As filed with the Securities and Exchange Commission on August 10, 2007

Registration No. 333-143891

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GLOBAL ENERGY, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | |

| OHIO | | 4931 | | 31-1271534 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification Number) |

312 Walnut Street, Suite 2300

Cincinnati, Ohio 45202

(513) 621-0077

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive office)

H. H. Graves

President and Chief Executive Officer

312 Walnut Street, Suite 2300

Cincinnati, Ohio 45202

(513) 621-0077

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Jonathan B. Abram, Esq. Dorsey & Whitney LLP 50 South Sixth Street Minneapolis, Minnesota 55402 (612) 340-2600 Fax: (612) 340-2868 | | Jeffrey J. Delaney, Esq. Pillsbury Winthrop Shaw Pittman LLP 1540 Broadway New York, New York 10036 (212) 858-1292 Fax: (212) 858-1500 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated , 2007

Prospectus

Shares

Global Energy, Inc.

Common Stock

We are selling shares of our common stock. This is the initial public offering of our common stock. We anticipate that the initial public offering price will be between $ and $ per share.

Prior to this offering, there has been no public market for our common stock. We have applied to have our common stock listed on The Nasdaq Global Market under the symbol “GEGT”.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus.

| | | | | | |

| | | Per Share | | Total |

| | |

Initial public offering price | | $ | | | $ | |

| | |

Underwriting discounts and commissions | | $ | | | $ | |

| | |

Proceeds to Global Energy, Inc., before expenses | | $ | | | $ | |

We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of our common stock on the same terms and conditions set forth above to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

J.P. Morgan Securities Inc. will act as sole book-running manager and on behalf of the underwriters expects to deliver the shares of our common stock to investors on or about , 2007.

, 2007

Table of contents

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to those jurisdictions.

i

Industry data and other statistical information relating to the energy industry used in this prospectus are based on independent publications, government publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, derived from our review of internal surveys and the independent sources listed above.

Unless otherwise indicated, any projections and any information contained in this prospectus relating to or based upon the market prices of commodities, production levels and items of a similar nature are based upon prevailing market prices for such commodities in effect as of the date of this prospectus.

A glossary of certain terms used in this prospectus appears beginning on page 157 of this prospectus.

ii

Prospectus summary

This summary highlights selected information contained elsewhere in this prospectus. Because this section is only a summary, it does not contain all of the information that may be important to you or that you should consider before making an investment decision. Before making an investment decision, you should read this entire prospectus, including the information contained in the section entitled “Risk Factors.” You should read the following summary together with the more detailed information and the consolidated financial statements and the notes thereto included elsewhere in this prospectus. Except as otherwise indicated or required by the context, references in this prospectus to “we,” “us,” “our,” “Global Energy” or the “company” refer to the combined businesses of Global Energy, Inc. and its subsidiaries.

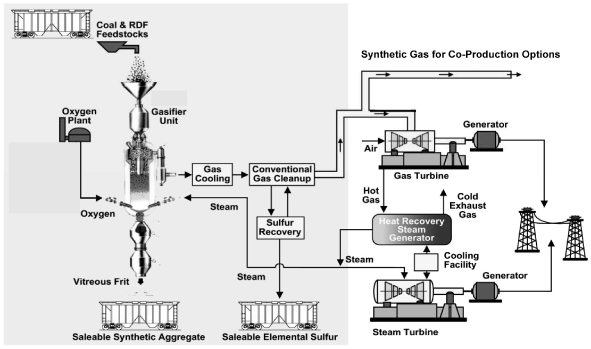

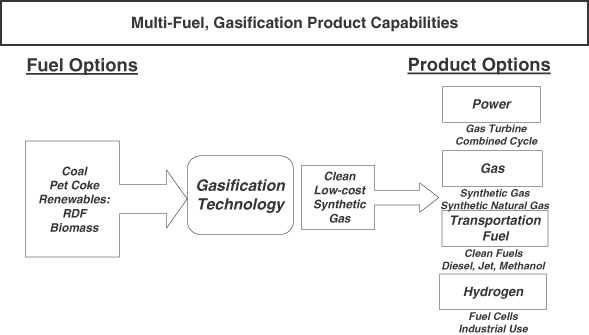

Our company

We are an environmentally focused alternative energy company pursuing clean energy solutions based on gasification technologies. We are utilizing our ownership and operating experience to develop, construct, own and operate gasification facilities, certain of which will employ Integrated Gasification Combined Cycle (IGCC) technology. Gasification facilities cost-effectively convert low-value, solid carbon fuel sources, such as coal, petroleum coke (petcoke) and renewables, into higher value, environmentally cleaner energy sources such as synthetic gas or synthetic natural gas, which is virtually identical to natural gas. IGCC facilities use the SG that is produced through gasification to efficiently produce electricity. Gasification and IGCC technologies represent emerging segments of the energy market. Based on our experience of owning and operating a gasification facility (the Wabash River facility discussed below) and our portfolio of active development projects, we believe that we are the leading gasification and IGCC company in the U.S. and in the U.K.

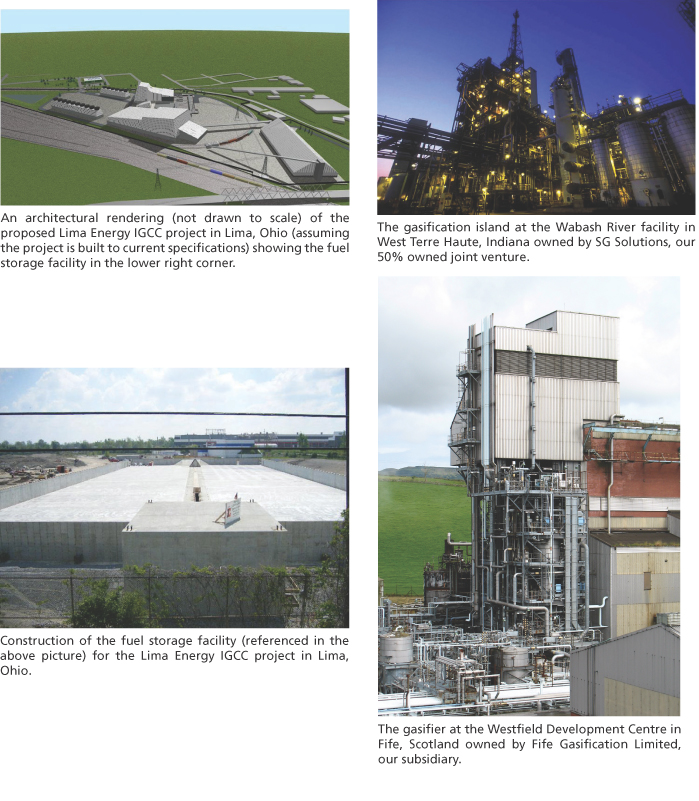

With three major near-term projects in active development, we believe that we have the most advanced portfolio of gasification and IGCC projects in the U.S. and U.K. energy markets. We are one of the first companies in the U.S. to receive the permits necessary to begin construction work on an IGCC facility, which is located in Lima, Ohio. We believe that our Wabash SNG Export project, which is under development at the Wabash River gasification facility in West Terre Haute, Indiana (the Wabash River facility), will be the first new gasification project in the U.S. since 1984 to produce synthetic natural gas from coal for delivery through the natural gas pipeline system. We also believe that our proposed expansion project at the Westfield Development Centre in Fife, Scotland will be the only solid feedstock conversion gasification facility in the U.K. to produce synthetic natural gas and electricity. Upon completion of these three gasification projects as designed, we would have gasification production capacity of approximately 940 MW (a unit equivalent to one million watts of electrical power and used to describe the generating capacity and output of power plants) net of electricity and 63 BCF (a standard measure equivalent to one billion standard cubic feet used to measure the flow of gas, such as synthetic natural gas) per year of synthetic natural gas, which would give us the largest gasification capacity in each of the U.S. and the U.K. based on current production levels.

