UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35985

|

|

| |

| CDW CORPORATION |

| (Exact name of registrant as specified in its charter) |

| |

|

| | |

| Delaware | | 26-0273989 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

200 N. Milwaukee Avenue Vernon Hills, Illinois | | 60061 |

| (Address of principal executive offices) | | (Zip Code) |

(847) 465-6000

(Registrant’s telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

____________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class: | | Name of each exchange on which registered |

| | | |

| Common stock, par value $0.01 per share | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

____________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

| | | |

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

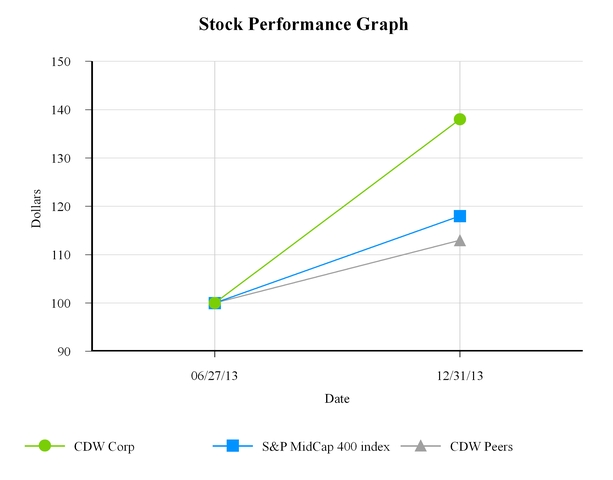

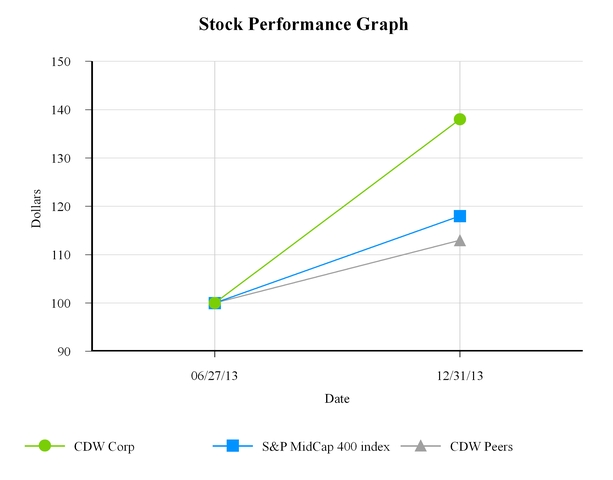

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 28, 2013, the last business day of the registrant’s most recently completed second fiscal quarter, was $654,984,661, based on the per share closing sale price of $18.62 on that date (assuming the closing of the registrant's initial public offering).

As of February 28, 2014, there were 171,954,277 shares of common stock, $0.01 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for use in connection with its 2014 Annual Meeting of Shareholders, to be filed not later than 120 days after December 31, 2013, are incorporated by reference into Part III of this report.

CDW CORPORATION AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

Year Ended December 31, 2013

TABLE OF CONTENTS

|

| | |

| Item | | Page |

| PART I | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| PART III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV | | |

| Item 15. | | |

| SIGNATURES | |

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact included in this report are forward-looking statements. These statements relate to analyses and other information, which are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to our future prospects, developments and business strategies. We claim the protection of The Private Securities Litigation Reform Act of 1995 for all forward-looking statements in this report.

These forward-looking statements are identified by the use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” and similar terms and phrases, including references to assumptions. However, these words are not the exclusive means of identifying such statements. Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that we will achieve those plans, intentions or expectations. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected.

Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the section entitled “Risk Factors” included elsewhere in this report. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements contained in the section entitled “Risk Factors” included elsewhere in this report as well as other cautionary statements that are made from time to time in our other Securities and Exchange Commission ("SEC") filings and public communications. You should evaluate all forward-looking statements made in this report in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

PART I

Item 1. Business

Our Company

CDW is a Fortune 500 company and a leading provider of integrated information technology (“IT”) solutions in the U.S. and Canada. We help our customer base of approximately 250,000 small, medium and large business, government, education and healthcare customers by delivering critical solutions to their increasingly complex IT needs. Our broad array of offerings ranges from discrete hardware and software products to integrated IT solutions such as mobility, security, data center optimization, cloud computing, virtualization and collaboration. We are technology "agnostic," with a product portfolio that includes more than 100,000 products from more than 1,000 brands. We provide our products and solutions through sales force and service delivery teams consisting of more than 4,400 coworkers, including nearly 1,800 field sellers, highly-skilled technology specialists and advanced service delivery engineers.

We are a leading U.S. sales channel partner for many original equipment manufacturers (“OEMs”) and software publishers (collectively, our “vendor partners”), whose products we sell or include in the solutions we offer. We believe we are an important extension of our vendor partners' sales and marketing capabilities, providing them with a cost-effective way to reach customers and deliver a consistent brand experience through our established end-market coverage and extensive customer access.

We provide value to our customers by simplifying the complexities of technology across design, selection, procurement, integration and management. Our goal is to have our customers, regardless of their size, view us as an indispensable extension of their IT staffs. We seek to achieve this goal by providing our customers with superior service through our large and experienced sales force and service delivery teams. Our multi-brand offering approach enables us to identify the products or combination of products that best address each customer's specific organizational IT requirements and to evolve our offerings as new technologies develop.

We believe we offer the following value proposition to our customers and our vendor partners:

|

| |

| Our value proposition to our customers | Our value proposition to our vendor partners |

Ÿ Broad selection of products and multi-branded IT solutions Ÿ Value-added services with integration capabilities Ÿ Highly-skilled specialists and engineers Ÿ Solutions across a very broad IT landscape

| Ÿ Access to approximately 250,000 customers throughout the U.S. and Canada Ÿ Large and established customer channels Ÿ Strong distribution and implementation capabilities Ÿ Value-added solutions and marketing programs that generate end-user demand

|

Our customers include private sector businesses that typically employ fewer than 5,000 employees, government agencies and educational and healthcare institutions. We serve our customers through channel-specific sales teams and service delivery teams with extensive technical skills and knowledge of the specific markets they serve. This market segmentation allows us to customize our offerings and to provide enhanced expertise in designing and implementing IT solutions for our customers. We currently have five dedicated customer channels: medium/large business, small business, government, education and healthcare, each of which generated over $1 billion in net sales in 2013. The scale and diversity of our customer channels provide us with multiple avenues for growth and a balanced customer base to weather economic and technology cycles.

The following table provides information regarding our reportable segments and our customer channels:

|

| | | | | | | | | | | |

| | Corporate Segment | | Public Segment | | |

| Customer Channels | Medium/Large Business | | Small Business | | Government | | Education | | Healthcare | | Other |

| Target Customers | 100 - 5,000 employees | | 10 - 100 employees | | Various federal, state and local agencies | | Higher education and K-12 | | Hospitals, ambulatory service providers and long-term care facilities | | Advanced services customers plus Canada |

2013 Net Sales (in billions) | $4.9 | | $1.1 | | $1.3 | | $1.4 | | $1.5 | | $0.6 |

For further information on our segments, including financial results, see Note 16 to the accompanying audited consolidated financial statements included elsewhere in this report.

