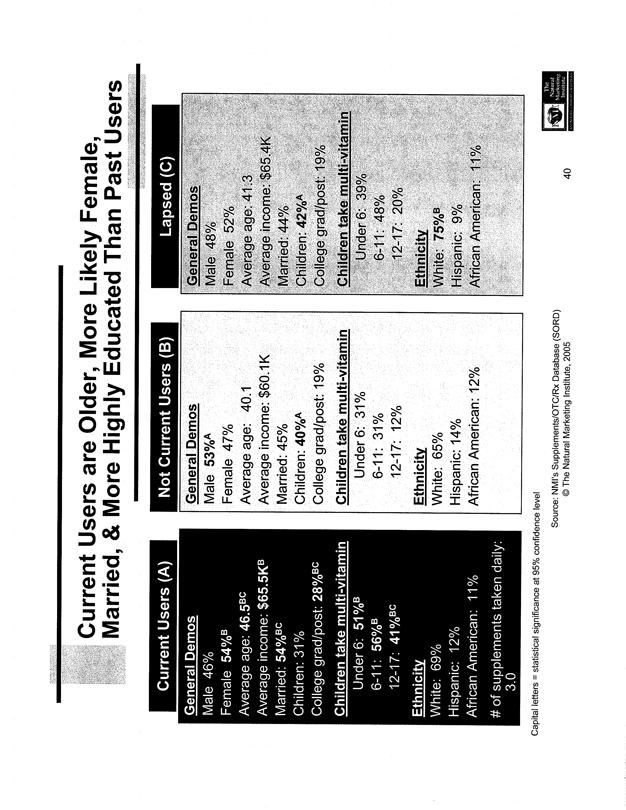

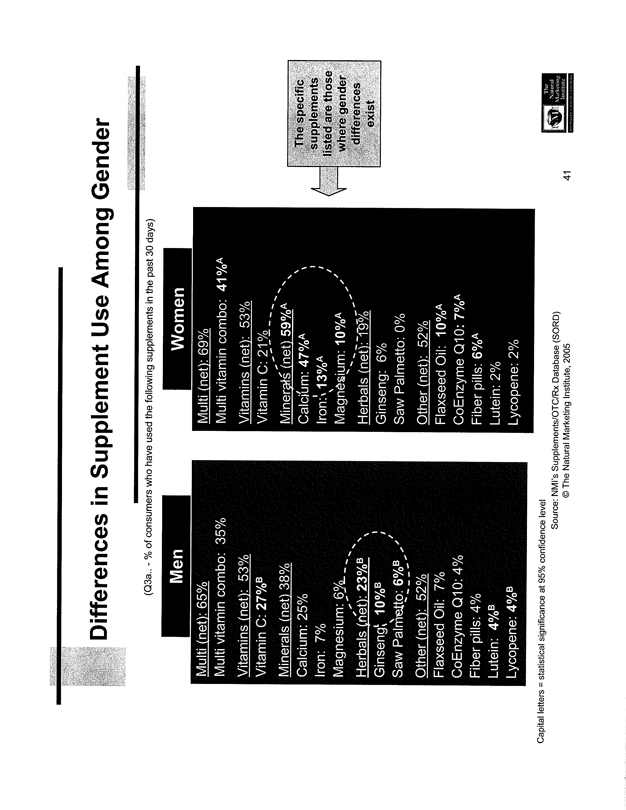

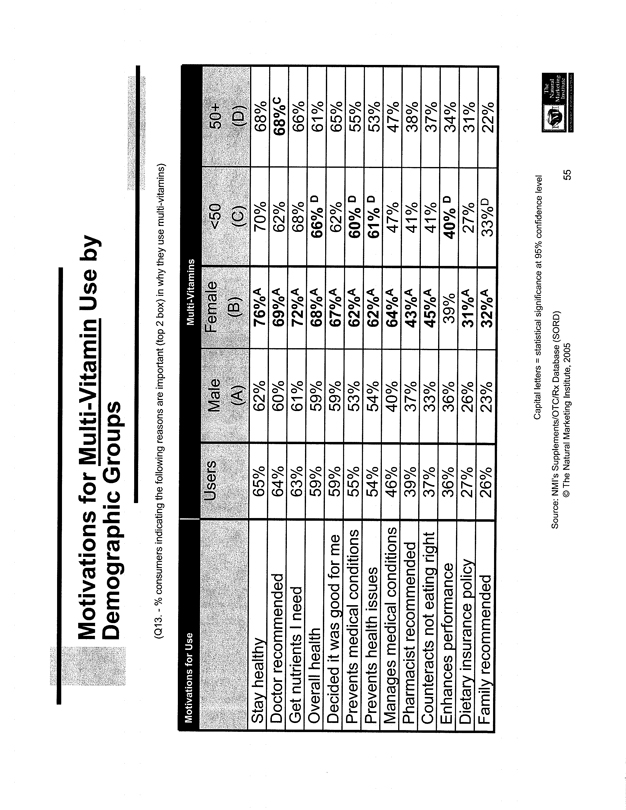

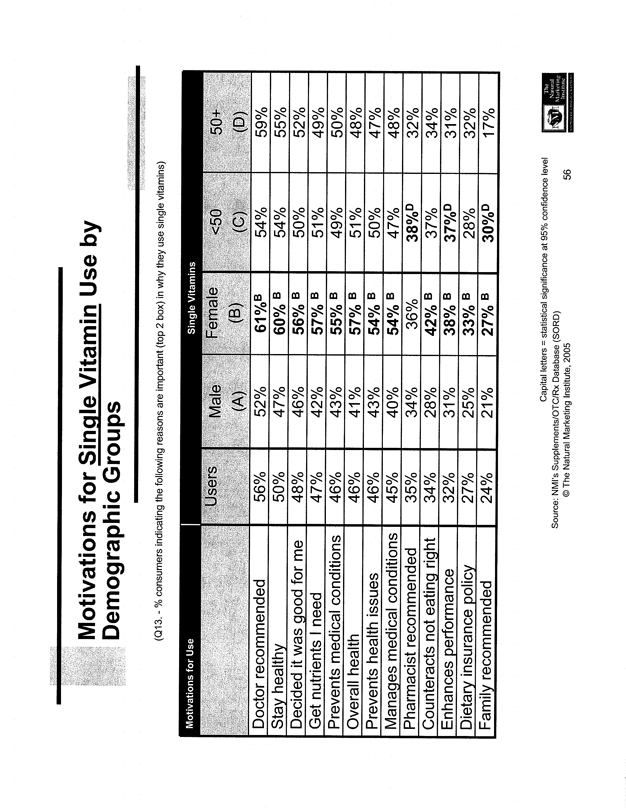

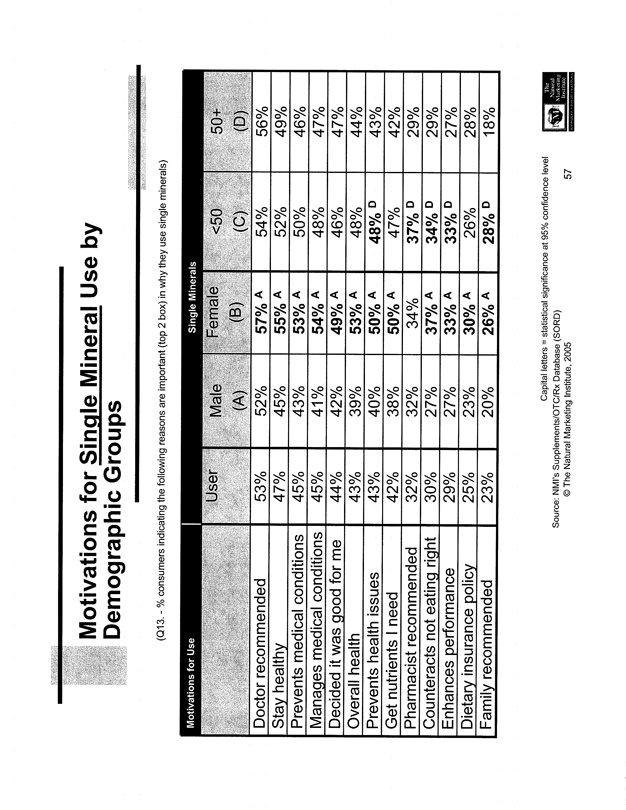

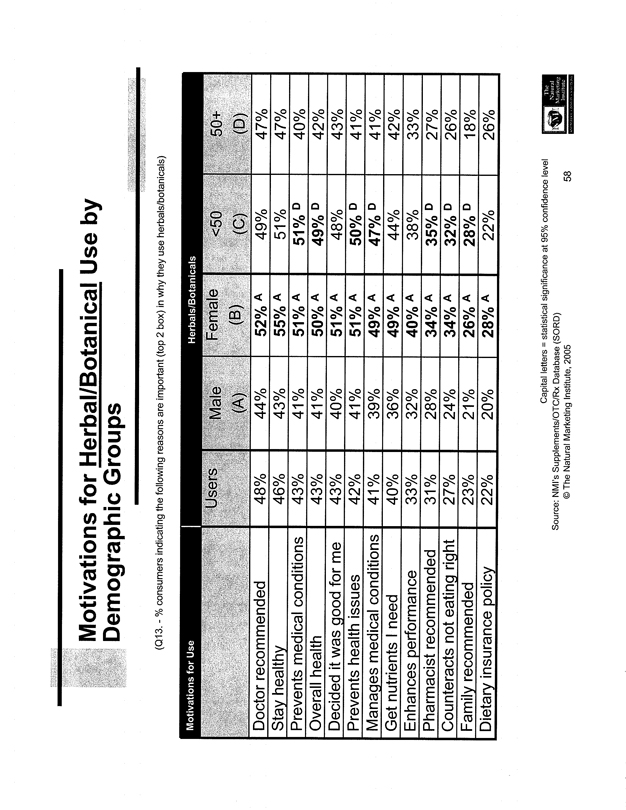

Our Markets and Opportunities, page 2

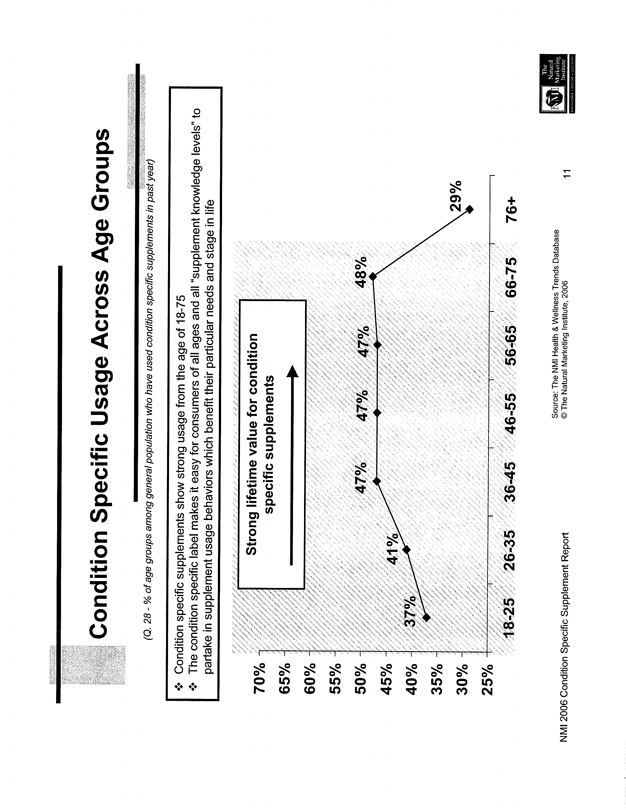

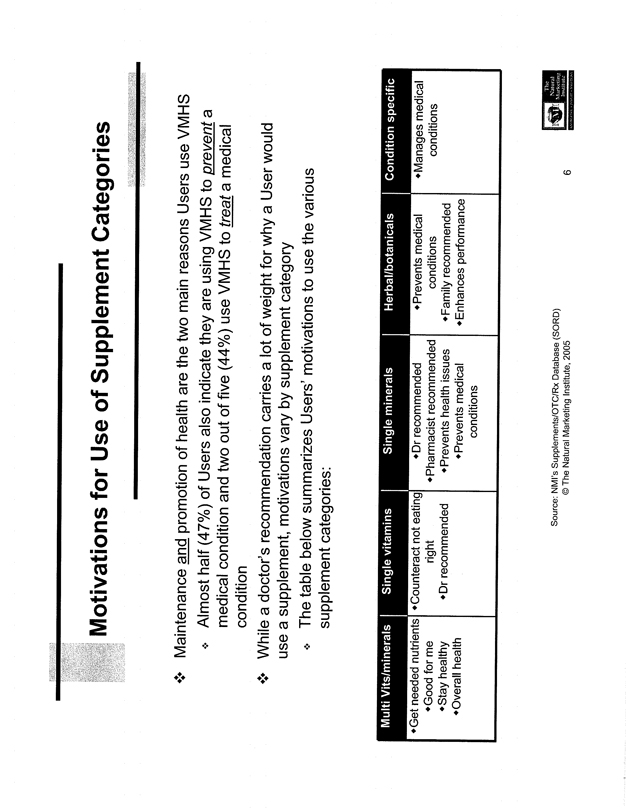

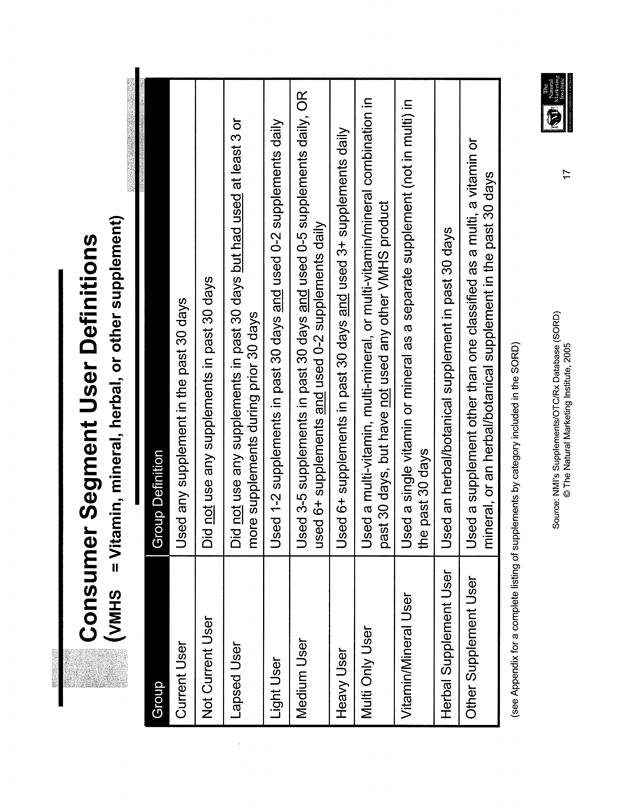

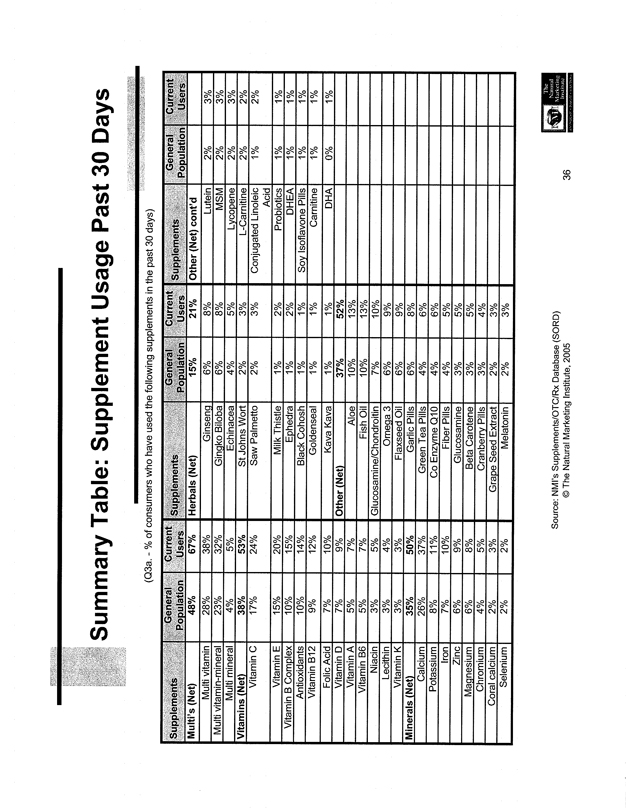

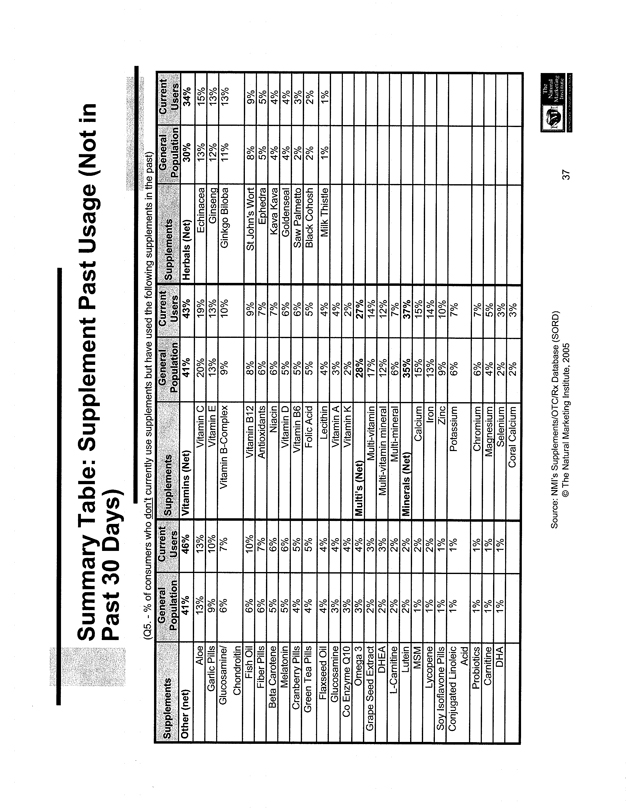

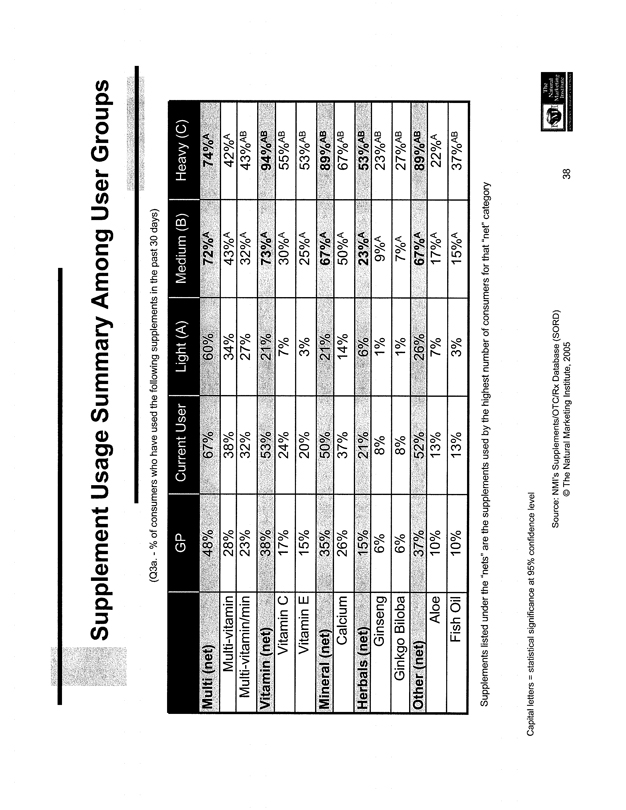

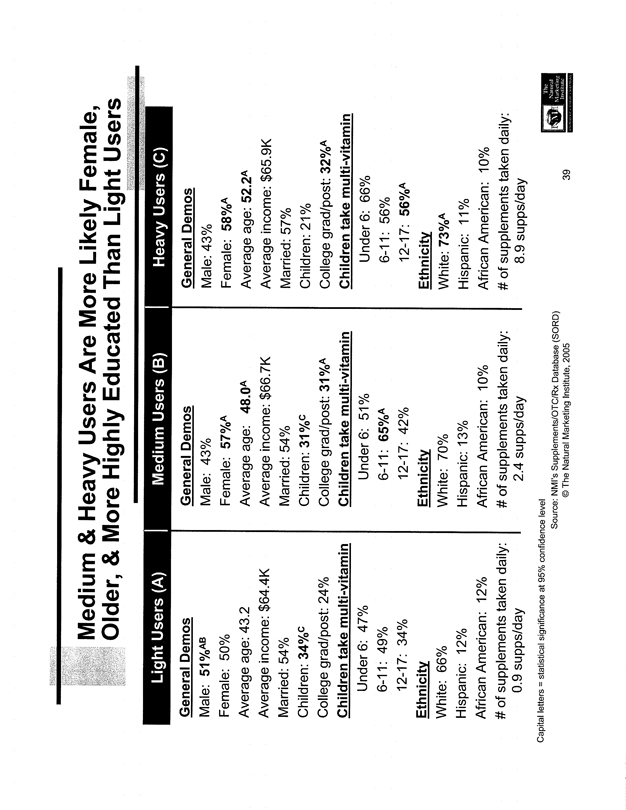

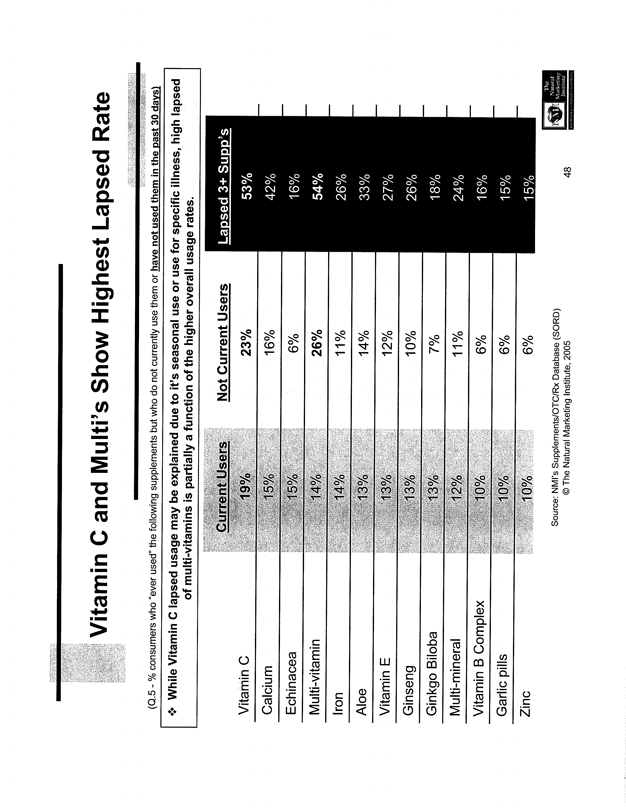

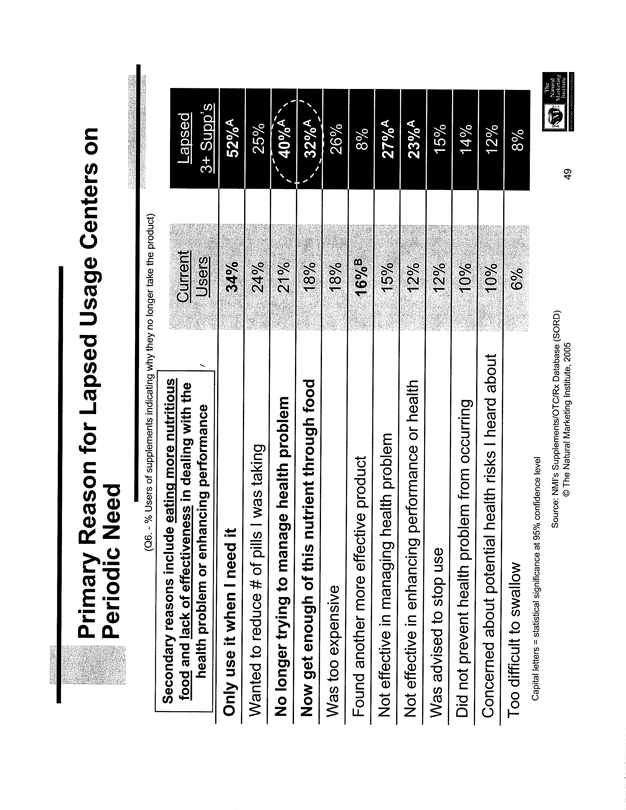

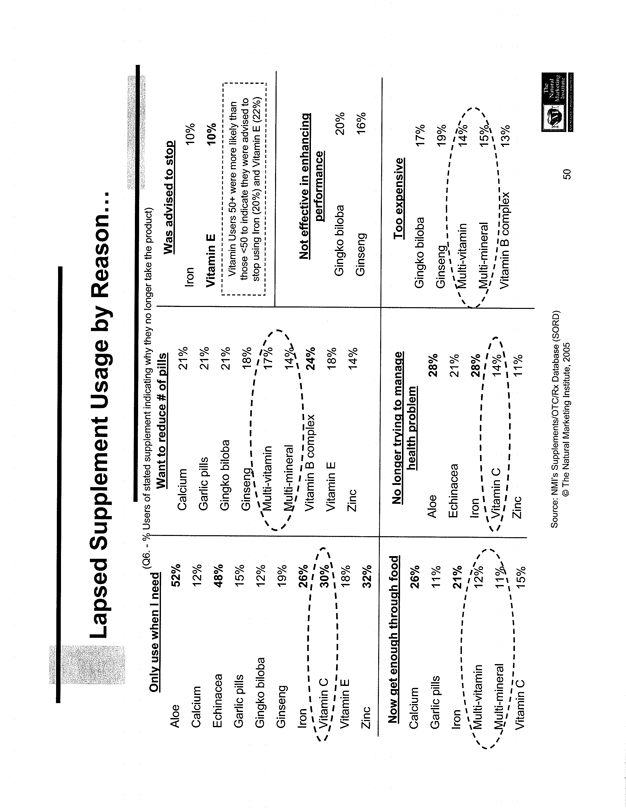

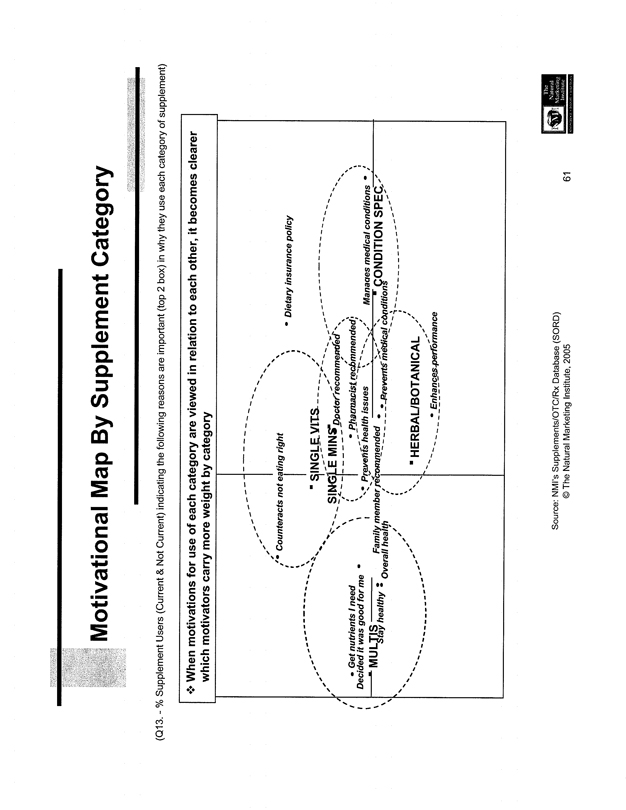

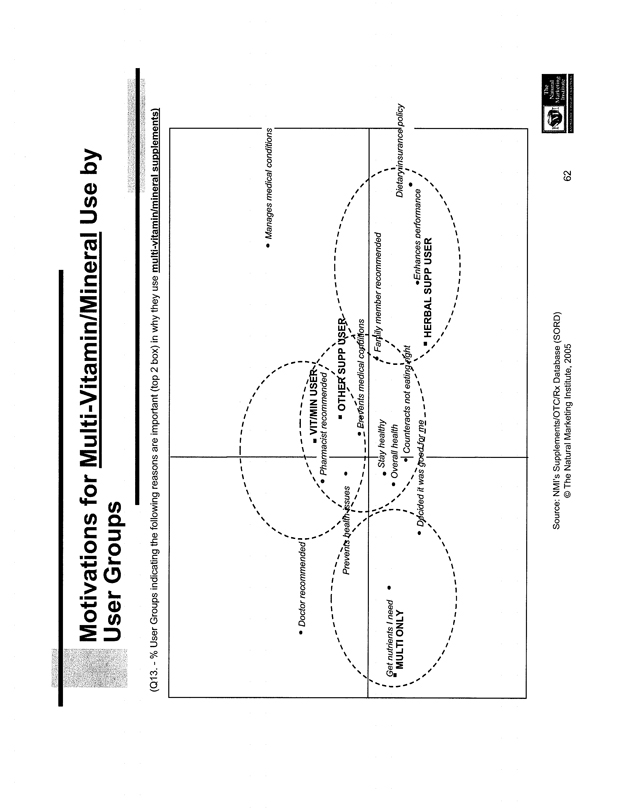

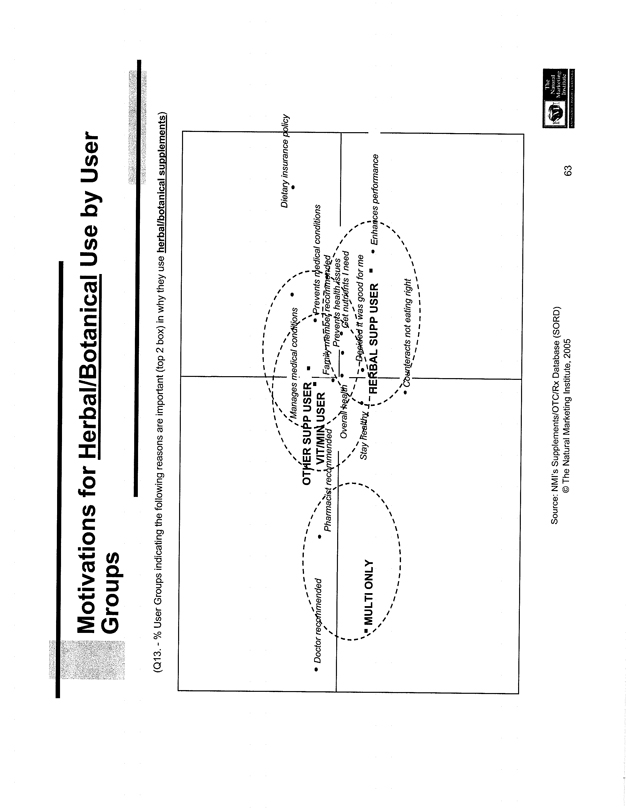

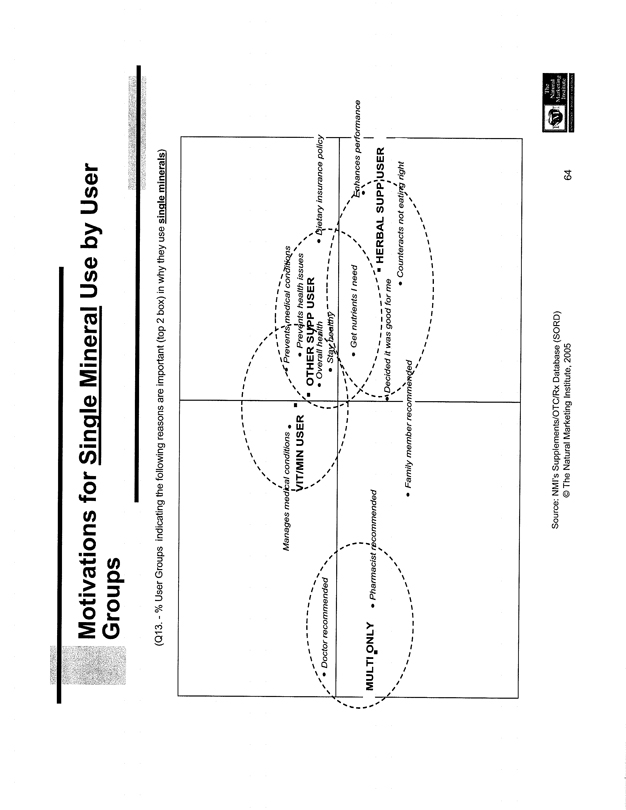

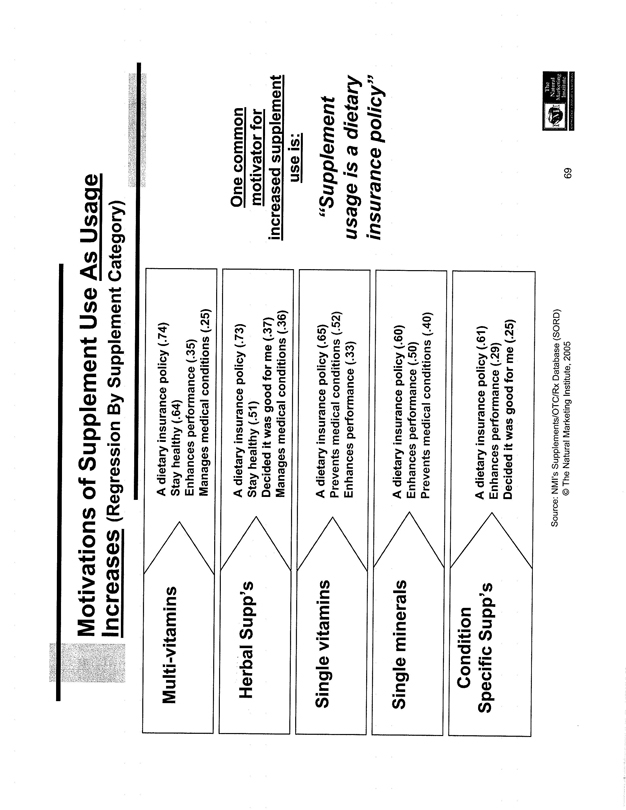

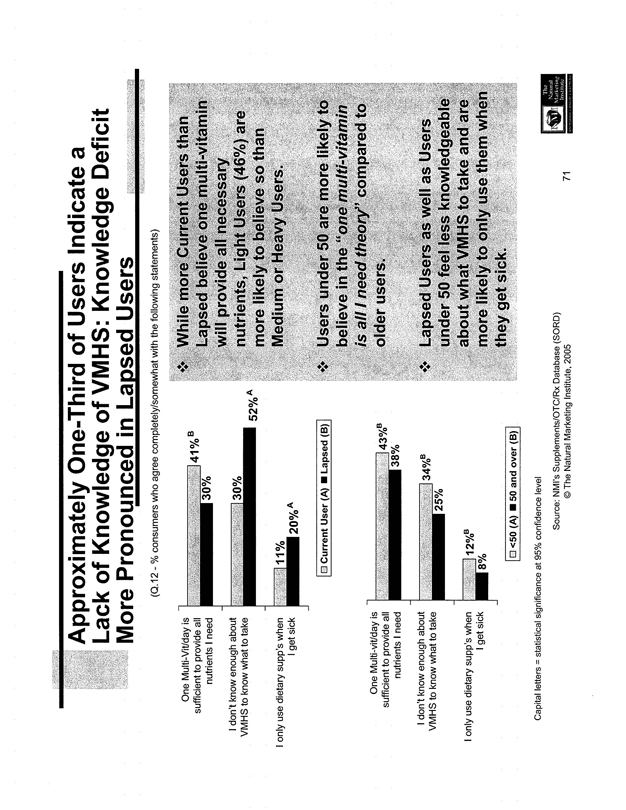

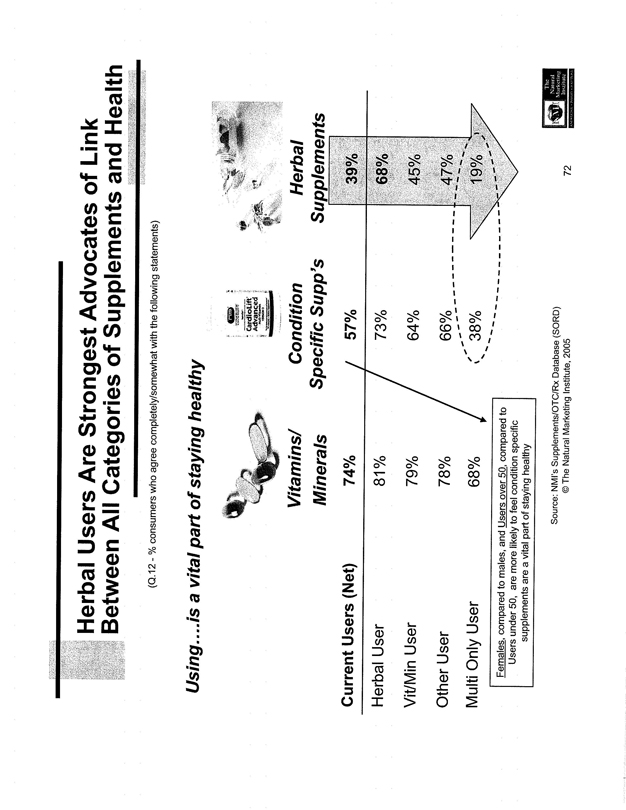

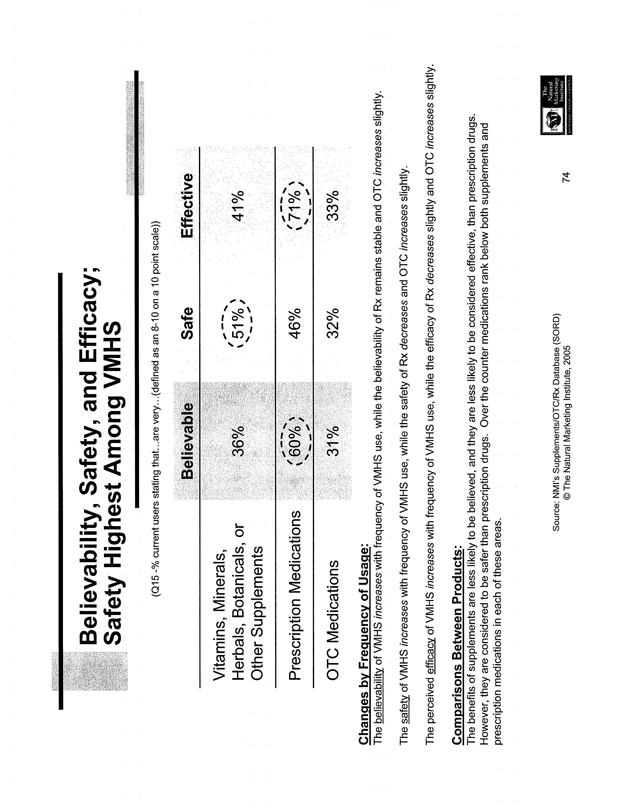

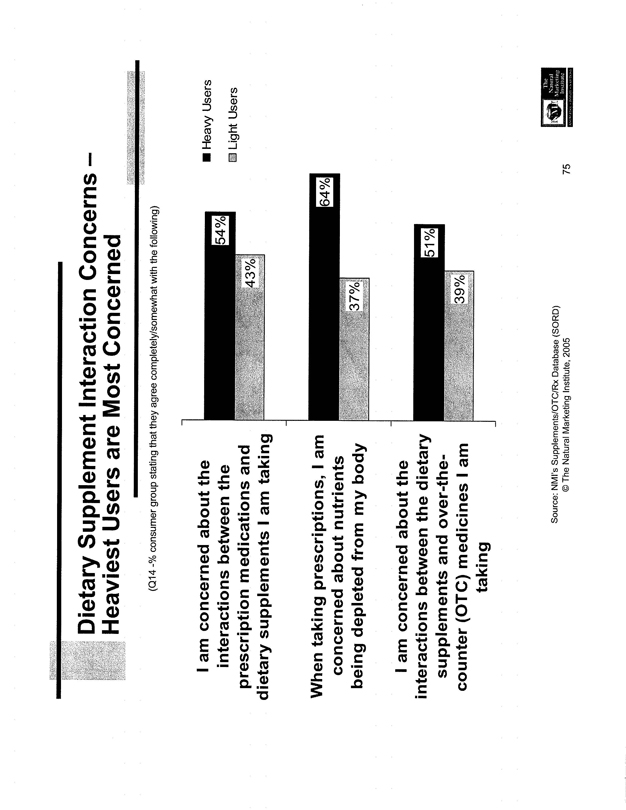

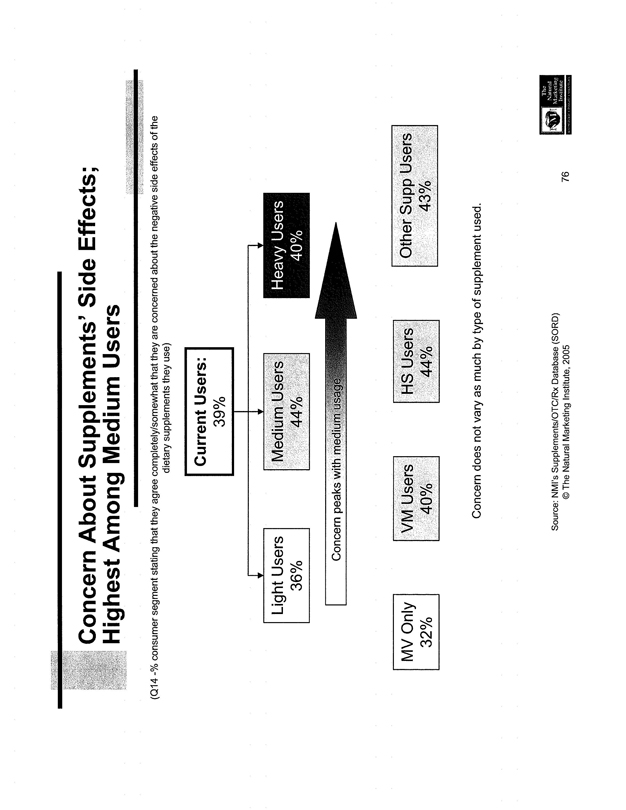