We believe that our prior ownership and operation of the Wabash River facility in the U.S. gives us the unique expertise required for developing, constructing, owning and operating gasification facilities. We have assembled a management team with a combined experience of over 300 years

1

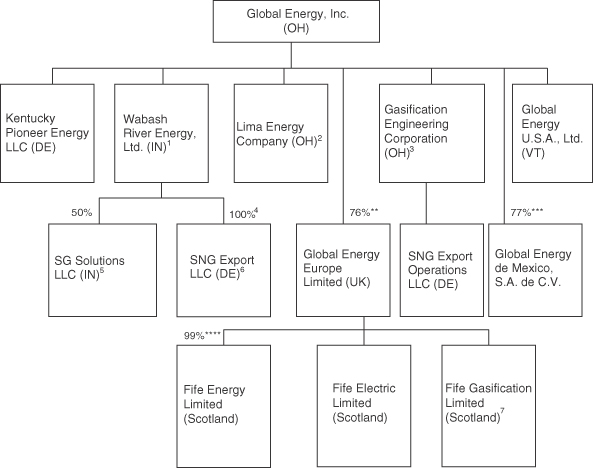

in the development, construction, ownership and operation of gasification and other energy facilities. From January 2000 through January 2005, we owned and operated the Wabash River facility, one of only two IGCC facilities in the U.S., and, since that time, we have shared ownership of that facility through a joint venture. During the period that we owned and operated the Wabash River facility, we demonstrated an ability to reduce operating costs, produce clean synthetic gas at competitive costs compared to prevailing market prices for natural gas and increase reliability at the Wabash River facility. The Wabash River facility is one of the world’s cleanest coal-based power stations according to the U.S. Department of Energy (DOE). We also own a gasification demonstration facility in Fife, Scotland at the Westfield Development Centre, which our employees previously operated on behalf of British Gas.

We intend to commence commercial operations within the next four years at our three major projects currently in active development:

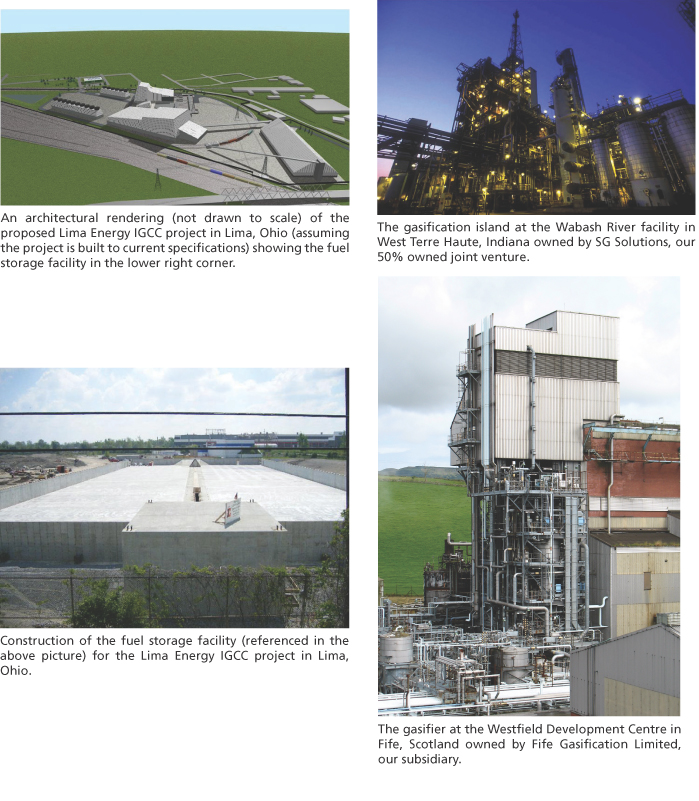

| • | | Lima Energy IGCC. Our project in Lima, Ohio is being designed to produce 540 MW net of electricity, 26 BCF per year of synthetic natural gas and six million SCF (a standard unit for natural gas deliveries that refers to a quantity of gas that is one cubic foot by volume) per day of hydrogen. We refer to this project as the Lima project or Lima Energy IGCC. The Lima project is located on a 63-acre site which we intend to acquire from the City of Lima and will consist of three operating gasifiers and one connected spare gasifier. We expect that approximately half the gasification capacity will produce synthetic gas that will be used as fuel in General Electric (GE) gas turbines to generate electricity while the remaining half of the gasification capacity will produce synthetic gas that will be converted to pipeline quality synthetic natural gas and hydrogen products. We have entered into a ten-year synthetic natural gas purchase and sale agreement with The Procter & Gamble Paper Products Company (P&G), a subsidiary of The Procter & Gamble Company, for six million MMBtu (a measure of heat meaning one million British thermal units and used to describe output of a particularly large number of British thermal units, or Btus, such as in the context of the production of synthetic natural gas) of annual synthetic natural gas production at the Lima project. We began construction on the Lima project in October 2005. After we completed the engineering and design work on, and construction of a portion of, the fuel handling facility at the Lima project, on-site construction activities at the facility were paused in October 2006, until we obtain further financing for the Lima project. We expect to restart construction once full financing is in place, which we anticipate will be in the fourth quarter of 2007. Based on the price and completion date set forth in our engineering, procurement and construction (EPC) agreements relating to the Lima project, the Lima project is expected to have project costs of approximately $1.01 billion and is expected to commence commercial operations in the fourth quarter of 2010. |

| • | | Wabash SNG Export. At the Wabash River facility, located in West Terre Haute, Indiana, we have the right to expand and commence commercial operations of an existing gasifier to produce pipeline quality synthetic natural gas. We refer to this project as the Wabash River project or Wabash SNG Export. We have entered into a ten-year agreement with Eagle Energy Partners I, L.P. for the sale of all of the synthetic natural gas that will be produced by Wabash SNG Export. Wabash SNG Export is expected to produce 14 BCF of synthetic natural gas per year. When Wabash SNG Export is operational, we plan to use coal from our own Indiana coal deposits, located approximately two miles from the Wabash River facility, to produce pipeline |

2

| | quality synthetic natural gas. We currently expect to begin construction work on Wabash SNG Export in the fourth quarter of 2007. We have entered into a “fast-track” EPC contract with a third party which will allow work to progress under a general services arrangement on a time and materials contract basis for Wabash SNG Export and allows us to agree the terms of a fixed price EPC contract with such third party. Based upon our internal estimates with respect to anticipated costs and timing for completion, Wabash SNG Export is expected to have project costs of approximately $280 million and is expected to commence commercial operations in the first quarter of 2010. |

| • | | Westfield project. At the Westfield Development Centre, located in Fife, Scotland, we plan to start operations in two phases consisting of two gasification projects (Fife gasification) and one electric project (Fife electric). We refer to these three phases collectively as the Westfield project. In the first phase, which focuses on Fife gasification, we have begun the design work necessary to recommission our existing gasifier and to add new related equipment and site services. We expect that this gasifier will provide fuel to a gas turbine owned by a third party at the Westfield Development Centre to generate electricity. The second phase, consisting of the further development and completion of Fife gasification and the development of Fife electric, is expected to add seven new gasifiers, each utilizing coal and renewable feedstock, and a new 400 MW net IGCC facility at the site. The Westfield project is expected to produce 23 BCF of synthetic natural gas per year. We expect that the gas turbines to be used by Fife electric will be fueled by the synthetic gas produced by the increased gasification capacity resulting from the installation of the seven new gasifiers in connection with Fife gasification. The Westfield project is expected to have project costs of approximately $860 million. We have entered into a “fast-track” EPC contract with a third party which will allow work to progress under a general services arrangement on a time and materials contract basis for the Westfield project and allows us to agree the terms of a fixed price EPC contract with such third party. Based upon our internal estimates with respect to anticipated costs and timing for completion, the two gasification projects are expected to commence commercial operations following completion of the first and second phases in the third quarter of 2008 and the second quarter of 2010, respectively. |

In addition, following the completion of these three major projects, we intend to complete the development and construction of a second, large gasification facility in the Lima, Ohio area and the development and construction of a large gasification facility to be located near a 712 million in-place ton coal deposit in Wyoming to which we acquired the rights pursuant to the assignment of several leases from the State of Wyoming in 2005 and 2007.