We offer more than 1,000 brands, from well-established companies such as APC, Apple, Cisco, EMC, Hewlett-Packard, IBM, Lenovo, Microsoft, NetApp, Symantec and VMware to emerging vendor partners such as Drobo, Fusion-io, Meraki, Nimble Storage, Salesforce.com, Sophos and Splunk. In 2013, we generated over $1 billion of revenue for each of four of our vendor partners and over $100 million of revenue for each of 11 other vendor partners. We have received the highest level of certification from major vendor partners such as Cisco, EMC and Microsoft, which reflects the extensive product and solution knowledge and capabilities that we bring to our customers' IT challenges. These certifications also provide us with access to favorable pricing, tools and resources, including vendor incentive programs, which we use to provide additional value to our customers. Our vendor partners also regularly recognize us with top awards and select us to develop and grow new customer solutions.

History

CDW was founded in 1984. In 2003, we purchased selected U.S. assets and the Canadian operations of Micro Warehouse, which extended our growth platform into Canada. In 2006, we acquired Berbee Information Networks Corporation, a regional provider of technology products, solutions and customized engineering services in advanced technologies primarily across Cisco, IBM and Microsoft portfolios. This acquisition increased our capabilities in customized engineering services and managed services.

On October 12, 2007, CDW Corporation, an Illinois corporation, was acquired through a merger transaction by an entity controlled by investment funds affiliated with Madison Dearborn Partners, LLC and Providence Equity Partners L.L.C. (the “Acquisition”). CDW Corporation continued as the surviving corporation and same legal entity after the Acquisition, but became a wholly owned subsidiary of VH Holdings, Inc., a Delaware corporation.

On December 31, 2009, CDW Corporation merged into CDWC LLC, an Illinois limited liability company owned by VH Holdings, Inc., with CDWC LLC as the surviving entity. This change had no impact on our operations or management. On December 31, 2009, CDWC LLC was renamed CDW LLC (“CDW LLC”). On August 17, 2010, VH Holdings, Inc. was renamed CDW Corporation (“Parent”), a Delaware corporation.

Throughout this report, the terms “the Company” and “CDW” refer to Parent and its 100% owned subsidiaries subsequent to the Acquisition.

Parent was previously owned directly by CDW Holdings LLC ("CDW Holdings"), a company controlled by investment funds affiliated with Madison Dearborn Partners, LLC and Providence Equity Partners L.L.C. (the "Sponsors"), certain other co-investors and certain members of CDW management. See "Sponsors" below. On July 2, 2013, Parent completed an initial public offering ("IPO") of its common stock. In connection with the IPO, CDW Holdings distributed all of its shares of Parent's common stock to its members in June 2013 in accordance with the members' respective membership interests and was subsequently dissolved in August 2013. See Note 9 to the accompanying audited consolidated financial statements included elsewhere in this report for additional discussion of the IPO.

The Sponsors beneficially owned approximately 63.7% of our common stock as of December 31, 2013.

Our Market

We operate in the U.S. and Canadian IT market, which is a large and growing market. According to IDC, the overall U.S. IT market generated approximately $660 billion in sales in 2013. We believe our addressable market in the U.S. in the indirect sales channel represents more than $200 billion in annual sales and for the year ended December 31, 2013, our U.S. net sales of $10.3 billion represented approximately 5% of that highly diverse and fragmented market. According to IDC, the overall Canadian IT market generated more than $50 billion in sales in 2013. We believe our addressable market in Canada in the indirect sales channel represents more than $10 billion in annual sales and for the year ended December 31, 2013, our net sales of $475 million in Canada represented approximately 4% of that market. We believe we have the largest market share in our addressable market, with our 2013 net sales exceeding the cumulative North American net sales of our four largest publicly traded sales channel competitors, based upon publicly available information for those companies. New technologies, including cloud, virtualization and mobility, coupled with the resulting increase in demand for data as well as aging infrastructure, are increasingly requiring businesses and institutions to seek integrated solutions to their IT needs. We expect this trend to continue for the foreseeable future, with end-user demand for business efficiency and productivity driving future IT spending growth.

Our Offerings

Our offerings range from discrete hardware and software products and services to complex integrated solutions that include one or more of these elements. We believe our customers increasingly view technology purchases as integrated solutions rather than discrete product and service categories and we estimate that approximately 51% of our net sales in 2013 came from sales of product categories and services typically associated with solutions. Our hardware products include notebooks/mobile devices (including tablets), network communications, enterprise and data storage, video monitors, printers, desktop computers and servers. Our software products include application suites, security, virtualization, operating systems, network management and Software as a Service (“SaaS”) offerings. We also provide a full suite of value-added-services, which range from basic installation, warranty and repair services to custom configuration, data center and network implementation services, as well as managed services that include Infrastructure as a Service (“IaaS”) offerings.

We also offer a variety of integrated solutions, such as:

•Mobility: We assist our customers with the selection, procurement and integration of mobile security software, hardware devices such as smartphones, tablets and notebooks, and cellular wireless activation systems. We also provide mobile device management applications with policy and security management capabilities across a variety of mobile operating systems and platforms.

•Security: We assess our customers' security needs and provide them with threat prevention tools in order to protect their networks, servers and applications, such as anti-virus, anti-spam, content filtering, intrusion prevention, firewall and virtual private network services, and network access control. We also design and implement data loss prevention solutions, using data monitoring and encryption across a wide array of devices to ensure the security of customer information, personal employee information and research and development data.

•Data Center Optimization: We help our customers evaluate their data centers for convergence and optimization opportunities. Our data center optimization solutions consist of server virtualization, physical server consolidation, data storage management and energy-efficient power and cooling systems.

•Cloud Computing: Cloud computing is a combination of software and computing delivered on demand as a service. We provide SaaS and IaaS solutions that reside in the public cloud, meaning any person or organization interested in porting applications and resources to an external “public” cloud system can do so. Likewise, we provide similar private cloud-based solutions to our customers that prefer to avoid running their infrastructure on a shared public platform but want to obtain the flexibility, scalability and access offered by cloud computing and collaboration.

•Virtualization: We design and implement server, storage and desktop virtualization solutions. Virtualization enables our customers to efficiently utilize hardware resources by running multiple, independent, virtual operating systems on a single computer and multiple virtual servers simultaneously on a single server. Virtualization also can separate a desktop environment and associated application software from the hardware device that is used to access it, and provides employees with remote desktop access. Our specialists assist customers with the steps of implementing virtualization solutions, including evaluating network environments, deploying shared storage options and licensing platform software.