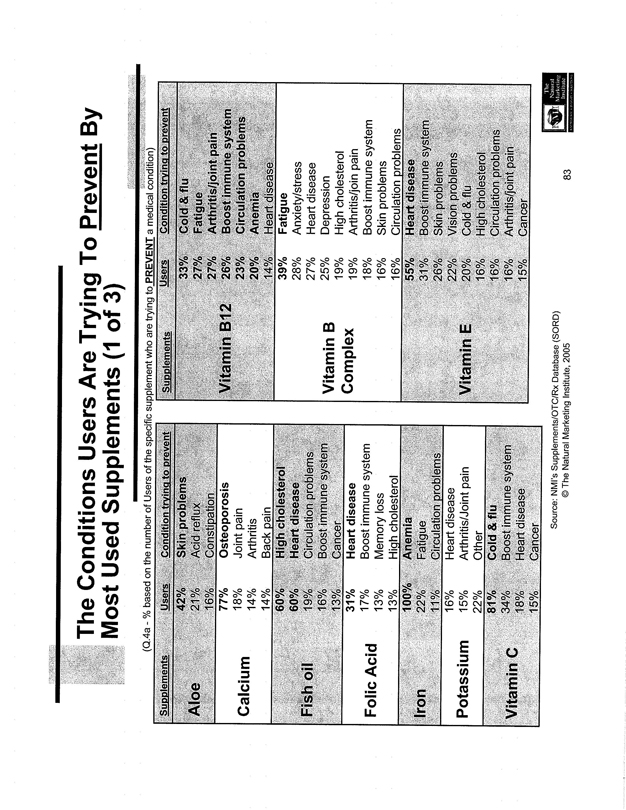

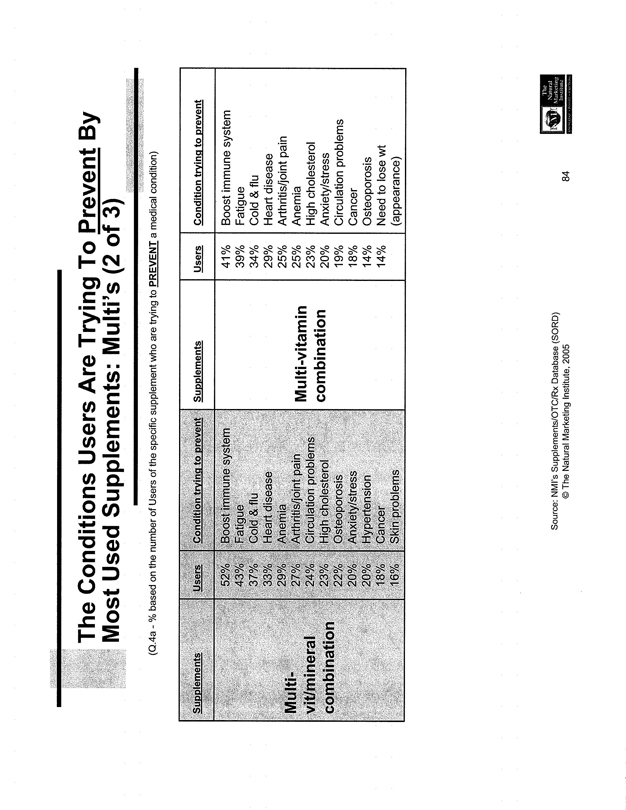

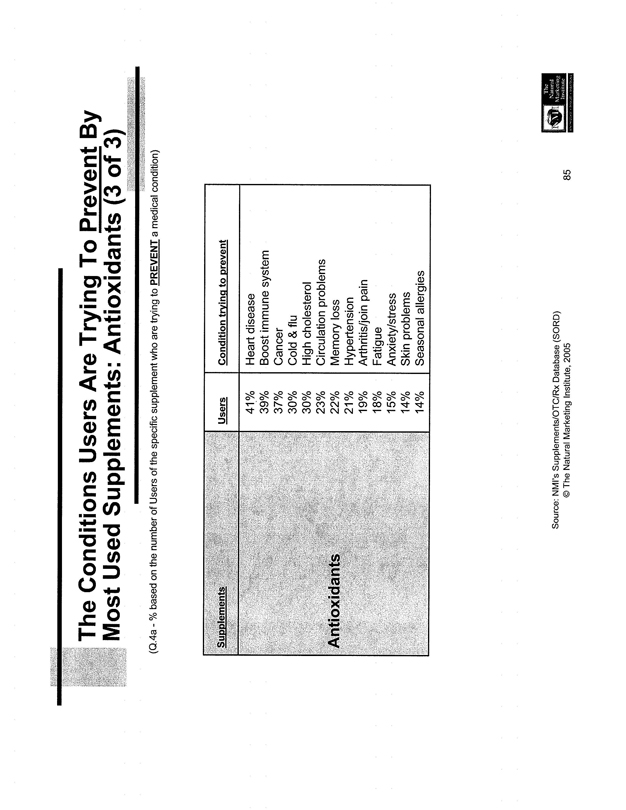

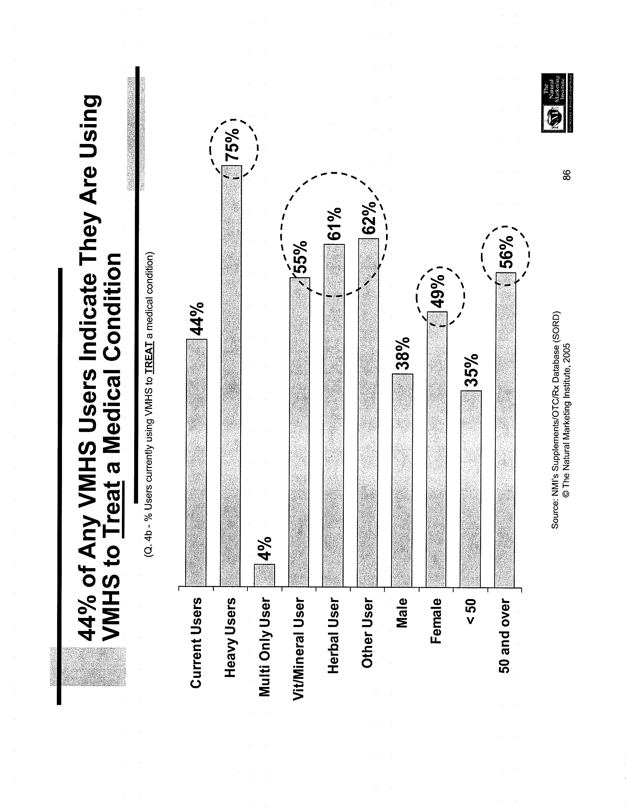

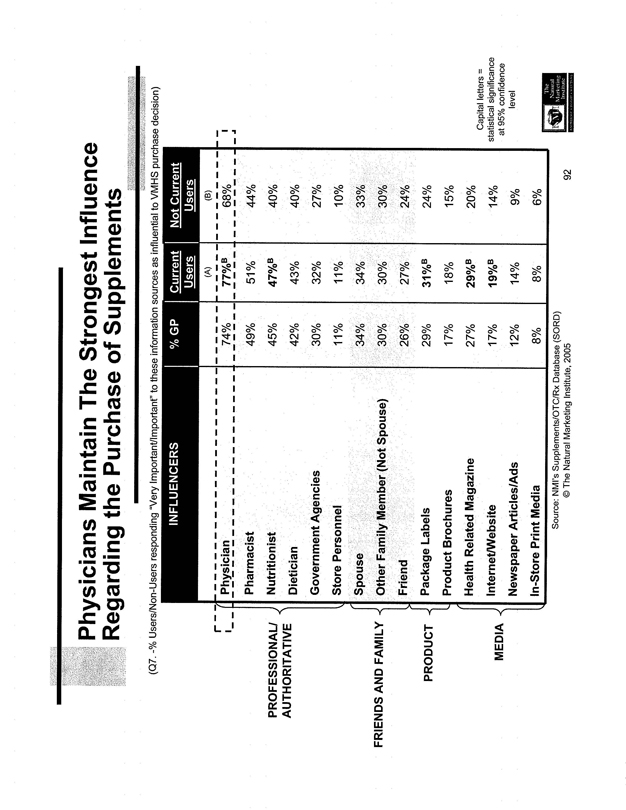

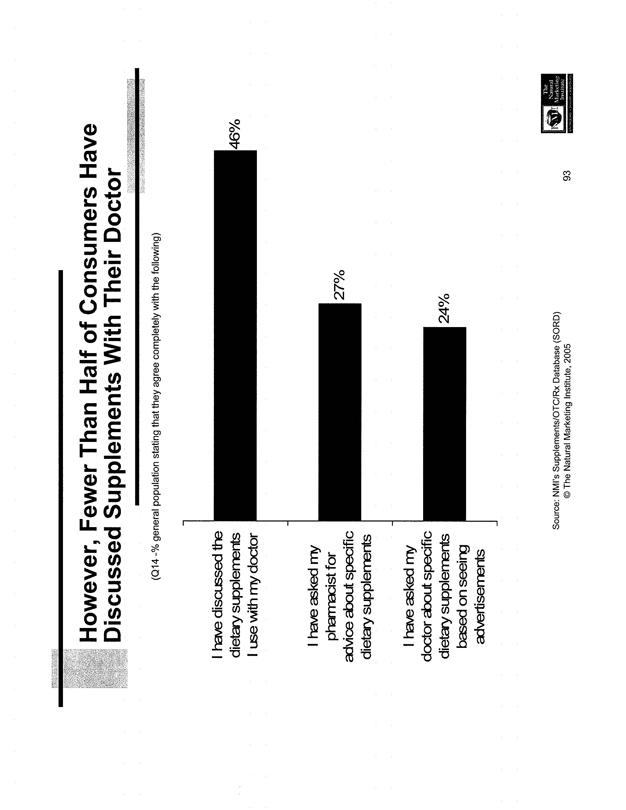

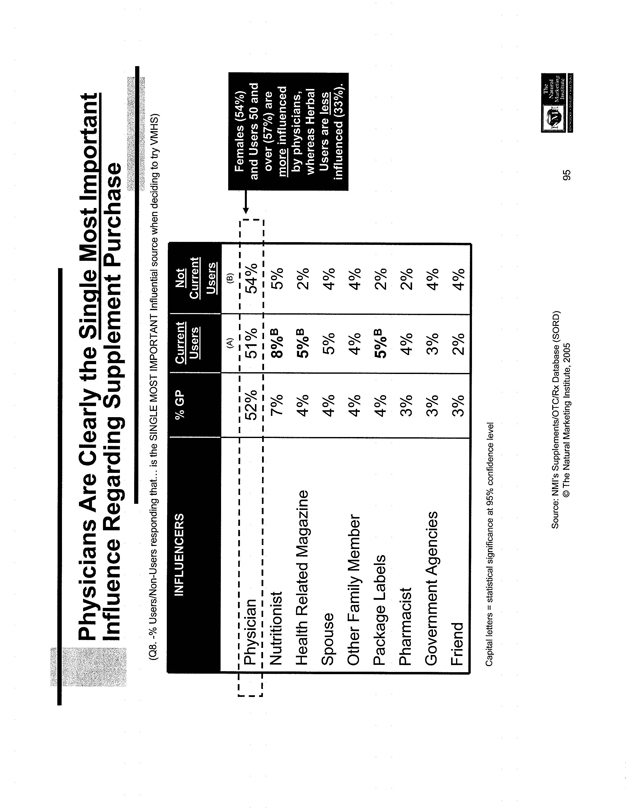

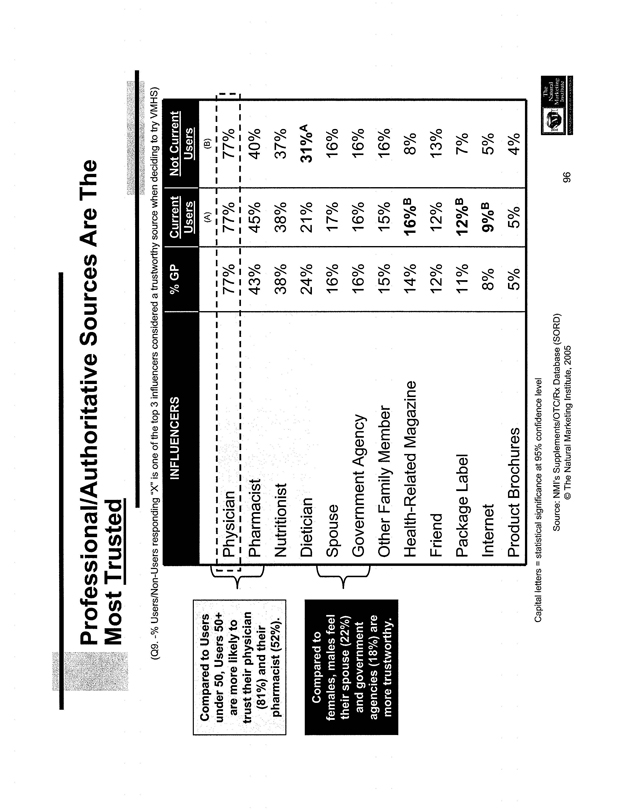

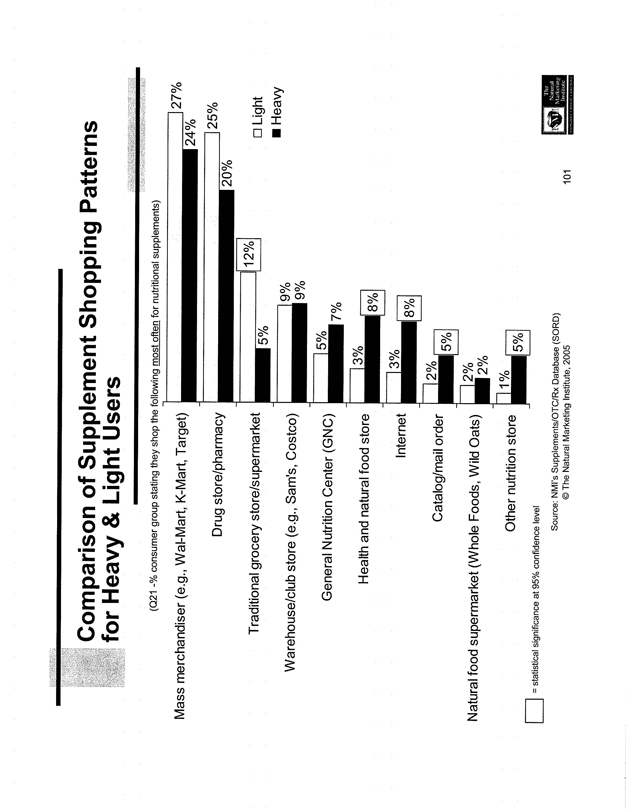

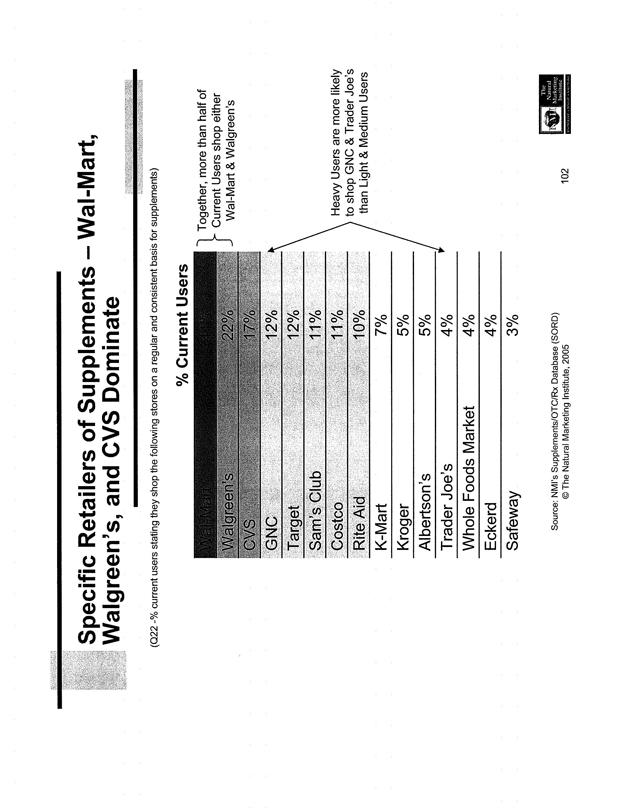

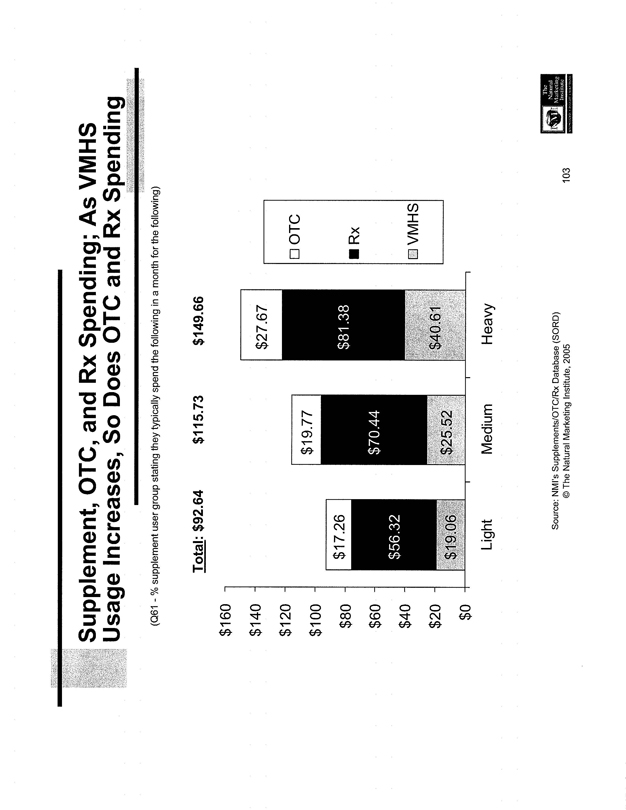

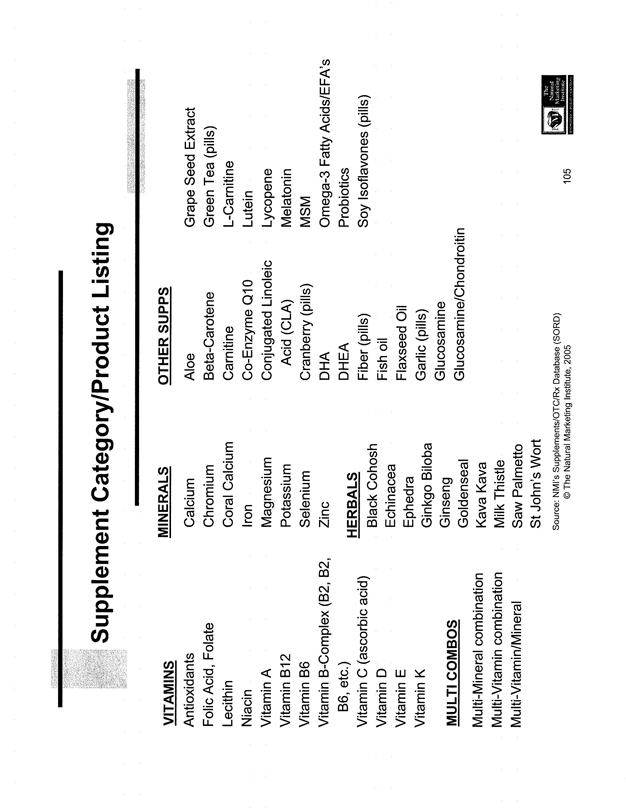

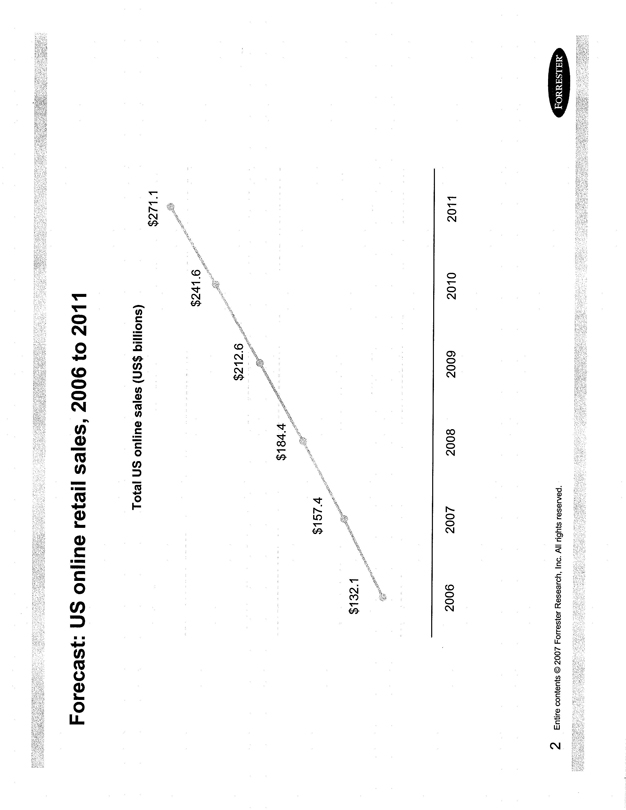

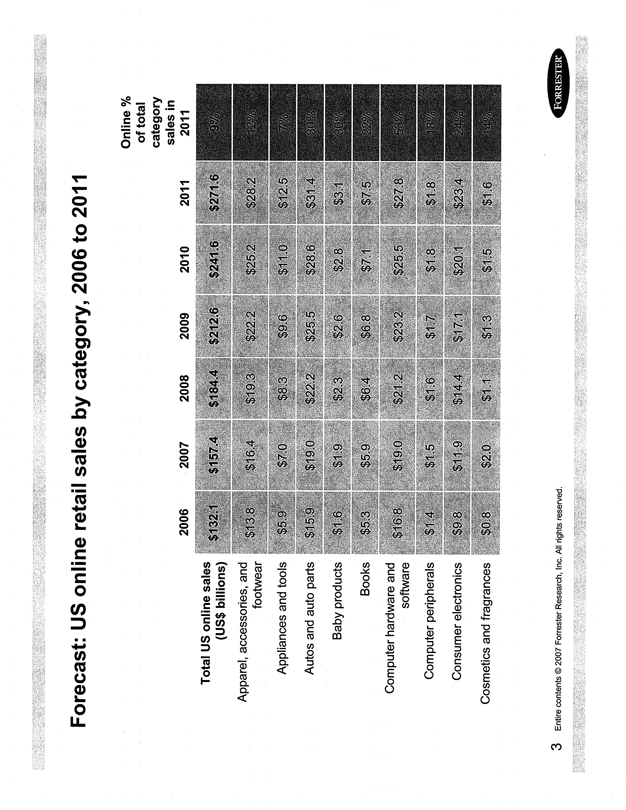

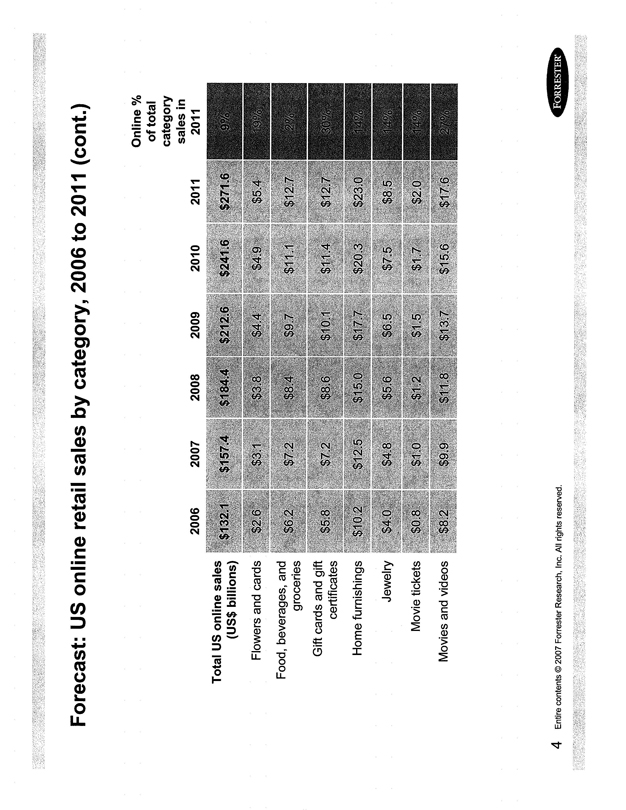

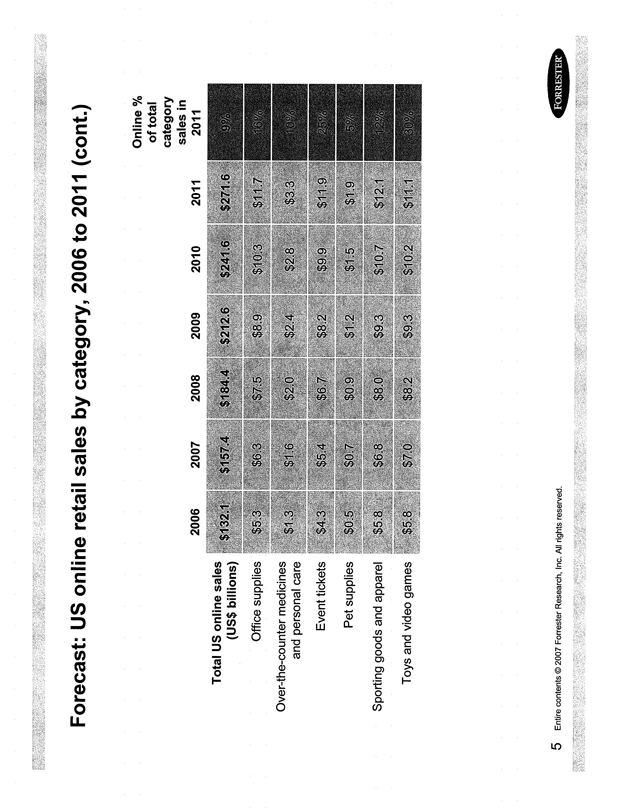

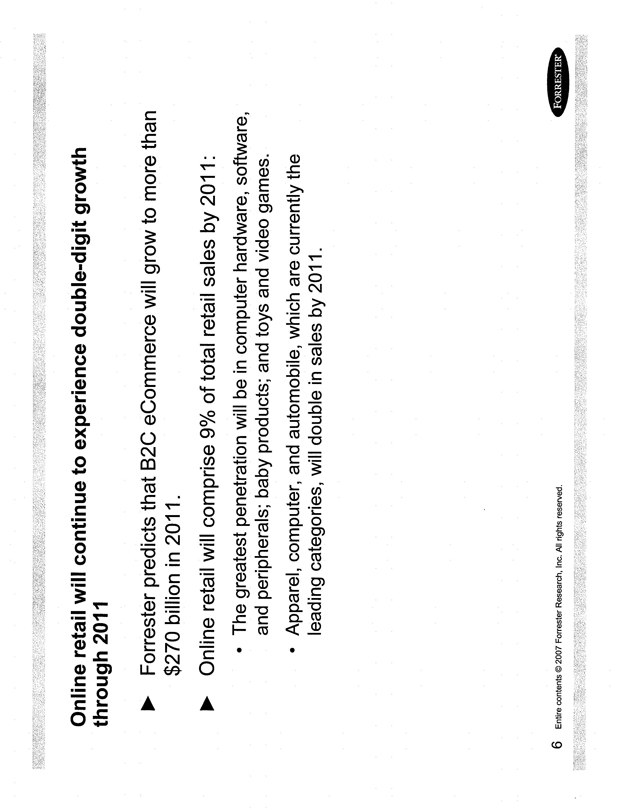

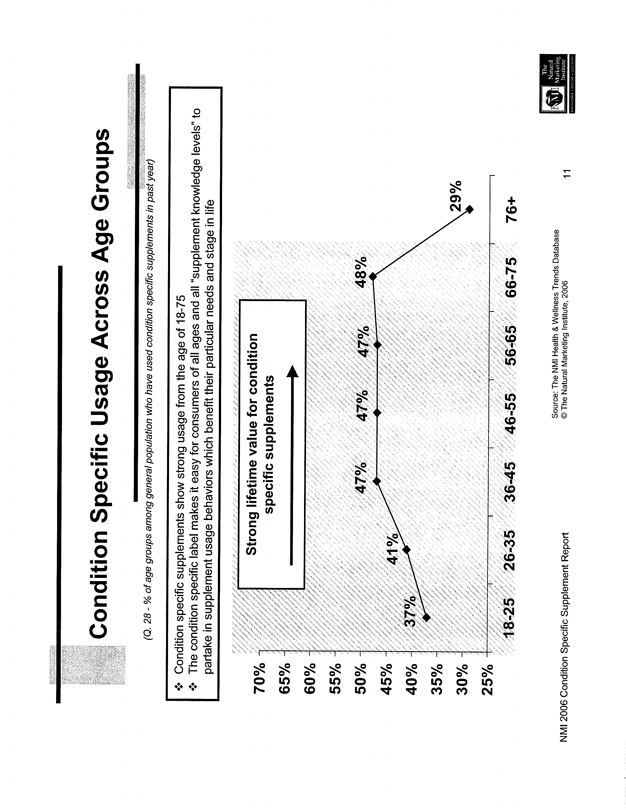

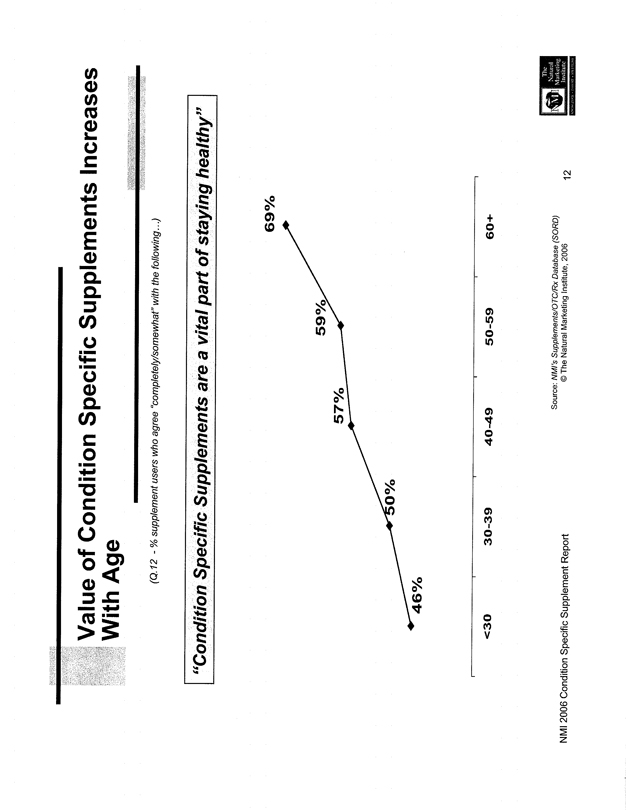

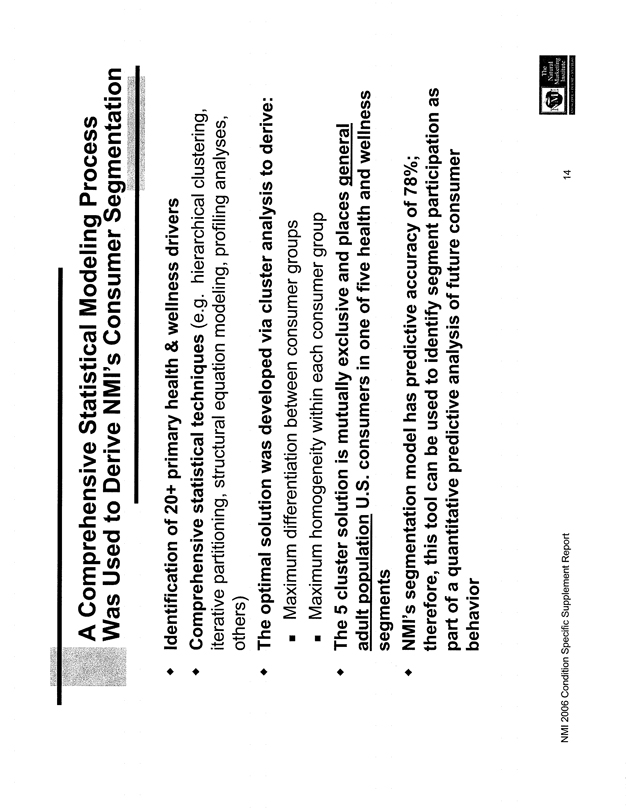

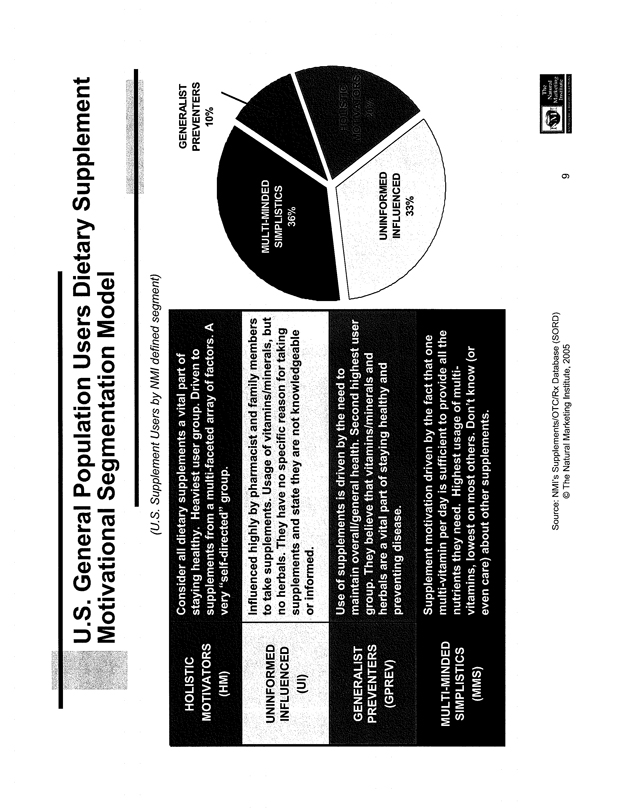

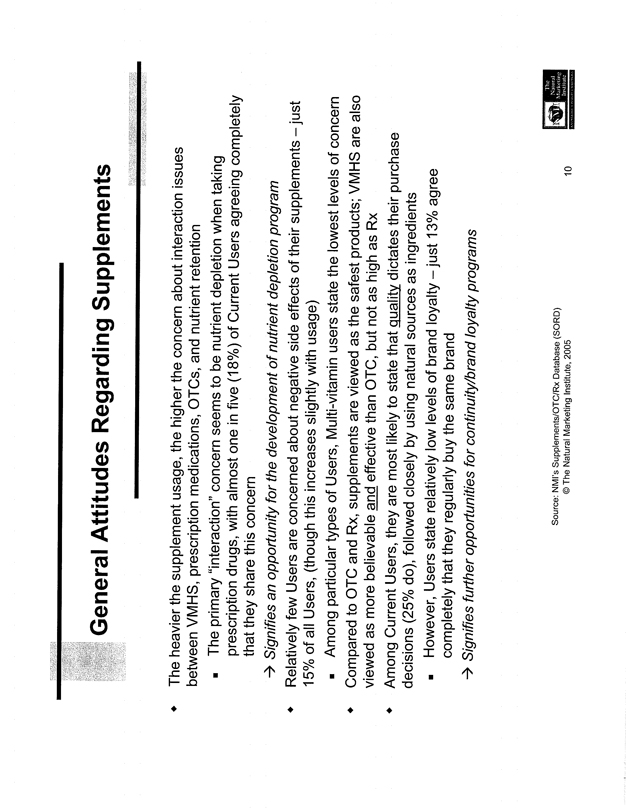

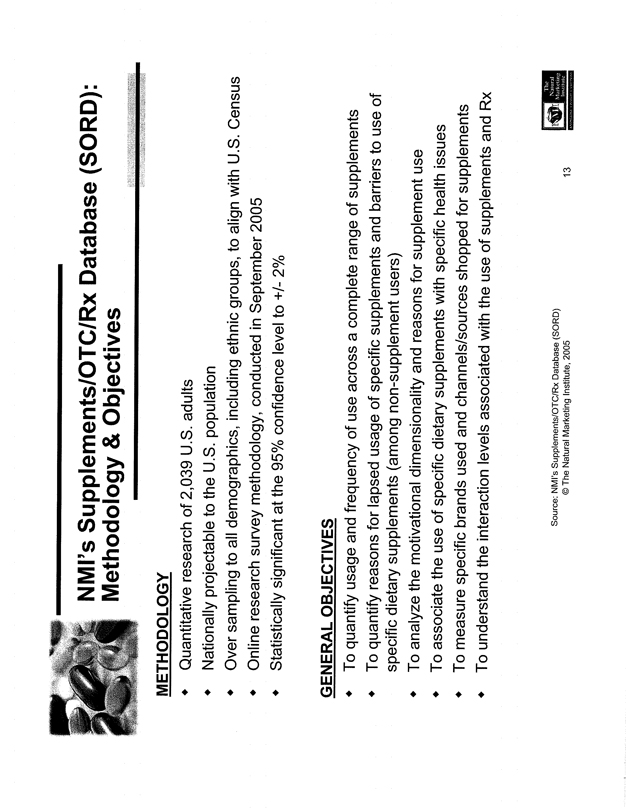

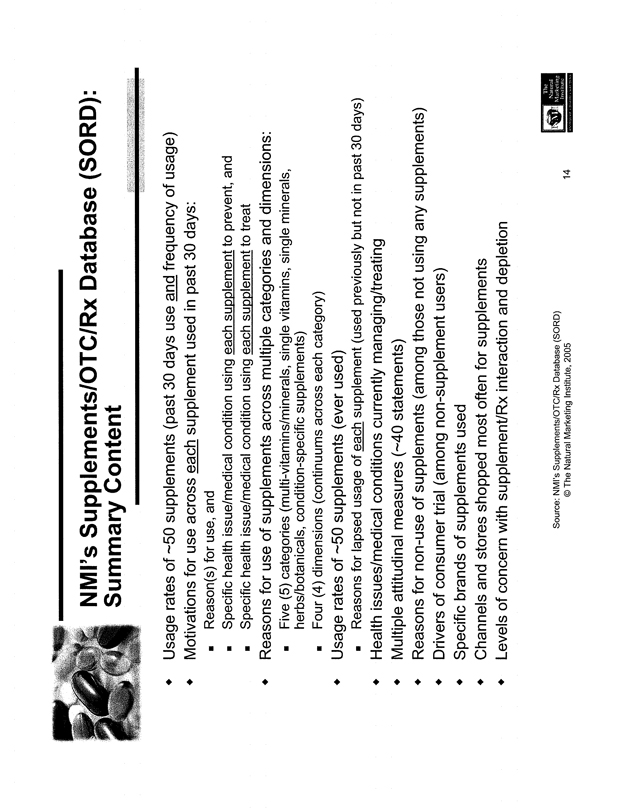

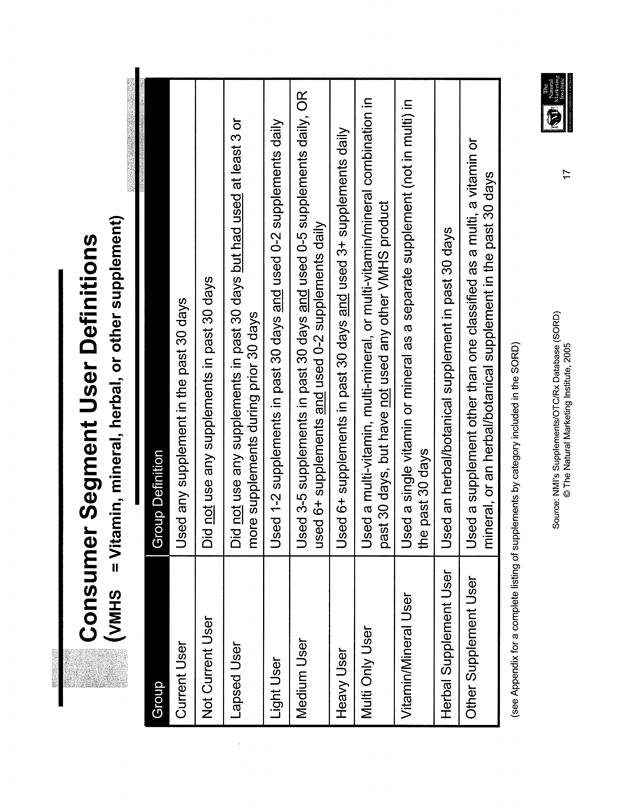

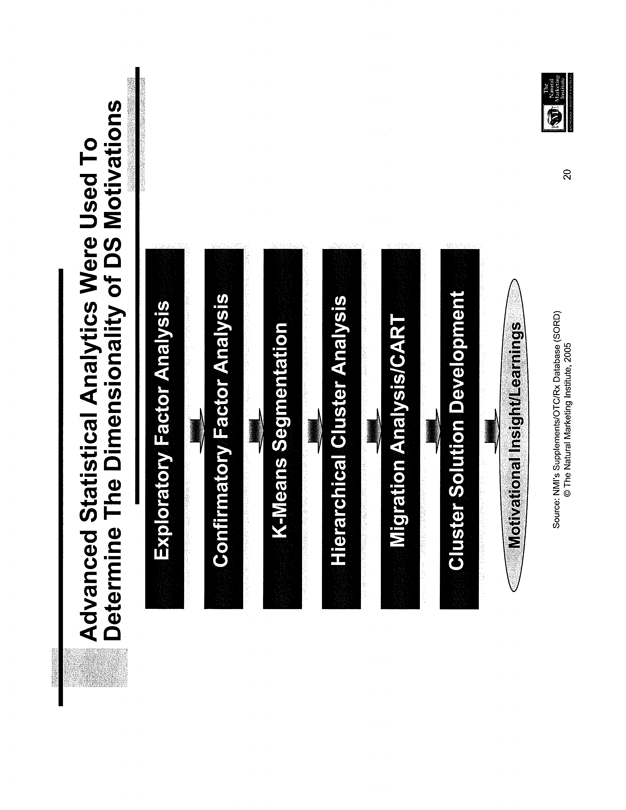

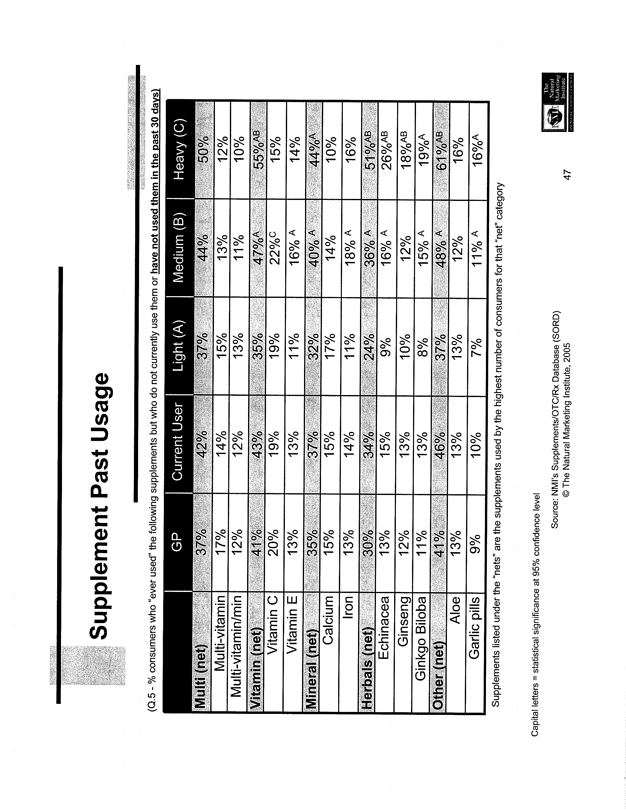