To support our development and construction plans, we have developed several strategic alliances including the following:

| • | | Shaw/Stone & Webster (SS&W), who will be our preferred provider of EPC services for projects where we do not provide our own EPC services and pipes/vessels to our facilities, as well as our partner in developing future gasification technologies; |

| • | | Oxbow Carbon & Minerals (Oxbow), who will be our preferred provider of petcoke and other feedstock to our facilities; |

3

• | | HTC Purenergy, who will provide carbon dioxide (CO2) management advisory services, including CO2 sequestration and enhanced oil recovery services at our facilities, to offset emissions through storage of CO2 in underground formations in commercial proximity to these facilities; and |

| • | | Porvair Filtration Group (Porvair), from whom we expect to purchase all of our requirements for synthetic gas filters for certain entrained flow gasification technology projects and any filter-related equipment required with respect to such synthetic gas filters that Porvair or its affiliates manufacture and agree to supply. |

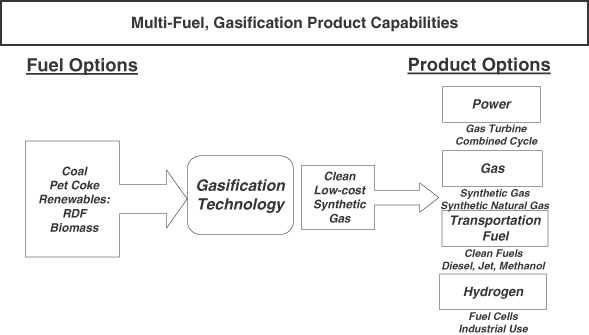

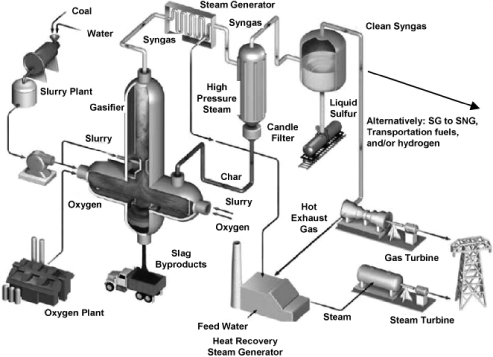

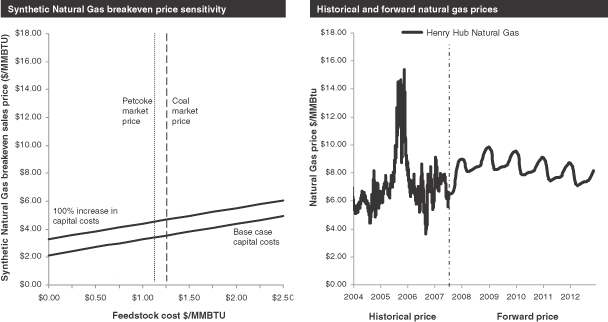

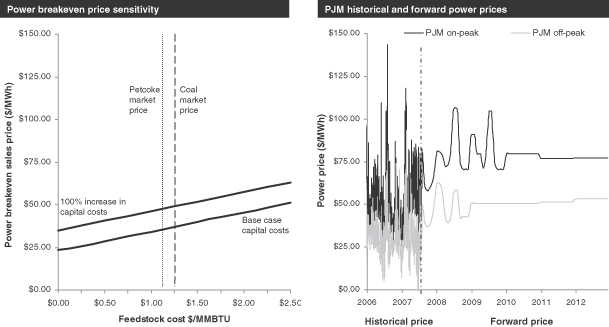

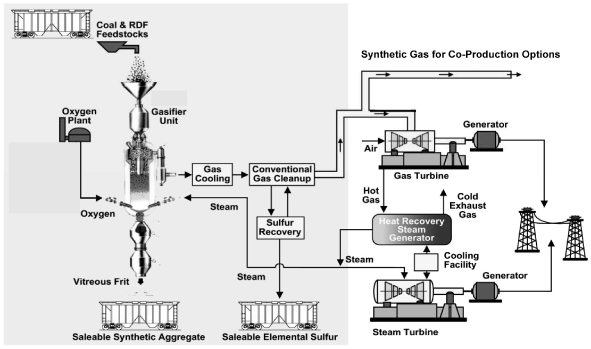

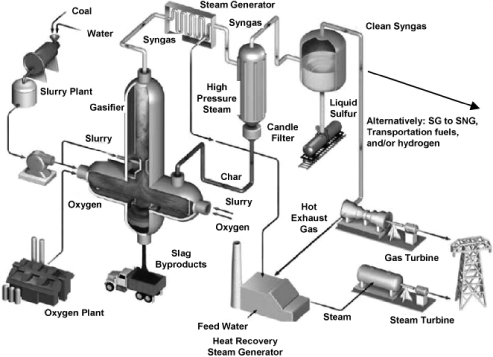

Gasification and IGCC technologies

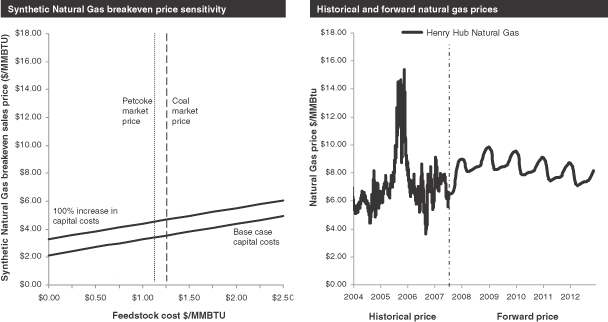

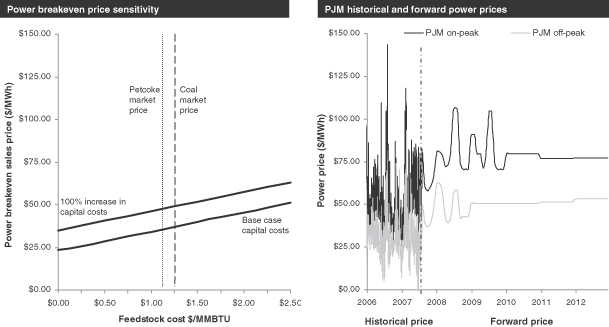

Gasification and IGCC are well-established technologies that represent emerging alternative technologies for the natural gas, electricity and transportation fuels markets. Gasification has been in commercial use for more than 50 years around the world. We believe that gasification products, such as synthetic gas or synthetic natural gas, represent attractive economic alternatives to the historically high and volatile costs of liquid and gas-based fuel sources, particularly natural gas. In addition to this economic advantage, we believe that synthetic gas and synthetic natural gas are alternative energy products that address the current environmental concerns associated with traditional carbon-based fuel sources, particularly coal.

Gasification technology is flexible and has consistently been able to efficiently convert several different low value hydrocarbon fuel sources, such as coal, petcoke and renewables, into various higher value fuels including synthetic gas, synthetic natural gas, transportation fuels and hydrogen, which are environmentally superior fuel sources compared to the original hydrocarbon fuels. We believe that the most significant application of gasification is the conversion of coal and petcoke into synthetic gas or synthetic natural gas at costs that compare favorably to current market prices for natural gas. The price of solid hydrocarbons such as coal, on a Btu basis, has historically been considerably lower and less volatile than the price of natural gas. We believe that the conversion of coal into synthetic gas to produce electricity provides cost advantages over electricity generated by natural gas and will be cost competitive with traditionally sourced coal-fired power generation, especially low-sulfur coal.

The environmental benefits of gasification result from the capability to produce energy with extremely low sulfur oxides (SOx), nitrogen oxides (NOx) and particulate emissions compared to burning coal and other solid fuels. In addition, we believe that the ability to convert coal into synthetic natural gas in the gasification process results in a fuel source with the environmental qualities of natural gas. Gasification by definition is a closed system with minimal air emissions during normal operation. We believe that gasification offers a further potential environmental advantage in addressing current concerns over the atmospheric buildup of greenhouse gases such as CO2. Using the gasification process, CO2 can be separated and captured efficiently for use in enhanced oil recovery (EOR) projects or carbon sequestration, when techniques for carbon sequestration are fully developed by research programs.

The 2004 World Gasification Survey indicates that existing world gasification capacity grew to 45,001 MWth of synthetic gas output in 2004. This capacity is equivalent to more than 25,000 MW net of electricity according to the DOE. The DOE also states, “The reason for this long-term and continuing growth is clear: modern, high temperature slagging gasifiers have the ability to

4

convert low value feedstocks into higher value products—chemicals, fuels and electricity—while meeting the most demanding environmental standards for air emissions, solids, water use and CO2 removal from the product gas.”

We also believe that gasification will benefit from the abundant supply of coal and other feedstock around the world and can serve as a large-scale energy supply solution. We believe that due to gasification’s broad and dynamic matrix of potential inputs and outputs, flexibility to use worldwide abundant feedstock, potential environmental benefits compared to other energy production methods and status as a proven and established process, we will be provided with a wide range of business opportunities and the flexibility to maximize value in an environment of high and volatile commodity prices.

Our markets

We intend to sell synthetic natural gas into the natural gas market and electricity into the power market.