•Collaboration: We provide our customers with communication tools that allow employees to share knowledge, ideas and information among each other and with clients and partners effectively and quickly. Our collaboration solutions unite communications and applications via the integration of products that facilitate the use of

multiple enterprise communication methods including email, instant messaging, presence, social media, voice, video, hardware, software and services. We also host cloud-based collaboration solutions.

While we believe customers increasingly view technology purchases as solutions rather than discrete product and service categories, the following table shows our net sales by major category, based upon our internal category classifications.

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2013 | | Year Ended December 31, 2012(1) | | Year Ended December 31, 2011(1) |

| | | Dollars in Millions | | Percentage of Total Net Sales | | Dollars in Millions | | Percentage of Total Net Sales | | Dollars in Millions | | Percentage of Total Net Sales |

| Notebooks/Mobile Devices | | $ | 1,706.0 |

| | 15.8 | % | | $ | 1,470.1 |

| | 14.5 | % | | $ | 1,336.9 |

| | 13.9 | % |

| NetComm Products | | 1,489.1 |

| | 13.8 |

| | 1,351.1 |

| | 13.3 |

| | 1,237.7 |

| | 12.9 |

|

| Enterprise and Data Storage (Including Drives) | | 998.1 |

| | 9.3 |

| | 979.4 |

| | 9.7 |

| | 929.9 |

| | 9.7 |

|

| Other Hardware | | 4,173.3 |

| | 38.8 |

| | 4,068.8 |

| | 40.2 |

| | 3,988.3 |

| | 41.5 |

|

| Software | | 1,994.7 |

| | 18.5 |

| | 1,849.4 |

| | 18.3 |

| | 1,767.2 |

| | 18.4 |

|

| Services | | 327.1 |

| | 3.0 |

| | 284.6 |

| | 2.8 |

| | 254.3 |

| | 2.6 |

|

Other (2) | | 80.3 |

| | 0.8 |

| | 124.8 |

| | 1.2 |

| | 88.1 |

| | 1.0 |

|

| Total net sales | | $ | 10,768.6 |

| | 100.0 | % | | $ | 10,128.2 |

| | 100.0 | % | | $ | 9,602.4 |

| | 100.0 | % |

| |

| (1) | Amounts have been reclassified for changes in individual product classifications to conform to the presentation for the year ended December 31, 2013. |

| |

| (2) | Includes items such as delivery charges to customers and certain commission revenue. |

Our Customers

We provide integrated IT solutions to approximately 250,000 small, medium and large business, government, education and healthcare customers throughout the U.S. and Canada. Sales to the U.S. federal government, which are diversified across multiple agencies and departments, collectively accounted for approximately 7%, 10% and 10% of total net sales in 2013, 2012 and 2011, respectively. However, there are several independent purchasing decision-makers across these agencies and departments. Excluding these sales to the federal government, we are not reliant on any one customer, as our next five largest customers cumulatively comprised approximately 3% of our net sales in 2013.

Inventory Management

We utilize our IT systems to manage our inventory in a cost-efficient manner, resulting in a rapid-turn inventory model. We generally only stock items that have attained a minimum sales volume.

Our distribution process is highly automated. Once a customer order is received and credit approved, orders are automatically routed to one of our distribution centers for picking and shipping as well as configuration and imaging services. We operate two distribution centers: an approximately 450,000 square foot facility in Vernon Hills, Illinois, and an approximately 513,000 square foot facility in North Las Vegas, Nevada. We ship almost 35 million units annually on an aggregate basis from our two distribution centers. We believe that the location of our distribution centers allows us to efficiently ship products throughout the U.S. and provide timely access to our principal distributors. In addition, in the event of weather-related or other disruptions at one of our distribution centers, we are able to shift order processing and fulfillment from one center to the other quickly and efficiently, enabling us to continue to ship products in a timely manner. We believe that competitive sources of supply are available in substantially all of the product categories we offer. We continue to improve the productivity of our distribution centers as measured by key performance indicators such as units shipped per hour worked and bin accuracy.

We also have drop-shipment arrangements with many of our OEMs and wholesale distributors, which permit us to offer products to our customers without having to take physical delivery at either of our distribution centers. These arrangements generally represent approximately 40% to 50% of total net sales, including approximately 10% to 15% related to electronic delivery for software licenses.

Information Technology Systems

We maintain customized IT and unified communication systems that enhance our ability to provide prompt, efficient and expert service to our customers. In addition, these systems enable centralized management of key functions, including

purchasing, inventory management, billing and collection of accounts receivable, sales and distribution. Our systems provide us with thorough, detailed and real-time information regarding key aspects of our business. This capability helps us to continuously enhance productivity, ship customer orders quickly and efficiently, respond appropriately to industry changes and provide high levels of customer service. We believe that our websites, which provide electronic order processing and advanced tools, such as order tracking, reporting and asset management, make it easy for customers to transact business with us and ultimately strengthen our customer relationships.

Product Procurement

We may purchase all or only some of the products that our vendor partners offer for resale to our customers or for inclusion in the solutions we offer. Each vendor partner agreement provides for specific terms and conditions, which may include one or more of the following: product return privileges, price protection policies, purchase discounts and vendor incentive programs, such as purchase or sales rebates and cooperative advertising reimbursements. We also purchase software from major software publishers for resale to our customers or for inclusion in the solutions we offer. Our agreements with software publishers allow the end-user customer to acquire software or licensed products and services.

In addition to purchasing products directly from our vendor partners, we purchase products from wholesale distributors for resale to our customers or for inclusion in the solutions we offer. These wholesale distributors provide logistics management and supply-chain services for us, as well as for our vendor partners. For the year ended December 31, 2013, we purchased 54% of the products we sold as discrete products or as components of a solution directly from our vendor partners and the remaining 46% from wholesale distributors. Purchases from wholesale distributors Tech Data, SYNNEX and Ingram Micro represented 11%, 9% and 9%, respectively, of our total purchases. Sales of products manufactured by Apple, Cisco, EMC, Hewlett-Packard, Lenovo and Microsoft, whether purchased directly from these vendor partners or from a wholesale distributor, represented in the aggregate 56% of our net sales in 2013. Sales of products manufactured by Hewlett-Packard and Cisco represented 20% and 14%, respectively, of our 2013 net sales.

Competition

The market for technology products and services is highly competitive. Competition is based on the ability to tailor specific solutions to customer needs, quality and breadth of product and service offerings, knowledge and expertise of sales force, customer service, price, product availability, speed of delivery and credit availability. Our competition includes:

| |

| • | resellers such as Dimension Data, ePlus, Insight Enterprises, PC Connection, PCM, Presidio, Softchoice, World Wide Technology and many smaller resellers; |

| |

| • | manufacturers who sell directly to customers, such as Dell, Hewlett-Packard and Apple; |

| |

| • | large service providers and system integrators, such as IBM, Accenture, Hewlett-Packard and Dell; |

| |

| • | e-tailers such as Amazon, Newegg, and TigerDirect.com; |

| |

| • | cloud providers such as AT&T, Amazon Web Services and Box; and |

| |

| • | retailers (including their e-commerce activities) such as Staples and Office Depot. |

We expect the competitive landscape in which we compete to continue to change as new technologies are developed. While innovation can help our business as it creates new offerings for us to sell, it can also disrupt our business model and create new and stronger competitors. For a discussion of the risks associated with competition, see “Risk Factors” included elsewhere in this report.