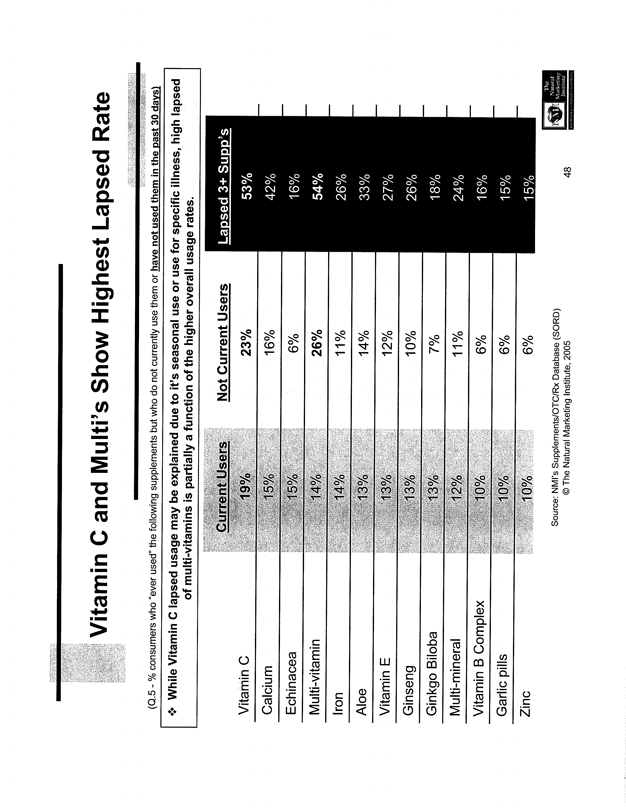

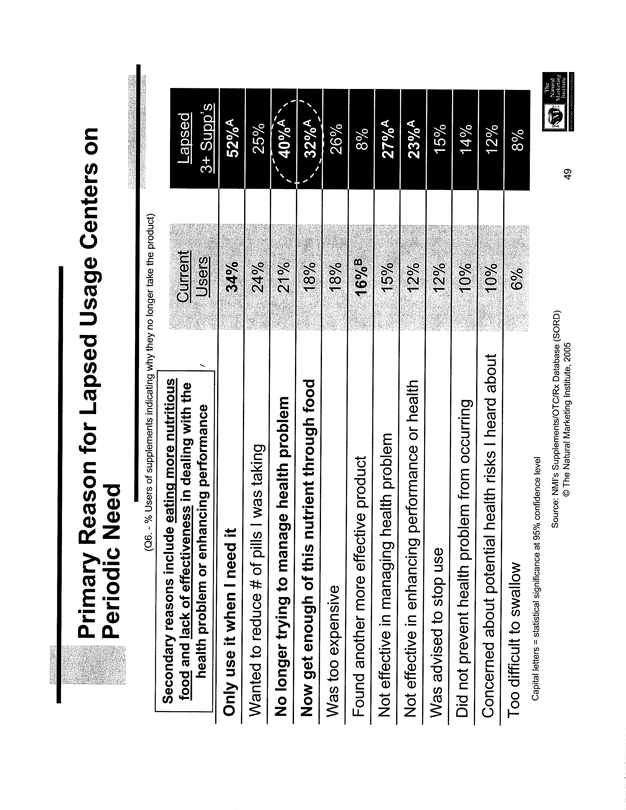

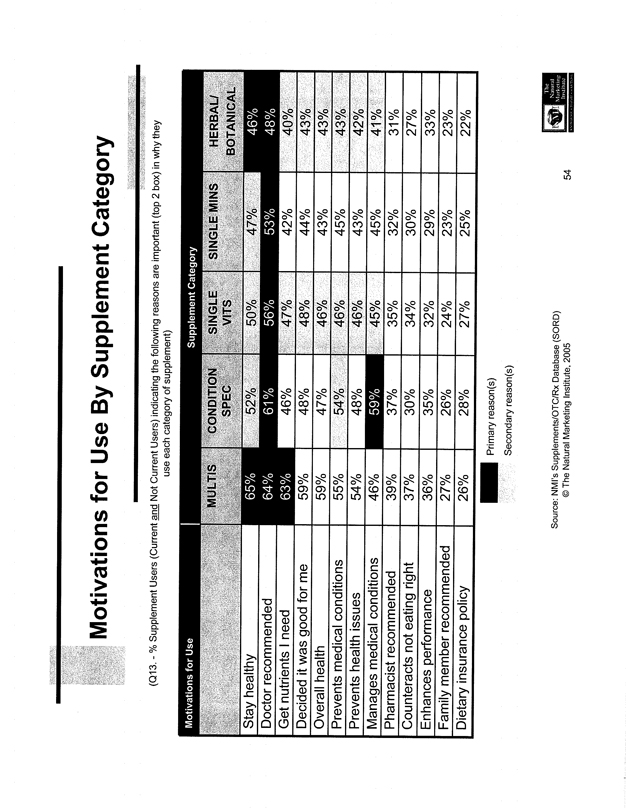

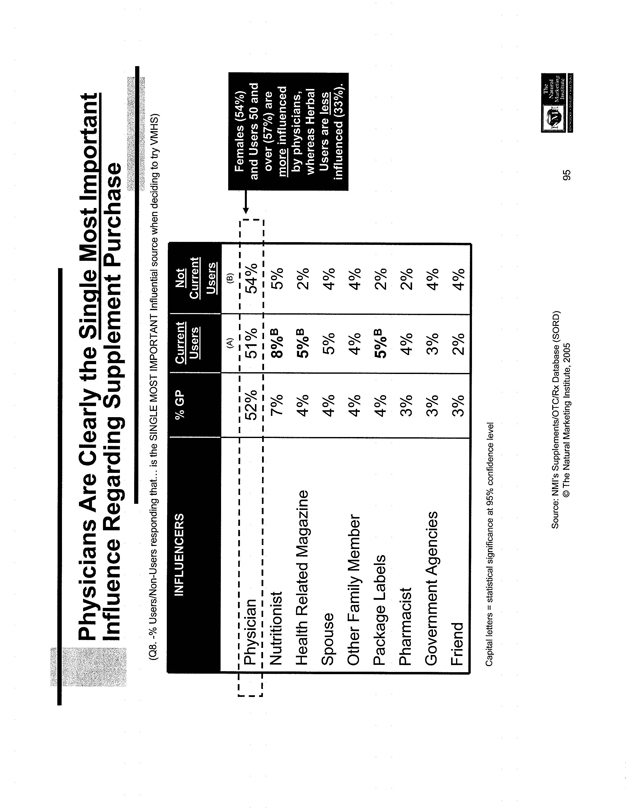

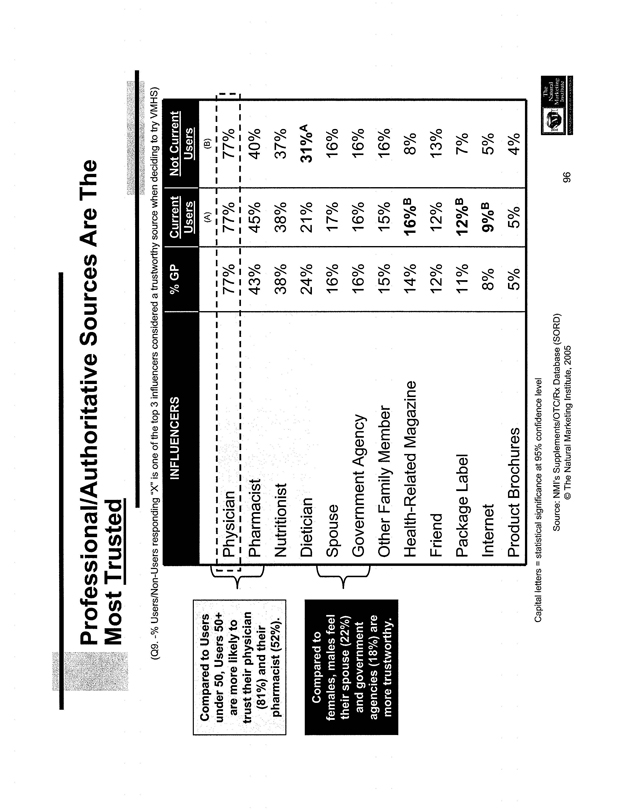

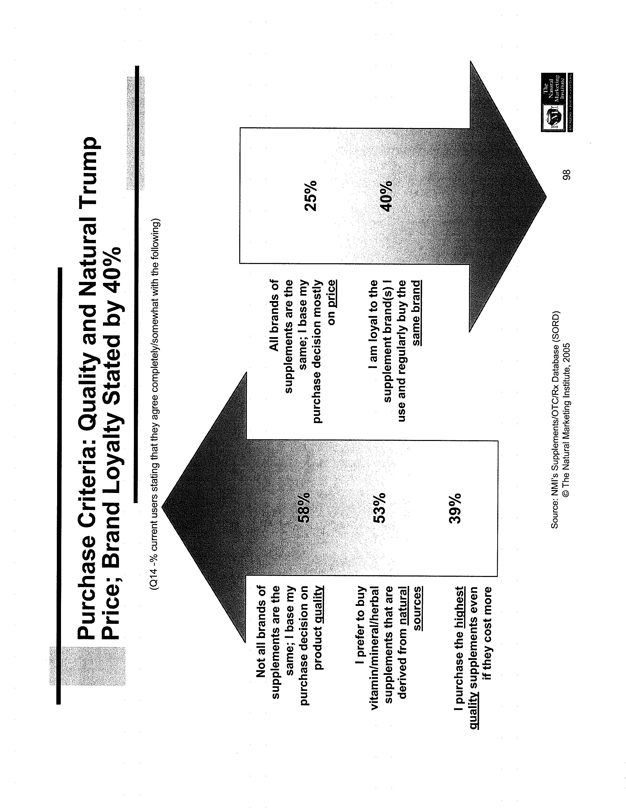

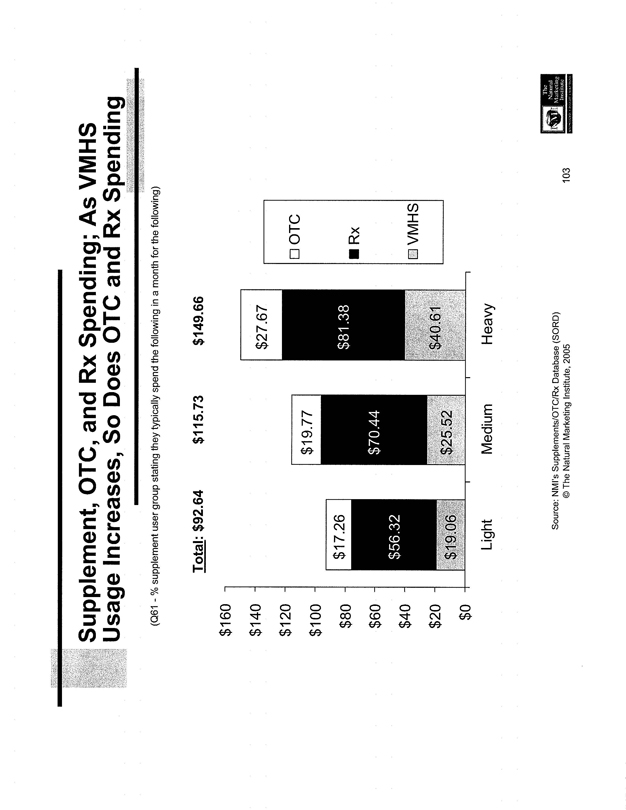

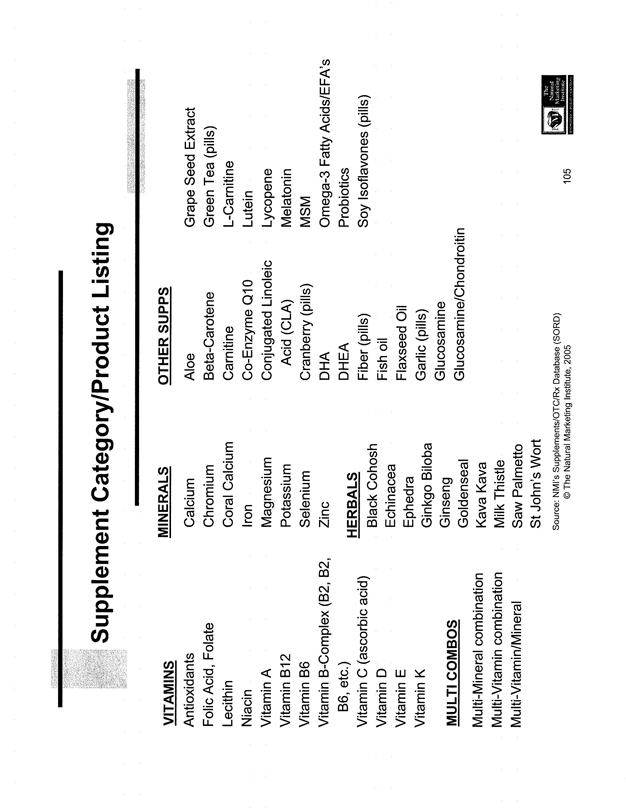

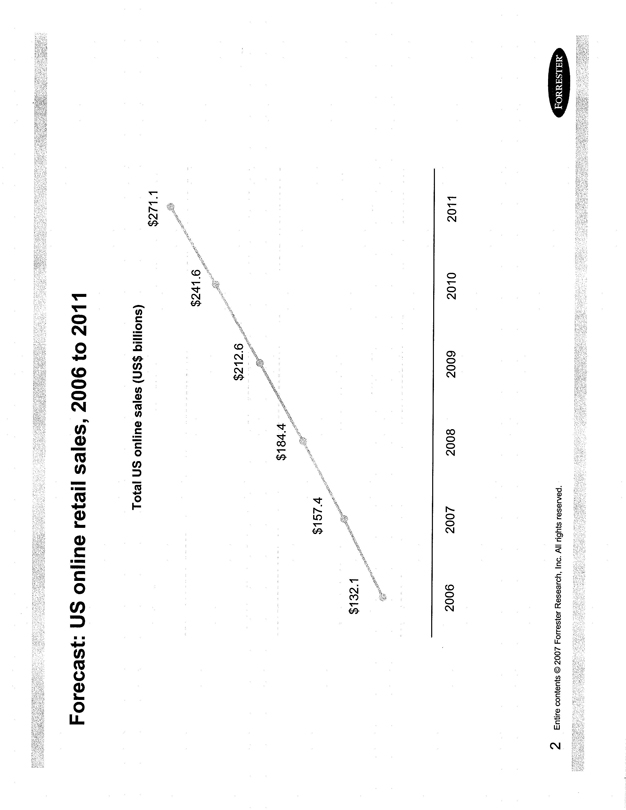

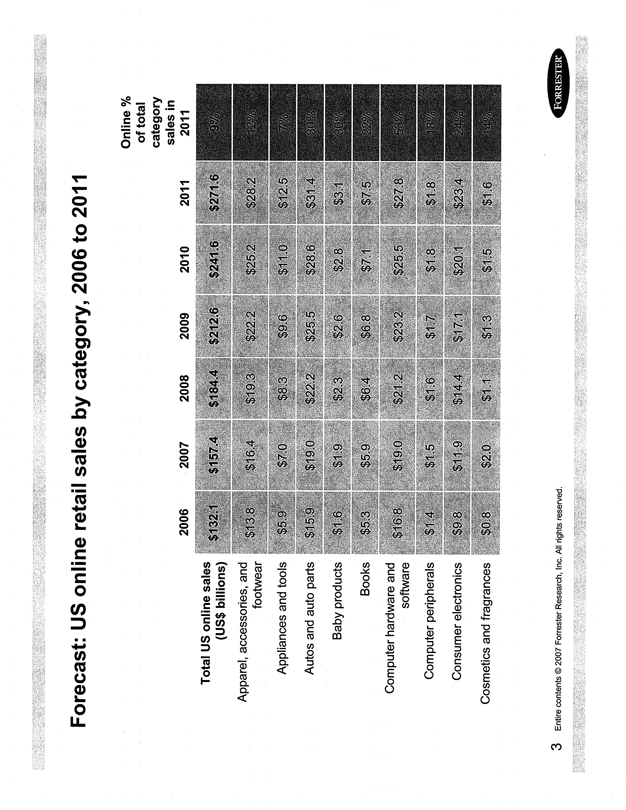

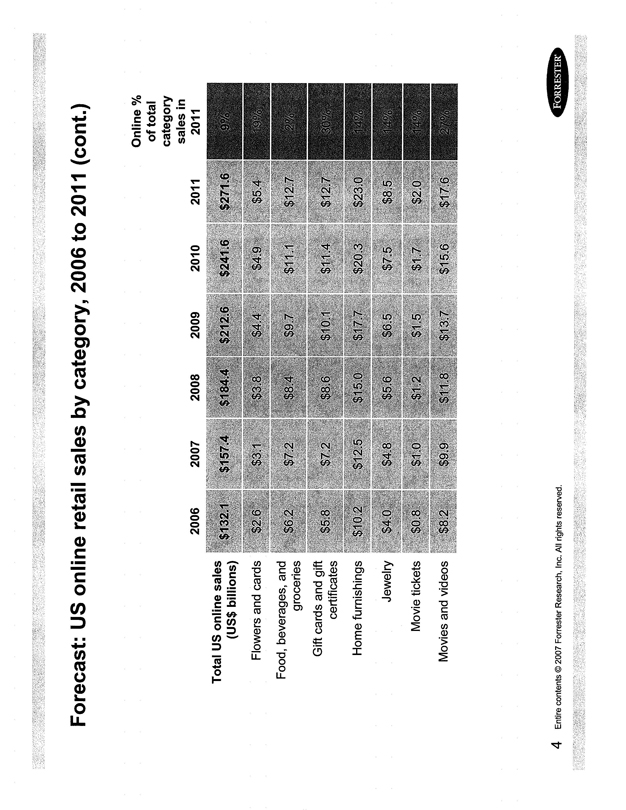

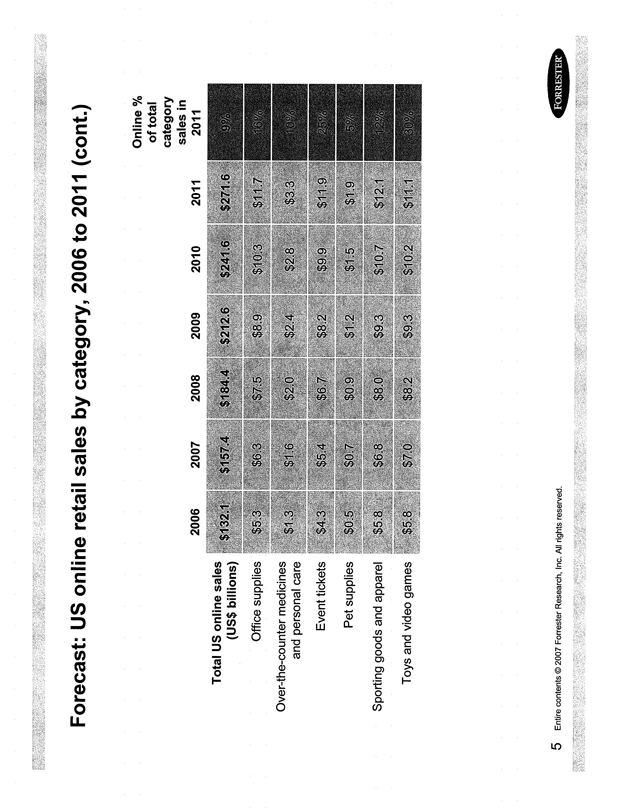

14. You refer here and under Industry Overview on page 40 to various reports, articles and studies from such sources as the Natural Marketing Institute, Forrester Research, the Hartman Group, the Centers for Medicare and Medicaid, the American Medical Association, etc. in connection with industry data you discuss. Please provide these documents to us appropriately marked and dated for these and any similar statements, such as those that appear in your Business section. If any of this material was prepared especially for you and is not publicly available, please file a consent from the source.