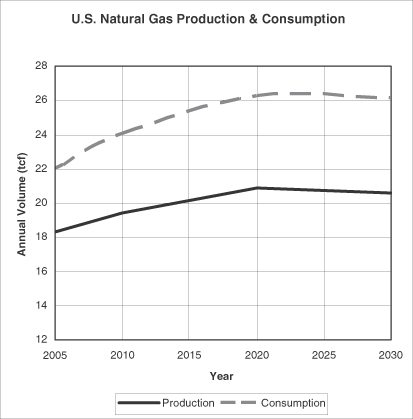

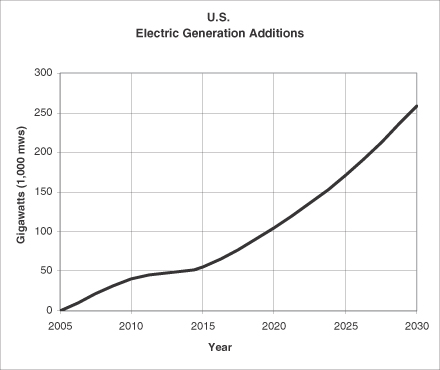

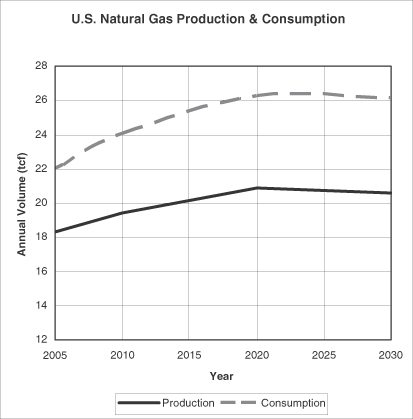

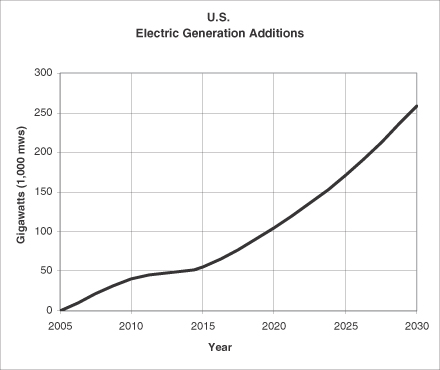

Natural gas is used primarily as a fuel to produce chemicals, to generate electricity and to heat buildings. In recent years, the U.S. natural gas industry has been characterized by a steady increase in demand and consumption coupled with a widening gap between production and consumption, which has resulted in increased importation of natural gas into the U.S. The U.S. Energy Information Administration (EIA) estimates that consumption of natural gas in the U.S. will increase from approximately 22.0 trillion cubic feet (tcf) per year in 2005 to a peak of approximately 26.3 tcf per year in 2020, while production will only increase from approximately 18.3 tcf per year to approximately 20.9 tcf per year over the same period. In addition, according to the EIA, total electricity consumption in the U.S. is projected to grow by 43% from approximately 3,821 billion kilowatt hours in 2005 to approximately 5,478 billion kilowatt hours in 2030. Furthermore, according to the EIA’s International Energy Outlook 2007, worldwide marketed energy consumption is projected to increase by 57% from 2004 to 2030. Within this projection, worldwide natural gas consumption is anticipated to grow 64% from 2004 to 2030 from 99.6 tcf per year in 2004 to 163.2 tcf per year in 2030, and worldwide net electricity generation is anticipated to increase 85% from 2004 to 2030 from approximately 16,424 billion kilowatt hours in 2004 to approximately 30,364 billion kilowatt hours in 2030.

We believe that this anticipated growth in demand requires significant investment in additional facilities for power generation and supplies of natural gas, including gasification and IGCC facilities. In the U.S., in order to meet this increasing demand, the EIA anticipates that 156 gigawatts of coal-fired power plants will be required from 2005 through 2030, including an anticipated 67 gigawatts of newly constructed IGCC facilities. We believe that additional demand for clean, cost-effective power generation, including renewable power and other technologies, will result from clean air legislation, environmental regulations and concerns about rising levels of greenhouse gases.

5

Our competitive strengths

We believe the gasification and IGCC technologies we intend to employ and our operational experience, technical expertise and strategic alliances give us several potential competitive strengths in the natural gas and electricity markets, including the following:

| • | | Our management team has significant expertise in the ownership and operation of gasification facilities, has been instrumental in the advancement of gasification and IGCC technologies and has over 300 years of combined experience in the development, construction, ownership and operation of gasification and other energy facilities. |

| • | | We have an advanced portfolio of gasification and IGCC projects in the U.S. and the U.K. We are one of the first companies in the U.S. to receive the permits necessary to begin construction work on an IGCC facility (Lima Energy IGCC). |

| • | | Our gasification and IGCC facilities will use proven technologies. |

| • | | Our gasification facilities are being designed to produce synthetic natural gas that we believe will provide cost advantages over traditionally sourced natural gas. |

| • | | Our IGCC facilities are being designed to produce electricity at costs that we expect will be advantageous compared with the costs of electricity generated by natural gas-fired plants and competitive with the costs of electricity produced by coal-fired plants. |

| • | | Our gasification facilities are being designed to produce environmentally superior fuels (synthetic gas and synthetic natural gas) compared to coal, while our IGCC facilities are being designed to significantly reduce emissions of pollutants and control those pollutants that our facilities do emit. |

| • | | Our gasification and IGCC facilities are being designed to flexibly convert a broad and dynamic range of fuel sources, including renewables, into a variety of different fuel outputs. |

| • | | Our gasification and IGCC facilities are being designed to run on a variety of abundant global resources, such as coal, petcoke and renewables. |

| • | | We currently have mineral rights to approximately 783 million in-place tons of coal deposits in Wyoming and Indiana. |

| • | | We have entered into several strategic alliances that will support our development and construction plans. |

• | | Our projects are being designed to allow us in the future to implement technology to separate and isolate carbon dioxide (CO2). |

| • | | While U.S. federal government regulation is supportive of gasification and IGCC technology, we do not anticipate requiring government subsidies to execute our business strategy. |

6

Our business strategy

Our goal is to be the worldwide leader in the development, construction, ownership and operation of environmentally responsible gasification and IGCC facilities. In order to achieve this goal, we are pursuing the following business strategies:

| • | | We intend to operate our facilities in an environmentally responsible manner. |

| • | | We intend to focus on the completion of the three major gasification projects currently in active development, which we intend to begin operating within the next four years. |

| • | | We plan to finance each of our projects through a mix of equity and debt, which will consist primarily of project-specific non-recourse debt using the assets of our projects to secure such debt. |

| • | | We plan to enter into long-term offtake agreements (agreements for the purchase of a product by a customer from a producer and particularly common in the energy industry where power and gas are bought and sold) for a sufficient portion of the output from each project to support project-specific debt while selling the remainder of the output, if any, in retail and wholesale markets to take advantage of prevailing energy commodity prices. |

| • | | We intend to leverage the energy facility expertise of our management team to efficiently bring our projects to commercial operation. |

| • | | We intend to leverage our fuel sourcing capabilities to efficiently capitalize on the fuel flexibility of our projects. |

| • | | We intend to expand our product offerings over time to capitalize on the conversion flexibility of our gasification facilities. |

| • | | We intend to expand our existing strategic alliances and enter into new strategic alliances to support our capabilities in areas such as development, construction, fuel sourcing and product marketing. |

| • | | In the long term, we intend to develop, construct, own and operate additional gasification and IGCC facilities, including large scale gasification facilities to produce synthetic natural gas, electricity and other products. |

Risks affecting us

In operating our business we have faced and will continue to face significant challenges. Our ability to successfully operate our business, and execute our development and construction plan, is subject to numerous risks, as discussed more fully in the section entitled “Risk Factors.” Among the risks and uncertainties that face our business are the following:

| • | | we have a limited history of operations and we do not currently directly operate a gasification facility; |

| • | | we may be unable to complete our projects presently under development and construction; |

| • | | we may not be able to achieve our planned schedules and budgets for our projects presently under development; |

7

| • | | we have incurred operating losses and negative cash flows since our inception, we anticipate that we will continue to incur increasing losses for the foreseeable future and in its report on our consolidated financial statements, our independent registered public accounting firm has included an explanatory paragraph describing conditions that raise substantial doubt about our ability to continue as a going concern; |

| • | | we may be unable to raise the substantial additional capital required by our development and construction plan; |

| • | | we or our project companies may be unable to meet the debt service requirements of the financing arrangements used to finance our projects; |

| • | | we are subject to increased construction risk as a result of our wholly-owned subsidiary acting as our main EPC contractor with respect to EPC arrangements at Lima Energy IGCC; |

| • | | we may be unable to obtain or maintain the regulatory permits, approvals and consents required to construct and commence commercial operations at our projects; |

| • | | we may be unable to obtain feedstock for our projects at acceptable prices; |

| • | | we may be unable to enter into acceptable offtake agreements due to fluctuations in natural gas prices and other energy commodity prices; |

| • | | we may be unable to sell our end-products at favorable prices or at all if market acceptance of gasification and IGCC technologies and processes does not continue to increase or the price of natural gas decreases; |

| • | | we may be unable to protect the confidentiality of sensitive information and know-how; |

| • | | we will need to hire, retain and integrate key executive officers and skilled technical and field personnel; and |

| • | | we may be adversely affected by existing and future U.S. and U.K. governmental regulation and energy policies. |

Any of the above risks could have a material adverse effect on our business, financial condition, prospects and results of operations. An investment in our common stock involves risks. You should read and consider the information set forth in the section entitled “Risk factors” and all other information set forth in this prospectus before investing in our common stock.