Marketing

We market the CDW brand to both national and local audiences using a variety of channels that include online, broadcast, print, social and other media. This promotion is supported by integrated communication efforts that target decision-makers, influencers and the general public using a combination of news releases, case studies, media interviews and speaking opportunities. We also market to current and prospective customers through integrated marketing programs that include behaviorally targeted email, print, online media, events and sponsorships, as well as broadcast media.

As a result of our relationships with our vendor partners, a significant portion of our advertising and marketing expenses are reimbursed through cooperative advertising reimbursement programs. These programs are at the discretion of our vendor partners and are typically tied to sales or purchasing volumes or other commitments to be met by us within a specified period of time. We believe that our national scale and analytical techniques that measure the efficacy of our marketing programs differentiate us from our competitors.

Coworkers

As of December 31, 2013, we employed nearly 7,000 coworkers, none of whom is covered by collective bargaining agreements. We consider our coworker relations to be good.

Intellectual Property

The CDW trademark and certain variations thereon are registered or subject to pending trademark applications in the U.S., Canada and certain other jurisdictions. We believe our trademarks have significant value and are important factors in our marketing programs. In addition, we own registrations for domain names, including cdw.com and cdwg.com, for certain of our primary trademarks. We also have unregistered copyrights in our website content.

Sponsors

Madison Dearborn Partners, LLC is a leading private equity investment firm based in Chicago, Illinois that has raised over $18 billion of equity capital. Since its formation in 1992, it has invested in approximately 125 companies across a broad spectrum of industries, including basic industries, business and government services, consumer, financial and transaction services, healthcare and telecom, media and technology services. Madison Dearborn's objective is to invest in companies in partnership with outstanding management teams to achieve significant long-term appreciation in equity value.

Providence Equity Partners L.L.C. ("Providence") is a leading global private equity firm focused on media, communications, education and information investments. Providence manages funds with $39 billion of commitments and has invested in more than 130 companies over its 25-year history. Providence is headquartered in Providence, Rhode Island and has offices in New York, London, Hong Kong, Beijing and New Delhi. Providence's objective is to build extraordinary companies that will shape the future of the media, communications, education and information industries.

Item 1A. Risk Factors

There are many factors that affect our business and the results of operations, some of which are beyond our control. The following is a description of some important factors that may cause the actual results of operations in future periods to differ materially from those currently expected or desired.

Risks Related to Our Business

General economic conditions could negatively affect technology spending by our customers and put downward pressure on prices, which may have an adverse impact on our business, results of operations or cash flows.

Weak economic conditions generally, sustained uncertainty about global economic conditions, U.S. federal government spending cuts and the impact of new government programs, or a tightening of credit markets could cause our customers and potential customers to postpone or reduce spending on technology products or services or put downward pressure on prices, which could have an adverse effect on our business, results of operations or cash flows.

Our financial performance could be adversely affected by decreases in spending on technology products and services by our Public segment customers.

Our sales to our Public segment customers are impacted by government spending policies, budget priorities and revenue levels. Although our sales to the federal government are diversified across multiple agencies and departments, they collectively accounted for approximately 7% of 2013 net sales. An adverse change in government spending policies (including ongoing budget cuts at the federal level), budget priorities or revenue levels could cause our Public segment customers to reduce their purchases or to terminate or not renew their contracts with us, which could adversely affect our business, results of operations or cash flows. For example, in 2013, as a result of sequestration and related budget uncertainty and the partial shutdown of the federal government for 16 days, we experienced significantly reduced Federal sales in our Public segment.

Our business depends on our vendor partner relationships and the availability of their products.

We purchase products for resale from vendor partners, which include OEMs and software publishers, and wholesale distributors. For the year ended December 31, 2013, we purchased approximately 54% of the products we sold directly from vendor partners and the remaining amount from wholesale distributors. We are authorized by vendor partners to sell all or some of their products via direct marketing activities. Our authorization with each vendor partner is subject to specific terms and conditions regarding such things as sales channel restrictions, product return privileges, price protection policies, purchase discounts and vendor partner programs and funding, including purchase rebates, sales volume rebates, purchasing incentives and cooperative advertising reimbursements. However, we do not have any long-term contracts with our vendor partners and many of these arrangements are terminable upon notice by either party. A reduction in vendor partner programs or funding or our failure to timely react to changes in vendor partner programs or funding could have an adverse effect on our business, results of operations or cash flows. In addition, a reduction in the amount of credit granted to us by our vendor partners could increase our need for, and the cost of, working capital and could have an adverse effect on our business, results of operations or cash flows, particularly given our substantial indebtedness.

From time to time, vendor partners may terminate or limit our right to sell some or all of their products or change the terms and conditions or reduce or discontinue the incentives that they offer us. For example, there is no assurance that, as our vendor partners continue to sell directly to end users and through resellers, they will not limit or curtail the availability of their products to solutions providers like us. Any such termination or limitation or the implementation of such changes could have a negative impact on our business, results of operations or cash flows.

Although we purchase from a diverse vendor base, in 2013, products we purchased from distributors Tech Data, SYNNEX and Ingram Micro represented 11%, 9% and 9%, respectively, of our total purchases. In addition, sales of Apple, Cisco, EMC, Hewlett-Packard, Lenovo and Microsoft products comprise a substantial portion of our sales, representing approximately 56% of net sales in 2013. Sales of products manufactured by Hewlett-Packard and Cisco represented approximately 20% and 14%, respectively, of our 2013 net sales. The loss of, or change in business relationship with, any of these or any other key vendor partners, the diminished availability of their products, or backlogs for their products leading to manufacturer allocation, could reduce the supply and increase the cost of products we sell and negatively impact our competitive position.

Additionally, the relocation of key distributors utilized in our purchasing model could increase our need for, and the cost of, working capital and have an adverse effect on our business, results of operations or cash flows. Further, the sale, spin-off or combination of any of our vendor partners and/or certain of their business units, including any such sale to or combination with a vendor with whom we do not currently have a commercial relationship or whose products we do not sell, could have an adverse impact on our business, results of operations or cash flows.

Our sales are dependent on continued innovations in hardware, software and services offerings by our vendor partners and the competitiveness of their offerings, and our ability to partner with new and emerging technology providers.