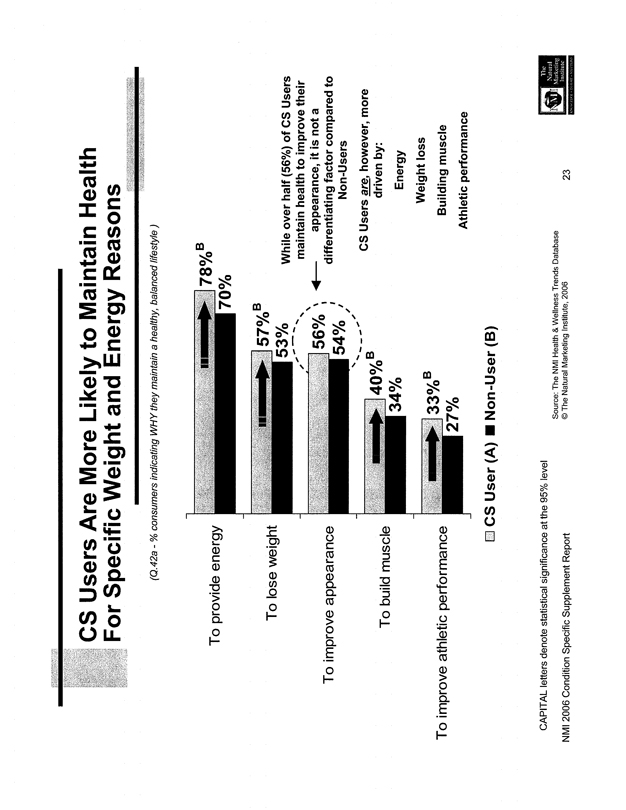

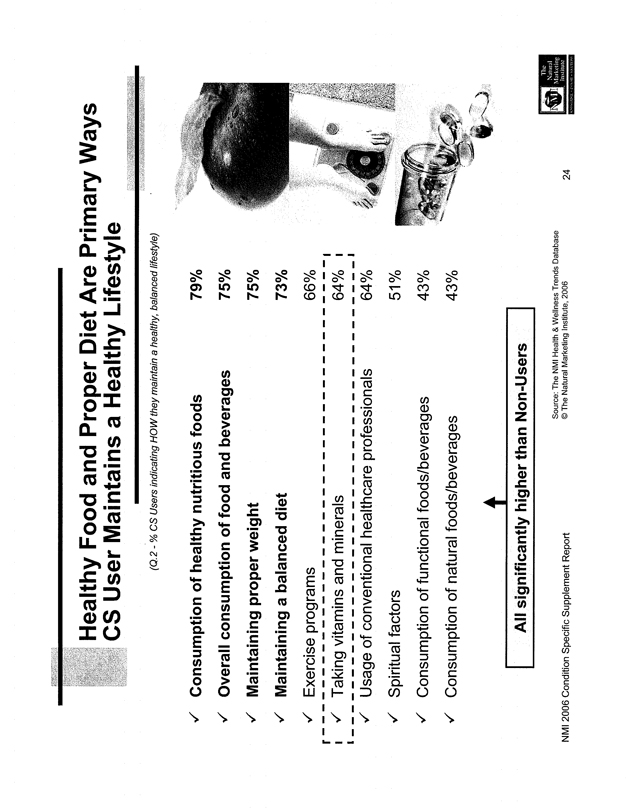

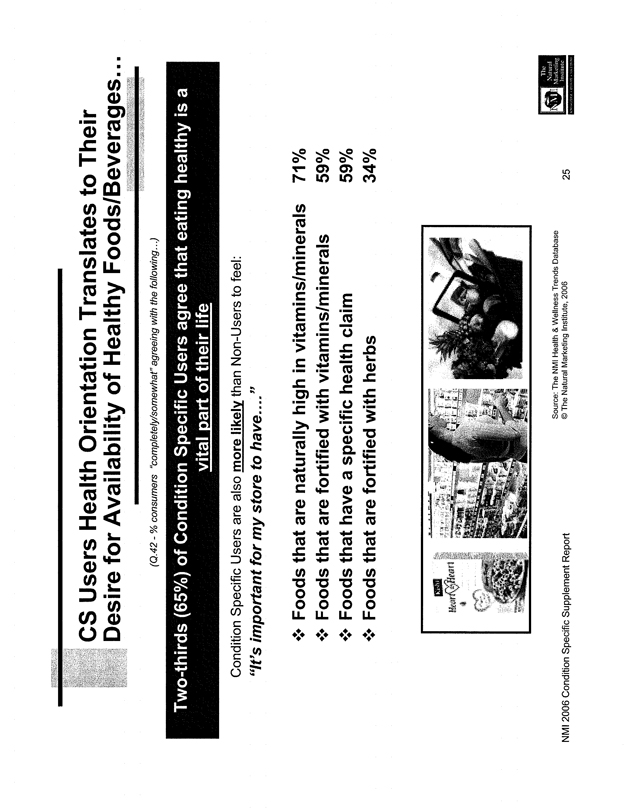

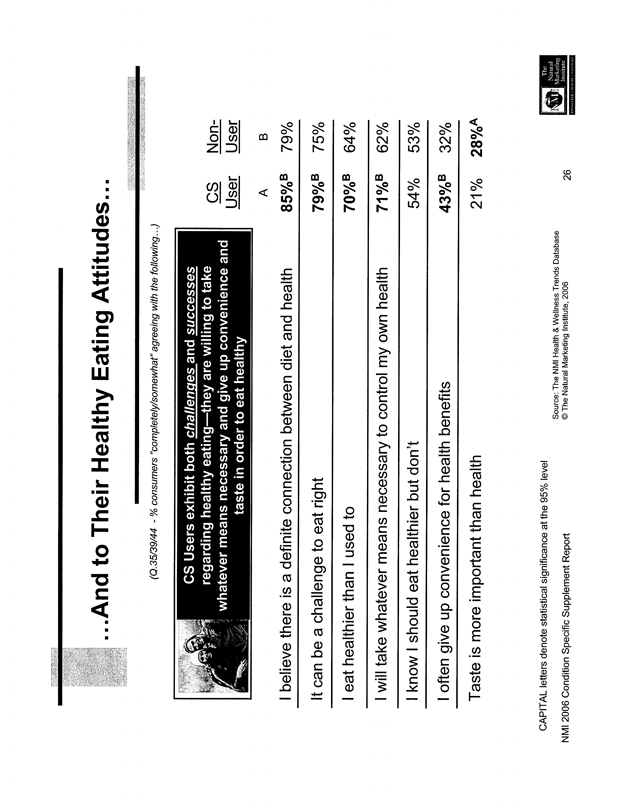

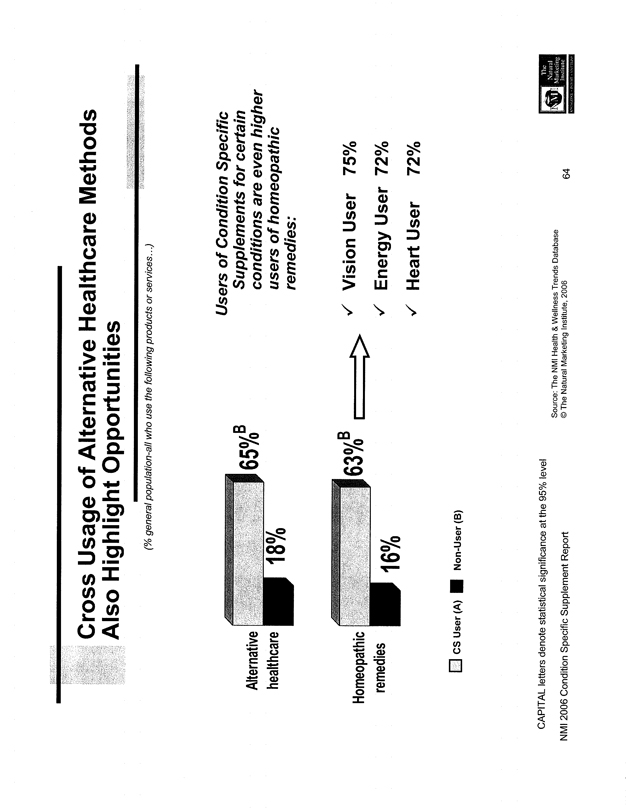

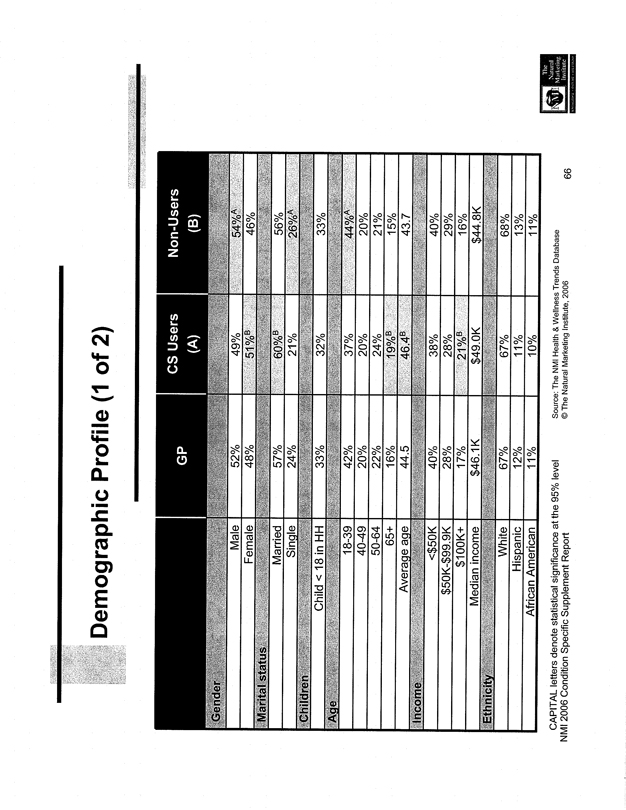

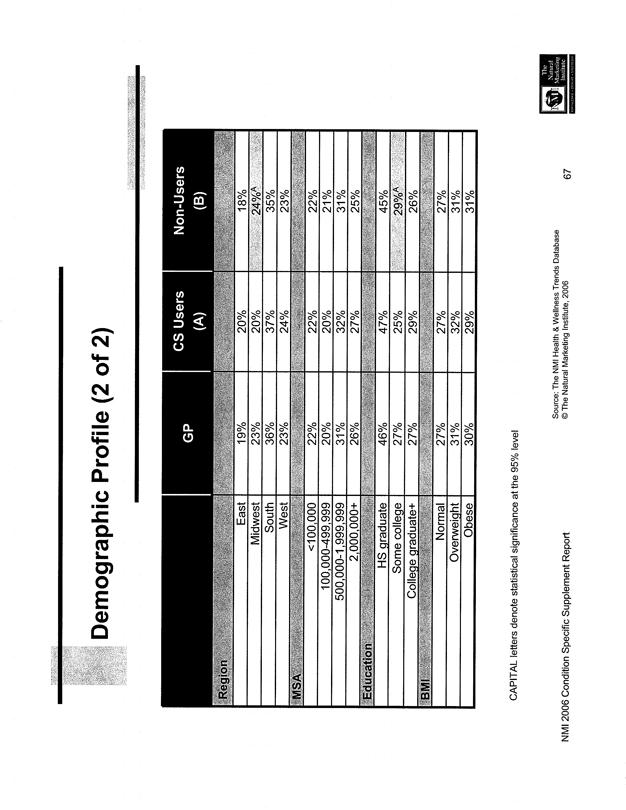

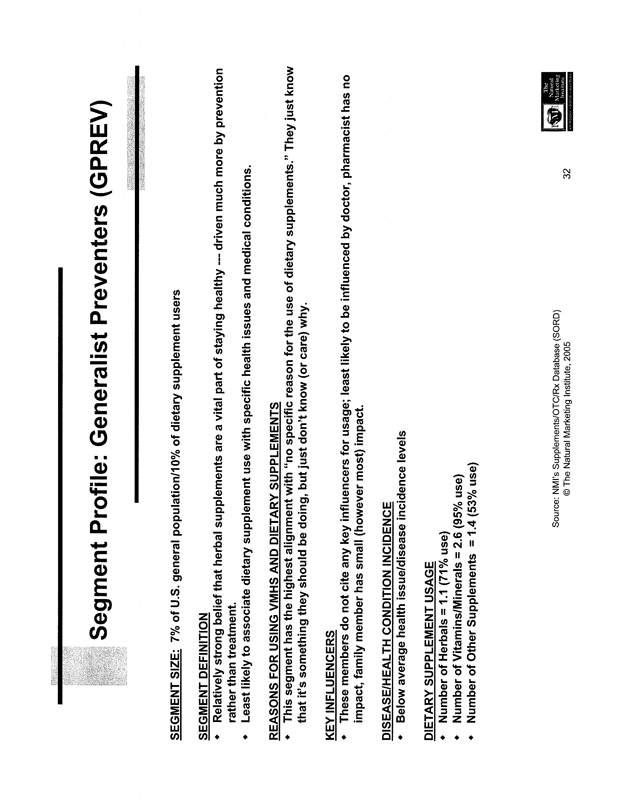

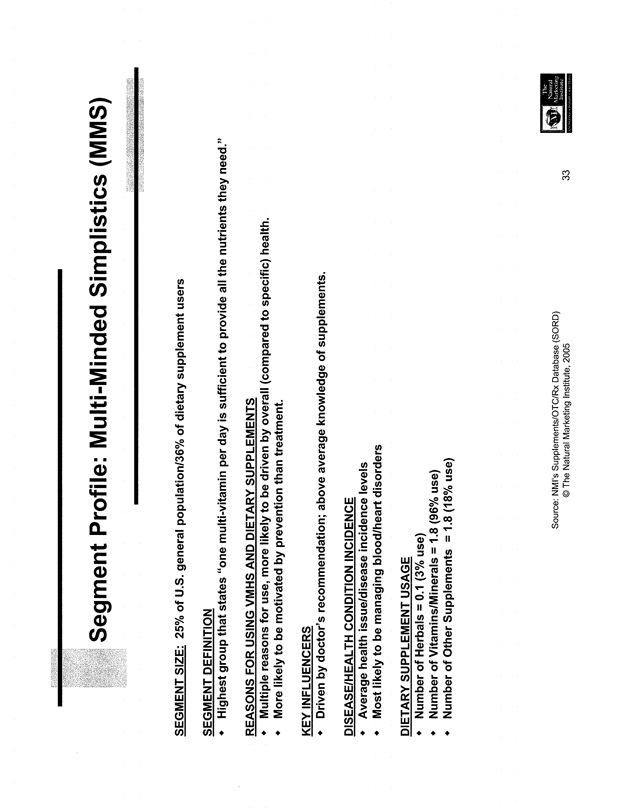

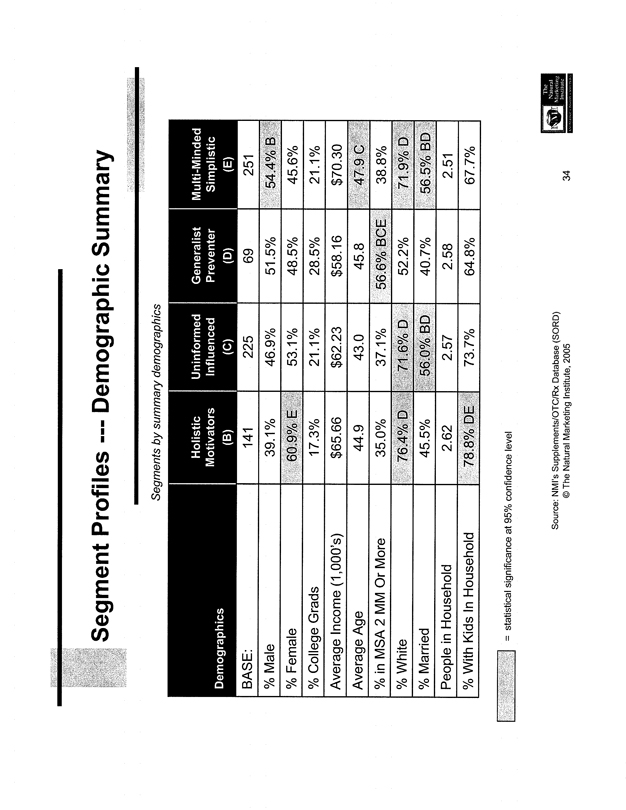

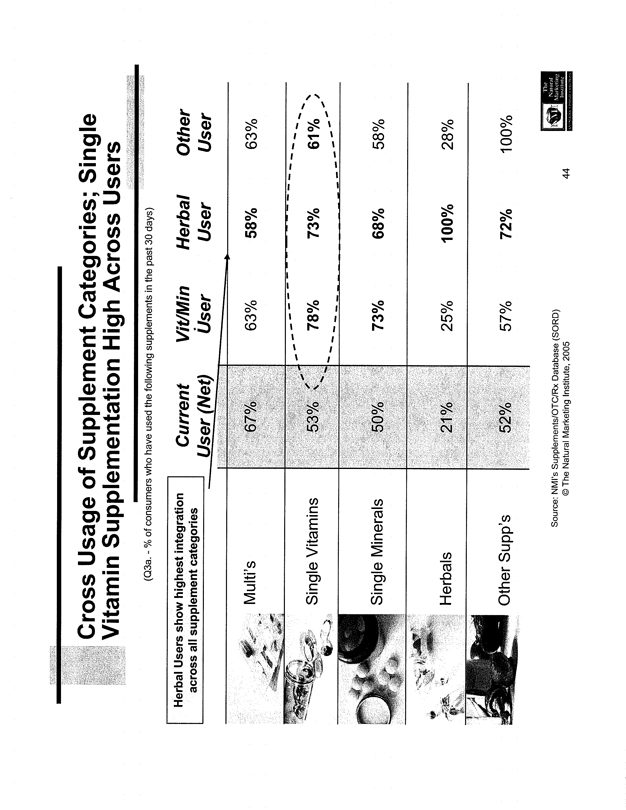

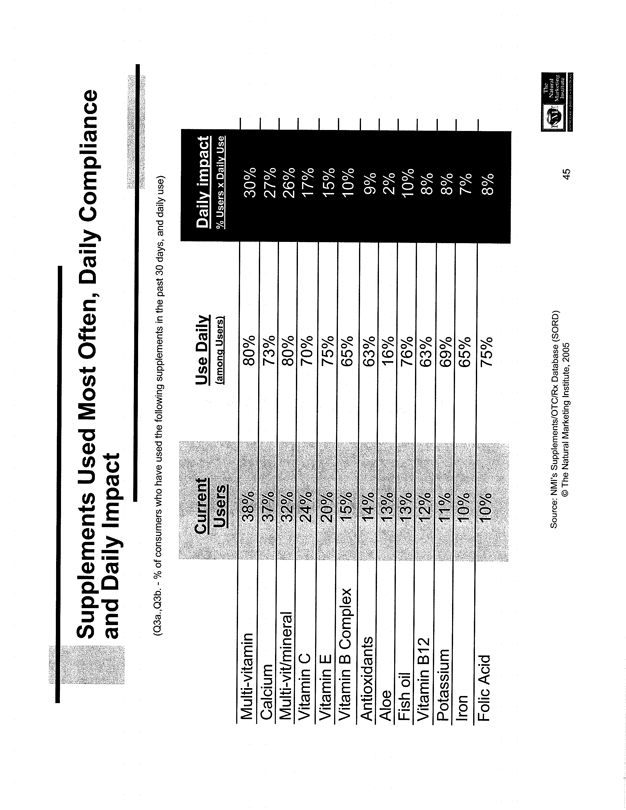

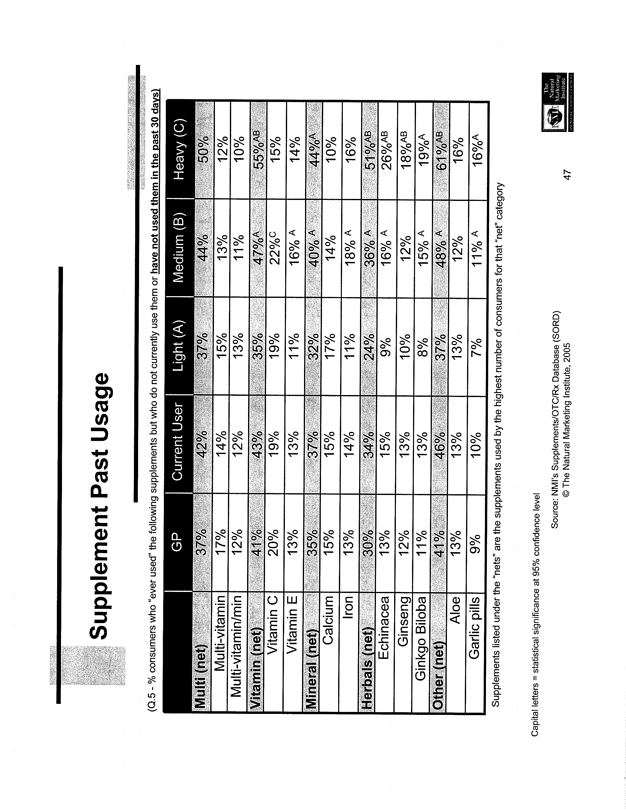

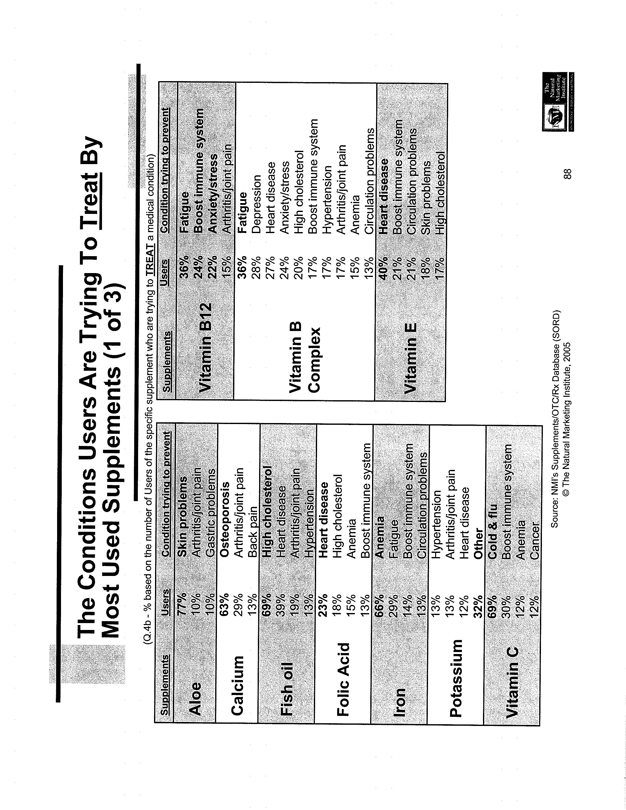

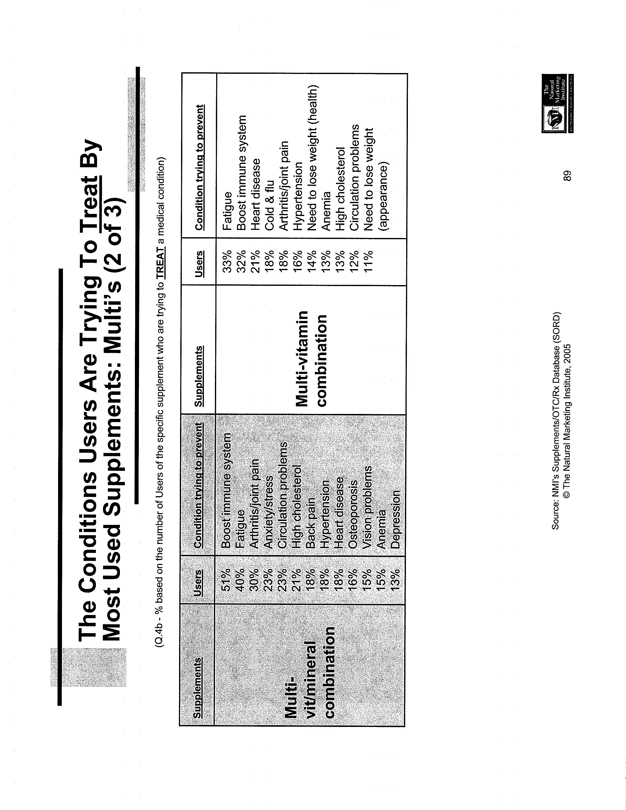

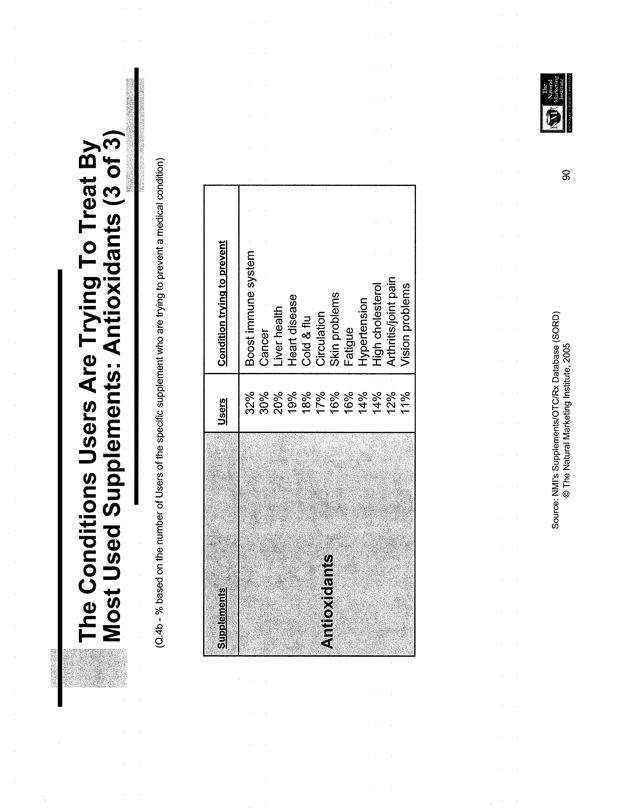

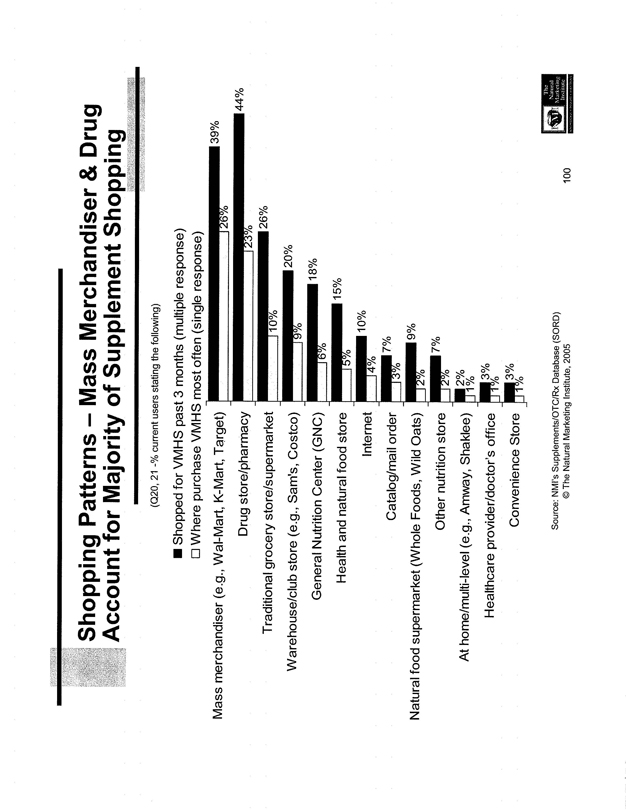

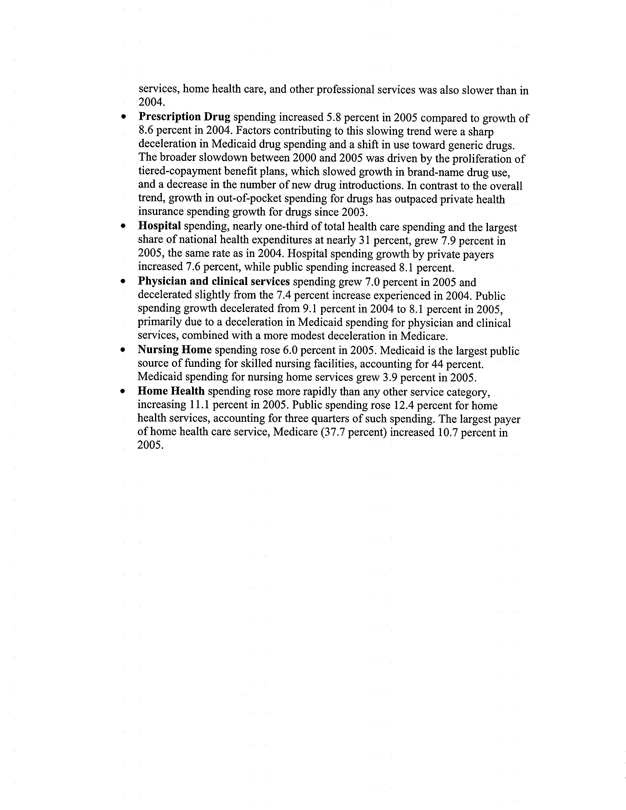

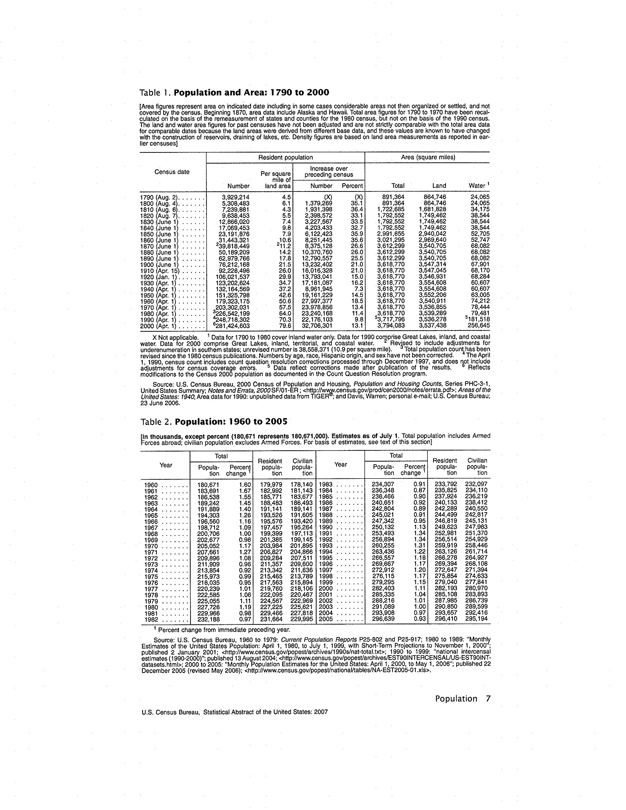

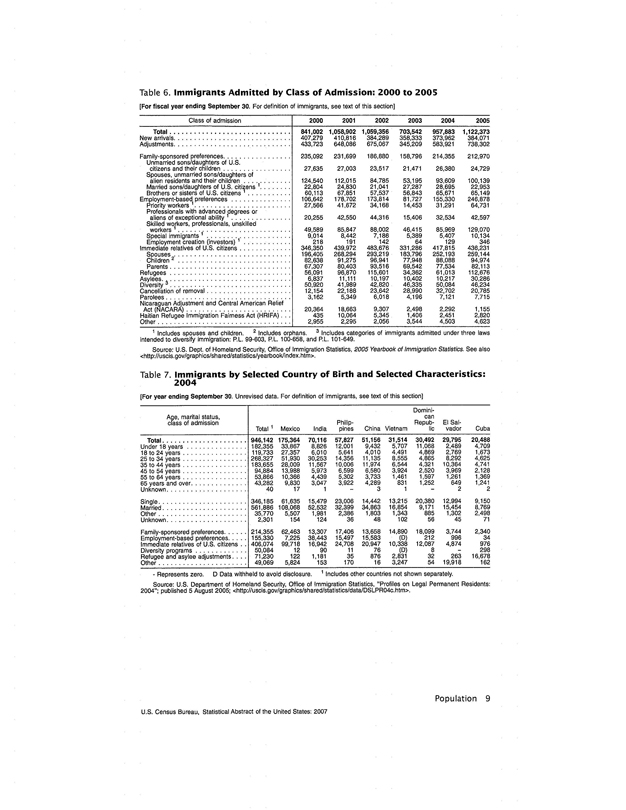

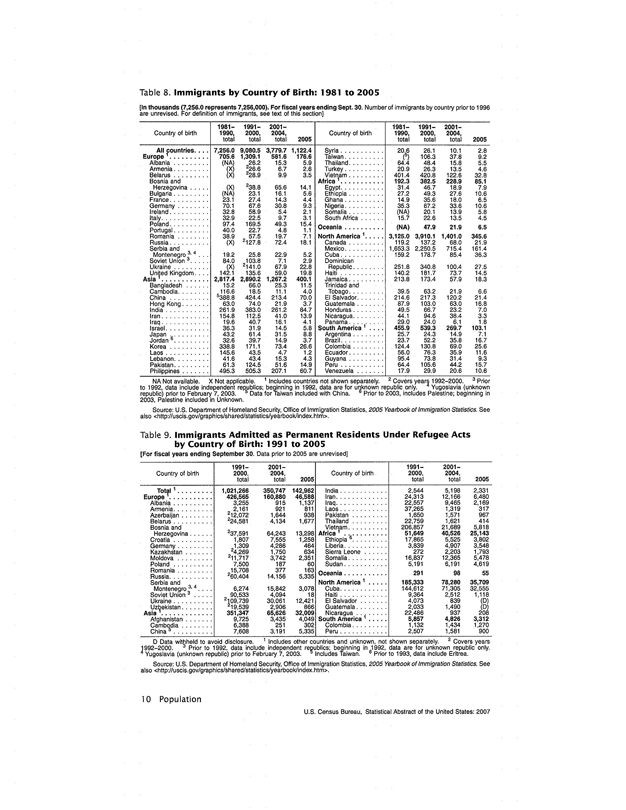

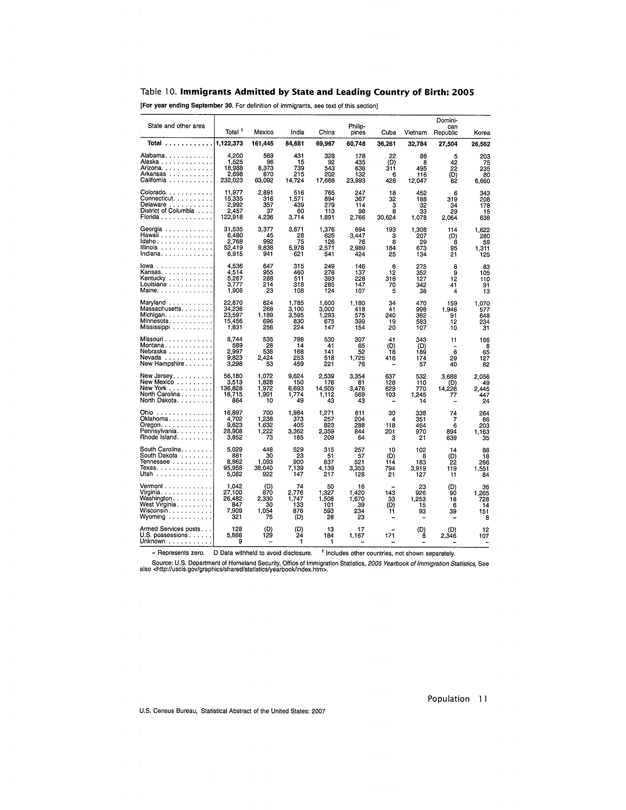

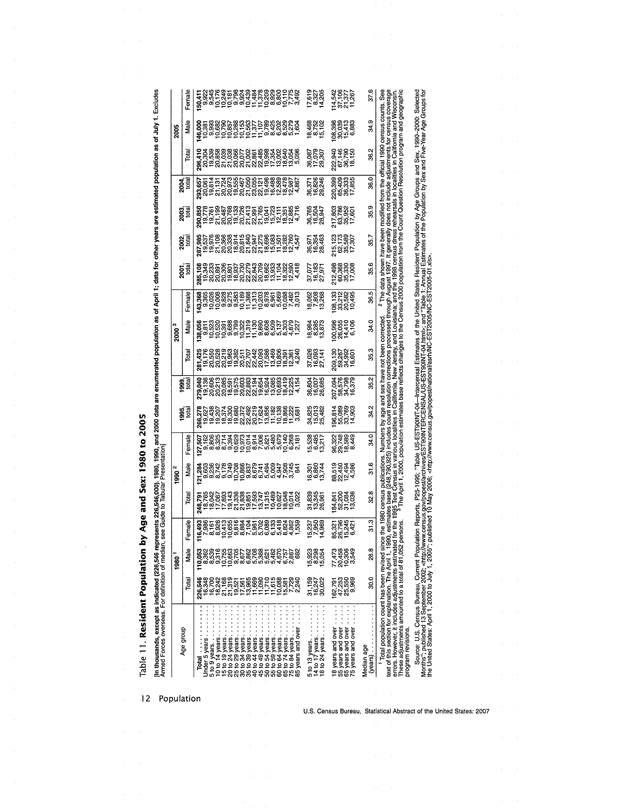

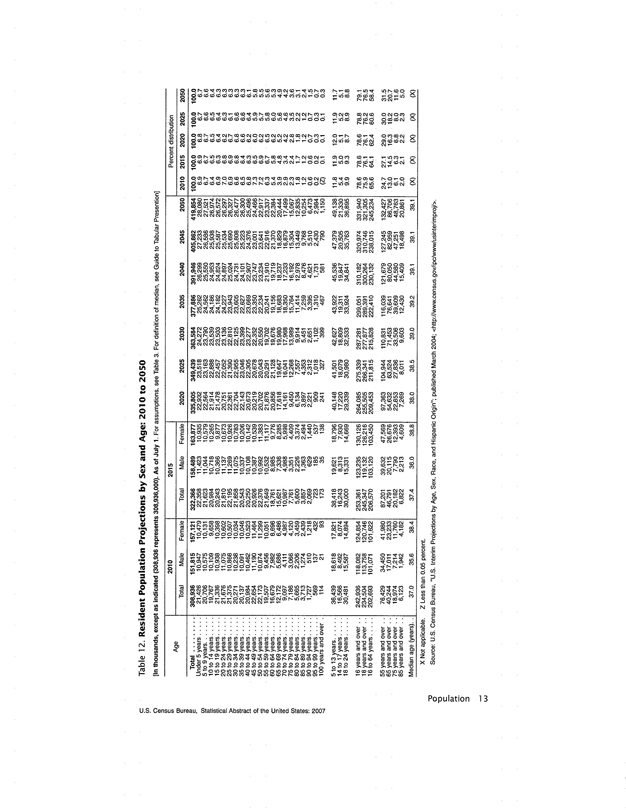

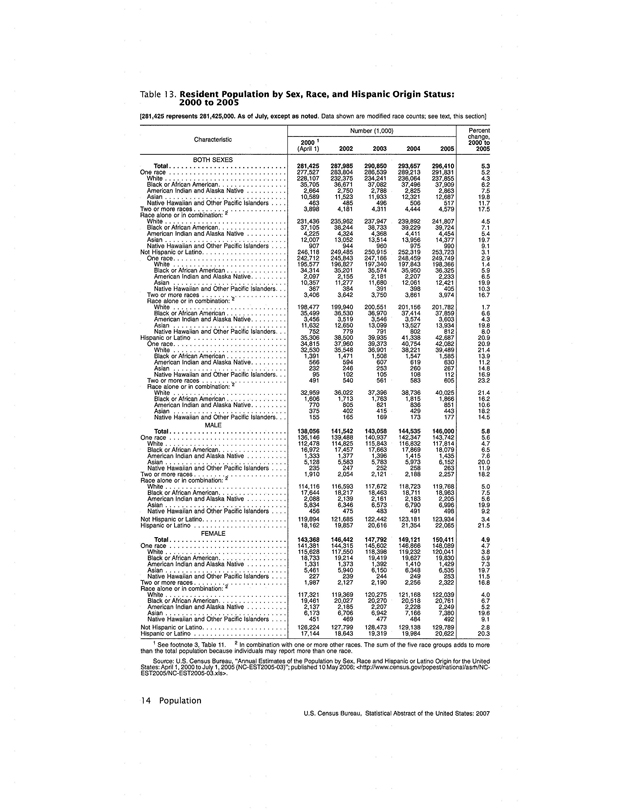

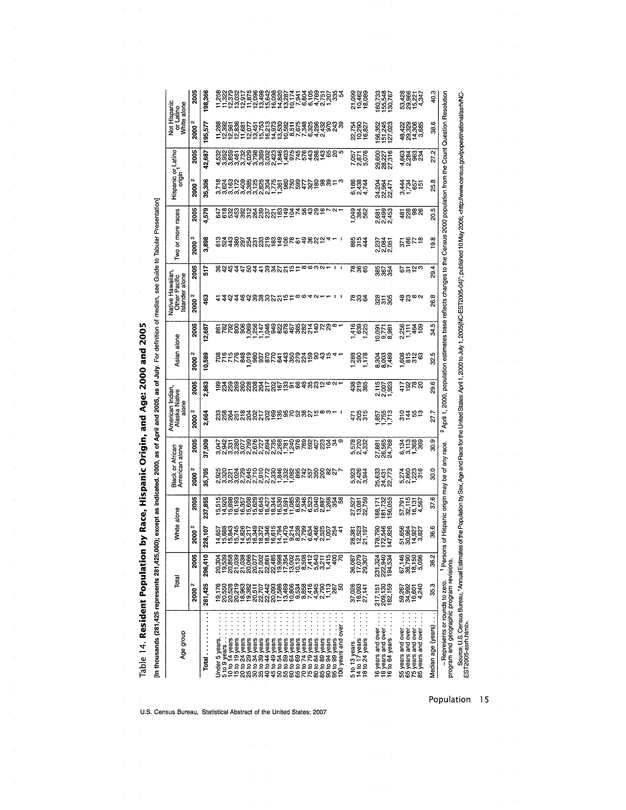

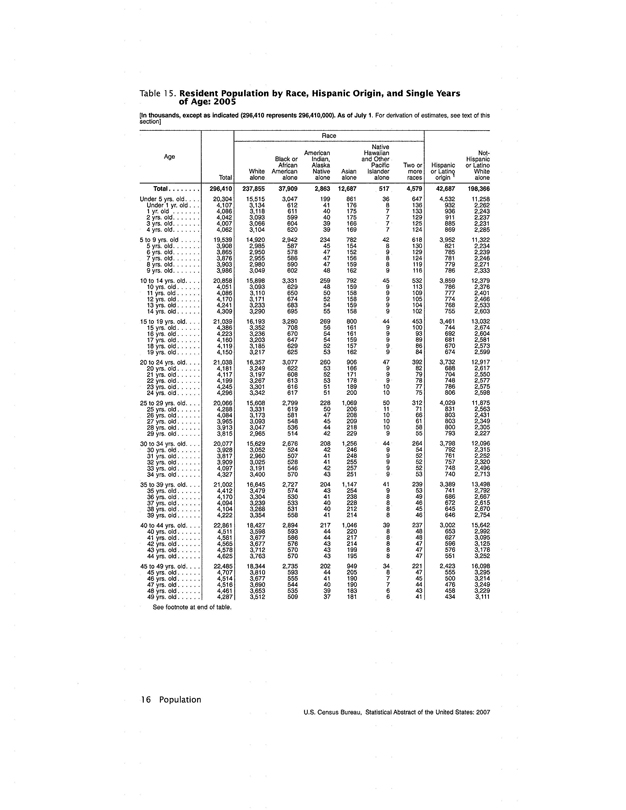

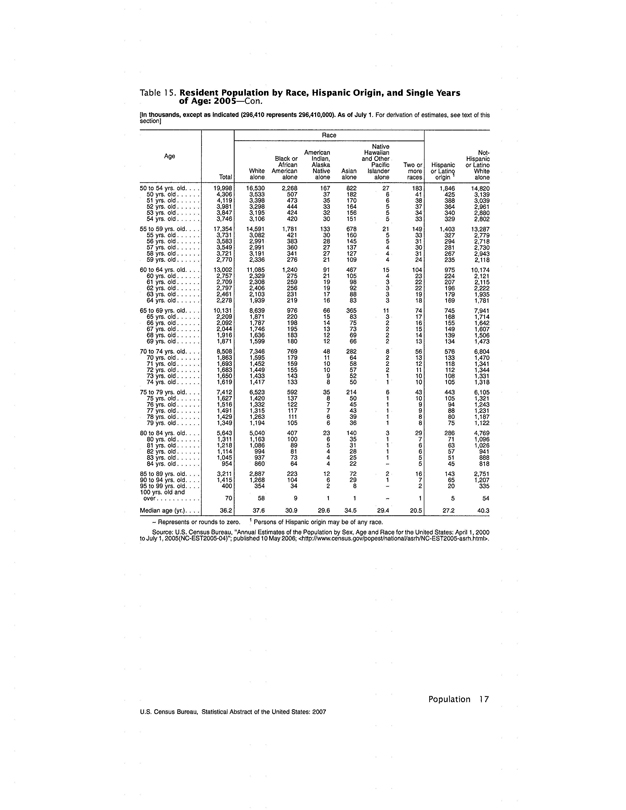

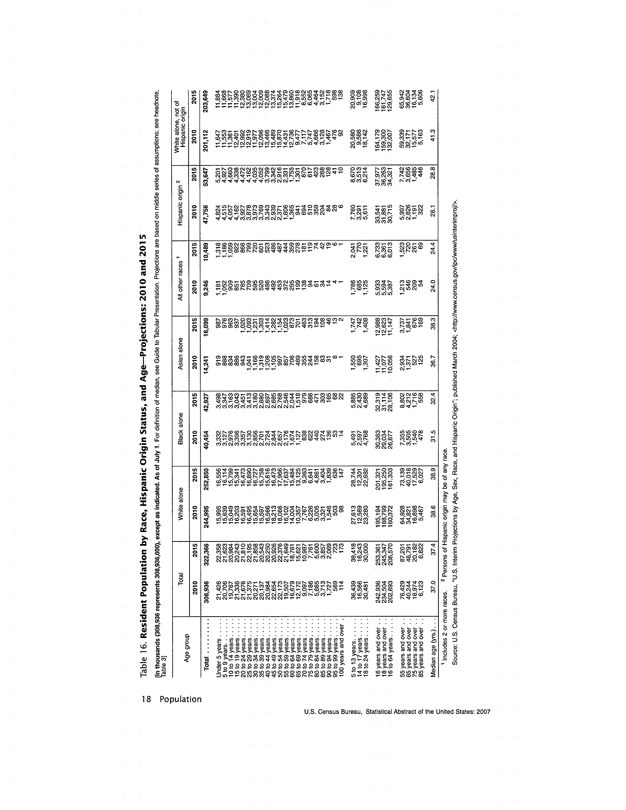

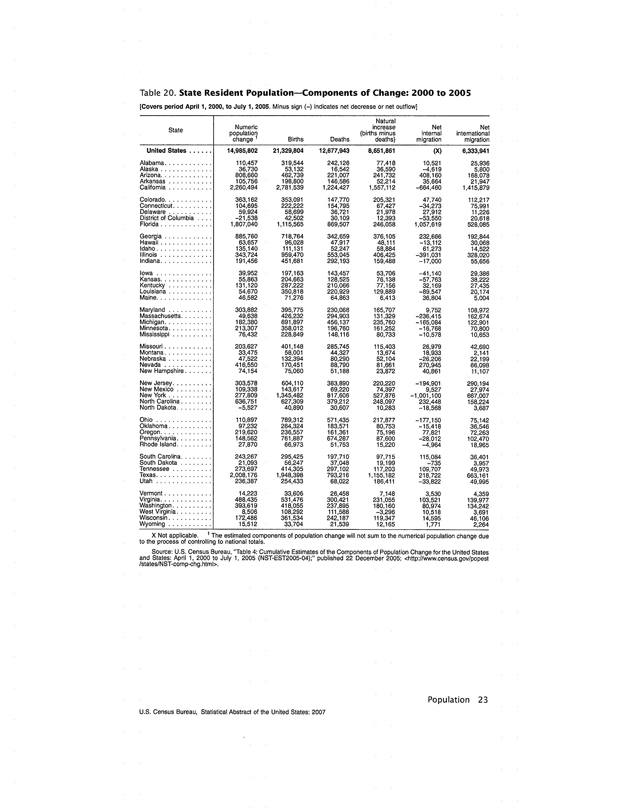

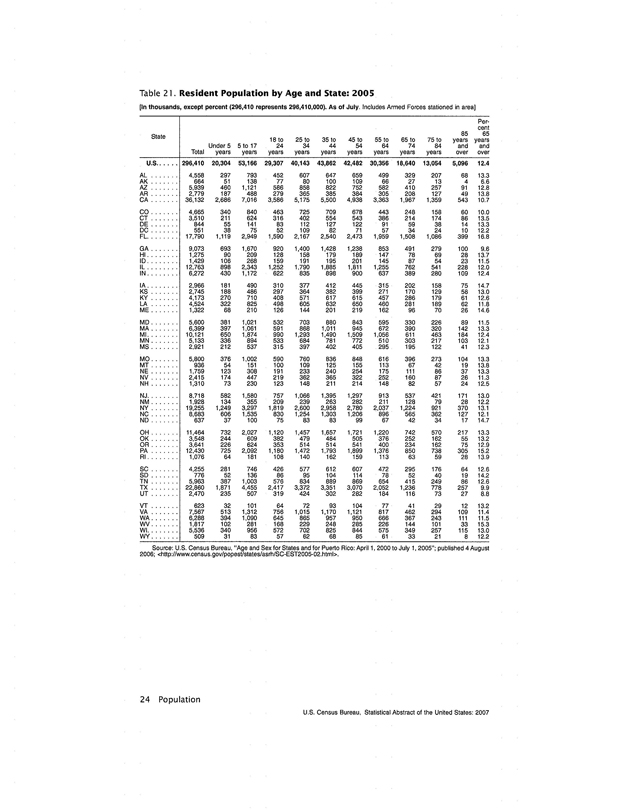

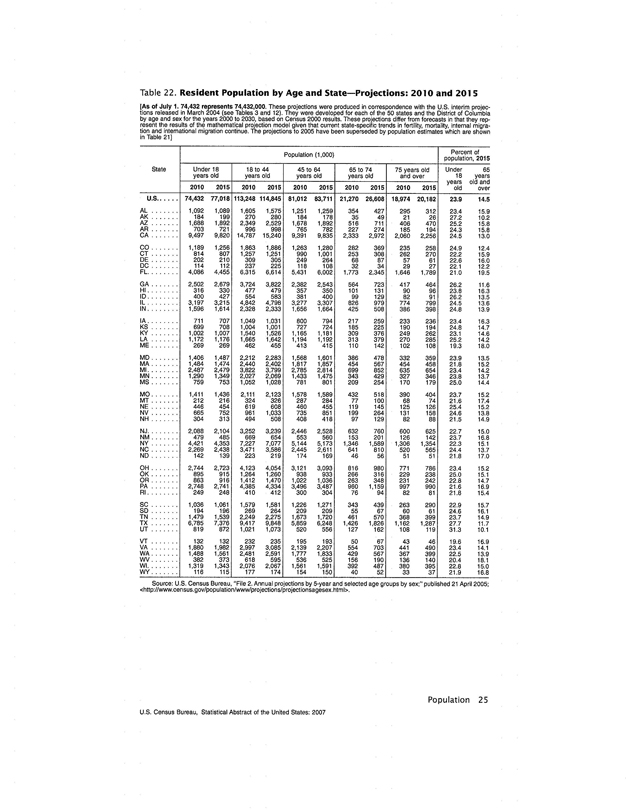

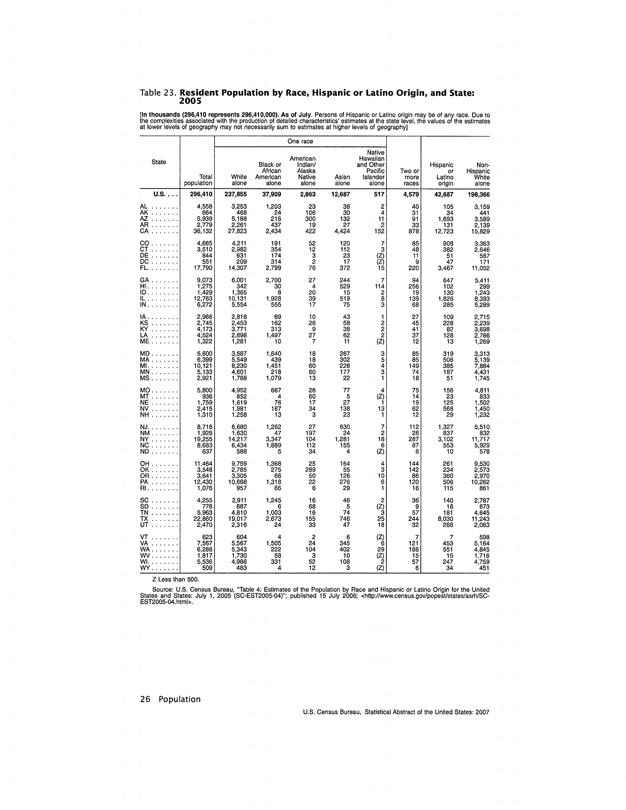

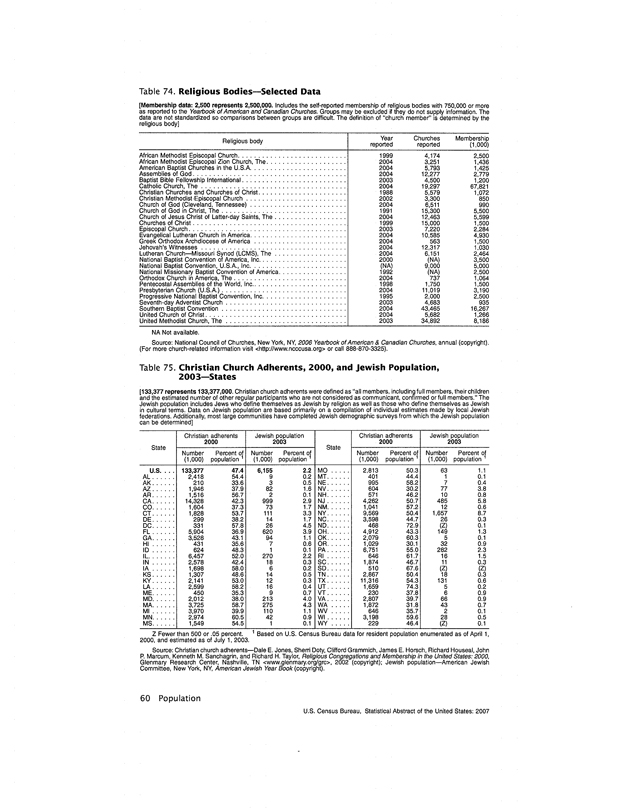

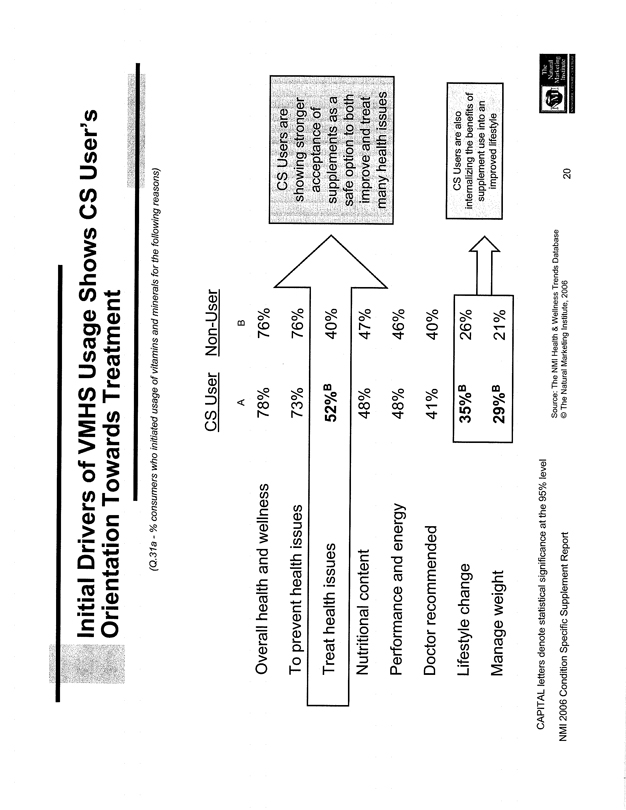

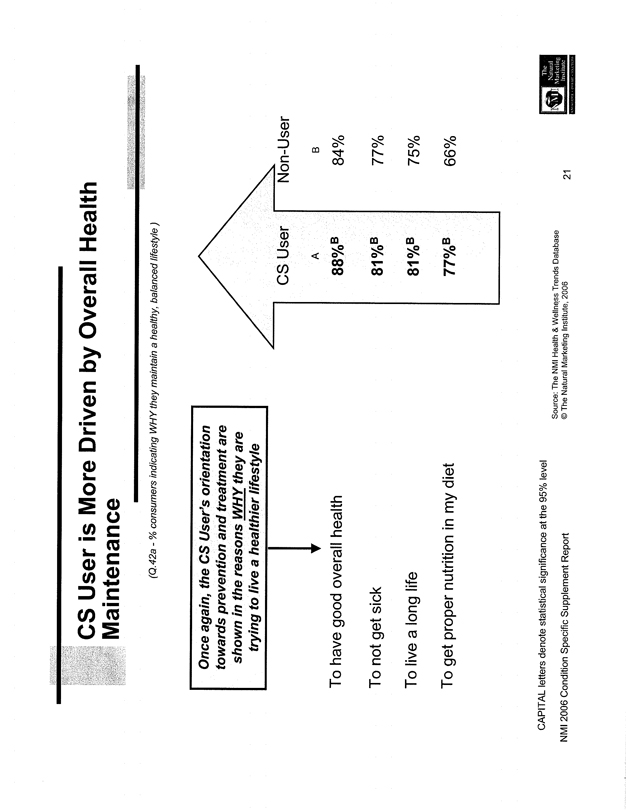

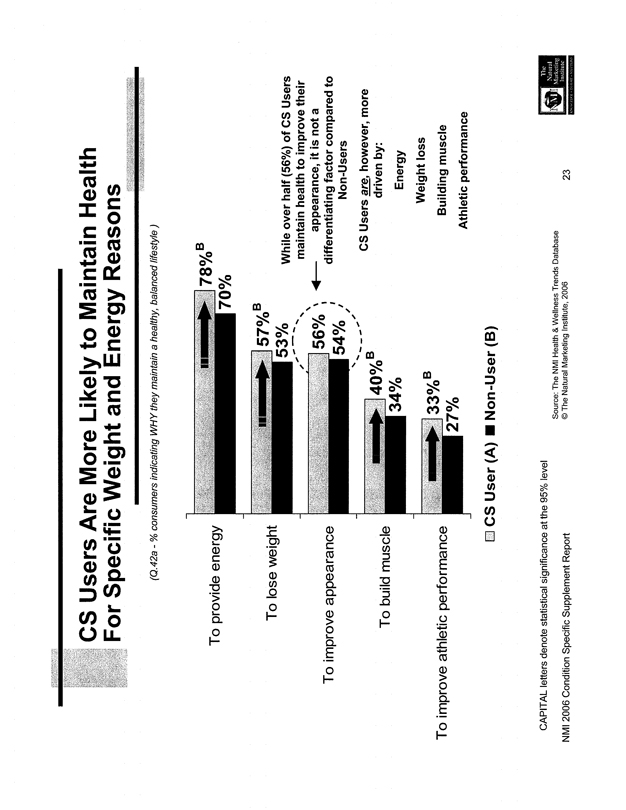

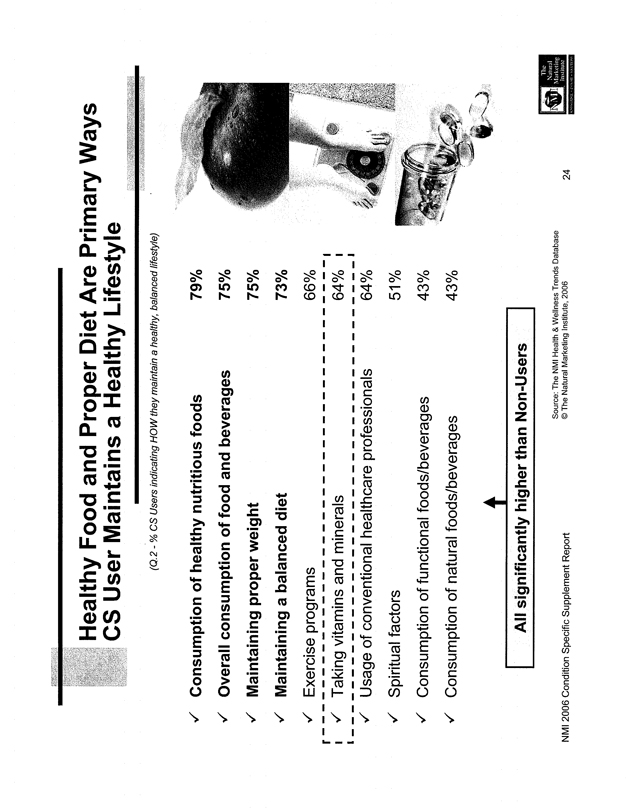

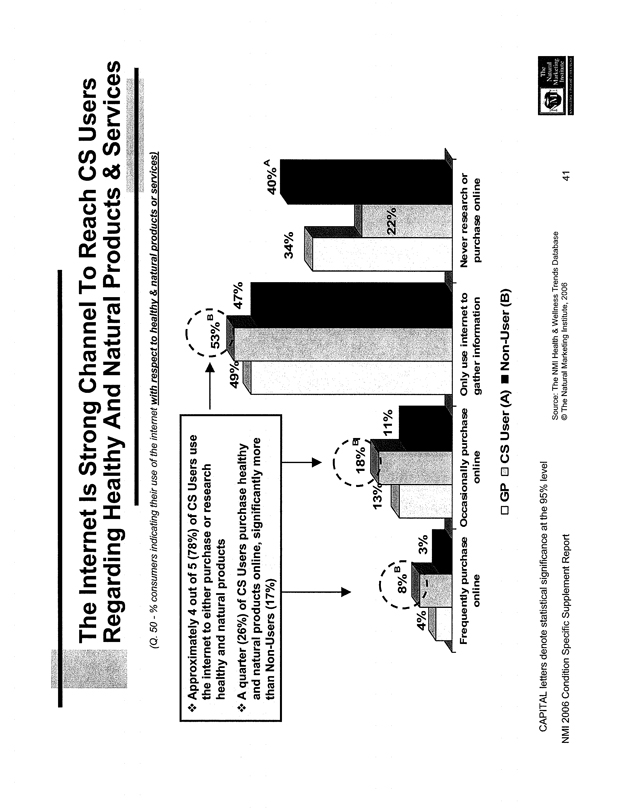

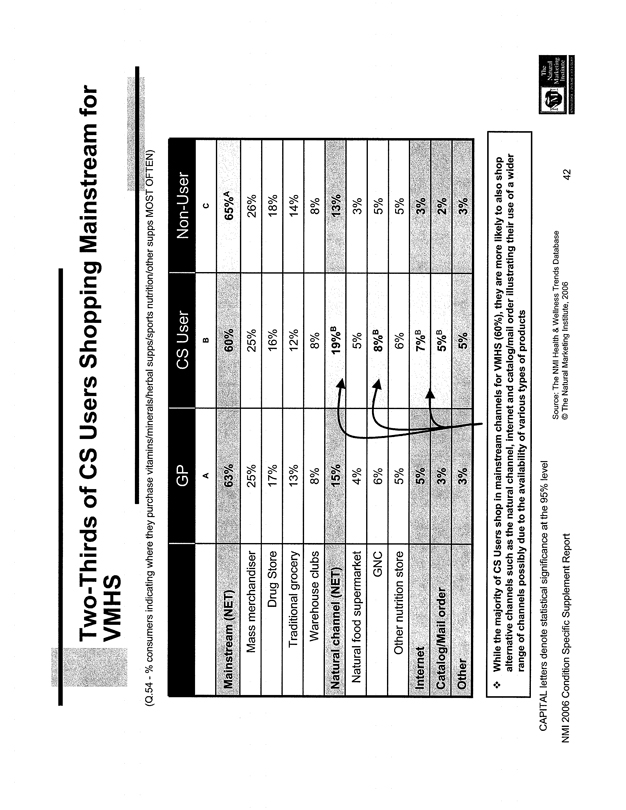

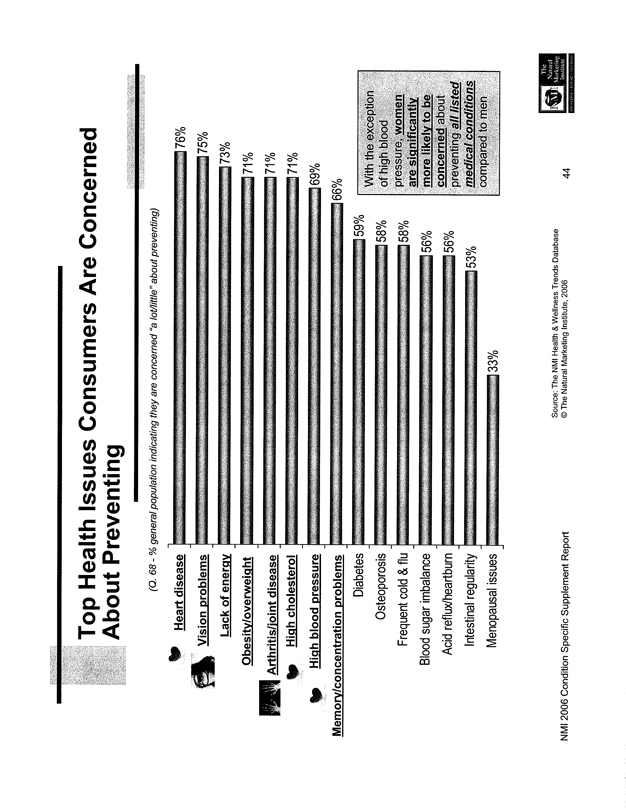

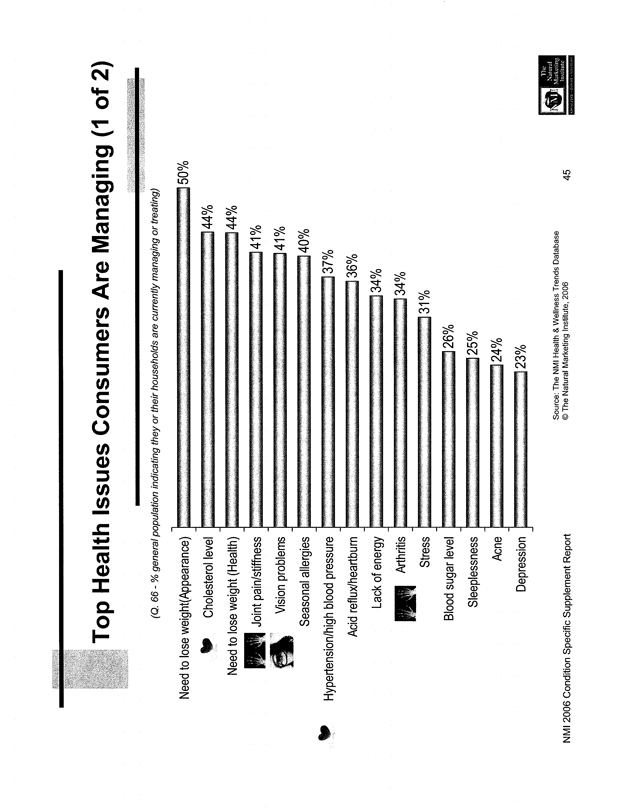

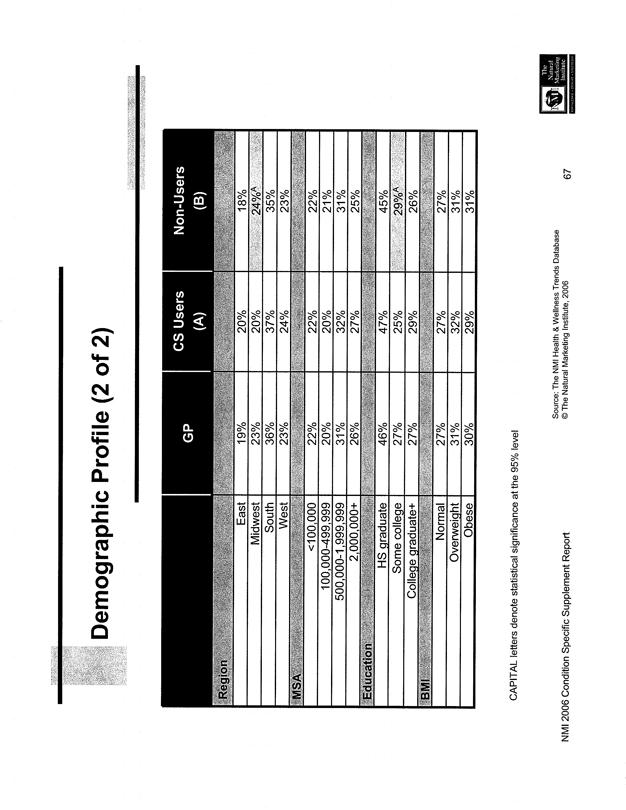

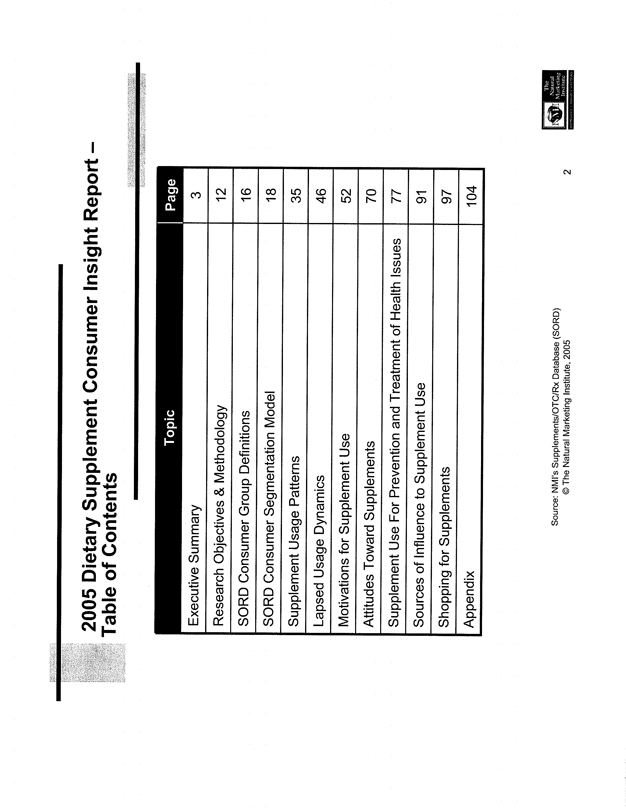

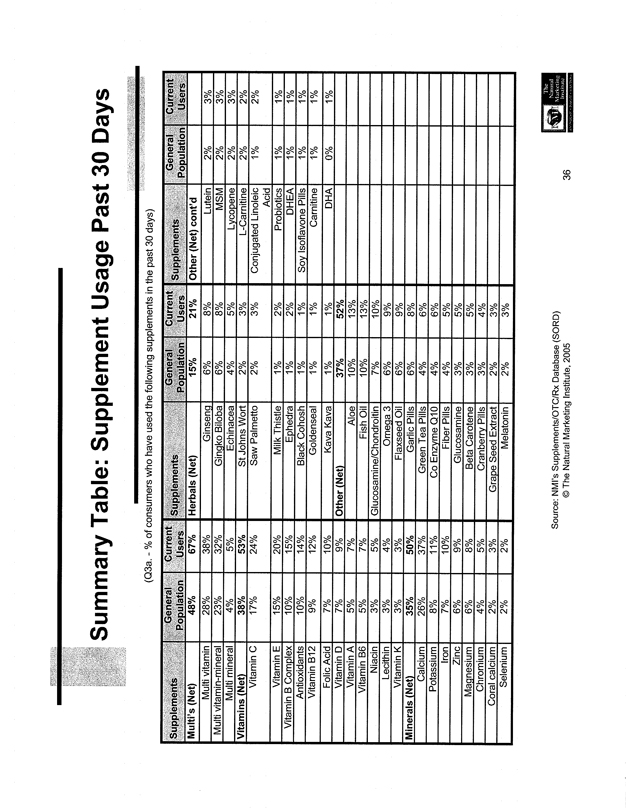

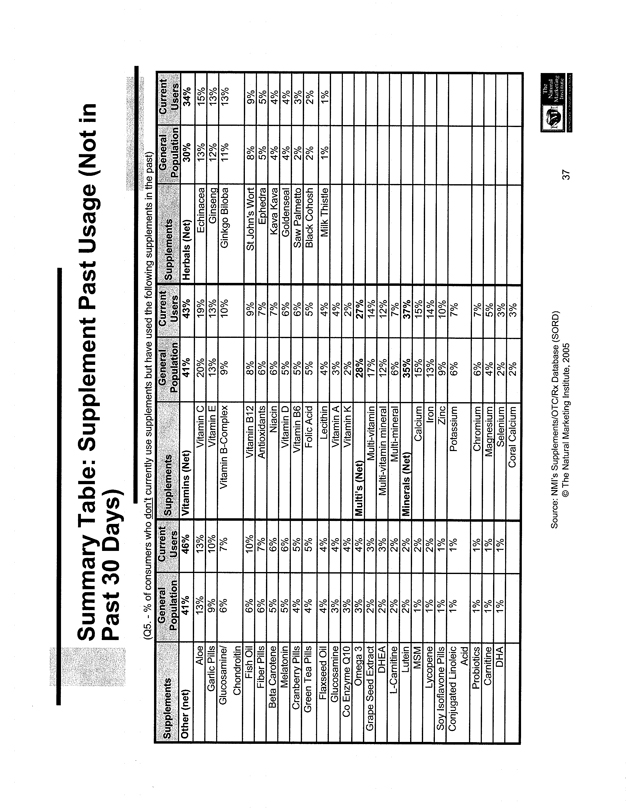

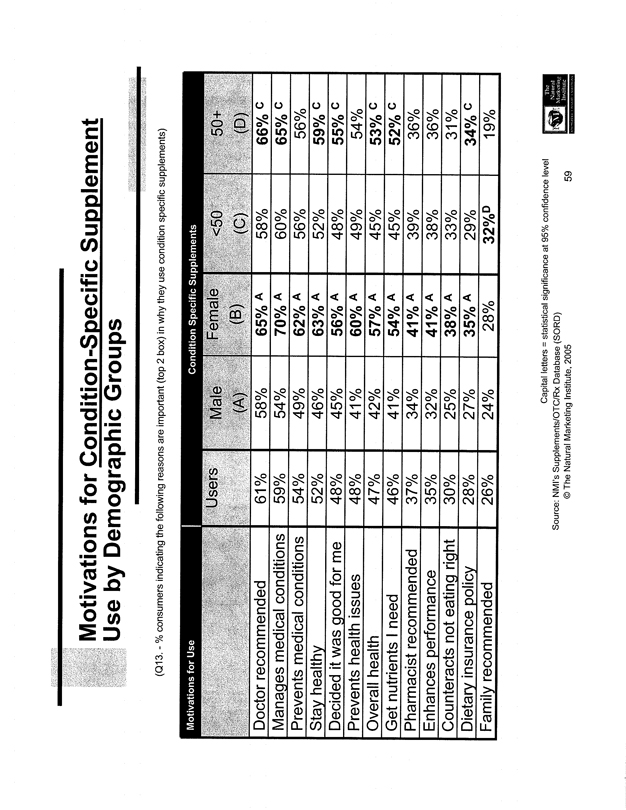

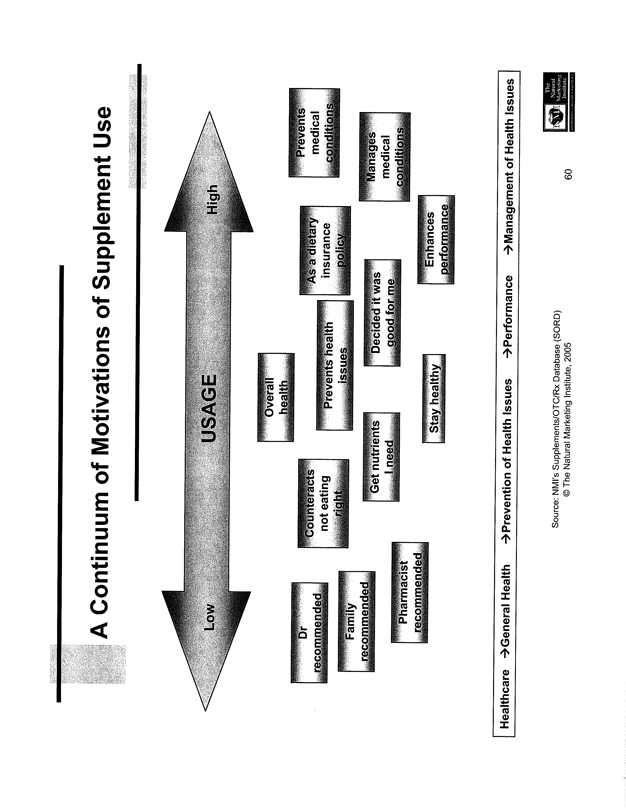

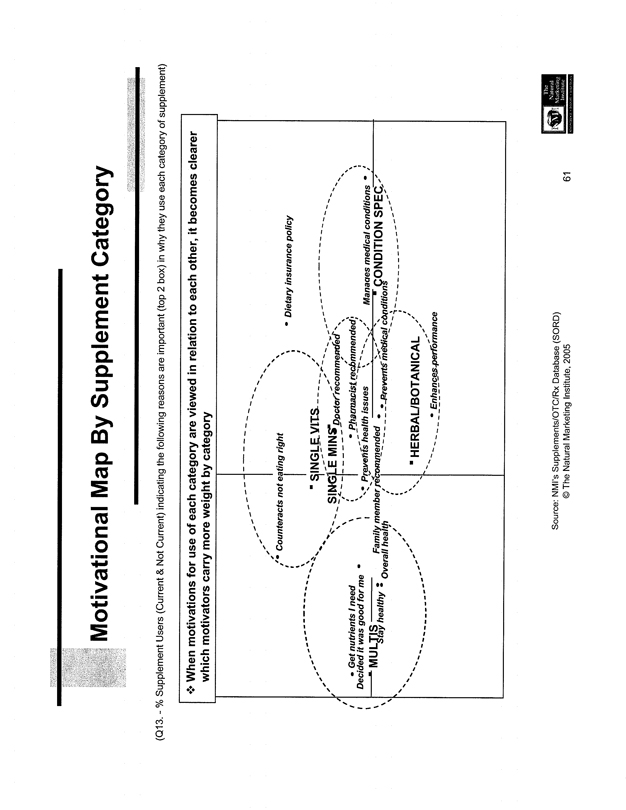

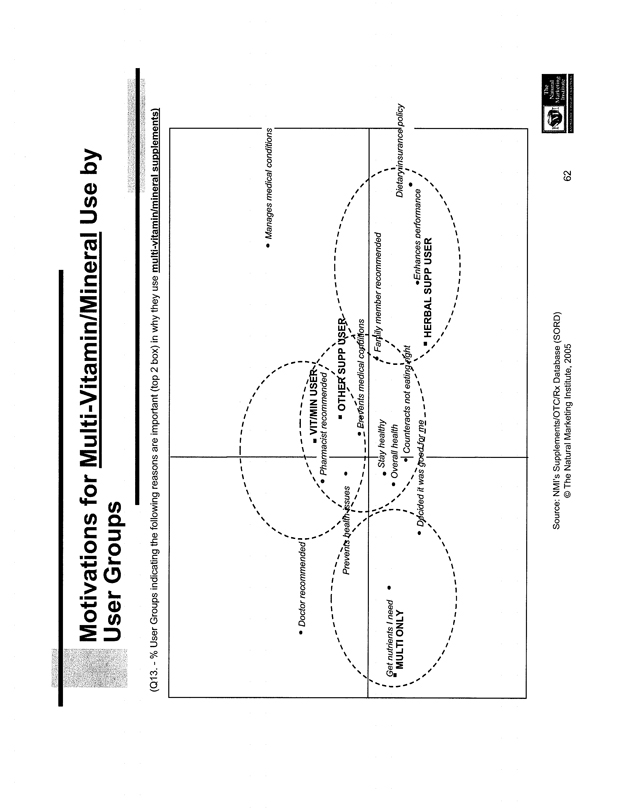

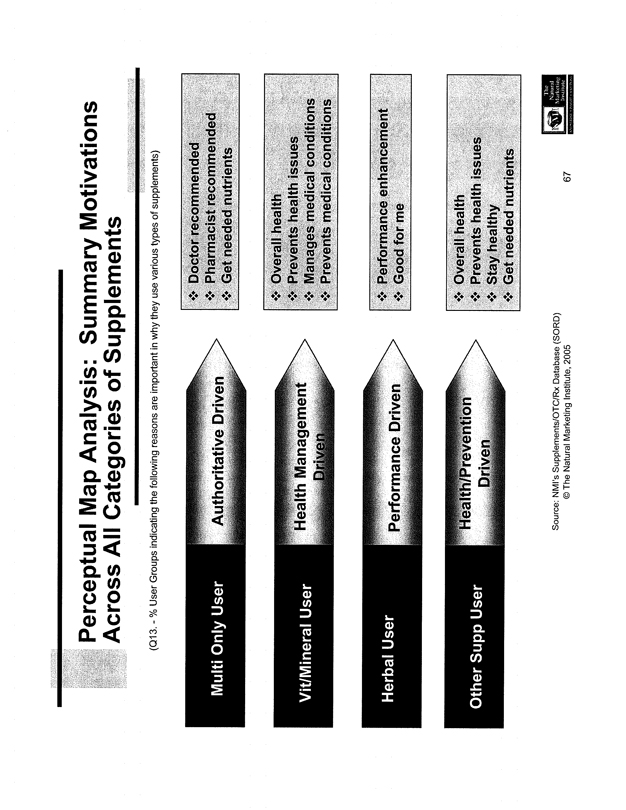

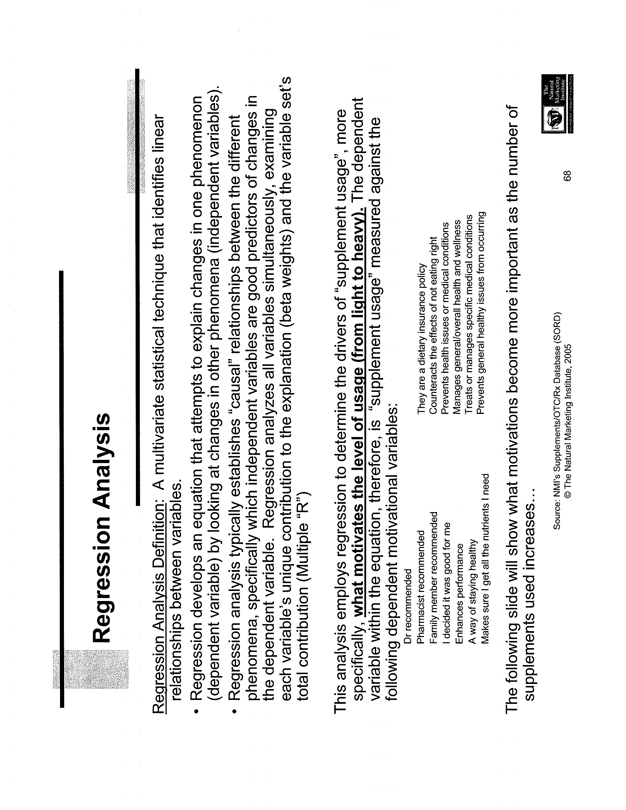

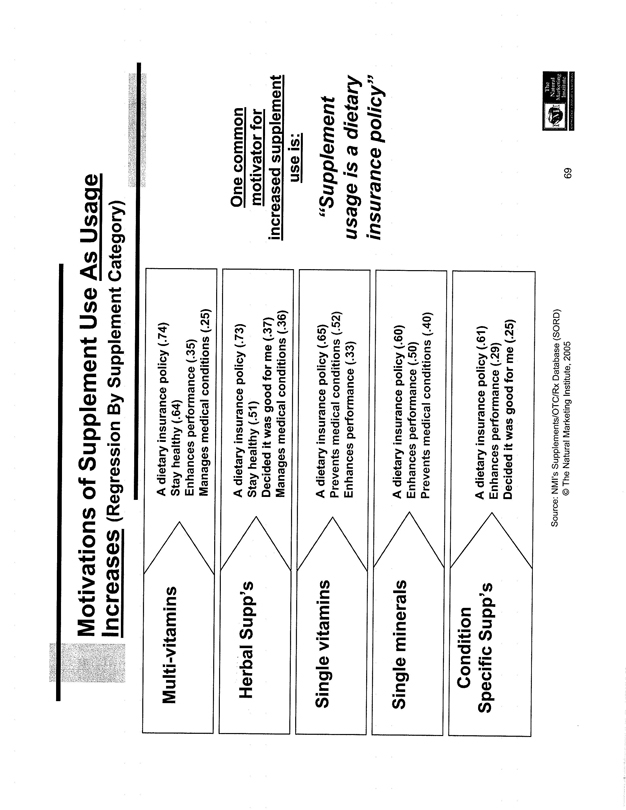

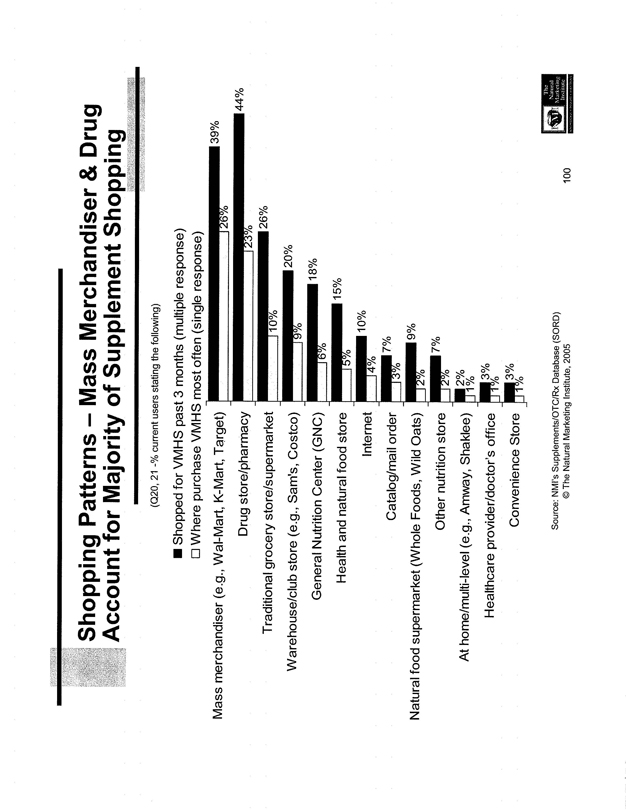

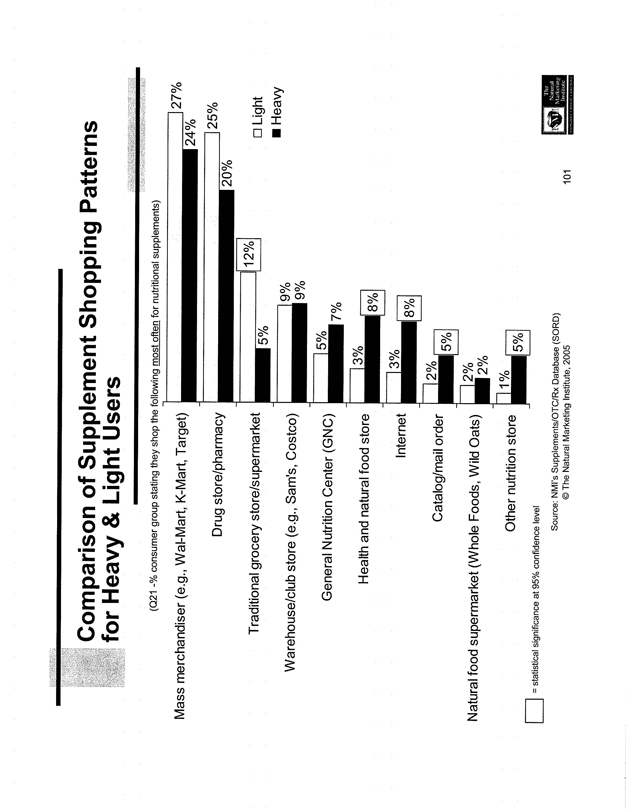

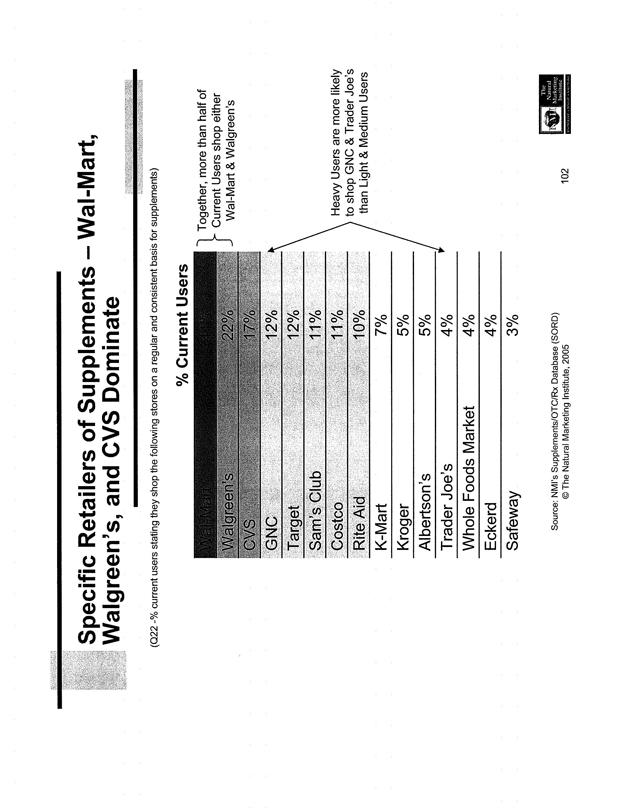

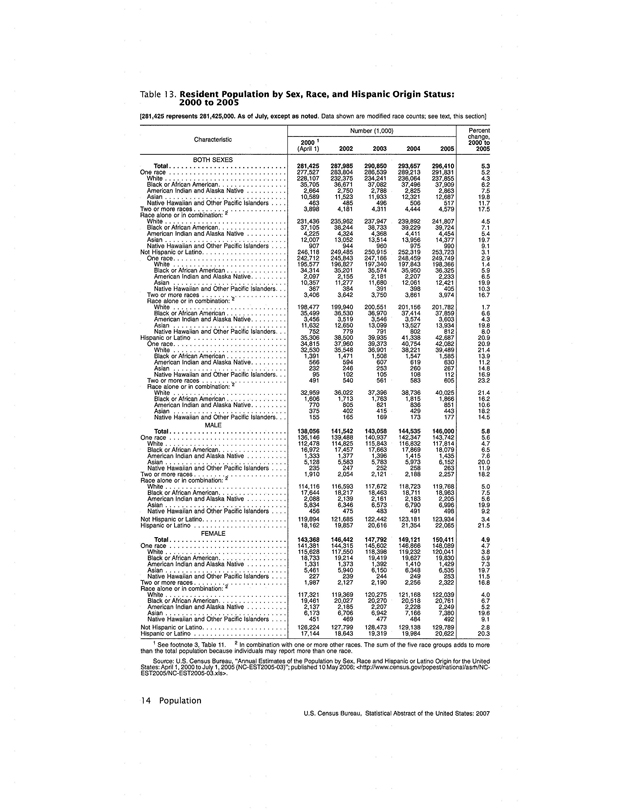

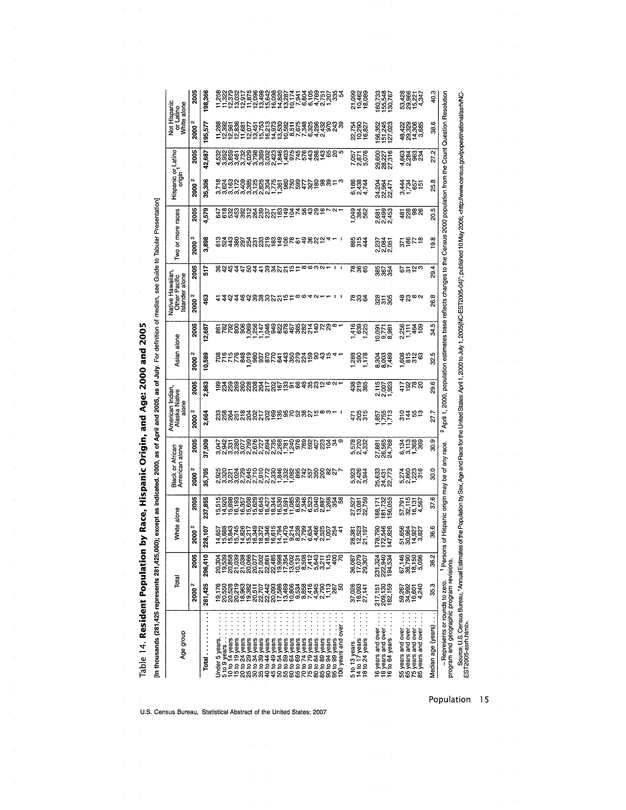

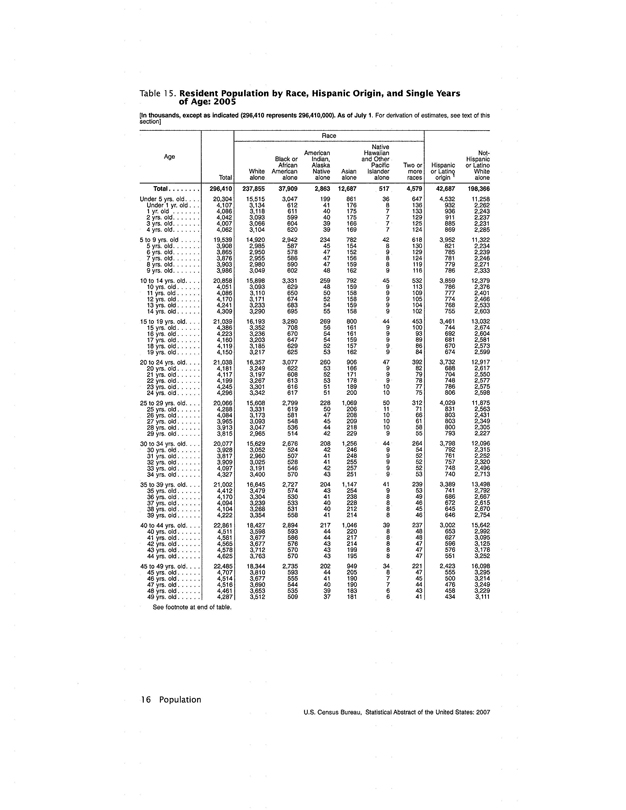

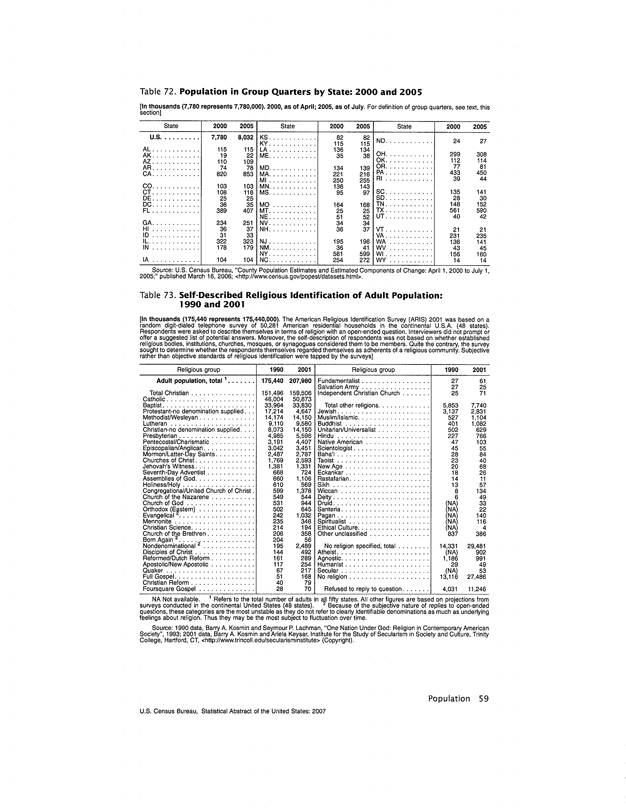

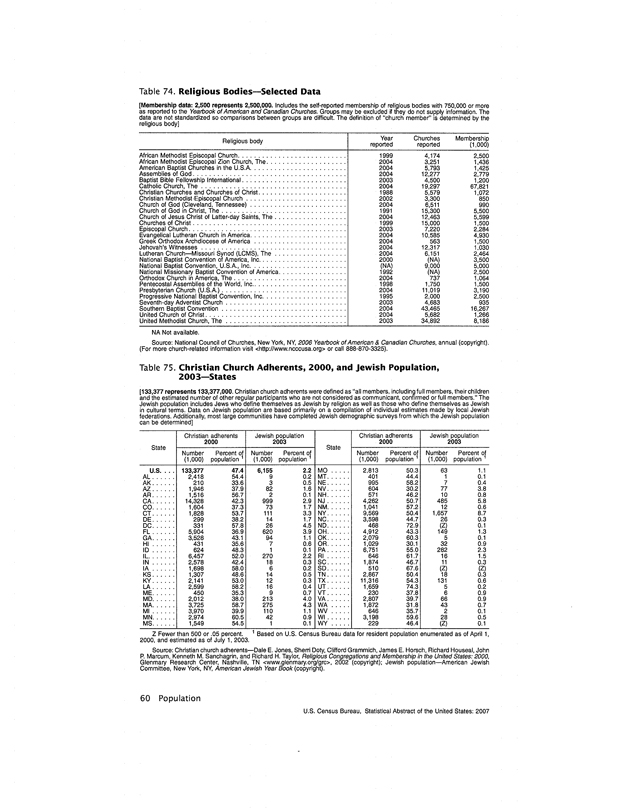

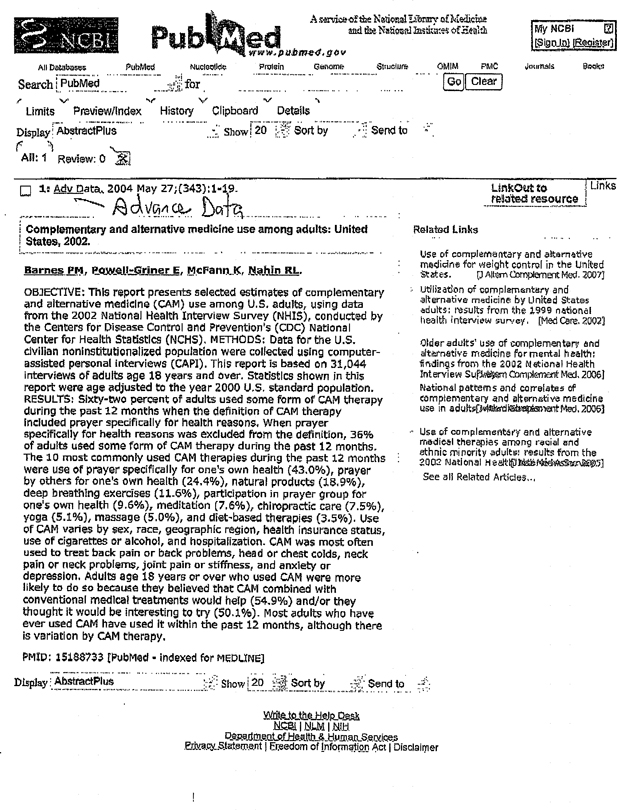

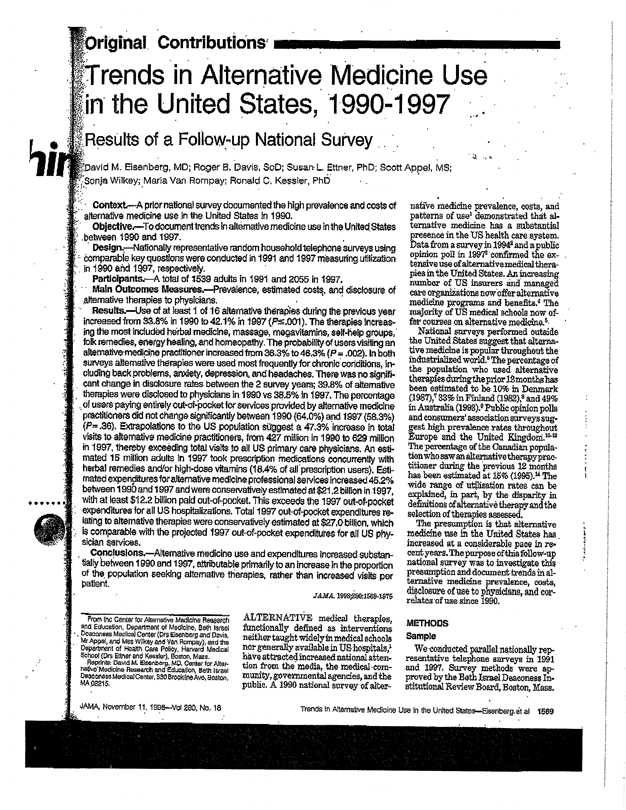

Response: In response to the Staff’s comment, enclosed are copies of articles and studies from Natural Marketing Institute, Forrester Research, the Hartman Group website, the Centers for Medicare and Medicaid site, the Journal of the American Medical Association and data information and U.S. Census Bureau Information. None of this material was prepared especially for the Company.

15. You discuss several trends that you expect will drive continued growth of [y]our industry. In an appropriate place in your disclosure document, please elaborate upon the basis for your belief of the trend involving “medical acceptance of nutritional supplements” or remove this statement. We note the discussion you provide on page 41 but the establishment of the NCAAM does not appear to be the equivalent of “medical acceptance.”

Response: In response to the Staff’s comment, the word “medical” on page two under the section Our Markets and Opportunities in the prospectus has been deleted. Respectfully, with respect to the disclosure on page 43, the Company believes the disclosure provided supports its statements regarding a trend toward acceptance of nutritional supplements while eliminating the statement that implies that this trend includes general “medical acceptance.”

Mr. H. Christopher Owings

August 10, 2007

Page 6

The Offering, page 4