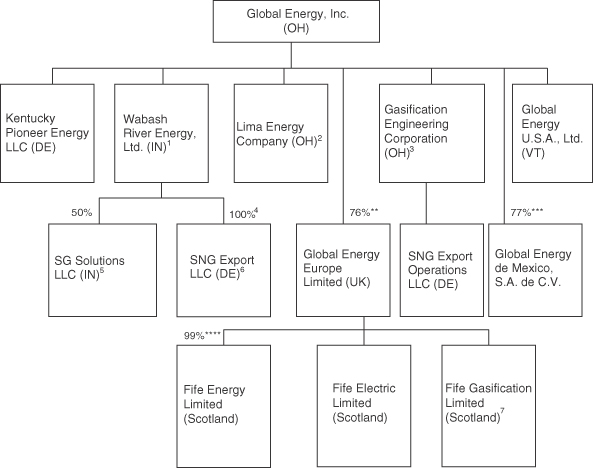

Our corporate information

We were incorporated in Ohio in October 1988. Our principal executive offices are located at 312 Walnut Street, Suite 2300, Cincinnati, Ohio, 45202, and our telephone number is (513) 621-0077. Our website address is www.globalenergyinc.com. The information on, or that may be accessed through, our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

8

The offering

Common stock offered by Global Energy | shares |

Common stock to be outstanding immediately after this offering | shares |

Over-allotment option | shares |

Use of proceeds | We expect to receive net proceeds from this offering of approximately $ million (or approximately $ million assuming exercise of the underwriters’ over-allotment option in full). We intend to use, (1) approximately $ million to repay indebtedness, including certain indebtedness that is currently overdue, and additional interest and certain remaining accrued interest on indebtedness repaid late, (2) approximately $ million of the net proceeds to pay accrued salaries, wages and bonuses to certain members of our senior management team, (3) approximately $ million to fund the purchase price of certain shares of our common stock which we expect to be required to purchase upon the closing of this offering from one of our shareholders, (4) approximately $ million of the net proceeds to fund project costs and (5) the remainder of the net proceeds for the addition of new employees and services to meet the demands of growth in a public company environment, working capital and general corporate purposes, including future gasification and IGCC projects. See “Use of proceeds.” |

Proposed Nasdaq Global Market symbol | GEGT |

Risk Factors | See “Risk factors” beginning on page 13 for a discussion of factors you should consider carefully before deciding to invest in our common stock. |

The number of shares of our common stock that will be outstanding immediately after this offering is based on shares of our common stock outstanding as of , 2007 (as adjusted to reflect the adjustments set forth below).

Unless otherwise indicated, the information in this prospectus assumes that the underwriters will not exercise the over-allotment option granted to them by us and has been adjusted to reflect:

| • | | a -for-1 stock split of our common stock to be effected immediately prior to the effectiveness of this offering; |

| • | | the automatic conversion of all shares of our outstanding cumulative convertible redeemable preferred stock into shares of our common stock (on a post-split basis) upon the closing of this offering; |

9

| • | | the conversion of $ million in outstanding principal and accrued interest as of 2007 under a $2.8 million secured note bearing interest at LIBOR plus 5% issued by us to an affiliate of Ohio National Financial Services, Inc. (ONFS) in December 2002 into a total of shares of our common stock upon the closing of this offering, assuming that such affiliate of ONFS elects to fully convert such outstanding principal and accrued interest into shares of our common stock; |

| • | | the issuance of shares of our common stock to affiliated minority shareholders of our Global Energy Europe Limited and Global Energy de Mexico, S.A. de C.V. subsidiaries upon the closing of this offering in connection with certain corporate reorganization matters, as discussed in the section entitled “Certain relationships and related transactions—Subsidiary relationships;” |

| • | | the retirement by us of shares of our common stock which we expect to be required to purchase upon the closing of this offering from one of our shareholders, as discussed in the section entitled “Description of capital stock;” and |

| • | | our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share (the mid-point of the initial public offering price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and the application of the net proceeds from those shares; and |

| • | | amendments to our charter and bylaws to be effective upon the closing of this offering. |

10

Summary consolidated financial data

The following tables summarize our consolidated financial data for the periods presented. The summary consolidated statements of operations data for the years ended December 31, 2004, 2005 and 2006 are derived from our audited annual consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the three months ended March 31, 2006 and 2007 and summary consolidated balance sheet data as of March 31, 2007 have been derived from our unaudited quarterly consolidated financial statements, which are included elsewhere in this prospectus. Our unaudited quarterly consolidated financial statements include, in the opinion of our management, all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentation of those statements. The historical results are not necessarily indicative of the results to be expected for any future periods. You should read this data together with the consolidated financial statements and related notes appearing elsewhere in this prospectus, as well as the information in the following sections: “Capitalization,” “Selected consolidated financial data” and “Management’s discussion and analysis of financial condition and results of operations.”

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, | | | Three months

ended

March 31, | |

| | | 2004 | | | 2005 | | | 2006 | | | 2006 | | | 2007 | |

| (in thousands except per share data) | | | | | | | | | | | (unaudited) | |

| | | | | | | | | | | | | | | | | | | | | |

Consolidated statements of operations data: | | | | | | | | | | | | | | | | | | | | |

Product sales | | $ | 6,591 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Cost of goods sold | | | 12,111 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit (loss) | | | (5,520 | ) | | | — | | | | — | | | | — | | | | — | |

Selling, general and administrative expenses | | | 3,771 | | | | 7,930 | | | | 17,071 | | | | 3,527 | | | | 4,019 | |

Depreciation and amortization | | | 668 | | | | 407 | | | | 407 | | | | 101 | | | | 103 | |

Impairment of long-lived assets | | | — | | | | — | | | | 903 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Operating loss | | | (9,959 | ) | | | (8,337 | ) | | | (18,381 | ) | | | (3,628 | ) | | | (4,122 | ) |

| | | | | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | |

Interest expense, financing fees and penalties, net | | | (11,713 | ) | | | (3,585 | ) | | | (7,695 | ) | | | (698 | ) | | | (1,156 | ) |

Foreign exchange gain (loss) | | | 749 | | | | (1,080 | ) | | | 1,516 | | | | 102 | | | | 24 | |

Gain on formation of joint venture (SG Solutions, LLC) | | | — | | | | 15,383 | | | | — | | | | — | | | | — | |

Gain on sale of air separation unit | | | — | | | | 29,301 | | | | — | | | | — | | | | — | |

Gain on E-Gas™ Technology contract amendment | | | — | | | | — | | | | 7,760 | | | | 7,760 | | | | — | |

Dividend income from SG Solutions, LLC | | | — | | | | — | | | | 1,096 | | | | 106 | | | | 660 | |

Other | | | 623 | | | | 256 | | | | 284 | | | | 76 | | | | 34 | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income before taxes | | | (20,300 | ) | | | 31,938 | | | | (15,420 | ) | | | 3,718 | | | | (4,560 | ) |

Provision for income taxes | | | 34 | | | | 962 | | | | 376 | | | | 94 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (20,334 | ) | | $ | 30,976 | | | $ | (15,796 | ) | | $ | 3,624 | | | $ | (4,560 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Dividends on cumulative convertible redeemable preferred stock | | | (48 | ) | | | (48 | ) | | | (48 | ) | | | (11 | ) | | | (11 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net (loss) income to common shareholder | | $ | (20,382 | ) | | $ | 30,928 | | | $ | (15,844 | ) | | $ | 3,613 | | | $ | (4,571 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Loss (earnings) per common shareholder | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (3.55 | ) | | $ | 5.32 | | | $ | (2.63 | ) | | $ | 0.62 | | | $ | (0.73 | ) |