The technology industry is characterized by rapid innovation and the frequent introduction of new and enhanced hardware, software and services offerings, such as cloud-based solutions, including SaaS, IaaS and Platform as a Service ("PaaS"). We have been and will continue to be dependent on innovations in hardware, software and services offerings, as well as the acceptance of those innovations by customers. A decrease in the rate of innovation, or the lack of acceptance of innovations by customers, could have an adverse effect on our business, results of operations or cash flows.

In addition, if we are unable to keep up with changes in technology and new hardware, software and services offerings, for example by providing the appropriate training to our account managers, sales technology specialists and engineers to enable them to effectively sell and deliver such new offerings to customers, our business, results of operations or cash flows could be adversely affected.

We also are dependent upon our vendor partners for the development and marketing of hardware, software and services to compete effectively with hardware, software and services of vendors whose products and services we do not currently offer or that we are not authorized to offer in one or more customer channels. In addition, our success is dependent on our ability to develop relationships with and sell hardware, software and services from new emerging vendors and vendors that we have not historically represented in the marketplace. To the extent that a vendor's offering that is highly in demand is not available to us for resale in one or more customer channels, and there is not a competitive offering from another vendor that we are authorized to sell in such customer channels, or we are unable to develop relationships with new technology providers or companies that we have not historically represented, our business, results of operations or cash flows could be adversely impacted.

Substantial competition could reduce our market share and significantly harm our financial performance.

Our current competition includes:

| |

| • | resellers, such as Dimension Data, ePlus, Insight Enterprises, PC Connection, PCM, Presidio, Softchoice, World Wide Technology and many smaller resellers; |

| |

| • | manufacturers who sell directly to customers, such as Dell, Hewlett-Packard and Apple; |

| |

| • | large service providers and system integrators, such as IBM, Accenture, Hewlett-Packard and Dell; |

| |

| • | e-tailers, such as Amazon, Newegg and TigerDirect.com; |

| |

| • | cloud providers, such as AT&T, Amazon Web Services and Box; and |

| |

| • | retailers (including their e-commerce activities), such as Staples and Office Depot. |

We expect the competitive landscape in which we compete to continue to change as new technologies are developed. While innovation can help our business as it creates new offerings for us to sell, it can also disrupt our business model and create new and stronger competitors. For instance, technologies that deliver technology solutions as a service, such as cloud-based solutions, could increase the amount of sales directly to customers rather than through solutions providers like us, or could lead to a reduction in our profitability. In addition, some of our hardware and software vendor partners sell, and could intensify their efforts to sell, their products directly to our customers. Moreover, traditional OEMs have increased their services capabilities through mergers and acquisitions with service providers, which could potentially increase competition in the market to provide comprehensive technology solutions to customers. If any of these trends becomes more prevalent, it could adversely affect our business, results of operations or cash flows.

We focus on offering a high level of service to gain new customers and retain existing customers. To the extent we face increased competition to gain and retain customers, we may be required to reduce prices, increase advertising expenditures or take other actions which could adversely affect our business, results of operations or cash flows. Additionally, some of our competitors may reduce their prices in an attempt to stimulate sales, which may require us to reduce prices. This would require us to sell a greater number of products to achieve the same level of net sales and gross profit. If such a reduction in prices occurs and we are unable to attract new customers and sell increased quantities of products, our sales growth and profitability could be adversely affected.

The success of our business depends on the continuing development, maintenance and operation of our information technology systems.

Our success is dependent on the accuracy, proper utilization and continuing development of our information technology systems, including our business systems, such as our sales, customer management, financial and accounting, marketing, purchasing, warehouse management, e-commerce and mobile systems, as well as our operational platforms, including voice and data networks and power systems. The quality and our utilization of the information generated by our information technology systems, and our success in implementing new systems and upgrades, affects, among other things, our ability to:

| |

| • | conduct business with our customers, including delivering services and solutions to them; |

| |

| • | manage our inventory and accounts receivable; |

| |

| • | purchase, sell, ship and invoice our hardware and software products and provide and invoice our services efficiently and on a timely basis; and |

| |

| • | maintain our cost-efficient operating model while scaling our business. |

The integrity of our information technology systems is vulnerable to disruption due to forces beyond our control. While we have taken steps to protect our information technology systems from a variety of threats, including computer viruses, malware, phishing, social engineering, unauthorized access and other malicious attacks, both internal and external, and human error, there can be no guarantee that those steps will be effective. Furthermore, although we have redundant systems at a separate location to back up our primary systems, there can be no assurance that these redundant systems will operate properly if and when required. Any disruption to or infiltration of our information technology systems could significantly harm our business and results of operations.

Breaches of data security could adversely impact our business.

Our business involves the storage and transmission of proprietary information and sensitive or confidential data, including personal information of coworkers, customers and others. In addition, we operate data centers for our customers which host their technology infrastructure and may store and transmit both business-critical data and confidential information. In connection with our services business, our coworkers also have access to our customers' confidential data and other information. We have privacy and data security policies in place that are designed to prevent security breaches; however, as newer technologies evolve, we could be exposed to increased risk of breaches in security. Breaches in security could expose us, our customers or other individuals to a risk of public disclosure, loss or misuse of this information, resulting in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, as well as the loss of existing or potential customers and damage to our brand and reputation. In addition, the cost and operational consequences of implementing further data protection measures could be significant. Such breaches, costs and consequences could adversely affect our business, results of operations or cash flows.

The failure to comply with our Public segment contracts or applicable laws and regulations could result in, among other things, termination, fines or other liabilities, and changes in procurement regulations could adversely impact our business, results of operations or cash flows.

Revenues from our Public segment customers are derived from sales to governmental departments and agencies, educational institutions and healthcare customers, through various contracts and open market sales of products and services. Sales to Public segment customers are highly regulated. Noncompliance with contract provisions, government procurement regulations or other applicable laws or regulations (including but not limited to the False Claims Act and the Medicare and Medicaid Anti-Kickback Statute) could result in civil, criminal and administrative liability, including substantial monetary fines or damages, termination of government contracts or other Public segment customer contracts, and suspension, debarment or ineligibility from doing business with the government and other customers in the Public segment. In addition, generally contracts in the Public segment are terminable at any time for convenience of the contracting agency or group purchasing organization (“GPO”) or upon default. Furthermore, our inability to enter into or retain contracts with GPOs may threaten our ability to sell to customers in those GPOs and compete. The effect of any of these possible actions could adversely affect our business, results of operations or cash flows. In addition, the adoption of new or modified procurement regulations and other requirements may increase our compliance costs and reduce our gross margins, which could have a negative effect on our business, results of operations or cash flows.

If we fail to provide high-quality services to our customers, or if our third-party service providers fail to provide high-quality services to our customers, our reputation, business, results of operations or cash flows could be adversely affected.