16. Please add a separate paragraph indicating that your executive officers, directors and affiliated entities will own % of your common stock after completion of the offering and will have significant control over your affairs.

Response: In response to the Staff’s comment, the requested revision has been made to page 6 of the disclosure.

Risk Factors, page 7

17. Please revise your headnote to clearly state that the material risks are set forth below and to remove the implication that they also appear elsewhere in your document.

Response: In response to the Staff’s comment, the requested revision has been made and the following sentence has been added:

The risks and uncertainties described below may not be the only risks that we face.

18. Please set forth your risk factors according to their relevance. Therefore please present as your first, second and third risk factors the following, respectively:

| | (a) | “We may incur material product liability claims...” |

| | (b) | “If we experience product recalls...” |

| | (c) | “Complying with new and existing government regulation...” |

Response: In response to the Staff’s comment, the requested revisions have been made.

19. In addition, please review the caption “We may incur material product liability claims...” so that it is preceded by your statement: “Our products could contain contaminated substances, and some of our products contain ingredients that do not have long histories of human consumption, therefore we may incur material product liability claims... .”

Response: In response to the Staff’s comment, the requested revision has been made.

20. Please move up the risk factor “We depend on our executive officers and other key personnel...” However, please revise this caption to state, as you indicate: “Our continued success will largely depend on the abilities and continued efforts of our

Mr. H. Christopher Owings

August 10, 2007

Page 7

former CEO Wayne Gorsek who is prohibited by the Nasdaq Global Market from being an officer or director for an indefinite period of time.”

Response: In response to the Staff’s comment, the requested revision has been made.

21. Some of your risk factor captions state that the particular risk may damage or adversely affect your business but do not explain how. As an example, refer to “Computer viruses or Internet service interruptions could damage our business” and “Government regulation of the Internet and eCommerce is evolving and unfavorable changes could substantially harm our business and results of operations.” Other risk factor captions merely state facts and do not describe the risk. See, for example, “We face significant inventory risk” and “We are subject to a number of risks related to payments we accept.” Please generally review your risk factor captions to ensure they clearly and concisely describe the relevant risk.

Response: In response to the Staff’s comment, the requested revisions have been made.

22. In general, descriptions of risks that describe circumstances that could apply equally to other businesses that are similarly situated are generic risks that should not be included in your risk factor section. Please either eliminate these generic risks, or revise them to state specific material risks to your company or to the purchasers in this offering. For example, we note that the following risk factors appear to contain generic disclosures:

| | (a) | “Our quarterly results of operations may fluctuate in the future.” |

| | (b) | “We cannot assure you that we will effectively manage our growth.” |

| | (c) | “Our failure to appropriately respond to changing consumer preferences and demand for new products and services...” |

| | (d) | “We may not be able to identify, negotiate, finance, close or integrate acquisitions.” |

| | (e) | “We might require additional capital to support business growth, and this capital might not be available.” |

| | (f) | “‘There has been no public market, and it is possible that no trading market will develop or be maintained, for our common stock...” |