Diluted | | | (3.55 | ) | | | 5.07 | | | | (2.63 | ) | | | 0.60 | | | | (0.73 | ) |

| | | | | |

Weighted average shares outstanding | | | | | | | | | | | | | | | | | | | | |

Basic | | | 5,739 | | | | 5,810 | | | | 6,032 | | | | 5,857 | | | | 6,222 | |

Diluted | | | 5,739 | | | | 6,158 | | | | 6,032 | | | | 6,079 | | | | 6,222 | |

| | |

11

| | | | | |

| | | As of March 31, 2007 |

| | | Actual | | | As adjusted(1) |

| (in thousands) | | (unaudited) |

| |

| |

Consolidated balance sheet data: | | |

Cash and cash equivalents | | $ 74 | | | $ |

Total assets | | 37,509 | | | |

Total debt | | 23,656 | | | |

Cumulative convertible redeemable preferred stock | | 680 | | | |

Total shareholders’ (deficit) equity | | $(40,388 | ) | | |

| |

| (1) | | As adjusted information reflects (a) a -for-1 stock split of our common stock to be effected immediately prior to the effectiveness of this offering, (b) the automatic conversion of all shares of our outstanding cumulative convertible redeemable preferred stock into shares of our common stock (on a post-split basis) upon the closing of this offering, (c) the conversion of $ million in outstanding principal and accrued interest as of 2007 under a $2.8 million secured note bearing interest at LIBOR plus 5% issued by us to an affiliate of ONFS in December 2002 into a total of shares of our common stock upon the closing of this offering, assuming that such affiliate of ONFS elects to fully convert such outstanding principal and accrued interest into shares of our common stock, (d) the issuance of shares of our common stock to affiliated minority shareholders of our Global Energy Europe Limited and Global Energy de Mexico, S.A. de C.V. subsidiaries upon the closing of this offering in connection with certain corporate reorganization matters, (e) the retirement by us of shares of our common stock which we expect to be required to purchase upon the closing of this offering from one of our shareholders, (f) our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share (the mid-point of the initial public offering price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and the application of the net proceeds from those shares, and (g) amendments to our articles of incorporation and code of regulations to be effective upon the closing of this offering. Each $1.00 increase (decrease) in the assumed public offering price of $ per share would increase (decrease) each of cash and cash equivalents, total assets and total shareholders’ (deficit) equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase of 1.0 million shares in the number of shares offered by us, together with a concomitant $1.00 increase in the assumed offering price of $ per share, would increase each of cash and cash equivalents, total assets and total shareholders’ (deficit) equity by approximately $ million. Similarly, each decrease of 1.0 million shares in the number of shares offered by us, together with a concomitant $1.00 decrease in the assumed offering price of $ per share, would decrease each of cash and cash equivalents, total assets and total shareholders’ (deficit) equity by approximately $ million. The as adjusted information discussed above is illustrative only and will differ based on the actual initial public offering price and other terms of this offering determined at pricing. |

12

Risk factors

Investing in shares of our common stock involves a high degree of risk. Before deciding to invest in shares of our common stock, you should carefully consider the following risk factors. The risks described below are the ones we consider material to your decision to invest in our common stock at this time. If any of the following risks occur, our business, financial condition, prospects or results of operations could be materially harmed. Additional unknown risks may also materially harm our business, financial condition, prospects or results of operations. The trading price of our common stock could decline due to any of these risks and you may lose all or part of your investment in our common stock.

Risks relating to our business and industry

We have a limited history of operations and we do not currently directly operate a gasification facility.

We have a limited operating history upon which you can evaluate our business, and we do not currently directly operate a gasification facility. We are focused on developing, constructing, owning and operating new or expanded gasification and IGCC facilities that we intend to complete within the next four years. As a result, we do not have an operating history, other than our operation of the Wabash River facility from 2000 through January 2005, on which you can evaluate our business and prospects. In addition, our financial statements are not indicative of the operating results that we are likely to experience after the completion of the development and construction of our projects. As a consequence, our prospects must be considered in light of the uncertainties and risks associated with a limited operating history.

We may be unable to complete the development and construction of our projects on our planned schedule or within our project budget.

Our ability to complete the design, development and construction of each project, and to commence commercial operations at each project, according to our planned schedule and within our project budget, if at all, will depend upon a variety of factors, including:

| • | | obtaining adequate project-specific debt or other financing, |

| • | | completing the project design and engineering for each project, |

| • | | negotiating commercially acceptable EPC contracts and engaging qualified sub-contractors to perform under these EPC contracts, |

| • | | receiving critical components and equipment from third parties on schedule and according to design specifications, |

| • | | integrating and optimizing the operation of critical components and equipment supplied by third parties into a single plant that operates according to design specifications, |

| • | | receiving quality and timely performance of third-party services, |

| • | | hiring and training key personnel, including plant managers and facility operators, |

| • | | obtaining adequate and reliable supply agreements for feedstock, water, utilities and other necessary raw materials, |

| • | | negotiating pipeline easement, interconnection and transmission agreements for the delivery of synthetic natural gas and electricity through local and national natural gas pipelines and electrical grids, |

13

| • | | establishing long-term offtake arrangements for a sufficient portion of each project’s output to support project debt, |

| • | | acquiring adequate real estate rights, |

| • | | securing and maintaining required regulatory and environmental permits or approvals, |

| • | | obtaining necessary third-party consents, |

| • | | licensing, or otherwise obtaining, on acceptable terms, any technology needed to construct and operate each project, and |

| • | | avoiding force majeure or other events out of our control with respect to our projects. |

The development and construction process for our first three projects is expected to require at least four years given the complex nature of designing, constructing, permitting and starting the operation of commercial scale gasification and IGCC facilities. Any delay in, or failure to, achieve one or more of the foregoing factors could:

| • | | cause a project to miss its scheduled date to begin operations or not begin operations at all, |

| • | | result in cost overruns compared to project budget, |

| • | | prevent the project from operating according to design specifications, |

| • | | cause termination of our offtake agreements, |

| • | | reduce operating income at the project, or |

| • | | make commercial operation of the project uneconomic or impracticable. |

Our planned schedule and project budget for each of our projects may not be achievable.

The expected date of first commercial operations, and the projected total project costs, for each project (other than total project costs for the Lima project) are based on our internal estimates and depend on a variety of assumptions that ultimately may prove to be incorrect. At this time, we have not entered into a fixed price EPC contract for our Wabash SNG Export or Westfield projects with a third party EPC contractor, in which the EPC contractor agrees to meet our planned schedule and projected total construction costs for these projects. In addition, we have not received a final independent engineer’s report with respect to any of our projects, and therefore do not have an independent evaluation as to whether we can achieve our planned schedules and projected total project costs at any of our projects. As a consequence, our project schedules and budgets may contain incorrect assumptions and unknown execution risks and other uncertainties that may cause our planned schedules and estimated costs for our projects to not be achievable. To a large degree, our financial results will depend on our ability to implement our development and construction plan on time and on budget.

An evaluation by an independent engineer has raised challenges with respect to the construction and financing of Lima Energy IGCC.

In connection with our evaluation of alternative financing arrangements for Lima Energy IGCC, we have consulted with an independent engineer. We have been advised by this independent engineer that certain of our plans for the construction and financing of Lima Energy IGCC are subject to risks and uncertainties, including:

| • | | Lima Energy IGCC is the initial gasification project for the project’s general contractor, Industrial Construction Company (ICC), the systems integrator, SSOE, Inc., and the designer of the power island and total plant integration, Sega, Inc. |

14

| • | | Lima Energy IGCC is the largest project that ICC has attempted to construct. |

| • | | Although ICC has a guaranteed maximum price contract for the construction of Lima Energy IGCC, the independent engineer considered all cost estimates for the project to be preliminary. Any required modifications to the design of Lima Energy IGCC project will not be known until engineering is at least 25% complete, a point intended to be reached within 90 days after the full notice to proceed is delivered. |

| • | | ICC’s contract guarantees the maximum construction cost of Lima Energy IGCC (subject to change orders for up to $86.2 million which are made during the 90 days following delivery of the full notice to proceed), the construction completion date, and the performance of the facility. However, ICC’s liability for delays in the construction completion date is limited to 20% of the maximum construction cost in the contract and its liability for failure to meet performance standards is limited to 20% of the maximum construction cost in the contract. ICC’s total liability on all its guarantees is limited to 25% of the maximum construction cost in the contract. |

| • | | The independent engineer has not been able to confirm that the estimating methods that form the basis for the guaranteed maximum construction cost in the ICC contract were in accordance with generally accepted conceptual engineering and estimating practices and methods. |

| • | | The independent engineer is of the opinion that the estimated total construction costs for Lima Energy IGCC are significantly lower than the estimated construction costs for reasonably similar combined IGCC and synthetic natural gas projects with which the independent engineer is familiar. As a result, the independent engineer has not been able to form an opinion as to the adequacy of the proposed contingency reserves to be provided by GEC for Lima Energy IGCC. |

In addition, the independent engineer initially advised us that our proposed contractual duration from full notice to proceed to commercial operation of Lima Energy IGCC did not appear to be achievable. Subsequent to receiving such advice, we issued a change order to lengthen the contractual duration and we are in discussions with the independent engineer regarding such contractual duration.