Our service offerings include field services, managed services, warranties, configuration services, partner services and telecom services. Additionally, we deliver and manage mission critical software, systems and network solutions for our customers. We also offer certain services, such as implementation and installation services and repair services, to our customers through various third-party service providers engaged to perform these services on our behalf. If we or our third-party service providers fail to provide high quality services to our customers or such services result in a disruption of our customers' businesses, this could, among other things, result in legal claims and proceedings and liability. Moreover, as we expand our services and solutions business, we may be exposed to additional operational, regulatory and other risks. We also could incur liability for failure to comply with the rules and regulations applicable to the new services and solutions we provide to our customers. If any of the foregoing were to occur, our reputation with our customers, our brand and our business, results of operations or cash flows could be adversely affected.

If we lose any of our key personnel, or are unable to attract and retain the talent required for our business, our business could be disrupted and our financial performance could suffer.

Our success is heavily dependent upon our ability to attract, develop, engage and retain key personnel to manage and grow our business, including our key executive, management, sales, services and technical coworkers.

Our future success will depend to a significant extent on the efforts of Thomas E. Richards, our Chairman and Chief Executive Officer, as well as the continued service and support of our other executive officers. Our future success also will depend on our ability to retain our customer-facing coworkers, who have been given critical CDW knowledge regarding, and the opportunity to develop strong relationships with, many of our customers. In addition, as we seek to expand our offerings of value-added services and solutions, our success will even more heavily depend on attracting and retaining highly skilled technology specialists and engineers, for whom the market is extremely competitive.

Our inability to attract, develop and retain key personnel could have an adverse effect on our relationships with our vendor partners and customers and adversely affect our ability to expand our offerings of value-added services and solutions. Moreover, our inability to train our sales, services and technical personnel effectively to meet the rapidly changing technology needs of our customers could cause a decrease in the overall quality and efficiency of such personnel. Such consequences could adversely affect our business, results of operations or cash flows.

The interruption of the flow of products from suppliers could disrupt our supply chain.

A significant portion of the products we sell are manufactured or purchased by our vendor partners outside of the U.S., primarily in Asia. Political, social or economic instability in Asia, or in other regions in which our vendor partners purchase or manufacture the products we sell, could cause disruptions in trade, including exports to the U.S. Other events that could also cause disruptions to our supply chain include:

| |

| • | the imposition of additional trade law provisions or regulations; |

| |

| • | the imposition of additional duties, tariffs and other charges on imports and exports; |

| |

| • | foreign currency fluctuations; |

| |

| • | natural disasters or other adverse occurrences at, or affecting, any of our suppliers' facilities; |

| |

| • | restrictions on the transfer of funds; |

| |

| • | the financial instability or bankruptcy of manufacturers; and |

| |

| • | significant labor disputes, such as strikes. |

We cannot predict whether the countries in which the products we sell are purchased or manufactured, or may be purchased or manufactured in the future, will be subject to new or additional trade restrictions or sanctions imposed by the U.S. or foreign governments, including the likelihood, type or effect of any such restrictions. Trade restrictions, including new or increased tariffs or quotas, embargoes, sanctions, safeguards and customs restrictions against the products we sell, as well as foreign labor strikes and work stoppages or boycotts, could increase the cost or reduce the supply of product available to us and adversely affect our business, results of operations or cash flows.

A natural disaster or other adverse occurrence at one of our primary facilities or customer data centers could damage our business.

Substantially all of our corporate, warehouse and distribution functions are located at our Vernon Hills, Illinois facilities and our second distribution center in North Las Vegas, Nevada. If the warehouse and distribution equipment at one of our distribution centers were to be seriously damaged by a natural disaster or other adverse occurrence, we could utilize the other distribution center or third-party distributors to ship products to our customers. However, this may not be sufficient to avoid interruptions in our service and may not enable us to meet all of the needs of our customers and would cause us to incur incremental operating costs. In addition, we operate three customer data centers and numerous sales offices which may contain both business-critical data and confidential information of our customers. A natural disaster or other adverse occurrence at any of the customer data centers or at any of our major sales offices could negatively impact our business, results of operations or cash flows.

We are heavily dependent on commercial delivery services.

We generally ship hardware products to our customers by FedEx, United Parcel Service and other commercial delivery services and invoice customers for delivery charges. If we are unable to pass on to our customers future increases in the cost of commercial delivery services, our profitability could be adversely affected. Additionally, strikes, inclement weather, natural disasters or other service interruptions by such shippers could adversely affect our ability to deliver products on a timely basis.

We are exposed to accounts receivable and inventory risks.

We extend credit to our customers for a significant portion of our net sales, typically on 30-day payment terms. We are subject to the risk that our customers may not pay for the products they have purchased, or may pay at a slower rate than we have historically experienced, the risk of which is heightened during periods of economic downturn or uncertainty or, in the case of Public segment customers, during periods of budget constraints.

We are also exposed to inventory risks as a result of the rapid technological changes that affect the market and pricing for the products we sell. We seek to minimize our inventory exposure through a variety of inventory management procedures and policies, including our rapid-turn inventory model, as well as vendor price protection and product return programs. However, if we were unable to maintain our rapid-turn inventory model, if there were unforeseen product developments that created more rapid obsolescence or if our vendor partners were to change their terms and conditions, our inventory risks could increase. We also from time to time take advantage of cost savings associated with certain opportunistic bulk inventory purchases offered by our vendor partners or we may decide to carry high inventory levels of certain products that have limited or no return privileges due to customer demand or request. These bulk purchases could increase our exposure to inventory obsolescence.

We could be exposed to additional risks if we make acquisitions or enter into alliances.

We may pursue transactions, including acquisitions or alliances, in an effort to extend or complement our existing business. These types of transactions involve numerous business risks, including finding suitable transaction partners and negotiating terms that are acceptable to us, the diversion of management's attention from other business concerns, extending our product or service offerings into areas in which we have limited experience, entering into new geographic markets, the potential loss of key coworkers or business relationships and successfully integrating acquired businesses, any of which could adversely affect our operations.

In addition, our financial results could be adversely affected by financial adjustments required by accounting principles generally accepted in the United States of America (“GAAP”) in connection with these types of transactions where significant goodwill or intangible assets are recorded. To the extent the value of goodwill or identifiable intangible assets with indefinite lives becomes impaired, we may be required to incur material charges relating to the impairment of those assets.

Our future operating results may fluctuate significantly.

We may experience significant variations in our future quarterly results of operations. These fluctuations may cause the market price of our common stock to be volatile and may result from many factors, including the condition of the technology industry in general, shifts in demand and pricing for hardware, software and services and the introduction of new products or upgrades.

Our operating results are also highly dependent on our level of gross profit as a percentage of net sales. Our gross profit percentage fluctuates due to numerous factors, some of which may be outside of our control, including general macroeconomic conditions; pricing pressures; changes in product costs from our vendor partners; the availability of price protection, purchase discounts and incentive programs from our vendor partners; changes in product, order size and customer mix; the risk of some items in our inventory becoming obsolete; increases in delivery costs that we cannot pass on to customers; and general market and competitive conditions.