| | (g) | “If securities analysts do not publish research or reports about our business or if they downgrade our stock...” |

Mr. H. Christopher Owings

August 10, 2007

Page 8

| | (h) | “Being a public company will increase our administrative costs.” |

Please note these are examples only. Please review your entire risk factor section and revise as necessary.

Response: In response to the Staff’s comment, the requested revisions have been made. The (d), (e) and (g) risk factors listed above have been deleted and the (a), (b), (c), (f) and (h) risk factors listed above have been modified.

23. Please eliminate language that mitigates the particular risk. See, for example, “Although raw materials are generally available from numerous sources...”; “Although it is anticipated that the common stock will be approved for quotation on the Nasdaq Global Market…”, and “An interruption or shortage in the supply or increase in the cost of raw materials could have a material adverse effect on our business and results of operations.”

Response: In response to the Staff’s comment, the requested revisions have been made.

24. We note the risk factor you include that states “We have broad discretion in the use of the net proceeds from this offering, and we may not use these proceeds effectively.” You indicate in this risk factor that you have not determined the specific allocation of the net proceeds of the offering and yet, on page 23 you appear to have gone into some detail regarding your intended use of the proceeds. Please revise to remove this risk factor or explain why you believe it is appropriate.

Response: In response to the Staff’s comment, the risk factor has been deleted and the use of proceeds disclosure amended.

Information Regarding Forward-Looking Statements, page 22

25. Please be aware that the statutory safe harbor provision for forward-looking statements does not apply to forward-looking statements made with respect to an issuer in an initial public offering. See Section 27A(b)(2)(D) of the Securities Act of 1933. Please revise to eliminate any reference to the Private Securities Litigation Reform Act of 1995.

Response: In response to the Staff’s comment, the requested revision has been made.

Capitalization/Dilution, pages 24-25

26. Please complete these sections in the next amendment.

Mr. H. Christopher Owings

August 10, 2007

Page 9

Response: We note the Staff’s comment and respectfully submit that the requested information will be provided in a subsequent amendment. It is our intent to file the subsequent amendment with sufficient time to permit the Staff to review the disclosure before the distribution of any preliminary prospectus.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), page 27

Historical Cash Flows, page 33 and Liquidity and Capital Resources, page 34

27. Please update your discussion through the date of the most recent interim balance sheet presented.

Response: In response to the Staff’s comment, the requested revision has been made to pages 34 and 36 of the disclosure.

Business, page 40

Our Value Proposition To Our Customers, page 42

28. Please describe in further detail how together with your founder, the advisory board “utilizes current medical and scientific research to formulate your proprietary NSI-branded products to deliver nutrients in blends and at dosage levels that maximize their nutritional value.” Describe the process by which your products are formulated or reformulated. Explain, for example, if a member of your advisory board utilizes personal experience with his patients in his evaluation of a particular product.

Response: In response to the Staff’s comment, the Company has revised the disclosure of Our Value Proposition To Our Customers—Proprietary Products on page 44.

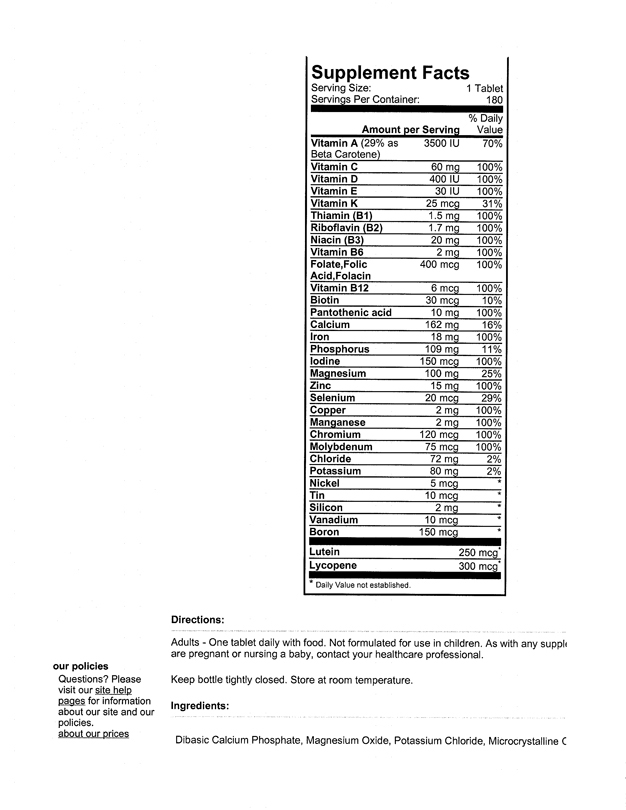

29. Please state the basis of your belief that certain of your competitors’ products contain vitamins and nutrients formulated at dosage levels which either do not provide optimal dietary benefit or lack the combination of supplements/nutrients to maximize nutritional value.