The advice of the independent engineer has not been issued in the form of a final written report and may be subject to change based on several factors, including, among other factors, modifications in our construction schedule for Lima Energy IGCC, adjustments to our estimates of construction costs to account for design modifications and additional engineering, and amendments of our construction agreements with ICC and other sub-contractors. Any report of an independent engineer that may be issued in the future could reach substantially different conclusions regarding Lima Energy IGCC depending on the circumstances at the time any such report is issued.

We have incurred operating losses and negative cash flows since our inception, we anticipate that we will continue to incur increasing losses for the foreseeable future and in its report on our consolidated financial statements, our independent registered public accounting firm has included an explanatory paragraph describing conditions that raise substantial doubt about our ability to continue as a going concern.

We have incurred operating losses and negative cash flows since our inception in October 1988. We had operating losses of $10.0 million in 2004, $8.3 million in 2005 and $18.4 million in 2006. We currently have no revenues and do not expect to generate significant revenues, if any, until

15

at least our Lima project and our Wabash River and Westfield expansion projects are completed, which we currently anticipate will occur in 2010. Our only current source of operating cash flows comes from payments related to our 50% ownership interest in the joint venture that owns the Wabash River facility, SG Solutions LLC (which payments are currently pledged in favor of Standard General Master Fund L.P. (Standard General)), the lender under, and are used to pay interest on, a loan and security agreement entered into by Wabash River Energy, Ltd. (WRE), one of our wholly owned subsidiaries as described elsewhere in this prospectus), and potential royalty payments from ConocoPhillips in connection with our sale of the E-Gas™ gasification technology described elsewhere in this prospectus.

We anticipate that our expenses will continue to increase substantially following the closing of this offering as we implement our project development and construction plan and expand our marketing and general and administrative operations. In addition, such factors as increases in labor or material costs, higher than anticipated financing costs for our projects, non-performance by third-party suppliers or subcontractors and major incidents and/or catastrophic events, such as fires, explosions, earthquakes or storms, may cause us to experience increased costs with respect to our projects. For these reasons, we expect to continue to incur significant and increasing operating losses for the next several years. These losses have had and will continue to have an adverse effect on our shareholders’ equity and working capital. In its report on our consolidated financial statements, our independent registered public accounting firm included an explanatory paragraph describing these and other conditions that raise substantial doubt about our ability to continue as a going concern.

Our ability to become profitable is uncertain.

Our ability to become and remain profitable will depend on, among other things:

| • | | our ability to identify, develop and construct gasification and IGCC facilities, including our projects currently in development, at our projected cost and within our projected timetables; |

| • | | our ability to obtain adequate financing for our projects on terms consistent with our expectations; |

| • | | our ability to effectively manage the operations at our facilities and to avoid extended outages or other breakdowns or failures of equipment or processes, whether due to catastrophic natural events or otherwise; |

| • | | prices for traditional and alternative fuel sources and competitive power generation technologies; |

| • | | our ability to develop and market our end-products at a sufficient margin; |

| • | | our ability to develop an effective internal corporate organization and systems; and |

| • | | our ability to attract, hire and retain qualified and experienced management and technical and field personnel. |

Because of the numerous uncertainties associated with the development, construction, ownership and future operation of our projects, we are unable to predict the extent of any future losses or when we will become profitable, if ever. Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future.

16

We anticipate undergoing a period of rapid growth and activity related to our development and construction plan and our failure to manage this growth and activity could harm our business.

Subsequent to the completion of this offering, in the near term, we anticipate undergoing a period of rapid growth in the number of employees and in the scope of our operations as we accelerate the development and construction of our three near term projects. In the long term, we intend to develop, construct or acquire new projects, increase our gasification capacity, develop gasification technologies and improve the application of existing gasification technologies we select for our projects. This anticipated growth, as well as any other growth that we may experience in the future, will provide challenges to our organization and may strain our management, technical and field personnel and operations, especially since our development and construction plan involves simultaneous activity on multiple projects. We may misjudge the amount of time or resources that will be required to manage effectively any anticipated or unanticipated growth or activity in our business or with respect to our development and construction plan or we may not be able to attract, hire or retain qualified and experienced personnel, including additional senior management personnel and technical and field personnel, to meet our needs. Our ability to manage growth and to execute our development and construction plan will depend in large part on our ability to continue to enhance our operating, financial and management information systems. If we cannot scale our business appropriately, maintain control over expenses or otherwise adapt to anticipated and unanticipated growth or changes to our development and construction plan, our business resources may become strained, and we may fail to stay within our project budgets or fail to achieve our target commercial operation dates for one or more of our projects.

Our development and construction plan requires substantial additional capital, and we may be unable to raise capital when needed, which could force us to delay, reduce or eliminate some or all of our development and construction plan.

We will require substantial capital resources in addition to the proceeds from this offering to fund our development and construction plan. Over the next four years, we expect to need $1.01 billion for the Lima project, $280 million for the Wabash River project and $860 million for the Westfield project. We also expect to need substantial funds for the development and construction of our proposed second gasification facility near Lima, Ohio and our proposed new gasification facility in Wyoming. We intend to supply the funds necessary for these projects through a combination of equity, including this offering, and debt, primarily non-recourse debt financing specific to each project. Our ability to obtain adequate funding for our projects will depend on a variety of factors, including adequacy of equity investment in each project, adequacy of EPC and related contracts, the opinions of the independent engineers we retain for each project, the adequacy of offtake arrangements and market conditions for each project. We may not be able to obtain adequate funding on terms consistent with our expectations to support our development and construction plan in a timely manner.

We may also need additional financing for a variety of reasons, including to support ongoing operations (including operations and maintenance expenses at our projects after commercial operations start), to pursue new project development opportunities (including EOR and CO2sequestration), to attract and retain qualified management and technical and field personnel, to establish an effective infrastructure and to acquire complementary businesses or technologies. We do not have a credit facility to provide short term borrowing capacity.

17

Future financings may include terms that disadvantage us or restrict our operations or use of operating cash flow. For example:

| • | | borrowings or debt issuances by us may subject us to restrictive covenants, including limitations on our ability to raise additional capital; |

| • | | borrowings or debt issuances at the project level may subject the project to restrictive covenants, including covenants limiting its ability to make distributions to us or raise additional capital; |

| • | | borrowing or debt issuances at the project level could carry higher financing costs than expected due to credit market conditions and the supply of funds for gasification and IGCC projects; and |

| • | | additional offerings of our equity securities would cause dilution of our common stock. |

In addition, it is also possible that the actual costs to complete any one of our projects may be greater than anticipated, in which case we may be forced to raise additional funds to complete the project on terms that substantially reduce the value of the project to us.

If we are unable to raise adequate funds, or to raise adequate funds on terms acceptable to us, we may have to delay, reduce or eliminate some or all of our development and construction plan, liquidate some or all of our assets, or transfer ownership of one or more of our projects to our lenders or strategic partners.

If we or our project companies are unable to meet the debt service requirements of the financing arrangements used to finance our projects, our lenders may take over ownership of our projects.

We intend to supply a significant amount of the funds necessary for our projects through non-recourse debt financing specific to each project, which will be secured by the assets of such project. As a result, we expect to be highly leveraged. In the event that after a debt financing, a project experiences cost overruns or a material delay in the start of commercial operations, the project may be unable to meet its debt service requirements. In addition, once a project becomes operational, an increase in the price of feedstock or other raw materials, a decrease in prices for natural gas and electricity, a failure of the project to achieve its specified reliability or performance standards, or the occurrence of other events that may or may not be within our control, such as natural disasters, could cause the project to be unable to meet its debt service requirements, possibly resulting in a default under a project financing agreement and ultimately the bankruptcy of that project company. In the event of a default that we or our project company cannot cure, the lenders would generally have rights to enforce their security interest in the assets of the relevant project and assume control over the ownership of such project. A bankruptcy of a project company may also constitute an event of default under any future debt agreements of ours even though such project company may not be a party to such agreement.

If we are unable to release existing liens on our assets, we may be unable to obtain financing at the project level.

At March 31, 2007, we had $26.7 million (principal and interest) of outstanding indebtedness in default, most of which was secured by assets related to our projects. In July 2007, we paid off approximately $7.1 million of this outstanding indebtedness in default using the proceeds of the

18

one-year loan and security agreement which WRE, one of our wholly owned subsidiaries, entered into with Standard General. In order to obtain non-recourse debt financing specific to each project, we will need to pay off any remaining outstanding indebtedness of this type and obtain releases of the liens associated with such indebtedness. We intend to use $ million of proceeds from this offering to repay outstanding indebtedness. We will require the assistance of our lenders to release liens on project assets in a timely manner once they receive repayment. A delay in obtaining the release of liens on project assets could affect the timing of financings for one or more of our projects.