In addition, our cost structure is based, in part, on anticipated sales and gross margins. Therefore, we may not be able to adjust our cost structure quickly enough to compensate for any unexpected sales or gross margin shortfall, and any such inability could have an adverse effect on our business, results of operations or cash flows.

We are exposed to risks from legal proceedings and audits.

We are party to various legal proceedings that arise in the ordinary course of our business, which include commercial, employment, tort and other litigation.

We are subject to intellectual property infringement claims against us in the ordinary course of our business, either because of the products and services we sell or the business systems and processes we use to sell such products and services, in the form of cease-and-desist letters, licensing inquiries, lawsuits and other communications and demands. In our industry, such intellectual property claims have become more frequent as the complexity of technological products and the intensity of competition in our industry have increased. Increasingly, many of these assertions are brought by non-practicing entities whose principal business model is to secure patent licensing revenue, but we may also be subject to suits from inventors, competitors or other patent holders who may seek licensing revenue, lost profits and/or an injunction preventing us from engaging in certain activities, including selling certain products and services.

Because of our significant sales to governmental entities, we also are subject to audits by federal, state and local authorities. We also are subject to audits by various vendor partners and large customers, including government agencies, relating to purchases and sales under various contracts. In addition, we are subject to indemnification claims under various contracts.

Current and future litigation, infringement claims, governmental proceedings, audits or indemnification claims that we face may result in substantial costs and expenses and significantly divert the attention of our management regardless of the outcome. In addition, current and future litigation, infringement claims, governmental proceedings, audits or indemnification claims could lead to increased costs or interruptions of our normal business operations. Litigation, infringement claims, governmental proceedings, audits or indemnification claims involve uncertainties and the eventual outcome of any litigation, infringement claim, governmental proceeding, audit or indemnification claim could adversely affect our business, results of operations or cash flows.

We have significant deferred cancellation of debt income.

As a result of a 2009 debt modification, we realized $395.5 million of cancellation of debt income (“CODI”). We made an election under Code Section 108(i) to defer this CODI from taxable income, pursuant to which we are also required to defer certain original issue discount (“OID”) deductions as they accrue. As of December 31, 2013, we had already deferred approximately $114.5 million of OID deductions. Starting in 2014, we will be required to include the deferred CODI into taxable income ratably over a five-year period ending in 2018. During this same period, we will also be permitted to benefit from our deferred OID deductions. Because we have more CODI than the aggregate of our deferred and unaccrued OID on the relevant remaining debt instruments, we will have a future cash tax liability associated with our significant deferred CODI. We have reflected the associated cash tax liability in our deferred taxes for financial accounting purposes.

All of our deferred CODI will be accelerated into current taxable income if, prior to 2018, we engage in a so-called “impairment transaction” and the gross value of our assets immediately afterward is less than 110% of the sum of our total liabilities and the tax on the net amount of our deferred CODI and OID (the “110% test”) as determined under the applicable Treasury Regulations. An “impairment transaction” is any transaction that impairs our ability to pay the tax on our deferred CODI, and includes dividends or distributions with respect to our equity and charitable contributions, in each case in a manner that is not consistent with our historical practice within the meaning of the applicable Treasury Regulations.

Prior to 2018, our willingness to pay dividends or make distributions with respect to our equity could be adversely affected if, at the time, we do not meet the 110% test and, as a result, the payment of a dividend or the making of a distribution would accelerate the tax payable with respect to our deferred CODI. We believe that, based on our interpretation of applicable Treasury Regulations, the gross value of our assets exceeds 110% of the sum of our total liabilities and the tax on the net amount of our deferred CODI and OID as of the filing date of this Annual Report on Form 10-K. However, we cannot assure you that this will continue to be true in the future.

Risks Related to Our Indebtedness

We have a substantial amount of indebtedness, which could have important consequences to our business.

We have a substantial amount of indebtedness. As of December 31, 2013, we had $3.3 billion of total long-term debt outstanding, as defined by GAAP, and $256.6 million of obligations outstanding under our inventory financing agreements, and the ability to borrow an additional $641.1 million under our senior secured asset-based revolving credit facility (the “Revolving Loan”). Our substantial indebtedness could have important consequences, including the following:

| |

| • | making it more difficult for us to satisfy our obligations with respect to our indebtedness; |

| |

| • | requiring us to dedicate a substantial portion of our cash flow from operations to debt service payments on our and our subsidiaries' debt, which reduces the funds available for working capital, capital expenditures, acquisitions and other general corporate purposes; |

| |

| • | requiring us to comply with restrictive covenants in our senior credit facilities and indentures, which limit the manner in which we conduct our business; |

| |

| • | making it more difficult for us to obtain vendor financing from our vendor partners; |

| |

| • | limiting our flexibility in planning for, or reacting to, changes in the industry in which we operate; |

| |

| • | placing us at a competitive disadvantage compared to any of our less-leveraged competitors; |

| |

| • | increasing our vulnerability to both general and industry-specific adverse economic conditions; and |

| |

| • | limiting our ability to obtain additional debt or equity financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements and increasing our cost of borrowing. |

Restrictive covenants under our senior credit facilities and indentures may adversely affect our operations and liquidity.

Our senior credit facilities and our indentures contain, and any future indebtedness of ours may contain, various covenants that limit our ability to, among other things:

| |

| • | incur or guarantee additional debt; |

| |

| • | pay dividends or make distributions to holders of our capital stock or to make certain other restricted payments or investments; |

| |

| • | repurchase or redeem capital stock; |

| |

| • | make loans, capital expenditures or investments or acquisitions; |

| |

| • | receive dividends or other payments from our subsidiaries; |

| |

| • | enter into transactions with affiliates; |

| |

| • | merge or consolidate with other companies or transfer all or substantially all of our assets; |

| |

| • | transfer or sell assets, including capital stock of subsidiaries; and |

| |

| • | prepay, repurchase or redeem debt. |

As a result of these covenants, we are limited in the manner in which we conduct our business and we may be unable to engage in favorable business activities or finance future operations or capital needs. A breach of any of these covenants or any of the other restrictive covenants would result in a default under our senior credit facilities. Upon the occurrence of an event of default under our senior credit facilities, the lenders:

| |

| • | will not be required to lend any additional amounts to us; |

| |

| • | could elect to declare all borrowings outstanding thereunder, together with accrued and unpaid interest and fees, to be due and payable; |

| |

| • | could require us to apply all of our available cash to repay these borrowings; or |

| |

| • | could prevent us from making payments on our senior subordinated notes due 2017; |

| |

| • | any of which could result in an event of default under the indentures. |

If we were unable to repay those amounts, the lenders under our senior credit facilities could proceed against the collateral granted to them to secure our borrowings thereunder. We have pledged a significant portion of our assets as collateral under our senior credit facilities and our senior secured notes due 2018. If the lenders under our senior credit facilities or the holders of our senior secured notes due 2018 accelerate the repayment of borrowings, we cannot assure you that we will have sufficient assets to repay our senior credit facilities and our other indebtedness or the ability to borrow sufficient funds to refinance such indebtedness. Even if we were able to obtain new financing, it may not be on commercially reasonable terms, or terms that are acceptable to us.