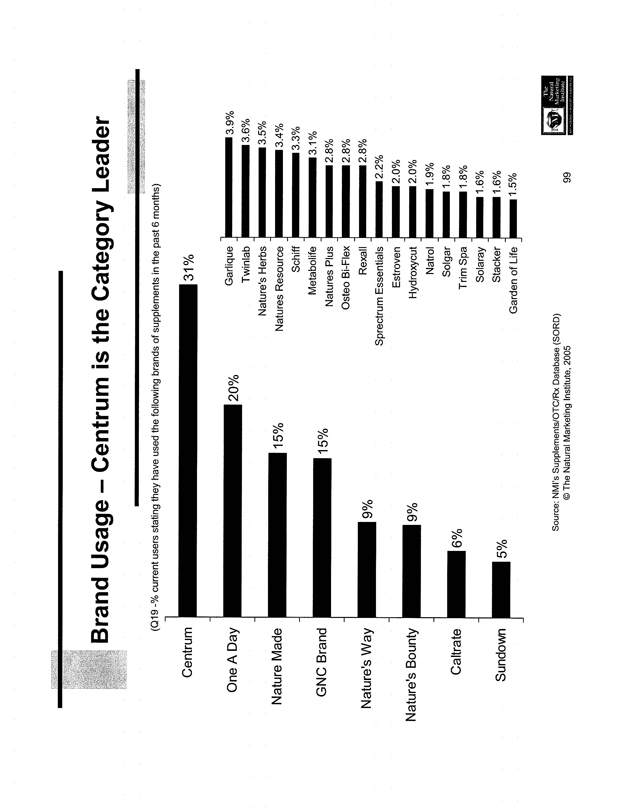

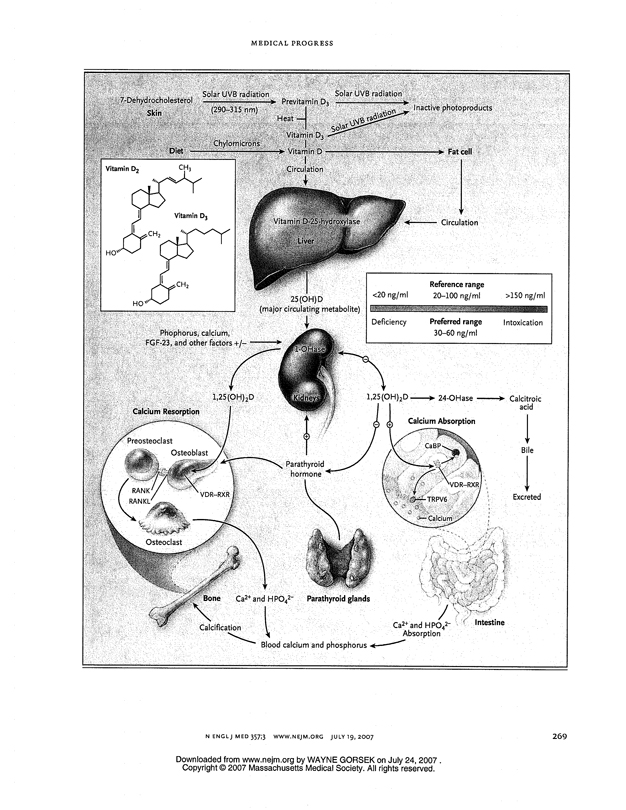

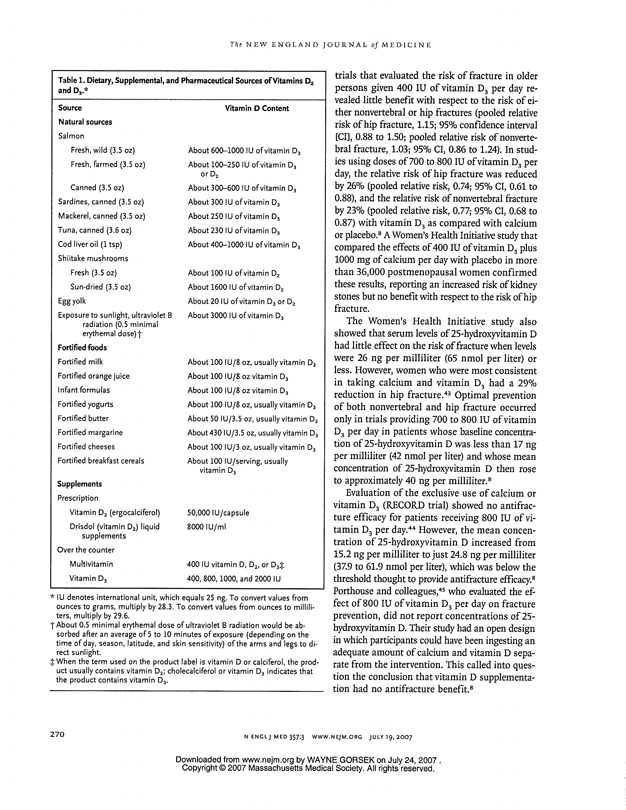

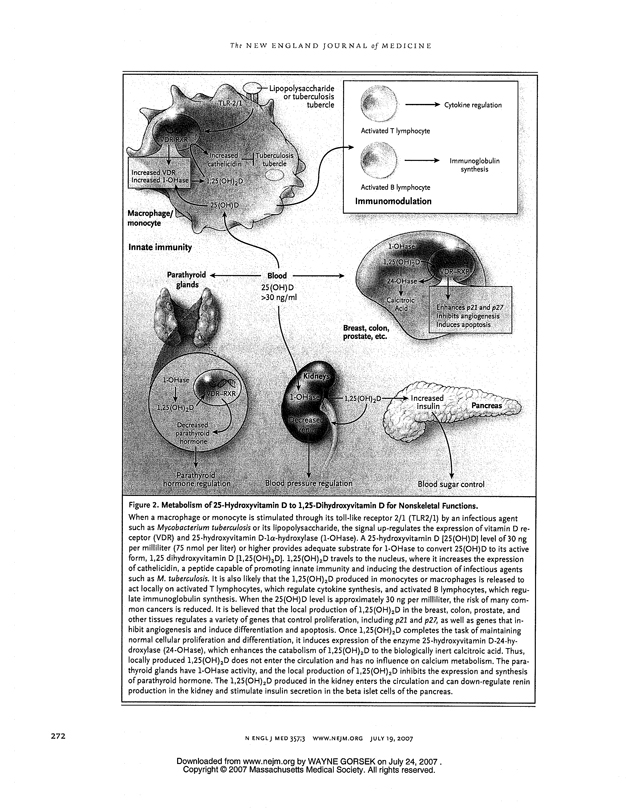

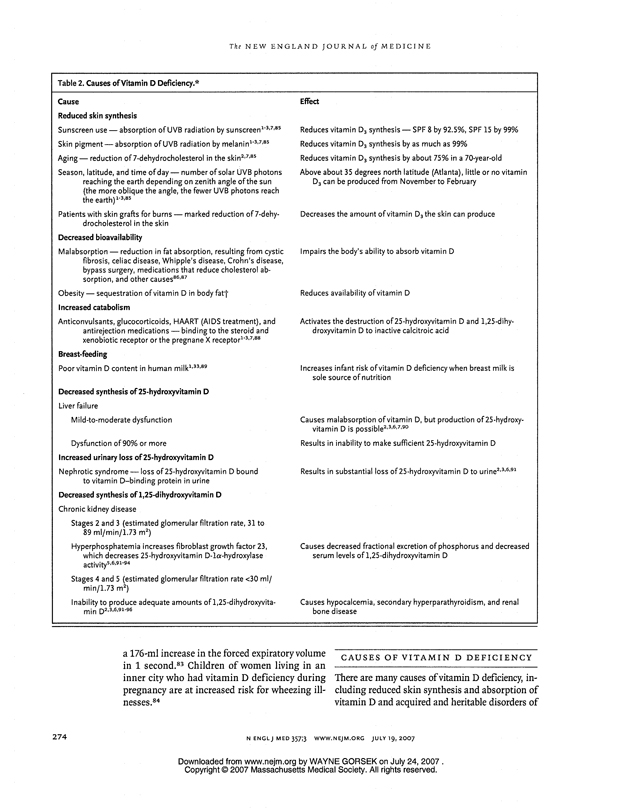

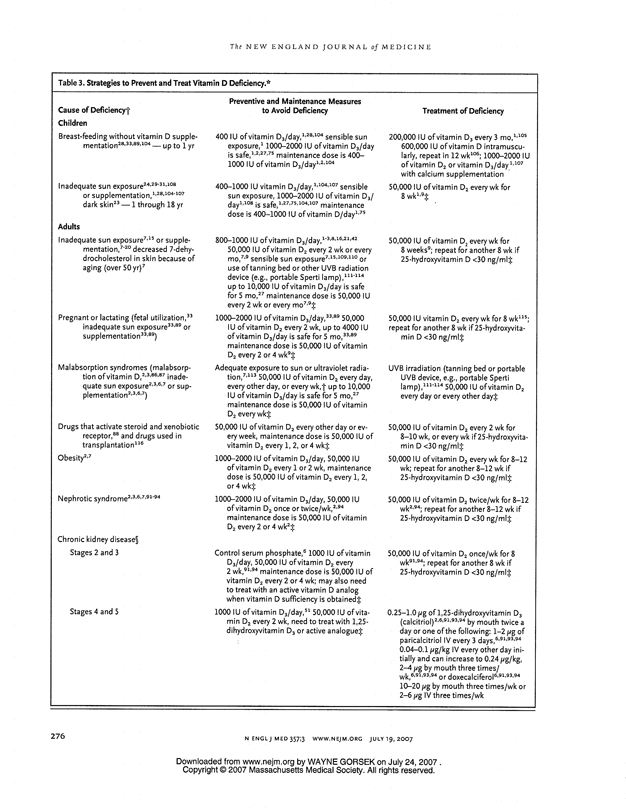

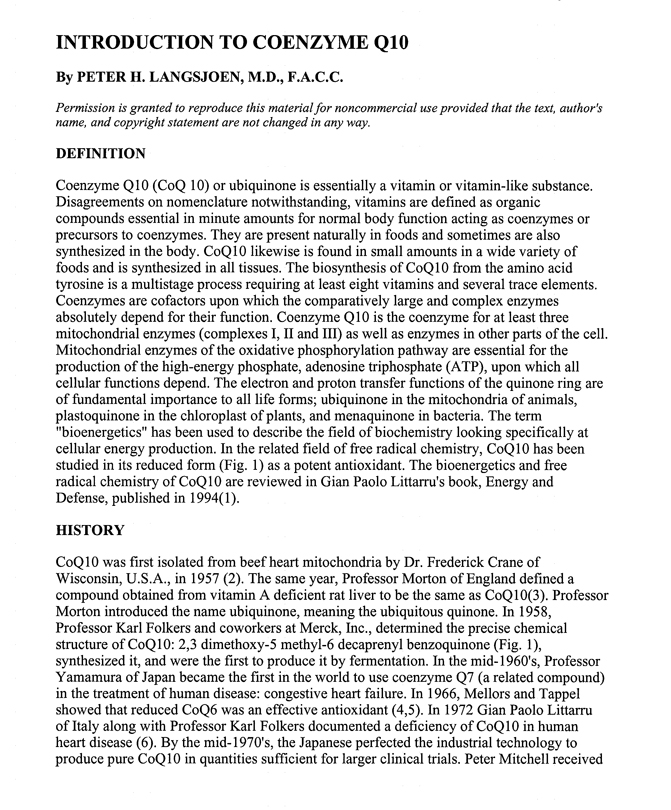

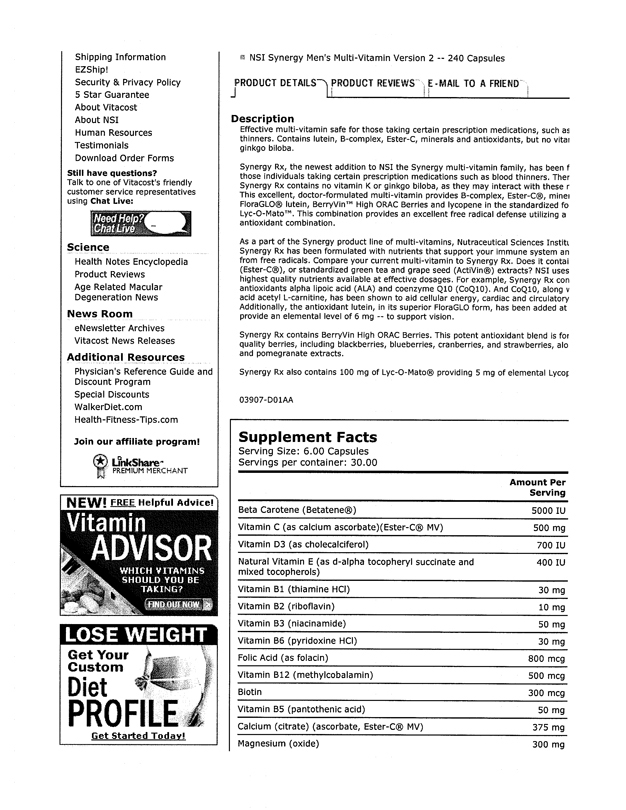

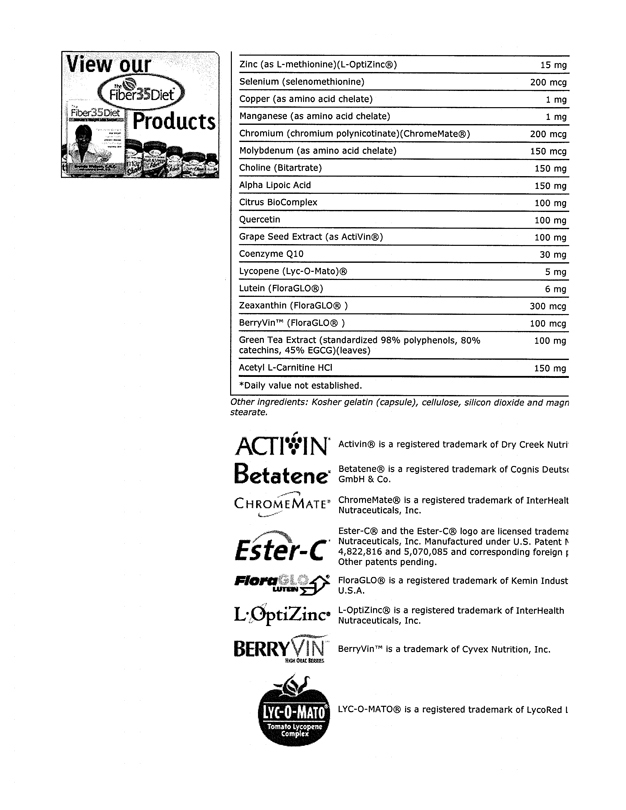

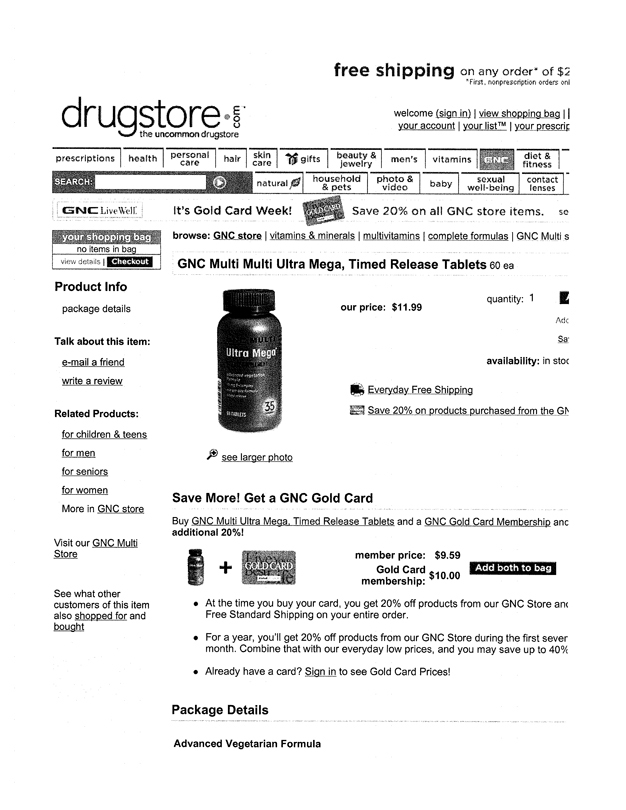

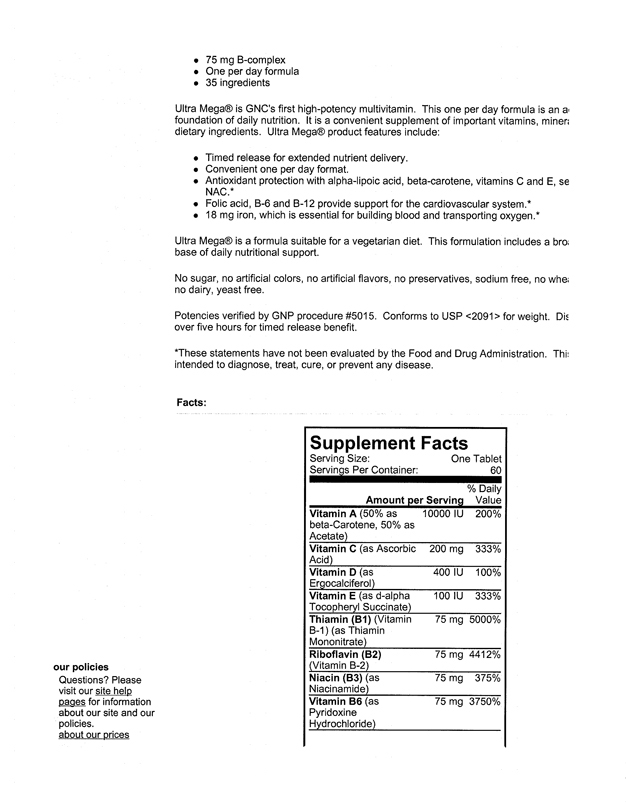

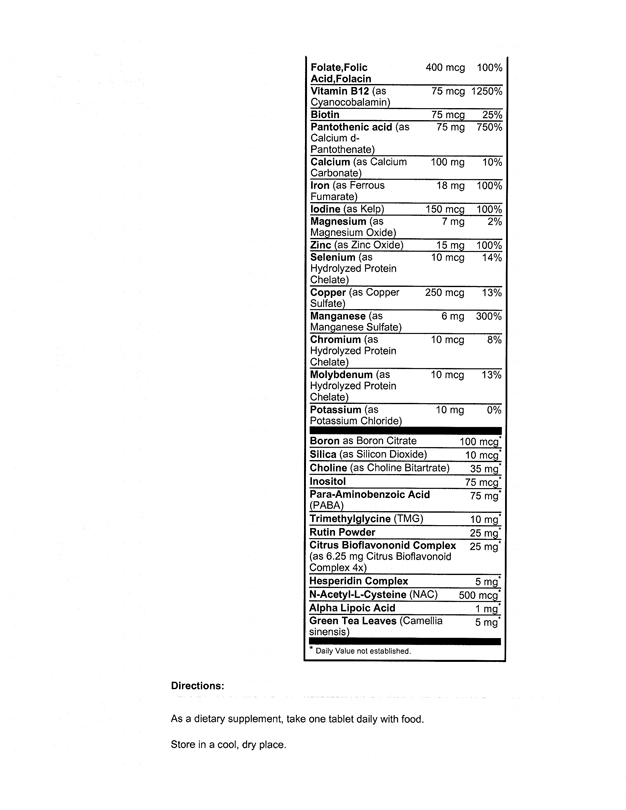

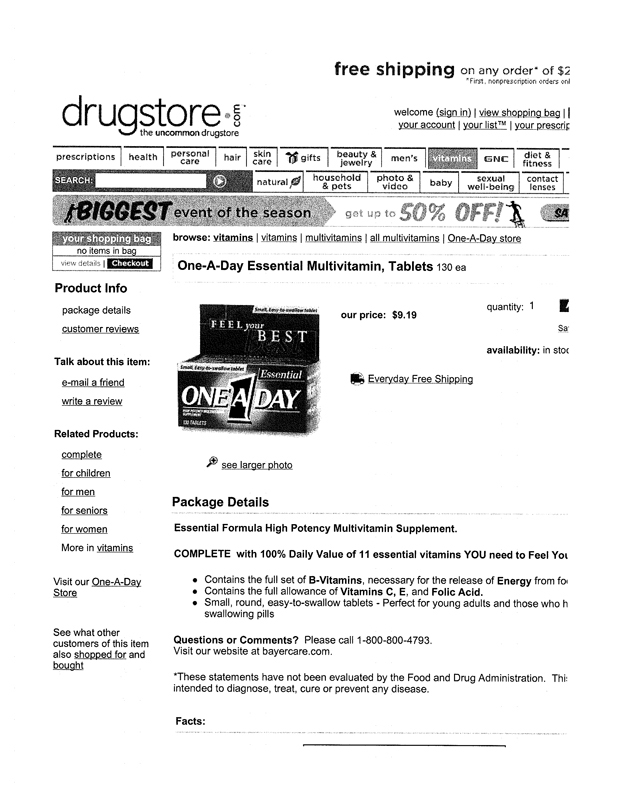

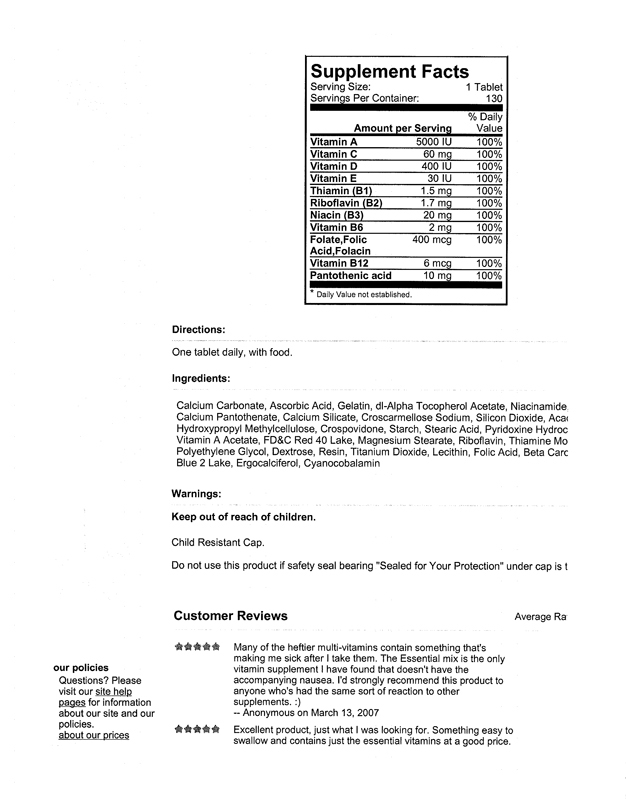

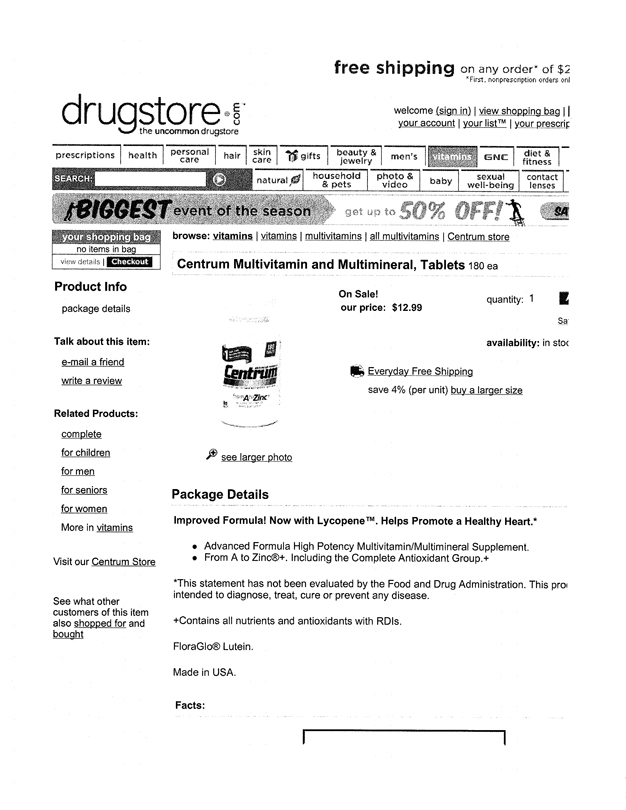

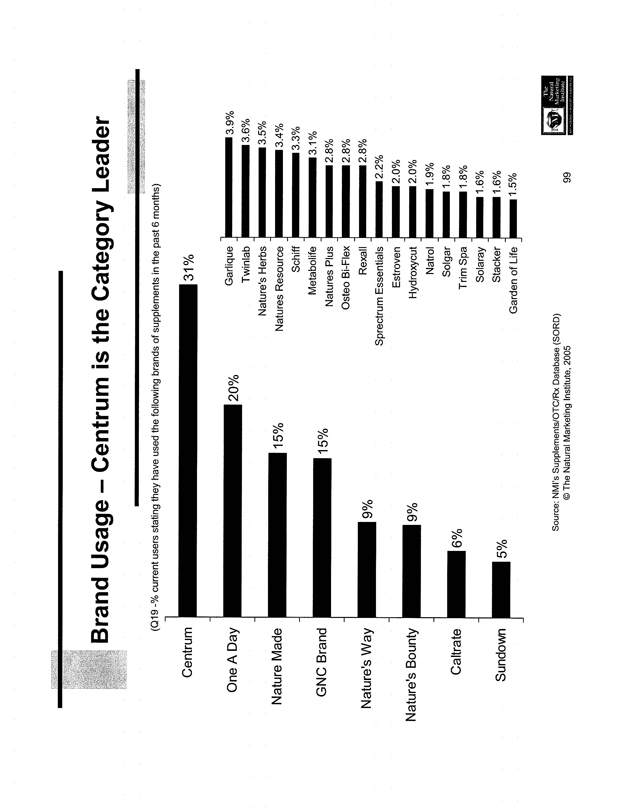

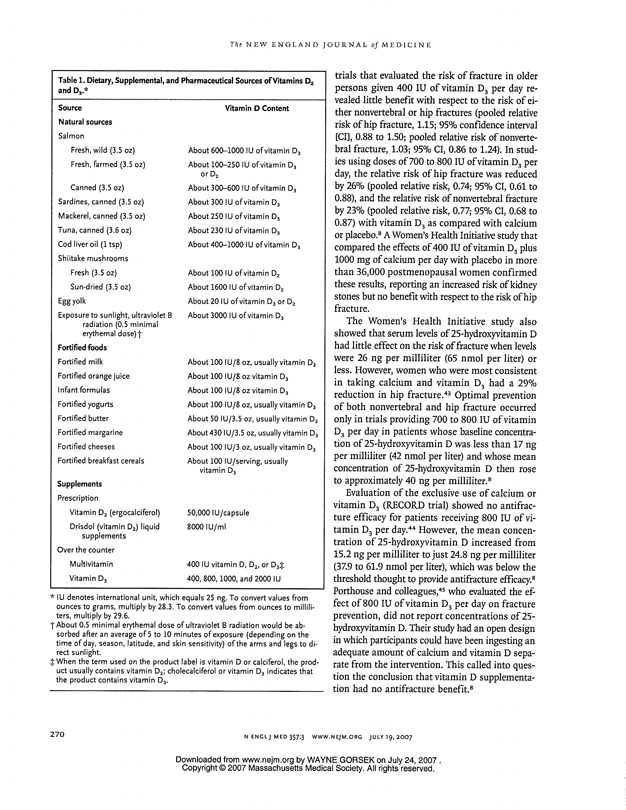

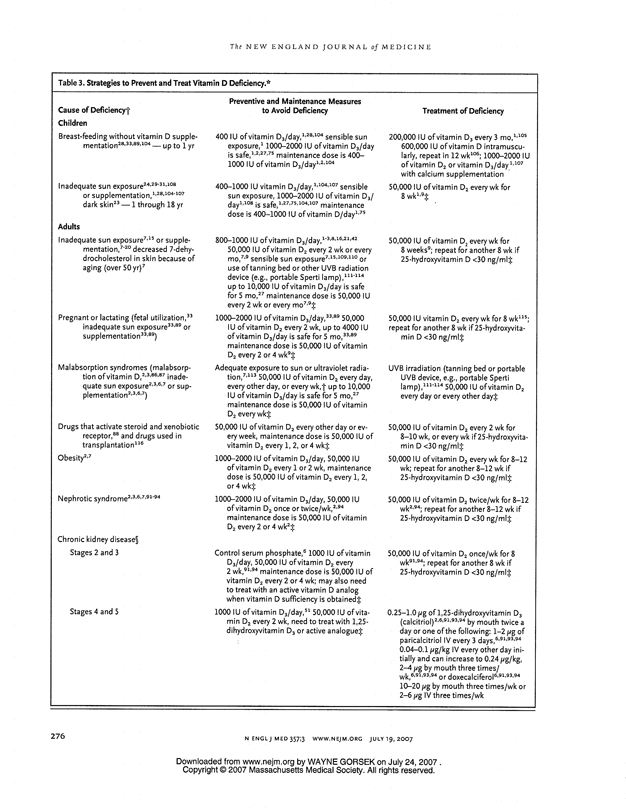

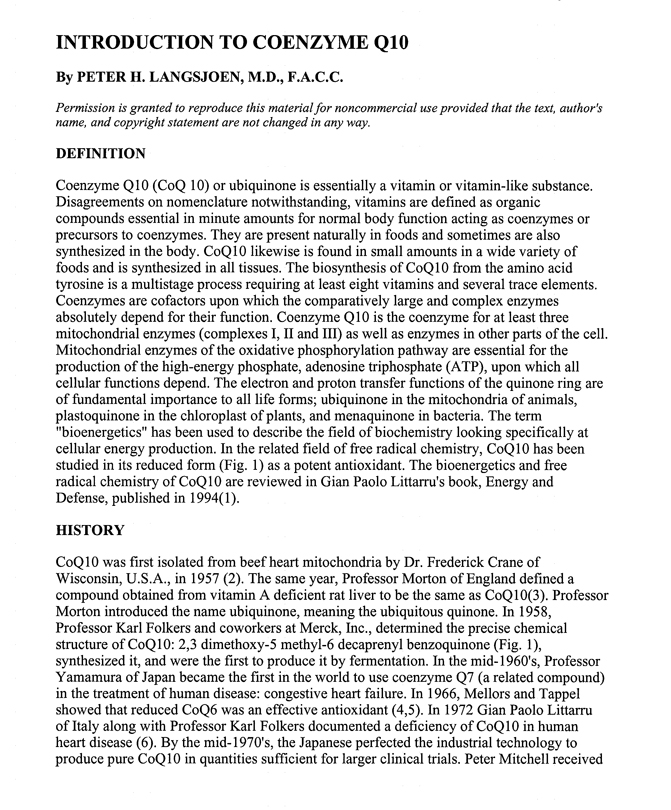

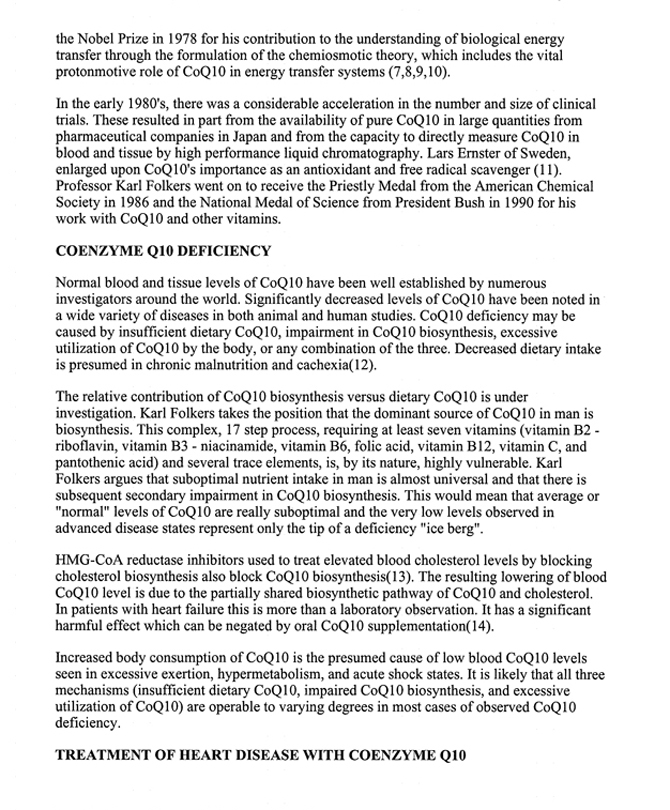

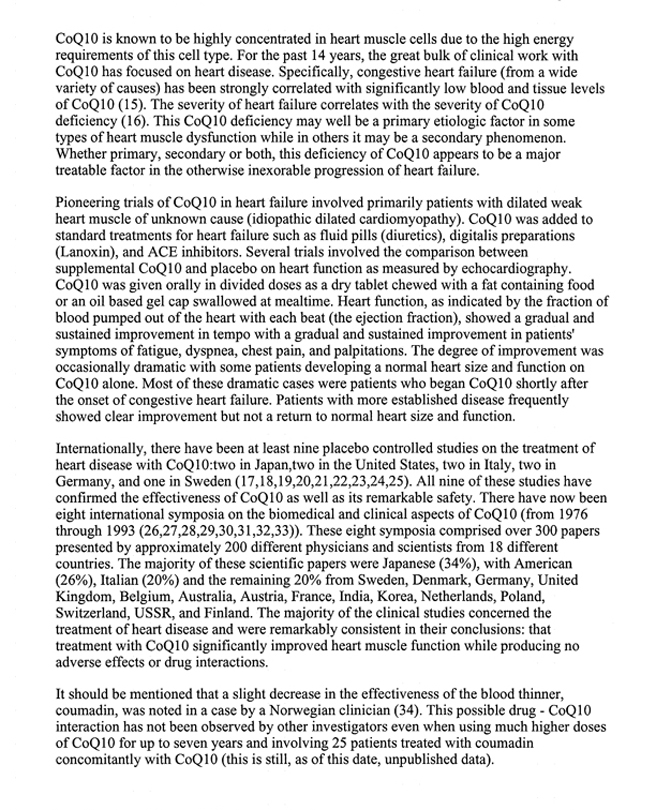

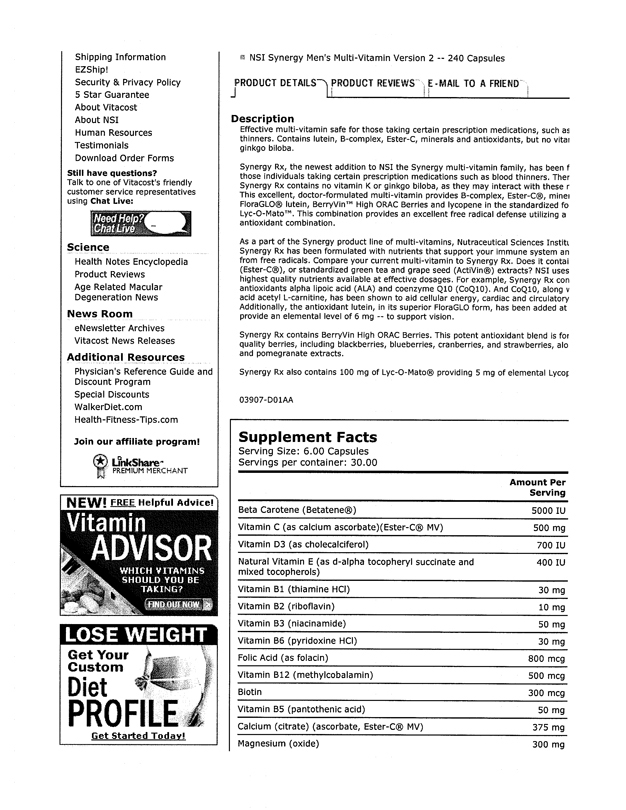

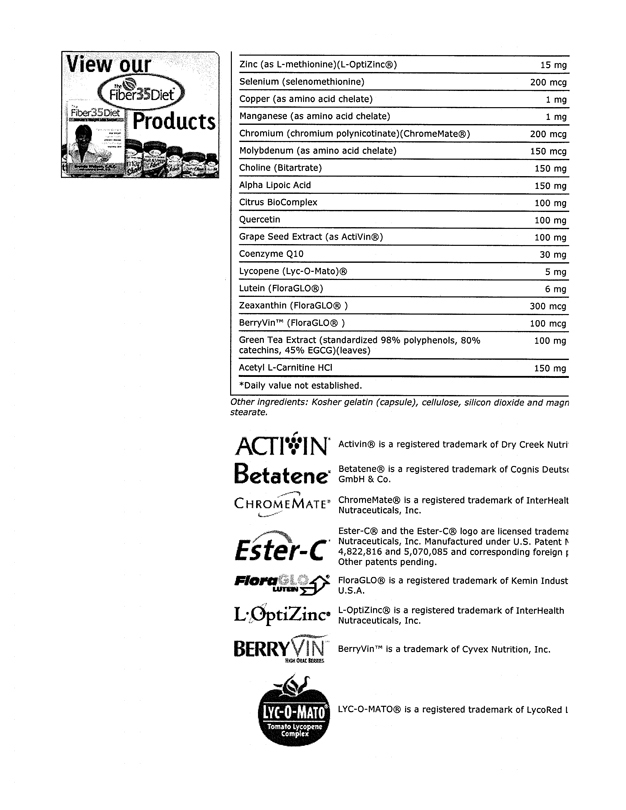

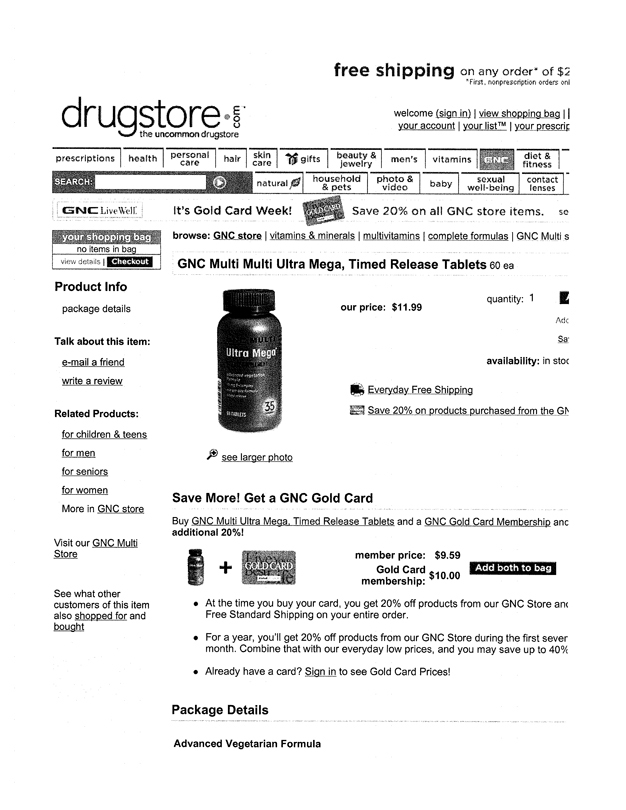

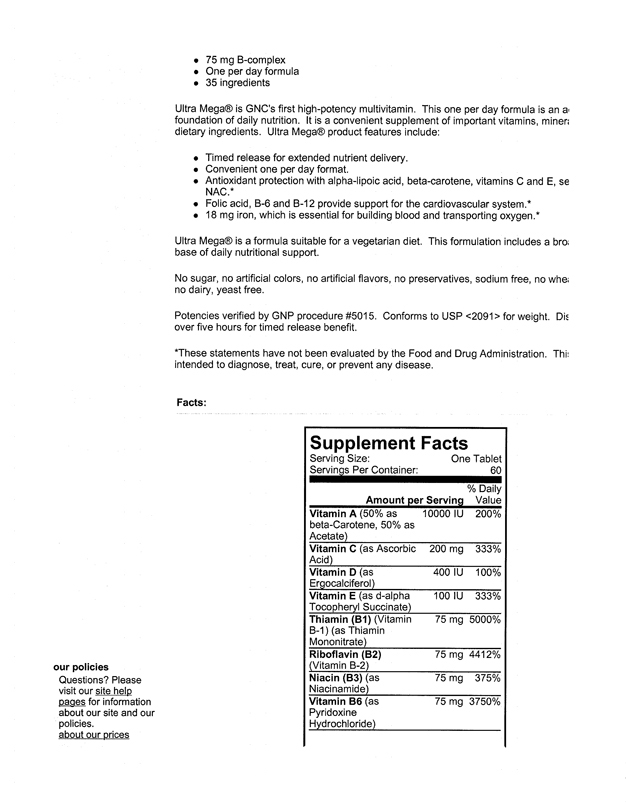

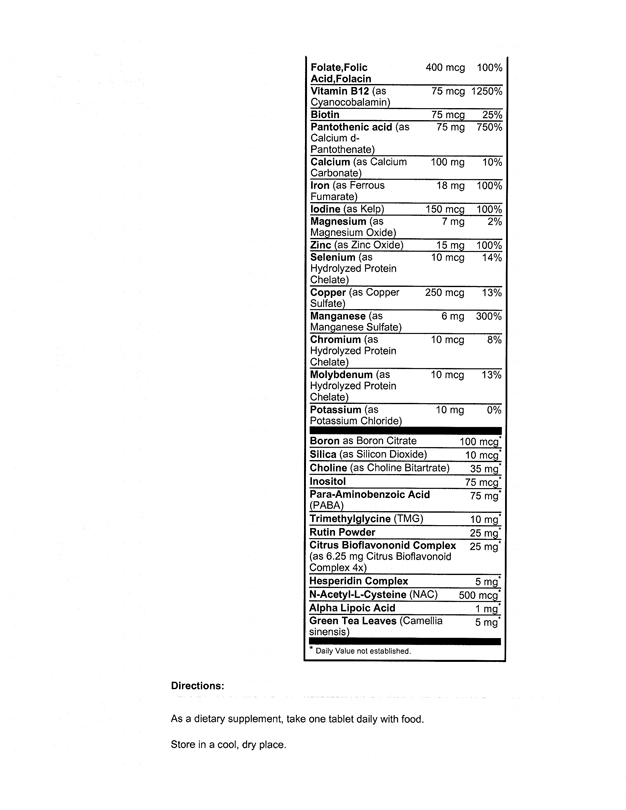

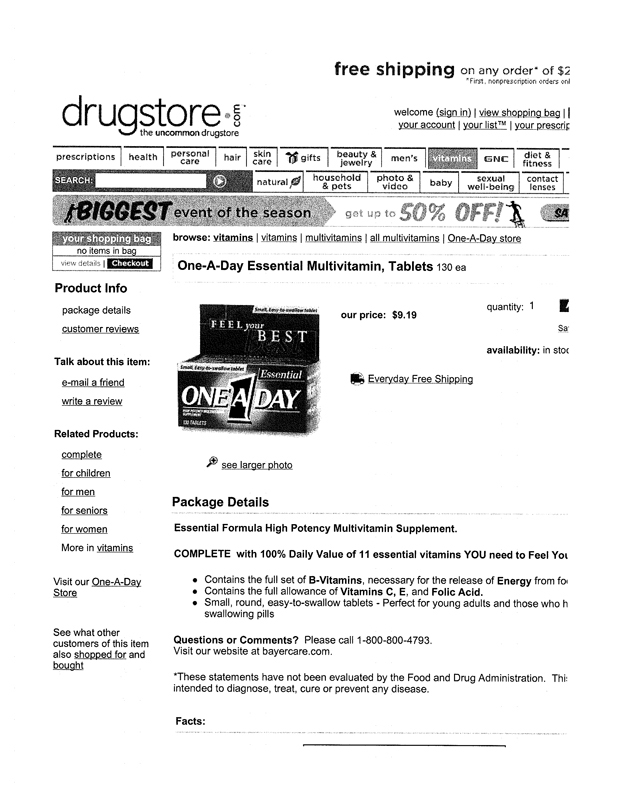

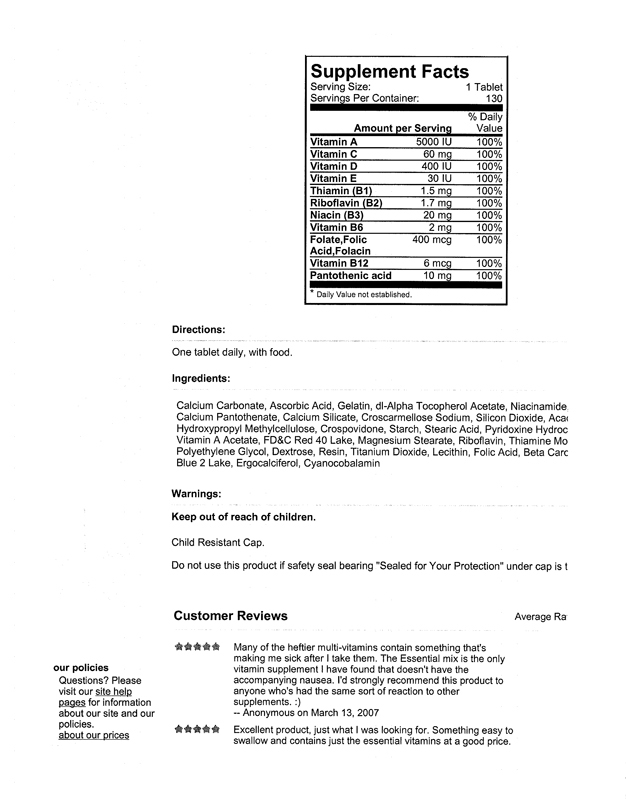

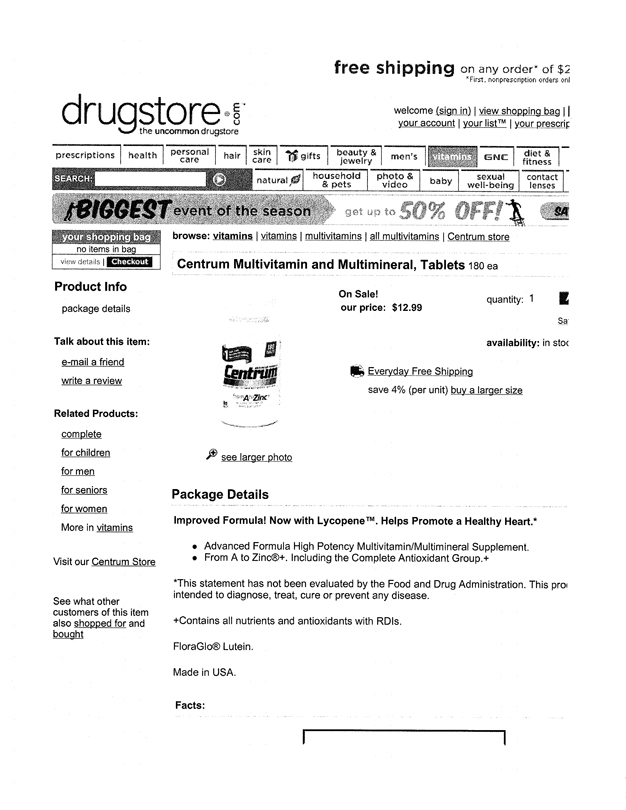

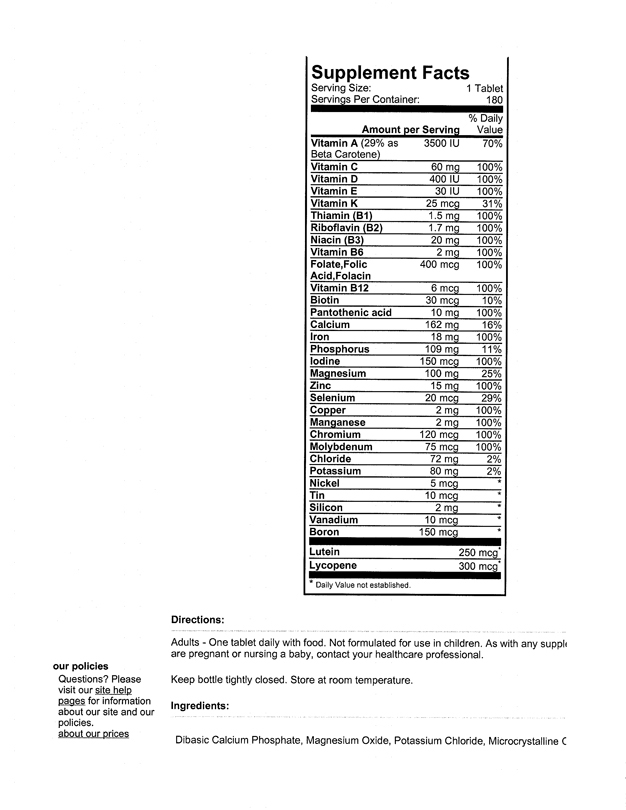

Response: In response to the Staff’s comment, the Company has revised the disclosure to Our Value Proposition To Our Customers—Proprietary Products on page 44. Scientific studies indicate that the minimally efficacious level of lutein is 6 milligrams, CoQ10 is 30 milligrams and vitamin D is 700 IU (international units). NSI Synergy Rx provides these levels of nutrients while our main competitors, Centrum, Bayer, One-A-Day and GNC Multi Ultra Mega, do not. Included in this response are copies of studies and supplement product information in support of the disclosure.

Mr. H. Christopher Owings

August 10, 2007

Page 10

Products, page 44

30. Please provide a chart showing your major product categories and the percentage of your net sales provided by each category.

Response: Respectfully, the Company advises the Staff that it does not track sales by category due to the fact that a single product can cross over multiple categories. For example, a protein bar could be included in the diet, sports nutrition and/or food categories. Instead, the Company analyzes individual products for velocity trends and makes strategic decisions based on demand for a particular product. This methodology enables the Company to respond quickly and capitalize on changes in the marketplace by adjusting inventory levels accordingly.

New Product Development, page 45

31. We note that your product development is led by your Scientific Advisory Board. Seeing as how product development would seem to play such a crucial role in your business, please revise to elaborate upon exactly what they do, how often they meet, and who comprises your Board. Please indicate whether you compensate the members of this Board and whether they have any other financial interest in the development of your products.

Response: In response to the Staff’s comment, the Company has revised the New Product Development disclosure on pages 47-48.

32. Please define “nutraceutical” [products]. Please generally elaborate upon how your NSI product-line compares to that of what you offer from third-party brands. For example, disclose whether the NSI-branded products compete against third-party products on your web-site or in your catalog or whether they supplement the overall products you offer. Explain how you identify the brands that you choose to develop as compared to the brands you choose to retail that are manufactured by others.

Response: In response to the Staff’s comment, the following disclosure was inserted on page 48:

|

Nutraceutical refers to foods claimed to have a medicinal effect on human health. It can also refer to individual chemicals present in common foods. NSI is a proprietary line of dietary supplements including multivitamins, minerals, herbs, amino acids, antioxidants and others. NSI consists of over 500 products and competes with other brands we sell on our websites and catalogs. NSI provides price conscious consumers with quality products at competitive prices as an alternative to often higher-priced, comparable third-party products. We use customer feedback and |

Mr. H. Christopher Owings

August 10, 2007

Page 11

|

competitive analysis to determine the product mix of NSI and third-party brand products. |

Marketing, page 46

33. Please explain in further detail your online advertising initiatives that include paid placement on search engines, shopping engines and other online media. Explain more specifically what you are doing in this regard.

Response: In response to the Staff’s comment, the heading on page 48 has been renamed and the disclosure modified as follows:

|

Keyword and Shopping Engine Advertising.Online advertising initiatives include purchases of keywords such as “vitamins” and “supplements” on search engines, shopping engines and other online media. We constantly monitor the performance of our online advertising and adjust our keyword purchases to minimize our costs to attract new customers. |

34. Please explain “prospect activation.”

Response: In response to the Staff’s comment, the Company deleted the words “prospect activation” and modified the disclosure on page 48 as follows:

|

Our e-mail marketing campaigns are designed to distribute health and wellness and product information to promote sales, customer referrals, customer retention and repeat purchases. |

35. Also explain in further detail how you attract customers and generate online revenue from affiliate programs.

Response: In response to the Staff’s comment, the disclosure on page 48 was amended as follows:

|

We attract customers and generate revenue from online affiliate programs. We pay websites commissions when they refer visitors from their website who complete purchases on our website. These affiliate websites typically generate referrals through keywords, text links or banners posted on their website. |

Contract Manufacturing, pace 46

36. You state that currently all of the materials and ingredients for your NSI-branded products are purchased from third-party manufacturers and that the ingredients for your NSI products and the formulations are sent to one of 17 contract manufacturers for

Mr. H. Christopher Owings

August 10, 2007

Page 12

production. Please indicate where these materials and ingredients are purchased, where they are manufactured and identify the manufacturers involved. If you have contracts in place with these manufacturers that ensure minimum production or purchase requirements, please describe them.

Response: In response to the Staff’s comments, the disclosure on page 49 was amended as follows:

|

Currently, all of the materials and ingredients for our NSI-branded products are purchased from third-party manufacturers. The ingredients for the NSI products and the formulations are sent to one of 17 contract manufacturers for production, the top three of which, Health Wright Products, Nutra Manufacturing and Nutri-Force Nutrition accounted for approximately 71% of our finished goods in 2006. We do not have contracts in place with these manufacturers that ensure minimum production or purchase requirements. |

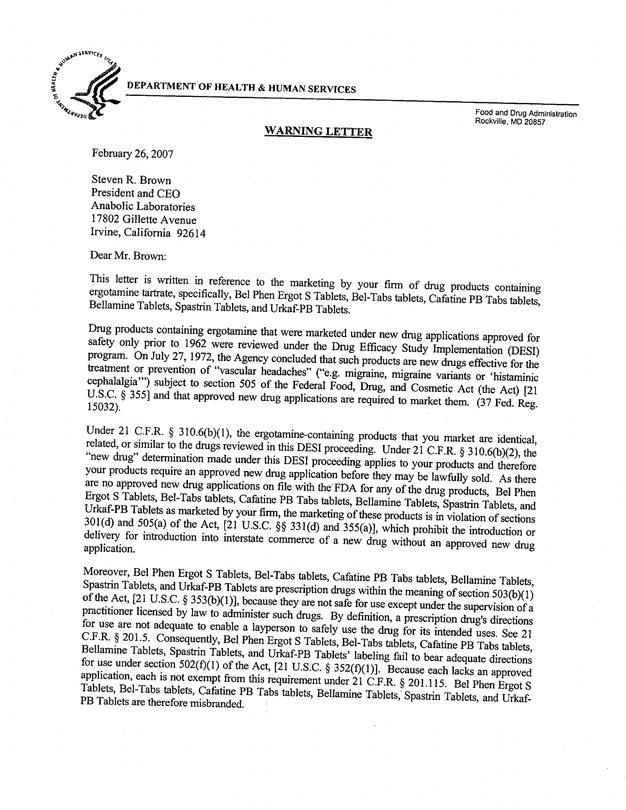

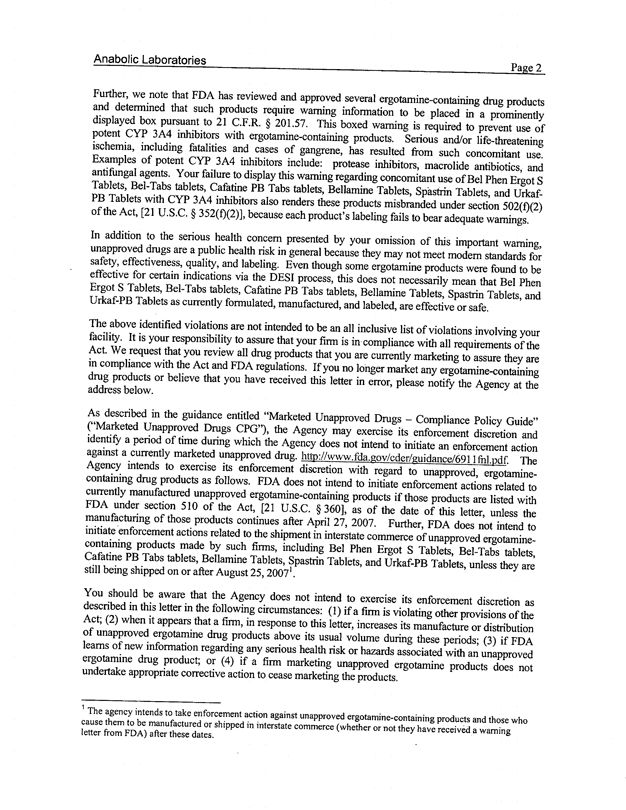

37. Please indicate whether any of these manufactures have been cited by the FDA for violations of FDA regulations.

Response: Anabolic Laboratories, which accounts for approximately 10% of the Company’s manufactured goods, received a warning letter from the Department of Health and Human Services, dated February 26, 2007, a copy of which is included with this response.

Technology and Operations, page 47

38. Please revise your discussion of Other Systems so that it is less technical in nature.

Response: In response to the Staff’s comment, the disclosure on page 50 was amended as follows:

|

We use several information technology systems to support supply chain, customer relationships and marketing. We believe the systems have the proven ability to function efficiently as our revenues increase. |

Regulatory Proceeding, page 54

39. Please revise to disclose the April 2001 summary judgment that was entered against Mr. Gorsek and, in doing so, please state that he was also found liable and enjoined for violations of Section 17(b) of the Securities Act. Also, please revise your description of the findings of the Court as it appears that your description states that Mr. Gorsek merely failed to disclose the “exact” amount and nature of the compensation, when it is our understanding that he failed to disclose that he was

Mr. H. Christopher Owings

August 10, 2007

Page 13

receiving cash and securities from the issuers of securities that he was, in turn, recommending to his clients. Clearly disclose that he was both the owner of the public relations firm and the broker-dealer that was implicated in the case.

Response: In response to the Staff’s comment, the disclosure on pages 56-57 was amended as follows:

|

From 1992 to 1996, Wayne F. Gorsek, our founder and former Chief Executive Officer, was a registered representative and part-owner of a broker-dealer registered with the SEC. In a civil complaint filed in 1999, the SEC alleged that Mr. Gorsek, in his role as an owner of a public relations firm, published research profiles which failed to disclose material information, which in turn served to artificially inflate the trading prices for shares of common stock of approximately 20 publicly traded microcap companies. On April 23, 2001, the Court found that Mr. Gorsek, acting through the public relations firm, failed to adequately disclose the receipt of compensation by it (in the form of cash and securities) from the issuer clients whose securities were being recommended, that in some instances additional compensation (in the form of securities) would be granted to Mr. Gorsek through the public relations firm based on the performance of the issuer clients securities, and that the reports and profiles published by the public relations firm of the issuer clients were reprints of projections and target prices received from the issuer clients whose securities were being recommended and that Mr. Gorsek acting through the public relations firm did not perform independent research on the issuer clients. On April 23, 2001, the U.S. District Court entered a summary judgment against Mr. Gorsek and on May 28, 2002, the U.S. District Court entered an order finding Mr. Gorsek liable for violations of Sections 17(a) and (b) of the Securities Act of 1933, Section 10(b) of the Exchange Act of 1934, as amended and Rule 10(b)(5). |

40. Please revise to elaborate upon the role Mr. Gorsek will play as “founder” and “consultant” to the company.

Response: In response to the Staff’s comments, the disclosure on page 57 has been modified as follows:

|

Pursuant to the terms of his consulting agreement, Mr. Gorsek will consult with such employees on matters as determined by the Chief Executive Officer including, but not limited to manufacturing, facilities design and |

Mr. H. Christopher Owings

August 10, 2007

Page 14

|

equipping, advertising, customer relations, marketing, Internet strategies, product formulation and packaging, scientific advisory board matters and business strategy. Mr. Gorsek is obligated to continue to remain current with medical and scientific literature as it relates to nutritional supplements, vitamins and nutrients, consistent with a comparable level of understanding as when he served as Chief Executive Officer of the Company. |

Management, page 56

Directors, Executive Officers, and Key Employees, page 56

41. Please generally revise the biographies to provide in a factual manner, and without excessive gratuitous detail, the information required by Item 401 of Regulation S-K for the requisite five year period. For example, please:

| | (a) | delete “integral” from Mr. Kerker’s biography; |

| | (b) | briefly describe the businesses of Hair Club for Men, Inc., Coppercom, Inc., Rexall Sundown, NBTY, Inc, etc. |

| | (c) | delete “He has had significant operating and financial positions throughout his 28-year career” from Mr. Oppenheimer’s biography; the asset size of Kenmar and Midatlantic National Bank; and his being named a “financial expert” under Sarbanes-Oxley. |

| | (d) | delete “one of The American Lawyer top 100 law firms” from Ms. Rehnquist’s biography. |

Response: In response to the Staff’s comments, the requested revisions have been made.

Founder, pace 58

42. Please delete “key” [advice], “broad” [knowledge], “extensive” [reading] and “frequent” [dialogue].

Response: In response to the Staff’s comments, the requested revisions have been made.

Mr. H. Christopher Owings

August 10, 2007

Page 15

Executive Compensation, page 61

Compensation Discussion and Analysis, page 61

43. Much of this discussion appears to speak in terms of your future compensation policies and plans “once [you] become a publicly-held company.” Please revise to also discuss how you have for the last fiscal year established compensation amounts for your Named Executive Officers and, where applicable, draw distinctions between how you plan to establish such amounts in the future. For example, the Summary Compensation Table indicates that you have compensated your Named Executive Officers with a combination of base salary, short-term incentive compensation (i.e. bonuses), option awards and non-equity incentive plan compensation. Discuss how you arrived at each of these amounts.

Response: In response to the Staff’s comments, the disclosure on page 63 has been amended as follows:

|

Historically, our former CEO and Founder, Wayne F. Gorsek, negotiated the terms of employment agreements for named executive officers subject to the review and approval of the board. There were no formal policies or guidelines dictating the types and amounts of compensation provided. |

44. In the context of your discussion of Short-Term Incentive Compensation, you mention that bonuses will be based upon your “overall corporate level performance measures including growth in EBIDTA, etc.” Please elaborate upon how compensation will be tied to these performance targets and what, if any, discretion may be exercised in awarding this form of compensation. See Item 402(b)(2)(vi) of Regulation S-K.

Response: In response to the Staff’s comment, the disclosure on page 64 has been amended as follows:

|

The Compensation Committee has not specifically established how compensation will be tied to performance targets, or the level of discretion permitted in awarding this form of compensation. |

45. In the context of your discussion of Long-Term Incentive Compensation, you indicate that a total dollar pool will be recommended by your CEO and the compensation committee will then determine the final total dollar amount to be awarded to the Named Executive Officers. Please revise to elaborate upon how the amount of the total pool and individual grants will be arrived at.