Our dependence on third-party service providers and suppliers may cause delays in the development and construction of our projects.

In certain instances, we will rely entirely on third parties to supply us with all of the equipment, components and construction and engineering services necessary for the development and construction of our projects. As of the date of this prospectus, we have entered into limited contractual arrangements with service providers and suppliers for the development and construction of our projects. As a result, we do not yet have many of the contractual arrangements with service providers, such as fixed price EPC contracts for the Wabash River and Westfield projects, or equipment and component suppliers that will be needed to obtain adequate financing for our projects and to complete the development and construction of our projects. We may have difficulty obtaining agreements with third-party service providers and equipment and component suppliers on terms favorable or acceptable to us.

Once a services or supply agreement is obtained, we cannot be sure that our third-party service providers and equipment and component suppliers will provide their services or deliver equipment or components in a timely manner. Generally, our service providers and equipment and component suppliers will have had limited experience with gasification and IGCC projects, which increases the risk of untimely, incomplete or insufficient performance, especially with respect to EPC services. If these service providers and equipment and component suppliers should fail to provide services or deliver equipment or components in a timely manner or if the services or equipment fail to meet our quality, quantity or cost standards, we could experience construction delays or cost increases, which will adversely affect our ability to complete construction, to commence project operations and to generate revenue. If an EPC contractor fails to perform under its agreement to complete a project by a scheduled date at a fixed price or is unable to pay performance guarantees or liquidated damages, we may be unable to complete the project. Even if that EPC contractor pays all performance guarantees and liquidated damages required under its agreement with us, that agreement may not provide for sufficient performance guarantees or liquidated damages to enable the completion of a project.

Some key gasification equipment and components are complex and highly specialized in nature, are available from only a limited number of sources, are difficult to manufacture and require long lead times from the time an order is placed to when the equipment or components are delivered. As a result, if our equipment and component suppliers do not perform as expected, we may have difficulty finding alternative suppliers on a timely basis and we could experience a significant delay in receiving key equipment and components for our projects. Any interruption or delay in the supply of equipment or components, or our inability to obtain equipment or components from alternative sources at acceptable prices in a timely fashion, could impair our ability to develop and construct any of our projects consistent with our projected timing, if at all.

19

We are subject to increased construction risk as a result of our wholly-owned subsidiary acting as our main EPC contractor with respect to EPC arrangements at the Lima project.

In connection with the construction of the Lima project, Gasification Engineering Corporation (GEC), our wholly owned engineering and operations subsidiary, entered into an EPC contract with Lima Energy, another of our wholly owned subsidiaries and the owner of the Lima project, to provide main EPC contractor services to the Lima project, which means that GEC is responsible for building and testing the Lima project and training the operators of the Lima project. GEC in turn has entered into an EPC agreement with ICC, providing that ICC, as general contractor, will assume day-to-day execution and implementation provide certain construction services and hire additional, separate subcontractors with respect to the Lima project. The Lima project is the first gasification project and the largest project attempted by ICC and the first project for GEC. If ICC fails to perform under its contract for any reason, we would be forced to engage a substitute contractor, which would likely result in a significant delay in our development and construction schedule for the Lima project. Although ICC has guaranteed overall facility performance and construction schedule and is obligated to pay liquidated damages up to a specified amount in the event of certain delays or performance shortfalls in its work, GEC has guaranteed that commercial operation of the Lima project will occur by the guaranteed completion date and is also required to pay liquidated damages to Lima Energy in the event that the schedule and performance guarantees agreed to in the two EPC contracts are not met or covered by ICC. In addition, GEC must maintain a separate reserve to finance cost overruns and as a backup to ICC’s performance guarantees and obligation to pay liquidated damages. A portion of GEC’s reserve will be funded with the proceeds of this offering.

We believe that our role as the main EPC contractor and our arrangement with ICC as general contractor for the Lima project is unique in the context of the development and construction of energy facilities. Because we are acting as the main EPC contractor, we are not relying on a third-party EPC contractor to be responsible for cost overruns, schedule or performance guarantees or liquidated damages, which such third-party EPC contractor would typically be required to pay in the event that such amounts are not otherwise paid by a responsible subcontractor. Instead, we must provide back-up guarantees and establish reserves for project contingencies ourselves and rely directly upon the reserves and liquidated damages obligations of ICC and other subcontractors. This contracting approach places us, through GEC, in the position of providing the overall guarantees for the Lima project to the lenders for the project. As a result, potential lenders may require us to incur higher financing costs due to this contracting approach to the extent that they are willing to finance the Lima project on this basis at all. In the event that the schedule or performance guarantees for the Lima project are not met or covered by ICC or other subcontractors and we exhaust our own established reserves, we may default on any future Lima project financing arrangements and the lenders would generally have the right to assume ownership of the Lima project.

In the future, we may choose to provide main EPC contractor services to a particular project, which would expose that project to similar risks as the Lima project. Our lack of experience in the role of EPC contractor for projects of our proposed magnitude, including the Lima project, coupled with our potentially acting as main EPC contractor on several of our projects simultaneously, may delay the development, construction or completion of one or more of our projects, may increase our financing costs and put us at a disadvantage compared to other alternative energy or similar companies that may utilize the services of established outside EPC contractors for similar projects.

20

Our projects involve the use of specialized technology and equipment that must conform to particular design specifications, which may cause delays or increased costs in connection with their completion and delivery.

Gasification and IGCC projects are technically complex. Our projects are being designed to meet specified engineering and performance standards and they involve the use of specialized gasification equipment, including fuel islands, gasification islands, power islands, air separation units, and environmental systems and control equipment, as well as various custom design elements. The manufacturing of this specialized gasification equipment and the construction of facilities in accordance with established design specifications involves substantial engineering expertise coupled with the use of highly specialized, gasification technology, which may vary from project to project. We have not completed (or, in certain cases, significantly begun) the design and engineering work for the projects currently in development, which means we may encounter unexpected engineering, construction or technical difficulties and delays during the construction process as a result of required design modifications. In addition, this equipment or engineering expertise may become more costly in the future. Factors such as design and engineering errors and construction performance falling below expected levels of output or efficiency could cause us to experience delays in completing the construction or commencing the commercial operations of our projects on time or on budget.

We may be unable to obtain or maintain the regulatory permits, approvals and consents required to construct and commence operations at our projects.

We must obtain numerous environmental and other regulatory permits and certifications from federal, state and local agencies and authorities, including air permits and wastewater discharge permits, in order to construct and commence operations at our projects. A number of these permits and certifications must be obtained prior to the start of construction for a project, while other permits are required to be obtained at or prior to the time of first commercial operation. Any failure to obtain the necessary environmental permits and certifications on a timely basis could delay the construction or commercial operation of our projects. In addition, once a permit or certification has been issued to us for a project, we must take steps to develop the project or the permit could lapse. We may also need to modify existing permits to reflect changes in design or in project requirements, which modification could be evaluated under a legal or regulatory regime that may be more stringent than when the permits were originally granted.

After the issuance of environmental permits and certifications, they are subject to an appeal period during which the permits or certifications can be challenged by third parties, before an administrative appeal body, such as the Indiana Office of Environmental Adjudication or the Ohio Environmental Review Appeals Commission, or in a federal or state court action. These challenges can occur when initial permits or certifications are issued, or after a permit or certification is modified. We may also be subject to legal challenge, either by government agencies or through citizen suits, if our facilities do not comply with the environmental permits and certifications that have been issued to us.

At the Lima project, delays in our construction schedule have required us to seek an extension of our air permit, which was issued on March 26, 2002. Under this air permit we were required to begin construction on the Lima project prior to September 26, 2003, which date was extended to September 26, 2004. Under the air permit as extended, Lima Energy was required to undertake a continuing program of installation or modification at the Lima project, or enter into a binding

21

contractual obligation to undertake and complete within a reasonable time a continuing program of installation or modification at the Lima project, prior to September 26, 2004. On September 16, 2004, Lima Energy entered into a $29 million Contract to Install Material Handling Equipment with Roberts & Schaefer Company (the R&S Contract) for the installation of a fuel handling facility at the Lima project. Engineering and design work on the fuel handling facility began upon award of the contract. On October 1, 2004, Lima Energy provided the Ohio Environmental Protection Agency (OEPA) with a Notice of Construction Start based on its entrance into this contract. After the completion of certain of the work required under the R&S Contract, Lima Energy paused on-site construction activities at the facility in October 2006, pending our obtaining further financing in connection with the Lima project.