In addition, under our Revolving Loan, we are permitted to borrow an aggregate amount of up to $900 million; however, our ability to borrow under our Revolving Loan is limited by a borrowing base and a liquidity condition. The borrowing base at any time equals the sum of up to 85% of CDW LLC and its subsidiary guarantors’ eligible accounts receivable (net of accounts reserves) (up to 30% of such eligible accounts receivable which can consist of federal government accounts receivable) plus the lesser of (i) 70% of CDW LLC and its subsidiary guarantors’ eligible inventory (valued at cost and net of inventory reserves) and (ii) the product of 85% multiplied by the net orderly liquidation value percentage multiplied by eligible inventory (valued at cost and net of inventory reserves), less reserves (other than accounts reserves and inventory reserves). The borrowing base in effect as of December 31, 2013 was $1,065.5 million.

Our ability to borrow under our Revolving Loan is also limited by a minimum liquidity condition, which provides that, if excess cash availability is less than the lesser of (i) $90 million or (ii) the greater of (A) 10% of the borrowing base or (B) $60 million, the lenders are not required to lend any additional amounts under our Revolving Loan unless the consolidated fixed charge coverage ratio (as defined in the credit agreement for our Revolving Loan) is at least 1.0 to 1.0. Moreover, our Revolving Loan provides discretion to the agent bank acting on behalf of the lenders to impose additional availability reserves, which could materially impair the amount of borrowings that would otherwise be available to us. We cannot assure you that the agent bank will not impose such reserves or, were it to do so, that the resulting impact of this action would not materially and adversely impair our liquidity.

We will be required to generate sufficient cash to service our indebtedness and, if not successful, we may be forced to take other actions to satisfy our obligations under our indebtedness.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. Our outstanding long-term debt will impose significant cash interest payment obligations on us in 2014 and subsequent years and, accordingly, we will have to generate significant cash flow from operating activities to fund our debt service obligations. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources” included elsewhere in this report.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional debt or equity capital, restructure or refinance our indebtedness, or revise or delay our strategic plan. We cannot assure you that we would be able to take any of these actions, that these actions would be successful and permit us to meet our scheduled debt service obligations or satisfy our capital requirements, or that these actions would be permitted under the terms of our existing or future debt agreements, including our senior credit facilities and indentures. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Our senior credit facilities and indentures restrict our ability to dispose of assets and use the proceeds from the disposition. We may not be able to consummate those dispositions or to obtain the proceeds which we could realize from them and these proceeds may not be adequate to meet any debt service obligations then due. Furthermore, the Sponsors have no obligation to provide us with debt or equity financing.

If we cannot make scheduled payments on our debt, we will be in default and, as a result:

| |

| • | our debt holders could declare all outstanding principal and interest to be due and payable; |

| |

| • | the lenders under our senior credit facilities could foreclose against the assets securing the borrowings from them and the lenders under our term loan facility could terminate their commitments to lend us money; and |

| |

| • | we could be forced into bankruptcy or liquidation. |

Despite our indebtedness levels, we and our subsidiaries may be able to incur substantially more debt, including secured debt. This could further increase the risks associated with our leverage.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of our senior credit facilities and indentures do not fully prohibit us or our subsidiaries from doing so. To the extent that we incur additional indebtedness or such other obligations, the risks associated with our substantial indebtedness described above, including our possible inability to service our debt, will increase. As of December 31, 2013, we had approximately $641.1 million available for additional borrowing under our Revolving Loan after taking into account borrowing base limitations (net of $2.2 million of issued and undrawn letters of credit and $256.7 million of reserves related to our floorplan sub-facility).

Variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Certain of our borrowings, primarily borrowings under our senior credit facilities, are at variable rates of interest and expose us to interest rate risk. As of December 31, 2013, we had $1,528.9 million of variable rate debt outstanding. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income would decrease. Although we have entered into interest rate cap agreements on our term loan facility to reduce interest rate volatility, we cannot assure you we will be able to do so in the future on acceptable terms or that such caps or the caps we have in place now will be effective.

Risks Related to Ownership of Our Common Stock

Our common stock price may be volatile and may decline regardless of our operating performance, and holders of our common stock could lose a significant portion of their investment.

The market price for our common stock may be volatile. Our stockholders may not be able to resell their shares of common stock at or above the price at which they purchased such shares, due to fluctuations in the market price of our common stock, which may be caused by a number of factors, many of which we cannot control, including the risk factors described in this Annual Report on Form 10-K and the following:

| |

| • | changes in financial estimates by any securities analysts who follow our common stock, our failure to meet these estimates or failure of securities analysts to initiate or maintain coverage of our common stock; |

| |

| • | downgrades by any securities analysts who follow our common stock; |

| |

| • | future sales of our common stock by our officers, directors and significant stockholders, including the Sponsors; |

| |

| • | market conditions or trends in our industry or the economy as a whole; |

| |

| • | investors’ perceptions of our prospects; |

| |

| • | announcements by us or our competitors of significant contracts, acquisitions, joint ventures or capital commitments; |

| |

| • | changes in key personnel; and |

| |

| • | our limited public float in light of the Sponsors’ beneficial ownership of a majority of our common stock, which may result in the trading of relatively small quantities of shares by our stockholders having a disproportionate positive or negative influence on the market price of our common stock. |

In addition, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies, including companies in our industry. In the past, securities class action litigation has followed periods of market volatility. If we were involved in securities litigation, we could incur substantial costs, and our resources and the attention of management could be diverted from our business.

The Sponsors have the ability to control significant corporate activities and their interests may not align with yours.

The Sponsors beneficially own approximately 63.7% of our common stock as of February 28, 2014. As a result of their ownership, the Sponsors, so long as they hold a majority of our outstanding common stock, will have the ability to control the outcome of matters submitted to a vote of stockholders and, through our board of directors, the ability to control decision-making with respect to our business direction and policies. Matters over which the Sponsors will, directly or indirectly, exercise control include:

| |

| • | the election of our board of directors and the appointment and removal of our officers; |

| |

| • | mergers and other business combination transactions, including proposed transactions that would result in our stockholders receiving a premium price for their shares; |

| |

| • | other acquisitions or dispositions of businesses or assets; |

| |

| • | incurrence of indebtedness and the issuance of equity securities; |

| |

| • | repurchase of stock and payment of dividends; and |

| |

| • | the issuance of shares to management under our equity incentive plans. |

Even if the Sponsors’ ownership of our shares falls below a majority, they may continue to be able to strongly influence or effectively control our decisions. Under our amended and restated certificate of incorporation, the Sponsors and their affiliates do not have any obligation to present to us, and the Sponsors may separately pursue, corporate opportunities of which they become aware, even if those opportunities are ones that we would have pursued if granted the opportunity.