Mr. H. Christopher Owings

August 10, 2007

Page 16

Response: In response to the Staff’s comment, the disclosure on page 64 has been amended as follows:

|

The Compensation Committee has not established the specific parameters and policies for the total dollar amount to be granted or the individual grants. |

Director Compensation, page 66

46. Please disclose by footnote the aggregate number of option awards outstanding at fiscal year end.

Response: The aggregate number of option awards outstanding at December 31, 2006 was 3,993,500. In response to the Staff’s comment, the requested revision has been made.

Certain Relationships and Related Party Transactions, page 75

47. Please state whether the terms of your related party transactions are comparable to terms of transactions with unrelated third parties.

Response: In response to the Staff’s comment, the disclosure on page 78 has been amended as follows:

|

We believe the terms of our related party transactions are comparable to terms of transactions with unrelated third parties. |

48. Please describe the registrant’s policies and procedures for the review, approval or ratification of any related party transaction. See Item 404(b) of Regulation S-K.

Response: In response to the Staff’s comment, the disclosure on page 78 has been amended as follows:

|

We believe the terms of our related party transactions are comparable to terms of transactions with unrelated third parties. All related party transactions must be reviewed, approved and/or ratified by our board of directors. |

Principal Stockholders, page 77

49. Footnote (5) to the ownership table appears incomplete. Please revise.

Response: In response to the Staff’s comment, the disclosure on page 80 has been amended.

Mr. H. Christopher Owings

August 10, 2007

Page 17

Selling Stockholders, page 79

50. Please provide the information required by Item 507 of Regulation S-K as we may have further comment upon receipt of this information.

Response: We note the Staff’s comment and respectfully submit that the requested information will be provided in a subsequent amendment. It is our intent to file the subsequent amendment with sufficient time to permit the Staff to review the disclosure before the distribution of any preliminary prospectus.

Where You Can Find Additional Information, page 91

51. Please revise to show our address as 100 F Street, N.E. Washington, D.C. 20549.

Response: In response to the Staff’s comment, the requested revision has been made to page 93.

Annual Financial Statements Balance Sheets, page F-3

52. Please remove the two subtotals between total current assets and total assets, as such subtotals are not prescribed by Rule 5-02 of Regulation S-X.

Response: In response to the Staff’s comment, the requested revision has been made.

Statements of Operations, page F-3

53. Please remove the subtotal between operating Income (loss) and income (loss) before income taxes, as such subtotal is not prescribed by Rule 5-03 of Regulation S-X.

Response: In response to the Staff’s comment, the requested revision has been made.

54. Please separately present other non-operating income and other non-operating expense. Net presentation is generally not permitted. See paragraphs 7 and 9 to Rule 5-03 of Regulation S-X. Briefly disclose in a footnote the nature of the amounts included in the revised other non-operating income and other non-operating expense line items for each period presented. Additionally, revise your comparison of period to period operating results in MD&A to include a discussion of material changes in the other non-operating income and other non-operating expense line items, as it appears these items significantly affected reported net income or loss in the periods presented.

Response: In response to the Staff’s comment, the requested revisions have been made to pages F-4 and F-20. However, we have not disclosed these items due to the fact that they have historically been immaterial with the exception of the gain related to the sale of the land in Utah during the three months ended March 31, 2007. We respectfully direct the Staff’s attention to

Mr. H. Christopher Owings

August 10, 2007

Page 18

our discussion regarding this matter in Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Note 1. Nature of Business and Significant Accounting Policies, page F-7

55. Please disclose the amount of research and development costs charged to expense in each period presented, if material. Refer to paragraph 13 of SFAS 2. Please also disclose the line item in your financial statements that includes such costs.

Response: The Company notes the Staff’s comment and respectfully submits that the Company does not have research and development costs although certain employees and advisors do engage, in addition to other activities, in the development of our products. As product development is considered to be only one aspect of the relevant responsibilities, the Company does not track this separately. These expenses are included in General and Administrative in our consolidated statement of operations.

Revenue Recognition and Shipping and Handling, page F-8

56. Please tell us and disclose whether you stock inventory for all of your product sales, or whether certain of your sales are arranged through third-party suppliers who drop-ship merchandise on your behalf. To the extent any of your sales are derived from drop-ship type arrangements, please disclose whether such sales are recorded based on the gross amount billed to the customer or the net amount retained as a commission on the sale.

Also tell us in detail and disclose the basis in GAAP for gross or net reporting, as applicable. Refer to EITF 99-19.

Response: The Company stocks all inventory for product sales and there are no drop-ship type arrangements. In response to the Staff’s comment, the disclosure has been amended to reflect this fact.

Stock Based Compensation, page F-9

57. In estimating the fair value of share options issued during 2006, please tell us in a reasonable amount of detail the methodology you used to determine the fair value of the common shares underlying the share options. Refer, for best practices, to the AlCPA’s practice aid on valuation of privately-held company equity securities issued as compensation.

Response: The Company notes the Staff’s comment and submits that the Company’s estimated fair value of share options for stock based compensation was obtained from a valuation analysis prepared by an investment banking firm. In performing this analysis, the investment banking firm selected ten public nutritional supplement companies: Herbalife, Mannatech,

Mr. H. Christopher Owings

August 10, 2007

Page 19

Natrol, Nature’s Sunshine Products, NBTY, Nutraceutical International, Nu Skin Enterprises, Reliv International, USANA Health Sciences, and Weider Nutrition International. For these ten companies the valuation median and trimmed mean, which excludes high and low values, were both 1.2 times revenue. The Company therefore has historically used a multiple of 1.2 times revenue to estimate its enterprise value and related fair value of its common stock for stock based compensation. The Company considered using a discounted cash flow method, but due to the Company’s rapid growth in sales and lack of historical profitability, this approach was deemed inferior to the method selected.

58. Because you use the calculated value method to estimate the expected volatility of your shares, please disclose the reasons why it is not practicable for you to estimate the expected volatility of your share price, the appropriate industry sector that you selected, the reasons for selecting that particular index, and how you calculated historical volatility using that index. Refer to paragraph A240.e.(2)(b) of SFAS 123(R).

Response: The Company notes the Staff’s comment and respectfully submits that as a result of its limited trading history, the Company uses expected volatilities based on the historical volatility of a sample of companies in its industry. The Company selected comparable companies which are considered competitive in the e-commerce market. The selection was further narrowed to include those companies whose product offerings include dietary and/or nutritional supplements. The companies were evaluated in terms of total asset size and total revenues and includes the following comparable companies:

| | • | | Mannatech Inc., with total revenues of $389.4 million and total assets of $122.8 million; |

| | • | | USANA Health Sciences, Inc., with total revenues of $374.2 million and total assets of $99.1 million; |

| | • | | drugstore.com, Inc., with total revenues of $415.8 million and total assets of $168.3 million; and |

| | • | | eDiets.com, Inc., with total revenues of $53.7 million and total assets of $20.6 million. |

The Company determined historic volatility using the comparable companies. In response to the Staff’s comment, the Company has modified the disclosure in Footnote 1 to include, “As a result of its limited trading history, the Company uses expected volatilities based on the historical volatility of a sample of companies in its industry.”

Mr. H. Christopher Owings

August 10, 2007

Page 20

Note 4. Intangible Assets, page F-l2

59. With respect to the impairment loss recognized in 2006 related to your internet domain names, please disclose: 1) a description of the impaired intangible asset(s); 2) the facts and circumstances leading to the impairment(s); and 3) the caption in the statements of operations in which the impairment loss is aggregated. Refer to paragraph 46 of SFAS 142. Also tell us what the remaining balance in “internet domain names” relates to and how you concluded that the remaining balance is not impaired.

Response: In response to the Staff’s comment, the disclosure on page F-13 has been amended as follows:

|

This impairment loss of $38,252 was charged to general and administrative expenses and related to Internet domain names that ceased being used during 2006. |

The remaining book value of Internet domain names in the amount of $28,250, relates to Internet addresses that direct traffic to the Company’s website to generate sales. The Company periodically reviews the traffic patterns of these addresses to determine sales generation and to test impairment.

Note 8, Stock Option Plan, page F-l4

60. For fully vested share options and share options expected to vest at the latest balance sheet date, please disclose the aggregate intrinsic value of options outstanding and options currently exercisable. Refer to paragraph A240d. of SFAS 123R.

Response: The requested revision has been made.

Note 9. Income Tax Matters, page F-l 5

61. Please tell us the items and their amounts included in “other” in the reconciliation between the reported amount of income tax expense or benefit and the amount from applying the federal statutory tax rate for the most recent fiscal year. In addition, please revise the reconciliation to disclose the amount and nature of each significant reconciling item between the reported amount of income tax expense or benefit and the amount from applying the federal statutory tax rate. Refer to paragraph 47 of SFAS 109.

Response: In response to the Staff’s comment, the Company has revised the disclosure to disclose the amount and nature of each significant reconciling item and have eliminated the “other” in the reconciliation.

Mr. H. Christopher Owings

August 10, 2007

Page 21

62. Please explain to us why the line item captioned “[i]ncrease (decrease) in deferred tax asset valuation allowance” in your effective income tax rate reconciliation does not tie to the change in the valuation allowance as computed based on your disclosures regarding the balance in the valuation allowance as of year-end 2005 and 2006.

Response: In response to the Staff’s comment, the Company has revised the disclosure relative to the deferred tax asset valuation allowance.

Interim Financial Statements

63. Please provide a reconciliation of the beginning and ending balance of each caption of stockholders’ equity, with all significant reconciling items described by appropriate captions. We believe such disclosure is required in light of the significant changes in stockholders’ equity since your most recent fiscal year end. Refer to Rules 3-04 and 10-01(a)(5) of Regulation S-X.

Response: In response to the Staff’s comment, the disclosure has been amended to include a consolidated statement of stockholders’ equity for the three months ended March 31, 2007 in the Company’s interim financial statements.

Recent Sales Of Unregistered Securities, page II-2

64. Please revise to provide the information required by Item 701 of Regulation S-K.

Response: In response to the Staff’s comment, the requested revision has been made.

Exhibits and Financial Statement Schedules, page II-3

65. Please include your opinion of counsel in the next amendment to allow sufficient time for staff review.

Response: We note the Staff’s comment and respectfully submit that the requested information will be provided in a subsequent amendment. It is our intent to file the subsequent amendment with sufficient time to permit the Staff to review the disclosure before the distribution of any preliminary prospectus.

66. Exhibit 21 states that the company does not have any subsidiaries, but disclosures in your document show otherwise. See Summary, page 1 and Principles of Consolidation, page F-7.

Response: In response to the Staff’s comment, Exhibit 21 has been amended to reflect the Company’s two subsidiaries, Nutraceutical Sciences Institute, Inc. and Nutraceutical

Mr. H. Christopher Owings

August 10, 2007

Page 22

Life Sciences, Inc. Neither of the subsidiaries is an operating company nor do they have any assets.

Undertakings, page II-5

67. Please include the undertakings required by Item 512(a) of Regulation S-K, such as those that may be applicable relating to the shares that may be resold in reliance upon Rule 430B or 403C.

Response: The Company notes the Staff’s comment and respectfully believes that no additional revision is required at this time.

In addition to the disclosures described above, the Company has amended the document to update the Subsequent Events disclosure to reflect the receipt of an $8.0 million line of credit, update the Legal Proceedings disclosure to reflect the order of administrative closure of theJuvenon v. Vitacost,case, to amend the Company’s address, as well as make additional edits.

Please contact the undersigned at (312) 836-4192 with any questions or comments you may have regarding this letter or the amendment.

| | |

Very truly yours, SHEFSKY & FROELICH LTD. |

|

/s/ Susan W. Wiles |

Susan W. Wiles |

| | |

SWW/dfh/1053519_2

cc: | Ira P. Kerker, Vitacost.com, Inc. |

| J. Scott Hodgkins, Latham & Watkins LLP |